#bank account online

Explore tagged Tumblr posts

Text

That moment of anxiety before checking your bank account after a weekend out… maybe ignorance is bliss.

12 notes

·

View notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account app#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app

2 notes

·

View notes

Text

UPI: The Force Behind Inclusion and Economic Growth

In this rapidly evolving world of digital finance, the Unified Payments Interface (UPI) has emerged as a powerful driver of economic growth and financial inclusion. UPI has revolutionized the way transactions are handled. It plays an important role in promoting a more inclusive and robust economic landscape.

Download App :

#net banking app upi#upi bank#fast mobile banking#bank account online#bank upi#contactless banking#mobile banking apps in india#safe mobile banking#quick fd account creation#app upi mobile banking#upi account number check#banking mobile upi#phone banking#upi mobile banking app#upi account check#new bank account#bank online account#mobilebanking app upi

2 notes

·

View notes

Text

ICICI Corporate E-Banking Internet Banking Login: Your Guide to Seamless Business Banking Online

The ICICI Corporate E-Banking Internet Banking Login is a revolutionary online banking solution that empowers businesses to manage their financial transactions with ease and security. This platform enables businesses to access a range of banking services, from fund transfers and account management to bill payments and payroll processing. With its robust security features and user-friendly interface, ICICI Corporate E-Banking Internet Banking Login offers businesses a secure and efficient way to handle financial operations in today’s digital world.

What is ICICI Corporate E-Banking Internet Banking Login?

The ICICI Corporate E-Banking Internet Banking Login is a secure online portal designed for businesses to manage their banking transactions. It offers services like fund transfers, bill payments, and more, all accessible with just a few clicks. ICICI Corporate E-Banking ensures that businesses can conduct their financial operations safely and efficiently from anywhere in the world.

Key Features of ICICI Corporate E-Banking Internet Banking Login

Secure Transactions: ICICI Corporate E-Banking Internet Banking Login comes with advanced security protocols like multi-factor authentication and encryption to keep your business data safe.

Efficient Fund Transfers: Easily transfer funds between business accounts or to third parties using the ICICI Corporate E-Banking platform.

Bulk Payments: The ICICI Corporate E-Banking Internet Banking Login allows businesses to handle bulk payments, ensuring timely disbursements of salaries, vendor payments, and more.

Account Management: With ICICI Corporate E-Banking, businesses can track their accounts, view transaction histories, and generate detailed financial reports to keep track of their operations.

Customizable Settings: Businesses can tailor their ICICI Corporate E-Banking account settings, including user permissions and access rights.

How to Log In to ICICI Corporate E-Banking Internet Banking?

To access ICICI Corporate E-Banking Internet Banking Login, follow these simple steps:

Go to the official website.

Click on the "Login" button located at the top-right corner.

Enter your User ID and Password.

If prompted, provide additional authentication like an OTP or security token.

Click "Login" to access your business account.

Benefits of ICICI Corporate E-Banking Internet Banking Login

Convenience: The ICICI Corporate E-Banking Internet Banking Login provides businesses with 24/7 access to banking services, allowing them to manage their accounts anytime, anywhere.

Improved Security: With robust security features, ICICI Corporate E-Banking ensures that all transactions are protected from unauthorized access.

Time-Saving: ICICI Corporate E-Banking Internet Banking Login reduces the need for physical visits to the bank, saving valuable time and resources.

Streamlined Operations: The ICICI Corporate E-Banking platform helps businesses streamline their financial processes, making them more efficient and organized.

Troubleshooting Issues with ICICI Corporate E-Banking Internet Banking Login

If you encounter any issues while logging in, consider these troubleshooting steps:

Verify Credentials: Double-check that your User ID and Password are entered correctly.

Clear Browser Cache: Clear your browser’s cache and cookies if the login page isn't loading properly.

Reset Password: If you forget your login credentials, use the “Forgot Password” feature to reset your password.

Contact Support: For unresolved issues, contact ICICI Corporate E-Banking customer support for assistance.

FAQs

Q1: What is ICICI Corporate E-Banking Internet Banking Login?

Ans. The ICICI Corporate E-Banking Internet Banking Login is an online banking portal for businesses to manage their accounts, process transactions, and conduct financial operations securely.

Q2: How can I log in to ICICI Corporate E-Banking?

Ans. To log in, go to the ICICI Corporate E-Banking website, enter your User ID and Password, and complete any required security steps.

Q3: Is ICICI Corporate E-Banking safe to use?

