#Corporate Financing

Explore tagged Tumblr posts

Text

The Basics of Investment: A Beginner’s Guide to Growing Your Wealth

The Basics of Investment is your essential starting point to understanding how to grow your money smartly and securely. Whether you're a student, working professional, or planning for retirement, this guide introduces the core principles of investing in a simple and practical way. Learn about different investment options such as stocks, bonds, mutual funds, and real estate, along with the importance of risk management, diversification, and long-term planning.

#Best Investment Opportunities#Best Investment Company#investments strategies#investment management#investments opportunities#Equity Investment#Corporate Financing#investment#investors#making money#how to earn money

1 note

·

View note

Text

What Everyone Must Know About Take Over Loan In 2024

INTRODUCTION

In the ever-changing landscape of real estate financing, takeover loans, also known as assumption loans, are emerging as an alternative option for astute homebuyers in 2024. While this concept may seem unfamiliar to many, it's crucial to comprehend the ins and outs of takeover loans, as they could potentially offer significant advantages. This comprehensive guide will provide you with the essential knowledge you need to navigate this unique financing opportunity successfully.

What is a Takeover Loan?

Before delving into the details, let's first define what a take-over loan is. Simply stated, it's a type of financing arrangement where a buyer assumes (or takes over) the existing mortgage from the current property owner. Instead of applying for a new loan, the buyer steps into the shoes of the seller and continues making payments on the existing mortgage.

The Advantages of Takeover Loans

Takeover loans offer several prospective benefits that make them an attractive option for homebuyers in 2024. Here are some important advantages:

Lower Closing Costs: By assuming an existing mortgage, buyers can avoid many of the traditional closing costs associated with procuring a new loan, such as origination fees, appraisal fees, and title insurance premiums. These savings can add up to thousands of dollars.

If the current mortgage has a lower interest rate than the prevailing market rates, the new buyer can benefit from those more favourable terms, potentially saving significant amounts over the life of the loan.

Quicker Closing Process: Compared to traditional mortgages, takeover loans typically involve less documentation and fewer administrative requirements, resulting in a faster closing process.

Bypass Strict Lending Criteria: For buyers who may not qualify for a new mortgage due to credit issues or income constraints, taking over an existing loan can provide an alternative path to homeownership, provided they satisfy the necessary requirements.

Important Considerations

While takeover loans offer appealing advantages, it's crucial to approach them with a comprehensive understanding of the potential drawbacks and considerations.

Loan Qualification: Lenders will still evaluate the new borrower's creditworthiness, income, and capacity to make payments before approving a takeover loan. Meeting their specific requirements is essential.

Assumption Fees: Some lenders may charge assumption fees, or administrative fees, for transferring the loan to a new borrower. These expenditures should be factored into the overall savings calculation.

Remaining Loan Terms: The new borrower will be constrained by the existing loan's terms, including the remaining balance, interest rate, and repayment period. It's crucial to ensure these terms align with your financial goals and plans.

Property Value Considerations: If the remaining loan balance is higher than the property's current market value, the lender may require the new borrower to pay the difference or provide additional collateral.

Steps to Secure a Takeover Loan in 2024

To increase your odds of successfully securing a Sundaram home finance takeover loan in 2024, follow these steps:

Research and Understand the Existing Loan Terms

Obtain a copy of the current mortgage statement and examine the details, such as the remaining balance, interest rate, and repayment period.

Determine if the existing loan terms are favourable compared to current market rates and your financial situation.

Gather the Required Documentation

Prepare your financial documents, including tax returns, pay receipts, bank statements, and credit reports.

Be prepared to provide proof of income, employment, and assets to demonstrate your ability to make payments.

Seek Professional Guidance

Work with experienced real estate agents and mortgage professionals who specialise in takeover loans.

They can guide you through the process, ensure you meet the lender's requirements, and negotiate favourable terms on your behalf.

Submit the Assumption Application

Once you've identified a suitable takeover loan opportunity, submit the assumption application to the lender, along with all required documentation.

Be prepared to respond promptly to any additional requests or clarifications from the lender.

