Don't wanna be here? Send us removal request.

Text

Malabar Hill: Mumbai's Most Prestigious Address

Malabar Hill is synonymous with luxury, exclusivity, and opulence. Located on the southern tip of Mumbai, this prestigious neighborhood is often referred to as the costliest area in Mumbai. Its breathtaking sea views, serene ambiance, and proximity to iconic landmarks make it one of the most coveted residential addresses in India.

A Glimpse into History

Malabar Hill has a rich history dating back to the British colonial era. It was once a popular retreat for British officers and wealthy Parsi families. Over the years, it has evolved into a haven for India's elite, attracting billionaires, celebrities, and politicians.

The Allure of Malabar Hill

Prime Location: Malabar Hill's strategic location offers easy access to South Mumbai's business districts, cultural hubs, and entertainment venues.

Breathtaking Sea Views: The neighborhood boasts stunning panoramic views of the Arabian Sea, making it a truly mesmerizing place to live.

Luxurious Lifestyle: Malabar Hill is home to some of the most luxurious residential properties in India. These opulent mansions and high-rise apartments offer world- class amenities, including private pools, gyms, and landscaped gardens.

Serene Environment: The neighborhood's serene and peaceful atmosphere provides a much-needed respite from the hustle and bustle of city life.

Proximity to Iconic Landmarks: Malabar Hill is located near iconic landmarks such as the Hanging Gardens, Kamala Nehru Park, and the Babulnath Temple.

A Symbol of Status and Success

Owning a property in Malabar Hill is not just a matter of luxury; it's a symbol of status and success. The neighborhood's exclusivity and high property values make it a coveted

investment for the ultra-rich. Reputed real estate groups like Birla Estate have their property- Birla Anayu Malabar Hill for kuxury residences and breathtaking views.

In conclusion, Malabar Hill remains the epitome of luxury living in India. Its unique blend of history, culture, and modern amenities continues to attract the elite, making it one of the most prestigious addresses in the world.

0 notes

Text

0 notes

Text

Myths and Real Facts about Online Banking:

You can complete things like transferring money and paying bills for no cost with it quickly and without visiting your bank or making a phone call. Below mentioned are the myths and truths about Internet Banking:

#upi payment#quick fd account#fd account transfer application#fd account yearly#fd account benefits#create fd#open fd online

0 notes

Text

Empowering Kids with Financial Literacy: The Role of Zero-Balance Accounts and Money Transfer App.

In today's world, where financial independence is paramount, educating your children about finance should be a top priority for parents and educators. As the financial landscape becomes increasingly complex, it's essential to equip the future generation with the skills necessary to navigate it successfully. One practical approach is through zero-balance account openings online, which can provide a gateway to financial knowledge for kids. Here’s why educating your kids about finance is so important:

Early Financial Education's Importance

While financial literacy is crucial for adults, starting financial education early sets a foundation for responsible financial behavior in children. By introducing concepts like investing, budgeting, and saving at a young age, you enable children to make informed and responsible financial decisions in the future.

Zero-Balance Accounts: A Safe and Easy Place to Start

Zero-balance accounts offer a safe and welcoming introduction to banking for kids taking their first financial steps. These accounts, which do not require maintaining a minimum balance, provide young savers an excellent starting point without the pressure of balance requirements.

No Requirements for Minimum Balance or Pressure

The zero-balance feature relieves account holders, including children, from the need to maintain a minimum balance, a common issue in traditional accounts. This allows children to focus on learning the principles of saving without worrying about balance thresholds.

Practical Educational Experience

Opening a zero-balance account for your child is not just about setting up an account; it’s about providing a practical financial education. As children watch their savings grow, they gain a real-world understanding of money's value. Engaging in activities like deposits and withdrawals fosters a sense of accountability and ownership.

The Importance of Early Savings Education

Teaching children about savings early on offers numerous benefits, laying a strong foundation for their financial stability. It helps them understand the value of money and the importance of saving for specific goals. Through this, children learn essential life skills such as goal-setting, budgeting, and responsible spending. Early savings education also instills a sense of independence and responsibility, setting the stage for lifelong financial security.

The Role of Parenting in Financial Education

Parental involvement is crucial in guiding children through their financial journey. With a zero-balance account, parents can engage in regular discussions about money, saving goals, and prudent spending. These conversations teach children valuable lessons about budgeting and future planning, imparting critical financial literacy skills. By working together to set and achieve realistic goals, parents help their children develop sound financial habits early on, preparing them for a stable financial future.

Final Words

The above points clearly illustrate the importance of teaching your kids about finance. Now that you understand the benefits, prioritizing zero-balance account openings online can be a practical first step. Additionally, incorporating tools like money transfer and UPI payments into their financial education can further enhance their understanding and proficiency in managing money in today's digital age.

By focusing on financial education from a young age, you can set your children on a path to financial success and independence, ensuring they are well-prepared to make smart financial decisions throughout their lives.

1 note

·

View note

Text

Reasons why you should switch to e-statements:

In today's digital age, everything is done electrically. With so many mobile banking app flooding our app store each month, customers are embracing the convenience and security they offer. The transition from physical banking to Internet banking is inevitable. An example is switching from paper statements to electronic statements. It is the most convenient way to track expenditures. The following are some important reasons why you should consider enrolling in e-statements.

Faster Delivery:

As you know, it takes a longer time to print and ship the paper statements. However, e-statements do not require any time to print and spend time traveling. You can generally view the statements earlier than those sent through the postal service. To do this, you just need to enroll in an e-statement through a digital banking app or bank website. You will get a notification once the statement is available.

Email Notification:

Are you worried about constantly checking your mailbox for statements? No worries! Once the statement is ready, you will receive a notification from the bank. Hence, you can view important statement inserts by simply clicking on the link provided.

Convenient Access and Retrieval:

Most people face this issue which is they do not get the paper statement on time when they need it. With e-statements, you can manage your statement at your convenience. You can also download this statement to your mobile phone or personal computer. You can also print this statement and file a hard copy for future reference. Therefore, e-statement provides huge convenience.

Increased Security:

In some situations, paper statements can get lost during the mailing process. Hence, there is a chance they might get into the wrong hands. There may be a chance for theft as the personal information is available in the statement. This could be avoided by enrolling in e-statements, as they provide you with an extra layer of security and are accessed through an online banking portal.

Save on fees:

You need to pay some fees to get a paper statement from the bank. This is to cover the cost of printing and mailing. You can avoid this by enrolling in e-statements, as they do not require any charge for printing and mailing.

Free yourself from clutter:

Using less paper is good for your home environment. Nothing is more frustrating than sifting through files to find the previous month's paper statement. You can overcome this with e-statements by efficiently organizing them in your mail.

Go green and reduce carbon footprints:

Conserving natural resources is important in today's world. Moving away from multiple-page paper statements saves trees, especially when people shift to e-statements. Also, choosing e-statements helps reduce greenhouse gas emissions associated with paper manufacturing, printing, and distributing. You can join millions of people who are trying to protect the environment.

Wrapping it up: This read has given you enough knowledge about electronic statements. If you have a bank account or want to open account, then consider registering for an e-statement. Switching from paper statements to e-statements gives you enormous benefits. Also, e-statements are absolutely free.

#net banking#internet banking#online banking#phone banking#bank account#mobile banking#e banking#bank account online#money transfer app#new bank account#digital banking#mobile banking app#digital savings account#best savings account

