#instant account opening zero balance

Explore tagged Tumblr posts

Text

Unprecedented Role of Artificial Intelligence in the banking sector

Banking is all about using consumer data shared via different networks to the advantage of customers and banks. Back-office banking operations comprise a sizeable portion of the banking industry because they primarily deal with handling customer databases, extracting useful information from the data available for improving bank businesses, customer relationship management, and, most importantly, maintaining this vast amount of data for the greater good. The buzzword in banking today is data, without which banks cannot operate profitably. On the other hand, saving accounts applied onlinecan be executed to have a lot of benefits with some technological advancements; Technology, specifically artificial intelligence technology, plays a crucial part in handling data since it uses sophisticated algorithms to complete various tasks.

Prevention and detection of fraud

Artificial intelligence technologies are essential for identifying and stopping fraud in the banking and financial sector. To spot potential scams, AI algorithms analyze massive data sets to identify user behavior, transaction history, patterns, and anomalies. By utilizing AI, Banks can detect fraudulent transactions, reduce financial losses, and safeguard customer accounts.

Superior Customer Experience

Many businesses, including banking, AI-powered chatbots, and personal assistants, are commonplace. Artificial intelligence-enabled assistants employ machine learning algorithms and natural language processing to deliver personalized services, rapid answers to consumer questions, and help with banking procedures. Banks may expedite various operational processes, protect transactions, shorten wait times, offer 24/7 customer service, and provide a seamless customer experience by incorporating AI into the construction of mobile apps. So, fasten your working horse to execute a saving account apply online, and let artificial intelligence help you positively.

Making Decisions Using Data Analytics

Banks can now handle massive amounts of structured and unstructured data thanks to AI technologies to forecast market trends, gather insights, and uncover investment opportunities. This will ultimately result in better decision-making. By using data-driven decision-making, banks can increase efficiency, save expenses, and maintain an advantage in a cutthroat market.

Portfolio Management and Trading

AI in banking helps identify potential trading opportunities and provides valuable insights for making better investment decisions thanks to its capacity to process market data and recognize trends. Additionally, AI-driven portfolio management systems keep track of market trends, optimize asset allocation, and make modifications in real time, all of which improve investment management, reduce risk, and increase returns. To effectively make data-driven investment decisions and enhance portfolio performance, banks can effectively use AI.

Strengthen the Cybersecurity System

Sensitive user data continues to be in danger of theft in today's constantly changing digital environment due to the enormous rise in cybercrime. AI-powered applications have become a cutting-edge technology, enhancing cybersecurity in the financial sector to address this issue. The effective use of AI in banking reduces the danger of security breaches in real-time by analyzing historical threats, learning from trends, and spotting abnormalities and other factors. Artificial intelligence (AI) solutions give financial institutions a proactive defense system that shields user data from potential cybercrime and enhances the security of their whole network.

Bottom Line:

The points mentioned above can define how impactful the role of AI in the banking sector is. All you have to do is to open a saving account online. With the growth in technology, the future can witness enormous significant advancements.

#instant account opening online#instant account opening zero balance#instant bank account#instant bank account online transfer#instant bank account opening online#instant fd account setup#instant open bank account#instant saving account#instant zero balance account online#instant zero balance account opening#instant zero balance account opening online#internet banking#internet banking app#khata kholne wala app

0 notes

Text

Are digital banking the future of banking?

Digital account is the trend of the future for personal financial services. All of the characteristics of a standard savings account are included, along with some extras. Another method to state it is that a digital banking app is a modernized savings account. Given the comfort of access to the Internet and everyone’s dependence on smart devices, it is not surprising that your bank can now enter your space rather than you entering your bank. The digital age has made everything on this planet accessible, including services that you may access online or via your phone.

What is digital banking?

A website or mobile app is used for all-online financial transactions, known as digital banking. Without physically visiting a branch, customers can utilize it to execute financial transactions and obtain banking services.

Due to its many benefits and conveniences, digital banking has become increasingly widespread in recent years. Customers can conduct various transactions by accessing their accounts at any time and location, including checking account balances, moving money, paying bills, and applying for loans.