Obtain Lender Approval

If approved, the lender will provide the necessary paperwork to finalise the loan transfer to your name.

Review all documents carefully and ensure you completely understand the terms and conditions before signing.

The Future of Takeover Loans

As the housing market continues to evolve and affordability remains a concern for many, takeover loans are expected to acquire traction in 2024 and beyond. Their potential cost savings and flexible requirements make them an attractive option for both buyers and vendors. For more details click learn More…

However, it's essential to approach taking over loans with a thorough comprehension of the process, requirements, and potential pitfalls. By following the steps outlined in this guide and seeking professional guidance, you can position yourself for success and potentially uncover significant financial advantages through this innovative financing solution. By educating yourself about takeover loans, you'll be better equipped to make informed decisions and navigate the complexities of the homebuying process in 2024 and beyond.

To get more information about takeover loan, click this link

0 notes

Text

The CFPB is genuinely making America better, and they're going HARD

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

Let's take a sec here and notice something genuinely great happening in the US government: the Consumer Finance Protection Bureau's stunning, unbroken streak of major, muscular victories over the forces of corporate corruption, with the backing of the Supreme Court (yes, that Supreme Court), and which is only speeding up!

A little background. The CFPB was created in 2010. It was Elizabeth Warren's brainchild, an institution that was supposed to regulate finance from the perspective of the American public, not the American finance sector. Rather than fighting to "stabilize" the financial sector (the mission that led to Obama taking his advisor Timothy Geithner's advice to permit the foreclosure crisis to continue in order to "foam the runways" for the banks), the Bureau would fight to defend us from bankers.

The CFPB got off to a rocky start, with challenges to the unique system of long-term leadership appointments meant to depoliticize the office, as well as the sudden resignation of its inaugural boss, who broke his promise to see his term through in order to launch an unsuccessful bid for political office.

But after the 2020 election, the Bureau came into its own, when Biden poached Rohit Chopra from the FTC and put him in charge. Chopra went on a tear, taking on landlords who violated the covid eviction moratorium:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

Then banning payday lenders' scummiest tactics:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Then striking at one of fintech's most predatory grifts, the "earned wage access" hustle:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Then closing the loophole that let credit reporting bureaus (like Equifax, who doxed every single American in a spectacular 2019 breach) avoid regulation by creating data brokerage divisions and claiming they weren't part of the regulated activity of credit reporting:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Chopra went on to promise to ban data-brokers altogether:

https://pluralistic.net/2024/04/13/goulash/#material-misstatement

Then he banned comparison shopping sites where you go to find the best bank accounts and credit cards from accepting bribes and putting more expensive options at the top of the list. Instead, he's requiring banks to send the CFPB regular, accurate lists of all their charges, and standing up a federal operated comparison shopping site that gives only accurate and honest rankings. Finally, he's made an interoperability rule requiring banks to let you transfer to another institution with one click, just like you change phone carriers. That means you can search an honest site to find the best deal on your banking, and then, with a single click, transfer your accounts, your account history, your payees, and all your other banking data to that new bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Somewhere in there, big business got scared. They cooked up a legal theory declaring the CFPB's funding mechanism to be unconstitutional and got the case fast-tracked to the Supreme Court, in a bid to put Chopra and the CFPB permanently out of business. Instead, the Supremes – these Supremes! – upheld the CFPB's funding mechanism in a 7-2 ruling:

https://www.scotusblog.com/2024/05/supreme-court-lets-cfpb-funding-stand/

That ruling was a starter pistol for Chopra and the Bureau. Maybe it seemed like they were taking big swings before, but it turns out all that was just a warmup. Last week on The American Prospect, Robert Kuttner rounded up all the stuff the Bureau is kicking off:

https://prospect.org/blogs-and-newsletters/tap/2024-06-07-window-on-corporate-deceptions/

First: regulating Buy Now, Pay Later companies (think: Klarna) as credit-card companies, with all the requirements for disclosure and interest rate caps dictated by the Truth In Lending Act:

https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

Next: creating a registry of habitual corporate criminals. This rogues gallery will make it harder for other agencies – like the DOJ – and state Attorneys General to offer bullshit "delayed prosecution agreements" to companies that compulsively rip us off:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-creates-registry-to-detect-corporate-repeat-offenders/

