#High-deductible health plans

Explore tagged Tumblr posts

Text

Why Americans Are Fed Up with Health Insurers

Anger at healthcare insurers and healthcare providers is not new, but ways of expressing that anger should not get out of control.

Like you, I was shocked and saddened by the brutal murder of a man on a street in Manhattan, singled out because he was CEO of a major health insurance company. And like you, I have been frustrated and angered with the health insurance industry, both as a practicing physician and as a patient. This article reviews the reasons behind frustration and anger and how they might or might not be…

0 notes

Text

The HSA, HRA and FSA – which is right for you?

Navigating the differences between Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs), and Flexible Spending Accounts (FSAs) can be challenging, but each offers unique tax advantages for managing healthcare costs. HSAs are individually owned and must be paired with high-deductible health plans, allowing tax-free growth and rollover of unused funds. HRAs are employer-funded and reimburse employees for qualifying medical expenses, while FSAs let employees set aside pre-tax money for healthcare expenses but may have a "use it or lose it" policy.

#Helthy Reimbursement Accounts#Prescription savings#High-deductible health plans#Medical expense reimbursement#Pre-tax healthcare savings#Employer-sponsored health plans

0 notes

Text

Types of Health Insurance Plans and Their Key Feature

Catastrophic Health Insurance,

Choosing Health Insurance ,

EPOHealth Insurance ,

Health Insurance Coverage ,

Health Insurance Plans ,

Health Maintenance Organization ,

High Deductible Health Plans ,

HMOHealth Insurance ,

POSHealth Insurance ,

PPOHealth Insurance ,

Preferred Provider Organization ,

Types Of Health Insurance

#Catastrophic Health Insurance#Choosing Health Insurance#EPOHealth Insurance#Health Insurance Coverage#Health Insurance Plans#Health Maintenance Organization#High Deductible Health Plans#HMOHealth Insurance#POSHealth Insurance#PPOHealth Insurance#Preferred Provider Organization#Types Of Health Insurance

0 notes

Text

World Finance System

Website: worldfinancesystem.blogspot.com

Address: 4516 Tenmile Road Needham, MA 02192

Phone: 720-474-9464

Lucy Matoke - HealthMarkets Insurance is located in Fort Worth TX and is dedicated to providing quality services of High Deductible Health Plan Fort Worth TX ,Health Savings Account Fort Worth TX ,Medicare Insurance Fort Worth TX ,Medicaid Insurance Services Fort Worth TX ,Premium Insurance Fort Worth TX ,Copayment Insurance Fort Worth TX . Call us today at (817) 724-7350. We can help! We look forward to hearing from you.

Business Email: [email protected]

#High Deductible Health Plan Fort Worth TX#Health Savings Account Fort Worth TX#Medicare Insurance Fort Worth TX#Medicaid Insurance Services Fort Worth TX#Premium Insurance Fort Worth TX#Copayment Insurance Fort Worth TX#CoInsurance Services Fort Worth TX#Vision insurance Services Fort Worth TX#Hearing insurance Services Fort Worth TX#Life insurance Services Fort Worth TX#Open Enrollment Insurance Fort Worth TX#Supplemental Health Insurance Fort Worth TX#Medicare Supplement Plan Services Fort Worth TX#Obamacare Affordable Care Insurance Fort Worth TX#Medigap Insurance Fort Worth TX#Co-pay insurance Services Fort Worth TX#Affordable Insurance Fort Worth TX#Cheap Insurance Services Fort Worth TX#Long-Term Care Disability Insurance#Employee Health Coverage Services Fort Worth TX#Small Business Health Insurance Fort Worth TX

0 notes

Text

2 Reasons an HDHP May Not Be the Best Option for You

High-deductible health plans (HDHPs) are a type of health insurance plan that helps you save on monthly premium costs. When you compare an HDHP vs PPO or other health plan, your monthly premium bill will be much more affordable. But there are several disadvantages to consider.

There are many benefits to getting an HDHP, including the ability to open a health savings account (HSA). But is an HDHP right for you? Here are a few reasons why you might want to reconsider.

You Can't Afford Higher Out-of-Pocket Expenses

Despite all the perks of having an HDHP, one significant tradeoff exists. That's the higher deductible and out-of-pocket maximum.

Your deductible is how much you'll have to pay before your health insurance coverage takes over. You must pay 100 percent of healthcare costs before coverage kicks in. Depending on your plan, you may have to cover copays or coinsurance until you reach the out-of-pocket maximum.

The out-of-pocket maximum is the total amount you'll have to pay for covered healthcare services annually. Once you meet that, your health insurance will take care of the rest. In the fight between HDHP vs PPO, the former typically has a higher deductible, but that out-of-pocket max protects you from significantly higher expenses. For 2024, the out-of-pocket maximums for an HDHP can't exceed $8,050 for individuals or $16,100 for families.

If you're unable to cover your deductible, you may want to reconsider getting an HDHP.

You'll Need Substantial Medical Care

If you think you'll need considerable healthcare services throughout the year, exploring other plan options may be a better choice. HDHPs are often the go-to for people who are young and relatively healthy. They're a fantastic way to save on monthly premiums when you don't think you'll need much medical care.

The coverage is still there if needed, but you're not paying high premiums to get it. If you don't fall into that category, getting a plan that focuses on lower deductibles with better coverage over more affordable premiums may be better.

Read a similar article about 2024 contribution limits for FSA here at this page.

#flexible employee benefits#hsa vs fsa#high deductible health plan#hdhp vs ppo#hsa investment#flexible benefit administrators#hsa tax forms

0 notes

Text

The Pros Of High-Deductible Health Insurance Plans

High-deductible health insurance plans in PA offer lower premiums, making them cost-effective for healthier individuals. They often come with Health Savings Accounts (HSAs), allowing tax-free contributions for medical expenses. These plans promote consumer engagement by requiring higher out-of-pocket spending, potentially reducing unnecessary healthcare utilization. They can be suitable for those seeking lower monthly costs and are willing to manage higher upfront deductibles.

