#online payment solutions

Explore tagged Tumblr posts

Text

The Art of the Seamless Swipe: Optimizing Transactions with Intelligent Routing

In today's fast-paced world, a smooth and efficient checkout experience is no longer a luxury; it's an expectation. Customers crave a frictionless journey, from browsing products to completing their purchase.

Enter intelligent transaction routing, a powerful technology transforming the way businesses handle payments, boosting authorization rates, and maximizing revenue.

The Challenge: Streamlining the Payment Maze

Traditional payment processing often operates in silos. Transactions follow a pre-determined path to a single acquiring bank, potentially leading to:

Declined Transactions: If the chosen bank experiences high volumes or technical issues, your customer's payment may be declined, leading to frustration and lost sales.

Hidden Fees: Routing choices may not consider factors like transaction fees associated with different banks. Businesses may unknowingly incur unnecessary costs.

Inefficient Processing: Static routing strategies don't leverage the full potential of available payment networks and processing options.

Intelligent Routing: A Smarter Approach

Intelligent transaction routing (ITR) tackles these challenges head-on. It acts as a sophisticated decision engine, dynamically selecting the optimal path for each transaction based on real-time data and pre-defined parameters. Think of it as a smart traffic controller for your payments, directing them to the most efficient and reliable route for successful authorization.

Key Elements of Intelligent Routing:

Data Analysis: ITR systems analyze a wealth of data points, including card type, issuing bank, transaction amount, location, and historical trends.

Dynamic Routing: Based on the data analysis, ITR chooses the best route from a network of acquiring banks and payment processors. This ensures the highest probability of authorization and the most favorable fees.

Real-Time Processing: ITR decisions are made in real-time, ensuring transactions are routed to the most available and efficient processing channel at the time of purchase.

Benefits of Intelligent Routing: A Win-Win for Businesses and Customers

ITR offers a multitude of benefits for both businesses and customers, streamlining the payment process and fostering a positive experience for all:

Increased Authorization Rates: By analyzing card data and network conditions, ITR significantly reduces the risk of declined transactions, leading to higher sales and happier customers.

Reduced Processing Costs: ITR can identify the most cost-effective routing options based on transaction characteristics, potentially saving businesses substantial amounts on processing fees.

Improved Cash Flow: Faster transaction processing and reduced declines lead to quicker access to funds, improving a business's cash flow and financial health.

Enhanced Customer Experience: A frictionless checkout experience with fewer declines keeps customers happy and encourages repeat business.

Beyond the Basics: Advanced Features of ITR Systems

Modern ITR solutions go beyond simply routing transactions. They offer additional features that further enhance payment processing and security:

Fraud Detection and Prevention: By analyzing transaction patterns and historical data, ITR can identify potential fraudulent activities and prevent unauthorized charges.

Level 3 Data Processing: Sending additional data points with transactions (like product descriptions and shipping addresses) can qualify merchants for lower processing fees. ITR systems can automate this process for enhanced efficiency.

Tokenization: ITR can integrate with tokenization solutions, replacing sensitive card data with unique tokens during transactions, adding an extra layer of security.

Implementing Intelligent Routing: A Seamless Transition

Transitioning to an ITR system is a relatively straightforward process:

Partner with a Payment Processor: Choose a payment processor offering ITR solutions that integrate seamlessly with your existing system.

Data Integration: Ensure relevant data points are readily available for ITR to analyze and make informed routing decisions.

Configuration and Testing: Work with your payment processor to configure routing parameters and test the system thoroughly before deployment.

The Future of Payments: Powered by Intelligence

Intelligent transaction routing is revolutionizing the payment processing landscape. By dynamically optimizing transaction flow, businesses can unlock a world of benefits, from increased revenue to enhanced customer satisfaction. As technology advances, ITR systems are expected to become even more sophisticated, integrating seamlessly with emerging technologies like artificial intelligence and machine learning, further streamlining the payment experience for the years to come. In conclusion, intelligent transaction routing is not just a technological advancement; it's a strategic investment for businesses seeking to optimize their payment processes, maximize profits, and stay ahead of the curve in the ever-evolving world of commerce.

0 notes

Text

Simplify Your Transactions, Explore the Best Online Payment Collection Solutions

Discover the easiest way to streamline your transactions and enhance your online payment collection experience.

Explore the top solutions available to simplify and optimize your payment processes.

Whether you're a small business owner or a large corporation, these tools will revolutionize the way you handle transactions.

Embrace the convenience and efficiency of online payment collection solutions today.

Online payment solutions

If you're seeking efficient online payment solutions, consider integrating one reliable platform to streamline your transactions.

When it comes to easy payment collection online, opting for the best easy payment collection solutions is crucial for your business success. Online payment solutions offer convenience, flexibility, and security for both you and your customers.

By utilizing a robust platform, you can ensure seamless transactions, quick processing times, and hassle-free payment experiences. Choose a solution that aligns with your business needs, whether it's for e-commerce, services, or subscriptions.

With the right online payment system in place, you can enhance customer satisfaction, increase your revenue streams, and stay ahead in today's competitive market.

Easy payment collection online

When it comes to easy payment collection online, you need a reliable platform to ensure seamless transactions and hassle-free experiences for both you and your customers. Opt for payment solutions that offer user-friendly interfaces, secure payment gateways, and diverse payment options.

Look for platforms that provide automated invoicing, recurring billing features, and easy integration with your existing systems. By choosing a reputable online payment collection service, you can streamline your payment processes, reduce manual errors, and enhance customer satisfaction.

With the right tools in place, you can efficiently manage transactions, track payments in real-time, and improve overall financial management. Invest in a robust payment collection solution to simplify your online transactions and elevate your business operations.

Best easy payment collection solutions

To effectively streamline your payment collection process online, consider utilizing a platform that offers seamless integration with your existing systems. Look for payment collection solutions that provide easy setup and user-friendly interfaces.

Opt for services that offer multiple payment options to cater to a broader range of customers. Choose a solution that ensures secure transactions to protect both your business and your clients.

Evaluate platforms that offer automated invoicing and recurring billing features to save time and improve efficiency. Prioritize solutions with detailed reporting capabilities to track payments and monitor your financial performance easily.

Conclusion

So there you have it - simplify your transactions with the best online payment collection solutions available.

Bid farewell to lengthy lines and intricate payment proceduresWith easy payment collection online, you can streamline your business operations and provide a convenient experience for your customers.

Don't wait any longer, explore the possibilities and start reaping the benefits today.

1 note

·

View note

Text

The Strategic Role of E-NACH in Digital Finance

Imagine a seamless way to authenticate transactions, reduce paperwork, and enhance financial services in India. Enter E-NACH, a digital marvel transforming the financial landscape. Let's explore the strategic significance of E-NACH in the realm of digital finance.

E-NACH: Revolutionizing Digital Finance

Electronic National Automated Clearing House (E-NACH) may sound like a tech buzzword, but its impact on the Indian financial sector is undeniable. It serves as a vital cog in the wheel of digital finance, ensuring smoother, more efficient transactions.

Also Read: Unveiling Why Entrepreneurs Prefer MSME Loans

1. Streamlined Verification Process

E-NACH simplifies the customer verification process for financial institutions. Instead of the traditional cumbersome paperwork and in-person verification, E-NACH enables banks and other entities to authenticate customers electronically. This not only saves time but also reduces the risk of manual errors.

2. Enhanced Security

In a world where data security is paramount, E-NACH steps up to the plate. It employs robust encryption and authentication mechanisms to safeguard sensitive customer information. This ensures that transactions are not only efficient but also secure, gaining the trust of users.

3. Paperless Transactions

Gone are the days of paper-based transactions. E-NACH eliminates the need for physical documents, making financial transactions eco-friendly and convenient. This shift towards a paperless environment aligns with India's digitalization efforts.

4. Financial Inclusion

E-NACH plays a pivotal role in advancing financial inclusion in India. Abhay Bhutada says that E-NACH brings accessibility to a wider range of mobile users. It enables individuals from remote and underserved areas to access financial services easily.

5. Faster Loan Approvals

For borrowers, E-NACH means quicker loan approvals. Lenders can verify applicants' credentials swiftly, reducing the waiting time for loan disbursal. This speed not only benefits customers but also fosters a competitive lending environment.

