#Compound your investment in real estate

Explore tagged Tumblr posts

Text

Wealth Building: Money Topics You Should Learn About If You Want To Make More Money

Budgeting: This means keeping track of how much money you have and how you spend it. It helps you save money and plan for your needs.

Investing: This is like putting your money to work so it can grow over time. It's like planting seeds to grow a money tree.

Saving: Saving is when you put some money aside for later. It's like keeping some of your treats for another day.

Debt Management: This is about handling money you owe to others, like loans or credit cards. You want to pay it back without owing too much.

Credit Scores: Think of this like a report card for your money habits. It helps others decide if they can trust you with money.

Taxation: Taxes are like a fee you pay to the government. You need to understand how they work and how to pay them correctly.

Retirement Planning: This is making sure you have enough money to live comfortably when you're older and no longer working.

Estate Planning: This is like making a plan for your stuff and money after you're no longer here.

Insurance: It's like paying for protection. You give some money to an insurance company, and they help you if something bad happens.

Investment Options: These are different ways to make your money grow, like buying parts of companies or putting money in a savings account.

Financial Markets: These are places where people buy and sell things like stocks and bonds. It can affect your investments.

Risk Management: This is about being careful with your money and making smart choices to avoid losing it.

Passive Income: This is money you get without having to work for it, like rent from a property you own.

Entrepreneurship: It's like starting your own business. You create something and try to make money from it.

Behavioral Finance: This is about understanding how your feelings and thoughts can affect how you use money. You want to make good choices even when you feel worried or excited.

Financial Goals: These are like wishes for your money. You need a plan to make them come true.

Financial Tools and Apps: These are like helpers on your phone or computer that can make it easier to manage your money.

Real Estate: This is about buying and owning property, like a house or land, to make money.

Asset Protection: It's about keeping your money safe from problems or people who want to take it.

Philanthropy: This means giving money to help others, like donating to charities or causes you care about.

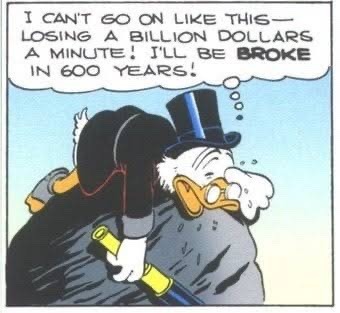

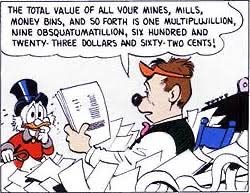

Compounding Interest: This is like a money snowball. When you save or invest your money, it can grow over time. As it grows, you earn even more money on the money you already earned.

Credit Cards: When you borrow money or use a credit card to buy things, you need to show you can pay it back on time. This helps you build a good reputation with money. The better your reputation, the easier it is to borrow more money when you need it.

Alternate Currencies: These are like different kinds of money that aren't like the coins and bills you're used to like Crypto. It's digital money that's not controlled by a government. Some people use it for online shopping, and others think of it as a way to invest, like buying special tokens for a game.

993 notes

·

View notes

Note

do u have some ways/explanations I could logically become rich and wealthy? I wanna be a billionaire but I just can’t imagine doing that without being unethical…

I was just thinking of this question a few days ago and consulted with ChatGPT, so I have the answers ready and loaded!

Ways to become super ultra rich without having to resort to unethical or immoral methods/practices:

› Entrepreneurship: Start your own business in a growing industry. Identify a gap in the market, create a product or service that meets a need, and scale it. Focus on innovation and customer satisfaction.

› Investing: Educate yourself on investing in stocks, real estate, or other assets. Consider long-term investment strategies, such as index funds or rental properties, which can compound wealth over time.

› Build a Personal Brand: Create a strong online presence in your field. Share knowledge through blogs, podcasts, or social media, and leverage your brand for consulting, speaking engagements, or product endorsements.

› Develop Valuable Skills: Acquire skills in high-demand fields like technology, finance, or healthcare. Expertise can lead to high-paying job opportunities or freelance work.

› Networking: Build relationships with influential people in your industry. Networking can lead to collaborations, partnerships, and opportunities that can significantly boost your wealth.

› Innovate and Create: Focus on research and development in emerging fields, such as renewable energy, biotechnology, or artificial intelligence. Invent new products or improve existing ones.

› Real Estate Development: Invest in real estate, starting with rental properties or flipping houses. Learn the market and focus on areas with potential growth.

› Passive Income Streams: Create sources of passive income, such as writing books, creating online courses, or investing in dividend-paying stocks.

› Franchise Ownership: Consider investing in a reputable franchise. This can provide a proven business model and brand recognition while allowing you to operate your own business.

› Philanthropy and Ethical Investing: Invest in socially responsible businesses or initiatives. This can lead to both financial returns and positive societal impact, enhancing your reputation and network.

Ways to “stumble” into wealth without (directly) hoarding wealth:

› Inheriting Wealth: Unexpectedly inheriting wealth from a distant unknown relative or family friend.

› Winning the Lottery: Not a very sustainable source of income but it works.

› Discovering Hidden Talents: Uncovering a unique skill or talent that becomes highly valued—like writing a bestselling book or creating viral content.

› Investing Early: Accidentally investing in a promising startup or stock that later skyrockets in value.

› Networking: Making a valuable connection at a social event that leads to a lucrative job or business opportunity.

› Crowdfunding Success: Launching a project that resonates with a broad audience, leading to substantial financial backing.

› Accidental Invention: Creating a product by chance that fills a market need, like a popular app or gadget.

31 notes

·

View notes

Text

25 Passive Income Ideas to Build Wealth in 2025

Passive income is a game-changer for anyone looking to build wealth while freeing up their time. In 2025, technology and evolving market trends have opened up exciting opportunities to earn money with minimal ongoing effort. Here are 25 passive income ideas to help you grow your wealth:

1. Dividend Stocks

Invest in reliable dividend-paying companies to earn consistent income. Reinvest dividends to compound your returns over time.

2. Real Estate Crowdfunding

Join platforms like Fundrise or CrowdStreet to invest in real estate projects without the hassle of property management.

3. High-Yield Savings Accounts

Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn guaranteed interest.

4. Rental Properties

Purchase rental properties and outsource property management to enjoy a steady cash flow.

5. Short-Term Rentals

Leverage platforms like Airbnb or Vrbo to rent out spare rooms or properties for extra income.

6. Peer-to-Peer Lending

Lend money through platforms like LendingClub and Prosper to earn interest on your investment.

7. Create an Online Course

Turn your expertise into an online course and sell it on platforms like Udemy or Teachable for recurring revenue.

8. Write an eBook

Publish an eBook on Amazon Kindle or similar platforms to earn royalties.

9. Affiliate Marketing

Promote products or services through a blog, YouTube channel, or social media and earn commissions for every sale.

10. Digital Products

Design and sell digital products such as templates, printables, or stock photos on Etsy or your website.

11. Print-on-Demand

Use platforms like Redbubble or Printful to sell custom-designed merchandise without inventory.

12. Mobile App Development

Create a useful app and monetize it through ads or subscription models.

13. Royalties from Creative Work

Earn royalties from music, photography, or artwork licensed for commercial use.

14. Dropshipping

Set up an eCommerce store and partner with suppliers to fulfill orders directly to customers.

15. Blogging

Start a niche blog, grow your audience, and monetize through ads, sponsorships, or affiliate links.

16. YouTube Channel

Create a YouTube channel around a specific niche and earn through ads, sponsorships, and memberships.

17. Automated Businesses

Use tools to automate online businesses, such as email marketing or subscription box services.

18. REITs (Real Estate Investment Trusts)

Invest in REITs to earn dividends from real estate holdings without owning property.

19. Invest in Index Funds

Index funds provide a simple way to earn passive income by mirroring the performance of stock market indexes.

20. License Software

Develop and license software or plugins that businesses and individuals can use.

21. Crypto Staking

Participate in crypto staking to earn rewards for holding and validating transactions on a blockchain network.

22. Automated Stock Trading

Leverage robo-advisors or algorithmic trading platforms to generate passive income from the stock market.

23. Create a Membership Site

Offer exclusive content or resources on a membership site for a recurring subscription fee.

24. Domain Flipping

Buy and sell domain names for a profit by identifying valuable online real estate.

25. Invest in AI Tools

Invest in AI-driven platforms or create AI-based products that solve real-world problems.

Getting Started

The key to success with passive income is to start with one or two ideas that align with your skills, interests, and resources. With dedication and consistency, you can build a diversified portfolio of passive income streams to secure your financial future.

2 notes

·

View notes

Photo

McPike Mansion

Henry Guest McPike was a multi-faceted spirit. He was a two-time mayor of Alton, Illinois, and a kingmaker in local politics. He dabbled in horticulture, propagating his own variety of grape coveted in winemaking circles. He was also a skilled businessman, who counted real estate and insurance among his ventures. A man of such prominence needed a stately home, and, in 1869, McPike commissioned a local architect to build an ornate Italianate-style estate on a 15-acre compound in Alton.

McPike adored the property, particularly the grove of fruit trees, before he succumbed to a brief illness at the house in 1910. Legend has it, his spirit never left.

For more than a century, local lore has held that the home now known as McPike Mansion is haunted by its original owner.

McPike, however, may not be the only apparition who has seemingly taken eternal residence inside the mansion’s walls. Sharyn and George Luedke, who have invested thousands of dollars in renovating the dilapidated house since purchasing it in 1994, believe there are a dozen spirits who have maintained a presence in and around the home.

Among the putative spectral inhabitants is Henry’s mother, Lydia. “She’s the matriarch of the family,” Sharyn says. “She is a pretty strong presence who likes to be introduced when I bring people into the entranceway.” McPike’s first wife, Mary, also makes regular appearances. “She’s kind of shy, but she’s a good spirit,” Sharyn says. “She loves children.” There have also been encounters with McPike’s son, James, and daughter-in-law, Jenny, who Sharyn calls the trickster of the spiritual group. “She’ll touch people. Not in a harmful way—she might tug on your hair a little bit or touch your ear.”

Neither Lydia nor Mary lived in the mansion before their deaths, and not all of the supposed spirits are of the McPike clan. Sharyn says she’s felt the spirit of a woman named Sarah, who is believed to have been a personal attendant to the McPikes. Sharyn claims that at least three children who may have lived on the property before McPike purchased it still haunt the grounds today.

No earthly bodies have lived in the house since 1954—it was long ago condemned—but the site has become a popular destination in recent decades for hunters of paranormal activity. Recently, a photograph captured a dark shadow in the doorway to the cellar. “It’s pretty obvious,” Sharyn says. “That was Henry.”

41 notes

·

View notes

Text

10 Strategies to Reach $1 Million in 2025

Building wealth and reaching $1 million by 2025 might seem daunting, but with a combination of smart strategies and disciplined action, it’s within reach! Here’s an outline of 10 proven strategies to guide you on your journey:

Embrace Digital Entrepreneurship: Launch an online business, like an e-commerce store or blog, to create scalable income with low overhead costs.

Invest in Stocks and ETFs: Regular investments in diverse stocks and ETFs can build wealth through compound interest and market growth.

Leverage Freelancing: Monetize in-demand skills remotely on platforms like Upwork or Fiverr, building a side income that can grow significantly over time.

Explore Real Estate Opportunities: Start small with rental properties, house hacking, or REITs to gain exposure to real estate’s wealth-building potential.

Utilize Social Media Channels: Platforms like YouTube and Instagram offer revenue through ads, sponsorships, and product sales.

Engage in Peer-to-Peer Lending: Lend money directly to individuals or businesses, earning passive income from interest on loans.

Launch an E-Commerce Business: Tap into dropshipping or print-on-demand models to run an online store without managing physical inventory.

Explore Affiliate Marketing: Recommend and promote products you believe in, earning a commission on each sale made through your unique links.

Consider Cryptocurrency Investments: For those with higher risk tolerance, crypto offers high growth potential if approached strategically.

Expand Your Network: Connect with like-minded individuals and potential partners to create opportunities for collaborative ventures and growth.

Each of these strategies offers unique ways to grow your wealth, whether you’re starting with a little or a lot. For a detailed guide on how to implement each strategy, head to 10 Strategies to Reach $1 Million in 2025 and kickstart your journey toward financial independence today!

#financetips#management#personal finance#investing stocks#investment#investing#blockchain#finance#crypto#fintech

2 notes

·

View notes

Text

The Importance of Investing in Yourself: The Ultimate Guide to Lifelong Growth

When it comes to investing, people often think of stocks, real estate, or Bitcoin. But there's one investment that will always give you the highest return—investing in yourself. It’s not about the dollars you put into an asset or the number of hours spent working. It’s about putting in the effort and resources to become the best version of you. Investing in yourself is the foundation for everything else in life—your happiness, success, and overall fulfillment.

Why Investing in Yourself Is the Best Investment You Can Make

Imagine planting a tree. You nurture it with water, sunlight, and care. Over time, that small seedling grows into a magnificent tree that provides shade, oxygen, and perhaps even fruit. Investing in yourself works the same way—it's the single most important thing you can do to ensure growth and fulfillment. The return on this investment doesn’t just impact you; it ripples outward, affecting those around you, your community, and even the world.

When you invest in yourself, you are building a foundation for your future, where opportunities aren’t something you chase but something that naturally comes to you. You’re positioning yourself to not only weather the uncertainties of life but to thrive amidst them. Investing in yourself empowers you with confidence, opens doors to new opportunities, and cultivates a sense of worth that transcends material wealth.

Practical Ways to Invest in Yourself

Education: Never Stop Learning

Learning is a lifelong process, and in today’s world, the opportunities for education are limitless. Whether it's reading books, attending webinars, taking online courses, or simply listening to podcasts, investing in your education enriches your perspective and helps you stay adaptable. Knowledge is power, and the more you learn, the better equipped you are to navigate life’s challenges.

Think of it this way: every time you learn a new skill, you're adding another tool to your personal toolkit. It might be taking an online course about Bitcoin or learning a new programming language—all these little efforts compound to make you more knowledgeable, adaptable, and ready to seize opportunities when they come.

Health: Your Wealth Depends on It

A wise person once said, "A healthy person has a thousand wishes, but a sick person has only one." Physical and mental health are often overlooked forms of investment, but without good health, all other forms of success lose their meaning. Exercise, eating nutritious food, and practicing mindfulness are all investments in your longevity and well-being.

By taking care of your physical health, you’re giving yourself the energy needed to achieve your goals. Investing in mental health, through meditation, therapy, or even just quality time with loved ones, ensures you have the resilience needed to navigate the ups and downs of life.

Financial Literacy: Knowing How Money Works

Investing in yourself also means understanding how to manage your money. Developing financial literacy—learning about saving, budgeting, and investing—equips you with the knowledge to create financial independence. For me, discovering Bitcoin led to a deep dive into understanding money, value, and the economic forces shaping our world. This investment in knowledge transformed not only my financial situation but also my entire outlook on life.

Learning about money empowers you to make decisions that align with your long-term goals, giving you the freedom to invest in other areas of your life, like pursuing passions or building relationships. It’s about creating opportunities to grow, rather than living paycheck to paycheck.

Time: The Most Valuable Resource

Time is your most finite and precious resource. Choosing to spend it on activities that enrich your life is a profound way of investing in yourself. This could mean pursuing hobbies that bring you joy, taking time to rest, or working on projects that fuel your passion. Every hour spent intentionally is an investment in your growth and well-being.

Consider what you would do if you had the freedom of time—maybe it’s learning a new skill, connecting with family, or building your own business. By investing time in these areas now, you’re laying the foundation for a fulfilling future.

My Journey: How Investing in Myself Changed My Life

I vividly remember when I started my journey with Bitcoin. At the time, it wasn't just an investment in a digital asset—it was an investment in myself. I learned about the history of money, economics, and the pitfalls of our current financial system. It changed how I viewed the world, and it gave me a new sense of purpose. The returns weren't just financial; they were deeply personal. It gave me a mission—to help others see the power of taking control of their financial future.

Investing in myself also meant creating content to educate and inspire. It’s become a way of growing not just my own understanding but helping others unplug from traditional financial systems. It’s an ongoing journey, and every piece of knowledge I share, every skill I acquire, takes me one step further.

Conclusion: The Lifelong Journey of Investing in Yourself

Investing in yourself isn’t about instant gratification. It’s about making choices today that will yield incredible dividends in the future. Whether it’s gaining knowledge, nurturing your health, understanding money, or wisely spending your time, every effort you make compounds into something extraordinary.

So start today. Pick up that book, take that course, prioritize your health, or learn how to budget. The beauty of investing in yourself is that the returns are limitless—you’re building a better future not just for yourself, but for those around you as well. Remember, the best investment you can make is in the person staring back at you in the mirror.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#InvestInYourself#PersonalGrowth#SelfInvestment#SelfImprovement#LifelongLearning#FinancialFreedom#MindsetMatters#Motivation#GrowthMindset#BitcoinEducation#KnowledgeIsPower#HealthIsWealth#SuccessTips#SelfCare#FinancialLiteracy#Productivity#InvestInYourFuture#Empowerment#MentalHealth#cryptocurrency#financial empowerment#digitalcurrency#finance#financial experts#globaleconomy#blockchain#financial education#bitcoin#unplugged financial

5 notes

·

View notes

Text

Progression: Chapter 26 Preview

“Try not to talk unless you absolutely have to,” Tankhun tells Arm as he straightens Arm's shirt collar, “If you do, just stick to the basics of the truth: You bonded with me after we were both traumatized by the attack he spurred on, and we fell in love.”

“So imply that this never would have happened if it weren't for him,” Arm says.

“Exactly!” Tankhun says agreeably, then rolls his eyes and decides to be more serious, “No, but it's sort of the truth. I might resort to using it if needed. Just keep it honest but vague. I have only improved and become more productive while in this relationship, and you took on Chan’s responsibilities, all while continuing your previous duties. He should be grateful, if anything.”

Arm breathes out and nods, then puts his arms around Tankhun’s shoulders, “Malai got to Hansa’s house okay. She says she is willing to talk about how present you have been with the girls and that you are one of the few people she would trust to leave them with.”

“That's sweet of her to say,” Tankhun murmurs.

“It's sweet, and also true. She means it,” Arm tells him, “She also mentioned something else to me.”

“And what was that?”

“Something about you studying for the last two trainings and certifications you would need to get your law license?”

Tankhun shrugs at that, “Hm. She's a paralegal. She has been thinking about taking that step too. I figured if we got certified as lawyers together, it may convince her to move to back to Bangkok. Maybe we’ll open a practice together.”

Arm smiles a little at that and pulls him closer, “And that's something you want? You aren't pushing yourself into a career to…I don't know, prove a point.”

Tankhun shrugs, “Maybe a little. But…I actually did enjoy it when I was enrolled in college. I graduated at the top of my class despite only going to campus when it was absolutely necessary. Even before that, Pa had me take care of Ma’s estate. While things were tense between our families by the time Auntie Milan died, I reached out to Uncle Gun to see if he wanted me to help with anything in that regard too! I was even willing to leave the compound in order to help!”

“Did he let you?”

Tankhun lets out a huff, “No. He yelled at me and said Pa was putting me up to some sneaky agenda. That wasn't true at all, but I understood why he may think that way and just let the matter go. But I have been known to walk some of the guards through their wills and estate paperwork we give them. I helped Pol, Porsche, Ken, Big, Pete, First, Sand, and even Chan when he came into some money and wanted to make some adjustments!”

“Why didn't I know about this? You never offered to walk me through that paperwork,” Arm says, narrowing his eyes a little.

“Because you're the smartest one here, Arm! You don't need my help with such things!”

“It was complicated!” Arm says, “I kept putting it off and your father annoyed me about it.”

“Well, you should have said something!” Tankhun says to him, “I figured if you could understand complex technology, you could figure out paper.”

“I could have, but it was repetitive, monotonous, and annoying.”

“How dare you!” Tankhun says with a gasp, “That was a huge improvement compared to the system we had before! I set it up myself!”

“Malai was impressed with it too. She said she has seen more complicated paperwork after I gave it to her to handle.”

“She's smart!” Tankhun agrees, “That's why we are going to open a practice together! I'm thinking we will focus on real estate law, financial law, and estate law. Contracts, wills, investments, contracts, and securing business loans are simple. Neither of us want to go to stupid court rooms if we can avoid it.”

“I figured you would love the drama that a courtroom could bring,” Arm says.

Tankhun rolls his eyes, “The drama, sure. But the stupidity and self-importance? Please. Do you know how grating it is to argue with people who are completely wrong or flat out lying and act like they're not? So annoying! I can spend my time doing better things. Like you.”

Arm lets out a snort, only for Tankhun to cut it off with a kiss. While Tankhun has some conflicting feelings about finishing up the trainings he will need to officially become a lawyer, it mainly stems from anxiety and feelings of inadequacy. But Tankhun knows that some of those feelings stem from Pa. Then again, Pa pushed him to get a college education. It was important to maintain appearances, but it also gave Tankhun something to do and something to stimulate his mind. Even though the major was strongly suggested to him by Pa and his advisors, he had known the reason behind it. He excelled in finding loopholes and suspicious wording in contract agreements. He also excels at keeping track of finances, growing wealth, and making good investment decisions. So it was either law, or it was business and finance. Law felt like it was more widespread. Tankhun had felt like he could maybe help people more as a lawyer, both rich and poor, rather than just advising Pa’s rich friends on what to do with their money.

Besides, as annoying as the thought of being in a courtroom is, it would be more annoying to solely help Pa and his associates get richer while Tankhun’s money gets stored away in an account he only has limited access to.

Of course, Tankhun has other ways to make money. He has built upon his finances through investing in stocks, bonds, and promising start-ups for quite some time, before Arm even started working here. But Tankhun plans on keeping that private for now. He had pondered revealing his long-term side hustles to Kim if his little brother's restrictions went on much longer, but maybe Tankhun can be an inspiration this way. He can become independent. He can pursue a career that may end up being a passion if he is on that track with someone he trusts. But most of all, he can be strong and stand up to his father for the man he loves.

He just needs to present himself differently than he has for the past twelve years. Tankhun knows he has changed a lot. Untreated trauma, long-term defiance, and being controlled, belittled, and gaslighted by a parent does that to a person.

Despite all of that, Tankhun still loves Pa. He hates that he still loves him, especially when he remembers everything Namphueng was put through. She only partially came back to her former self recently, or some version of it. Tankhun needs to do the same. He needs to revive his former self.

His former self feels like such a stranger. He had been calmer and more collected back then, trained to push aside his tendency to become distracted or his feelings of restlessness in favor of becoming someone simultaneously approachable and intimidating. He was taught to be intelligent, but easy to understand. He was trained to be powerful, all while exuding a sense of calm. But most importantly, he had to prove himself by being equally sharp with his wit, tongue, and aim.

He had been so fucking sharp.

“You alright?” Arm asks gently, taking Tankhun's face into his hands.

Does he want to be that person again? Part of him wants anything but that. He feels a sense of pride at being Pa’s source of shame, although the occasional yet genuine concern and pity are negative side effects.

But he also yearns for it. Not necessarily for his birthright as the head, but for the opportunity to be who he had been before.

“...I’m okay,” Tankhun says hesitantly, then takes his boyfriend's hands, “But…If I change a bit going forward, will you still love me?”

Arm tilts his head at that, “What do you mean?”

Tankhun breathes in, “I was…very different prior to my kidnapping. The person who you have gotten to know is…mostly genuine. But I…There are probably aspects of myself I have hidden or amplified I may adjust now that I am to be more transparent with Pa. I think this is the best way to go about this. It will take him off guard, but it may…please him or confuse him enough to back off. I don't know what I'm saying-”

“As long as any changes or adjustments make you happy, I am fine with it,” Arm cuts in gently, “But only if you are doing it for you. Not for your father, not for your brothers, and not even for me. You. As long as I can still recognize you, I will still be in love with you.”

Tankhun feels his eyes get wet, only to sniffle when Arm quickly wipes the moisture away, “...I was so different, Arm.”

“I’ve heard stories.”

“I was supposed to be great.”

“You are,” Arm says, cupping his face, “You always have been. I never thought otherwise, even on your worst days. Your trauma may have changed you, but it didn't take away your greatness, Khun.”

Tankhun would like to believe that. He isn't sure that he does, but Arm’s optimism is encouraging.

“...I will become a hybrid version of me, then,” Tankhun decides, “I will keep your favorite parts of me-”

“That's pretty much every part.”

“But let the favorite parts of who I used to be come back out,” Tankhun continues, “Parts I hope you will like too.”

“As long as you aren't trying to pretend to be someone you're not, then I'm fine with it,” Arm tells him. He sounds sincere, so Tankhun feels at peace with his decision. In fact, he already feels a shift occurring, as if Arm's blessing was all he needed.

Now, he just needs his father's blessing. This is his best shot at getting it. The only other option Tankhun could think of as he was mulling this over in his head was a move so defiant and bold that it would leave Pa completely clueless about what to do, at least in the moment.

However, Tankhun would prefer to not propose to Arm in front of Pa, despite it being slightly tempting. His boyfriend deserves something more private, romantic, and authentic. The ring Tankhun carefully picked out eight months ago will continue to stay hidden in his desk drawer.

At least for now.

#progression#progression 26#progression preview#progression spoilers#progression sneak peek#ArmKhun#ArmTankhun#kinnporsche fanfic

6 notes

·

View notes

Text

How to Become a Millionaire in Your 20s: Unlocking the Path to Financial Success!

Introduction:

Achieving millionaire status in your 20s may sound like an audacious goal, but it's not an impossible feat. With careful planning, smart financial choices, and determination, you can set yourself on the path to financial independence and potentially reach millionaire status early in life. In this article, we'll explore actionable steps that can help you achieve this milestone and build a solid foundation for a prosperous future.

1. Set Clear Goals: The journey to becoming a millionaire starts with setting clear and specific financial goals. Define how much money you want to accumulate and by what age. Having a well-defined vision will serve as a powerful motivator and help you stay focused on your objectives.

2. Embrace Frugality: Living below your means and adopting a frugal lifestyle can significantly impact your ability to accumulate wealth. Be mindful of your spending habits, avoid unnecessary expenses, and save as much as possible. Every dollar saved is a dollar that can be invested to grow your wealth further.

3. Invest Wisely: Investing is one of the most effective ways to build wealth over time. Take the time to educate yourself about different investment options, such as stocks, bonds, real estate, and mutual funds. Understand the principles of risk and return, and create a diversified investment portfolio that aligns with your risk tolerance and financial goals.

4. Build Multiple Streams of Income: Relying solely on a single income stream might not be sufficient to achieve millionaire status. Consider exploring side hustles, freelancing, or starting a small business to supplement your primary income. Diversifying your income sources can provide financial stability and increase your earning potential.

5. Harness the Power of Compounding: The earlier you start investing, the more you can benefit from the power of compounding. Compounding allows your investments to generate returns, and those returns, in turn, generate their own returns. Over time, this snowball effect can lead to significant wealth accumulation.

6. Focus on Personal Development: Investing in yourself is as crucial as investing in financial assets. Constantly upgrade your skills, knowledge, and education. The more valuable you become in the job market or as an entrepreneur, the higher your income potential. Attend workshops, read books, and seek mentorship to improve your personal and professional capabilities.

7. Surround Yourself with Success: The people you surround yourself with can significantly influence your mindset and drive your success. Network with like-minded individuals who inspire and challenge you. Engage with mentors or join mastermind groups to gain insights from experienced individuals who can help you navigate your path to success.

8. Avoid Debt Traps: While some debt may be necessary, such as student loans for education or a mortgage for a home, it's crucial to minimize high-interest debts. High-interest debts can quickly become a burden, hindering your ability to invest and grow your wealth. Prioritize paying off debts strategically to free up more resources for investments.

9. Be Patient and Persistent: Building wealth takes time and consistent effort. Be prepared for setbacks and challenges along the way. Stay committed to your goals, and don't let temporary obstacles deter you from your long-term vision. Embrace the journey, learn from your experiences, and keep pushing forward.

10. Seek Professional Advice: If you feel overwhelmed or uncertain about your financial decisions, don't hesitate to seek guidance from financial advisors or experts. A professional can help you create a personalized financial plan, offer valuable insights, and keep you on track to achieve your millionaire goals.

Conclusion:

Becoming a millionaire in your 20s is an ambitious but achievable objective with the right mindset, financial discipline, and perseverance. It requires a strong commitment to setting clear goals, making smart financial choices, and continuously investing in your personal and financial growth.Remember, the path to financial success is unique for each individual. It's essential to craft a plan that aligns with your values, passions, and long-term aspirations. By implementing these strategies and staying focused on your objectives, you can set yourself up for financial independence and a prosperous future. Start today, and embrace the exciting journey to becoming a millionaire!

Here's a Free Ebook on The Hidden Credit Secret to $1 Million Dollars: Click here to access now!

#Success#success mindset#success motivation#success quotes#focus#mindset#money making#make money online#millionaire

5 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement Diversifying Your Portfolio Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning What is the ideal age to start retirement planning? Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income? While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal? Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring? It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet? Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise? Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

McPike Mansion

Henry Guest McPike was a multi-faceted spirit. He was a two-time mayor of Alton, Illinois, and a kingmaker in local politics. He dabbled in horticulture, propagating his own variety of grape coveted in winemaking circles. He was also a skilled businessman, who counted real estate and insurance among his ventures. A man of such prominence needed a stately home, and, in 1869, McPike commissioned a local architect to build an ornate Italianate-style estate on a 15-acre compound in Alton.

McPike adored the property, particularly the grove of fruit trees, before he succumbed to a brief illness at the house in 1910. Legend has it, his spirit never left.

For more than a century, local lore has held that the home now known as McPike Mansion is haunted by its original owner.

McPike, however, may not be the only apparition who has seemingly taken eternal residence inside the mansion’s walls. Sharyn and George Luedke, who have invested thousands of dollars in renovating the dilapidated house since purchasing it in 1994, believe there are a dozen spirits who have maintained a presence in and around the home.

Among the putative spectral inhabitants is Henry’s mother, Lydia. “She’s the matriarch of the family,” Sharyn says. “She is a pretty strong presence who likes to be introduced when I bring people into the entranceway.” McPike’s first wife, Mary, also makes regular appearances. “She’s kind of shy, but she’s a good spirit,” Sharyn says. “She loves children.” There have also been encounters with McPike’s son, James, and daughter-in-law, Jenny, who Sharyn calls the trickster of the spiritual group. “She’ll touch people. Not in a harmful way—she might tug on your hair a little bit or touch your ear.”

Neither Lydia nor Mary lived in the mansion before their deaths, and not all of the supposed spirits are of the McPike clan. Sharyn says she’s felt the spirit of a woman named Sarah, who is believed to have been a personal attendant to the McPikes. Sharyn claims that at least three children who may have lived on the property before McPike purchased it still haunt the grounds today.

No earthly bodies have lived in the house since 1954—it was long ago condemned—but the site has become a popular destination in recent decades for hunters of paranormal activity. Recently, a photograph captured a dark shadow in the doorway to the cellar. “It’s pretty obvious,” Sharyn says. “That was Henry.”

3 notes

·

View notes

Text

Mastering the Art of Long-Term Investing

youtube

Are you ready to embark on a journey towards financial independence and wealth accumulation? Look no further! In this comprehensive video, we delve deep into the world of long-term investing, equipping you with the knowledge, strategies, and insights to make informed decisions that will shape your financial future. 📈 Why Long-Term Investing? Discover the undeniable advantages of adopting a long-term investment approach. Learn how patience, compound interest, and a diversified portfolio can work wonders over time, ensuring you reap the rewards of your wise decisions. 🔑 Key Investment Principles Uncover the golden rules of successful investing that stand the test of time. We'll explore fundamental concepts like risk tolerance, asset allocation, and the power of staying invested even during market fluctuations. 💎 Navigating Market Volatility Market ups and downs are part of the investing journey. Our experts share valuable tips on how to navigate through volatile times, keeping emotions in check and making rational choices that align with your long-term goals. 🚀 Investing in Different Asset Classes From stocks and bonds to real estate and more, learn how to build a well-rounded investment portfolio that aligns with your risk appetite and financial objectives. Our comprehensive breakdown of various asset classes will empower you to make informed investment decisions. 📚 Continuous Learning and Adaptation The financial world evolves, and so should your investment strategy. We'll guide you through the importance of staying updated, continuously learning about market trends, and adapting your approach to stay ahead in the game. 🌟 Your Host - Join our seasoned host, [Your Name], a respected financial expert with a proven track record in long-term investing. With years of experience and a passion for educating others, [Your Name] will be your trusted guide on this enlightening journey. 🔔 Don't Miss Out! Subscribe to GOLDEN FINANCES and hit the notification bell so you never miss an episode full of valuable insights. Whether you're a novice investor or looking to refine your strategies, this channel is your go-to resource for mastering the art of long-term investing. 📢 Share this video with your friends and family who are eager to take control of their financial destiny. Remember, the path to financial freedom begins with knowledge and action. Start your journey with us today!

LongTermInvesting #FinancialFreedom #InvestWisely #GoldenFinances #longterminvesting #investmentstrategy #investmenteducation #investingtips #valueinvesting

investmenttips #valueinvestment #warrenbuffetinvestment #investinglikewarrenbuffet #investmentwisdom #investmentinsights #fundamentalanalysis #portfoliodiversification #riskmanagement

3 notes

·

View notes

Text

The Secrets of How Rich People Make Money: A Detailed Guide

Introduction:

Have you ever wondered how the rich become wealthy? While there is no one-size-fits-all answer, there are certain strategies and habits that many wealthy individuals use to create and grow their wealth. In this article, we'll explore some of the secrets of how rich people make money.

1. They Invest in Appreciating Assets:

One of the key strategies used by the wealthy to make money is investing in assets that appreciate in value over time. These assets can include real estate, stocks, and businesses. Wealthy individuals understand that these assets can generate significant returns if held for the long term.

2. They Create Multiple Streams of Income:

Another strategy used by the rich is creating multiple streams of income. They leverage their skills, knowledge, and resources to start businesses, invest in real estate, and create passive income streams through investments in dividend-paying stocks, bonds, and rental properties.

3. They Work Smart, Not Just Hard:

Rich people work smart by leveraging their skills and knowledge to create income-generating assets that can generate passive income. They understand that working hard alone is not enough to create wealth, and they focus on creating systems and processes that can generate income even when they're not actively working.

4. They Understand the Power of Compounding:

The wealthy understand the power of compounding, which is the ability of an asset to generate earnings that are reinvested to generate more earnings over time.

5. They Prioritize Financial Education:

Finally, the rich prioritize financial education and continuously seek to learn about investing, personal finance, and wealth creation.

Conclusion:

While there is no magic formula for becoming wealthy, following the strategies and habits of the rich can help you create and grow your wealth over time. By investing in appreciating assets, creating multiple streams of income, working smart, understanding the power of compounding, and prioritizing financial education, you can achieve your financial goals and live life on your own terms.

5 notes

·

View notes

Text

Financial Independence: Take Control of Your Finances and Achieve Freedom

Introduction: Welcome to the world of financial independence, where you can take control of your finances and pave the way towards a life of freedom and security. Our comprehensive guide is designed to provide you with valuable insights and strategies to achieve financial independence. Discover the transformative power of budgeting, investing, and smart money management to build a solid financial foundation.

Understanding Financial Independence: Gain a deeper understanding of what financial independence means and the possibilities it holds for your life. Learn about the benefits of financial independence, such as freedom from debt, the ability to pursue your passions, and the peace of mind that comes with financial security. Explore the steps necessary to achieve financial independence and create a roadmap for success.

Creating a Solid Financial Plan: Develop a solid financial plan that aligns with your goals and values. Learn techniques for setting financial goals, creating a budget, and managing your expenses effectively. Discover the power of tracking your spending, identifying areas for savings, and making informed financial decisions that align with your long-term vision.

Building Wealth through Investing: Explore strategies for building wealth and growing your financial assets through smart investing. Learn about different investment options, such as stocks, bonds, real estate, and retirement accounts. Discover techniques for diversifying your investment portfolio, managing risk, and harnessing the power of compound interest for long-term financial growth.

Debt Management and Financial Freedom: Take control of your debts and work towards financial freedom. Learn strategies for managing and reducing debt, including techniques for budgeting, debt consolidation, and negotiation. Discover the importance of prioritizing high-interest debts, creating a repayment plan, and developing healthy financial habits to achieve debt-free living.

Building Multiple Income Streams: Explore the possibilities of building multiple income streams to accelerate your path to financial independence. Learn techniques for generating passive income through investments, rental properties, or online business ventures. Discover the power of diversifying your income sources and leveraging your skills and passions to create additional revenue streams.

Planning for Retirement and Long-Term Security: Secure your future by planning for retirement and long-term financial security. Learn about retirement savings options, such as 401(k) plans, IRAs, or pension plans. Discover techniques for estimating your retirement needs, maximizing your savings, and creating a comprehensive retirement plan that ensures a comfortable and fulfilling future.

Conclusion: Take control of your financial destiny and embrace the power of financial independence. From understanding financial independence to creating a solid financial plan, building wealth through investing to debt management and financial freedom, building multiple income streams to planning for retirement, our comprehensive guide equips you with the tools and knowledge to achieve financial independence. Embrace the possibilities of financial freedom, take charge of your financial well-being, and experience the profound impact of a life of security and abundance. Start your journey towards financial independence today and unlock the unlimited possibilities that await you.

"Join our thriving community of [industry] enthusiasts on our website forum."

2 notes

·

View notes

Note

I LOVED seeing glimpses of what the other gorls are up to in the latest chap of your jackienat roommates fic. Especially how receiving the settlement impacted them individually - because that kind of money is life changing. Van, Laura Lee, and Shauna got me the most mostly because there’s so much to explore with their futures. The world is your oyster and I’m glad it includes Shauna 1) fleeing the country after murder 2) Laura Lee escaping a life she was boxed into and making her own way 3) van getting to figure out her purpose

Thank you for keeping these girls as unhinged as possible. Shauna wouldn’t be shauna without her murdery tendencies. Jackie sending her the pinkie in the mail was perfection and I cannot imagine wtf their reunion will be like after all these years.

Hey thanks! I appreciate you reaching out to tell me. The settlement money has always been a source of curiosity for me. I mean Shauna invested in Jeff’s business, Tai probably paid for college, Van bought a business, Misty probably paid for school or a house, Nat bought a car, and Lottie invested in prime cult compound real estate. So doing the exercise with the other characters was invigorating. Totally agree that having that level of agency is life changing, and without the whole… two years in the wilderness they will have different priorities.

Yeah! Insanity is a key ingredient of the cake. It wouldn’t be YJ without unhinged women and the thesis statement of The Pilot is that they have all Always Been Like This.

2 notes

·

View notes

Text

youtube

Turn $500 Into $5,000 in 6 Months 🚀 Want to learn how to turn $500 into $5,000 in just 6 months? 🚀 There’s too much sauce online to be broke! In this video, I’m breaking down a step-by-step guide to grow your money fast with high-growth stocks, crypto, and smart investment strategies. Whether you’re new to investing or ready to take bold steps toward financial freedom, I’ve got you covered! 💸 From evaluating your risk tolerance to diversifying with high-growth assets like Tesla, Bitcoin, and Ethereum, I’ll show you how to make your money work harder for you. Plus, we’ll explore game-changing tools like dollar-cost averaging, portfolio rebalancing, and even high-yield options like P2P lending and fractional real estate investing. This is for anyone who’s tired of missing out and ready to join the "Online Gravy" crew in achieving big financial goals! 💡 Want to make money online and seize your shot at financial freedom? Let's get started! Don’t forget to subscribe for more proven strategies and tips—there’s no limit to what you can achieve! 🔥 #stockstobuynow #pennystockstobuynow #beststockstobuynow #financialeducation #dividendinvesting CHAPTERS: 00:00 - How to Turn $500 into $5,000 in 6 Months 00:30 - Setting Clear Goals and Evaluating Risk Tolerance 01:53 - Choosing the Right Brokerage Account 02:40 - Diversifying with High-Growth Assets 03:39 - Implementing Dollar-Cost Averaging 04:30 - Monitoring and Rebalancing Your Portfolio 05:15 - Compounding Gains by Reinvesting Profits 06:03 - Exploring High-Yield Side Investments 06:59 - Avoiding Common Pitfalls in High-Growth Investing 08:15 - Recap: How to Turn $500 into $5,000 in 6 Months via Online Gravy https://www.youtube.com/channel/UC9v5UhrL5hYKZmu2hkgCWfQ January 17, 2025 at 07:59AM

#onlinegravy#financialeducation#financialfreedom#makemoneyonline#dividendinvesting#financialindependence#selfimprovement#realestate#Youtube

0 notes

Text

Golden Palms Mulshi: The Perfect Place for Your Dream NA Bungalow Plots

If you’ve been envisioning a serene yet well-connected destination to build your dream bungalow, Golden Palms Mulshi is here to turn that vision into reality. Located near Hinjewadi Phase 3, Pune’s booming IT and residential hub, this exclusive project offers 115 NA bungalow plots designed to blend luxury, comfort, and investment potential.

Why Choose Golden Palms Mulshi?

Golden Palms, bungalow plots in Mulshistand out as a great investment for those seeking homes. Every plot here is PMRDA-sanctioned, so there's no hassle in the process of buying. It's also RERA-registered, ensuring complete transparency and following the legal guidelines. Being an amalgamation of the current lifestyle requirements, these plots are Vastu-compliant too, allowing you to enjoy life peacefully.

The plots come with an FSI of up to 2, giving you the scope to design spacious villas that cater to the needs of your family.

Safety and Security

Golden Palms Mulshi prioritizes your security. The entire project is safeguarded by a 6-ft-high compound wall, ensuring a gated community feel. Each plot also comes with its own 2-ft-high compound wall, adding an extra layer of security and privacy.

Amenities That Elevate Your Lifestyle

Golden Palms Mulshi is a lifestyle destination as much as it is a residential project. The amenities count runs to 30+ in total, comprising of swimming pool, modern clubhouse, vibrant kids' play area, pet-friendliness, etc. Designed with the purpose of being a community-centric lifestyle where one can just go ahead and enjoy some leisure time or relax, Golden Palms Mulshi provides it all to its patrons.

Prime Location Advantage

Golden Palms Mulshi is located close to Hinjewadi Phase 3 and offers connectivity at its best. It connects you with the IT sectors or brings you closer to the major hubs of Pune if you want to. Its excellent road infrastructure and proximity to schools, hospitals, and entertainment zones make it an ideal location for balancing work and life.

An Investment Worth Making

Golden Palms Mulshi is not just about owning land; it’s about securing your future. These signature plots offer an excellent opportunity to build your dream villa or make a profitable investment in Pune’s rapidly growing real estate market.

Choose Golden Palms Mulshi for a home that celebrates luxury, comfort, and community living. Visit today and take the first step toward creating your dream bungalow!

0 notes