#Insurance Providers

Explore tagged Tumblr posts

Text

NPR: 'I Don’t Want to Die.' He needed mental health care. He found a ghost network

#npr#mental health#insurance providers#health insurance#healthcare#american healthcare#us healthcare

5 notes

·

View notes

Text

Best Homeowners Insurance in US

🏡 Protecting your home is essential, and finding the best homeowners insurance can make all the difference. With comprehensive coverage options, competitive rates, and exceptional customer service, you can ensure your home and belongings are safeguarded against unexpected events. Take the time to compare policies and choose the one that fits your needs best. Your peace of mind is worth it! #HomeownersInsurance #InsuranceCoverage #ProtectYourHome #PeaceOfMind #HomeSafety #InsuranceTips #HomeProtection #FinancialSecurity #SmartInvesting #HomeInsurance

Owning a home is a significant milestone, but it also comes with responsibilities. Among these, securing the best homeowners insurance in the USA is crucial. This article will guide you through everything you need to know to protect your home and gain peace of mind. Understanding Homeowners Insurance What is Homeowners Insurance? Homeowners insurance is a policy that provides financial…

0 notes

Text

How to Choose the Right Insurance Plan

Right Insurance Plan: Insurance is becoming a need rather than a luxury in the modern society. Selecting the appropriate insurance plan can have a big impact on your financial stability and peace of mind, whether you're insuring your life, home, health, or vehicle.

#Auto Insurance#Choosing Insurance#Health Insurance#Home Insurance#Insurance Advice#Insurance Claims#Insurance Coverage#Insurance Deductibles#Insurance Plans#Insurance Premiums#Insurance Providers#InsuranceProviders#Life Insurance

0 notes

Text

So funny how Blue Cross basically went "You guys make a great point" and rolled back their anesthesia policy after the United CEO was killed

Seems like we might have found a form of protest that works

#not art#politics#united ceo#united healthcare#united states#leftism#fuck ceos#kill ceos#kill your insurance provider!!!#deny defend depose

11K notes

·

View notes

Text

How to Choose the Right Travel Insurance for Your Needs

Traveling is an exhilarating experience that opens doors to new cultures, breathtaking landscapes, and unforgettable adventures. However, it also introduces certain risks, whether it's a flight cancellation, lost luggage, or unexpected medical emergencies. To mitigate these risks, travel insurance becomes an essential part of your journey. But with a plethora of options available, how do you choose the right travel insurance for your specific needs?

Understand Your Travel Needs

Before diving into the world of travel insurance, take a moment to assess your travel plans. Consider factors such as the duration of your trip, the destination, the type of activities you’ll be engaging in, and your personal health condition. For example, if you are embarking on an adventurous trip that includes activities like scuba diving or hiking, you may require a policy that covers specific adventure sports. On the other hand, a relaxing beach getaway might call for less comprehensive coverage.

Know the Different Types of Coverage

Travel insurance policies come in various types, each designed to address different aspects of your journey. Here are some common types of coverage you might consider:

Trip Cancellation or Interruption Insurance: This type of coverage protects you in case unforeseen circumstances—like illness or a family emergency—force you to cancel or cut short your trip.

Medical Coverage: Essential for international travel, medical coverage ensures you’re protected in case of an illness or injury abroad. Check the policy limits and exclusions regarding pre-existing conditions.

Baggage Loss or Delay: This coverage provides compensation for lost, stolen, or delayed luggage, which can alleviate stress if your bags don’t arrive on time.

Evacuation Insurance: Particularly relevant for travelers venturing to remote areas, evacuation insurance covers the costs associated with emergency evacuation to a medical facility or back to your home country.

Read the Fine Print

Once you have narrowed down your options, it’s crucial to dig into the details of each policy. Pay attention to coverage limits, deductibles, and exclusions. Some policies may have specific exclusions for certain scenarios, like acts of terrorism or natural disasters. Moreover, confirm whether the policy includes assistance services, such as 24/7 emergency hotlines, which can be invaluable during unexpected situations.

Compare Insurance Providers

With numerous insurance providers available, it's advisable to compare policies, rates, and customer reviews before making a decision. Visiting reputable websites like Travel Insurance Info can provide insights into various plans and help you make informed comparisons. Look for testimonies regarding claims processes as well—how smoothly does the provider handle claims when they arise?

Personalize Your Policy

Don’t hesitate to ask for additional coverage tailored to your needs. Some travelers may require higher medical limits, while others might want to include coverage for high-value items, such as electronics or cameras. Speak with insurance agents to tailor a plan that aligns with your travel goals and personal circumstances.

