#Instant Savings Account

Explore tagged Tumblr posts

Text

there was like a single scrap of dsmp lore that woke up some old fans and my twitter fyp is already shoving discourse in my face, do you guys even like to have fun 😭

#I KNOW MOST PEOPLE ARE JUST ENJOYING IT BUT IT'S KINDA FUNNY HOW IT WAS SO INSTANT KGJFHG#twitter's main goal is to make you upset and i wish that wasnt how it worked#im here to talk to friends and find fun art to share why are we fighting... can you shut the fuck up#and i just kinda stopped having as much fun on tumblr i dont have shit to do anymore :')#bluesky the second you get private accounts...#i have a bluesky but im too scared to actually post. i dont wanna post anymore man im tired#nearly everything i do is nonrebloggable. i JUST wanna talk. i dont wanna Post i wanna Talk it's different#youtube documentaries save me. been getting really into casino heists lately#the balatro to criminal record pipeline#chat

10 notes

·

View notes

Text

A Beginners Guide To Fund Transfer Using QR Codes:

Digital payments have revolutionised the way customers used to make payments. Debit cards, credit cards, digital wallets, and now QR codes are used to pay for a purchase. Smartphones facilitate easy cashless fund transfers for purchases. It relieves you of the burden of carrying money whenever you go out.

You can make QR payments by scanning the code and initiating a money transfer from your account to the seller’s account. The mobile wallet completes the transaction by transferring money from your account once you validate the transaction.

Are you here to seek information about QR codes? Are you new to the QR code ecosystem? Welcome to this new revolutionary payment system. Here is a quick guide for the QR code noobs.

What Is A QR Code?

It is a two-dimensional scanning code with a black-and-white square on a white backdrop. Any smart mobile with a QR code reader can scan the code and complete a transaction. They are better than barcodes as these codes can store huge data. The automotive industry used these codes before the payment ecosystem started using them. QR codes can help to initiate a payment, donate money to charitable institutions, and design creative marketing initiatives. These codes facilitate cashless payment.

Types Of QR Code Payments:

You can scan QR codes with a bar code or a smartphone. They can be used for bank balance enquiries also. It is a faster payment option than credit cards because all you need to do is download the QR code App. Open the mobile camera, scan the merchant code, and you are done! There are different types of QR payments.

Payment to Merchant:

Once you finish buying in a supermarket or a local store, you open a payment application. The merchant would enter the payable amount in his POS system. You have to scan the barcode of the product and complete the transaction. When you buy online, this process is done by adding your desired product to the cart.

Scan the QR code of the receiver:

You need to open your mobile camera to scan the code on the bill. The transaction will be completed once scanning is complete. Every store has a unique application. They will provide offers once you finish payment using a store-specific app.

App to App payment:

It facilitates payment of money from App to App. The recipient opens his App and you scan it through the app on your mobile. You need to check whether the details entered are correct and complete the transaction.

Benefits of using QR codes:

There are multiple benefits to using QR codes. They are:

Easy payment experience.

Enables easy data collection and identification.

Secured method of payment.

Cost-effective as they don’t need any equipment to facilitate payment.

Final Words:

QR codes are an effective payment mode. If you have a smartphone, or QR reader on your mobile, you have completed a transaction. There is an expected 58% growth in the QR payment market by 2028. They are easy to use and a secure method of cashless payment. You only need to scan the QR code scanner and make digital payments. When your seller scans the QR code on your mobile, your bank sends a code and the vendor uses his bank account to facilitate payments.

#online savings bank account#new bank account online#mobile banking account app#bank account opening online zero balance#online new account open#opening account online#bachat khata#open a savings account#online new bank account opening#online savings account opening#instant account opening online#online saving bank account#online open saving account#bank account online#open a free bank account#bank fd#open a bank account online free#mobile banking app#online digital account opening#banking app#open a new bank account#apply for savings account#bank app#opening a bank account#online savings bank account opening#open savings bank account online#account online open#apply for savings account online#mobile banking apps#bank account online open

1 note

·

View note

Text

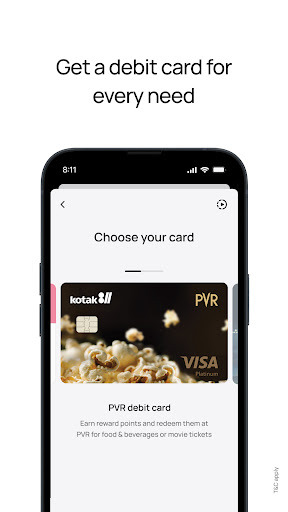

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#open instant account#0 account opening bank#instant saving account#open a bank account#0 balance account opening#zero balance open bank account#bank account with zero balance#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#zero account opening online#online savings account opening#online zero balance bank account opening#saving account opening#bank account kholna#instant account opening#open zero balance account online instantly#open online savings account#zero balance bank account opening online

1 note

·

View note

Text

Offline UPI Payments- Are They Even Possible?

You may have the latest smartphone with high-speed internet connectivity. How would you feel if the internet fails when you try to pay your valued client? Your 5G mobile with a UPI-enabled app, couldn't help when you needed it the most. Is there a way to pay without an internet connection?

Come on. Let us find out ways to complete a UPI payment transaction offline! National Payments Corporation of India has brought forward a solution that enables payment without the internet. A USSD code- *99#, helps those in areas with poor internet facilities.

What is a USSD number?

It is a mobile banking arena and assists users in transferring money offline. Four telecom providers and 83 participating banks assist with the transfer of money without the need for an internet connection. Whenever you need to make a payment, dial this USSD number. Your mobile screen will display an interactive menu that assists in completing the transaction.

There is an upper limit of Rs.5000 for making a transaction. There is a small charge of 50 paise per transaction.

How Can We Set Up The UPI Payments App For Offline Payments?

Step 1: Open your mobile dialer, and dial *99#. It will help you to start a transaction and make a payment.

Step 2: When you dial this number, it will ask you to select a language of your choice from thirteen language options.

Step 3: Enter your bank IFSC code in the space provided.

Step 4: Your smartphone will display all the registered mobile numbers of different bank accounts. You need to choose from them and complete the transaction. The money will be debited when you click confirm from the provided bank account.

Step 5: Enter the last 6 digits of your account number and the expiry date of your card.

If you follow these five steps, your offline UPI payment is activated.

How Can We Send Money Through UPI Offline?

It is a simple process, and you should follow these instructions carefully.

Dial *99# from your mobile with the mobile number linked to your UPI bank account.

Choose a language of your choice.

Click on the send money or transfer money button.

Type in the receiver's mobile number or VPN ID.

Type the amount you wish to transfer.

You may type the UPI pin to complete the transfer.

Click confirm.

You can complete a payment transaction immediately. If you don't have an uninterrupted internet connection and the problem is with your bank, download the UPI Lite app.

Summing Up:

UPI is a payment interface that facilitates payment from one account to another. Generally, people believe they should have a smartphone with an uninterrupted 5G connection to make a payment. However, NPCI has developed an unstructured supplementary service data-based payment facility to enable people without an internet connection to complete payments.

You can now authorise a payment from your mobile, having any bank account linked to your registered mobile number. Your UPI money payment app facilitates merchant payment and peer-to-peer payment too. People living in areas with low internet connectivity can pay from their mobile. Thus, NPCI has debunked the myth that you need high-speed internet to facilitate a transaction.

#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank#digital account opening#fd bank

0 notes

Text

How to build an Emergency fund

Unexpected events can happen in life that might be good or bad. So, it would help full if you were financially prepared to face it. Before the pandemic, no one knows about the emergency fund. After experiencing layoffs, the pandemic, and medical issues, many people are thinking about savings. At this time, an FD account can help to save money. FD savings can help you get through difficult times quite easily. You won’t have to depend on loans or credit cards, if you have an emergency fund that keeps you surviving during difficult situations. Here is a quick guide to building a fund:

Set a clear target:

Prepare yourself from the starting point for success. Set a goal for at least 3 to 6 months of living expenses. This target will guide your savings strategy. Review your financial goals regularly. It can help you manage the budget. Even small changes can affect the time you need to reach your emergency savings. So set a clear target to achieve your savings goal.

Automate your savings:

The simplest way to save money is to investing. It means most employers send cash through online, so you can easily spend more money for buying things. It will affect your savings. So, set up a separate account for your savings and deposit the amount you selected for your contribution. Use a savings account that you cannot access easily. Because these things can easily change your mind to spend more money. Put it out of your mind and let time do its thing.

Avoid increasing your monthly spending:

If saving has become a routine, you may think that you’re financially secure. This can make you spend money on unwanted things, so be aware. For example, if you buy new dresses or shoes every month, it becomes a regular habit. So you are not saving anything. Having appropriate savings is essential for your financial stability. Be realistic, but try to achieve your savings target. That makes your life more enjoyable.

