#Credit Card Interchange

Explore tagged Tumblr posts

Text

The credit card fee victory is a defeat

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me next weekend (Mar 30/31) in ANAHEIM at WONDERCON, then in Boston with Randall "XKCD" Munroe (Apr 11), then Providence (Apr 12), and beyond!

The headline was pure David and Goliath: America's small businesses had finally triumphed in their 20-year litigation campaign against Visa and Mastercard over price-gouging on fees, and V/MC were going to cough up $30B as reparations:

https://edition.cnn.com/2024/03/26/economy/visa-mastercard-swipe-fee-settlement/index.html

But if you actually delve into that settlement, the victory gets very hollow indeed. Here's the figure that didn't make the headline: as a part of this settlement, the sky-high fees merchants pay to process your credit-card transaction are going up by 25%:

https://www.creditslips.org/creditslips/2024/03/the-proposed-credit-card-interchange-settlement.html

The payments system is a hellish complex, rotten cartel, dominated by a handful of firms who have raised their already-high fees by 40% since the start of covid:

https://prospect.org/power/2023-02-07-small-business-credit-card-fees/

These companies who take 2-5% out of virtually every dollar exchange in the American company are wildly profitable, but their aggregate profits are still much lower than the profits of all the merchants they prey upon. More: the combined market capitalization of every company that accepts credit-cards is orders of magnitude larger than the payment processing companies. If we're just talking about sheer economic muscle, the "Goliath" here is "all the companies" and the "David" is "the three companies that process payments for them."

So, how is it that these puny middlemen are able to run circles around this massive retail sector? To learn the answer, you need to consider the fine technical details of the lawsuit and the settlement. That's something few of us are capable of doing on our own, because – as is ever the case with finance – the whole system is wreathed in an enormous amount of performative complexity. It's what finance bros call "MEGO," for "My Eyes Glaze Over." Finance loves things that are made complicated so that they'll be hard to understand – because so many of us will assume that they are hard to understand because they are complicated and just "leave it to the experts."

Thankfully, not all of the experts are on the side of finance. When I want a cheat-sheet for the lies buried in Uber's balance sheet, I look to Hubert Horan:

https://horanaviation.com/publications-uber

And when I want to understand credit markets, I go to Adam Levitin and his co-authors at the indispensable Credit Slips blog – and the Credit Card Interchange Settlement is no exception:

https://www.creditslips.org/creditslips/2024/03/the-proposed-credit-card-interchange-settlement.html

Formally, the fight over credit-card fees is over "interchange fees" – the fees charged to a merchant's bank by Visa and Mastercard. But of course, these fees are passed on to the merchants. If you've ever shopped for a credit-card, you'll know that some cards offer massive rebates to consumers (especially wealthy consumers with great credit scores). These gifts don't come out of V/MC's bottom-line: every time you use one of those Platinum/Emerald/Unobtanium cards, V/MC levy an even higher interchange fee. So ultimately, when a wealthy customer with a "good" credit card shops at a merchant, the merchant ends up paying more to process their payment.

But merchants aren't allowed to charge that back to their customers – and that's the crux of the lawsuit. It's why American merchants pay the highest interchange fees in the developed world.

Enter the $30b settlement. Under its terms, average interchange fees will go down by 7 basis-points (0.07%) over the next five years, while all fees will go down by 0.04% over three years – a reduction of about $3b/year. Additionally: merchants will now be able to levy small, extremely limited surcharges based on either the type of card or the card brand (e.g., "We charge a fee for Visa" or "We charge a fee for gold cards"). If merchants are able to levy these fees and figure out how to max them out, they stand to make another 3b/year.

In other words, the $30b settlement comes from $15b in guaranteed savings and $15b in possible savings, for just five years – while V/MC will continue to charge more than $100b/year in interchange fees.

This litigation began in 2005, with merchants outraged over the sky-high average interchange fee of 1.75%. Today, after the settlement, those fees have climbed by 25%, to 2.19% – and they'll start climbing again after just five years. A 20-year fight over high fees resulted in a victory in which the fees are even higher.

How did this happen? Levitin gives us some tantalyzing hints. Over the two decades of litigation, the credit card cartel were able to peel off different groups of merchants and settle with them separately. Some of those settlements were vacated by courts, and other ones are still pending, but fundamentally, the merchants were not unified in the way the credit-card companies are.

This shouldn't surprise anyone. Hundreds of thousands – millions? – of merchants are unable to coordinate strategies in the way that just two credit-card companies can. Indeed, when you have hundreds of thousands of companies, that represents many, many different kinds of businesses, each of which has different kinds of customers and different labor, inventory, cash-flow and profitability specifics.

But as an industry grows more concentrated, all the firms within that industry converge on a single, homogeneous style of operations. Walmart operates very differently from the mom-and-pop shops it forced out with predatory pricing and sweetheart deals with wholesalers – but Costco, Walmart and Sam's Club are all remarkably similar to one another. As a shopper, that means that if have needs that aren't well-served by a big box store, you're out of luck – and it means that a credit-card settlement that works for Walmart will probably work equally well for Costco and Sam's Club.

Think of the mobile phone duopoly of Apple/Google. These two "competitors" have nearly identical ways of dealing with their suppliers – both charging 30% fees for processing payments (and yes, that's a racket that makes Visa/Mastercard look like pikers). These two "competitors" are also one another's most important business-partners: the single largest transaction either company makes every year is with the other – the $26B that Google pays Apple every year to be the Ios and Safari default search engine, through which Apple exposes every one of its customers to Google's incredibly invasive, continuous surveillance.

Speaking of surveillance: consider the surveillance advertising duopoly of Google/Facebook. Not only do these companies extract the nearly identical (sky-high) fees from advertisers and dribble out the nearly identical (miserly) payouts to publishers – they also illegally collude to rig the advertising market, dividing it between themselves:

https://en.wikipedia.org/wiki/Jedi_Blue

The economists' term for this is the "collective action problem." It's a problem we want corporations to have. The problem with monopolies and cartels isn't merely that they're "too big to fail" and "too big to jail" – it's that a handful of companies can form a cartel to capture their regulators:

https://pluralistic.net/2022/06/05/regulatory-capture/

The surveillance industry is unified; the surveilled are not. The rewards from surveillance are concentrated. The costs of surveillance are diffused. This is as good a working definition of corruption as you could ask for: conduct that produces concentrated gains and diffuse losses.

Our generations-long failure to enforce antitrust law created monopolies that rippled out through whole supply chains. As David Dayen described in his brilliant 2021 book Monopolized, it's the story of US health industry:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

First, pharma companies merged to monopoly and started to gouge hospitals on drug prices. So hospitals formed regional monopolies that could resist these pricing demands – and then turned around and started gouging insurance companies. So insurance companies merged, too. Every corner of health-care is now a monopoly or a cartel – from pharmacy benefit managers to hospital beds:

https://pluralistic.net/2022/01/05/hillrom/#baxter-international

The only parts of the industry that aren't concentrated are the parts that can't concentrate: patients and health-care workers. The monopolized health care sector reaps the concentrated gains, and the patients and workers pay the diffused costs. Those costs are diffused, but they're still substantial – a literal matter of life or death:

https://kffhealthnews.org/news/article/investors-private-equity-nonprofit-nursing-homes-quality-of-care/

Monopolization lets businesses solve their collective action problem, so they can run circles around less concentrated, less organized sectors. But concentration also lets companies solve the collective action problem of lobbying governments and capturing their regulators. A concentrated industry can maintain message discipline in front of regulators and legislators. A diffuse sector will always have credible defectors who'll say, "No, we can absolutely function with tighter controls – my competition is bullshitting you and I have receipts to prove it."

The surveillance industry's massive concentration is why America can't seem to pass a federal consumer privacy law. The last consumer privacy law Congress passed was 1988's Video Privacy Protection Act, a law that bans video-store clerks from telling anyone which VHS cassettes you're renting. But federal law is effectively silent on every other kind of invasion – your ISP, your TV, your car, your phone, your medical implant, your dishwasher and your smart speaker can all harvest your data, charge you for the privilege and sell it to anyone, for any purpose.

That silence didn't come cheap: whenever Congress moots a privacy law, the concentrated surveillance industry is all on the same page for the ensuing lobbying blitz, which it can afford thanks to the massive profits that an industry reaps when it eliminates "wasteful competition."

This is a point that leftists sometimes miss about competition law. The point of competition isn't merely to discipline companies into finding more efficient ways to run their businesses so that their prices go down. Sure, that's sometimes a good thing for the public.

But there's plenty of commercial conduct that we don't want to improve – rather, we want to extinguish that conduct. We don't want more efficient commercial surveillance – we want no commercial surveillance.

Without competition, an industry can outmaneuver the government. Think of IBM: the DOJ sued IBM for antitrust violations from 1970 to 1982. For 12 consecutive years, IBM spent more on lawyers to fight the DOJ's Antitrust Division than the DOJ spent on all the lawyers it employed to fight every antitrust violation in the country. IBM literally outspent the US government, year after year, for 12 years! That let them delay the DOJ's breakup long enough for Ronald Reagan to be elected, and then Reagan dropped the suit.

This doesn't just effect customers for a monopoly's products – it also (and especially) effects the workers for that monopoly. When employers don't have to compete for labor, they can pay workers less and save money they might otherwise have to pay for benefits and workplace safety. Those additional profits can be plowed into lobbying against pro-union laws, and to pay the eye-watering sums charged by scumbag union-busting law firms.

Look at the companies who've gone to the Supreme Court to get the National Labor Review Board abolished: these are giant corporations from heavily concentrated sectors with little competition to erode their profits. And while Tesla, Trader Joe's and Amazon all have very different businesses, they're all similar enough that none of them sees an advantage to courting workers by offering a unionized shop:

https://newrepublic.com/article/179165/musk-supreme-court-nlrb-labor

It's not just leftists who fail to grasp the relationship between competition and the ability of regulators to do their job. Libertarians miss this, too. Even if you're a fully Fountainhead-poisoned freedom-to-contract hobgoblin, you still want a government that can enforce those contracts and defend the property rights they invoke. For a government to force a corporation to abide by its contractual obligations, that government has to be more powerful than the corporation it is charged with policing. Which means that however large you're willing to let a monopoly or cartel grow, you're going to have to tolerate a government that's even larger:

https://pluralistic.net/2023/02/05/small-government/

The "$30b win" for America's merchants is, in fact, a loss. 20 years of litigation over high fees, and the fees are now much higher. But that loss is surely unevenly distributed. Walmart and Amazon and other retail giants are going to be able to bargain for all kinds of off-the-books rebates, promotions, and other sweetheart deals, meaning that they'll have even more unfair advantages over smaller, more disorganized retailers. That means more of those mom-and-pops will vanish, leaving shoppers with less choice and higher prices – and workers with less choice and lower wages.

The lesson of 40 years of pro-monopoly policy couldn't be clearer: you can either have an economy that is regulated by lawmakers who are at least nominally transparent and democratically accountable, or you can have an economy regulated by totally unaccountable and opaque monopolists. Fail to do the former, and you will always end up with the latter.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/28/concentrated-benefits/#diffuse-harms

#pluralistic#credit cards#Credit Card Interchange Settlement#Credit Card Interchange#payment processing#payments#network fee#steering#multi-district litigation#monopoly#regulatory capture#cartels#concentrated benefits#diffuse harms#adam levitin#credit slips

211 notes

·

View notes

Text

Ingenico Credit Card Processing Terminals: Revolutionizing Payment Solutions

#Ingenico Credit Card Processing Terminals: Revolutionizing Payment Solutions#hypercom#terminal#credit card terminal#terminals#t4100#virtual terminal#hypercom t7plus user#credit card terminals#hypercom t7plus#hypercom m4240 ip#iphone credit card terminal#eclipse credit card terminal#i5100#retriever services#co-op financial services#\enterprise resource planning\#totalmerchantservices#interchange regulations#merchant payment services#barcode reader#merchat services#merchant services#merrchant services#review

1 note

·

View note

Text

A Guide to My AU ("Evay AU")

Hello! I make art for anything and everything I love, but if you follow me you'll find that a large amount of my content is centered around my own Sonic AU. I thought I'd make a handy little guide for those of you who are new and just learning about my AU or for those of you who have been following me but might want a refresher.

★This guide is a living document that will be continuously amended as I make changes and additions to my stories. ★

♡♡♡♡♡♡

OVERALL PREMISE

My AU centers around Sonic & Friends through adulthood as they navigate relationships, careers, marriage and family. The primary genres are "slice of life" and "romantic comedy" with some action/drama interspersed throughout. My AU mostly follows the video game canon and the IDW canon with some elements from Sonic Boom and Sonic X tossed in and then I created my own characters and stories to fill in the gaps. My AU DOES NOT include the Sonic Cinematic Universe, Archie comics/characters, Fleetway comics/characters, Sonic Prime, SatAM, the OVA, Sonic Underground, the 1992 Manga, etc.

SPECIAL NOTES

In my AU, I depict "Classic" versions of the Sonic cast as their younger selves with their "Modern/Boom" versions being older.

Although my canon does not include Archie/SatAM, I do refer to Sonic characters' classification as "Mobians" and the planet they are on is referred to as Earth/Mobius interchangeably. I credit this as simply "cultural variation" between humans and Sonic characters but they all originate from the same planet.

MOST IMPORTANTLY please remember this is a fanmade AU. Nothing I say, write or draw influences the Sonic franchise or canon in any way. I'm just here to have fun and I hope you enjoy the ride!

KEY

For the timeline below, Canon Sonic characters will be highlighted in blue and my original characters will be highlighted in pink.

If there is a comic or written fic that corresponds with an element of the timeline, I will include it as a hyperlink.

ABRIDGED TIMELINE

Project Shadow is created and suspended.

Domino and Phlox meet. Sonic is conceived.

Domino raises Sonic to approx. toddler age until she loses her life in a flash flood. Sonic is left alone to fend for himself and eventually represses his memories of Domino to cope with the trauma.

Clay Rose and Lulu Petula meet. Together, they have Amy and she lives with her parents until her fortune cards lead her to meeting Sonic.

Majority of the game/IDW canon takes place.

CC (originally labeled as "Code Compiler") is a spherical/ovoid robot created (August 26) by an independent inventor (no relation to the Robotniks) to assist with production. CC's intelligence rapidly evolves and she gains sentience much to her creator's dismay. After a struggle, the inventor powers her off and the workshop falls into disrepair. The building is marked condemned and CC's chassis remains hidden within the rubble.

Sonic and Phlox run into each other on several occasions. Neither realize they are related.

Amy begins her pursuit of archaeological studies.

A mystery woman going by the name "Light" (who is secretly Aurora from the future) appears and warns Sonic & Team of an oncoming threat that is hellbent on killing Shadow before wreaking havoc on the planet. Light claims she was sent here with the task of protecting Shadow but is not forthcoming with any other information about herself or her 'previous team'. Light & the Team work together to fight off 'the threat' and along the way Shadow develops a romantic interest in Light who also has strong feelings and an allegiance to him for reasons he does not know. Upon defeating the villain, Light must return to where she came from. Shadow tries to discourage her and even asks to accompany her, but she insists that if she stays any longer, she risks causing catastrophic damage. She departs and Shadow vows to find her again.

Rouge and Omega join Shadow in his search to find Light. After combing the globe with no luck, their quest takes them off-world and they go on an interplanetary journey. The three become mercenaries to fund their space expedition.

Knuckles bulks up! His goal of spending time away from Angel Island did him some good!

Sonic and Amy begin a romantic relationship.

Sonic moves in with Amy.

Tails establishes Yellow Sky Industries, a company where he can begin sharing his gadgetry with the world as well as partner up with other innovators to put their genius to good use.

Stone establishes The Mean Bean coffee shop. Much to his delight, Eggman frequents this cafe but is unaware of Stone's affection.

Sonic and Amy get engaged. Upon hearing the news and growing homesick, Rouge and Omega return home, leaving Shadow to continue his journey on his own. While attending the wedding festivities, Knuckles and Rouge rekindle their budding romance.

During one of Eggman's many failed attempts at world domination, he falls victim to a near-fatal accident of his own making. Sonic rescues him, but Eggman loses his right hand in the process. Eggman is forced to reconsider his health and kickstarts some moral dilemmas for him. His attempts at world domination begin to dwindle.

Cream departs home to pursue humanitarian/Mobianitarian(?) efforts

Rouge uses her mercenary wealth to develop her own mining and jewelry business (she does not give up thievery). Knuckles is initially hired on as head excavator, but this job is only temporary until he secures enough money to fund a dream project of his.

With his own money and with the support of Yellow Sky Industries and his friends' investments, Knuckles develops the Young Heroes Program - a nonprofit youth organization. He works full time as a trainer at the program to help empower kids and strengthen the community. Sonic assists YH as needed, but is not a full-time volunteer.

Sonic and Amy decide to start a family. Aurora is conceived.

Rouge and Knuckles get married.

In one last ditch effort to regain Sonic's attention and to encourage Sage to follow in her father's footsteps**(See note), Eggman kidnaps Amy. This triggers her to go into labor early and Aurora is born (March 13). This is the nail in the coffin as far as Eggman's villainous efforts go and he makes an unspoken agreement with Sonic to 'retire' from villainy. He still plans to regularly annoy them by inserting himself into their lives. (**Note: This comic was made before Sage was introduced to the game canon. In retrospect, Sage would have been a part of this story and part of the reason Eggman decided to kidnap Amy, no matter how much Sage discouraged him. Sage instantly bonds with Aurora and vows to be her lifelong friend.)

Amy takes on a second job as an interior designer to support her family while Sonic becomes a stay-at-home dad and focuses most of his time and attention on raising Aurora.

Once Aurora is old enough, she begins attending the YH program. This is the closest Sonic will allow her to participating in any adventures.

Ruff Hyena is born (January 29).

As a defense mechanism against constant bullying from her peers, Aurora’s light powers begin to manifest.

In addition to attending the Young Heroes Program, Aurora begins a mentorship with her Uncle Tails for optics/physics lessons in order to better understand her powers.

Eggman and Stone begin dating.

Aurora begins to experience premonitions in the form of dreams. Amy does her best to help Aurora hone this skill, but without much success.

Tumble Hyena is born (January 30). Ruff and Tumble are abandoned and left to fend on their own before ending up in the foster care system. They remain there for many years.

Aurora develops a crush on a boy named Kyle and they go on a few “playdates”. Aurora invites Kyle over to the house to meet her parents and Sonic does not handle it well. After an argument, Aurora and Kyle agree to not hang out together anymore.

Knuckles and Rouge adopt Ruff and Tumble.

Aurora ages out of the Young Heroes Program. Sonic discourages her from venturing out on her own and convinces her to work for YH instead.

After receiving a heartfelt message from Rouge, Shadow resigns from his quest and returns to Earth. He decides his new mission will be to get to better know the world Maria had always spoken so highly about.

Feeling “stuck” in her life, Aurora broaches the topic of moving out to be on her own. Sonic talks her out of it.

While reconnecting with The Team, Shadow is introduced to Aurora. He instantly recognizes her as the woman he’s spent the last several decades looking for, but doesn’t understand how that’s possible and she is adamant they have never met before. While telling Sonic and Amy of his world travel plans, Aurora offers to be his guide around town as she knows every inch of it. Shadow takes her up on her offer and the two quickly develop a friendship.

Shadow decides it doesn’t matter if Aurora is the Light he formerly met or not. He asks her on a date. Remembering how badly things went the last time one of Aurora’s “boyfriends” and Sonic interacted, she accepts Shadow’s courtship but only if they can keep it a secret for now. Shadow is wary of this, but agrees to her terms.

Keeping secrets from her parents begins to take a toll on Aurora, to the point she is getting sick. She tells Shadow she can’t keep lying to her family, so she tells him they shouldn’t see each other anymore. In hopes to “fix” the situation, Shadow meets with Sonic and Amy to ask their permission to date Aurora. This immediately escalates into a battle between Sonic and Shadow. Aurora intercepts the fight and, heartbroken, she tells Sonic that as much as she wants his blessing, she doesn’t need it, and is going to continue to date Shadow. Sonic, Amy and Aurora have a heart-to-heart to try and reconcile things, but Sonic makes it clear that though Aurora is a grown up and can technically date whoever she wants, she has to follow certain rules while she’s still living in their house.

Tails purchases an abandoned factory to expand Yellow Sky Industries. There, he finds the deactivated CC. He powers her on but she is severely traumatized and significantly damaged. He repairs her and after understanding how advanced her intelligence is, he offers her a job as his lab assistant.

CC quickly develops romantic feelings for Tails.

Knuckles, Rouge, Ruff and Tumble legally change their last names to “Motley”

In her pursuit to become “Mobian,” CC fabricates herself a Mobian-like body.

As Shadow and Aurora’s relationship progresses, they begin to explore more of the world together.

Tails and CC host a charity banquet. Things go awry.

Aurora gets her first apartment. She also begins a singing career.

Tails and CC officially begin a romantic relationship.

Aurora begins to have recurring premonitions about Shadow being in danger. She puts her musical tour on pause to stay vigilant.

A dangerous, mysterious entity appears and attacks The Team, severely wounding several members and nearly killing Shadow. Before the threat can be defeated, it retreats by escaping via time travel where it plans to successfully kill Shadow. With most of The Team out of commission or fearful of altering the timeline, Aurora travels back in time to save Past Shadow and the rest of her family. To protect her identity, she goes by the name “Light.”

Sonic and Shadow reconcile their differences. Sonic becomes noticeably more accepting of Shadow and Aurora’s relationship.

Shadow and Aurora get engaged and move in together.

Aurora continues her musical career.

Shadow and Aurora get married.

Ruff ages out of the Young Heroes Program and in the hopes to follow in Knuckles’ footsteps, he becomes a crime fighter. When Tumble isn’t helping his brother fight crime, he’s working on his own mechs.

Eggman and Stone digitally uploadt heir consciousness to Cyberspace so they can live indefinitely.

Shadow and Aurora decide to start a family. They have their first litter of triplets: Piper, Zane and Nova (November 12).

Shadow and Aurora have a second litter of twins: Aster and Blitz (April 8). At this time, Shadow uses the wealth he’s amassed to construct a large house that can accommodate their growing family.

Shadow and Aurora have a third litter of triplets: Cinder, Diamond and Boon (February 18).

Sonic and Amy return to a life of world traveling.

In addition to attending the Young Heroes Program, Shadow trains all of his children in how to best use their powers for the greater good of the planet.

During a fight, Cinder critically wounds Diamond with his “Stellar Tantrum” power. Boon uses his powers of healing to restore Diamond to full health without any scarring, but Cinder never forgives himself. He becomes withdrawn and distances himself from his family members from this point on.

♡♡♡♡♡♡

You can learn more about my AU by looking through My Art tag, referencing "My (Major) Comics" Directory, or by looking through My AU tag.

#evay au#my au#my ocs#Aurora the hedgehog#cc the ai#ruff the hyena#tumble the hyena#sonicparents#amyparents#clay rose#lulu petula#domino the hedgehog#phlox the hedgehog#lovebytes#tall!tails#shadora horde#shadora babies#shadowxaurora#Shadora#shadowxaurora?#sonic trash#Piper the hedgehog#Zane the hedgehog#nova the hedgehog#aster the hedgehog#blitz the hedgehog#cinder the hedgehog#Diamond the hedgehog#boon the hedgehog#long post

201 notes

·

View notes

Text

i am now about three-quarters of the way through my book about credit cards (plastic capitalism by sean h. vanatta), which means i have gotten through a good part of the early credit card fraud stuff, and i have two main thoughts about it, which are: a) this shit is completely fucking bananas and b) the supernatural guys making their living by credit card fraud is much funnier than i realized

the reason it's very funny to me is that credit card fraud started out being sort of not technically illegal, because credit cards were novel technology & weren't immediately directly covered by the law. banks that issued credit cards were committed to unsolicited mailing as an advertising strategy, beginning with the bankamericard launch in 1958. i knew that credit card junk mail is a big old thing but i didn't realize that they just mailed out ACTIVATED CARDS???? like tens of millions of them over fifteen years???? so people, obviously, stole them out of other people's mailboxes, because the intended recipient didn't know it was there to contact the bank and cancel the card, and it was more or less a free money card. banks for some reason did not foresee this problem, and struggled with combating it: in rabidly pursuing market share, they neglected to ensure that they had adequate infrastructure to respond promptly to fraud, which was technologically difficult anyway because credit card processing went through the mail. law nerds will at this point go, "oh? it went through the mail? well it sounds like credit card fraud was, if nothing else, perhaps covered by the notoriously broad mail fraud statute," which credit card companies did successfully convince a few federal prosecutors & judges to pursue. [FUNNY TO ME because by the time that supernatural decided to bring up how dean's revenue streams are basically all illegal, i.e. season three, which aired in 2008, it was transparently illegal to steal someone's credit card and unsolicited mailing of activated cards was banned, but banks still mailed preapproved credit card applications, which dean would steal and fraudulently fill in, so. you know. mail fraud!]

actually for a while one of the circuits decided that credit card fraud necessarily used the mail, so anyone with a fraudulent credit card could be found guilty of mail fraud out of hand. some hardworking defense lawyers elsewhere managed to argue successfully that their clients were, in effect, too incompetent and careless to have ever considered how credit cards worked, and thus had no criminal intent with regards to the mail. some people walked away from thousands of dollars of fraudulent charges on the defense that they were clueless. beautiful. (sidebar, the book spends in my opinion objectively too much time on case law, probably as a symptom of having begun life as a dissertation, but it's also pretty funny, so i get it.)

because credit cards were processed through the mail, all of the advice for criminally using credit cards was like, 'don't spend more than a thousand dollars in one place, and use out-of-state cards, because those banks will be slower to realize what's happened.' really funny shit, honestly. because the whole enforcement system was, extremely on purpose, deeply regional! usury laws were set at the state level; fraud laws varied by state; federal courts mostly didn't think it was their problem, unless prosecutors thought credit card fraud was being used to fund organized crime, which it sometimes was; individual credit card companies made different investments in internal fraud prevention (american express went long on this, apparently). the whole system of interchange between banks was super slow & pretty goofy, because the system for interstate credit cards required an issuing bank to work with a local agent bank through a whole wacky series of relationships. for example, a bank americard might be issued by an omaha bank, and mailed to a consumer in minnesota (as occurred in the landmark marquette case!); the consumer would take their bankamericard to local merchants, who accepted the card at point of sale, then sent an invoice to the omaha bank through the mail. the omaha bank would pay the merchant, minus a service fee, charge bank of america's account through the fed's system, and then veeeery slowly bother to process and mail the transaction slip so bank of america could charge them. the unprocessed transaction slips, which at one point accounted for millions of dollars in 1969 money, was called "float." this shit is so stupid. i can't believe they did that. they did change it up in the early '70s, by restructuring how the interchange system worked. but it still ran through the MAIL. you can see why those guys were all hyped up on the idea of mainframes, not just to cut labor costs (it was also to cut labor costs: margins on early credit card programs were very low or often negative because the processing labor was so high).

there was a huge regulatory fight where credit card companies wanted to keep doing stupid shit and make the government responsible for enforcement, and the government wanted to apply consumer protections and not shoulder the expensive project of fraud enforcement. the post office must've hated those guys, they caused so many problems & kept acting like it was USPS's fault that the credit card fraud was happening. the reason i bring this trend up is that that's the story of financial regulation in the united states: private actors want the right to innovate around the rules, and then hand over the responsibility for the risk generated to the state, which is to say to taxpayers. i was, nonsensically, astonished by how set the playbook is. it's easier to see why the crypto guys keep acting like this is going to work out when you know how much shit finance guys have historically gotten away with.

there was a lot of back-and-forth about interest caps, too. consumer groups wanted cheaper credit; some people pointed out that cheaper credit required lenders to only service less-risky borrowers, which meant that credit availability for lower-income borrowers would dry up. the obvious solution, i.e. just providing social goods to lower-income borrowers, was off the table because we had to be Tough on Communism. labor unions were really into consumer protection, because they understood the availability of cheap consumer credit as clear to driving the demand that sustained union jobs. really american perspective! the american economy was more or less uniquely reliant on private credit to effect social policy.

anyway it's very appropriate stupid crime for the winchesters to do, because it points to the fragmented regulatory environment in the united states! which maps neatly onto their whole rugged individualism thing! and it's also coded as clever in a lazy, petty-crook way, which works really well for their whole deal. did this sidebar need to be there? yes & i make no apologies. well. very little apology.

if you have read something fun about financial history please feel personally invited to tell me about it!!!

#i think this is the most on-brand possible post that doesn't mention libraries or industrial safety lmao#plastic capitalism

42 notes

·

View notes

Text

Mouthwashing notes/analysis: Intro/Chapter 1

The Tulpar is absent from the game's opening shot. We're never given an external view of the ship, just as we're never given an internal view of the void outside. There's an uncrossable chasm between the system and the surroundings — nothing can enter or exit. The windows are plastic. God is not watching.

There's no destination. Wherever they're going, we're told from the onset that the crew won't arrive.

'I hope this hurts' contrasts with the previous objective information. It's unclear is this line is diegetic.

Mouthwashing establishes its non-linear structure in less than a sentence. This narrative style is unusual in games, which often take advantage of their interactive medium to allow the player influence over the story. Even titles with fixed plotlines cultivate the illusion of choice — we're encouraged to take credit for decisions characters are railroaded down, blurring the divide between player and protagonist. Mouthwashing's ludonarrative is a deconstruction of this relationship. We're told from the onset that our choices won't matter — they were never 'our' choices to begin with.

The Tulpar travels at a physics defying speed (21 AU is equivalent to 180 light-minutes) while the ship's appearance is anything but futuristic. The cockpit is crowded with 1-bit displays and analogue dials, all covered in a thick layer of grime — there's even a fax machine stowed in the corner.

Pony Express' branding harkens back even further. Its 1860's namesake lasted all of 18 months, before the telegraph rendered its disposable riders obsolete.

These aesthetics serve as environmental storytelling — technology advances while capitalism stagnates, falling back on the same tried and tested exploitation.

Although Mouthwashing's gameplay is sparse, it still makes use of its medium. During the first 'decision', the player is trapped in the copilot's chair (a piece of early foreshadowing), the ship's yoke the only point of interaction. The option to 'leave' is openly mocking, but presenting it at all instills a sense of culpability. Unlike book or film, gaming requires constant input. Crashing the Tulpar is an active process. We can't look away. We can only delay the inevitable.

Jimmy shares Pony Express' ethos of collective punishment: his suicide method is designed to take the rest of the Tulpar with him.

'Navigational staff' is plural — both Jimmy and Curly bear responsibility, albeit to drastically different extents.

Anya's face is the first we're shown all game. She's at the heart of the narrative, no matter how hard Jimmy tries to erase her.

In contrast with the rest of the crew, her employee card appears undamaged. Her pain is hidden — her trauma, forced pregnancy and eventual overdose are all internal.

The player is led to believe the 'cartoon horses' stem from Curly's resentment towards Pony Express, but the rest of the imagery contradicts this explanation. The crying baby layered beneath the sirens is the most obvious example; more subtle are the series of unlocked doors.

Polle is used to represent both Anya and her fetus — to Jimmy, the two are interchangeable. He's haunted not by the rape he committed but by its ensuing pregnancy.

Jimmy is outside the cockpit at the moment of impact. He's putting physical distance between himself and his imminent murder-suicide. Evading responsibility until the bitter end.

#mouthwashing#mouthwashing analysis#text posting#need to somehow organise my thoughts so i'm going to go chapter by chapter. allergic to structure so it'll all be in bullet points

20 notes

·

View notes

Text

Batman & Robin 1/6th Scale Collectible Figures by Hot Toys

As Mr. Freeze plots to turn Gotham City into a frozen wasteland to save his wife, Batman must navigate the chaos and betrayal by Poison Ivy, who seeks revenge against him. Fortunately, with Robin remaining his indispensable partner, they are ready to take on the threats to Gotham City.

In celebration of Batman 85th Anniversary, Hot Toys is thrilled to present the 1/6th scale Batman collectible figure based on the 90s classic, “Batman & Robin”.

The stunningly detailed collectible figure is crafted based on George Clooney’s portrayal of Batman in “Batman & Robin”, featuring a newly developed Batman head with separate rolling eyeballs and interchangeable lower faces, a newly tailored Batsuit that mimics a rubber-liked appearance, along with a selection of unique Bat gadgets including Bat Launcher with interchangeable accessories, Batarangs in different sizes, Bat Saw for cutting off Poison Ivy’s vines, a Bat Bomb, a Bat Laser, as well as the signature credit card with Batman logo and a figure stand.

The new Batman figure will take you back to the '90s, honoring the classic “Batman & Robin” movie as part of Batman's 85th anniversary celebration!

Serving as Batman’s sidekick, Dick Grayson has been a loyal partner to Batman. However, the relationship between Robin and Batman is tested in Batman & Robin. While they are supposed to fight against Freeze, the misunderstanding prompts Robin to reevaluate their partnership and decide to pursue his own path. Yet, to protect Gotham from crime, they must reconcile and team up.

Inspired by the classic Batman & Robin, Hot Toys is proud to introduce Robin in sixth scale, teaming up with the Batman collectible figure to save Gotham from turning into a frozen wasteland.

Masterfully crafted based on the appearance of Chris O'Donnell as Robin, the highly detailed figure features a newly developed head sculpt with separate rolling eyeballs, a newly tailored all-black suit accentuated by metallic red details, along with an arrays of weapons and accessories in a red and silver color scheme including Robin’s Throwing Bird, a laser gun, a pair of climbing devices and pair of ice-climbing pick, and a specially designed movie-themed figure stand.

Recruit the new 1/6th scale Robin Collectible Figure to fight against villains in Gotham with Batman!

19 notes

·

View notes

Text

#tiktok#monopoly#duopoly#visa#Mastercard#late stage capitalism#anti capitalism#fuck capitalism#capitalism is a scam#capitalism is hell#capitalism is a disease#capitalism is evil#capitalism is the worst#capitalism kills#us senate

13 notes

·

View notes

Text

Gas Station Stream of Consciousness Post

Gas Stations as Liminal Spaces

I've had quite a few hyperfixations in my day - ATMs, laundry detergents, credit cards - so my current one pertaining to gas stations is fitting considering my affinity for liminal spaces and the dedication of this blog to them. Liminal spaces are transitory in nature, hence their portrayal in online circles through photos of carpeted hallways, illuminated stairwells, dark roads, and backrooms, among other transitional points.

Gas stations are posted online as well; images of their fuel pumps or neon signage photographed through a rainy car window communicate their liminality and the universal experiences they provide to all of society. Perhaps they are the ultimate specimen of a liminal space. The machines they are created for, automobiles and tractor trailers alike, themselves are tools for motion, vestibules that enable travel and shipment across long distances at high speeds. Cars and roads are liminal spaces, albeit in different formats, and gas stations serve as their lighthouses. Vehicles at filling stations, therefore, are in a sense liminal spaces within liminal spaces within liminal spaces.

The uniqueness of a gas station as a liminal space, however, is its intersection with the economics and aesthetics of capitalism. Gasoline (and diesel fuel) is a commodity, downstream from crude oil, merely differentiated by octane ratings. Some argue that minute distinctions between agents, detergents, and additives make some brands better than others. Indeed, fuels that are approved by the Top Tier program, sponsored by automakers, have been shown to improve engine cleanliness and performance, but this classification does not prefer specific refiners over others; it is simply a standard. To a consumer, Top Tier fuels are themselves still interchangeable commodities within the wider gasoline commodity market.

The Economics of Gas Stations

The market that gas stations serve is characterized by inelastic demand, with customers who reckon with prices that fluctuate day in and day out. This is not to say that consumer behavior does not change with fuel prices. It has been observed that as prices rise, consumers are more eager to find the cheapest gas, but when prices fall, drivers are less selective with where they pump and are just happy to fill up at a lower price than last week. In response, gas stations lower their prices at a slower rate than when increasing prices, allowing for higher profit margins when wholesale prices fall. This has been dubbed the "rockets and feathers" phenomenon.

When portrayed as liminal spaces, gas stations are most often depicted at night, places of solitude where one may also enter the adjacent convenience store and encounter a fellow individual who isn't asleep, the modern day lightkeeper. The mart that resides at the backcourt of a gas station is known to sell goods at higher prices than a supermarket, simultaneously taking advantage of a captive customer, convenient location, and making up for the inefficiencies of a smaller operation. It may come as no surprise, then, that gas stations barely make any money from fuel sales and earn their bulk through C-store sales. This is a gripe I have with our economic system. Business is gamified, and in many cases the trade of certain goods and services, called loss leaders, is not an independent operation and is subsidized by the success of another division of a business, a strategy inherently more feasible for larger companies that have greater scale to execute it.

Nevertheless, most gas station owners, whether they have just one or hundreds of sites, find this method fruitful. Even though most gas stations in the US sell one of a handful of national brands, they operate on a branded reseller, or dealer, model, with oil companies themselves generally not taking part in the operations of stations that sell their fuels. The giants do still often have the most leverage and margin in the business, with the ability to set the wholesale price for the distributor, which sells at a markup to the station owner, which in turn will normally make the least profit in the chain when selling to the end customer at the pump. This kind of horizontal integration that involves many parties lacks the synergies and efficiencies of vertical integration that are so applauded by capitalists, but ends up being the most profitable for firms like ExxonMobil, who only extract and refine oil, and on the other end of the chain merely license their recognizable brands to the resellers through purchasing agreements. Furthermore, in recent years, independent dealers have sold their businesses to larger branded resellers, in many cases the ones from whom they had been buying their fuel.

A Word on ExxonMobil's Branding Potential

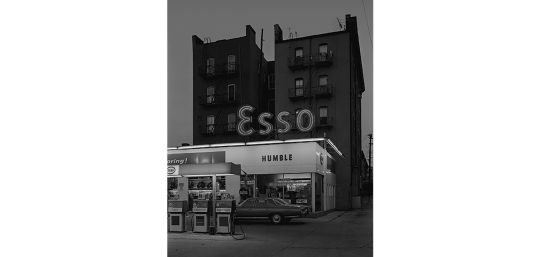

The largest publicly traded oil company in the world is Exxon Mobil Corporation. It is a direct descendent of the Rockefeller monopoly, Standard Oil, which was broken up in 1911 into 34 companies, the largest of which was Jersey Standard, which became Exxon in 1973. This title was generated by a computer as the most appealing replacement name to be used nationwide to unify the Humble, Enco, and Esso brands, decades before AI was spoken of. The latter brand is still used outside of the United States for marketing, arising from the phonetic pronunciation of the initials of Standard Oil. In 1999, Exxon and Mobil merged, and the combined company to this day markets under separate brands. Exxon is more narrowly used, to brand fuel in the United States, while Mobil has remained a motor oil and industrial lubricant brand, as well as a fuel brand in multiple countries.

Mobil originated in 1866 as the Vacuum Oil Company, which first used the current brand name for Mobiloil, and later Mobilgas and Mobilubricant products, with the prefix simply short for "automobile". Over time, Mobil became the corporation's primary identity, with its official name change to Mobil Oil Corporation taking place in 1966. Its updated wordmark with a signature red O was designed by the agency Chermayeff & Geismar, and the company's image for service stations was conceived by architect Eliot Noyes. New gas stations featured distinctive circular canopies over the pumps, and the company's recognizable pegasus logo was prominently on display for motorists.

I take issue with the deyassification of the brand's image over time. As costs were cut and uniformity took over, rectangular canopies were constructed in place of the special ones designed by Noyes that resembled large mushrooms. The pegasus remained a prominent brand icon, but the Mobil wordmark took precedence, which I personally believe to be an error in judgement. This disregard for the pegasus paved the way for its complete erasure in 2016 with the introduction of ExxonMobil's "Synergy" brand for its fuel. The mythical creature is now much smaller and appears only at the top right corner of pumps at Mobil gas stations, if at all.

Even into the 90s and the 21st century the Pegasus had its place in Mobil's marketing. In 1997, the company introduced its Speedpass keytag, which was revolutionary for its time and used RFID technology, akin to mobile payments today, to allow drivers to get gas without entering the store or swiping a card. When a Speedpass would be successfully processed, the pegasus on the gas pump would light up red.

When Exxon and Mobil merged in 1999, the former adopted the payment method too, with Exxon's less iconic tiger in place of the pegasus.

The program was discontinued in 2019 in favor of ExxonMobil's app, which is more secure since it processes payments through the internet rather than at the pump.

What Shell has done with its brand identity is what Mobil should've done for itself. The European company's logo was designed in 1969 by Raymond Loewy, and is a worth contender for the "And Yet a Trace of the True Self Exists in the False Self" meme. In recent years, Shell went all in on its graphic, while Mobil's pegasus flew away. I choose to believe that the company chose to rebrand its stations in order to prevent the malfunction in the above image from happening.

ExxonMobil should have also discontinued the use of the less storied Exxon brand altogether, and simplifying its consumer-facing identity to just the global Mobil mark. Whatever, neither of the names are actual words. As a bonus, here is a Google map I put together of all 62 gas stations in Springfield, MA. This is my idea of fun. Thanks for reading to the end!

#exxonmobil#exxon#mobil#gas station#gas stations#liminal space#liminal spaces#liminal#liminalcore#liminal aesthetic#justice for pegasus#shell#corporations#capitalism#branding#marketing#standard oil#economics#gas#gasoline#fuel#oil companies

110 notes

·

View notes

Text

A Scenic Drive through Izu via the Izu Skyline

Location: Izu Skyline, Shizuoka, Japan Timestamps: 15:05 on February 14, 2024

Pentax K-1 II + DFA 28-105mm F3.5-5.6 + CP 105 mm ISO 100 for 1/160 sec. at ƒ/8.0

Leaving the lovely Kawazu Cherry Blossom Festival in Kawazu, Shizuoka Prefecture, my journey continued northward on Route 135, a picturesque two-lane highway that closely hugs the eastern coastline of the Izu Peninsula.

From Route 135, heading west on Prefectural Road 80 for a brief 10-minute drive (6 km) to reach the breathtaking Izu Skyline, a well-known toll road that extends over 40 km along the eastern Izu ridgeline and connects Atami Pass to the Amagi Plateau.

Toll charges vary based on the chosen interchange, ranging from 220 yen to 1,000 yen. It's important to note that the Izu Skyline only accepts cash payments; ETC or credit card transactions are not available.

The Izu Skyline boasts multiple rest stops where drivers can safely pull over and take a break and stretch their legs, give their dogs some exercise, and capture stunning photos of the windswept landscape and panoramic views of Mt. Fuji.

This shot shows a hint of the city of Susono, nestled near the southwestern base of Mt. Fuji. Despite the overcast skies, the slow-moving clouds delicately hovered high enough above the peak of Mt. Fuji, offering a clear and iconic view of one of Japan’s most revered symbols.

My latest write-up (a 2-min. read) is a bit more extensive with a short history of the Izu Skyline, and includes links to the interchanges I took, and links to sources of English guides highlighting attractions you can enjoy on the Izu Skyline (https://www.pix4japan.com/blog/20240214-izu-skyline).

#風景写真#伊豆半島#伊豆スカイライン#富士山#pix4japan#pentax_dfa28105#pentaxk1mkii#landscape photography#Japan#Izu Skyline#Shizuoka Prefecture#Mt. Fuji#Mount Fuji

13 notes

·

View notes

Text

What Are the Key Factors to Consider When Choosing a Payment Solution Provider?

The rapid growth of digital transactions has made choosing the right payment solution provider a crucial decision for businesses. Whether you operate an e-commerce store, a subscription-based service, or a financial institution, selecting the right provider ensures secure and efficient payment processing. With the increasing demand for fintech payment solutions, businesses must evaluate providers based on security, compatibility, scalability, and cost-effectiveness.

1. Security and Compliance

Security is the top priority when selecting a payment solution provider. Since financial transactions involve sensitive customer data, businesses must ensure that their provider follows strict security protocols. Look for providers that comply with PCI DSS (Payment Card Industry Data Security Standard) and offer encryption, tokenization, and fraud prevention measures.

A reputable provider should also offer real-time fraud detection and risk management tools to safeguard transactions. Compliance with regional regulations such as GDPR, CCPA, or PSD2 is also crucial for businesses operating in multiple locations.

2. Integration and Compatibility

Seamless Payment gateway integration is essential for a smooth transaction experience. Businesses should assess whether the provider’s APIs and SDKs are compatible with their existing platforms, including websites, mobile apps, and POS systems. A well-documented API enables easy customization and enhances the overall customer experience.

Additionally, businesses should consider whether the provider supports multiple payment methods such as credit cards, digital wallets, cryptocurrencies, and bank transfers. The ability to integrate with accounting, CRM, and ERP software is also beneficial for streamlining financial operations.

3. Cost and Pricing Structure

Understanding the pricing structure of payment solution providers is crucial for managing operational costs. Different providers offer various pricing models, including:

Flat-rate pricing – A fixed percentage per transaction

Interchange-plus pricing – A combination of network fees and provider markup

Subscription-based pricing – A fixed monthly fee with lower transaction costs

Businesses should evaluate setup fees, transaction fees, chargeback fees, and any hidden costs that may impact profitability. Opting for a transparent pricing model ensures cost-effectiveness in the long run.

4. Scalability and Performance

As businesses grow, their payment processing needs will evolve. Choosing a provider that offers scalable fintech payment solutions ensures seamless expansion into new markets and accommodates higher transaction volumes without downtime or slow processing speeds.

Look for providers with a robust infrastructure that supports high uptime, fast transaction processing, and minimal payment failures. Cloud-based payment solutions often offer better scalability and reliability for growing businesses.

5. Customer Support and Service Reliability

Reliable customer support is essential when dealing with financial transactions. Payment-related issues can result in revenue loss and customer dissatisfaction. Businesses should opt for providers that offer 24/7 customer support via multiple channels such as phone, email, and live chat.

Additionally, a provider with dedicated account management services can offer personalized solutions and proactive issue resolution, ensuring minimal disruptions to business operations.

6. Multi-Currency and Global Payment Support

For businesses targeting international markets, multi-currency support is a key consideration. The ability to accept payments in different currencies and offer localized payment methods enhances customer satisfaction and expands the business’s global reach.

Providers that support cross-border transactions with competitive exchange rates and minimal conversion fees are ideal for businesses operating in multiple countries.

7. Fintech Payment System Compatibility

A modern fintech payment system should be adaptable to emerging financial technologies. Businesses should evaluate whether the provider supports innovations like blockchain payments, real-time payment processing, and artificial intelligence-driven fraud prevention.

The ability to integrate with open banking solutions and provide seamless transaction experiences across various fintech ecosystems is becoming increasingly important in the digital payment landscape.

8. Reputation and Industry Experience

The credibility of a payment solution provider is another critical factor. Researching customer reviews, case studies, and testimonials can provide insights into the provider’s reliability and performance.

Established providers with years of experience and partnerships with reputable financial institutions are more likely to offer stable and secure payment processing services. Collaborations with fintech leaders, such as Xettle Technologies, demonstrate a provider’s commitment to innovation and excellence in payment solutions.

Conclusion

Choosing the right payment solution provider requires careful consideration of security, integration, pricing, scalability, customer support, and industry experience. Businesses must align their choice with long-term growth objectives and ensure that the provider offers secure, seamless, and cost-effective fintech payment solutions.

With the rise of digital transactions, businesses that invest in a robust fintech payment system with seamless payment gateway integration will gain a competitive edge and enhance customer trust. By partnering with reputable payment solution providers, businesses can ensure secure and efficient transaction experiences for their customers while maximizing operational efficiency.

3 notes

·

View notes

Text

my prediction for pokemon masters ex is by next month, that fairy team star brat uhhh (googles name) ortega will be out. aoi and/or haruto will come out next year possibly february (since pokemon presents will happen at that time too). honest to god idk when hassel will come out. maybe he'll be with the paldean protags as well. idk

but what i WANT to know is kierans appearance in masters. of course he cant possibly come in yet before the protags. and if we were to compare his fame to the swsh dlc characters, he got famous instantly the second the teal mask dlc is out.

and why wouldnt he? he was the first character whose arc got bastardized by protags actions. he was the good turned bad rival. his whole story is his obsession with ogerpon which then evolves into obsession into getting stronger to beat protag. literally no brainwashing whatsoever. we were told that our actions caused him his downfall.

but even in during those moments, he was implied to like protag. the festival date? him giving a candy apple? thats just a standard shoujo scene. and him feeling betrayed by protag? protag apologizing and feeling guilty as fuck but he was too hurt to forgive?

that scene with terapagos? him being saved by protag. him being guilty but then steeled himself before fighting with protag side by side? he was just written in a way thats meant for me.

and the fact that he traded an applin with protag. thats just written in a way thats meant for the me part 2

and how protag answers arvens question about their relationship with kieran? 'he's just a....friend' girl what does that mean

kieran was written so specifically romantic. he was the closest to any romantic implication since Ns 'i like you a little' dialogue.

he got number 4 in the top 100 dream girls poll. he literally swept the majority of most famous male characters who have been in that poll for so long and he just got number 4 at first try. he apparently also got first place in one of the pokemon paldea polls?

kieran got A LOT of merch. hes a nui. he has 3 full art SAR cards. he has a figurine form. he has that cute interchangeable pouch. i think hes one of the male characters who got the most spotlight??? the last time any male character got this spotlight fast was N and N is still relevant to this day.

and what i notice about pokemon masters is they like to cast A-star seiyuus for their characters. they credit the voice actors (which i love) but its inherently funny for me that characters who are famous will get a really strong seiyuu lineup (N, steven, calem, cynthia, serena, silver HEHE, green, hikari). even piers was given to a very famous rockstar in japan??? and larry and kabu were given by Legends

the fact that hosoya yoshimasa got volo is the funniest shit ever. no one expected that. like we know he might get an A-star seiyuu but we were thinking someone like ishida akira or hirakawai daisuke. someone with a sweet charming almost feminine but still trickster-like voice. but no we got a deep sexy smooth voice. not complaining <3

volo was introduced coz he is now involved in the arceus arc as the main villain. honest to God idk when kieran will show up but i doubt itll be 2 years from now when a new arc is introduced. maybe he'll show up a few months after the protags are in the game.

his seiyuu will be someone famous and well-known. the pokemon company isnt blind to his fame and the amount of merch he has is proof. tpc and dena Will assign someone well-known to voice kieran who. as of now. has NO voice whatsoever in any media.

maybe its kakihara tetsuya (tho i bet his voice fits ortega more). maybe its shunichi toki. maybe its amasaki kouhei. maybe its one of the legends like kishio daisuke.

i hope its kaji yuki. by GOD i hope its kaji yuki. idc if kaji yuki got cilan but that green-haired grass gym boy has been in npc jail for 2 years and thats before kieran was released and no one knew how much of an impact he'll make please let kieran be voiced by kaji yuki

#tldr i just want kieran to be voiced by kaji yuki#YES VERONICA I KNOW THIS IS THE 70TH TIME IM SAYING THIS#AND ILL SAY IT AGAIN#i mean come on.........looking at kieran....thats THE most kaji yuki character#come on....COME ON....#fafar yaps#about pokemon

5 notes

·

View notes

Text

Nurit 2085 Terminal: A Comprehensive Overview

#Nurit 2085 Terminal: A Comprehensive Overview#hypercom#terminal#credit card terminal#terminals#t4100#virtual terminal#hypercom t7plus user#credit card terminals#hypercom t7plus#hypercom m4240 ip#iphone credit card terminal#eclipse credit card terminal#i5100#retriever services#co-op financial services#\enterprise resource planning\#totalmerchantservices#interchange regulations#merchant payment services#barcode reader#merchat services#merchant services#merrchant services#review

1 note

·

View note

Text

Introduction Post

Hi everyone, we're The Precure System! We're a bodily-adult professionally diagnosed Dissociative Disorder System that happens to have every main Cure (and Echo) as part of our system. We decided this blog would be a fun place for us to exist.

We're also a:

Proship Love Zone Banner credit to @derangedfujoshi

Disclaimer: This is not a roleplay account. This is an account for a DID system, and we would appreciate people not utilizing roleplay-based situations in regards to questions they ask us or replies they may give us. Please treat yourself as yourself when talking to us, even though we are a fictive-heavy system. Those who treat us as a roleplay blog may find themselves blocked by us.

Some important things about us:

All of us use She/Her pronouns ONLY, aside from Tsubasa, who uses He/Him. If referring to the system overall, however, or groups of us, please use She/Her plural (Shes, Hers, Herselves) - We'd appreciate that!

We support people's right to enjoy whatever they want in fiction, and do not believe others should demand others stop enjoying the fictional content that they like. We also believe that this fictional content should not be censored, and that nobody should be insulted or sent death threats for their enjoyment of fictional content. If you make these kinds of comments about people over any type of fiction, you might find us to have you blocked.

Outside of our DID, you won't find us discussing personal medical related content on the blog. That is private information to us and we owe this information to nobody.

While we are professionally diagnosed with DID, we are supportive of endogenic systems.

We don't use our civilian and Cure names interchangeably - while they're both us, we like to be specific about whether or not we're transformed. For example, if I were at a picnic in civilian form, we'd say "Oh, Hibiki was at the picnic the other day". If I were in Cure form, we'd say "Oh, Melody was at the picnic the other day"

We will never send asks outwardly from this blog name, as this is a sideblog rather than a main. Take those who claim to be our system with a grain of salt.

Despite this, we still practice Ask Game Reblog Etiquette - if we reblog an ask game from you, we'll send you an Anon Ask. We kindly ask that you practise Ask Game Reblog Etiquette with us, too.

Feel free to send any asks you may have, or talk to us about anything! That said, we block, delete asks, and step away liberally depending on our personal comfort - so not everything may be seen. Enjoy your stay here!

YGOracle Information

YGOracle Slots: (0/7)

These will be simple three-card "Problem, Advice, Potential Outcome" spreads.

The available decks to choose a reading from are:

Physical Ursarctic Master Duel Ursarctic Physical D/D/D Master Duel D/D/D Master Duel Sky Striker.

Please make any requests for readings begin with "for YGOracle", and keep them to simple advice questions, rather than complex questions, please. Please also specify which deck you would like the reading done with.

Taken Anon Signoff Tags: 🪱 - Worm Anon

11 notes

·

View notes

Note

curious what specifically your opinions are for romantic relationships in a/b/o au since it came up... i feel like i've seen you mention entangled polyamory before but idk about specifics

Entangled polyamory is almost always how I approach romantic fictional relationships. I don't really care for dating or sex myself, but I really love romance and sex in fiction as a means for exploring personality, characters' relationships with themselves through others, interlocking dynamics, and narrative themes. I tend to experience my own relationships very intensely and romantically (for lack of a better word; none of them are romantic in the sense that the term is generally used). They're all intense and distinct, even if some are more ephemeral or impersonal or contextual than others, such that they're not interchangeable or relative to each other. So, when I'm exploring sex and romantic relationships in fiction, I gravitate towards a similar intensity and diversity of emotion and attachment, and it sometimes feels unnatural to separate, prioritize, or neglect one relationship over another.

(In other words, some are more ambiguous and mercurial than others, such that polyamory might not be quite the right term, but platonic isn't well fitted either.)

I approach romantic relationships in the a/b/o au the same as I do in my canonverse bsd headcanons, as adapted to a/b/o genre conventions and worldbuilding:

Dazai and Chuuya each have the other's mating bite/are swan-married. But their mating bite scars are wild; they're messy and vicious and it looks like they mauled each other (they did). They also bit each other at 15, which is not socially acceptable, to Mori and Kouyou's exasperation.

Dazai and Chuuya are dating Kunikida, together and separately from one another. Kunikida is their partner, but not their mate (i.e., it would be egregious, offensive, and violating for him to bite them.)

Ango and Dazai are in a years-long situationship that. Resists description. If you asked each of them separately about the nature of their relationship, they'd offer wildly different but similarly cryptic explanations.

Ango is an alpha and becomes immensely sexist regarding omegas when speaking about Dazai, like, entirely unprovoked; flagrantly offensive; shockingly out-of-pocket. But only in contexts involving Dazai. Otherwise, he doesn't seem to notice or harbor any explicit or implicit biases related to designations.

Katai and Kunikida have each other's mating bites/are swan-married.

Jun'ichiro and Naomi blatantly have each other's mating bites, because there isn't a reality in which they don't.

Ranpo and Poe are in a relationship but haven't bitten each other as far as anyone is aware. Fukuzawa is not tolerating the matter especially well regardless.

Chuuya and Dazai's heats are synced, and typically spent in the Agency dorms rather than Chuuya's Port Mafia-affiliated penthouse to avoid triggering Dazai while they're both vulnerable.

They're both aggressive while in heat; Kunikida doesn't join them until near the end of each cycle, when they've calmed down enough to tolerate him.

Chuuya has an elaborate, multilevel nest in his penthouse. He makes do in Dazai's dorm.

Atsushi also has an elaborate nest, but only because of an incident in which Kunikida threw most of Chuuya's makeshift dorm-nest in the wash without realizing it was a nest, resulting in a conniption over which Dazai quietly sent Akutagawa and Atsushi on an errand to fix the matter, during which Atsushi discovered fancy, high-end nesting furniture and engaged in intensely brat-like behavior until Akutagawa conceded his credit card.

The above incident is also how Kunikida learned he has been regularly destroying Dazai's nests on the assumption they are trash piles; Dazai just let him without saying anything, unlike Chuuya, who made him duly suffer for the transgression.

Akutagawa and Atsushi keep using sudden and vicious mating bites to one-up each other/prove points/win fights against the other, only to scamper to Yosano to whine and throw fits and accuse each other of impropriety until she heals them. The first time it happened was a miscalculation, but it's become habitual. They're in a romantic relationship, and Atsushi, who would rather not be cut to bits by Yosano every time Akutagawa is about to lose an argument, insists they could just leave the mating bites alone. But the circumstances in which they bite each other are so terribly stupid and unfit for sincerity that Akuagawa is committed to shaking Atsushi like an Etch-a-Sketch until they're competent about it.

#bsd#bungou stray dogs#bsd headcanons#omegaverse#sorry this is SO self indulgent#there are more headcanons/relationships#i'm trying to keep each list relatively on theme/organized/limited in scope

5 notes

·

View notes

Link

0 notes

Text

Credit Card Processing

Credit card processing has become essential for Texas firms in the quickly changing world of commerce. Whether you own a software company in Dallas, a restaurant in Houston, or a tiny retail store in Austin, providing easy ways for customers to pay with credit cards can boost sales and improve customer satisfaction. In the United States, credit card payments are currently the most popular way for customers to make purchases. Approximately 75% of consumers utilize credit or debit cards when making purchases, per recent statistics. Consequently, businesses are no longer able to reject credit card payments. Whether the price system is tiered, flat-rate, or interchange-plus, be sure to understand it and avoid any hidden fees.

Reliable round-the-clock assistance is necessary to quickly address technical issues. Scalability Select a processor that can grow with your business by providing innovative services like loyalty programs, e-commerce integration, and mobile payments. When accepting credit card payments, businesses in Texas are subject to several rules. One of these is adhering to the Payment Card Industry Data Security Standard (PCI DSS), which guarantees that companies handle credit card data securely. Businesses in Texas must process credit cards to satisfy customers and expedite payment procedures. Businesses may select the best credit card processing system to improve operations and give their clients a smooth payment experience by being aware of the essential elements, advantages, and considerations. A payment gateway and a credit card processor are two different companies, even though they are both required for a transaction. While a credit card processor transmits money, a payment gateway securely moves data. In essence, a credit card processor serves as a middleman, managing debit and credit card transactions on behalf of businesses. Some processors charge a fixed monthly cost for a merchant account or payment gateway that includes these necessary services. Retailers might also be charged incidental costs, such as a chargeback or insufficient money. A merchant account and payment gateway are two more services that some credit card processors bundle, so you just need to work with one supplier to finish transactions.

0 notes