Then there's the rule against "fine print deception" – which is when the fine print in a contract lies to you about your rights, like when a mortgage lender forces you waive a right you can't actually waive, or car lenders that make you waive your bankruptcy rights, which, again, you can't waive:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-warns-against-deception-in-contract-fine-print/

As Kuttner writes, the common thread running through all these orders is that they ban deceptive practices – they make it illegal for companies to steal from us by lying to us. Especially in these dying days of class action suits – rapidly becoming obsolete thanks to "mandatory arbitration waivers" that make you sign away your right to join a class action – agencies like the CFPB are our only hope of punishing companies that lie to us to steal from us.

There's a lot of bad stuff going on in the world right now, and much of it – including an active genocide – is coming from the Biden White House.

But there are people in the Biden Administration who care about the American people and who are effective and committed fighters who have our back. What's more, they're winning. That doesn't make all the bad news go away, but sometimes it feels good to take a moment and take the W.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

#pluralistic#cfpb#consumer finance protection board#rohit chopra#scotus#bnpl#buy now pay later#repeat corporate offenders#fine print deception#whistleblowing#elizabeth warren

1K notes

·

View notes

Video

youtube

How Wall Street Priced You Out of a Home

Rent is skyrocketing and home buying is out of reach for millions. One big reason why? Wall Street.

Hedge funds and private equity firms have been buying up hundreds of thousands of homes that would otherwise be purchased by people. Wall Street’s appetite for housing ramped up after the 2008 financial crisis. As you’ll recall, the Street’s excessive greed created a housing bubble that burst. Millions of people lost their homes to foreclosure.

Did the Street learn a lesson? Of course not. It got bailed out. Then it began picking off the scraps of the housing market it had just destroyed, gobbling up foreclosed homes at fire-sale prices — which it then sold or rented for big profits.

Investor purchases hit their peak in 2022, accounting for around 28% of all home sales in America.

Home buyers frequently reported being outbid by cash offers made by investors. So called “iBuyers” used algorithms to instantly buy homes before offers could even be made by actual humans.

If the present trend continues, by 2030, Wall Street investors may control 40% of U.S. single-family rental homes.

Partly as a result, homeownership — a cornerstone of generational wealth and a big part of the American dream — is increasingly out of reach for a large number of Americans, especially young people.

Now, Wall Street’s feasting has slowed recently due to rising home prices — even the wolves of Wall Street are falling victim to sticker shock. But that hasn’t stopped them from specifically targeting more modestly priced homes — buying up a record share of the country’s most affordable homes at the end of 2023.

They’ve also been most active in bigger cities, particularly in the Sun Belt, which has become an increasingly expensive place to live. And they’re pointedly going after neighborhoods that are home to communities of color.

For example, in one diverse neighborhood in Charlotte, North Carolina, Wall Street-backed investors bought half of the homes that sold in 2021 and 2022. On a single block, investors bought every house but one, and turned them into rentals.

Folks, it’s a vicious cycle: First you’re outbid by investors, then you may be stuck renting from them at excessive prices that leave you with even less money to put up for a new home. Rinse. Repeat.

Now I want to be clear: This is just one part of the problem with housing in America. The lack of supply is considered the biggest reason why home prices and rents have soared — and are outpacing recent wage gains. But Wall Street sinking its teeth into whatever is left on the market is making the supply problem even worse.

So what can we do about this? Start by getting Wall Street out of our homes.

Democrats have introduced a bill in both houses of Congress to ban hedge funds and private equity firms from buying or owning single-family homes.

If signed into law, this could increase the supply of homes available to individual buyers — thereby making housing more affordable.

President Biden has also made it a priority to tackle the housing crisis, proposing billions in funding to increase the supply of homes and tax credits to help actual people buy them.

Now I have no delusions that any of this will be easy to get done. But these plans provide a roadmap of where the country could head — under the right leadership.

