#dividendinvesting

Explore tagged Tumblr posts

Text

Fundamental Analysis of Maruti Suzuki

Established in February 1981 as Maruti Udyog Limited, Maruti Suzuki India Limited (MSIL) is now the largest passenger car manufacturer in India. A joint venture between the Government of India and Suzuki Motor Corporation of Japan, the latter currently holds a 58.19% stake in the company. With a diverse portfolio of 16 car models and over 150 variants, Maruti Suzuki caters to various consumer segments, from entry-level small cars like the Alto to the luxury sedan Ciaz.

Sales and Industry Trends

Indian passenger vehicle industry saw record sales of 4.1 million units in 2023, becoming the third largest market globally

Share of utility vehicles in the industry increased to 53% in Q3, with SUVs contributing to about 63%

CNG vehicles saw a share increase to about 16.5% in the industry, with CNG sales reaching an all-time high of ~30%

Company crossed annual sales milestone of 2 million units in 2023 and had highest ever exports of about 270,000 units

Q3 FY23–24 saw total sales of 501,207 vehicles, with net profit rising over 33% year-on-year

Retail sales in Q3 were higher than wholesales, with discounts of INR 23,300 per vehicle

Maruti Suzuki Financials

Revenue and Net Profit: In FY23, Maruti Suzuki witnessed a YoY increase of 33.10% in revenue, reaching Rs. 1,17,571.30 crore, with a net profit of Rs. 8,211 crore, marking a 111.65% YoY increase.

Profit Margins: Operating Profit Margin (OPM) and Net Profit Margin (NPM) improved in FY23, standing at 9% and 6.83%, respectively.

Return Ratios: Return on Equity (RoE) and Return on Capital Employed (RoCE) showed improvements in FY23, reaching 13.28% and 16.02%, respectively.

Debt Analysis: The Debt to Equity ratio slightly increased to 0.02 in FY23, with a healthy Interest Coverage ratio of 70.37.

#StockMarket#Investing#TradingTips#FinancialFreedom#InvestmentStrategy#MarketAnalysis#StockPicks#PortfolioManagement#EconomicIndicators#StockResearch#RiskManagement#MarketTrends#DividendInvesting#TechnicalAnalysis#FundamentalAnalysis

3 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

youtube

Your Path to Wealth Starts NOW! 🚀 #shorts #success Your Path to Wealth Starts NOW! 🚀 #shorts #success #wealth #financialfreedom #motivation #successmindset #moneytips #financegoals #financialdiscipline #wealthbuilding #stayfocused #financialgrowth #smartchoices #selfimprovement Watch the full video here: https://www.youtube.com/watch?v=ttnTyREKQD8 via Online Gravy https://www.youtube.com/channel/UC9v5UhrL5hYKZmu2hkgCWfQ March 28, 2025 at 12:15AM

#onlinegravy#financialeducation#financialfreedom#makemoneyonline#dividendinvesting#financialindependence#selfimprovement#realestate#Youtube

0 notes

Text

Sunday Spiritual Motivation: Start Your Week with Faith & Purpose

Sunday Spiritual Motivation: Start Your Week with Faith & Purpose https://www.youtube.com/watch?v=B-arKadiBB8 "Sunday Spiritual Motivation: Start Your Week with Faith & Purpose" Description: Need a boost of faith and positivity this Sunday? Let this quick dose of spiritual motivation uplift your soul and set the tone for a week filled with purpose, peace, and blessings. Take a moment to reflect, renew your spirit, and step forward with hope. #SundayMotivation #SpiritualInspiration #FaithJourney #motivation #Sunday via Rise And Shine Daily https://www.youtube.com/channel/UCoGV1IZTNNwYNOHicdgnjJg February 16, 2025 at 09:00PM

#makemoneyonline#dividendinvesting#dividendstocks#swingtrading#optionselling#wheelstrategy#tradingtips#stockoptions#income

0 notes

Text

“From a $140,000 loss in short-term trading to earning $20,000 per month in dividend income—this is my journey of transformation. Learn how I shifted my mindset, rebuilt my portfolio, and achieved financial freedom through dividend investing. Discover actionable insights to grow your passive income and avoid costly mistakes

#dividendinvesting#passive income#financialfreedom#stock market#investingtips#personal finance#DividendGrowth#wealthbuilding#FinancialIndependence#money management#investmentjourney#longterminvesting

1 note

·

View note

Text

LSE Dividend Stocks Insights On Dividend-Driven Opportunities

LSE Dividend Stocks present a compelling outlook for those following dividend trends. With a focus on high-yielding companies, this category offers a closer look at key players in the market. Explore the latest updates on dividend stocks and their significance in maintaining a strong market presence.

#LSEDividendStocks#DividendStocks#StockMarket#DividendInvesting#UKStocks#FinancialInsights#MarketTrends#DividendIncome#StockAnalysis#DividendGrowth

0 notes

Link

#bestdividendetf#bestdividendetfs#bestdividendstocks#bestetfsfordividends#bestmonthlydividendetfs#dividendetf#dividendetfportfolio#dividendetfs#dividendgrowthinvesting#dividendincome#dividendinvesting#dividendinvestingstrategy#dividendportfolio#dividendstocks#dividends#liveoffdividends#monthlydividendetf#monthlydividendetfs#monthlydividends#topdividendetf#topdividendetfs#topdividendstocks

0 notes

Text

Learn how to generate #passive #income and make money work for YOU. From earning interest to collecting dividends and renting out property, discover simple ways to earn without the daily grind. Start building your financial safety net today!

youtube

#passiveincome#financialfreedom#investing#makemoney#earningwhilesleeping#dividendinvesting#realestateincome#capitalgains#royalties#creativeincome#wealthbuilding#financialindependence#incomestreams#moneymanagement#personalfinance#investsmart#growyourmoney#sidehustles#earnmore#financialliteracy#banking#career#education#ipb#1lakhbankersby2030#indiabanegaskilledandemployed#Youtube

0 notes

Text

Introducing Dhanvikas ,where your financial dreams find their path to reality. As your dedicated investment partner, we're committed to delivering personalized solutions and expert guidance to help you achieve your goals. Let's embark on this journey together. Let's grow together

#Dhanvikas#Finance#InvestmentStrategy#WealthManagement#CapitalGrowth#StockMarket#FinancialPlanning#AssetManagement#ROI#PortfolioManagement#EconomicOutlook#DividendInvesting#FinancialFreedom#RetirementPlanning#PassiveIncome#ValueInvesting#Diversification#MarketAnalysis#InvestmentOpportunity#InvestmentEducation

1 note

·

View note

Text

Earning While You Sleep: Unlocking Wealth with Dividend Stocks

In the dynamic world of investing, the allure of earning money while you sleep is a concept that resonates with many. One strategy that aligns with this financial dream is investing in dividend stocks. In this article, we’ll explore the art of leveraging dividend-paying stocks to generate passive income and build a foundation for lasting wealth. Check out the treature trove Check out the…

View On WordPress

0 notes

Text

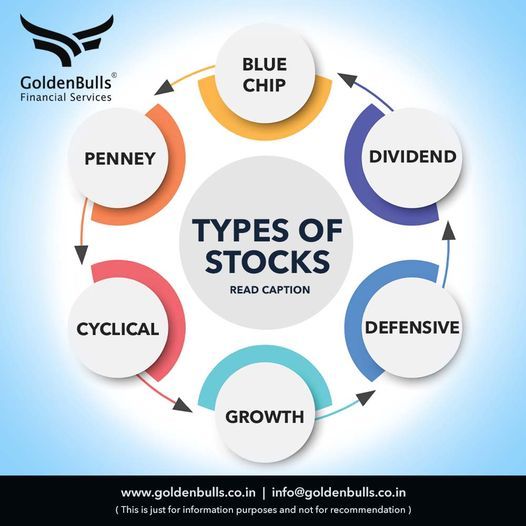

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Text

How dividend investing can help you escape financial struggles

1 note

·

View note

Text

Warren Buffett 3 Simple Rules On How To Invest For Beginners.

Warren Buffett 3 Simple Rules On How To Invest For Beginners. https://www.youtube.com/watch?v=B2_Z8z1a8AE Warren Buffett shares 3 core principles for stock market investing. They’re all very simple yet so important! Buffett generously explains each one in detail, hope you guys enjoy it and learn a great lesson. Warren E. Buffett is an American long-term investor, philanthropist, business tycoon, and the chairman & CEO of Berkshire Hathaway. He is considered one of the most successful investors in the world and has a net worth of over 100 billion dollars. Buffett was born in Omaha, Nebraska. He developed an interest in business and investing in his youth and made truly incredible stock market returns over his career. Share this video with a friend if you found it useful! Consider subscribing to the channel for videos about investing, business, stock market, managing money, building wealth, passive income, and other finance-related content! 🔔 Subscribe to our channel for expert guidance on managing finances, investments, and assets: https://www.youtube.com/@asset_informant ✅ For Business Enquiries: [email protected] ============================== ✅Recommended Playlists: 👉 Dividend Stocks: https://www.youtube.com/watch?v=zUP2FbiCNTE&list=PLNzc5UwzOZTxaGvhFj8shTcxlvc1eM7gj 👉 Stock Picks: https://www.youtube.com/watch?v=7vhIxh92Fzk&list=PLNzc5UwzOZTwmVwoZzI7KkbwKe0Z0uhIC 👉 Investing for Beginners: https://www.youtube.com/watch?v=HZ9HbObdyP8&list=PLNzc5UwzOZTx5aw-XhntekItyGTfR1lMi ✅ Other Videos You Might Be Interested In Watching: 👉 Smart Ways To Invest Your First $1000 | Investing For Beginners https://www.youtube.com/watch?v=HZ9HbObdyP8 👉 Ray Dalio's Top 5 Stocks for 2023 https://www.youtube.com/watch?v=Mx6Orudsz5k 👉 Top 3 Dividend ETFs to Invest In and Boost Your Portfolio https://www.youtube.com/watch?v=zUP2FbiCNTE 👉 Warren Buffet's Top 5 stocks for 2023 https://www.youtube.com/watch?v=zjNoDknxbVE 👉 Best undervalued dividend stock to buy in 2023 https://www.youtube.com/watch?v=_K20Su_Xyc4 ============================= ✅ About Asset Informant: We're Asset Informant, When managing finances and investments, Asset Informant is the leading source of expert-driven, actionable content on optimizing your finances and investments. With our help, you can easily and confidently navigate the complex world of finance and investments. We also provide content and information on asset allocation, tax strategies, retirement planning, debt management, insurance, and estate planning. Asset informants will also provide content that can help you with your short-term and long-term goals, such as saving for college or retirement. Our mission is to elevate the financial well-being of humanity. For Collaboration and Business inquiries, please use the contact information below: 📩 Email: [email protected] 🔔 Subscribe to our channel for expert guidance on managing finances, investments, and assets: https://www.youtube.com/@asset_informant ===================== #dividendinvesting #passiveincome #investmentstrategy #wealthbuilding #stockmarket #financialfreedom Disclaimer: We do not accept any liability for any loss or damage which is incurred by you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. Do your own research. Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in favor of fair use © Asset informant via Asset informant https://www.youtube.com/channel/UCj1XPhaWjBUMRAgy-EOko0w July 05, 2023 at 10:51PM

#personalfinance#Assetinformant#dividendinvesting#passiveincome#investmentstrategy#wealthbuilding#stockmarket#financialfreedom#aiinvesting

0 notes

Text

youtube

The 'Three Times Rule'_ Is Your Lifestyle Are you tired of trying to "Keep Up with the Joneses 🛑" and feeling stuck in a cycle of overspending? Let’s talk about breaking free and focusing on your own path to financial freedom! 💸 In this video, I share practical advice on avoiding lifestyle inflation, managing your money wisely, and building a secure future without the stress of debt or unnecessary expenses. Want To Learn How To Make Money Online? It’s all about making smarter choices—there’s too much sauce online to be broke! 🌟 Join the "Online Gravy" community as we focus on giving you simple, step-by-step tips to take control of your finances. From using the three-times rule to tracking your spending and automating your savings, I'll show you how to create a life of financial stability while staying grounded in your goals. Remember, true wealth isn’t about showing off—it’s about living life on your own terms. Don’t let social media or the latest gadgets dictate your happiness. Take charge of your financial journey today and be part of a movement that’s helping regular people like you achieve success, one step at a time. 💪 Drop a comment below, share your goals, and let’s build that Online Gravy together! 🚀 #frugalliving #lifestyleinflationtrap #lifestyleinflationtips #financialeducation #financialfitness CHAPTERS: 00:00 - The Allure of Keeping Up With the Joneses 02:09 - The Three Times Rule: Avoiding Lifestyle Inflation 05:45 - Practical Tips for Financial Stability 08:02 - Importance of Budgeting and Saving 08:45 - Finding Contentment Amid Excess 09:27 - Your Financial Journey: A Marathon, Not a Sprint via Online Gravy https://www.youtube.com/channel/UC9v5UhrL5hYKZmu2hkgCWfQ March 27, 2025 at 08:52PM

#onlinegravy#financialeducation#financialfreedom#makemoneyonline#dividendinvesting#financialindependence#selfimprovement#realestate#Youtube

0 notes

Text

Sunday Morning Spiritual Vibes: A Journey Within

Sunday Morning Spiritual Vibes: A Journey Within https://www.youtube.com/watch?v=SE4rwgp7D6E Immerse yourself in the serene world of spiritual philosophy with "Sunday Morning Spiritual Vibes: A Journey Within." In this enlightening 5-minute video, we explore the essence of Sunday mornings as a sacred time for reflection and inner peace. Join us as we delve into mindful practices, uplifting affirmations, and profound insights that inspire gratitude and personal growth. Whether you seek to deepen your spiritual understanding or simply enjoy a moment of tranquility, this video offers a perfect blend of calming visuals and soothing sounds. Like and share if you find inspiration in this journey within! #SpiritualVibes #Mindfulness #SundayMorning #InnerPeace #Philosophy #personalgrowth via Rise And Shine Daily https://www.youtube.com/channel/UCoGV1IZTNNwYNOHicdgnjJg February 16, 2025 at 08:00PM

#makemoneyonline#dividendinvesting#dividendstocks#swingtrading#optionselling#wheelstrategy#tradingtips#stockoptions#income

0 notes

Text

Understanding Dividend Stocks: A Key To Consistent Returns

Dive into the world of dividend stocks and learn how companies in sectors like utilities and finance offer regular payouts to shareholders. This blog breaks down the concept of dividend yield stocks, explains their advantages, and highlights how consistent dividends can provide financial stability.

1 note

·

View note