#open a bank account online free

Explore tagged Tumblr posts

Text

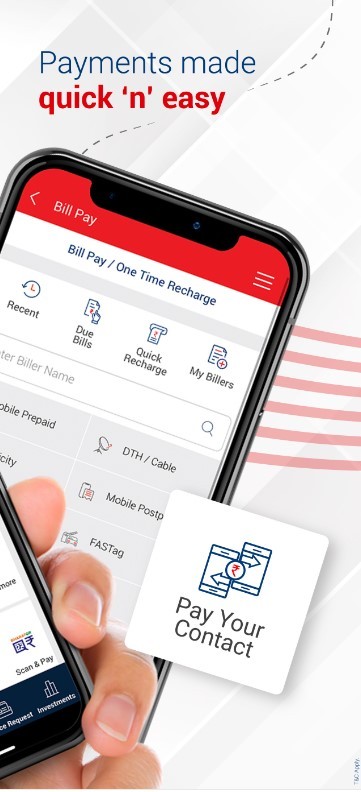

Kotak811 Mobile Banking & UPI - Apps on Google Play

Experience Seamless Banking with the Kotak811 Mobile Banking App. Apply for a 0 balance account online and enjoy hassle-free banking from your smartphone. With the Kotak811 app, you can apply for a bank account, manage your zero balance bank account, make seamless UPI payments, apply for credit cards, and much more.

#premium mobile banking#online banking application#apply for savings account#my upi#online saving bank account#open a bank account online free#upi online#upi app bank#paynow upi#bank app#net banking app upi#fd mobile app#bank fixed deposit#best online account opening#bank account kholna#mobile banking upi#fd deposit#digital account opening#mobile banking app#mobilebanking app upi

0 notes

Text

How Does Online Savings Account Work?

In this digital age, everyone is aware of and switched to online bank accounts. You may begin saving money after making an initial contribution to your online savings account. You may manage your funds with an online savings account anytime, anywhere. While many banks and credit unions frequently offer unique benefits on online account management capabilities, completely online savings accounts. It is also important to note to open savings bank account online, so you do not have to worry about entering a branch and depositing or withdrawing your money. In this post, you will learn about how does online savings account works:

What is an online savings account?

An online savings bank account, commonly called a digital account, including the process of open savings bank account online conducted entirely digitally. Financial technology frequently provides these online accounts in collaboration with large, well-known banks or small finance banks. As you are familiar with conventional banks, they are governed by the Reserve Bank of India. They must follow all the laws and guidelines established by the regulatory authorities.

How to open an online savings account?

Opening an online savings account is much easier than opening in the bank. First, you need to research and choose your desired banking sector. Before choosing it, check that your chosen bank has all the online banking features like mobile applications and high-interest rates paid to customers. Your account opening methods can change from bank to bank.

Once and for all, when you finalize your desired bank, you may need to download their mobile application or online account opening form on their website. Your bank will require basic information like your name, age, address, phone number, mail ID, etc. In addition, for identity proof, they may ask for your Aadhaar card.

After verification, they ask you to complete the KYC form like Know Your Customer. With e-KYC and video KYC development, proving your identity by sharing a brief video or your Aadhaar-OTP can be done quickly with biometrics.

Benefits of online savings account

Easy to use: You can manage your funds whenever and wherever you want without adding another stop to your schedule or waiting for the bank to open because all of your interactions with your account occur digitally.

User-friendly apps: Online banks frequently invest a lot of effort to make sure their websites and mobile banking apps are optimized and simple to use. This enables you to shift your money without any problems with just a few clicks on your bank's website.

Security: Online savings accounts intensely focus on encrypting user data and ongoing monitoring to protect your accounts. With the help of two-factor authentications like passwords and biometrics, your online accounts are safeguarded efficiently.

Customer support: Many online savings accounts offers a 24-hour in-app service and toll-free calling feature because their main goal is to give a hassle-free banking experience.

Final Thoughts

By opening a savings account in online you can easily and flexibly able to manage your money. It is crucial that you should compare bank accounts in order to determine which one best suits your banking requirements.

