#Loan amortization schedule

Explore tagged Tumblr posts

Text

Can You Get a Personal Loan with a Step-Up EMI Plan?

A personal loan is a great financial tool that provides quick access to funds for various needs, including medical emergencies, home renovations, education, and travel. However, managing loan repayments can sometimes be challenging, especially if your income is expected to increase in the future.

This is where a Step-Up EMI Plan comes into play. A Step-Up EMI (Equated Monthly Installment) Plan is designed to make loan repayments more manageable by allowing borrowers to start with low EMIs and gradually increase them over time. But can you get a personal loan with this repayment option? Let’s explore how it works, its benefits, and whether it is the right choice for you.

1. What Is a Step-Up EMI Plan?

A Step-Up EMI Plan is a structured loan repayment method where EMIs start low and increase periodically throughout the loan tenure. This type of repayment plan is beneficial for individuals who expect their income to rise over time, such as young professionals, business owners, or salaried employees due for promotions.

How Does It Work?

The borrower initially pays a lower EMI for a certain period.

Over time, the EMI amount gradually increases based on a pre-defined schedule.

The loan tenure remains fixed, but the repayment burden aligns with the borrower's growing income.

This plan makes personal loan repayment more flexible and helps borrowers manage their finances efficiently.

2. Can You Get a Personal Loan with a Step-Up EMI Plan?

Yes, several banks and Non-Banking Financial Companies (NBFCs) offer personal loans with Step-Up EMI Plans. However, the availability depends on:

Lender policies – Not all banks offer this facility for personal loans.

Borrower’s creditworthiness – A strong credit score and income stability increase eligibility.

Loan tenure and amount – Step-Up EMI Plans are more common for long-term loans.

Before applying, it’s crucial to check whether your lender provides Step-Up EMI options for personal loans and understand the specific terms and conditions.

3. Benefits of Choosing a Step-Up EMI Plan for a Personal Loan

A Step-Up EMI Plan can be a strategic choice for borrowers with increasing income potential. Here are some key benefits:

A. Lower Initial EMIs Reduce Financial Stress

Borrowers can start with lower EMIs, making loan repayment affordable in the initial stages.

This is particularly beneficial for young professionals or new business owners with limited income at the start.

B. Helps Manage Cash Flow Efficiently

Low initial EMIs allow borrowers to allocate funds toward other financial goals.

As income increases, borrowers can handle higher EMIs comfortably without financial strain.

C. Improves Loan Affordability

Step-Up EMI Plans allow borrowers to qualify for a higher loan amount since lenders consider the future increase in income.

This is ideal for borrowers looking to finance big-ticket expenses.

D. Reduces Overall Interest Outflow

Since EMIs increase over time, the principal repayment accelerates, reducing the total interest paid.

Faster principal repayment means lower outstanding loan balance, leading to interest savings.

E. Boosts Credit Score

Regular and timely EMI payments build a positive credit history.

A strong credit score enhances eligibility for future loans at better interest rates.

4. Eligibility Criteria for a Step-Up EMI Personal Loan

To qualify for a personal loan with a Step-Up EMI Plan, borrowers must meet certain eligibility requirements:

A. Credit Score Requirement

A minimum credit score of 750 is preferred by most lenders.

A high score increases approval chances and helps secure better interest rates.

B. Stable Income Source

Salaried employees should have a stable job with a reputed company.

Self-employed individuals must show a consistent income flow with valid financial documents.

C. Age Criteria

Applicants typically need to be between 21 and 60 years old.

Younger professionals with strong future earning potential are more likely to get approval.

D. Debt-to-Income Ratio (DTI)

Lenders assess existing liabilities to ensure borrowers can handle the increasing EMIs.

A lower DTI ratio (below 40%) improves loan approval chances.

5. How to Apply for a Step-Up EMI Personal Loan?

If you meet the eligibility requirements, you can follow these steps to apply for a Step-Up EMI personal loan:

Step 1: Research Lenders Offering Step-Up EMI Plans

Compare interest rates, loan terms, and eligibility criteria.

Check if the lender explicitly offers Step-Up EMI options for personal loans.

Step 2: Calculate EMI Using an Online EMI Calculator

Use a Step-Up EMI Calculator to determine the initial EMI, periodic increase, and final EMI.

Ensure the repayment schedule aligns with your expected income growth.

Step 3: Gather Required Documents

Most lenders require the following documents:

Identity Proof: Aadhaar Card, PAN Card, Passport, or Voter ID.

Address Proof: Utility bill, rental agreement, or passport.

Income Proof: Salary slips (for salaried) or income tax returns (for self-employed).

Bank Statements: Last 3 to 6 months' statements to assess financial stability.

Step 4: Submit Application Online or Offline

Visit the lender’s website or branch to apply.

Fill in the application form, upload documents, and wait for approval.

Step 5: Loan Approval and Disbursement

If approved, the loan amount is credited directly to your bank account.

Ensure you understand the repayment schedule and interest calculations.

6. Things to Consider Before Choosing a Step-Up EMI Plan

While a Step-Up EMI Plan offers several benefits, it's essential to evaluate whether it suits your financial situation. Here are some factors to consider:

A. Can You Handle the Increasing EMIs?

Ensure that your income growth matches the EMI hikes.

If income remains stagnant, higher EMIs in later years could become a burden.

B. Compare with Regular EMI Plans

Check if a standard EMI plan with a lower interest rate is more cost-effective.

In some cases, lenders may charge higher interest rates for Step-Up EMI Plans.

C. Understand the Interest Calculation

Some lenders back-load interest payments, meaning the initial EMIs primarily cover interest rather than the principal.

Always ask for a detailed loan amortization schedule before signing the agreement.

D. Check for Prepayment or Foreclosure Charges

If you plan to prepay or foreclose the loan early, check if the lender charges penalties.

Some lenders offer zero prepayment charges after a certain period.

Conclusion

A Step-Up EMI Plan for a personal loan is a smart choice for borrowers expecting a steady rise in income over time. It provides financial flexibility, making initial repayments easier while allowing for higher EMIs later.

However, it’s essential to compare lenders, assess future income stability, and understand the total interest cost before choosing this repayment plan.

If managed well, a Step-Up EMI personal loan can help you achieve your financial goals without straining your current budget. Always evaluate your repayment capability and choose a plan that aligns with your financial growth and stability.

#personal loan online#fincrif#nbfc personal loan#personal loans#loan apps#loan services#bank#finance#personal loan#personal laon#Personal loan#Step-up EMI plan#Loan repayment#Personal loan EMI#Flexible EMI options#How does a step-up EMI plan work?#Benefits of step-up EMI for personal loans#Best banks for step-up EMI personal loans#Can you increase your EMI over time?#Step-up vs. step-down EMI plans#Personal loan interest rates#Loan amortization schedule#Reducing personal loan interest#Personal loan prepayment#Interest savings on step-up EMI#Credit score for personal loans#Debt-to-income ratio for loans#Personal loan approval process#Loan application requirements#Minimum salary for a personal loan

0 notes

Text

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Introduction Managing a loan can be a complex task, especially when it comes to tracking payments, interest, and prepayments. In this article, we’ll explore a Python script that generates a loan amortization schedule with the ability to apply prepayments. The script utilizes the Pandas library for data manipulation and Excel export. Loan Amortization Schedule A loan amortization schedule is a…

View On WordPress

#Compound interest#Excel export#Financial management#Financial planning#Loan amortization schedule#Loan analysis#Loan interest savings#Loan management tool#Loan optimization#Loan payment breakdown#Loan payoff calculator.#Loan payoff strategy#Loan repayment#Loan schedule generation#Loan tenure reduction#Loan tracking#Pandas library#Personal finance#Prepayments#Python loan calculator

1 note

·

View note

Text

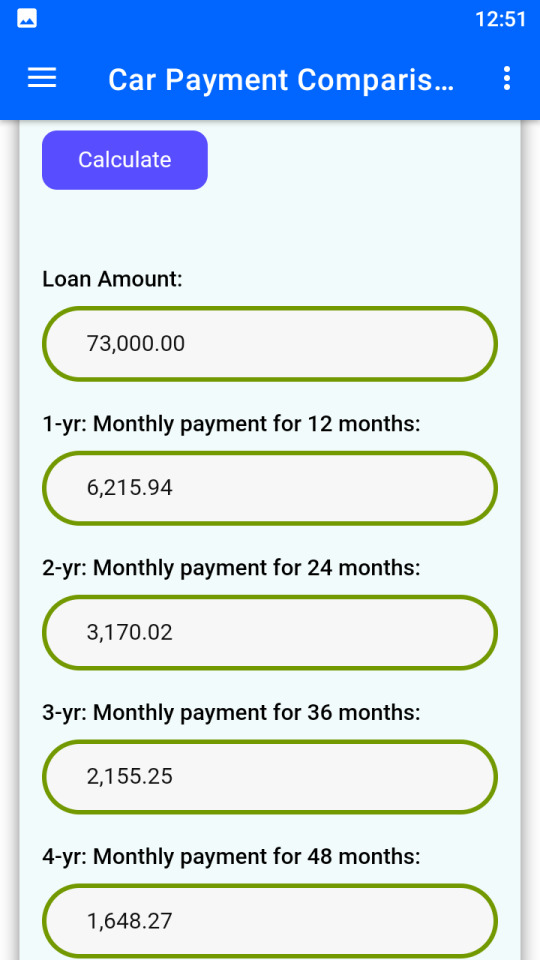

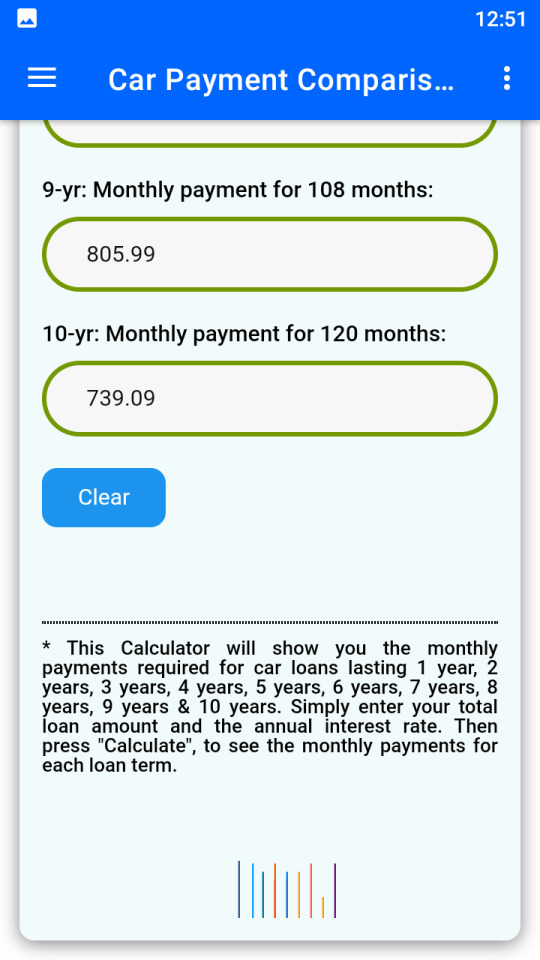

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

Amortization Loan Calculator – Loan Amortization Schedule Calculator – EMI Amortization Calculator – Amortization Calculator Free

Are you considering taking out a loan, but wondering how much you'll be paying each month? Do you want to know how much interest you'll be paying over the life of the loan? An amortization loan calculator can help you answer these questions and more.

What is an Amortization Loan Calculator?

An amortization loan calculator is a tool that can help you calculate how much your loan will cost over time. It takes into account the loan amount, interest rate, and the length of the loan to give you an estimate of what your monthly payments will be. Additionally, it can provide you with an amortization schedule, which shows how much of each payment goes toward the principal and how much goes toward interest.

Benefits of Using an Amortization Loan Calculator

Accurate Estimates

One of the most significant benefits of using an amortization loan calculator is that it can provide you with accurate estimates. When you use this tool, you can be confident that the numbers you're getting are reliable, which can help you make better decisions about your finances.

Saves Time

Using an amortization loan calculator can also save you time. Instead of manually calculating how much you'll be paying each month, you can use the calculator to get an estimate within seconds.

Better Decision Making

When you know how much your loan will cost over time, you can make better decisions about whether or not to take out a loan. For example, you may find that the interest rate is too high, or that the monthly payments are too high for your budget. With this information, you can adjust the terms of the loan to better suit your needs.

Helps with Budgeting

An amortization loan calculator can also help you with budgeting. By knowing how much you'll be paying each month, you can plan your finances accordingly. This can help you avoid missed payments, late fees, and other financial problems.

Types of Amortization Loan Calculators

Loan Amortization Schedule Calculator

A loan amortization schedule calculator is a tool that provides a breakdown of your loan payments over time. It shows how much of each payment goes toward the principal and how much goes toward interest. Additionally, it shows the remaining balance of the loan after each payment.

EMI Amortization Calculator

An EMI (Equated Monthly Installment) amortization calculator is a tool that helps you calculate your monthly loan payments. It takes into account the loan amount, interest rate, and the length of the loan to provide you with an estimate of what your monthly payments will be.

Amortization Loan Calculator with Extra Payments

An amortization loan calculator with extra payments is a tool that allows you to add extra payments to your loan. It takes into account the loan amount, interest rate, and the length of the loan, as well as the amount and frequency of the extra payments. This can help you see how much you'll save in interest by paying extra each month.

Amortization Calculator Free

An amortization calculator free is a tool that provides you with the same benefits as other amortization calculators, but without any cost. These tools are often available online and can be used by anyone to get an estimate of their loan payments.

Conclusion

If you're considering taking out a loan, using an amortization loan calculator can be incredibly helpful. It can provide you with accurate estimates, save you time, and help you make better decisions about your finances. Additionally, there are different types of amortization loan calculators available, including loan amortization schedule calculators, EMI amortization calculators, and calculators with extra payments. And the best part is that there are many free amortization calculators available online, so you don't have to pay anything to use them.

#Amortization Loan Calculator#Loan Amortization Schedule Calculator#EMI Amortization Calculator#Amortization Calculator Free

1 note

·

View note

Text

Choosing the Right Commercial Real Estate Financing: Why the SBA 504 Real Estate Loan Stands Out?

Securing the right financing option for commercial real estate could be a significant aspect for business owners. Expanding your business, acquiring a new property, or investing in other assets are all processes that would warrant taking out a loan, and knowing which type of loan to take is important to ensure favorable terms and rates are secured. Of all the different loan products available, many small business owners are keen on the SBA 504 Real Estate Loan. In this blog, we will see the reasons why the SBA 504 loan is worth your consideration when it comes to commercial real estate financing.

Understanding commercial real estate financing

Commercial real estate financing refers to the funding used for buying, improving, or refinancing any income-generating asset such as an office, retail, or industrial building. Business people looking for such funding can consider several sources, such as bank loans, commercial mortgages, and government loans. All these options present their own pros and cons, making it important to select one that fits the needs of one's business.

What Is a 504 Real Estate Loan?

In finance, it is a long-term, fixed-rate loan aimed at small businesses for purchasing capital assets, for example, real estate or expensive machinery. The difference between an SBA 504 real estate loan and an ordinary commercial loan is that the former is a tri-partite agreement between the lender, a CDC (Certified Development Company), and the borrower. Here is how it works:

1. The lender advances 50% of the project costs.

2. A non-profit counterpart, the CDC, takes 40% of that.

3. The last 10% is taken up by the borrower.

This risk-sharing approach helps in giving better terms to the small business owners, making them less risky for the lenders.

Advantages of the SBA 504 Loan for Real Estate Financing

Following are the reasons making the SBA 504 Real Estate Loan an ideal option for most people in need of commercial real estate financing:

Lower Deposit Requirement- In factor analysis, the low deposit perceived as one of the primary working capital loan merits, as in a few cases starting from 10% only required. This is advantageous to most small enterprises that want to safeguard their liquidity. Unlike commercial loans that may have more expensive down payments, the SBA 504 loan enables businesses to keep a greater portion of their funds available for other purposes.

Locked-in Interest Rates-The SBA 504 loan has locked in interest rates, which implies that the interest rate will be charged at the same rate for the duration of the loan. This provides an element of certainty that is often not present owing to the unique nature of other commercial real estate financing. This makes it easily possible to plan and budget for such activities.

Amortization Schedule- The repayment period of the SBA 504 loan is also quite long, often extending to a full 25 years on the purchase of real estate. This helps to lower the level of monthly payments; hence, it’s easier for small businesses to repay their debts. Greater repayment terms are a big plus in comparison with several direct commercial financing institutions whose repayment periods tend to be shorter.

Enabler for Investment Spending- Where a business has the need to make an investment, such as a purchase of a bigger office, a warehouse, or buying machinery, the SBA 504 loan comes in handy. It is a perfect match for advancing companies that are in serious need of buying new properties.

Why Choose Zeus Commercial Capital?

Finding the right financing can be hard, and that’s where Zeus Commercial Capital stands out. We form and manage portfolios of debt to minimize cost while enabling the financing of all commercial real estate loans. You can rely on us for professional assistance and successful realization of your plans and goals in regard to SBA 504 real estate loans.

Final Thoughts

The importance of selecting the most appropriate commercial real estate financing for the advancement and achievement of your business cannot be overstated. The majority of small businesses can opt for the SBA 504 Real Estate Loan since it has comparatively low equity requirements, fixed government rates, as well as more extended payback periods. For those seeking professional assistance with understanding the most appropriate financing options for their business, Zeus Commercial Capital is available. We will help you with relevant guidance and find the most suitable solution.

2 notes

·

View notes

Text

0 notes

Text

Financial Calculators for Smart Money Management in the USA – Free Tools at Maveric Elite Tech

Managing personal and business finances requires careful planning and accurate calculations. Whether you are budgeting your salary, planning a mortgage, evaluating an investment, or figuring out how much you need to save, having the right financial tools at your fingertips is crucial. That’s where Maverick Elite Tech comes in.

At Maverick Elite Tech, we offer a range of free financial calculators designed to simplify your financial decisions and help you gain better control over your money. From determining your take-home pay to calculating interest rates and loan amortizations, our tools provide quick and precise answers to your financial queries.

