#Open Banking Market Industry

Explore tagged Tumblr posts

Text

#Open Banking Market#Open Banking Market Trends#Open Banking Market Growth#Open Banking Market Industry#Open Banking Market Research#Open Banking Market Report

0 notes

Text

Future of Banking Industry: Trends and Market Analysis

The banking market is a critical component of the global economy, providing essential financial services to individuals and businesses. This blog will explore various aspects of the banking market, including its size, share, growth trends, key players, and challenges it faces.

Market Size, Share, and Growth

The global banking market is projected to grow significantly over the next few years. According to recent forecasts, the worldwide banking market is expected to expand at a compound annual growth rate (CAGR) of 4.92% from 2024 to 2029, reaching a market volume of approximately USD 10.83 trillion by 2029.

Retail Banking Segment

The retail banking sector, a major segment of the overall banking market, was valued at approximately USD 2.08 trillion in 2023 and is anticipated to grow to USD 3.97 trillion by 2034, reflecting a CAGR of 6% during the forecast period from 2024 to 2034. The Asia Pacific region is currently the largest market for retail banking, with significant growth driven by increasing disposable incomes and a growing middle class.

Market Share Distribution

The banking market is characterized by a mix of large global banks and regional players. The North American region is expected to dominate the retail banking market due to its focus on innovation and customer-centric services. In contrast, the Asia Pacific region is rapidly expanding, driven by technological advancements and a rising demand for digital banking services.

Market Trends

Several key trends are shaping the banking market today:

Digital Transformation: The shift towards digital banking is one of the most significant trends. Consumers increasingly prefer online and mobile banking solutions for their convenience and accessibility. This trend is prompting banks to invest heavily in technology to enhance their service offerings and improve customer experiences.

Personalized Banking Services: There is a growing demand for personalized banking experiences. Customers are looking for tailored financial solutions that meet their specific needs. Banks are leveraging data analytics and artificial intelligence to provide customized services and improve customer engagement.

Regulatory Changes: The banking sector is experiencing ongoing regulatory changes aimed at enhancing consumer protection and financial stability. Banks must adapt to these regulations while continuing to innovate and meet customer demands.

Sustainability Initiatives: Increasingly, banks are focusing on sustainability and responsible banking practices. This includes offering green financial products and investing in sustainable projects, reflecting a broader societal shift towards environmental responsibility.

Key Market Players

The banking market is populated by numerous players, ranging from large multinational banks to local institutions. Some of the prominent players include:

JPMorgan Chase & Co. (U.S.)

Bank of America (U.S.)

Citigroup Inc. (U.S.)

Wells Fargo (U.S.)

Goldman Sachs (U.S.)

ICBC (China)

Mitsubishi UFJ Financial Group (Japan)

These banks are continuously seeking to enhance their market position through innovation, mergers, and acquisitions. For instance, JPMorgan Chase has been at the forefront of adopting new technologies to streamline operations and improve customer service.

Market Share Insights

North America is projected to hold the largest share of the retail banking market, driven by innovation and a focus on customer-centric models. The Asia Pacific region, however, is expected to see the fastest growth, fueled by a burgeoning population and increasing digital banking adoption.

Market Challenges

Despite the positive growth outlook, the banking market faces several challenges:

Regulatory Compliance: Banks must navigate complex regulatory environments that can vary significantly across regions. Compliance with these regulations requires substantial resources and can hinder operational flexibility.

Cybersecurity Threats: As banks increasingly rely on digital platforms, the risk of cyberattacks has escalated. Protecting customer data and maintaining trust is paramount, necessitating ongoing investment in cybersecurity measures.

Economic Uncertainty: Global economic fluctuations can impact lending practices and consumer confidence. Economic downturns can lead to increased loan defaults, affecting banks' profitability.

Competition from Fintech: The rise of fintech companies poses a significant challenge to traditional banks. These agile startups often provide innovative solutions that cater to the evolving needs of consumers, forcing banks to adapt quickly to remain competitive.

Conclusion The banking market is poised for significant growth, driven by digital transformation, personalized services, and a focus on sustainability. While the market presents numerous opportunities, it also faces challenges that require strategic navigation. Key players in the banking sector must continue to innovate and adapt to changing consumer preferences and regulatory landscapes to maintain their competitive edge. As the market evolves, those that embrace technology and prioritize customer experience will likely emerge as leaders in this dynamic industry.

#Banking Market#banking market share#banking industry reports#Open Banking Market#banking market size

0 notes

Text

Online Banking Market Outlook - 2027: Navigating Growth amidst Digital Transformation

The global online banking market demonstrated substantial growth, valued at $11.43 billion in 2019, and is projected to reach $31.81 billion by 2027, marking a significant Compound Annual Growth Rate (CAGR) of 13.6% from 2020 to 2027.

1. Market Dynamics and Growth Projections

The surge in demand for online banking services continues to reshape the financial landscape. Online banking, also known as internet banking or web banking, is an electronic payment system that empowers users to conduct financial transactions seamlessly via the internet. This digital transformation is designed for convenience, providing users with a time-saving banking experience and real-time problem resolution services.

2. Understanding Online Banking

Online banking has become more than a convenience; it's an essential part of the modern banking experience. With electronic payment systems, users can conduct transactions, check account balances, and perform various banking activities through internet platforms. The emphasis is on providing a user-friendly interface and efficient services.

3. Market Size and Growth Trends

As of 2019, the global online banking market stood at $11.43 billion, and the projection for 2027 is an impressive $31.81 billion. The robust growth, evident in the CAGR of 13.6%, signifies a sustained trajectory towards a digitally dominated banking landscape.

4. Seamless Experience: Bridging Online and Mobile Channels

While the surge in online banking is undeniable, the challenge lies in providing a seamless experience across online and mobile channels. Banks must focus on creating an integrated environment where users can transition effortlessly between platforms. This approach ensures not only convenience but also aligns with the evolving preferences of the digitally savvy consumer.

5. Accelerating Customer Engagement: Meeting Demands and Preferences

The digital era demands more than just a functional online banking platform. Customer engagement is paramount, necessitating banks to go beyond transactional services. By understanding and meeting customer demands, needs, and preferences, banks can foster lasting relationships and secure their position in the competitive digital banking landscape.

6. Challenges and Opportunities in the Online Banking Sphere

6.1 Challenges: Security Concerns and Digital Literacy

The growth of online banking is not without challenges. Security concerns persist, requiring continuous innovation in cybersecurity measures. Additionally, digital literacy remains a barrier for some users, highlighting the importance of educational initiatives to enhance user confidence in online transactions.

6.2 Opportunities: Fintech Collaborations and Innovation

On the flip side, opportunities abound in the form of collaborations with Fintech companies and continuous innovation. Fintech partnerships enable banks to leverage cutting-edge technologies, enhancing the user experience and staying ahead in the competitive digital banking landscape.

7. Future Trends: Personalization and AI Integration

Looking ahead, personalization and Artificial Intelligence (AI) integration are anticipated to be key trends. Tailoring online banking experiences to individual preferences and incorporating AI-driven solutions for predictive analytics and problem resolution will further elevate the digital banking experience.

8. Conclusion: Shaping the Future of Banking

In conclusion, the Online Banking Market Outlook for 2027 is a testament to the transformative power of digital banking. The industry's growth has opened new avenues and presented challenges that demand innovative solutions. As banks navigate this digital frontier, the focus on seamless experiences, customer engagement, and staying abreast of emerging trends will be instrumental in shaping the future of Online banking.

9. FAQs (Frequently Asked Questions)

Q: What drove the surge in demand for online banking services?

