#Crypto Cloud Pricing

Explore tagged Tumblr posts

Text

Crypto Cloud Review – Make Us $500/Day in Bitcoin Automatically!

Welcome to my Crypto Cloud Review Post, Where I will discuss the features, upgrades, demo, price, and bonuses, how Crypto Cloud can benefit you, and my opinion. This Crypto Cloud’s Revolutionary Mining Platform Makes $100-$300 While You Sleep!

Are you ready to dive into the world of cryptocurrency and turn your mobile phone or computer into a powerful daily earning machine? With Crypto Cloud, you can effortlessly harness the power of your device to mine cryptocurrencies such as Bitcoin, Ethereum, and many more. Say goodbye to traditional investment strategies and hello to a revolutionary way of earning passive income, Can you imagine effortless crypto mining that leaves you in awe? making everything the whole process simple.That’s what Crypto cloud does for you. But the heck is this? This agreement will expire tonight. It’s selling out faster than we expected, and once this offer expires, it won’t be available again.

Crypto Cloud Review: What Is Crypto Cloud?

Crypto Cloud is a cloud mining platform that allows users to participate in cryptocurrency mining without the need for physical mining hardware or technical expertise. Essentially, you rent computing power from their data centers, which house powerful mining rigs. This eliminates the technical setup, noise, heat, and energy consumption associated with traditional home-based mining.

Through Crypto Cloud, users can mine various popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. They offer different contract durations and hashrate levels, allowing users to scale their mining involvement based on their budget and desired earnings. The platform also boasts passive income potential, as users can potentially earn cryptocurrency 24/7 without actively participating in the mining process.

Crypto Cloud Review: Overview

Creator: Peter Onwe

Product: Crypto Cloud

Date Of Launch: 2024-May-06

Time Of Launch: 10:00 EDT

Front-End Price: $17 (One-time payment)

Official Website: Click Here To Access

Product Type: Software (Online)

Support: Effective Response

Discount: Get The Best Discount Right Now!

Recommended: Highly Recommended

Bonuses: Huge Bonuses

Skill Level Required: All Levels

Discount Code: “CryptoCloud5” $5 OFF Entire Funnel!

Refund: YES, 365 Days Money-Back Guarantee

<<>> Click Here & Get Access Now Crypto Cloud Discount Price Here <<>>

Crypto Cloud Review: About Authors

Peter Onwe was created by CryptoCloud. Peter has a long history of success in the software developer, digital marketing, and entrepreneur sectors. He’s now on a mission to share his knowledge and provide answers to anyone looking to make additional money, drawing on years of experience learning money-making techniques. His latest venture, CryptoCloud, offers a remarkable opportunity for numerous individuals.

However, it is not all. Peter’s portfolio showcases other outstanding works such as AvatoAI and NewsMailer. And he hasn’t finished yet. Expect more groundbreaking inventions from him in the future!

Crypto Cloud Review: Features

Admin Control Panel: Take charge of the platform and all associated investments effortlessly through our intuitive control panel.

Mining Platform Control: Customize and design the platform according to your preferences with our user-friendly page builder tool.

Automation: Experience seamless operation with our automation feature, ensuring the platform works efficiently on 100% autopilot.

Plan Manager: Tailor- Make plans for platform customers with our plan manager, offering flexibility and scalability.

Varied Payment Methods: Easily accept investments with a range of payment methods, enhancing accessibility and convenience for users.

Newbie-friendly and easy-to-use interface.

100% Newbie-Friendly

FULL Commercial License Included — sell Lead generation services to clients

Pay one time and use it forever.

And Many more.

Crypto Cloud Review: How Does It Work?

You’re 3 STEPS AWAY From Making 3-Figures A Day

Step #1:

Get access to the software’s dashboard.

Step #2:

Insert the required details to initiate the cloud setup.

Step #3:

Run your own crypto mining business & earn commissions per member.

<<>> Click Here & Get Access Now Crypto Cloud Discount Price Here <<>>

Crypto Cloud Review: Can Do For You

1 Click Crypto Generation Up To $500/Day

#1 Easiest Way To Break Into The Crypto Boom

ZERO Experience Required, Just Need A Phone Or Laptop

1-Time Payment For Lifelong Access

How To Establish A Real Proper Crypto Business That People Will Pay For

How To Immediately Deploy The Business To Rapidly Generate Income

Learn To Maximize The Flow Of Customers By Using Unlimited High-Quality Traffic Sources

Create A Cloud Crypto Mining Business Effortlessly & Achieve Financial Freedom

World class 24*7 customer support.

Iron-clad 365 day money-back-guarantee

Crypto Cloud Review: Who Should Use It?

CPA Marketing

SEO

Affiliate Marketing

Internet Marketer

List Buildin

eCommerce Store Owners

Dropshipping

Freelancers

Website Owners

Content Creators

YouTubers

Marketers

Crypto Cloud Review: OTO’s And Pricing

Add My Coupon Code “CryptoCloud30″ — For 30% Off Any Funnel

Front End Price: Crypto Cloud ($17)

OTO1: Crypto Cloud Pro ($47)

OTO2: Crypto Cloud Unlimited ($197)

OTO3: Crypto Cloud DFY ($67)

OTO4: Crypto Cloud Agency Edition ($37)

OTO5: Crypto Cloud DFY Template Club ($49)

OTO6: Crypto Cloud NewsMailer ($47)

OTO7: Crypto Cloud Unlimited Traffic ($197)

OTO8: Crypto Cloud Reseller ($37)

OTO9: Crypto Cloud Whitelabel ($397)

<<>> Click Here & Get Access Now Crypto Cloud Discount Price Here <<>>

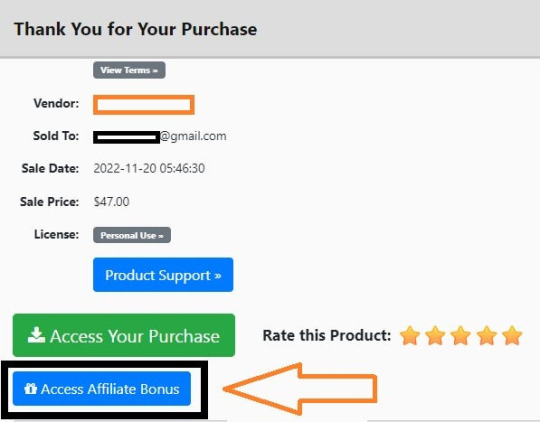

Crypto Cloud Review: My Unique Bonus Bundle

My Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase.

And before ending my honest Crypto Cloud Review, I told you that I would give you my very own unique PFTSES formula for Free.

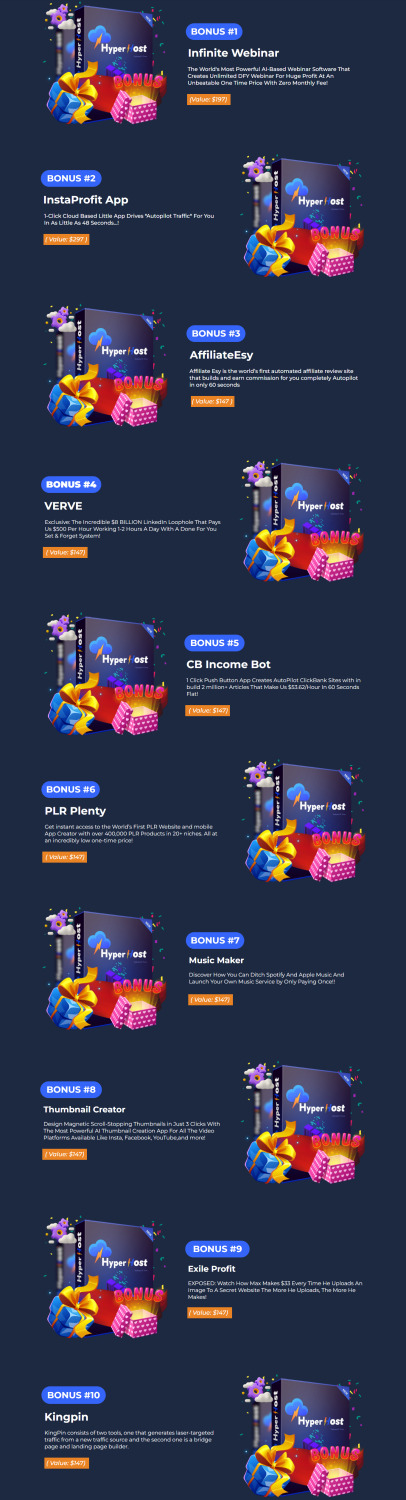

Crypto Cloud Review: Free Bonuses

BONUS #1: Crypto Nights (Value — $197)

Investors Are Buying Crypto And So Should You!

BONUS #2: 7 Techniques To Successful Crypto Trading (Value — $197)

7 Techniques To Successful Crypto Trading .

BONUS #3: Google Maps Profits (Value — $197)

Google Maps listings have been revamped!

BONUS #4: Boost Your Business Profits (Value — $197)

Skyrocket Your Profits Drastically!

BONUS #5: Insta Profit Magnet (Value — $197)

Insta Profit Magnet.

Crypto Cloud Review: Demo Video

Just Watch The Crypto Cloud Demo Video Down Below To Get All The Details:

vimeo

<<>> Click Here & Get Access Now Crypto Cloud Discount Price Here <<>>

Crypto Cloud Review: Money Back Guarantee

Our 100% Risk-Free 365 Days Money Back Guarantee

We Are So Confident That Our Crypto Cloud Software Will Transform Your Life That We’ll Shoulder All The Risk Involved We believe so much in our one-time fee and crypto cloud software, and we want to make you feel peace of mind when purchasing. It’s not like what we charge is a lot, but we want you to be safe. So here’s, from our point of view, an impossible-to-refuse offer: It’s like giving a tool to generate up to seven figures per year in commissions for as little as $12.99. It’s 100% risk-free for you. It ‘s like a no-brainer. 365-Day Money-Back Guarantee: If you feel like our crypto cloud software isn’t suitable for you and doesn’t help you at all as a result of using it, we will double your money back after giving it a try.

Crypto Cloud Review: Pros and Cons

Pros :

Convenience: Cloud-based mining eliminates the need for users to purchase, maintain, and operate their own mining rigs.

Accessibility: Offers entry into crypto mining for beginners without technical knowledge.

Passive Income Potential: Promises generation of passive income through cryptocurrency mining.

Cons:

You cannot use this product without an active internet connection.

In fact, I haven’t found any additional Crypto Cloud issues.

Frequently Asked Questions (FAQ’s)

Q. Will I get Support for this software?

Yes, our 24*7 support team is always available to solve your issues and help you get the best results from Crypto Cloud.

Q. Are there any monthly fees?

No, currently we are offering a one-time price for this tool. So, get this best deal before reversing to a Monthly subscription.

Q. Is there any money-back guarantee?

Yes, we are offering a 365-day money-back guarantee. So there is no risk when you act now. The only way you lose is by taking no action.

Q. Do you update your product and improve it?

Yes, we always maintain our product and improve with new features.

Q. How to Activate my Early Bird discount?

Click the below button to grab this at an early bird discount.

Crypto Cloud Review: My Recommendation

Crypto Cloud presents a convenient avenue for cryptocurrency mining. However, the lack of transparency, potentially inflated profitability claims, and concerns about user experiences raise significant red flags. Before diving in, conduct thorough research, understand the inherent risks, and consider alternative mining options. Remember, “if it sounds too good to be true, it probably is” often holds weight in the cryptocurrency world.

<<>> Click Here & Get Access Now Crypto Cloud Discount Price Here <<>>

Check Out My Previous Reviews: $50 Billion Giveaway Review, AI eBookStore Review, Infinite Hub Review, Infinite Hub Review, Vidhive Review, Coursiify Review, Azon AutoSites Review Konnect App Review.

Thank for reading my Crypto Cloud Review till the end. Hope it will help you to make purchase decision perfectly.

Disclaimer: This Crypto Cloud review is for informational purposes only and does not constitute professional advice. Before making a purchase decision, we recommend conducting your own research and exploring the software.

Note: Yes, this is a paid tool, however the one-time fee is $17 for lifetime.

#Crypto Cloud#Crypto Cloud App#Crypto Cloud Upgrades#Crypto Cloud Overview#Crypto Cloud Features#Crypto Cloud Review#Crypto Cloud Works#What Is Crypto Cloud#Buy Crypto Cloud#Crypto Cloud Price#Crypto Cloud Demo#Crypto Cloud Discount#Crypto Cloud Honest Review#Crypto Cloud Pricing#Crypto Cloud FE#Crypto Cloud Pros#Crypto Cloud OTO#Crypto Cloud Preview#Crypto Cloud Scam#Get Crypto Cloud#Crypto Cloud Reviews#Purchase Crypto Cloud#Crypto Cloud Legal#Artificial Intelligence#AI#Crypto Cloud Benefits#Crypto Cloud Bonus#Crypto Cloud Bonuses#Crypto Cloud Software#Crypto Cloud Software Review

0 notes

Text

When you hear "fintech," think "unlicensed bank"

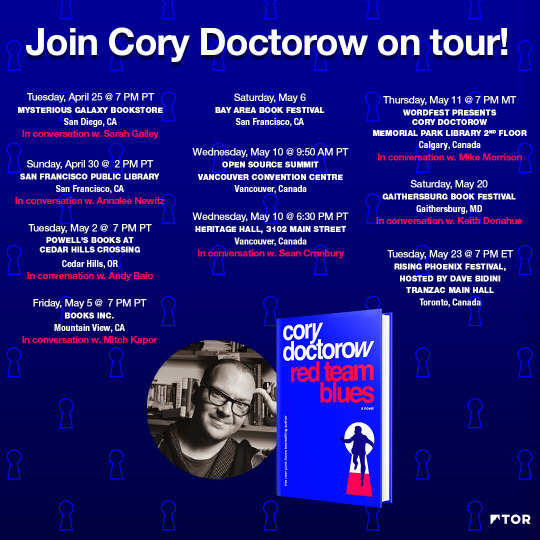

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image: Andre Carrotflower (modified) https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

668 notes

·

View notes

Text

Remember a couple years ago when everyone was talking about how Bitcoin alone was using as much energy as a medium-sized country to enable rampant speculation and financial scams? The demand was so high in some jurisdictions that it was keeping fossil-fuel power plants from being taken offline, and even reactivating some defunct polluting generation infrastructure. Crypto’s environment toll was rightfully seen as unconscionable to many people following the industry. But the generative AI boom is taking it to a whole new level.

Since the launch of ChatGPT in December 2022, the entire tech industry has reoriented itself to try to get a boost from the interest in generative AI and many sectors beyond have pretended they’re doing something with artificial intelligence (AI) too in the hopes of increasing their share price. But if there are any winners from the AI hype, it’s the companies running the data centers — especially Microsoft, Google, and Amazon — and those making the chips that power it all. Nvidia is the standout example in that category, given its ascent to become one of the most valuable publicly traded companies in the world and the questions that’s prompted about the AI bubble.

All those generative AI tools are incredibly computationally intensive, which means they require a lot of dedicated hardware within massive hyperscale data centers owned by the cloud oligopoly, and all that computing power requires a immense amount of water and electricity to keep it running. If you’ve followed tech investment news over the past year, you’ve been seeing the effect of that as Microsoft, Google, and Amazon have dropped billions of dollars every few weeks on new communities around the world for new data center projects.

24 notes

·

View notes

Text

The Power of Doing Your Own Research: Why Informed Decisions Matter More Than Ever

In an age where information is at our fingertips, it’s easier than ever to form opinions or make decisions based on what we see online, hear from others, or absorb from headlines. But have you ever found yourself caught up in the hype, only to realize later that you didn’t have the full picture? Whether it’s a financial investment, a health decision, or simply believing a news story, the dangers of acting without proper research are real.

Let’s take a step back and think about this: How often do we accept what we’re told without digging deeper? In today’s noisy world, doing your own research (DYOR) isn’t just a skill—it’s a necessity.

2. The Problem With Blind Trust

Blindly trusting information can lead to disastrous consequences. Think back to the 2008 financial crisis. Millions of people lost their savings because they trusted the traditional financial system without questioning its vulnerabilities. Or consider the countless crypto scams today, where people are misled by flashy promises and influencer endorsements, only to lose everything.

The truth is, misinformation spreads faster than ever, often dressed up as credible advice. Social media algorithms feed us content designed to confirm our biases, and the pressure to conform to popular opinions can cloud our judgment. Without research, we risk becoming victims of groupthink, leaving us vulnerable to poor decisions and manipulation.

3. What Does 'Doing Your Own Research' Really Mean?

DYOR is more than a buzzword; it’s a mindset. It means:

Cross-checking sources: Don’t rely on a single article or video. Look for multiple perspectives to get a clearer picture.

Following the money: Ask yourself who benefits from this information. Is there an agenda behind it?

Verifying facts: Trust but verify. Independent studies, reputable sources, and primary data are your best friends.

Staying skeptical: Approach every claim with curiosity and a healthy dose of doubt until you’ve validated it.

This approach requires effort, but the payoff is worth it. You’re not just a passive consumer of information; you’re an active participant in your own decision-making process.

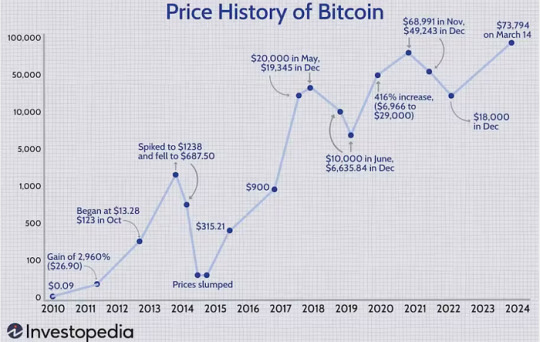

4. Why Bitcoin Is a Prime Example

Bitcoin is a perfect case study for why DYOR matters. Many dismiss it outright as a speculative bubble or a “fad” without understanding its fundamentals. Others dive in blindly, swayed by hype, only to panic sell when the price drops.

When I discovered Bitcoin, it wasn’t an overnight decision. I spent countless hours researching what it is, why it exists, and how it works. That journey changed my life. Bitcoin isn’t just money; it’s a system rooted in transparency, decentralization, and financial sovereignty. But to see that, you have to go down the rabbit hole—you have to do the work.

5. The Rewards of Independent Thinking

There’s a unique empowerment that comes from making decisions based on your own informed understanding. You’re not just taking someone’s word for it; you’re building a foundation of knowledge that gives you confidence and clarity.

For example, I once made an investment decision after weeks of research. Friends thought I was crazy, but I trusted the data and my analysis. That decision paid off, not just financially but in the confidence it gave me to trust my own process.

Informed decisions lead to better outcomes—not because they’re always perfect, but because they’re deliberate and grounded in understanding.

6. Call to Action

Here’s a challenge: Take one topic you’re curious about but don’t fully understand. It could be Bitcoin, renewable energy, or even something as simple as a health trend. Commit to spending an hour digging into it. Read articles, watch videos, and compare perspectives. Don’t stop until you’ve asked and answered better questions.

Remember, it’s not just about finding answers; it’s about cultivating a mindset of curiosity and critical thinking. In a world full of noise, doing your own research is how you cut through the chaos and make decisions that truly matter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#DoYourOwnResearch#CriticalThinking#InformedDecisions#BitcoinEducation#FinancialFreedom#KnowledgeIsPower#ResearchMatters#ThinkForYourself#DYOR#Empowerment#Misinformation#IndependentThinking#TruthSeeker#Decentralization#StayCurious#bitcoin#cryptocurrency#financial experts#digitalcurrency#blockchain#finance#financial education#financial empowerment#globaleconomy#unplugged financial

2 notes

·

View notes

Text

C.C's thoughts on the FFVII Rebirth/Apex collab...

I used to play Apex a lot, but not so much anymore. This collab mindfucked me for a good hour or so when I first saw the trailer for it.

To explain to my non-Apex familiar followers: the legendary/iconic skins for the Apex collab are Crypto (Cloud/Zack), Horizon (Aerith) Wraith (Vincent/Tifa), Wattson, Newcastle, and Valkyrie.

I have a strong feeling that Valkyrie will likely get a Sephiroth/Young Sephiroth skin. Her hair and wing motif are huge points in that favor. And it would be really weird for Sephiroth to not get anything in a major video game collaboration. Though, personality-wise, Cid would be a better fit for her. Newcastle would also probably be Barret. As for Wattson, I'm thinking Yuffie because of the energetic and happy personalities but I wouldn't be surprised if they threw a curve ball and made her a Chocobo costume or Cait Sith...

The Aerith/Horizon skin is...bleh... I honestly think Loba and Lifeline would've been much better choices to represent Aerith. But Horizon is undoubtedly the more popular of the three. The most fitting collab for FF7 would've been Overwatch in my supremely biased opinion.

For my ideas of OW/FF7 collab skins, I think the following characters would work very well:

Aerith - Mercy

Sephiroth - Lifeweaver or Sigma

Vincent - Reaper.

Soldier 76 - Shinra Grunt

Tifa - Either Brigitte or Junker Queen

Cloud/Zack - Genji

Yuffie - 100 percent Kiriko (though I can kinda see Sombra working out for this too)

Cait Sith - Wrecking Ball or D.Va (Might be a bit similar to her black cat skin)

JENOVA - Widowmaker

And probably much more options... The character designs from FF7 would transfer over to Overwatch much more smoothly than Apex. And I would pay so fucking much for an Aerith/Mercy skin, honestly.

I'm really curious about how much EA paid for this exclusive collab. Apex is incredibly popular in Japan, which I believe played a major role in making this collab happen. My theory is that EA invested a significant amount of money for this, not only to capitalize on the hype surrounding Rebirth, but also to prevent its main competitor, Fortnite, from getting hold of the IP. In my opinion, even Fortnite would have been a better fit for a FF7 crossover than Apex. The character designs in Apex lack so much versatility, and the overall mood and settings of both franchises are so different that it feels quite jarring to see an official crossover between them. Additionally, some of the choices for the character skins bother me, like forcing elements of Tifa onto Wraith, who would've worked better as a Yuffie skin consider that she's literally a ninja too. It all just one big cash grab. These skins will be expensive, and they probably wouldn't be worth the price. I want to be hopeful, but I'm not.

#final fantasy 7#c.c rambles#sephiroth#ff7#ff7 sephiroth?#aerith gainsborough#Cloud strife#ffvii#ffviir#ff7 rebirth#ff7 remake#final fantasy vii#tifa lockhart#vincent valentine

13 notes

·

View notes

Text

How to Ride the Uptrend and Maximize Profits

Capitalizing on a market uptrend can significantly increase your investment returns. Read on for practical tips to navigate market movements and optimize your profits. Start improving your investment strategy today!

How to Predict the Uptrend?

Predicting exactly when the market will experience an uptrend is challenging. Even if experts anticipate an uptrend soon, the exact timing—whether in 2024, 2025, or beyond—remains uncertain.

The real challenge lies in avoiding premature profit-taking that could cause you to miss out on gains, while also not holding investments too long and risking losses when the market turns.

So, how can we navigate these challenges and maximize our gains during an uptrend? Here are some strategies to consider:

Focus on Your Goals

Monitoring market movements is not sufficient on its own. It’s crucial to establish clear financial goals. Attempting to buy at the absolute lowest and sell at the highest points is an impractical approach since it’s impossible to precisely predict the end of an uptrend.

Instead, set clear, achievable targets that align with your financial objectives. This approach will guide you in making well-informed decisions rather than chasing market trends.

Use the Four-Year Cycle

The four-year cycle remains a dependable framework for anticipating market movements, even though minor deviations can occur. This cycle can help guide your profit-taking strategy, allowing you to gauge the mid-phase of an uptrend.

Utilizing a dollar-cost averaging (DCA) approach, particularly from late 2024 to Q3 2025, can be beneficial. DCA involves consistently investing a fixed amount, which mitigates the risk of buying at peak prices manipulated by market whales. For those preferring a safer strategy, DCA can be an effective way to spread investment risk over time.

Stick to Your Strategy

Maintaining a well-defined and disciplined strategy is crucial. This disciplined approach helps you stay focused and avoid making emotional decisions driven by market volatility.

Adhering to your plan, even amidst market fluctuations, is key to successful profit-taking. Regularly reviewing and adjusting your strategy based on your goals and market conditions can also enhance your decision-making process.

Diversify Your Investments

Diversification is a time-tested strategy to manage risk and enhance profit potential. While applying DCA to established assets like Bitcoin, consider diversifying your portfolio by holding presale tokens such as $BUSAI or participating in airdrops.

Presale tokens are often available at lower prices, offering potential high returns with reduced initial investment. Diversification spreads your risk across various assets, reducing the impact of any single asset’s performance on your overall portfolio.

BUSAI PRESALE CASE STUDY

In today’s crowded presale landscape, distinguishing between genuine opportunities and scams is crucial. For example, the meme AI project BUSAI is gaining significant attention, but don’t let the hype cloud your judgment.

Before diving in, it's vital to thoroughly examine the whitepaper, tokenomics, and the project's backers. If your research checks out, it could be worth considering.

BUSAI stands out with its impressive ecosystem and strategic tokenomics. Its innovative features, such as the interact-and-earn and staking rewards, set it apart from typical meme tokens.

Its tokenomics emphasizing substantial presale, marketing, and liquidity allocations, the project shows strong growth potential. Additionally, BUSAI’s focus on community engagement and cutting-edge technology makes it a distinctive and promising investment in the evolving crypto arena.

By following these guidelines, you can navigate the uptrend effectively and avoid common pitfalls. Stay focused, be disciplined, and make informed decisions to achieve your financial goals.

BUSAI Official Channel: Website | Twitter | Telegram

3 notes

·

View notes

Text

What Equipment to Use for Mining Bitcoin Profitably After the Halving?

In April 2024, the next Bitcoin halving took place. The reward for mining one block was reduced by 50% and is now 3.125 BTC. Due to this, some may begin to doubt mining — will this activity continue to bring in a decent income? Based on our extensive experience, we can confidently say that mining can and should remain profitable even after the halving. In this article, we will discuss how to organize Bitcoin mining most rationally and what equipment to choose for this.

Bitcoin Price Will Definitely Rise After the Halving

Since the launch of the first cryptocurrency, its halving has occurred approximately every four years. In 2024, this happened for the fifth time. Throughout all these years, the price of BTC, its market capitalization, and audience have steadily increased. The popularity of mining is also growing, and new technologies are being developed to increase its efficiency.

The person or team behind Bitcoin came up with halving to control inflation and maintain demand for the coin. Halving benefits Bitcoin and in no way deprives miners of their well-deserved reward. The rarer the asset, the higher its value — this rule works after each halving. That’s why starting mining right now is an excellent idea.

Three Secrets to Keep Mining Profitable

To make money mining BTC after its halving in 2024, you need to:

Buy or rent the latest generation equipment

Reduce expenses

Find a reliable hosting provider

Let’s take a closer look at all these points.

Today, one of the best ASICs for mining Bitcoin is the Antminer 21 series. It stands out for its high hashing power combined with relatively modest energy consumption. The Antminer 21 significantly outperforms miners of previous generations. The manufacturer of this series, Bitmain, is one of the most well-known in the industry. This is a reliable brand with a very strong team, extremely popular among crypto professionals.

To increase revenue, you can purchase multiple devices and combine them into a mining farm. However, this may require too high initial costs. Additionally, you will need to find a place to host the equipment. It not only consumes a lot of energy but also makes a lot of noise. To reduce the noise level, you can buy ASICs with a water cooling system — but they are more expensive than regular ones.

To cut costs, you can rent a miner instead of buying it. Remote providers can afford the most modern ASICs. You will be able to choose one or several machines with suitable characteristics. The provider will take care of the installation, maintenance, and repair of the equipment. Their staff has all the necessary knowledge and skills. Your involvement in mining will be minimal, and you will be able to receive truly passive income.

Another option is to try cloud mining, a more modern and accessible alternative. You will be renting not an ASIC but hashing power. First, you will purchase a contract on the most comfortable terms for you. After that, your task will be reduced to regularly transferring the commission to the provider — and they will take care of everything else. You will start receiving income on the rise in the price of Bitcoin. If you want to increase your profits, you can buy multiple contracts.

Each halving forces mining providers to rethink their strategies and optimize their activities. Some of those who cannot cope with these tasks close down. That’s why it’s important to check the provider’s history — the longer they have been in business, the better.

The second important parameter is customer reviews. It’s not a problem if some of them are negative — the main thing is that the majority are positive. The contract terms of a good provider are detailed and transparent. The support service is polite, informed, and responds promptly to customer inquiries.

ECOS meets all the criteria of a first-class provider for remote mining. This company is located in the free economic zone of Armenia, where cryptocurrencies are legal, and miners are exempt from taxes for 25 years. The Razdan power plant provides stable access to cheap energy. The security of the territory where the equipment is located is guaranteed by armed guards. The equipment downtime is close to zero. If an ASIC breaks down, it will be promptly repaired on-site, without wasting time sending it to the manufacturer’s service center.

ECOS clients can choose a cloud mining contract from existing options or create their own, individual one. The selection of equipment rental or purchase options is also very large. Clients appreciate ECOS for its transparent terms, reasonable prices, and quality service. This is an ideal provider for beginner miners who are just taking their first steps in the industry. Experienced miners note the exceptional reliability of ECOS, honesty, and timely payment of rewards.

ECOS Client Case

To confirm the above theory, let’s consider a real case of one of the ECOS clients. Let’s denote him by the nickname anto******duate.org.

Immediately after the previous halving in 2020, he bought an Antminer T17 for $699. The hashing speed of this miner was 38 terahashes per second. Four years ago, this model was considered advanced, one of the best on the market.

From November 25, 2020, to November 1, 2021, anto******duate.org earned 0.08026213 BTC with his Antminer T17, which in fiat currency amounted to $5,327. Hosting and miner maintenance costs were only $1,080. The client received a net profit of $3,548. Mining turned out to be a more profitable activity for him than buying bitcoins. If he had bought bitcoins, his profit would have been only $2,900.

To estimate your upcoming expenses and profits, you can use the calculator on the ECOS website. We hope that with the help of this tool, you will see that mining BTC can still be profitable even after the halving!

3 notes

·

View notes

Text

How Effective is Crypto Algo Trading Bot in the Trading Journey

The cryptocurrency market is well-known for its volatility and quick price changes. Amidst this activity, crypto algo trading bots have appeared as effective tools for guiding the complexity of trading. These automated systems, driven by algorithms and advanced data analysis, offer the potential to improve trading efficiency and profitability. But how effective are they truly in a trader's journey?

Comprehending Crypto Algo Trading Bots

Crypto algo trading bots are computer programs developed to perform trades automatically based on predefined parameters. They work on various strategies, from simple trend-following to complex arbitrage opportunities. These bots can analyze market data at sparky speed, recognizing patterns and executing trades exactly, often exceeding human capabilities.

Key Advantages of Crypto Algo Trading Bots

Emotional detachment: One of the biggest advantages of algo trading is the elimination of human emotions. Fear and desire can often cloud judgment, leading to impulsive decisions. Bots operate in a pure sense, without emotional preferences, ensuring disciplined trading.

Speed and efficiency: Humans have limitations in processing data and responding to market changes. Algo bots can execute trades in milliseconds, capitalizing on quick opportunities that humans might miss.

All time function: The crypto market never sleeps. Algo bots can trade constantly, without the need for rest or breaks, maximizing potential profits.

Backtesting and optimization: Before deploying a bot, traders can backtest its performance on recorded data to assess its significance. This allows for the optimization of trading strategies and risk management parameters.

Diversification: Algo bots can manage numerous trading strategies simultaneously, diversifying risk and increasing the possibility for constant returns.

Impact and Success Stories

Multiple traders have reported significant benefits from using crypto algo trading bots. Some have achieved consistent profitability, outperforming manual trading strategies. These bots have been confirmed particularly effective in high-frequency trading, where speed is essential. Additionally, they can be valuable for arbitrage opportunities, using price differences across different exchanges.

However, it's essential to recognize that not all algo trading bots are created equal. The point of a bot depends on several aspects, including the underlying trading method, the quality of data used, and the bot's ability to adjust to market conditions.

Challenges and Concerns

While the potential advantages of crypto algo trading bots are important, it's crucial to approach them with real expectations. Overfitting to historical data can lead to suboptimal performance in future market conditions.

Moreover, developing and maintaining a good algo trading system requires specialized expertise and continuous monitoring. Traders should carefully evaluate the risks involved and consider their ability and help before launching into algo trading.

Conclusion

Crypto algo trading bots have the prospect of being effective tools in a trader's journey. They offer advantages in terms of speed, efficiency, and emotional detachment. While not a guaranteed path to riches, they can significantly improve trading performance when used wisely.

It's important to approach algo trading with a combination of confidence and notice. Thorough research, backtesting, and ongoing monitoring are essential for increasing the benefits and reducing risks. As with any investment, diversification is key. Combining algo trading with other strategies can help create a well-rounded investment portfolio.

In conclusion, crypto algo trading bots represent an exciting frontier in the world of trading. While challenges exist, the potential rewards are significant for those who approach this technology with knowledge and discipline.

Get a opportunity to grab a FREE DEMO - Crypto Algo Trading Bot Development

2 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

2 notes

·

View notes

Text

HyperHost Review – Get Super-Fast Unlimited Web Hosting

Welcome to my HyperHost Review. Are you currently fed up with paying a monthly subscription for hosting charges you have to pay for hosting companies, like GoDaddy, Hostinager, and many more? In today’s fast paced digital world, a reliable, secure web hosting provider is a must have, for businesses, entrepreneurs, bloggers and developers.

HyperHost is a standout in the crowded web hosting space, offering an all-in-one Linux web hosting solution with lightning-fast servers, 99.9% uptime, and unbeatable features that make it a prime choice for users looking to power their websites and domains.

This comprehensive HyperHost review will explore everything you need to know about the hosting solution, including its core features, benefits pricing, and . Whether you’re starting a new project or looking to switch web hosts, this guide will provide you with valuable insights to help you make an informed decision.

What Is HyperHost?

HyperHost is a game changer in the web hosting industry with unbeatable combination of performance, reliability and affordability. Based on one time payment model, combined with its advanced features such as unlimited hosting, better reliability and resiliency, enhanced security, and 3x faster performance, it is an option to take seriously by any enterprise, developer or individual.

If you’re searching for a rapid hosting solution with excellent security bid, reliability, and range of freebies alongside without recession cost, HyperHost positively sounds great. Today, take advantage of its robust features and raise your online presence.

HyperHost Review: Overview of Product

Product Creator: Venkatesh and Visves

Product Name: HyperHost

Launch Date: 2025-Jan-04

Launch Time: 11:00 EST

Front-End Price: $17 (One-time payment)

Official Site: Click Here To Visit Official Salespage

Product Type: Tools and Software

Support: Effective Response

Discount: Get The Best Discount Right Here!

Recommended: Highly Recommended

Bonuses: YES, Huge Bonuses

Skill Level Required: All Levels

Discount Coupon: Use Code “HH5OFF” To Get $5 Off (Full Funnel)

Refund: YES, 30 Days Money-Back Guarantee

HyperHost Review: About Authors

The software HyperHost was successfully made by Venkatesh and Visves. They have both been making tools for the online business for a long time. They’ve made a lot of useful goods for people and work well together. They’ve helped a lot of people make more money and deal with problems.

For example, MailPal, Infinite Hub, DEVIO, Gen AI, Infinite Webinar, Infinite Hosting, Infinite Crypto, Infinite Core, CartCash, AI CB PROFITZ, Ai Cartoonz, EVER HOSTING, Mail Mate, and many more show how much they love technology.

HyperHost Review: Key Features of HyperHost

100% Cloud-based app allows you to host unlimited websites, unlimited domains, and Unlimited everything.

Host unlimited websites, and unlimited web pages without any restriction for a low one-time fee.

Blazing-fast web hosting and Unlimited web pages are optimized for high speed.

Create Unlimited Domains and Unlimited Sub-Domains.

Free SSL Certificate and Highly Secured Hosting.

100% Uptime guarantee.

Easy to use Control Panel.

Unlimited Bandwidth and Unlimited storage.

Automated Daily Backup and many more.

100% Cloud-based and SSD Server helps you get faster loading speed.

Newbie-friendly and easy-to-use software.

100% Newbie-Friendly

FULL Commercial License Included – sell Lead generation services to clients

Pay one time and use it forever.

And Many more.

HyperHost Review: How Does It Work?

You’re Now Just 3-Steps Away From Super-Fast Hosting!

Step #1:

Login-in to our secure web-based server & add your domain names

(User-Friendly Interface. Fast Website Installation Process. Add Unlimited Domains)

Step #2:

Choose your preferred website deployment app

(e.g WordPress ) and use our 1-click function within our User-Friendly Control Panel. (100% SSL-Encryption Included To Ensure Secure & Safe Data within Our High-Speed Servers)

Step #3:

Access & Control Your Websites From Anywhere

(Build Fast-loading & highly profitable websites with 100% uptime, unlimited bandwidth and maximum malware protection)

HyperHost Review: Benefits of HyperHost

No Monthly Fees Ever

100% Newbie-Friendly Interface

Easy-to-move your websites

No Tech Skills Needed

Ultra-High-Speed Servers

Host Unlimited Websites

24/7 Support Included

No Restrictions Or Limitations

30-Day Money Back Guarantee

HyperHost Review: Who Should Use It?

SAAS Sellers

Website Owners

YouTube Marketers

Affiliate Marketers

Ecom Store Owners

Bloggers/Vloggers

Coaches & Course Creators

Web Developers

Fiverr & Upwork Professionals

Digital Marketers

And Many Others

HyperHost Review: OTO’s And Pricing

Add My Bundle Coupon Code “HH30OFF″ – For 30% Off Any Funnel OTO Below

Front End Price: HyperHost ($17)

OTO1: HyperHost Unlimited PRO ($37)

OTO2: HyperHost DFY SETUP ($97)

OTO3: HyperHost DFY Profit Articles Upgrade ($37)

OTO4: HyperHost PageMate ($19)

OTO5: HyperHost MailMate ($27)

OTO6: HyperHost Profit Sites ($17)

OTO7: HyperHost Traffic Automation ($19)

OTO8: HyperHost Reseller ($97)

HyperHost Review: Money Back Guarantee

We Are So Confident That You’ll Love HyperHost That We’re Giving You A Full 30-Days To Test-Drive It

So we believe in our One-time FEE, HyperHost so much and as we want to make you move peace of mind when buying our products. We aren’t charging much but WE WANT YOU SAFE.

And here is our impossible to refuse offer, from out view. Well, its like giving a commission generator making money as easy as an apple pie on a plate to earn $1000/day in commissions for free. FOR FREE! It’s 100% RISK-FREE FOR YOU.

30 Days Money Back Guarantee: If you don’t like our hosting package and it doesn’t assist you what so ever after using it, well, we’ll refund your money twice if you feel so.

HyperHost Review: Pros and Cons

Pros:

One-time payment with no recurring fees.

Lightning-fast servers with 3x faster performance.

Unlimited hosting for websites and domains.

Robust security features.

99.9% uptime guarantee.

Easy-to-use control panel.

Cons:

Requires a subscription fee.

Requires stable internet connection.

Nothing wrong with it, it works perfectly!

My Own Customized Exclusive VIP Bonus Bundle

***How To Claim These Bonuses***

Step #1:

Complete your purchase of the HyperHost: My Special Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase. And before ending my honest HyperHost Review, I told you that I would give you my very own unique PFTSES formula for Free.

Step #2:

Send the proof of purchase to my e-mail “[email protected]” (Then I’ll manually Deliver it for you in 24 HOURS).

HyperHost Free Premium Bonuses

Frequently Asked Questions (FAQ’s)

Q. Will I get Support for this software?

Yes, our 24*7 support team is always available to solve your issues and help you get best results from HyperHost.

Q. Are there any monthly fees?

No, currently we are offering a onetime price for this tool. So, get this Infinite deal before reversing to Monthly subscription.

Q. Is there any money back guarantee?

Yes, we are offering 30 days money back guarantee. So there is no risk when you act now. Only way you lose is by taking no action.

Q. Do you update your product and improve?

Yes, we always maintain our product and improve with new features.

Q. How to Activate my Early Bird discount?

Click the below button to grab this at early bird discount.

My Recommendation

Finally, HyperHost is a solid roomy hosting which leaves almost no chance in the roomy hosting market. HyperHost comes with lightning fast servers, unbeatable 99.9% uptime guarantee, all the security features you need and are able to host unlimited websites and domains. It’s an attractive option for anyone hoping to grow their online presence, offering a lifetime hosting for a one time low price, and a 3x faster performance boost.

While it may not have all the bells and bells, HyperHost offers superb value for money, it fuses features with speed, security and reliability in one of the better hosting packages out there. Hyperhost is a great hosting service, especially if you want a hosting service that will grow with you and give you long term value and superior performance.

>>> Click Here To Get Instant Access HyperHost Now <<<

Check Out My Previous Reviews: VidMax AI Review, Litmus App Review, WhitelabelSuite Review, Kyros App Review, and Prestige App Review.

Thank for reading my “HyperHost Review” till the end. Hope it will help you to make purchase decision perfectly.

#HyperHost#HyperHostreview#HyperHostccoupon#HyperHosthonestreview#HyperHostfeatures#HyperHostworks#whatisHyperHost#HyperHostreviews#buyHyperHost#HyperHostprice#HyperHostdiscount#HyperHostfe#HyperHostoto#getHyperHost#HyperHostbenefits#HyperHostbonus#howtoHyperHostworks#litmussoftware#litmussoftwarereview#HyperHostFunnels#marketingprofitmedia#HyperHostUpsell#HyperHostinfo#purchaseHyperHost#HyperHostwebsite#software#traffic#HyperHostexample#HyperHostworthgorbuying#ai

0 notes

Text

Hide In The Bushes And Watch

Back in 2013 at a Conference in San Jose, a man was giving a presentation on Bitcoin Neutrality to a small handful of attendees. When he began talking, some of these folks started to walk out, leaving rows and rows of chairs unoccupied, which for many of us, would be a humiliating experience. While continuing to talk as though there were hundreds of intent listeners to his topic, the reality is that there were only about 5 people casually taking in the message. Yes, it was early days for Bitcoin, and thus, the belief level was not at a fever pitch during this time when BTC was at about $100. However, the fundamentals and decentralized nature of Bitcoin has not changed since Andreas Antonopoulos gave that speech... only the value. Lost Opportunity The true value placed on an asset, crypto or otherwise, is grounded in belief and fact... both of which need to be considered if there is to be any chance of success. Many other attributes fall into either of these two criteria, with risk being one of them, but this is not a guiding principle... rather just par for the course. If you have no belief, even though the facts are not in dispute, no possible solution can ever reach the boiling point, and in contrast, with belief but no sense of the facts, you may appreciate Bitcoin, but not participate. Whether a spectator, or player in the realm of digital assets, being one or the other doesn't make us better or worse than anyone else, but if your goal is to use crypto as a vehicle to transport your financial outcome, there comes a time when you must cross the chasm and become a stakeholder by getting on the front lines. Cloak And Dagger Over the years since the dawn of Bitcoin in 2009, many have speculated on the price of where the true value could cap-out at. In the first couple of years, BTC was going through the 'acceptance' phase with only a small number of people understanding the vision and possibilities which Bitcoin offered. When trying to explain the decentralized nature of this new form of money, most of us could not fathom how this new technology could alter the future via its underlying technology, the Blockchain, as it was a concept that was completely unfamiliar. Taking into account the notion of how scarce Bitcoin is compared to other asset classes which can be created at will, coming to the realization of this has motivated many to take a position. While the validity of Bitcoin has long since passed as being a true asset-class with clear evidence from enterprises, banks and, most recently, ETF's issued by household financial names such as Blackrock and Fidelity, the vast majority are still pondering on whether to add it to their portfolio. Perhaps it's the media not giving BTC it's due, or the continued message from officials professing the fear of Bitcoin as a so-called nefarious asset (though in reality this has long been debunked).

Make no mistake, there has been a well-organized campaign of confusion for many years from those we hold in high regard (in the financial sense), which by now has been painfully obvious for those of us who have our eyes wide open and seen the truth first-hand. Add to this the ambiguity of the regulators, who have intentionally put a cloud over the space and dismissed it at every corner, and you have additional ammunition of fear in the minds of the consumer who otherwise have the most to gain from the promise of where Bitcoin is heading. Putting this all in perspective, we have seen many contradictions from major institutional investors who proclaimed years ago that they would not touch Bitcoin only to discover years later that they were buying the whole time. Taking a lesson from their irresistible tendency to brag and say one thing, and mean another, we can use this as clear evidence in which to make calculated decisions based on what they do, and not what they say.

Someday Never Comes Bitcoin is going to 1 Million per coin. To some, this may sound like Looney-Tunes, where for others it's an inevitability. The fact of the matter is, it doesn't matter what we think or feel about the price of Bitcoin because Bitcoin doesn't care… it just keeps on appreciating. For some, no decision will be the decision, regardless of the price, either due to fear or ignorance (or both). Looking back over time, there are those who knew Bitcoin when it was at $100, which was far too expensive even at the time, and the notion of it going to $1000 seemed like a mirage in the desert. When it did reach $1000, the next statement was "I'll just wait until it goes down again", but in all likelihood, if it did go back to the $100 level, they would still wait for it to go lower, and thus miss out again when the price rises again proving once again that it's always better to have time IN the market instead of timING the market. With Bitcoin now at $100,000, this may seem out of reach for some folks, but this is only because they don't realize the divisibility to 8 decimal places, allowing them to invest small amounts, and in this case, regardless of the amount speculated, the price appreciation will still be the same… only the amount will be different. For those of us who realize the macro-economic insight and clear evidence from far too many sources, it is just a matter of time when a $1M Bitcoin will be realized (and with it, the upsurge of the alt-coins), and those same individuals who were too cautious to invest when BTC was $100 will once again wish they had bought BTC when it was only $100,000, so as to realize a 10x return, regardless the denomination. If all of the evidence is clear (endowments, hedge funds, major banks, governments and so on), this leaves only the removal of so-called 'experts' who are telling us that this asset-class is not to be trusted. Again, these same individuals are buying and fooling you by playing their confidence-trickster games to keep you out of the market, and if you keep believing them, you are willingly letting them win… by choice. The alternative (yet still low-risk) option is to ignore the 'noise' and decide to be part of the new system of value so that in the years to come, you won't be saying "if only… I knew it all along".

__________________________________________________________________________________________ Title image by Eli Roth, Cabin Fever | Quote by John Fogerty / Creedence Clearwater Revival

#andreas Antonopoulos#san jose#opportunity#decentralization#value#belief#cloak and dagger#2009#money#blockchain#scarcity#blackrock#fidelity#etf#fear#endowments#contradiction#ccr#economics

0 notes

Text

The Best Cloud Mining Sites for 2025

Cloud mining has become an increasingly popular option for individuals who want to mine cryptocurrency without investing in expensive hardware or dealing with technical complexities. By renting computational power from remote data centers, users can participate in cryptocurrency mining from anywhere in the world. However, choosing a reliable cloud mining platform is crucial to ensure profitability and avoid scams. Below are some of the top cloud mining sites in 2025 based on their reputation, transparency, and offerings: cloud mining best sites

1. Genesis Mining

Genesis Mining is one of the most trusted cloud mining platforms, offering a wide range of plans for mining cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Founded in 2013, it has built a solid reputation for transparency and reliability. Genesis Mining provides user-friendly dashboards, flexible contracts, and excellent customer support, making it an excellent choice for beginners and experienced miners.

2. Hashflare

Hashflare has been a well-known name in the cloud mining industry for several years. It offers competitive pricing, a variety of mining contract options, and an intuitive platform. Users can monitor their mining activities in real time and withdraw earnings easily. Hashflare specializes in Bitcoin mining but also supports other altcoins.

3. NiceHash

Unlike traditional cloud mining services, NiceHash operates as a hash power marketplace. Users can buy or sell hash power to mine a variety of cryptocurrencies. This flexibility makes NiceHash an attractive option for miners who want to switch between different coins depending on profitability. The platform also offers advanced security features to protect users' funds.

4. ECOS

ECOS is an emerging platform that has gained traction for its transparent and user-friendly services. Backed by a free economic zone, ECOS offers Bitcoin mining contracts and allows users to reinvest their earnings directly into new contracts. It also provides a mobile app for tracking progress on the go.

5. StormGain

StormGain combines cloud mining with cryptocurrency trading, offering users a seamless experience. It provides a free cloud mining feature accessible through its mobile app, making it ideal for beginners who want to try mining without upfront investment. The platform also offers high-leverage trading and various crypto services.

Key Considerations for Choosing a Cloud Mining Site

Before investing in any cloud mining platform, consider the following:

Reputation: Research the platform’s history, user reviews, and feedback.

Transparency: Look for platforms that clearly disclose their pricing, mining operations, and terms of service.

Profitability: Use profitability calculators to estimate returns based on current market conditions.

Security: Ensure the platform has robust security measures to protect your funds and personal information. cloud mining best sites

Final Thoughts

Cloud mining can be a convenient and profitable way to earn cryptocurrency, but it’s essential to choose a trustworthy platform. The sites mentioned above are among the most reliable options for 2025. Always conduct thorough research and invest only what you can afford to lose in this volatile industry.

0 notes

Text

How to Create a Crypto Trading Bot: A Beginner’s Guide

Cryptocurrency trading has gained immense popularity, with millions of users participating in this dynamic and volatile market. However, keeping up with 24/7 trading can be exhausting, leading to the rise of crypto trading bots. These automated tools allow traders to streamline processes, eliminate emotional decision-making, and potentially maximize profits.

This guide will walk you through the essentials of creating a crypto trading bot, from understanding its purpose to step-by-step instructions for building and deploying one. Let’s dive into the exciting world of crypto bot development and discover how platforms like PrimeTrader can make automation a reality.

What Are Crypto Trading Bots?

Crypto trading bots are software programs designed to execute trades automatically based on predefined algorithms and strategies. They operate using real-time market data, enabling them to place trades faster and more efficiently than humans.

Types of Crypto Trading Bots:

Arbitrage Bots: Capitalize on price differences between exchanges.

Market-Making Bots: Provide liquidity by placing buy and sell orders around the current market price.

Trend-Following Bots: Execute trades based on market trends, such as moving averages or momentum.

Platforms like PrimeTrader offer both pre-built and customizable bots, allowing users to tailor their trading experience.

Key Features of a Successful Trading Bot

A robust trading bot should include the following features:

Customizable Strategies: Adapt the bot to suit your trading goals and risk tolerance.

Market Analysis: Process real-time and historical data for accurate decision-making.

Risk Management: Incorporate tools like stop-loss orders, take-profit levels, and portfolio diversification.

API Integration: Seamlessly connect to platforms like Binance, Coinbase, and PrimeTrader for trading execution.

Backtesting Capability: Test strategies using historical data to optimize performance before going live.

Prerequisites for Building a Crypto Trading Bot

Before creating your trading bot, ensure you have the following:

Technical Skills: Familiarity with programming languages such as Python, JavaScript, or C++.

API Access: Obtain API keys from your preferred trading platform.

Trading Knowledge: Understand basic market dynamics and trading strategies.

Tools: Use IDEs like Visual Studio Code, libraries such as ccxt, and data analysis tools.

Budget: Consider costs for hosting, cloud services, and third-party tools if required.

Step-by-Step Guide to Creating a Crypto Trading Bot

Step 1: Define Your Trading Strategy

Start by identifying a strategy that aligns with your goals:

Arbitrage: For quick profit opportunities.

Scalping: Frequent small trades for incremental gains.

Trend-Following: Trade based on market momentum.

Step 2: Choose a Programming Language

Python is highly recommended for its simplicity and extensive libraries like pandas, NumPy, and ccxt. Alternatives include JavaScript, Java, and C++.

Step 3: Set Up API Access

Register on a trading platform like Binance or PrimeTrader.

Obtain and securely store your API keys for account access.

Step 4: Develop the Bot

Fetch real-time market data.

Analyze data based on your trading strategy.

Execute trades through the exchange API.

Step 5: Deploy the Bot

Host your bot on a local server or cloud platforms like AWS or Azure.

Monitor and maintain the bot to ensure optimal performance.

Advantages of Using a Trading Bot

24/7 Trading: Bots operate around the clock without breaks.

Emotion-Free Decisions: Remove emotional bias from trading.

Data Processing: Analyze large datasets quickly for better decision-making.

Customization: Tailor bots to fit unique strategies and goals.

Risks and Challenges of Trading Bots

While trading bots offer convenience, they also come with challenges:

Over-Optimization: Excessive tweaking during backtesting can lead to poor real-world performance.

API Dependencies: Stable API connections are crucial for reliable bot operations.

Market Unpredictability: Sudden news or market shifts can disrupt strategies.

Blind Trust: Always understand the bot’s logic to avoid costly mistakes.

Best Practices for Building and Using Trading Bots

Start Small: Test with a minimal investment.

Regular Updates: Adapt the bot to changing market conditions.

Risk Management: Use stop-loss orders and diversify your portfolio.

Combine Automation with Oversight: Regularly monitor the bot to ensure it performs as expected.

Alternatives to Building Your Own Bot

Not ready to build your bot from scratch? Pre-built trading bots like those on PrimeTrader, 3Commas, and Cryptohopper offer excellent alternatives.

Advantages: Faster setup, user-friendly interfaces, and tested algorithms.

Limitations: Reduced customization and potential higher costs.

Conclusion: Your First Step Toward Automation

Creating a crypto trading bot can revolutionize your trading experience, offering efficiency, emotionless decision-making, and 24/7 market access. Whether you decide to build your own or explore pre-built options like those on PrimeTrader, ensure you invest time in understanding trading strategies and market dynamics.

0 notes

Text

Top Tips to Secure Your Cryptocurrency Investments

In the ever-evolving world of cryptocurrency, protecting your investments is more important than ever. With the rise of digital currencies, hackers and scammers are constantly finding new ways to target unsuspecting investors. Whether you’re a newcomer to crypto or a seasoned trader, ensuring your digital assets' safety is paramount. This guide will provide you with comprehensive tips to secure your cryptocurrency investments and mitigate potential risks.

Why Security Matters in Crypto

The decentralized nature of cryptocurrency offers numerous advantages, such as transparency, independence from traditional banking systems, and global accessibility. However, it also comes with significant security challenges. Unlike traditional bank accounts, there’s no central authority to recover stolen or lost funds. Once your crypto is compromised, it’s often gone forever.

In addition, the crypto space is rife with phishing scams, malware attacks, and other sophisticated hacking attempts. This makes understanding and implementing strong security measures critical for protecting your investments. By taking the necessary steps, you not only safeguard your assets but also gain peace of mind in a volatile and risky market.

Basic Security Practices

To start, let’s focus on foundational practices that every crypto investor should adopt. These straightforward steps provide a strong defense against common threats.

1. Use Strong Passwords

A strong password is your first line of defense against unauthorized access. Weak passwords like "123456" or "password" are easily guessed or cracked by hackers. To create a secure password:

Combine uppercase and lowercase letters, numbers, and special characters.

Avoid using personal information, such as your birthdate or pet’s name.

Use a password manager to generate and securely store passwords.

2. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security to your accounts. Even if your password is compromised, 2FA ensures that only you can access your crypto wallet or exchange account. Popular 2FA tools include Google Authenticator, Authy, and hardware security keys like YubiKey.

3. Keep Private Keys Safe

Your private keys are the gateway to your crypto holdings. If someone gains access to your private keys, they can control your funds. Best practices include:

Storing private keys offline, such as on a piece of paper or a hardware wallet.

Avoid saving private keys in cloud storage or on devices connected to the internet.

Using a secure backup method, like a fireproof vault, for long-term storage.

Advanced Security Measures

Once you’ve mastered the basics, consider implementing advanced measures for enhanced protection.

1. Invest in a Hardware Wallet

A hardware wallet, or cold wallet, is a physical device that stores your private keys offline. This keeps your funds safe from online threats like hacking or malware attacks. Popular hardware wallets include Ledger and Trezor.

For example, imagine you’ve invested in a promising cryptocurrency like Terra Luna. Keeping your assets in a hardware wallet ensures they remain secure, even if exchange platforms are compromised. For the latest updates on LUNA price. Hardware wallets are especially recommended for long-term investors and those holding significant amounts of cryptocurrency.

2. Stay Vigilant Against Phishing Scams

Phishing scams are among the most common ways investors lose their cryptocurrency. These scams often involve fake emails or websites that mimic legitimate companies, tricking users into revealing sensitive information. To avoid falling victim:

Verify the authenticity of emails and website URLs.

Never click on links from unknown or unverified sources.

Use browser extensions that detect phishing sites.

3. Regularly Update Wallets and Software

Keeping your software up-to-date is crucial for preventing vulnerabilities. Developers frequently release updates to patch security flaws, so always use the latest versions of your wallet and related apps. This includes updating firmware for hardware wallets.

4. Diversify Storage Options

Storing all your crypto in one place increases the risk of losing everything in case of a security breach. Instead, consider using multiple wallets:

Hot wallets for day-to-day transactions.

Cold wallets for long-term storage.

Distribute funds across different wallets to reduce overall risk.

Planning for the Future

Beyond protecting your current investments, it’s important to plan for future contingencies, including unforeseen events like accidents or death.

1. Crypto Estate Planning