0 notes

Text

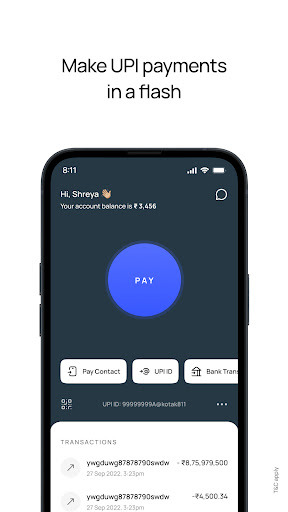

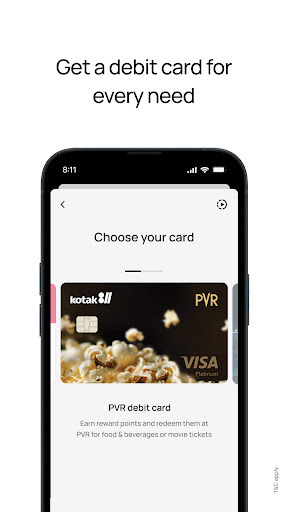

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#mobile banking#bank account online#money transfer app#bank account check#new bank account#digital banking#mobile banking app

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank accounts opening#zero balance account#phone banking#saving account#bank online#open online bank account app#online open account bank#create bank account online#free bank account opening online

0 notes

Text

Step-by-Step Process to Open Saving Account Online

A savings account is the basic account you can use to save money. Opening a savings account helps you earn interest, and you can easily deposit and withdraw funds. Many banks provide you with the feature of an online bank account opening app zero balance. It is easy and convenient for you to open your bank account online as the steps to open your account are simple and similar in most banks. Here is the step-by-step procedure to open a new savings account online:

Choose Your Bank:

Before opening a savings account, choose the bank that best fits your requirements. Some of the important features to consider before opening the account are:

Minimum balance requirement

Interest rate

Branches nearby

ATM facility

Monthly charges

Comparing between banks gives you a good understanding of the features available in the bank and helps you to make a proper decision.

Choose Your Account:

Checking or savings account: A checking account is best suited for regular transactions, ATM withdrawals, and bill payments. A savings account is best for saving your money safely. There may be some withdrawal limitations in savings accounts.

Joint account or Single account: A joint account is shared between two or more individuals, generally the child or the family members. A joint account is similar to a single account, but one or more individuals have access to that particular account. In a single account, you are the only owner of your account.

Required Documents:

It is important to provide proper documents while opening a new bank account online. Here is a list of documents you may need when opening the account.

Aadhar number linked to your mobile number

Address proof(PAN card or voter ID)

Date Of Birth

Recent passport-size photo

Some banks may ask you to submit a copy of your ID proof to the bank branch before opening an online account.

If you are opening a joint account, make sure you to keep the required documents for your partner also.

Use the app or visit the bank website:

After gathering the necessary documents, you can now visit the bank website or use the new bank account open app. Use a secure internet connection during this process to avoid cyber breaches. Navigate to the account opening section and fill in the required information. Make sure to give the correct information. Some banks may ask you to mail or fax a copy of the required documents for verification.

Complete KYC Process:

KYC is a simple process of verifying a customer’s identity before opening a new account online and there are two ways in which you can complete your KYC process. They are Aadhar-based biometrics and Aadhar OTP.

Fund You Account:

After completing all the steps mentioned above, log in to your account. It may take a few hours or days, depending on the bank. Once you log in to your account, start funding your account. You can fund your account by transferring money from your existing account if you have one, or you can mail a cheque. You can also visit the local branch to deposit the funds.

Bottom Line:

New bank account open app makes it easy for you to open a savings account effortlessly. Use the entire feature provided by the bank online. Choose the bank that meets all your requirements. Complete all the necessary information carefully and have a safe banking.

#online bank account opening#bank account kholna#online bank account opening app#open online bank account#bank account app#open bank account#open bank account online#online open bank account#new bank account open

0 notes

Text

Information on zero balance savings accounts that you should know

It is critical to manage finances effectively in today's fast-paced world. Zero balance savings accounts, are becoming increasingly common. Savings accounts are essential for everyone. One kind of savings account with no minimum balance required of account holders is a zero-balance savings account online. Since you can occasionally deposit any amount into the account, you can save whenever convenient and don't worry about maintaining a minimum balance. Here mentioned are the things you need to know about zero-balance accounts:

Benefits:

There are multiple advantages to having a zero-balance savings account. It removes the concern of keeping a minimum balance and the potential for incurring penalties. There is no obligation to deposit a sizable amount of money consistently, which motivates you to save. It is a fantastic choice for people whose income varies or whose pay schedule needs consistency. Finally, opening and maintaining a zero-balance savings account typically requires no documentation.