#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account

1 note

·

View note

Text

Understanding video KYC: A complete guide

KYC verification is an integral part of opening bank accounts. KYC stands for know your customer, which is an important step followed by many banking sectors. This is done for security purposes, verifying the customer’s identity and residence to avoid banking fraud and risks. The traditional KYCprocess requires a lot of paperwork and documentation. And it is a time-consuming process; it will take days or weeks. Nowadays, video KYC arrives as a trend. Let’s understand how the video KYC process works and how it benefits us.

What is Video KYC?

As the name insists, Video KYC is taken online through a video call. KYC specialists will verify the customer’s identity and liveliness when opening a bank account. It is a contactless verification that can be done within a few minutes. Not only in banks, most organizations and financial institutions are following this KYC process before onboarding a customer. Video KYC simplifies the verification process at a considerable range.

Traditional KYC vs. video KYC:

Traditional KYC follows a customer identification program (CIP) to verify the customer’s identity and address. This process will take weeks or months to complete and involves lots of paperwork. It consists of a lot of physical visits. High-cost expenses will be spent on verification.

Video KYC is a digitized form of the verification process. There is no need for paper works, and it can be done within a few minutes. It is cost-effective and saves time and effort of people. It is a real-time verification of customers and business partners to ensure their identity and liveliness.

Steps involved in Video KYC:

Customers are instructed to do a Video KYC before opening a bank account. For that, you need to visit the official bank and submit a request for video KYC. That request application form will ask you to attach some identity proofs of you. The process of video KYC is listed below:

The KYC specialists will arrange an online video call. They only start the video call. The process will be done by trained specialists only.

They will capture a live photo of you and detect your live location using geo-tagging software.

You are asked to show the identity proofs. This includes your Aadhaar card, driving license, and PAN card. The specialist will ask you a few questions regarding the documents.

They will verify the live image of you and your photo in the documents match to ensure your liveliness.

The whole call will be recorded, and your approval or rejection will be declared once the call is done.

Benefits of video KYC:

As we mentioned earlier, video KYC saves the time and effort of a lot. The ultimate aim of the process is to prevent scams and banking fraud. The physical presence of customers was optional. This is the faster and more seamless verification process. Video KYC provides a better customer experience and suits many people stuck with their work. As it was a face-to-face video interview, the safety of the documents was ensured.

Final words:

KYC is done to avoid conflicts and it ensures providing services to the right customer. The above-mentioned points will clearly explain video KYC processes and benefits.

#online open saving account#online open saving bank account#online open zero balance account#online savings account opening#online savings bank account opening#online upi payment app#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account

0 notes

Text

A Beginners Guide To Fund Transfer Using QR Codes:

Digital payments have revolutionised the way customers used to make payments. Debit cards, credit cards, digital wallets, and now QR codes are used to pay for a purchase. Smartphones facilitate easy cashless fund transfers for purchases. It relieves you of the burden of carrying money whenever you go out.

You can make QR payments by scanning the code and initiating a money transfer from your account to the seller’s account. The mobile wallet completes the transaction by transferring money from your account once you validate the transaction.

Are you here to seek information about QR codes? Are you new to the QR code ecosystem? Welcome to this new revolutionary payment system. Here is a quick guide for the QR code noobs.

What Is A QR Code?

It is a two-dimensional scanning code with a black-and-white square on a white backdrop. Any smart mobile with a QR code reader can scan the code and complete a transaction. They are better than barcodes as these codes can store huge data. The automotive industry used these codes before the payment ecosystem started using them. QR codes can help to initiate a payment, donate money to charitable institutions, and design creative marketing initiatives. These codes facilitate cashless payment.

Types Of QR Code Payments:

You can scan QR codes with a bar code or a smartphone. They can be used for bank balance enquiries also. It is a faster payment option than credit cards because all you need to do is download the QR code App. Open the mobile camera, scan the merchant code, and you are done! There are different types of QR payments.

Payment to Merchant:

Once you finish buying in a supermarket or a local store, you open a payment application. The merchant would enter the payable amount in his POS system. You have to scan the barcode of the product and complete the transaction. When you buy online, this process is done by adding your desired product to the cart.

Scan the QR code of the receiver:

You need to open your mobile camera to scan the code on the bill. The transaction will be completed once scanning is complete. Every store has a unique application. They will provide offers once you finish payment using a store-specific app.

App to App payment:

It facilitates payment of money from App to App. The recipient opens his App and you scan it through the app on your mobile. You need to check whether the details entered are correct and complete the transaction.

Benefits of using QR codes:

There are multiple benefits to using QR codes. They are:

Easy payment experience.

Enables easy data collection and identification.

Secured method of payment.

Cost-effective as they don’t need any equipment to facilitate payment.

Final Words:

QR codes are an effective payment mode. If you have a smartphone, or QR reader on your mobile, you have completed a transaction. There is an expected 58% growth in the QR payment market by 2028. They are easy to use and a secure method of cashless payment. You only need to scan the QR code scanner and make digital payments. When your seller scans the QR code on your mobile, your bank sends a code and the vendor uses his bank account to facilitate payments.

#online savings bank account#new bank account online#mobile banking account app#bank account opening online zero balance#online new account open#opening account online#bachat khata#open a savings account#online new bank account opening#online savings account opening#instant account opening online#online saving bank account#online open saving account#bank account online#open a free bank account#bank fd#open a bank account online free#mobile banking app#online digital account opening#banking app#open a new bank account#apply for savings account#bank app#opening a bank account#online savings bank account opening#open savings bank account online#account online open#apply for savings account online#mobile banking apps#bank account online open

1 note

·

View note

Text

Starting an Online Business with UPI: How It Helps

The Unified Payments Interface is India’s major step toward a cashless society. It is a payment system that allows users to connect multiple bank accounts to one smartphone app. It also provides fund transfers without needing IFSC codes and bank account numbers. If you add the UPI money transfer app to your business, it’s easy to transfer your money. Ensure you have a smartphone, active bank account, mobile phone, and bank account that are both connected and have better internet access. Here are some key advantages of UPI with business.

Small transaction:

UPI payments allow small shopkeepers and consumers to conduct low-cost transactions. Comparing a Visa and Master card can charge some fee of 1-2% of the transaction amount, UPI transactions are entirely free of cost. This leads to higher savings over the longer term.

Expand your customer:

UPI can help you expand your customer reach. If you have one or two payment options, it affects your business and your customers. Recently, many people have been using UPI accounts to make payments. By including UPI in your business operations, you can connect with several customers and expand your business.

Many accounts with one app:

UPI has allowed you to manage all your bank accounts with a single app anywhere. You don’t need to use various types of apps, just link your bank account to a UPI app. However, you must choose a default bank account, so if anyone pays to your UPI ID, the amount is directly deposited to that account.

Real-time monitoring:

One of the key features of UPI is real-time transaction monitoring. As a small business owner, you can easily track your payments and expenses. Which helps to improve your financial management. With the help of the UPI app, you can maintain a clear and current financial status and improve your financial performance. Also, you can address the problems.

Safe and secure:

Payments can only be transferred from a mobile phone in which your SIM card or mobile number is registered with your bank account. If you are making a UPI payment, you need to verify your secret PIN. The major advantage of UPI is that it makes transactions fast and secure. UPI features like two-factor authentication and encryption can protect against fraudulent activities.

Better than wallet:

Online banking is better than a wallet because you can’t put a lot of money into your wallet. But in online bank accounts, you can save a lot of amounts and use it everywhere. Wallets don’t let business owners earn interest on their balance, but with UPI, your money stays in your bank account. This way, you earn interest on the money you keep in the bank.

Final words: The points mentioned above demonstrate that UPI offers many advantages for your business. It is safe to use UPI as a payment method because it has excellent security features. With UPI payments, your customers can make the fastest money transfers, providing peace of mind for you and your customers.

#online upi#online upi payment app#online zero balance account#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account#open savings bank account online#open zero balance account#open zero balance account online instantly#open zero balance bank account

0 notes

Text

How to use the UPI payment app to boost your business

The unified payments interface (UPI) is a dependable, immediate, real-time payment technology that offers various financial services and activities on a single platform. UPI improves financial inclusion, expedites money transfers, and hastens the country’s shift to a cashless economy. Companies must use the UPI bank app to meet the growing demand from customers for this payment method. Here mentioned are the ways the UPI payment app to boost your business:

Connect to a payment gateway that facilitates UPI flow:

You can interface with a payment gateway to streamline your payment procedures. You must confirm that your payment gateway supports UPI flow. This feature should ideally function on the web, iOS, and Android devices.

