#open instant zero balance account

Explore tagged Tumblr posts

Text

What is POS in debit card? Why it matters?

In recent days, convenience and security in transactions have never been more crucial. This is where POS systems come into play. Mobile banking apps also play a major part in digital transactions. You may swipe your debit card at a retail store or enter your PIN at a restaurant. POS systems are the backbone of modern transactions. But what exactly is POS in a debit card, and why is it so important? Let us explore the details and how they impact your banking experience.

What is POS?

POS stands for Point of Sale. It refers to the location or system where a transaction takes place. When you use your debit card at a checkout counter, the POS system is the technology that processes the payment. It involves a combination of hardware and software. This enables merchants to accept payments from customers easily. This includes card readers, terminals, and the accompanying software that communicates with your bank to authorize and complete the transaction.

How Does POS Work?

When you make a purchase with your debit card, the POS terminal captures your card details and sends them to your bank for authorization. The bank checks your account to ensure you have sufficient funds and whether the transaction is legitimate. If everything is in order, the bank returns an authorization code to the POS system. This will complete the transaction. The entire process usually happens in a matter of seconds. This provides a smooth and quick payment experience.

Why Does POS Matter?

POS systems modernize transactions, making it easy for you to pay for goods and services quickly. With just a swipe or tap, your payment is processed. It will save you time and effort.

Modern POS systems come equipped with advanced security features like encryption and tokenization. This means your card details are protected during the transaction.

Using your debit card with a POS system lets you track your spending. With mobile banking apps, you can check bank balance and review your transaction history.

Many POS systems now integrate with UPI payment apps. This integration allows for smooth transactions between various payment methods and simplifies payment.

POS systems provide a smoother checkout experience. It will improve customer satisfaction. Faster transactions and reliable processing help ensure a positive shopping experience.

The Future of POS Systems

As technologies advance, POS systems are evolving to offer more features. With the rise of mobile payments and digital wallets, the role of POS systems is expanding to include various payment options. Advancements in AI and machine learning are enhancing the security and efficiency of POS systems. These technologies can detect and prevent fraudulent activities. This makes transactions safer and more reliable.

To conclude

Point-of-sale systems are a vital component of the modern payment setting. With the integration of UPI payment apps and the ongoing evolution of technology, POS systems offer enhanced features and improved security. So, next time you swipe your debit card, you will know that the POS system is working diligently behind the scenes to ensure a smooth and secure transaction.

#zero balance bank account open#zero balance account opening#0 account opening bank#bank account opening#open a zero balance account#open zero balance account#banking upi mobile#saving account opening zero balance#0 balance account opening#open new savings account#instant account opening zero balance#zero balance open bank account#bank account with zero balance#online zero balance account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open instant zero balance account#open a zero balance account online#new account opening#instant zero balance account opening#zero account opening online#zero account open online#instant zero balance account opening online#online savings account opening#online zero balance bank account opening#account open 0 balance#instant account opening#open zero balance account online instantly

1 note

·

View note

Text

Starting an Online Business with UPI: How It Helps

The Unified Payments Interface is India’s major step toward a cashless society. It is a payment system that allows users to connect multiple bank accounts to one smartphone app. It also provides fund transfers without needing IFSC codes and bank account numbers. If you add the UPI money transfer app to your business, it’s easy to transfer your money. Ensure you have a smartphone, active bank account, mobile phone, and bank account that are both connected and have better internet access. Here are some key advantages of UPI with business.

Small transaction:

UPI payments allow small shopkeepers and consumers to conduct low-cost transactions. Comparing a Visa and Master card can charge some fee of 1-2% of the transaction amount, UPI transactions are entirely free of cost. This leads to higher savings over the longer term.

Expand your customer:

UPI can help you expand your customer reach. If you have one or two payment options, it affects your business and your customers. Recently, many people have been using UPI accounts to make payments. By including UPI in your business operations, you can connect with several customers and expand your business.

Many accounts with one app:

UPI has allowed you to manage all your bank accounts with a single app anywhere. You don’t need to use various types of apps, just link your bank account to a UPI app. However, you must choose a default bank account, so if anyone pays to your UPI ID, the amount is directly deposited to that account.

Real-time monitoring:

One of the key features of UPI is real-time transaction monitoring. As a small business owner, you can easily track your payments and expenses. Which helps to improve your financial management. With the help of the UPI app, you can maintain a clear and current financial status and improve your financial performance. Also, you can address the problems.

Safe and secure:

Payments can only be transferred from a mobile phone in which your SIM card or mobile number is registered with your bank account. If you are making a UPI payment, you need to verify your secret PIN. The major advantage of UPI is that it makes transactions fast and secure. UPI features like two-factor authentication and encryption can protect against fraudulent activities.

Better than wallet:

Online banking is better than a wallet because you can’t put a lot of money into your wallet. But in online bank accounts, you can save a lot of amounts and use it everywhere. Wallets don’t let business owners earn interest on their balance, but with UPI, your money stays in your bank account. This way, you earn interest on the money you keep in the bank.

Final words: The points mentioned above demonstrate that UPI offers many advantages for your business. It is safe to use UPI as a payment method because it has excellent security features. With UPI payments, your customers can make the fastest money transfers, providing peace of mind for you and your customers.

#online upi#online upi payment app#online zero balance account#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account#open savings bank account online#open zero balance account#open zero balance account online instantly#open zero balance bank account

0 notes

Text

Different types of savings account:

If you want to save your money and generate a decent amount of interest, then choose a savings account. The interest rate in a savings account may be less, but the security feature it offers is high. A savings account is a good option for saving short-term and emergency fund. Many types of savings accounts are available. Let us first discuss the different types of accounts, and then you get a clear idea about how to open a new savings account based on your requirements.

Regular Savings Account:

Traditional savings accounts are one of the most common types of savings accounts. In a regular savings account, you need to pay a certain amount every month. It is easy to access the funds in a traditional savings account. The process of opening savings account is very simple, and in some banks, the minimum deposit amount is also very low. You can choose this account if you do not want to invest more at once and you want to save money regularly.

High Yield Savings Account:

Traditional savings accounts and high-yield savings accounts are similar, but there is one major difference. The interest rate in high -yielding savings accounts is high without compromising on safety. The withdrawal rate is lower in high-yield account. You can find many high-yielding savings accounts online. You can prefer this if you can manage your accounts online.

Money Market Account:

Money market accounts pay higher interest rates than other savings accounts. It is best suited for short-term goals. There are more features in money market accounts than in traditional savings accounts. It offers debit card purchases and check-writing privileges, and it is more flexible. If you would like to invest more money and increase your interest rate, you can choose this account.

Health Savings Account:

A health savings account is designed to pay for medical expenses. It is tax-free if you withdraw it for a valid medical expense such as copayments, deductibles, and more. In order to use a health savings account, you need a proper health care plan.

Certificates Of Deposit:

It holds a specific amount for a fixed period of time. It may be one year or five years. After a specific period of time, you can withdraw your original amount in addition to some interest, depending upon the bank. You can withdraw the amount only after the mentioned period of time. If you wish to withdraw it earlier, you may need to pay a penalty.

Student Savings Account:

A student's savings account is designed to help students start saving money. There are several benefits in this which include no minimum balance, overdraft facility, availability of debit cards, and no monthly fee. The initial amount to be paid is also very little in the student's account. In some banks, they do not charge any fee for ATM also. But a co-signer is needed to open a student account.

The Bottom Line:

Opening a new savings account is the most important thing to save money and gain interest from it. Analyze your requirements before choosing your account and choose the account which best fits your needs. It is also important to carefully read the terms and conditions before opening the account.

#zero balance account saving account#online saving account#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

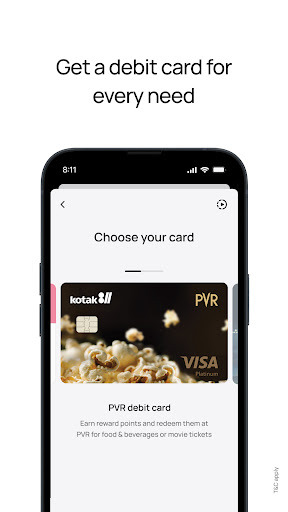

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

A Beginners Guide To Fund Transfer Using QR Codes:

Digital payments have revolutionised the way customers used to make payments. Debit cards, credit cards, digital wallets, and now QR codes are used to pay for a purchase. Smartphones facilitate easy cashless fund transfers for purchases. It relieves you of the burden of carrying money whenever you go out.

You can make QR payments by scanning the code and initiating a money transfer from your account to the seller’s account. The mobile wallet completes the transaction by transferring money from your account once you validate the transaction.

Are you here to seek information about QR codes? Are you new to the QR code ecosystem? Welcome to this new revolutionary payment system. Here is a quick guide for the QR code noobs.

What Is A QR Code?

It is a two-dimensional scanning code with a black-and-white square on a white backdrop. Any smart mobile with a QR code reader can scan the code and complete a transaction. They are better than barcodes as these codes can store huge data. The automotive industry used these codes before the payment ecosystem started using them. QR codes can help to initiate a payment, donate money to charitable institutions, and design creative marketing initiatives. These codes facilitate cashless payment.

Types Of QR Code Payments:

You can scan QR codes with a bar code or a smartphone. They can be used for bank balance enquiries also. It is a faster payment option than credit cards because all you need to do is download the QR code App. Open the mobile camera, scan the merchant code, and you are done! There are different types of QR payments.

Payment to Merchant:

Once you finish buying in a supermarket or a local store, you open a payment application. The merchant would enter the payable amount in his POS system. You have to scan the barcode of the product and complete the transaction. When you buy online, this process is done by adding your desired product to the cart.

Scan the QR code of the receiver:

You need to open your mobile camera to scan the code on the bill. The transaction will be completed once scanning is complete. Every store has a unique application. They will provide offers once you finish payment using a store-specific app.

App to App payment:

��It facilitates payment of money from App to App. The recipient opens his App and you scan it through the app on your mobile. You need to check whether the details entered are correct and complete the transaction.

Benefits of using QR codes:

There are multiple benefits to using QR codes. They are:

Easy payment experience.

Enables easy data collection and identification.

Secured method of payment.

Cost-effective as they don’t need any equipment to facilitate payment.

Final Words:

QR codes are an effective payment mode. If you have a smartphone, or QR reader on your mobile, you have completed a transaction. There is an expected 58% growth in the QR payment market by 2028. They are easy to use and a secure method of cashless payment. You only need to scan the QR code scanner and make digital payments. When your seller scans the QR code on your mobile, your bank sends a code and the vendor uses his bank account to facilitate payments.

#online savings bank account#new bank account online#mobile banking account app#bank account opening online zero balance#online new account open#opening account online#bachat khata#open a savings account#online new bank account opening#online savings account opening#instant account opening online#online saving bank account#online open saving account#bank account online#open a free bank account#bank fd#open a bank account online free#mobile banking app#online digital account opening#banking app#open a new bank account#apply for savings account#bank app#opening a bank account#online savings bank account opening#open savings bank account online#account online open#apply for savings account online#mobile banking apps#bank account online open

1 note

·

View note

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#open instant account#0 account opening bank#instant saving account#open a bank account#0 balance account opening#zero balance open bank account#bank account with zero balance#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#zero account opening online#online savings account opening#online zero balance bank account opening#saving account opening#bank account kholna#instant account opening#open zero balance account online instantly#open online savings account#zero balance bank account opening online

1 note

·

View note

Text

Offline UPI Payments- Are They Even Possible?

You may have the latest smartphone with high-speed internet connectivity. How would you feel if the internet fails when you try to pay your valued client? Your 5G mobile with a UPI-enabled app, couldn't help when you needed it the most. Is there a way to pay without an internet connection?

Come on. Let us find out ways to complete a UPI payment transaction offline! National Payments Corporation of India has brought forward a solution that enables payment without the internet. A USSD code- *99#, helps those in areas with poor internet facilities.

What is a USSD number?

It is a mobile banking arena and assists users in transferring money offline. Four telecom providers and 83 participating banks assist with the transfer of money without the need for an internet connection. Whenever you need to make a payment, dial this USSD number. Your mobile screen will display an interactive menu that assists in completing the transaction.

There is an upper limit of Rs.5000 for making a transaction. There is a small charge of 50 paise per transaction.

How Can We Set Up The UPI Payments App For Offline Payments?

Step 1: Open your mobile dialer, and dial *99#. It will help you to start a transaction and make a payment.

Step 2: When you dial this number, it will ask you to select a language of your choice from thirteen language options.

Step 3: Enter your bank IFSC code in the space provided.

Step 4: Your smartphone will display all the registered mobile numbers of different bank accounts. You need to choose from them and complete the transaction. The money will be debited when you click confirm from the provided bank account.

Step 5: Enter the last 6 digits of your account number and the expiry date of your card.

If you follow these five steps, your offline UPI payment is activated.

How Can We Send Money Through UPI Offline?

It is a simple process, and you should follow these instructions carefully.

Dial *99# from your mobile with the mobile number linked to your UPI bank account.

Choose a language of your choice.

Click on the send money or transfer money button.

Type in the receiver's mobile number or VPN ID.

Type the amount you wish to transfer.

You may type the UPI pin to complete the transfer.

Click confirm.

You can complete a payment transaction immediately. If you don't have an uninterrupted internet connection and the problem is with your bank, download the UPI Lite app.

Summing Up:

UPI is a payment interface that facilitates payment from one account to another. Generally, people believe they should have a smartphone with an uninterrupted 5G connection to make a payment. However, NPCI has developed an unstructured supplementary service data-based payment facility to enable people without an internet connection to complete payments.

You can now authorise a payment from your mobile, having any bank account linked to your registered mobile number. Your UPI money payment app facilitates merchant payment and peer-to-peer payment too. People living in areas with low internet connectivity can pay from their mobile. Thus, NPCI has debunked the myth that you need high-speed internet to facilitate a transaction.

#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank#digital account opening#fd bank

0 notes

Text

Effective Tips to Get the Most Out of Your Fixed Deposits

Everyone has dreams and long-term goals. They could be owning a car, taking that dream vacation abroad, or securing our children’s future education. While a savings account might seem like a step toward achieving these goals, it may not be the most effective way to grow your savings. Looking for an alternative option? If so, then a fixed deposit is the right solution. Fixed deposits offer a safe and reliable way to earn higher returns on your savings. But how can you maximize those returns? Let’s explore strategies to help you get the most out of your fixed deposits!

Choose the Right Tenure

Selecting the appropriate tenure for your FD is important to achieving your financial goals. The interest rate on fixed deposits can vary significantly depending on the term. For example, in India, the difference in interest rates between a 1-year FD and a 3-year FD can be as much as 1.5%. Therefore, it is important to align the FD tenure with your financial objectives. If you plan to buy property or land within the next two years, opting for a 5-year term might not be the best choice. Choosing the right tenure ensures that your investments are both accessible and optimized for maximum growth.

Explore Fixed Deposit Laddering

Another effective strategy to enhance your returns is known as fixed deposit laddering. This involves splitting your investment into multiple FDs with varying maturities. By doing so, you can manage your financial needs more flexibly and achieve different goals without having to break your FDs prematurely. For instance, you could divide a lump sum into three portions. Each FD can be aligned with a specific financial goal. This staggered approach allows you to benefit from potentially higher interest rates on longer-term deposits.

Capitalize on Compounding Interest

You can also benefit from compounding interest. Compounding means that the interest you earn is added to your principal, and you then earn interest on this new, larger sum in the subsequent period. To maximize this benefit, consider reinvesting the interest earned along with any additional funds you may have. Over time, the power of compounding can lead to substantial growth in your investment. It provides a significant boost to your returns. The longer you keep your money invested, the more you can take advantage of this compounding effect.

Stay Updated

Interest rates are a key factor in determining the returns on your FD investments. Therefore, staying informed about market conditions and economic trends that could impact these rates is essential. By keeping an eye on interest rate fluctuations, you can time your FD investments to coincide with periods of favorable rates. Additionally, check transaction history, which allows you to track your investment performance and make more informed decisions.

Final Thoughts By applying these strategies, you can optimize your fixed deposit investments and secure the best possible returns. Always check the balance of fixed deposits and stay informed about interest rate trends and economic conditions. You also need to consider your financial goals, risk tolerance, and liquidity requirements before making any investment decisions.

#zero balance bank account open#zero balance account opening#instant saving account#zero balance account open#0 balance account opening#instant account opening zero balance#zero balance open bank account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#instant zero balance account opening#online zero balance bank account opening#open zero balance account online instantly#zero balance bank account opening online#zero balance bank account online#zero balance account online#zero balance account app#0 balance bank account open online#online savings bank account opening

0 notes

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#digital account app#mobile banking app#open bank account app#digital account opening app#online new account opening app#instant account opening app#best mobile banking app

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online 0 balance account opening#online savings account opening#new bank account open#open new bank account online#open saving account#online open saving bank account#open a bank account online free#online saving bank account#0 bank account opening#instant bank account#zero balance account app#opening a bank account#bank account opening process#online savings bank account#bank account opening procedure#bank online account open#zero balance account open online

0 notes

Text

How to build an Emergency fund

Unexpected events can happen in life that might be good or bad. So, it would help full if you were financially prepared to face it. Before the pandemic, no one knows about the emergency fund. After experiencing layoffs, the pandemic, and medical issues, many people are thinking about savings. At this time, an FD account can help to save money. FD savings can help you get through difficult times quite easily. You won’t have to depend on loans or credit cards, if you have an emergency fund that keeps you surviving during difficult situations. Here is a quick guide to building a fund:

Set a clear target:

Prepare yourself from the starting point for success. Set a goal for at least 3 to 6 months of living expenses. This target will guide your savings strategy. Review your financial goals regularly. It can help you manage the budget. Even small changes can affect the time you need to reach your emergency savings. So set a clear target to achieve your savings goal.

Automate your savings:

The simplest way to save money is to investing. It means most employers send cash through online, so you can easily spend more money for buying things. It will affect your savings. So, set up a separate account for your savings and deposit the amount you selected for your contribution. Use a savings account that you cannot access easily. Because these things can easily change your mind to spend more money. Put it out of your mind and let time do its thing.

Avoid increasing your monthly spending:

If saving has become a routine, you may think that you’re financially secure. This can make you spend money on unwanted things, so be aware. For example, if you buy new dresses or shoes every month, it becomes a regular habit. So you are not saving anything. Having appropriate savings is essential for your financial stability. Be realistic, but try to achieve your savings target. That makes your life more enjoyable.

Increase your emergency fund:

Utilize the opportunity that can help you increase your emergency fund, whenever you can have extra money transferred to your savings account. A great opportunity to grow your funds is to finish paying off your money. After you have paid off your loan, deposit money into a savings account. This is a great way to secure available money.

Final words:

These times, the majority of the people aim for early financial independence. So, if you want all your financial needs taken care of at the time of retirement, follow the above strategies. The initial step is to build an emergency fund to cover all sudden costs shortly. Even though it requires careful planning and intelligent investing during emergency medical needs like lockdowns or pandemic situations, it’s really useful. You can also try saving money through online platforms and easily send amounts through money-sharing apps. This is really useful in emergencies. So save your money for better future and risk-free life!

#bachat khata#zero balance account opening app#instant account opening online#open saving account#0 balance bank account open online#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank

0 notes

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below *Adhaar Address Update *Adhaar download *Adaar PVC card apply *Adhaar Update History *Adhaar Card Slot Booking *Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services * New Pan Card Apply *Pan card Corrections *Instant Pan card *Minor Pan Card *Duplicate Pan Card

4.Micro& Mini ATM Services *Cash withdrawal *Fund transfer *Cash Deposit *Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines: 1.Adhaar card photo 2.Pan Card photo 3.Phone number 4.Email Id 5.Live Location to be shared 6.2-4 Sec video Recording by holding adhaar /pan 7.Any other person reference contact number and ID proof 8.bank passbook photo 9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339 Note : Registration fees non Refundable

2 notes

·

View notes

Text

How to Choose the Best Savings Account for Maximum Returns?

Introduction

A savings account is one of the safest and most convenient ways to grow your money while maintaining liquidity. However, not all savings accounts are the same. Choosing the right account can help you maximize returns and achieve your financial goals faster. This guide will help you understand the key factors to consider when selecting the best savings account.

1. Check the Interest Rates

The interest rate determines how much your savings will grow over time.

Banks offer different interest rates, typically ranging from 2.5% to 7% per annum.

Some private and small finance banks offer higher rates than traditional banks.

2. Understand the Minimum Balance Requirement

Many banks require you to maintain a minimum balance, failing which penalties apply.

Choose an account with a low or zero minimum balance if you don’t want restrictions.

Online banks and fintech savings accounts often provide better flexibility.

3. Look for Additional Benefits & Features

Some savings accounts offer extra perks, such as:

Free ATM withdrawals at multiple locations.

Debit card benefits like cashback and rewards.

Online banking and UPI access for seamless transactions.

4. Compare Fees & Charges

Banks may charge fees for services like:

ATM withdrawals beyond the limit

Cheque book issuance

Fund transfers (NEFT, RTGS, IMPS) Check the fee structure before opening an account to avoid hidden charges.

5. Opt for Auto-Sweep Facility for Higher Returns

An auto-sweep account transfers surplus funds into a fixed deposit (FD) to earn higher interest.

You can withdraw funds whenever needed without breaking the FD.

This feature helps you earn better returns while keeping liquidity intact.

6. Consider Digital Banking Convenience

With digital banking on the rise, choose a bank that provides:

A user-friendly mobile app for easy transactions.

24/7 customer support for resolving banking issues.

Instant fund transfer options like UPI, NEFT, and IMPS.

7. Evaluate the Reputation of the Bank

Choose a bank with a strong financial reputation and excellent customer service.

Public sector banks offer reliability, while private and digital banks provide innovation.

Check online reviews and customer feedback before making a decision.

8. Check for Tax Benefits

Interest earned above ₹10,000 in a year is taxable under the Income Tax Act.

Some savings schemes, like the Post Office Savings Account, offer tax benefits.

9. Look for Special Savings Accounts

Many banks offer customized savings accounts for specific groups:

Senior Citizens: Higher interest rates and added benefits.

Students & Minors: No minimum balance requirement.

Women & Salaried Employees: Special perks and cashback offers.

Conclusion

Choosing the right savings account is crucial for maximizing your returns while keeping your money secure. Compare interest rates, fees, and features before making a decision. Whether you prefer a traditional bank or a digital-first solution, selecting the right savings account can help you achieve financial stability and growth.

0 notes

Text

Types of savings bank accounts for everyone

Bank accounts are one of the best things ever created and are a core component of the lives of all people on earth. Customers always prefer savings accounts because they provide security and liquidity. However, many people miss out on the benefits of using the right bank account because they are not aware of the bank account types they can choose. Opening bank account online and using online banking apps offers you additional benefits than paper-based banking. Read this article to learn about the types of bank accounts available for use.

Regular savings account

A regular savings account facilitates safe money management because it offers a consistent interest rate on deposits that doesn't fluctuate from high to low or vice versa. In short, customers who are interested in this kind of savings account desire to keep some money liquid and secure in a bank. Most people use a regular savings bank account and enjoy online banking services.

Savings account for students

A campus account or student savings account is a kind of savings account available to students between the ages of 18 and 27 who are enrolled in pre-approved courses. Some banks also offer student bank accounts for NRI students who need the benefits.

Instant savings account

You can compare an instant savings account to a traditional savings account. Visiting the bank to open an instant savings account is unnecessary because you can do it online. You can easily open an instant savings account with your Aadhaar, PAN, and other necessary information. If you want to open a savings account without having to go to a bank, use your bank’s official app.

Savings account for women.

If you are a strong, independent woman, opening savings account of this type provides special benefits that support your career and lifestyle. Features like reward points on debit cards, instant account opening, and more are available for women who open a women's savings account online.

Family savings account

If you open a family savings account, your family members can use a single platform to handle all of their financial needs. It is preferable to a regular savings account due to its wealth management features, reduced minimum balance requirements, and other advantages. Contact your bank's family banking division to find out more about family savings deposit accounts.

3-in-one online trading, demat, and savings account

The 3-in-one banking account is suitable for 3 types of banking purposes. It works as a standard bank account, demat account, and trading account, all under one product to trade the markets profitably. More prestigious banks and financial organizations are providing customers with 3-in-one accounts as retail trading gains traction in the country.

Salaried accounts

The typical benefits of a regular savings account are available to salaried employees only through the account. A zero minimum balance requirement indicates that you are not required to keep a minimum amount in your account.

A variety of savings account types are available, some with rates higher than those of a regular savings account.

Final thoughts

There are many types of bank accounts designed to benefit all kinds of people, so read through them clearly before opening savings account using online banking apps.

#upi pay#upi payment#credit card upi#upi payment app#upi payments#new bank account upi limit#secure upi payments#upi transaction tracking#upi account create#e banking#upi app#fd deposit app#upi enabled app#online upi payment app#quick fd account#mobile banking apps#fd bank#bank upi#create new upi id#upi payment bank app#upi registration

1 note

·

View note