#online open zero balance account

Explore tagged Tumblr posts

Text

Understanding video KYC: A complete guide

KYC verification is an integral part of opening bank accounts. KYC stands for know your customer, which is an important step followed by many banking sectors. This is done for security purposes, verifying the customer’s identity and residence to avoid banking fraud and risks. The traditional KYCprocess requires a lot of paperwork and documentation. And it is a time-consuming process; it will take days or weeks. Nowadays, video KYC arrives as a trend. Let’s understand how the video KYC process works and how it benefits us.

What is Video KYC?

As the name insists, Video KYC is taken online through a video call. KYC specialists will verify the customer’s identity and liveliness when opening a bank account. It is a contactless verification that can be done within a few minutes. Not only in banks, most organizations and financial institutions are following this KYC process before onboarding a customer. Video KYC simplifies the verification process at a considerable range.

Traditional KYC vs. video KYC:

Traditional KYC follows a customer identification program (CIP) to verify the customer’s identity and address. This process will take weeks or months to complete and involves lots of paperwork. It consists of a lot of physical visits. High-cost expenses will be spent on verification.

Video KYC is a digitized form of the verification process. There is no need for paper works, and it can be done within a few minutes. It is cost-effective and saves time and effort of people. It is a real-time verification of customers and business partners to ensure their identity and liveliness.

Steps involved in Video KYC:

Customers are instructed to do a Video KYC before opening a bank account. For that, you need to visit the official bank and submit a request for video KYC. That request application form will ask you to attach some identity proofs of you. The process of video KYC is listed below:

The KYC specialists will arrange an online video call. They only start the video call. The process will be done by trained specialists only.

They will capture a live photo of you and detect your live location using geo-tagging software.

You are asked to show the identity proofs. This includes your Aadhaar card, driving license, and PAN card. The specialist will ask you a few questions regarding the documents.

They will verify the live image of you and your photo in the documents match to ensure your liveliness.

The whole call will be recorded, and your approval or rejection will be declared once the call is done.

Benefits of video KYC:

As we mentioned earlier, video KYC saves the time and effort of a lot. The ultimate aim of the process is to prevent scams and banking fraud. The physical presence of customers was optional. This is the faster and more seamless verification process. Video KYC provides a better customer experience and suits many people stuck with their work. As it was a face-to-face video interview, the safety of the documents was ensured.

Final words:

KYC is done to avoid conflicts and it ensures providing services to the right customer. The above-mentioned points will clearly explain video KYC processes and benefits.

#online open saving account#online open saving bank account#online open zero balance account#online savings account opening#online savings bank account opening#online upi payment app#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account

0 notes

Text

Offline UPI Payments- Are They Even Possible?

You may have the latest smartphone with high-speed internet connectivity. How would you feel if the internet fails when you try to pay your valued client? Your 5G mobile with a UPI-enabled app, couldn't help when you needed it the most. Is there a way to pay without an internet connection?

Come on. Let us find out ways to complete a UPI payment transaction offline! National Payments Corporation of India has brought forward a solution that enables payment without the internet. A USSD code- *99#, helps those in areas with poor internet facilities.

What is a USSD number?

It is a mobile banking arena and assists users in transferring money offline. Four telecom providers and 83 participating banks assist with the transfer of money without the need for an internet connection. Whenever you need to make a payment, dial this USSD number. Your mobile screen will display an interactive menu that assists in completing the transaction.

There is an upper limit of Rs.5000 for making a transaction. There is a small charge of 50 paise per transaction.

How Can We Set Up The UPI Payments App For Offline Payments?

Step 1: Open your mobile dialer, and dial *99#. It will help you to start a transaction and make a payment.

Step 2: When you dial this number, it will ask you to select a language of your choice from thirteen language options.

Step 3: Enter your bank IFSC code in the space provided.

Step 4: Your smartphone will display all the registered mobile numbers of different bank accounts. You need to choose from them and complete the transaction. The money will be debited when you click confirm from the provided bank account.

Step 5: Enter the last 6 digits of your account number and the expiry date of your card.

If you follow these five steps, your offline UPI payment is activated.

How Can We Send Money Through UPI Offline?

It is a simple process, and you should follow these instructions carefully.

Dial *99# from your mobile with the mobile number linked to your UPI bank account.

Choose a language of your choice.

Click on the send money or transfer money button.

Type in the receiver's mobile number or VPN ID.

Type the amount you wish to transfer.

You may type the UPI pin to complete the transfer.

Click confirm.

You can complete a payment transaction immediately. If you don't have an uninterrupted internet connection and the problem is with your bank, download the UPI Lite app.

Summing Up:

UPI is a payment interface that facilitates payment from one account to another. Generally, people believe they should have a smartphone with an uninterrupted 5G connection to make a payment. However, NPCI has developed an unstructured supplementary service data-based payment facility to enable people without an internet connection to complete payments.

You can now authorise a payment from your mobile, having any bank account linked to your registered mobile number. Your UPI money payment app facilitates merchant payment and peer-to-peer payment too. People living in areas with low internet connectivity can pay from their mobile. Thus, NPCI has debunked the myth that you need high-speed internet to facilitate a transaction.

#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank#digital account opening#fd bank

0 notes

Text

How to build an Emergency fund

Unexpected events can happen in life that might be good or bad. So, it would help full if you were financially prepared to face it. Before the pandemic, no one knows about the emergency fund. After experiencing layoffs, the pandemic, and medical issues, many people are thinking about savings. At this time, an FD account can help to save money. FD savings can help you get through difficult times quite easily. You won’t have to depend on loans or credit cards, if you have an emergency fund that keeps you surviving during difficult situations. Here is a quick guide to building a fund:

Set a clear target:

Prepare yourself from the starting point for success. Set a goal for at least 3 to 6 months of living expenses. This target will guide your savings strategy. Review your financial goals regularly. It can help you manage the budget. Even small changes can affect the time you need to reach your emergency savings. So set a clear target to achieve your savings goal.

Automate your savings:

The simplest way to save money is to investing. It means most employers send cash through online, so you can easily spend more money for buying things. It will affect your savings. So, set up a separate account for your savings and deposit the amount you selected for your contribution. Use a savings account that you cannot access easily. Because these things can easily change your mind to spend more money. Put it out of your mind and let time do its thing.

Avoid increasing your monthly spending:

If saving has become a routine, you may think that you’re financially secure. This can make you spend money on unwanted things, so be aware. For example, if you buy new dresses or shoes every month, it becomes a regular habit. So you are not saving anything. Having appropriate savings is essential for your financial stability. Be realistic, but try to achieve your savings target. That makes your life more enjoyable.

Increase your emergency fund:

Utilize the opportunity that can help you increase your emergency fund, whenever you can have extra money transferred to your savings account. A great opportunity to grow your funds is to finish paying off your money. After you have paid off your loan, deposit money into a savings account. This is a great way to secure available money.

Final words:

These times, the majority of the people aim for early financial independence. So, if you want all your financial needs taken care of at the time of retirement, follow the above strategies. The initial step is to build an emergency fund to cover all sudden costs shortly. Even though it requires careful planning and intelligent investing during emergency medical needs like lockdowns or pandemic situations, it’s really useful. You can also try saving money through online platforms and easily send amounts through money-sharing apps. This is really useful in emergencies. So save your money for better future and risk-free life!

#bachat khata#zero balance account opening app#instant account opening online#open saving account#0 balance bank account open online#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank

0 notes

Text

How to Apply for a Bank Account Online Using UPI: Step-by-Step Guide with Best Apps

In the age of digital transformation, traditional banking methods have evolved dramatically. You no longer need to visit a bank branch or fill out paper forms to open a savings account. With the help of modern account opening apps, you can now apply for a bank account online in minutes and start using UPI payments immediately. Whether you’re opening your first account or switching to a more convenient digital option, this guide explains how to submit an application for opening a bank account with ease.

What is Online Account Opening?

Account opening online refers to the process of creating a new bank account using a mobile app or website, without visiting a physical bank. It’s fast, paperless, and accessible 24/7. The process typically includes digital KYC (using Aadhaar and PAN), mobile verification, and instant access to your account through an app.

Benefits of Applying for a Bank Account Online

📝 No paperwork required

📲 Instant mobile banking access

💳 UPI and debit card support from day one

💼 Ideal for professionals, students, freelancers

🕒 Submit application anytime — no working hours needed

How to Apply for Bank Account Online: Step-by-Step

Here’s how you can apply using any account opening app:

Step 1: Choose a Bank or Fintech Platform

Popular banks offering online account opening:

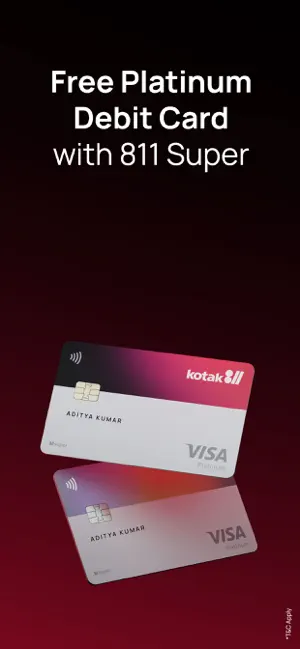

Kotak Mahindra (Kotak 811)

ICICI (iMobile Pay)

Axis Bank (ASAP)

SBI (YONO App)

Fintechs: Paytm, Airtel Payments Bank, Jupiter

Step 2: Download the Account Opening App

Head to Google Play Store or App Store and install the chosen bank or fintech app.

Step 3: Start the Application for Account Opening in Bank

Click on “Open New Account” or “Start Application.” You’ll be asked for:

Name

Date of Birth

Email ID

Mobile number (linked to Aadhaar)

Step 4: Complete eKYC Process

Most apps will require:

PAN card number

Aadhaar number verification via OTP

Some may conduct video KYC

Step 5: Set Up UPI and Mobile Banking

After successful verification:

Get your account number, IFSC, and virtual debit card

Choose your UPI ID (e.g., yourname@upi)

Set your UPI PIN

You can now make instant account UPI payments for bills, transfers, and online shopping.

Top Account Opening Apps in India (2025)

App/Platform

Type

Key Features

Kotak 811

Bank App

Zero balance, full mobile banking, UPI

Bank App

Government bank, Aadhaar-based eKYC

Instant account number, digital onboarding

Advantages of UPI-Linked Accounts

🔄 Send and receive money instantly

🏪 Pay at stores using QR codes

📥 Get salary or business payments directly

🔐 Secure PIN-based authentication

📲 Manage all banking from your phone

Once submitted, the app generates your account credentials and enables UPI payments instantly.

Conclusion

Submitting an application for opening a bank account has never been easier. With powerful account opening apps and instant UPI payment integration, anyone can apply for a bank account online and go fully digital in just minutes. Whether you're opening your first account or looking for a smarter way to bank, choose a trusted platform and enjoy the future of finance today.

#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry

0 notes

Text

Mobile Banking on the Rise: How to Choose the Best App for Everyday Banking

Managing your money on the go has never been easier. Thanks to the rise of mobile banking apps, people can now send payments, check balances, open accounts, and even invest—right from their smartphones. But with so many apps available, how do you know which one is right for you?

Let’s break down how to choose the best mobile banking app and what features really matter.

Why Mobile Banking is Now Essential

The pandemic accelerated a shift toward digital banking, and now mobile banking is not just a luxury—it’s a necessity. Whether you're paying for groceries via UPI payment, setting up an FD, or checking your account balance, the convenience of having your bank in your pocket is unmatched.

Must-Have Features in a Mobile Banking App

Not all apps are created equal. Here’s what to look for when choosing the best mobile banking app:

Feature

Why It Matters

UPI Integration

Enables instant money transfers via your UPI app bank

Online Account Opening

Helps you open zero balance account or savings account in minutes

Instant FD Setup

Allows quick instant FD account setup

24/7 Customer Support

Ensures assistance whenever you need it

Security

Two-factor authentication, biometrics, and encrypted data

How to Evaluate Your Banking Needs

Before you pick a mobile app, assess your own usage:

Do you need to send daily UPI payments?

Are you planning to open a bank account digitally?

Do you prefer Hindi or other languages? Choose apps that support मोबाइल बैंकिंग in your language.

Want to build savings? Look for built-in FD setup tools.

Top Reasons to Go Mobile with Banking

Convenience: Do everything from the comfort of home

Speed: Instant transactions and services like online 0 balance account opening

Control: Real-time alerts and spending analytics

Accessibility: Services are just a few taps away

With a powerful UPI mobile banking app, your phone becomes your personal bank branch.

Safety First: Tips for Secure Mobile Banking

Always use apps from verified sources (Google Play or App Store)

Enable biometric login or strong passwords

Avoid logging in from public Wi-Fi

Keep your app updated to the latest version

These practices keep your bank saving account and FD investments secure.

Real-Life Scenario: A Day with the Right Mobile App

Morning: Check balance and pending UPI payments

Afternoon: Use UPI app bank to pay a vendor

Evening: Start a quick instant FD account setup to lock away savings

Anytime: Track all activity with notifications and analytics

Your mobile app can help you build a financial routine effortlessly.

Final Thoughts

The future of personal banking lies in your hands—literally. A good mobile banking app does more than just show your balance; it empowers you with smart tools to save, invest, and manage money on the fly. Whether you're looking to set up an FD, make UPI payments, or open a bank account online free, make sure you’re using the app that gives you control, flexibility, and peace of mind.

#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry#bank balance enquiry app#bank best fixed deposit rates#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit rates#bank khata#bank online account open

0 notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Make Money Transfers Smooth & Easy

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

Kotak811 mobile banking app is your one-stop solution for managing your bank account anytime, anywhere. Kotak811caters to your needs with its easy-to-use interface and wide range of features.

#bank account app#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process

0 notes

Text

How Does Online Savings Account Work?

In this digital age, everyone is aware of and switched to online bank accounts. You may begin saving money after making an initial contribution to your online savings account. You may manage your funds with an online savings account anytime, anywhere. While many banks and credit unions frequently offer unique benefits on online account management capabilities, completely online savings accounts. It is also important to note to open savings bank account online, so you do not have to worry about entering a branch and depositing or withdrawing your money. In this post, you will learn about how does online savings account works:

What is an online savings account?

An online savings bank account, commonly called a digital account, including the process of open savings bank account online conducted entirely digitally. Financial technology frequently provides these online accounts in collaboration with large, well-known banks or small finance banks. As you are familiar with conventional banks, they are governed by the Reserve Bank of India. They must follow all the laws and guidelines established by the regulatory authorities.

How to open an online savings account?

Opening an online savings account is much easier than opening in the bank. First, you need to research and choose your desired banking sector. Before choosing it, check that your chosen bank has all the online banking features like mobile applications and high-interest rates paid to customers. Your account opening methods can change from bank to bank.

Once and for all, when you finalize your desired bank, you may need to download their mobile application or online account opening form on their website. Your bank will require basic information like your name, age, address, phone number, mail ID, etc. In addition, for identity proof, they may ask for your Aadhaar card.

After verification, they ask you to complete the KYC form like Know Your Customer. With e-KYC and video KYC development, proving your identity by sharing a brief video or your Aadhaar-OTP can be done quickly with biometrics.

Benefits of online savings account

Easy to use: You can manage your funds whenever and wherever you want without adding another stop to your schedule or waiting for the bank to open because all of your interactions with your account occur digitally.

User-friendly apps: Online banks frequently invest a lot of effort to make sure their websites and mobile banking apps are optimized and simple to use. This enables you to shift your money without any problems with just a few clicks on your bank's website.

Security: Online savings accounts intensely focus on encrypting user data and ongoing monitoring to protect your accounts. With the help of two-factor authentications like passwords and biometrics, your online accounts are safeguarded efficiently.

Customer support: Many online savings accounts offers a 24-hour in-app service and toll-free calling feature because their main goal is to give a hassle-free banking experience.

Final Thoughts

By opening a savings account in online you can easily and flexibly able to manage your money. It is crucial that you should compare bank accounts in order to determine which one best suits your banking requirements.

#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account

1 note

·

View note

Text

Why keep salary and savings account separate from each other?

Getting your financial affairs in order is crucial to building and protecting your money. Separate your savings and checking accounts to maximize your rewards. A salary account is a bank account that is essential for receiving a salary from your employer. Start saving account apply online to store your savings money and make daily transactions. There are many benefits you can enjoy if you only do what the account is intended for.

So examine the advantages of maintaining separate savings and checking accounts:

Organized finances

Your budget can be made more efficient by having a separate salary and savings account. It will make tracking spending simple. For example, if you pay your utility bills with one account, you can track all of your payments through that account. Instead, if you conduct all of your transactions through a single account, it could become challenging to track your finances at the end of the month. It might be easier for you to handle your money if you have different accounts.

More savings

You can set a monthly savings target if your salary and savings accounts are separate. Depending on the goal, you could routinely transfer funds each month from your salary account to your savings account.

Having a saving account in bank will enable you to visualize how much money you are saving. In an emergency, you can check your savings account balance to see how much money you have available to spend. If you didn't have a second account, you would have to put in the extra work of figuring out how much instant liquidity you could afford from your single account.

Keeping your regular withdrawals to your payment account only may be made easier if you have a separate account for savings. Your savings account balance would increase as a result.

Increased rewards and benefits

These days, salary accounts automatically include a variety of features like mobile banking, Net banking, an ATM, internet banking, and more are helpful in making transactions easier. These features are available with a savings account. The identical facilities would consequently be available to you on two accounts. You might use both of your accounts to benefit from discounts and benefits that come with a debit card or net banking. Therefore, you might increase the benefits twofold by properly utilizing the features.

Higher interest/profit rate

The different interest rates on your savings account or checking account may be advantageous to you. You can profit from one of the accounts have a higher interest rate depending on the banks where you keep your accounts. You might increase your earnings on your money by moving it to an account with a greater interest rate. Different interest rates for a salary and savings account could be provided by the same bank. It is possible to open a second account with the same bank and then transfer funds to the one that offers a better interest rate.

Final thoughts

A sound financial strategy is crucial to building and protecting your wealth. To maximize advantages and improve money management, keep your salary account and savings account separate. You can use your saving account in bank to purchase daily items and enjoy surprising discounts.

#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app

0 notes

Text

Amazing benefits of having a good CIBIL score as a bank customer

CIBIL score is something that can give you various advantages if taken care of properly. You can maintain your credit score successfully if you are aware of the CIBIL score range. The total range of CIBIL scores is between 300 and 900. Making on-time payments and avoiding penalties at all costs is crucial for maintaining a decentCIBIL Score. This will not only increase your chances of receiving loans but will also establish you as a trustworthy lender if you decide to submit a loan application in the future.

A lender won't just base their decision on your credit score when considering your loan or credit card application.

The following are some advantages of having a high score:

Low-interest rates

Rates of interest are lower for those with better credit scores. Lenders will provide you with a credit product with a cheaper interest rate, such as a personal loan, house loan, or credit card if your credit score is high. Your EMIs and, in turn, your finances could be impacted by an increase in interest rates of even 0.5 percentage points. Thus, one advantage of having a high credit score is being able to borrow money at cheap interest rates.

Loan with long term

You can obtain a loan with a longer repayment time if you have a high credit score. Lower monthly payments might be obtained by choosing a loan with a longer term. This will assist you in lessening your payback obligations and allow you to make timely loan payments.

Additional credit card benefits:

Before approving a credit card application, lenders consider your EMI and income ratio to determine your ability for payments. They also evaluate your CIBIL score and report to determine your credit profile. Good credit behavior is indicated by a high CIBIL Score. This aids lenders in making crucial underwriting decisions like increasing the credit limit on your credit card or providing a reward program like cashback.

Increase your opportunities to get pre-approved loans from banks.

A wonderful approach to receiving a personal loan from the bank right away is with a pre-approved loan from the bank. These loans aren't offered to every customer. Before making a pre-approved offer, there is a minimum required credit score and extensive account balance examination. A good credit score may increase your chances of receiving a "pre-approved" and "personal" loan from your bank or credit card.

Better negotiating power with your lenders

All lenders prefer to work with borrowers that have good credit and a track record of timely loan repayment. Customers with excellent CIBIL scores have a better chance of being accepted as borrowers. As a result, you may be able to bargain with the lender for a reduced processing charge or a better interest rate, giving you an advantage over other clients.

Final thoughts

Over time, it is possible to increase and keep a decent credit score. All you have to do to qualify for credit is to maintain good credit behavior. This will not only help you obtain credit but will also enable you to be rewarded for your credit-conscious behavior with a variety of pre-approved loan offers, etc. Remember to choose Video KYC when opening an account because it is easy and secure.

#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app

0 notes

Text

#Best bank for zero balance account#best bank to open zero balance account#best bank to open zero balance account online#best online zero balance account#best zero balance account opening online#best zero balance bank account#best zero balance savings account#Best Zero-Balance Savings Account in India#Does HDFC allow 0 balance account?#Which bank is best for a zero balance current account in India?#Which bank is best for a zero balance salary account?#Which zero balance account is best in India?#Zero-Balance Savings Accounts in India#IDFC zero balance account#ICICI zero balance account#HDFC zero balance account

0 notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account app#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app

2 notes

·

View notes

Text

Are digital banking the future of banking?

Digital account is the trend of the future for personal financial services. All of the characteristics of a standard savings account are included, along with some extras. Another method to state it is that a digital banking app is a modernized savings account. Given the comfort of access to the Internet and everyone’s dependence on smart devices, it is not surprising that your bank can now enter your space rather than you entering your bank. The digital age has made everything on this planet accessible, including services that you may access online or via your phone.

What is digital banking?

A website or mobile app is used for all-online financial transactions, known as digital banking. Without physically visiting a branch, customers can utilize it to execute financial transactions and obtain banking services.

Due to its many benefits and conveniences, digital banking has become increasingly widespread in recent years. Customers can conduct various transactions by accessing their accounts at any time and location, including checking account balances, moving money, paying bills, and applying for loans.

Security:

Security is of the utmost significance for digital banks. They employ the newest encryption technology to ensure the confidentiality and security of your private and financial data. Digital banks also have robust security measures to prevent fraud and protect your account from unauthorized access. This indicates that you might feel confident knowing your money is secure when choosing a digital savings account.

The ease of convenience:

The convenience that a digital account app provides is among its most important advantages. You can quickly and conveniently start a savings account online from anywhere in the world with a few mouse clicks. All you need is a mobile with an internet facility. Spending hours standing in a queue is no longer necessary to speak to bank staff. It is ideal for folks who are constantly on the go because you can access your account anytime from anywhere in the world.

Banking via mobile:

Having a digital savings account entitles you to use mobile banking services. Therefore, using a mobile device, you can access your account and perform several actions, like money transfers, bill payments, and balance checks. Mobile banking is a popular choice because it is efficient, useful, and secure.

Best features:

Many banks provide mobile and Internet banking services, which offer at least as many features as in-person banking. Peer-to-peer payments might not come to mind, but many banks now offer the capability to transmit money rapidly using your mobile banking app, which might be useful. An ATM location, cardless ATM withdrawals, tracking and budgeting features, and other benefits might all be included in your mobile banking software.

Final thoughts:

By making it more leisurely for you to access necessary tools and services, digital banking can help you achieve more control over your finances. No matter where you live, a digital banking app may provide benefits beyond banking by connecting you with a community and providing financial solutions tailored to your requirements and interests.

#fd transfer account#fd transfer status#finance upi mandate#fixed deposit interest#fixed deposit plans#fixed deposit rate for senior citizens#fixed deposit scheme#flexible fd#flexible fixed deposit#get online upi payments#hide transactions#highest bank fixed deposit rates#highest fd interest rate bank#highest fd rates in bank#instant account opening#instant account opening online#instant account opening zero balance#instant bank account#instant bank account online transfer#instant bank account opening online#instant fd account setup#instant open bank account#instant saving account#instant zero balance account online#instant zero balance account opening#instant zero balance account opening online#internet banking#internet banking app#khata kholne wala app#kyc bank account

0 notes

Text

Ways to cut off unwanted expenses:

Determining how to use our money most effectively is one of the trickier parts of personal finance. Finding significant savings on a tight budget is challenging, especially for the millennial age. However, rather than eliminating substantial portions of your budget all at once, the secret to cutting back on your spending is to do so gradually in each area. It could take a little work once you can save money and pay off more debt, but you'll notice your financial stress dropping. The best way to save money is to open online savings account. Here, you will learn some ways to cut off unwanted expenses:

Know where your money is going.

Financial confidence has been demonstrated to increase when you write down your weekly expenses. You should therefore keep track of your spending to improve your financial stability. Budgeting is helpful in this situation. Monthly spending and revenue are the first two crucial figures in every budget. Make a budget that records both your income and your expenses. Understanding how your money is coming in and going out will help you examine your spending and saving habits over time to spot any patterns. Open online savings account to ensure your money is safe to spend.

Make Your Meals

It can be challenging to muster the energy to prepare supper after a hard day at the office. If you frequently dine out, make it a habit to cook at least twice weekly and gradually increase that number to three or four. If that's not feasible for you, set aside some time on Sunday to prepare a few quick dinners for the next week. In this manner, when you get home from work, you'll already have supper prepared. The same is true of coffee. Even though buying coffee daily may seem like a modest investment, it may significantly drain your finances over time. Eliminating this one fair cost can save hundreds.

Fashion and entertainment expenses:

Plan a play, concert, sporting event, stand-up comedy show, or movie with popcorn. Set aside money for amusement every week, divide it up, and avoid spending too much on enjoyable activities at the expense of other costs. Instead of eating at pricey restaurants or getting takeaway, make your meals. It takes skill to eat well while keeping costs down. It can be rather expensive to go shopping for shoes, clothes, or cosmetics. Stylish clothing is only sometimes necessary to look amazing.

Make a List of Groceries before Visiting the Store

If you've ever gone grocery shopping without a list or when you're hungry, it can be tempting to buy more food than you would typically. Before shopping, write a list of everything you'll need for the coming week to ensure you remember everything and to help you avoid buying unnecessary extras. A checklist ensures you don't succumb to another pointless journey or temptation.

Bottom Line:

Money is always ultimate and can always be a great tool to bring change in your life. So, please follow the above points to save money to use it wisely. Open zero balance bank account online to save money to spend it smartly in the future.

#fd transfer account#fd transfer status#finance upi mandate#fixed deposit interest#fixed deposit plans#fixed deposit rate for senior citizens#fixed deposit scheme#flexible fd#flexible fixed deposit#get online upi payments#hide transactions#highest bank fixed deposit rates#highest fd interest rate bank#highest fd rates in bank#instant account opening#instant account opening online#instant account opening zero balance#instant bank account#instant bank account online transfer#instant bank account opening online#instant fd account setup#instant open bank account#instant saving account#instant zero balance account online#instant zero balance account opening#instant zero balance account opening online#internet banking#internet banking app#khata kholne wala app#kyc bank account

1 note

·

View note

Text

Mistakes you ought to avoid when paying online bills:

Everyone hates paying bills, but chances are you have a couple, at least. Naturally, the restrictions vary depending on who is collecting the money. You may mail checks or set up autopay or bot using your bank's bill payment services. A proper strategy when paying bills will significantly reduce unnecessary fees and double charges. Internet banking has benefited people a lot, even in terms of online billing. Here are several errors to keep away from when paying your invoices.

Not reading your statement.

You already have the bill and can pay it, right? More so if your payment schedule is automatic. Reviewing your statement is still a good idea, even if you use autopay. Your statement contains details regarding charges, fees, and other information. Check your statement carefully to make sure you are not getting charged for services you are not utilizing. Additionally, you can check your bill to determine if any unauthorized charges have been made.

Set it and forget it:

To ensure you don't skip or pay late, autopay can be a great tool. However, it's a good idea to double-check your payments, particularly your first payment, when setting up autopay in your Internet banking statement. Depending on the firm, your autopay account setup may take several business days. You might have to pay something in the interim. In some situations, it's conceivable that you will find out about a missing payment the following billing cycle.

Confirm that the business has the correct information and learn when the first payment will be deducted from your account. After that, confirm that the payment was successfully deducted from your account. Once your autopay is set up, ensure the money is deducted on time by checking in frequently.

Assuming a grace period:

Some businesses provide you with a grace period to make your payment. Therefore, even if you are late, you won't be penalized if you pay within a few days. But only some businesses provide this. There is no guarantee that your current landlord will be as understanding as your previous landlord started collecting a late charge on the fifth day of the month. A daily late fee could be assessed right away.

Not reviewing the price you are paying:

Remember that you can always shop around for a better deal. Never assume you are receiving the best deal. Consider various plans and prices before committing to a bill. Remember to routinely check to see if you are still getting the most outstanding value once you have committed to service. You can find a lower cost if you compare expenses for insurance.

Additionally, you can research several internet and mobile service providers. Check for a better offer, and inform your present provider that you could cancel. They might equal the cost of a rival. You can switch and save money if they don't.

Bottom line:

Online billing is made easy since the internet and mobile phones have given a significant breakthrough in people's lives. By following the above points, you can avoid billing mistakes. So, an online account opening in any indian bank is highly recommended.

#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure

0 notes

Text

What are the steps to opening an online saving account?

The money you save for short-term financial objectives or to keep your emergency fund in a savings account is safe there. Managing finances effectively and conveniently now often involves saving account applied online. This step-by-step manual will simplify the procedure and introduce you to the world of online banking, whether you have been dubious about online banking or are not up to speed. Learn about the steps to opening an online saving account in the following guide:

Understanding the rules and regulations:

The bank will now ask you to certify that you have read the disclosure documents describing the costs, obligations, and how account interest is calculated. You have ideally selected an account with high rates and either no monthly service fees or low monthly service fees. You have the chance to affirm.

Select a banking provider:

Now that the online banking is underway, you may open an online bank account with most banks. Analyse your options for a while and select a banking partner that makes you feel comfortable after researching their expenses, interest rates, and minimum balance requirements.

Visit their website or get the app:

Once you have made your choice, go to the website or download the bank app of your chosen banking partner. You can typically select to create a new online bank account in the products section of the app or website. Go to the appropriate section and choose the option to open an account.

Include a phone number:

Along with your ID number, you can anticipate adding your contact details, including your first and last names, phone numbers, and addresses. Additionally, information like your email address and birthdate might be requested.

Complete the KYC process:

Knowing your customer is referred to as KYC. Banks must follow a particular process before allowing you to register an online account. They must verify your identity and ensure you are who you claim to be. Some organisations may demand video KYC to open a bank account. If your preferred banking partner meets this requirement, a bank representative will connect with you through a video call. Simply attend the call and provide them with the details they require so they can verify your identity.

Submit your application:

While the bank may confirm your online application within a few minutes, it may take two to five business days to verify your details, open the saving account opening online, and give you access.

Add the money:

The login details for your online bank account will be provided once the KYC process is complete. Depending on the bank, it can take a few hours or a few days. You can begin banking using these credentials after adding funds to your online bank account.

Final thoughts:

You can conduct financial transactions effortlessly and comfortably from the comfort of your dwelling by saving account opening online. The procedure described above makes it simple to open an online bank account and obtain access to various online banking services.

#zero balance account saving account#online saving account#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

Different types of savings account:

If you want to save your money and generate a decent amount of interest, then choose a savings account. The interest rate in a savings account may be less, but the security feature it offers is high. A savings account is a good option for saving short-term and emergency fund. Many types of savings accounts are available. Let us first discuss the different types of accounts, and then you get a clear idea about how to open a new savings account based on your requirements.

Regular Savings Account:

Traditional savings accounts are one of the most common types of savings accounts. In a regular savings account, you need to pay a certain amount every month. It is easy to access the funds in a traditional savings account. The process of opening savings account is very simple, and in some banks, the minimum deposit amount is also very low. You can choose this account if you do not want to invest more at once and you want to save money regularly.

High Yield Savings Account:

Traditional savings accounts and high-yield savings accounts are similar, but there is one major difference. The interest rate in high -yielding savings accounts is high without compromising on safety. The withdrawal rate is lower in high-yield account. You can find many high-yielding savings accounts online. You can prefer this if you can manage your accounts online.

Money Market Account:

Money market accounts pay higher interest rates than other savings accounts. It is best suited for short-term goals. There are more features in money market accounts than in traditional savings accounts. It offers debit card purchases and check-writing privileges, and it is more flexible. If you would like to invest more money and increase your interest rate, you can choose this account.

Health Savings Account:

A health savings account is designed to pay for medical expenses. It is tax-free if you withdraw it for a valid medical expense such as copayments, deductibles, and more. In order to use a health savings account, you need a proper health care plan.

Certificates Of Deposit:

It holds a specific amount for a fixed period of time. It may be one year or five years. After a specific period of time, you can withdraw your original amount in addition to some interest, depending upon the bank. You can withdraw the amount only after the mentioned period of time. If you wish to withdraw it earlier, you may need to pay a penalty.

Student Savings Account:

A student's savings account is designed to help students start saving money. There are several benefits in this which include no minimum balance, overdraft facility, availability of debit cards, and no monthly fee. The initial amount to be paid is also very little in the student's account. In some banks, they do not charge any fee for ATM also. But a co-signer is needed to open a student account.

The Bottom Line:

Opening a new savings account is the most important thing to save money and gain interest from it. Analyze your requirements before choosing your account and choose the account which best fits your needs. It is also important to carefully read the terms and conditions before opening the account.

#zero balance account saving account#online saving account#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes