#greedflation

Explore tagged Tumblr posts

Text

That is the truth sadly

#That is the truth sadly#truth#money#society#ausgov#politas#australia#greedflation#extortion#exploitation#exploitative#auspol#tasgov#taspol#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

10K notes

·

View notes

Text

You never think it's going to happen to you until it does.

Hi, my name is Luke and I'm 24. As of two days ago, I spent the last of my money on rent and I have precisely £27 to my name. I can't afford food at all any more - let alone rent and bills.

I know the world is so full of despair atm. Especially with what's going in in America. But I beg you to give me a chance, midst it all.

Depressingly, I only ever seem to make sales when I'm in a dire situation. Ideally, I need to make sales before then so I don't end up in the dire situation in the first place, but alas. I'm poor and hungry and can't heat my home. I'm wracked with guilt every time I fail to make progress on the project because I'm so damn focused on survival I have little time for what brings me joy in this world. And that's depressing!

I dislike having to make posts like this - but as I said at the start of this post - no-one ever thinks it's going to happen to them. If you can spare some cash, please consider buying a print or my dissertation to help me buy food (see here for my prints and diss). I have plans to introduce badges to my site as well - but sadly due to new postage laws they'll be UK only. However. I can ship prints to Canada, the US, UK and EU (with a view to shipping to Aus and NZ soon, amongst other places, if Royal Mail'll let me).

I hope one day to be able to make a post saying that I got out of poverty and am no longer surviving but thriving. Until then, your support is quite literally putting bread on the table. I want more than anything right now to be able to get back to doing what I love. But I cannot do so presently.

If you're about in Swansea on the 7th of February at 7pm, please consider coming to Elysium Gallery for the opening of Queer Land, an exhibition which my art is in! In spite of these circumstances I find myself in - I refuse to stop creating. Down, yes - but not out.

So please, please if you can, please reblog and purchase a print if you are able. It will help me wo much and I'm infinitely grateful to those who do.

Diolch

#cost of living#cost of living crisis#food poverty#food insecurity#greedflation#poverty#please help#thank you

160 notes

·

View notes

Link

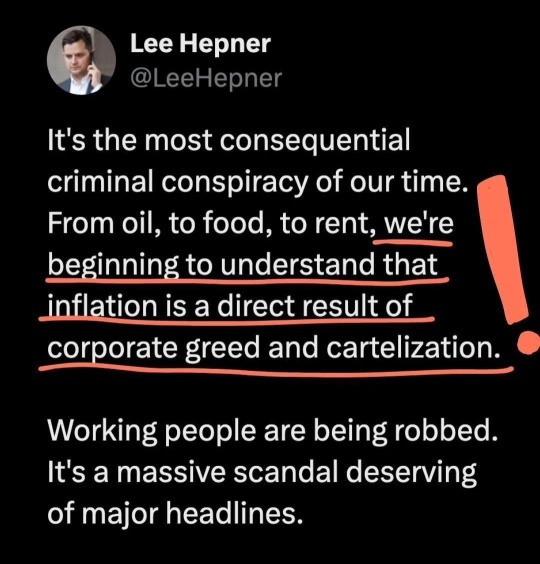

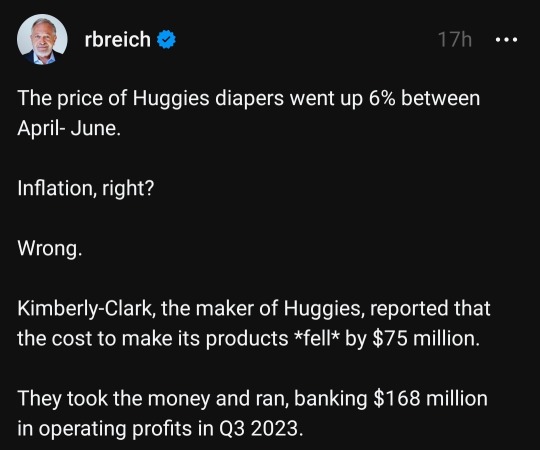

Very obvious to me and others:

1. Companies have been bragging about record profits. You don’t get record profits if your costs are going up. You get them if your profit margin is going up.

2. In Seattle, during covid, many workers got a hazard pay bump of $4. Groceries raised prices and blamed increased worker pay. But hazard pay ended nearly a year ago and prices have not come down.

It’s greed and taking advantage of a crisis and the soft collusion of capitalists getting away with whatever they can.

This is one reason why I think the gov’t should offer some basic economic services. E.g. A gov’t run grocery store. It can have the exact same stuff as other stores but there’s zero profit margin. So, firstly, consumers are more likely to get the best deal possible. Secondly, if we have a similar situation where groceries are hiking prices, we can check with the gov’t run store and ask, “why haven’t *they* needed to raise prices?” Or, “why have their prices only increased 10% while yours have increased 80%?”

Frankly, I don’t know why we don’t have non-profit options for all the essentials people need to live, esp food, housing, and medicine. I’m not saying we need to destroy the private market: people who want luxury food and luxury homes etc can still get them, but most people just want the basics to literally stay alive in this economy. We don’t need everyone getting screwed with every single financial transaction they make.

2K notes

·

View notes

Text

Raising the Minimum Wage Would Make All Our Lives Better

158 notes

·

View notes

Text

Trump supporters complain about socialism and communism so much that they often forget that it's not our current system.

That's why they frequently blame democratic politicians whenever prices are too high. They think we already live in a system in which the government sets prices.

They're completely unaware that even when the president is a democrat, the system is still capitalist. Corporations still set the prices and are making record profits.

That's also why they complain when a democratic politician tries to pass price control legislation, which would solve the problem they're complaining about. They think the government intervention is already happening and is why the prices are high.

Capitalism requires endless increasing of profits. Early stage capitalism allows inventing new ideas or attracting new customers. But eventually, they already have all the customers they're going to get. So the only way to keep increasing profits is to raise prices, underpay employees, and put ads everywhere. Inflation is inevitable under capitalism.

87 notes

·

View notes

Text

100 notes

·

View notes

Text

#shrinkflation#corporate greed#greedflation#vote blue#vote democrat#vote blue 2024#vote democratic#vote blue to save democracy#vote biden#ffs vote blue#democrats#social democracy#democracy#democratic socialism#democrats now socialism later#biden/harris 2024

94 notes

·

View notes

Text

A LOT of "inflation" is actually corporations taking advantage of "inflation" to hide profiteering.

46K notes

·

View notes

Text

...

Two things are driving the divide between how homeowners and renters experience inflation.

First, while most homeowners’ monthly payments have not risen, the cost of renting has surged. Rent jumped 11% in 2022 from the year before. It also climbed higher in 2023, although at a significantly slower pace. Rent prices increased just 0.2% last year, according to Realtor.com.

As of November, the price of rent nationally was up 22% compared to pre-pandemic levels, according to Realtor.com.

Meanwhile, because most homeowners have a fixed-rate loan, their costs have not changed even as mortgage rates have soared during the Fed’s historic effort to rein in inflation. [...]

111 notes

·

View notes

Text

I know no company has ever really truly cared about anyone under capitalism, but you know how during the Depression, flour sellers realized people were using the cloth sacks the flour came in as cheap fabric to make clothes out of, and so then they started selling the flour sacks with pretty patterns on it so people wouldn't feel embarrassed about wearing flour sack clothes?

If a company did that today they'd jack up the price of flour to obscene and beyond cost to justify the "act of helping people"

#great depression#flour sack#i'd still be fucked even if they didn't because if one granule of flour touches me I go into autoimmune hell but my point still stands#corporate greed#greedflation

43 notes

·

View notes

Text

Price gouging / profiteering

45 notes

·

View notes

Text

☑️ Vote BLUE no matter who 🗳

34 notes

·

View notes

Text

If you are mad at inflation and you want weaker government, fewer regulations, and hate labor unions, you are the problem.

Vote Blue.

772 notes

·

View notes

Text

"As many as one in six workers in Britain are skipping meals to make ends meet as households remain under pressure from the higher cost of groceries, energy and other essentials."

#poverty#homeless#british#britain#cost of living#greedflation#greed#uk politics#uk police#ukpol#uk government#uk govt#ukgov#uk#class war#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#anti capitalism#antifascist#antiauthoritarian

24 notes

·

View notes