6. Cost-Efficiency

The cost savings associated with E-NACH are significant. Financial institutions can streamline their operations, reduce administrative overhead, and pass on these benefits to customers in the form of lower fees and better interest rates.

7. Regulatory Compliance

In an increasingly regulated financial landscape, compliance is non-negotiable. E-NACH helps institutions adhere to regulatory requirements seamlessly. It ensures that KYC (Know Your Customer) and AML (Anti-Money Laundering) norms are followed diligently.

Also Read: The Importance of Financial Literacy Education in Schools

8. Future-Ready Infrastructure

As India's financial landscape continues to evolve, E-NACH provides a scalable infrastructure that can adapt to changing needs. It accommodates new technologies and innovations, positioning the financial sector for sustained growth. Ganesh Ram, CEO of MF Utilities India, also highlights E-NACH's crucial role in the rapidly expanding SIP sector.

Conclusion

In a country where financial transactions are rapidly shifting to digital channels, E-NACH emerges as a strategic enabler. It streamlines verification, enhances security, promotes financial inclusion, and paves the way for a more efficient and cost-effective financial ecosystem. Embracing E-NACH is not just a choice; it's a necessity in today's digital finance landscape.

0 notes

Text

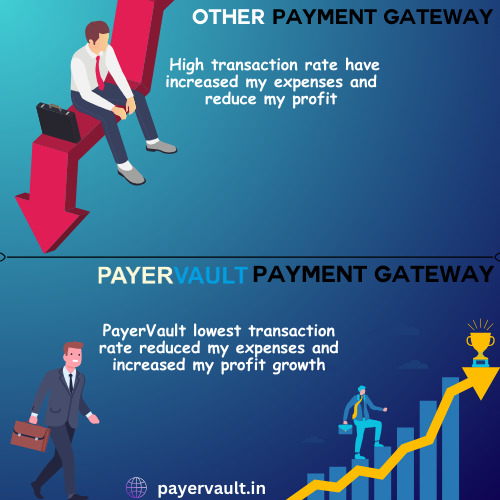

Best payout gateway in India with lowest charges and fastest setup.

PayerVault: Your Path to Instant Payouts and Secure Transactions

In a world where digital transactions reign supreme, having a reliable payout gateway at your disposal is essential. This is where PayerVault steps in, offering you a seamless experience that's not only efficient but secure too.

Unlocking Efficiency with Payout Gateways

Picture this: you run a thriving online business, and it's time to disburse payments to your vendors or employees. With PayerVault, you can kiss those tedious, manual processes goodbye. Payout gateways, especially PayerVault, streamline your financial operations, making transactions swift and error-free.

Real-Time Tracking: A Game-Changer

One of PayerVault's standout features is its real-time tracking capabilities. Say goodbye to the days of anxiously waiting for payment confirmations. With PayerVault, you get instant updates on successful transactions, allowing you to stay on top of your finances effortlessly.

Instant Payouts, Low Fees: A Winning Combination

PayerVault takes pride in offering instant payouts – a game-changer for businesses. Imagine the convenience of quick access to your funds. And the best part? PayerVault ensures this at minimal transaction fees, making it a cost-effective solution for businesses of all sizes.

User-Friendly Interface: No Hassle, Just Results

Worried about a steep learning curve? Don't be. PayerVault's user-friendly interface ensures that even if you're new to payout gateways, you'll have no trouble navigating the system. It's designed to simplify your financial operations, leaving you with more time to focus on what matters most – your business.

Why Choose PayerVault?

With PayerVault, you're not just opting for a payout gateway – you're choosing efficiency, security, and convenience. Our commitment to providing instant, secure transactions at competitive rates has made us a trusted name in the industry.

So, whether you're a budding entrepreneur, an e-commerce mogul, or a nonprofit organization, PayerVault has you covered. Say goodbye to payment hassles and embrace a future where financial transactions are seamless, secure, and efficient.

Join us at PayerVault and unlock a world of possibilities in the realm of payout gateways. It's time to experience finance the way it should be – fast, secure, and hassle-free.

"Explore PayerVault Today and Transform Your Financial Transactions!"