Increase your emergency fund:

Utilize the opportunity that can help you increase your emergency fund, whenever you can have extra money transferred to your savings account. A great opportunity to grow your funds is to finish paying off your money. After you have paid off your loan, deposit money into a savings account. This is a great way to secure available money.

Final words:

These times, the majority of the people aim for early financial independence. So, if you want all your financial needs taken care of at the time of retirement, follow the above strategies. The initial step is to build an emergency fund to cover all sudden costs shortly. Even though it requires careful planning and intelligent investing during emergency medical needs like lockdowns or pandemic situations, it’s really useful. You can also try saving money through online platforms and easily send amounts through money-sharing apps. This is really useful in emergencies. So save your money for better future and risk-free life!

#bachat khata#zero balance account opening app#instant account opening online#open saving account#0 balance bank account open online#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank

0 notes

Text

What is POS in debit card? Why it matters?

In recent days, convenience and security in transactions have never been more crucial. This is where POS systems come into play. Mobile banking apps also play a major part in digital transactions. You may swipe your debit card at a retail store or enter your PIN at a restaurant. POS systems are the backbone of modern transactions. But what exactly is POS in a debit card, and why is it so important? Let us explore the details and how they impact your banking experience.

What is POS?

POS stands for Point of Sale. It refers to the location or system where a transaction takes place. When you use your debit card at a checkout counter, the POS system is the technology that processes the payment. It involves a combination of hardware and software. This enables merchants to accept payments from customers easily. This includes card readers, terminals, and the accompanying software that communicates with your bank to authorize and complete the transaction.

How Does POS Work?

When you make a purchase with your debit card, the POS terminal captures your card details and sends them to your bank for authorization. The bank checks your account to ensure you have sufficient funds and whether the transaction is legitimate. If everything is in order, the bank returns an authorization code to the POS system. This will complete the transaction. The entire process usually happens in a matter of seconds. This provides a smooth and quick payment experience.

Why Does POS Matter?

POS systems modernize transactions, making it easy for you to pay for goods and services quickly. With just a swipe or tap, your payment is processed. It will save you time and effort.

Modern POS systems come equipped with advanced security features like encryption and tokenization. This means your card details are protected during the transaction.

Using your debit card with a POS system lets you track your spending. With mobile banking apps, you can check bank balance and review your transaction history.

Many POS systems now integrate with UPI payment apps. This integration allows for smooth transactions between various payment methods and simplifies payment.

POS systems provide a smoother checkout experience. It will improve customer satisfaction. Faster transactions and reliable processing help ensure a positive shopping experience.

The Future of POS Systems

As technologies advance, POS systems are evolving to offer more features. With the rise of mobile payments and digital wallets, the role of POS systems is expanding to include various payment options. Advancements in AI and machine learning are enhancing the security and efficiency of POS systems. These technologies can detect and prevent fraudulent activities. This makes transactions safer and more reliable.

To conclude

Point-of-sale systems are a vital component of the modern payment setting. With the integration of UPI payment apps and the ongoing evolution of technology, POS systems offer enhanced features and improved security. So, next time you swipe your debit card, you will know that the POS system is working diligently behind the scenes to ensure a smooth and secure transaction.

#zero balance bank account open#zero balance account opening#0 account opening bank#bank account opening#open a zero balance account#open zero balance account#banking upi mobile#saving account opening zero balance#0 balance account opening#open new savings account#instant account opening zero balance#zero balance open bank account#bank account with zero balance#online zero balance account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open instant zero balance account#open a zero balance account online#new account opening#instant zero balance account opening#zero account opening online#zero account open online#instant zero balance account opening online#online savings account opening#online zero balance bank account opening#account open 0 balance#instant account opening#open zero balance account online instantly

1 note

·

View note

Text

Effective Tips to Get the Most Out of Your Fixed Deposits

Everyone has dreams and long-term goals. They could be owning a car, taking that dream vacation abroad, or securing our children’s future education. While a savings account might seem like a step toward achieving these goals, it may not be the most effective way to grow your savings. Looking for an alternative option? If so, then a fixed deposit is the right solution. Fixed deposits offer a safe and reliable way to earn higher returns on your savings. But how can you maximize those returns? Let’s explore strategies to help you get the most out of your fixed deposits!

