#Payment processing company

Explore tagged Tumblr posts

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

Reliable Payment Processing Solutions for Your Business

Clear Charge Solutions offers trusted Payment Processing Solutions designed to make accepting payments easy and secure. Whether you run a small shop or a growing online store, their tools help you get paid fast and without hassle.

As a top Payment Processing Company, Clear Charge Solutions provides smooth checkout experiences, protects customer data, and supports all major payment types. If you’re looking for a partner that puts your business first, they’re the team to call.

Choose Clear Charge Solutions for payment processing that’s simple, smart, and dependable.

#Payment Processing Solutions#Payment Processing Company#Payment Processing Services#Payment Processing

0 notes

Video

youtube

Visa Mastercard Censorship Comes for Denpasoft! How Can It Be Stopped?

a bit late for finding this type of stuff~~ I think I also saw a video from Rev Says Desu about this kind of thing too~~

why’re card companies trying to decide for us what types of art we can or cannot enjoy?

I think the Rev Says Desu video I saw on this was about mastercard and visa pulling funding for pixiv or melonbooks or some other anime/manga sites? idr so the only way to pay on whatever site that was is by japanese card companies or whatever funding platforms are on the site...

just let us buy the thing as long as it doesn’t hurt anyone~~ only thing that’s wrong with fictional art is papercuts and hand cramps from writing/drawing for a long time....

or censoring japanese games but allowing similar or worse stuff in western games, like a “it’s ok if we do it” ..... T_T;; the main thing I’m thinking of in that regard is all the customization and nsfw in “baulder’s gate 3″ yet the anime/manga/visual novels get censored??

not angry but why does this double standard for east/west media exist? censorship is a slippery slope~~~ didn’t like it when 4kids westernized the japanese culture out of childhood anime that I watched, and it seems to be getting worse~~

#youtube#youtube video#otaku spirit youtube#not mine#just wanted to share#card companies#bank cards#censorship#anti censorship#bank#banks#payment#payment processing#payment processors#discussion#anti censorship discussion#art#artist#artists#denpa#denpasoft

3 notes

·

View notes

Text

High-Risk Payment Processing Regulations

Strict regulations in high-risk industries make compliance challenging. WebPays helps businesses manage high-risk payment processing regulations while reducing fraud risks. With expertise in record-keeping and risk management, we support smooth financial operations. Contact us for details.

#payment processing#payment processor#payments#processor#payment processor companies#payment gateway#payment solutions#online payments#payment gateways

1 note

·

View note

Text

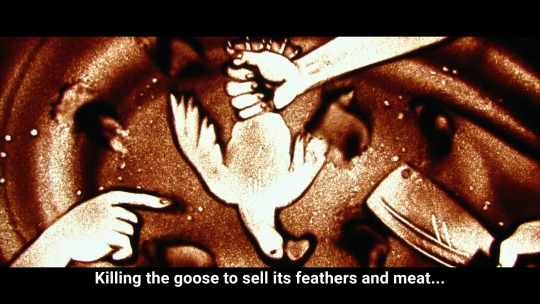

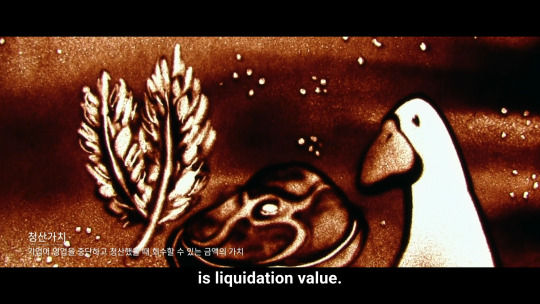

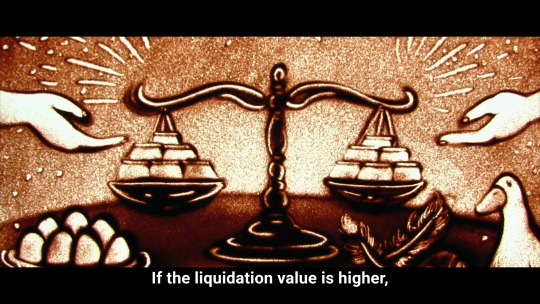

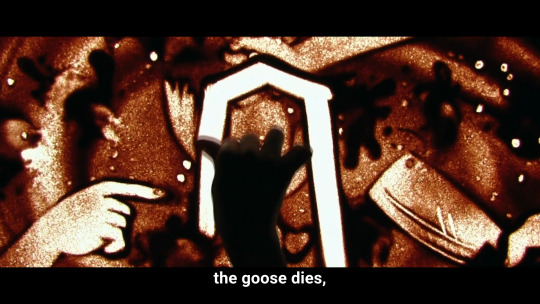

#this is a simplified narrative obviously#because before a company even goes to liquidation there are steps and due process#the auditor only gives an opinion or in certain cases refuses to give an opinion on the financial statements of a company#what happens next depends on the shareholders#if creditors demand immediate payment in full of the debt and the company somehow manages to strike a deal then the company survives#this is what you call voluntary administration#however if the insolvent company fails to meet its obligations then creditors may try seeking a court order for liquidation#and that is a separate exercise#the court would would then allow for the creditors to appoint a third party independent auditor to provide recommendations to the court#the court then may issue an order to liquidate the company based on recommendations from the third party independent auditor#so the narrative in this scene is the later stage obviously#mbc numbers#kdrama

8 notes

·

View notes

Text

so like what the fuck even are our options for where to post/distribute/sell nsfw content anymore. like literally what is fucking left it feels like everyone is banning everything lately

#i hate it here lmao. this prompted by the gumroad thing#like thats not even something i really Get Into much but the way it seems like the plan is to just wipe everything thats not perfectly#sanitized off the face of the internet is so. bad lmao#cant even host it on ur own damn site bc u gotta process payments somehow & those companies are half the fucking issue#fucking mail a check i guess idfk

4 notes

·

View notes

Text

Ok so my kid had an ear infection, right? As kids often do.

The doctor scraped out a bit of earwax to have a better look inside.

I was sent a bill for $200 PER EAR for this 5 second procedure which I did not give permission for them to do.

That was key- they did not ASK me if they could do this "procedure". And, as I OWN a medical practice (it's me. The medical practice is me, sitting in my house on video calls) I knew to call them when this bill came in to be like "You did not obtain informed consent for this procedure, and it was not en emergency procedure. You had full ability to gain my consent and didn't. I'm not paying."

And the massive hospital who owned the bill said "yuh-huh you do have to pay."

And I said "I own a practice. I know these laws. I do not owe you money for this."

And they conducted an "internal review" and SURPRISE! Decided I totally owed them money and they had never done anything wrong ever.

And so I called my state's Attorney General office, and explained the situation because, as I mentioned, I know the law. The AG got in touch within a couple days to say they were taking the case and would send the massive hospital conglomerate a knock it off, guys letter.

Lo and Behold, today I have a letter where said hospital graciously has agreed to forfeit the payment.

"How not to get screwed over by companies" should be part of civics class.

Know your rights and know who to call when they're infringed on. This whole process cost me $0 and honestly less effort than I would have expected.

May this knowledge find its way to someone else who can use it.

123K notes

·

View notes

Text

Why Payments Are Always Late in Europe’s Healthcare System

If you’ve ever worked with public hospitals, clinics, pharmacies, or distributors in Europe, you’ve probably asked yourself one simple question: why does it always take so long to get paid? It’s a common frustration. Invoices stretch out for months, reminders go unanswered, and there’s always some excuse. But the reasons behind these delays are more than just bad habits—they’re built into the way…

#budget allocation#cash flow issues#delayed reimbursements#Distributors#European healthcare#funding cycles#government healthcare#healthcare cash management#healthcare finance#healthcare funding#healthcare payments#healthcare suppliers#healthcare system#hospital budgets#insurance companies#invoice delays#Late Payments#payment delays#pharmacies#pharmacy cash flow#public hospitals#public sector healthcare#reimbursement process#supply chain delays#treasury departments#wholesalers

0 notes

Text

Best Credit Card Payment Companies

Credit card processing companies are crucial for secure transactions. WebPays, one of the best credit card payment companies, provides payment services with high-grade security measures, fraud detection, and multi-currency support. We help businesses remain compliant while processing payments globally. Contact us to upgrade your payment system.

#credit card companies#credit card payment#payment processing#credit card processing#credit card processor#payment processor#payments#credit card

0 notes

Text

Businesses today face growing scrutiny regarding their ethical practices, financial transparency, and regulatory compliance. Ethical audits play a critical role in evaluating whether a company operates responsibly, follows legal guidelines, and maintains fair business practices. Proper preparation for these audits ensures that companies meet industry standards and avoid penalties. Understanding the ethical audit process and implementing best practices can help businesses maintain trust among stakeholders and regulatory bodies. Read.

#legal#tax#legal services#payment gateway license#payment gateway registration#ethical audits#businesses#company#startups#ethical audit process#insurance audit#audit of insurance companies

0 notes

Text

#payment processing company#payment gateway#payment processor#payment processing#online payments#payment processing solutions#merchant account#echeck payment#merchant services#echeck#echecks#business#financial

0 notes

Text

Insurance Payment Platform

Smooth payment transactions are at the heart of seamless insurance processes. Tranzpay offers modern payment solutions for the insurance industry. Our insurance payment platform facilitates recurring premium payment collection as well as fast, outbound claims payments to deliver optimal policyholder experiences.

#insurance company#Insurance Payment Platform#payment solutions#payment processing#payment gateway#medical insurance

0 notes

Text

Best Payment Processing Companies

Businesses depend on reliable payment processing solutions for secure transactions. At WebPays, we provide advanced payment gateway systems, merchant account services, and dedicated support for high-risk sectors, positioning us as one of the best payment processing companies. Contact us today to learn how our solutions can improve your transaction security.

#payment processing#payment processor#payments#payment solutions#payment processor companies#high risk payments

1 note

·

View note

Text

How to Optimize Your eCommerce Website for Better Conversions

In today’s competitive digital landscape, having an eCommerce website is just the first step. The real challenge lies in converting visitors into paying customers. With countless online stores vying for attention, optimizing your eCommerce website for better conversions is essential to boost revenue and grow your business. Here’s a comprehensive guide to achieving higher conversions through proven strategies.

1. Streamline the User Experience (UX)

A seamless and intuitive user experience is the cornerstone of any high-converting eCommerce website. Ensure your site is easy to navigate, visually appealing, and responsive across all devices. Key points to focus on include:

Simple Navigation: Categorize products logically and provide clear menus.

Search Functionality: Incorporate advanced search features with filters and auto-suggestions.

Fast Loading Speed: Optimize images and code to ensure pages load in under 3 seconds.

2. Optimize Product Pages

Your product pages play a critical role in influencing purchase decisions. To maximize their impact:

Use high-quality images with zoom features.

Include detailed product descriptions that highlight key features and benefits.

Add customer reviews and ratings to build trust.

Provide clear calls-to-action (CTAs) such as “Add to Cart” or “Buy Now.”

3. Simplify the Checkout Process

A complicated or lengthy checkout process is one of the leading causes of cart abandonment. Optimize your checkout by:

Offering a guest checkout option to eliminate the need for account creation.

Reducing the number of steps required to complete a purchase.

Providing multiple payment options, including credit cards, digital wallets, and Buy Now, Pay Later (BNPL) services.

Displaying a progress bar during checkout to show customers how close they are to completion.

4. Leverage Personalization

Personalized experiences can significantly improve conversion rates. By analyzing customer behavior and preferences, you can tailor their journey:

Use personalized product recommendations based on browsing history.

Send targeted email campaigns featuring products customers viewed but didn’t purchase.

Show location-based offers or currency preferences.

5. Build Trust with Your Audience

Trust is a key factor in eCommerce success. To foster credibility:

Display secure payment badges and SSL certificates prominently.

Highlight a clear return and refund policy to ease concerns.

Include detailed contact information and live chat support for customer queries.

Showcase social proof through testimonials, ratings, and user-generated content.

6. Optimize for Mobile Commerce

With mobile devices accounting for a large percentage of online shopping, your website must be mobile-friendly.

Ensure your site is responsive and adapts seamlessly to different screen sizes.

Optimize mobile loading speeds to avoid slow performance.

Simplify navigation and checkout processes for smaller screens.

7. Use Data to Drive Decisions

Regularly analyze website data to identify bottlenecks and opportunities for improvement:

Track metrics such as bounce rates, time on page, and conversion rates.

Use heatmaps to understand how users interact with your site.

Conduct A/B testing to compare variations of your product pages, CTAs, and design elements.

8. Harness the Power of Social Proof

Social proof can significantly influence buying decisions. Implement the following:

Highlight customer testimonials and success stories on your homepage.

Showcase real-time purchase updates like “5 customers bought this item today.”

Encourage customers to leave reviews and share their purchases on social media.

9. Implement Retargeting Strategies

Not all visitors will convert on their first visit. Retargeting helps bring them back:

Use dynamic retargeting ads to remind users of products they viewed.

Send cart abandonment emails with incentives like discounts or free shipping.

Offer personalized deals to re-engage past customers.

10. Enhance Website Security

Customers are more likely to shop when they feel their data is safe.

Use secure HTTPS protocols for data encryption.

Regularly update software and plugins to avoid vulnerabilities.

Include a privacy policy to assure customers that their data is protected.

11. Engage Customers with Content

High-quality content can attract visitors and drive conversions.

Create detailed buying guides to help customers make informed decisions.

Use videos to demonstrate product features and benefits.

Publish blog posts that address common customer pain points or questions.

12. Offer Incentives to Drive Sales

Enticing deals and promotions can nudge hesitant buyers:

Provide limited-time discounts to create urgency.

Offer free shipping or bundles for higher-value purchases.

Implement loyalty programs to reward repeat customers.

Conclusion: Boost Conversions with a Strategic Approach

Optimizing your eCommerce website for better conversions involves a combination of user experience enhancements, personalized strategies, and data-driven decisions. By focusing on creating a seamless shopping experience, building trust, and leveraging modern technology, you can significantly improve your website’s performance and revenue.

Partner with SKAD IT Solutions for Retail and eCommerce Success

Looking to enhance your online store? At SKAD IT Solutions in Dubai, we provide cutting-edge retail and eCommerce solutions tailored to your business needs. From responsive designs to scalable platforms, our experts deliver strategies that maximize conversions and growth.

Contact us today to transform your eCommerce website into a high-performing retail powerhouse!

#Retail and E-Commrce Solutions#Retail and E-Commerce Platforms#Custom E-Commerce Solutions#POS and Payment Processing#ecommerce website solution#ecommerce web design Dubai#ecommerce website development Dubai#ecommerce development company in Dubai

0 notes

Text

Discover global high-risk payment solutions designed for businesses in challenging sectors. Secure, reliable processing for all your payment needs. Get started today! Keywords-

0 notes

Text

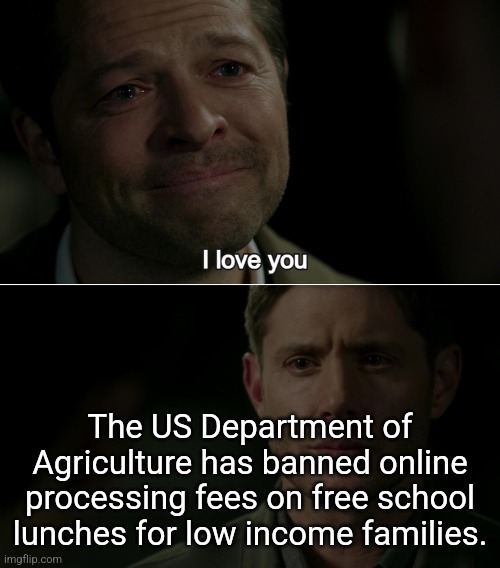

"School districts currently work with processing companies to offer cashless payment systems for families. But the companies can charge “processing fees” for each transaction. By law, students who are eligible for reduced price meals cannot be charged more than 30 cents for breakfast and 40 cents for lunch. With processing fees, however, families can end up paying 10 times that amount. Processing companies charge as much as $3.25 or 4% to 5% per transaction, according to a recent report from the Consumer Financial Protection Bureau."

source 1

source 2

source 3

#destiel meme news#destiel meme#news#united states#us news#us politics#free school meals#free school lunches#school lunches#low income#low income families#food is a human right#basic human rights#finally some good fucking news#i'll be going back and adding the good news tag to things#we could really use it right now

14K notes

·

View notes