0 notes

Text

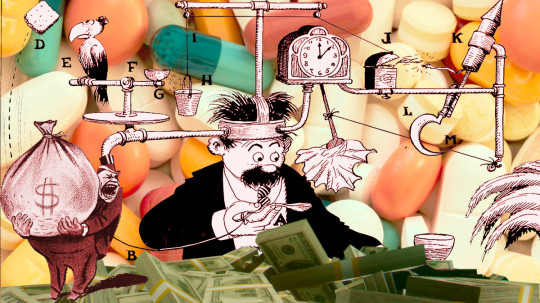

What the fuck is a PBM?

TOMORROW (Sept 24), I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Terminal-stage capitalism owes its long senescence to its many defensive mechanisms, and it's only by defeating these that we can put it out of its misery. "The Shield of Boringness" is one of the necrocapitalist's most effective defenses, so it behooves us to attack it head-on.

The Shield of Boringness is Dana Claire's extremely useful term for anything so dull that you simply can't hold any conception of it in your mind for any length of time. In the finance sector, they call this "MEGO," which stands for "My Eyes Glaze Over," a term of art for financial arrangements made so performatively complex that only the most exquisitely melted brain-geniuses can hope to unravel their spaghetti logic. The rest of us are meant to simply heft those thick, dense prospectuses in two hands, shrug, and assume, "a pile of shit this big must have a pony under it."

MEGO and its Shield of Boringness are key to all of terminal-stage capitalism's stupidest scams. Cloaking obvious swindles in a lot of complex language and Byzantine payment schemes can make them seem respectable just long enough for the scammers to relieve you of all your inconvenient cash and assets, though, eventually, you're bound to notice that something is missing.

If you spent the years leading up to the Great Financial Crisis baffled by "CDOs," "synthetic CDOs," "ARMs" and other swindler nonsense, you experienced the Shield of Boringness. If you bet your house and/or your retirement savings on these things, you experienced MEGO. If, after the bubble popped, you finally came to understand that these "exotic financial instruments" were just scams, you experienced Stein's Law ("anything that can't go forever eventually stops"). If today you no longer remember what a CDO is, you are once again experiencing the Shield of Boringness.

As bad as 2008 was, it wasn't even close to the end of terminal stage capitalism. The market has soldiered on, with complex swindles like carbon offset trading, metaverse, cryptocurrency, financialized solar installation, and (of course) AI. In addition to these new swindles, we're still playing the hits, finding new ways to make the worst scams of the 2000s even worse.

That brings me to the American health industry, and the absurdly complex, ridiculously corrupt Pharmacy Benefit Managers (PBMs), a pathology that has only metastasized since 2008.

On at least 20 separate occasions, I have taken it upon myself to figure out how the PBM swindle works, and nevertheless, every time they come up, I have to go back and figure it out again, because PBMs have the most powerful Shield of Boringness out of the whole Monster Manual of terminal-stage capitalism's trash mobs.

PBMs are back in the news because the FTC is now suing the largest of these for their role in ripping off diabetics with sky-high insulin prices. This has kicked off a fresh round of "what the fuck is a PBM, anyway?" explainers of extremely variable quality. Unsurprisingly, the best of these comes from Matt Stoller:

https://www.thebignewsletter.com/p/monopoly-round-up-lina-khan-pharma

Stoller starts by pointing out that Americans have a proud tradition of getting phucked by pharma companies. As far back as the 1950s, Tennessee Senator Estes Kefauver was holding hearings on the scams that pharma companies were using to ensure that Americans paid more for their pills than virtually anyone else in the world.

But since the 2010s, Americans have found themselves paying eye-popping, sky-high, ridiculous drug prices. Eli Lilly's Humolog insulin sold for $21 in 1999; by 2017, the price was $274 – a 1,200% increase! This isn't your grampa's price gouging!

Where do these absurd prices come from? The story starts in the 2000s, when the GW Bush administration encouraged health insurers to create "high deductible" plans, where patients were expected to pay out of pocket for receiving care, until they hit a multi-thousand-dollar threshold, and then their insurance would kick in. Along with "co-pays" and other junk fees, these deductibles were called "cost sharing," and they were sold as a way to prevent the "abuse" of the health care system.

The economists who crafted terminal-stage capitalism's intellectual rationalizations claimed the reason Americans paid so much more for health care than their socialized-medicine using cousins in the rest of the world had nothing to do with the fact that America treats health as a source of profits, while the rest of the world treats health as a human right.

No, the actual root of America's health industry's problems was the moral defects of Americans. Because insured Americans could just go see the doctor whenever they felt like it, they had no incentive to minimize their use of the system. Any time one of these unhinged hypochondriacs got a little sniffle, they could treat themselves to a doctor's visit, enjoying those waiting-room magazines and the pleasure of arranging a sick day with HR, without bearing any of the true costs:

https://pluralistic.net/2021/06/27/the-doctrine-of-moral-hazard/

"Cost sharing" was supposed to create "skin in the game" for every insured American, creating a little pain-point that stung you every time you thought about treating yourself to a luxurious doctor's visit. Now, these payments bit hardest on the poorest workers, because if you're making minimum wage, at $10 co-pay hurts a lot more than it does if you're making six figures. What's more, VPs and the C-suite were offered "gold-plated" plans with low/no deductibles or co-pays, because executives understand the value of a dollar in the way that mere working slobs can't ever hope to comprehend. They can be trusted to only use the doctor when it's truly warranted.

So now you have these high-deductible plans creeping into every workplace. Then along comes Obama and the Affordable Care Act, a compromise that maintains health care as a for-profit enterprise (still not a human right!) but seeks to create universal coverage by requiring every American to buy a plan, requiring insurers to offer plans to every American, and uses public money to subsidize the for-profit health industry to glue it together.

