#Amortization Calculator Free

Explore tagged Tumblr posts

Text

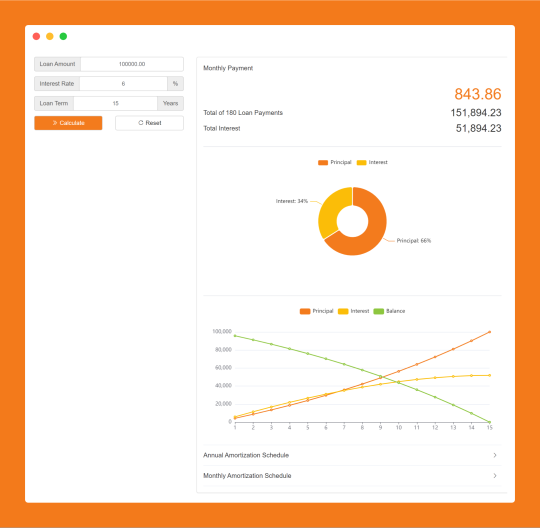

Amortization Loan Calculator – Loan Amortization Schedule Calculator – EMI Amortization Calculator – Amortization Calculator Free

Are you considering taking out a loan, but wondering how much you'll be paying each month? Do you want to know how much interest you'll be paying over the life of the loan? An amortization loan calculator can help you answer these questions and more.

What is an Amortization Loan Calculator?

An amortization loan calculator is a tool that can help you calculate how much your loan will cost over time. It takes into account the loan amount, interest rate, and the length of the loan to give you an estimate of what your monthly payments will be. Additionally, it can provide you with an amortization schedule, which shows how much of each payment goes toward the principal and how much goes toward interest.

Benefits of Using an Amortization Loan Calculator

Accurate Estimates

One of the most significant benefits of using an amortization loan calculator is that it can provide you with accurate estimates. When you use this tool, you can be confident that the numbers you're getting are reliable, which can help you make better decisions about your finances.

Saves Time

Using an amortization loan calculator can also save you time. Instead of manually calculating how much you'll be paying each month, you can use the calculator to get an estimate within seconds.

Better Decision Making

When you know how much your loan will cost over time, you can make better decisions about whether or not to take out a loan. For example, you may find that the interest rate is too high, or that the monthly payments are too high for your budget. With this information, you can adjust the terms of the loan to better suit your needs.

Helps with Budgeting

An amortization loan calculator can also help you with budgeting. By knowing how much you'll be paying each month, you can plan your finances accordingly. This can help you avoid missed payments, late fees, and other financial problems.

Types of Amortization Loan Calculators

Loan Amortization Schedule Calculator

A loan amortization schedule calculator is a tool that provides a breakdown of your loan payments over time. It shows how much of each payment goes toward the principal and how much goes toward interest. Additionally, it shows the remaining balance of the loan after each payment.

EMI Amortization Calculator

An EMI (Equated Monthly Installment) amortization calculator is a tool that helps you calculate your monthly loan payments. It takes into account the loan amount, interest rate, and the length of the loan to provide you with an estimate of what your monthly payments will be.

Amortization Loan Calculator with Extra Payments

An amortization loan calculator with extra payments is a tool that allows you to add extra payments to your loan. It takes into account the loan amount, interest rate, and the length of the loan, as well as the amount and frequency of the extra payments. This can help you see how much you'll save in interest by paying extra each month.

Amortization Calculator Free

An amortization calculator free is a tool that provides you with the same benefits as other amortization calculators, but without any cost. These tools are often available online and can be used by anyone to get an estimate of their loan payments.

Conclusion

If you're considering taking out a loan, using an amortization loan calculator can be incredibly helpful. It can provide you with accurate estimates, save you time, and help you make better decisions about your finances. Additionally, there are different types of amortization loan calculators available, including loan amortization schedule calculators, EMI amortization calculators, and calculators with extra payments. And the best part is that there are many free amortization calculators available online, so you don't have to pay anything to use them.

#Amortization Loan Calculator#Loan Amortization Schedule Calculator#EMI Amortization Calculator#Amortization Calculator Free

1 note

·

View note

Text

Amortization Calculator will estimate and show you how much your monthly payments will be and the breakdown of your payments based on your loan amount, interest rate, and loan term.

#Online Web Tools#Web Tools#Free Web Tools#Online Tools#Free Online Tools#A.Tools#Finance Calculator#Amortization Calculator

0 notes

Text

Financial Calculators for Smart Money Management in the USA – Free Tools at Maveric Elite Tech

Managing personal and business finances requires careful planning and accurate calculations. Whether you are budgeting your salary, planning a mortgage, evaluating an investment, or figuring out how much you need to save, having the right financial tools at your fingertips is crucial. That’s where Maverick Elite Tech comes in.

At Maverick Elite Tech, we offer a range of free financial calculators designed to simplify your financial decisions and help you gain better control over your money. From determining your take-home pay to calculating interest rates and loan amortizations, our tools provide quick and precise answers to your financial queries.

Why Use Financial Calculators?

Financial calculators are essential tools for making informed financial decisions. They help individuals, business owners, and investors assess their financial health and plan for the future. Instead of manually performing complex calculations, you can rely on these tools to get instant and accurate results.

Our financial calculators in the USA are designed to help you:

Understand how much you will take home after taxes.

Plan your mortgage payments and home-buying expenses.

Estimate your returns on investments (ROI).

Calculate interest on loans and savings.

Budget for rent and other monthly expenses.

Create an amortization schedule for loan repayments.

With Maverick Elite Tech, you get access to these essential financial calculators for free, ensuring that you make the best financial choices without hassle.

Types of Financial Calculators Available at Maverick Elite Tech

1. Salary Calculator in the USA

If you want to determine your take-home salary after deductions such as federal and state taxes, Social Security, and other withholdings, our salary calculator in the USA is the perfect tool. It helps employees and freelancers understand how much they will actually earn after tax deductions, allowing for better financial planning.

2. ROI Calculator in the USA

Investing your money wisely requires an understanding of potential returns. Our ROI calculator in USA helps investors estimate their return on investment by calculating the percentage of profit or loss relative to the initial investment. Whether you are investing in stocks, real estate, or a new business venture, this tool provides valuable insights into your investment decisions.

3. Simple Interest Calculator in the USA

For those who want to determine how much interest they will earn or pay on a loan, our simple interest calculator in USA makes it easy. This tool calculates the interest based on the principal amount, rate of interest, and time period, making it useful for personal loans, savings accounts, and short-term investments.

4. Interest Calculator in the USA

Unlike simple interest, compound interest calculations can be more complex. Our interest calculator in USA helps you determine how much interest will accrue over time on savings, investments, or loans, factoring in compounding periods. This is an essential tool for those looking to maximize their earnings or understand loan repayment structures.

5. Rent Calculator in the USA

Are you planning to move to a new apartment or house? Our rent calculator in USA helps you estimate how much rent you can afford based on your income and expenses. This tool is particularly useful for renters who want to budget wisely and ensure they do not overspend on housing costs.