Security:

Security is of the utmost significance for digital banks. They employ the newest encryption technology to ensure the confidentiality and security of your private and financial data. Digital banks also have robust security measures to prevent fraud and protect your account from unauthorized access. This indicates that you might feel confident knowing your money is secure when choosing a digital savings account.

The ease of convenience:

The convenience that a digital account app provides is among its most important advantages. You can quickly and conveniently start a savings account online from anywhere in the world with a few mouse clicks. All you need is a mobile with an internet facility. Spending hours standing in a queue is no longer necessary to speak to bank staff. It is ideal for folks who are constantly on the go because you can access your account anytime from anywhere in the world.

Banking via mobile:

Having a digital savings account entitles you to use mobile banking services. Therefore, using a mobile device, you can access your account and perform several actions, like money transfers, bill payments, and balance checks. Mobile banking is a popular choice because it is efficient, useful, and secure.

Best features:

Many banks provide mobile and Internet banking services, which offer at least as many features as in-person banking. Peer-to-peer payments might not come to mind, but many banks now offer the capability to transmit money rapidly using your mobile banking app, which might be useful. An ATM location, cardless ATM withdrawals, tracking and budgeting features, and other benefits might all be included in your mobile banking software.

Final thoughts:

By making it more leisurely for you to access necessary tools and services, digital banking can help you achieve more control over your finances. No matter where you live, a digital banking app may provide benefits beyond banking by connecting you with a community and providing financial solutions tailored to your requirements and interests.

#fd transfer account#fd transfer status#finance upi mandate#fixed deposit interest#fixed deposit plans#fixed deposit rate for senior citizens#fixed deposit scheme#flexible fd#flexible fixed deposit#get online upi payments#hide transactions#highest bank fixed deposit rates#highest fd interest rate bank#highest fd rates in bank#instant account opening#instant account opening online#instant account opening zero balance#instant bank account#instant bank account online transfer#instant bank account opening online#instant fd account setup#instant open bank account#instant saving account#instant zero balance account online#instant zero balance account opening#instant zero balance account opening online#internet banking#internet banking app#khata kholne wala app#kyc bank account

0 notes

Text

Ways to cut off unwanted expenses:

Determining how to use our money most effectively is one of the trickier parts of personal finance. Finding significant savings on a tight budget is challenging, especially for the millennial age. However, rather than eliminating substantial portions of your budget all at once, the secret to cutting back on your spending is to do so gradually in each area. It could take a little work once you can save money and pay off more debt, but you'll notice your financial stress dropping. The best way to save money is to open online savings account. Here, you will learn some ways to cut off unwanted expenses:

Know where your money is going.

Financial confidence has been demonstrated to increase when you write down your weekly expenses. You should therefore keep track of your spending to improve your financial stability. Budgeting is helpful in this situation. Monthly spending and revenue are the first two crucial figures in every budget. Make a budget that records both your income and your expenses. Understanding how your money is coming in and going out will help you examine your spending and saving habits over time to spot any patterns. Open online savings account to ensure your money is safe to spend.

Make Your Meals

It can be challenging to muster the energy to prepare supper after a hard day at the office. If you frequently dine out, make it a habit to cook at least twice weekly and gradually increase that number to three or four. If that's not feasible for you, set aside some time on Sunday to prepare a few quick dinners for the next week. In this manner, when you get home from work, you'll already have supper prepared. The same is true of coffee. Even though buying coffee daily may seem like a modest investment, it may significantly drain your finances over time. Eliminating this one fair cost can save hundreds.

Fashion and entertainment expenses:

Plan a play, concert, sporting event, stand-up comedy show, or movie with popcorn. Set aside money for amusement every week, divide it up, and avoid spending too much on enjoyable activities at the expense of other costs. Instead of eating at pricey restaurants or getting takeaway, make your meals. It takes skill to eat well while keeping costs down. It can be rather expensive to go shopping for shoes, clothes, or cosmetics. Stylish clothing is only sometimes necessary to look amazing.

Make a List of Groceries before Visiting the Store

If you've ever gone grocery shopping without a list or when you're hungry, it can be tempting to buy more food than you would typically. Before shopping, write a list of everything you'll need for the coming week to ensure you remember everything and to help you avoid buying unnecessary extras. A checklist ensures you don't succumb to another pointless journey or temptation.

Bottom Line:

Money is always ultimate and can always be a great tool to bring change in your life. So, please follow the above points to save money to use it wisely. Open zero balance bank account online to save money to spend it smartly in the future.

#fd transfer account#fd transfer status#finance upi mandate#fixed deposit interest#fixed deposit plans#fixed deposit rate for senior citizens#fixed deposit scheme#flexible fd#flexible fixed deposit#get online upi payments#hide transactions#highest bank fixed deposit rates#highest fd interest rate bank#highest fd rates in bank#instant account opening#instant account opening online#instant account opening zero balance#instant bank account#instant bank account online transfer#instant bank account opening online#instant fd account setup#instant open bank account#instant saving account#instant zero balance account online#instant zero balance account opening#instant zero balance account opening online#internet banking#internet banking app#khata kholne wala app#kyc bank account

1 note

·

View note

Text

What is POS in debit card? Why it matters?

In recent days, convenience and security in transactions have never been more crucial. This is where POS systems come into play. Mobile banking apps also play a major part in digital transactions. You may swipe your debit card at a retail store or enter your PIN at a restaurant. POS systems are the backbone of modern transactions. But what exactly is POS in a debit card, and why is it so important? Let us explore the details and how they impact your banking experience.

What is POS?

POS stands for Point of Sale. It refers to the location or system where a transaction takes place. When you use your debit card at a checkout counter, the POS system is the technology that processes the payment. It involves a combination of hardware and software. This enables merchants to accept payments from customers easily. This includes card readers, terminals, and the accompanying software that communicates with your bank to authorize and complete the transaction.

How Does POS Work?

When you make a purchase with your debit card, the POS terminal captures your card details and sends them to your bank for authorization. The bank checks your account to ensure you have sufficient funds and whether the transaction is legitimate. If everything is in order, the bank returns an authorization code to the POS system. This will complete the transaction. The entire process usually happens in a matter of seconds. This provides a smooth and quick payment experience.

Why Does POS Matter?

POS systems modernize transactions, making it easy for you to pay for goods and services quickly. With just a swipe or tap, your payment is processed. It will save you time and effort.

Modern POS systems come equipped with advanced security features like encryption and tokenization. This means your card details are protected during the transaction.

Using your debit card with a POS system lets you track your spending. With mobile banking apps, you can check bank balance and review your transaction history.

Many POS systems now integrate with UPI payment apps. This integration allows for smooth transactions between various payment methods and simplifies payment.

POS systems provide a smoother checkout experience. It will improve customer satisfaction. Faster transactions and reliable processing help ensure a positive shopping experience.

The Future of POS Systems

As technologies advance, POS systems are evolving to offer more features. With the rise of mobile payments and digital wallets, the role of POS systems is expanding to include various payment options. Advancements in AI and machine learning are enhancing the security and efficiency of POS systems. These technologies can detect and prevent fraudulent activities. This makes transactions safer and more reliable.

To conclude

Point-of-sale systems are a vital component of the modern payment setting. With the integration of UPI payment apps and the ongoing evolution of technology, POS systems offer enhanced features and improved security. So, next time you swipe your debit card, you will know that the POS system is working diligently behind the scenes to ensure a smooth and secure transaction.

#zero balance bank account open#zero balance account opening#0 account opening bank#bank account opening#open a zero balance account#open zero balance account#banking upi mobile#saving account opening zero balance#0 balance account opening#open new savings account#instant account opening zero balance#zero balance open bank account#bank account with zero balance#online zero balance account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open instant zero balance account#open a zero balance account online#new account opening#instant zero balance account opening#zero account opening online#zero account open online#instant zero balance account opening online#online savings account opening#online zero balance bank account opening#account open 0 balance#instant account opening#open zero balance account online instantly

1 note

·

View note

Text

Effective Tips to Get the Most Out of Your Fixed Deposits

Everyone has dreams and long-term goals. They could be owning a car, taking that dream vacation abroad, or securing our children’s future education. While a savings account might seem like a step toward achieving these goals, it may not be the most effective way to grow your savings. Looking for an alternative option? If so, then a fixed deposit is the right solution. Fixed deposits offer a safe and reliable way to earn higher returns on your savings. But how can you maximize those returns? Let’s explore strategies to help you get the most out of your fixed deposits!

Choose the Right Tenure

Selecting the appropriate tenure for your FD is important to achieving your financial goals. The interest rate on fixed deposits can vary significantly depending on the term. For example, in India, the difference in interest rates between a 1-year FD and a 3-year FD can be as much as 1.5%. Therefore, it is important to align the FD tenure with your financial objectives. If you plan to buy property or land within the next two years, opting for a 5-year term might not be the best choice. Choosing the right tenure ensures that your investments are both accessible and optimized for maximum growth.

Explore Fixed Deposit Laddering

Another effective strategy to enhance your returns is known as fixed deposit laddering. This involves splitting your investment into multiple FDs with varying maturities. By doing so, you can manage your financial needs more flexibly and achieve different goals without having to break your FDs prematurely. For instance, you could divide a lump sum into three portions. Each FD can be aligned with a specific financial goal. This staggered approach allows you to benefit from potentially higher interest rates on longer-term deposits.

Capitalize on Compounding Interest

You can also benefit from compounding interest. Compounding means that the interest you earn is added to your principal, and you then earn interest on this new, larger sum in the subsequent period. To maximize this benefit, consider reinvesting the interest earned along with any additional funds you may have. Over time, the power of compounding can lead to substantial growth in your investment. It provides a significant boost to your returns. The longer you keep your money invested, the more you can take advantage of this compounding effect.

Stay Updated

Interest rates are a key factor in determining the returns on your FD investments. Therefore, staying informed about market conditions and economic trends that could impact these rates is essential. By keeping an eye on interest rate fluctuations, you can time your FD investments to coincide with periods of favorable rates. Additionally, check transaction history, which allows you to track your investment performance and make more informed decisions.

Final Thoughts By applying these strategies, you can optimize your fixed deposit investments and secure the best possible returns. Always check the balance of fixed deposits and stay informed about interest rate trends and economic conditions. You also need to consider your financial goals, risk tolerance, and liquidity requirements before making any investment decisions.

#zero balance bank account open#zero balance account opening#instant saving account#zero balance account open#0 balance account opening#instant account opening zero balance#zero balance open bank account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#instant zero balance account opening#online zero balance bank account opening#open zero balance account online instantly#zero balance bank account opening online#zero balance bank account online#zero balance account online#zero balance account app#0 balance bank account open online#online savings bank account opening

0 notes

Text

How Does Online Savings Account Work?

In this digital age, everyone is aware of and switched to online bank accounts. You may begin saving money after making an initial contribution to your online savings account. You may manage your funds with an online savings account anytime, anywhere. While many banks and credit unions frequently offer unique benefits on online account management capabilities, completely online savings accounts. It is also important to note to open savings bank account online, so you do not have to worry about entering a branch and depositing or withdrawing your money. In this post, you will learn about how does online savings account works:

What is an online savings account?

An online savings bank account, commonly called a digital account, including the process of open savings bank account online conducted entirely digitally. Financial technology frequently provides these online accounts in collaboration with large, well-known banks or small finance banks. As you are familiar with conventional banks, they are governed by the Reserve Bank of India. They must follow all the laws and guidelines established by the regulatory authorities.

How to open an online savings account?

Opening an online savings account is much easier than opening in the bank. First, you need to research and choose your desired banking sector. Before choosing it, check that your chosen bank has all the online banking features like mobile applications and high-interest rates paid to customers. Your account opening methods can change from bank to bank.

Once and for all, when you finalize your desired bank, you may need to download their mobile application or online account opening form on their website. Your bank will require basic information like your name, age, address, phone number, mail ID, etc. In addition, for identity proof, they may ask for your Aadhaar card.

After verification, they ask you to complete the KYC form like Know Your Customer. With e-KYC and video KYC development, proving your identity by sharing a brief video or your Aadhaar-OTP can be done quickly with biometrics.

Benefits of online savings account

Easy to use: You can manage your funds whenever and wherever you want without adding another stop to your schedule or waiting for the bank to open because all of your interactions with your account occur digitally.

User-friendly apps: Online banks frequently invest a lot of effort to make sure their websites and mobile banking apps are optimized and simple to use. This enables you to shift your money without any problems with just a few clicks on your bank's website.

Security: Online savings accounts intensely focus on encrypting user data and ongoing monitoring to protect your accounts. With the help of two-factor authentications like passwords and biometrics, your online accounts are safeguarded efficiently.

Customer support: Many online savings accounts offers a 24-hour in-app service and toll-free calling feature because their main goal is to give a hassle-free banking experience.

Final Thoughts

By opening a savings account in online you can easily and flexibly able to manage your money. It is crucial that you should compare bank accounts in order to determine which one best suits your banking requirements.

#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account

1 note

·

View note

Text

Understanding video KYC: A complete guide

KYC verification is an integral part of opening bank accounts. KYC stands for know your customer, which is an important step followed by many banking sectors. This is done for security purposes, verifying the customer’s identity and residence to avoid banking fraud and risks. The traditional KYCprocess requires a lot of paperwork and documentation. And it is a time-consuming process; it will take days or weeks. Nowadays, video KYC arrives as a trend. Let’s understand how the video KYC process works and how it benefits us.

What is Video KYC?

As the name insists, Video KYC is taken online through a video call. KYC specialists will verify the customer’s identity and liveliness when opening a bank account. It is a contactless verification that can be done within a few minutes. Not only in banks, most organizations and financial institutions are following this KYC process before onboarding a customer. Video KYC simplifies the verification process at a considerable range.

Traditional KYC vs. video KYC:

Traditional KYC follows a customer identification program (CIP) to verify the customer’s identity and address. This process will take weeks or months to complete and involves lots of paperwork. It consists of a lot of physical visits. High-cost expenses will be spent on verification.

Video KYC is a digitized form of the verification process. There is no need for paper works, and it can be done within a few minutes. It is cost-effective and saves time and effort of people. It is a real-time verification of customers and business partners to ensure their identity and liveliness.

Steps involved in Video KYC:

Customers are instructed to do a Video KYC before opening a bank account. For that, you need to visit the official bank and submit a request for video KYC. That request application form will ask you to attach some identity proofs of you. The process of video KYC is listed below:

The KYC specialists will arrange an online video call. They only start the video call. The process will be done by trained specialists only.

They will capture a live photo of you and detect your live location using geo-tagging software.

You are asked to show the identity proofs. This includes your Aadhaar card, driving license, and PAN card. The specialist will ask you a few questions regarding the documents.

They will verify the live image of you and your photo in the documents match to ensure your liveliness.

The whole call will be recorded, and your approval or rejection will be declared once the call is done.

Benefits of video KYC:

As we mentioned earlier, video KYC saves the time and effort of a lot. The ultimate aim of the process is to prevent scams and banking fraud. The physical presence of customers was optional. This is the faster and more seamless verification process. Video KYC provides a better customer experience and suits many people stuck with their work. As it was a face-to-face video interview, the safety of the documents was ensured.

Final words:

KYC is done to avoid conflicts and it ensures providing services to the right customer. The above-mentioned points will clearly explain video KYC processes and benefits.

#online open saving account#online open saving bank account#online open zero balance account#online savings account opening#online savings bank account opening#online upi payment app#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account

0 notes

Text

What are the steps to opening an online saving account?

The money you save for short-term financial objectives or to keep your emergency fund in a savings account is safe there. Managing finances effectively and conveniently now often involves saving account applied online. This step-by-step manual will simplify the procedure and introduce you to the world of online banking, whether you have been dubious about online banking or are not up to speed. Learn about the steps to opening an online saving account in the following guide:

Understanding the rules and regulations:

The bank will now ask you to certify that you have read the disclosure documents describing the costs, obligations, and how account interest is calculated. You have ideally selected an account with high rates and either no monthly service fees or low monthly service fees. You have the chance to affirm.

Select a banking provider:

Now that the online banking is underway, you may open an online bank account with most banks. Analyse your options for a while and select a banking partner that makes you feel comfortable after researching their expenses, interest rates, and minimum balance requirements.

Visit their website or get the app:

Once you have made your choice, go to the website or download the bank app of your chosen banking partner. You can typically select to create a new online bank account in the products section of the app or website. Go to the appropriate section and choose the option to open an account.

Include a phone number:

Along with your ID number, you can anticipate adding your contact details, including your first and last names, phone numbers, and addresses. Additionally, information like your email address and birthdate might be requested.

Complete the KYC process:

Knowing your customer is referred to as KYC. Banks must follow a particular process before allowing you to register an online account. They must verify your identity and ensure you are who you claim to be. Some organisations may demand video KYC to open a bank account. If your preferred banking partner meets this requirement, a bank representative will connect with you through a video call. Simply attend the call and provide them with the details they require so they can verify your identity.

Submit your application:

While the bank may confirm your online application within a few minutes, it may take two to five business days to verify your details, open the saving account opening online, and give you access.

Add the money:

The login details for your online bank account will be provided once the KYC process is complete. Depending on the bank, it can take a few hours or a few days. You can begin banking using these credentials after adding funds to your online bank account.

Final thoughts:

You can conduct financial transactions effortlessly and comfortably from the comfort of your dwelling by saving account opening online. The procedure described above makes it simple to open an online bank account and obtain access to various online banking services.

#zero balance account saving account#online saving account#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

Different types of savings account:

If you want to save your money and generate a decent amount of interest, then choose a savings account. The interest rate in a savings account may be less, but the security feature it offers is high. A savings account is a good option for saving short-term and emergency fund. Many types of savings accounts are available. Let us first discuss the different types of accounts, and then you get a clear idea about how to open a new savings account based on your requirements.

Regular Savings Account:

Traditional savings accounts are one of the most common types of savings accounts. In a regular savings account, you need to pay a certain amount every month. It is easy to access the funds in a traditional savings account. The process of opening savings account is very simple, and in some banks, the minimum deposit amount is also very low. You can choose this account if you do not want to invest more at once and you want to save money regularly.

High Yield Savings Account:

Traditional savings accounts and high-yield savings accounts are similar, but there is one major difference. The interest rate in high -yielding savings accounts is high without compromising on safety. The withdrawal rate is lower in high-yield account. You can find many high-yielding savings accounts online. You can prefer this if you can manage your accounts online.

Money Market Account:

Money market accounts pay higher interest rates than other savings accounts. It is best suited for short-term goals. There are more features in money market accounts than in traditional savings accounts. It offers debit card purchases and check-writing privileges, and it is more flexible. If you would like to invest more money and increase your interest rate, you can choose this account.

Health Savings Account:

A health savings account is designed to pay for medical expenses. It is tax-free if you withdraw it for a valid medical expense such as copayments, deductibles, and more. In order to use a health savings account, you need a proper health care plan.

Certificates Of Deposit:

It holds a specific amount for a fixed period of time. It may be one year or five years. After a specific period of time, you can withdraw your original amount in addition to some interest, depending upon the bank. You can withdraw the amount only after the mentioned period of time. If you wish to withdraw it earlier, you may need to pay a penalty.

Student Savings Account:

A student's savings account is designed to help students start saving money. There are several benefits in this which include no minimum balance, overdraft facility, availability of debit cards, and no monthly fee. The initial amount to be paid is also very little in the student's account. In some banks, they do not charge any fee for ATM also. But a co-signer is needed to open a student account.

The Bottom Line:

Opening a new savings account is the most important thing to save money and gain interest from it. Analyze your requirements before choosing your account and choose the account which best fits your needs. It is also important to carefully read the terms and conditions before opening the account.

#zero balance account saving account#online saving account#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

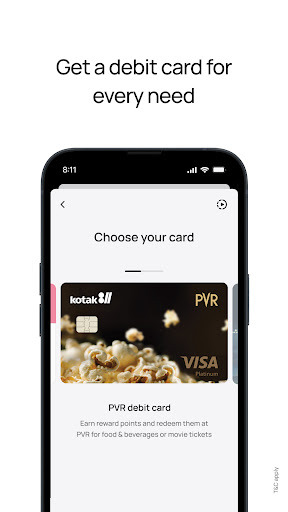

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#open instant account#0 account opening bank#instant saving account#open a bank account#0 balance account opening#zero balance open bank account#bank account with zero balance#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#zero account opening online#online savings account opening#online zero balance bank account opening#saving account opening#bank account kholna#instant account opening#open zero balance account online instantly#open online savings account#zero balance bank account opening online

1 note

·

View note

Text

Offline UPI Payments- Are They Even Possible?