So many Americans I meet these days are cynical about the country. I understand their cynicism. But cynicism can be a self-fulfilling prophecy if it means giving up the fight.

The captains of American industry and Wall Street would like nothing better than for the rest of us to give up that fight, so they can take it all.

I say we keep fighting.

711 notes

·

View notes

Text

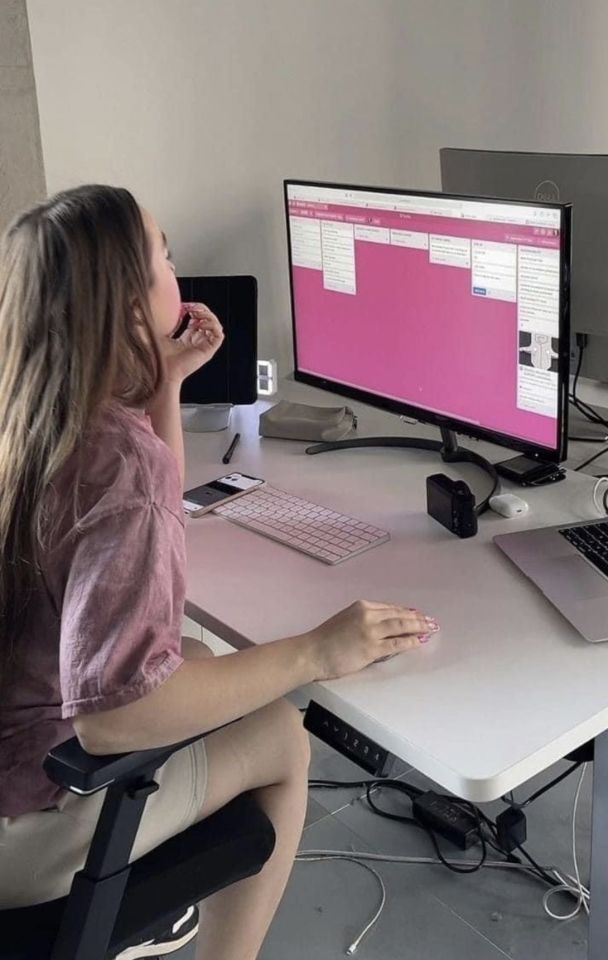

corporate barbie 👩💼💄💗📈

gonna be starting my full-time job soon, i'm looking forward to being the newbie who's on top of things & surprise everyone with how much i know 💅

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog

635 notes

·

View notes

Text

Raising the Minimum Wage Would Make All Our Lives Better

160 notes

·

View notes

Text

I love LinkedIn spam to work email addresses

A guy emailed me today to follow up on his offer to buy a government agency. Greg I do not know how to tell you that I am not authorised to do that even if you can offer 3x it's turn over to me, personally.

The team who emailed 5 times with increasing insinuations I was racist for not wanting to expand my business (assisting Scottish children access Scottish benefits) into the incredibly lucrative United Arab Emirates and Saudi Arabia markets.

I do not care how many Sheikh's you have access to, I simply do not think you have Scottish children living in Scotland in the Middle East, it is geographically impossible and you cannot make me more profit because I DO NOT MAKE ANY PROFIT

Also shout out to the 20 different email addresses that offered me a prestigious nomination for a biomedical Nobel prize, for only a small fee

10/10 office entertainment, we do enjoy reading them out to the group

#Corporate life#I was#🤏 this close#To fwd Greg to the Scottish government finance team#With the subject#“national budget crisis solved!”#But alas#I was instead professional#And merely shared it with everyone I spoke to today

44 notes

·

View notes

Text

A study in expressions Tom Hulce edition: Double trouble? Part III, now an established regular of the Quintessential Tom series. Remarkable how I still haven't run out of these ridiculously adorable "parallels" and I'm losing my fckn mind

(Part I) (Part II)

#Tom Hulce#1st set is incredible: Bewildered by Dessert#SO FCKN CUTE#almost cried making these#i'd be lying if i said these were easy to deliver#but only because i have to find THE TIME#unfortunately i do need my full time corporate job#to finance this violent admiration if anything else#everyday i fight to function#i want to throw up for how much i love him#not just brain chem my whole fuckn existence is messed up#my queer king#I kneel in front of you YOUR GRACE COMMAND ME TO BATTLE#thomas hulce#st. elsewhere#st elsewhere#amadeus#amadeus 1984#slam dance#national lampoon's animal house#parenthood#slamdance#black rainbow#moviegifs#filmgifs#queer actors#Thgop

35 notes

·

View notes

Text

Why are they trying to defend this, why is the Trump administration trying to defend putting tarrifs on uninhabited islands?? America is fucking cooked, if this is something the Trump Administration is willing to defend I can't even begin to imagine the other stupid shit they'll try and spew.

#politics#the left#leftism#progressive#communism#us politics#tax the rich#eat the rich#corporate greed#culture#stock market crash#stocks#investors#banking#finance#investments#tariffs#trump tariffs#us economy#donald trump#trade war#penguins against trump#seals#islands#coast#seascape#trump#elon musk#white house#fuck trump

35 notes

·

View notes

Text

oh my god its jack marston

#rdr#rdr2#red dead redemption 2#red dead redemption#jack marston#IGNORE THE BOOK TITLE LMAO#jack marston reading about corporate finance is more real than you think /j

318 notes

·

View notes

Text

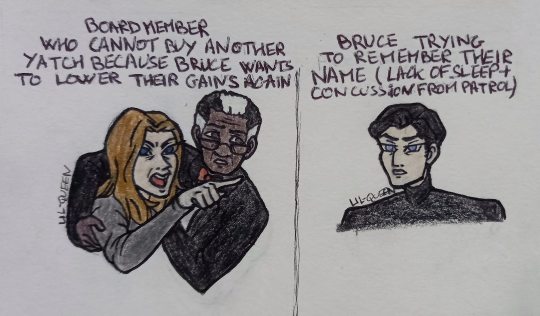

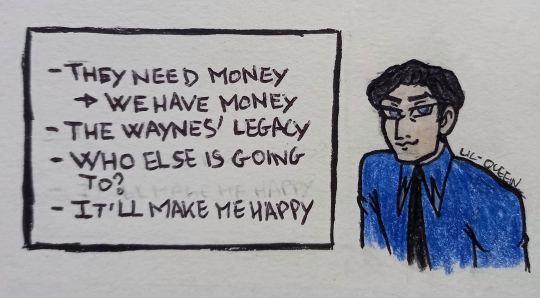

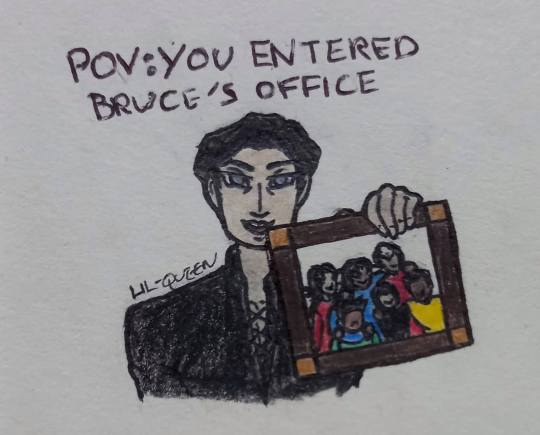

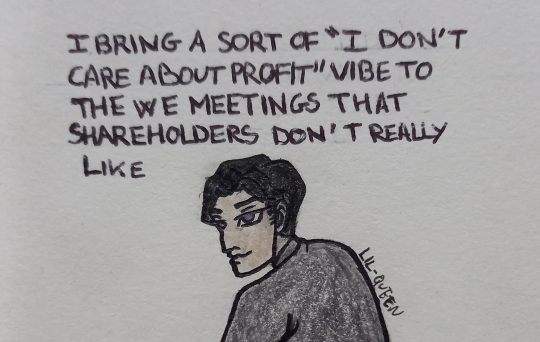

Bruce: The most Nepo Baby of the Nepo Babies

Type of day when he pretends he has a hangover to not deal with their bs. The peace inside the company is all Lucius works.

He does not accept criticism.

The Gotham Knights' hoodie is Dick's or Jason's, and was in the kitchen that morning when Bruce ran late for the meeting.

Rip to the (paid) intern that was terrified to bring documents to THE Bruce Wayne and found themselves stuck in his office, listening to him telling stories about his kids for hours.

"I don't understand why we need to make more money, we're already rich." (he's talking about the highers up)

Just a bunch of doodled memes of how I believe Bruce Wayne acts with his company. He is not a capitalist, he doesn't care about making more profit and doesn't understand finance.

If you think Brucie Wayne is just an act, talk to Lucius Fox, who has to endure Bruce' antics at WE. The man whines like a child about having to speak to any shareholders, he has to be dragged to meetings. In Bruce's eyes, his job is "using the company's money to improve the people's life", "talking about his kids" and "being a pain in the ass of the highers up". If someone is trying to kill Bruce Wayne, 50% of chances some WE shareholder or board member ordered the kill because they are tired of him stopping them from playing the game of capitalism. His other employees love him, tho. There aren't janitors as well treated than the ones working for Wayne.

#bruce wayne#batman#lucius fox#batfam#dc comics#fanart#my art#doodle#traditional art#colored pencils#do not criticize as the effort put in this is minimum it's for fun#also my knowledge of how managing a company and shareholders is nonexistent#but anyway#promoting my “corporate goth” bruce wayne agenda#I'm treating him like a dress up doll#I want to put him in so many outfit boo dc for making him dress boringly#who is playing a tree? It's up to you#also yes the Gotham Knights symbol have bat ears gothamites are proud of being the city of the bat#also promoting my “Bruce dislikes and doesn't understand finance” agenda he would not be in charge of a company if he wasn't a nepo baby#personally I think he would work with kids but that's another subject

98 notes

·

View notes

Text

Pecco finds out that Marc is joining the team, backfilling Enea’s vacant role, on Monday. By Tuesday, Marc has managed to acquire Pecco’s phone number in order to invite him out for a coffee. Pecco agrees because he can’t think of a good reason not to. Bez shakes his head incredulously when Pecco shows him the text.

#corporate au that was inspired by the corporate Horrors I have been experiencing this past week ❤️#the finance team are my enemy ❤️#ao3 crashed on me half a dozen times while editing this so I just said fuck it time to post it#fic things#corporate au

34 notes

·

View notes

Text

fall lookbook: business casual🍂💼🎀👩💻

if you can't tell, my business casual style icons include lorelai gilmore, rachel zane, elle greenaway, rachel green, etc. 💌

#it girl#becoming that girl#pink pilates princess#glow up#self care#that girl#wonyoungism#girl blogger#pink pilates girl#motivation#corporate barbie#working#business woman#business#entrepreneur#finance#accounting#girlblogging#girlblog#pink moodboard#pink aesthetic#pink blog#business casual#work outfits#office attire#office aesthetic#work aesthetic#lawyer#law student#law studyblr

339 notes

·

View notes

Text

Why are you in jail: "I used humans instead of AI" :| :| :|

#news#ai#artificial intelligence#CEO#law#prison#job#funny post#funny#call center#business#corporation#industrial#413#interview with the vampire#charli xcx#usa#america#united states#money#finance

15 notes

·

View notes

Text

All you have to do is study and network

#aesthetic#banker#banking#girlblogging#investment banking#finance girl#finance#jp morgan#corporate girlie#corporate girl#corporate#finance aesthetic#banker aesthetic

26 notes

·

View notes

Text

Today has been rough. Woke up with half my face swollen up from a tooth infection. But we were able to get antibiotics and the pain hasn't reached the wishing for death point today so that's an improvement. The swelling has reduced but is still there. Hoping we'll wake up feeling better tomorrow.

#on a more positive note#S said finances are in order for me to start pursuing getting my teeth fixed#gonna contact a local dental school tomorrow to see if this is something they can do#starlit posts#corporeal complaints

8 notes

·

View notes