6. Mortgage Calculator in the USA

Buying a home is one of the biggest financial decisions you’ll make. Our mortgage calculator in USA helps you estimate your monthly mortgage payments based on loan amount, interest rate, and loan term. This tool allows homebuyers to plan their finances accordingly and choose the best mortgage option.

7. Amortization Calculator in the USA

Loan repayment schedules can be complex, especially with interest calculations. Our amortization calculator in USA breaks down your loan repayment schedule, showing how much of each payment goes toward interest and principal. This tool is essential for borrowers who want to understand their loan structure and repayment strategy.

8. Saving Calculator in the USA

Saving money requires discipline and proper planning. Our saving calculator in USA helps users estimate how much they need to save each month to reach their financial goals. Whether you are saving for retirement, an emergency fund, or a big purchase, this tool provides clear savings projections.

Why Choose Maverick Elite Tech for Financial Calculators?

At Maverick Elite Tech, we believe financial clarity should be available to everyone. That’s why we offer these tools completely free of charge. Our financial calculators provide:

Accuracy – Get precise calculations for your financial needs.

Ease of Use – Simple, user-friendly interfaces make calculations quick and easy.

Instant Results – Save time with immediate financial insights.

Comprehensive Tools – A wide range of calculators to cover all financial aspects.

Whether you are an individual looking to plan your finances, a homebuyer assessing mortgage payments, or an investor analyzing returns, our financial calculators offer everything you need in one place.

Get Started with Free Financial Calculators Today!

Take control of your finances today with Maverick Elite Tech. Our suite of financial calculators in USA is designed to make money management effortless. No hidden fees, no complicated steps—just reliable financial tools at your fingertips.

Explore our financial calculator, salary calculator, ROI calculator, interest calculators, rent calculator, mortgage tools, amortization calculator, and saving calculator in the USA for free now and start making smarter financial decisions!

#financial calculators#salary calculator in usa#roi calculator in usa#simple interest calculator in usa#interest calculator in usa#rent calculator in usa#financial calculator in usa#amortization calculator in usa#mortgage calculator in usa#saving calculator in usa

0 notes

Text

What is Amortization?

An amortization calculator, whether it’s a basic tool or specialized like a home loan amortization calculator, is invaluable for understanding your financial commitments. By breaking down each payment into its components—principal and interest—it empowers borrowers with clarity about their loans' repayment structure.

Whether you're using it for financial planning or comparing different loans, tools like free amortization calculators or monthly mortgage payment calculators make managing debt simpler and more transparent. Take advantage of these resources today to make informed decisions about borrowing and repayment strategies!

0 notes

Text

The Best Side of 79 cash

It absolutely was simpler than I imagined getting a lender with credit rating troubles up to now, however, you did it. Thank both you and your crew in your assist.

In the event the fields are usually not Are living it is possible to drag on the fields to complete it swiftly. Upon getting completed the form click the download icon from the toolbar to down load a duplicate of your finished PDF. Or send it for signing.Open up a totally free account on Fill here

Numerous commercial loans or short-time period loans are In this particular category. Compared with the first calculation, that's amortized with payments distribute uniformly in excess of their lifetimes, these loans have one, big lump sum owing at maturity.

Our on-line varieties are very easy to fill out with the comfort and ease of your personal home and might be accomplished in minutes.

Google Chrome’s browser has received its all over the world popularity because of its variety of handy capabilities, extensions and integrations. As an illustration, browser extensions allow it to be doable to help keep all the tools You will need a simply click absent.

Quite a few security systems are used which assist to shield the private info of visitors to our Web page from unauthorized use, disclosure and accessibility. An example of This really is that we'll keep own information that you provide on our Pc programs in sites which has restricted entry often located in very controlled amenities.

Before you take a loan, take some time to study the stipulations cautiously. This provides you with a clear photo on the charges and expenses chances are you'll incur underneath distinct conditions.

Are you presently trying to find a 1-measurement-fits-all solution to design private moneylender handbook PDF form? airSlate SignNow brings together ease of use, affordability and protection in one on the net Software, all without forcing additional DDD on you. All you would like is clean internet connection and a tool to operate on.

A loan phrase would be the length with the loan, provided that essential minimal payments are made every month. The time period in the loan can influence the structure of your loan in numerous ways.

We now have collected tens of millions in settlements for our clientele! When you or simply a family member have 79 loan been harm in an automobile incident, then Allow our experienced attorneys get you the very best attainable settlement. No payment until finally we earn! We will Speak to you that will help.

For more thorough assistance on safeguarding your SSN and how to proceed if you suspect a scam, consult the SSA's official means. Bank FAQ's

Completing and distributing the applying normally takes no more than a few minutes, and our lenders informs you of the appliance’s standing presently. On acceptance, you'll be able to count on the accredited resources to be transferred into your bank account as soon as subsequent business day.

Capability—steps a borrower's capability to repay a loan using a ratio to match their credit card debt to cash flow

Overdraft fees might induce your account for being overdrawn by an amount that is larger than your overdraft protection. A $fifteen rate may possibly utilize to each suitable transaction that brings your account unfavorable. Equilibrium have to be brought to at least $0 in just 24 hours of authorization of the first transaction that overdraws your account to steer clear of the price. Learn more at .

0 notes

Text

Tax Planning for Companies: How to Utilize Depreciation and Amortization

Depreciation and amortization are essential tax planning tools that companies can use to reduce taxable income and improve cash flow. These accounting methods allow businesses to allocate the cost of assets over time rather than expensing them in a single year. Properly utilizing depreciation and amortization can lead to significant tax savings, making them integral components of an effective tax strategy.

Understanding Depreciation and Amortization

Both depreciation and amortization are methods of expensing the cost of long-term assets. However, they apply to different types of assets:

Depreciation: This applies to tangible assets like machinery, buildings, and equipment. Depreciation spreads the cost of these assets over their useful life.

Amortization: This applies to intangible assets such as patents, trademarks, and goodwill. Like depreciation, amortization allocates the cost of these intangible assets over their estimated useful life.

Both depreciation and amortization reduce taxable income by recognizing the expense over time, rather than when the asset is purchased.

Accelerating Depreciation with Section 179 and Bonus Depreciation

In many cases, businesses can accelerate depreciation through Section 179 deductions and bonus depreciation. These options allow companies to write off a larger portion of an asset’s value in the first year, providing immediate tax relief.

Section 179: This provision allows businesses to deduct the full cost of qualifying assets (such as equipment or software) in the year they are placed in service, up to a specified limit. For 2024, the limit is $1,160,000, with a phase-out threshold of $2.89 million. Section 179 is particularly beneficial for small and medium-sized businesses that invest heavily in equipment or technology.

Bonus Depreciation: Under the Tax Cuts and Jobs Act (TCJA), businesses can take advantage of 100% bonus depreciation on qualifying assets (new or used) placed in service. This allows businesses to deduct the entire cost of the asset in the first year. This provision is temporary, and scheduled to phase out over the next few years, so businesses should act quickly to maximize their deductions.