Conclusion

Choosing the right travel insurance can seem daunting, but by understanding your travel needs, exploring various types of coverage, and thoroughly comparing policy options, you can find a plan that offers peace of mind during your travels. The right insurance can protect not only your finances but also enhance your overall travel experience by allowing you to focus on creating unforgettable memories. With the right preparation and information, you can embark on your adventures with confidence, knowing you’re safeguarded against the unexpected. Safe travels!

1 note

·

View note

Text

Navigating the maze of health insurance options can be daunting, but selecting the right plan is crucial for your health and finances. Whether you’re exploring health insurance in Maryland or weighing medicare options, understanding your needs and the available plans is key.

0 notes

Text

A Comprehensive Insurance Guide: Protecting What Matters Most

Insurance is a financial safety net that provides individuals, families, and businesses with protection and peace of mind. It is a vital tool that helps manage risk, safeguard assets, and ensure financial stability in the face of unexpected events. In this comprehensive insurance guide, we will delve into the world of insurance, exploring its various types, the importance of insurance, and tips for making informed decisions.

Table of Contents

I. The Importance of Insurance A. Risk Management B. Financial Security C. Legal Requirements

II. Types of Insurance A. Life Insurance B. Health Insurance C. Auto Insurance D. Homeowners/Renters Insurance E. Business Insurance

III. Choosing the Right Insurance A. Assessing Your Needs B. Understanding Policy Coverage C. Comparing Insurance Providers D. Premiums and Deductibles

IV. Insurance Claims A. Filing a Claim B. Claim Process C. Tips for Successful Claims

V. Additional Considerations A. Long-term Care Insurance B. Disability Insurance C. Travel Insurance

VI. Conclusion: Securing Your Future

I. The Importance of Insurance

A. Risk Management Insurance is a fundamental tool for managing risk. It protects individuals and businesses from unexpected losses, such as accidents, illnesses, natural disasters, or property damage. By paying a relatively small premium, policyholders can transfer the financial burden of these events to an insurance company.

B. Financial Security Insurance provides financial security, ensuring that policyholders and their families do not face financial ruin in the wake of a catastrophe. For example, life insurance can replace lost income, and health insurance can cover medical expenses, reducing the economic impact of an illness or injury.

C. Legal Requirements In many cases, insurance is legally required. Auto insurance is mandatory in most states to cover potential accidents, and homeowners or renters insurance may be required by landlords. Non-compliance with these legal requirements can result in penalties or even the loss of assets.

II. Types of Insurance

A. Life Insurance Life insurance provides a payout to beneficiaries upon the death of the insured. It is a critical tool for providing financial security to dependents, paying off debts, and covering funeral expenses.

B. Health Insurance Health insurance covers medical expenses, making healthcare more affordable and accessible. It can include doctor's visits, hospital stays, prescription medications, and preventive care.

C. Auto Insurance Auto insurance protects against the financial consequences of accidents, damage to vehicles, and liability for injuries or property damage to others.

D. Homeowners/Renters Insurance Homeowners and renters insurance safeguard your home and personal belongings from various perils, including fire, theft, and natural disasters. These policies can also cover liability for accidents that occur on your property.

E. Business Insurance Businesses need insurance to protect against a wide range of risks, from property damage and liability claims to employee injuries. Various types of business insurance, including general liability, property, and workers' compensation, are available to address specific needs.

III. Choosing the Right Insurance

A. Assessing Your Needs Before purchasing insurance, evaluate your specific needs and financial situation. Consider factors such as your age, health, assets, and potential risks.

B. Understanding Policy Coverage Carefully read and understand the terms and conditions of your insurance policy. Be aware of coverage limits, exclusions, and deductibles to ensure you have the right protection.

C. Comparing Insurance Providers Research and compare insurance providers. Evaluate their financial stability, customer service, and reputation. Online reviews and ratings can provide valuable insights.

D. Premiums and Deductibles Consider your budget and risk tolerance when choosing premiums and deductibles. Higher deductibles can lower premiums but may require you to pay more out-of-pocket in the event of a claim.

IV. Insurance Claims

A. Filing a Claim In the event of an incident covered by your policy, promptly file a claim with your insurance company. Be accurate and thorough in providing documentation and details.

B. Claim Process Understand the claim process, which can vary depending on the type of insurance and the circumstances. Work closely with your insurance company and follow their instructions.

C. Tips for Successful Claims Maintain good records, document damage or injuries, and communicate openly with your insurer. Seek professional assistance if needed, such as a public adjuster for property claims or a lawyer for complex cases.

V. Additional Considerations

A. Long-term Care Insurance Long-term care insurance helps cover the costs of extended healthcare services, such as nursing homes and in-home care, for those who require ongoing assistance with daily living activities.

B. Disability Insurance Disability insurance provides income replacement if you are unable to work due to a disability. It ensures you have financial support during a time when you can't earn your regular income.

C. Travel Insurance Travel insurance covers unexpected events during trips, such as trip cancellations, lost luggage, or medical emergencies while abroad. It can provide peace of mind when traveling.

VI. Securing Your Future

Insurance is an indispensable tool for managing life's uncertainties and securing your financial future. Whether you're protecting your family, your health, your home, or your business, understanding the various types of insurance, making informed decisions, and being prepared to navigate the claims process are essential steps to ensure you're adequately protected. By taking these measures, you can enjoy the peace of mind that comes with knowing you're prepared for whatever life may throw your way.

#insurance policy#car insurance#guide#health insurance#insurance#life insurance#Insurance Providers#Auto Insurance#auto insurance coverage#auto insurance ca#auto insurance coinsurance#auto insurance deductibles#auto insurance policy benefits#finances#renters insurance

1 note

·

View note

Text

It's important to me that folks understand that it is deeply distressing to us as veterinary professionals to have to decline care due to pet owners' financial constraints. We're talking nightmares, panic attacks, break down sobbing in front of the entire ICU distressed.

We hate it, and we do everything we can to make it work for people and their pets. We are stuck in a broken system just like you are. Unfortunately, there is only so much that can be done for free before we stop being able to pay our staff, upkeep our machines, and purchase supplies.

Vets do not "only care about money," and if we did, we would be in a different field. We are not rich. I have 6 figures in debt from vet school and currently make less than I would working full time at McDonald's. Verbally abusing vet staff does not help anyone or anything, least of all your pet.

#I've already gotten into some trouble for providing care without payment#please get pet insurance#an emergency credit card#care credit#a savings account#set up a gofundme if you must (I've done it for my own pet)#do this BEFORE something happens#pets#pet ownership#veterinarian#vet tech#vet med#vetblr

184 notes

·

View notes

Text

#going w/o ur meds thru no fault of ur own is ungood#when it happens every month its double plus ungood#bad healthcare provider bad insurance bad pharmacy#shame on u all

845 notes

·

View notes

Text

"depose," "deny," and "defend" being scratched on the shell casings is likely a play on what's known as the "3 D's of Health Insurance," which are "delay, deny, defend:" all slimy tactics that insurance companies deploy to increase profit margins

#brian thompson#united healthcare#qi.txt#uhc is my insurance provider my premium better not go up next year

111 notes

·

View notes

Text

Best Car Insurance in USA

Best Car Insurance in USA #CarInsurance #AutoInsurance #InsuranceGuide #CarInsuranceUSA #BestCarInsurance #InsuranceProviders #Geico #StateFarm #Progressive #Allstate #USAA #InsuranceCoverage #InsuranceDiscounts #CustomerService #InsuranceRates #SaveOnInsurance #InsuranceTips #CarInsuranceComparison #InsurancePremiums #DrivingHistory #InsurancePolicy #AffordableInsurance #InsuranceForMilitary #InsuranceReviews #InsuranceFeatures #InsuranceClaims #InsuranceOptions #CarInsuranceSavings #InformedChoice

Car insurance is an essential part of owning and driving a vehicle in the United States. With so many options available, choosing the right provider can feel overwhelming. This guide simplifies your decision-making process by detailing the best car insurance companies in the USA, their features, and what makes them stand out. Outline Introduction Importance of car insurance in the USA Factors…

0 notes

Text

Insurance History and Evolution in the USA

Insurance history and Evolution: has become an important part of modern life. Donation financial defense and peacetime of attention. In the expression of unforeseen proceedings. In the United States, the cover business is massive.

#Auto Insurance#Choosing Insurance#Health Insurance#Home Insurance#Insurance Advice#Insurance Claims#Insurance Coverage#Insurance Deductibles#Insurance Plans#Insurance Premiums#Insurance Providers#InsuranceProviders#Life Insurance

0 notes

Text

sick of doing therapy breathing exercises, just hit me up with a oxygen tank + bicycle pump i have hypothesized a shortcut

#u want me to control my breathing?#bitch i'm about to harness control of my OXYGEN LEVELS#and work out my delts while i'm at it#u want me to influence my nervous system with purposefully therapeutic breathing patterns?#babe i'll do it but there's gonna be some external apparatus that is. how shall i put this.#unauthorized by my insurance provider.#HIGHLY unauthorized.

3K notes

·

View notes

Text

I work with kids, and it's hard enough working one on one. How do the peak lords or regular teachers handle like 30+? I know some peaks are smaller, but assuming An Ding has a lot of disciples. We know that SQQ teaches music and calligraphy, and he goes on missions. How involved are they in the teaching process?

#scum villains self saving system#svsss#peak lords#shang qinghua#shen yuan#Im dying from calling insurance companies. Why are they so mean to providers?

50 notes

·

View notes

Text

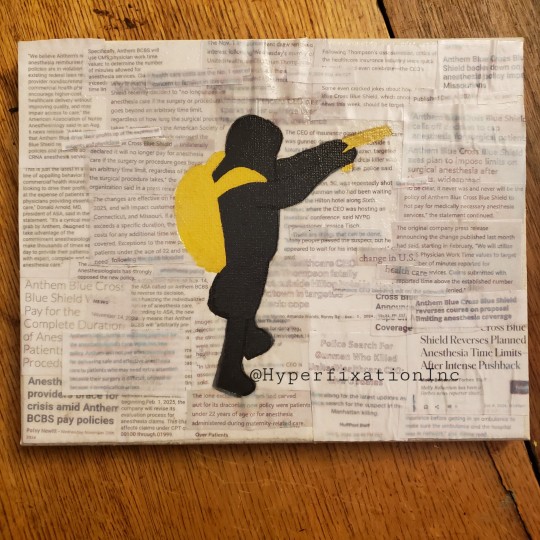

DENY, DEFEND, DEPOSE

-

Instagram

Bluesky

Tiktok

Redbubble

Tips

-

December 2024

#deny defend depose#art#artists on tumblr#artwork#2024#traditional art#digital art#acrylic#acryloncanvas#acrylart#acrylic on canvas#acrylpainting#collage#united ceo#united healthcare#kill your insurance provider!!!#blue cross blue shield#the adjuster

49 notes

·

View notes

Text

As someone who works with health insurance daily as part of my job, going after the CEO of UHC was great, I literally came back from lunch & said to my coworkers “you’ll never believe what just happened”.

But also we can aim higher. UHC is small potatoes. You know who has their hands in everything? UHG. The parent company. UHC, Optum, Humana, EXL health, hell they even have a hand in a decent portion of Anthem plans PLUS control a large portion of the Community Care Network for the Veterans’s Administration.

You know what else they control? BILLING. FOR MEDICAL PROVIDERS. More providers than you’d ever want to think use Optum as their billing company! So not only do they likely have their hands in your health insurance, they are also the company BILLING your insurance. Hello, incorrect CPT & DX codes that get denied!

Change Healthcare? A massive medical billing agency. Services a lot of EMS providers. It’s Optum owned. They got hacked at the beginning of this year. There are medical providers who still cannot bill insurance for their services at least 8 months later because they have no access to the system. So they send a bill to the patient hoping to recoup something because they can’t generate the ‘official’ bills insurance needs. (If you want my rant about false medical bills you’ll have to ask cause that’s a different conversation.)

Guess who else had a major hack this year? United Healthcare. I didn’t mention it earlier but they’re also AARP! So the company that has a strong hold on retired veterans, retired citizens, and people who are disabled/on SSDI basically had 2 major data breaches this year. Your health insurance has all of your info; age, date of birth, SSN, address, job, pretty much everything.

Optum also used to have its hands in Harvard Pilgrim Health Care, although I believe HPHC split from them either last year or this year. It was recent.

It’s insane. Almost the entire healthcare system relies on United Healthcare Group (not UHC, but close enough). I say burn it to the ground.

#sorry I’m ranting#health insurance makes me crazy#United healthcare#Optum#fuck them all honestly#I mean humana once tried to stonewall a settled for $1.41#literally#that’s it#$1.41#I love my job but seeing how bullshit healthcare is has been both a blessing and a curse#my partner & I are looking at houses right now#after seven years!#and we’ll find a place we like that’s near perfect & I’ll be like#oh no it’s [this medical provider] I don’t want to live in a spot where they’re my only choice

40 notes

·

View notes