#Jay Lane

Explore tagged Tumblr posts

Text

youtube

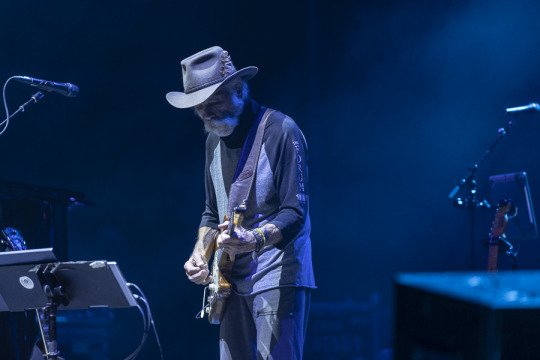

Song Review: Bobby Weir & Wolf Bros feat. Tyler Childers - “Mama Tried” (Live, April 3, 2022)

Bobby Weir & Wolf Bros are authentically outlaw, wrapping Tyler Childers in country immunity as he leads the band through “Mama Tried.”

Recorded professionally April 3, 2022, at Radio City Music Hall and freshly released, this owes more to Merle Haggard’s original studio recording than to the Grateful Dead’s live arrangement. Which is not only the aim with Wolf Bros’ instrumentation of pedal-steel and electric guitar, acoustic piano, double bass and drums, but well-suited for Childers, who dwells in that space.

Weir’s guitar solo could’ve - and should’ve - yielded to Barry Sless’ steel. But expecting Weir to cede that territory after ceding the mic to Childers is folly and this “Mama Tried” is a refreshing Dead-world take on a Grateful warhorse.

Everybody say, “Thank you, Tyler.”

Grade card: Bobby Weir & Wolf Bros feat. Tyler Childers - “Mama Tried” (Live - 4/3/22) - B+

12/6/24

#Youtube#bobby weir & wolf bros#tyler childers#bob weir#grateful dead#don was#was (not was)#jay lane#primus#jeff chimenti#ratdog#barry sless#merle haggard

15 notes

·

View notes

Text

Willie Nelson Brings Outlaw Music Festival to Forest Hills Stadium

Outlaw Music Festival – Forest Hills Stadium – September 17, 2023

You don’t so much attend a Willie Nelson concert these days as you conform to its warmly understated, sometimes leisurely, sometimes-invigorating pace. Then again, he’s always seemed to have that pause-a-sec-and-listen effect: Whether 30 or 90, delivering sad-eyed, tear-in-beer weepers, tender folk, inspiring hymns or outlaw country rousers, he’s got you. Hearing him play, surrounded by his adoring band, still has that time-stopping quality, and Forest Hills Stadium was in thrall to one of American music’s true and unimpeachable legends on a rainy but warm Sunday evening.

The Outlaw Music Festival, a going concern for a while now, is Willie’s eclectic seasonal caravan, loading up a sprawling six-hour bill with a range of artists that don’t sound quite like Nelson but are at the same time just right for a show like this, underscoring his own lineage and place in the history of many potent strains of Americana. As ever, he and his impressive band crowned the show with an hour-long set of their own, setting a brisk but not workmanlike pace through his classics (“Whiskey River,” “Mammas Don’t Let Your Babies Grow Up to Be Cowboys,” “On the Road Again,” “I Gotta Get Drunk,” “Always On My Mind,” “Roll Me Up and Smoke Me When I Die”) and those of friends and favorites, including Billie Joe Shaver’s “I Been to Georgia on a Fast Train,” “Stay a Little Longer” from the Bob Willis catalog, “Move It On Over” from Hank Williams, and the immortal “Georgia on My Mind.” Willie’s sung these songs thousands of times, but each one still felt like a warm embrace, even the wistful ones, and even the ones for which he wouldn’t need to do more than go through the motions but is just too classy for that.

About the bill: There were plenty of willing conspirators and indeed, half the fun of a tour like this is the cross-pollination and spirit of collaboration that happens throughout. No less than Norah Jones — a surprise guest, unannounced — low-key sat in on keyboards for most of the Willie set. (It wasn’t even clear it was her until she took a few backing vocals and then a full verse of “I Gotta Get Drunk.”) Harmonica ace Mickey Raphael — a stalwart of Nelson’s band — joined for sections of earlier sets from Los Lobos, the String Cheese Incident and Bob Weir & Wolf Bros using a range of harmonica modes, from sawing roadhouse blues to sweet-’n’-tender folk. And as ever, Willie made his customary invite to many of the musicians, including a game and all-smiles Weir, to join in for the rootsy, hymnal “Will the Circle Be Unbroken” and several more selections, hootenanny-ing up the stage to close the night.

Weir’s Wolf Bros — one of the most interesting post–Grateful Dead bands and as oddly compelling a capture of Weir’s Weir-ness as any other group he’s been part of — got about 90 minutes to roam as the night’s coheadliner and more than made the most of it. The core trio of Weir, Don Was and Jay Lane has mushroomed on the road into a full ensemble, including Weir’s longtime swingman Jeff Chimenti on keys and ace pedal steel from Barry Sless, plus a sturdy horns-and-strings section called the Wolfpack. That bigness was well used here: “Jack Straw,” “Estimated Prophet” (neatly segued into its forever companion, “Eyes of the World,” which itself neatly segued into Marvin Gaye’s “What’s Going On”), the Sunday-special “Samson & Delilah” and a rollicking “Turn On Your Lovelight” were Grateful Dead staples all getting jammy workouts.

Earlier came a potent set from jam-bluegrass stalwarts the String Cheese Incident, somehow now approaching their own 30th anniversary. And earlier still came the mighty Los Lobos — themselves, whoa, 50 years along! — who played a ripsnorting 45-minute frame full of cumbia and full-boogie rockers, including the beloved “Georgia Slop.” 30 years? 50 years? So much beautiful longevity here, but the bar appears to be 90 years, gang. —Chad Berndtson | @Cberndtson

Photos courtesy of Silvia Saponaro | @Silvia_Saponaro

#Barry Sless#Bill Nershi#Billy Joe Shaver#Bob Weir#Bob Weir & Wolf Bros#Bob Willis#Cesar Rosas#Chad Berndtson#Conrad Lozano#David Hidalgo#Don Was#Forest Hills#Forest Hills Stadium#Grateful Dead#Hank Williams#Jason Hann#Jay Lane#Jeff Chimenti#Keith Moseley#Kyle Hollingsworth#Louie Pérez#Marvin Gaye#Michael Kang#Michael Travis#Mickey Raphael#Norah Jones#Outlaw Music Festival#Photos#Queens#Review

2 notes

·

View notes

Text

A Year Of Songs #56: “Ashes & Glass” by Bob Weir And RatDog

“What if all tomorow brings is ashes and glass

And I can't tell you child, ‘This too shall pass’

If all the world were windswept, cold and gray

And in the end there's nothing left to say”

Wondering in the next breath “If all the silicon and best laid plans became the master and the fall of man,” Bob Weir sketches a bleak future before suggesting we throw our cares to the wind and “swing and sway.”

Partying While Rome Burns songs are part of Weir’s go-to themes right next to Women That Did Him Well/Wrong, and “Ashes And Glass” ranks up there with “Hell In A Bucket.”

Aided on lyrics by Bay Area songwriting ringer Andre Pessis with music co-written with his RatDog bandmates, “Ashes And Glass” has all the markings of a huge fan favorite…if fans after the mid-2000s or today’s streaming listeners had a chance to hear it.

2000’s Evening Moods is one of few Weir related albums not readily available online, on CD or collector edition vinyl. It’s a head scratcher given that Evening Moods and the band that made it constitute Weir’s strongest, most interesting work post-Garcia.

Post-GD Weir hasn’t sung, played, or especially, created new work with the same gusto as late 90s through mid-2000s RatDog. “Ashes And Glass” showcases this combo firing on all cylinders. Mark Karan (guitar, vocals), Jeff Chimenti (keys, vocals), Rob Wasserman (bass) and Jay Lane (drums) move with muscle and dexterity, a bluesier, tighter descendent to late period Grateful Dead - a separate entity but sharing some DNA.

Karan is particularly eloquent here, his guitar sounding nothing like Garcia, instead drawing from Mike Bloomfield and Stephen Stills, offering a rockier counterpart to Weir’s sparking guitar outbursts and angled rhythms. Karan remains my favorite guitar foil for Weir since Garcia because their musical conversation was free of the Jerry seance nearly every other guitarist falls into with Bob. The absence of horn players Dave Ellis and Kenny Brooks on “Ashes And Glass” further lays bare their chemistry.

Only Weir can explain why he ended this ensemble and most of its songbook but that changes nothing about the quality of this album and the performances on it. Just one more mysterious artifact in the post-Garcia wake that’s lead to Dead & Company’s ongoing ghost dance.

“Well ashes to ashes, baby, dust to dust

Baby, it's time for one last rave

Keep on dancin' on our own graves

On our own graves

Keep on dancing”

youtube

#a year of songs#song of the day#ayearofsongs#bob weir#ratdog#grateful dead#evening moods#Ashes and Glass#Mark Karan#Jay lane#Jeff Chimenti#Youtube

0 notes

Text

Vintage Enamel Caterpillar Pin Kenneth Jay Lane KJL

#under 200$#under 100$#caterpillar#bug#insect#bug jewelry#enamel#pin#brooch#kenneth jay lane#kjl#vintage jewelry#fashion#old jewlery#vintage#jewelry#green#blue

795 notes

·

View notes

Text

David Bailey - Jan Ward Wearing a Necklace by Kenneth Jay Lane (Vogue UK 1970)

#david bailey#jan ward#vogue#photography#fashion photography#vintage fashion#vintage style#vintage#retro#aesthetic#beauty#70s#70s fashion#70s style#70s model#1970s#1970s fashion#editorial#vogue uk#kenneth jay lane

627 notes

·

View notes

Text

new post collecting everybody i've done now because the old one is getting too long through reblogs. maybe i'll post these in groups of threes, after all.

[ma, pa and kon]

#dc#dc comics#fanart#bobbinart#lois lane#clark kent#clois#superman#jon kent#superboy#jay nakamura#jayjon#gossamer#otho-ra#osul-ra#super-twins#super twins#supertwins#how do we spell them i don't remember lmao#also YES i'm including the logo once more#it's eyegrabbing

610 notes

·

View notes

Text

some trans jay sillyness

193 notes

·

View notes

Text

the superfam tag is just batfam 2.0 tag. where are the women??? where are the men of colour??? why is it only clark, kon and jon??? and why are they always in the presence of a bat??? WHY???

(i love the boys, don’t get me wrong. clark is literally my second all-time favourite character. but the superfam is more than three white dudes.)

#batfamily stans leave the superfam tag alone#and even though clark kon and jon are there#the posts aren’t even about them#not really#be serious now#supers aren’t there to prop your fav bats!!!#enough of that#anyways here are all the current superfam members if you’re wondering:#kara zor el#clark kent#lois lane#natasha irons#john henry irons#lana lang#jon kent#kon el#kenan kong#otho ra#osul ra#jay nakamura#(pretty sure he is also superfam?)#idc i’m counting him as superfam jon proposed to him in soke#SUPERFAM#anti batfam#anti batfanon

376 notes

·

View notes

Text

Fun fact i suppose:

On the 1988 sucking songs demo, this song was originally called They, more fitting with the lyrics of the song

Later it was renamed to Eleven, likely because of the 11/8 time siganture

Timestamped below, the demo version :-)

youtube

Favorite song ever

2 notes

·

View notes

Text

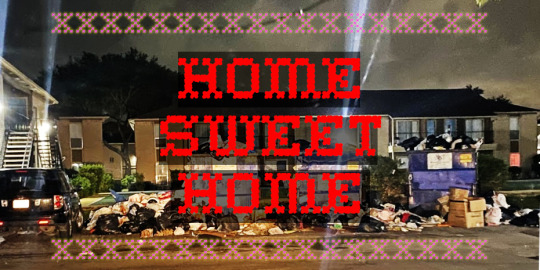

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

number one all-time sad wet cat jay moment imo. look at him.

#lane speaks#ive posted about this exact scene before bc LOOK AT HIM#pathetic#ur poor little meow meows could never#marble hornets#mh#jay merrick#entry 42

312 notes

·

View notes

Text

Dead & Company Mourn Bill Walton; Extend Sphere Residency

- “Bill was an irreplaceable force & spirit in our family,” band says

Though they are “having a ball” playing in the Sphere, Dead & Company are also mourning the man they called the “biggest Dead Head ever.”

That would be Bill Walton, the NBA great & Grateful Dead enthusiast, who died May 27 at 71. He was a fanatic who befriended the band - Mickey Hart called Walton “the best friend I ever had” - & was often seen towering over other concertgoers near the front of the stage.

“Bill was an irreplaceable force & spirit in our family,” Dead & Company said in a statement that referenced his participation with the group on stage.

“Father Time, Rhythm Devil, biggest Dead Head ever. … He loved this band & we loved him. We will miss our beloved friend, Bill Walton, deeply. Rest in peace & may the four winds blow you safely home.”

Dead & Company also extended their Las Vegas residency at the Sphere to 30 dates with six shows - Aug. 1-3 & 8-10 - that include gigs on the anniversaries of Jerry Garcia’s birth (Aug. 1) & death (Aug. 9).

“We’re having a ball at Sphere, so let’s keep it going,” the band said.

Ticketing info here.

5/28/24

#dead & company#bill walton#grateful dead#bob weir#mickey hart#oteil burbridge#jeff chimenti#jay lane#john mayer

4 notes

·

View notes

Text

"Powerless"

by me

#dc comics#superman#jon kent#2024 election#dc characters#lois lane#jay nakamura#clark kent#comic#digital art#fan art#fan comic

55 notes

·

View notes

Text

I forgot that I drew this when SOKE ended lmao

#ultfreakme art#jon kent#superman son of kal el#jay nakamura#superman#jonjay#soke#jonathan kent#supertruth#nia nal#dreamer#robin#lois lane#superboy#dc comics#dc#damian wayne

183 notes

·

View notes

Text

source

#dc comics#batman#catwoman#batcat#superman#lois lane#superman and lois#green arrow#black canary#poison ivy#harley quinn#harlivy#harley x ivy#batgirl#barbara gordon#nightwing#dick grayson#dickbabs#jon kent#Jay Nakamura#midpollo#midnighter#apollo#beat boy#raven#beast boy x raven

177 notes

·

View notes

Text

Irving Penn - Jewelry by Kenneth Jay Lane, 1965, from the book Costume Jewelry in Vogue by Jane Mulvagh (1988)

#irving penn#kenneth jay lane#vogue#photography#fashion photography#vintage fashion#vintage style#vintage#retro#aesthetic#beauty#sixties#60s#60s fashion#1960s#1960s fashion#swinging sixties#editorial#jewelry#jane mulvagh

622 notes

·

View notes