Ans. Yes, ICICI Corporate E-Banking Internet Banking Login uses high-level security features like encryption and multi-factor authentication to ensure the safety of your business data and transactions.

Q4: Can I make payments through ICICI Corporate E-Banking?

Ans. Yes, the ICICI Corporate E-Banking Internet Banking Login enables businesses to make payments, transfers, and manage accounts with ease.

Q5: What do I do if I forget my ICICI Corporate E-Banking login credentials?

Ans. If you forget your login details, use the "Forgot Password" option on the ICICI Corporate E-Banking login page to reset your credentials.

Conclusion

The ICICI Corporate E-Banking Internet Banking Login offers businesses a secure, efficient, and easy-to-use platform to manage their financial operations. With features such as fund transfers, bulk payments, account management, and more, businesses can conduct their banking activities at any time, from anywhere. The robust security measures ensure that all financial data remains protected, giving businesses peace of mind. By utilizing the ICICI Corporate E-Banking platform, businesses can streamline their operations and improve efficiency.

Summary

The ICICI Corporate E-Banking Internet Banking Login is a vital tool for businesses to manage their financial transactions online. It provides secure access to services like fund transfers, account management, and bulk payments. With user-friendly features and state-of-the-art security, ICICI Corporate E-Banking simplifies corporate banking. Follow the easy steps to log in, and enjoy a more efficient and secure way to handle your business finances.

#bank account online#axis bank#banksy#west bank#banking#manager#max bankman#business loan#sarkariyojana

0 notes

Text

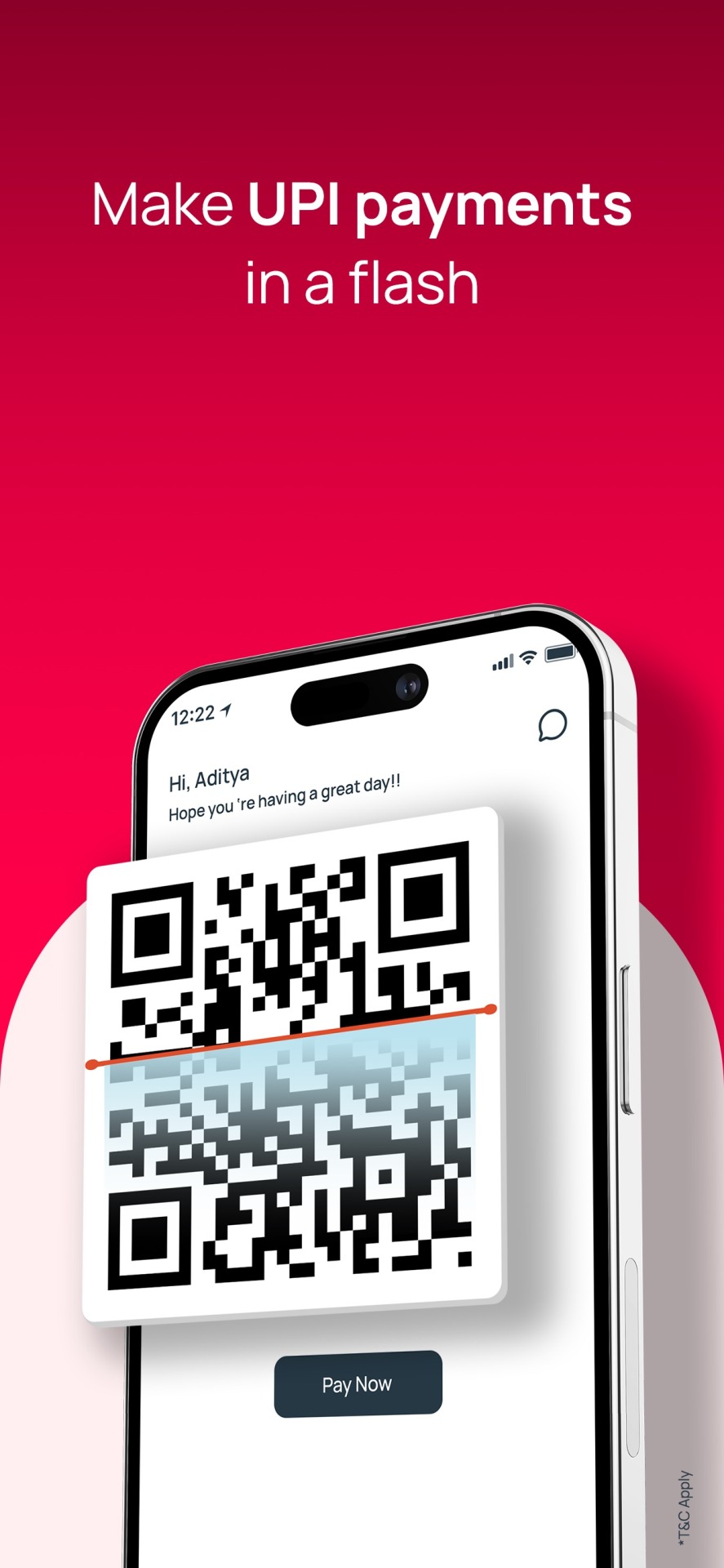

A Beginners Guide To Fund Transfer Using QR Codes:

Digital payments have revolutionised the way customers used to make payments. Debit cards, credit cards, digital wallets, and now QR codes are used to pay for a purchase. Smartphones facilitate easy cashless fund transfers for purchases. It relieves you of the burden of carrying money whenever you go out.

You can make QR payments by scanning the code and initiating a money transfer from your account to the seller’s account. The mobile wallet completes the transaction by transferring money from your account once you validate the transaction.

Are you here to seek information about QR codes? Are you new to the QR code ecosystem? Welcome to this new revolutionary payment system. Here is a quick guide for the QR code noobs.

What Is A QR Code?

It is a two-dimensional scanning code with a black-and-white square on a white backdrop. Any smart mobile with a QR code reader can scan the code and complete a transaction. They are better than barcodes as these codes can store huge data. The automotive industry used these codes before the payment ecosystem started using them. QR codes can help to initiate a payment, donate money to charitable institutions, and design creative marketing initiatives. These codes facilitate cashless payment.

Types Of QR Code Payments:

You can scan QR codes with a bar code or a smartphone. They can be used for bank balance enquiries also. It is a faster payment option than credit cards because all you need to do is download the QR code App. Open the mobile camera, scan the merchant code, and you are done! There are different types of QR payments.

Payment to Merchant:

Once you finish buying in a supermarket or a local store, you open a payment application. The merchant would enter the payable amount in his POS system. You have to scan the barcode of the product and complete the transaction. When you buy online, this process is done by adding your desired product to the cart.

Scan the QR code of the receiver:

You need to open your mobile camera to scan the code on the bill. The transaction will be completed once scanning is complete. Every store has a unique application. They will provide offers once you finish payment using a store-specific app.

App to App payment:

It facilitates payment of money from App to App. The recipient opens his App and you scan it through the app on your mobile. You need to check whether the details entered are correct and complete the transaction.

Benefits of using QR codes:

There are multiple benefits to using QR codes. They are:

Easy payment experience.

Enables easy data collection and identification.

Secured method of payment.

Cost-effective as they don’t need any equipment to facilitate payment.

Final Words:

QR codes are an effective payment mode. If you have a smartphone, or QR reader on your mobile, you have completed a transaction. There is an expected 58% growth in the QR payment market by 2028. They are easy to use and a secure method of cashless payment. You only need to scan the QR code scanner and make digital payments. When your seller scans the QR code on your mobile, your bank sends a code and the vendor uses his bank account to facilitate payments.

#online savings bank account#new bank account online#mobile banking account app#bank account opening online zero balance#online new account open#opening account online#bachat khata#open a savings account#online new bank account opening#online savings account opening#instant account opening online#online saving bank account#online open saving account#bank account online#open a free bank account#bank fd#open a bank account online free#mobile banking app#online digital account opening#banking app#open a new bank account#apply for savings account#bank app#opening a bank account#online savings bank account opening#open savings bank account online#account online open#apply for savings account online#mobile banking apps#bank account online open

1 note

·

View note

Text

Short-Term vs. Long-Term Fixed Deposit

When it comes to financial planning, choosing the right investment option can make a big difference in achieving your financial goals. For these reasons, fixed deposits are the popular choice. You know what? You can watch your money grow steadily with predictable returns from your fixed deposit. They come with short-term and long-term options. But what are the advantages and which one should you choose? Instead of confusing yourself, continue to read this article to find out.

What are Short-Term and Long-Term FD?

Short-term deposits are investment accounts requiring a minimum investment of 7 days up to a maximum of 2 years. They allow you to deposit a specific amount of money for a short duration, enabling it to grow over time.

Long-term deposits are the type of investment where you can deposit your money for an extended duration ranging from 5 to 10 years.

Short Term vs. Long-Term FDs

Investing your money is about choosing the financial instrument and determining the duration you invest your funds. Short-term deposits offer minimal interest amounts compared to long-term fixed deposits.

However, they provide more flexibility and liquidity, which allows you to access your funds whenever needed. In the same way, long-term fixed deposits also offer higher liquidity and more gainful returns.

Advantages of Short-Term FD

Below are the most important advantages of short-term fixed deposits.

Liquidity

Because of the higher liquidity, short-term deposits will be the best choice for accessing your funds shortly. You can also break your short-term FD account without getting any severe penalties. This makes it an ideal choice for dealing with unexpected financial needs. You can easily check balance to monitor your investments.

Lowered Interest Rate Risk

With the short-term fixed deposits, you are less exposed to the interest fluctuations. If interest rates decline, your investments will not be locked for an external period. This allows you to reinvest with higher interest rates when the market grows.

Interest Rate Adaptability

They provide the benefit of being able to change your interest rates. If there are any rises in the interest rates, you can reinvest your funds in a new and higher interest rate after the maturity of your short-term fixed deposits.

Advantages of Long-Term FD

While short-term FDs have their own benefits, long-term benefits have more advantages.

Consistency and Predictability

Long-term FDs offer a consistent and predictable source of interest rates. You can benefit from this predictability if you search for a regular income stream or plan for a long-term financial goal.

Increasing Growth

The long-term FD allows your money to grow with the help of compounding. The interest amount you have earned from this is reinvested in your cash and increases growth over the period.

Increased Interest Rates

Compared to short-term FDs, long-term FDs offer higher interest rates. Thus resulting in higher interest rates over the period. This increase in interest rate helps you to grow your money effectively.

Wrapping It Up

Ultimately, the choice between long-term and short-term FDs varies depending on your needs and preferences. Short-term FD will be helpful for you if you need flexibility and access to your money in a short period. You can alsocheck transaction history to manage and review your investments. Long-term FDs will suit you if you want to grow your wealth over time, are looking for a steady income, or are planning your retirement. Choose wisely and enjoy the utmost benefit of FD it offers.

#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app#bank balance enquiry#bank balance enquiry app#bank best fixed deposit rates#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit#bank fixed deposit rates

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#open a bank account#open new savings account#online savings account opening#open online savings account#zero balance bank account opening online#bachat khata#0 balance bank account open online#online savings bank account opening#bank account opening process#zero balance account opening online#new bank account open online#saving account opening online#online saving bank account#online savings bank account#open savings bank account online#online open account in bank#digital account opening#account online open#bank account online#mobile banking application#open a bank account online#fd account app#online open saving account#online open saving bank account#digital account app

0 notes

Text

Recent Trends in the Banking Sector

People can earn money in many ways, but managing the money is the most important thing. Nowadays, banks play an essential role in money management. We are living in a digital world. So, every quick money transfer is easily handled through digital transactions. Previously, you had to visit a bank directly to open an account and for every banking need. But now, the banking trends have been developed, and everything is digitalized, so there is no need to visit a bank for every purpose. You can access the option through the digital platform provided by the banks. Here, you can see the recent trends in banking.

Digital Banking

If you want to deposit or withdraw an amount previously, you have to go to the bank and fill out the form. Only then can you make the transaction. You have to wait for long in the queue. But now everything is digitalized even for opening, you do not need to go to the banks. Everything is done with the help of online portals, internet banking, and mobile banking apps. You can easily use credit cards, debit cards, and digital wallets without carrying cash.

Automation in Banking

Automation combines robotic process automation (RPA) with Artificial Intelligence (AI) and Machine Learning (ML) technologies to automate complex and critical business tasks. Banks can automate repetitive tasks such as data entry, document processing, and customer onboarding. It reduces errors and improves the efficiency of banking systems.

AI & ML Technologies

Artificial Intelligence and Machine Learning technologies are highly used in bank sectors to improve the efficiency of operations, fraud detection, and improve customer experience. AI-driven chatbots and virtual assistants to improvise customer assistance by providing 24/7 chat support. These technologies also enhance the overall customer experience and strengthen security measures.

Block Chain Banking

Blockchain technology is a decentralized distributed ledger system that enables safe and transparent transactions between two parties without requiring the involvement of a third party. A list of transactions is contained in each of the connecting blocks that make up the ledger.

Regtech Technology

The integration of tools and technologies designed to help banks and insurers manage compliance and regulations is called Regtech (Regulation Technology). Banks' increased use of AI, blockchain, big data, and machine learning algorithms has made improving risk management capabilities and automating compliance processes a top priority.

Internet Usage

The Internet is used for every bank process. A physical device connected to the Internet gives notifications about your banking activities. You can search for your nearby ATMs, do UPI money transfer, and do all the mobile banking activities with the help of the Internet. The Internet integrated Hospitals, Education Institutions, Shopping Malls, and merchandise shops with the bank.

Winding up Digital banking helps you live a cash-free life, like using UPI payment services. Now, banking trends and technologies are growing very fast. They will become more efficient every day. It gives you real-time security about your bank accounts. Also, the new and upcoming trends will make many changes in the future.

#0 account opening bank#0 balance account#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#मोबाइल बैंकिंग#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account#bank account app#bank account check#bank account check app#bank account kholna#bank account online

0 notes

Text

VillagePe: Revolutionizing Instant Credit Card to Bank Account Transfers

In today’s fast-paced world, the need for instant financial solutions is paramount. With countless transactions happening every day, people look for ways to simplify processes and make financial management easier. Enter VillagePe, a fintech solution that brings a much-needed change to how people handle their credit card transactions. VillagePe enables users to transfer money from their credit cards directly into their bank accounts, with an added focus on speed, security, and added rewards.

1 note

·

View note

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#digital account app#upi net banking app#upi registration#upi account#premium mobile banking#fd account#upi mobile banking#mobile banking account app#mobile banking upi#mobile banking account#fixed deposit account#create fd#bank khata#fast mobile banking#digital account#fd bank#bank account online#mobile banking application#online fd#bank fd#mobilebanking app upi#banking mobile upi#online fd app#bank online account#check balance#manage bank account online#mobile banking apps in india

0 notes

Text

How UPI App can teach money management to kids?

Kids have become more techno-savvy than elders, of late. Teens and tweens have to learn to manage their pocket money. Parents can advise them about money management to make them realise its importance. Many mobile banking apps can do the work for you. Since the attention span of your teen is only 8 seconds, these kid-friendly apps can provide this information in bits and pieces.

There are multiple options for money payment and it is surprising to see 350 million teens using the UPI payment App. This intensifies the fintech sector to cater more vigorously to this section of the population, recently.

Now let us discuss how these apps help your kid manage his money. They are:

Kids learn the importance of security: Increased usage of the pocket money app will help the kids make instant payments with more security. Parents can help the kids understand the safety protocols that help them make a safe payment. These kids can now use UPI in the nearest grocery shop or for online shopping.

Kids feel appreciated: When more and more retail brands offer discounts for making payments through pocket money apps, these kids feel acknowledged, and appreciated.

Kids learn to maintain secrecy: Teens using UPI would deal with PINs to operate it. Parents should help them understand the importance of maintaining secrecy to keep money safe. Take your kid to the nearest ATM centre and show him how to enter the PIN without others' knowledge. Thus he can make a transaction less vulnerable to fraud.

Assist them to mature wisely: When the UPI app helps them satisfy their needs through instant secured payment. Now, they don't need to wait for their parents to buy them a notebook or a burger.

Safety tips for teens while using the UPI app:

Usually, the UPI App is connected to a bank account and enables the users to check their balance to identify an unknown transaction. But, kids can have mobile UPI apps without having a bank account. We know that more and more teens and tweens are using UPI lately. It is an undeniable fact that these are time-saving apps. But are they safe for children?

Let us see some of the safety tips to protect them from fraudsters.

Do not tell PIN to friends: Instruct your kid not to share ATM PIN with anyone. Fraudulent transactions are more common now and the kid would lose money to fraudsters.

Set strong passwords: Advise your kids to set strong passwords to lock the mobile and UPI app. It will prevent unauthorised entry into your app by strangers. People usually create a combination of dates of birth to remember passwords. But cheaters may identify it easily.

Let kids use one App: Ask your kid to use only one UPI app to avoid confusion. Moreover, using multiple apps enables the tricksters to cheat him easily. Never fall prey to lucrative offers and have multiple UPI app accounts.

Update your UPI App: If you use the UPI payment App, don't forget to update them. Updating Apps would provide new features and better benefits.

Final Words:

Modern parents allow the younger generation to handle their own money. Kids get an opportunity to learn money management at a younger age. 2022 saw an upsurge in teens and tweens using the UPI payment app for monetary transactions. They should be cautious while using the app. Otherwise, they tend to lose money.

#upi bank account#upi account#upi registration#digital account#secure net banking#fixed deposit account#fd transfer account#mobile banking account#phone banking#bank khata#mobile banking account app#mobile banking application#fd card account#banking app#mobile banking upi#bank online account#bank account online#online bank#phone banking app#best net banking app#fd bank#banking mobile upi#instant bank account online transfer#app upi mobile banking

1 note

·

View note

Text

Safe Mobile Banking: What to Consider When Choosing Mobile Banking App?

You can easily access your bank account with mobile banking apps. You can check your history, make transactions, pay invoices, and examine account balances. Locating an online banking app with these common features is relatively easy. Numerous financial organizations provide banking services via their mobile apps. While online banking is also available from banks and credit unions, the advantages of mobile banking apps that operate without physical locations are typically higher. When choosing amobile banking app, you must consider a few important things to have a safe online banking experience. Continue reading about what to consider when selecting a mobile banking app:

Fees and ATM Network

Consumers may find fees like overdrafts, ATM transactions, and monthly payments inconvenient. Choose the expenses that will affect you the most and look for mobile banking apps that charge little or nothing for those services. ATM users should regularly see if an app has nearby locations and what network it operates on. ATM networks help you save money on each transaction by lowering or eliminating ATM fees. ATM transactions are fee-free with certain mobile banking apps.

Ease of Use

The mobile app for your bank should be easy to use and simple, and it should work on both Apple and Android smartphones. On your first app usage, allow yourself around half an hour to find everything you need, depending on how comfortable you are with mobile applications. It could be a better app, but it will irritate you later if it initially looks overwhelming. Digital wallets can be integrated with a good banking app.

Account Minimums

Mobile banking app frequently set minimum deposit and balance requirements. Sadly, some of these minimums exceed what most individuals want or can pay. If the minimum balance on your account is not met, they could charge you fees. Make a shortlist of the mobile banking apps that offer minimal payments that are less than your means. Certain banks make opening a checking or savings account simpler by not having any minimum requirements.

Compare features and functions

Different mobile banking apps have different features. While some include more sophisticated features like budgeting tools, investing alternatives, and rewards programs, others only provide basic services like bill payment, balance checking, and fund transfers. Depending on your habits and aspirations, you could seek an app to help you reach your financial goals or include the features and functionalities you use most frequently. For instance, you can look for an app with goal-setting tools, automatic savings plans, or cash-back incentives if your objective is to save more money.

Mobile Deposit

The best banking applications provide features like mobile check capture and electronic check deposit. With just a few taps on the app, you can enter the deposit amount, snap pictures of the front and back of the check, and quickly get confirmation that the bank has received and is processing your deposit.

Bottom Line

When you are looking for a UPI application choose one with good features. Then, search for one that provides a safe and easy way to access your accounts from your smartphone whenever possible. With the right mobile banking app, you can watch your spending, save money, raise or lower your credit score, and have access to budgeting and financial tools.

#mobile banking account app#upi bank app#phone banking#net banking app upi#banking mobile upi#internet banking app#upi account create#bank online account#net banking#upi net banking#upi bank#bank account online#net banking app#mobile banking apps in india#best net banking app#phone banking app#internet banking#fixed deposit account

0 notes

Text

Tallyman Collection: A Fashion Statement with Quality, Style, and Versatility

The Tallyman Collection is synonymous with timeless fashion, offering a range of stylish, high-quality clothing for both men and women. Known for its versatile designs, it has become a staple in many wardrobes. Whether you're looking for smart casual wear, office attire, or evening elegance, the Tallyman Collection delivers on every front. In this article, we explore the key features, popular items, and styling tips that make the Tallyman Collection a must-have for fashion enthusiasts.

What is Tallyman Collection?

Tallyman Collection is a renowned fashion line that offers an extensive range of premium apparel, combining modern trends with classic designs. With a commitment to quality fabrics and expert tailoring, this collection has become a go-to for individuals seeking stylish and versatile clothing. The brand’s diverse offerings cater to a variety of fashion needs, from office wear to casual day outs, ensuring there’s something for every occasion.

The Evolution of Tallyman Collection

Over time, Tallyman Collection has evolved from a niche brand into a trusted name in the fashion industry. With a focus on both contemporary style and timeless classics, the collection has gained a loyal customer base and is recognized for delivering high-end designs that never go out of style.

Key Features of Tallyman Collection

Tallyman Collection is known for its several distinguishing features that set it apart from other fashion brands:

Premium Fabrics: The collection uses only the finest materials, ensuring comfort, durability, and luxury in every piece.

Versatile Designs: Whether for formal, casual, or semi-formal occasions, the collection offers versatile options to suit every style.

Timeless Appeal: Tallyman pieces are crafted to stay in fashion season after season, offering enduring value with their classic cuts and modern sensibilities.

Attention to Detail: Each item is designed with care, showcasing meticulous stitching, perfect fits, and thoughtful finishing touches.

Sustainable Fashion Choices

Tallyman Collection also focuses on sustainability, using eco-friendly fabrics and ethical production methods, making it a fashionable and responsible choice for conscious consumers.

Popular Items in the Tallyman Collection

The Tallyman Collection features a wide array of popular items that have become wardrobe essentials for many fashion-forward individuals:

Tallyman Shirts: Known for their sharp cuts and comfortable fits, Tallyman shirts are perfect for office wear and casual outings alike.

Tallyman Jackets: Elegant yet functional, these jackets are perfect for both formal and informal settings, adding a sophisticated touch to any outfit.

Tallyman Suits: Crafted with precision, Tallyman suits are tailored to perfection, ideal for business meetings, formal events, or any occasion where you want to make a lasting impression.

Tallyman Trousers: These trousers offer the perfect balance of comfort and style, available in various cuts to complement every figure.

Signature Pieces

Some of the standout items in the Tallyman Collection include leather jackets and tailored blazers, which have become iconic for their durability and timeless style.

How to Style Tallyman Collection Apparel

Styling Tallyman Collection clothing is simple due to its versatile designs. Here are a few ideas on how to incorporate these pieces into your daily wardrobe:

For Work: Pair a crisp Tallyman shirt with tailored trousers and formal shoes for a polished office look.

For Casual Wear: Opt for a Tallyman jacket over a simple t-shirt and jeans for a chic yet laid-back style.

For Special Occasions: Tallyman suits, when paired with classic accessories like a tie and dress shoes, create an elegant ensemble perfect for weddings, corporate events, or formal dinners.

FAQs

Q1: What types of clothing are available in Tallyman Collection? A1: Tallyman Collection offers a wide range of apparel including shirts, trousers, jackets, suits, and casual wear, suitable for various occasions.

Q2: Where can I purchase Tallyman Collection clothing? A2: Tallyman Collection can be purchased through official brand stores, online retailers, and select fashion boutiques.

Q3: What is the price range of Tallyman Collection items? A3: Tallyman Collection offers high-quality fashion at a mid-to-premium price range, ensuring accessibility without compromising on quality.

Q4: Does Tallyman Collection offer clothing for both men and women? A4: Yes, Tallyman Collection provides stylish clothing for both men and women, with options for a wide range of occasions.

Q5: Is Tallyman Collection eco-friendly? A5: Yes, Tallyman Collection is committed to sustainable fashion, using eco-friendly fabrics and ethical manufacturing processes.

Conclusion

Tallyman Collection stands as a beacon of quality, style, and versatility in the fashion industry. Its carefully crafted designs and premium fabrics ensure that every piece is a long-lasting investment for any wardrobe. Whether you're looking for smart work attire, casual everyday wear, or something special for an event, Tallyman Collection offers a variety of options to suit every style and occasion. By blending classic elegance with modern trends, Tallyman has established itself as a top choice for fashion lovers who appreciate timeless pieces with a touch of sophistication.

#banking#personal finance#axis bank#tally marks#million#money#bank account online#online payments#technology

0 notes

Text

Cracking the Code: Your Guide to Opening a Business Bank Account in the UAE

Opening a business bank account is a crucial step when setting up your company in the UAE. With its strategic location, business-friendly policies, and booming economy, the UAE is a hotspot for global entrepreneurs. However, navigating the business bank account opening process can be a bit complex, especially for those unfamiliar with the local system. In this guide, we’ll walk you through the essentials of opening a business bank account in the UAE, as well as highlight key aspects to consider when you setup Dubai business ventures.

Why Opening a Business Bank Account in the UAE Is Essential

Opening a business bank account in the UAE is mandatory for conducting business transactions, managing company finances, and maintaining compliance with local regulations. It also ensures transparency, accountability, and credibility in your business dealings. Whether you’re looking to setup a Dubai business or expand your operations in the UAE, a business bank account is critical for maintaining proper financial management and accessing the many services offered by UAE banks.

Step 1: Choose the Right Bank for Your Business

The UAE is home to a wide range of local and international banks, all offering diverse services tailored to various types of businesses. Some of the most popular choices for business banking include Emirates NBD, Mashreq Bank, First Abu Dhabi Bank (FAB), and international institutions like HSBC and Citibank.

When selecting the right bank, consider the following factors:

Type of Business: Some banks cater better to specific industries, like startups, SMEs, or large corporations.

Transaction Volume: Evaluate whether the bank offers solutions that suit the size and scale of your business.

Global Reach: If your business operates internationally, you may prefer a bank with strong international capabilities.

Customer Service: Look for a bank that provides excellent customer support and easy access to account managers.

Step 2: Get the Required Documents in Order

Once you’ve selected your bank, the next step in the business bank account opening process is to gather the necessary documentation. Banks in the UAE typically require a comprehensive set of documents to ensure that your business is legitimate and compliant with regulatory requirements.

Commonly requested documents include:

Trade License: Issued by the relevant UAE authorities, this is a fundamental document that proves your company’s legal standing.

Certificate of Incorporation: This proves that your company is officially registered in the UAE.

Shareholder and Director Information: Detailed profiles and passport copies of the company’s shareholders and directors.

Memorandum of Association (MOA): This document outlines the structure, purpose, and rules governing your business.

Proof of Address: A utility bill or lease agreement that verifies the company’s physical location.

Personal Identification: Passports, visas, and Emirates ID for the company’s shareholders and directors.

Additional documents such as business plans, financial statements, or contracts with suppliers or clients may also be required depending on the nature of your business.

Step 3: Understand the KYC (Know Your Customer) Process

UAE banks adhere to strict anti-money laundering (AML) regulations, which means they implement a thorough Know Your Customer (KYC) process during the business bank account opening stage. As part of this process, banks will verify your business’s background, transaction history, and potential risk factors.

Expect the bank to ask for detailed information about your:

Business Activities: The nature of your business, including industry, market, and operational details.

Revenue Projections: Expected turnover and revenue sources.

Client Base: Key customers and geographical markets.

Business Plan: A document outlining your company’s growth strategy and financial projections.

Being transparent and providing clear, accurate information during the KYC process will expedite the opening of your business bank account.

Step 4: Comply with Minimum Balance Requirements

Most UAE banks have minimum balance requirements for business accounts. Depending on the bank and the type of account, these requirements can vary significantly. Be prepared to maintain a minimum balance that may range from AED 20,000 to AED 250,000 or more, depending on the bank’s policies and the account type.

Failing to meet the minimum balance requirement can result in monthly fees, so it’s important to choose an account that aligns with your business’s cash flow and financial capabilities.

Step 5: Take Advantage of Business Banking Services

Once your account is active, UAE banks offer a wide array of business banking services that can support your company’s growth. These services may include:

Corporate Credit Cards: Offering flexible spending limits for your business.

Online Banking: Managing finances remotely and conducting transactions with ease.

Merchant Accounts: Enabling your company to accept credit card payments from customers.

Multi-Currency Accounts: Ideal for businesses with international clients, these accounts allow you to hold multiple currencies and avoid conversion fees.

These services are designed to simplify your financial management and support the expansion of your Dubai business setup.

Challenges and Tips for a Smooth Account Opening

While the process of opening a business bank account in the UAE can be straightforward, there are a few challenges to keep in mind:

Time Frame: The process can take anywhere from 1 to 4 weeks depending on the bank and the completeness of your documentation.

Local Presence: Some banks may require a personal visit from the business owner or directors, so be prepared for this if you’re setting up remotely.

Account Rejections: Some banks are cautious about opening accounts for certain industries considered high-risk. To avoid rejections, ensure that your business is clearly presented as compliant with UAE regulations.

Conclusion

Opening a business bank account in the UAE is an essential part of the process when you setup Dubai business ventures. By selecting the right bank, preparing the necessary documents, and understanding the KYC process, you can streamline the account-opening procedure and start managing your company’s finances in one of the world’s most attractive business environments. With the right approach, you’ll be well on your way to leveraging the benefits of Dubai’s robust economy and business-friendly infrastructure.

Take the first step and unlock your business potential in the UAE today!

#business consulting#business setup in dubai#business setup in uae#business setup company in dubai#bank account online#bank Account opening

0 notes

Text

Best Mobile Banking app Features

Nowadays, mobile banking app has become a daily part of your lives, providing convenience, accessibility, and security like never before. As technology grows, mobile banking apps are constantly updated to fit client’s needs. Now, let us look at some of the best features of mobile banking apps.

Download App:

#upi registration#digital account app#upi net banking app#upi bank account#fd account app#upi account#upi enabled app#app upi mobile banking#digital account#upi account number check#fd account benefits#banking mobile upi#मोबाइल बैंकिंग#phone banking#upi mobile banking app#upi account check#upi banking app#fd account yearly#new bank account#bank online account#mobile banking account#mobile banking account app#phone banking app#net banking app upi#upi bank#fast mobile banking#upi bank app#bank account online#bank upi#mobile banking application

1 note

·

View note