Using both Section 179 and bonus depreciation, businesses can reduce their taxable income substantially in the year of purchase, freeing up cash for other investments or operational expenses.

Utilizing the Straight-Line Method for Long-Term Assets

For assets that don’t qualify for accelerated depreciation methods, companies often use the straight-line depreciation method, which spreads the cost evenly over the asset’s useful life. This method provides predictable and stable deductions year after year. It is particularly useful for assets like buildings or property that have a long useful life, ensuring companies can reduce their taxable income consistently over time.

Amortization of Intangible Assets

Intangible assets, such as patents, trademarks, and copyrights, can also be amortized over their useful life. Unlike depreciation, which can be calculated using multiple methods, amortization is generally done using the straight-line method. By amortizing intangible assets, businesses can deduct a portion of their investment annually, reducing taxable income without affecting cash flow.

For example, if a company purchases a patent for $500,000 with a 10-year useful life, it would be able to deduct $50,000 each year for 10 years. This ongoing deduction provides tax benefits while the asset continues to contribute to the business.

Strategic Tax Planning with Depreciation and Amortization

To optimize tax savings, companies should strategically plan the timing and selection of depreciation and amortization methods. For example, by combining accelerated depreciation in the first few years with straight-line depreciation afterward, businesses can balance short-term tax relief with long-term savings. Additionally, when purchasing new assets, companies should evaluate the benefits of Section 179 and bonus depreciation to maximize immediate deductions.

Keeping Accurate Records and Compliance

Proper documentation is crucial when utilizing depreciation and amortization for tax purposes. Companies should keep detailed records of their assets, including purchase prices, dates of acquisition, and estimated useful lives. Regularly reviewing depreciation schedules with the experts offering tax planning for companies in Fort Worth, TX ensures that companies remain compliant with tax laws and avoid any potential audits or penalties.

Conclusion

Depreciation and amortization are powerful tools for tax planning, allowing businesses to reduce their taxable income and increase cash flow. By strategically using accelerated depreciation methods like Section 179 and bonus depreciation, as well as implementing regular amortization for intangible assets, companies can significantly lower their tax burden. Proper record-keeping and expert guidance from are essential to ensuring compliance and maximizing these tax-saving opportunities.

0 notes

Text

Free Financial Video Games For Kids To Boost Their Business and Entrepreneurial Skills

I recently found this financial games website that offers lots of fun financial and real estate games for kids and for adults as well. I'm trying to teach my younger nephews how businesses work so these games are actually quite educational and useful.

You can find these games at mortgagecalculator.org/money-games. My husband works in real estate and he actually uses the site Mortgage Calculator when he needs to compute monthly amortizations and prices for his projects. That's how I stumbled upon these Financial Games which are a part of their website. There are dozens of financial games available here that you can all play for FREE!

One of the first games I played was the Burger Shop game. Here you play as the owner and staff of the burger shop, taking orders from the customers then preparing and stacking all the ingredients for their burger together.

The customer will ask for a different types of burgers and you have to stack them according to their orders. You also have to manage the inventory of the ingredients since they may also run out. You then collect money from the customers when you give them their correct orders. It's a fun way for kids to learn how a burger stand or retail shop operates in the real world.

Another fun and entertaining game is the Cashier Simulator. This one lets you play as the cashier of a grocery where you have to add the prices of the items manually and then give the exact change needed. Kids will love playing this and it will also teach them proper math and counting skills.

You can also find some exciting Real Estate games on the website. City Builder lets you stack blocks on top of each other to make a building that can go as high as you can.

One of the best Real Estate games I enjoyed playing is Real Estate Tycoon. This one is where you can buy and sell properties at a profit or sometimes at a loss.

It's much similar to how the real estate business actually is, where you have to invest your money on properties in the hopes of selling them at a higher price. This game is great for kids to learn more about the real estate industry and how to manage their finances.

There are many other fun games to find at mortgagecalculator.org/money-games including Hidden Object games as well. What's Grandma Hiding? is a mysterious hidden object game that really got me curious about the main storyline. This one will also teach kids reading comprehension aside from sharpening their investigative skills. So if you want your kids to have fun while learning more about finance and real estate, head over to the website and discover all these exciting games for the family.

0 notes

Text

What You Need to Know About Mortgage Calculators?

Mortgage calculators are useful tools for potential homebuyers, offering critical information about the financial elements of buying a home. Here's a quick primer to understanding and using mortgage calculators efficiently.

What is a Mortgage Calculator?

A mortgage calculator is an online application that allows you to estimate your monthly mortgage payments using loan amount, interest rate, loan length, and down payment. By entering these facts, you can estimate your monthly financial commitment.

Key Inputs for Accurate Estimates:

To get the most accurate answers from a mortgage calculator, you'll need to provide a few crucial pieces of information:

Loan Amount:

The total amount you want to borrow.

Interest Rate:

The annual interest rate on the mortgage.

Loan Term:

The loan's repayment term, which is commonly 15, 20, or 30 years.

Down Payment:

The initial amount you plan to pay upfront.

Property Taxes and Insurance:

Some calculators allow you to include these extra fees to get a more complete estimate.

Benefits of Using a Mortgage Calculator:

Budget Planning:

It helps you determine what you can afford by displaying prospective monthly payments.

Comparative Analysis:

You can compare loan alternatives, interest rates, and terms to get the best deal.

Financial Preparation:

Understanding the payment structure allows you to better plan your money and avoid unexpected expenses.

Understanding the Results:

The output of a mortgage calculator includes:

Monthly Payment:

The expected monthly mortgage payment, which includes principal and interest.

Amortization Schedule:

A summary of each payment over the loan period, including how much goes toward interest and principal.

Total Payment:

The total amount paid over the term of the loan, including interest.

Additional Features:

Some advanced mortgage calculators include features such as:

Extra Payments:

Allows you to assess the impact of making additional payments to the principal.

Refinancing Options:

Calculate your potential savings from refinancing your mortgage.

Affordability Calculator:

Calculates the highest home price you can afford based on your income and other debts.

Conclusion:

Mortgage calculators are extremely useful for anyone looking to buy a property. They provide a clear picture of what to expect financially, allowing you to make more informed decisions. Using a mortgage calculator, you can easily navigate the home-buying process and ensure that you are financially prepared for this important commitment.

Alpha Mortgage is a trusted mortgage broker in Surrey, providing personalized solutions to secure the best rates and terms. With local market expertise, they ensure a smooth, stress-free home financing process.

0 notes

Text

PAY YOUR MORTGAGE OFF FASTER - FREE AND CLEAR

Your home is your biggest investment. Your mortgage is your largest debt. The problem is the main concern of the typical borrower is how much the monthly payment is going to be and how it fits into the monthly budget (affordability). Unfortunately this way of thinking results in tens of thousands, even hundreds of thousands of dollars needlessly wasted by giving it to the banks. What you the purchaser should be concerned with is the total amount to be repaid. For example, let's say you buy a house for $500,000, you put $100,000(20%) down and finance the rest. A $400,000 mortgage amortized over 30 years at a rate of 5%(Approx current 5 yr fixed rates), the total cost or the total you will pay back after 30 years of payments is $768,514. Give or take a penny. So in effect you are buying this house for $868,514 (including your down payment). As you can see for every dollar you borrow you will pay almost two back even at today’s historically low rates. It only follows that every dollar you save you are actually saving two. So you can see it is imperative you do everything in your power to minimize this cost of borrowing as much as possible. Remember it is your money.

The first thing you can do is make sure you get the best mortgage rate possible. It is a very competitive market so shop around. Different banks use different prime rates to base their mortgage rates off of, this is misleading as there is only 1 real prime rate. You can look it up online to check. Banks use this tactic to artificially inflate their mortgage rates to rip off you the consumer. Always ask for their best rate, they will want to be competitive so always ask. Even a 1/2 point difference in the lending rate on a $400,000 mortgage over 30 years will save you just over $42,000. It is best to use a mortgage broker, they cost you nothing and you will almost always find a better deal than the banks are giving. You can see a little ground work is well worth it.

Want help with your finances click here

For the purpose of this report, and to illustrate the power of the strategies presented in this report, we will use a typical 30 year amortization period, a mortgage rate of 5%(approx current market conditions) and mortgage amounts of $400,000, $500,000. The total cost amount does not include the down payment applied to the purchase price before financing, that amount must be added to the total cost of the financing to reflect a true total cost of the property.

$400,000 mortgage @ 5%: payment of $2,134.76 x 12 payments/year x 30 years: total cost $768,514.58.

$500,000 mortgage @ 5%: payment of $2,668.45 x 12 payments/year x 30 years: total cost $960,643.22.

Even with today’s record low mortgage rates the amount you will actually pay back is almost two times the amount you borrowed.

The only way you can reduce this cost is to shorten the term of the amortization of the mortgage, thereby reducing the total number of payments you will make. We will work through four very simple strategies.

First, you must understand that with a fixed rate mortgage your interest is calculated monthly. The amount of your monthly mortgage payment placed against your principal balance is calculated monthly on a declining balance basis. To illustrate, your first monthly payment on our $400,000 mortgage example is $2,134.476. Out of this payment $1,666.67 is interest, so $468.09 is applied to your principal balance. So you now have a principal balance of $400,000 - $468.09 = $399,531.91. Your interest accrued for your second monthly payment is calculated on this balance. So out of your next monthly payment there will be a little less interest charged and a little more applied to your principal. It continues like this until your loan is repaid. As you can see it is going to take you an awfully long time before you make any significant progress in reducing your principal balance.

Strategy #1: Make an additional payment every month on top of your monthly mortgage payment. When you make an additional payment over and above your scheduled mortgage payment the entire amount of this extra payment is applied directly against your principal balance. For example, let's say you pay an additional $100 a month, a conservative amount, you can probably do better. Watch what effect this small additional payment will have. We will use the numbers from the examples;

$400,000 mortgage @ 5% = $2,134.76 mo. + $100 = $2,234.76 total/mo. Total time to repay loan reduced to 27 yrs from 30 yrs. Reduce time reduce cost. You save yourself 3 full years of payments, which equates to $2,134.76 x 12 payments per year x 3 years for a total of $76,851.36. That's $76,851.36 of your money. Let's look at what this cost us, $100 additional per month x 12 payments per year x 27 years equals $32,400. It cost $32,400 to save $76,851.36. For every extra dollar spent you saved yourself $2.37. Not bad. Now if you have a $500,000 mortgage and make an additional payment of $100 each month, you would save yourself $77,385.05. Or $2.34 for every dollar spent. You can see the bigger your mortgage is, the more powerful and effective this strategy becomes.

If you could manage to pay an additional $200 a month, your $400,000 mortgage would be paid off in 25 years saving yourself 5 years of payments, or $134,490, $138,765 on a $500,000 mortgage. The ratios for dollars spent verses dollars saved remain the same yet you can see, from the numbers, the larger the additional payment each month the sooner you are mortgage free and subsequently the more money you save yourself. This is a very powerful strategy and yet very easy to implement. The bank’s typically allow 10% of balance to be prepaid without fees or penalties, at $100 or $200 a month we would be nowhere near that. It’s easy to do, just include it in your regular monthly payment. That's all there is to it.

A variation of this strategy is to just reduce the amortization period for the mortgage at it's inception. For example, amortize the loan over 25 years as opposed to 30 years. When you look at the numbers the amount saved will be identical and the monthly payment will increase by approx $200. But here's the problem, when you amortize over the shorter period you are locked into higher monthly payments. If you are sure your cashflow(income)isn’t going to change over the term of loan eg: 5 yrs, then no problem. The good part about reducing the amortization period is you are committed to the higher payment and thus the savings where as with paying a discretionary amount every month it is voluntary and can be “missed”.

Make up a budget to find some extra money. Pay whatever you can every month. At least you will know that whatever you do pay will save you multiples down the road. It’s your money, why give it to the banks?

Want more help click here

Strategy#2: Let's say you don't have the extra money needed for an additional $100 or $200 payment each month. Take the total amount of your monthly payment for the year and divide it by 26 and make these payments every 2 weeks. You have converted your mortgage from a monthly to a bi-weekly. This won’t save you a lot of money but it’s better than nothing. A better option is take your monthly mortgage payment and divide it by two. Make payments of this amount bi-weekly(every two weeks). There are 52 weeks in a year, so you will be making 26 bi-weekly payments. This is a bi-weekly accelerated payment. If you had kept with the monthly payment schedule you would have made the equivalent of 24 bi- weekly payments. Those two extra bi-weekly payments add up to making one extra monthly payment per year. Saving you approx $68,000. As you can see, this is another very powerful money saving strategy.

Now you might think to yourself, why don't I leave my monthly mortgage payment schedule alone and make that one extra payment whenever I can within the next year. The only thing wrong with this way of thinking is the odds of that payment ever happening are slim. When it comes to money, something always comes up. But if you implement this strategy you are committed, forcing yourself to make that one extra payment per year and thus ensuring you money saving success.

Get more help with your finances here

Strategy #3: Your budget doesn’t leave you any extra cash to make an additional payment whether it is once a month or once a year. There is still a way to reduce the term of your mortgage without costing you anything extra what so ever. Take the total of your monthly payments for the year. Using our $400,000 mortgage example, $2,134.76 x 12 = $25,617.12, divide this amount by 52, $25,617.12 / 52 = $492.64. Change your payment schedule to a weekly and make your payment of this amount every week. Now, what does this accomplish? Since your mortgage is an amortized simple interest note, you are charged the interest rate x the outstanding principal balance x the term between payments. This means the interest charged each month accrues as each month progresses. So your first weekly payment saves you 3 weeks of interest on the payment amount, your second weekly payment will save you 2 weeks of interest and your third one week of interest. The interest savings is applied directly to your principal balance, which, as we have learned, will reduce the amortization term of your mortgage thus saving you money without costing you one cent extra. The savings here are not as great as the other strategies but you are still saving yourself money. If your financial situation changes at some point in the future you can switch and apply a different strategy. Our purpose here is to save you money however possible. After all it is your money right? Better in your pocket than the banks, whatever the amount.

