#credit card terminals

Explore tagged Tumblr posts

Text

Renting vs. Buying Credit Card Terminals: Which Is Right for You?

Credit card processing has become a fundamental aspect of any merchant's operations. Whether you are a small business or a high-risk merchant, accepting credit cards is essential for ensuring customer satisfaction and improving sales. One of the key decisions you’ll need to make is whether to rent or buy a credit card terminal. This decision can have a significant impact on your business's credit card processing fees, upfront costs, and long-term financial commitments.

#merchant services#merchant service provides#high-risk merchants#merchant services in USA#Credit Card Terminals#Credit card processing#high-risk merchant#rent or buy a credit card terminal#credit card processing fees#high-risk payment gateways

0 notes

Text

Ingenico Credit Card Processing Terminals: Revolutionizing Payment Solutions

#Ingenico Credit Card Processing Terminals: Revolutionizing Payment Solutions#hypercom#terminal#credit card terminal#terminals#t4100#virtual terminal#hypercom t7plus user#credit card terminals#hypercom t7plus#hypercom m4240 ip#iphone credit card terminal#eclipse credit card terminal#i5100#retriever services#co-op financial services#\enterprise resource planning\#totalmerchantservices#interchange regulations#merchant payment services#barcode reader#merchat services#merchant services#merrchant services#review

1 note

·

View note

Text

Motus Financial partners with top credit card terminal manufacturers like Verifone, Ingenico, and Clover to offer secure, reliable payment solutions. Whether you're in retail or services, our terminals provide fast, secure transactions to keep your business running smoothly. Choose the best for seamless payments today

1 note

·

View note

Text

Discover how NMI Payment Gateway and 5Star Processing can streamline your business transactions. Learn about features, benefits, and integration options in this comprehensive guide.

#5Star Processing#nmi credit card processing#nmi gateway#nmi payment gateway#nmi virtual terminal#what is nmi payment

0 notes

Text

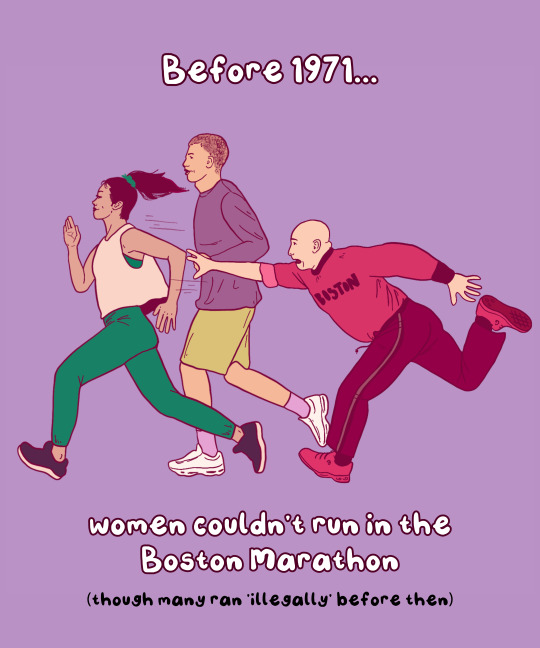

Women's Not So Distant History

This #WomensHistoryMonth, let's not forget how many of our rights were only won in recent decades, and weren’t acquired by asking nicely and waiting. We need to fight for our rights. Here's are a few examples:

📍 Before 1974's Fair Credit Opportunity Act made it illegal for financial institutions to discriminate against applicants' gender, banks could refuse women a credit card. Women won the right to open a bank account in the 1960s, but many banks still refused without a husband’s signature. This allowed men to continue to have control over women’s bank accounts. Unmarried women were often refused service by financial institutions entirely.

📍 Before 1977, sexual harassment was not considered a legal offense. That changed when a woman brought her boss to court after she refused his sexual advances and was fired. The court stated that her termination violated the 1974 Civil Rights Act, which made employment discrimination illegal.⚖️

📍 In 1969, California became the first state to pass legislation to allow no-fault divorce. Before then, divorce could only be obtained if a woman could prove that her husband had committed serious faults such as adultery. 💍By 1977, nine states had adopted no-fault divorce laws, and by late 1983, every state had but two. The last, New York, adopted a law in 2010.

