#how amortization affects personal loan interest

Explore tagged Tumblr posts

Text

How Do Loan Amortization Schedules Impact Interest Costs?

A personal loan is a convenient financial solution that helps individuals manage various expenses, including medical emergencies, education, home renovation, and debt consolidation. While taking a personal loan, understanding how your repayment structure works is crucial to managing your finances effectively. One of the key factors that determine how much interest you will pay over the loan tenure is the loan amortization schedule.

A loan amortization schedule is a structured plan that outlines how each monthly EMI (Equated Monthly Installment) is divided between principal repayment and interest payment. The way your loan is amortized directly impacts the total interest cost you incur over time. In this article, we will explore how loan amortization schedules work, how they influence interest costs, and strategies to reduce the total interest burden on your personal loan.

1. What Is a Loan Amortization Schedule?

A loan amortization schedule is a detailed breakdown of how each EMI is allocated toward principal repayment and interest payment over the loan tenure. It provides clarity on how the outstanding loan balance decreases over time.

Key Components of a Loan Amortization Schedule:

✅ EMI Amount – The fixed monthly payment made by the borrower. ✅ Principal Component – The portion of the EMI that goes toward reducing the loan amount. ✅ Interest Component – The portion of the EMI that is paid as interest to the lender. ✅ Outstanding Balance – The remaining loan amount after each EMI payment.

📌 Tip: In the early months of the personal loan, a larger portion of the EMI is allocated toward interest, while the principal repayment portion increases over time.

2. How Loan Amortization Schedules Impact Interest Costs

The structure of a loan amortization schedule significantly influences the total interest you pay throughout the loan tenure. Here’s how:

A. Higher Interest Payments in the Initial Years

In an amortized personal loan, a major portion of your EMI goes toward interest in the early months. As the principal reduces over time, the interest component also decreases.

✅ Example: If you take a ₹5,00,000 personal loan at 12% interest for 5 years:

First EMI: ₹5,000 toward interest, ₹3,500 toward principal.

Last EMI: ₹500 toward interest, ₹8,000 toward principal.

B. Longer Tenure Increases Interest Costs

The longer the loan tenure, the more interest you pay overall. While a longer tenure reduces EMI amounts, it significantly increases the total interest burden.

✅ Example:

₹5,00,000 loan at 12% for 5 years → Total Interest = ₹1,67,000

₹5,00,000 loan at 12% for 3 years → Total Interest = ₹98,000

📌 Tip: If you can afford higher EMIs, opt for a shorter tenure to save on interest costs.

C. Early Loan Repayment Reduces Interest Expenses

Since most interest is paid in the initial years, making prepayments early in the tenure can drastically reduce total interest costs.

✅ Example: If you prepay ₹1,00,000 in the first year, you can save significant interest over the remaining tenure.

3. How to Use an Amortization Schedule to Your Advantage?

By analyzing your loan amortization schedule, you can strategically plan your loan repayment to reduce the overall interest cost. Here are some tips:

A. Opt for a Shorter Loan Tenure

Since longer tenures result in higher interest payments, choosing a shorter repayment period can save money.

✅ Example: A 3-year loan incurs less interest than a 5-year loan, even if EMIs are higher.

B. Make Prepayments or Extra EMI Payments

If your lender allows it, making extra payments toward the principal reduces the outstanding balance and, consequently, the interest payable.

✅ Tip: Even one extra EMI payment per year can reduce your loan tenure and save significant interest.

C. Choose the Right EMI Amount

Use a personal loan EMI calculator to determine the best EMI amount that balances affordability with lower interest payments.

✅ Tip: A slightly higher EMI can save thousands in interest over the loan tenure.

D. Consider Balance Transfer for Lower Interest Rates

If your lender’s interest rate is high, transferring your loan to another bank with a lower rate can help reduce total interest costs.

✅ Tip: Compare different lenders’ interest rates before opting for a balance transfer.

4. Comparing Loan Amortization: Fixed vs. Floating Interest Rates

Your personal loan amortization schedule may differ based on whether you choose a fixed or floating interest rate.FeatureFixed Interest RateFloating Interest RateInterest Rate StabilityRemains constantChanges based on market ratesEMI AmountFixedMay vary over timeRiskPredictable repaymentCan fluctuate with economic conditionsBest ForBorrowers who prefer stable EMIsBorrowers expecting rate reductions

📌 Tip: If interest rates are expected to decline, opting for a floating rate loan may reduce long-term costs.

5. Common Mistakes to Avoid in Loan Amortization

🚫 Ignoring the Amortization Schedule: Not reviewing your schedule can lead to poor financial planning. 🚫 Choosing a Longer Tenure for Lower EMIs: While lower EMIs are attractive, they increase overall interest payments. 🚫 Skipping Prepayments: Avoiding early repayments can lead to unnecessarily high interest expenses. 🚫 Not Comparing Lenders: Different lenders offer different interest rates and loan structures; comparing them can help secure a better deal.

📌 Tip: Always check if prepayment penalties apply before making additional payments on your personal loan.

6. Conclusion

A loan amortization schedule is a powerful tool that helps borrowers understand how their personal loan repayments work. By analyzing your amortization table, you can make informed decisions to reduce interest costs, optimize loan tenure, and save money.

To minimize interest payments, choose a shorter tenure, make prepayments, select the right EMI, and explore balance transfer options. Understanding loan amortization can significantly improve your financial health and repayment strategy.

For expert guidance and the best personal loan offers, visit www.fincrif.com today!

#loan apps#personal loan online#fincrif#bank#loan services#personal loans#personal laon#personal loan#finance#nbfc personal loan#loan amortization schedule#personal loan interest cos#personal loan EMI calculation#loan repayment schedule#how amortization affects personal loan interest#personal loan principal vs. interest payment#how to reduce personal loan interest#loan tenure impact on interest cost#personal loan prepayment benefits#EMI breakdown for personal loan#personal loan balance transfer#fixed vs floating interest rate personal loan#personal loan amortization calculator#how to choose the best personal loan tenure#strategies to pay off personal loan faster#impact of early repayment on personal loan interest#personal loan interest vs. principal breakdown#how personal loan EMI is calculated#effect of longer tenure on personal loan interest#how to minimize interest on a personal loan

0 notes

Text

10 Common Interview Questions and Answers for the Banking Industry

For both newcomers and seasoned professionals, banking offers a wide range of job choices. The interview process, which includes a variety of interview questions, must be passed in addition to the academic credentials and aptitude tests.

A banking position could or might not require experience, but it does require a strong interview performance.

The banking and finance sectors offer a variety of entry points for graduates from different academic disciplines, including corporate banking, customer relationship management, researchers, tax analysts, analysts, etc.

Let’s examine the top 10 banking interview questions and responses in the article that follows so that you can ace the interview.

Top 10 Banking Interview Questions and Answers are:

Question 1: Brief me about yourself?

Every interviewer starts the conversation and gets to know the candidate with this key question. Therefore, always be upbeat and start your introduction by listing your name, education, and any other pertinent details that the interviewer should be aware of. Just finish it in under two minutes to avoid having a long, dull talk.

Question 2: Why do you want to join the banking sector?

Be reasonable in your response to this question and explain how the banking industry has affected individuals by providing all the data you have available to support your claim that it is the industry with the quickest rate of expansion. Don’t begin by saying that you want a secure career or some other aspect of your life. Simply ensure that it is knowledgeable enough to form an accurate evaluation of your response.

Question 3: What are the types of accounts in a bank?

Be direct and begin your response by providing details that can address the interviewer’s query. Bank accounts come in the following varieties:

Checking Account: This account functions similarly to a savings account, however unlike a savings account, it does not accrue interest. There is no withdrawal cap when you create a checking account with a bank, which is a plus.

Money Market Account: This account offers the advantages of both checking and savings accounts. The cash can be withdrawn while still earning higher interest. There is no minimum balance required to open this kind of account.

Account with a certificate of deposit (CD): By establishing such an account, you must make a fixed deposit of funds.

Question 4: What are the necessary documents a person requires to open an account in a bank?

The Know Your Customer (KYC) regulations, which require banks to gather some personal information about account holders, are in accordance with the RBI’s advice to banks. The main documents required to open an account are identification evidence (such as an Aadhar card or Pan card) and address verification.

Question 5: What are the types of Commercial Banks?

Retail or Consuming Bank: A small to medium branch that focuses on serving individual customers rather than corporations or other banks.

Corporate banking, often known as business banking, deals with cash management, stock and bond issuance, financing, and underwriting.

Non-traditional Options: – There are numerous non-banking organisations that provide financial services comparable to those provided by banks. The organisations in question are credit card issuers, credit card businesses, and credit card reporting agencies.

Securities and Investment Banking: Investment banking oversees the management of financial asset portfolios, including those for commodities, currencies, corporate finance, fixed income, debt and equity writing, etc.

Question 6: What is the annual percentage rate (APR)?

The term “APR” stands for annual percentage rate. For using their services, such as loans, credit cards, etc., customers of the bank are subject to a fee or interest. Every year, the interest is calculated.

Question 7: What is Amortization and negative amortization?

Amortization refers to the repayment of the loan by instalment to cover principal amount with interest whereas, negative amortization is when the repayment of the loan is less than the loans accumulated interest, then negative amortization takes places.

Question 8: What is the debt to income ratio?

A loan applicant’s total monthly debt payments are divided by his gross income to get his debt to income ratio.

Question 9: What is loan grading?

Loan grading is the classification of a loan based on numerous risks and criteria, such as the likelihood of payback, the credit history of the borrower, etc. Depending on the loan’s stability and risk, the system assigns it to one to six categories.

Question 10: What do you mean by Co-Maker?

A person who signs a note to guarantee the payment of the loan on behalf of the main loan applicant’s is known as Co-maker or signer.

1 note

·

View note

Text

How to Calculate Home Loan Payments in Canada

Purchasing a home is one of the most significant financial decisions Canadians make. To make informed choices, it’s essential to understand how home loan payments are calculated. This article will break down the components of a mortgage payment, explain the math behind it, and offer insights into current statistics and trends in the Canadian real estate market.

Understanding Mortgage Payments

Your monthly mortgage payment typically includes four main components:

Principal: The original amount borrowed.

Interest: The cost of borrowing the principal.

Property Taxes: Often included in your mortgage payment and held in escrow by your lender.

Mortgage Insurance: Required for down payments under 20% (CMHC insurance).

The Formula for Calculating Mortgage Payments

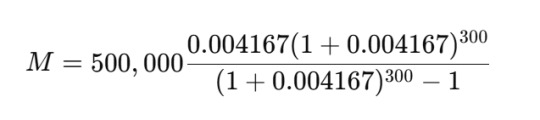

Most lenders use the amortization formula to calculate monthly payments:

Where:

M = Monthly mortgage payment

P = Principal loan amount

r = Monthly interest rate (annual rate divided by 12)

n = Total number of payments (amortization period in years × 12)

Example Calculation

Let’s assume:

Loan Amount (Principal): $500,000

Interest Rate: 5% annually (0.05/12 = 0.004167 monthly)

Amortization Period: 25 years (300 payments)

Plugging into the formula:

Using a financial calculator or software, the monthly payment is approximately $2,923.55.

Current Trends in Canada’s Mortgage Market

Interest Rates

As of 2024, the Bank of Canada’s benchmark interest rate remains a key factor affecting mortgage rates. Variable-rate mortgages are hovering around 6%, while fixed-rate mortgages range between 5.5% and 6.5%, depending on the lender and term.

Home Prices

The Canadian Real Estate Association (CREA) reports the average home price in Canada is approximately $729,000 as of October 2024. This figure varies significantly by region, with Toronto and Vancouver maintaining the highest prices.

Amortization Periods

Most Canadian homebuyers choose a 25-year amortization period, although longer terms of up to 30 years are available, especially for those with higher loan-to-value ratios.

Down Payments

A minimum of 5% down payment is required for homes under $1,000,000, while homes above this threshold necessitate at least 20%.

Tools to Simplify Calculations

For ease, many Canadians turn to online mortgage calculators offered by banks and financial institutions. These tools allow users to input different scenarios, including changes in interest rates or down payments, to see how their monthly payments might vary.

Tips for Managing Mortgage Payments

Shop Around for Rates: Even a small difference in interest rates can save thousands over the life of a mortgage.

Consider Pre-Payments: Making lump-sum payments or increasing your regular payment amount can significantly reduce interest costs.

Stay Updated: Keep an eye on the Bank of Canada’s announcements and market trends that could influence rates.

Conclusion

Understanding how home loan payments are calculated empowers Canadian homebuyers to navigate their mortgage journey confidently. By using the formula or leveraging online tools, you can plan effectively and ensure your dream home fits within your budget.

For personalized advice, consider consulting a financial advisor or mortgage specialist. With Canada’s dynamic real estate market, staying informed is your best strategy for success.

0 notes

Text

In today's fast-paced world, managing finances efficiently is crucial. Whether it's purchasing a new gadget, planning a dream vacation, or funding higher education, loans have become an integral part of our lives. However, the key to smart borrowing lies in understanding the financial commitments associated with loans, particularly the Equated Monthly Installments (EMIs). This is where the EMI Calculator app comes into play, emerging as the best monthly EMI loan app to help you make informed decisions.

Why EMI Calculator Stands Out

EMI Calculator is not just another financial tool; it's a comprehensive solution designed to simplify loan management. The app caters to all your loan calculation needs, providing detailed insights into your monthly payments, interest rates, and loan tenure. Here's why EMI Calculator stands out:

User-Friendly Interface: The app boasts an intuitive interface that makes it easy for users of all ages to navigate. Whether you're tech-savvy or a beginner, you'll find it simple to input your loan amount, interest rate, and tenure to calculate your EMIs within seconds.

Accurate Calculations: With EMI Calculator, you can rely on precise calculations. The app uses advanced algorithms to ensure that the EMI amounts displayed are accurate, helping you avoid any financial surprises later on.

Multiple Loan Types: Whether you're looking for a personal loan, home loan, car loan, or education loan, EMI Calculator covers all bases. You can compare different loan types and choose the one that best suits your financial situation.

Flexible Loan Tenure: The app allows you to adjust the loan tenure to see how it affects your monthly EMI. This feature is particularly useful if you're trying to balance your budget and need to find the most affordable repayment plan.

Detailed Amortization Schedule: EMI Calculator provides a detailed amortization schedule, breaking down each EMI into principal and interest components. This transparency helps you understand how much of your payment goes towards repaying the principal and how much towards interest.

Additional Features: The app also includes features like a prepayment calculator, which allows you to see the impact of making early payments on your loan. This can be a game-changer if you want to reduce your overall interest burden.

Why You Need EMI Calculator

Taking out a loan is a significant financial decision, and having the right tools to manage it is essential. EMI Calculator not only helps you plan your finances better but also ensures that you don't overextend yourself. By providing a clear picture of your monthly commitments, the app empowers you to make informed decisions that align with your financial goals.

In conclusion, if you're in the market for a reliable, user-friendly, and comprehensive loan management tool, EMI Calculator is your best bet. It simplifies the complex process of loan management, making it the best monthly EMI loan app available. Download EMI Calculator today and take control of your financial future!

0 notes

Text

Discover the Ultimate Mortgage Solution in Dubai: Amplusmortgage

Are you dreaming of owning a home in Dubai but feeling overwhelmed by the financial aspects? Look no further than Amplusmortgage, your go-to resource for the best mortgage calculator in Dubai.

Navigating the complex world of mortgages can be daunting, especially in a dynamic market like Dubai. That’s where Amplusmortgage shines, offering a user-friendly and comprehensive housing loan calculator Dubai residents and expats can rely on.

With just a few clicks, you can input your desired loan amount, interest rate, and loan term. Our advanced algorithm instantly crunches the numbers, providing you with accurate monthly payment estimates and a detailed amortization schedule.

But Amplusmortgage is more than just a calculator. We understand that every homebuyer’s journey is unique. That’s why our platform offers personalized insights based on your financial situation and goals. Whether you’re a first-time buyer or looking to refinance, our tool helps you make informed decisions.

Curious about how changes in interest rates might affect your payments? Our housing loan calculator Dubai feature allows you to compare different scenarios side by side. This empowers you to plan for various market conditions and choose the best mortgage option for your needs.

In a city known for its luxury real estate, Amplusmortgage ensures that the path to homeownership is clear and accessible. We’re committed to transparency, providing you with all the information you need to navigate the Dubai property market with confidence.

Don’t let mortgage complexities hold you back from your dream home. Visit Amplusmortgage today and experience the best mortgage calculator in Dubai. Your journey to homeownership starts here!

0 notes

Text

The Ultimate Guide to Using an EMI Calculator Online for Financial Planning

When it comes to managing loans and making informed financial decisions, an EMI Calculator Online is a crucial tool that can help you streamline your budgeting and planning efforts. Whether you're applying for a home loan, personal loan, or car loan, this online tool provides valuable insights into your monthly payments and overall financial strategy. Here’s a comprehensive guide on how to effectively use an EMI Calculator Online to optimize your financial planning.

What is an EMI Calculator Online?

An EMI Calculator Online is a digital tool designed to calculate the Equated Monthly Installment (EMI) that you will need to pay for a loan. The EMI is a fixed monthly payment that you make to the lender over the loan’s tenure, which covers both the principal amount and the interest charged on the loan. This calculator helps you determine the EMI amount based on the loan amount, interest rate, and loan tenure, providing you with a clear understanding of your financial commitments.

Why Use an EMI Calculator Online?

Easy to Use:

EMI calculators are user-friendly and require only a few pieces of information to provide accurate results. You don’t need any specialized knowledge to use these tools effectively.

Instant Calculations:

With just a few clicks, you can get an immediate calculation of your EMI, saving you time and effort compared to manual calculations.

Financial Planning:

By knowing your monthly EMI, you can better plan your budget and ensure that you can comfortably manage your monthly expenses. It helps in setting realistic financial goals and avoiding financial strain.

Comparison of Loan Options:

An EMI Calculator Online allows you to compare different loan offers by adjusting variables such as loan amount, tenure, and interest rates. This helps you choose the best loan product that suits your financial situation.

Prepayment and Loan Adjustment Planning:

You can use the calculator to evaluate the impact of prepaying a portion of your loan. It shows how prepayment affects your EMI and overall loan tenure, helping you make decisions about additional payments.

How to Use an EMI Calculator Online

Using an EMI Calculator Online involves a few simple steps:

Access the Calculator:

Search for “EMI Calculator Online” and choose a reliable financial website or app that offers this tool.

Enter the Loan Amount:

Input the total amount of money you are borrowing.

Input the Interest Rate:

Enter the annual interest rate offered by your lender.

Select the Loan Tenure:

Choose the duration of your loan, typically in months or years.

Generate the EMI:

The calculator will process the information and display the EMI amount, along with a breakdown of the principal and interest components.

Example of Using an EMI Calculator Online

Suppose you want to take a home loan of $200,000 at an annual interest rate of 5% for a tenure of 20 years. Using the EMI Calculator Online, you would enter:

Loan Amount: $200,000

Interest Rate: 5% per annum

Tenure: 20 years (240 months)

The calculator will show you the EMI amount you need to pay each month, along with a detailed amortization schedule that breaks down how much of each payment goes towards the principal and how much goes towards interest.

Benefits of Using an EMI Calculator Online

Clarity and Transparency:

The calculator provides clear information about your EMI obligations, helping you understand how your monthly payments are structured.

Enhanced Budgeting:

By knowing your EMI, you can create a more accurate budget and manage your finances more effectively.

Informed Loan Decisions:

You can use the calculator to experiment with different loan amounts, interest rates, and tenures to find the best loan option for your needs.

Future Planning:

It helps in planning for future expenses by giving you a snapshot of how much you will be paying over the course of the loan.

Conclusion

An EMI Calculator Online is an indispensable tool for anyone considering taking out a loan. It simplifies the process of calculating your monthly payments, helps you manage your budget, and aids in making informed financial decisions. By providing instant, accurate results, this tool allows you to compare different loan offers, plan for future payments, and ensure that you can comfortably meet your financial obligations.

Whether you are looking to buy a home, purchase a car, or cover personal expenses, integrating an EMI Calculator Online into your financial planning process will help you achieve your financial goals and maintain a stable financial future.

0 notes

Text

Manage Your Finances Effortlessly with Our Loan Calculator

In today’s fast-paced world, managing finances effectively is more important than ever. Whether you’re planning to buy a home, car, or invest in a major purchase, understanding your loan options and repayment schedules is crucial. At Free Calculator Site, we offer a comprehensive Loan Calculator designed to help you calculate your loan payments, interest rates, and repayment schedules effortlessly. This powerful tool empowers you to make informed financial decisions and plan your financial future with confidence.

Why Use a Loan Calculator?

A Loan Calculator is an essential tool for anyone considering taking out a loan. Here’s why you should use our Loan Calculator: Loan Calculator

Accurate Calculations: Get precise calculations of your monthly payments, total interest paid, and overall cost of the loan.

Easy to Use: Our user-friendly interface makes it simple to input your loan amount, interest rate, and loan term to get instant results.

Time-Saving: Quickly determine the affordability of a loan without complex manual calculations.

Informed Decisions: Understand the impact of different interest rates and loan terms on your finances to choose the best loan option.

Financial Planning: Plan your budget and manage your finances effectively by knowing exactly what to expect in terms of loan repayments.

Features of Our Loan Calculator

Our Loan Calculator is packed with features designed to provide you with the most accurate and useful information:

1. Monthly Payment Calculation

Enter your loan amount, interest rate, and loan term to calculate your monthly payments. This helps you determine how much you will need to pay each month and ensures that the loan fits within your budget.

2. Total Interest Paid

Our calculator also computes the total interest paid over the life of the loan. This feature helps you understand the true cost of the loan and can be a deciding factor when comparing different loan options.

3. Repayment Schedule

View a detailed repayment schedule that breaks down each payment into principal and interest components. This allows you to see how your loan balance decreases over time and helps you track your progress.

4. Amortization Table

The Loan Calculator generates an amortization table, providing a month-by-month breakdown of your loan payments. This table is especially useful for long-term financial planning and for understanding how different loan terms affect your repayment strategy.

How to Use Our Loan Calculator

Using our Loan Calculator is simple and straightforward. Follow these easy steps to get started:

Visit Our Website: Go to Free Calculator Site and navigate to the Loan Calculator page.

Enter Loan Details: Input the loan amount, annual interest rate, and loan term in months or years.

Calculate: Click the “Calculate” button to instantly see your monthly payment, total interest paid, and detailed repayment schedule.

Review Results: Analyze the results to understand your loan repayment plan and make any necessary adjustments to fit your financial goals.

Benefits of Using a Loan Calculator

Utilizing our Loan Calculator offers numerous benefits that can greatly enhance your financial planning and decision-making:

Budgeting: Helps you create a realistic budget by factoring in monthly loan payments.

Comparison: Allows you to compare different loan options to find the one that best suits your needs.

Planning: Assists in long-term financial planning by providing a clear picture of your repayment schedule.

Confidence: Empowers you to make informed decisions with confidence, knowing you have accurate and detailed information.

Start Planning Your Financial Future Today

At Free Calculator Site, we are committed to helping you manage your finances effectively. Our Loan Calculator is a valuable tool that simplifies the process of calculating loan payments and planning your financial future. Whether you’re considering a mortgage, car loan, or personal loan, our calculator provides the insights you need to make smart financial decisions.

Visit Free Calculator Site today and take the first step towards a secure and well-planned financial future. With our Loan Calculator, managing your finances has never been easier!

Loan Calculator

0 notes

Text

What Are the Risks of Using a Small Business Loan?

Beginning a tiny company feels exciting and full of chances to succeed. But often, there's a difference between hopes and money. Small business loans can fill this gap, giving cash needed to make hopes real. However, these loans, though vital, have risks. Let's look at the dangers of using a small business loan so you know what you're doing.

Risks Associated with Small Business Loans

Taking a small business loan is more than getting money. You're accepting debt and must repay it. You'll deal with interest rates and fees. You might give assets as collateral. It could impact your credit. If plans fail, you must meet sales goals or underestimate costs. This avoids trouble with your lender and keeps your business running.

Understanding Debt Burden and Repayment Obligations

The path of loan repayment is paved with decisions:

Fixed vs. variable interest rates

Understanding amortization schedules

The consequences of missing a payment

Each choice can significantly affect how manageable your loan is down the line. Fixed rates offer predictability, but variable rates might provide savings if market rates dip. And those repayment terms? They dictate how long you'll repay the loan and how hefty each payment is. Miss a payment, and you're not just facing a slap on the wrist; you could be looking at penalties, increased interest rates, or worse.

Interest Rates and Fees

Interest rates hide from view, lurking like silent predators on loans. They will strike when least expected, biting harder than anticipated. The annual percentage rate, or APR, reveals the true cost-interest plus fees combined. Fees can ambush unsuspecting borrowers: origination and closing costs sneak up unexpectedly; prepayment penalties punish those racing to pay off debt early. It's a treacherous jungle of fees inflating total debt far beyond the initial loan amount.

Collateral Requirements

Ever heard the phrase "to get a loan, you need to prove you don't need one"? That's where collateral comes into play. Lenders might ask for a personal guarantee, meaning your assets are on the line if your business can't repay the loan. They might also require specific assets as collateral, like your real estate or equipment, or even place a blanket lien on your business assets. It's a high-stakes game of poker, and you're betting your assets that your business will succeed.

Potential Impact on Personal Credit

Starting a small company needs money. You may get a loan. But be careful! Lenders check your personal credit score. If you miss payments, your score drops. This shows you must keep business and personal money apart. Any business issues should not hurt your credit record.

Failure to Meet Expectations or Projections

Optimism powers entrepreneurs yet it risks derailing your plans. Overestimating revenue, underestimating expenses? Classic pitfalls. Cash flow management isn't just a strategy; it's a daily necessity. Keeping operations running might hinge on managing funds wisely, especially when borrowed.

Streamline Your Business Finances With Jaz

Small business loans can be vital for turning entrepreneurial dreams into reality, but they come with inherent risks. These risks include debt burden and repayment obligations, navigating interest rates and fees, collateral requirements that put assets at stake, potential impacts on personal credit, and the challenge of meeting financial expectations. Understanding these risks is crucial for entrepreneurs considering utilizing small business loans to ensure they can manage their financial responsibilities effectively and sustain their business growth.

Jaz is an all-in-one accounting solution built to simplify and automate your most complex accounting tasks, such as invoices, bills, bank reconciliations, payments, and more, so you can get back to growing your business or serving more clients.

Get Started for free and take control of your financial operations with Jaz.

#accounting software#accounting#finance#fintech#small business accounting services#small business owner

0 notes

Text

How to Use a Personal Loan Calculator?

A personal loan calculator is a powerful financial tool that helps individuals make informed decisions when considering borrowing money. Whether you’re planning to fund a major purchase or cover unexpected expenses, a personal loan calculator can provide valuable insights about the potential costs associated with the loan. Let’s explore how a personal loan calculator is effective in assisting borrowers in managing their finances wisely.

Table of Contents

1. Loan Amount Determination:

2. Interest Rate Evaluation:

3. Loan Term Analysis:

4. Monthly Payment Planning:

5. Budget Alignment:

6. Cost Comparison:

7. Financial Planning and Goal Setting:

Conclusion

1. Loan Amount Determination:

One of the primary functions of a personal loan calculator is to help borrowers determine the optimal loan amount. By entering the desired loan amount into the calculator, individuals can assess their borrowing needs and ensure that they are not taking on more debt than necessary. This aspect is crucial in maintaining financial responsibility and preventing overborrowing.

2. Interest Rate Evaluation:

It can allow users to input the anticipated or offered interest rate for the loan. This information is vital for understanding the total cost of borrowing over the loan term. By manipulating the interest rate variable, borrowers can see how it affects monthly payments and the overall repayment amount. This enables them to compare different loan offers and choose the one that aligns with their financial goals.

3. Loan Term Analysis:

The loan term, or the duration over which the loan is repaid, is a critical factor in determining monthly payments and overall interest costs. A personal loan calculator enables users to experiment with various loan terms, such as 12 months, 24 months, or longer. This flexibility empowers borrowers to find a repayment period that fits their budget and financial circumstances. Shorter terms typically result in higher payments monthly but lower overall interest costs, while longer terms may offer low monthly payments but result in higher overall interest expenses.

4. Monthly Payment Planning:

The calculator can generate detailed amortization schedules, breaking down monthly payments into principal and interest components. This transparency allows borrowers to see how much of each payment goes toward paying back the principal amount borrowed and how much is attributed to interest. This insight aids in budgeting and financial planning, helping individuals manage their cash flow more effectively.

5. Budget Alignment:

Understanding the monthly payments associated with a personal loan is crucial for ensuring that the repayment plan aligns with the borrower’s budget. The calculator assists individuals in evaluating whether the proposed monthly payments are manageable within their existing financial framework. This proactive approach can prevent financial strain and ensure that borrowers are well-prepared to meet their repayment obligations.

6. Cost Comparison:

A personal loan calculator facilitates easy comparison of different loan offers from various lenders. By inputting the terms, interest rates, and loan amounts from different sources, borrowers can evaluate and contrast the total cost of each option. This empowers individuals to make informed decisions, selecting the loan that not only meets their financial needs but also offers the most favorable terms and conditions.

7. Financial Planning and Goal Setting:

Beyond individual loan scenarios, personal loan calculators can play an important role in long-term financial planning. Users can model different borrowing scenarios, assess the impact of interest rate changes, and plan for early repayment. This forward-looking approach helps individuals set financial goals, track progress, and make strategic decisions to achieve financial stability.

Conclusion

A personal loan calculator is an effective and versatile tool for individuals navigating the borrowing landscape. By providing insights into loan amounts, interest rates, loan terms, monthly payments, and overall costs, this tool empowers borrowers to make informed financial decisions, align their borrowing with budgetary constraints, and work towards their financial goals. As with any financial tool, it is essential for users to enter accurate information and consider additional factors, such as fees and prepayment options, to make the most of the personal loan calculator’s capabilities.

0 notes

Text

Earnings Before Interest & Taxes (EBIT): Everything You Need to Know

Understanding your finances, whether for personal or business purposes, can often feel like navigating a maze. One essential concept that simplifies this puzzle is Earnings Before Interest & Taxes (EBIT). In this article, we’ll explore what EBIT is, why it’s important, and how it affects businesses and investors alike.

What Is EBIT?

Have you ever wondered how companies determine their profitability before they account for loans or taxes? That’s where Earnings Before Interest & Taxes (EBIT) steps in. Think of EBIT as a clean slate—it helps us understand a company’s core profitability without getting tangled in the web of financial obligations. But why is this important? Let’s dive in.

What Is EBIT and Why Does It Matter?

Earnings Before Interest & Taxes (EBIT) is a measure of a company’s profitability that excludes interest and tax expenses. Imagine peeling back the layers of a financial onion. EBIT reveals the company’s core earnings power, helping us see how well it generates profit purely from its operations.

Why is EBIT important? It’s like the GPS for investors and analysts. It shows whether the business is financially healthy and efficient, regardless of external factors like taxes or debt.

How to Calculate EBIT

Calculating EBIT is simpler than you think. Here’s the formula:

EBIT = Revenue - Operating Expenses

Operating expenses include costs like rent, salaries, and utility bills but exclude interest and taxes. Let’s put this into perspective with a quick example:

Revenue: $500,000

Operating Expenses: $300,000

EBIT = $500,000 - $300,000 = $200,000

This $200,000 represents the earnings generated purely from business operations.

EBIT vs Net Income

Many people confuse EBIT with net income, but they’re not the same. Think of EBIT as a cake before the frosting, while net income is the final product with all layers (interest, taxes, and deductions) included.

EBIT focuses only on operational efficiency.

Net Income reflects the company’s overall profitability, including taxes and interest.

EBIT vs EBITDA

Here’s another common question: How does EBIT differ from EBITDA? EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. While EBIT considers operational earnings, EBITDA goes a step further by excluding non-cash expenses like depreciation.

In simple terms, EBIT shows profitability from core operations, while EBITDA paints a broader picture by ignoring non-cash costs.

The Role of EBIT in Decision Making

EBIT acts as a guiding star in financial decision-making. For example:

Investors use EBIT to compare companies in the same industry.

Managers analyze EBIT to identify cost-cutting opportunities.

Creditors evaluate EBIT to assess a company’s ability to repay loans.

Benefits of Understanding EBIT

Why should you care about EBIT? Here are some compelling reasons:

Clarity in Profits: EBIT highlights operational efficiency without distractions.

Ease of Comparison: It’s a universal metric for comparing businesses.

Better Planning: EBIT helps in strategic decisions like pricing and investments.

Limitations of EBIT

No financial metric is perfect, and EBIT is no exception. Here are its limitations:

Ignores Debt Costs: EBIT doesn’t reflect the impact of interest payments.

Overlooks Tax Efficiency: It misses potential tax advantages.

Not Always Comparable: Different accounting practices can skew EBIT calculations.

EBIT in Financial Analysis

Financial analysts love EBIT because it’s straightforward and insightful. Here’s how they use it:

Profitability Assessment: EBIT indicates how well a company is utilizing its resources.

Industry Benchmarking: Analysts compare EBIT margins across competitors.

Trend Analysis: Tracking EBIT over time reveals growth patterns.

Real-Life Example of EBIT

Let’s consider a fictional company, "GreenTech Inc.":

Revenue: $1,000,000

Operating Expenses: $600,000

EBIT = $1,000,000 - $600,000 = $400,000

This $400,000 tells investors and managers that GreenTech’s core operations are profitable before accounting for loans or taxes.

How Investors Use EBIT

Investors rely on EBIT for several reasons:

Valuation: EBIT helps calculate metrics like the P/E ratio.

Risk Assessment: A steady EBIT indicates financial stability.

Investment Decisions: High EBIT often signals a good investment opportunity.

EBIT and Business Planning

Business owners can use EBIT to:

Set Pricing Strategies: Ensure profitability by covering operating costs.

Control Costs: Identify and reduce unnecessary expenses.

Forecast Earnings: Predict future profitability trends.

Common Misconceptions About EBIT

Let’s clear up some myths:

“EBIT Is the Same as Profit.” Not exactly—EBIT excludes interest and taxes.

“EBIT Shows the Full Picture.” It doesn’t account for all financial obligations.

“Every Business Uses EBIT.” While common, some prefer EBITDA or other metrics.

Tips for Using EBIT Effectively

Want to make the most of EBIT? Here are some tips:

Compare Within Industries: EBIT varies across sectors; stick to similar companies.

Monitor Trends: Look for consistent EBIT growth over time.

Combine Metrics: Use EBIT alongside other indicators for a holistic view.

Conclusion

In a world of complex financial metrics, Earnings Before Interest & Taxes (EBIT) stands out as a reliable measure of profitability. By focusing on core operations, it gives businesses and investors a clearer picture of financial health. Whether you’re an investor, a business owner, or just curious, understanding EBIT is a step toward smarter financial decisions.

FAQs

1. What is the main purpose of EBIT?

EBIT helps evaluate a company’s profitability from its core operations, excluding interest and taxes.

2. How is EBIT different from EBITDA?

EBIT excludes interest and taxes, while EBITDA also excludes non-cash expenses like depreciation and amortization.

3. Can EBIT be negative?

Yes, a negative EBIT indicates that a company’s operating expenses exceed its revenue.

4. Why do investors use EBIT?

Investors use EBIT to assess profitability, compare companies, and evaluate financial stability.

5. Is EBIT useful for small businesses?

Absolutely! EBIT helps small business owners analyze their operational efficiency and plan for growth.

0 notes

Text

Understanding the 30-Year Home Loan: A Comprehensive Guide to Long-Term Financing

What is a 30-Year Home Loan?

The 30-year home loan, a type of fixed-rate mortgage, provides borrowers with a repayment period spanning 30 years. It offers a stable interest rate and consistent monthly payments throughout the loan term.

Advantages of a 30-Year Home Loan:

Lower Monthly Payments:

The extended loan term results in lower monthly payments compared to shorter loan options, making it more affordable for borrowers.

Predictable Payments:

With a fixed interest rate, borrowers enjoy predictability in monthly payments, allowing for better budgeting and financial planning.

Easier Qualification:

Longer loan terms often make it easier for borrowers to qualify, as the monthly payments are lower, improving debt-to-income ratios.

Considerations for Borrowers:

Total Interest Paid:

While the lower monthly payments are advantageous, the longer loan term leads to paying more interest over the life of the loan compared to shorter-term mortgages.

Equity Buildup:

The slower equity buildup in the initial years might delay home equity growth compared to shorter loan terms.

Higher Total Cost:

Due to the extended loan period, the total cost of borrowing can be higher, considering the additional interest paid over 30 years.

Factors Affecting 30-Year Loan Rates:

Economic Conditions:

Fluctuations in economic indicators, like inflation rates and bond yields, influence mortgage rates.

Credit Score:

A higher credit score often leads to better interest rates for borrowers seeking 30-year home loans.

Down Payment:

Larger down payments might help secure more favorable rates, reducing the lender's risk.

Is a 30-Year Loan Right for You?

Financial Goals:

Assess your financial goals and long-term plans to determine if a 30-year home loan aligns with your objectives.

Affordability:

Evaluate your budget and financial stability to ensure comfortable monthly payments for the extended loan term.

Homeownership Duration:

Consider how long you plan to stay in the property; a 30-year loan might be suitable for those planning long-term residency.

Understanding Amortization:

30-year loans follow an amortization schedule, meaning a higher portion of initial payments goes towards interest, gradually shifting towards paying more principal over time.

Comparing Loan Types:

Compare various loan options, such as 15-year or adjustable-rate mortgages, to understand their differences in terms of interest rates, monthly payments, and total interest costs.

Seeking Expert Advice:

Consulting mortgage professionals and financial advisors is essential. They can provide personalized guidance, help explore financing options, and assist in making informed decisions.

0 notes

Text

Term Loan Definition, Types, and Common Attributes

What Is a Term Loan?

A term loan is a loan provided by a financial institution, such as a bank or credit union, with a fixed repayment schedule and a set maturity date. Unlike a revolving credit facility (like a credit card) where you can borrow, repay, and borrow again, a term loan is paid off over a specified period, typically ranging from one to 30 years.

Here are the key features of a term loan:

Fixed Amount: When you take out a term loan, you receive a lump sum amount upfront. This amount is determined based on your creditworthiness, financial situation, and the purpose of the loan.

Fixed or Variable Interest Rate: The loan can have either a fixed interest rate, which remains constant throughout the loan term, or a variable interest rate, which can change based on market conditions. Fixed rates provide predictability, while variable rates can lead to fluctuating payments.

Repayment Schedule: You are required to make regular, usually monthly, payments over the term of the loan. Each payment includes both principal (the amount borrowed) and interest (the cost of borrowing the money).

Purpose: Term loans can be used for various purposes, such as funding business expansions, purchasing equipment, real estate, or financing other significant investments.

Collateral: Term loans can be secured or unsecured. Secured loans require collateral, such as property or assets, which the lender can claim if you fail to repay the loan. Unsecured loans do not require collateral but often come with higher interest rates due to the increased risk for the lender.

Maturity Date: Every term loan has a specific maturity date, which is the date by which the loan must be repaid in full.

Term loans are common in both personal and business finance. In personal finance, people might take out term loans for buying a house or a car. In business, term loans are often used for capital expenditures, expansion projects, or other large investments that can't be funded through day-to-day operations.

Understanding Term Loans

Understanding term loans involves grasping the fundamental concepts and aspects associated with this financial product. Here’s a detailed breakdown:

**1. Purpose of Term Loans:

Business Investments: Term loans are often used by businesses to fund expansions, buy equipment, hire staff, or boost working capital.

Personal Needs: Individuals might use term loans for purchasing homes, cars, or financing education.

2. Key Components:

Principal Amount: The total amount borrowed.

Interest Rate: The cost of borrowing, can be fixed or variable.

Repayment Term: The duration over which the loan must be repaid.

Repayment Schedule: Specifies how often payments are made (monthly, quarterly, etc.).

Collateral: Assets pledged to secure the loan (in the case of secured loans).

3. Types of Term Loans:

Short-term Loans: Repaid within a year.

Intermediate-term Loans: Repaid within 1-3 years.

Long-term Loans: Repaid over more than 3 years, even up to 30 years in some cases.

4. Secured vs. Unsecured Term Loans:

Secured Loans: Backed by collateral, like property or equipment, which the lender can seize if the borrower defaults.

Unsecured Loans: No collateral required, but interest rates are often higher due to the increased risk for the lender.

5. Application Process:

Credit Assessment: Lenders evaluate the borrower’s creditworthiness and financial stability.

Documentation: Requires providing financial records, business plans, and details about the intended use of the loan.

Approval and Disbursement: Once approved, the funds are disbursed to the borrower.

6. Repayment and Interest:

Amortization: Payments typically include both principal and interest. In the initial period, a larger portion goes towards interest, while later payments primarily reduce the principal balance.

Interest Calculation: Depending on the loan type, interest can be simple or compound, affecting the total amount repaid.

7. Impact of Term Loans:

Credit Score: Proper repayment can positively impact credit scores, enabling easier access to credit in the future.

Financial Planning: Borrowers and businesses need to plan their budgets to accommodate monthly loan payments.

Business Growth: For businesses, term loans can facilitate expansion, increased production, and hiring, leading to potential growth and profitability.

Understanding these elements is essential for individuals and businesses considering term loans. It enables informed decision-making and ensures borrowers can manage their loans effectively, promoting financial stability and growth.

Types of Term Loans

Term loans come in various forms to cater to different needs and circumstances. Here are some common types of term loans:

1. Short-Term Loans:

Duration: Usually repaid within a year, often within a few months.

Purpose: Used for immediate needs like working capital, inventory purchases, or covering unexpected expenses.

Interest Rates: Generally have higher interest rates due to the short repayment period.

2. Intermediate-Term Loans:

Duration: Repaid over 1 to 3 years.

Purpose: Suited for businesses investing in equipment, technology upgrades, or moderate expansions.

Collateral: May require collateral, depending on the lender and the amount borrowed.

Interest Rates: Typically lower than short-term loans due to the slightly longer repayment period.

3. Long-Term Loans:

Duration: Repaid over 3 years or more, sometimes extending up to 30 years.

Purpose: Common for substantial investments like real estate purchases, large-scale expansions, or business acquisitions.

Collateral: Usually requires significant collateral due to the high loan amounts involved.

Interest Rates: Can have fixed or variable rates. Fixed rates offer stability, while variable rates may change based on market conditions.

4. Equipment Loans:

Specific Purpose: Dedicated to purchasing machinery, vehicles, or other types of equipment.

Terms: Repayment schedules are often tailored to the expected lifespan of the equipment being financed.

Collateral: The equipment being purchased serves as collateral, reducing the need for additional security.

5. Real Estate Loans:

Purpose: Used for purchasing, refinancing, or renovating real estate properties (commercial or residential).

Terms: Repayment periods can be long, ranging from 5 to 30 years.

Collateral: The property being financed serves as collateral, and loan-to-value ratios are crucial considerations for lenders.

6. SBA Loans (U.S. Small Business Administration Loans):

Purpose: Offered to small businesses and entrepreneurs, often for starting a new business, expansion, or working capital.

Terms: Various SBA loan programs exist, each with specific terms and conditions, but they generally offer longer repayment periods and lower down payments.

Guarantee: Partially guaranteed by the U.S. Small Business Administration, reducing the risk for lenders and making it easier for businesses to qualify.

7. Balloon Loans:

Structure: These loans have regular monthly payments for a specific term (often 5 to 7 years), after which the remaining balance is due in one large payment (the "balloon" payment).

Purpose: Suitable for businesses or individuals expecting substantial cash flow at a specific point in the future, enabling them to make the balloon payment.

Understanding these different types of term loans is essential for borrowers, as each type serves specific needs and comes with distinct terms and conditions. Choosing the right type of loan depends on the purpose of the loan, the borrower's financial situation, and their ability to meet the repayment obligations.

Example of a Term Loan

Let's consider an example of a term loan for a small business:

Scenario:

Business: XYZ Electronics, a small electronics retail store, wants to expand its operations by opening a new branch in a different part of the city. To finance this expansion, XYZ Electronics decides to take out a term loan from a local bank.

Loan Details:

Loan Amount: $200,000

Loan Type: Long-term term loan with a fixed interest rate

Interest Rate: 6% per annum

Repayment Period: 10 years (120 months)

Repayment Schedule: Monthly payments

Loan Terms:

XYZ Electronics is approved for a $200,000 term loan with a fixed interest rate of 6% per annum.

The loan has a repayment period of 10 years, which means they will make monthly payments for 120 months.

The monthly payment amount, calculated using an amortization formula, would be approximately $2,211.59.

Use of Funds:

XYZ Electronics uses the $200,000 to secure a new retail space, renovate the store, purchase inventory, and cover initial operating expenses for the new branch.

Repayment Schedule:

XYZ Electronics makes monthly payments of $2,211.59 for the next 10 years to repay the loan.

Each payment covers a portion of the principal amount (the $200,000 borrowed) and the interest accrued for that month.

Impact:

The loan allows XYZ Electronics to expand its business, attract more customers, and generate additional revenue from the new branch.

By making regular monthly payments, XYZ Electronics steadily reduces the loan balance, building a positive credit history and potentially qualifying for better financial opportunities in the future.

This example illustrates how a term loan works in a real-world scenario, helping a business fund its expansion plans with a structured repayment schedule over a fixed period.

Why Do Businesses Get Term Loans?

Businesses obtain term loans for various strategic and operational reasons, each geared toward achieving specific goals. Here are some common reasons why businesses opt for term loans:

1. Expansion and Growth:

Opening New Locations: Businesses use term loans to finance the opening of new branches or outlets, enabling them to reach a broader customer base.

Market Diversification: Funds from term loans can be used to diversify products or services, tapping into new markets or customer segments.

Mergers and Acquisitions: Loans facilitate the acquisition of other businesses, allowing for strategic mergers or buyouts.

2. Capital Expenditure:

Purchasing Equipment: Businesses often require specialized equipment or machinery. Term loans cover these substantial upfront costs.

Technology Upgrades: Staying competitive often means investing in the latest technology. Loans help finance software, hardware, or infrastructure upgrades.

3. Working Capital:

Inventory Financing: Retailers and manufacturers use term loans to buy inventory in bulk, taking advantage of discounts and economies of scale.

Seasonal Cash Flow: Businesses with seasonal sales cycles use term loans to manage cash flow during off-peak periods.

4. Business Improvement:

Renovations and Remodeling: Loans support businesses in renovating existing facilities, improving customer experience and attracting more patrons.

Staffing and Training: Funds can be allocated for hiring and training employees, ensuring the business has a skilled and capable workforce.

5. Debt Refinancing:

Consolidation: Businesses might consolidate multiple high-interest loans or debts into a single, more manageable term loan with a lower interest rate.

Extension of Repayment Period: Extending the loan term can reduce monthly payments, easing financial strain.

6. Emergency Funds:

Unforeseen Circumstances: Term loans provide a financial safety net for unexpected events like natural disasters, economic downturns, or sudden increases in operational costs.

7. Building Credit History:

Establishing Creditworthiness: Responsible repayment of a term loan can enhance the business's credit profile, improving access to more favorable financing terms in the future.

8. Opportunity Seizing:

Limited-Time Opportunities: Businesses might require quick funding to seize advantageous opportunities, such as bulk inventory purchases at discounted rates or strategic investments in emerging markets.

Term loans offer structured financing solutions, allowing businesses to achieve their objectives without compromising their day-to-day operations. By providing a predictable repayment schedule and access to substantial capital, term loans are a popular choice for businesses aiming for sustainable growth and stability.

What Are the Types of Term Loans?

Certainly! Term loans come in various types, tailored to different business needs and circumstances. Here's an overview of the types of term loans commonly available:

1. Traditional Term Loans:

Long-Term: Repaid over several years, usually ranging from 3 to 30 years.

Purpose: General-purpose loans for business expansion, equipment purchase, real estate acquisition, or refinancing existing debt.

Collateral: Can be secured or unsecured, depending on the lender and borrower's creditworthiness.

2. Intermediate-Term Loans:

Duration: Typically repaid over 1 to 3 years.

Purpose: Suitable for businesses needing funds for equipment, technology upgrades, or moderate expansions.

Collateral: May require collateral, often the asset being financed.

3. Short-Term Loans:

Duration: Usually repaid within a year, sometimes in a few months.

Purpose: Addresses immediate working capital needs, inventory purchases, or handling unexpected expenses.

Interest Rates: Higher due to the shorter repayment period.

4. Equipment Loans:

Specific Purpose: Used exclusively for purchasing equipment, machinery, or vehicles.

Terms: Repayment periods structured according to the equipment's expected lifespan.

Collateral: The equipment being financed serves as collateral, minimizing additional security requirements.

5. Real Estate Loans:

Purpose: Designed for real estate purchases, refinancing, or property development.

Duration: Repayment periods can be lengthy, ranging from 5 to 30 years.

Collateral: The property being financed serves as collateral.

6. SBA Loans (U.S. Small Business Administration Loans):

Purpose: Offered to small businesses, often for starting a new business, expansion, or working capital.

Terms: Various SBA loan programs exist, each with specific terms and conditions, including 7(a) loans, CDC/504 loans, and microloans.

7. Balloon Loans:

Structure: Monthly payments for a specific term (e.g., 5 or 7 years), with a large final payment (balloon payment) due at the end.

Purpose: Useful for businesses expecting increased cash flow in the future to cover the balloon payment.

8. Business Acquisition Loans:

Purpose: Financing the acquisition of another business.

Terms: Structured based on the purchase price and the financial health of the acquired company.

Collateral: The acquired business and its assets often serve as collateral.

Each type of term loan has its specific advantages and is suitable for different business needs. When choosing a term loan, businesses consider factors such as the purpose of the loan, repayment ability, interest rates, and collateral requirements to make an informed decision.

What Are the Common Attributes of Term Loans?

Term loans share several common attributes that define their structure and terms. Here are the key elements associated with term loans:

1. Principal Amount:

Definition: The initial amount of money borrowed by the borrower.

Importance: Determines the total amount to be repaid, including interest.

2. Interest Rate:

Definition: The percentage of the loan amount charged by the lender as interest.

Types: Fixed interest rates (remain constant) or variable interest rates (fluctuate based on market conditions).

Impact: Affects the total cost of the loan; higher rates mean higher overall repayment amounts.

3. Repayment Schedule:

Definition: Specifies how often and when the borrower must make payments (e.g., monthly, quarterly, annually).

Structure: Monthly payments are common, but the schedule can vary based on the agreement between the lender and borrower.

4. Loan Term:

Definition: The duration of the loan, indicating how long the borrower has to repay the loan in full.

Types: Short-term (up to 1 year), intermediate-term (1 to 3 years), and long-term (more than 3 years, potentially up to 30 years).

Impact: Longer terms often result in lower monthly payments but higher overall interest payments.

5. Collateral:

Definition: Assets pledged by the borrower to secure the loan, providing the lender with a source of repayment if the borrower defaults.

Types: Secured loans require collateral; unsecured loans do not but typically have higher interest rates.

Examples: Real estate, equipment, inventory, or accounts receivable can serve as collateral.

6. Amortization:

Definition: The process of gradually paying off the loan through regular payments that cover both principal and interest.

Impact: In the early stages, a larger portion of the payment goes toward interest, while later payments primarily reduce the principal balance.

7. Fees and Charges:

Definition: Additional costs associated with the loan, such as origination fees, application fees, or prepayment penalties.

Importance: These fees impact the overall cost of borrowing and should be considered when evaluating the loan offer.

8. Covenants:

Definition: Financial or operational requirements that the borrower must adhere to during the term of the loan.

Purpose: Protects the lender's interests and ensures the borrower maintains a healthy financial position.

Examples: Debt-to-equity ratio, minimum cash flow, or restrictions on additional borrowing.

Understanding these common attributes is essential for borrowers, as they influence the total cost of the loan and the borrower's financial obligations. Evaluating these factors helps businesses and individuals make informed decisions when selecting and managing term loans.

Read more: https://computertricks.net/term-loan-definition-types-and-common-attributes/

0 notes

Text

What is a Loan Term? - Guide to Loan Terms

what is loan term policy In today's financial landscape, loans are a common way for individuals and businesses to access funds. But understanding the intricacies of loans, including the loan term, is crucial before you dive into the borrowing process. In this comprehensive guide, we'll break down everything you need to know about loan terms, from the basics to the fine details.

1. Introduction

Welcome to our comprehensive guide on loan terms! If you've ever wondered what loan terms are, how they work, and how to choose the right ones, you're in the right place. Whether you're considering a personal loan, a mortgage, or a business loan, understanding loan terms is essential for making informed financial decisions. In this article, we'll dive deep into loan terms, exploring their significance, various types, factors influencing them, and how to negotiate and select the most suitable terms for your needs.

2. Understanding Loan Terms

2.1 What Are Loan Terms? Loan terms refer to the specific conditions and parameters set by lenders when borrowing money. These terms dictate the interest rate, duration, repayment schedule, and other crucial aspects of the loan. Essentially, they outline the rules of the borrowing agreement between the lender and borrower. 2.2 Importance of Loan Terms Understanding loan terms is vital because they directly impact your financial commitments. Properly structured loan terms can save you money and make loan repayment manageable. On the other hand, unfavorable terms can lead to financial stress and even default. 2.3 Common Loan Terminology Before we delve further, let's familiarize ourselves with some common loan terminology: - Principal: The initial amount borrowed. - Interest Rate: The cost of borrowing money, expressed as a percentage. - Loan Duration: The period over which you'll repay the loan. - Amortization: The process of gradually paying off both principal and interest. - Collateral: An asset used to secure a loan.

3. Types of Loan Terms

There are different loan term options available, each catering to specific financial needs and goals. 3.1 Short-Term Loans Short-term loans typically have a duration of less than one year. They are ideal for covering immediate expenses or seizing short-lived opportunities. Examples include payday loans and bridge loans. 3.2 Medium-Term Loans Medium-term loans have durations ranging from one to five years. They are often used for business expansion, equipment purchases, or debt consolidation. 3.3 Long-Term Loans Long-term loans extend beyond five years and are common in mortgages and business loans. They provide lower monthly payments but result in higher overall interest costs.

4. Factors Influencing Loan Terms

Several factors come into play when lenders determine the terms of a loan. 4.1 Credit Score Your credit score significantly influences the interest rate and loan approval. A higher credit score generally leads to more favorable terms. 4.2 Interest Rates Interest rates are a critical component of loan terms. They can be fixed or variable, affecting the predictability of your payments. 4.3 Loan Amount The amount you borrow can impact the terms. Larger loans may come with more stringent conditions. 4.4 Collateral Secured loans, backed by collateral, often have more flexible terms and lower interest rates.

5. Choosing the Right Loan Terms

Selecting the appropriate loan terms requires careful consideration of your financial situation and goals. 5.1 Assessing Your Financial Situation Evaluate your income, expenses, and financial stability to determine what you can afford. 5.2 Understanding Your Goals Consider whether you want to minimize monthly payments, pay off the loan quickly, or balance both. 5.3 Consulting with Financial Experts Seek advice from financial advisors or loan specialists to make informed decisions.

6. Negotiating Loan Terms

Negotiating loan terms can lead to more favorable conditions. 6.1 Interest Rate Negotiation Explore opportunities to lower the interest rate based on your creditworthiness. 6.2 Loan Duration Negotiation Negotiate the loan duration to align with your repayment capabilities. 6.3 Repayment Options Negotiation Discuss flexible repayment options, such as bi-weekly payments or interest-only periods.

7. Loan Term FAQs

Let's address some common questions about loan terms. 7.1 What Is an Amortization Period? The amortization period is the time it takes to fully repay the loan through regular installments. 7.2 Can Loan Terms Be Modified? In some cases, loan terms can be modified through refinancing or loan modifications. 7.3 How Do I Calculate Loan Payments? You can calculate loan payments using loan calculators or formulas that take into account the principal, interest rate, and loan duration.

8. Conclusion

In this comprehensive guide, we've explored the intricacies of loan terms, from their definition to the factors that influence them. Armed with this knowledge, you can confidently navigate the world of borrowing, making informed choices that align with your financial goals. Remember that loan terms play a significant role in your financial well-being, so take the time to research, analyze, and negotiate for the best terms possible. Whether you're a first-time borrower or a seasoned investor, understanding loan terms is key to financial success. Read the full article

0 notes

Text

Financial Terms You Need to Know Before You Borrow Money Online

While most modern financial institutions do their best to simplify the borrowing process, it can still be a little confusing. Your experience greatly hinges on your existing financial literacy. You need some idea of how online loans work when you first start researching your options. But more importantly, this knowledge needs to follow you to the final negotiations, when you read your loan contract for the last time before you agree to the terms. If you’re like most people, several terms stand out for the wrong reasons—you don’t know what they mean! Don’t sign a financial document and hope they don’t come up. Read this list of definitions first. It will provide a solid foundation of financial literacy as you search for online loans in the future. Principal No, this doesn’t refer to the head teachers who managed your old grade schools. Principal in a financial context refers to the amount you borrow. This is an important number to know, as it determines whether your loan provides enough funds to support your goals. Interest Rate Few lenders will only ever expect you to repay the principal on its own. Most apply interest, which is a percentage of your principal that compounds on a regular schedule, usually daily. Interest rates are considered a normal cost of borrowing. However, they may vary drastically from lender to lender, loan to loan, and borrower to borrower. The higher your interest is, the more your loan will cost at the end of the day. Annual Percentage Rate The annual percentage rate, shortened conveniently to APR, is an important shortcut in calculating the cost of borrowing. That’s because it factors in more than just the interest rate when determining the cost. It also includes other finance charges, such as administrative or origination fees. Truncating all your charges into one percentage makes it easier to compare multiple loans at a time. Amortization This mouthful of a word is related to your term, or the timing of your loan. It refers specifically to the time it will take you to repay your full cost of borrowing. For example, a payday cash advance only gives you until your next payday to do this. The average installment loan, on the other hand, has an amortization period of weeks, months, or even years. If your lender allows you to make additional or early payments, you can use this calculator to see how your extra payments affect what you owe. Secured vs Unsecured You can roughly chop personal loans into two distinct categories: one secured, the other unsecured. Secured financial products are backed by collateral, or a financial asset, that the lender may take as payment if you default. Unsecured financial products don’t require collateral, which means there’s more risk involved for lenders. As a result, you may notice unsecured loans are more expensive than secured alternatives. Grace Period Depending on the type of loan you take out, you might have a grace period. This is a set amount of time following your due date where your lender may accept payments without penalties. While each lender has unique rules, most grace periods last 30 days. After that, your lender may report your late payment to the credit bureaus. These Terms Get You Off to a Good Start While these form a core group of words you should understand inside and out, there may be more terms that cause some confusion. Before you sign your contract, always ask your lender to explain anything you don’t understand. This could help you avoid accepting financing you can’t afford. Read the full article

0 notes

Text

Personal Loan Calculator – Personal Loan Amortization Schedule Calculator – Amortization Personal Loan

Personal loans can be a lifesaver when you need cash for various reasons, like consolidating credit card debts, paying for a wedding or medical expenses, or financing a home improvement project. But before you apply for a personal loan, it's essential to understand how much you can afford to borrow and how much you'll have to pay back in interest and principal. This is where a personal loan calculator can come in handy. In this article, we'll explain what a personal loan calculator is, how to use it, and why it's beneficial.

What is a Personal Loan Calculator?

A personal loan calculator is a financial tool that helps you estimate how much you'll have to repay each month and the total interest you'll pay over the loan's term. With this calculator, you can input the loan amount, the interest rate, and the loan term to get a breakdown of your monthly payments, including the principal and interest.

Personal Loan Amortization Schedule Calculator

A personal loan amortization schedule calculator helps you create a detailed payment schedule for your personal loan. It breaks down each payment into its principal and interest components and shows you how much of your payment goes towards interest and how much goes towards reducing the principal. It also shows you how much interest you'll pay over the life of the loan.

Amortization Personal Loan

Amortization is the process of paying off debt over time. It involves making regular payments that include both principal and interest. In the case of a personal loan, amortization means that each payment you make reduces the loan's principal balance, which means you owe less interest in the future. An amortization schedule is a table that shows the breakdown of each payment, including the amount of interest and principal paid, and the remaining balance.

How to Use a Personal Loan Calculator?

Using a personal loan calculator is simple. You need to enter three key pieces of information: the loan amount, the interest rate, and the loan term. Once you enter these values, the calculator will show you your monthly payment, the total interest paid, and the total cost of the loan.

Let's take an example to understand this better. Suppose you want to borrow $10,000 for a personal loan with a 6% interest rate and a term of three years. Using a personal loan calculator, you can see that your monthly payment would be $304.17, and the total interest paid over the loan's term would be $947.97. The total cost of the loan would be $10,947.97.

Benefits of Using a Personal Loan Calculator

Using a personal loan calculator offers several benefits. Here are a few:

Helps You Plan Your Finances