Fix your finances here

Strategy #4: This is a variation of strategies #2 and #3. Let's say you receive your paycheck weekly, take your monthly payment amount and divide it by 4, and make that payment amount every week. This accomplishes the same as strategy #2, in that you pay the equivalent of one extra monthly payment per year. Also, you utilize the interest saving power of strategy #3 by paying weekly. You have two strategies working for you at the same time.

TIP: When re-financing your mortgage do not reset the clock. By this I mean if you started with a 30 yr amortization, when you renew your mortgage say after 5 yrs, make sure the clock stays at 25 years, that it doesn’t reset to 30 yrs. This is a favorite trick by the bank to get you to pay more interest. You can set your amortization period to whatever you want or can afford. Most people go with the longest amortization period because it gives them the lowest monthly payment but in the end you pay the most interest. Remember banks are in business for one reason to make money, they can only do that by taking yours…

Change your finances here

Re-investment: Ok, so you have implemented one of the strategies and now you are mortgage free. What do you do? Do you go out and buy a fancy new car or boat? No, you take those mortgage payments you were making and feed that money into your retirement savings(in a tax sheltered vehicle). For example, let's use our monthly payment of $2,134.76, continue making payments of $2,134.76, only now you put the money into an RRSP, TFSA or RESP. Make sure this money is working for you by being invested wisely so it will compound and at the end when retirement rolls around you will have a nice fat nest egg. Do not buy GIC’s, you are just giving free money to the banks. Sorry, that’s one of my pet peeves.

This re-investment strategy is just an option on your part of course and would be a part of your complete financial plan. A financial plan is like a roadmap, if you don’t have a map how do you know where you are going and how do you get there? Beat the banks at their own game……If you would like more help with your finances click here

GOOD LUCK!!!

1 note

·

View note

Text

Manage Your Finances Effortlessly with Our Loan Calculator

In today’s fast-paced world, managing finances effectively is more important than ever. Whether you’re planning to buy a home, car, or invest in a major purchase, understanding your loan options and repayment schedules is crucial. At Free Calculator Site, we offer a comprehensive Loan Calculator designed to help you calculate your loan payments, interest rates, and repayment schedules effortlessly. This powerful tool empowers you to make informed financial decisions and plan your financial future with confidence.

Why Use a Loan Calculator?

A Loan Calculator is an essential tool for anyone considering taking out a loan. Here’s why you should use our Loan Calculator: Loan Calculator

Accurate Calculations: Get precise calculations of your monthly payments, total interest paid, and overall cost of the loan.

Easy to Use: Our user-friendly interface makes it simple to input your loan amount, interest rate, and loan term to get instant results.

Time-Saving: Quickly determine the affordability of a loan without complex manual calculations.

Informed Decisions: Understand the impact of different interest rates and loan terms on your finances to choose the best loan option.

Financial Planning: Plan your budget and manage your finances effectively by knowing exactly what to expect in terms of loan repayments.

Features of Our Loan Calculator

Our Loan Calculator is packed with features designed to provide you with the most accurate and useful information:

1. Monthly Payment Calculation

Enter your loan amount, interest rate, and loan term to calculate your monthly payments. This helps you determine how much you will need to pay each month and ensures that the loan fits within your budget.

2. Total Interest Paid

Our calculator also computes the total interest paid over the life of the loan. This feature helps you understand the true cost of the loan and can be a deciding factor when comparing different loan options.

3. Repayment Schedule

View a detailed repayment schedule that breaks down each payment into principal and interest components. This allows you to see how your loan balance decreases over time and helps you track your progress.

4. Amortization Table

The Loan Calculator generates an amortization table, providing a month-by-month breakdown of your loan payments. This table is especially useful for long-term financial planning and for understanding how different loan terms affect your repayment strategy.

How to Use Our Loan Calculator

Using our Loan Calculator is simple and straightforward. Follow these easy steps to get started:

Visit Our Website: Go to Free Calculator Site and navigate to the Loan Calculator page.

Enter Loan Details: Input the loan amount, annual interest rate, and loan term in months or years.

Calculate: Click the “Calculate” button to instantly see your monthly payment, total interest paid, and detailed repayment schedule.

Review Results: Analyze the results to understand your loan repayment plan and make any necessary adjustments to fit your financial goals.

Benefits of Using a Loan Calculator

Utilizing our Loan Calculator offers numerous benefits that can greatly enhance your financial planning and decision-making:

Budgeting: Helps you create a realistic budget by factoring in monthly loan payments.

Comparison: Allows you to compare different loan options to find the one that best suits your needs.

Planning: Assists in long-term financial planning by providing a clear picture of your repayment schedule.

Confidence: Empowers you to make informed decisions with confidence, knowing you have accurate and detailed information.

Start Planning Your Financial Future Today

At Free Calculator Site, we are committed to helping you manage your finances effectively. Our Loan Calculator is a valuable tool that simplifies the process of calculating loan payments and planning your financial future. Whether you’re considering a mortgage, car loan, or personal loan, our calculator provides the insights you need to make smart financial decisions.

Visit Free Calculator Site today and take the first step towards a secure and well-planned financial future. With our Loan Calculator, managing your finances has never been easier!

Loan Calculator

0 notes

Text

Creating a Passive Income Stream: A Guide to Financial Assets

In the quest for financial independence, passive income has become a key objective for many individuals. The allure of earning money without the need to actively work for it each day is compelling. Passive income can come from various sources, and in this guide, we will explore a range of financial assets that can contribute to building a passive income stream.

Dividend Stocks: These are shares of companies that pay out a portion of their earnings to shareholders. Investing in dividend stocks can provide a regular income stream, and if chosen wisely, these stocks can also appreciate in value over time.

Here are the main indicators to consider:

Dividend Yield: This is the ratio of a company's annual dividends compared to its share price. It's expressed as a percentage and helps investors understand how much they can earn from dividends relative to the stock price.

Dividend Payout Ratio: This ratio measures the proportion of earnings paid out as dividends to shareholders. It's calculated by dividing the annual dividends per share by the earnings per share. A lower payout ratio may indicate that the company has room to grow its dividends, while a higher ratio could suggest a ceiling to growth or potential sustainability issues.

Dividend Coverage Ratio: This ratio assesses a company's ability to pay dividends based on its net income. It's the inverse of the dividend payout ratio and provides a buffer indicator; the higher the coverage ratio, the more secure the dividend payment.

Free Cash Flow to Equity (FCFE): Free cash flow to equity reflects the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. It's an important measure because it shows how much cash is available to be returned to shareholders in the form of dividends.

Net Debt to EBITDA: This ratio compares a company's total debt minus cash and cash equivalents to its earnings before interest, taxes, depreciation, and amortization. It gives investors an idea of how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant. A lower ratio suggests a company is less burdened by debt and potentially in a better position to pay dividends.

Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate. They offer a way to invest in real estate without the need to directly manage properties, and they typically distribute at least 90% of their taxable income to shareholders in the form of dividends.

Bonds and Bond Funds: Bonds are debt securities issued by corporations or governments. Bond funds invest in a diversified portfolio of bonds and can provide regular interest payments, making them a stable passive income source.

Peer-to-Peer Lending: This involves lending money to individuals or businesses through online platforms. Investors can earn interest on the loans they provide, which can be a lucrative source of passive income.

The advantages of P2P lending platforms include the potential for higher returns for investors and more accessible loans for borrowers. Additionally, loans can be secured, providing some level of recourse should a borrower default. Some platforms also offer provision funds as a safety net for investors.

However, it's important to note that P2P lending is not without its risks. Investors' capital is at risk, and there may be charges if funds need to be withdrawn quickly. Returns can also be lower than expected if loans are repaid early.

For those considering P2P lending, whether as a borrower or an investor, it's crucial to conduct thorough research and understand the terms and conditions of the platform being used. It's also wise to diversify investments across different loans and platforms to mitigate risk.

High-Yield Savings Accounts and CDs: These are bank accounts that offer higher interest rates than regular savings accounts. Certificates of Deposit (CDs) are time-bound deposits that typically offer a fixed interest rate for the term of the CD.

Money Market Funds: These funds invest in short-term debt securities and can offer higher returns than traditional savings accounts, with relatively low risk.

Rental Properties: Owning rental real estate can provide a steady stream of income. However, it requires an upfront investment and can involve ongoing management responsibilities unless a property manager is employed.

Asset Sharing: This can include renting out a room, parking space, or even your car. It's a way to make money from assets you already own.

Asset Building: This involves creating something that can generate income over time, such as writing a book, developing an online course, or creating a blog with affiliate marketing.

Digital Products: Selling digital products like e-books, online courses, or stock photography can provide passive income. Once created, these products can be sold repeatedly without much additional effort.

Automated Businesses: Some businesses can be automated to a degree that they require minimal ongoing effort. This might include drop-shipping stores or websites with automated services.

It's crucial to understand that although these assets offer passive income potential, they typically demand an initial investment of time, money, or both. Furthermore, ongoing management or monitoring might be required to sustain and expand these income sources. Like any investment, there's inherent risk, so thorough research and diversification are essential to minimize potential losses.

Passive income can significantly contribute to achieving financial independence, but it's not a shortcut to instant wealth. It demands foresight, perseverance, and astute investment decisions. By examining the aforementioned options and identifying the right combination that aligns with your financial objectives and risk tolerance, you can construct a resilient passive income stream that bolsters your long-term financial security.

For comprehensive insights into each passive income avenue, consider delving into financial advisories and investment platforms offering customized guidance and opportunities. Remember, the cornerstone of successful passive income lies in establishing a coherent strategy and adapting it as you gain experience and cultivate your investments. Here's to prosperous investing!

0 notes

Text

How Would you Estimate the EMI Payable on a house Loan

A home bank loan is an important financial dedication that usually lasts a long time; for that reason, borrowers should really perform thorough monetary organizing in advance of taking over an obligation of the magnitude. Utilizing a Household Personal loan Calculator is amongst the easiest solutions to approach your private home personal loan journey. The calculator is a helpful on the internet Device that is certainly readily available for totally free about the Internet sites of most lenders. It can be utilized to forecast a rough EMI approach that corresponds into the financial loan sum ideal. This could not only Provide you a good suggestion of how possible your house personal loan request is, nonetheless it will likely lower the possibility of human error.

Borrowers may make use of the EMI Calculator to experiment with various loan amounts and tenor combos to discover the ideal EMI for them. In straightforward text, a Home Financial loan Calculator will allow someone to produce a repayment program and system their loan journey appropriately.

What on earth is Residence Loan Calculator? A house financial loan calculator is a web-based calculator that is certainly utilized to compute house loan EMIs. HomeFirst calculator calculates the EMI plus the payment breakdown component, which incorporates the principal and desire quantity. This is certainly an online calculator that may be accustomed to estimate the monthly EMIs for a specific bank loan volume. This EMI calculator considers the financial loan amount of money, the interest price charged through the financial institution, along with the repayment period of time, and calculates the quantity of EMI the borrower ought to pay back each month during the specified interval.

How Do You Work out the EMI Payable on a house Financial loan? Property loans are repaid by way of EMIs, which include things like both equally a principal and an fascination part.

The lender may even offer you an amortization timetable that specifics simply how much of each monthly EMI goes towards principal repayment and the amount of goes toward desire repayment. The amortization agenda may even offer you your month to month corresponding balance.

So how exactly does Property Loan EMI Allows in Getting a Home? The house loan EMI is a crucial element to think about When picking a home financial loan. Consequently, calculating EMIs beforehand with a web-based calculator helps you in preparing for the house loan. home finance loan mortgage calculation EMI is helpful –

Determine the amount to borrow dependant on your month to month spending plan. Program household loan repayment to be sure EMI payments are created on time. Produce a prepayment system. How you can Use a Home Bank loan EMI Calculator? Because We all know the formula for calculating EMIs will not mean we should always sit down having a pen and paper and get it done ourselves. Because the EMI calculation method is obscure, guide calculations are liable to errors. Moreover, manually generating your amortization agenda will choose longer. Consequently, to grasp their regular EMI obligation and amortization agenda, a person must use online monetary resources such as a EMI calculator.

Here are some of the advantages of using a home loan calculator.

House mortgage EMI calculators can be relied on to be exact every time. They normally deliver precise final results. Your calculator is accurate and speedy; immediately after coming into all of the information, you can get your month to month EMI and amortization schedule in seconds. Considering the fact that this on the net calculator creates brings about seconds, you may experiment with as several loan volume, interest amount, and tenor combinations as you'd like. Striving out different mixtures can help you locate the very best blend for you. You should utilize the online calculator to check distinctive gives from unique lenders and select the one that most closely fits your budget and desires. Property personal loan EMI calculators are straightforward to implement and totally absolutely free. Why can it be Crucial to Use a Home Financial loan EMI Calculator? It might be difficult to determine the exact EMI for your own home personal loan. Probably the most a layperson can normally do is consult with an accountant to operate the quantities.

But Imagine if someone produced a web-based Device which will conduct elaborate calculations in seconds and supply exact success? In this article’s where by an EMI calculator is available in helpful.

Acquiring these kinds of an estimate previous to making use of for a home loan will allow you to better plan your funds and lower the chance of payment default. The best part is that almost all of on the net EMI calculators are fully cost-free to utilize. You can even use a house bank loan EMI calculator to determine the right financial loan dimension for yourself. You shouldn’t Chunk off over you are able to chew, as the expressing goes. This implies that you need to not borrow the total amount accessible to you. As an alternative, use an EMI calculator to ascertain the utmost EMI amount of money it is possible to pay for right before choosing on the scale of the borrowing. Great things about Residence Personal loan EMI Calculator The following are a few of the advantages of utilizing a EMI calculator:

It helps you in budgeting your costs based upon your earnings. Point out the total fascination you pays at the end of your bank loan expression. The calculator helps you in identifying no matter if to boost or lower the tenure dependant on your price range. This is a brief and simple Instrument so that you can use. It can be dynamic; figures could be quickly changed. The first step is to determine your eligibility for a home bank loan, to not estimate your EMI. The house personal loan eligibility calculator can make it simple to determine your eligibility.

To know more details visit here: Home loan calculator

0 notes

Text

Moneymango.in

Get affordable B Khata and home loan finance options in Bengaluru. Apply now for the best mortgage loan interest rates at MoneyMango

Fast Secure, and Esay HOME LOAN PROCESS

We are a unique Financial advisory company for the last 8 years. with a good in-depth sound product knowledge Team to advise our clients. We process every loan to get sanctions. we help employees entrepreneurs and business owners get money to achieve their dream of a home, grow a business, etc.,

Navigating the realm of home loans and mortgage loan interest rates demands informed decision-making to secure the best financial options. Enter MoneyMango—a trusted ally for individuals seeking comprehensive insights and guidance in the intricate landscape of home loan finance.

For many, purchasing a home represents a significant milestone, and home loans serve as the gateway to realizing this dream. MoneyMango specializes in simplifying this complex financial process, offering expert advice and a plethora of resources to assist individuals in making sound financial decisions.

At the core of MoneyMango's services lies a commitment to empowering individuals with information. Understanding the nuances of home loan finance can be daunting, but their platform equips borrowers with the knowledge needed to navigate the various loan options, interest rates, and repayment structures.

home loan finance One of the pivotal factors in home loan finance is the mortgage loan interest rate. MoneyMango provides comprehensive insights into prevailing interest rates, guiding borrowers in understanding how rates influence overall loan affordability and the long-term financial implications.

mortgage loan interest rates Moreover, MoneyMango's platform facilitates comparison shopping—an invaluable tool in the quest for the best mortgage loan interest rates. By analyzing and comparing rates from multiple lenders, borrowers gain a clearer understanding of available options, enabling them to make informed decisions aligned with their financial goals.

Furthermore, MoneyMango doesn't just stop at providing information; they guide borrowers through the entire loan application process. From pre-qualification to loan approval, their experts offer personalized assistance, ensuring borrowers comprehend the intricacies of loan terms and conditions before making commitments.

MoneyMango recognizes the significance of aligning loan options with individual financial circumstances. Their platform allows borrowers to explore various loan types, repayment plans, and interest rate structures, empowering them to select options that suit their financial capabilities and future aspirations.

apply for mortgage loan Moreover, their website serves as a repository of resources—articles, guides, and calculators—designed to demystify the complexities of mortgage loan interest rates and home loan finance. Borrowers can access valuable insights and tools to estimate monthly payments, understand amortization schedules, and plan for the long-term financial impact of their loan decisions.

The benefits of MoneyMango's expertise extend beyond just securing a loan. They advocate for financial literacy and responsibility, encouraging borrowers to make informed choices that align with their financial well-being. Their guidance helps borrowers not only secure loans at favorable rates but also manage their finances responsibly throughout the loan tenure.

In conclusion, MoneyMango emerges as a reliable partner for individuals navigating the realm of home loan finance and mortgage loan interest rates. Their platform provides not only information but also personalized guidance, empowering borrowers to make well-informed decisions that align with their financial goals and aspirations.

For those seeking to embark on the journey of homeownership or navigate refinancing options, MoneyMango stands as a beacon of expertise and guidance in the ever-evolving landscape of home loan finance.

Feel free to adapt this content to better align with the specific services and expertise offered by MoneyMango!

All type service

Mortgage loan In Karnataka

home loan finance

mortgage loan interest rates

apply for mortgage loan

Visit for more information: https://moneymango.in/

0 notes

Text

B Khata mortgage loan In Bengaluru

Get affordable B Khata and home loan finance options in Bengaluru. Apply now for the best mortgage loan interest rates at MoneyMango

Fast Secure, and Esay HOME LOAN PROCESS

We are a unique Financial advisory company for the last 8 years. with a good in-depth sound product knowledge Team to advise our clients. We process every loan to get sanctions. we help employees entrepreneurs and business owners get money to achieve their dream of a home, grow a business, etc.,

Navigating the realm of home loans and mortgage loan interest rates demands informed decision-making to secure the best financial options. Enter MoneyMango—a trusted ally for individuals seeking comprehensive insights and guidance in the intricate landscape of home loan finance.

For many, purchasing a home represents a significant milestone, and home loans serve as the gateway to realizing this dream. MoneyMango specializes in simplifying this complex financial process, offering expert advice and a plethora of resources to assist individuals in making sound financial decisions.

At the core of MoneyMango's services lies a commitment to empowering individuals with information. Understanding the nuances of home loan finance can be daunting, but their platform equips borrowers with the knowledge needed to navigate the various loan options, interest rates, and repayment structures.

home loan finance One of the pivotal factors in home loan finance is the mortgage loan interest rate. MoneyMango provides comprehensive insights into prevailing interest rates, guiding borrowers in understanding how rates influence overall loan affordability and the long-term financial implications.

mortgage loan interest rates Moreover, MoneyMango's platform facilitates comparison shopping—an invaluable tool in the quest for the best mortgage loan interest rates. By analyzing and comparing rates from multiple lenders, borrowers gain a clearer understanding of available options, enabling them to make informed decisions aligned with their financial goals.

Furthermore, MoneyMango doesn't just stop at providing information; they guide borrowers through the entire loan application process. From pre-qualification to loan approval, their experts offer personalized assistance, ensuring borrowers comprehend the intricacies of loan terms and conditions before making commitments.

MoneyMango recognizes the significance of aligning loan options with individual financial circumstances. Their platform allows borrowers to explore various loan types, repayment plans, and interest rate structures, empowering them to select options that suit their financial capabilities and future aspirations.

apply for mortgage loan Moreover, their website serves as a repository of resources—articles, guides, and calculators—designed to demystify the complexities of mortgage loan interest rates and home loan finance. Borrowers can access valuable insights and tools to estimate monthly payments, understand amortization schedules, and plan for the long-term financial impact of their loan decisions.

The benefits of MoneyMango's expertise extend beyond just securing a loan. They advocate for financial literacy and responsibility, encouraging borrowers to make informed choices that align with their financial well-being. Their guidance helps borrowers not only secure loans at favorable rates but also manage their finances responsibly throughout the loan tenure.

In conclusion, MoneyMango emerges as a reliable partner for individuals navigating the realm of home loan finance and mortgage loan interest rates. Their platform provides not only information but also personalized guidance, empowering borrowers to make well-informed decisions that align with their financial goals and aspirations.

For those seeking to embark on the journey of homeownership or navigate refinancing options, MoneyMango stands as a beacon of expertise and guidance in the ever-evolving landscape of home loan finance.

Feel free to adapt this content to better align with the specific services and expertise offered by MoneyMango!

All type service

Mortgage loan In Karnataka

home loan finance

mortgage loan interest rates

apply for mortgage loan

Visit for more information: https://moneymango.in/

0 notes

Text

Cash Flow: What It Is, How It Works, and Statement

What’s cash flow?

Whereas the inflows and outflows of an organization's cash flow relate to the amount of money received and spent, respectively, the cash flow system calculates the net cash and cash equivalents transferred in and out of an organization. “what is cash flow system” As we all know, maximizing long-term free cash flow (FCF) and producing positive cash flows are essential to building value for shareholders. FCF is the cash that remains after deducting operating costs from total revenue.

Defining Cash Flow

The money that companies spend on expenses that they receive as revenues from sales is known as cash flow in the context of how we operate our businesses.”what is cash flow system” These earnings come from additional interest, investments, royalties, and licensing contracts in addition to goods sold on credit. To ascertain and evaluate cash flows, a company's overall financial performance, liquidity, and flexibility are crucial.

Positive cash flow is a sign that a company's liquid assets are growing, which enables it to pay bills, reinvest in the company, return capital to investors, cover commitments, act as a safety net against upcoming financial difficulties, and remain adaptable in the face of hardship.

The company's standard financial statement that details its cash source and uses over time is determined by looking at its cash flow statement. The purpose of the company's financial report is to make the earnings, debt payments, and operating expenses available to investors, analysts, and corporate management. Along with balance sheets and income statements, it's a crucial financial document that businesses release.

Cash Flow Statement

The cash flow statement functions more like a corporate checkbook, a reconciliation between the income statement and balance sheet. “define Cash Flow system” The net increase/decrease in cash and cash equivalents (CCE), or the total change in the company's cash and equivalents over the previous period, represents the bottom line. The difference between the current CCE and that of the prior year or quarter should be precisely equal to the number at the bottom of the cash flow statement.

The cash flow statement for Walmart as of January 31, 2019, demonstrates a $742 million increase in positive cash flow. Because the company has saved cash and built it up in reserves, it shows that it can withstand short-term obligations and fluctuations. The investments in its properties, plants, and equipment as well as the acquisitions of other companies are represented by its clash flow from investing activities.

Walmart's 2019 Statement of Cash Flows

Operating activity cash flows:

Combined net income of 7179

(Income) loss on operations that are terminated, net of income taxes

Revenue from ongoing business activities 7179

Comparing operating cash flow to consolidated net income:

Unrealized profits as well as losses3516

Disposition of earnings and losses from business operations 4850

10,678 in depreciation and amortization

Postponed income taxes (499).

Additional operational tasks1734

Modifications to specific assets and liabilities:

Net 368 Receivables and Inventory (1,311)

Payables in advance 1,831

Liabilities accrued 183

Income taxes accumulated (40)

Operating activities' net cash provided (27,753)

Cash flows from investments: Equipment and property payments (10,344)

money received from selling equipment and property519 follows the termination of specific operations.876 Purchase payments, net of total cash received ($14,656)

Additional financial undertakings 431

Net cash utilized for investments (24,036)

Finance-related cash flows: Net variation in short-term borrowings (53

money received from the long-term debt issue15, 872

Long-term debt payments (3,784)

Paid dividends (6102)

Acquisition of Business Stock (7,410)

Payments made as dividends to noncontrolling interest (431

Additional financial undertakings (629)

Net cash utilized for financing operations (25, 37)

Exchange rate effects on currency and its equivalents (438).

Net change in cash and cash equivalents (growth or decrease): 742

There was cash and cash equivalents available at the start of the year.7,014

At year's end, cash and cash equivalents were 7,756.

Cash flow categories

Cash Flows for Operations

The cash used to produce sales and goods through regular business operations is known as an operating cash flow for any given company. To put it simply, a company's operating cash flow is demonstrated by its ability to pay its bills on time or for ongoing expenses.

The operating cash flow is computed as the cash from sales less the operating expenses that are paid for in cash over a given time period. “define Cash Flow system” It also establishes whether the business needs outside funding for any additional capital raise, while producing enough cash flow to support and grow operations.

How to Invest Cash Flows

The amount of money created or spent on investment-related activities over a given time period is ascertained by investing cash flow, also known as cash flow from investing (CFI) activities. Investing in assets, securities, or selling securities or assets is known as exercising CFI. It's not always necessary to raise the alarm when investing activities like research and development (R&D) reveal a negative cash flow.

Money Flows from Loans

The cash flow from financing (CFI) is the net cash flow used to fund the business and its capital. Among its operations are those involving the provision of debt, “define Cash Flow system” equity, and dividend payments. Cash flows from financing activities are of interest to investors because they provide information about a company's overall capital structure management and overall strength of finances.

#real estate#property#real estate news#realestateinindia#latest news#propertysales#saleproperty#sale for house

0 notes

Text

[ad_1] A stockholder in Avantax Inc., which is being acquired by the enormous broker-dealer community Cetera Holdings Inc., final week sued Avantax, claiming that its board of administrators had permitted the submitting of a proxy assertion that had incorrect details about the merger and doubtlessly may hurt buyers. A type of named within the grievance is Christopher Walters, Avantax CEO and a member of the board, who may stroll away from the cope with a golden parachute worth $21.6 million, in keeping with the proxy statement that's now being questioned in court docket. In September, Cetera stated it meant to purchase Avantax, which makes a speciality of CPAs and tax-focused monetary advisors, for $1.2 billion, or $26 per share. Weeks later, it filed its initial proxy statement, which included quite a lot of info in regards to the deal that shareholders would wish to tell their vote on whether or not to approve the merger or not. And that’s the place Avantax fell brief, in keeping with the investor grievance, which was filed final Thursday in federal court docket in Delaware by Brian Jones. In accordance with the grievance, the proxy assertion, which recommends that Avantax stockholders vote their shares in favor of the acquisition, “accommodates materially incomplete and deceptive data regarding, amongst different issues: the corporate’s monetary projections; the monetary analyses that assist the equity opinion offered by the corporate’s monetary advisor, PJT Companions; and potential conflicts of curiosity confronted by firm insiders.” The failure to make enough disclosures is a violation of federal securities legal guidelines, in keeping with the grievance. Shareholders are scheduled to vote on Cetera’s buy of Avantax Nov. 21. A spokesperson for Avantax didn't return a name Monday morning to remark. A spokesperson for Cetera additionally didn't return a name Monday to remark. Cetera Holdings is the father or mother of Cetera Monetary Group, an enormous community of broker-dealers with 9,000 monetary advisors and $341 billion in consumer property. Avantax’s 3,100 monetary advisors work with $83.8 billion in consumer property. In accordance with the grievance, the proxy allegedly didn't disclose the road gadgets underlying the calculation of adjusted EBITDA, or earnings earlier than curiosity, taxes, depreciation and amortization; unlevered free money stream; and non-GAAP earnings per share. Economic system will land softly until oil costs spike, says Ameriprise chief economist [ad_2]

0 notes