Predictably, the cheapest insurance offered on the Obamacare exchanges – and ultimately, by employers – had sky-high deductibles and co-pays. That way, insurers could pocket a fat public subsidy, offer an "insurance" plan that was cheap enough for even the most marginally employed people to afford, but still offer no coverage until their customers had spent thousands of dollars out-of-pocket in a given year.

That's the background: GWB created high-deductible plans, Obama supercharged them. Keep that in your mind as we go through the MEGO procedures of the PBM sector.

Your insurer has a list of drugs they'll cover, called the "formulary." The formulary also specifies how much the insurance company is willing to pay your pharmacist for these drugs. Creating the formulary and paying pharmacies for dispensing drugs is a lot of tedious work, and insurance outsources this to third parties, called – wait for it – Pharmacy Benefits Managers.

The prices in the formulary the PBM prepares for your insurance company are called the "list prices." These are meant to represent the "sticker price" of the drug, what a pharmacist would charge you if you wandered in off the street with no insurance, but somehow in possession of a valid prescription.

But, as Stoller writes, these "list prices" aren't actually ever charged to anyone. The list price is like the "full price" on the pricetags at a discount furniture place where everything is always "on sale" at 50% off – and whose semi-disposable sofas and balsa-wood dining room chairs are never actually sold at full price.

One theoretical advantage of a PBM is that it can get lower prices because it bargains for all the people in a given insurer's plan. If you're the pharma giant Sanofi and you want your Lantus insulin to be available to any of the people who must use OptumRX's formulary, you have to convince OptumRX to include you in that formulary.

OptumRX – like all PBMs – demands "rebates" from pharma companies if they want to be included in the formulary. On its face, this is similar to the practices of, say, NICE – the UK agency that bargains for medicine on behalf of the NHS, which also bargains with pharma companies for access to everyone in the UK and gets very good deals as a result.

But OptumRX doesn't bargain for a lower list price. They bargain for a bigger rebate. That means that the "price" is still very high, but OptumRX ends up paying a tiny fraction of it, thanks to that rebate. In the OptumRX formulary, Lantus insulin lists for $403. But Sanofi, who make Lantus, rebate $339 of that to OptumRX, leaving just $64 for Lantus.

Here's where the scam hits. Your insurer charges you a deductible based on the list price – $404 – not on the $64 that OptumRX actually pays for your insulin. If you're in a high-deductible plan and you haven't met your cap yet, you're going to pay $404 for your insulin, even though the actual price for it is $64.

Now, you'd think that your insurer would put a stop to this. They chose the PBM, the PBM is ripping off their customers, so it's their job to smack the PBM around and make it cut this shit out. So why would the insurers tolerate this nonsense?

Here's why: the PBMs are divisions of the big health insurance companies. Unitedhealth owns OptumRx; Aetna owns Caremark, and Cigna owns Expressscripts. So it's not the PBM that's ripping you off, it's your own insurance company. They're not just making you pay for drugs that you're supposedly covered for – they're pocketing the deductible you pay for those drugs.

Now, there's one more entity with power over the PBM that you'd hope would step in on your behalf: your boss. After all, your employer is the entity that actually chooses the insurer and negotiates with them on your behalf. Your boss is in the driver's seat; you're just along for the ride.

It would be pretty funny if the answer to this was that the health insurance company bought your employer, too, and so your boss, the PBM and the insurer were all the same guy, busily swapping hats, paying for a call center full of tormented drones who each have three phones on their desks: one labeled "insurer"; the second, "PBM" and the final one "HR."

But no, the insurers haven't bought out the company you work for (yet). Rather, they've bought off your boss – they're sharing kickbacks with your employer for all the deductibles and co-pays you're being suckered into paying. There's so much money (your money) sloshing around in the PBM scamoverse that anytime someone might get in the way of you being ripped off, they just get cut in for a share of the loot.

That is how the PBM scam works: they're fronts for health insurers who exploit the existence of high-deductible plans in order to get huge kickbacks from pharma makers, and massive fees from you. They split the loot with your boss, whose payout goes up when you get screwed harder.

But wait, there's more! After all, Big Pharma isn't some kind of easily pushed-around weakling. They're big. Why don't they push back against these massive rebates? Because they can afford to pay bribes and smaller companies making cheaper drugs can't. Whether it's a little biotech upstart with a cheaper molecule, or a generics maker who's producing drugs at a fraction of the list price, they just don't have the giant cash reserves it takes to buy their way into the PBMs' formularies. Doubtless, the Big Pharma companies would prefer to pay smaller kickbacks, but from Big Pharma's perspective, the optimum amount of bribes extracted by a PBM isn't zero – far from it. For Big Pharma, the optimal number is one cent higher than "the maximum amount of bribes that a smaller company can afford."

The purpose of a system is what it does. The PBM system makes sure that Americans only have access to the most expensive drugs, and that they pay the highest possible prices for them, and this enriches both insurance companies and employers, while protecting the Big Pharma cartel from upstarts.

Which is why the FTC is suing the PBMs for price-fixing. As Stoller points out, they're using their powers under Section 5 of the FTC Act here, which allows them to shut down "unfair methods of competition":

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The case will be adjudicated by an administrative law judge, in a process that's much faster than a federal court case. Once the FTC proves that the PBM scam is illegal when applied to insulin, they'll have a much easier time attacking the scam when it comes to every other drug (the insulin scam has just about run its course, with federally mandated $35 insulin coming online, just as a generation of post-insulin diabetes treatments hit the market).

Obviously the PBMs aren't taking this lying down. Cigna/Expressscripts has actually sued the FTC for libel over the market study it conducted, in which the agency described in pitiless, factual detail how Cigna was ripping us all off. The case is being fought by a low-level Reagan-era monster named Rick Rule, whom Stoller characterizes as a guy who "hangs around in bars and picks up lonely multi-national corporations" (!!).

The libel claim is a nonstarter, but it's still wild. It's like one of those movies where they want to show you how bad the cockroaches are, so there's a bit where the exterminator shows up and the roaches form a chorus line and do a kind of Busby Berkeley number:

https://www.46brooklyn.com/news/2024-09-20-the-carlton-report

So here we are: the FTC has set out to euthanize some rentiers, ridding the world of a layer of useless economic middlemen whose sole reason for existing is to make pharmaceuticals as expensive as possible, by colluding with the pharma cartel, the insurance cartel and your boss. This conspiracy exists in plain sight, hidden by the Shield of Boringness. If I've done my job, you now understand how this MEGO scam works – and if you forget all that ten minutes later (as is likely, given the nature of MEGO), that's OK: just remember that this thing is a giant fucking scam, and if you ever need to refresh yourself on the details, you can always re-read this post.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/23/shield-of-boringness/#some-men-rob-you-with-a-fountain-pen

Image: Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#matthew stoller#pbms#pharmacy benefit managers#cigna#ftc#antitrust#intermediaries#bribery#corruption#pharma#monopolies#shield of boringness#Caremark#Express Scripts#OptumRx#insulin#gbw#george w bush#co-pays#obamacare#aca#rick rules#guillotine watch#euthanize rentiers#mego

446 notes

·

View notes

Text

This!!! Your health insurance is not a good place to cut your budget. If you get a high deductible plan, you will end up skipping appointments or putting off care because you don't want to pay out of pocket.

If your employer offers you the choice between a high deductible use only in emergencies health plan and literally any other kind of standard plan, take the standard plan.

Your employer will give you all kinds of incentives to take the high deductible plan. They will offer you HSAs that can be rolled into your 401k. This is a trap. Take the actual health insurance.

#health insurance#just say no to high deductible plans#high deductible plans are a scam perpetuated by people who know you think you see the doctor less than you do

21 notes

·

View notes

Note

Any tips on saving money?

Track your income/expenses. Knowing your monthly cash flow + essential and discretionary spending is the only sound starting point toward setting your financial goals.

Evaluate your non-essential spending habits. Consider where this money is going, and whether these expenses add value/are necessary to your life (pleasure or peace of mind is an acceptable "necessity" if you're living within your means to be clear!).

Determine the money you have left over after you cover your essential expenses and most fulfill discretionary expenses. This amount is your "saving/investment" money.

Divide your leftover amount into 3 categories: Emergency fund, goal-oriented savings (like buying a desired luxury item/furniture, a down payment on a house, a vacation, etc.), and investments.

Put your savings in a high-yield savings account. If possible, have different accounts for each purpose, especially your emergency fund and savings for future purposes. You can also get a CD for a long-term savings goal.

Put your investments (in the USA at least) in the following buckets: Roth IRA (max it out), ALWAYS take your employer's full 401k match, HSA (if you have a high-deductible health insurance plan), and S&P 500 index funds/other evergreen mutual funds + blue-chip stocks.

Purchase fewer, higher-quality items. Know the sales seasons for each product category and shop around this calendar (down to the produce items in season). If possible, rent items when it makes sense.

Only say "yes" to plans/financial obligations that add value/pleasure to your life. Don't let yourself feel shortchanged financially or emotionally. It's never worth it, honestly.

Invest in your physical, mental, and financial health first. This can mean something different for everyone but it's important!

**I'm not a professional, just another young woman on the internet, so please take this advice accordingly. Please meet with a financial advisor/CPA for formal advice and personal financial planning.

Hope this helps xx

227 notes

·

View notes

Text

TimBer Week 2024: First Sleepover

TimBer Week 2024 Day #7: First Sleeepover

Last one of the week. We made it!

It was amazing how casually it had come about.

They’d been dating for six months, officially boyfriends for only a few weeks. And yet…it felt like they’d been together for years. Bernard came by almost every day, they shared meals and swapped clothes, then bickered over whose turn it was to do laundry. It felt like they were sharing the boat as a home together and that filled Tim with delight that he couldn't fully express.

But the one thing they had yet to do was spend a night together.

N-not like that! Just…you know, sleeping in the same space. They’d done that a lot in high school, when they’d stay up late playing video games or watching movies, then crash at one person’s house. They’d make pallets across the floor or just collapse on top of someone’s bed, where parents would drape them in individual blankets.

It wasn’t a new thing… but this was a new thing!

One bed. One blanket. A pre-planned slumber party.

Granted, it had come about for a very non-romantic reason.

--

“Fumigate?!”

Bernard winced at his boyfriend’s outraged exclamation, setting the phone aside while he struggled to fold his clothes into his duffel bag.

“Yeah, some idiot called the health inspector on one of the neighbors. I don’t know what they found, but they gave us all an hour to pack up and get out. They said it won’t be safe to come back until tomorrow.”

“And where exactly do they expect you to go until then?”

Bernard wished they were on video chat so Tim could see his deadpan look. “Tim, babe, this is a low-income district. They don’t care if I sleep on the street as long as I don’t come back until they give the go-ahead.”

Tim squawked over the line while Bernd packed some underwear. “I’ll just sleep at a friend’s house. It’s fine. Jared has a pull-out couch and as long as Toby didn’t get kicked out of his girlfriend’s place again, I can just-”

“Stay here.”

“Huh?”

“Here. At the boat. With me.”

“Uh, are you sure about that?”

“Am I- Bear! You just told me you’re going to be homeless for a night. Why wouldn’t I want you to be here with me?”

“Well, when you put it like that, sure. I have a work shift for the next few hours, but I’ll come around sometime after 8. That cool?”

“Sure, that’s perfect. See you then.”

“Love you.”