A: The increasing demand for convenient and efficient banking services, coupled with the digitalization of financial activities, contributed to the surge in online banking usage.

Q: What is the projected market size for online banking in 2027?

A: The market is projected to reach $31.81 billion by 2027, growing at a CAGR of 13.6% from 2020.

Q: How can banks provide a more seamless experience between online and mobile channels?

A: Banks should focus on creating an integrated environment that allows users to transition effortlessly between online and mobile channels.

Q: What challenges does the online banking industry face?

A: Security concerns and the need for enhanced digital literacy are key challenges in the online banking sphere.

Q: What future trends are anticipated in the online banking sector?

- A: Personalization and AI integration are expected to be key trends, enhancing the user experience and problem resolution in online banking.

#banking industry reports#digital banking market#open banking market size#Digital Banking Industry#Digital Banking Platform Market

0 notes

Note

So why do you hate the advertising industry?

Hokay so.

Let me preface this with some personal history. It's not relevant to the sins of the advertising industry perse but it illustrates how I started to grow to hate it.

I wanted to be a veterinarian growing up, but to be a vet you basically have to be good enough to get into medical school. I do not have the math chops or discipline to make it in medical school. I went into art instead, and in a desperate attempt to find some commercial viability that didn't involve moving to California, I went into graphic design.

I've been a graphic designer for about seven or eight years now and I've worn a lot of hats. One of them was working in a print shop. Now, the print shop had a lot of corporate customers who had various ad campaigns. One of them was Gate City Bank, which had a bigass stack of postcards ordered every couple months to mail to their customers.

Now, paper comes from Dakota Paper, and they make their paper the usual way. Somewhere far, far from our treeless plain there is a forest of tall trees. These trees are cut down and put on big fossil fuel burning trucks and hauled to a paper mill that turns them into pulp while spewing the most fowl odors imaginable over the neighboring town and loads the pulp up with bleach to give it a nice white color.

Then the paper is put on yet another big truck and hauled off to the local paper depot, then put on another big truck and delivered to my print shop, where I turned the paper into postcards telling people to go even deeper into debt to buy a boat because it's almost summer. The inks used are a type of nasty heat sensitive plastic that is melted to the surface of the paper with heat. Then the postcards are put on yet ANOTHER truck and sent to the bank, which puts them on ANOTHER truck and finally into the hands of their customers, who open their mail and take one look at the post card and immediately discard it.

Heaps and heaps and literal hundreds of pounds of literal garbage created at the whim of the marketing team several times a year. And thats just one bank in one city.

I came to realize very quickly that graphic design was the delicate art of turning trees into junk mail.

And wouldn't you know it there are a TON of companies that basically only do junk mail. Many of them operate under the guise of a "charity," sending you pictures of suffering children or animals and begging for handouts and when they get those handouts the executives take a nice fat cut, give some small token amount to whatever cause they pay lip service to, and then put the rest of the cash right back into making more mailers. "Direct mail marketing" they call it.

Oh but maybe it's not so bad, you can advertise online after all. Now that there's decent ad blocker out there and better anti-virus ads usually don't destroy your computer anymore just by existing.

Except now when I search for the exact business I want on Google it's buried under three or four different "promoted search items" tricking me into clicking on them only to shoot themselves in the foot because I searched for the specific result I wanted for a reason and couldn't use those other websites even if I felt like it.

And now we have advertising on YouTube and on every streaming service, forcing more and more eyes onto the ad for the brand new Buick Envision that parks itself because you're too stupid to do it on your own.

Oh thats ok maybe I'll get Spotify premium and go ad free and listen to some podcasts- SIKE we have the hosts of your show doing the song and dance now. Are you depressed and paranoid from listening to my true crime podcast about murdered and mutilated teenagers? That's ok, my sponsor Better Help can keep you sane enough to stay alive and spend more money.

It's gotten so terrible that now you have content farms, huge hubs of shell companies that crank out video after video to get more and more precious clicks. Which if the videos were innocuous maybe that wouldn't be so awful except now you have cooking hacks that can actually burn your house down and craft hacks that can electrocute you being flung into your eyes at the speed of mach fuck so some slimy internet clickbait jockey doesn't need to get a real job.

It of course goes without saying that animals are also relentlessly exploited by clickbait companies that will put them in compromising situations on purpose to create a fake fishing hack video or even just straight up killing them for sport by feeding small animals to a pufferfish that rips them apart for the camera.

And all of this, ALL of this doesn't even touch how adveritising is the death of art in general. Queer topics, any kind of interesting art, any kind of sex or substance use topics are scrubbed clean and hidden at the behest of advertisers.

Sex education, a nude statue, topics such as racism or sexism or bigotry in general have tags purged or hidden from search, even life saving information about SDTs or drug use, because if someone saw that and complained then Verizon might sell fewer tablets and we can't fucking have that.

Conservative talking heads often bitch and moan that they're being censored on social media. The stupid part is, they're right! They are being censored! But it's not by a woke mob, it's by ATT and Coca Cola not wanting their adspace sharing screen time with their stupid fucking opinions.

However, they won't ever figure that out, because the talking heads they get their marching orders from like Tucker and Jones ALSO rely on the sweet milk flowing from the sponsorship teat and they aren't about to turn on their meal ticket so they have to come up with even stupider shit to say for the train to continue rolling.

I managed to rant this far without even getting into the ads I see for the beauty industry. The other day a botox ad described wrinkles as "moderate to severe crows feet" as if wrinkles are a symptom of a fucking serious disease! Like having a flaw in your skin is a medical problem that you need thousands of dollars of literal botulism toxin to fix! I was incandescent with anger.

Advertising is a polluting, censoring, anti educational and anti art industry at it's very core. It destroys human connections, suppresses human thought and makes us hate our own bodies. It ads no value, actively detracts from value, and serves no real purpose and I believe it should be almost if not entirely banned.

23K notes

·

View notes

Text

𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞 - 𝐖𝐡𝐞𝐫𝐞 𝐭𝐨 𝐟𝐢𝐧𝐝 𝐠𝐚𝐢𝐧𝐬?

Masterlist - YouTube (subliminals)

In Vedic Astrology, the eleventh house is known as the House of Gains and represents your aspirations, income, and the fulfillment of desires. This house shows how and where you are likely to achieve success and material wealth in life. The placement of the ruling planet of your eleventh house, as well as any planets within it, offers insight into the sources of your financial gains, social connections, and overall prosperity. Essentially, understanding the eleventh house helps you see where opportunities for growth and abundance may manifest in your life.

𝐀𝐫𝐢𝐞𝐬 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Aries influencing your eleventh house, you tackle friendships, goals, and financial gains with enthusiasm, boldness, and a trailblazing attitude. You’re likely to secure wealth by being assertive, taking calculated risks, and pursuing competitive or entrepreneurial paths. Your friends and social networks are often key to your success, frequently drawn from dynamic or high-energy environments.

Mars in the Houses (Mars is the ruler of Aries)

Mars in the 1st House: Your gains come from personal drive, leadership, and independent projects. For example, you might start a business like a fitness studio, using your energy and visibility to promote your brand and grow your venture.

Mars in the 2nd House: Wealth tends to flow from managing finances, property, or physical assets. You might find success through real estate investments, or in financial sectors such as banking, perhaps working as a stockbroker or in property management.

Mars in the 3rd House: Profits are linked to communication, marketing, media, or travel. You might thrive in advertising, writing for publications, or running a travel blog, turning your communication skills into financial gain.

Mars in the 4th House: Your wealth could come from real estate, family inheritance, or home-based businesses. For instance, you might profit from buying and renovating homes or establish a successful home business, such as property management or interior design.