#payment gateway#payment processing#payment systems#payments#businesses#business#high risk merchant account#high risk payment gateway#payouts#payout#paypal#online#ecommerce#business growth#online payment gateway#online payment solutions#online payment systems#paying#internet#small business#online store#digital transformation

1 note

·

View note

Text

Grow Your Business With Our eCommerce Payment Processing Solutions

If you're looking for the best eCommerce payment processing services for your business, Electronic Merchant Systems (EMS) can help.

We will help you grow your business with reliable eCommerce and online payment processing options.

If you are offering industry-leading products, but your revenue and sales volume doesn't seem to flow as anticipated, it could be that the payment gateway you are using might be turning away your customers.

Some customers may abandon their online cart if the process is too lengthy or slow. Simplifying checkout by minimizing steps can help you grow your customer base and your business.

Electronic Merchant Systems has been helping online businesses like yours grow their business with innovative online payment solutions. And with our free rate review, 95% of merchants saved money on payment processing fees.

When you partner with us, you can:

Establish your web presence

Add a store to your existing website

Enable online payment methods for your business

Streamline your customers' buying experience.

By creating a seamless user experience from start to checkout, your customers can fill their online shopping carts and pay in a breeze with our payment solutions.

This will allow your customers to place orders and make secure payments, allowing you to increase your business!

Get started on growing your online business with one of our leading eCommerce Payment Systems today!

#ecommercepaymentprocessing#e commerce payment processing#online payment solutions#online payment gateway

1 note

·

View note

Text

Benefits of Blockchain Technology for Financial Institutions

In the digital age, where trust is the ultimate currency, blockchain technology has emerged as a game-changer for financial institutions in India. This revolutionary technology has the potential to transform the way financial transactions are conducted, bringing security, efficiency, and transparency to the forefront.

Enhanced Security and Transparency

Blockchain's decentralized and immutable nature ensures that every transaction is securely recorded and verified across multiple computers. This eliminates the risk of fraud, manipulation, and unauthorized access, providing financial institutions with a higher level of security and transparency.

Also Read: Top 10 Fintech Companies In India

Streamlined Processes and Efficiency

By removing the need for intermediaries and automating processes, blockchain streamlines financial operations, making them faster, more efficient, and cost-effective. From KYC procedures to trade settlements, blockchain simplifies and accelerates processes, saving time and reducing operational costs for financial institutions.

Cost Reduction

With blockchain, financial institutions can eliminate intermediaries and redundant processes, reducing costs associated with traditional systems. By enabling direct peer-to-peer transactions, blockchain cuts out the middlemen, resulting in lower fees and transaction costs.

Improved Data Management

Blockchain enables secure and efficient management of data. It provides a decentralized and tamper-resistant ledger where data is recorded and verified. Financial institutions can benefit from better data accuracy, integrity, and availability, leading to improved decision-making processes.

Enhanced Customer Experience

Blockchain has the potential to revolutionize the customer experience by providing greater control and transparency. Customers can have real-time access to their financial data, track transactions, and enjoy faster and more secure payments.

Financial Inclusion

In a country as diverse as India, blockchain technology can play a crucial role in promoting financial inclusion. Its decentralized nature allows for the inclusion of the unbanked population, providing them with access to secure financial services through mobile devices.

Challenges and Considerations

While blockchain presents numerous benefits, it also comes with challenges. Scalability, energy consumption, regulatory compliance, and interoperability are factors that need to be addressed for widespread adoption. Financial institutions need to carefully evaluate their existing infrastructure and invest in the necessary technology and expertise to harness the full potential of blockchain.

Also Read: The Rise of Digital Lending in India: A Game Changer for Borrowers and Lenders

Conclusion

Blockchain technology holds immense promise for financial institutions in India, bringing enhanced security, efficiency, and transparency to the forefront. As technology evolves and regulatory frameworks are developed, financial institutions must embrace this digital revolution to stay competitive in the evolving financial landscape.

#blockchain#fintech#online payment solutions#financial inclusion#economy#innovations#financial institutions#stockexchange#insurance

0 notes

Text

This YouTube video provides a comprehensive overview of how AI chat GPT technology can be used in an online business to drive business growth and customer satisfaction. It explains the advantages of using AI chat GPT technology over traditional customer service methods, such as cost savings, real-time insights, and scalability. Additionally, the video provides examples of how AI chat GPT is already being used in an online business setting, and explains the potential benefits of using this technology. The video also explores tips and best practices for implementation, coding examples, and optimization techniques to get the most out of AI chat GPT technology. Finally, the video offers advice on how to get started with AI chat GPT and maximize its potential to benefit your online business.

#Online business marketing#online business growth strategies#online business opportunities#online customer engagement#online customer service#online payment solutions#online retail trends.

0 notes

Text

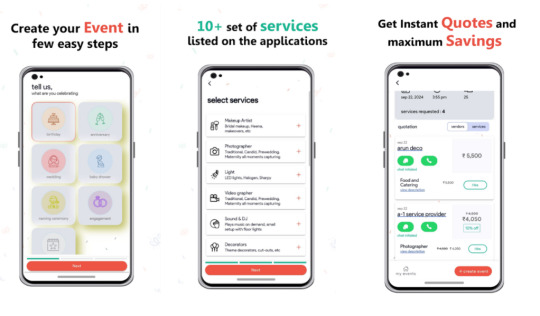

🎉 Say Hello to Seamless Event Planning with Ootbo App! 🎉

Planning an event can feel like juggling too many tasks at once. From finding the perfect venue to managing vendor communications and staying within budget, it’s easy to get overwhelmed. But what if you had an app that handled everything in one place? Enter the Ootbo App—the ultimate event planning tool designed to make organizing events stress-free, seamless, and fun! 🎈

Whether you’re planning a wedding, corporate event, birthday party, or any special occasion, the Ootbo App is your go-to solution for managing every aspect of the event planning process. 🗓️✨

🌟 Why Choose Ootbo App?

Gone are the days of switching between multiple apps, emails, and spreadsheets. Ootbo App simplifies the entire event planning process, from start to finish. Here’s how:

1. Create Events Effortlessly 🎨

Ootbo offers an intuitive interface that allows you to create detailed events in minutes. Simply input event details, set the date and time, and let Ootbo do the rest. 💡 Pro Tip: Customize your event profile to include specific requirements and preferences for vendors!

2. Receive Multiple Vendor Quotes 💼

Why chase down vendors when they can come to you? With Ootbo, you can: 🔍 Post your event requirements. 📩 Receive multiple quotes from verified vendors. 📊 Compare options side-by-side to choose the best fit.

This saves you time and ensures you get competitive pricing without the hassle of endless phone calls. 📞

3. In-App Vendor Chats 💬

Communication is key when planning an event, and Ootbo has you covered! 📱 Chat with potential vendors directly through the app. 📋 Discuss availability, services, and pricing in real time. 📎 Share documents, photos, and event details seamlessly.

Forget the confusion of scattered email threads—Ootbo keeps all your conversations in one place, organized and easy to access.

4. In-App Calls for Quick Decisions 📞

Sometimes, a quick call can make all the difference. Ootbo allows you to: 🔊 Make in-app calls to vendors without sharing personal contact details. 📌 Record important discussions and reference them later. 📈 Keep all event-related calls connected to your event profile.

No more searching through your call history for vendor numbers—everything stays in the app!

5. Hire Vendors with Confidence 🤝

Once you’ve reviewed quotes and discussed details, hiring your chosen vendor is as easy as a tap! 📄 Securely finalize agreements within the app. 💳 Pay vendors through a secure payment gateway. 🔒 Enjoy peace of mind knowing your transactions are protected.

With Ootbo, you’re not just hiring vendors—you’re partnering with professionals who are ready to make your event a success! 🎉

🏆 The Benefits of Using Ootbo App

All-in-One Solution: Manage your event from creation to completion in a single app.

Time-Saving: No more endless emails, phone calls, or spreadsheets.

Competitive Pricing: Receive and compare quotes to get the best value for your budget.

Seamless Communication: Chat and call vendors directly within the app.

Secure Transactions: Make payments and finalize contracts with confidence.

🎯 Who Can Use Ootbo?

Ootbo is designed for everyone! Whether you’re:

👰 Planning a wedding. 🏢 Organizing a corporate event. 🎂 Hosting a birthday party. 🎭 Coordinating a community event.

Ootbo App is your trusted event planning companion.

📲 Download the Ootbo App Today!

Ready to take the stress out of event planning? Download the Ootbo App today and experience the future of event management!

🔗 Visit Ootbo App to learn more. 📱 Available on iOS and Android.

Make your next event unforgettable with Ootbo! 🎉

With the Ootbo App, event planning has never been easier or more efficient. Start planning your dream event today! 🎈

#vent planning app#Best event management tool#Event vendor management#In-app vendor communication#Compare event vendor quotes#Event budget management app#Online event planning solution#Seamless event planning app#Event planning made easy#Chat with event vendors#Event organizer tool#Hire vendors online#Manage events from mobile#Event planning software for Android & iOS#ow to plan events with a mobile app#Best app to hire event vendors#Manage event budgets and vendors in one app#Event planning solution for weddings and parties#Secure in-app payments for event vendors

2 notes

·

View notes

Text

I think my little brother got me the last issue for superboy man of tomorrow for Christmas

#txt#I MEAN. i mentioned that to him#that I didn’t have that last one bc I kept putting it off for my payments for my classes#I order my comics online#just bc I have no impulse control.#I go into a comic store & spend more than I should every time. so this is my solution.#yeah that means I have to wait an extra week to get them 😭😭😭 BUT that’s what pirating is for

4 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

As your trusted merchant services provider, Your Merchant Services Rep is committed to delivering reliable and flexible payment solutions that meet the unique needs of your business. With NMI Payment Gateway, you can streamline your payment processing, enhance your customer experience, and grow your business with confidence. Visit Us;

#nmi payment gateway#merchant account fees#electronic merchant solutions#online payment gateway integration#merchant account for car dealership

4 notes

·

View notes

Text

How To Use AI Chat GPT in Your Online Business - Make #money from #home #affiliatemarketing

This YouTube video provides a comprehensive overview of how AI chat GPT technology can be used in an online business to drive business growth and customer satisfaction. It explains the advantages of using AI chat GPT technology over traditional customer service methods, such as cost savings, real-time insights, and scalability. Additionally, the video provides examples of how AI chat GPT is already being used in an online business setting, and explains the potential benefits of using this technology. The video also explores tips and best practices for implementation, coding examples, and optimization techniques to get the most out of AI chat GPT technology. Finally, the video offers advice on how to get started with AI chat GPT and maximize its potential to benefit your online business.

#Online business marketing#online business growth strategies#online business opportunities#online customer engagement#online customer service#online payment solutions#online retail trends.

0 notes

Text

Efficient Foreign Currency Accounts by Routefusion for Global Payments

Routefusion’s foreign currency accounts make international payments easier by enabling businesses to hold, manage, and transfer funds in multiple currencies. This service reduces the cost and hassle of foreign exchange transactions, offering a simple, flexible way to conduct global business. With Routefusion, businesses can access competitive exchange rates, streamline cross-border payments, and lower transaction fees. Whether managing payroll for international teams or paying overseas suppliers, Routefusion ensures businesses operate smoothly in a global economy while keeping finances efficient and compliant. Trust Routefusion for hassle-free global payments and optimized currency management.

0 notes

Text

Casino Merchant Account in 2025

As the online casino industry continues to grow, payment processing becomes more important. This blog explores the role of casino merchant accounts in 2025, covering aspects like fraud prevention, chargeback management, and regulatory compliance. It’s crucial for casino operators to understand these factors to provide smooth payment solutions. Read the whole blog to know more.

#casino merchant account#merchant account#casino#online casino#casino payment processing#payment processing#payment processor#payment solutions#gambling

0 notes

Text

Are you ready to streamline your operations and elevate your business? At JustForPay, we provide everything you need under one roof—from payment solutions and invoicing to inventory management and customer support.

For more info visit at: https://www.justforpay.co.in

#Payment Solutions#Online Payments#Secure Transactions#Digital Payment Gateway#Payment Processing#E-commerce Solutions

0 notes