📍In 1967, Kathrine Switzer, entered the Boston Marathon under the name "K.V. Switzer." At the time, the Amateur Athletics Union didn't allow women. Once discovered, staff tried to remove Switzer from the race, but she finished. AAU did not formally accept women until fall 1971.

📍 In 1972, Lillian Garland, a receptionist at a California bank, went on unpaid leave to have a baby and when she returned, her position was filled. Her lawsuit led to 1978's Pregnancy Discrimination Act, which found that discriminating against pregnant people is unlawful

📍 It wasn’t until 2016 that gay marriage was legal in all 50 states. Previously, laws varied by state, and while many states allowed for civil unions for same-sex couples, it created a separate but equal standard. In 2008, California was the first state to achieve marriage equality, only to reverse that right following a ballot initiative later that year.

📍In 2018, Utah and Idaho were the last two states that lacked clear legislation protecting chest or breast feeding parents from obscenity laws. At the time, an Idaho congressman complained women would, "whip it out and do it anywhere,"

📍 In 1973, the Supreme Court affirmed the right to safe legal abortion in Roe v. Wade. At the time of the decision, nearly all states outlawed abortion with few exceptions. In 1965, illegal abortions made up one-sixth of all pregnancy- and childbirth-related deaths. Unfortunately after years of abortion restrictions and bans, the Supreme Court overturned Roe in 2022. Since then, 14 states have fully banned care, and another 7 severely restrict it – leaving most of the south and midwest without access.

📍 Before 1973, women were not able to serve on a jury in all 50 states. However, this varied by state: Utah was the first state to allow women to serve jury duty in 1898. Though, by 1927, only 19 states allowed women to serve jury duty. The Civil Rights Act of 1957 gave women the right to serve on federal juries, though it wasn't until 1973 that all 50 states passed similar legislation

📍 Before 1988, women were unable to get a business loan on their own. The Women's Business Ownership Act of 1988 allowed women to get loans without a male co-signer and removed other barriers to women in business. The number of women-owned businesses increased by 31 times in the last four decades.

Free download

📍 Before 1965, married women had no right to birth control. In Griswold v. Connecticut (1965), the Supreme Court ruled that banning the use of contraceptives violated the right to marital privacy.

📍 Before 1967, interracial couples didn’t have the right to marry. In Loving v. Virginia, the Supreme Court found that anti-miscegenation laws were unconstitutional. In 2000, Alabama was the last State to remove its anti-miscegenation laws from the books.

📍 Before 1972, unmarried women didn’t have the right to birth control. While married couples gained the right in 1967, it wasn’t until Eisenstadt v. Baird seven years later, that the Supreme Court affirmed the right to contraception for unmarried people.

📍 In 1974, the last “Ugly Laws” were repealed in Chicago. “Ugly Laws” allowed the police to arrest and jail people with visible disabilities for being seen in public. People charged with ugly laws were either charged a fine or held in jail. ‘Ugly Laws’ were a part of the late 19th century Victorian Era poor laws.

📍 In 1976, Hawaii was the last state to lift requirements that a woman take her husband’s last name. If a woman didn’t take her husband’s last name, employers could refuse to issue her payroll and she could be barred from voting.

📍 It wasn’t until 1993 that marital assault became a crime in all 50 states. Historically, intercourse within marriage was regarded as a “right” of spouses. Before 1974, in all fifty U.S. states, men had legal immunity for assaults their wives. Oklahoma and North Carolina were the last to change the law in 1993.

📍 In 1990, the Americans with Disability Act (ADA) – most comprehensive disability rights legislation in U.S. history – was passed. The ADA protected disabled people from employment discrimination. Previously, an employer could refuse to hire someone just because of their disability.

📍 Before 1993, women weren’t allowed to wear pants on the Senate floor. That changed when Sen. Moseley Braun (D-IL), & Sen. Barbara Mikulski (D-MD) wore trousers - shocking the male-dominated Senate. Their fashion statement ultimately led to the dress code being clarified to allow women to wear pants.

📍 Emergency contraception (Plan B) wasn't approved by the FDA until 1998. While many can get emergency contraception at their local drugstore, back then it required a prescription. In 2013, the FDA removed age limits & allowed retailers to stock it directly on the shelf (although many don’t).

📍 In Lawrence v. Texas (2003), the Supreme Court ruled that anti-cohabitation laws were unconstitutional. Sometimes referred to as the ‘'Living in Sin' statute, anti-cohabitation laws criminalize living with a partner if the couple is unmarried. Today, Mississippi still has laws on its books against cohabitation.

#art#feminism#women's history#women's history month#iwd2024#international women's day#herstory#educational#graphics#history#70s#80s#rights#women's rights#human rights

17K notes

·

View notes

Text

Portable Credit Card Machine

#Portable Credit Card Machine#credit card machine#portable credit card machines for small business#best portable credit card machine#credit card processing#credit card reader#credit card#debit and credit cards#portable card machine#portable credit card terminal#portable credit card reader#card payment machine#machine#best portable credit card terminal#best portable credit card reader#credit card cloning machine#credit card machine for small business#credit#credit card terminal

1 note

·

View note

Text

Rise of the Machines – Why You Should Purchase a Smart Payment Terminal in Calgary

Outpacing traditional card-swiping machines by ensuring a seamless and secure end-user experience with virtue of state-of-the-art technology, smart payment terminals in Calgary are now transforming the way Canadians make payments in the fast-paced realm of digital transactions. One can trace back their modest arrival to the era of magnetic stripe cards when individuals used to slide their cards through a simple card reader to initiate the transaction process.

However, the consumer demand for increasingly sophisticated solutions grew as technology matured. Smart payment terminals have since evolved to support various payment methods, including chip cards, contactless payments, and mobile wallets. One of their most significant advantages is the astounding capability to support contactless payments.

People can now make transactions swiftly by simply tapping their cards or mobile devices on such devices (Clover Flex, Clover Mini, Ingenico 5000, New Clover Mini: Third Generation, and New Clover Flex: Third Generation), which not only enhances the speed of transactions but also reduces physical contact by aligning with the prevailing global emphasis on safety and hygiene respectively.

Integration with Mobile Wallets

Catering to the growing trend of more consumers preferring digital wallets over traditional payment means, smart payment terminals effortlessly integrate with popular mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay. The sheer convenience of leaving physical wallets at home and relying on smartphones for transactions is no doubt a game-changing feature that smart terminals can boast of.

Enhanced Security Measures

Security is a top priority in the world of finance and at Blueline Point Corporation, one of the most preferred and trusted authorized resellers of smart payment terminals in Calgary we take it very seriously. With advanced encryption technologies and secure authentication methods, the smart payment terminals that our company sells ensure that sensitive financial information remains encrypted throughout the process. This not only safeguards the payers but also promotes trust in shoppers when it comes to the adaptation of digital payment avenues.

Empowering Businesses by Bringing Efficiency to the Table

The efficiency of transactions is crucial for businesses and smart payment terminals streamline the entire payment process by reducing wait times for the paying party along with improving overall service. Their astonishing ability to comply with numerous payment standards also helps enhance the accessibility of establishments by serving a diverse client base.

Cutting-Edge Analytics for Informed Decision-Making

Equipping business owners with real-time data on sales trends, peak transaction times, and most used payment methods, smart payment terminals help them with making informed decisions, optimizing inventory, and purpose-designing their services from the ground up to meet the varying preferences of present-day buyers.

Global Connectivity

Poised to integrate with emerging technologies like blockchain and artificial intelligence to further enhance security, streamline processes, and open doors to innovative payment solutions that human civilization may not even foresee today, smart payment systems have long surpassed geographical constraints.

With the latest generation of every smart payment terminal in Calgary offering out-of-the-box global connectivity, corporations can now accept payments from customers worldwide, and this is particularly crucial in an increasingly interconnected global economy, where businesses of all sizes and every kind aspire to expand their market outreach.

#Smart payment terminal in Calgary#payment solutions calgary#credit card processing & pos solutions calgary#debit and credit card payment processing calgary#pos and payment solutions in calgary#smart payment terminal calgary#Blueline Point Corporation

0 notes

Text

Canadian Credit Card Surcharge Rules

Q. What is the process that a merchant must follow in order to surcharge Visa credit cards? A. A merchant that chooses to apply a surcharge to consumers who pay with Visa credit cards must: • provide it’s acquirer with a minimum of thirty (30) days advance written notice of it’s intention to surcharge • disclose it’s surcharging practices to cardholder at the point of interaction (POI) and on the…

View On WordPress

#Accept debit#credit card processing#Credit Card Processing Ontario#Credit Card Surcharge Rules#debit machine London#debit machine ontario#fraudprotection#London Accept debit#london Credit Card Processing#london Debit Machine#London Wireless Debit Machine#POS terminals London

1 note

·

View note

Text

Canadian Credit Card Surcharge Rules

Q. What is the process that a merchant must follow in order to surcharge Visa credit cards? A. A merchant that chooses to apply a surcharge to consumers who pay with Visa credit cards must: • provide it’s acquirer with a minimum of thirty (30) days advance written notice of it’s intention to surcharge • disclose it’s surcharging practices to cardholder at the point of interaction (POI) and on the…

View On WordPress

#Accept debit hamilton#Credit Card Processing Ontario#Credit Card Surcharge Rules#debit machine Hamilton#debit machine ontario#Hamilton Accept debit#hamilton Credit Card Processing#hamilton Wireless Debit Machine#merchant account Hamilton#Payment Processing Hamilton#POS terminals Hamilton#Wireless debit machine hamilton

1 note

·

View note

Text

Canadian Credit Card Surcharge Rules

Q. What is the process that a merchant must follow in order to surcharge Visa credit cards? A. A merchant that chooses to apply a surcharge to consumers who pay with Visa credit cards must: • provide it’s acquirer with a minimum of thirty (30) days advance written notice of it’s intention to surcharge • disclose it’s surcharging practices to cardholder at the point of interaction (POI) and on the…

View On WordPress

#Accept debit#Accept debit edmonton#Credit Card Processing Alberta#credit card processing edmonton#credit card processing rate#Credit Card Surcharge Rules#debit machine canada#debit machine edmonton alberta#edmonton Credit Card Processing#Merchant account#merchant account Canada#merchant account edmonton#payment processing#Payment Processing edmonton#POS terminals#POS terminals edmonton#Wireless Debit Machine

1 note

·

View note

Text

Nurit 2085 Terminal: A Comprehensive Overview

#Nurit 2085 Terminal: A Comprehensive Overview#hypercom#terminal#credit card terminal#terminals#t4100#virtual terminal#hypercom t7plus user#credit card terminals#hypercom t7plus#hypercom m4240 ip#iphone credit card terminal#eclipse credit card terminal#i5100#retriever services#co-op financial services#\enterprise resource planning\#totalmerchantservices#interchange regulations#merchant payment services#barcode reader#merchat services#merchant services#merrchant services#review

1 note

·

View note

Text

Canadian Credit Card Surcharge Rules

Q. What is the process that a merchant must follow in order to surcharge Visa credit cards? A. A merchant that chooses to apply a surcharge to consumers who pay with Visa credit cards must: • provide it’s acquirer with a minimum of thirty (30) days advance written notice of it’s intention to surcharge • disclose it’s surcharging practices to cardholder at the point of interaction (POI) and on the…

View On WordPress

#Accept debit saskatoon saskatoon#Credit Card Processing#Credit Card Surcharge Rules#debit machine saskatoon Saskatchewan#Merchant account#merchant account saskatoon Saskatchewan#merchant credit card processing rate#POS terminals#POS terminals saskatoon Saskatchewan Canada#saskatoon Credit Card Processing#saskatoon Debit Machine#saskatoon Saskatchewan Credit Card Processing#Saskatoon Wireless Debit Machine#Wireless Debit Machine

1 note

·

View note

Text

No fraudulent purchases

Fraud; Deceit; Trickery, An Imposter, a Cheat. To put it lightly, not a nice person. If you’ve ever been a victim of fraud, you’re not alone. I had my bank account emptied right before Christmas one year when my daughter was little- I eventually got it back, but if it wasn’t for my mom still being around to lend me the money while I waited, I would have had to explain to my 5-year-old daughter…

View On WordPress

#Accept debit Calgary#Calgary Credit Card Processing#Calgary Debit Machine#Credit Card Processing Alberta#credit card processing calgary#debit machine calgary alberta#debit machine canada#Merchant account#merchant account Calgary#nochargebacks#payment processing#Payment Processing Calgary#POS terminals#POS terminals Calgary#Visa merchant credit card processing rate calgary alberta

1 note

·

View note

Text

Reduce your fees by up to 100% #auxpay #AUXPAYNOW #payments #pos #terminal #creditcard #debitcard Learn more at auxpay.net

#business#business strategy#fintech#payment systems#merchant services#payment services#payment solutions#finance#high risk merchant account#customerexperience#point of sale#terminal#debit card#credit cards#auxpay#customer engagement#customer satisfaction#customer service#customerfeedback#customer segmentation#high risk payment processing#high risk merchant highriskpay.com#high risk payment gateway

0 notes

Text

1st Choice Card Payments Ltd

1st Choice Payments Ltd is a leading provider of B2B payment processing and card machine services in Nottingham. Our team of experts will help you streamline your payment processing, making it easy and efficient for your business. Contact us today for more information!

#payments gateway#virtual payment terminal#pay by link#merchant account uk#online payments#card machines#card payment solutions#salon credit card processing#restaurant credit card processing#take card payments

1 note

·

View note

Text

Revolutionize Your Business with Free Credit Card Terminals from Shaw Merchant Group

If you own a business, you know how important it is to have the right tools to help you succeed. One of those tools is a credit card terminal, which allows you to accept credit and debit card payments from your customers. However, purchasing a credit card terminal can be expensive, especially if you are a small business owner. That's where Shaw Merchant Group comes in - they offer free credit card terminals to help you revolutionize your business.

What is Shaw Merchant Group?

Shaw Merchant Group is a payment processing company that helps businesses of all sizes accept credit and debit card payments. They offer a wide range of payment solutions, including mobile payments, online payments, and in-store payments. Their goal is to make payment processing as simple and affordable as possible for businesses.

How Does it Work?

Shaw Merchant Group offers free credit card terminals to businesses that sign up for their payment processing services. These terminals are top-of-the-line and come with all the features you need to accept credit and debit card payments. Some of the features include contactless payments, chip card readers, and EMV compliance. They also offer 24/7 support and a lifetime warranty on their terminals.

To get started, all you need to do is sign up for Shaw Merchant Group's payment processing services. Once you are approved, they will send you a free credit card terminal that you can use to accept payments from your customers. It's that simple!

Benefits of Using Shaw Merchant Group's Free Credit Card Terminals

There are many benefits to using Shaw Merchant Group's free credit card terminals. Here are just a few:

Save Money

One of the biggest benefits of using Shaw Merchant Group's free credit card terminals is that you can save a lot of money. Purchasing a credit card terminal can cost hundreds of dollars, which can be a significant expense for small businesses. By using Shaw Merchant Group's free terminals, you can avoid this expense and put that money towards other areas of your business.

Increase Sales

Accepting credit and debit card payments can help you increase your sales. Many customers prefer to use their credit or debit cards for purchases, and if you don't accept these payment methods, you could be missing out on potential sales. By using Shaw Merchant Group's free credit card terminal, you can accept a wide range of payment methods, which can help you attract more customers and increase your sales.

Improve Customer Experience

Using a credit card terminal can improve the customer experience by making the checkout process faster and more convenient. With Shaw Merchant Group's free terminals, you can accept payments quickly and easily, which can help you provide a better overall experience for your customers.

Conclusion

If you're looking for a way to revolutionize your business and accept credit and debit card payments, look no further than Shaw Merchant Group's free credit card terminals. With their top-of-the-line terminals and affordable payment processing services, you can save money, increase sales, and improve the customer experience. Don't let the cost of a credit card terminal hold you back - sign up for Shaw Merchant Group's services today and take your business to the next level!

1 note

·

View note