You may have the latest smartphone with high-speed internet connectivity. How would you feel if the internet fails when you try to pay your valued client? Your 5G mobile with a UPI-enabled app, couldn't help when you needed it the most. Is there a way to pay without an internet connection?

Come on. Let us find out ways to complete a UPI payment transaction offline! National Payments Corporation of India has brought forward a solution that enables payment without the internet. A USSD code- *99#, helps those in areas with poor internet facilities.

What is a USSD number?

It is a mobile banking arena and assists users in transferring money offline. Four telecom providers and 83 participating banks assist with the transfer of money without the need for an internet connection. Whenever you need to make a payment, dial this USSD number. Your mobile screen will display an interactive menu that assists in completing the transaction.

There is an upper limit of Rs.5000 for making a transaction. There is a small charge of 50 paise per transaction.

How Can We Set Up The UPI Payments App For Offline Payments?

Step 1: Open your mobile dialer, and dial *99#. It will help you to start a transaction and make a payment.

Step 2: When you dial this number, it will ask you to select a language of your choice from thirteen language options.

Step 3: Enter your bank IFSC code in the space provided.

Step 4: Your smartphone will display all the registered mobile numbers of different bank accounts. You need to choose from them and complete the transaction. The money will be debited when you click confirm from the provided bank account.

Step 5: Enter the last 6 digits of your account number and the expiry date of your card.

If you follow these five steps, your offline UPI payment is activated.

How Can We Send Money Through UPI Offline?

It is a simple process, and you should follow these instructions carefully.

Dial *99# from your mobile with the mobile number linked to your UPI bank account.

Choose a language of your choice.

Click on the send money or transfer money button.

Type in the receiver's mobile number or VPN ID.

Type the amount you wish to transfer.

You may type the UPI pin to complete the transfer.

Click confirm.

You can complete a payment transaction immediately. If you don't have an uninterrupted internet connection and the problem is with your bank, download the UPI Lite app.

Summing Up:

UPI is a payment interface that facilitates payment from one account to another. Generally, people believe they should have a smartphone with an uninterrupted 5G connection to make a payment. However, NPCI has developed an unstructured supplementary service data-based payment facility to enable people without an internet connection to complete payments.

You can now authorise a payment from your mobile, having any bank account linked to your registered mobile number. Your UPI money payment app facilitates merchant payment and peer-to-peer payment too. People living in areas with low internet connectivity can pay from their mobile. Thus, NPCI has debunked the myth that you need high-speed internet to facilitate a transaction.

#open new bank account#zero balance account opening online#online bank account opening 0 balance#zero balance account open online#new bank account open online#saving account opening online#online account open#online saving bank account#bank account opening online zero balance#online new account open#0 balance account opening bank#open zero balance bank account online#zero balance account online opening#instant open bank account#0 balance account open online#online open zero balance account#open account online#bank online account open#online open account in bank#digital account opening#fd bank

0 notes

Text

A Beginners Guide To Fund Transfer Using QR Codes:

Digital payments have revolutionised the way customers used to make payments. Debit cards, credit cards, digital wallets, and now QR codes are used to pay for a purchase. Smartphones facilitate easy cashless fund transfers for purchases. It relieves you of the burden of carrying money whenever you go out.

You can make QR payments by scanning the code and initiating a money transfer from your account to the seller’s account. The mobile wallet completes the transaction by transferring money from your account once you validate the transaction.

Are you here to seek information about QR codes? Are you new to the QR code ecosystem? Welcome to this new revolutionary payment system. Here is a quick guide for the QR code noobs.

What Is A QR Code?

It is a two-dimensional scanning code with a black-and-white square on a white backdrop. Any smart mobile with a QR code reader can scan the code and complete a transaction. They are better than barcodes as these codes can store huge data. The automotive industry used these codes before the payment ecosystem started using them. QR codes can help to initiate a payment, donate money to charitable institutions, and design creative marketing initiatives. These codes facilitate cashless payment.

Types Of QR Code Payments:

You can scan QR codes with a bar code or a smartphone. They can be used for bank balance enquiries also. It is a faster payment option than credit cards because all you need to do is download the QR code App. Open the mobile camera, scan the merchant code, and you are done! There are different types of QR payments.

Payment to Merchant:

Once you finish buying in a supermarket or a local store, you open a payment application. The merchant would enter the payable amount in his POS system. You have to scan the barcode of the product and complete the transaction. When you buy online, this process is done by adding your desired product to the cart.

Scan the QR code of the receiver:

You need to open your mobile camera to scan the code on the bill. The transaction will be completed once scanning is complete. Every store has a unique application. They will provide offers once you finish payment using a store-specific app.

App to App payment:

It facilitates payment of money from App to App. The recipient opens his App and you scan it through the app on your mobile. You need to check whether the details entered are correct and complete the transaction.

Benefits of using QR codes:

There are multiple benefits to using QR codes. They are:

Easy payment experience.

Enables easy data collection and identification.

Secured method of payment.

Cost-effective as they don’t need any equipment to facilitate payment.

Final Words:

QR codes are an effective payment mode. If you have a smartphone, or QR reader on your mobile, you have completed a transaction. There is an expected 58% growth in the QR payment market by 2028. They are easy to use and a secure method of cashless payment. You only need to scan the QR code scanner and make digital payments. When your seller scans the QR code on your mobile, your bank sends a code and the vendor uses his bank account to facilitate payments.

#online savings bank account#new bank account online#mobile banking account app#bank account opening online zero balance#online new account open#opening account online#bachat khata#open a savings account#online new bank account opening#online savings account opening#instant account opening online#online saving bank account#online open saving account#bank account online#open a free bank account#bank fd#open a bank account online free#mobile banking app#online digital account opening#banking app#open a new bank account#apply for savings account#bank app#opening a bank account#online savings bank account opening#open savings bank account online#account online open#apply for savings account online#mobile banking apps#bank account online open

1 note

·

View note

Text

Starting an Online Business with UPI: How It Helps

The Unified Payments Interface is India’s major step toward a cashless society. It is a payment system that allows users to connect multiple bank accounts to one smartphone app. It also provides fund transfers without needing IFSC codes and bank account numbers. If you add the UPI money transfer app to your business, it’s easy to transfer your money. Ensure you have a smartphone, active bank account, mobile phone, and bank account that are both connected and have better internet access. Here are some key advantages of UPI with business.

Small transaction:

UPI payments allow small shopkeepers and consumers to conduct low-cost transactions. Comparing a Visa and Master card can charge some fee of 1-2% of the transaction amount, UPI transactions are entirely free of cost. This leads to higher savings over the longer term.

Expand your customer:

UPI can help you expand your customer reach. If you have one or two payment options, it affects your business and your customers. Recently, many people have been using UPI accounts to make payments. By including UPI in your business operations, you can connect with several customers and expand your business.

Many accounts with one app:

UPI has allowed you to manage all your bank accounts with a single app anywhere. You don’t need to use various types of apps, just link your bank account to a UPI app. However, you must choose a default bank account, so if anyone pays to your UPI ID, the amount is directly deposited to that account.

Real-time monitoring:

One of the key features of UPI is real-time transaction monitoring. As a small business owner, you can easily track your payments and expenses. Which helps to improve your financial management. With the help of the UPI app, you can maintain a clear and current financial status and improve your financial performance. Also, you can address the problems.

Safe and secure:

Payments can only be transferred from a mobile phone in which your SIM card or mobile number is registered with your bank account. If you are making a UPI payment, you need to verify your secret PIN. The major advantage of UPI is that it makes transactions fast and secure. UPI features like two-factor authentication and encryption can protect against fraudulent activities.

Better than wallet:

Online banking is better than a wallet because you can’t put a lot of money into your wallet. But in online bank accounts, you can save a lot of amounts and use it everywhere. Wallets don’t let business owners earn interest on their balance, but with UPI, your money stays in your bank account. This way, you earn interest on the money you keep in the bank.

Final words: The points mentioned above demonstrate that UPI offers many advantages for your business. It is safe to use UPI as a payment method because it has excellent security features. With UPI payments, your customers can make the fastest money transfers, providing peace of mind for you and your customers.

#online upi#online upi payment app#online zero balance account#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account#open savings bank account online#open zero balance account#open zero balance account online instantly#open zero balance bank account

0 notes

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes