#Loan forgiveness

Explore tagged Tumblr posts

Text

The tweet thread.

#jim banks#politics#military#tweets#twitter#loan forgiveness#student loan forgiveness#military enlistment#military recruiting

43K notes

·

View notes

Text

Things Biden and the Democrats did, this week #16

April 26-May 3 2024

President Biden announced $3 billion to help replace lead pipes in the drinking water system. Millions of Americans get their drinking water through lead pipes, which are toxic, no level of lead exposure is safe. This problem disproportionately affects people of color and low income communities. This first investment of a planned $15 billion will replace 1.7 million lead pipe lines. The Biden Administration plans to replace all lead pipes in the country by the end of the decade.

President Biden canceled the student debt of 317,000 former students of a fraudulent for-profit college system. The Art Institutes was a for-profit system of dozens of schools offering degrees in video-game design and other arts. After years of legal troubles around misleading students and falsifying data the last AI schools closed abruptly without warning in September last year. This adds to the $29 billion in debt for 1.7 borrowers who wee mislead and defrauded by their schools which the Biden Administration has done, and a total debt relief for 4.6 million borrowers so far under Biden.

President Biden expanded two California national monuments protecting thousands of acres of land. The two national monuments are the San Gabriel Mountains National Monument and the Berryessa Snow Mountain National Monument, which are being expanded by 120,000 acres. The new protections cover lands of cultural and religious importance to a number of California based native communities. This expansion was first proposed by then Senator Kamala Harris in 2018 as part of a wide ranging plan to expand and protect public land in California. This expansion is part of the Administration's goals to protect, conserve, and restore at least 30 percent of U.S. lands and waters by 2030.

The Department of Transportation announced new rules that will require car manufacturers to install automatic braking systems in new cars. Starting in 2029 all new cars will be required to have systems to detect pedestrians and automatically apply the breaks in an emergency. The National Highway Traffic Safety Administration projects this new rule will save 360 lives every year and prevent at least 24,000 injuries annually.

The IRS announced plans to ramp up audits on the wealthiest Americans. The IRS plans on increasing its audit rate on taxpayers who make over $10 million a year. After decades of Republicans in Congress cutting IRS funding to protect wealthy tax cheats the Biden Administration passed $80 billion for tougher enforcement on the wealthy. The IRS has been able to collect just in one year $500 Million in undisputed but unpaid back taxes from wealthy households, and shows a rise of $31 billion from audits in the 2023 tax year. The IRS also announced its free direct file pilot program was a smashing success. The program allowed tax payers across 12 states to file directly for free with the IRS over the internet. The IRS announced that 140,000 tax payers were able to use it over their target of 100,000, they estimated it saved $5.6 million in tax prep fees, over 90% of users were happy with the webpage and reported it quicker and easier than companies like H&R Block. the IRS plans to bring direct file nationwide next year.

The Department of Interior announced plans for new off shore wind power. The two new sites, off the coast of Oregon and in the Gulf of Maine, would together generate 18 gigawatts of totally clean energy, enough to power 6 million homes.

The Biden Administration announced new rules to finally allow DACA recipients to be covered by Obamacare. Deferred Action for Childhood Arrivals (DACA) is an Obama era policy that allows people brought to the United States as children without legal status to remain and to legally work. However for years DACA recipients have not been able to get health coverage through the Obamacare Health Care Marketplace. This rule change will bring health coverage to at least 100,000 uninsured people.

The Department of Health and Human Services finalized rules that require LGBTQ+ and Intersex minors in the foster care system be placed in supportive and affirming homes.

The Senate confirmed Georgia Alexakis to a life time federal judgeship in Illinois. This brings the total number of federal judges appointed by President Biden to 194. For the first time in history the majority of a President's nominees to the federal bench have not been white men.

#Thanks Biden#Joe Biden#student loans#loan forgiveness#lead poisoning#clean water#DACA#health care#LGBT rights#queer kids#taxes#tax the rich

5K notes

·

View notes

Text

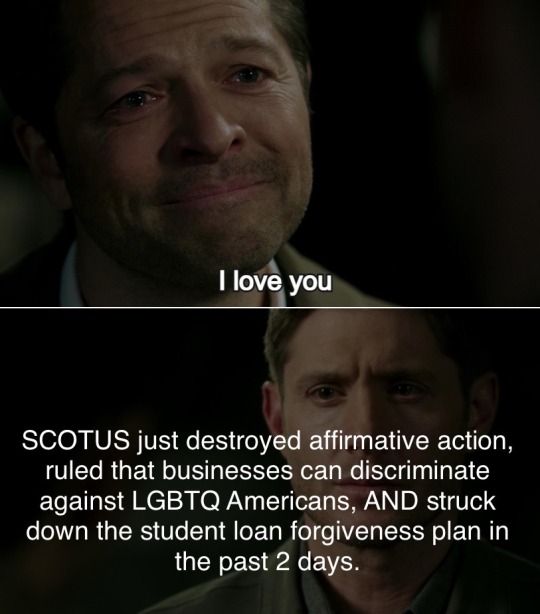

i didn't see anything on my dash yet, so—

#destiel news#scotus#supreme court#affirmative action#lgbt discrimination#pride#student loans#loan forgiveness#edited twice now lol

5K notes

·

View notes

Text

Fortunately, fed student loan borrowers have certain protections per the contractual obligations by Dept. of Ed!

@bookersquared

#department of education#project 2025#republicans#education#college tuition#student loans#donald trump#2024 presidential election#election 2024#us elections#presidential election#loan forgiveness#democrats#politics#black lives matter#kamala 2025#republican lies#students#student loan forgiveness

142 notes

·

View notes

Text

To any American reading this of voting age. Or will be of voting age for the 2024 election… VOTE! Vote vote vote. Register to vote. Ensure your friends are registered to vote. If it wasn’t clear before the SCOTUS decisions in the last two days have spelled it out clearly.

If you are not an able-bodied cis white heterosexual man, you are at risk. They will strip away your rights, they will do everything they can to make sure you are erased. That you are silenced that you are dead.

And if you think that your vote doesn’t matter. That there is no point. Then they have won. You have already let them win. You have let them control you.

They will come after you. If you are not a cis white male you are a target. You are disposable. And you will eventually lose your basic rights as a human being. Because if you are not a cus white man… to them you are not human. Simple as.

#vote#democracy#democrats#republicans#election#elections#scotus#affirmative action#debt forgiveness#loan forgiveness#student debt#America#lgbt#lgbt+#poc#woc#trans#gay rights

1K notes

·

View notes

Text

🙃☹️

#us politics#scotus#student loans#loan forgiveness#is supernatural always tending#spn#196#rule#Clarence Thomas can eat my stinky ass#Brett kavanaugh too#signal boost

1K notes

·

View notes

Text

NDP Leader David Eby is promising to offer a $75-million loan forgiveness program to entice doctors, nurses and health professionals to expand health-care services in rural British Columbia. Eby’s pledge comes as hospitals in rural B.C. face periods of emergency closures, due primarily to staff shortage issues. “There are challenges out there, like rural emergency rooms and staffing in smaller centres, and that’s what today’s announcement is all about,” said Eby at an outdoor news conference at a municipal park in Vernon on the shores of Lake Okanagan. “We need to win the competition for doctors and nurses, both nationally and internationally.”

Continue Reading

Tagging: @newsfromstolenland

#healthcare#healthcare crisis#student loans#loan forgiveness#doctors#nurses#british columbia#ndp#bc election#cdnpoli#canadian politics#canadian news#canada

29 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

188 notes

·

View notes

Text

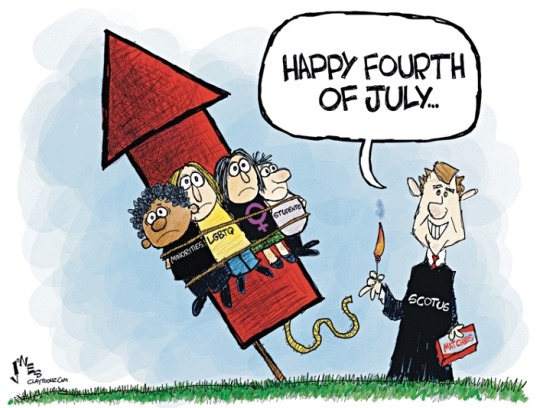

How the Republican Supreme Court is celebrating the holiday.

We ourselves should celebrate by brushing up on SCOTUS corruption and conflict of interest.

Here's an interactive SCOTUS corruption graphic. It's best viewed on medium and larger screens for detail.

Supreme Court Corruption June 27, 2023 • Corrupt Supreme Court

#4th of july#us supreme court#scotus#rights#loan forgiveness#lgbtq+#affirmative action#supreme court corruption#clarence thomas#samuel alito#clay jones

84 notes

·

View notes

Photo

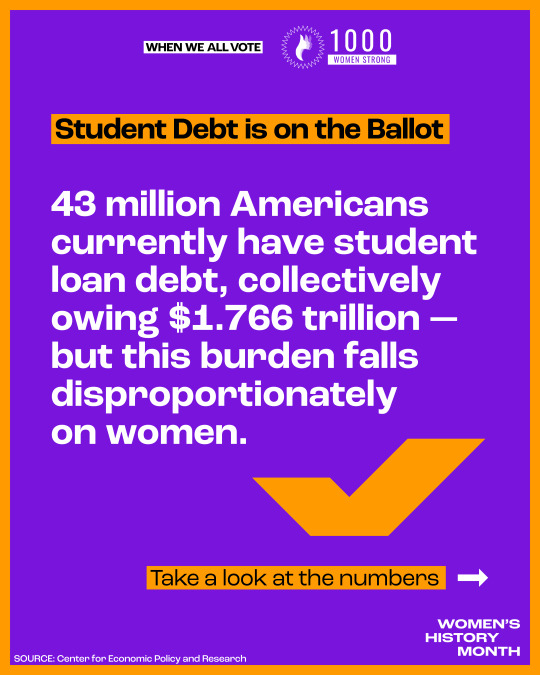

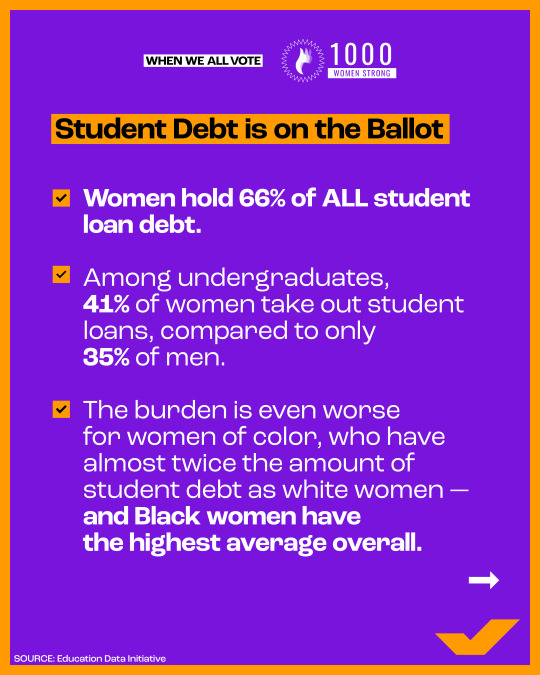

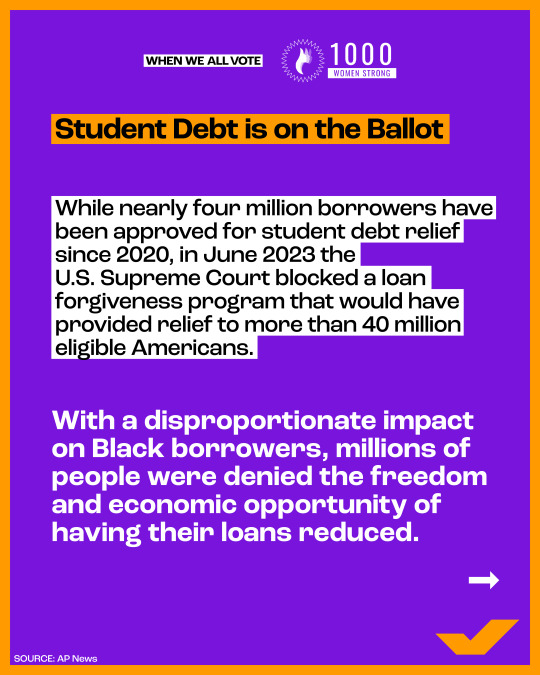

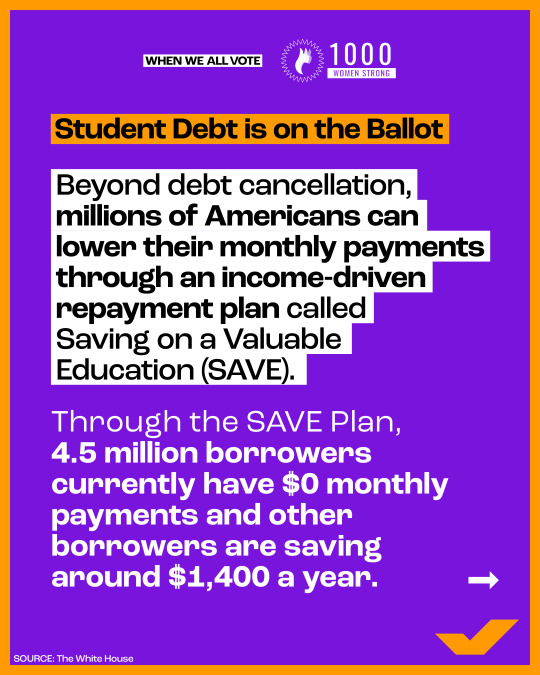

Millions of Americans have student debt on their minds heading into the ballot box this year — especially women of color, who are disproportionately impacted by this burden. 👩🏿🎓👩🏽🎓👩🏾🎓👩🏻🎓

The politicians WE elect can create policies to address student debt relief, college affordability, and repayment plans. Student debt is on the ballot in 2024, and we’ll be voting. 🗳️

Join us and 1k Women Strong in making YOUR voice heard this year. Make sure you’re registered and ready to vote NOW at weall.vote/1kwomenstrong.

#student debt#student debt relief#student loans#college#college affordability#loan forgiveness#SAVE plan#ballot#voting#vote#1k women strong#when we all vote#register to vote

5 notes

·

View notes

Text

By: Preston Cooper

Published: May 8, 2024

Key Points

This report estimates return on investment (ROI) — how much college increases lifetime earnings, minus the costs of college — for 53,000 different degree and certificate programs.

Bachelor’s degree programs have a median ROI of $160,000, but the payoff varies by field of study. Engineering, computer science, nursing, and economics degrees have the highest ROI.

Associate degree and certificate programs have variable ROI, depending on the field of study. Two-year degrees in liberal arts have no ROI, while certificates in the technical trades have a higher payoff than the typical bachelor’s degree.

Nearly half of master’s degree programs leave students financially worse off. However, professional degrees in law, medicine, and dentistry are extremely lucrative.

Around a third of federal Pell Grant and student loan funding pays for programs that do not provide students with a return on investment.

Executive Summary

In recent years, young Americans have expressed more skepticism about the financial value of higher education. While prospective students often ask themselves if college is worth it, this report shows the more important question is when college is worth it.

This report presents estimates of return on investment (ROI) for 53,000 degree and certificate programs ranging from trade schools to medical schools and everything in between. I define ROI as the increase in lifetime earnings that a student can expect when they enroll in a certain degree program, minus the costs of tuition and fees, books and supplies, and lost earnings while enrolled. My preferred measure of ROI accounts for the risk that some students will not finish their programs.

This report updates FREOPP’s previous research on ROI, utilizing new data from the U.S. Department of Education’s College Scorecard.

The findings show that college is worth it more often than not, but there are key exceptions. ROI for the median bachelor’s degree is $160,000, but that median belies a wide range of outcomes for individual programs. Bachelor’s degrees in engineering, computer science, nursing, and economics tend to have a payoff of $500,000 or more. Other majors, including fine arts, education, English, and psychology, usually have a smaller payoff — or none at all.

Alternatives to the traditional four-year degree produce varied results. Undergraduate certificates in the technical trades tend to have a stronger ROI than the median bachelor’s degree. However, many other subbaccalaureate credentials — including associate degrees in liberal arts or general education — have no payoff at all. Field of study is the paramount consideration at both the baccalaureate and subbaccalaureate levels.

The ROI of graduate school is also mixed. Professional degrees in law, medicine, and dentistry tend to have a strong payoff, often in excess of $1 million. However, nearly half of master’s degree programs have no ROI, thanks to their high costs and often-modest earnings benefits. Even the MBA, one of America’s most popular master’s degrees, frequently has a low or negative payoff.

The report introduces a new metric — the mobility index — to quantify the aggregate financial impact of each degree or certificate program. The mobility index multiplies each program’s ROI by the number of students it enrolls, thus rewarding programs for both financial value and inclusivity. Bachelor’s degrees in nursing and business administration dominate the top ranks of the mobility index.

Finally, the report estimates how much federal government funding flows to programs that leave students with no ROI. Around 29 percent of federal Pell Grant and student loan dollars over the last five years were used at programs that leave students with a negative ROI. The results point to a role for federal policymakers in improving the ROI of higher education.

While ROI should not be the only consideration for students approaching the college decision, the ROI estimates presented in this report can help students and their families make better choices regarding higher education. The estimates may also be of interest to other stakeholders, including policymakers, researchers, journalists, and institutions.

The full ROI estimates for undergraduate programs are available here. The full ROI estimates for graduate programs are available here.

[ Continued... ]

==

The article includes an interactive graph which allows you to choose from various majors and find the ROI. Some samples.

Controversial opinion: While there may be an argument to waiving or subsidizing college loans for courses that strongly benefit society, no program with a negative ROI should ever be given loan forgiveness or federal funding.

If you want to study Ancient Mesopotamian Interpretive Dance - or even more uselessly, Gender Studies - for your own pleasure and enjoyment, that's your business. And your financial responsibility; the bill for that resides with you. As far as society and our tax dollars are concerned, forgiving that loan or funding that course is just setting fire to money.

Reminder that you may be better off at a trade school. Courses are often shorter, more targeted and cheaper, so you end up working quicker, earning money more rapidly and have a lower debt that's paid off sooner.

#higher education#student loans#loan forgiveness#return on investment#college#college loans#academic merit#trade school#religion is a mental illness

3 notes

·

View notes

Text

Yesterday i still can’t fathom, my brain hasn’t wrapped around it yet

My loans are being forgiven

My school was found guilty? Or something? It was decided that they didn’t deserve my money

Which I’ve been paying for years

I thought I’d be carrying these loans (and the reminder of my failure and bad decisions) until my kids were grown

So “forgiveness” is the word I’m sticking with

#student debt#loan forgiveness#I want to cry but I’m just too tired#I never should have gone#but now I can finally let it go

2 notes

·

View notes

Text

I'm calling it now, student loan debt forgiveness is gonna be struck down 6-3 with a majority opinion written by Brett Kavanaugh. Who better to say student loan forgiveness is unconstitutional than the guy who had all his debts paid off by an anonymous bribe donation the second he was appointed to the bench? This is all about symbolism, theatrics, culture war bullshit. The court will say that the law in question was an overreach of power, that forgiving debts to those affected by national emergencies is unconstitutional; I'm not even gonna guess at their reasoning, because they don't need any. They can rule however they want and that's final, no matter how flimsy the justification. Their decisions define what the constitution means, so they could turn any amendment around on a whim and we'd be powerless to stop them.

Oh, and now that Biden has ended the covid national emergency they could very well say that the point is moot. "Debt forgiveness under this law only applies to people affected by emergencies, but now there is no emergency so there's no grounds to forgive anything, fuck you POORS!"

It was always a pipe dream, I knew it was, but this still stings.

#student loans#student loan relief#student loan forgiveness#student debt#student debt forgiveness#student debt relief#debt forgiveness#debt relief#loan forgiveness#scotus#supreme court#covid#national emergency

13 notes

·

View notes

Text

800k to get federal loan forgiveness

View On WordPress

#America#biden#college#debt#economics#economy#education#Joe Biden#loan forgiveness#loans#meme#memes#money#news#student loans#supreme court#united states#university

8 notes

·

View notes

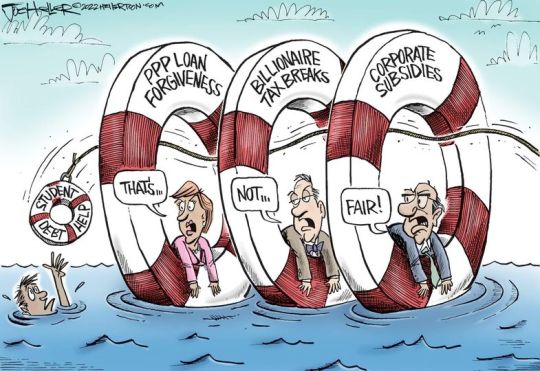

Text

Joe Heller

* * * * *

LETTERS FROM AN AMERICAN

June 30, 2023

HEATHER COX RICHARDSON

JUN 30, 2023

Today the Supreme Court followed up on yesterday’s decision gutting affirmative action with three decisions that will continue to push the United States back to the era before the New Deal.

In 303 Creative LLC v. Elenis the court said that the First Amendment protects website designer Lorie Smith from having to use words she doesn’t believe in support of gay marriage. To get there, the court focused on the marriage website designer’s contention that while she is willing to work with LGBTQ customers, she doesn’t want to use her own words on a personalized website to celebrate gay marriages. Because of that unwillingness, she said, she wants to post on her website that she will not make websites for same-sex weddings. She says she is afraid that in doing so, she will run afoul of Colorado’s anti-discrimination laws, which prevent public businesses from discriminating against certain groups of people.

This whole scenario of being is prospective, by the way: her online business did not exist and no one had complained about it. Smith claims she wants to start the business because “God is calling her ‘to explain His true story about marriage.’” She alleges that in 2016, a gay man approached her to make a website for his upcoming wedding, but yesterday, Melissa Gira Grant of The New Republic reported that, while the man allegedly behind the email does exist, he is an established designer himself (so why would he hire someone who was not?), is not gay, and married his wife 15 years ago. He says he never wrote to Smith, and the stamp on court filings shows she received it the day after she filed the suit.

Despite this history, by a 6–3 vote, the court said that Smith was being hurt by the state law and thus had standing to sue. It decided that requiring the designer to use her own words to support gay marriage violated the First Amendment’s guarantee of free speech.

Taken together with yesterday’s decision ruling that universities cannot consider race as a category in student admissions, the Supreme Court has highlighted a central contradiction in its interpretation of government power: if the Fourteenth Amendment limits the federal government to making sure that there is no discrimination in the United States on the basis of race—the so-called “colorblind” Constitution—as the right-wing justices argued yesterday, it is up to the states to make sure that state laws don’t discriminate against minorities. But that requires either protecting voting rights or accepting minority rule.

This problem has been with us since before the Civil War, when lawmakers in the southern states defended their enslavement of their Black (and Indigenous) neighbors by arguing that true democracy was up to the voters and that those voters had chosen to support enslavement. After the Civil War, most lawmakers didn’t worry too much about states reimposing discriminatory laws because they included Black men as voters first in 1867 with the Military Reconstruction Act and then in 1870 with the Fifteenth Amendment to the Constitution, and they believed such political power would enable Black men to shape the laws under which they lived.

But in 1875 the Supreme Court ruled in Minor v. Happersett that it was legal to cut citizens out of the vote so long as the criteria were not about race. States excluded women, who brought the case, and southern states promptly excluded Black men through literacy clauses, poll taxes, and so on. Northern states mirrored southern laws with their own, designed to keep immigrants from exercising a voice in state governments. At the same time, southern states protected white men from the effects of these exclusionary laws with so-called grandfather clauses, which said a man could vote so long as his grandfather had been eligible.

It turned out that limiting the Fourteenth Amendment to questions of race and letting states choose their voters cemented the power of a minority. The abandonment of federal protection for voting enabled white southerners to abandon democracy and set up a one-party state that kept Black and Brown Americans as well as white women subservient to white men. As in all one-party states, there was little oversight of corruption and no guarantee that laws would be enforced, leaving minorities and women at the mercy of a legal system that often looked the other way when white criminals committed rape and murder.

Many Americans tut-tutted about lynching and the cordons around Black life, but industrialists insisted on keeping the federal government small because they wanted to make sure it could not regulate their businesses or tax them. They liked keeping power at the state level; state governments were far easier to dominate. Southerners understood that overlap: when a group of southern lawmakers in 1890 wrote a defense of the South’s refusal to let Black men vote, they “respectfully dedicated” the book to “the business men of the North.”

In the 1930s the Democrats under President Franklin Delano Roosevelt undermined this coalition by using the federal government to regulate business and provide a social safety net. In the 1940s and 1950s, as racial and gender atrocities began to highlight in popular media just how discriminatory state laws really were, the Supreme Court went further, recognizing that the Fourteenth Amendment’s declaration that states could not deprive any person of the equal protection of the laws meant that the federal government must protect the rights of minorities when states would not. Those rules created modern America.

This is what the radical right seeks to overturn. Yesterday the Supreme Court said that the Fourteenth Amendment could not address racial disparities, but today, like lawmakers in the 1870s, it signaled that it would not protect voting in the states either. It rejected a petition for a review of Mississippi’s strict provision for taking the vote away from felons. That law illustrates just how fully we’re reliving our history: it dates from the 1890 Mississippi constitution that cemented power in white hands. Black Mississippians are currently 2.7 times more likely than white Mississippians to lose the right to vote under the law.

The court went even further today than allowing states to choose their voters. It said that even if state voters do call for minority protections, as Colorado’s anti-discrimination laws do, states cannot protect minorities in the face of someone’s religious beliefs. In her dissent, Justice Sonia Sotomayor wrote that for “the first time in its history,” the court has granted “a business open to the public a constitutional right to refuse to serve members of a protected class.”

It is worth noting that segregation was defended as a deeply held religious belief.

Today, using a case concerning school loans, the Supreme Court also took aim at the power of the federal government to regulate business. In Biden v. Nebraska the court declared by a vote of 6 to 3 that President Biden’s loan forgiveness program, which offered to forgive up to $20,000 of federally held student debt, was unconstitutional. The right-wing majority of the court argued that Congress had not intended to give that much power to the executive branch, although the forgiveness plan was based on law that gave the secretary of education the power to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs…as the Secretary deems necessary in connection with a…national emergency…to ensure” that “recipients of student financial assistance…are not placed in a worse position financially in relation to that financial assistance because of [the national emergency]”.

The right-wing majority based its decision on the so-called major questions doctrine, invented to claw back regulatory power from the federal government. By saying that Congress cannot delegate significant decisions to federal agencies, which are in the executive branch, the court takes on itself the power to decide what a “significant” decision is. The court established this new doctrine in the West Virginia v. Environmental Protection Agency case, stripping the EPA of its ability to regulate certain kinds of air pollution.

“Let’s not beat around the bush,” constitutional analyst Ian Millhiser wrote today in Vox, today’s decision in Biden v. Nebraska “is complete and utter nonsense. It rewrites a federal law which explicitly authorizes the loan forgiveness program, and it relies on a fake legal doctrine known as ‘major questions’ which has no basis in any law or any provision of the Constitution.”

Today’s Supreme Court, packed as it has been by right-wing money behind the Federalist Society and that society’s leader, Leonard Leo, is taking upon itself power over the federal government and the state governments to recreate the world that existed before the New Deal.

Education Secretary Miguel Cardona called out the lurch toward turning the government over to the wealthy, supported as it is by religious footsoldiers like Lorie Smith: “Today, the court substituted itself for Congress,” Cardona told reporters. “It’s outrageous to me that Republicans in Congress and state offices fought so hard against a program that would have helped millions of their own constituents. They had no problem handing trillion-dollar tax cuts to big corporations and the super wealthy.”

Cardona made his point personal: “And many had no problems accepting millions of dollars in forgiven pandemic loans, like Senator Markwayne Mullin from Oklahoma had more than $1.4 million in pandemic loans forgiven. He represents 489,000 eligible borrowers that were turned down today. Representative Brett Guthrie from Kentucky had more than $4.4 million forgiven. He represents more than 90,000 eligible borrowers who were turned down today. Representative Marjorie Taylor Greene from Georgia had more than $180,000 forgiven. She represents more than 91,800 eligible borrowers who were turned down today.”

In the majority opinion of Biden v. Nebraska, Chief Justice John Roberts lamented that those who dislike the court’s decisions have accused the court of “going beyond the proper role of the judiciary.” He defended the court’s decision and urged those who disagreed with it not to disparage the court because “such misperception would be harmful to this institution and our country.” But what is at stake is not simply these individual decisions, whether or not you agree with them; at stake is the way our democracy operates.

Norman Ornstein of the American Enterprise Institute didn’t offer much hope for Roberts’s plea. “It is not just the rulings the Roberts Court is making,” he tweeted. “They created out of [w]hole cloth a bogus, major questions doctrine. They made a mockery of standing. They rewrite laws to fit their radical ideological preferences. They have unilaterally blown up the legitimacy of the Court.”

In a shot across the bow of this radical court, in her dissent to Biden v. Nebraska, Justice Elena Kagan wrote that “the Court, by deciding this case, exercises authority it does not have. It violates the Constitution.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Joe Heller#Loan forgiveness#political cartoon#student loan debt#radical SCOTUS#corrupt SCOTUS#partisan SCOTUS#Heather Cox Richardson#Letters From An American

11 notes

·

View notes

Note

Hi, I don't mean to bother you, but I'm at a loss and don't know anyone reliable to ask, but this is regarding your text post about SAVE. I went to apply for it, and got directed to apply for an IDR plan. Two days later the servicer received the IDR application, then I got a monthly statement from the servicer the day after. I checked my studentaidgov account and it states the IDR plan is approved. I try going to the SAVE plan, but get directed to IDR? Is there anything else I need to do?

Answering this publicly because student loans are scary and confusing. Save IS an income-driven repayment plan, so being redirected to IDR is normal and correct. It will tell you which plan you applied for on the student aid website (studentaid.gov) if you navigate to My Activity on your account dashboard. You can select View All Activity and there will be a little more info. Screenshot for context!

If you aren't happy with what your requested IDR is, you can go back through the steps of applying under the Manage Your IDR option. You should be given all of the different IDRs that you qualify for. See below screenshot for context.

In all likelihood SAVE will be your best option. But it might not be. It's important to actually look at them and assess.

Anyway, go forth and save money, tumblr!

3 notes

·

View notes