Tim was quiet for a moment. Bernard was patient. Then, “I love you, too. See you later. Bye.”

Bernard grinned. It was a tactical risk pulling that on him. It hadn’t been that long ago Tim could call them boyfriends without stuttering. And now, they were going to have their first sleepover together since high school.

Bernard looked at his clothes as he packed them up, particularly his pajamas. They were hand-me-downs from Toby, and while Bernard liked them well enough, would they be a little too ratty for this? And moreover, would showing up there in Batman pajamas be a little too on the nose? He loved teasing Tim about his secret identity but that might actually get him suspicious that Bernard knew the truth. He’d need to pick up something else after he was done with work. He would not show up to his boyfriend’s boat looking like a slob!

--

Tim was a slob messy person. His mind was sharp, his deductive reasoning unparalleled, and his skills across various fields were masterful. But like most geniuses, he thrived in chaos of his own making, and there was no clearer sign of that than his houseboat. Once, his neighbor Lauren had stopped by to ask him to have dinner with her and Tammy, and nearly killed herself walking down the stairs when she slipped on a discarded takeout bag. Not Tim’s fault, though Tammy’s wrath after that incident said otherwise.

So while Tim definitely had to clean up any evidence of his Robin activities - case files, hardware, suit pieces, gadgets - he also gave the space a proper cleaning. Like on-the-floor-with-a-scrub-brush, window-washing, dishes-put-away kind of cleaning. The laundry… well, that went under the bed. He only had so many hours!

The fervor with which he cleaned his living space surprised even him. He had ignored it when his siblings talked about his junky boat; Bernard had already seen it this way from the very start. But he still wanted to make it shine for him. Make it just a little bit better for his boyfriend’s first night over.

--

Bernard arrived in the evening, with his necessities and valuables he didn’t want to leave behind where strangers might rummage through his drawers. A Gothamite born and raised. Tim tried not to linger over the idea that his boyfriend's whole life could probably fit in just three bags and met him on the dock for a welcoming kiss. They had been sharing a lot more kisses since officially calling each other boyfriends (though apparently, Bernard had been calling them that way longer). When they finally pulled back, Bernard was beaming with unrestrained glee. “Hey.”

“Hey yourself,” Tim returned, picking up one of the bags and bringing it into his home.

Bernard gawked at the place. “Uh, did you buy a new house without telling me? Because I swear I haven't seen the floor of your boat since the day before you moved in.”

“Ha-ha,” Tim said, setting the duffel bag down on his clutter-free floor. “If you wanted to sleep in a Five-Star hotel, you should have spoken up sooner.

Actually, his back-up apartment over near Crime Alley might qualify. If Bernard was really uncomfortable sleeping on the boat, maybe he could bring him over there instead. He’d have to be extra careful about the access points to the Nest but…

“No way!” his boyfriend declared, sounding offended at the idea. “I love your boat. It's so cozy and homey and so totally you. It’s perfect just as it is, even when it’s messier than a frat-boy’s dorm!” He just couldn’t resist that last dig.

But Tim appreciated his words all the same.

--

They ordered delivery for dinner, a local Thai place that they both adored. While sitting around Tim’s table, Bernard brought out his laptop to show him his latest discover: a fan-made Green Lantern movie. Tim was genuinely impressed by the flick and was already plotting how to get Bruce into a situation where he couldn’t escape watching it. The aroma of green curry and spring rolls, Bernard’s theories that the filmmakers were actually part of a Lantern Corp splinter group wishing to sway public opinion and take over the universe - all of it felt right. For them, at least.

“It just makes sense,” Bernard insisted between bites of his curry. "By hiding in plain sight on YouTube, they can secretly influence galactic events and just blame it on the more famous members!”

Tim laughed, urging him on. Bernard's eyes sparkled when he was passionate about a new idea.

The conversation flowed effortlessly, weaving through topics of jobs, school, family and anything else they wanted. There was a lightheartedness to it all, but also a deeper connection, an unshakable comfort and safety that let them be as unfiltered and silly as they pleased. As the night went on and their movie ended, they were still talking, ignoring their food that had long gone cold. Bernard leaned back against the bench, a satisfied sigh escaping his lips. "This is what I like most about being here. It’s just you and me. It’s nice.”

Tim smiled, reaching out to squeeze Bernard's hand. "I love having you here.”

--

Bernard’s yawning told Tim they’d stayed up long enough. He had already called off of patrol for the night but the other still had work tomorrow, so they couldn’t burn the late-night oil like the might any other time. Tim insisted Bernard could head to the bedroom first and get changed while Tim cleaned up the mess.

“He’s already mending his ways,” Bernard wiped a fake tear from his eyes. “I’ve never been more proud.”

He ran to the bedroom, closing the door fast before the couch cushion could hit him.

--

Bernard felt far less sure about his choice of sleeping clothes now that they were on his body. He’d only allowed himself thirty minutes after his shift to dash into a store and grab a “respectable” set of pajamas off the shelf. No garish logos, no quirky patterns; just something nice and neat for when he shared a bed with his Significant Other.

But seeing himself in the light blue, pinstriped flannel, he looked...wrong. Like he was trying to hide behind something "presentable" and fake his way through. A harsh reminder to his teen years, causing a rush of those old insecurities he'd tried to hard to shed. He shouldn't have bought this. He was proud of who he was and what he liked. So why did he keep having these moments of doubt that made him do things he would end up regretting?

Tim knocked on the door, politely refraining from barging into his own bedroom. Bernard would have given anything to rewind, hit pause, and change his life’s decisions. But he couldn’t.

“Come in,” he said, his voice as steady as he could manage.

Tim pushed the door open, took one look at him, and smiled. “Cute.”

Usually, that word from Tim would make him happy, but this time it hit a little wrong. “Yeah, I know it’s… it’s stupid.” He gripped the offensive fabric between his fingers, hating it more with each passing second. “I should have worn the Batman ones instead.”

“Well, that would be very much your style, you fanboy,” Tim said, coming closer. He wrapped his arms around Bernard’s waist, pulling their bodies together, then murmured into his ear, “But these are nice, too. You're a handsome guy, Bernard, no matter what you wear. These look good on you."

Tim’s boldness was unusual, but his ability to read Bernard's insecurities and immediately sooth them was commonplace. Bernard hugged his wonderful boyfriend in gratitude for those words. He then left the room so Tim could change into his own pajamas, which were a lot simpler: basketball shorts and an oversized T-shirt.

Bernard didn’t let their dissimilarity of outfits bother him a second time. He chose to savor the moment; brushing his teeth together in Tim’s tiny bathroom, hip-checking each other for space in the mirror, and trying not to choke on foam amidst their laughter.

--

Tim’s bed wasn’t small, but it was compact. Enough for one person comfortably and two if they didn’t mind touching in the middle. Bernard waited to see which side the other preferred climbing under the sheets with him, taking the spot closer to the wall.

Was that intentional?

The dock lanterns outside shone their light through the windows, the only illumination they had. Bernard was 80% certain Tim could actually see in this dark, so he felt a little more self-conscious than he might have otherwise. A calloused hand found his beneath the blanket and squeezed it, offering silent reassurance to what he must have read on Bernard’s face.

Finding the right sleeping position was hard; Bernard was used to a much firmer (and lumpier) mattress, so his body was a little unsure how to work with Tim’s memory foam. For his part, Tim couldn’t seem to settle on what part of the bed he actually wanted, going from the very edge of his side to taking up a good chunk in the middle. There was a lot of shifting limbs, sometimes kicking each other which provoked retaliation, but that was a familiar part of their old sleepovers too. It was nostalgic.

“Fair warning: I’ve been told I snore,” Tim whispered.

“That won’t bother me. My roommates are like grizzly bears trying to harmonize with one another in an all-night concert. When my eyes are closed, I’m deaf.” Bernard paused, considering, before adding, “But, um, I might wake up in the middle of the night. I get nightmares sometimes.”

Tim was quiet; Bernard wished he could see his face. Then warm arms came up around his shoulders, pulling him into a hug that always felt like a safe place to hide. “I’ll be right here if you do,” Tim promised, soft yet unyielding. “I’ll be here when you get up tomorrow, too. You're safe, Bear. "

Bernard bit his lip to keep the tears of gratitude at bay. How had he found someone who care so much, who actually paid attention enough to see the fears he’d never admit to. Bernard shifted until his lips found warm skin, trailing them across Tim’s cheek until he could properly kiss the man he loved. It was gentler than what they’d had outside, but twice as meaningful. Simple but perfect, just like this moment. Just like every moment they got to share in this comfy houseboat.

The night dragged on, their attempt to sleep interrupted by whispered comments and gentle touches. Snuggling under the blankets was the best part by far, feeling heartbeats and gentle breaths, the warmth and safety of having a lover’s arms to hold you tightly through the night.

The bond they shared was already strong, but taking a step like this made it feel like they were truly unbreakable.

---

I wonder if you can tell how tired I was after a week of writing. Still, I gave it my best to end TimBer Week 2024 on a good note. That said, I might come back through these on a later date and do some editing. Not for a while, though.

Thank you to everyone who read even one of my posts and a special thanks if anyone joined me in this project!

Let's see what next year brings!

53 notes

·

View notes

Text

VoxTek™ Employment Contract

I, @helluvahotelfan , invoke the infernal powers of Hell to complete the following contract between myself and the Overlord, Vox. Hereafter, "the employee" will refer to Jenn, "the employer" will refer to VoxTek™, "the Overlord" will refer to Vox, and "the contract" will refer to this agreement, signed and sealed by a handshake.

Payment: to complete this contract, the employee signs over possession of their soul to the Overlord. For as long as the soul remains in the Overlord's possession, the terms and conditions of this contract are considered valid. Additionally, the Overlord cannot kill or willfully maim or harm the employee while this contract is in effect.

Terms: The employer will provide housing(1), a competitive(2) salary, the latest(3) model of Hellphone, insurance (4), two weeks of paid training, 30 vacation days per year (5), 30 days of sick leave per year (6), a free upgrade to replace or enhance a body part(7), a 200 year(8) retirement plan, and 24/7 protection from reasonable(9) threats. The employee will fulfill the job description provided below to the best of their ability.

Conditions: This contract remains in effect provided both the employee and the Overlord wish to continue adhering to the terms. At any time, either party may request breaking the contract. The request must be accepted by the Overlord. The Overlord reserves the right to change the job assigned to the employee in the event of subpar performance.

Job Title: Junior Data Collector

Department: Research & Development

Job Scope: Junior Data Collectors follow instructions from Senior Data Collectors and report to Project Leads all data obtained throughout marketing, testing, and further analysis. Data Collectors observe tests, trends, and other indicated measurements at the direction of Project Leads and record data as instructed by Project Leads. Data Collectors are expected to report accurate figures. Data Collectors may, on occasion, be asked to participate directly in Projects but never to the extent Hazard Pay would be required. Any injuries incurred as a result of Data Collection are to be reported immediately to the Project Lead.

Hours: Mandated work hours are 1000-1600, Monday-Thursday unless Project Leads get approved for a different work cycle.

(1) Housing starts at one bedroom, one bathroom, kitchen and washer/dryer included 550 square foot apartment. Housing can be upgraded through promotion or by registering dependents with Human Resources. (2) Competitive rates based on job title and relative cost-of-living analysis for Pride ring standards. Salary will always be 400% of current housing cost. (3) Latest model refers to latest model to pass all safety checks and either is commercially available or in phase 4 of production. (4) Insurance covers health, vision, and dental plans, as well as maternity/paternity leave, Family Medical Leave Allocation, and associated costs. (5) Unused vacation days roll over but will not exceed 75 days. Vacation days accrued past 75 days will either be paid out to the employee in a lump sum, signed over to another employee, or forfeit. Decision must be made within 1 month of employment anniversary date. (6) Unused sick leave rolls over but will not exceed 60 days. Illness or injury requiring more than 60 days to recover but at no fault of the employer will be deducted from vacation days. Illness or injury incurred during the execution of job duties will not be charged to the employee. (7) Available upgrades subject to change depending on demand. Specific upgrade offered: replacement of one eye with a VokTek™ High Definition digital recorder. Any data or information recorded by an upgrade becomes property of the employer with employee consent. (8) 200 year retirement plan based on projected life expectancy increase following the cessation of Exterminations. In the event Exterminations resume, this requirement will be lowered to 50 years. (9) Reasonable threats are those not provoked by the employee, provided the employee remains within designated areas when directed by senior personnel. Ex: leaving the approved VoxTek™ Extermination Bunker during an Extermination or insulting an Overlord/Sin/Ars Goetia are examples where the employer is no longer liable for the employee's protection.

Signed and confirmed via handshake with the Overlord,

Jenn

It took me a moment to find it, I apologize; you wouldn't believe how many copies I have in my office. Of course I have a digitized copy but Hell runs on old school methodologies, so having a hard copy is still required.

Now, @zayne1, you can make your determinations.

#ask overlord vox#vox has eyes everywhere#ask blog#sinner jenn#((this took entirely too long and it's way too concise to be a proper contract))#((but there's a reason I didn't become any type of lawyer and it's because their shit's too fucking wordy))#((also fuck now I wanna work for Vox give me those fucking hours bro))

79 notes

·

View notes

Text

Good organizations to support right now to prepare for a Trump presidency with links:

ACLU:

Over the past year, the ACLU has fought against a resurgent wave of extremism in all 50 states. Now more than ever, we need you by our side.

Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy.

Making a gift to the ACLU via a wire transfer allows you to have an immediate impact on the fight for civil liberties.

Trevor Project:

TP works to make sure that LGBTQ+ young people who need support know they are not alone. Your support will help us provide them with the affirmation and love they deserve. Your gift also helps Trevor to:

Advocate against anti-LGBTQ+ laws and work with policymakers to pass legislation to protect LGBTQ+ youth

Connect LGBTQ+ peers through TrevorSpace, our safe space social networking site

Conduct original research to capture the unique experiences of LGBTQ+ young people

Planned Parenthood:

Planned Parenthood is made up of many separate entities that are tied by a central mission:

Help people live full, healthy lives — no matter your income, insurance, gender identity, sexual orientation, race, or immigration status;

Provide the high-quality inclusive and comprehensive sexual and reproductive health care services all people need and deserve — with respect and compassion;

Advocate for public policies that protect and expand reproductive rights and access to a full range of sexual and reproductive health care services, including abortion;

Provide medically accurate education that advances the understanding of human sexuality, healthy relationships, and body autonomy;

Promote research and technology that enhances reproductive health care and access.

Satanic Temple:

The TST have publicly confronted hate groups, fought for the abolition of corporal punishment in public schools, applied for equal representation when religious installations are placed on public property, provided religious exemption and legal protection against laws that unscientifically restrict people's reproductive autonomy, exposed harmful pseudo-scientific practitioners in mental health care, organized clubs alongside other religious after-school clubs in schools besieged by proselytizing organizations, and engaged in other advocacy in accordance with our tenets.

Challenges government theocrats and unconstitutional laws/bills

Provides free abortion healthcare services

Works to protect reproductive rights

Establishing educational after-school programs with certified teachers

Provides services and resources for mental health and addiction recovery

And these certainly aren’t the only ones! Feel free to tag/include local, national and international organizations and charities. Every dollar helps people in need no matter how hopeless it seems right now.

#charity#trevor project#aclu#satanic temple#planned parenthood#us elections#2024 presidential election#pika speaks

21 notes

·

View notes

Text

I need y'all to understand something about US health care: providers WILL NOT tell you how much an appointment or procedure costs prior to authorizing payment from your insurance. You could be about to pay a hundred dollars or a thousand and you will not know in advance.

Some providers can give you a "good faith estimate" by mail (never! over! the phone!) but it's not guaranteed to be accurate and they'll always tell you to contact your insurance.

I currently have a high-deductible plan, so we've been paying out of pocket for my ADHD testing. I have a psychiatrist telehealth appointment to talk about medication to treat it. They will not tell me how much that appointment will cost, even if I am paying out of pocket. I know it will be several hundred dollars, but how many hundred? It's a mystery.

USA! USA! USA!

40 notes

·

View notes

Text

If you are on a high-deductible health plan (which is common on state marketplace health plans in America), you can set up a Health Savings Account with many banks. You put money into the account--and you get a tax break for doing this. And then you can use the money for certain medical expenses, and it's more than people think.

I am not a CPA, so def make sure with an accountant and/or your bank and/or your health plan.

But you can often get things like flu shots, PPE and even hand sanitizer, certain "feminine hygiene products" as they still put it (including period panties), some vaccines, mouth guards for grinding teeth, canes, crutches, eye tests, some prescriptions, and even some dental treatments.

So yeah, you have to have the money to put into your account (or your employer might offer it), and you get a tax break for making the contributions, and you can use the funds to pay for certain health care expenses.

Consult a tax person or your bank/credit union!

#america is a shithole#but like try to find bonuses and loopholes!#health savings accounts#finances#health care

6 notes

·

View notes

Text

So I’ve made a few references to Steve being an Excel guy as an adult (because someone had to be in charge of Steve and Eddie’s money and it certainly wasn’t going to be Eddie).

He’s got the classic spreadsheets – monthly budget, college savings projections, income tracking because he and Eddie both work jobs with variable incomes (Steve is a counselor and Eddie is an author), the whole nine yards.

Steve also has some “extracurricular” spreadsheets. I’ve talked about how Steve has a spreadsheet tracking the combinations of Mario Kart racers/vehicles he tries out (there’s a ranking system involved, it’s very complex). He’s got one for his fantasy football league, obviously, and he and Moe put money on their March Madness brackets so there’s a spreadsheet for that too.

Eddie’s personal favorite is the one comparing monthly expenses by kid, which isn’t exactly a necessary metric per se, but from it stems a game Steve and Eddie secretly play: who is the most expensive Harrington daughter?

The winner tends to rotate throughout the year, but Hazel is usually their least expensive child in the long run. She does ballet, which isn’t too bad when she’s little but then she graduates to pointe shoes, and Steve had no idea that not only do pointe shoes set you back $100 minimum, they also wear out ridiculously fast, and, as he’s been told many times, you can’t wear the dead ones.

Moe usually takes that top spot in the winter – elite basketball teams aren’t cheap by any stretch of the imagination, and then in high school she gets into snowboarding, which is somehow even more expensive. She’s also consistently the reason they hit their health insurance deductible every year.

Robbie is their overall most expensive kid by a mile. She drove up their car insurance by getting into an accident a month after she got her driver's license, had braces for five years, and the prescription on her glasses has changed every eighteen months since she was seven. She’s notorious for breaking her phone, so she racks up quite a tab in that regard too (the one year they got a protection plan was also the one year she had no phone-related incidents, so they didn’t even bother renewing it – they just make her suffer with a cracked screen for a few months before they finally drag her to the mall to get it fixed). There’s also the year Eddie bought her an electric violin which was, naturally, not cheap (Eddie argues it shouldn’t count because he was the brains behind that operation).

#they all get jobs at 16 - non-negotiable#steve was hoping at least one of them would work somewhere with a dumb uniform but alas#moe works at the mountain she snowboards at#usually she operates the lift and makes sure to slow it down to a *crawl* for the best skiers#“to humble them” she says#hazel teaches the baby classes at her ballet school#robbie does reception at the joint music school/instrument shop she takes violin lessons at#steddie#liv’s steddie dads verse#steddie dads#steve harrington#eddie munson

145 notes

·

View notes

Note

What is it gonna take for HYBE to give Jimin the support he deserves? Will it ever even happen? Because I'm tired of feeling so miserable all the time. I even wanna delete all my socials and just find something else in my life to fixate on. I feel terrible for feeling this way because it's like I'm abandoning Jimin (even if I'll still be streaming his music). I'm tired of all of this, it's not good for my mental health at all.

All this corruption and evil simply can't keep winning like this, can it? Are we just supposed to make peace with JK being BTS' "break out star"? Really? I naïvely thought that they'd abandon their sinister plans after seeing how poorly he's been performing in comparison to the crazy amount of push they've been giving him. What the hell is going on at that company?

Anon,

I'm sharing with you this poor quality video of Michael Jackson calling out Tommy Mottola and Sony because it's worth remembering that record labels using and abusing their artists is the rule, not the exception. Not even The King of Pop was immune.

youtube

At around 3:20, MJ mentions that he "owes" the label two more songs and then he's a free agent. He says he writes about 120 songs per album, so he'll just pick two songs he's got hanging around and then he's done.

I bring this up because I suspect Jimin might be doing something similar. Having as few solo songs under Big Hit as possible is smart, because he likely won't own the rights to his own music if/when he leaves. The less they own, the better. Writing and recording two albums at once was efficient. Also, by keeping his marketing budget (ads, playlist placement, music videos, etc.) as small as possible, he'll keep more of the album sales and streaming revenue. All those expensive marketing costs are deducted from an artist's earnings, so best to keep them at a minimum if the plan is to make the most money possible. Between the writing credits, lower marketing budget, and the high profile brand ambassador deals Jimin's got, I feel like he's positioning himself to create his own company or label. This is my hope even if I have zero proof.

The way FACE went down really bothered me. I knew the company was behind Jimin's sabotage immediately and it drove me crazy that it took so long for others to catch up. But look at the response to MUSE. Jimin really does have an army of dedicated fans who are calling out the company's (intentional) incompetence 24/7. In reality, it's fun to watch PJMs catch the company and create a stink. It's almost like a game. Don't take it too seriously. Plus, in the long run, who cares about charts? The quality of the music itself is far more important.

Once again I've droned on way too long, but hear me out. I think HYBE/BH is investing so heavily in JK because they have to. BTS isn't going to last forever, and if Jimin leaves, they've lost a huge revenue source. But please trust me when I say they have an uphill battle before them because JK doesn't currently have the artistry or charisma to enthrall the west the way Jimin does. Don't expect them to abandon ship anytime soon, though. And if he does make it big, so be it.

I really wish BTS fans, or at least PJMs, didn't feel so much hate for Min Hee Jin because there's a lot to learn about Bang Si-hyuk and HYBE when you follow the whole ADOR saga. There are some astute NewJeans fans out there who've sized up Bang PD so well and their observations help explain Jimin's treatment by the company. He breaks people down (the idols, staff, and fans) using the "death by a thousand cuts" method. Endless small transgressions and slights, that individually appear like no big deal and are therefore not taken seriously by the media or fans, but collectively are detrimental to careers and one's mental health.

You know what? If Jimin announced he's leaving the music industry after military service, I would say congratulations and thank you for all the amazing music and performances during your BTS and solo career. Have a wonderful life! While I don't think he'll do that, it's worth remembering that none of this is all that serious. Enjoy his music. Take a break from social media, because in the real world nobody cares about this stuff.

Anon, did you make to the end of this long post? Way to use the umlaut on naïvely!

18 notes

·

View notes