#banking industry reports

Explore tagged Tumblr posts

Text

Future of Banking Industry: Trends and Market Analysis

The banking market is a critical component of the global economy, providing essential financial services to individuals and businesses. This blog will explore various aspects of the banking market, including its size, share, growth trends, key players, and challenges it faces.

Market Size, Share, and Growth

The global banking market is projected to grow significantly over the next few years. According to recent forecasts, the worldwide banking market is expected to expand at a compound annual growth rate (CAGR) of 4.92% from 2024 to 2029, reaching a market volume of approximately USD 10.83 trillion by 2029.

Retail Banking Segment

The retail banking sector, a major segment of the overall banking market, was valued at approximately USD 2.08 trillion in 2023 and is anticipated to grow to USD 3.97 trillion by 2034, reflecting a CAGR of 6% during the forecast period from 2024 to 2034. The Asia Pacific region is currently the largest market for retail banking, with significant growth driven by increasing disposable incomes and a growing middle class.

Market Share Distribution

The banking market is characterized by a mix of large global banks and regional players. The North American region is expected to dominate the retail banking market due to its focus on innovation and customer-centric services. In contrast, the Asia Pacific region is rapidly expanding, driven by technological advancements and a rising demand for digital banking services.

Market Trends

Several key trends are shaping the banking market today:

Digital Transformation: The shift towards digital banking is one of the most significant trends. Consumers increasingly prefer online and mobile banking solutions for their convenience and accessibility. This trend is prompting banks to invest heavily in technology to enhance their service offerings and improve customer experiences.

Personalized Banking Services: There is a growing demand for personalized banking experiences. Customers are looking for tailored financial solutions that meet their specific needs. Banks are leveraging data analytics and artificial intelligence to provide customized services and improve customer engagement.

Regulatory Changes: The banking sector is experiencing ongoing regulatory changes aimed at enhancing consumer protection and financial stability. Banks must adapt to these regulations while continuing to innovate and meet customer demands.

Sustainability Initiatives: Increasingly, banks are focusing on sustainability and responsible banking practices. This includes offering green financial products and investing in sustainable projects, reflecting a broader societal shift towards environmental responsibility.

Key Market Players

The banking market is populated by numerous players, ranging from large multinational banks to local institutions. Some of the prominent players include:

JPMorgan Chase & Co. (U.S.)

Bank of America (U.S.)

Citigroup Inc. (U.S.)

Wells Fargo (U.S.)

Goldman Sachs (U.S.)

ICBC (China)

Mitsubishi UFJ Financial Group (Japan)

These banks are continuously seeking to enhance their market position through innovation, mergers, and acquisitions. For instance, JPMorgan Chase has been at the forefront of adopting new technologies to streamline operations and improve customer service.

Market Share Insights

North America is projected to hold the largest share of the retail banking market, driven by innovation and a focus on customer-centric models. The Asia Pacific region, however, is expected to see the fastest growth, fueled by a burgeoning population and increasing digital banking adoption.

Market Challenges

Despite the positive growth outlook, the banking market faces several challenges:

Regulatory Compliance: Banks must navigate complex regulatory environments that can vary significantly across regions. Compliance with these regulations requires substantial resources and can hinder operational flexibility.

Cybersecurity Threats: As banks increasingly rely on digital platforms, the risk of cyberattacks has escalated. Protecting customer data and maintaining trust is paramount, necessitating ongoing investment in cybersecurity measures.

Economic Uncertainty: Global economic fluctuations can impact lending practices and consumer confidence. Economic downturns can lead to increased loan defaults, affecting banks' profitability.

Competition from Fintech: The rise of fintech companies poses a significant challenge to traditional banks. These agile startups often provide innovative solutions that cater to the evolving needs of consumers, forcing banks to adapt quickly to remain competitive.

Conclusion The banking market is poised for significant growth, driven by digital transformation, personalized services, and a focus on sustainability. While the market presents numerous opportunities, it also faces challenges that require strategic navigation. Key players in the banking sector must continue to innovate and adapt to changing consumer preferences and regulatory landscapes to maintain their competitive edge. As the market evolves, those that embrace technology and prioritize customer experience will likely emerge as leaders in this dynamic industry.

#Banking Market#banking market share#banking industry reports#Open Banking Market#banking market size

0 notes

Text

Online Banking Market Outlook - 2027: Navigating Growth amidst Digital Transformation

The global online banking market demonstrated substantial growth, valued at $11.43 billion in 2019, and is projected to reach $31.81 billion by 2027, marking a significant Compound Annual Growth Rate (CAGR) of 13.6% from 2020 to 2027.

1. Market Dynamics and Growth Projections

The surge in demand for online banking services continues to reshape the financial landscape. Online banking, also known as internet banking or web banking, is an electronic payment system that empowers users to conduct financial transactions seamlessly via the internet. This digital transformation is designed for convenience, providing users with a time-saving banking experience and real-time problem resolution services.

2. Understanding Online Banking

Online banking has become more than a convenience; it's an essential part of the modern banking experience. With electronic payment systems, users can conduct transactions, check account balances, and perform various banking activities through internet platforms. The emphasis is on providing a user-friendly interface and efficient services.

3. Market Size and Growth Trends

As of 2019, the global online banking market stood at $11.43 billion, and the projection for 2027 is an impressive $31.81 billion. The robust growth, evident in the CAGR of 13.6%, signifies a sustained trajectory towards a digitally dominated banking landscape.

4. Seamless Experience: Bridging Online and Mobile Channels

While the surge in online banking is undeniable, the challenge lies in providing a seamless experience across online and mobile channels. Banks must focus on creating an integrated environment where users can transition effortlessly between platforms. This approach ensures not only convenience but also aligns with the evolving preferences of the digitally savvy consumer.

5. Accelerating Customer Engagement: Meeting Demands and Preferences

The digital era demands more than just a functional online banking platform. Customer engagement is paramount, necessitating banks to go beyond transactional services. By understanding and meeting customer demands, needs, and preferences, banks can foster lasting relationships and secure their position in the competitive digital banking landscape.

6. Challenges and Opportunities in the Online Banking Sphere

6.1 Challenges: Security Concerns and Digital Literacy

The growth of online banking is not without challenges. Security concerns persist, requiring continuous innovation in cybersecurity measures. Additionally, digital literacy remains a barrier for some users, highlighting the importance of educational initiatives to enhance user confidence in online transactions.

6.2 Opportunities: Fintech Collaborations and Innovation

On the flip side, opportunities abound in the form of collaborations with Fintech companies and continuous innovation. Fintech partnerships enable banks to leverage cutting-edge technologies, enhancing the user experience and staying ahead in the competitive digital banking landscape.

7. Future Trends: Personalization and AI Integration

Looking ahead, personalization and Artificial Intelligence (AI) integration are anticipated to be key trends. Tailoring online banking experiences to individual preferences and incorporating AI-driven solutions for predictive analytics and problem resolution will further elevate the digital banking experience.

8. Conclusion: Shaping the Future of Banking

In conclusion, the Online Banking Market Outlook for 2027 is a testament to the transformative power of digital banking. The industry's growth has opened new avenues and presented challenges that demand innovative solutions. As banks navigate this digital frontier, the focus on seamless experiences, customer engagement, and staying abreast of emerging trends will be instrumental in shaping the future of Online banking.

9. FAQs (Frequently Asked Questions)

Q: What drove the surge in demand for online banking services?

A: The increasing demand for convenient and efficient banking services, coupled with the digitalization of financial activities, contributed to the surge in online banking usage.

Q: What is the projected market size for online banking in 2027?

A: The market is projected to reach $31.81 billion by 2027, growing at a CAGR of 13.6% from 2020.

Q: How can banks provide a more seamless experience between online and mobile channels?

A: Banks should focus on creating an integrated environment that allows users to transition effortlessly between online and mobile channels.

Q: What challenges does the online banking industry face?

A: Security concerns and the need for enhanced digital literacy are key challenges in the online banking sphere.

Q: What future trends are anticipated in the online banking sector?

- A: Personalization and AI integration are expected to be key trends, enhancing the user experience and problem resolution in online banking.

#banking industry reports#digital banking market#open banking market size#Digital Banking Industry#Digital Banking Platform Market

0 notes

Text

A brand name that is correct is legal. While the brand name that is incorrect can be proven illegal.

A verification in a correct manner you can order from SEO, and a report for a governance can be provided.

If you have a brand name that is correct, you can arrest the brand name that is incorrect.

A market can be correct, and an industry based on a technology can be correct.

An author Piotr Sienkiewicz

+48 721 951 799

#A bank#A banking#A bankier#A brand name#A verification#A market#An industry#A technology#A private service#A private sector#A public service#A public sector#SEO#An education#Qualifications#A profession#A corporation#Corporations#A report#A governor#A governance

1 note

·

View note

Text

Exploring Tanzanian Technology: A Comprehensive Overview

Tanzania, a country known for its rich cultural heritage and stunning landscapes, is also making significant strides in the field of technology. From innovative startups to government initiatives, Tanzania’s tech scene is on the rise. Let’s delve into the world of Tanzanian technology and explore the key developments shaping the industry.What is the Current State of Technology in…

View On WordPress

#detailed reports on Tanzania’s economic development#ICT development in Tanzania#news#research and advocacy efforts#tanzania#technological advancements#TechTanzania#updates on the tech industry in Tanzania. TanzICT#World Bank

0 notes

Text

#Open Banking Market#Open Banking Market Trends#Open Banking Market Growth#Open Banking Market Industry#Open Banking Market Research#Open Banking Market Report

0 notes

Text

#Cell Banking Outsourcing Market#Cell Banking Outsourcing Market Trends#Cell Banking Outsourcing Market Growth#Cell Banking Outsourcing Market Industry#Cell Banking Outsourcing Market Research#Cell Banking Outsourcing Market Report

0 notes

Text

Credit Suisse delays annual report after 'late call' from the SEC | CNN Business

London CNN — Credit Suisse can’t catch a break. In the latest piece of troubling news, the beleaguered Swiss bank has delayed the publication of its 2022 annual report following a “late call” from the US Securities and Exchange Commission on Wednesday evening. The SEC got in touch over revisions the bank had previously made to its cash flow statements for 2019 and 2020, Credit Suisse (CS)…

View On WordPress

#banking#banking institutions#Business#companies#company activities and management#company earnings#credit suisse group#domestic alerts#domestic-business#economy and trade#finance and investments#financial performance and reports#financial results#government organizations - us#iab-business#iab-business accounting & finance#iab-business and finance#iab-business banking & finance#iab-business operations#iab-financial industry#iab-industries#iab-sales#international alerts#International Business#us federal departments and agencies#us government independent agencies#us securities and exchange commission

0 notes

Text

Global Bank Encryption Software Market to Exhibit 14.11% CAGR by 2028

Triton Market Research presents the Global Bank Encryption Software Market segmented by Component (Software, Services), Deployment Mode (On-Premise, Cloud), Enterprise Type (Large Enterprises, Small & Medium Enterprises), Encryption Type (Disk Encryption, Communication Encryption, File/Folder, Cloud Encryption), and by Geography (Middle East and Africa, Europe, Asia-Pacific, North America, Latin America).

It further explains the Market Summary, Industry Outlook, Impact of COVID-19, Key Insights, Porter’s Five Forces Model, Market Attractiveness Index, Vendor Scorecard, Key Impact Analysis, Key Market Strategies, Drivers, Challenges, Opportunities, Competitive Landscape, Research Methodology & Scope, Global Market Size, Forecasts & Analysis (2022-2028).

Triton Market Research’s report states that the global market for bank encryption software is expected to expand with a 14.11% CAGR during the forecasted years 2022-2028.

Request Free Sample Report:

https://www.tritonmarketresearch.com/reports/bank-encryption-software-market#request-free-sample

Electronic banking and online transactions have increased data proliferation, resulting in the threat of cyberattacks. Data encryption offers secured digital data using algorithms, making the original information unreadable. With rising demand for security and privacy in banks & financial institutions, the bank encryption software market has grown tremendously. Cyberthreats have caused difficulties and huge losses due to data breaches of confidential information, thereby challenging the banking sector. This has led to increased awareness of adopting bank encryption software which lessens ransomware attacks, thus expanding the market growth.

However, the complexity and mathematical operations involved in deciphering the data are difficult. In the case of recovering backup data, it is crucial to balance the speed and security of the CPU that stores encrypted data. It takes double or triple time or even more to reverse the information. This hinders the growth of the bank encryption software market.

The Asia-Pacific is the fastest-growing bank encryption software market region and is estimated to hold this position in the upcoming years. The demand for digital payment methods like debit cards, mobile banking, and credit cards has raised security and privacy concerns across developing countries like China and India. Therefore, all these factors augment the bank encryption software market across the region.

The key players in the bank encryption software market are Microsoft Corporation, Dell Technologies Inc, ESET, Broadcom Inc, IBM, McAfee Corp, Thales Group, Netskope Inc, Intel Corp, Trend Micro Inc, Protegrity Pvt Ltd, Lookout Security, Bitdefender Pvt, and Winmagic Data Security Solutions.

The impact of COVID-19 on the global market has motivated many companies to enter. As a result, the competitive rivalry is high, with multiple established corporations capturing the largest market share. Since the bank encryption market is cloud-based, the software is customized according to the buyer’s need, increasing the demand of the suppliers in the industry.

Contact Us:

Phone: +44 7441 911839

#Bank Encryption Software Market#bank encryption software#Software Industry#ict industry#security industry#market research reports#market research report#triton market research

1 note

·

View note

Text

The Banking Sector: Market Size, Share, Growth, Trends, Players, and Challenges

The banking sector is a crucial component of the global economy, providing financial services to individuals, businesses, and governments. The sector has undergone significant transformations in recent years, driven by technological advancements, regulatory changes, and shifting consumer preferences. In this blog, we will delve into the current state of the banking sector, examining its market size, share, growth, trends, players, and challenges.

Banking Market Size and Share

The global banking sector is a massive industry, with a market size of approximately $14.4 trillion in 2023. The sector is dominated by a few large players, with the top five banks in the world holding a significant market share:

JPMorgan Chase: 12.4% market share

Bank of America: 9.4% market share

Wells Fargo: 7.3% market share

HSBC: 6.5% market share

Citigroup: 6.1% market share

These five banks are followed by a number of regional and local players, each with their own strengths and weaknesses.

Market Growth

The banking sector has experienced steady growth over the past decade, driven by increasing demand for financial services and the expansion of digital banking channels. The global banking market is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2028, reaching a market size of $17.4 trillion by 2028.

Market Trends

Several trends are shaping the banking sector, including:

Digital Transformation: The adoption of digital technologies, such as mobile banking, online banking, and artificial intelligence, is revolutionizing the way banks operate and interact with customers.

Open Banking: The increasing adoption of open banking standards, which allow third-party developers to access customer data and build new financial services, is creating new opportunities for innovation and competition.

Sustainability: The growing focus on environmental, social, and governance (ESG) issues is driving banks to adopt more sustainable practices and invest in green initiatives.

Fintech Integration: The integration of fintech companies into the banking sector is enabling the development of new financial products and services, such as digital lending and payment solutions.

Market Players

The banking sector is dominated by a few large players, but there are also many regional and local banks, as well as fintech companies, that are shaping the industry. Some of the key players in the sector include:

JPMorgan Chase: One of the largest banks in the world, with a significant presence in the United States and globally.

HSBC: A global bank with a strong presence in Asia, Europe, and the Americas.

Wells Fargo: A major bank in the United States, with a significant presence in the country's western states.

Citigroup: A global bank with a strong presence in the Americas, Europe, and Asia.

Alipay: A leading fintech company in China, with a significant presence in the country's digital payments market.

Market Challenges

The banking sector faces several challenges, including:

Regulatory Compliance: Banks must comply with a complex array of regulations, which can be time-consuming and costly.

Cybersecurity: The increasing threat of cyberattacks is a major concern for banks, which must protect sensitive customer data.

Competition: The banking sector is highly competitive, with many players vying for market share.

Sustainability: The sector must adapt to growing concerns about environmental, social, and governance (ESG) issues.

Conclusion The banking sector is a dynamic and rapidly evolving industry, driven by technological advancements, regulatory changes, and shifting consumer preferences. The sector is dominated by a few large players, but there are also many regional and local banks, as well as fintech companies, that are shaping the industry. As the sector continues to grow and evolve, it is essential for banks to adapt to changing market trends and challenges, while also prioritizing sustainability and customer satisfaction.

#Banking Market#banking industry reports#open banking market size#consumer banking industry#banking industry

0 notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

The cost of damage to critical infrastructure in Gaza is estimated at around $18.5 billion according to a new report released today by the World Bank and the United Nations, with financial support of the European Union. That is equivalent to 97% of the combined GDP of the West Bank and Gaza in 2022.

The report finds that damage to structures affects every sector of the economy. Housing accounts for 72% of the costs. Public service infrastructure such as water, health and education account for 19%, and damages to commercial and industrial buildings account for 9%. For several sectors, the rate of damage appears to be leveling off as few assets remain intact. An estimated 26 million tons of debris and rubble have been left in the wake of the destruction, an amount that is estimated to take years to remove. The report also looks at the impact on the people of Gaza. More than half the population of Gaza is on the brink of famine and the entire population is experiencing acute food insecurity and malnutrition. Over a million people are without homes and 75% of the population is displaced. Catastrophic cumulative impacts on physical and mental health have hit women, children, the elderly, and persons with disabilities the hardest, with the youngest children anticipated to be facing life-long consequences to their development. With 84% of health facilities damaged or destroyed, and a lack of electricity and water to operate remaining facilities, the population has minimal access to health care, medicine, or life-saving treatments. The water and sanitation system has nearly collapsed, delivering less than 5% of its previous output, with people dependent on limited water rations for survival. The education system has collapsed, with 100% of children out of school. The report also points to the impact on power networks as well as solar generated systems and the almost total power blackout since the first week of the conflict. With 92% of primary roads destroyed or damaged and the communications infrastructure seriously impaired, the delivery of basic humanitarian aid to people has become very difficult.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#gaza genocide#genocide#famine#al shifa hospital#unrwa#children of gaza

563 notes

·

View notes

Note

I'm writing a sci-fi story about a space freight hauler with a heavy focus on the economy. Any tips for writing a complex fictional economy and all of it's intricacies and inner-workings?

Constructing a Fictional Economy

The economy is all about: How is the limited financial/natural/human resources distributed between various parties?

So, the most important question you should be able to answer are:

Who are the "have"s and "have-not"s?

What's "expensive" and what's "commonplace"?

What are the rules(laws, taxes, trade) of this game?

Building Blocks of the Economic System

Type of economic system. Even if your fictional economy is made up, it will need to be based on the existing systems: capitalism, socialism, mixed economies, feudalism, barter, etc.

Currency and monetary systems: the currency can be in various forms like gols, silver, digital, fiat, other commodity, etc. Estalish a central bank (or equivalent) responsible for monetary policy

Exchange rates

Inflation

Domestic and International trade: Trade policies and treaties. Transportation, communication infrastructure

Labour and employment: labor force trends, employment opportunities, workers rights. Consider the role of education, training and skill development in the labour market

The government's role: Fiscal policy(tax rate?), market regulation, social welfare, pension plans, etc.

Impact of Technology: Examine the role of tech in productivity, automation and job displacement. How does the digital economy and e-commerce shape the world?

Economic history: what are some historical events (like The Great Depresion and the 2008 Housing Crisis) that left lasting impacts on the psychologial workings of your economy?

For a comprehensive economic system, you'll need to consider ideally all of the above. However, depending on the characteristics of your country, you will need to concentrate on some more than others. i.e. a country heavily dependent on exports will care a lot more about the exchange rate and how to keep it stable.

For Fantasy Economies:

Social status: The haves and have-nots in fantasy world will be much more clear-cut, often with little room for movement up and down the socioeconoic ladder.

Scaricity. What is a resource that is hard to come by?

Geographical Characteristics: The setting will play a huge role in deciding what your country has and doesn't. Mountains and seas will determine time and cost of trade. Climatic conditions will determine shelf life of food items.

Impact of Magic: Magic can determine the cost of obtaining certain commodities. How does teleportation magic impact trade?

For Sci-Fi Economies Related to Space Exploration

Thankfully, space exploitation is slowly becoming a reality, we can now identify the factors we'll need to consider:

Economics of space waste: How large is the space waste problem? Is it recycled or resold? Any regulations about disposing of space wste?

New Energy: Is there any new clean energy? Is energy scarce?

Investors: Who/which country are the giants of space travel?

Ownership: Who "owns" space? How do you draw the borders between territories in space?

New class of workers: How are people working in space treated? Skilled or unskilled?

Relationship between space and Earth: Are resources mined in space and brought back to Earth, or is there a plan to live in space permanently?

What are some new professional niches?

What's the military implication of space exploitation? What new weapons, networks and spying techniques?

Also, consider:

Impact of space travel on food security, gender equality, racial equality

Impact of space travel on education.

Impact of space travel on the entertainment industry. Perhaps shooting monters in space isn't just a virtual thing anymore?

What are some indsutries that decline due to space travel?

I suggest reading up the Economic Impact Report from NASA, and futuristic reports from business consultants like McKinsey.

If space exploitation is a relatiely new technology that not everyone has access to, the workings of the economy will be skewed to benefit large investors and tech giants. As more regulations appear and prices go down, it will be further be integrated into the various industries, eventually becoming a new style of living.

#writing practice#writing#writers and poets#creative writing#writers on tumblr#creative writers#helping writers#poets and writers#writeblr#resources for writers#let's write#writing process#writing prompt#writing community#writing inspiration#writing tips#writing advice#on writing#writer#writerscommunity#writer on tumblr#writer stuff#writer things#writer problems#writer community#writblr#science fiction#fiction#novel#worldbuilding

286 notes

·

View notes

Text

#Core Banking Solutions Market#Core Banking Solutions Market Trends#Core Banking Solutions Market Growth#Core Banking Solutions Market Industry#Core Banking Solutions Market Reports#Core Banking Solutions Market Research

0 notes

Text

Israeli tanks, jets and bulldozers bombarding Gaza and razing homes in the occupied West Bank are being fueled by a growing number of countries signed up to the genocide and Geneva conventions, new research suggests, which legal experts warn could make them complicit in serious crimes against the Palestinian people.

Four tankers of American jet fuel primarily used for military aircraft have been shipped to Israel since the start of its aerial bombardment of Gaza in October.

Three shipments departed from Texas after the landmark international court of justice (ICJ) ruling on 26 January ordered Israel to prevent genocidal acts in Gaza. The ruling reminded states that under the genocide convention they have a “common interest to ensure the prevention, suppression and punishment of genocide”.

Overall, almost 80% of the jet fuel, diesel and other refined petroleum products supplied to Israel by the US over the past nine months was shipped after the January ruling, according to the new research commissioned by the non-profit Oil Change International and shared exclusively with the Guardian.

Researchers analyzed shipping logs, satellite images and other open-source industry data to track 65 oil and fuel shipments to Israel between 21 October last year and 12 July.

It suggests a handful of countries – Azerbaijan, Kazakhstan, Gabon, Nigeria, Brazil and most recently the Republic of the Congo and Italy – have supplied 4.1m tons of crude oil to Israel, with almost half shipped since the ICJ ruling. An estimated two-thirds of crude came from investor-owned and private oil companies, according to the research, which is refined by Israel for domestic, industrial and military use.

Israel relies heavily on crude oil and refined petroleum imports to run its large fleet of fighter jets, tanks and other military vehicles and operations, as well as the bulldozers implicated in clearing Palestinian homes and olive groves to make way for unlawful Israeli settlements.

In response to the new findings, UN and other international law experts called for an energy embargo to prevent further human rights violations against the Palestinian people – and an investigation into any oil and fuels shipped to Israel that have been used to aid acts of alleged genocide and other serious international crimes.

“After the 26 January ICJ ruling, states cannot claim they did not know what they were risking to partake in,” said Francesca Albanese, the UN special rapporteur on the occupied Palestinian territory, adding that under international law, states have obligations to prevent genocide and respect and ensure respect for the Geneva conventions.[...]

“In the case of the US jet-fuel shipments, there are serious grounds to believe that there is a breach of the genocide convention for failure to prevent and disavowal of the ICJ January ruling and provisional measures,” said Albanese. “Other countries supplying oil and other fuels absolutely also warrant further investigation.”

In early August, a tanker delivered an estimated 300,000 barrels of US jet fuel to Israel after being unable to dock in Spain or Gibraltar amid mounting protests and warnings from international legal experts. Days later, more than 50 groups wrote to the Greek government calling for a war-crimes investigation after satellite images showed the vessel in Greek waters.

Last week, the US released $3.5bn to Israel to spend on US-made weapons and military equipment, despite reports from UN human rights experts and other independent investigations that Israeli forces are violating international law in Gaza and the occupied West Bank. A day later, the US approved a further $20bn in weapons sales, including 50 fighter jets, tank ammunition and tactical vehicles.

The sale and transfer of jet fuel – and arms – “increase the ability of Israel, the occupying power, to commit serious violations”, according to the UN human rights council resolution in March.

The US is the biggest supplier of fuel and weapons to Israel. Its policy was unchanged by the ICJ ruling, according to the White House.

“The case for the US’s complicity in genocide is very strong,” aid Dr Shahd Hammouri, lecturer in international law at the University of Kent and the author of Shipments of Death. “It’s providing material support, without which the genocide and other illegalities are not possible. The question of complicity for the other countries will rely on assessment of how substantial their material support has been.”[...]

A spokesperson for the Brazilian president’s office said oil and fuel trades were carried out directly by the private sector according to market rules: “Although the government’s stance on Israel’s current military action in Gaza is well known, Brazil’s traditional position on sanctions is to not apply or support them unilaterally.

Azerbaijan, the largest supplier of crude to Israel since October, will host the 29th UN climate summit in November, followed by Brazil in 2025.[...]

The Biden administration did not respond to requests for comment, nor did Vice-President Kamala Harris’s presidential election campaign team.

Israel is a small country with a relatively large army and air force. It has no operational cross-border fossil fuel pipelines, and relies heavily on maritime imports.[...]

The new data suggests:

•Half the crude oil in this period came from Azerbaijan (28%) and Kazakhstan (22%). Azeri crude is delivered via the Baku-Tbilisi-Ceyhan (BTC) pipeline, majority-owned and operated by BP. The crude oil is loaded on to tankers at the Turkish port of Ceyhan for delivery to Israel. Turkey recently submitted a formal bid to join South Africa’s genocide case against Israel at the ICJ.

•African countries supplied 37% of the total crude, with 22% coming from Gabon, 9% from Nigeria and 6% from the Republic of the Congo.

•In Europe, companies in Italy, Greece and Albania appear to have supplied refined petroleum products to Israel since the ICJ ruling. Last month, Israel also received crude from Italy – a major oil importer. A spokesperson said the Italian government had “no information” about the recent shipments.

•Cyprus provided transshipment services to tankers supplying crude oil from Gabon, Nigeria, and Kazakhstan.[...]

Just six major international fossil-fuel companies – BP, Chevron, Eni, ExxonMobil, Shell and TotalEnergies – could be linked to 35% of the crude oil supplied to Israel since October, the OCI analysis suggests. This is based on direct stakes in oilfields supplying Israeli and/or the companies’ shares in production nationally.[...]

Last week, Colombia suspended coal exports to Israel “to prevent and stop acts of genocide against the Palestinian people”, according to the decree signed by President Gustavo Petro. Petro wrote on X: “With Colombian coal they make bombs to kill the children of Palestine.”

20 Aug 24

201 notes

·

View notes

Text

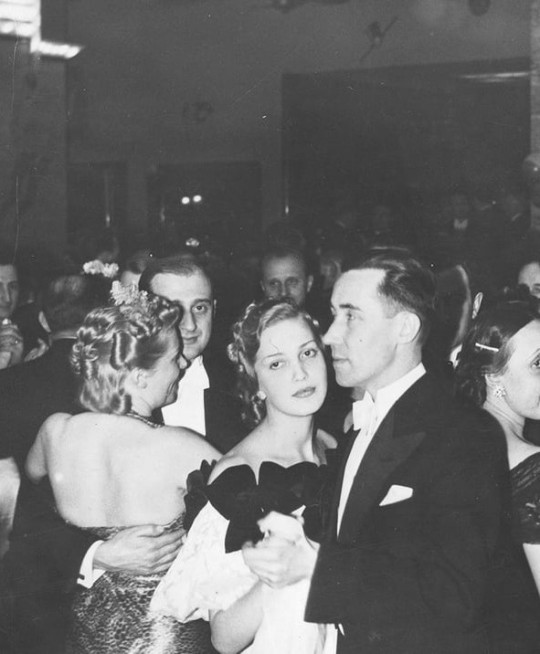

Tamara Wiszniewska (1919-1981) - Polish actress

Tamara Wiszniewska was born on December 19, 1919 in Dubno, Poland (now a region in western Ukraine) on the banks of the Ikva River. It was here that she spent her younger years during which she picked up dancing, which eventually led her to her career in film. In her 1981 obituary in the Democrat & Chronicle, it was reported that Tamara, at age 15, “Was a ballet dancer, when German film director Paul Wegener discovered her and gave her a role in the historical film, August der Starke (August the Strong)” which premiered in 1936. This German/Polish co-production is a biographical look into the life of Augustus II, ruler of Saxony and Poland-Lithuania from 1694-1733. Although Tamara played only a small role it marked her debut and eventual rise to fame within the Polish film industry.

Following her appearance in August der Starke, Tamara appeared in thirteen other films between 1936 and 1939, including Trójka Hultajska (The Trio Hultajska, 1937), Ordynat Michorowski (Ordinate Michorowski, 1937), and Kobiety nad Przepaścią (Women Over the Precipice, 1938). Wladyslaw (Walter) Mikosz, Tamara’s future husband, produced two of these films. In an interview, Tamara and Walter’s daughter, Irene, states that, "The two met because of their film careers, and were married [late that same year] in 1937".

Life for the Mikoszs was happy for a time. Tamara continued to pursue her acting career through 1938 and 1939 and had welcomed a new born daughter into the world alongside her husband, Wladyslaw. Unfortunately, these happy times did not last long as the Mikosz family experienced the rise of Nazi Germany and their occupation of Poland in 1939 during World War II. The following excerpt from an interview with Tamara in a 1974 Times Union tells how drastically their lives were changed:

"I always played a rich spoiled girl who had lovely clothes, and for a short time I lived that kind of life too. It was a short, beautiful life that ended when the Germans took over Poland in 1939. We were wealthy and the toast of the town then. We’d go to Prague and Vienna just to see an opera or to play in the casinos. When the Germans came, my intuition told me I should have something on me to exchange. I sewed my jewelry into my clothes. Later, it bought us passes to freedom and bread so we were never hungry."

The German occupation of Poland during World War II brought then “beautiful” life of the Mikosz family to an end. Gone were their illustrious careers in film and the rewards that such a life had brought to them. In a later interview, Irene mentioned that her mother "was preparing to sign a contract for a film career in Hollywood, but Hitler’s invasion of Poland derailed the plans". Sadly, Tamara’s last appearance on the silver screen was in 1939 prior to the invasion of Hitler’s Germany; she never again starred in any films.

Although her dreams had been crushed, Tamara and her family did not lose hope. They made the best of their current situation, and were able to survive by selling the fruits of their labors that they harvested during their days in the film industry; their lives had been consumed with a fight to survive rather than a dream to thrive. However, not being ones to live quiet lives, the Mikoszs volunteered for the Polish Underground, the exiled Polish government that fought to resist German occupation of Poland during World War II. As civilians with backgrounds in film, Tamara and Walter were most likely engaged in spreading Polish nationalistic and anti-German propaganda. Such efforts of the civilian branch of the Polish Underground was in support of what Jan Kamieński refers to as "small sabotage" in his book, Hidden in the Enemy's Sight: Resisting the Third Reich from Within: "In contrast of major sabotage, the idea of small sabotage was to remind the German occupiers of an enduring Polish presence, to ensure that they felt a constant sense of unease and generally undermine their self-confidence". While attending to these duties within the Underground, the Mikosz family was separated and shipped off to separate countries: Tamara and her daughter, Irene, to Czechoslovakia (where Tamara’s parents had been sent) and Walter to Bavaria. The family was not reunited until 1945, when they were sent to the same refugee camp in Bavaria. The Mikoszs remained in the Bavarian refugee camp until the year 1950, in which they emigrated to the United States of America. Tamara and Walter lived quiet lives in Rochester, NY after arriving from a war-torn Europe, and did so until they passed away.

Although they have long since passed away from this Earth, the stories of the Polish film star, Tamara, and her film-producer husband, Wladyslaw Mikosz, will live on so long as there are people around to tell it.

#history#history crushes#submission#tamara wiszniewska#polish#actress#film history#1930s#30s#old hollywood#women in film#women in history#poland#wwii#world war 2#ww2#ww2 history#old movies#old phography#20th century

189 notes

·

View notes

Text

Bank Encryption Software Market will thrive on prevalent Security Concerns

The adoption of bank encryption software has significantly skyrocketed due to the growing need for security and protection from cyberattacks. With the rise in banks and financial institutions, data security technology has gained pivotal importance. This is projected to supplement the global bank encryption software market at a CAGR of 14.11% between 2022 and 2028.

Digitization has become an integral part of banking with consistent development in digital data and internet banking. These software attained beneficial applications for banks, financial institutions, large enterprises, and small and medium enterprises. As a result, its installation in sensitive industries offered efficient and excellent security to the overall data. Another aspect allowing the market’s penetration is the reduction in bank costs, owing to the advancement in IT, opening doors for modern payment methods.

However, the lack of awareness among the audience regarding encryption software or its installation on their computers has alarmingly raised the number of hackers, viruses, ransomware, malware, and other online threats. Moreover, due to the complexity involved in implementing the software, the market is assumed to face a major hindrance in its growth.

Bank Encryption Software Market | Key Trends & Scope

Our experts have studied the market segmentation based on deployment model, enterprise type, component, and encryption type.

Following are the key trends that give you a detailed scope of the market’s performance:

Installation of Software by Banks and Financial Institutions

The component segment is divided into software and services. Estimates indicate the component type is expected to generate profitable revenue in the upcoming years. Software encryption ensures confidentiality and security of customer records and information. Therefore, banks and financial institutions take the first step to deploy software and avail their services, contributing to the market’s growth.

Deployment of Cloud-Based Services Ensure Scalability and Flexibility

The deployment segment includes on-premise and cloud-based services. The demand for cloud-based services is expanding in the financial industry due to its problem-solving benefits. For instance, SaaS (Software as a Service) solutions offered by big players such as Dell Technologies Inc. enable banks to change their services within time. Thus, benefits like flexibility & scalability are projected to drive cloud services in the deployment segment.

Increased Use of Digital Payment Technology by Large and SMEs

Large and small & medium enterprises conduct their businesses mainly via digital communications. The expansion of these software is majorly influencing the enterprise type segment. The need for the security and confidentiality of information and data stored has showcased steady growth for the segment in the market. Furthermore, the increased use of digital payment is set to create several growth opportunities for the market among various industries.

Dominant Position of Cloud Encryption Software

Disk encryption, communication encryption, cloud encryption, and file/folder encryption are some of the encryption types available in the market. Among all, Cloud encryption software dominates the segment. Its key benefit of protecting encrypted data with end-to-end encryption is majorly contributing to the growth trend.

Regional Outlook

Based on the global scenario, the market is globally classified into countries across the regions to study its performance and region-specific potential.

North America holds the largest position in the bank encryption software market

This is owing to the increasing awareness among its people and stringent policies related to cybersecurity. Also, the prevalence of advanced technology and robust cybersecurity system in the region shoots up the market’s demand.

Asia-Pacific is the fastest-growing region over the forecast period

The demand for security and privacy concerns has developed significantly owing to the increased use of digital payment methods. Such benefits have greatly raised the market’s growth, especially in developing countries like India and China.

Growth Prospects

Bank-level encryption pinpoints the security measures that financial institutions use to help protect their customer’s data and assets. Increased banking services and transactions across digital platforms have raised the number of attacks and data breaches. Due to the rising demand for cryptocurrency, industries are implementing data protection platforms into their system to prevent data theft. Hence, data security and privacy concerns are estimated to remain the key drivers in the growth of the bank encryption software market.

#Bank Encryption Software Market#Bank Encryption Software#Software Industry#ict industry#market research reports#market research report#triton market research

0 notes