#Online banking software

Explore tagged Tumblr posts

Text

How Much Does it Cost to Build the Mobile Banking App: A Complete Guide?

Online banking software represents a potential growth area in the financial sector. Banking apps provide customers with convenient, secure, and easy access to financial services. Online banking apps help banks better serve their customers by providing a convenient, secure, and user-friendly mobile banking experience. Mobile banking apps that are the best allow users to perform fraudulent transactions on their mobile phones and other devices, giving them greater control over their finances. Making online banking apps allows customers to get the needed services quickly and efficiently. This will improve brand recognition.

Visit us:

#Cost to Build the Mobile Banking App#Online banking software#blockchain application development#ios app development#perfectiongeeks#website design services#best iphone app development#website development company

0 notes

Text

Cybersecurity in Banking: Protecting Data with Advanced Solutions

Introduction

Discuss the critical importance of cybersecurity in the banking industry.

Highlight the rising threat of cyberattacks and the need for advanced protection measures.

Key Cybersecurity Challenges in Banking

Phishing and Social Engineering: Explain how attackers exploit customer vulnerabilities.

Ransomware Attacks: Highlight the growing trend of holding core banking data hostage.

Data Breaches: Discuss the risks associated with sensitive customer data exposure.

Advanced Cybersecurity Solutions

AI and Machine Learning: Explain how predictive analytics detect and prevent fraud in real time.

Multi-Factor Authentication (MFA): Describe how MFA adds an extra layer of security to customer accounts.

Blockchain for Secure Transactions: Highlight the use of blockchain for tamper-proof record-keeping.

Cloud Security Measures: Mention secure storage and disaster recovery in cloud environments.

Strategies for Banks to Enhance Cybersecurity

Conduct regular security audits and penetration testing.

Invest in employee training to identify and mitigate cyber threats.

Collaborate with cybersecurity firms for proactive threat management.

Conclusion

Emphasize the importance of adopting advanced cybersecurity solutions to protect customer trust and ensure compliance with regulations.

#qa testing services#core banking system#core banking solutions#t24 banking#online business banking#software testing#test automation solution#codeless test automation

0 notes

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes

Text

Amazon Prime Day occasion begins, gross sales up 12% in first 7 hours: Report | Firm Information

Prime Day can function a bellwether for the vacation procuring season. 3 min learn Final Up to date : Jul 17 2024 | 12:10 AM IST Amazon.com Inc.’s Prime Day gross sales rose virtually 12 per cent within the first seven hours of the occasion in contrast with the identical interval final 12 months, based on Momentum Commerce, which manages 50 manufacturers in a wide range of product…

#amazon#Amazon Prime#artificial intelligence#bank account#Check Point Software Technologies#counterfeit products#director of worldwide buyer risk prevention#E-commerce & Auction Services#e-commerce shoppers#eBay#Federal Trade Commission#Food Retail & Distribution (NEC)#HTTP#Internet & Mail Order Department Stores#Josh Planos#online hoaxes#online retailer#online shopping giant#Online shopping scams#phony products#public relations#retail calendar#Scott Knapp#Security Software#social media ads#vice president of communications and public relations#Walmart

0 notes

Text

#job interview#employment#inside job#job search#work#career#jobseekers#online jobs#jobsearch#jobs#banking software#banking jobs#banking sector#banking services#banking tips#sales presentation#home loan#loan#business loan#placement engineering colleges in bangalore#placement agency#placement consultancy#placement assistance#placement service#online#recruitment services#recruitment agency#recruitment 2024#recruitment process outsourcing#recruitment company

1 note

·

View note

Text

a failed update from billion-dollar cybersecurity firm crowdstrike has crashed windows machines worldwide today (july 19th 2024), leaving everything from airport terminals to checkout machines to delivery apps to banks stuck with a blue screen of death. here's a screenshot from downdetector (au) to illustrate:

the issue appears to be with crowdstrike falcon, a form of antivirus software widely used in the corporate world -- with emphasis on the world. there have been reports from the us, uk, australia, germany, india, france, japan and more. places affected include (but are not limited to) supermarkets, banks, basically every airline, public transport networks, major broadcasters, emergency services, corporate offices, healthcare providers and stock exchanges.

(woolies pic via archiestaines9 on twitter; s3pirion; akothari. yes that is masahiro sakurai of smash bros fame)

emergency service lines are currently experiencing problems within the american states of alaska, arizona, indiana, minnesota, new hampshire and ohio. similar problems likely plague other areas of the world, they just haven't been reported on yet. australian emergency services are operating, and critical infrastructure remains stable. be sure to check in with the local news stations still online for more updates.

welcome to y2k............................. 2!!!!!!!!!!!!!

13K notes

·

View notes

Text

Examining the Advantages of Accounting Software for Small Enterprises: Numbers Made Simple

In this era, small businesses might need help managing their money quickly. In the absence of appropriate efficiency, managing spending, payroll, and checks can easily become an exhausting task. However, with the integration of the best accounting software for small businesses, handling finances becomes an easy task.

Effortless Check Management with Integration

Do you need help managing checks within complex interfaces? By integrating the accounting software, users can simplify the process significantly. This integration makes it simple to import checks from software. You can quickly make, save, and send checks to your customers, which helps you save time and effort. It works whether you are at your desk or away.

Payroll Automation Solutions

Payroll administration doesn't have to be difficult for small firms. Fintech platforms offer reliable payroll accounting features that simplify and automate the entire process. With an array of features, organizations can effortlessly manage payroll tasks. Employee payments are made quickly and precisely thanks to these platforms, whether they are made via paper checks, Direct Deposits, or eChecks.

Efficient Expense Tracking

It's critical to monitor business expenses if you want to stay financially stable. Businesses can simply manage and arrange their spending using the powerful expense monitoring feature of the platform. All you need to do is enter the desired outcome, vendor, date, amount, and target, and the platforms will take care of the rest. This provides small business owners with peace of mind by guaranteeing that financial records are correct and present.

Increased Accessibility of Financial Data

A greater understanding of their finances is provided to small business owners by using the software. They can view the financial health of their company with features like dashboards that can be customized and rapid reporting. They are better able to make judgments as a result of having easy access to crucial data like earnings and cash flow. By identifying areas in which they are overspending, they can also come up with solutions to save costs. All things considered, these characteristics assist small business owners in making wiser financial decisions.

Flawless Integration for Efficiency

Another key benefit is the flawless integration capabilities. By integrating with necessary software, efficiency is maximized across all operations. Additionally, this connectivity makes sure that data moves smoothly across different applications. This improves accuracy and saves time by doing away with the necessity for human data entry and lowering the possibility of mistakes. All of this connectivity and synchronization makes it easier for small businesses to run and concentrate on what really matters—growing their business.

Conclusion: Simplifying Finances for Small Businesses

In conclusion, the best accounting software for small businesses, integrated with the features of fintech platforms, offer a powerful solution for managing finances efficiently. From check management to payroll and expense tracking, these features improve processes, saving time and effort for small business owners. With simplified financial management, businesses can focus on growth and success.

0 notes

Text

https://www.betabyte.in/services/nidhi-software

Powering Your Financial Success With Our Nidhi Software

Power Up your financial business success with Beta Byte Technologies, your trusted partner in cutting-edge software development. Explore our advanced Nidhi Software solutions to enhance efficiency, streamline processes, and ensure seamless compliance. Transform your Nidhi business with us – Explore the future today!

