#Cultured Meat Industry

Explore tagged Tumblr posts

Text

Understanding Cultured Meat Market: Trends and Growth Opportunities

The global cultured meat market was valued at USD 246.9 million in 2022 and is anticipated to grow at an impressive compound annual growth rate (CAGR) of 51.6% from 2023 to 2030. This rapid expansion is largely driven by ongoing technological advancements in the alternative protein sector, which are pushing the global food system toward more sustainable and ethically produced food sources. As the global population continues to grow, there is an increasing demand for sustainable meat options, particularly given the challenges associated with meat shortages and the significant environmental impact of traditional meat production.

The cultured meat industry is gaining traction as a potential solution to these challenges. Cultured meat, often referred to as lab-grown meat, is produced by cultivating animal cells in a controlled environment, offering a way to produce meat without raising and slaughtering animals. Growing consumer awareness about environmental sustainability, coupled with the urgent need to secure meat supply, is accelerating interest in cultured meat as a viable alternative to conventional meat.

Additionally, there is an emerging vegan population and an increasing number of consumers who are concerned with animal welfare. These shifts in consumer sentiment are expected to further fuel the growth of the cultured meat market, as many individuals are seeking more ethical, sustainable, and animal-friendly food options. Although the market for cultured meat is still in its early stages, significant research and development (R&D) efforts are underway to scale up production and make cultured meat commercially viable. Key market players are focusing on obtaining the regulatory approvals required to bring cultured meat products to market on a larger scale.

Gather more insights about the market drivers, restrains and growth of the Cultured Meat Market

End-Use Insights

In terms of revenue, the burgers segment dominated the cultured meat market with a share of approximately 41% in 2022. The growing demand for sustainable and ethical meat alternatives is expected to drive the continued popularity of cultured meat burgers. Cultured meat burgers offer a significant opportunity to reduce the environmental footprint of the meat industry, which is responsible for high greenhouse gas emissions and other ecological impacts. As consumers increasingly seek out ethical, sustainable, and clean food options, the cultured burger segment is poised for substantial growth.

Several startups and established companies are innovating in the cultivated meat space, and partnerships are emerging to advance production capabilities. For example, in January 2020, Mosa Meat, the creator of the world’s first cultured meat hamburger, partnered with Nutreco, an animal nutrition company, to develop a nutrient-rich liquid to support the scaling-up of their production process. These collaborations are expected to contribute to the growth of the cultured burger segment, making it more accessible to consumers and facilitating wider adoption.

The meatballs segment is forecast to experience the fastest CAGR of 52.5% over the forecast period. Processed meat products like meatballs are popular in supermarkets and among consumers due to their convenience and taste appeal. As consumers become more aware of the health benefits of cultured meats—such as reduced fat content, lower levels of antibiotics and hormones, and cleaner production processes—the demand for cultured meat products like meatballs is expected to grow rapidly.

The trend of shifting consumer preferences toward clean meats and alternative proteins is also contributing to the rising demand for cultured meatballs, as they offer an opportunity to enjoy a familiar, popular meat product without the associated ethical and environmental concerns. The growth of the cultured meatball segment is expected to be supported by the increasing consumer base and broader acceptance of lab-grown meat products, as well as the convenience and versatility of meatballs in various cuisines.

Order a free sample PDF of the Cultured Meat Market Intelligence Study, published by Grand View Research.

#Cultured Meat Market#Cultured Meat Market Analysis#Cultured Meat Market Report#Cultured Meat Industry

0 notes

Text

As per BIS Research, the Cultured Meat Market, projected to reach a valuation of $1,154.8 million in 2024, is poised for considerable growth, with an estimated value of $3,810.6 million by 2033. This expansion is bolstered by a robust Compound Annual Growth Rate (CAGR) of 14.19% from 2024 to 2033.

#Cultured Meat Market#Cultured Meat Market Report#Cultured Meat Industry#Cultured Meat Market CAGR#Cultured Meat Market Forecast#Cultured Meat Market Size#FoodTech#BIS Research

0 notes

Text

The cultured meat market, also known as lab-grown or cell-based meat, is an emerging sector within the food industry that has gained considerable attention in recent years. Cultured meat is produced by cultivating animal cells in a controlled environment, cutting the need for traditional animal farming. This innovative approach aims to address various environmental, ethical, and health concerns associated with conventional meat production. According to MarketsandMarkets, the global cultured meat market size is projected to reach USD 0.2 billion in 2023 and USD 1.1 billion by 2034, at a CAGR of 16.5% from 2028 to 2034. In the next five years from 2023, the cultured meat market is projected to grow at 16.1% of CAGR.

0 notes

Text

It's so weird how meat-forward American food culture is that Americans who don't eat meat every day will say to me "yeah I'm basically vegetarian I don't eat meat *every* day" like????? Please I'm begging you to consider other forms of protein the human body is not meant to only eat meat, we are omnivores.

Like. It was honestly pretty easy for me to switch to a vegetarian diet because I grew up in a kosher household and kosher meat is *expensive* so we only had meat on Shabbat (once a week). But then I'll talk to other Americans and they'll talk about eating meat every day and I'm like??? How???

I think humans are meant to eat meat and I think expecting everyone to give it up is wrong, but c'mon this is not sustainable you do not need to be eating meat every single day.

Why is America so meat obsessed?????

#food anthropology#food production#american food culture#meat industry#if I had the time I'd answer my question and the answer would be the legacy of colonialism and displacing indigenous#to make way for cattle pastures

64 notes

·

View notes

Text

#child abuse#culture#leftism#politics#the left#progressive#us politics#communism#eat the rich#tax the rich#corporate greed#children#childhood#kids#child labor#1900s#child labour laws#fuck corporate america#america#trump#united states of america#New Gilded Age#chemicals#tools#cleaning#Industry#industry inspection#Meat#The jungle

3 notes

·

View notes

Text

White vegans stop comparison poc (specifically black people) to animals challenge difficulty IMPOSSIBLE

#stop equating eating meat to literal chattel slavery#yes i think animals should have better treatment and humane living conditions and that the entire meat/animal products industry needs to be#overturned or at least have stricter regulations but holy shit poc aren’t you’re gotchas to use against ppl who eat meat#keep black and brown people outta your conversations#also a lot of white vegans are straight up sinophobic/racist towards Asian cuisine#always talking about Chinese people eating dog meat#fuck off#straight disrespectful towards indigenous cultures who respect and use all of the animal too#my takes

3 notes

·

View notes

Text

i'm 99% certain that one day i'll be an elder and my opinion "vegans that make a big deal abt ppl eating 'pet' animals are annoying bc i have no problem eating Any Animal" will sound a lot like the edgy opinion "i'm not a bigot bc i hate everyone equally" and idk how to feel abt that

#a lot of white usa americans make such a horrified when ppl say that they sometimes culturally eat guinea pigs or dogs or cats#and the way that i perceive it#it's just racism (not even well-hidden)#(arbitrary animal hierarchies are silly imo)#but also the animal-farming industry is v evil#but yummy : (#yes this all stems from a tweet abt some rando being horrified abt being invited to culturally eat a dog at a full moon in another country#(rather than politely saying 'no thank u')#i know that in a Perfect society we don't kill animals so horribly to eat them#(my personal problem is the excess killing and not the killing itself?)#or maybe we don't kill them at all (lab-grown meats and such)#but as for now i really wanna eat the way that i was raised bc it's one of the few ways i feel connected to my culture#thinking abt that speaker at the mit vegans club that compared hanged dead gay ppl to hanged dead chickens in a market#W H A T#but oh well#there are bigger problems (imo) in the world and i'm okay w not caring abt the animals' feelings#dash rambles#dash may be problematic#dash is an elder bigot in 2050#tumblasha#vegan#animal rights#thinking abt the time i was in the ihouse kitchen and i said#'so we all agree that animals are inferior to humans right?'#and i didn't give anyone time to disagree bc i'm not gonna do all that at 2 in the pm ifjewoiajfew

12 notes

·

View notes

Link

“We have a behaviour change problem when it comes to meat consumption,” said George Peppou, CEO of Vow .

“The goal is to transition a few billion meat eaters away from eating [conventional] animal protein to eating things that can be produced in electrified systems.

The company has already investigated the potential of more than 50 species, including alpaca, buffalo, crocodile, kangaroo, peacocks and different types of fish.

6 notes

·

View notes

Text

Was derping about YouTube the other day and came across a terribly obnoxious thumbnail:

*chin in hands*

#i didn't bother watching the video because the thumbnail irritated me so bad lmao#judging from the comments though it was yet another think piece hitting people over the head with the words 'parasocial' and 'normalize'#and allegedly did touch on the fact that perfect blue was originally made as a commentary on the meat grinder#also known as the japanese idol industry#but jesus fucking christ this fucking thumbnail#people in the comments had the audacity to complain about people not watching the video before commenting#couldn't possibly be due to this clickbait ass thumbnail#people going in hackles raised why the fuck are you surprised????#it's giving 'yeah that movie about a specific industry in japan that was particularly bad at the time the film released?#yeah ackchually it's about White Women in the modern western celebrity culture! ☝️🤓'#also i want to yank the word 'normalize' out of video essayist's hands and put it away forever#people have never been normal about celebs#normalization of being weird about famous people happened a LONG FUCKING TIME AGO#the change that happened after the internet age began is that celebs are now ACCESSIBLE#either due to company pressure#or due to their own dumbass selves oversharing with strangers#also i saw a commenter use the term 'pew-pewing' when referring to someone that committed suicide#and i wanted to commit homicide#STOP SELF-CENSORING#AAAAAAHHHHHHHHH#personal bloggity

0 notes

Text

Exploring Trends in the Cultured Meat Market

The global cultured meat market was valued at approximately USD 246.9 million in 2022 and is poised for remarkable growth, with projections indicating a compound annual growth rate (CAGR) of 51.6% from 2023 to 2030. This substantial growth is primarily driven by advancements in technology within the alternative proteins sector, which is facilitating a shift toward more sustainable food systems worldwide. The increasing focus on meat substitutes and alternative proteins reflects a global response to the dual challenges of addressing meat shortages due to a burgeoning population and mitigating the environmental impact associated with traditional meat production.

Growing awareness surrounding environmental sustainability has played a crucial role in propelling the cultured meat industry forward. As concerns over climate change and resource depletion rise, the need for sustainable food sources has become paramount. Cultured meat, produced through cellular agriculture, offers a viable solution that reduces the environmental footprint of meat production, using significantly fewer resources such as land and water compared to conventional livestock farming.

The COVID-19 pandemic has had a profound impact on supply chains across various industries, including the cultivated meat sector. The lockdowns imposed globally disrupted many supply channels, which in turn affected the production of cultivated meat. One of the critical challenges faced was the procurement of necessary equipment, particularly bioreactors, which are vital for providing the optimal environment for cultivating animal cells. Trade barriers and shipping delays further exacerbated these challenges, leading to setbacks in production timelines.

Interestingly, during this same period, there was a surge in demand for bioreactors from the pharmaceutical industry, particularly for COVID-19 vaccine production. This heightened demand contributed to extended lead times for bioreactors, which are essential for both pharmaceutical and cultivated meat applications. Despite these challenges, the cultivated meat industry witnessed significant growth post-2020, especially in 2021, which emerged as a pivotal year marked by technological advancements, an increase in product launches, and a notable rise in investments and funding directed toward the sector.

Gather more insights about the market drivers, restrains and growth of the Cultured Meat Market

Source Insights and Market Segmentation

In terms of revenue, the poultry segment dominated the cultured meat market, capturing over 39% of the share in 2022. The popularity of chicken consumption in North America has seen substantial growth over the past 50 years, making it the most consumed meat in the United States. Annually, over 8 billion chickens are processed for food, and globally, more than 50 billion chickens are raised each year. This high level of consumption has prompted a wave of startups and new market entrants to invest in cellular agriculture technology, specifically targeting the development of poultry-cultivated products. These innovations are expected to further enhance the growth of the poultry segment, as consumers increasingly seek sustainable alternatives to traditional meat.

The pork segment is also anticipated to experience significant growth, projected to register a CAGR of 52.6% from 2023 to 2030. Classified as red meat by the United States Department of Agriculture (USDA), pork remains one of the most popular types of meat consumed globally. The demand for pork substitutes was notably intensified during the COVID-19 pandemic, which brought to light the vulnerabilities inherent in the traditional meat supply chain and the broader risks associated with reliance on animal agriculture. As consumers become more aware of these issues, the appeal of cultivated pork products has increased.

Moreover, the expansion of the pork segment can be attributed to the growing number of startups and established companies that are actively experimenting with cultivated meat derived from pig cells. This sector is not only innovating in terms of product development but also addressing consumer concerns about health, safety, and ethical considerations associated with conventional pork production.

Order a free sample PDF of the Cultured Meat Market Intelligence Study, published by Grand View Research.

#Cultured Meat Market#Cultured Meat Market Analysis#Cultured Meat Market Report#Cultured Meat Industry

0 notes

Text

[Updated] Global and Regional Research Analysis on Cultured Meat Market | BIS Research

The Cultured Meat Industry is at the forefront of a transformative shift in the food industry, heralding a new era of sustainable and ethical protein production.

As per BIS Research, the cultured meat market, projected to reach a valuation of $1,154.8 million in 2024, is poised for considerable growth, with an estimated value of $3,810.6 million by 2033. This expansion is bolstered by a robust Compound Annual Growth Rate (CAGR) of 14.19% from 2024 to 2033.

Global Key Market Dynamics

Sustainability Driving Market Growth: The global Cultured Meat Market experiences significant growth propelled by a surge in sustainability consciousness. As consumers seek environmentally friendly alternatives, cultured meat emerges as a viable solution, addressing concerns related to traditional meat production's ecological impact.

Technological Innovations: Technological advancements play a pivotal role in shaping the global market. Innovations in cell cultivation techniques, bioreactor technology, and tissue engineering contribute to the scalability and efficiency of cultured meat production, fostering industry growth.

Shifting Consumer Preferences: Changing consumer preferences towards plant-based diets and ethical consumption drive the demand for cultured meat. The market caters to individuals seeking animal-free alternatives without compromising on taste, nutritional value, or culinary experience.

Access our Free Sample Report on Cultured Meat Market Research!

Regional Perspectives

North America: North America leads the way in embracing cultured meat, with a burgeoning market driven by a robust demand for sustainable and cruelty-free protein sources. The region witnesses significant investments in research and development, with startups and established players vying for a share of the growing market.

Europe: Europe emerges as a key player in the cultured meat landscape, fueled by a proactive regulatory environment and a strong emphasis on sustainability. The European market witnesses collaborations between scientists, policymakers, and industry players, fostering innovation and market penetration.

Asia-Pacific: In the Asia-Pacific region, particularly in countries like Singapore and Japan, cultured meat gains traction. Regulatory support, coupled with a rising awareness of food sustainability, propels the adoption of cultured meat products, opening new avenues for market expansion.

Challenges and Opportunities

Regulatory Frameworks: Establishing clear and consistent regulatory frameworks remains a challenge in the cultured meat industry. Harmonizing regulations across regions is essential for fostering consumer trust and facilitating market growth.

Production Scalability: The challenge of achieving cost-effective production scalability is an opportunity for innovation. Advancements in bioprocessing and bioreactor technologies are critical for addressing scalability concerns and making cultured meat more accessible to a broader market.

Consumer Education and Acceptance: Opportunities lie in consumer education and acceptance. Initiatives to inform consumers about the benefits of cultured meat, its positive environmental impact, and its potential to revolutionize the FoodTech industry contribute to widespread acceptance.

Key Prominent Players in the Market

Mosa Meat

UPSIDE Foods

Aleph Farms

Mission Barns

Air Protein

BlueNalu

Meatable

SuperMeat

GOOD Meat

Finless Foods

CUBIQ FOODS

Believer Meats

Future Outlook and Opportunities

Diversification of Cultured Meat Products: The future of the Cultured Meat Market envisions a diversification of product offerings. As technology advances, a broader range of cultured meat products, including steaks, burgers, and processed meats, is expected to enter the market, catering to diverse consumer preferences.

Collaboration for Market Expansion: Collaborations between industry players, research institutions, and governments will be pivotal for market expansion. Joint efforts in research, development, and marketing initiatives contribute to establishing cultured meat as a mainstream food choice.

Global Market Penetration: Cultured meat's global market penetration is set to increase, driven by a convergence of factors such as environmental concerns, ethical considerations, and the quest for sustainable protein sources. As awareness grows, the market is poised to witness widespread adoption across continents.

Conclusion

The Cultured Meat Industry stands at the forefront of a culinary revolution, challenging traditional notions of meat production. As technological innovations, consumer preferences, and sustainability goals align, the global and regional prospects for cultured meat signal a future where ethical and sustainable protein choices redefine the way we eat.

#Cultured Meat Market#Cultured Meat Market Report#Cultured Meat Industry#Cultured Meat Market CAGR#Cultured Meat Market Forecast#Cultured Meat Market Size#Cultured Meat Market Trend#Cultured Meat Market Research#Cultured Meat Industry Analysis#Cultured Meat Market Share#BIS Research#FoodTech

0 notes

Text

Chef WK, lead charcuterie specialist in Alberta Canada

Table of contents

1. Control Program Requirements for Fermented Meat Products

2. Facility and Equipment Requirements

3. Starter Culture

4. Chemical Acidification

5. Water Activity Critical Limits

6. Time and Temperature for Fermented Products

7. Fermentation Done at a Constant Temperature

8. Examples of Degree-hours at constant room temperatures

9. Fermentation Done at Different Temperatures

10. Fermentation done at Different temperatures

11. What happens if fermentation fails to hit critical limit?

12. E. coli and Salmonella Control in Fermented Sausages

13. Options for E. coli validation

14. Option1; Heating

15. Option 2; pH, heating, holding, diameter

16. Safety and consistency

Control Program Requirements for Fermented Meat Products

The producer must have a program in place to assess the incoming product. This program should outline specifications for the incoming ingredients. This may include criteria including receiving temperature, farm/ supplier, lot code or packed on date, species/cut etc.

2. Facility and Equipment Requirements

Equipment used in the fermentation process must be included in the operator's prerequisite control programs. These must include the following elements:

Temperature in the fermentation, drying and smoking chambers must be uniform and controlled to prevent any fluctuation that could impact on the safety of the final product.

Fermentation, drying and smoking chambers must be equipped with a shatter resistant indicating thermometer, (or equivalent), with graduations of 1°C or less. If mercury thermometers are used, their mercury columns must be free from separations. All thermometers must be located such that they can be easily read.

Fermentation and smoking chambers must be equipped with a recording thermometer for determining degree-hours calculations in a reliable manner. Recording thermometers are also preferable in drying and aging rooms but, in these rooms, it may be sufficient to read and record the temperatures 2 times a day.

Drying and aging rooms must be equipped with humidity recorders in order to prevent uncontrolled fluctuations of the relative humidity. The only alternative to an automatic humidity recorder in these rooms would be for the company to manually monitor and record ambient humidity twice a day (morning and afternoon) every day with a properly calibrated portable humidity recorder.

For routine monitoring, accurate measurement electronic pH meters (± 0.05 units) should be employed. It is important that the manufacturer's instructions for use, maintenance and calibration of the instrument as well as recommended sample preparation and testing be followed.

When the aw of a product is a critical limit set out in the HACCP plan for a meat product, accurate measurement devices must be employed. It is important that the manufacturer's instructions for use, maintenance and calibration of the instrument be followed.

3. Starter Culture

The operator must use a CFIA approved starter culture. This includes Freeze-dried commercially available culture as well as back-slopping (use of previously successful fermented meat used to inoculate a new batch). When performing back-slopping, the operator must have a control program in place to prevent the transmission of pathogens from when using the inoculum from a previous batch to initiate the fermentation process of a new batch. These must include:

The storage temperature must be maintained at 4°C or less and a pH of 5.3 or less.

Samples for microbiological analysis must be taken to ensure that the process is in line with the specifications.

The frequency of sampling is to be adjusted according to compliance to specifications.

Any batch of inoculum which has a pH greater than 5.3 must be analysed to detect at least Staphylococcus aureus. Only upon satisfactory results will this inoculum be permitted for use in back slopping.

This can be an expensive and a time exhaustive process and is generally avoided due to food safety concerns. AHS does not allow back-slopping.

[Chef WK was in communication with the U of A to get his method, a starter mix, studied.]

4. Chemical Acidification

If product is chemically acidified by addition of citric acid, glucono-delta-lactone or another chemical agent approved for this purpose, controls must be in place and records kept to ensure that a pH of 5.3 or lower is achieved by the end of the fermentation process. These acids are encapsulated in different coatings that melt at specific temperatures, which then release the powdered acids into the meat batter and directly chemically acidulate the protein.

Summer sausage is a very common chemically acidified product. The flavor profile tends to be monotone and lacking depth.

5. Water Activity Critical Limits

The aw may be reduced by adding solutes (salt, sugar) or removing moisture.

Approximate minimum levels of aw (if considered alone) for the growth of:

molds: 0.61 to 0.96

yeasts: 0.62 to 0.90

bacteria: 0.86 to 0.97

Clostridium botulinum: 0.95 to 0.97

Clostridium perfringens: 0.95

Enterobacteriaceae: 0.94 to 0.97

Pseudomonas fluorescens: 0.97

Salmonella: 0.92 - 0.95

Staphylococcus aureus: 0.86

parasites: Trichinella spiralis will survive at an aw of 0.93 but is destroyed at an aw of 0.85 or less.

The above levels are based on the absence of other inhibitory effects such as nitrite, competitive growth, sub-optimum temperatures, etc., which may be present in meat products. In normal conditions, Staphylococcus aureus enterotoxins are not produced below aw 0.86, although in vacuum packed products this is unlikely below aw 0.89.

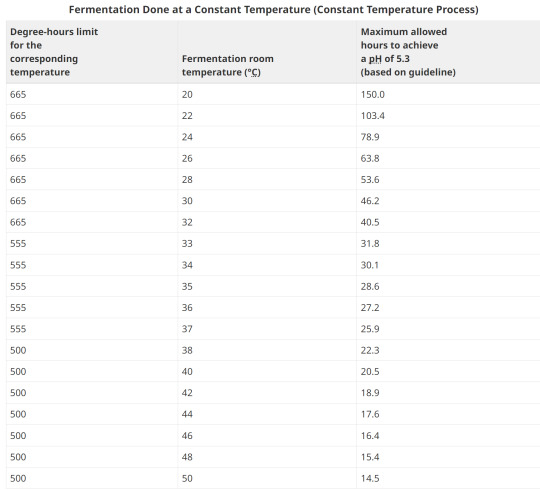

6. Time and Temperature for Fermented Products

Certain strains of the bacteria Staphylococcus aureus are capable of producing a highly heat stable toxin that causes illness in humans. Above a critical temperature of 15.6°C, Staphylococcus aureus multiplication and toxin production can take place. Once a pH of 5.3 is reached, Staphylococcus aureus multiplication and toxin production are stopped.

Degree-hours are the product of time as measured in hours at a particular temperature multiplied by the "degrees" measured in excess of 15.6°C (the critical temperature for growth of Staphylococcus aureus). Degree-hours are calculated for each temperature used in the process. The limitation of the number of degree-hours depends upon the highest temperature in the fermentation process prior to the time that a pH of 5.3 or less is attained.

The operator is encouraged to measure temperatures at the surface of the product. Where this is not possible, the operator should utilize fermentation room temperatures. The degree hour calculations are based on fermentation room temperatures. Temperature and humidity should be uniform throughout the fermentation room.

A process can be judged as acceptable provided the product consistently reaches a pH of 5.3 using:

fewer than 665 degree-hours when the highest fermentation temperature is less than 33°C;

fewer than 555 degree-hours when the highest fermentation temperature is between 33° and 37°C; and

fewer than 500 degree-hours when the highest fermentation temperature is greater than 37°C.

This means that as the temperature increases, the amount of time that you have available to reach 5.3 or under is shorter. The warmer the temperature, the sharper the log growth phase of bacteria, which equates to more overshoot in lactic acid production, faster.

8. Examples of Degree-hours at constant room temperatures

Example 1:

Fermentation room temperature is a constant 26°C. It takes 55 hours for the pH to reach 5.3.

Degrees above 15.6°C: 26°C - 15.6°C = 10.4°C Hours to reach pH of 5.3: 55 Degree-hours calculation: (10.4°C) x (55) = 572 degree-hours

The corresponding degree-hours limit (less than 33°C) is 665 degree-hours.

Conclusion: Example 1 meets the guideline because its degree-hours are less than the limit.

Example 2:

Fermentation room temperature is a constant 35°C. It takes 40 hours for the pH to reach 5.3.

Degrees above 15.6°C: 35°C - 15.6°C = 19.4°C Hours to reach pH of 5.3: 40 Degree-hours calculation: (19.4°C) x (40) = 776 degree-hours

The corresponding degree-hours limit (between 33 and 37°C) is 555 degree-hours.

Conclusion: Example 2 does not meet the guideline because its degree-hours exceed the limit

9. Fermentation Done at Different Temperatures

When the fermentation takes place at various temperatures, each temperature step in the process is analyzed for the number of degree-hours it contributes. The degree-hours limit for the entire fermentation process is based on the highest temperature reached during fermentation.

Example 1:

It takes 35 hours for product to reach a pH of 5.3 or less. Fermentation room temperature is 24°C for the first 10 hours, 30°C for second 10 hours and 35°C for the final 15 hours.

Step 1

Degrees above 15.6°C: 24°C - 15.6°C = 8.4°C Hours to reach pH of 5.3: 10 Degree-hours calculation: (8.4°C) x (10) = 84 degree-hours

Step 2

Degrees above 15.6°C: 30°C - 15.6°C = 14.4°C Hours to reach pH of 5.3: 10 Degree-hours calculation: (14.4°C) x (10) = 144 degree-hours

Step 3

Degrees above 15.6°C: 35°C - 15.6°C = 19.4°C Hours to reach pH of 5.3: 15 Degree-hours calculation: (19.4°C) x (15) = 291 degree-hours

Degree-hours calculation for the entire fermentation process = 84 + 144 + 291 = 519

The highest temperature reached = 35°C

The corresponding degree-hour limit = 555 (between 33°C and 37°C)Conclusion: Example 1 meets the guideline because its degree-hours are less than the limit.

10. Fermentation done at Different temperatures

Example 2:

It takes 38 hours for product to reach a pH of 5.3 or less. Fermentation room temperature is 24°C for the first 10 hours, 30°C for the second 10 hours and 37°C for the final 18 hours.

Step 1

Degrees above 15.6°C: 24°C - 15.6°C = 8.4°C Hours to reach pH of 5.3: 10 Degree-hours calculation: (8.4°C) x (10) = 84 degree-hours

Step 2

Degrees above 15.6°C: 30°C - 15.6°C = 14.4°C Hours to reach pH of 5.3: 10 Degree-hours calculation: (14.4°C) x (10) = 144 degree-hours

Step 3

Degrees above 15.6°C: 37°C - 15.6°C = 21.4°C Hours to reach pH of 5.3: 18 Degree-hours calculation: (21.4°C) x (18) = 385.2 degree-hours

Degree-hours calculation for the entire fermentation process = 84 + 144 + 385.2 = 613.2

The highest temperature reached = 37°C

The corresponding degree-hour limit = 555 (between 33°C and 37°C)

Conclusion: Example 2 does not meet the guidelines because its degree-hours exceed the limit.

11. What happens if fermentation fails to hit critical limit?

What happens if the batch takes longer than degree-hours allows? For restaurant level production, it's always safer to discard the product. The toxin that Staph. Aureus produces is heat stable and cannot be cooked to deactivate. In large facilities that produce substantial batches, the operator must notify the CFIA of each case where degree-hours limits have been exceeded. Such lots must be held and samples of product submitted for microbiological laboratory examination after the drying period has been completed. Analyses should be done for Staphylococcus aureus and its enterotoxin, and for principal pathogens, such as E. coli O157:H7, Salmonella, and Clostridium botulinum and Listeria monocytogenes.

If the bacteriological evaluation proves that there are fewer than 104 Staphylococcus aureus per gram and that no enterotoxin or other pathogens are detected, then the product may be sold provided that it is labelled as requiring refrigeration.

In the case of a Staphylococcus aureus level higher than 104 per gram with no enterotoxin present the product may be used in the production of a cooked product but only if the heating process achieves full lethality applicable to the meat product.

In the case where Staphylococcus aureus enterotoxin is detected in the product the product must be destroyed.

12. E. coli and Salmonella Control in Fermented Sausages

Business' that manufacture fermented sausages are required to control for verotoxinogenic E. coli including E. coli O157:H7 and Salmonella when they make this type of product. This includes:

establishments which use beef as an ingredient in a dry or semi-dry fermented meat sausage;

establishments which store or handle uncooked beef on site;

Establishments which do not use beef and do not obtain meat ingredients from establishments which handle beef are not currently required to use one of the five options for the control of E. coli O157:H7 in dry/semi-dry fermented sausages.

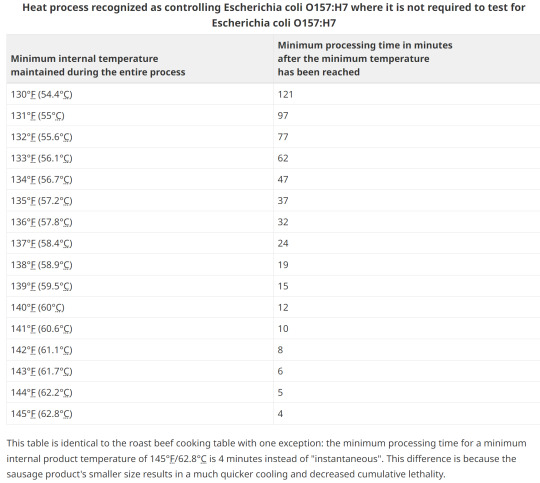

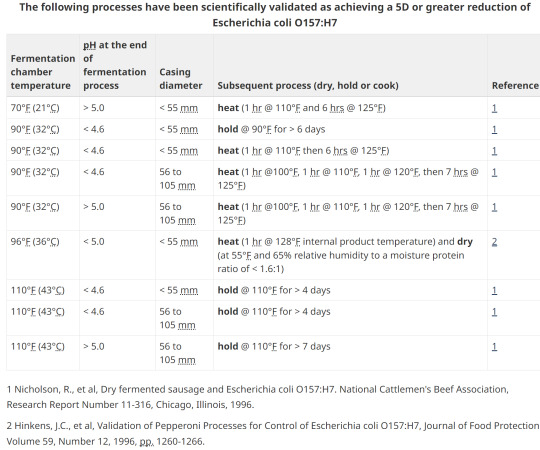

Any processed RTE product containing beef or processed in a facility that also processed beef, must be subjected to a heat treatment step to control E. coli O157:H7. Heating to an internal temperature of 71°C for 15 seconds or other treatment to achieve a 5D reduction is necessary. This is a CFIA requirement and is not negotiable.

Uncooked air dried products produced as RTE, must meet shelf stable requirements as detailed for Fermented-Dry products.

13. Options for E. coli validation

Without lab testing, the two main methods of validation are with heat treating by either low temp and a long duration, or various hotter processing temperatures for a shorter timeframe.

A challenge study to validate a process can take 1 year and over $100,000!

14. Option1; Heating

15. Option 2; pH, heating, holding, diameter

16. Safety and consistency

The aw and pH values are critical in the control of pathogens as well as to ensure shelf-stability in all semi-dry and dry fermented meat products. Each batch must be tested for aw and/or pH in order to verify that the critical limits are met.

Although aw measurement is mandatory only for shelf stable products, it is strongly recommended that the producer determine the aw values achieved for each product type they manufacture and for each product. Once this has been established, frequent regular checks should be made to ensure consistency. In the U.S., they rely on moisture to protein ratio and have set targets. This lab-tested value is a direct correlation of the % water to % meat protein and not aw. This gives more consistency to common names. For example, to legally call a product "jerky" it must have a MPR of 0.75:1 or lower. Remember your ABCs:

Always be compliant.

-AND-

Documentation or it didn't happen.

(tags)

Charcuterie,Fermented Meat,Food Safety,Starter Culture,Chemical Acidification,Water Activity,Fermentation Process,Degree-Hours Method,Foodborne Pathogens,Meat Processing Guidelines,Chef WK Alberta Canada,Food Industry Standards,pH Critical Limits,Thermal Processing,Food Preservation,Food Microbiology,Sausage Fermentation,Charcuterie Expertise,Fermented Meats ,Food Safety Standards,Food Processing Guidelines,Starter Cultures,Chemical Acidification,Water Activity (a_w),Critical Limits,Degree-Hours Method,Foodborne Pathogens,Meat Processing Equipment,Processing Facility Requirements,Hazard Analysis and Critical Control Points (HACCP),Food Preservation Techniques,Temperature Control,Pathogen Reduction,Food Industry Compliance,Documentation Practices,Heat Treatment,pH Control,Food Stability,Consistency in Production,Microbial Testing,Real-time Monitoring,Process Validation,Regulatory Requirements,Verotoxigenic E. coli,Lethality Standards,Product Labelling,Spoilage Prevention,Enterotoxin Detection,Shelf-Stable Products,Moisture to Protein Ratio (MPR)

#Charcuterie#Fermented Meat#Food Safety#Starter Culture#Chemical Acidification#Water Activity#Fermentation Process#Degree-Hours#Meat Processing Guidelines#Thermal Processing#Food Preservation#Food Microbiology#Sausage Fermentation#Starter Cultures#Critical Limits#Meat Processing#Food Preservation Techniques#Temperature Control#Pathogen Reduction#Food Industry#Heat Treatment#pH Control#Food Stability#Microbial Testing#Real-time Monitoring#Process Validation#Spoilage Prevention#Enterotoxin Detection#Shelf-Stable Products#Moisture to Protein Ratio (MPR)

1 note

·

View note

Text

US Approves Sale of Cultured Chicken Meat

"Big news in the food industry! US regulators approve sale of lab-grown chicken meat, paving the way for a more sustainable future. #culturedmeat #sustainability"

Cultured meat. (2023, June 21). In Wikipedia. https://en.wikipedia.org/wiki/Cultured_meat This is a major milestone for the fledgling industry, which aims to address concerns about the environmental impact of traditional meat production and improve animal welfare by eliminating the need for slaughter. Cultured meat is made by taking cells from an animal and growing them in a lab under controlled…

View On WordPress

#animal cells#animal welfare#chicken#cultured meat#environmental impact#food industry#lab-grown#sale#sustainability.#US regulators

0 notes

Text

Some notes on worldbuilding with carnivorous cultures:

Animals feed more people than you think. You don't kill a cow for just one steak, this is a modern misconception since we're removed from the actual animals we eat our meat from; a single cow has several kilos of meat. In fact, slaughtering a single cow often means a feast time for possibly dozens of people. Every part of an animal can be used, and you can see this in cultures that live by ranching and transhumance.

Here, you should look at the Mongols and the people of the Eurasian Steppe, the people of the North American Plains, the people of the Pampas (fun fact; Buenos Aires was called the "carnivore city"), European and Asian cultures that practice transhumance, and those of the Arctic circle.

There are many ways to cook meat, but arguably, the most nutritious way to consume meat is in stew, as it allows you to consume all the fats of the animal and add other ingredients. In fact, mutton soup and stew historically was one of the basic meals for the for people in the Eurasian Steppe, who are one of the people with the highest meat consumption in the world.

Of course, meat spoils away easily. Fortunately, from jerky to cured meats, there are ways to prevent this. In pre-industrial and proto-industrial societies, salted meat was the main way of consumption and exporting meat. This makes salt even a more prized good.

Often, certain parts of animals like eyes, the liver, the testicles, the entrails, are considered not only cultural delicacies but as essential for vitamins and nutrients unavailable in environments such as the poles. The Inuit diet is a very strong example.

Pastures and agriculture have often competing dynamics. The lands that are ideal for mass pasture, that is, temperature wet grasslands, are also often ideal for agriculture. So pastoralism has often been in the margins of agrarian societies. This dynamic could be seen in the Americas. After the introduction of cattle and horses, the Pampas hosted semi-nomadic herdsmen, natives and criollo gauchos. The introduction of wire eventually reduced this open territory, converting it into intense agriculture, and traditional ranching was displaced to more "marginal" land less suitable for agriculture. Similar processes have happened all over the world.

This also brings an interesting question to explore. Agriculture is able to feed more people by density. What about species that DON'T do agriculture, because they're completely carnivorous? The use of what human civilization considers prime agricultural land will be different. They will be able to support much higher population densities than pastoralism.

Pastoral human populations have developed lactase persistance to be able to feed on dairy products even in adulthood. This mutation has happened all over the world, presumably with different origins. In any mammalian species that domesticates other mammals such a thing would be very common if not ubiqutous, as it massively expands the diet. Milk provides hydration, and cheese, yogurth and other such products allows long lasting food sources.

What about hunting? Early humans were apex predators and we are still ones today. However, humans can eat plants, which somewhat reduces the hunting pressure on fauna (though not the pressure of agrarian expansion which can be even worse). An exclusively carnivorous species (for example some kind of cat people) would have to develop very rigid and very complex cultural behavior of managing hunting, or else they would go extinct from hunger before even managing domestication. These cultural views towards hunting have also arosen in people all over the world, so you can get a sense of them by researching it.

It is possible for pastoral nomadic people, without any agriculture, to have cities? Of course. All nomadic peoples had amazing cultures and in Eurasia, they famously built empires. But they traded and entered conflicts with agrarian societies, too. They weren't isolated. Most of nomadic societies were defined by trade with settled ones.

The origin of human civilization and agriculture is still debated. It would be probably completely different for a non-human carnivorous society. One possible spark would be ritual meeting points (such as the historical Gobleki Tepe) or trade markets growing into permanent cities. But in general, pastoralism, hunting and ranching favors low-density populations that would be quite different.

Fishing, on the other hand, is a reliable source of protein and promotes settled cities. One can imagine acquaculture would be developed very early by a civilization hungry for protein.

Other possibilities of course are the raising of insects and mushrooms, both very uncommonly explored in fiction besides passing mentions.

Of course, most carnivorous species have some limited consumption of plant matter and many herbivores are oportunistic predators. The main thing to ask here is what the daily meal is here. For most human agrarian cultures, it's actually grain (this is where the word meal comes from). What about species that cannot live with a grain-based diet? You will find that many things people take for granted in agrarian society would be completely different.

As I always say: the most important question you can ask is "where does the food comes from?"

I hope you found these comments interesting and useful! I would love to do a better post once I'm able to replace my PC (yes, I wrote this all in a phone and I almost went insane). If you like what I write and would love to see more worldbuilding tips, consider tipping my ko-fi and checking my other posts. More elaborate posts on this and other subjects are coming.

#cosas mias#worldbuilding#speculative evolution#spec evo#spec bio#writing advice#biotipo worldbuilding

1K notes

·

View notes

Text

As the link between animal agriculture and climate breakdown becomes clearer, if anything, we are seeing more ordinary people falling over themselves to defend an industry that is destroying our planet, polluting our communities, exploiting animals and human workers. This is especially worrying to see from leftists, in spaces that are supposed to be progressive. I promise you, you do not need to spend your time greenwashing leather and wool, repeating blatant industry propaganda about veganism, 'regenerative agriculture' or whatever other buzzword they're using to sow doubt this week. The industry already spends millions of your dollars to lobby our politicians and influence public opinion; they don't need you to do it for free.

Vox – The greenwashing of wool explained

New Republic – The comforting lie of climate-friendly meat

Guardian – Big Beef’s climate messaging machine

The Breakthrough – Is Feedlot Beef Better for Environment?

International Journey of Biodiversity – Misinformation on Science of Grazed Ecosystems

Food Climate Research Network – Grazed & Confused

Science 2.0 – The regenerative ranching racket

DeSmog – A guide to six greenwashing terms

Truthdig – The backlash to plant-based meats

Independent – Meat & dairy industries downplaying role in climate crisis using tobacco tactics

Guardian – Meat & dairy lobbyists turn out in record numbers at COP28

Greenpeace – How Big Agriculture is borrowing Big Oil’s playbook at COP28

Guardian – Plans to present meat as ‘sustainable nutrition’ at Cop28 revealed

Guardian – Ex-officials at UN farming body say work on methane emissions was censored

Guardian – How UN food body played down role of farming in climate change

QZ – The meat industry blocked the IPCC’s attempt to recommend a plant-based diet

The Times – Red Tractor farms more likely to pollute environment

Influence Map – European meat & dairy industry weaken EU’s climate policies

The Grocer – Meat Industry lobbying behind cultured meat bans

Food Unfolded – Truth, tactics and the mist of meat lobby science

Business Green – Climate lobbying: Are meat and dairy lobbyists the ‘new merchants of doubt’?

131 notes

·

View notes

Text

American Jewish food is most typically defined as pastrami sandwiches, chocolate babka, or bagels and lox. But I am here to argue that the greatest American Jewish food may actually be the humble hot dog. No dish better embodies the totality of the American Jewish experience.

What’s that you say? You didn’t know that hot dogs were a Jewish food? Well, that’s part of the story, too.

Sausages of many varieties have existed since antiquity. The closest relatives of the hot dog are the frankfurter and the wiener, both American terms based on their cities of origin (Frankfurt and Vienna respectively). So what differentiates a hot dog from other sausages? The story begins in 19th century New York, with two German-Jewish immigrants.

In 1870, Charles Feltman sold Frankfurt-style pork-and-beef sausages out of a pushcart in Coney Island, Brooklyn. Sausages not being the neatest street food, Feltman inserted them into soft buns. This innovative sausage/bun combo grew to be known as a hot dog (though Feltman called them Coney Island Red Hots).

Two years later, Isaac Gellis opened a kosher butcher shop on Manhattan’s Lower East Side. He soon began selling all-beef versions of German-style sausages. Beef hot dogs grew into an all-purpose replacement for pork products in kosher homes, leading to such classic dishes as Franks & Beans or split pea soup with hot dogs. Though unknown whether Gellis was the originator of this important shift, he certainly became one of the most successful purveyors.

Like American Jews, the hot dog was an immigrant itself that quickly changed and adapted to life in the U.S. As American Jewry further integrated into society, the hot dog followed.

In 1916, Polish-Jewish immigrant Nathan Handwerker opened a hotdog stand to compete with Charles Feltman, his former employer. Feltman’s had grown into a large sit-down restaurant, and Handwerker charged half the price by making his eatery a “grab joint.” (The term fast food hadn’t yet been invented, but it was arguably Handwerker who created that ultra-American culinary institution.)

Nathan’s Famous conquered the hot dog world. Like so many of his American Jewish contemporaries, Handwerker succeeded via entrepreneurship and hard work. His innovative marketing stunts included hiring people to eat his hot dogs while dressed as doctors, overcoming public fears about low-quality ingredients. While his all-beef dogs were not made with kosher meat, he called them “kosher-style,” thus underscoring that they contained no horse meat. Gross.

The “kosher-style” moniker was another American invention. American Jewish history, in part, is the story of a secular populace that embraced Jewish culture while rejecting traditional religious practices. All-beef hotdogs with Ashkenazi-style spicing, yet made from meat that was not traditionally slaughtered or “kosher”, sum up the new Judaism of Handwerker and his contemporaries.

Furthermore, American Jewry came of age alongside the industrial food industry. The hot dog also highlights the explosive growth of the kosher supervision industry (“industrial kashrut”).

Hebrew National began producing hot dogs in 1905. Their production methods met higher standards than were required by law, leading to their famous advertising slogan, “We Answer to a Higher Authority.”

While the majority of Americans may be surprised to hear this, Hebrew National’s self-supervised kosher-ness was not actually accepted by more stringent Orthodox and even Conservative Jews at the time. But non-Jews, believing kosher dogs were inherently better, became the company’s primary market. Eventually, Hebrew National received the more established Triangle-K kashrut supervision, convincing the Conservative Movement to accept their products. Most Orthodox Jews, however, still don’t accept these hot dogs as kosher.

But over the last quarter of the 20th century in America, the Orthodox community has gained prominence and their opinions, and food preferences, hold more weight in the food industry.

The community’s stricter kashrut demands and sizable purchasing power created a viable market, and glatt kosher hot dogs hit the scene. Abeles & Heymann, in business since 1954, was purchased in 1997 by current owner Seth Leavitt. Meeting the demands of the Orthodox community’s increasingly sophisticated palate, their hot dogs are gluten-free with no filler. Recently, they’ve begun producing a line of uncured sausages, and the first glatt hot dogs using collagen casing.

Glatt kosher dogs can now be purchased in nearly thirty different sports arenas and stadiums. American Jews have successfully integrated into their society more than any other in history. So too, the hot dog has transcended its humble New York Jewish immigrant roots to enter the pantheon of true American icons. So when you bite into your hot dog this summer, you are really getting a bite of American Jewish history, and the great American Jewish food.

354 notes

·

View notes