#FLORIDA DEPARTMENT OF FINANCIAL REGULATION

Explore tagged Tumblr posts

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

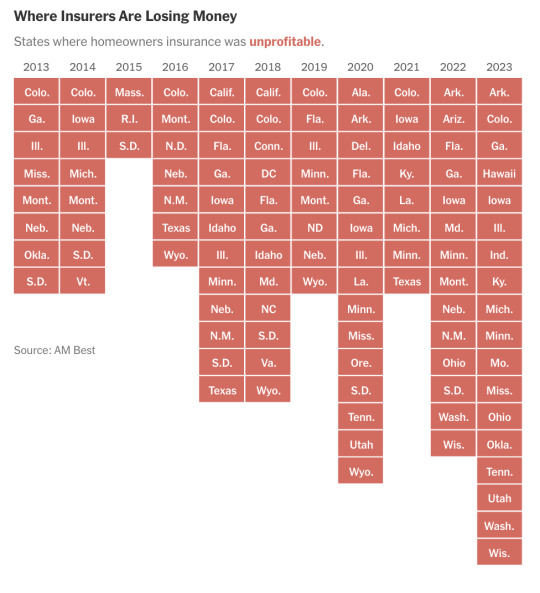

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

136 notes

·

View notes

Text

Elon Musk essentially bought the election. And he had no ethical problem with deceiving voters in the process.

Elon Musk plowed at least $260 million into efforts to send Donald Trump back to the White House, new filings show – a massive infusion that makes him one of the largest single political underwriters of a presidential campaign and underscores the outsized influence of the world’s wealthiest person on this year’s election. Thursday’s filings with the Federal Election Commission show that the Tesla and SpaceX executive gave a total of $238 million to a super PAC that he founded this year, America PAC, which worked to turn out voters on Trump’s behalf in key states. But he also was the financial backer of other groups that cropped up in the final days of the election to support Trump, including one that spent millions on advertising to defend his record on abortion. It had sought to link Trump’s views on abortion to those of late Supreme Court Justice and liberal icon Ruth Bader Ginsburg. Musk, through a trust that bears his name, donated $20.5 million to the group, named RBG PAC, on October 24, according to filings with the Federal Election Commission. He was the sole donor to the group, which was formed in mid-October. The donation’s timing meant that Musk’s involvement was not disclosed until Thursday’s post-election filings with the federal regulators.

And Musk even promoted RFK Jr. in swing states where Brain Worm was still on the ballot.

According to the new filings, Musk also donated $3 million to the MAHA Alliance, a super PAC that ran stark ads in key swing states urging supporters of Robert F. Kennedy Jr. to back Trump in the closing stretch of the campaign. Kennedy himself had ended his independent campaign over the summer and endorsed Trump. MAHA stands for “Make America Healthy Again,” Kennedy’s spin on Trump’s MAGA catchphrase. Trump has now tapped Kennedy, one of the nation’s most prominent anti-vaccine conspiracy theorists, to oversee the Health and Human Services Department.

If Musk invested $260 million in getting Trump elected, you can imagine what sort of return on that investment he is expecting.

A historical digression...

The ability to buy elections is a result of the odious Citizens United v. Federal Election Commission SCOTUS decision in 2010. Citizens United happened because George W. Bush was able to appoint Samuel Alito and John Roberts to the Supreme Court. And George W. Bush won in 2000 thanks to the idiotic third party candidacy of Ralph Nader. If just 538 of the 97,488 people in Florida who voted for Nader had instead voted for Democrat Al Gore, Bush would not have been elected and Citizens United probably would not have happened. And without Citizens United, it would be very difficult for billionaires like Musk to buy elections.

#elon musk#billionaires#buying elections#donald trump#election 2024#citizens united vs. fec#scotus#john roberts#samuel alito#george w. bush#election 2000#ralph nader

18 notes

·

View notes

Text

If you want to see what the GOP has in store for the rest of America, visit the Old South

Thom Hartmann

June 27, 2024 5:42AM ET

Photo by Miltiadis Fragkidis on Unsplash

Today is the first Biden-Trump debate and many Americans are wondering how each will articulate their ideas for the future of America.

Republicans have a very specific economic vision for the future of our country, although they rarely talk about it in plain language: they want to make the rest of America look and function just like Mississippi. Including the racism: that’s a feature, not a bug.

It’s called the “Southern Economic Development Model” (SEDM) and has been at the core of GOP economic strategy ever since the days of Ronald Reagan. While they don’t use those words to describe their plan, and neither did the authors of Project 2025, this model is foundational to conservative economic theory and has been since the days of slavery.

The SEDM explicitly works to:

— Maintain a permanent economic underclass of people living on the edge of poverty, — Rigidify racial and gender barriers to class mobility to lock in women and people of color, — Provide a low-cost labor force to employers,

— Prevent unions or any other advocates for workers’ rights to function, — Shift the tax burden to the working poor and what’s left of the middle class while keeping taxes on the morbidly rich extremely low, — Protect the privileges, power, and wealth of the (mostly white and male) economic overclass, — Ghettoize public education and raise the cost of college to make social and economic mobility difficult, — Empower and subsidize churches to take over public welfare functions like food, housing, and care for indigent people, — Allow corporations to increase profits by dumping their waste products into the air and water, — Subsidize those industries that financially support the political power structure, and, — Heavily use actual slave labor.

For hardcore policy wonks, the Economic Policy Institute(EPI) did a deep dive into the SEDM last month: here’s how it works in summary.

Republicans claim that by offering low-cost non-union labor and little to no regulatory oversight to massive corporations, they’re able to “attract business to the region.” This, they promise, will cause (paraphrasing President Kennedy out of context) “a rising tide that lifts all boats.”

Somehow, though, the only people who own boats that rise are those of the business owners and senior executives. The permanent economic underclass is key to maintaining this system with its roots in the old plantation system; that’s why Mississippi, Louisiana, Alabama, Tennessee, and South Carolina have no minimum wage, Georgia’s is $5.15/hour, and most other GOP states use the federal minimum wage of $7.25/hour and $2.13/hour for tipped workers.

It’s thus no coincidence that ten out of the 20 Republican-run states that only use the federal minimum wage are in the Old South.

Anti-union or “right to work for less” efforts and laws are another key to the SEDM; the failed unionization effort last month at the Alabama Mercedes factory was a key victory for the GOP. Unions, after all, balance the power relationship between management and workers; promote higher wages and benefits; support workplace and product safety regulations; advance racial and gender equality; boost social mobility; and have historically been the most effective force for creating a healthy middle class.

Unionization, however, is antithetical to creating and maintaining a permanent economic underclass, which is why, as EPI notes, “while union coverage rates stand at 11.2% nationally, rates in 2023 were as low as 3.0% in South Carolina, 3.3% in North Carolina, 5.2% in Louisiana, and 5.4% in Texas and Georgia.”

Unions also make wage theft more difficult, essentially forcing government to defend workers who’ve been ripped off by their employers. That’s why Florida doesn’t even have a Department of Labor (it was dismantled by Republican Governor Jeb Bush in 2002), and the DOLs in Alabama, Delaware, Georgia, Louisiana, Mississippi, and South Carolina no longer bother to enforce wage theft laws or recover stolen money for workers.

Another key to the SEDM is to end regulation of corporate “externalities,” a fancy word for the pollution that most governments in the developed world require corporations to pay to prevent or clean up. “Cancer Alley” is probably the most famous example of this at work: that stretch from west Texas to New Orleans has more than 200 refineries and chemical plants pouring poison into the air resulting in downwind communities having a 7 to 21 times greater exposure to these substances. And high rates of cancer: Southern corporate profits are boosted by sick people.

Between 2008 and 2018, EPI documents, funding for state environmental agencies was “cut [in Texas and Louisiana] by 35.2% and 34.8% respectively.… Funding was down by 33.7% in North Carolina, 32.8% in Delaware, 20.8% in Georgia, 20.3% in Tennessee, and 10% in Alabama.”

To keep income taxes low on the very wealthy, the SEDM calls for shifting as much of the taxpaying responsibility away from high-income individuals and dumping it instead on the working poor and middle class. This is done by either ending or gutting the income tax (Texas, Florida, and Tennessee have no income tax) and shifting to sales tax, property taxes, fees, and fines.

Nationally, for example, sales taxes provide 34.4% of state and local revenue, but in the SEDM states that burden is radically shifted to consumers: Tennessee, for example, gets 56.6% of their revenue from sales tax, Louisiana 53.3%, Florida 50.9%, Arkansas 49.6%, Alabama 48%, and Mississippi 45.5%. Fees for registering cars, obtaining drivers’ and professional licenses, tolls, traffic and other fines, and permits for home improvements all add to the load carried by average working people.

Republicans argue that keeping taxes low on “job creators” encourages them to “create more jobs,” but that old canard hasn’t really been taken seriously by anybody since Reagan first rolled it out in 1981. It does work to fill their money bins, though, and helps cover the cost of their (tax deductible) private jets, clubs, and yachts.

Another way the SEDM maintains a low-wage workforce is by preventing young people from getting the kind of good education that would enable them to move up and out of their economic and social class. Voucher systems to gut public education, villainization of unionized teachers and librarians, and increasing college tuition all work together to maintain high levels of functional illiteracy. Fifty-four percent of Americans have a literacy rate that doesn’t exceed sixth grade, with the nation’s worst illiteracy mostly in the Old South.

Imposing this limitation against economic mobility on women is also vital to the SEDM. Southern states are famous for their lack of female representation in state legislatures (West Virginia 13%, Tennessee 14%, Mississippi and South Carolina 15%, Alabama and Louisiana 18%), and the states that have most aggressively limited access to abortion and reproductive healthcare (designed to keep women out of the workplace and dependent on men) are entirely Republican-controlled.

Perhaps the most important part of the SEDM pushed by Republicans and Project 2025 is gutting the social safety net. Wealthy rightwingers have complained since FDR’s New Deal of the 1930s that transferring wealth from them to poor and middle-class people is socialism, the first step toward a complete communist tyranny in the United States. It’s an article of faith for today’s GOP.

Weekly unemployment benefits, for example, are lowest in “Mississippi ($235), Alabama ($275), Florida ($275), Louisiana ($275), Tennessee ($275), South Carolina ($326), and North Carolina ($350)” with Southern states setting the maximum number of weeks you can draw benefits at 12 in Florida, North Carolina, and Kentucky, 14 in Alabama and Georgia, and a mere 16 weeks in Oklahoma and Arkansas.

While only 3.3% of children in the Northeast lack health insurance, for the Southern states that number more than doubles to 7.7%. Ten states using the SEDM still refuse to expand Medicaid to cover all state residents living and working in poverty, including Mississippi, Alabama, Georgia, South Carolina, Florida, Tennessee, and Texas.

The main benefit to employers of this weak social safety net is that workers are increasingly desperate for wages — any sort of wages — and even the paltriest of benefits to keep their heads above water economically. As a result, they’re far more likely to tolerate exploitative workplace conditions, underpaid work, and wage theft.

Finally, the SEDM makes aggressive use of the 13th Amendment’s legalization of slavery. That’s not a metaphor: the Amendment says, “Neither slavery nor involuntary servitude, except as a punishment for crime whereof the party shall have been duly convicted, shall exist within the United States, or any place subject to their jurisdiction.” [emphasis added]

That “except as punishment for crime” is the key. While Iceland’s and Japan’s incarceration rates are 36 for every 100,000 people, Finland and Norway come in at 51, Ireland and Canada at 88, there are 664 people in prison in America for every 100,000 people. No other developed country even comes close, because no other developed country also allows legalized slavery under color of law.

Fully 800,000 (out of a total 1.2 million prisoners) Americans are currently held in conditions of slave labor in American jails and prisons, most working for private prison corporations that profitably insource work and unfairly compete against normal American companies. Particularly in the South, this workforce is largely Black and Hispanic.

As the ACLU documented for the EPI, “The vast majority of work done by prisoners in Alabama, Arkansas, Florida, Georgia, Mississippi, South Carolina, and Texas is unpaid.” Literal slave labor, in other words. It’s a international scandal, but it’s also an important part of this development model that was, after all, first grounded in chattel slavery.

The Christian white supremacist roots of the SEDM worldview are best summed up by the lobbyist and head of the Southern Committee to Uphold the Constitution, Vance Muse — the inventor of the modern “right to work for less” model and advocate for the Southern Economic Development Model — who famously proclaimed in 1944, just days after Arkansas and Florida became the first states to adopt his anti-union legislation, that it was all about keeping Blacks and Jews in their places to protect the power and privileges of wealthy white people.

So, if you want to see what Republicans have in mind for the rest of America if Trump or another Republican becomes president and they can hold onto Congress, just visit the Old South. Or, as today’s MAGA GOP would call it, “the New Model.”

20 notes

·

View notes

Text

The Supreme Court unanimously handed the National Rifle Association a win Thursday in the gun rights group's effort to revive a 2018 First Amendment lawsuit accusing a New York official of causing damage to the NRA's relationships with banks and insurers.

Justice Sonia Sotomayor wrote a unanimous opinion that found the NRA "plausibly alleged" that Maria Vullo, a former superintendent of New York's Department of Financial Services, illegally retaliated against the pro-Second Amendment group after the Parkland, Florida, high school mass shooting that left 17 people dead.

The question before the justices was whether Vullo used her regulatory power to force state financial institutions to cut off ties with the NRA in violation of constitutional First Amendment protections.

Vullo, who worked in former Democratic Gov. Andrew Cuomo's administration, said her regulations targeted an insurance product that is illegal in New York, which is dubbed by critics as "murder insurance." In essence, such insurances are third-party policies sold via the NRA that cover personal injury and criminal defense costs after the use of a firearm.

"Here, the NRA plausibly alleged that Vullo violated the First Amendment by coercing DFS-regulated entities into disassociating with the NRA in order to punish or suppress gun-promotion advocacy," Sotomayor, an appointee of former President Barack Obama, wrote in her decision.

Although the gun rights group is typically involved in litigation surrounding the Second Amendment, the case marked an unusual departure to a First Amendment claim that even had backing from the American Civil Liberties Union, which has historically targeted the gun rights group in other cases before the high court.

The result of the case means the NRA can continue its lawsuit against Vullo.

Justices Neil Gorsuch and Ketanji Brown Jackson penned separate concurrences.

8 notes

·

View notes

Text

Brandi Buchman at HuffPost:

Andrew Kloster, who once proclaimed online he is a ”raging misogynist,” is now the general counsel for the Office of Personnel Management, an entity that oversees more than 2 million civilian federal workers. Kloster described himself as a misogynist on X, formerly Twitter, in February 2023 when replying to a user who said, “women love a sprinkle of misogyny in a man.” He wrote: “I’m 100% women respecter precisely because I’m a raging misogynist. I’m so kind you’ll want to kill yourself and die, which is the goal.” Kloster served as a deputy general counsel at the Office of Personnel Management during President Donald Trump’s first term. His return to the agency was first reported Wednesday by public corruption watchdog Project On Government Oversight. Neither Kloster nor the OPM immediately returned a request for comment to HuffPost on Wednesday. Kloster slid into the role of general counsel just last week as a slew of hiring, firing and funding freeze memos and directives from the new Trump administration started flowing in. As HuffPost reported Tuesday, federal workers are currently being targeted with questions by the Trump administration, including asking them to explain whether any of their grants, loans or other financial aid is being used to engage in DEI programs, support or promote abortion or if their services assist immigrants. In part of his responsibilities as general counsel, Kloster is tasked with helping to interpret and create rules that cover everything from how federal workers are protected in the workplace to how a government worker’s personal political activities should be regulated. Before this return, Kloster was general counsel for the now-former Republican Rep. Matt Gaetz of Florida, who came under federal and congressional investigation over alleged illicit activities. The Justice Department declined to press charges after a sex-trafficking investigation into the former lawmaker, but the House Ethics Committee issued a public report in December stating that it found “substantial evidence” Gaetz paid for sex, had sex with a 17-year-old girl and purchased illegal drugs while serving in Congress. Gaetz has strongly denied all of these claims. The uber-conservative Federalist Society has Kloster listed as a contributor and describes him in a site biography as a “long-time fixture of the conservative movement” before also lauding his credentials: Kloster served as an associate director to the White House Office of Presidential Personnel under the first Trump administration.

[...] Kloster also was a legal fellow at The Heritage Foundation, the same group that helped shape the second Trump administration’s Project 2025 agenda.

Andrew Kloster, who formerly worked for Matt Gaetz and bills himself a “raging misogynist”, is now the general counsel for the Office of Personnel Management (OPM).

#Andrew Kloster#Matt Gaetz#Trump Administration II#Misogyny#Manosphere#Sexism#Federalist Society#Trump Administration#The Heritage Foundation#Office of Personnel Management

2 notes

·

View notes

Text

Understanding Bad Faith Insurance Practices in Florida, New Jersey, and New York

What is Bad Faith Insurance?

Bad faith insurance practices involve an insurer's intentional refusal to honor its contractual obligations to the policyholder. This occurs when an insurance company fails to act in good faith and fair dealing, which it is legally required to do. Bad faith can be both first-party (directly against the policyholder) and third-party (against a party making a claim against the policyholder).

How Does Bad Faith Occur?

Bad faith can occur through various deliberate actions by the insurer, including:

Misrepresentation of Policy Terms: Insurers may intentionally misrepresent the terms of the policy to deny coverage.

Improper Investigation: Conducting a biased or incomplete investigation to justify denying a claim.

Unreasonable Denial or Delay: Denying or delaying payment without a reasonable basis.

Lowball Offers: Offering settlements far below the claim's actual value.

Florida Law

Under Florida Statutes §624.155, an insurer can be held liable for bad faith if it fails to settle claims when it could and should have done so, had it acted fairly and honestly toward its insured and with due regard for their interests.

New Jersey Law

In New Jersey, the "fairly debatable" standard applies, meaning the insurer must demonstrate a reasonable basis for denying a claim. The case of Pickett v. Lloyd’s, 131 N.J. 457 (1993), is a pivotal ruling that requires insurers to justify their actions reasonably.

New York Law

In New York, proving bad faith requires showing that the insurer engaged in egregious conduct or a pattern of unfair practices, as established in Pavia v. State Farm Mutual Auto. Ins. Co., 82 N.Y.2d 445 (1993). This case demonstrates the high burden of proof required to establish bad faith.

What to Do If You Suspect Bad Faith

If you believe your insurance company is acting in bad faith, take the following steps:

Understand Your Policy: Review your insurance policy to understand your coverage and rights.

Document Everything: Keep detailed records of all communications with your insurer, including emails, letters, and phone calls.

File a Complaint: You can file a complaint with your state's insurance regulatory agency. In Florida, this is the Florida Office of Insurance Regulation; in New Jersey, it's the New Jersey Department of Banking and Insurance; and in New York, it's the New York State Department of Financial Services.

Seek Legal Advice: Consult with an experienced attorney who specializes in insurance bad faith claims. They can help you understand your rights and take appropriate legal action.

State-Specific Tips

Handling bad faith insurance claims varies significantly depending on the state.

Each jurisdiction has its own laws, procedures, and standards that affect how these cases are approached. Below, we provide specific tips for Florida, New Jersey, and New York to help you effectively address bad faith practices in your state. These tailored insights will help you take appropriate action and protect your rights based on your location.

Florida Tip

In Florida, policyholders have the right to file a Civil Remedy Notice (CRN) with the Department of Financial Services. This notice gives the insurer 60 days to resolve the issue before a lawsuit can be filed (Fla. Stat. §624.155).

New Jersey Tip

In New Jersey, keeping meticulous records of all interactions with the insurer is crucial for building a strong case under the "fairly debatable" standard. Refer to the case Pickett v. Lloyd’s, 131 N.J. 457 (1993), for guidance on how courts assess these claims.

New York Tip

In New York, due to the high burden of proof required to establish bad faith, it is essential to gather substantial evidence of the insurer's egregious conduct or pattern of unfair practices. Refer to Pavia v. State Farm Mutual Auto. Ins. Co., 82 N.Y.2d 445 (1993) for more details on the legal standards applied in these cases.

Continue reading our Bad Faith article by clicking here.

Have a question about a bad faith claim?

Call The Sheldrick Law Firm at (561) 440-7775 and ask to speak with attorney Kayla Sheldrick.

Proudly Serving Florida, New Jersey, & New York

#bad faith claim#florida lawyer for bad faith claim#florida lawyer#personal injury lawyer#florida accident attorney#insurance company acting in bad faith#hire law lawyer for a bad faith claim#catastrophic injuries#sarasota lawyer#bad faith signs#how to file a bad faith claim#insurance company bad faith tactics to avoid

3 notes

·

View notes

Text

Florida and North Carolina Consider Bitcoin Reserves for State Treasuries

Key Points

Florida is advancing Senate Bill 550, which would allow the state to invest up to 10% of specific public funds into Bitcoin.

North Carolina is leading the U.S. in passing strategic Bitcoin reserve legislation, with 11 bills introduced.

Florida is taking the lead in integrating Bitcoin into its financial system.

This is being done through the advancement of Senate Bill 550, which aims to incorporate Bitcoin into the state’s public investment strategy.

Florida’s Bitcoin Reserve Strategy

The bill was introduced by Senator Joe Gruters.

It seeks to authorize the state to allocate up to 10% of certain public funds into Bitcoin.

This positions Bitcoin as a hedge against inflation and a means of increasing financial autonomy.

The proposal for Florida Bill SB 550 noted that Bitcoin has greatly increased in value throughout its history.

It is becoming more widely accepted as an international medium of exchange, and countries around the world, including the U.S., hold Bitcoin within their treasury departments.

If enacted, the legislation would empower the state’s Chief Financial Officer to manage Bitcoin holdings through qualified custodians, exchange-traded products, or direct ownership.

Other States Following Suit

Florida is not alone in its push for Bitcoin.

North Carolina and South Dakota are also exploring Bitcoin investments, joining a growing list of states considering digital asset reserves.

In North Carolina, the House Speaker’s staff recently engaged with industry advocate Dan Spuller, who asserted that the state aims to secure the “top spot” in Bitcoin reserves.

Meanwhile, South Dakota Representative Logan Manhart is pushing for legislative action, emphasizing that “now is one of the few chances government has at being proactive.”

At least 18 states are currently assessing Bitcoin investments, marking a growing momentum for state-level adoption of cryptocurrency.

Brazil has also seen a significant rise in cryptocurrency adoption, with stablecoins becoming the preferred choice for payments.

This has raised concerns among regulators regarding oversight and financial stability.

Utah is emerging as one of the top states in passing formal legislation on Bitcoin reserves.

Dennis Porter, CEO of Satoshi Act Fund, recently suggested that Utah could be the first state to successfully implement such a policy.

This growing interest underscores a broader shift toward Bitcoin’s role in state financial strategies, signaling a potential wave of adoption that could reshape traditional investment models across the U.S.

0 notes

Text

Safe & Sustainable Medical Waste Disposal in Orlando

With a booming tourism and healthcare sector, Orlando produces tons of medical waste daily. Proper disposal is important for public health, environmental sustainability, and regulatory compliance. In this blog, we are going to discuss the importance of safe and sustainable medical waste disposal in Orlando while highlighting the best practices and innovative solutions for health care facilities, clinics, and medical-related businesses.

Understanding Medical Waste

Medical waste includes materials generated from healthcare-related activities, such as hospitals, dental clinics, laboratories, and nursing homes. These wastes can be categorized as:

Infectious Waste: Items contaminated with blood, bodily fluids, or pathogens.

Sharps Waste: Needles, syringes, and scalpels that pose injury and infection risks.

Pharmaceutical Waste: Expired or unused medications requiring proper disposal.

Hazardous Waste: Chemicals and materials that pose environmental and health risks.

General Medical Waste: Non-hazardous waste, such as packaging and disposable gowns.

Without responsible disposal, medical waste can spread infections, harm wildlife, and pollute soil and water sources.

Regulations for Medical Waste Disposal in Orlando

To secure the protection of Mother Earth and the health of the people, the state of Florida rigorously applies rules and regulations on medical waste management. Cooperatively, Florida's Department of Health (FDOH) and Environmental Protection Agency (EPA) make sure that disposal protocols are followed to ensure the proper collection, treatment, and disposal of medical waste with minimum risk.

Healthcare facilities must:

Separate medical waste properly according to state guidelines.

Store waste in leak-proof, labeled containers.

Use licensed medical waste disposal companies for collection and treatment.

Maintain records of waste disposal practices.

Violations of medical waste regulations can result in hefty fines and legal consequences, making compliance essential for healthcare providers.

Sustainable Medical Waste Disposal Practices

With sustainability now taking the forefront as concerns for businesses and medical institutions, Orlando is shifting to greener medical waste disposal methods. Some of the significant sustainable practices include:

Waste Segregation & Reduction

In this era of sustainable trending, businesses and medical institutions are in full steam introducing greener mechanisms of disposal in Orlando. Major sustainable ways may comprise:

Advanced Treatment Methods Instead of incineration, many facilities now opt for autoclaving (steam sterilization) and microwave treatment to disinfect infectious waste, reducing emissions and environmental harm.

Recycling Initiatives Some non-hazardous medical waste, such as plastics and certain metals, can be safely recycled. Partnering with specialized recycling programs ensures that waste is repurposed instead of sent to landfills.

Partnering with Sustainable Waste Disposal Companies Many disposal companies in Orlando focus on green medical waste solutions, using energy-efficient transport, eco-friendly treatment processes, and digital tracking to reduce carbon footprints.

Why Proper Medical Waste Disposal Matters

1️. Protects Public Health – Prevents the spread of infections and diseases. 2️. Preserves the Environment – Reduces pollution and landfill waste. 3️. Ensures Regulatory Compliance – Avoids legal risks and financial penalties. 4️. Enhances Community Well-Being – Creates a safer living environment for residents.

Choosing the Right Medical Waste Disposal Partner in Orlando

Finding a reliable medical waste disposal company is essential for ensuring compliance and sustainability. When selecting a provider, consider:

Proper licensing and compliance with Florida regulations.

Environmentally friendly disposal techniques.

Affordable and customized waste management plans.

Reliable pickup schedules and customer service.

By working with a trusted disposal partner, healthcare facilities can streamline waste management while contributing to a healthier Orlando.

Final Thoughts

The public, waste management firms, and medical practitioners should all share responsibility in ensuring safe and sustainable disposal of medical waste. Orlando can expect to ensure the safety of its inhabitants and the environment against the dangers of improper waste disposal by setting up environmentally sustainable methods and adhering to the applicable regulations.

Stay tuned for our next blog, where we explore Safe & Sustainable Medical Waste Disposal in Pembroke Pines

0 notes

Text

Open Your Career Potential: Top Medical Billing and Coding Jobs in Florida for 2023

Unlock Your Career Potential: Top Medical Billing and Coding Jobs in Florida for 2023

Unlock Your Career Potential: Top Medical Billing and Coding Jobs in Florida for 2023

Are you looking to shape your future in the healthcare industry? With the increasing demand for skilled professionals in medical billing and coding, there has never been a better time to explore career opportunities in Florida. This comprehensive guide delves into the top medical billing and coding jobs available in Florida for 2023, offering insights into the job market, requirements, benefits, and practical tips to enhance your career prospects.

Understanding Medical Billing and Coding

Medical billing and coding are two essential components of the healthcare ecosystem. Medical billing involves processing and following up on claims with health insurance companies, while medical coding translates healthcare diagnoses, procedures, and services into universal codes. Together, these roles ensure that healthcare providers are reimbursed accurately and promptly.

The Growing Demand for Medical Billing and Coding Professionals in Florida

Florida is consistently ranked among the best states for healthcare employment. The Bureau of Labor Statistics indicates a substantial growth trend for medical billing and coding jobs, with an expected increase of 8% from 2020 to 2030. This growth is driven by:

Increasing healthcare needs of a growing and aging population.

Expansion of health information technology.

Legislation promoting medical billing code standardization.

Top Medical Billing and Coding Jobs in Florida for 2023

Here are some of the most promising job opportunities for medical billing and coding professionals in Florida this year:

Job Title

Average Salary

Job Demand

Medical Billing Specialist

$43,000

High

Coding Specialist

$48,000

Very High

Medical Records Technician

$45,500

High

Healthcare Compliance Officer

$65,000

Moderate

Billing Manager

$60,000

High

1. Medical Billing Specialist

As a Medical Billing Specialist, you will manage billing procedures, generate invoices, and ensure payments are processed. This role requires attention to detail and knowledge of healthcare regulations.

2. Coding Specialist

Coding Specialists are responsible for coding patient diagnoses and procedures using the latest ICD-10 and CPT codes. Proficiency in coding is crucial for obtaining accurate payments for services rendered.

3. Medical Records Technician

Medical Records Technicians maintain and protect patient medical records. They work closely with healthcare providers and coding specialists to ensure accurate documentation and billing.

4. Healthcare Compliance Officer

This role focuses on overseeing compliance with healthcare laws and regulations. A background in billing and coding is essential, as it ensures the adherence to standardized processes.

5. Billing Manager

Billing Managers oversee the entire billing department, ensuring efficient operations. This role often requires experience in billing processes, personnel management, and financial reporting.

Benefits of Pursuing a Career in Medical Billing and Coding

Choosing a career in medical billing and coding comes with numerous advantages:

Job Security: With an ongoing demand for billing and coding professionals, job security is high.

Flexible Work Options: Many positions offer remote work opportunities, allowing for a better work-life balance.

Career Growth: Advancement opportunities abound, with roles evolving into management or specialized coding areas.

Competitive Salaries: Salaries are competitive and can significantly increase with experience and specialization.

Contribution to Healthcare: You play a vital role in ensuring accurate patient care and reimbursement.

Practical Tips for Starting Your Career in Medical Billing and Coding

Here are some actionable tips to kickstart your career in medical billing and coding:

Get Educated: Enroll in accredited medical billing and coding programs. Online courses offer flexibility for working individuals.

Obtain Certification: Certifications from organizations such as AAPC or AHIMA can enhance your employability.

Gain Experience: Consider internships or part-time positions while studying to build practical experience.

Network: Join local healthcare organizations and attend conferences to meet industry professionals.

Stay Updated: Keep up with changes in codes and regulations to ensure compliance and accuracy.

Case Study: A Success Story in the Field

Meet Sarah Johnson, who transitioned from a retail job to become a successful Medical Coding Specialist in Orlando, Florida. After completing a community college course in medical billing and coding, she obtained her certification through AAPC.

Within a year, Sarah secured a position at a major hospital, where her attention to detail and dedication propelled her into a senior role with a salary increase of over 25%. She now advocates for aspiring professionals, offering mentorship to new coding students in her community.

First-Hand Experience: A Day in the Life of a Coding Specialist

As a Coding Specialist, your day may include reviewing patient records, entering codes for procedures, and collaborating with healthcare providers to resolve discrepancies. Expect to spend time on:

Analyzing patient charts and documents.

Utilizing coding software and databases.

Communicating with insurance companies regarding claims.

Staying informed about updates in billing regulations.

Conclusion

Unlocking your career potential in medical billing and coding in Florida can lead to a fulfilling and prosperous professional life. With robust job opportunities, competitive salaries, and the chance to significantly contribute to the healthcare system, now is the perfect time to embark on this career path. Follow the tips outlined above and consider the top job roles mentioned to give yourself the best chance of success in 2023 and beyond.

Ready to take the next step? Explore local programming options and certification courses today to start your journey in the rewarding field of medical billing and coding.

youtube

https://medicalcodingandbillingclasses.net/open-your-career-potential-top-medical-billing-and-coding-jobs-in-florida-for-2023/

0 notes

Text

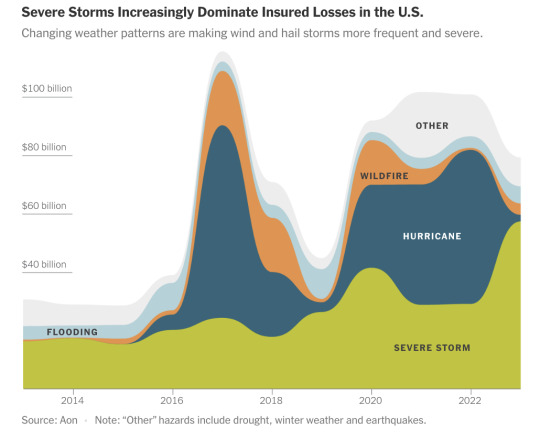

As climate change produces more extreme weather, insurers are losing money, even in states with low hurricane and wildfire danger. Across the country, insurers are facing more bad years than good years. If this trend continues, it could destabilize the broader economy.

Excerpt from this story from the New York Times:

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators. To understand what’s happening in the insurance industry, The New York Times interviewed more than 40 insurance executives, brokers, officials and homeowners in a dozen states, and also reviewed financial records from insurers in all 50 states going back more than a decade.

5 notes

·

View notes

Text

Fuck even the REPUBLICANS recognize this as a serious fuck up and have been massively criticizing DeSantis over it.

I mean the most obvious reason is that, regardless of whatever statement Disney may have made publically, the corporation was likely going to be footing the bill for a lot of Republican campaigns in the future. Whatever criticism the company may have said against Floridas insanely archaic and prejudiced "dont say gay" law was showmanship pushed forward by Disneys PR and marketing departments and literally everyone knew that.

However, for whatever reason, DeSantis was convinced that sticking it to the largest employer in his home state and a major funder of the Republican party was a great way to make a splash and propel himself forward as a potential candidate for president. Tbh I think he and the Florida legislature were trying to make him Trump 2.0 given how Trump has been notorious for flagrantly defying his own party, however DeSantis doesnt have the cult following Trump has nor the reputation to believably pull off the bullshit. So now hes in deep shit.

Even if DeSantis somehow managed to walk away from this unscathed, the Republicans are likely not going to want to touch him as a serious presidential candidate because as a party they rely heavily on the image of being pro-business and anti-regulation. As in, they aim for as little government interference in business as possible. This works for them because it results in a lot of businesses footing their campaigns. Like Trump destroyed the Republicans public reputations a lot, and went after "woke capitalism" as they like to call it, but at the end of the day he largely presented himself as pro-business and anti-regulation so he was able to net the financial support the republicans needed.

And DeSantis's actions are endangering ALL of that.

Like, this whole thing has been a clusterfuck legally, morally, socially, and politically for everyone in the state of florida as well as further damaging both the the governors and Republicans political reputations to literally no ones benefit.

(Except maybe disney who gets to flounder in the public eye as perceived victim of 'govt overreach' but thats a discussion for another day)

64K notes

·

View notes

Text

The Importance of Hiring a Slip and Fall Injury Attorney in Palm Beach Gardens

Are you a resident of Palm Beach Gardens, FL who has recently suffered a slip and fall injury? If so, you may be wondering if you need to hire a slip and fall injury attorney to help you with your case. The short answer is yes. Slip and fall injuries can have serious consequences and it is important to have a skilled and experienced attorney on your side to help you navigate the legal process. In this blog post, we will discuss the importance of hiring a slip and fall injury attorney in Palm Beach Gardens and how they can help you get the compensation you deserve.

Understanding Slip and Fall Injuries

Slip and fall injuries are one of the most common types of accidents that occur in the United States. According to the National Floor Safety Institute, slip and fall accidents account for over 1 million emergency room visits each year. These types of accidents can happen anywhere, from a grocery store to a public park. They can range from minor bruises to more serious injuries such as broken bones, head trauma, and spinal cord injuries. These injuries can have a significant impact on a person's life, resulting in medical expenses, lost wages, and pain and suffering.

Why You Need a Slip and Fall Injury Attorney

If you have suffered a slip and fall injury in Palm Beach Gardens, it is important to seek legal representation from a slip and fall injury attorney. Here are some reasons why:

Knowledge and Experience

Slip and fall injury attorneys have the knowledge and experience to handle these types of cases. They are well-versed in the laws and regulations surrounding slip and fall accidents and can help you navigate the legal process. They also have experience in dealing with insurance companies and can negotiate on your behalf to ensure you receive fair compensation.

Investigation and Evidence Gathering

Attorneys have the resources to thoroughly investigate your case and gather evidence to support your claim. This may include reviewing surveillance footage, interviewing witnesses, and consulting with experts. Gathering strong evidence is crucial in proving liability and getting the compensation you deserve.

Maximizing Compensation

A slip and fall injury attorney will fight to get you the maximum compensation possible for your injuries. They will take into account all of your damages, including medical expenses, lost wages, and pain and suffering, and ensure that you are not shortchanged by the insurance company.

Statistics on Slip and Fall Injuries in Florida

To further understand the importance of hiring a slip and fall injury attorney in Palm Beach Gardens, let's take a look at some statistics on slip and fall injuries in Florida:

According to the Florida Department of Health, falls are the leading cause of injury-related hospitalizations in the state.

In 2019, there were over 3,000 hospitalizations due to falls in Palm Beach County alone.

The Centers for Disease Control and Prevention (CDC) reports that falls are the leading cause of traumatic brain injuries (TBI) in the United States, accounting for 40% of all TBIs.

In Florida, falls are the leading cause of TBI-related deaths, with over 1,600 deaths reported in 2018.

Why Choose Hicks & Motto?

If you have suffered a slip and fall injury in Palm Beach Gardens, you need a trusted and experienced attorney on your side. Hicks & Motto is a highly reputable law firm that specializes in personal injury cases, including slip and fall injuries. They have 40 years of experience and a track record of successful case outcomes. They understand the physical, emotional, and financial toll that slip and fall injuries can have on a person and we are dedicated to helping their clients get the compensation they deserve.

Contact Hicks & Motto Today

If you or a loved one has been injured in a slip and fall accident in Palm Beach Gardens, do not hesitate to contact Hicks & Motto. They will provide you with a free consultation and guide you through the legal process. Hicks & Motto work on a contingency fee basis, which means they only get paid if they win your case. Call 561-944-7856 to schedule your consultation today.

0 notes

Text

Investing in Land for Sale in Florida: A Comprehensive Guide

Investing in land for sale in Florida offers promising opportunities due to the state’s robust real estate market and desirable locations. Start by researching market trends and identifying high-growth areas. Consider factors like proximity to amenities, zoning regulations, and future development plans. Conduct thorough due diligence, including land surveys and environmental assessments. Understanding legal requirements and securing proper financing are crucial steps. Engage with local real estate experts to gain insights and navigate the process smoothly. Whether for residential, commercial, or agricultural purposes, investing in Florida land can yield substantial returns and provide a valuable asset in a thriving market.

Why Invest in Land for Sale in Florida?

Investing in land for sale in Florida is a smart choice due to the state's booming real estate market, diverse landscapes, and robust economy. Florida offers numerous opportunities for investors, from residential developments to commercial properties and agricultural land. The state's growing population, tourism industry, and favorable climate make it an attractive destination for long-term investments. By understanding the market dynamics and potential growth areas, investors can capitalize on Florida's real estate opportunities.

Identifying Prime Locations for Land Investments in Florida

When considering land for sale in Florida, location is crucial. Prime areas include coastal regions, popular tourist destinations, and rapidly developing suburbs. Cities like Miami, Orlando, and Tampa offer excellent investment prospects due to their economic growth and high demand for real estate. Additionally, exploring emerging markets in smaller towns and rural areas can yield significant returns. Researching local infrastructure projects, zoning laws, and future development plans can help investors pinpoint the best locations for their land investments.

Understanding Zoning Laws and Regulations in Florida

Navigating Florida's zoning laws and regulations is essential for successful land investments. Different areas have specific rules regarding land use, building restrictions, and environmental protections. Understanding these regulations helps investors make informed decisions and avoid potential legal issues. Consulting with local planning departments and real estate attorneys can provide valuable insights into zoning requirements and ensure compliance with state and local laws. Thorough knowledge of zoning laws can enhance the value and usability of your land investment.

Evaluating the Potential Return on Investment (ROI)

Assessing the potential return on investment (ROI) is a key step when investing in land for sale in Florida. Factors influencing ROI include location, market demand, land development potential, and holding costs. Conducting a comprehensive market analysis and feasibility study can help estimate future property values and rental income. Additionally, considering the costs of land improvements, taxes, and maintenance is crucial for calculating accurate ROI. By evaluating these factors, investors can make strategic decisions to maximize their profits.

Financing Options for Purchasing Land in Florida

Securing financing for land investments in Florida involves exploring various options, including traditional bank loans, private lenders, and owner financing. Each option has its advantages and considerations. Traditional bank loans typically offer lower interest rates but may require higher credit scores and down payments. Private lenders and owner financing can provide more flexible terms but often come with higher interest rates. Understanding the pros and cons of each financing method can help investors choose the best option for their financial situation and investment goals.

The Role of Due Diligence in Land Investments

Due diligence is a critical process when purchasing land for sale in Florida. This involves researching the property's history, conducting environmental assessments, and verifying legal ownership and title status. Due diligence helps identify any potential issues, such as environmental hazards, legal disputes, or encumbrances that could affect the land's value or usability. Working with experienced real estate professionals, such as land surveyors, environmental consultants, and attorneys, can ensure thorough due diligence and protect your investment.

Developing a Long-Term Investment Strategy for Florida Land

Creating a long-term investment strategy is essential for maximizing the benefits of purchasing land for sale in Florida. This strategy should include setting clear investment goals, identifying target markets, and planning for future development or resale. Diversifying your land portfolio across different regions and property types can mitigate risks and enhance returns. Additionally, staying informed about market trends, economic indicators, and local development plans can help investors make proactive decisions. A well-defined investment strategy ensures sustained growth and profitability in Florida's dynamic real estate market.

Conclusion

Investing in land for sale in Florida offers immense opportunities due to the state's vibrant real estate market, diverse landscapes, and robust economy. By carefully selecting prime locations, understanding zoning laws, evaluating ROI, exploring various financing options, and conducting thorough due diligence, investors can maximize their potential returns. Developing a long-term investment strategy is essential for sustained growth and profitability. With the right knowledge and strategic planning, investing in Florida land can be a highly rewarding endeavor, providing both financial gains and valuable assets for future development or resale.

0 notes

Text

Iran sanctions US officials over human rights violations by suppressing pro-Palestinian protests

The Foreign Ministry of the Islamic Republic of Iran has announced the imposition of sanctions against some US authorities involved in gross human rights violations by suppressing a pro-Palestinian student protest movement, Iranian media reported.

The Foreign Ministry announced on Wednesday that the new sanctions are imposed in accordance with Iran’s 2017 law on “Countering Human Rights Violations and Adventurist and Terrorist Activities of the United States in the Region.”

According to Article 5 of the law, the following US individuals are sanctioned for “their involvement in human rights violations by suppressing peaceful protests by students and professors of US universities who supported the oppressed Palestinian people against the Israeli crimes in Gaza.”

“List of rights violators”

The following individuals were embargoed:

William Billy Hitchens, Commissioner of the Georgia Department of Public Safety,

Eddie Guerrier, commander of Georgia Field Operations,

Linda J. Stump-Kurnick, Chief of the University of Florida Police Department,

Pamela A. Smith, chief of the District of Columbia Metropolitan Police Department,

Jeffery Carroll, executive assistant chief of the Metropolitan Police Department,

Carl Jacobson, Chief of the New Haven Police Department,

Shane Streepy, assistant chief of the University of Texas Police Department (UTPD),

Michael Cox, Commissioner of the Boston Police Department,

Scott Dunning, Chief of the Central Division of the Indiana University Police Department,

Michael Thompson, Chief of Police, Arizona State University,

John Brockie, Chief of Police of the California State Police Department in Long Beach.

Pursuant to articles 6, 7 and 8 of the sixth section of the Act, the aforementioned individuals will be subject to the sanctions provided for in the Act, which include blocking accounts and transactions in the Iranian financial and banking systems, blocking assets within Iran’s jurisdiction, and prohibiting the issuance of visas and entry into the territory of the Islamic Republic.

All relevant national organisations and institutions of the Islamic Republic of Iran, in accordance with the regulations adopted by the relevant authorities, will take the necessary measures for the effective implementation of the said sanctions.

Read more HERE

#world news#world politics#news#middle east#middle east conflict#middle east crisis#middle east war#middle east news#israel#war crimes#palestine#palestine news#gaza strip#gaza#gazaunderattack#rafah#gaza under attack#gaza news#pro palestine#iran#iran news#iran politics#usa news#usa politics#usa today#usa election#united states#united states of america#america#us news

1 note

·

View note

Text

Your Ultimate Guide to Renewing Your CNA License in Florida

**Title: Your Ultimate Guide to Renewing Your CNA License in Florida**

**Introduction**

If you are a Certified Nursing Assistant (CNA) in Florida, it is essential to renew your license to continue practicing. Renewing your CNA license ensures that you are up-to-date with the latest standards and practices in the healthcare industry. In this comprehensive guide, we will walk you through the steps to renew your CNA license in Florida, along with some practical tips to make the process smoother and more efficient.

**Renewing Your CNA License in Florida**

Renewing your CNA license in Florida is a straightforward process, but it is crucial to understand the requirements and deadlines to avoid any complications. Here is a step-by-step guide to help you renew your CNA license:

1. **Check the Renewal Deadline**: The renewal deadline for CNA licenses in Florida is every two years on the licensee’s birth month. It is essential to keep track of your renewal deadline to avoid any late fees or penalties.

2. **Complete Continuing Education Units (CEUs)**: To renew your CNA license in Florida, you must complete a certain number of Continuing Education Units (CEUs). The Florida Board of Nursing requires CNAs to complete 24 hours of in-service training within the two-year renewal period.

3. **Submit Renewal Application**: You can renew your CNA license online through the Florida Department of Health’s online renewal system. Make sure to fill out the renewal application accurately and submit any required documentation, such as proof of CEU completion.

4. **Pay Renewal Fee**: Along with your renewal application, you will need to pay a renewal fee. The fee for renewing your CNA license in Florida is $55. Make sure to pay the fee on time to avoid any delays in processing your renewal application.

5. **Pass Background Check**: CNAs in Florida are required to pass a background check as part of the renewal process. Make sure to provide any necessary information or documentation for the background check to be completed successfully.

6. **Receive Renewed License**: Once your renewal application is processed and approved, you will receive your renewed CNA license in the mail. Keep your updated license in a safe place and make sure to display it prominently in your workplace.

**Benefits of Renewing Your CNA License**

Renewing your CNA license in Florida is not just a requirement – it also comes with several benefits:

– Ensures you are current with the latest healthcare practices and regulations. – Maintains your professional credibility and integrity. – Allows you to continue working as a CNA in Florida legally. – Opens up opportunities for career advancement and specialization in the healthcare industry.

**Practical Tips for Renewing Your CNA License**

Here are some practical tips to help you smoothly renew your CNA license in Florida:

– Keep track of your renewal deadline and start the renewal process early. – Stay organized with your CEU documentation and make sure to complete the required hours on time. – Double-check your renewal application for any errors or missing information before submitting. – Set aside funds for the renewal fee to avoid any financial stress. – Stay informed about any changes to the renewal process or requirements by regularly checking the Florida Department of Health’s website.

**Conclusion**

Renewing your CNA license in Florida is a crucial step to continue practicing as a Certified Nursing Assistant. By following the steps outlined in this guide and staying proactive in the renewal process, you can ensure that your license is up-to-date and compliant with the state regulations. Remember to prioritize your professional development and maintain your commitment to providing quality care to patients as a CNA in Florida.

youtube

https://cnacertificationprogram.net/your-ultimate-guide-to-renewing-your-cna-license-in-florida/

0 notes

Text

New DOD Breast Milk Reimbursement Policy

The Defense Department has introduced a new policy that covers costs associated with shipping breast milk during permanent change of station (PCS) moves. This policy aims to support breastfeeding military parents by reimbursing up to $1,000 in expenses.

Air Force Staff Sgt. Brent Rochette inspects the condition of shipped items at Robins Air Force Base, Ga. Photo by the DOD.

Introduction

Military families often face unique challenges during relocations. The new Defense Department policy offers financial relief by covering breast milk shipping costs during PCS moves. This initiative aims to ease the burden on breastfeeding service members and their families, ensuring that they receive the support they need.

Policy Details

The Defense Department’s new policy, published in the Joint Travel Regulations, reimburses up to $1,000 for breast milk shipping expenses. This reimbursement covers costs such as: - Dry ice - Commercial shipping fees - Excess baggage charges Federal law prohibits reimbursement for packaging and container expenses. Impact on Military Families Christopher Woods, policy branch chief for the Defense Travel Management Office, emphasized the importance of this policy. "This allowance allows the breastfeeding service member to ship that milk back to the previous, permanent duty station where the dependents still are," Woods stated. This policy aims to support military families who often have to travel separately during PCS moves. Military families frequently incur significant costs to store and transport breast milk during moves. Whether it’s purchasing ice, dry ice, or special containers to keep the milk cold during long trips, these expenses can add up quickly. This policy change provides much-needed financial relief, ensuring that breastfeeding service members can maintain their routines without added stress.

A woman filling in a claim form. Photo by Digits. Wikimedia.

How to Claim Reimbursement

Service members seeking reimbursement must follow these steps: - Authorization: Obtain authorization included on PCS orders prior to incurring any expenses. - Claim Submission: Submit all receipts associated with the claimed expenses with the PCS voucher once the move is complete. Reimbursement Process Step Description Authorization Include on PCS orders before incurring expenses Expense Tracking Keep all receipts for associated expenses Claim Submission Submit receipts with PCS voucher after move This process ensures transparency and proper use of funds, making it straightforward for service members to claim their reimbursements.

Navy Lt. Cmdr. Christine Higgins and husband Jermaine Higgins use the lactation pod at Naval Hospital Jacksonville, Florida. Photo by Deidre Smith, Navy. DOD. Broader Implications The new policy aligns with Secretary of Defense Lloyd J. Austin III's "Taking Care of Our Service Members and Families" campaign. This initiative focuses on enhancing support for military personnel and their families through various measures, including: - Improving access to quality and affordable childcare - Easing the burdens of relocation According to Military OneSource, more than 400,000 service members change duty stations each year. This policy is part of a broader effort to address the unique challenges faced by military families during these frequent moves. Woods highlighted the department's ongoing commitment to improving the experiences of service members. "We're adapting to challenges and different circumstances in order to better support our workforce," Woods said. This includes recent policy changes to cover travel expenses for transporting pets during PCS moves. Final Thoughts The Defense Department's new policy on breast milk shipping reimbursements is a significant step towards supporting military families. By alleviating the financial burden associated with shipping breast milk, the DOD is reinforcing its commitment to the well-being of its personnel. This policy not only supports breastfeeding service members but also aligns with broader efforts to improve the quality of life for all military families. Sources: THX News & US Department of Defense. Read the full article

#breastmilkexpenses#breastfeedingmilitaryparents#DefenseDepartmentpolicy#JointTravelRegulations#militarybenefits#militaryfamilysupport#thxnews#servicememberallowances#shippingbreastmilk#travelreimbursements

0 notes