Choose the Right Tenure

Selecting the appropriate tenure for your FD is important to achieving your financial goals. The interest rate on fixed deposits can vary significantly depending on the term. For example, in India, the difference in interest rates between a 1-year FD and a 3-year FD can be as much as 1.5%. Therefore, it is important to align the FD tenure with your financial objectives. If you plan to buy property or land within the next two years, opting for a 5-year term might not be the best choice. Choosing the right tenure ensures that your investments are both accessible and optimized for maximum growth.

Explore Fixed Deposit Laddering

Another effective strategy to enhance your returns is known as fixed deposit laddering. This involves splitting your investment into multiple FDs with varying maturities. By doing so, you can manage your financial needs more flexibly and achieve different goals without having to break your FDs prematurely. For instance, you could divide a lump sum into three portions. Each FD can be aligned with a specific financial goal. This staggered approach allows you to benefit from potentially higher interest rates on longer-term deposits.

Capitalize on Compounding Interest

You can also benefit from compounding interest. Compounding means that the interest you earn is added to your principal, and you then earn interest on this new, larger sum in the subsequent period. To maximize this benefit, consider reinvesting the interest earned along with any additional funds you may have. Over time, the power of compounding can lead to substantial growth in your investment. It provides a significant boost to your returns. The longer you keep your money invested, the more you can take advantage of this compounding effect.

Stay Updated

Interest rates are a key factor in determining the returns on your FD investments. Therefore, staying informed about market conditions and economic trends that could impact these rates is essential. By keeping an eye on interest rate fluctuations, you can time your FD investments to coincide with periods of favorable rates. Additionally, check transaction history, which allows you to track your investment performance and make more informed decisions.

Final Thoughts By applying these strategies, you can optimize your fixed deposit investments and secure the best possible returns. Always check the balance of fixed deposits and stay informed about interest rate trends and economic conditions. You also need to consider your financial goals, risk tolerance, and liquidity requirements before making any investment decisions.

#zero balance bank account open#zero balance account opening#instant saving account#zero balance account open#0 balance account opening#instant account opening zero balance#zero balance open bank account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#instant zero balance account opening#online zero balance bank account opening#open zero balance account online instantly#zero balance bank account opening online#zero balance bank account online#zero balance account online#zero balance account app#0 balance bank account open online#online savings bank account opening

0 notes

Text

Starting an Online Business with UPI: How It Helps

The Unified Payments Interface is India’s major step toward a cashless society. It is a payment system that allows users to connect multiple bank accounts to one smartphone app. It also provides fund transfers without needing IFSC codes and bank account numbers. If you add the UPI money transfer app to your business, it’s easy to transfer your money. Ensure you have a smartphone, active bank account, mobile phone, and bank account that are both connected and have better internet access. Here are some key advantages of UPI with business.

Small transaction:

UPI payments allow small shopkeepers and consumers to conduct low-cost transactions. Comparing a Visa and Master card can charge some fee of 1-2% of the transaction amount, UPI transactions are entirely free of cost. This leads to higher savings over the longer term.

Expand your customer:

UPI can help you expand your customer reach. If you have one or two payment options, it affects your business and your customers. Recently, many people have been using UPI accounts to make payments. By including UPI in your business operations, you can connect with several customers and expand your business.

Many accounts with one app:

UPI has allowed you to manage all your bank accounts with a single app anywhere. You don’t need to use various types of apps, just link your bank account to a UPI app. However, you must choose a default bank account, so if anyone pays to your UPI ID, the amount is directly deposited to that account.

Real-time monitoring:

One of the key features of UPI is real-time transaction monitoring. As a small business owner, you can easily track your payments and expenses. Which helps to improve your financial management. With the help of the UPI app, you can maintain a clear and current financial status and improve your financial performance. Also, you can address the problems.

Safe and secure:

Payments can only be transferred from a mobile phone in which your SIM card or mobile number is registered with your bank account. If you are making a UPI payment, you need to verify your secret PIN. The major advantage of UPI is that it makes transactions fast and secure. UPI features like two-factor authentication and encryption can protect against fraudulent activities.

Better than wallet:

Online banking is better than a wallet because you can’t put a lot of money into your wallet. But in online bank accounts, you can save a lot of amounts and use it everywhere. Wallets don’t let business owners earn interest on their balance, but with UPI, your money stays in your bank account. This way, you earn interest on the money you keep in the bank.

Final words: The points mentioned above demonstrate that UPI offers many advantages for your business. It is safe to use UPI as a payment method because it has excellent security features. With UPI payments, your customers can make the fastest money transfers, providing peace of mind for you and your customers.

#online upi#online upi payment app#online zero balance account#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account#open savings bank account online#open zero balance account#open zero balance account online instantly#open zero balance bank account

0 notes

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Top Tips for Secure Online Banking: Safeguard Your Transactions - itechfy

In today’s digital age, online banking offers unparalleled convenience for managing your finances. However, ensuring the safety of your online transactions is paramount. While online banking platforms come equipped with built-in security features, it’s essential to take proactive measures to protect your sensitive information.

#zero bank account open#online instant bank account opening#open savings bank account online#instant online account opening#payment bank account opening

0 notes

Text

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes

Text

From Gaza to Ireland: Out of the Fire of War to the Fire of Soul-Crushing Survival Guilt and Fear for my Family

Note: My main account (@mahmoudkhalafff) was unfortunately terminated by Tumblr for no reason. This is my back up account. Please continue to boost my campaign. We are too close!

At times of peace, having to be away from your family for months and years is a high price you pay for obtaining an academic degree or securing a better job. Imagine while you are away, they were trapped in a besieged strip of land and thousands of missiles rained down on that besieged area of 360 km² around the clock for almost 11 months. That would crush every cell of your mind and drive you crazy, wouldn't it?!

Imagine suddenly getting addicted to watching the news and the gory videos and pictures all the freaking time. You follow relevant social media pages that only show images, videos, and stories of entire families that were wiped out in an instant in an airstrike and deemed as collateral insignificant damage. While plunging deeper and deeper into an unprecedented state of acute depression, I wondered: how come all my suffering from displacement, fear, and hunger in Gaza for 5 months during the war before being evacuated to Ireland is nothing but a drop compared to my ocean of suffering now?

The constant thinking of my family in Gaza during the genocide and all the potential scenarios is consuming my sanity and mental health at a time in my life and a place where I am required to be 199% focused and productive. To give you a glimpse of my horrible psychological suffering these days: I fear going to sleep because I know horrible horrible nightmares are waiting for me on the other side. Some have to do with the horrors of wars I witnessed in Gaza myself and others relate to the horrible potential scenarios I keep thinking about.

Seeing the images and pictures of Gaza makes you think a thousand earthquakes hit every neighborhood of the Gaza Strip! Nothing and no one has been spared. The horrific war has turned the place into a hell on earth, unfortunately. How can young people have any hope for a better future seeing the mass destruction and the relentless Israeli efforts to stifle Gaza and squeeze hope out of its people as a form of collective punishment. How monstrous and heartless!!!

Amid all this chaos and madness, my number one priority and focus is evacuating my family to Egypt as a first step and hopefully reuniting with them in Ireland at a later stage.

Please do consider helping me save my family by donating, reblogging, and sharing.

Note: Vetted by:

1. @el-shab-hussein and @nabulsi # 151 on the spreadsheet of Vetted Gaza Fundraisers List]

2. @riding-with-the-wild-hunt Here .

Tagging for reach <3

@riding-with-the-wild-hunt @ibtisams @vakarians-babe @90-ghost @sayruq @fairuzfan @sar-soor @fallahifag

@el-shab-hussein @taamarrud @humanvoicebox

@plomegranate @queerstudiesnatural @commissions4aid-international @nabulsi @stil-lindigo @soon-palestine @communistchilchuck @palestinegenocide @northgazaupdates2 @northgazaupdates @ghost-and-a-half @kyra45-helping-others @kyra45 @commissions4aid-international @feluka @appsa

#vetted#verified#free gaza#free palestine#gaza#gaza genocide#gaza strip#signal boost#mutual aid#palestine aid#save palestine#palestinian genocide#i stand with palestine#all eyes on palestine#palestine news#help gaza#gazaunderattack

6K notes

·

View notes

Text

You Can Help Hammad Save His Family🍉‼️🫶🏻

VETTED BY ASSOCIATION; Hammad was referred to me through Safaa and her campaign (vetted by 90-ghost)

This campaign is created on behalf of a very valuable and dear friend of mine, Hammad A., who is dealing with devastating tragedy and loss that none of us in the empirical core could possibly begin to imagine.

Hammad is one of the most thoughtful, considerate, and hard-working people I know -- and while he has tried his best to provide for his family under these immensely difficult circumstances, he now needs our help to keep him and his family alive.

Picture this: Your life has been turned upside down instantly; everything you have worked your whole life for -- gone in an instant. Everything you once knew turned to rubble and destruction. Your home, where you grew up and created childhood memories with -- gone. Your job, where you dedicated your energy and effort into building a career you loved -- gone. The most basic necessities we take for granted -- warmth, fresh air, the ability to move around freely and safely -- ripped away from you.

These are only a few of the difficulties that Hammad and his family have been facing for over 464 days.

As you understand by now, there is only so much resilience the human body can endure, and the urgent need to do anything you can to save your family is the exact reason Hammad has allowed us the opportunity to help him and his family be freed from the immense suffering and stress they currently face.

His tent was recently flooded, damaging the little items that he had after losing everything, and destroying the little shelter he and his family had to protect them against the harsh elements.

Hammad needs your help NOW.

Even the smallest amount is so highly valuable in lifting a margin of stress from the weight of this tragedy off the shoulders of Hammad and his family. Your contributions to these lifesaving funds are invaluable.

Chuffed has a waiting period for processing and transferring funds. If you want your donation to IMMEDIATELY be sent to Hammad, paypal is linked below.

#tiktok ban#free palestine#sabrina carpenter#miku#fortnite#one direction#overwatch#fnaf#artwork#lgbtq#neil gaiman#sherlock holmes#gaza#palestine#falasteen

3K notes

·

View notes

Text

How is using an online bank account helpful for you?

Most individuals have been using online banking for the last few years. There are many wonderful advantages to using an app or website for banking. Digital banking is any banking done online through a mobile application or website. It eliminates the need for clients to physically visit a branch by enabling them to conduct banking transactions and access banking services remotely. Because digital banking is so convenient and useful, it has grown in popularity recently. In today's fast-paced world, most people prefer instant bank account opening online. This post explains how using an online bank account is helpful for you:

Bank on your phone or tablet

Starting an online banking account does not require sitting at a computer; you can do it from your phone or tablet. Most bank websites are mobile-friendly, making accessing the internet on your preferred device simple. Furthermore, assistance is typically well-marked and offers live chat or a phone line to the department you require, so you don't have to worry about losing out on the in-person interaction.

Pay bills and make payments

The days of filling out long papers and sending checks to pay bills are long gone. You may use your bank's website to pay all your bills and make payments, which is one of the main advantages of online banking. In addition to sending money to friends and family, you can set up standing orders and direct debits. That is as convenient as it gets.

Minimize unnecessary costs with low-fee online accounts

More customers choose to new bank accounts open online because of their fee-friendly approach, which typically offers accounts with lower costs compared to traditional banks. Access to accounts with few or no fees is one advantage of using an online bank, including several high-yield savings accounts.

However, while comparing accounts from different online banks, thoroughly review the charge schedules like any other bank account. To save money, look for accounts with low or no fees for services like overdrafts, ATM usage, and monthly maintenance. You should also fulfill any other account requirements.

Control

Real-time access to managing and transferring money as needed and having self-serve control over your funds are two other important advantages of digital banking. There are typically no time limits on when you can carry out banking operations, such as depositing checks or transferring money between accounts, with mobile banking apps and websites, in contrast to traditional banking establishments. Also, navigating daily transactions is becoming simpler.

Keep on top of your finances

You will find it much easier to stay on top of your finances if you use online banking. In addition to checking your balance and seeing your transactions easily, you will also be able to view past payments to ensure they were made on time. You may also flag any unauthorized purchases more easily, allowing you to act quickly if you become aware of them.

Wrapping it up As a result, the above detailed are about how using online bank account helpful for you. Banks employ various technologies to guarantee that online banking is secure. Online and mobile banking systems can assist you with everyday banking duties, improve your financial management, and, in certain situations, link you to a group of like-minded people after new bank accounts open.

#best savings account#ebanking#instant online bank account opening#safe mobile banking#instant open bank account#manage bank account online#digital banking

0 notes

Text

paid tuition and rent and my phone bill and my credit card bill and truly. what if i killed myself

#i have. less than 600$ left in my savings account. & less than 600$ left in my chequing.& my student loan payment is coming out on the 2nd#AND i don't think i'm getting paid next friday bc i didn't work these past 2 weeks. so. lotta instant ramen this month i think#i'm getting some of the tuition money BACK bc i'm registered for 4 classes and i think i'll only take 2. but jesus christ.#OH GOD AND I HAVE TO REFILL MY OPUS CARD WHEN I GET BACK.#isabel.txt

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#apply for bank account online#new bank account open app#banking app#bank online account opening#new bank account open#new bank account opening app#online banking#account opening app#digital savings account#instant online bank account opening

0 notes