#EMI Amortization Calculator

Explore tagged Tumblr posts

Text

Amortization Loan Calculator – Loan Amortization Schedule Calculator – EMI Amortization Calculator – Amortization Calculator Free

Are you considering taking out a loan, but wondering how much you'll be paying each month? Do you want to know how much interest you'll be paying over the life of the loan? An amortization loan calculator can help you answer these questions and more.

What is an Amortization Loan Calculator?

An amortization loan calculator is a tool that can help you calculate how much your loan will cost over time. It takes into account the loan amount, interest rate, and the length of the loan to give you an estimate of what your monthly payments will be. Additionally, it can provide you with an amortization schedule, which shows how much of each payment goes toward the principal and how much goes toward interest.

Benefits of Using an Amortization Loan Calculator

Accurate Estimates

One of the most significant benefits of using an amortization loan calculator is that it can provide you with accurate estimates. When you use this tool, you can be confident that the numbers you're getting are reliable, which can help you make better decisions about your finances.

Saves Time

Using an amortization loan calculator can also save you time. Instead of manually calculating how much you'll be paying each month, you can use the calculator to get an estimate within seconds.

Better Decision Making

When you know how much your loan will cost over time, you can make better decisions about whether or not to take out a loan. For example, you may find that the interest rate is too high, or that the monthly payments are too high for your budget. With this information, you can adjust the terms of the loan to better suit your needs.

Helps with Budgeting

An amortization loan calculator can also help you with budgeting. By knowing how much you'll be paying each month, you can plan your finances accordingly. This can help you avoid missed payments, late fees, and other financial problems.

Types of Amortization Loan Calculators

Loan Amortization Schedule Calculator

A loan amortization schedule calculator is a tool that provides a breakdown of your loan payments over time. It shows how much of each payment goes toward the principal and how much goes toward interest. Additionally, it shows the remaining balance of the loan after each payment.

EMI Amortization Calculator

An EMI (Equated Monthly Installment) amortization calculator is a tool that helps you calculate your monthly loan payments. It takes into account the loan amount, interest rate, and the length of the loan to provide you with an estimate of what your monthly payments will be.

Amortization Loan Calculator with Extra Payments

An amortization loan calculator with extra payments is a tool that allows you to add extra payments to your loan. It takes into account the loan amount, interest rate, and the length of the loan, as well as the amount and frequency of the extra payments. This can help you see how much you'll save in interest by paying extra each month.

Amortization Calculator Free

An amortization calculator free is a tool that provides you with the same benefits as other amortization calculators, but without any cost. These tools are often available online and can be used by anyone to get an estimate of their loan payments.

Conclusion

If you're considering taking out a loan, using an amortization loan calculator can be incredibly helpful. It can provide you with accurate estimates, save you time, and help you make better decisions about your finances. Additionally, there are different types of amortization loan calculators available, including loan amortization schedule calculators, EMI amortization calculators, and calculators with extra payments. And the best part is that there are many free amortization calculators available online, so you don't have to pay anything to use them.

#Amortization Loan Calculator#Loan Amortization Schedule Calculator#EMI Amortization Calculator#Amortization Calculator Free

1 note

·

View note

Text

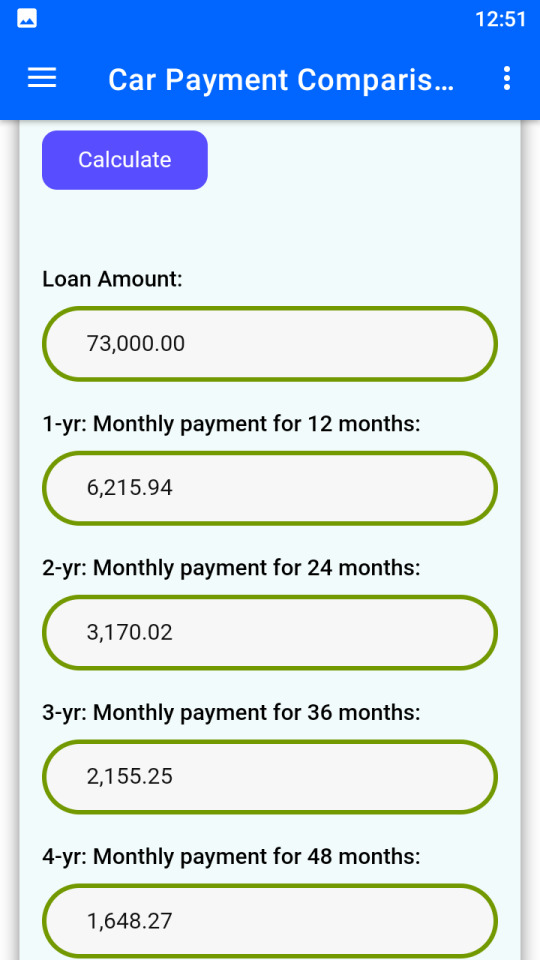

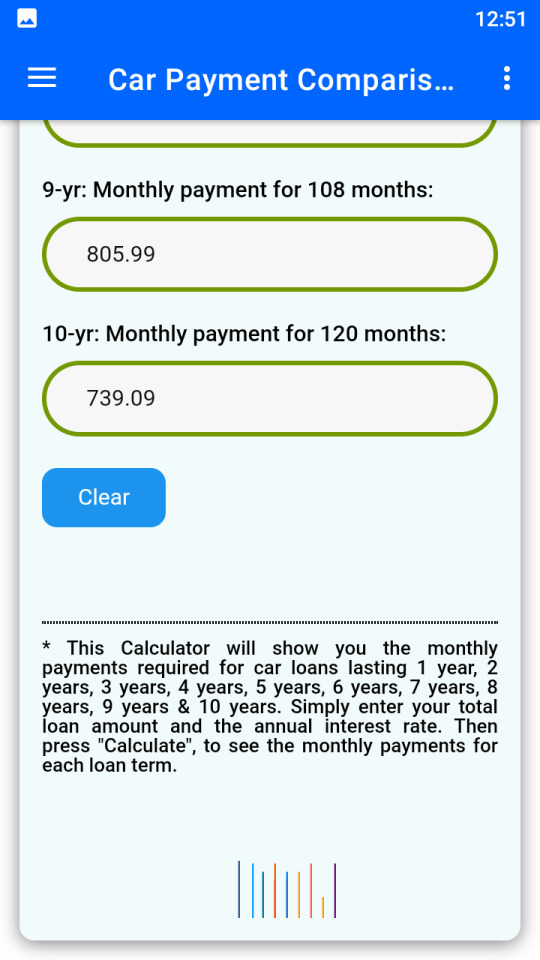

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

How Do Loan Amortization Schedules Impact Interest Costs?

A personal loan is a convenient financial solution that helps individuals manage various expenses, including medical emergencies, education, home renovation, and debt consolidation. While taking a personal loan, understanding how your repayment structure works is crucial to managing your finances effectively. One of the key factors that determine how much interest you will pay over the loan tenure is the loan amortization schedule.

A loan amortization schedule is a structured plan that outlines how each monthly EMI (Equated Monthly Installment) is divided between principal repayment and interest payment. The way your loan is amortized directly impacts the total interest cost you incur over time. In this article, we will explore how loan amortization schedules work, how they influence interest costs, and strategies to reduce the total interest burden on your personal loan.

1. What Is a Loan Amortization Schedule?

A loan amortization schedule is a detailed breakdown of how each EMI is allocated toward principal repayment and interest payment over the loan tenure. It provides clarity on how the outstanding loan balance decreases over time.

Key Components of a Loan Amortization Schedule:

✅ EMI Amount – The fixed monthly payment made by the borrower. ✅ Principal Component – The portion of the EMI that goes toward reducing the loan amount. ✅ Interest Component – The portion of the EMI that is paid as interest to the lender. ✅ Outstanding Balance – The remaining loan amount after each EMI payment.

📌 Tip: In the early months of the personal loan, a larger portion of the EMI is allocated toward interest, while the principal repayment portion increases over time.

2. How Loan Amortization Schedules Impact Interest Costs

The structure of a loan amortization schedule significantly influences the total interest you pay throughout the loan tenure. Here’s how:

A. Higher Interest Payments in the Initial Years

In an amortized personal loan, a major portion of your EMI goes toward interest in the early months. As the principal reduces over time, the interest component also decreases.

✅ Example: If you take a ₹5,00,000 personal loan at 12% interest for 5 years:

First EMI: ₹5,000 toward interest, ₹3,500 toward principal.

Last EMI: ₹500 toward interest, ₹8,000 toward principal.

B. Longer Tenure Increases Interest Costs

The longer the loan tenure, the more interest you pay overall. While a longer tenure reduces EMI amounts, it significantly increases the total interest burden.

✅ Example:

₹5,00,000 loan at 12% for 5 years → Total Interest = ₹1,67,000

₹5,00,000 loan at 12% for 3 years → Total Interest = ₹98,000

📌 Tip: If you can afford higher EMIs, opt for a shorter tenure to save on interest costs.

C. Early Loan Repayment Reduces Interest Expenses

Since most interest is paid in the initial years, making prepayments early in the tenure can drastically reduce total interest costs.

✅ Example: If you prepay ₹1,00,000 in the first year, you can save significant interest over the remaining tenure.

3. How to Use an Amortization Schedule to Your Advantage?

By analyzing your loan amortization schedule, you can strategically plan your loan repayment to reduce the overall interest cost. Here are some tips:

A. Opt for a Shorter Loan Tenure

Since longer tenures result in higher interest payments, choosing a shorter repayment period can save money.

✅ Example: A 3-year loan incurs less interest than a 5-year loan, even if EMIs are higher.

B. Make Prepayments or Extra EMI Payments

If your lender allows it, making extra payments toward the principal reduces the outstanding balance and, consequently, the interest payable.

✅ Tip: Even one extra EMI payment per year can reduce your loan tenure and save significant interest.

C. Choose the Right EMI Amount

Use a personal loan EMI calculator to determine the best EMI amount that balances affordability with lower interest payments.

✅ Tip: A slightly higher EMI can save thousands in interest over the loan tenure.

D. Consider Balance Transfer for Lower Interest Rates

If your lender’s interest rate is high, transferring your loan to another bank with a lower rate can help reduce total interest costs.

✅ Tip: Compare different lenders’ interest rates before opting for a balance transfer.

4. Comparing Loan Amortization: Fixed vs. Floating Interest Rates

Your personal loan amortization schedule may differ based on whether you choose a fixed or floating interest rate.FeatureFixed Interest RateFloating Interest RateInterest Rate StabilityRemains constantChanges based on market ratesEMI AmountFixedMay vary over timeRiskPredictable repaymentCan fluctuate with economic conditionsBest ForBorrowers who prefer stable EMIsBorrowers expecting rate reductions

📌 Tip: If interest rates are expected to decline, opting for a floating rate loan may reduce long-term costs.

5. Common Mistakes to Avoid in Loan Amortization

🚫 Ignoring the Amortization Schedule: Not reviewing your schedule can lead to poor financial planning. 🚫 Choosing a Longer Tenure for Lower EMIs: While lower EMIs are attractive, they increase overall interest payments. 🚫 Skipping Prepayments: Avoiding early repayments can lead to unnecessarily high interest expenses. 🚫 Not Comparing Lenders: Different lenders offer different interest rates and loan structures; comparing them can help secure a better deal.

📌 Tip: Always check if prepayment penalties apply before making additional payments on your personal loan.

6. Conclusion

A loan amortization schedule is a powerful tool that helps borrowers understand how their personal loan repayments work. By analyzing your amortization table, you can make informed decisions to reduce interest costs, optimize loan tenure, and save money.

To minimize interest payments, choose a shorter tenure, make prepayments, select the right EMI, and explore balance transfer options. Understanding loan amortization can significantly improve your financial health and repayment strategy.

For expert guidance and the best personal loan offers, visit www.fincrif.com today!

#loan apps#personal loan online#fincrif#bank#loan services#personal loans#personal laon#personal loan#finance#nbfc personal loan#loan amortization schedule#personal loan interest cos#personal loan EMI calculation#loan repayment schedule#how amortization affects personal loan interest#personal loan principal vs. interest payment#how to reduce personal loan interest#loan tenure impact on interest cost#personal loan prepayment benefits#EMI breakdown for personal loan#personal loan balance transfer#fixed vs floating interest rate personal loan#personal loan amortization calculator#how to choose the best personal loan tenure#strategies to pay off personal loan faster#impact of early repayment on personal loan interest#personal loan interest vs. principal breakdown#how personal loan EMI is calculated#effect of longer tenure on personal loan interest#how to minimize interest on a personal loan

0 notes

Text

Common Home Loan Mistakes to Avoid and How to Get the Best Deal

Buying a home is one of the most significant financial decisions you will make, and securing a home loan is often a crucial step in the process. While home loans make homeownership accessible, mistakes during the application process can lead to higher costs, financial strain, or loan rejection. Many borrowers, especially first-time homebuyers, make avoidable mistakes that can impact their financial stability.

In this article, we will explore the common home loan mistakes people make and how to get the best deal to ensure a smooth and cost-effective borrowing experience.

1. Not Checking Your Credit Score Before Applying

The Mistake:

One of the most common mistakes is applying for a home loan without checking your credit score. Lenders use your credit score to assess your creditworthiness, and a low score can lead to:

Loan rejection or difficulty in approval.

Higher interest rates, increasing the cost of the loan.

Stricter loan terms and lower loan amounts.

How to Avoid It:

Check your credit score before applying for a home loan.

If your credit score is below 700, take steps to improve it by paying off debts, clearing outstanding dues, and maintaining a good credit history.

Avoid taking multiple loans or credit inquiries, as they can lower your score.

2. Not Comparing Different Lenders and Loan Offers

The Mistake:

Many borrowers accept the first loan offer they receive without comparing options. Different banks and financial institutions offer varying interest rates, processing fees, and loan terms, which can significantly affect the cost of borrowing.

How to Avoid It:

Compare home loan offers from multiple banks, NBFCs (Non-Banking Financial Companies), and online lenders.

Check for additional costs such as processing fees, prepayment charges, and hidden fees.

Use an online home loan comparison tool to find the best interest rates and terms.

3. Ignoring the Total Cost of the Loan (Not Just Interest Rates)

The Mistake:

Borrowers often focus only on interest rates, ignoring the overall loan cost, which includes:

Processing fees

Legal and administrative charges

Prepayment or foreclosure penalties

Insurance premiums (if bundled with the loan)

How to Avoid It:

Ask for a loan amortization schedule to understand the total repayment amount over the tenure.

Choose lenders that offer low processing fees and zero prepayment penalties.

Consider taking insurance separately instead of bundling it with the loan to reduce extra costs.

4. Choosing a Longer Loan Tenure Without Evaluating the Impact

The Mistake:

While longer loan tenures reduce monthly EMI payments, they increase the overall interest paid on the loan. Some borrowers choose the maximum tenure available, unaware of how much extra they will pay in interest.

How to Avoid It:

Use a home loan EMI calculator to compare the total interest paid for different tenures.

If financially comfortable, opt for a shorter tenure to save on interest.

Consider making prepayments when possible to reduce the loan tenure.

5. Not Factoring in Future Financial Stability

The Mistake:

Many homebuyers take on a high EMI burden, assuming their future income will increase. Unexpected events like job loss, medical emergencies, or economic downturns can impact repayment ability.

How to Avoid It:

Keep your EMI within 30-40% of your monthly income to maintain financial stability.

Maintain an emergency fund of at least 6-12 months of expenses, including EMI payments.

Consider opting for a flexible home loan plan that allows adjustments in EMI payments if needed.

6. Ignoring Government Home Loan Schemes and Benefits

The Mistake:

Many borrowers miss out on government benefits that could reduce their home loan burden. Schemes like Pradhan Mantri Awas Yojana (PMAY) and Credit Linked Subsidy Scheme (CLSS) offer interest subsidies for eligible buyers.

How to Avoid It:

Check eligibility for government home loan subsidies and tax benefits.

Apply for loans under PMAY or other state housing schemes to avail interest rate reductions.

Utilize Section 80C and Section 24 tax benefits on home loan interest and principal repayment.

7. Not Understanding Fixed vs. Floating Interest Rates

The Mistake:

Borrowers often choose fixed interest rates without understanding that they may miss out on lower rates when market conditions change. On the other hand, floating rates fluctuate, which can increase EMIs when interest rates rise.

How to Avoid It:

If you expect interest rates to drop, opt for a floating rate loan.

If you prefer stable EMI payments, choose a fixed-rate loan.

Some lenders offer hybrid loans, where the rate remains fixed for a few years and then converts to floating—consider this if it fits your needs.

How to Get the Best Home Loan Deal

1. Improve Your Credit Score

A higher credit score (750+) can get you the best interest rates and loan terms.

2. Compare Multiple Lenders

Always check interest rates, processing fees, and repayment terms from different banks and NBFCs.

3. Negotiate for Better Terms

Don’t hesitate to negotiate loan terms with lenders, especially if you have a good credit history and a stable income.

4. Choose the Right Loan Tenure

Shorter loan tenures save on interest, but ensure that your EMI is manageable.

5. Take Advantage of Government Schemes

Check for PMAY and tax benefits to reduce your loan cost.

Conclusion

A home loan is a long-term financial commitment, and making mistakes in the process can lead to unnecessary financial stress. By avoiding common pitfalls like neglecting credit scores, failing to compare lenders, overlooking total loan costs, and choosing the wrong tenure, you can secure the best home loan deal with favorable terms.

Always research thoroughly, plan your finances wisely, and negotiate effectively to make your home loan journey smooth and cost-effective. With careful planning, you can own your dream home while maintaining financial stability.

0 notes

Text

Get the Best Home Loan Deals: Know the Rates

A home loan is a significant financial decision that impacts your life for years. Choosing the best deal requires understanding the market, comparing rates, and evaluating benefits. Here’s how you can secure the most suitable home loan for your needs.

1. Understanding Home Loan Interest Rates

Home loan interest rates play a crucial role in determining the affordability of your loan. These rates are influenced by factors such as:

Repo Rate: A change in the Reserve Bank of India’s (RBI) repo rate directly affects loan rates.

Loan Tenure: Shorter tenures often have higher EMIs but lower total interest.

Credit Score: A strong credit score (750 and above) often results in lower interest rates.

Employment Status: Salaried individuals usually receive better rates compared to self-employed applicants due to consistent income.

2. Fixed vs. Floating Interest Rates

Home loan interest rates are generally of two types:

Fixed Rate: The interest rate remains constant throughout the tenure. This offers stability but may not benefit from rate cuts.

Floating Rate: The interest rate fluctuates with market conditions. While it offers lower initial rates, it carries an element of risk.

Evaluate your financial stability and risk tolerance before choosing.

3. Comparing Offers from Lenders

Different financial institutions provide various offers on home loans. Use online comparison tools or consult lenders directly to assess:

Processing Fees: This is an upfront cost that can vary significantly.

Prepayment Charges: Some lenders impose penalties for early repayment.

Additional Benefits: Look for insurance coverage, top-up loans, or discounts on legal fees.

4. The Role of Home Loan Calculators

Online home loan calculators are essential tools to understand the repayment structure. By entering the loan amount, tenure, and interest rate, you can calculate:

EMI (Equated Monthly Installments): Monthly repayment amount.

Total Interest Payable: Helps gauge the loan’s long-term cost.

Amortization Schedule: Details the principal and interest components over the loan period.

5. Negotiating Better Rates

If you’re a loyal customer or have an excellent credit history, many banks are open to negotiation. Additionally, applying during festive seasons or promotional periods can fetch you discounted rates.

6. Choosing the Right Loan Tenure

Longer loan tenures reduce EMI but increase the total interest paid, while shorter tenures save on interest but require higher EMIs. Strike a balance based on your income and future financial goals.

7. Final Thoughts

Securing the best home loan deal involves thorough research and planning. Understand interest rates, compare offers, and negotiate effectively. A smart approach can save you money and make your dream of owning a home a reality.

0 notes

Text

Unlocking Your Dream Home: A Quick Guide to Mastering Home Loan EMI Calculations

Owning a home - it's the cornerstone of Indian dreams, a symbol of stability and success. But navigating the financial intricacies of a home loan can feel like deciphering hieroglyphics. Enter the Home Loan EMI Calculator, your trusty decoder ring in this financial adventure.

What's this magical calculator, you ask? Imagine a genie who grants your wish to know your monthly payment (EMI) before you even sign on the dotted line. That's the Home Loan EMI Calculator! But to truly wield its power, let's crack the code on a few key terms:

EMI (Equated Monthly Installment): The fixed amount you pay towards your loan every month, like a delicious bite-sized piece of your dream home pie.

Interest Rate: The cost of borrowing the money, like the sprinkles on your pie - some like it sweet, some prefer less!

So, how does this EMI magic work? Buckle up, we're going on a formula field trip!

The EMI Formula: P x R x (1 + R)n / ((1 + R)n - 1)

Don't faint! We'll break it down:

P: Loan amount - Your desired palace size.

R: Interest rate - Sweet or not-so-sweet sprinkles.

n: Loan tenure - How many years to savor your pie.

Steps to Master the EMI Spell:

1. Gather your Loan Details: Know your desired loan amount and preferred tenure.

2. Uncover the Interest Rate: Consult lenders or use online resources to compare rates.

3. Channel your Inner Mathematician: Plug your details into the formula, or use the magic of online EMI calculators.

4. Embrace the Amortization Schedule: This table unveils how your payments chip away at the principal and interest over time.

Beyond the EMI Spell:

1. Home Loan Insurance: Shield your loved ones with this protective charm.

2. Tax Benefits: Enjoy tax deductions on your EMIs - like finding extra sprinkles in your pocket!

3. Refinancing Options: If interest rates dip, consider recasting your spell for a sweeter deal.

Remember, SRG Housing, your friendly neighborhood housing finance wizards, are here to guide you through every step. We specialize in empowering the underserved to turn their dream homes into reality. Contact us today and let's unlock your EMI magic together!

We are committed to empowering individuals in rural and semi-urban areas of India to realize their dream of owning a home. Explore your possibilities with SRG Housing.

Visit www.srghousing.com to unlock your dream home's EMI magic!

0 notes

Text

EMI Calculator

EMI Calculator can calculate EMI for home loan, car loan, personal loan, education loan or any other fully amortizing loan using this calculator. https://emicalculators.com.in//

0 notes

Text

A Step-by-Step Guide to Using an Online Home Loan Calculator

An online home loan calculator is an invaluable tool for anyone planning to take a home loan. It helps estimate monthly EMIs, interest payable, and total loan cost based on various factors like loan amount, interest rate, and tenure. This guide will walk you through the steps to effectively use an online home loan calculator and make informed financial decisions.

Step 1: Choose a Reliable Online Home Loan Calculator

First, find a reputable calculator from a trusted bank, financial institution, or loan comparison website. Ensure the calculator is up-to-date with current interest rates and offers a user-friendly interface.

Step 2: Enter the Loan Amount

In the first field, input the loan amount you're planning to borrow. This is the total amount the bank or lender will provide to finance your home purchase. For example, if you're buying a house worth ₹50 lakhs, and the lender is offering a loan of ₹40 lakhs, enter ₹40,00,000 as the loan amount.

Step 3: Set the Loan Tenure

Next, enter the loan tenure, or the number of years over which you plan to repay the loan. Home loan tenures typically range from 10 to 30 years. Longer tenures result in lower monthly EMIs but higher overall interest paid. Choose a tenure that suits your financial situation.

Step 4: Input the Interest Rate

The interest rate is the cost of borrowing the loan. Enter the rate offered by the lender or bank. It's important to differentiate between a fixed interest rate (which stays constant throughout the loan period) and a floating interest rate (which can change based on market conditions). Most online calculators allow you to toggle between fixed and floating rates.

Step 5: Review the EMI Results

After entering the loan amount, tenure, and interest rate, the calculator will display your estimated EMI (Equated Monthly Installment). The EMI is the amount you’ll need to pay each month to the lender. The result will give you a clear idea of how much the loan will cost you on a monthly basis, making it easier to plan your budget.

Step 6: Check the Total Interest Payable

Most online home loan calculators also provide a breakdown of the total interest payable over the loan tenure. This is important for understanding the long-term cost of your loan. A shorter tenure generally results in higher EMIs but lower interest paid, while a longer tenure leads to more interest accumulation.

Step 7: Compare Different Loan Options

Using the calculator, you can adjust the loan amount, tenure, and interest rate to explore different home loan scenarios. For example, try increasing or decreasing the tenure to see how it affects your EMI and overall interest payable. This will help you choose the most cost-effective loan option based on your repayment capacity.

Step 8: Factor in Additional Costs

Some online home loan calculators allow you to add processing fees or insurance premiums, which are usually associated with home loans. If the calculator offers this feature, include these costs for a more accurate calculation of your total loan expenses.

Step 9: Use the Amortization Table (if available)

Many calculators offer an amortization table, which shows a year-by-year breakdown of your loan repayment schedule, including how much of your EMI goes toward principal repayment and how much covers interest. This helps you understand how your loan progresses over time.

Step 10: Save and Share Results

Most calculators allow you to download or email the results. Save these for future reference or share them with your loan advisor or family members to make collective decisions.

Conclusion

Using an online home loan calculator simplifies the complex process of home loan planning. By inputting basic details like loan amount, tenure, and interest rate, you can quickly estimate your EMI, compare different loan options, and plan your finances better. This tool is essential for first-time home buyers and anyone looking to take a loan for property purchase, allowing you to manage your repayments confidently and avoid surprises.

#home loan calculator#emi calculator for housing loan#emi calculator for home loan#home loan interest rate calculator#online home loan calculator#home loan emi calculator#online home loan emi calculator#calculating home loan#house loan emi calculator

1 note

·

View note

Text

In today's fast-paced world, managing finances efficiently is crucial. Whether it's purchasing a new gadget, planning a dream vacation, or funding higher education, loans have become an integral part of our lives. However, the key to smart borrowing lies in understanding the financial commitments associated with loans, particularly the Equated Monthly Installments (EMIs). This is where the EMI Calculator app comes into play, emerging as the best monthly EMI loan app to help you make informed decisions.

Why EMI Calculator Stands Out

EMI Calculator is not just another financial tool; it's a comprehensive solution designed to simplify loan management. The app caters to all your loan calculation needs, providing detailed insights into your monthly payments, interest rates, and loan tenure. Here's why EMI Calculator stands out:

User-Friendly Interface: The app boasts an intuitive interface that makes it easy for users of all ages to navigate. Whether you're tech-savvy or a beginner, you'll find it simple to input your loan amount, interest rate, and tenure to calculate your EMIs within seconds.

Accurate Calculations: With EMI Calculator, you can rely on precise calculations. The app uses advanced algorithms to ensure that the EMI amounts displayed are accurate, helping you avoid any financial surprises later on.

Multiple Loan Types: Whether you're looking for a personal loan, home loan, car loan, or education loan, EMI Calculator covers all bases. You can compare different loan types and choose the one that best suits your financial situation.

Flexible Loan Tenure: The app allows you to adjust the loan tenure to see how it affects your monthly EMI. This feature is particularly useful if you're trying to balance your budget and need to find the most affordable repayment plan.

Detailed Amortization Schedule: EMI Calculator provides a detailed amortization schedule, breaking down each EMI into principal and interest components. This transparency helps you understand how much of your payment goes towards repaying the principal and how much towards interest.

Additional Features: The app also includes features like a prepayment calculator, which allows you to see the impact of making early payments on your loan. This can be a game-changer if you want to reduce your overall interest burden.

Why You Need EMI Calculator

Taking out a loan is a significant financial decision, and having the right tools to manage it is essential. EMI Calculator not only helps you plan your finances better but also ensures that you don't overextend yourself. By providing a clear picture of your monthly commitments, the app empowers you to make informed decisions that align with your financial goals.

In conclusion, if you're in the market for a reliable, user-friendly, and comprehensive loan management tool, EMI Calculator is your best bet. It simplifies the complex process of loan management, making it the best monthly EMI loan app available. Download EMI Calculator today and take control of your financial future!

0 notes

Text

The Ultimate Guide to Using an EMI Calculator Online for Financial Planning

When it comes to managing loans and making informed financial decisions, an EMI Calculator Online is a crucial tool that can help you streamline your budgeting and planning efforts. Whether you're applying for a home loan, personal loan, or car loan, this online tool provides valuable insights into your monthly payments and overall financial strategy. Here’s a comprehensive guide on how to effectively use an EMI Calculator Online to optimize your financial planning.

What is an EMI Calculator Online?

An EMI Calculator Online is a digital tool designed to calculate the Equated Monthly Installment (EMI) that you will need to pay for a loan. The EMI is a fixed monthly payment that you make to the lender over the loan’s tenure, which covers both the principal amount and the interest charged on the loan. This calculator helps you determine the EMI amount based on the loan amount, interest rate, and loan tenure, providing you with a clear understanding of your financial commitments.

Why Use an EMI Calculator Online?

Easy to Use:

EMI calculators are user-friendly and require only a few pieces of information to provide accurate results. You don’t need any specialized knowledge to use these tools effectively.

Instant Calculations:

With just a few clicks, you can get an immediate calculation of your EMI, saving you time and effort compared to manual calculations.

Financial Planning:

By knowing your monthly EMI, you can better plan your budget and ensure that you can comfortably manage your monthly expenses. It helps in setting realistic financial goals and avoiding financial strain.

Comparison of Loan Options:

An EMI Calculator Online allows you to compare different loan offers by adjusting variables such as loan amount, tenure, and interest rates. This helps you choose the best loan product that suits your financial situation.

Prepayment and Loan Adjustment Planning:

You can use the calculator to evaluate the impact of prepaying a portion of your loan. It shows how prepayment affects your EMI and overall loan tenure, helping you make decisions about additional payments.

How to Use an EMI Calculator Online

Using an EMI Calculator Online involves a few simple steps:

Access the Calculator:

Search for “EMI Calculator Online” and choose a reliable financial website or app that offers this tool.

Enter the Loan Amount:

Input the total amount of money you are borrowing.

Input the Interest Rate:

Enter the annual interest rate offered by your lender.

Select the Loan Tenure:

Choose the duration of your loan, typically in months or years.

Generate the EMI:

The calculator will process the information and display the EMI amount, along with a breakdown of the principal and interest components.

Example of Using an EMI Calculator Online

Suppose you want to take a home loan of $200,000 at an annual interest rate of 5% for a tenure of 20 years. Using the EMI Calculator Online, you would enter:

Loan Amount: $200,000

Interest Rate: 5% per annum

Tenure: 20 years (240 months)

The calculator will show you the EMI amount you need to pay each month, along with a detailed amortization schedule that breaks down how much of each payment goes towards the principal and how much goes towards interest.

Benefits of Using an EMI Calculator Online

Clarity and Transparency:

The calculator provides clear information about your EMI obligations, helping you understand how your monthly payments are structured.

Enhanced Budgeting:

By knowing your EMI, you can create a more accurate budget and manage your finances more effectively.

Informed Loan Decisions:

You can use the calculator to experiment with different loan amounts, interest rates, and tenures to find the best loan option for your needs.

Future Planning:

It helps in planning for future expenses by giving you a snapshot of how much you will be paying over the course of the loan.

Conclusion

An EMI Calculator Online is an indispensable tool for anyone considering taking out a loan. It simplifies the process of calculating your monthly payments, helps you manage your budget, and aids in making informed financial decisions. By providing instant, accurate results, this tool allows you to compare different loan offers, plan for future payments, and ensure that you can comfortably meet your financial obligations.

Whether you are looking to buy a home, purchase a car, or cover personal expenses, integrating an EMI Calculator Online into your financial planning process will help you achieve your financial goals and maintain a stable financial future.

0 notes

Text

How Would you Estimate the EMI Payable on a house Loan

A home bank loan is an important financial dedication that usually lasts a long time; for that reason, borrowers should really perform thorough monetary organizing in advance of taking over an obligation of the magnitude. Utilizing a Household Personal loan Calculator is amongst the easiest solutions to approach your private home personal loan journey. The calculator is a helpful on the internet Device that is certainly readily available for totally free about the Internet sites of most lenders. It can be utilized to forecast a rough EMI approach that corresponds into the financial loan sum ideal. This could not only Provide you a good suggestion of how possible your house personal loan request is, nonetheless it will likely lower the possibility of human error.

Borrowers may make use of the EMI Calculator to experiment with various loan amounts and tenor combos to discover the ideal EMI for them. In straightforward text, a Home Financial loan Calculator will allow someone to produce a repayment program and system their loan journey appropriately.

What on earth is Residence Loan Calculator? A house financial loan calculator is a web-based calculator that is certainly utilized to compute house loan EMIs. HomeFirst calculator calculates the EMI plus the payment breakdown component, which incorporates the principal and desire quantity. This is certainly an online calculator that may be accustomed to estimate the monthly EMIs for a specific bank loan volume. This EMI calculator considers the financial loan amount of money, the interest price charged through the financial institution, along with the repayment period of time, and calculates the quantity of EMI the borrower ought to pay back each month during the specified interval.

How Do You Work out the EMI Payable on a house Financial loan? Property loans are repaid by way of EMIs, which include things like both equally a principal and an fascination part.

The lender may even offer you an amortization timetable that specifics simply how much of each monthly EMI goes towards principal repayment and the amount of goes toward desire repayment. The amortization agenda may even offer you your month to month corresponding balance.

So how exactly does Property Loan EMI Allows in Getting a Home? The house loan EMI is a crucial element to think about When picking a home financial loan. Consequently, calculating EMIs beforehand with a web-based calculator helps you in preparing for the house loan. home finance loan mortgage calculation EMI is helpful –

Determine the amount to borrow dependant on your month to month spending plan. Program household loan repayment to be sure EMI payments are created on time. Produce a prepayment system. How you can Use a Home Bank loan EMI Calculator? Because We all know the formula for calculating EMIs will not mean we should always sit down having a pen and paper and get it done ourselves. Because the EMI calculation method is obscure, guide calculations are liable to errors. Moreover, manually generating your amortization agenda will choose longer. Consequently, to grasp their regular EMI obligation and amortization agenda, a person must use online monetary resources such as a EMI calculator.

Here are some of the advantages of using a home loan calculator.

House mortgage EMI calculators can be relied on to be exact every time. They normally deliver precise final results. Your calculator is accurate and speedy; immediately after coming into all of the information, you can get your month to month EMI and amortization schedule in seconds. Considering the fact that this on the net calculator creates brings about seconds, you may experiment with as several loan volume, interest amount, and tenor combinations as you'd like. Striving out different mixtures can help you locate the very best blend for you. You should utilize the online calculator to check distinctive gives from unique lenders and select the one that most closely fits your budget and desires. Property personal loan EMI calculators are straightforward to implement and totally absolutely free. Why can it be Crucial to Use a Home Financial loan EMI Calculator? It might be difficult to determine the exact EMI for your own home personal loan. Probably the most a layperson can normally do is consult with an accountant to operate the quantities.

But Imagine if someone produced a web-based Device which will conduct elaborate calculations in seconds and supply exact success? In this article’s where by an EMI calculator is available in helpful.

Acquiring these kinds of an estimate previous to making use of for a home loan will allow you to better plan your funds and lower the chance of payment default. The best part is that almost all of on the net EMI calculators are fully cost-free to utilize. You can even use a house bank loan EMI calculator to determine the right financial loan dimension for yourself. You shouldn’t Chunk off over you are able to chew, as the expressing goes. This implies that you need to not borrow the total amount accessible to you. As an alternative, use an EMI calculator to ascertain the utmost EMI amount of money it is possible to pay for right before choosing on the scale of the borrowing. Great things about Residence Personal loan EMI Calculator The following are a few of the advantages of utilizing a EMI calculator:

It helps you in budgeting your costs based upon your earnings. Point out the total fascination you pays at the end of your bank loan expression. The calculator helps you in identifying no matter if to boost or lower the tenure dependant on your price range. This is a brief and simple Instrument so that you can use. It can be dynamic; figures could be quickly changed. The first step is to determine your eligibility for a home bank loan, to not estimate your EMI. The house personal loan eligibility calculator can make it simple to determine your eligibility.

To know more details visit here: Home loan calculator

0 notes

Text

Business Loan Amortization Calculator – Business Loan Calculator EMI – Loan Calculator Business Loan

If you are a business owner, you know that cash flow management is a crucial aspect of running a successful company. One of the most important factors in cash flow management is knowing how much you can afford to borrow and how much you will have to pay back over time. This is where a business loan calculator comes in handy.

There are several types of business loan calculators available, each with its own unique features and benefits. In this article, we will discuss the three most popular types of business loan calculators: Business Loan Amortization Calculator, Business Loan Calculator EMI, and Loan Calculator Business Loan.

Business Loan Amortization Calculator

A Business Loan Amortization Calculator is a tool that helps you determine the monthly payment of a business loan, including the principal and interest. This calculator also helps you determine how much of each payment goes towards the principal and how much goes towards interest. With this information, you can make informed decisions about your business loan, including how much you can afford to borrow, how much your monthly payments will be, and how much interest you will pay over the life of the loan.

Using a Business Loan Amortization Calculator is easy. You simply enter the loan amount, the interest rate, and the term of the loan (in months). The calculator will then calculate your monthly payment and provide a breakdown of how much of each payment goes towards the principal and how much goes towards interest.

Business Loan Calculator EMI

A Business Loan Calculator EMI is a tool that helps you calculate the Equated Monthly Installment (EMI) of a business loan. The EMI is the fixed amount you pay every month towards the repayment of the loan. This calculator helps you determine how much you will have to pay each month and how much interest you will pay over the life of the loan.

Using a Business Loan Calculator EMI is simple. You enter the loan amount, the interest rate, and the term of the loan (in months). The calculator will then calculate the EMI and provide a breakdown of how much of each payment goes towards the principal and how much goes towards interest.

Loan Calculator Business Loan

A Loan Calculator Business Loan is a tool that helps you determine how much you can afford to borrow for your business. This calculator takes into account your business revenue, expenses, and other financial factors to determine how much you can afford to borrow. With this information, you can make informed decisions about your business loan and ensure that you are not borrowing more than you can afford to repay.

Using a Loan Calculator Business Loan is easy. You enter your business revenue, expenses, and other financial factors, such as the interest rate and term of the loan. The calculator will then calculate how much you can afford to borrow and provide a breakdown of the monthly payment, including how much of each payment goes towards the principal and how much goes towards interest.

Conclusion

A business loan calculator is an essential tool for any business owner who is looking to borrow money for their business. By using one of the three most popular types of business loan calculators - Business Loan Amortization Calculator, Business Loan Calculator EMI, or Loan Calculator Business Loan - you can make informed decisions about your loan, including how much you can afford to borrow, how much your monthly payments will be, and how much interest you will pay over the life of the loan. So, if you are considering taking out a business loan, be sure to use a business loan calculator to ensure that you make the right decision for your business.

0 notes

Text

How to Protect Yourself Legally When Taking a Personal Loan from an NBFC

Introduction

A personal loan is a convenient financial tool that helps individuals manage various expenses, including medical emergencies, home renovations, debt consolidation, and education. While Non-Banking Financial Companies (NBFCs) offer quick and flexible personal loans, borrowers must be cautious about legal and financial risks before signing any agreement.

This guide explores how to legally protect yourself when taking a personal loan from an NBFC, ensuring you avoid hidden charges, unethical recovery practices, and financial pitfalls.

Understanding the Role of NBFCs in Personal Loans

NBFCs are financial institutions that provide loans and credit facilities but do not hold banking licenses. They are regulated by the Reserve Bank of India (RBI) and offer competitive loan products with fewer formalities compared to traditional banks.

Advantages of Taking a Personal Loan from an NBFC

✔️ Quick Loan Approval – Faster processing with minimal documentation. ✔️ Flexible Eligibility Criteria – Suitable for individuals with lower credit scores. ✔️ Higher Loan Amounts – Some NBFCs offer larger loan limits than banks. ✔️ Customizable Repayment Options – Borrowers can choose flexible tenure plans.

🔹 Tip: While NBFCs provide easy access to credit, borrowers must carefully evaluate the terms and conditions before accepting a loan offer.

Legal Risks Associated with NBFC Personal Loans

While NBFCs are a viable alternative to banks, borrowers should be aware of potential risks:

📌 Higher Interest Rates: NBFCs generally charge higher interest rates than banks. 📌 Hidden Charges: Processing fees, late payment penalties, and foreclosure charges may be higher. 📌 Aggressive Loan Recovery Practices: Some NBFCs employ strict recovery agents. 📌 Unclear Loan Terms: Borrowers may face misleading clauses in loan agreements.

🔹 Tip: Always read the loan agreement carefully and clarify all terms before proceeding.

How to Legally Protect Yourself When Taking a Personal Loan from an NBFC

1. Verify the NBFC’s Legitimacy

Before applying for a personal loan, ensure the NBFC is registered with RBI. You can check the RBI website to confirm whether the lender is authorized to operate in India.

✅ Visit www.rbi.org.in to verify the NBFC’s registration. ✅ Avoid unlicensed lenders or fraudulent loan providers.

🔹 Tip: Never share personal or financial details with unverified lenders.

2. Understand the Loan Terms & Conditions

Before signing any agreement, review the following:

📌 Interest Rate & APR (Annual Percentage Rate): Ensure transparency in how interest is calculated. 📌 Processing & Foreclosure Charges: Check for hidden costs. 📌 Repayment Tenure & EMI Schedule: Ensure you can manage the repayment. 📌 Prepayment Penalty: Some NBFCs charge extra for early repayment. 📌 Late Payment Fees: Be aware of the consequences of delayed payments.

🔹 Tip: Request a loan amortization schedule to understand your total repayment liability.

3. Compare NBFC Loan Offers with Banks

NBFCs are more flexible in approving loans, but banks may offer better terms. Compare:

✅ Interest Rates – Banks generally have lower rates than NBFCs. ✅ Processing Fees – Check upfront fees before signing the agreement. ✅ Loan Tenure & Prepayment Charges – Some NBFCs charge penalties for prepayments.

🔹 Tip: Use a loan comparison tool to evaluate the best personal loan options.

4. Avoid NBFCs with Unethical Loan Recovery Practices

While RBI regulates NBFCs, some engage in unethical collection methods. Borrowers should:

📌 Check the NBFC’s reputation – Read customer reviews and complaints. 📌 Ensure RBI-compliant recovery methods – No harassment, threats, or coercion. 📌 Request a Written Repayment Plan – Verbal promises should be backed by documents.

🔹 Tip: If harassed by recovery agents, file a complaint with RBI or consumer courts.

5. Keep All Loan-Related Documents for Legal Protection

To avoid disputes, maintain copies of the following:

📌 Loan Agreement & Terms – The signed agreement serves as legal proof. 📌 EMI Payment Receipts – Keep bank statements as evidence of payments. 📌 Correspondence with the NBFC – Emails and messages act as supporting documents.

🔹 Tip: If facing loan-related issues, consult a legal advisor.

Best NBFCs Offering Safe & Reliable Personal Loans

1. Bajaj Finserv Personal Loan

✅ Loan Amount: ₹50,000 – ₹25 lakh ✅ Interest Rate: 11.50% – 20.00% p.a. ✅ Tenure: Up to 5 years 📌 Best For: Flexible repayment options and online approvals.

2. Tata Capital Personal Loan

✅ Loan Amount: ₹75,000 – ₹25 lakh ✅ Interest Rate: 10.99% – 18.00% p.a. ✅ Tenure: Up to 6 years 📌 Best For: Low processing fees and competitive interest rates.

3. HDB Financial Services Personal Loan

✅ Loan Amount: ₹50,000 – ₹20 lakh ✅ Interest Rate: 12.00% – 22.00% p.a. ✅ Tenure: Up to 5 years 📌 Best For: Quick disbursal and minimal paperwork.

Final Verdict: Stay Legally Safe When Borrowing from NBFCs

📌 For Borrowers:

Always verify the lender’s RBI registration before applying.

Read the loan terms carefully to avoid hidden charges.

Keep all loan-related documents for legal protection.

📌 For Lenders:

Follow ethical lending practices and disclose all charges upfront.

Ensure compliance with RBI loan recovery guidelines.

For expert financial guidance on safe borrowing, visit www.fincrif.com today!

FAQs

Q1: Is it safe to take a personal loan from an NBFC? Yes, as long as the NBFC is RBI-registered and follows transparent loan policies.

Q2: How do I check if an NBFC is genuine? Visit the RBI website to verify the NBFC’s registration status.

Q3: What legal action can I take if an NBFC harasses me? File a complaint with RBI, the Consumer Forum, or the Banking Ombudsman.

Borrow Smartly & Stay Financially Secure with the Right NBFC Loan!

#finance#personal loan online#fincrif#nbfc personal loan#bank#loan services#personal loan#loan apps#personal loans#personal laon#Personal loan#NBFC personal loan#Legal protection for borrowers#Safe borrowing from NBFCs#Personal loan from NBFC vs bank#RBI guidelines for NBFC loans#NBFC loan repayment rules#How to verify NBFC legitimacy#Avoiding fraud in NBFC loans#Legal rights of personal loan borrowers#How to check if an NBFC is RBI-registered?#What are the legal risks of borrowing from an NBFC?#How to file a complaint against an NBFC for harassment?#Best practices to protect yourself when taking an NBFC loan#What to do if an NBFC charges hidden fees on a personal loan?

0 notes

Text

Mastering Your Finances: A Comprehensive Guide to Using an Online Personal Loan Calculator

Introduction:

In the fast-paced digital era, managing your finances has become more convenient than ever. One powerful tool that can aid you in making informed financial decisions is the Online Personal Loan Calculator. This invaluable resource empowers individuals to assess their borrowing capacity, plan repayment strategies, and gain a clearer understanding of the financial implications of taking out a personal loan.

Understanding the Basics:

Before delving into the intricacies of an Online Personal Loan Calculator, it's crucial to grasp the basics of personal loans. These unsecured loans provide a flexible way to cover various expenses, from unexpected medical bills to home renovations. However, making an informed decision about borrowing requires a comprehensive understanding of the associated costs, interest rates, and repayment terms.

The Power of an Online Personal Loan Calculator:

An Online Personal Loan Calculator is a dynamic tool that enables users to estimate their monthly loan repayments based on different variables. Users can input the loan amount, interest rate, and loan term to receive instant calculations of their potential monthly payments. This user-friendly interface provides an immediate overview of the financial commitment associated with a personal loan.

Key Features and Functions:

Loan Amount: Determine the amount you wish to borrow and assess how it aligns with your financial goals and obligations.

Interest Rate: Input the interest rate associated with the personal loan to understand its impact on your overall repayment amount.

Loan Term: Adjust the loan term to explore how different timelines can influence your monthly payments and the total cost of the loan.

Amortization Schedule: Many Online Personal Loan Calculators provide an amortization schedule, breaking down each payment into principal and interest components. This feature allows users to track the progression of their loan repayment over time.

Benefits of Using an Online Personal Loan Calculator:

Informed Decision-Making: Accessing real-time calculations helps users make informed decisions about the feasibility of taking out a personal loan.

Budget Planning: By understanding the potential monthly repayments, individuals can incorporate these costs into their budget, ensuring financial stability.

Comparison Shopping: Compare multiple loan scenarios to find the most favorable terms and interest rates that align with your financial situation.

Time-Saving: Eliminate the need for manual calculations and extensive research by utilizing the efficiency of an Online Personal Loan Calculator.

For more info:-

Home Loan EMI Calculator Services

Car Loan Interest Rate Calculator

0 notes

Text

It seems like you're interested in transferring your home loan from one bank to another. Home loan transfers, also known as home loan refinancing, can be done for various reasons, such as obtaining a lower interest rate, better terms, or improved customer service. Here are the general steps involved in transferring a home loan:

1.

Research and Compare:

·

Research different banks and financial institutions to find the one that offers better terms, interest rates, and customer service.

·

Consider any additional fees or charges associated with the transfer.

2.

Check Eligibility:

·

Contact the prospective bank to check if you meet their eligibility criteria for a home loan.

3.

Collect Necessary Documents:

·

Collect all the necessary documents, such as income proof, property documents, and identity proof.

4.

Apply for Loan with New Bank:

·

Submit your loan application to the new bank along with the required documents.

5.

Property Valuation:

·

The new bank may conduct a valuation of your property to assess its current market value.

6.

Loan Approval:

·

Once the new bank reviews your application and property valuation, they will decide whether to approve the loan.

7.

Loan Sanction:

·

If your application is approved, the new bank will issue a sanction letter mentioning the terms and conditions.

8.

Loan Closure with Current Bank:

·

Inform your existing bank about your decision to transfer the loan.

·

Obtain a consent letter and foreclosure statement from the current bank.

9.

Prepayment of Existing Loan:

·

Pay off the outstanding amount with your current bank using the loan from the new bank.

10.

Loan Disbursement:

·

Once the prepayment is made, the new bank will disburse the loan amount.

11.

Update Property Documents:

·

Submit the property documents to the new bank for record-keeping.

12.

EMI Payments:

·

Start repaying the home loan to the new bank as per the agreed-upon terms.

Remember, it's crucial to carefully review the terms and conditions of the new loan offer and understand any associated costs before deciding to transfer your home loan. Additionally, consider consulting with a financial advisor to ensure that the transfer is in your best financial interest.

I don't have the capability to perform real-time calculations or access external databases, including online tools. However, I can guide you on how to use an EMI (Equated Monthly Installment) calculator, which you can find on many financial websites or banking portals. Here are the general steps:

1.

Open an EMI Calculator:

·

Visit the website of a bank or a financial institution that provides an online EMI calculator. Many financial websites also offer EMI calculators as a tool for users.

2.

Enter Loan Details:

·

Input the loan amount you wish to borrow.

·

Enter the interest rate offered by the bank or financial institution.

·

Specify the loan tenure or the number of years for which you plan to take the loan.

3.

Click Calculate:

·

After entering the necessary details, click on the "Calculate" or "Check EMI" button.

4.

View Results:

·

The calculator will provide you with the monthly EMI amount you would need to pay, along with a breakup of the principal and interest components.

5.

Review Amortization Schedule:

·

Some calculators may also generate an amortization schedule, showing the repayment schedule over the entire loan tenure, including the outstanding balance after each payment.

Keep in mind that the actual EMI you may be offered by a bank can depend on various factors, including your credit score, income, and the specific terms and conditions of the loan. The EMI calculator gives you an estimate based on the information you provide.

If you're considering applying for a loan, it's advisable to consult with the respective bank or financial institution to get accurate and up-to-date information tailored to your financial situation.

0 notes

Text

Mastering Mortgage Math: Your Easy Guide to Calculating Home Loan EMIs

Purchasing a home is a significant financial investment, and understanding the intricacies of home loan repayments is crucial for effective financial planning. Enter the Home Loan EMI (Equated Monthly Installment) Calculator – a powerful tool that simplifies the process of estimating your monthly loan repayments. This guide will walk you through the fundamentals of an EMI calculator and provide insights into maximizing its benefits.

Demystifying Home Loan EMI

Before delving into the calculator, it's essential to understand the concept of Home Loan EMI. It refers to the fixed amount a borrower pays every month to the lender, comprising both principal and interest components, until the loan is fully repaid. This systematic approach ensures timely repayment and helps maintain financial discipline.

The Magic Formula for EMI Calculation

At the heart of the EMI calculator lies a mathematical formula that takes into account three key factors: loan amount, interest rate, and loan tenure. By inputting these variables, the calculator applies a standard formula to compute the monthly installment amount accurately.

Step-by-Step Guide to Using the EMI Calculator

1. Gather Loan Details: Collect information such as the desired loan amount, interest rate (fixed or floating), and the preferred loan tenure from your lender.

2. Input the Variables: Enter the loan amount, interest rate, and tenure into the EMI calculator's respective fields.

3. Calculate: With a click of a button, the calculator will instantly generate the monthly EMI amount, providing you with a clear understanding of your financial commitment.

4. Review the Amortization Schedule: Explore the amortization schedule, which offers a detailed breakdown of each EMI payment, showcasing the portion allocated to principal repayment and interest payment over the loan tenure.

Unlock Additional Benefits

While the primary function of the EMI calculator is to determine your monthly installments, it offers additional advantages that can empower your financial decision-making:

1. Home Loan Insurance: Consider opting for home loan insurance to safeguard your family against unforeseen circumstances, ensuring loan repayment continuity in case of an unfortunate event.

2. Tax Benefits: Explore potential tax benefits available on home loan EMIs, such as deductions on principal and interest payments, as per applicable tax laws.

3. Loan Refinancing: Evaluate loan refinancing opportunities to potentially secure better terms, such as lower interest rates or extended tenure, to optimize your financial commitments.

About SRG Housing

SRG Housing, a pioneering housing finance company in Rajasthan, has consistently demonstrated its commitment to innovation and growth. As the first company to be registered as a Housing Finance Company under the National Housing Bank ACT in 2002 and the first to successfully migrate from the BSE SME Platform to the prestigious BSE Main Board in 2015, SRG Housing has set new benchmarks in the industry. Further solidifying its presence, the company achieved a remarkable milestone by listing on the National Stock Exchange (NSE) as of August 21, 2023, showcasing its dedication to enhancing value for its stakeholders and establishing itself as a leader in the financial markets.

By mastering the art of mortgage math with the Home Loan EMI Calculator, you can confidently navigate the complexities of home financing in India and make informed decisions that align with your financial goals. Embrace this powerful tool and embark on your journey towards homeownership with confidence and clarity, knowing that you're well-equipped to interact with housing finance companies in India.

#Housing Finance#Housingfinancecompanies#Home Loan#Home Loan Emi Calculator#homeloan#srghousingfinance#homeloanexperts#finance#loan#homeloanoptions#gujarat#homeloanpreapproval#srg

0 notes