Mars in the 5th House: Creative projects, speculative investments, or entertainment ventures may be lucrative for you. This could mean profiting from stock market investments, cryptocurrency, or finding success in the arts as a performer or artist.

Mars in the 6th House: Hard work, health-related fields, or competitive industries could bring financial rewards. You might build wealth through a career in healthcare, as a personal trainer, or by excelling in a demanding legal profession, gaining success by overcoming obstacles.

Mars in the 7th House: Financial gains are often tied to partnerships—whether personal or business-related. You could team up with someone to start a business like a law firm or gain wealth through marriage to a prominent or driven partner.

Mars in the 8th House: Joint ventures, inheritances, or industries focusing on transformation, such as finance or psychology, could bring you wealth. You might inherit assets or succeed through business partnerships or roles in fields like investment banking or insurance.

Mars in the 9th House: Wealth may arise from education, law, travel, or publishing. You could build success as a professor, lawyer, or publisher, or by pursuing international opportunities, such as work in the travel industry.

Mars in the 10th House: Career achievements, leadership positions, or public recognition are key to your financial success. You might rise to a leadership role, like CEO or political figure, where your ambition and dynamic energy lead you to the top.

Mars in the 11th House: Your wealth may stem from your social circles, technology, or large organizations. You could benefit by working in the tech industry, founding an innovative business, or through influential friends who open doors to profitable opportunities.

Mars in the 12th House: Profits come from behind-the-scenes efforts, foreign ventures, or spiritual pursuits. You might gain financially by working in hospitals, charitable organizations, or through businesses tied to travel, import/export, or spiritual guidance.

𝐓𝐚𝐮𝐫𝐮𝐬 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Taurus governing your eleventh house, your approach to wealth and gains is grounded, patient, and often centered around material security. You favor slow, steady growth, and may build your financial success through reliable investments or artistic ventures. Friendships and social networks can be significant in your financial development, particularly when aligned with shared values or tied to industries focused on luxury and beauty.

Venus in the Houses (Venus is the ruler of Taurus)

Venus in the 1st House: You are likely to attract wealth through your charm, physical appeal, and the way you present yourself. For instance, you could succeed in beauty, fashion, or personal branding—becoming a successful influencer or model, where your appearance and social magnetism are vital assets.

Venus in the 2nd House: Wealth flows through careful handling of finances, luxury goods, or industries related to beauty and aesthetics. You might find financial success in areas like fine art, jewelry, or running a high-end boutique. This placement supports a steady income in beauty or fashion-related businesses.

Venus in the 3rd House: Financial success arises through communication, media, or education, particularly in artistic fields. You could thrive as a writer, work in advertising or public relations, or make money from teaching or speaking on topics related to beauty or luxury.

Venus in the 4th House: Gains are often tied to property, real estate, or home-based ventures, particularly those related to comfort and aesthetics. You might generate wealth by flipping houses, engaging in interior design, or running a family business. Inheritance or familial wealth could also play a role.

Venus in the 5th House: Your financial success may come from creative endeavors, entertainment, or speculative investments. You could profit from acting, filmmaking, or other artistic projects. Additionally, this placement can indicate gains through stock market investments, particularly in sectors related to art or entertainment.

Venus in the 6th House: Profits are earned through service, health, or beauty-related industries. You might build wealth by working in areas like cosmetology, health spas, or wellness centers. A talent for creating a harmonious work environment could also lead to financial success in these fields.

Venus in the 7th House: Gains often come through partnerships, whether in marriage or business. You may benefit financially through a significant relationship or business collaboration, particularly with someone involved in luxury, legal fields, or the arts. Joint ventures in creative industries could be very profitable.

Venus in the 8th House: Wealth may come from inheritances, shared resources, or transformative industries. You might gain through an inheritance, or profit from partnerships in finance, psychology, or the arts. This placement can also suggest financial gains through investments or using other people’s assets effectively.

Venus in the 9th House: Financial success is connected to education, law, or travel, especially in beauty or luxury industries. You might earn through international fashion, tourism, or by teaching beauty-related subjects at a university. There’s also potential for profit from foreign investments or luxury travel enterprises.

Venus in the 10th House: Wealth comes from career success, public recognition, or artistic achievements. You might thrive in high-profile roles within the arts, luxury markets, or fashion industry. This placement is highly favorable for building wealth through a career in design, beauty, or entertainment.

Venus in the 11th House: Gains are tied to social networks, large organizations, or technology, particularly within the luxury or beauty sectors. You could profit from working in social media marketing or technology platforms related to fashion or beauty. Friendships and connections in elite circles may also lead to financial opportunities.

Venus in the 12th House: Profits come from behind-the-scenes work, foreign ventures, or spiritual and artistic pursuits. You might find financial success through working in luxury hotels or resorts abroad, or by being involved in art projects that promote beauty or tranquility. Investments in foreign luxury markets could also be rewarding.

𝐆𝐞𝐦𝐢𝐧𝐢 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Gemini ruling your eleventh house, your approach to financial gains is driven by intellect, communication, and adaptability. You may accumulate wealth through industries such as writing, media, technology, or education, where your ability to communicate ideas clearly and multitask proves invaluable. Social networks and friendships can be instrumental in your financial success, and you tend to thrive in environments where flexibility and quick thinking are required to stay ahead in an ever-evolving world.

Mercury in the Houses (Ruler of Gemini)

Mercury in the 1st House: Financial success comes from your personal communication skills, fast thinking, and intellectual pursuits. For example, you may achieve wealth as a public speaker, teacher, or writer, where your ability to express yourself clearly and think on your feet directly contributes to your success.

Mercury in the 2nd House: Wealth is generated through intellectual work, business, or trade, especially in fields involving communication or technology. You might find financial success by managing a tech startup, working in sales, or running a communications-based business, such as publishing or e-commerce.

Mercury in the 3rd House: Profits are tied to communication, writing, journalism, or short-distance travel. You could earn money as a journalist, blogger, or in public relations, using your communication skills to promote products, services, or ideas.

Mercury in the 4th House: You may gain wealth through real estate, family businesses, or intellectual work done from home. For example, running an online business, freelancing, or writing from home could be highly profitable. There is also potential for success in educational ventures related to real estate or family enterprises.

Mercury in the 5th House: Wealth can be accumulated through creative pursuits, entertainment, or speculative investments. You might succeed financially by writing screenplays, managing creative projects, or working in the entertainment industry. This placement also suggests potential gains from stock market investments or other speculative ventures.

Mercury in the 6th House: Profits come from service-oriented industries, health, or work involving communication or technology. For instance, you might find financial success working as a healthcare administrator, medical transcriptionist, or by managing digital solutions in the healthcare sector.

Mercury in the 7th House: Financial gains are often linked to partnerships, both personal and business, and intellectual collaborations. You may benefit by working with a business partner in legal, consulting, or writing fields. Marriage or partnerships in these industries may also bring financial advantages.

Mercury in the 8th House: Wealth is earned through joint ventures, inheritances, or industries that focus on transformation and finance. You might thrive in managing other people’s money, such as in financial planning or investments, or profit through publishing books on psychology or the occult.

Mercury in the 9th House: Profits come from teaching, law, travel, or publishing, especially on international platforms. For example, you might gain wealth by working as a professor, lawyer, or writer, particularly if your work involves education, international law, or travel blogging.

Mercury in the 10th House: Wealth is tied to career achievements, public speaking, or intellectual endeavors. You could succeed financially as a high-profile journalist, politician, or public speaker, where your communication skills and intellectual abilities propel your career forward.

Mercury in the 11th House: Gains are linked to social networks, technology, or large organizations, particularly those involving communication. You might profit by managing online platforms, social media businesses, or through connections with tech companies, where your ability to network and communicate pays off financially.

Mercury in the 12th House: Financial success comes from behind-the-scenes work, foreign ventures, or intellectual and spiritual pursuits. You might earn through research, spiritual writing, or working in foreign lands as a consultant or writer, especially on topics related to international affairs or spiritual matters.

𝐂𝐚𝐧𝐜𝐞𝐫 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Cancer ruling your eleventh house, your approach to financial gains is deeply influenced by emotional connections, nurturing relationships, and home-related ventures. You are likely to accumulate wealth through businesses that promote comfort, security, or caregiving, such as hospitality, food, real estate, or childcare. Your social networks and friendships often play a crucial role in your financial success, providing both emotional support and practical assistance.

Moon in the Houses (Ruler of Cancer)

Moon in the 1st House: Your financial gains are tied to self-driven efforts and emotional expression. For example, you might succeed by becoming a public figure in nurturing roles, such as a therapist, chef, or lifestyle coach, where you can connect with others through your emotions and personal brand.

Moon in the 2nd House: Wealth comes from a strong desire for financial security and possibly from family resources. You might accumulate wealth through real estate investments, family-run businesses, or careers related to food, home goods, or caregiving, such as owning a family restaurant or working in childcare.

Moon in the 3rd House: Profits arise through communication, media, or relationships within your local community. You might earn by writing about family, home life, or food, or through local ventures like running a café or bakery. Short-distance travel or involvement in local businesses can also bring financial success.

Moon in the 4th House: Gains are connected to family, real estate, or home-based businesses. You may profit from buying and selling properties, managing rentals, or running a business from home, such as interior design, home decor, or even a bed-and-breakfast.

Moon in the 5th House: Wealth comes from creative endeavors, children, or emotionally fulfilling projects. You could find financial success by working on projects related to children, such as writing children’s books or running a daycare. Speculative ventures, particularly those that resonate with family values, could also prove profitable.

Moon in the 6th House: Financial success is tied to service-oriented professions, health, or caregiving roles. You might earn money by working in healthcare, nutrition, or any field that involves caring for others, such as being a nurse, dietitian, or personal caregiver.

Moon in the 7th House: Wealth comes through partnerships, marriage, or collaborative ventures. You may benefit from a business partnership or marriage, particularly in caregiving or hospitality-related industries, such as real estate, family-owned businesses, or ventures focused on comfort and security.

Moon in the 8th House: Financial gains may come from inheritances, shared resources, or transformative industries. You could inherit family wealth or benefit from joint ventures in industries like psychology, emotional healing, or those dealing with death and transformation, such as funeral services.

Moon in the 9th House: Wealth arises from higher education, travel, or teaching in nurturing roles. You might profit from teaching caregiving or hospitality-related subjects, or by working in real estate or hospitality abroad. Writing or publishing on family, home, or caregiving topics can also bring financial rewards.

Moon in the 10th House: Your financial success is closely tied to career achievements in caregiving or public service roles. You might excel in public careers related to healthcare, food, or hospitality, such as managing a chain of hotels or leading a family business in the food or service industry.

Moon in the 11th House: Financial gains come through social networks, community involvement, or large organizations focused on caregiving and emotional well-being. You could profit by working in healthcare, social work, or community welfare organizations, or by leveraging supportive friendships and networks to create financial opportunities.

Moon in the 12th House: Profits are earned through behind-the-scenes work, foreign ventures, or roles involving emotional and spiritual healing. You might gain wealth by working in hospitals, spiritual retreats, or through caregiving roles in secluded settings like a hospice. Overseas ventures related to caregiving, or spiritual services, may also bring financial success.

𝐋𝐞𝐨 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Leo ruling your eleventh house, you pursue financial gains with a sense of confidence, creativity, and a desire for recognition. Leadership roles, creative ventures, and public visibility are likely to be avenues for accumulating wealth. Your social networks can significantly influence your success, particularly when they involve influential or creative individuals. Your drive to express your individuality and stand out pushes you toward financial success, especially in areas where you can shine and take on prominent roles.

Sun in the Houses (Ruler of Leo)

Sun in the 1st House: Financial gains come through personal charisma, leadership, and self-promotion. You might achieve wealth by being the face of a business, becoming a public figure, or stepping into leadership roles where your confidence and presence attract opportunities—such as becoming an entrepreneur, actor, or leader in a visible field.

Sun in the 2nd House: Wealth is earned through personal assets, financial management, and a focus on material security. You could profit from investments in luxury goods, art, or jewelry, or by taking leadership roles in industries related to wealth management or high-end markets. Your focus on stability and value makes you financially successful.

Sun in the 3rd House: Profits arise through communication, media, and entrepreneurial ventures involving short-distance travel or education. You might gain wealth by working in media, public speaking, or by leading a business that focuses on writing, marketing, or teaching.

Sun in the 4th House: Wealth comes through real estate, family businesses, or home-related industries. You may accumulate wealth by managing property, working in real estate, or profiting from family enterprises. This placement also favors ventures focused on luxury home environments, such as interior design or property development.

Sun in the 5th House: Your financial success comes from creative endeavors, entertainment, or speculative investments. You could thrive in careers involving acting, performing, or creating luxury goods. Additionally, speculative markets like stocks or investments in industries related to children, education, or entertainment could lead to wealth.

Sun in the 6th House: Wealth is gained through service-oriented professions, health industries, or leadership in daily work routines. You might find financial success by managing teams in healthcare, leading service industries, or excelling in high-profile positions that involve helping others, such as fitness or wellness management.

Sun in the 7th House: Gains come through partnerships, marriage, or collaborative business ventures. You may accumulate wealth through a significant partnership, whether in marriage or business, especially in high-profile fields like law, entertainment, or public relations. Taking a leadership role in joint ventures can also be a path to financial success.

Sun in the 8th House: Wealth may come from joint ventures, inheritances, or transformative industries. You could gain financially through family inheritance or by working in fields such as psychology, investments, or life-transition industries like insurance, counseling, or financial planning.

Sun in the 9th House: Profits arise from teaching, travel, law, or publishing, particularly in high-profile or international roles. You may gain wealth as a well-known educator, lawyer, or author. Opportunities in travel or working within global industries, such as luxury tourism or international business, can also lead to financial success.

Sun in the 10th House: Financial success is linked to career achievements, leadership roles, and public authority. You could become wealthy by taking on leadership positions in large corporations, government, or entertainment industries. Public recognition and respect for your work often translate into financial rewards.

Sun in the 11th House: Wealth comes from social networks, large organizations, or technology. You could profit from networking with influential individuals or working in large corporations or tech-based industries. This placement is ideal for standing out and taking leadership roles in media, technology, or large organizations.

Sun in the 12th House: Financial gains are achieved through behind-the-scenes work, foreign ventures, or spiritual and creative pursuits. You might build wealth by working in secluded settings such as hospitals, spiritual retreats, or foreign countries. Creative projects related to introspection, art, or spirituality can also be sources of financial success.

𝐕𝐢𝐫𝐠𝐨 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Virgo ruling your eleventh house, your approach to financial gains is practical, detail-oriented, and focused on efficiency. You are likely to accumulate wealth through work related to service, health, research, or intellectual pursuits. Success comes from refining systems, improving processes, and maintaining a methodical approach to your goals. Your social networks tend to be composed of hardworking, dedicated individuals who share your values. Your ability to analyze, organize, and solve problems ensures steady and sustainable financial growth over time.

Mercury in the Houses (ruler of Virgo)

Mercury in the 1st House: Financial gains come through your intelligence, communication skills, and self-promotion. For example, you might find success by using your analytical mind and problem-solving abilities in fields like consulting, writing, or teaching, where you can establish yourself as an expert.

Mercury in the 2nd House: Wealth is earned through intellectual work, business, or fields involving communication. You may thrive in careers such as accounting, bookkeeping, or managing small businesses, where attention to detail and financial management skills are crucial to your success.

Mercury in the 3rd House: Profits arise from writing, media, communication, or local businesses. You could earn by working as a journalist, editor, or teacher, or through running a local business. Communication-based work, such as starting a blog focused on health, wellness, or practical advice, may also be profitable.

Mercury in the 4th House: Gains are linked to home-based businesses, family enterprises, or real estate. You might succeed by running a family business, working from home as a consultant, or investing in property. This placement also favors careers in home improvement services or real estate management.

Mercury in the 5th House: Wealth comes from creative projects, education, or speculative ventures. You could achieve financial success by working in children's education, teaching, or coaching. Alternatively, you might profit from creative writing or speculative investments like the stock market or gambling.

Mercury in the 6th House: Profits are earned through health-related fields, service-oriented work, or administrative roles. You could find financial success by working in healthcare management, as a nutritionist, or in wellness-related industries, where your organizational skills and attention to detail are vital assets.

Mercury in the 7th House: Wealth comes through partnerships, collaborations, or legal work. You may benefit from working with a business partner on intellectual ventures, writing contracts, or consulting in fields like mediation, counseling, or legal advice.

Mercury in the 8th House: Financial gains are tied to joint ventures, investments, or transformative industries. You might earn through financial planning, investment management, or by working in research, psychology, or therapeutic industries that focus on personal or financial transformation.

Mercury in the 9th House: Profits arise from teaching, travel, law, or publishing. You might find success in education, international business, or travel-related industries, such as becoming a travel blogger. Writing or publishing, especially on academic or philosophical topics, can also lead to wealth.

Mercury in the 10th House: Wealth is linked to career achievements in intellectual or communication-driven roles. You could thrive in high-level administrative positions, corporate communication roles, or as an expert consultant in your chosen field, where your intellect and organizational abilities shine.

Mercury in the 11th House: Gains come from social networks, technology, or large organizations. You might profit from working in tech, analytics, or science-based industries, or by leveraging a large network of business or intellectual connections to create financial opportunities.

Mercury in the 12th House: Financial success comes from behind-the-scenes work, foreign ventures, or research. You could earn by working in secluded environments like hospitals or research institutions, or through intellectual pursuits abroad, such as becoming a translator, international consultant, or academic researcher.

𝐋𝐢𝐛𝐫𝐚 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Libra ruling your eleventh house, your approach to financial gains is driven by balance, harmony, and social relationships. You may accumulate wealth through collaborations, partnerships, and connections in fields related to beauty, art, law, or diplomacy. Your friendships and social networks are essential to your financial success, often helping you form important alliances. Creating peace and harmony in group settings or within partnerships is likely to open doors for lucrative opportunities.

Venus in the Houses (ruler of Libra)

Venus in the 1st House: Financial gains come through your personal charm, appearance, and social appeal. For instance, you might succeed in industries like fashion, beauty, or public relations, where your ability to present yourself in an attractive and harmonious manner brings lucrative opportunities.

Venus in the 2nd House: Wealth is earned through luxury goods, aesthetics, or careful financial management. You might thrive by working in the fashion industry, running a high-end boutique, or managing a jewelry business. Your appreciation for beauty and material comfort will likely guide you toward financial success.

Venus in the 3rd House: Profits arise through communication, media, or education, especially in artistic fields. You could gain financially by writing about beauty, fashion, or relationships, or by working in advertising, public relations, or media. Your ability to communicate artistic or aesthetic ideas effectively leads to financial gains.

Venus in the 4th House: Gains come from real estate, family businesses, or ventures related to home and beauty. You might profit from interior design, property management, or home-based beauty services. Family wealth or engaging in industries that enhance comfort and beauty within domestic spaces can also contribute to your financial success.

Venus in the 5th House: Wealth is generated through creative endeavors, entertainment, or speculative ventures. You might succeed in the arts, acting, or through performing. Additionally, investments in luxury or fashion-related industries may bring financial rewards. Romantic partnerships or ventures involving children could also be lucrative.

Venus in the 6th House: Profits come from service-oriented work, health, or beauty industries. You may earn by working in wellness, fashion, or beauty services, such as being a beautician, personal stylist, or running a health spa. Your ability to create harmonious environments in the workplace will further boost your income.

Venus in the 7th House: Gains come through partnerships, marriage, or legal work. You might profit from a marriage or business partnership, especially in beauty, law, or fashion. Collaborative ventures in fields like wedding planning, relationship counseling, or law could lead to significant financial gains.

Venus in the 8th House: Wealth comes from inheritances, joint ventures, or industries focused on transformation. You might gain through shared resources, marriage, or by working in financial planning or psychology. Joint investments, luxury services, or industries like cosmetic surgery could also lead to financial success.

Venus in the 9th House: Profits arise from teaching, travel, law, or publishing, particularly in areas related to beauty or relationships. You might earn money by teaching or writing about relationships, law, or artistic topics. Businesses involving luxury travel or beauty tourism may also be highly profitable.

Venus in the 10th House: Wealth comes from career achievements in the public sphere, particularly in beauty, law, or the arts. You could thrive by holding a prominent position in the fashion or beauty industry, or as a public figure in law, diplomacy, or entertainment. Public recognition for your work in aesthetic fields will likely lead to financial success.

Venus in the 11th House: Gains come through social networks, large organizations, or technology, particularly in fields related to beauty or luxury. You might profit by working in fashion technology, social media marketing, or through influential friends in high-end sectors. Networking with creative professionals can introduce lucrative opportunities.

Venus in the 12th House: Financial success comes from behind-the-scenes work, foreign lands, or spiritual and artistic endeavors. You might earn wealth by working in luxury hotels, wellness retreats, or through charitable work that promotes beauty and harmony. Artistic projects in secluded environments or abroad could also bring financial rewards.

𝐒𝐜𝐨𝐫𝐩𝐢𝐨 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Scorpio ruling the eleventh house, your approach to financial gains is strategic, intense, and often transformative. You tend to accumulate wealth through deep emotional relationships, joint ventures, or industries tied to finance, psychology, and transformation. Your social networks are likely to include powerful and influential individuals, and you may leverage these connections to access hidden resources or manage shared assets. Your determination and ability to navigate complex situations help you achieve long-term financial success.

Mars in the Houses (ruler of Scorpio)

Mars in the 1st House: Financial gains come through your personal drive, ambition, and assertive actions. You may accumulate wealth by starting your own business, taking on leadership roles, or working in high-energy fields like sports, fitness, or entrepreneurship, where quick decision-making and initiative are key.

Mars in the 2nd House: Wealth is earned through physical assets, assertive financial management, or industries tied to material goods. You might gain by investing in real estate, working in property management, or industries related to construction or metals. Your proactive approach to financial matters ensures solid material growth.

Mars in the 3rd House: Profits arise from communication, writing, or media-related ventures. You might build wealth by working in journalism, marketing, or running a media company. Quick thinking and direct communication are your assets, and industries like sales or short-term travel can also lead to financial success.

Mars in the 4th House: Financial success comes through real estate, family inheritances, or home-based businesses. You might accumulate wealth by investing in property, renovating homes, or managing a family business. Ventures related to real estate or home improvements, such as house flipping, can prove highly profitable.

Mars in the 5th House: Wealth comes from creative ventures, speculative investments, or entertainment industries. You could succeed as an actor, director, or in any creative field, especially those involving risk, like the stock market or cryptocurrency. Your willingness to take calculated risks could lead to significant financial rewards.

Mars in the 6th House: Profits come from service-oriented professions, health fields, or competitive industries. You may achieve financial success in healthcare as a surgeon or physical trainer, or by excelling in competitive environments like law, the military, or corporate sectors. Your perseverance and work ethic lead to consistent financial gains.

Mars in the 7th House: Financial gains are tied to partnerships, alliances, or marriage. You might profit from a strategic business partnership in fields like law, finance, or consulting. Alternatively, wealth may come through marriage, particularly if your partner works in a high-energy or competitive industry.

Mars in the 8th House: Wealth comes from joint ventures, inheritances, or industries focused on transformation. You could build financial success by managing other people’s resources in roles like investment banking, financial planning, or insurance. Inheritance or working in fields like psychology, healing, or transformative services could also bring wealth.

Mars in the 9th House: Profits arise from teaching, law, international business, or travel-related industries. You might gain by working as a professor, lawyer, or through international business ventures. Travel, foreign investments, or industries like adventure tourism or higher education can also be financially rewarding.

Mars in the 10th House: Wealth is tied to career achievements, public recognition, and leadership roles. You may achieve financial success by leading large organizations or taking on prominent roles in competitive fields like finance, military, or government. Your ambition and determination push you toward the top, where financial rewards follow.

Mars in the 11th House: Gains come through social networks, large organizations, or collective ventures. You might profit by working in technology, finance, or large-scale enterprises. Your ability to network within influential circles and lead group initiatives opens up significant financial opportunities.

Mars in the 12th House: Financial success comes from behind-the-scenes work, foreign investments, or industries related to healing and spirituality. You could build wealth by working in hospitals, prisons, or spiritual retreats. Investments abroad or in transformative fields, such as therapy or hidden resources, could also be lucrative.

𝐒𝐚𝐠𝐢𝐭𝐭𝐚𝐫𝐢𝐮𝐬 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Sagittarius ruling your eleventh house, your approach to financial gains is characterized by expansiveness, optimism, and a focus on growth, higher learning, and adventure. Wealth may come from teaching, international business, publishing, law, or travel-related endeavors. Your social circles are broad and diverse, often including individuals from various cultural and intellectual backgrounds. Financial success is likely to come by embracing opportunities that involve exploration, education, or philosophical pursuits, allowing you to expand your horizons.

Jupiter in the Houses (ruler of Sagittarius)

Jupiter in the 1st House: Gains come through personal charisma, leadership, and an optimistic outlook. Example: You could achieve wealth as a teacher, motivational speaker, or entrepreneur, where your confidence and expansive nature draw financial opportunities. Your leadership abilities and ability to inspire others help you attract success.

Jupiter in the 2nd House: Wealth is earned through investments, teaching, or industries tied to higher learning and travel. Example: You might accumulate wealth through international trade, real estate investments abroad, or by working in education, such as owning language schools or cultural institutions. Your ability to manage resources with a long-term perspective is key to your success.

Jupiter in the 3rd House: Profits arise from communication, writing, media, or short-distance travel, often connected to educational or philosophical topics. Example: You could earn by publishing books on travel, education, or philosophy, or by working in media that promotes intellectual growth. Local teaching ventures, educational tours, or creating content that inspires learning may also bring wealth.

Jupiter in the 4th House: Gains come from real estate, family businesses, or educational ventures related to the home. Example: You might profit from real estate investments, especially in culturally significant properties, or by running a family business involving education, such as homeschooling consulting or online educational programs.

Jupiter in the 5th House: Wealth is derived from creative pursuits, teaching, or speculative investments in educational or intellectual ventures. Example: You could build wealth by running educational programs for children, teaching creative subjects, or investing in entertainment or intellectual property. Your ability to inspire others through your creativity often leads to financial rewards.

Jupiter in the 6th House: Profits come through service industries, health, or teaching, particularly in educational or travel-related fields. Example: You might earn by teaching at universities, managing educational institutions, or working in healthcare sectors with an emphasis on wellness and travel, such as retreats or international health services.

Jupiter in the 7th House: Gains come through partnerships, collaborations, or legal work, especially in international or educational fields. Example: You could profit from a business or legal partnership that deals with international law, education, or foreign investments. Collaborative ventures that focus on growth, expansion, and global reach lead to significant financial success.

Jupiter in the 8th House: Wealth comes from joint ventures, inheritances, or transformation-based industries like finance or psychology. Example: You might gain financially through shared resources, investments, or inheritances. Working in transformative fields, such as financial planning, educational funding, or psychological counseling, could also bring wealth.

Jupiter in the 9th House: Profits arise from teaching, law, travel, or publishing, particularly in global or philosophical fields. Example: You might earn wealth as a professor, lawyer, or travel consultant. International business ventures, such as starting an educational travel company or publishing books on philosophy, could lead to significant financial success.

Jupiter in the 10th House: Wealth is tied to career achievements, public leadership, and authority in fields related to education, law, or travel. Example: You could gain wealth through high-profile roles in education, law, or as a public figure in global initiatives. Leadership in international business or educational reform could result in substantial financial rewards.

Jupiter in the 11th House: Gains come through social networks, large organizations, or technology, especially in education or travel. Example: You might profit by working with large educational or travel organizations, or by networking in intellectual and global circles. Involvement in global educational programs or travel technology startups could bring financial success.

Jupiter in the 12th House: Profits come from behind-the-scenes work, foreign lands, or spiritual and intellectual pursuits. Example: You might gain wealth by working in spiritual retreats, universities abroad, or industries related to foreign investments or educational ventures. Teaching or consulting in secluded or spiritual environments can also be lucrative, particularly in roles that focus on personal growth or spirituality.

𝐂𝐚𝐩𝐫𝐢𝐜𝐨𝐫𝐧 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Capricorn ruling your eleventh house, you take a disciplined, methodical approach to achieving financial gains, often focusing on long-term planning, hard work, and responsibility. Financial success may come through structured industries like business, government, real estate, or leadership roles. Your social networks are likely to include influential or authoritative figures, and you may achieve wealth by aligning yourself with institutions or steadily advancing within your chosen field. You are driven by the desire for stability, and your success often stems from careful, strategic efforts.

Saturn in the Houses (ruler of Capricorn)

Saturn in the 1st House: Financial gains come through personal discipline, leadership, and perseverance. Example: You might achieve wealth by taking on leadership roles where your reputation and hard work are essential. Becoming a CEO or rising in a field that values responsibility and structure could lead to long-term financial success.

Saturn in the 2nd House: Wealth is earned through careful financial planning, savings, and long-term investments. Example: You may accumulate wealth through cautious investments in real estate or by working in finance, accountancy, or banking. Your disciplined approach to managing money ensures steady financial rewards over time.

Saturn in the 3rd House: Profits arise from communication, writing, or media ventures that require discipline and long-term effort. Example: You might earn by working in publishing, journalism, or technical writing. Success in these fields comes from years of consistent effort and attention to detail, with financial rewards building slowly over time.

Saturn in the 4th House: Gains come through real estate, family businesses, or property-related investments. Example: You could profit by investing in real estate or managing family assets. Building wealth through property or home-based businesses, with a focus on long-term growth, can lead to financial security.

Saturn in the 5th House: Wealth is generated through creative endeavors, speculative investments, or education-related ventures. Example: You might earn by working in industries like film production, education management, or through long-term investments in stocks or real estate. Your structured approach to creative projects or speculative ventures ensures sustainable financial growth.

Saturn in the 6th House: Profits come from service-oriented industries, health, or disciplined work routines. Example: You may gain wealth by working in healthcare management, legal services, or in careers where service, structure, and discipline are essential, such as HR or law enforcement. Consistent work in these fields can lead to long-term financial success.

Saturn in the 7th House: Financial gains come through partnerships, business alliances, or legal work, often developed over time. Example: You could profit from long-term business partnerships or legal agreements in structured fields like law, real estate, or corporate business. Marrying a successful partner in a traditional field might also bring financial benefits.

Saturn in the 8th House: Wealth comes through joint ventures, inheritances, or managing shared resources. Example: You may achieve financial success by managing other people’s money or assets, working in fields like banking, finance, or insurance. Carefully handling joint ventures or family inheritances can also lead to long-term wealth.

Saturn in the 9th House: Profits arise from teaching, law, publishing, or international business, especially in structured fields. Example: You could earn wealth by building a career in academia, law, or international trade. Long-term involvement in publishing or large educational institutions, such as universities or think tanks, can also bring financial success.

Saturn in the 10th House: Wealth comes from career achievements, leadership roles, and authority in large organizations. Example: You may achieve financial success by steadily climbing the corporate ladder or taking leadership roles in business, government, or large institutions. Your dedication to long-term career goals brings substantial financial rewards.

Saturn in the 11th House: Financial gains come through social networks, large organizations, or collective efforts, often tied to responsibility and long-term planning. Example: You could profit by working in industries like technology or finance, where your network connects you to influential individuals and organizations. Building wealth through large companies, NGOs, or group ventures focused on long-term goals is a viable path.

Saturn in the 12th House: Wealth comes from behind-the-scenes work, foreign lands, or industries related to healing and institutions. Example: You might gain wealth by working in hospitals, prisons, or charitable organizations, particularly in roles that require discipline and structure. Long-term investments abroad or work in secluded environments may also bring financial success.

𝐀𝐪𝐮𝐚𝐫𝐢𝐮𝐬 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Aquarius ruling your eleventh house, your approach to financial gains is innovative, forward-thinking, and often tied to collective efforts, large organizations, or social causes. You are likely to accumulate wealth through long-term planning in industries such as technology, social reform, or intellectual pursuits. Your social networks, friendships, and collaborations are key to your financial success, and you may benefit from working within groups or organizations that focus on future growth or humanitarian efforts.

Saturn in the Houses (ruler of Aquarius)

Saturn in the 1st House: Financial gains come through personal discipline, leadership, and a structured approach to self-development. Example: You might achieve wealth by assuming leadership roles in technology, science, or social reform, where steady, long-term effort and responsibility are rewarded. Your ability to remain methodical and patient leads to financial success in these fields.

Saturn in the 2nd House: Wealth is accumulated through careful financial planning, long-term investments, and a conservative approach to resources. Example: You could gain wealth through disciplined investments in real estate, technology, or infrastructure. A patient approach to saving and building resources slowly will lead to significant financial stability over time.

Saturn in the 3rd House: Profits arise from communication, media, or tech-related industries that require perseverance and long-term effort. Example: You might earn by working in journalism, media production, or education, particularly in technical or innovative subjects. Careers in writing, teaching, or media focused on technology or social progress could lead to financial rewards after years of hard work.

Saturn in the 4th House: Gains come from real estate, family businesses, or property management, emphasizing long-term stability. Example: You could profit from managing family properties, investing in real estate, or working in property management or construction. Your disciplined and structured approach to building assets will create long-term financial stability through real estate.

Saturn in the 5th House: Wealth comes from creative endeavors, speculative investments, or education, achieved through slow and disciplined effort. Example: You may find financial success in structured creative fields, such as directing films, or by making well-researched investments in stocks or real estate. Your methodical approach to speculative ventures pays off in the long run.

Saturn in the 6th House: Profits come from service-oriented professions, health, or routine work, particularly in tech or efficiency-driven industries. Example: You could earn by managing teams in healthcare or technology, or by working in fields like IT or engineering. Your disciplined approach to work and service ensures financial stability, especially in industries focused on innovation and progress.

Saturn in the 7th House: Gains come through partnerships, business alliances, or legal work, particularly in tech, law, or structured industries. Example: You might gain wealth through a business partnership in fields like technology, law, or social reform. Long-term collaborations or marrying a partner in a structured industry may also bring financial benefits.

Saturn in the 8th House: Wealth comes from joint ventures, inheritances, or managing shared resources. Example: You may accumulate wealth by managing other people’s money, such as in banking, finance, or insurance. Careful and long-term planning in joint financial ventures or through inheritances can lead to financial success.

Saturn in the 9th House: Profits arise from teaching, law, travel, or publishing, particularly in intellectual or technology-related fields. Example: You could earn wealth as a professor, lawyer, or through publishing work related to science, technology, or social structures. Long-term ventures in international business or higher education will also lead to financial success.

Saturn in the 10th House: Wealth is tied to career achievements in leadership roles, especially in large organizations or government. Example: You might achieve financial success by rising to leadership positions in large corporations, tech companies, or governmental institutions. Your disciplined and steady approach to career advancement ensures significant rewards over time.

Saturn in the 11th House: Gains come from social networks, large organizations, or collective ventures, especially those focused on innovation or social progress. Example: You might profit from working with large organizations or humanitarian groups, or by leveraging your connections with influential people in tech or social causes. Long-term involvement in collective projects will bring financial stability and success.

Saturn in the 12th House: Profits come through behind-the-scenes work, foreign lands, or industries related to healing or institutional work. Example: You may gain wealth by working in hospitals, prisons, or charitable organizations, particularly in administrative or managerial roles. Long-term investments in foreign markets or work abroad in institutional settings can also lead to financial success.

𝐏𝐢𝐬𝐜𝐞𝐬 𝟏𝟏𝐭𝐡 𝐇𝐨𝐮𝐬𝐞

With Pisces ruling your eleventh house, your approach to financial gains is intuitive, creative, and often tied to spiritual or imaginative endeavors. You may find success in artistic ventures, healing professions, or charitable work, and industries related to water, spirituality, or creativity may also be sources of wealth. You tend to follow your inner vision, and your empathetic and spiritually inclined social networks can help guide you toward success. Your wealth is likely to be linked to your ability to dream big and connect with higher ideals.

Jupiter in the Houses (ruler of Pisces)

Jupiter in the 1st House: Financial gains come through personal growth, optimism, and leadership in creative or spiritual fields. Example: You might achieve wealth through public speaking, coaching, or becoming a spiritual leader. Your expansive personality and ability to inspire others can open up financial opportunities in creative or spiritual ventures.

Jupiter in the 2nd House: Wealth is earned through investments, teaching, or industries related to spirituality, healing, or creativity. Example: You could gain financially by working in wellness, holistic health, or education, with investments in art, music, or spiritual projects providing long-term financial rewards.

Jupiter in the 3rd House: Profits arise from communication, writing, or media ventures with a focus on creative or spiritual themes. Example: You may earn by writing books on spirituality or creativity, or by running a blog, podcast, or media platform that explores healing, the arts, or personal growth.

Jupiter in the 4th House: Gains come from real estate, family businesses, or ventures related to spirituality or healing at home. Example: You might profit from running a spiritual retreat, yoga studio, or investing in peaceful real estate that promotes healing and well-being. Holistic home businesses could also bring financial success.

Jupiter in the 5th House: Wealth is derived from creative endeavors, entertainment, or speculative investments, especially in the arts or spiritual education. Example: You could succeed financially by working in entertainment, acting, or teaching creative arts. Investments in artistic or spiritual ventures, such as music, film, or alternative education, may also be rewarding.

Jupiter in the 6th House: Profits come through service-oriented professions, health, or routine work, especially in healing, spiritual, or creative fields. Example: You may gain wealth by working as a healer, counselor, or wellness practitioner. Managing spiritual retreats, health clinics, or creative workspaces could bring steady financial growth over time.

Jupiter in the 7th House: Gains are achieved through partnerships, collaborations, or legal work, particularly in spiritual, creative, or healing industries. Example: You could profit from collaborating with a partner in a spiritual business or healing center. A marriage or partnership with someone in these fields might also bring financial success through shared ventures.

Jupiter in the 8th House: Wealth comes through joint ventures, inheritances, or industries related to finance, psychology, or spiritual transformation. Example: You could accumulate wealth by managing other people’s money or working in investment banking, or by running a business focused on psychology, healing, or esoteric practices. Inheritances or shared resources may also play a significant role in your financial success.

Jupiter in the 9th House: Profits arise from teaching, law, travel, or publishing, particularly in spiritual or creative fields. Example: You might earn wealth as a professor of spirituality or philosophy, or by writing and publishing books on creativity, personal growth, or spiritual topics. International work or teaching in foreign countries could also bring financial success.

Jupiter in the 10th House: Wealth comes from career achievements in leadership roles related to spirituality, creativity, or healing professions. Example: You may gain wealth by becoming a spiritual leader, motivational speaker, or public figure in the arts. Running a successful business or organization in healing, creativity, or spirituality can lead to long-term financial success.

Jupiter in the 11th House: Gains come through social networks, large organizations, or collective ventures involving spirituality, creativity, or humanitarian work. Example: You might profit from working with charitable organizations, creative collectives, or spiritual groups. Networking with individuals in the arts, healing, or spiritual communities will open up financial opportunities for you.

Jupiter in the 12th House: Profits come from behind-the-scenes work, foreign lands, or industries related to spirituality, healing, or charitable work. Example: You could gain wealth by working in hospitals, spiritual retreats, or other healing institutions, or through international work related to healing and spirituality. Long-term involvement in charitable work or esoteric fields could bring significant financial rewards.

Masterlist

#astrology#astro#astro notes#astrology notes#astro observation#vedic astrology#tropical astrology#vedic astro notes#astro community#astro observations#astronomy#universe#spirituality#eleventh house#11th house#aries#taurus#gemini#cancer#leo#virgo#libra#scorpio#sagittarius#capricorn#aquarius#pisces#sun#moon#mars

2K notes

·

View notes

Text

The reason you can’t buy a car is the same reason that your health insurer let hackers dox you

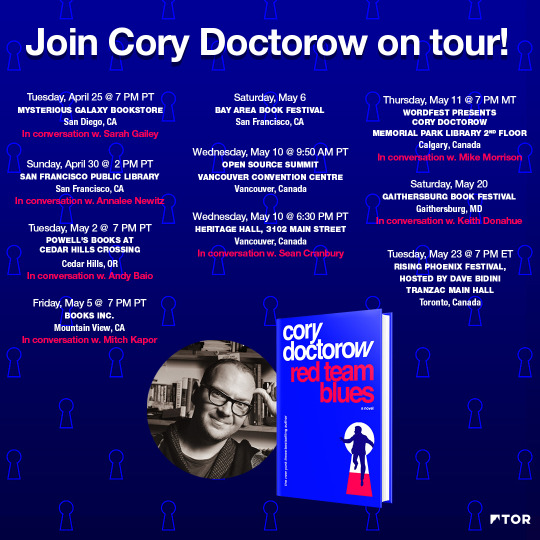

On July 14, I'm giving the closing keynote for the fifteenth HACKERS ON PLANET EARTH, in QUEENS, NY. Happy Bastille Day! On July 20, I'm appearing in CHICAGO at Exile in Bookville.

In 2017, Equifax suffered the worst data-breach in world history, leaking the deep, nonconsensual dossiers it had compiled on 148m Americans and 15m Britons, (and 19k Canadians) into the world, to form an immortal, undeletable reservoir of kompromat and premade identity-theft kits:

https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Equifax knew the breach was coming. It wasn't just that their top execs liquidated their stock in Equifax before the announcement of the breach – it was also that they ignored years of increasingly urgent warnings from IT staff about the problems with their server security.

Things didn't improve after the breach. Indeed, the 2017 Equifax breach was the starting gun for a string of more breaches, because Equifax's servers didn't just have one fubared system – it was composed of pure, refined fubar. After one group of hackers breached the main Equifax system, other groups breached other Equifax systems, over and over, and over:

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Doesn't this remind you of Boeing? It reminds me of Boeing. The spectacular 737 Max failures in 2018 weren't the end of the scandal. They weren't even the scandal's start – they were the tipping point, the moment in which a long history of lethally defective planes "breached" from the world of aviation wonks and into the wider public consciousness:

https://en.wikipedia.org/wiki/List_of_accidents_and_incidents_involving_the_Boeing_737

Just like with Equifax, the 737 Max disasters tipped Boeing into a string of increasingly grim catastrophes. Each fresh disaster landed with the grim inevitability of your general contractor texting you that he's just opened up your ceiling and discovered that all your joists had rotted out – and that he won't be able to deal with that until he deals with the termites he found last week, and that they'll have to wait until he gets to the cracks in the foundation slab from the week before, and that those will have to wait until he gets to the asbestos he just discovered in the walls.

Drip, drip, drip, as you realize that the most expensive thing you own – which is also the thing you had hoped to shelter for the rest of your life – isn't even a teardown, it's just a pure liability. Even if you razed the structure, you couldn't start over, because the soil is full of PCBs. It's not a toxic asset, because it's not an asset. It's just toxic.

Equifax isn't just a company: it's infrastructure. It started out as an engine for racial, political and sexual discrimination, paying snoops to collect gossip from nosy neighbors, which was assembled into vast warehouses full of binders that told bank officers which loan applicants should be denied for being queer, or leftists, or, you know, Black:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

This witch-hunts-as-a-service morphed into an official part of the economy, the backbone of the credit industry, with a license to secretly destroy your life with haphazardly assembled "facts" about your life that you had the most minimal, grudging right to appeal (or even see). Turns out there are a lot of customers for this kind of service, and the capital markets showered Equifax with the cash needed to buy almost all of its rivals, in mergers that were waved through by a generation of Reaganomics-sedated antitrust regulators.

There's a direct line from that acquisition spree to the Equifax breach(es). First of all, companies like Equifax were early adopters of technology. They're a database company, so they were the crash-test dummies for ever generation of database. These bug-riddled, heavily patched systems were overlaid with subsequent layers of new tech, with new defects to be patched and then overlaid with the next generation.

These systems are intrinsically fragile, because things fall apart at the seams, and these systems are all seams. They are tech-debt personified. Now, every kind of enterprise will eventually reach this state if it keeps going long enough, but the early digitizers are the bow-wave of that coming infopocalypse, both because they got there first and because the bottom tiers of their systems are composed of layers of punchcards and COBOL, crumbling under the geological stresses of seventy years of subsequent technology.

The single best account of this phenomenon is the British Library's postmortem of their ransomware attack, which is also in the running for "best hard-eyed assessment of how fucked things are":

https://www.bl.uk/home/british-library-cyber-incident-review-8-march-2024.pdf

There's a reason libraries, cities, insurance companies, and other giant institutions keep getting breached: they started accumulating tech debt before anyone else, so they've got more asbestos in the walls, more sagging joists, more foundation cracks and more termites.