Get in-app payments with UPI:

Consumers are switching to mobile payments more quickly, and there is a good chance that mobile payments will rise soon. Due to the mobile app UPI integration, your consumers can use their phones to make UPI payments. Furthermore, a quicker checkout process will significantly improve the consumer experience.

Payment retrieval over the UPI payment link:

Businesses can easily create a link with payment links that customers can send via SMS, email, or WhatsApp. You should make a UPI registration with your bank account. You can also decide to transmit a UPI payment link to receive payments.

UPI Intention:

UPI Intent entails a smooth app-to-app transition. Businesses benefit from increased transaction funnel visibility. You can see which UPI app a consumer uses and a decrease in the possibility of human error, which results in more successful payments.

QR Code:

The user can easily make payments by opening their preferred UPI app, scanning the dynamic QR code, and creating a unique one throughout the checkout process. QR codes come in two varieties: static and dynamic. The former is the one you constantly scan to pay for your coffee when you see it outside stores.

Make subscription plans available by turning on the UPI e-mandate:

You may design subscription plans for your clients and let them set up automatic withdrawals from their bank accounts connected to UPI. The user can enable this by completing a one-time UPI mandatory authentication. You can schedule these payments for weekly, annual, or monthly transactions. The client never forgets a date and doesn't have to worry about the payment schedule.

Success rates of UPI payment app:

Enhanced client satisfaction:

Customer experiences are made frictionless by embedded or in-app UPI payments. Additionally, improved visibility across the whole client purchase funnel is made possible via embedded payments.

Higher conversions.

There are no extra hops to third-party UPI apps, retailers may enable UPI for users on their apps and guarantee a seamless experience. This frictionless state improves conversions and, eventually, retention due to the easy and flawless payment process.

Partial words:

Digital payments are made simple and reliable with UPI payment apps. They are now a crucial component of the nation's financial landscape. With a QR code scanner, you can make your payment easier. It is expected that as digital transactions advance, they will become even more safe and convenient, facilitating the growth of the cashless economy.

#open a free bank account#bank fd#net banking app#bank online application#fd credit card#digital banking#upi transaction#online banking application#fix deposit#fd account app#fast mobile banking#upi bank account#upi bank#secure upi payment#upi account#bank upi app

1 note

·

View note

Text

0 notes

Text

Explore the Benefits of Online Kiosk Banking for Easy Financial Transactions

In today’s fast-paced world, the demand for convenient, efficient, and secure banking solutions has risen dramatically. As digital banking becomes the norm, services such as online kiosk banking are revolutionizing the way individuals and businesses manage their finances. Offering a hybrid approach that combines traditional banking with digital solutions, Kiosk Banking Service Online provides users with access to various banking functions without the need for physical branches. In this article, we will explore the key benefits of online kiosk banking, how digi kiosk self-service is transforming the banking landscape, and why it’s an ideal solution for users looking for Free Digital Account opening and Instant account opening.

What is Online Kiosk Banking?

Online kiosk banking is a financial service that allows users to access banking services through digital kiosks located in strategic places like retail outlets, shopping centers, and public spaces. These kiosks are equipped with various digital tools that enable users to perform financial transactions such as deposits, withdrawals, balance inquiries, and bill payments without having to visit a bank branch. It is particularly useful in areas where there is limited access to traditional banking infrastructure.

The convenience and ease of use make online kiosk banking an excellent option for people who may not have access to online banking or smartphones, offering them a secure way to manage their money. Additionally, kiosk banking can be an invaluable resource for businesses that need to offer quick banking solutions to their customers.

The Benefits of Online Kiosk Banking

Accessibility for All: One of the primary benefits of online kiosk banking is its accessibility. These kiosks are often placed in rural or semi-urban areas where there are few or no bank branches. By making banking accessible to all, regardless of location, online kiosks help bridge the gap between traditional banking and the unbanked or underbanked population. This form of banking has empowered people who may not have easy access to a smartphone or the internet to conduct basic financial transactions. With Kiosk Banking Service Online, even individuals without internet connections can enjoy the benefits of modern banking services.

Ease of Use with Digi Kiosk Self-Service: The integration of digi kiosk self-service has made online kiosk banking incredibly user-friendly. With intuitive interfaces and step-by-step instructions, users can perform transactions independently, without requiring assistance from a bank employee. This not only saves time but also empowers customers by giving them direct control over their financial activities. Whether it’s making a deposit, checking account balances, or transferring funds, digi kiosk self-service simplifies banking processes, reducing the need for long queues or waiting times at traditional branches.

Instant Account Opening: Another major advantage of online kiosk banking is the ability to provide an instant account opening facility. Users can quickly open a bank account via the kiosk, complete with all necessary documentation and identification verification. This is particularly useful for those who need immediate access to banking services, as they can have a functional account within minutes. The process is seamless and efficient, providing a hassle-free way for individuals to get started with digital banking. No longer do people have to wait for days to get their accounts activated; they can now enjoy instant financial inclusion through Kiosk Banking Service Online.

Free Digital Account Opening: One of the most attractive features of kiosk banking is the option for Free Digital Account opening. Many banks offer zero-balance accounts that can be opened through online kiosks, allowing individuals to enter the financial system without any upfront costs. This is particularly beneficial for students, daily wage earners, and small business owners who may not be able to maintain high minimum balances. The Free Digital Account opening process is simple, requiring minimal documentation and offering features like debit cards, online banking access, and mobile banking services. This democratization of banking is a key factor in promoting financial inclusion across various demographics.

Convenient Transactions Anytime, Anywhere: Kiosk banking operates 24/7, providing round-the-clock access to banking services. This is especially important for individuals who may not have time to visit a bank during regular business hours. With online kiosk banking, users can perform essential transactions such as cash withdrawals, deposits, and fund transfers at any time of the day or night. Moreover, kiosks are strategically located in convenient places like supermarkets, railway stations, and marketplaces, ensuring that banking is just a few steps away, even in remote areas.

Safe and Secure Transactions: One of the concerns with any banking service is security, and online kiosk banking is no exception. However, advanced security measures like biometric authentication, PIN codes, and secure networks ensure that all transactions conducted through these kiosks are safe. Users can trust that their financial data is protected, and their transactions are processed without any risks. The digi kiosk self-service platform also incorporates safety protocols to ensure that only authorized individuals can access their accounts, making it a secure option for all.

The Role of Online Kiosk Banking in Financial Inclusion

Online kiosk banking plays a vital role in promoting financial inclusion by offering banking services to underserved populations. In regions where traditional banks may not be present, kiosks act as micro-banking units, providing essential financial services at the local level. Through Kiosk Banking Service Online, users can enjoy the benefits of modern banking without the need for a full-fledged bank branch.

The digi kiosk self-service model empowers individuals to manage their money, make payments, and access credit facilities, contributing to economic growth at the grassroots level. Furthermore, the availability of Free Digital Account opening encourages more people to join the formal banking sector, leading to greater financial security for individuals and communities alike.

Revolutionize Your Banking with Digi Khata's Online Kiosk Services

At Digi Khata, we offer a seamless online kiosk banking experience, providing users with easy access to essential financial services. With our Kiosk Banking Service Online, you can perform transactions like deposits, withdrawals, and balance inquiries anytime, anywhere. Our innovative digi kiosk self-service platform ensures secure, hassle-free banking. Whether you need Free Digital Account opening or instant account opening, Digi Khata makes it simple and accessible for everyone. Empowering both individuals and businesses, we help bring banking services to underserved areas, promoting financial inclusion and convenience for all.

Conclusion

Online kiosk banking offers a convenient, secure, and accessible way for people to engage in banking services without the need for a traditional bank. With features like Kiosk Banking Service Online, digi kiosk self-service, Free Digital Account opening, and instant account opening, this system is paving the way for widespread financial inclusion. Whether you’re in a rural area with limited banking infrastructure or just looking for a quicker way to access your funds, online kiosk banking provides an efficient solution for all your financial needs.

#Kiosk Banking Service Online#kiosk banking#digi kiosk self service#instant account opening#open free digital account online

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank accounts opening#zero balance account#phone banking#saving account#bank online#open online bank account app#online open account bank#create bank account online#free bank account opening online

0 notes

Text

Kotak Mobile Banking app for iPhone

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://apps.apple.com/in/app/kotak-mobile-banking-app/id622363400

#online banking account opening#bank new account opening online#account opening online#create bank account online#apply for bank account online#free bank account opening online#apply online account opening#new bank account open app

1 note

·

View note

Text

An Overview of Zero Balance Account

A zero-balance savings account is a lifesaver for many people like students, small business owners, low-income individuals, senior citizens etc. Anyone can opt for a zero balance account in India. Of course, using a savings account can be easier, but maintaining a zero-balance account is more accessible. How? Because you do not need to maintain certain balances, in your account, like savings account. So that you do not always have to worry about your minimum balance requirements. In this post, you will learn all about zero-balance accounts:

What is a zero-balance account?

A zero-balance account aims to motivate customers to save money without making them feel by restrictions or limitations. These zero-balance accounts are mainly designed for frequent users. A zero balance account in India can be opened with little effort. Account holders can withdraw additional funds when they need more cash because they have no obligations to maintain a minimum balance.

How does it work?

The majority of account holders would switch to a zero-balance account. The fact that you do not lose money by maintaining a minimum or zero balance in your account is only one of the many reasons to prefer switching to a zero-balance account. In addition, it is pretty easy because opening one does not require much time. New users are benefitted by opening a zero-balance account entitles them to several advantages, including exclusive cashback offers, movie discounts, and the use of retail vouchers during point-of-sale transactions.

Benefits of zero balance account

Centralized cash with flexibility: Your cash flow is optimized by keeping most of your funds in a primary account and managing multiple zero balance accounts. When you want to invest or take advantage of other chances, you can transfer the funds into various child accounts instead of leaving them inactive.

Easier budget management: It may be necessary and challenging to manage many accounts depending on the size and complexity of your requirements. Thanks to a zero-balance account, you can have various dedicated accounts that are streamlined and organized.

Increased visibility awareness: It is frequently simpler to internally track and audit spending. Also you easily plan or manage your overspending and to more accurately determine your daily overall cash position when money is flowing smoothly in and out of zero balance accounts.

Limited errors: Technical errors are reduced by an automated mechanism that transfers funds from the parent account into your zero balance accounts. Additionally, it shortens the time needed for each and every transaction.

Reduced chances of fraud: You can reduce the risk that unauthorized or fraudulent transactions will compromise its bank account by maintaining one main account rather than multiple accounts with bank balances.

Better spending control: Zero balance accounts are superior control instruments for monitoring spending. In most cases, authorization is required before a debit card purchase.

Closing Thoughts

Frequently, zero-balance accounts are much more automated. Complete zero balance accounts enable complete functionality for traditional and digital use. Now opt for zero balance bank account opening online and enjoy their benefits!

#mobilebanking app upi#open online savings account#open a new bank account online#banking upi mobile#upi bank account#मोबाइल बैंकिंग#apply for savings account online#online savings bank account#bank app upi#upi application#open new savings account#open a free bank account#opening a new bank account#banking mobile upi#online banking#digital account app#online digital account opening#bank online account#application for opening bank account#bank online application#opening account online#open a bank account#bank khata#open savings bank account online#fd bank#upi account#fixed deposit account#mobile banking apps#app upi mobile banking#mobile banking application

0 notes

Text

Latest technologies used in the banking sector

Gaining a thorough understanding of operations can help you perform better. Technology integration in banking has shown a whole new range of capabilities. The global financial services ecosystem is changing quickly due to technological advancements. A thorough understanding of operations can help you perform better, as technology integration in banking has revealed a whole new spectrum of capabilities. Due to technological advancements today, many people apply online bank accounts and enjoy doing banking on their phones. Here you can see about technologies used in the banking sector:

Wearable technology

Imagine your bank is with you with just a simple gesture or touch. Wearable technology makes it conceivable now but a few years ago, it might not have been. By collecting data via technologies like sensors on smartwatches, fitness trackers, communication devices, and more, wearable technology is designed to give you an immersive experience. To assist in identifying users and prevent fraudulent transactions, these digital gadgets save consumers' payments and other crucial information. Customers can gain insights by interacting with other applications, too. Data is gathered and analyzed with the aid of servers, analytics engines, and decision support tools to assist businesses in making best choices for enhancing customer experiences.

Hyper-personalized banking

Personalized banking experiences increase customer loyalty. For this reason, banks today use a variety of tactics and tools, like omnichannel banking, purchase now pay later, and financial advice tools, to customize their products. For instance, omnichannel banking enables customers to communicate with banks through various channels while offering a uniform, customer-centric picture of their financial information. Personalized advice and investment guidelines are also provided through wealth management and financial advising tools, increasing investor and client satisfaction.

Banking of things

The banking sector is using IoT to collect data effectively. This automates data collecting for expediting banking procedures, including KYC and loans, to provide real-time event response. For instance, IoT-enabled smart, automated teller machines transmit alerts when there is insufficient cash or something wrong, ensuring prompt maintenance. Additionally, customers can make purchases using IoT-enabled digital wallets incorporated into their smartphones and wearables. Due to the real-time delivery of customer-specific data through linked devices, IoT in banking facilitates fraud detection, which reduces loss. Due to the advent of technology, many people fill out bank account online application and open digital bank accounts.

Artificial intelligence

The greater usage of artificial intelligence in banking is another one of the major banking technology trends that may be anticipated in 2023. Banks can lower financial crime risk and increase fraud detection with this technology. For instance, banking software and applications can use machine learning to monitor real-time transaction data and automatically send notifications or halt transactions if suspicious behavior is found. AI can also aid in the banking industry's process optimization. By cutting expenses and improving the effectiveness of their operations, banks can save time and resources by automating activities. Banks and other financial institutions can use AI to improve customer service and make more accurate choices.

Parting words Hopefully, you will learn about the technologies used in the banking sector. A fast-growing field, banking technology has a wealth of prospects for the financial industry. This technology development stimulates many people to open digital accounts by completing the bank account online application form.

#apply for bank account online#free bank account opening online#mobile banking app#online banking app#best mobile banking app

0 notes

Text

Open a zero balance savings account online in a few simple steps!

Welcome To Your Online Zero Balance Savings Account From Kotak! Get an instant online bank account number & CRN (Customer Registration Number) so you can start banking immediately on the Kotak 811 app.

#account online opening#account opening#free bank account opening online#new bank account opening online#online account open#online bank accounts opening

1 note

·

View note

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online 0 balance account opening#online savings account opening#new bank account open#open new bank account online#open saving account#online open saving bank account#open a bank account online free#online saving bank account#0 bank account opening#instant bank account#zero balance account app#opening a bank account#bank account opening process#online savings bank account#bank account opening procedure#bank online account open#zero balance account open online

0 notes

Text

Kotak Mobile Banking App

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank account opening app#apply online bank account#bank new account opening online#apply for bank account online#free bank account opening online#online banking app#mobile banking apps#online new account open

0 notes

Text

Local Company Registration in Dubai

Local Company Registration in Dubai |Best Local company registration in UAE | Local Company Registration in Dubai,UAE

Local company registration is an essential step for businesses looking to establish a presence in Dubai. It involves registering a company with the Dubai government authorities and obtaining the necessary permits and licenses to conduct business activities within the city.

Steps for Local Company Registration

The process of local company registration in Dubai may vary depending on the nature of the business and the legal structure of the company. In general, it involves several steps, including:

1. Selecting a suitable company name

2. Submitting the required documents

3. Obtaining necessary approvals

4. Paying the necessary fees

Options for Local Company Registration

The Dubai Department of Economic Development (DED) is the primary regulatory authority responsible for local company registration in Dubai. The DED offers several options for company registration, including:

1. Sole Proprietorship: A popular option for small businesses and entrepreneurs, as it allows for quick and easy registration with minimal documentation. However, it does not provide limited liability protection for the business owner.

2. Limited Liability Company (LLC): A more common legal structure for local company registration in Dubai, offering limited liability protection and allowing for up to 49% foreign ownership. The registration process for an LLC may take longer and require more documentation than a sole proprietorship.

3. Branch Office Registration: Allows foreign companies to establish a presence in Dubai without the need for a separate legal entity. It is a popular option for companies looking to expand their operations into Dubai and the UAE.

Partnering with a Business Set-up Consultancy Firm

Partnering with an experienced business set-up consultancy firm can streamline the local company registration process and ensure that all necessary requirements are met. An expert consultancy firm can also assist with post-registration compliance, such as visa applications, bank account opening, and other legal and administrative requirements.

#Local company registration in dubai#Business registration online in UAE#Best Virtual Office Services in Dubai#Best business setup consultants dubai#Business consulting firms in dubai#Free zone company registration in uae#Audit Services in Dubai#Audit and Accounting Services in UAE#Bank Account Assistance Services in UAE#Bank Account Opening Assistance in Dubai#company registration in Dubai

0 notes