Why Use Financial Calculators?

Financial calculators are essential tools for making informed financial decisions. They help individuals, business owners, and investors assess their financial health and plan for the future. Instead of manually performing complex calculations, you can rely on these tools to get instant and accurate results.

Our financial calculators in the USA are designed to help you:

Understand how much you will take home after taxes.

Plan your mortgage payments and home-buying expenses.

Estimate your returns on investments (ROI).

Calculate interest on loans and savings.

Budget for rent and other monthly expenses.

Create an amortization schedule for loan repayments.

With Maverick Elite Tech, you get access to these essential financial calculators for free, ensuring that you make the best financial choices without hassle.

Types of Financial Calculators Available at Maverick Elite Tech

1. Salary Calculator in the USA

If you want to determine your take-home salary after deductions such as federal and state taxes, Social Security, and other withholdings, our salary calculator in the USA is the perfect tool. It helps employees and freelancers understand how much they will actually earn after tax deductions, allowing for better financial planning.

2. ROI Calculator in the USA

Investing your money wisely requires an understanding of potential returns. Our ROI calculator in USA helps investors estimate their return on investment by calculating the percentage of profit or loss relative to the initial investment. Whether you are investing in stocks, real estate, or a new business venture, this tool provides valuable insights into your investment decisions.

3. Simple Interest Calculator in the USA

For those who want to determine how much interest they will earn or pay on a loan, our simple interest calculator in USA makes it easy. This tool calculates the interest based on the principal amount, rate of interest, and time period, making it useful for personal loans, savings accounts, and short-term investments.

4. Interest Calculator in the USA

Unlike simple interest, compound interest calculations can be more complex. Our interest calculator in USA helps you determine how much interest will accrue over time on savings, investments, or loans, factoring in compounding periods. This is an essential tool for those looking to maximize their earnings or understand loan repayment structures.

5. Rent Calculator in the USA

Are you planning to move to a new apartment or house? Our rent calculator in USA helps you estimate how much rent you can afford based on your income and expenses. This tool is particularly useful for renters who want to budget wisely and ensure they do not overspend on housing costs.

6. Mortgage Calculator in the USA

Buying a home is one of the biggest financial decisions you’ll make. Our mortgage calculator in USA helps you estimate your monthly mortgage payments based on loan amount, interest rate, and loan term. This tool allows homebuyers to plan their finances accordingly and choose the best mortgage option.

7. Amortization Calculator in the USA

Loan repayment schedules can be complex, especially with interest calculations. Our amortization calculator in USA breaks down your loan repayment schedule, showing how much of each payment goes toward interest and principal. This tool is essential for borrowers who want to understand their loan structure and repayment strategy.

8. Saving Calculator in the USA

Saving money requires discipline and proper planning. Our saving calculator in USA helps users estimate how much they need to save each month to reach their financial goals. Whether you are saving for retirement, an emergency fund, or a big purchase, this tool provides clear savings projections.

Why Choose Maverick Elite Tech for Financial Calculators?

At Maverick Elite Tech, we believe financial clarity should be available to everyone. That’s why we offer these tools completely free of charge. Our financial calculators provide:

Accuracy – Get precise calculations for your financial needs.

Ease of Use – Simple, user-friendly interfaces make calculations quick and easy.

Instant Results – Save time with immediate financial insights.

Comprehensive Tools – A wide range of calculators to cover all financial aspects.

Whether you are an individual looking to plan your finances, a homebuyer assessing mortgage payments, or an investor analyzing returns, our financial calculators offer everything you need in one place.

Get Started with Free Financial Calculators Today!

Take control of your finances today with Maverick Elite Tech. Our suite of financial calculators in USA is designed to make money management effortless. No hidden fees, no complicated steps—just reliable financial tools at your fingertips.

Explore our financial calculator, salary calculator, ROI calculator, interest calculators, rent calculator, mortgage tools, amortization calculator, and saving calculator in the USA for free now and start making smarter financial decisions!

#financial calculators#salary calculator in usa#roi calculator in usa#simple interest calculator in usa#interest calculator in usa#rent calculator in usa#financial calculator in usa#amortization calculator in usa#mortgage calculator in usa#saving calculator in usa

0 notes

Text

Canadian Mortgage Calculator | Estimate Your Home Loan Easily

Use our Canadian Mortgage Calculator to estimate your monthly payments, interest costs, and amortization schedule. Compare mortgage rates, APR vs. interest rate, and make informed home financing decisions. Whether you're a first-time buyer or refinancing, get accurate calculations in seconds. Learn more about mortgage basics at Trish DeBoer’s Blog.

0 notes

Text

Commercial Loan Documentation: Key Differences from Residential Mortgages!

Introduction:

Commercial loan documentation differs significantly from residential mortgages due to the complex nature of commercial transactions and the varying needs of commercial borrowers. Understanding these differences is essential for brokers transitioning from residential to commercial lending, as it impacts the loan origination process, risk assessment, and compliance requirements. This article explores the unique documentation requirements for commercial loans and highlights key differences compared to residential mortgages. 1. Legal Structure and Borrower Type:

Commercial loans often involve entities such as corporations, partnerships, or LLCs, rather than individual borrowers as seen in residential mortgages. As a result, documentation may include organizational documents, such as articles of incorporation, partnership agreements, or operating agreements, in addition to personal financial statements for guarantors. 2. Property Types and Usage:

Commercial properties encompass a wide range of asset classes, including office buildings, retail spaces, industrial properties, and multifamily complexes. Documentation requirements vary depending on the property type and its intended use. For example, lenders may require environmental assessments or zoning documentation for certain property types. 3. Financial Documentation:

Commercial loan underwriting involves a more in-depth analysis of a borrower's financials compared to residential mortgages. In addition to personal and business tax returns, lenders may request detailed financial statements, cash flow projections, and rent rolls for commercial properties to assess income stability and repayment capacity. 4. Appraisal and Due Diligence:

Commercial loan transactions often require more extensive due diligence and property valuation processes than residential mortgages. Appraisal reports for commercial properties may include income approach, cost approach, and sales comparison approach to determine property value accurately. Lenders may also conduct environmental and property condition assessments to evaluate risk. 5. Loan Terms and Conditions:

Commercial loan documentation typically includes detailed terms and conditions tailored to the specific transaction. Unlike standardized residential mortgage forms, commercial loan agreements are often negotiated between parties and may include customized provisions related to loan amounts, interest rates, amortization schedules, prepayment penalties, and collateral requirements. 6. Legal and Regulatory Compliance:

Compliance with legal and regulatory requirements is paramount in commercial lending. Brokers must ensure that all documentation complies with federal, state, and local laws governing commercial transactions, including Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and Anti-Money Laundering (AML) regulations. 7. Risk Mitigation and Guarantees:

Commercial loan documentation may include additional provisions to mitigate risk and protect lenders' interests. Personal guarantees from borrowers or principal owners are common in commercial loans, providing lenders with recourse in the event of default. Cross-collateralization and subordination agreements may also be utilized to secure loans.

Conclusion:

Navigating the documentation requirements for commercial loans requires a thorough understanding of the unique aspects of commercial transactions and diligent attention to detail. Brokers transitioning from residential to commercial lending must familiarize themselves with the legal, financial, and regulatory considerations involved in commercial loan documentation. By leveraging their expertise and adapting to the specific needs of commercial borrowers and lenders, brokers can facilitate successful commercial loan transactions and contribute to the growth of their clients' businesses.

#CommercialLoan#LoanDocumentation#ResidentialMortgage#MortgageBroker#RealEstateFinance#LoanOfficer#BusinessLoan#HomeLoan#LoanProcessing#FinancialDocumentation#PropertyInvestment#LoanUnderwriting#LegalCompliance#RiskMitigation#RealEstate

1 note

·

View note

Text

Key Benefits of Large Balance Commercial Loans Explained

Large balance commercial loans play a crucial role in fueling business expansion, acquisitions, and large-scale projects. These loans cater to businesses needing substantial capital, typically exceeding $5 million, to finance real estate acquisitions, development projects, or other major investments. Understanding the key benefits of large balance commercial loans can help businesses make informed financial decisions. Below, we explore some of the significant advantages of these loans.

1. Access to Substantial Capital

One of the primary benefits of large balance commercial loans & fix and flip loans is the ability to secure significant funding. Businesses that require substantial capital to purchase commercial properties, renovate existing structures, or expand operations can obtain the necessary funds without straining their cash flow. Unlike smaller business loans, which may not provide enough capital for large-scale projects, large balance loans offer the financial strength businesses need to achieve their strategic goals.

2. Flexible Loan Terms

Large balance commercial loans typically come with more flexible repayment terms, allowing businesses to structure their financing to meet their specific needs. Borrowers can often negotiate loan durations, repayment schedules, and interest rates that align with their cash flow and revenue projections. Some lenders offer interest-only periods, giving businesses the breathing room to focus on growth before making principal payments.

3. Lower Interest Rates

Compared to other forms of commercial financing, large balance commercial loans often have lower interest rates. Because these loans are generally secured by high-value assets such as commercial real estate or business infrastructure, lenders offer competitive rates to qualified borrowers. Lower interest rates translate into reduced borrowing costs over time, making these loans a cost-effective way to finance large-scale investments.

4. Business Expansion Opportunities

For companies looking to scale their operations, large balance commercial loans provide the financial foundation to acquire new properties, open additional locations, or invest in large infrastructure projects. Whether expanding into new markets, upgrading facilities, or purchasing high-value equipment, businesses can leverage these loans to achieve long-term growth and profitability.

5. Improved Cash Flow Management

Rather than using liquid assets or operational revenue to fund major purchases, businesses can use large balance commercial loans & new construction loans to maintain liquidity. Keeping cash reserves intact enables companies to cover daily expenses, invest in inventory, and manage payroll efficiently. With a well-structured repayment plan, businesses can sustain operations without disrupting their financial stability.

6. Potential for Higher ROI

Investing in commercial real estate or large-scale business projects can yield significant returns over time. Large balance commercial loans allow businesses to seize lucrative opportunities that may be unattainable with limited capital. By financing major acquisitions or expansion projects, companies position themselves for higher profitability and long-term success.

7. Customized Loan Structures

Lenders offering large balance commercial loans often provide customized loan structures to suit the borrower’s financial situation. Businesses can work with financial institutions to develop repayment plans tailored to their revenue streams and business cycles. Whether opting for fixed or variable interest rates, balloon payments, or extended amortization periods, borrowers can choose the terms that best align with their financial goals.

8. Tax Benefits

Depending on the loan’s structure and how the funds are used, businesses may benefit from various tax deductions. Interest payments on commercial loans are often tax-deductible, helping companies reduce their taxable income. Additionally, certain real estate purchases and equipment financing may qualify for tax incentives, further enhancing the financial advantages of large balance commercial loans.

9. Diversification of Funding Sources

Relying solely on internal capital or short-term financing can limit a business’s ability to grow. Large balance commercial loans provide an alternative funding source that allows businesses to diversify their financial strategy. By securing long-term financing, companies reduce their dependency on operational cash flow, ensuring stability during economic fluctuations.

10. Competitive Advantage

Access to significant funding gives businesses a competitive edge in their industry. Companies with the financial resources to invest in new technologies, expand their market presence, or acquire strategic assets can outpace competitors. Large balance commercial loans enable businesses to act swiftly on growth opportunities, solidifying their position in the market.

Conclusion

Large balance commercial loans provide businesses with the capital, flexibility, and financial leverage needed to undertake significant projects and expansion efforts. From lower interest rates and customized loan structures to tax benefits and improved cash flow management, these loans offer numerous advantages that can drive business success. For companies aiming for long-term growth, understanding and leveraging the benefits of large balance commercial loans is a strategic move toward achieving financial stability and competitive dominance.

0 notes

Text

How Do Loan Amortization Schedules Impact Interest Costs?

A personal loan is a convenient financial solution that helps individuals manage various expenses, including medical emergencies, education, home renovation, and debt consolidation. While taking a personal loan, understanding how your repayment structure works is crucial to managing your finances effectively. One of the key factors that determine how much interest you will pay over the loan tenure is the loan amortization schedule.

A loan amortization schedule is a structured plan that outlines how each monthly EMI (Equated Monthly Installment) is divided between principal repayment and interest payment. The way your loan is amortized directly impacts the total interest cost you incur over time. In this article, we will explore how loan amortization schedules work, how they influence interest costs, and strategies to reduce the total interest burden on your personal loan.

1. What Is a Loan Amortization Schedule?

A loan amortization schedule is a detailed breakdown of how each EMI is allocated toward principal repayment and interest payment over the loan tenure. It provides clarity on how the outstanding loan balance decreases over time.

Key Components of a Loan Amortization Schedule:

✅ EMI Amount – The fixed monthly payment made by the borrower. ✅ Principal Component – The portion of the EMI that goes toward reducing the loan amount. ✅ Interest Component – The portion of the EMI that is paid as interest to the lender. ✅ Outstanding Balance – The remaining loan amount after each EMI payment.

📌 Tip: In the early months of the personal loan, a larger portion of the EMI is allocated toward interest, while the principal repayment portion increases over time.

2. How Loan Amortization Schedules Impact Interest Costs

The structure of a loan amortization schedule significantly influences the total interest you pay throughout the loan tenure. Here’s how:

A. Higher Interest Payments in the Initial Years

In an amortized personal loan, a major portion of your EMI goes toward interest in the early months. As the principal reduces over time, the interest component also decreases.

✅ Example: If you take a ₹5,00,000 personal loan at 12% interest for 5 years:

First EMI: ₹5,000 toward interest, ₹3,500 toward principal.

Last EMI: ₹500 toward interest, ₹8,000 toward principal.

B. Longer Tenure Increases Interest Costs

The longer the loan tenure, the more interest you pay overall. While a longer tenure reduces EMI amounts, it significantly increases the total interest burden.

✅ Example:

₹5,00,000 loan at 12% for 5 years → Total Interest = ₹1,67,000

₹5,00,000 loan at 12% for 3 years → Total Interest = ₹98,000

📌 Tip: If you can afford higher EMIs, opt for a shorter tenure to save on interest costs.

C. Early Loan Repayment Reduces Interest Expenses

Since most interest is paid in the initial years, making prepayments early in the tenure can drastically reduce total interest costs.

✅ Example: If you prepay ₹1,00,000 in the first year, you can save significant interest over the remaining tenure.

3. How to Use an Amortization Schedule to Your Advantage?

By analyzing your loan amortization schedule, you can strategically plan your loan repayment to reduce the overall interest cost. Here are some tips:

A. Opt for a Shorter Loan Tenure

Since longer tenures result in higher interest payments, choosing a shorter repayment period can save money.

✅ Example: A 3-year loan incurs less interest than a 5-year loan, even if EMIs are higher.

B. Make Prepayments or Extra EMI Payments

If your lender allows it, making extra payments toward the principal reduces the outstanding balance and, consequently, the interest payable.

✅ Tip: Even one extra EMI payment per year can reduce your loan tenure and save significant interest.

C. Choose the Right EMI Amount

Use a personal loan EMI calculator to determine the best EMI amount that balances affordability with lower interest payments.

✅ Tip: A slightly higher EMI can save thousands in interest over the loan tenure.

D. Consider Balance Transfer for Lower Interest Rates

If your lender’s interest rate is high, transferring your loan to another bank with a lower rate can help reduce total interest costs.

✅ Tip: Compare different lenders’ interest rates before opting for a balance transfer.

4. Comparing Loan Amortization: Fixed vs. Floating Interest Rates

Your personal loan amortization schedule may differ based on whether you choose a fixed or floating interest rate.FeatureFixed Interest RateFloating Interest RateInterest Rate StabilityRemains constantChanges based on market ratesEMI AmountFixedMay vary over timeRiskPredictable repaymentCan fluctuate with economic conditionsBest ForBorrowers who prefer stable EMIsBorrowers expecting rate reductions

📌 Tip: If interest rates are expected to decline, opting for a floating rate loan may reduce long-term costs.

5. Common Mistakes to Avoid in Loan Amortization

🚫 Ignoring the Amortization Schedule: Not reviewing your schedule can lead to poor financial planning. 🚫 Choosing a Longer Tenure for Lower EMIs: While lower EMIs are attractive, they increase overall interest payments. 🚫 Skipping Prepayments: Avoiding early repayments can lead to unnecessarily high interest expenses. 🚫 Not Comparing Lenders: Different lenders offer different interest rates and loan structures; comparing them can help secure a better deal.

📌 Tip: Always check if prepayment penalties apply before making additional payments on your personal loan.

6. Conclusion

A loan amortization schedule is a powerful tool that helps borrowers understand how their personal loan repayments work. By analyzing your amortization table, you can make informed decisions to reduce interest costs, optimize loan tenure, and save money.

To minimize interest payments, choose a shorter tenure, make prepayments, select the right EMI, and explore balance transfer options. Understanding loan amortization can significantly improve your financial health and repayment strategy.

For expert guidance and the best personal loan offers, visit www.fincrif.com today!

#loan apps#personal loan online#fincrif#bank#loan services#personal loans#personal laon#personal loan#finance#nbfc personal loan#loan amortization schedule#personal loan interest cos#personal loan EMI calculation#loan repayment schedule#how amortization affects personal loan interest#personal loan principal vs. interest payment#how to reduce personal loan interest#loan tenure impact on interest cost#personal loan prepayment benefits#EMI breakdown for personal loan#personal loan balance transfer#fixed vs floating interest rate personal loan#personal loan amortization calculator#how to choose the best personal loan tenure#strategies to pay off personal loan faster#impact of early repayment on personal loan interest#personal loan interest vs. principal breakdown#how personal loan EMI is calculated#effect of longer tenure on personal loan interest#how to minimize interest on a personal loan

0 notes

Text

Navigating the Home Loan Maze: A Guide to Mortgage Loan Brokers and Compound Interest Calculations

Securing a mortgage involves more than just finding the lowest interest rate. It requires considering factors like loan features, eligibility criteria, and the overall cost over the loan's lifespan. This is where a Mortgage Loan Broker can provide invaluable assistance. A broker acts as an intermediary between the borrower and multiple lenders. They possess in-depth knowledge of the mortgage market, allowing them to identify suitable loan products from a range of banks, credit unions, and other financial institutions.

The benefits of using a broker are numerous. Firstly, they save borrowers significant time and effort by doing the research and application process on their behalf. Comparison Rate Calculator Instead of contacting multiple lenders, a borrower provides their information once to the broker, who then presents them with various options. Secondly, brokers often have access to loan products and rates that may not be readily available to the public. They can negotiate with lenders on behalf of their clients, potentially securing a lower interest rate or more favorable terms. Thirdly, a good broker provides expert advice and guidance, helping borrowers understand the intricacies of different loan types, fees, and conditions. They can assess a borrower's financial situation and recommend a loan that aligns with their needs and risk tolerance. They are also equipped to manage complex financial situations.

However, with the help of a loan broker, it is important for borrowers to arm themselves with the understanding of the fundamentals of mortgage calculations. The cornerstone of mortgage calculations is Compound Interest Loan Repayment Calculator. This calculator is important because most mortgages are calculated using compound interest. This means that interest is calculated not just on the principal amount of the loan but also on the accumulated interest from previous periods. This compounding effect significantly impacts the total cost of the loan and the speed at which the principal is repaid.

To better understand compound interest and its implications, tools such as the Mortgage Compound Interest Calculator are essential. This tool allows borrowers to estimate their monthly repayments, total interest paid, and the amortization schedule, which shows how the loan principal is reduced over time. By inputting the loan amount, interest rate, and loan term, users can see the impact of different scenarios on their finances. For instance, they can compare the effect of a fixed versus a variable interest rate or the impact of making extra repayments.

These calculators empower borrowers to make informed decisions. Understanding the relationship between interest rates, loan terms, and repayments is crucial. By exploring different scenarios using a calculator, borrowers can identify the loan option that best suits their budget and long-term financial goals. Furthermore, calculators allow borrowers to explore and see the impact of making additional payments or repaying the loan earlier.

0 notes

Text

Gantry Arranges $46.5 Million Financing for Power Center in Santa Clarita, California

6 Santa Clarita, Calif. — Gantry has arranged two loans totaling $46.5 million for financing of The Plaza at Golden Valley, a 600,000-square-foot power center in Santa Clarita, 30 miles north of Los Angeles. The non-recourse loans carry a fixed-rate, 10-year term with a 30-year amortization schedule. Gantry will service the loans. The center is shadow-anchored by Target, Lowe’s and Kohl’s. Other…

0 notes

Text

Personal Loan Calculator – Personal Loan Amortization Schedule Calculator – Amortization Personal Loan

Personal loans can be a lifesaver when you need cash for various reasons, like consolidating credit card debts, paying for a wedding or medical expenses, or financing a home improvement project. But before you apply for a personal loan, it's essential to understand how much you can afford to borrow and how much you'll have to pay back in interest and principal. This is where a personal loan calculator can come in handy. In this article, we'll explain what a personal loan calculator is, how to use it, and why it's beneficial.

What is a Personal Loan Calculator?

A personal loan calculator is a financial tool that helps you estimate how much you'll have to repay each month and the total interest you'll pay over the loan's term. With this calculator, you can input the loan amount, the interest rate, and the loan term to get a breakdown of your monthly payments, including the principal and interest.

Personal Loan Amortization Schedule Calculator

A personal loan amortization schedule calculator helps you create a detailed payment schedule for your personal loan. It breaks down each payment into its principal and interest components and shows you how much of your payment goes towards interest and how much goes towards reducing the principal. It also shows you how much interest you'll pay over the life of the loan.

Amortization Personal Loan

Amortization is the process of paying off debt over time. It involves making regular payments that include both principal and interest. In the case of a personal loan, amortization means that each payment you make reduces the loan's principal balance, which means you owe less interest in the future. An amortization schedule is a table that shows the breakdown of each payment, including the amount of interest and principal paid, and the remaining balance.

How to Use a Personal Loan Calculator?

Using a personal loan calculator is simple. You need to enter three key pieces of information: the loan amount, the interest rate, and the loan term. Once you enter these values, the calculator will show you your monthly payment, the total interest paid, and the total cost of the loan.

Let's take an example to understand this better. Suppose you want to borrow $10,000 for a personal loan with a 6% interest rate and a term of three years. Using a personal loan calculator, you can see that your monthly payment would be $304.17, and the total interest paid over the loan's term would be $947.97. The total cost of the loan would be $10,947.97.

Benefits of Using a Personal Loan Calculator

Using a personal loan calculator offers several benefits. Here are a few:

Helps You Plan Your Finances

A personal loan calculator helps you plan your finances by providing you with a clear picture of your monthly payment and the total cost of the loan. This helps you budget your monthly expenses and ensure that you can afford the loan payment.

Helps You Compare Different Loan Offers

A personal loan calculator helps you compare different loan offers by inputting different loan amounts, interest rates, and loan terms. This allows you to see how different loan options affect your monthly payment and the total cost of the loan.

Helps You Save Money

A personal loan calculator can help you save money by showing you the total cost of the loan, including the interest paid over the loan's term. This helps you find the best loan offer with the lowest interest rate and save money in the long run.

Helps You Pay Off Your Loan Faster

A personal loan calculator can help you pay off your loan faster by showing you the impact of making extra payments or increasing your monthly payment. This helps you pay down your loan's principal faster and save money on interest payments.

In conclusion, a personal loan calculator and amortization schedule calculator can be valuable tools for anyone considering taking out a personal loan. These calculators can help borrowers understand the true cost of their loan, including interest, fees, and other charges. They can also help borrowers create a repayment plan that fits their budget and financial goals.

By using a personal loan calculator and amortization schedule calculator, borrowers can make more informed decisions about their borrowing and repayment strategies. With this knowledge, borrowers can feel more confident in their ability to manage their debt and achieve their financial goals.

0 notes

Text

The steps I took to get here 👇

It came down to 5 areas of focus for me to be successful here:

1️⃣ Mindset.

When I first started this journey, I was the victim. And that made me want to do anything and everything not to face debt. Until you take ownership, it’s going to be a LOOONG journey.

2️⃣ Organization.

I had 12 loans that I knew nothing about. Most people are afraid to look at their debt. But you can’t beat it if you don’t know what’s there.

3️⃣ Budgeting.

A budget is great but it is incomplete if you’re not tracking your spending. When I realized this I got things under control.

4️⃣ Plan.

You need a roadmap. If you don’t have one, the journey to the goal won’t be clear. This is part of the reason I refinanced my federal loans with private loans. The prospect of some forgiveness after X payments over Y years wasn’t concrete enough for me. Once I had a loan with a clear amortization schedule, I could see the end.

5️⃣ Execute.

Since I implemented everything above, I’ve never once doubted that I was continually making progress to April 2024. Everything operates automatically in the background of my life. If you’re not automating, you’re spending way too much brain power on debt.

0 notes

Text

Common Home Loan Mistakes to Avoid and How to Get the Best Deal

Buying a home is one of the most significant financial decisions you will make, and securing a home loan is often a crucial step in the process. While home loans make homeownership accessible, mistakes during the application process can lead to higher costs, financial strain, or loan rejection. Many borrowers, especially first-time homebuyers, make avoidable mistakes that can impact their financial stability.

In this article, we will explore the common home loan mistakes people make and how to get the best deal to ensure a smooth and cost-effective borrowing experience.

1. Not Checking Your Credit Score Before Applying

The Mistake:

One of the most common mistakes is applying for a home loan without checking your credit score. Lenders use your credit score to assess your creditworthiness, and a low score can lead to:

Loan rejection or difficulty in approval.

Higher interest rates, increasing the cost of the loan.

Stricter loan terms and lower loan amounts.

How to Avoid It:

Check your credit score before applying for a home loan.

If your credit score is below 700, take steps to improve it by paying off debts, clearing outstanding dues, and maintaining a good credit history.

Avoid taking multiple loans or credit inquiries, as they can lower your score.

2. Not Comparing Different Lenders and Loan Offers

The Mistake:

Many borrowers accept the first loan offer they receive without comparing options. Different banks and financial institutions offer varying interest rates, processing fees, and loan terms, which can significantly affect the cost of borrowing.

How to Avoid It:

Compare home loan offers from multiple banks, NBFCs (Non-Banking Financial Companies), and online lenders.

Check for additional costs such as processing fees, prepayment charges, and hidden fees.

Use an online home loan comparison tool to find the best interest rates and terms.

3. Ignoring the Total Cost of the Loan (Not Just Interest Rates)

The Mistake:

Borrowers often focus only on interest rates, ignoring the overall loan cost, which includes:

Processing fees

Legal and administrative charges

Prepayment or foreclosure penalties

Insurance premiums (if bundled with the loan)

How to Avoid It:

Ask for a loan amortization schedule to understand the total repayment amount over the tenure.

Choose lenders that offer low processing fees and zero prepayment penalties.

Consider taking insurance separately instead of bundling it with the loan to reduce extra costs.

4. Choosing a Longer Loan Tenure Without Evaluating the Impact

The Mistake:

While longer loan tenures reduce monthly EMI payments, they increase the overall interest paid on the loan. Some borrowers choose the maximum tenure available, unaware of how much extra they will pay in interest.

How to Avoid It:

Use a home loan EMI calculator to compare the total interest paid for different tenures.

If financially comfortable, opt for a shorter tenure to save on interest.

Consider making prepayments when possible to reduce the loan tenure.

5. Not Factoring in Future Financial Stability

The Mistake:

Many homebuyers take on a high EMI burden, assuming their future income will increase. Unexpected events like job loss, medical emergencies, or economic downturns can impact repayment ability.

How to Avoid It:

Keep your EMI within 30-40% of your monthly income to maintain financial stability.

Maintain an emergency fund of at least 6-12 months of expenses, including EMI payments.

Consider opting for a flexible home loan plan that allows adjustments in EMI payments if needed.

6. Ignoring Government Home Loan Schemes and Benefits

The Mistake:

Many borrowers miss out on government benefits that could reduce their home loan burden. Schemes like Pradhan Mantri Awas Yojana (PMAY) and Credit Linked Subsidy Scheme (CLSS) offer interest subsidies for eligible buyers.

How to Avoid It:

Check eligibility for government home loan subsidies and tax benefits.

Apply for loans under PMAY or other state housing schemes to avail interest rate reductions.

Utilize Section 80C and Section 24 tax benefits on home loan interest and principal repayment.

7. Not Understanding Fixed vs. Floating Interest Rates

The Mistake:

Borrowers often choose fixed interest rates without understanding that they may miss out on lower rates when market conditions change. On the other hand, floating rates fluctuate, which can increase EMIs when interest rates rise.

How to Avoid It:

If you expect interest rates to drop, opt for a floating rate loan.

If you prefer stable EMI payments, choose a fixed-rate loan.

Some lenders offer hybrid loans, where the rate remains fixed for a few years and then converts to floating—consider this if it fits your needs.

How to Get the Best Home Loan Deal

1. Improve Your Credit Score

A higher credit score (750+) can get you the best interest rates and loan terms.

2. Compare Multiple Lenders

Always check interest rates, processing fees, and repayment terms from different banks and NBFCs.

3. Negotiate for Better Terms

Don’t hesitate to negotiate loan terms with lenders, especially if you have a good credit history and a stable income.

4. Choose the Right Loan Tenure

Shorter loan tenures save on interest, but ensure that your EMI is manageable.

5. Take Advantage of Government Schemes

Check for PMAY and tax benefits to reduce your loan cost.

Conclusion

A home loan is a long-term financial commitment, and making mistakes in the process can lead to unnecessary financial stress. By avoiding common pitfalls like neglecting credit scores, failing to compare lenders, overlooking total loan costs, and choosing the wrong tenure, you can secure the best home loan deal with favorable terms.

Always research thoroughly, plan your finances wisely, and negotiate effectively to make your home loan journey smooth and cost-effective. With careful planning, you can own your dream home while maintaining financial stability.

0 notes