Points to know before opening a zero-balance account:

Interest rate:

Examine the various zero-balance savings account interest rates while avoiding minimum balance fees. Pick one that gives your deposits a respectable return.

Charges and features:

Find out the selected zero-balance savings account costs and features. Recognize any restrictions on purchases, ATM withdrawals, check issuing, and dormancy fees.

Digital Accessibility:

Choose a zero-balance savings account with a comprehensive mobile app and Internet banking features for easy account administration and transactions.

Customer service:

Consider the bank's standing in this area and select one that provides timely and beneficial support when required. It is a major consideration before opening a bank account.

How to open a zero-balance account?

It is relatively easy to open a zero-savings account online. First, look for banks and other financial organizations that provide savings accounts with no balance. Next, contrast the fees and interest rates associated with other accounts. After deciding which account best fits your needs, gather the necessary paperwork, such as identification, proof of address, and passport-sized photos, and go to the bank branch to complete the procedure. Alternatively, many banks let you finish this procedure online while lounging in your house.

Ways to make money with a zero-balance account:

Here are some suggestions to make the most out of your savings account with no balance:

Have a monthly amount automatically sent from your checking account to your savings account. Over time, this can assist you in continually saving money.

To accelerate your funds' growth, pick a high-interest-rate savings account.

Always be on the lookout for any promotions or special offers that banks may have for accounts with no balance. These may enable you to win prizes or earn additional income.

Bottom line:

A zero savings account online can be a wonderful option to save money without worrying about keeping a minimum amount. Knowing that your money is growing and protected can provide comfort, making it a flexible choice for those with erratic incomes. You can easily open and keep up a zero-balance savings account and take advantage of all the perks it offers with some study.

#open account online zero balance#online bank account open#open bank account#best zero balance account opening online#open bank account online zero balance#zero balance current account opening online#open new bank account#bank account opening with zero balance#open account#create new bank account online

0 notes

Text

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Zero balance account: How small business can benefit from it:

Suppose you are a small business owner and want to make transactions without worrying about fraudulent activity and to keep track of the account you can choose a zero balance account. Typically, the company's main account contains zero balance to avoid suspicious activity. The secondary account includes the company's funds in which the interest rates are high while the zero balance account contains low or no interest. Opening a zero balance account provides so many features.

How does it work?

Consider having both accounts in the same bank. Transactions will be made easily from the primary account to the secondary account. The secondary account contains the main balance. If any charge is posted on the primary account, the secondary account transfers money to the primary account. Only the required amount will be transferred, not more than that.

At the end of the day, if any amount is left in the primary account, it will be automatically transferred to the secondary account if you use the same bank.

Benefits of having a zero balance account.

Reduce risk:

The main advantage of having a zero balance account is that it reduces fraud activity. The primary account, which is the main account of the business, contains zero balance, which reduces the risk of suspicious activity or being stolen.

Track cash flow:

Another advantage of having a zero-balance account is that it helps keep track of the cash flow. You can easily identify the overspending transactions. If you want to provide some funds, and your accounts are linked, you can easily transfer the amount and keep track of the transaction activity.

Saves time:

It helps you to manage the task easily as the accounts are linked, and the transactions are automatic, which saves your time. You can have multiple zero-balance accounts. For example, you can have one account for funds, another for paying the amount, and another for receiving the amount.

Reduce transactional Fees:

Banks charge a certain amount for transactions from one account to another, but having a zero-balance account linked to the main account eliminates the need for transactional fees.

Reduce Maintenance Fee:

Having one main account and another account as a zero balance account helps you reduce the maintenance fee as the bank charges a certain amount for maintaining the balance in the savings account, it helps reduce the maintenance fees.

Overdraft facility:

Some banks allow overdraft facilities, which means you can withdraw more than the available balance. You need pre-approval for this feature. This overdraft facility is helpful in emergency situations.

Services:

The bank provides the necessary 360-degree services to this account, thus helping small business owners. Opening an online zero balance account is a faster and simpler process and does not require more documentation.

In closing:

Zero balance accounts are best suited for small business owners and startups to maintain their balance and keep track of their transactions. It offers several benefits for your account maintenance if you look forward to opening a zero-balance account check for banks that meet your needs.

#zero balance account opening app#online new account opening zero balance#free online bank account opening with zero balance#bank account zero balance open#zero balance open account online#open zero bank account#open new bank account online zero balance#online bank zero account opening#new zero account opening

0 notes

Text

Ways online banking makes your life easier

What was the purpose of your most recent visit to a bank? It is okay if you don’t remember at all. However, you are losing the benefits that online banking provides if you just went to the bank last week to draw a demand draft in the name of your uncle, who lives in a different city.

Your life is easier when you bank online. All you need to get started is an internet-connected computer, tablet, or smartphone. So, read this article to know about how Fast Mobile Banking makes your life easier.

Tracking your account activity anytime, anywhere

You get instant access to all of your payments, withdrawals, deposits, and other account information. You get instant access to your account, no matter the time of day—even at midnight or midday. You can also stay informed about any fraudulent behavior as you get real-time transaction alerts.

Bill payments are made easily.

You can say goodbye to cheques, lengthy lines, and late fines. You can automate your online bank account to pay your monthly utility payments, including credit card and insurance premiums, phone and mobile bills, and energy. You don't even need to keep track of the deadlines because your Online Banking app will make sure your payment is made on time every month on the designated date.

Transfer funds in a click-second

Suppose, when shopping, your mother discovers she does not have enough money in her account to cover the purchases. All you have to do is take out your smartphone, use the IMPS banking feature to send money instantaneously, and you're done.

You can use NEFT or RTGS anywhere in the nation to transfer any amount between accounts held by the same bank or by a different one.

A wide variety of services

In addition to many other things, you can apply for a credit card or personal loan, recharge your phone, issue a demand draft to a friend or relative, have it delivered to their home in a distant city, etc. It is even possible for you to:

Pay your credit card bills online

Get a loan on your card

Apply for another new card

Request a credit line increase

Report lost card

Online Shopping

You can now make purchases from your preferred online retailers thanks to a safe multi-level PIN system. Use your debit or credit card to make online movie ticket purchases, plan a vacation, or take a bus, train, or airplane trip.

You should start using internet banking for more reasons than just the ones listed above. Now that you've saved so much time, you have more time to engage in activities you enjoy.

Wealth management

It's simpler to manage your wealth online. Open a fixed deposit to receive higher returns if you don't want your money sitting around. Mutual fund investments and stock market trading are also possible with an integrated investment/demat account.

Upon investing in stocks or mutual funds, the transaction amount will be automatically deposited to your bank account or deducted from it. Using Systematic Investment Plans, or SIPs, is another methodical approach to investing in mutual funds.

Final thoughts These are only the few benefits you enjoy if you use Online Banking apps and services. So start your savings account online and make your life easier.

#bank open account online#bank khata kholne wala app#banking app#account open online bank#online bank opening account#online bank account opening app#bank khata#open online bank account#open bank account#open bank account online#online open bank account#bank online account open

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#zero saving account open#open free zero balance account online#open online zero balance savings account#zero online bank account opening#best zero balance account online opening#new zero account opening#online bank zero account opening#open new bank account online zero balance#open zero bank account#zero balance open account online#bank account zero balance open#free online bank account opening with zero balance#online new account opening zero balance#zero balance account opening app

0 notes

Text

Birla Navya Gurugram | 3 BHK & 4 BHK Premium Floor Residences at Golf Course Extension, Gurugram

Indulge in Living at Birla Navya Gurugram | 3 BHK & 4 BHK Premium Floor Residences at Golf Course Extension , Gurugram | Birla Navya Amenities | Birla Navya Location | Birla Estates Gurugram

0 notes