#software development#custom erp software#custom software development company#nidhi software#nidhi software development#banking software#online nidhi software#best nidhi software#nidhi bank software#Financial Software

0 notes

Text

ATMs & CRMs – Unveiling Their Benefits in India’s Evolving Payment Landscape | AGS India

Both ATMs and CRMs facilitate various banking transactions, CRMs offer the additional functionality of cash recycling, making them more advanced and sophisticated machines.

#Billing software#Billing Machine#Fintech company#Digital payments#cash payment#cash management services#online payment systems#Cash transit#QR code payment#cashless transaction in India#Digital payment solutions#payment company#RFID solutions#Payment solutions#fuel management system#cashless payment#fraud prevention#Banking automation#retail automation#Banking outsourcing

0 notes

Text

How Software is Reshaping Customer Experiences

In the digital age, customer experience has become a top priority for businesses across all industries, and banking is no exception. With the advent of advanced software technologies, banks are revolutionizing the way they interact with and serve their customers. Let's delve into how software is reshaping customer experiences in the banking sector:

Personalized Service: Banking software is enabling personalized service like never before. Through data analytics and AI algorithms, banks can analyze customer behavior, preferences, and financial patterns to offer tailored products and services. Whether it's suggesting personalized investment options or providing targeted financial advice, banks can now cater to the unique needs of each customer.

Omni-channel Experience: Modern customers expect seamless experiences across various channels, be it online banking platforms, mobile apps, or in-person interactions. Banking software allows for the integration of these channels, ensuring that customers can access their accounts and perform transactions effortlessly, regardless of the platform they choose.

24/7 Accessibility: Gone are the days of being restricted by banking hours. With software solutions, customers have round-the-clock access to their accounts and banking services. Whether it's checking account balances, transferring funds, or applying for loans, customers can do it all at their convenience, from anywhere in the world.

Streamlined Processes: Software streamlines banking processes, reducing the time and effort required for both customers and bank employees. From opening new accounts to processing loan applications, automation and digitization make these processes faster, more efficient, and error-free, leading to improved customer satisfaction.

Enhanced Security: Security is paramount in the banking industry, and software plays a crucial role in ensuring the safety of customer data and transactions. Advanced encryption techniques, biometric authentication, and fraud detection algorithms protect customers from cyber threats and identity theft, instilling confidence and trust in the banking system.

Proactive Communication: Software enables banks to engage with customers proactively, keeping them informed about important updates, upcoming events, and relevant offers. Whether it's sending personalized notifications about account activity or offering targeted promotions based on customer preferences, proactive communication strengthens the bond between banks and their customers.

Feedback and Improvement: Software allows banks to gather valuable feedback from customers through surveys, reviews, and social media interactions. This feedback loop enables banks to identify areas for improvement and make necessary adjustments to enhance the overall customer experience continually.

In conclusion, banking software is transforming the way customers interact with banks, offering personalized service, seamless omni-channel experiences, enhanced security, and proactive communication. By leveraging these software solutions, banks can build stronger relationships with their customers, drive loyalty, and stay ahead in today's competitive market.

#banking software#online banking#banking software solutions#core banking software#digital banking software#mobile banking software

0 notes

Text

0 notes

Text

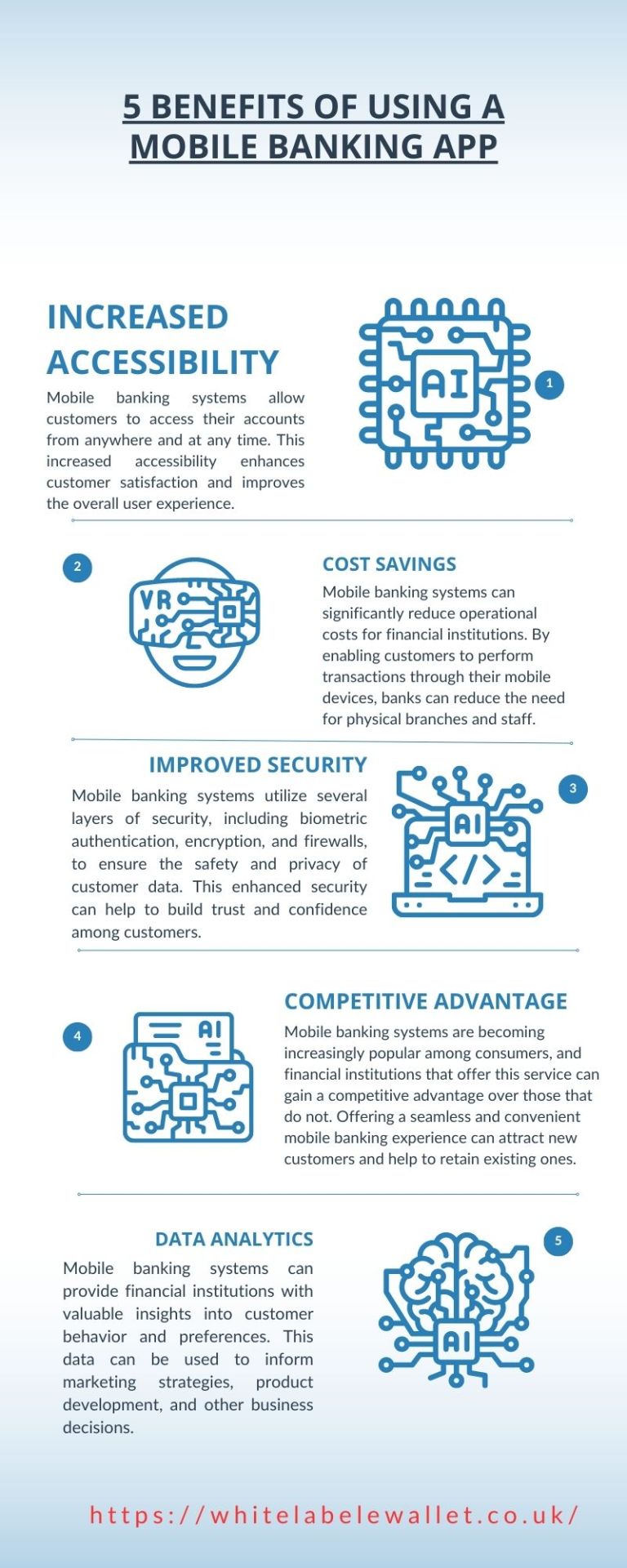

5 benefits of using a mobile banking app

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price

Increased Accessibility: Mobile banking systems allow customers to access their accounts from anywhere and at any time. This increased accessibility enhances customer satisfaction and improves the overall user experience.

Cost Savings: Mobile banking systems can significantly reduce operational costs for financial institutions. By enabling customers to perform transactions through their mobile devices, banks can reduce the need for physical branches and staff.

Improved Security: Mobile banking systems utilize several layers of security, including biometric authentication, encryption, and firewalls, to ensure the safety and privacy of customer data. This enhanced security can help to build trust and confidence among customers.

Competitive Advantage: Mobile banking systems are becoming increasingly popular among consumers, and financial institutions that offer this service can gain a competitive advantage over those that do not. Offering a seamless and convenient mobile banking experience can attract new customers and help to retain existing ones.

Data Analytics: Mobile banking systems can provide financial institutions with valuable insights into customer behavior and preferences. This data can be used to inform marketing strategies, product development, and other business decisions.

0 notes

Text

APT. 847b

𝐟𝐞𝐚𝐭: yoon jeonghan x camgirl! reader

Having sex with your roommate normally complicates things. What happens when being with Jeonghan just makes sense?

𝐠𝐞𝐧𝐫𝐞: roommates to lovers, friends with benefits??, soulmate au?? non idol au

𝐰𝐚𝐫𝐧𝐢𝐧𝐠𝐬: camgirl reader, camboy jeonghan, lots of emotions, they’re both very down bad for each other and don’t realize it. Smut warning below the cut.

𝐰𝐨𝐫𝐝 𝐜𝐨𝐮𝐧𝐭: 7.5k

an: this story switches between jeonghan and the readers pov. It will be label by his name and her, when the pov is switching. This is a part of my little universe of loosely connected SVT stories called all for you. Thank you @whimsical-whatever for helping me figure out this story.

𝐟𝐞𝐞𝐝𝐛𝐚𝐜𝐤 𝐚𝐧𝐝 𝐫𝐞𝐛𝐥𝐨𝐠 𝐰𝐢𝐭𝐡 𝐭𝐚𝐠𝐬 𝐚𝐫𝐞 𝐠𝐫𝐞𝐚𝐭𝐥𝐲 𝐚𝐩𝐩𝐫𝐞𝐜𝐢𝐚𝐭𝐞 𝐰𝐡𝐞𝐧 𝐲𝐨𝐮 𝐫𝐞𝐚𝐝 𝐨𝐧𝐞 𝐨𝐟 𝐦𝐲 𝐟𝐢𝐜𝐬.

𝐰𝐚𝐫𝐧𝐢𝐧𝐠𝐬: multiple sex scenes, camgirl reader, camboy jeonghan, soft dom/switch jeonghan, voyerism, masturbation, mutal masturbation, oral (male rec), sex toys, dirty talk, nipple play, squirting, unprotected sex, cream-pie, breeding kink, cum play, sex tapes, cam boy jeonghan??, lots of emotions, tipsy sex (they’re both fully consenting), filming sexual slut shaming (not by any of the boys. The mc refers to herself as one). names: hers (baby, good girl, angel), his (baby, hannie)

-JEONGHAN-

Jeonghan was tired of being one of the few single people in his friend group. He had zero desire to try online dating like a few friends and all his friends that were girls were already dating one of the other guys in his friend group. He thought maybe if he had a girlfriend or someone for companionship he wouldn’t feel like something is missing in his life.

-

Looking at his computer at the kitchen table his brain was hurting looking at all his banking info. It was coming up on that time if the month when rent was due. Since Jihoon moved out to move in with his girlfriend, Jeonghan and his other roommate Kitten decided to just split the amount of the whole apartment instead of finding another roommate. This was working out but now it’s been six months and Jeonghan is tired of spending so much on rent.

Kitten walked in the door with groceries in hand. She instantly noticed how stressed Jeonghan looked.

“What’s up?” She asked as she set some groceries on the table.

“I think we need to get a roommate. I can’t keep paying this much for rent.”

“Okay that works for me. I just request we maybe find a girl roommate. Also we should probably tell her right away about my job.” Jeonghan assumed Kitten would want a girl roommate. With her being a cam girl he knew having a random man she didn’t know living with them could make things weird. “Wait. Would it be weird if I asked one of my friends I met through Cherry moved in?”

“Is she a camgirl?” Honestly Jeonghan didn’t care what Kitten did for a living. He also didn’t care if another girl who did the same job moved in.

“Yeah she is.”

“That’s fine with me.”

-HER-

Your last roommate you had started making you uncomfortable after finding out about your job. You were in desperate need of a new place to live.

One day when you were out to lunch with Cherry she mentioned having friends that were looking for a roommate. She mentioned one of them being Kitten, a fellow camgirl. You knew right then that would be a good place to live.

You’ve been living with Jeonghan and Kitten for four months now. You and Kitten were already friends and your first reaction when you met Jeonghan was that he's absolutely beautiful.

You learned very quickly they’re both amazing roommates. Jeonghan keeps the apartment very tidy and Kitten loves cooking for you guys. Kitten’s boyfriend Joshua is often at the apartment. He’s best friends with Jeonghan so he’ll even come over just to hang out with him even if Kitten is busy.

You work at a tech company as a software programmer during the day and at night you stream to make extra money. Work has been absolutely shitty recently and this week all your deadlines have been driving you insane. After getting yelled at by your boss you can’t wait to get home. The moment you walk through the door you instantly notice how quiet the apartment is. Opening your phone you see a text sent to your roommate group chat.

5:32pm

From Kitten <3: I’m not coming home tonight. I’m staying at Shau’s place. I made pasta for lunch and I made you each a container. They’re in the fridge for you.

From Jeonghan: thank you. I’m heading home soon. I carpooled with Hao to work.

From you: if anyone needs me I’m getting wine drunk. I had a shitty day at work.

5:37pm

From Jeonghan: don’t get wasted before I get there. I’ll get wine drunk with you.

Walking into the apartment Jeonghan finds you sitting on the couch in your pajamas with a large glass of wine in your hands. You’re dressed in a pair of sweatpants and an oversized shirt.

Jeonghan sits his work bag down by the door and slips off his shoes.

“That’s a lot of wine,” he says walking closer to you.

“I had a shitty day,” you raise your glass at him.

“Let me get out of this work clothes.” He heads off to his room and comes back in a pair of sweats and baggy shirt.

He heads off to the kitchen and comes back with a wine glass for himself. He pours himself a big glass of red wine and sits down next to you.

“Am I crazy if I quit my tech job?” This week feels like it’s been absolutely eating you alive trying to maintain your nine to five job. You take another big drink of wine.

“Not necessarily. I don’t know how inappropriate this is to ask but do you make enough on your lives to afford to get by?” You know Jeonghan is one of the few people you can have that conversation with. He knows all about how being a full time camgirl works because of Kitten.

“Honestly I make enough to live comfortably. In all reality if I quit my tech job I could probably focus more on streaming and making my subscribers only page make even more money.” You’ve been thinking about this for a while, you've just never mentioned it to anyone.

“You’re pretty miserable at your tech job aren’t you?” He’s seen you so stressed out you started crying last week. Jeonghan is very aware of how much you hate your job.

“I fucking hate it,” you sigh.

“If you think you make enough steaming, I say do it. If you have a rough month with money. I can help you figure out rent.” Jeonghan has been so nice to you since the moment you met him. You can’t believe he’s willing to help you with money if things get tough.

“I’m gonna tell them Monday I’m quitting,” you can’t help but smile.

“I think you’re going to be so much happier.”

Taking a big sip of wine you instantly feel relieved. You can’t wait to no longer work a nine to five job.

“Did you already heat up Kitten’s food she made for us?”

“No.”

Reaching over his pats your thigh, and lets out a soft laugh. “Maybe we should eat something before we drink our weight in red wine.”

Getting up he goes into the kitchen and starts warming up the food your roommate left. Sitting at the kitchen table you pour yourself another large glass of wine. He places the food on the table in front of you. Before sitting down across from you.

The food is absolutely delicious. Just like it always is when Kitten makes anything.

“Did you wanna watch something in the living room together?” He asked picking up your empty bowl.

“Sure.”

Sitting back down on the couch you take another big drink of wine before sitting your glass down on the coffee table. Jeonghan turns on a drama he’s been watching before he gets comfortable next to you on the couch. It’s not uncommon for you to practically cuddle leaning against each other on the couch.

His arm is over your shoulder as you lean against him. The whole time his show is playing you aren’t really paying attention. Even the red wine can’t seem to stop your over thinking about work. Without even thinking you pick the little lent pieces that are on the thigh if Jeonghan’s sweats. He doesn’t say anything but you feel his thigh flex under your touch.

He takes a deep breath. Glancing up you see he’s no longer watching the tv, he’s eyes are trained on you.

“Sorry,” you pulled your hand away feeling instantly embarrassed.

He doesn’t say anything, he just stares at you blinking. The air feels heavy. Without even thinking you go back to playing with the fabric of his sweats. Your hand travels towards the inside of his thighs almost testing the waters. The sound of him swallowing loudly tells you you’re playing a dangerous game.

“Do you want me to stop?” You whisper not even sure if your voice is fully audible. Maybe it’s the red wine in your veins making you bold enough to make a move on your roommate.

“No,” he voice is clear as day.

Your hand slides up his thigh. The growing bulge in his sweatpants is a clear indicator that he’s enjoying this. “Can I touch you?”

“Yes.”

Slowly your hand slides up his thigh. Stopping just at his bulge. Your eyes stay locked on his as you cup his bulge. He’s a little bigger than average size by the feel of it. A low moan passes his lips as you feel him up.

Your eyes stayed locked on him as you groped him. He’s so hard in your hand and straining against his sweatpants.

“Hannie,” you whisper.

“Yes?”

“Are you sober?” You want to make sure he’s fully aware of what is happening.

“I was barely tipsy. Are you sober?” He looks so gentle suddenly.

“I’m just tad tipsy.” You don’t stop touching him as you speak. “But I want this.” You have thought about touching him for weeks.

“Can I please kiss you?”

“Please.”

Without another word he removes your hand from him and pulls your pilant body on to his lap. His straining erection is pressed up against your clothed core. Resting his hand on your cheek he drags his thumb across your bottom lip. Rolling your hips against his for some friction, a soft moan passes your lips.

The first time your lips touch in a tipsy state it feels sobering. The feeling of Jeonghan’s soft lips against yours gives you butterflies. He’s holding your face in his hands slowly he pulls away and smiles at you.

“I have wanted to kiss you for a while.” His voice is low. There’s no words you can think say. Crashing your lips into his once again for a heated kiss.

“I wondered what it was like to kiss you.” His hands grip your hips and guide your body against his. After your shitty day at work you didn’t think it would end with you dry humping your roommate while you make out.

“You’re so fucking hot,” he groans as his lips start kissing your jaw.

Rolling your hips against his erection you can feel your panties starting to stick to your wet core. “Hannie, can you fuck me?” You moan.

Pulling away from you, he rolls his head back moaning. “I want to so badly.”

Crawling off his lap you quickly remove your sleep shorts and your wet panties. His eyes stay locked on your pussy. It is clearly wet with need. You hope he doesn’t mind that you aren’t shaved bare. Since you started streaming you realized you didn’t need to wax all the time. Men tended to like you like that. He swallows watching you for a moment before he takes this as his cue to remove his sweats and boxers.

The sight of his cock is absolutely mouth watering. His cock is just as pretty as you thought it would be. It’s a little bigger than the average man. It’s a pretty blush color, and curves up towards him. The base of him has a well kept patch of pubes with a little happy trail.

Crawling onto his lap you nestle his length between your folds.

“Can I take this off?” He messes with the hem of your baggy shirt.

“Yes,” you sigh.

He pulls off your shirts and marvels at the fact you aren’t wearing a bra. “Can you take yours off?” Silently he follows your request.

You’re both completely naked sitting on your living room coach. Rolling your hips, his cock slides through your folds. Everytime his mushroom tip brushes your clit you can’t help but gasp.

“Should I get a condom?” He moans taking your breast in his hand. His hands knead your flesh.

“I’m clean and have an iud.”

“Where did you want me to finish?” He plays with your nipples, tweaking them between two fingers.

“Wherever you want. I would prefer you fill me up.”

“Are you asking me to come inside you?” He looks completely caught off guard by your request.

“Please,” you practically beg.

“Okay baby.”

Your lips move together as you slowly sink down on his length. Your fingers tangle in his blonde hair holding him close. Lifting your hips you keep a slow pace. Each time you roll your hips forward you clit brushes against his pubic bone earning a moan.

Your nose brushes his as your lips are so close to touching. The only sounds in the room are the soft moans, and pants. His lips connect to your neck leaving open mouth kisses.

The way his cock is curved his brushing against the spot inside you that has you seeing stars.

“You feel so good,” he moans. “You’re so tight.”

As you move your body up and down his length you can’t really think straight. You're lost in a lust filled haze. It feels like he was made for you. His cock hits the perfect spot inside of you.

The coil in your stomach tightens more and more with each thrust. His hands grip your sides helping you move. Suddenly the coil snaps and a white hot wave washes over you.

Moaning his name like a prayer. He starts lifting his hips helping you ride out your orgasm.

-JEONGHAN-

“Can I cum inside you?” He begs. He’s desperate and sounds like he’s on the verge of falling apart.

“Please fill me up.”

His hands grip your hips as he chases his release. Your walls contract around him as another orgasm follows, milking his cock. Thick white ropes fill you to the brim. He doesn’t think he’s ever come this much in his life. Looking into your eyes for a moment he feels like this was supposed to happen. He doesn’t know how he ever was to survive not touching you.

-HER-

You stop moving, leaning against him. Your face rest in the crook of his neck. You press open mouth wet kisses to the delicate skin on his neck.

“That was unexpected.” Gently he rubs your back.

“That was amazing.” You murmured against his skin.

“I need to clean you up and make sure my cum doesn’t get on the couch. Kitten might kill us if we stained this couch.”

Standing up your legs feel like jello. Looking down between your legs you watch as Jeonghan cum starts trickling down your thigh. Without even thinking his grabs his shirt and gently wipes away his release. Grabbing your hand he takes you to the bathroom where he sits you on the counter and wipes way any cum that is leaking out.

Standing between you legs his hand rest on your cheek. “You’re so pretty.”

“You sure know how to make a girl feel good.”

“The only girl I have ever wanted to make feel good is you.” Leaning forward he presses his lips to yours for a gentle kiss.

Everything feels like it makes sense right now. There isn’t any awkward tension or any feelings of regret. He helps you off the counter and without even asking takes you to his room. He pulls you close to his body and presses another kiss to your forehead.

- JEONGHAN-

“Can I ask you something that might be a little too intrusive?”

You’re naked in his bed you aren’t sure what he could possibly be worried about asking you. “Go for it?”

“What kind of stuff do you film?”

“You’ve never looked up my account?” You’ve mentioned your username before. You just kinda assumed he would investigate. Some of your other friends have. Hell even your last roommate did.

“Never. I’ve never looked up Kitten or Cherry either. It just felt like an invasion of privacy. Also I don’t think it’s really fair to Shau or Jun if I looked up their partners.”

“Do you think any of the boys have looked me up?” Jeonghan's whole friend group basically knows about your job. You found out when Cherry started seeing Jun she slowly let the friend group know and Kitten’s secret had slowly gotten out as well as she felt more comfortable letting close friends know.

“No none of them have. They all just see it as a normal job.”

“I film a lot of solo stuff with toys. I back in the day used to film with this guy I was casually seeing but he never fucked me on camera. I just used to film giving him head. Things with us ended when he got a serious girlfriend.”

“Would you ever film with someone again?” He can’t lie, he's curious. He is one of the only people Jun has told about filming with girlfriend. He knows Jun films with Cherry all the time but makes sure his face is never seen.

“I wouldn’t be against it. It has to be the right person. I need to make sure I trust them.”

He looks up at the ceiling. He doesn’t know why he’s suddenly so interested in the possibility of filming with you. He’s never had a desire to preform sexual acts in camera. But there is something about you that he’s interested in doing it with you.

“Would you trust me?”

Knitting your brows together you stare at him for a long moment. “I do trust you.” Lacing his fingers with yours he squeezes your hand gently. “Did you want to film with me?”

“I’m quite interested.”

“Have you talked to Jun?”

“Yeah he told me about his anonymous filming he does. It piqued my interest, but I don’t want you to think I slept with you because of that.” He’s suddenly worried you’re going to think he’s a creep.

“Last time I checked I started this when I was messing with your sweatpants,” you let out a little laugh. “If you were interested in filming with me. We could try whatever you’re comfortable doing.”

“I think I want to try at least once.”

-HER-

When morning comes you're reminded you’re in Jeonghan bed when you feel his morning wood poking your butt. His arm tights around your waist letting you know he’s awake.

“Hannie.”

“Baby,” he groans, pushing his dick further against your butt. His hand moved down your stomach. His hand cups your pussy. His finger dips between your folds earning a moan. “I want you again,” he groans.

“You can have me,” you moan.

“Are you going to put it in?”

“Do you want me to fuck you again?”

“Please, Hannie.”

He pushes your leg forward to give himself better access to your core. “Do I need to get a condom?”

“No want you raw,” you moan. He’s grinding against your core, making you feel like you’re going insane.

Slowly he pushes into you. He’s hitting a different angle than last night. “This might be the best way to wake up,” he groans. “You feel even tighter from this angle.”

It doesn’t take long before you fall apart moaning his name. The feeling of him finishing inside you is intoxicating. You understand why people have creampie kink. You’ve never fucked anyone on camera before, but now you can’t get the thought of Jeonghan fucking you on camera out of your mind.

Walking out of Jeonghan room dressed in a pair of his sweats and baggy shirt. He takes your hand in his before pressing his lips to your cheek.

“Hannie?”

“Yeah?”

“Maybe we don’t tell Kitten right away. Especially if we’re gonna film together.”

“Okay that works for me.”

-

You have officially quit your job and have decided to fully focus on being a camgirl.

After that night you and Jeonghan first slept together things between you have definitely changed. It feels like you’re definitely together but you’re sneaking around. Neither of you are ready for Kitten to know or any of your friends. You haven’t had a chance to film together yet, but Jeonghan sat in your room last night while you were filming. He sat on the other side of the camera. His hand stroking his length mimicking the speed you’re thrusting your sparkly blue dildo into yourself.

Him being in the room while you’re filming is absolutely thrilling. It’s intoxicating knowing that no one knows what’s happening other than the two of you.

After filming you always take a nice hot shower and the addition of Jeonghan joining you is welcomed. He massages mango scented shampoo into your hair.

“I like watching you film,” he says, breaking the comfortable silence that has formed between you.

“I liked you watching.”

“Did you still wanna go out to the bar with Seungcheol, Darling, Honey, Wonwoo, Chan and Minghao?”

“Oh yeah I’ll go. I think Shau is coming over here. Kitten mentioned wanting to film. We could give them some privacy.” He taps your butt signaling for you to turn around to rinse your hair.

You spend the rest of the shower not doing anything sexual. Jeonghan finishes washing your hair, and you help wash his hair before getting out. Each of you go to your seperate room to get dressed and get ready to go out.

Walking out into the living room you find Joshua sitting on the couch talking to Jeonghan. Kitten pops out of the kitchen holding a bottle of water.

“Are you guys meeting Cheol at the bar?” Joshua asked.

“Yeah Cheol was saying it’s been too long since we all met up for beers.”

“(Y/N) are you going?” Kitten asked.

“Yeah Jeonghan said we can use this to celebrate me being free from my job.”

“That means you should get wasted. Hannie can take care of you,” Joshua says, patting your roommate on the shoulder.

“Hannie take care of our girl,” Kitten says as she walks over and holds her hand out signaling her boyfriend to stand up.

“I always take care of her,” Jeonghan’s words have a double meaning that neither of them catch.

Jeonghan drives you to the bar telling you that he would be designated driver that you could let loose and have fun.

As soon as you arrive Darling and Honey pull you away saying they want to do shots to celebrate you quitting.

-JEONGHAN-

Standing at the bar Jeonghan is ordering himself a beer, and you a drink. Seungcheol walks up patting him on the back.

“I’m glad you brought (Y/N) with you. Darling and Honey seem to love her.” Seungcheol says before taking a sip of his beer.

“She’s great. She just quit her tech job so I told her this would be a good way to celebrate.” The bartender puts two drinks down in front of him, and Jeonghan hands him his card to pay.

“I take it that means she’s going to work full time doing the same thing as Kitten and Cherry?” It’s funny all the boys know now that Kitten and Cherry are camgirl but they’re all really respectful about it and never directly say what their jobs is.

“Yeah she makes good money doing it. She was absolutely miserable at her tech job. I can’t count the number of times she came home crying from work.” Jeonghan hated seeing you upset.

“You know I think she’s a good fit for the group. She gets along with all boys and the girls adore her. It’s a bonus that she understands and relates to Kitten and Cherry.” Seungcheol says.

“I think with Jun seeing Cherry and her being open about her job made Kitten feel more comfortable letting everyone know.” Jeonghan remembers when Kitten awkwardly told him about her job. She seemed so worried that Jeonghan would be upset or judge her, but he honestly didn’t care. He’s always been a very sex positive person, and if his roommate could make a living being a cam girl he would never judge her. He wouldn’t ever judge you either. Your job didn’t define you. He was quite interested in your job though, and wanted to explore aspects of it with you.

Seungcheol clears his throat, catching his attention. “You zoned out on me.”

“Sorry I was just thinking.” He stares at his drink before taking a sip.

“Why don’t you go take (Y/N) her drink?”

Walking over he interrupts your conversation with the girls to hand your drink. He wants to give you time to catch up with the girls. Walking over he joins Wonwoo and Minghao at the pool table.

The moment Chan joins the boys at the pool table he’s already in full gear complaining about his coworker. Jeonghan gets an earful about the new girl that is making Chan’s life, as he says “a living hell.” That’s probably because they’re competing for the same promotion.

Minghao just shakes his head before taking a drink of his beer. Seungcheol soon joins the rest of the boys after bugging his girlfriend who seems more interested in catching up with the girls.

The whole time boys are playing pool he can’t seem to fully focus on the game. He keeps glancing over at you.

“You’re not nearly as competitive tonight as you normally are,” Wonwoo bumps him. Jeonghan glances up at his friend. He’s trying to be subtle about the fact he can only focus on you.

“I got a lot on my mind.”

“Maybe, your roommate can help with that.”

“Wonwoo-“

“I’m just messing with you. I know you’ve had a crush for a while.”

“Let’s not talk about this,” Jeonghan doesn’t need any of the boys in his business. Especially since he hasn’t properly talked about what is going on between you.

The girls rush over with a tray of shots. Jeonghan passes on taking one knowing he needs to drive you home. He watches as everyone toast to you quitting your job.

As the night goes on Jeonghan watches as you, Chan, and Darling get absolutely wasted. Honey is quite drunk but nowhere on the level of the others. He doesn’t think he’s ever seen you this drunk. There is something so cute about how fluster you get in this drunken state.

Seungcheol is taking care of his girlfriend who is even more clingy than normal.

Chan is fighting with Wonwoo about not wanting to go home.

“I need to take Chan home,” Wonwoo says, holding the wrist of his very drunk friend.

“I’ll ride with you guys to help,” Minghao chimes in.

“Wonwoo, can you hold my hand?” Honey asked, walking up to her boyfriend.

“I need to get my own drunk one back to my place,” Seungcheol says, holding his girlfriend’s hand.

Leaning into Jeonghan you wrap your arms around his waist holding him. “Hannie, are you going to take me home?”

He leans down pressing his lips to the top of your head, “yes, angel.”

Taking your hand he leads out of the bar and helps you into his car. After buckling you in he starts heading home. Leaning your head against the cool glass window. Reaching over he rests his hand on your thigh.

“Hannie?”

“Yes angel?”

“Thank you,” you murmur, sounding like you’re trying not to fall asleep.

“For what?” He glances over at you trying to focus on the road.

“For being my person.”

“You’re my person too,” he gently squeezes your thigh.

Arriving home he helps you into the elevator. He notices the apartment is quite quiet but he can hear the sound of music lightly playing in Kitten’s room.

“Your bed or mine?” He asked.

“Mine but will you sleep with me? I wanna cuddle.” He had zero intention of letting you sleep alone. In your drunken state he wanted to make sure you were safe.

“Of course.”

He leads you off to the bathroom where he sits you on the toilet and uses one of your makeup wipes and helps you clean your face. Once in your room he helps you strip down to just your underwear. He even helps you remove your bra you were complaining about. He hands you a baggy shirt he knows you love to sleep in. He doesn’t bother going to his room to get his pajama pants. He strips down to his boxers and joins you under the covers.

Curling up on your side he can tell you’re barely awake. He turns off the light on the nightstand on his side of the bed. He curls up behind you spooning you. This is quite possibly his favorite way to fall asleep. He is never more comfortable than when he is holding you.

“Night Hannie,” you whisper.

“Goodnight baby.”

He doesn’t fall asleep as quickly as you. He can’t seem to shut off his mind. He doesn’t understand how one person can make him feel so many emotions like you do.

When sleep finally finds him, he only dreams of you.

-HER-

It’s been two months since the first time you slept together, the first of many times. Since then Jeonghan has brought up filming with you a few times. Recently he’s been enjoying being in the room masturbating with you off screen.

Today is the day he finally asked if he could officially go on your stream with you.

“Maybe pull your hair back so it looks short and wear a face mask in case any of you face shows.” You think it’s best if he stays anonymous as possible. Especially if it ends up being a one time thing.

“Okay.” He works on pulling his hair back.

“If you don’t want to do this I fully understand,” you want to give him an opportunity to back out.

“I want to do this.”

“How do you want to do this?” You need to know what his boundaries are. You’re willing to do anything he feels comfortable doing. You know with Junhui and Cherry he stays fully dressed and plays with her on camera. She’s mentioned they filmed a full sex tape before but she decided against posting it. You aren’t sure if you would ever feel comfortable posting one of those, but if you trust anyone enough to film a full sex tape it would be Jeonghan.

“Maybe the first time you give me head and I’ll finger you.” He seems a little nervous and you don’t blame him. Your first time you went live you were nervous too.

“I’m going to suggest you talk dirty to me while I give you head. People eat that up.”

Jeonghan sits on the bed and you make sure the camera isn’t showing his face. You adjust the camera so no matter where he sits it should only show him from the neck down.

You start your stream and sit on the bed next to him. You’re dressed in a see through lavender bra and crotchless panties.

You greet your audience and tell them you have a mystery friend helping you. All the comments are instantly excited that you have brought someone to film with you. Some of the requests people are leaving are asking him to do wild things to you.

Leaning over you whisper in his ear, “act like it’s just us two.”

He nods silently. Standing up he removes his underwear and sits on the chair angled in front of the camera. The angle makes it where you only see the bottom of his jaw that is covered by a mask. Slowly he strokes his length as you crawl towards him.

“Such a pretty cock,” you say as you sit on your knees in front of him. The sight of him naked on the chair in front of you is mouth watering.

Putting his hand under your chin he tilts your head up. “Are you going to be a good girl for me and suck it?”

“I want you to fuck my mouth.” He groans at your dirty words. You never talk like this to him when you’re fooling around.

Sticking your tongue out you stare at him through your lashes. Tapping his dick against your tongue. You smile as he pulls away. Neither of you are normally like this in bed together and this kind of feels like you’re role playing. This whole scenario is exciting.

“Open,” he commands.

Placing the tip of his dick in your mouth you instantly start sucking him. His dark eyes stay locked on you as you focus on taking him further in your mouth. One hand rests on his thigh steadying yourself while the other pumps his neglected shaft. Your focus is on his sensitive tip right now.

Hollowing your cheeks you take him all the way in. Thank god you don’t really have a gag reflex as he brushes the back of your throat. Looking up at him with watery eyes you wish you could see his whole face. His hands brush your hair away from your face. Making a makeshift ponytail with his hand.

“Such a good girl,” he moans.

He is not even touching you and he’s making you wet. You don’t think you’ve ever cum fully untouched, but today might be the day.

Popping off him you smile up at him taking this moment to properly breathe again. Taking his length in both hands you pump him and focus on his tip again. Tilting his head back he closes his eyes, taking a deep breath.

Taking him back into your mouth you take him until your nose brushes against his will trimmed patch of pubic hair. His stomach muscles tense as he’s on the brink of falling apart.

Pulling off him you look at him and say, “are you going to come in my mouth?”

“That depends, are you going to be a good girl and swallow?”

“Anything for you.”

Hollowing your cheeks you take him fully again. His fingers tangled in your hair helping guide you up and down his length. Your eyes are a watery mess as he keeps brushing the back of your throat. The echoing moan of the word “baby”’ takes over your senses as he feels your mouth with his milky release.

You keep sucking until he’s finished and clearly spent. Pulling off of him he rests his hand on your cheek. His thumb brushes your bottom lip wiping away some of his cum.

Opening your mouth you show him cum. You’ve never been a fan of swallowing, but you would do it everyday with him.

“Good girl,” he whispers. Closing your mouth you swallow everything he gave you.

“Can I play with your favorite vibrator?” He asked standing up. Walking off camera he grabs some tissues cleaning himself up.

“Please.”

“Lay on your bed and spread your legs wide for all the nice people to see.”

Crawling on the bed he sits on his knees next to you. Making sure your wet pussy is on full display for everyone watching. He’s attempting to make sure the only part of him that shows is his jaw that is covered by a mask.

Holding the vibrator to your already sensitive clit he starts by pumping one finger. Giving you a chance to adjust before he adds a second. He hooks his long fingers brushing your g spot over. Your body feels tense as the coil in your stomach tightens. At the rate he’s going you're going to fall apart the quickest you ever have.

“Is baby close to cumming?” He says staring into your lust filled eyes. You aren’t sure you can form proper words, you just nod your head.

“Can you take another finger?”

“Yes.”

He stretches you open more, adding another finger. He clicks up the speed of the vibrator practically making you scream.

Your orgasm hits you like a ton of bricks and for the first time ever fluid rushes out of you. Coating Jeonghan’s arm in your release. Your body feels weightless as you lay there trying to breathe.

Looking at Jeonghan you see his arm glistening. You’ve never squirted before and you weren’t even sure you could. Your cheeks instantly flush, feeling quite embarrassed.

“Such a good girl,” he pulls away from your core. He clicked off the vibrator tossing it on your bed.

“That’s all folks,” he walks over and ends your livestream.

Laying there you close your eyes staring up at the ceiling. Slowly sitting up you watch as he removes his face mask and pulls on his boxers before dashing out of your room. He comes back holding a washcloth.

“Baby spread your legs for me. I need to clean you up.”

The warm water cloth against your sensitive core is nice. “I’ve never squirted before.”

“Oh,” he instantly sports a cocky smile.

“I’m gonna need to clean my sheets.” You can’t even think about getting out of bed yet. Your body feels like jello.

“How about you take a shower and I’ll strip your bed and toss your bedding in the washer.”

“Can I sleep in your bed tonight?” Suddenly things feel very deeper between you and you honestly just want him to hold you.

He helps you stand up. He leans down and presses his lips to yours for a gentle kiss. “Of course you can stay in my bed.”

“What if Kitten sees us?” You ask the question that has been on your mind since this all started.

“We don’t have to hide anything. If she sees us I’m okay with that.”

Slowly you sit up and stare at him for a moment. You don’t think you can really keep your feelings out of whatever is happening between you. “Jeonghan, I like you a lot.”

“I like you a lot too. I actually more than like you.” His words instantly give you butterflies. “Go take a shower and we’ll talk more after. Come to my room after.”

Standing under the warm water you can’t seem to shut off your brain. Things suddenly feel so different, but that’s not a bad thing.

-JEONGHAN-

Three little words have been floating around in his head for a while now. He tries to stop thinking about it as he throws your bedding into the washer. When heads to his room he goes through his drawers finding something for you to sleep in. All he can do is picture your face as you lay on your bed completely blissed out.

The bedroom door opens and you walk in with a towel wrapped around you. “Is Kitten with Joshua?”

“Yeah they’re actually at her parents house for dinner.” He forgot to mention that earlier. “I picked out something for you to sleep in.”

“You don’t want to sleep naked?” You give him a smile.

“I mean we can if you want. I was thinking we could get cozy, and talk about some things.”

You take the clothes from him and get dressed, not bothering to get underwear. You’re wearing some of his sleep shorts, and a baggy shirt.”

Sitting on the edge of the bed Jeonghan stands in front of you for a moment before he leans forward and presses his lips to yours for a gentle kiss. “You know for the longest time you seem to be the only thing I can think about?” His heart swells instantly when he sees you smile at his words.

“Is that a good or a bad thing?”

“It’s very good. You make me so incredibly happy.” He smiles.

“Jeonghan, you make me happy.”

Sitting down on the bed next to you. Taking your hand in his he squeezes it three times. “Hannie-“

“Yes Angel?”

“You truly are my person. I like you so much.” You suddenly feel like crying. They aren’t sad tears. They’re anything but. “You're the first person I’ve ever been that doesn’t make me feel like I’m some slut for my job.”

“Don’t ever call yourself that.” He chimes in.

“I don’t think I am one. I just need you to know. You make me feel so normal.”

The smile on his face is heartwarming. “You know I watched Shau and Kitten figure out their shit. They went from friends to being head over heels for each other. I even watched Wonwoo fall for Honey. And I even saw the other boys find their girlfriends. I was always so jealous wishing that I would know what it’s like to find companionship like theirs and to fall hopelessly in love.” He pauses, reaching up and resting his hand on your cheek. “And then I met you. Everything suddenly felt like it clicked when you moved in. The moment we met I had a feeling I was going to love you.”

Tears start sliding down your cheek. “Yoon Jeonghan, is this your way of telling me you love me?”

“Absolutely,” his thumb brushes the tears staining your cheek.

“I remember when Kitten introduced us. I thought you were so beautiful and I knew I was royalty fucked.” A soft laugh passes your lips. “I love you too, by the way.”

“I should properly say, I love you.” He leans over and presses his lips to your for a soft kiss.

“Does this mean we’re officially a couple?” You think that it’s time you put a label on this.

“Angel have been my girlfriend since we fucked on the couch.” He laughs.

“Since the first night we hooked up?”

“Yes. I haven’t stopped thinking about you since.”

“So you’re my boyfriend?”

“Yes, and you’re my girlfriend.”

Holding your face in both hands he leans in pressing his lips to yours for a heated kiss. Your lips move together as if you need each other to breathe. Pulling away he rested his forehead against yours. “I love you.”

“I love you too.”

Since the beginning things between you have always made sense. You aren’t shocked that you fell in love with your roommate. It almost seems inevitable.

That night when you finally lose your clothes Jeonghan has you on your stomach with a pillow under your hips. Slowly he rolls his hips into you. He hits a spot deep inside. His thrusts are a little lazier than normal but you feel so incredibly close to him. His lips are over your bare shoulders. Between kisses you hear him whisper, “I love you.”

Both your highs reach you at the same time. Falling apart you moan his name. His thrust grows a little sloppy until he slows down.

He sits back on his knees and watches as his cum slowly starts to drip out of you. His mind feels fuzzy and all he can think about in that moment is how much he likes seeing you filled with him. Running his finger through your sensitive folds, he collects his cum and slowly pushes it back inside you.

He’s surprised you don’t comment on his fascination with pushing his cum back inside you.

“Hannie?”

“Yea Angel?”

“Are you having fun back there?” You tease him.

“Sorry I just like seeing you filled with me cum.” He doesn’t even bother trying to lie.

Crawling off the bed slowly he cleans himself off with a tissue before throwing in boxers and heading off to get a warm cloth to clean you up.

Jeonghan puts back on his sweatpants and you get dressed back in the sleep clothes he picked out for you.

Crawling back into bed a soft yawn passes your lips. Rolling in your side you signal for him to come hold you. The moment he is on the bed he pulls close to him. This feels perfect.

-HER-

When morning comes your wake with your body curled up against Jeonghan’s. Your head resting on his chest and your legs tangled together.

You never sleep better than you do when you’re in his arms. A soft yawn passes his lips as he pulls you closer.

“I need coffee,” his voice is raspy.

“We should get up and make some,” you nuzzle against his chest.

Slowly you both crawl out of his bed. He doesn’t bother putting a shirt on. He’s dressed in a pair of grey sweatpants that sit low on his hips. Holding your hand he leads you out of his room and out to the living room.

“Well I didn’t expect to see this,” Joshua's voice startles both of you.

Both of you stop in your tracks. Kitten pops out of the kitchen and instantly smiles at you and Jeonghan holding hands.

“I can’t say I’m shocked,” Kitten has a huge smile on her face. “You two always flirt and Hannie has always been quite fond of (Y/N).” Glancing up you see Jeonghan is blushing. You squeeze his hand and give him a smile. “Also seemed more touchy than normal.”

Kitten looks instantly happy as she stares at both of you. “So is this like an official thing?”

“I mean I love her and she’s my girlfriend,” Jeonghan responds.

“It’s about time you guys got together.” It turns out even your roommate knew that you were supposed to fall in love with Jeonghan.

Maybe Wonwoo is right when he talks about everyone having their own soulmate. Maybe Jeonghan is yours? You love him so much. He just makes everything feel right in your world.

#svthub#Seventeen smut#seventeen x reader#jeonghan smut#yoon jeonghan smut#jeonghan x reader#yoon jeonghan x reader#yoon jeonghan fanfic#jeonghan fanfiction#jeonghan fanfic#seventeen fanfiction#my writing#all for you#apt 847b#seventeen insert reader#jeonghan insert reader#seventeen writing

585 notes

·

View notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

"The majority of high-tech patent lawsuits are brought by patent trolls—companies that exist not to provide products or services, but primarily have a business using patents to threaten others’ work. Some politicians are proposing to make that bad situation worse. ...

The Patent Eligibility Restoration Act, S. 2140, (PERA), sponsored by Senators Thom Tillis (R-NC) and Chris Coons (D-DE) would be a huge gift to patent trolls, a few tech firms that aggressively license patents, and patent lawyers. For everyone else, it will be a huge loss. That’s why we’re opposing it, and asking our supporters to speak out as well.

Patent trolling is still a huge, multi-billion dollar problem that’s especially painful for small businesses and everyday internet users. But, in the last decade, we’ve made modest progress placing limits on patent trolling. The Supreme Court’s 2014 decision in Alice v. CLS Bank barred patents that were nothing more than abstract ideas with computer jargon added in. Using the Alice test, federal courts have kicked out a rogue’s gallery of hundreds of the worst patents.

Under Alice’s clear rules, courts threw out ridiculous patents on “matchmaking”, online picture menus, scavenger hunts, and online photo contests. The nation’s top patent court, the Federal Circuit, actually approved a patent on watching an ad online twice before the Alice rules finally made it clear that patents like that cannot be allowed. The patents on “bingo on a computer?” Gone under Alice. Patents on loyalty programs (on a computer)? Gone. Patents on upselling (with a computer)? All gone. ...

PERA’s attempt to roll back progress goes beyond computer technology. For almost 30 years, some biotech and pharmaceutical companies actually applied for, and were granted, patents on naturally occuring human genes. As a consequence, companies were able to monopolize diagnostic tests that relied on naturally occurring genes in order to help predict diseases such as breast cancer, making such testing far more expensive. The ACLU teamed up with doctors to confront this horrific practice, and sued. That lawsuit led to a historic victory in 2013 when the Supreme Court disallowed patents on human genes found in nature.

If PERA passes, it will explicitly overturn that ruling, allowing human genes to be patented once again. ...

“To See Your Own Blood, Your Own Genes”

From the 1980s until the 2013 Myriad decision, the U.S. Patent and Trademark Office granted patents on human genomic sequences. If researchers “isolated” the gene—a necessary part of analysis—they would then get a patent that described isolating, or purified, as a human process, and insist they weren’t getting a patent on the natural world itself.

But this concept of patenting an “isolated” gene was simply a word game, and a distinction without a difference. With the genetic patent in hand, the patent-holder could demand royalty payments from any kind of test or treatment involving that gene. And that’s exactly what Myriad Genetic did when they patented the BRCA1 and BRCA2 gene sequences, which are important indicators for the prevalence of breast or ovarian cancer.

Myriad’s patents significantly increased the cost of those tests to U.S. patients. The company even sent some doctors cease and desist letters, saying the doctors could not perform simple tests on their own patients—even looking at the gene sequences without Myriad’s permission would constitute patent infringement.

This behavior caused pathologists, scientists, and patients to band together with ACLU lawyers and challenge Myriad’s patents. They litigated all the way to the Supreme Court, and won. “A naturally occurring DNA segment is a product of nature and not patent eligible merely because it has been isolated,” the Supreme Court stated in Association for Molecular Pathology v. Myriad Genetics.

A practice like granting and enforcing patents on human genes should truly be left in the dustbin of history. It’s shocking that pro-patent lobbyists have convinced these Senators to introduce legislation seeking to reinstate such patents. Last month, the President of the College of American Pathologists published an op-ed reminding lawmakers and the public about the danger of patenting the human genome, calling gene patents “dangerous to the public welfare.”

As Lisbeth Ceriani, a breast cancer survivor and a plaintiff in the Myriad case said, “It’s a basic human right to see your own blood, your own genes.” "

227 notes

·

View notes

Text

Compliance Unraveled: How Accounting Software Keeps Small Businesses Legally Sound

Going through the complex legal compliance landscape is an important challenge for small businesses. One key tool that helps in this journey is small businesses accounting software. Integrating platforms like QuickBooks, Gusto, and Zoho is instrumental in addressing various financial needs while ensuring legal adherence.

Financial Transparency for Compliance:

Small businesses accounting software promotes financial transparency, a keystone of legal compliance. These platforms ease accurate record-keeping and financial reporting, enabling businesses to fulfill tax functions efficiently. By integrating QuickBooks, Gusto, or Zoho, businesses gain a detailed view of their financial health, which is vital for regulatory compliance.

Easing Tax Compliance:

Navigating tax regulations can be tiring for small and medium enterprises. However, accounting software eases this time-consuming process by automating calculations and ensuring adherence to tax laws. QuickBooks, Gusto, and Zoho integration improves tax filing, reducing errors and penalties while keeping businesses compliant with constantly evolving tax codes.

Enhanced Reporting and Documentation:

Strong reporting capabilities offered by small businesses accounting software like QuickBooks, Gusto, and Zoho are invaluable for compliance when integrated with the online check printing platform. These platforms generate detailed financial reports and maintain documentation, which is important for audits and regulatory checks. This level of documentation serves as a shield against legal outcomes and ideal for businesses looking for a safe platform.

Payroll Compliance and Accuracy:

Accurate payroll management is essential for legal compliance. Accounting software integrates with payroll functions, ensuring employee compensation and tax withholdings accuracy. Platforms like QuickBooks, Gusto, and Zoho help businesses meet payroll tax functions and maintain compliance with labor laws.

Scalable Solutions for Evolving Regulations:

Small businesses accounting software offers expandable solutions adaptable to changing regulatory landscapes. Integrating QuickBooks, Gusto, or Zoho enables businesses to stay active and compliant with evolving legal requirements. These platforms continuously update features to line up with new regulations, offering businesses peace of mind.

Upholding Integrity: Role of Integration

Integration of accounting software like QuickBooks, Gusto, and Zoho upholds the integrity of small businesses. Easy integration of these platforms ensures data accuracy and consistency, essential for maintaining compliance standards. The union between these tools improves not just financial efficiency but also professional practices. It establishes a framework where businesses operate transparently, lining up every transaction with legal requirements. This integration isn't merely technological; it becomes the backbone that upholds the company's commitment to legal soundness, promoting a culture of compliance within every operational facet.

Conclusion: