#5. Cash Home Buying Company

Explore tagged Tumblr posts

Text

Sell Your Home Quickly: The Benefits of Cash Home Buyers in Birmingham

If you're looking to sell your property fast and hassle-free, working with cash home buyers in Birmingham could be the perfect solution. Whether you’re facing financial challenges, relocating, or just want to sell your house quickly, cash home buyers offer a fast and reliable alternative to traditional property sales. In this blog, we’ll explore the benefits of choosing a Birmingham property buyer, and how they can help you secure the best cash offer for your house.

A cash home buying company specializes in purchasing properties directly from homeowners, often in as-is condition, allowing you to skip the lengthy process of repairs, viewings, and waiting for mortgage approval. With the rise of expert property buying companies, you can sell your property online and receive a fair cash offer in just days. This makes selling your property quickly more accessible than ever before.

Discover why working with cash buyers for UK homes is becoming the go-to choice for many homeowners. We’ll cover how these companies provide a seamless experience, ensuring you get cash for your home without the usual delays or complications. Ready to sell your home? Explore how a cash offer can help you sell your property fast and efficiently.

#1. Cash Home Buyers Birmingham#2. Birmingham Property Buyers#3. Best Cash Offer for House#4. Cash for UK Homes#5. Cash Home Buying Company#6. Expert Property Buying Company#7. Sell My Property Online#8. Sell Property Quickly#9. Quick Home Sale Birmingham#10. Fast Cash Property Sale#11. Sell Your Home Fast#12. Property Buyers in Birmingham#13. Sell Property As-Is#14. Cash Offers for Homes#15. Fast Property Sale#16. Sell House Fast Birmingham#17. Sell My House for Cash#18. Property Selling Tips#19. Property Buying Companies UK#20. Quick Home Sale Solutions

0 notes

Text

With the sudden collapse of the Soviet Union in the early 1990s, many of the former empire's resources were sold off to the highest bidder, and their $14 billion space shuttle program was no exception.

Seeking to recoup some of that eyewatering spend, in 1998, the "Buran" (Russia's answer to the American Space Shuttle) was offered up for sale on eBay for $10 million.

No serious offers were received - with most people assuming the listing to be a joke, until the New York Post confirmed the sale, with Russian authorities stating they "actually have two" if anyone is interested.

(Pictured: A later auction of a smaller scale Buran in 2005)

Sensing an opportunity, a group of Aussie entrepreneurs including Australia's first astronaut and the lawyer for Prime Minister Paul Keating offer to lease the shuttle from Russia, to put it on display in Australia during the Sydney Olympics.

After gaining permission from the Kremlin for the lease, in 1999 the Russian military briefly stops bombing Chechnya in order to dismantle the Buran, and it is placed on a barge to be shipped to Sydney on the (soon to be infamous for other reasons) Tampa shipping vessel at a cost of $5 million.

Once in Sydney, after a disastrous few months on display where crowds failed to flock to the shuttle exhibition featuring such compelling educational offerings as "activities is to assist in the development of issues of nutrition and hygiene at home" (an actual quote from their website) - the leasing company declared bankruptcy and washed their hands of the space shuttle completely.

The Buran Gift shop where you could buy soviet space ship themed football jerseys, in case you needed one of those

One of four people listed on the lease, described as a business partner of the Prime Minister, also claims he never knew he was a director of the company, which went on to cause a lot more problems.

This whole debacle presented a slight issue for the cash strapped Russian authorities, who had now only been paid $100,000 for the 9 year lease of the shuttle instead of the $600,000 they were owed. Eventually the decision was made to abandon the once $1 billion Soviet pride and joy in a Sydney carpark, where it resided for a year under a small tarpaulin.

Failed attempts to be rid of the shuttle included a 12 day auction hosted by an LA radio station, where listeners were offered the chance to buy the shuttle for $6 million, however all bids turned out to be pranks and the shuttle remained.

Multiple attempts were also made to sell the shuttle to Tom Cruise, with the exacerbated movie star's representatives repeatedly telling the insistent traders that he was not interested in owning a Russian spaceship.

Eventually a Singaporean group dismantled the shuttle and shipped it overseas, however Russian authorities soon reported they once again had been failed to be paid for the lease. Singaporean representatives responded that they definitely had paid for the shuttle, and that they simply couldn't remember when or how much was paid.

Representing the Russian government, Lawyer Suhaila Turani told the Wall Street Journal “I feel sorry for the Russians. They’re good in space, but they’re very naive in business.”

For a time the shuttle was abandoned in the storage yard of event company Pico, with the company owner telling the Wall Street Journal "I just want this thing out of my life" after three years of being stuck with it.

A few years later the shuttle was found by German journalists dismantled in a junkyard, and it was then bought and shipped to Germany to be put on display a museum, so all's well that ends well (except they dropped it from a crane while trying to set it up, but it polished up okay).

7K notes

·

View notes

Text

I WANNA RANT ABOUT SOMETHING THAT HAPPENED AT WORK TODAY

I GOT SCOLDED FOR HAVING BASIC HUMAN EMPATHY AND THIS JOB SUCKS

if you do not wish to have that negativity on your dash, then keep scrolling on by 😌 and if you're worried, don't be, I'm fine and everyone is fine, it ain't that bad

NAH IT'S ACTUALLY REALLY BAD

I just didn't wanna worry people who didn't have the energy to read an essay

I work as a tour guide and we have a strict no-free-tours policy. Everyone riding "must" buy a ticket. The thing is our tours are outrageously expensive, like almost $20 per person.

The tours are outside and in a big park, and it's very humid today. There was a little kid, no older than 5 who fainted from heat stroke today. Their parents asked me for a ride back to the entrance so they could get home as soon as possible (and get to the air conditioned welcome center).

With no hesitation I tell them of course and offer them a free ride back to the welcome center. I don't even ask them if they have tickets or not because it does not matter, they needed help, and there was plenty of space on the bus to bring them back home.

Because I do this, my manager calls me into his office, he's very mad, and he scolds me for giving those people a free ride.

like??? WE HAVE A VEHICLE, THAT CAN BRING THEM TO A SAFER PLACE VERY QUICKLY

I DO NOT CARE ABOUT COMPANY POLICY, HUMAN SAFETY COMES FIRST

If someone needs help, and I can help them, I will not try to sell them a ticket, not that I even have a cash register with me to do so.

just. what the hell

have some empathy.

The kid is definitely alright by the way, I got them their free ride and into the air conditioned building, so no need to worry. I'm just upset

2K notes

·

View notes

Note

Caitriona didn’t mention Tony. Seems the ‘reporter’ utilized Google. 😂

Dear Didn't Mention Anon,

It's always a sarcastic pleasure to see tension climbing for literally nothing across the street. Some other Brazilian Anon, just like you (best way to convey your thoughts was, in proper English, 'the reporter used Google' - not the Portuguese semantic calque 'utilized'...), even speculated we must be hiding this shattering press article, since no reaction and/or discussion happened as of yet.

Brazilian Anons would certainly have made better use of their time and grey cells if they simply presumed that in another time zone people really have other (simple and boring and prehaps even endearing) things to do. While Brazilan Anons were probably sleeping or having breakfast, someone else was just about to end a shorter Friday work schedule, buy Chinese takeaway on the way home, have a light lunch, take out Baby the Lab for a short pee stroll around the block. And mercifully collapse in flannel sheets for a blessed siesta, waiting for the first snowy day of the year. But enough about me, Anon, you are not here for this: you are here for that article - https://www.mindfood.com/article/caitriona-balfe-looks-ahead-to-life-after-outlander/

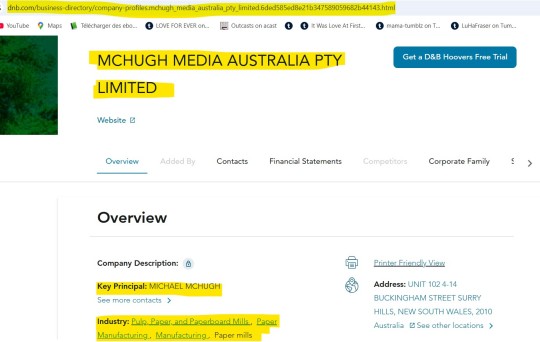

It is also an amusing factoid that C's PR and/or *** very often seem to favor second-tier media outlets in order to keep spreading around the Narrative Word. Pinoy regional gazettes, borderline clickbait/gossip websites and now Mindfood, a vanity/hybrid press magazine based and edited in New Zealand and Australia by McHugh Media Group, which main activity, at least in Oz, is (🥁🥁)...paper mills and paper manufacturing - of course.

[Source: https://www.dnb.com/business-directory/company-profiles.mchugh_media_australia_pty_limited.6ded585ed8e21b347589059682b44143.html]

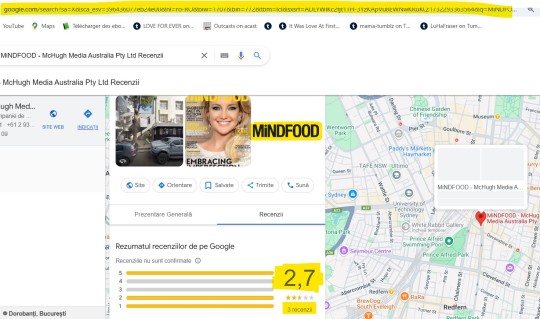

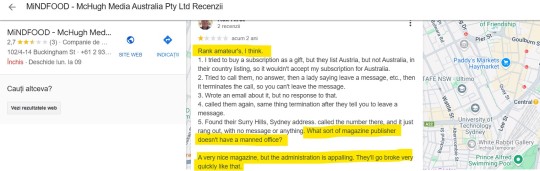

Within that group, the Mindfood project is but an apparently lucrative subsidiary ('integrated media company', LOL), despite some dire client reviews ( 2 out of a resounding global 3, how odd!) on Google:

'Rank amateur's' [sic!] (...) What sort of magazine publisher doesn't have a manned office? (...) They'll go broke very quickly like that.' '(...)pretty shabby treatment of a customer.'

😱😱😱

But let's assume I am twisting again the plot (I don't, I do not need to). Let's assume I am evil like that and I give credence to two very negative (but brutally clear, too) user reviews only. Perhaps I am wrong, you might say. So, let's also have a look at some company figures, shall we?

Nay contest, it's them.

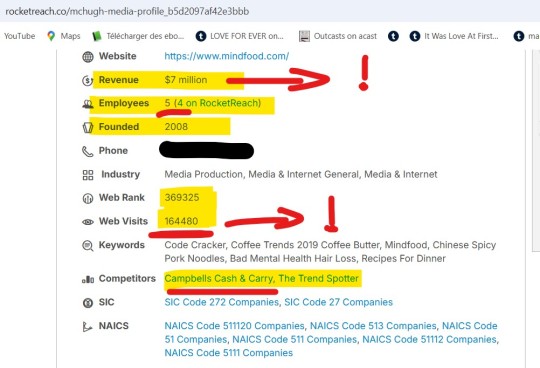

[Source: https://rocketreach.co/mchugh-media-profile_b5d2097af42e3bbb]

Now, my lovelies, how can I put it without offending anyone? What we are looking at, here, is a small company with 5 (five) employees, few web hits (164.480 hits is ridiculous, when we are talking about press/media!), but a comfortable revenue (7 million AUD - about 4.5 million USD). May I remind you that a company's revenue is roughly its gross income, before subtracting operating costs, wages and taxes. But given they have only 5 employees, wage expenses & operating costs must be marginal and taxes are rather friendly in New Zealand, where their HQ is (to the point there was, three years ago, an ongoing debate in order to determine if the country was a tax haven: https://thespinoff.co.nz/business/06-10-2021/is-nz-a-tax-haven-for-the-rich-and-dodgy-the-pandora-papers-reignite-the-debate), you do the maths. Therefore, how can this rather substantial profit be explained, otherwise than by a very friendly editorial policy towards paid and/or sponsored content and product placement galore (Lifestyle, anyone)?

Its immediate competitor is a supermarket chain in-house bulletin/leaflet, Campbell's Cash & Carry. The kind of thing that always lands somehow in your shopping bag and then directly in the kitchen trash:

This is enough to show their real reach and place on the market, I believe.

All this for what, Madam Knife? All this to say that paper is probably paid by the talent's PR/***. I will not go into useless detail, because there is very few new-ish/relevant information (e.g.: 'With a long season seven concluding in January, the Outlander epic will close out within the next 18 months, taking the episode total to 101. '). But I will, gleefully even, point out two tiny details, all of you patiently read this long rant for, in fact.

As always, McGill doesn't even deserve a quote, only reported speech that is, in fact, snowballing prior reference (this is exactly where copy/paste comes in very handy, you see). And a clumsy one at that, sugar on top - hence the copy/paste certainty and this is so, so rude, I could cry (nope...):

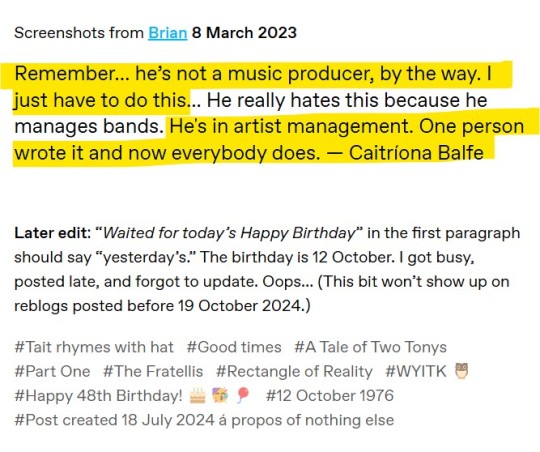

But... but... such a nice, thoughtful touch for her Stans, who spent DAYS in a row proving he was not a music producer, but the Night Media Manager (and I have to say, delivered actual quotes - still No Face, No Name, No Number, though):

[Tait rhymes with hate, alright - I know, darlings, it pisses you off to no tomorrow 😉.]

Copy paste/Goes to waste. Finally, I had to snort (not a pretty, nor feminine sight) when I realized Mindfood takes its readers for complete, amnesic idiots:

So she became 'a mother in August of 2021', but she did film 'the sixth season of the drama while pregnant'. Granted, this paper is written for casual OL viewers, the kind of people who did find C interesting/beautiful/clever/extraordinary, but who don't remember her name when prompted on candid camera, for example. The kind of superficial audience who will never do the maths and never question the fact a pregnant actress was filming beautiful (but steamy) scenes with her... ahem... with her co-star she is now 'consciously uncoupling' from.

ROFLMAO.

Not even sorry for the length, Anon. There you go, let's say good bye with a merry little song - I am told I have the best tunes on Tumblr (SMH). Really, Mindfood's client could have curated and tailored better the Retconning Operation - but perhaps even PR has trouble taking that man and his narrative role seriously?

youtube

40 notes

·

View notes

Text

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities.— Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily.

. . .

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper.

That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”This trend is massive.

. . .

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

. . .

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street

.”It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

. . .

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

. . .

Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

. . .

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

To address the housing shortage and bring down prices for renters and homeowners alike, the Harris campaign’s plan calls for a historic expansion of the Low-Income Housing Tax Credit (LIHTC) and the first-ever tax incentive for homebuilders who build starter homes sold to first-time homebuyers. Building upon the Biden-Harris administration’s proposed $20 billion innovation fund, the campaign proposes a $40 billion fund that would support local innovations in housing supply solutions, catalyze innovative methods of construction financing, and empower developers and homebuilders to design and build affordable homes.

To cut red tape and bring down housing costs, the plan calls for streamlining permitting processes and reviews, including for transit-oriented development and conversions. The agenda also proposes making certain federal lands eligible to be repurposed for affordable housing development. Collectively, these policy proposals seek to create 3 million homes in the next four years.

The campaign plan cites the Biden-Harris administration’s ongoing actions to support the lowest-income renters, including its actions to expand rental assistance for veterans and other low-income renters, increase housing supply for people experiencing homelessness, enforce fair housing laws, and hold corporate landlords accountable.

Building upon these commitments, the Harris agenda calls upon Congress to pass the “Stop Predatory Investing Act,” which would remove key tax benefits for major investors who acquire large numbers of single-family rental homes (see Memo, 7/17/23), and the “Preventing the Algorithmic Facilitation of Rental Housing Cartels Act,” which would crack down on algorithmic rent-setting software that enables price-fixing among corporate landlords.

To make homeownership attainable, Vice President Harris’s proposal would provide up to $25,000 in downpayment assistance for first-time homebuyers who have paid their rent on time for two years. First-generation homeowners – those whose parents did not own homes – would receive more generous assistance.

Vice President Harris’s economic agenda also includes proposals to lower grocery costs, lower the costs of prescription drugs and relieve medical debt, and cut taxes for workers and families with children. The plan would restore the American Rescue Plan’s expanded Child Tax Credit, which provided up to $3,600 per child for low- and middle-income families for one year before it expired in 2022, and would enact a new $6,000 tax credit for families in the first year after their child is born. These measures to reduce expenses and boost household income would also improve housing security for low-income families, who often face impossible tradeoffs between paying rent and affording food, medical care, and other basic needs.

-----

Sorry for the length, but I thought this was really important.

26 notes

·

View notes

Text

Daily update post:

Two independent terrorist attacks against Israelis took place over the last 24 hours. Yesterday, a Hamas terrorist stabbed in the back a 49 years old Israeli reserves soldier, who stopped to buy something at a shop in a gas station, on his way home. The soldier turned around and, despite being injured, pursued the terrorist, shot and wounded him. The terrorist was later arrested, he had a permit to work in Israel. In the second one, a terrorist started shooting at civilian vehicles passing by, and ended up injuring a 27 years old woman. Thankfully, a baby who is 1.5 months old, who was in the car with her, was not injured, despite at least 10 bullets being retrieved from her vehicle. The IDF is searching for the terrorist.

Israeli soldiers have found and confiscated suitcases with 5 million shekels in cash from the home of a senior Hamas terrorist in Gaza. I want everyone to understand that this sum is currently 1,369,507 $ (yes, I checked with professor Google), and that most Israelis will never see that kind of money. I imagine a majority of "privileged" westerners never will, either. And this kind of money was just lying around in this terrorist's home...

The IDF has exposed and is now in control of what is likely the biggest Hamas terror tunnel. It is about 4 kilometers long (roughly 2.5 miles), and it is wide enough for vehicles to comfortably drive through it. Israeli soldiers have also found footage showing Muhammad Sinwar, the brother of Hamas leader in Gaza Yahya Sinwar, doing exactly that, in addition to footage showing the construction of this terror tunnel...

youtube

I don't post every single day about the Israeli soldiers injured and killed in Gaza, because the truth is that it has become technically difficult and emotionally painful to keep track. Yesterday, five more soldiers were confirmed as killed, one of them having been injured last week, and he has now succumbed to his wounds. So far, 128 soldiers were killed in Gaza.

Last month, there was a cyber attack on Israeli hospital Ziv, trying to derail its medical activity. Israel has confirmed today that it has traced Iran and Hezbollah as responsible for the attack. If we count the cyber war (and in terms of requiring manpower and resources, as well as in terms of the potential loss in human life, there is no reason not to count it), then Israel has been defending its citizens on no less than six fronts.

The Iran-funded terrorist Houthis in Yemen have been attacking ships unconnected to Israel, for simply passing through territory close to Yemen. A lot of shipment companies from around the world have announced they will not be sailing through this area for at least a time, which means they would have to sail all around Africa, to pass goods between the far east and the western world. This will hurt the entire world's economy, as shipment prices are expected to rise (think of the Evergreen ship blockade of the Suez Canal... these ships will not be trying to get anywhere near the canal. Symbolically, Evergreen is one of the companies announcing they will no longer sail through the Red Sea due to the threat of the Houthis). This will financially hurt so many countries, including Egypt (which operates the Suez Canal), the US and China (this means Iran's move has created a rare moment when American and Chinese financial interests align). The biggest question is, when will the world fully take in the fact that the biggest threat to world peace is the Islamist regime in Iran, and start acting accordingly?

This is Haj Amin al-Husseini.

Out of all of the people who helped shape the Israeli-Arab conflict, he's probably the most influential one, an antisemite, a Nazi collaborator, and a believer in pan-Arab nationalism (he didn't want to fight Jews to establish a Palestinian state, he wanted to exterminate the Jews and establish a greater Arab Islamic state, a new chaliphate, if you will. There is a FASCINATING docu series in Israel, dedicated to the Arab and Muslim leaders who have fought Jews and Israel, interviewing intelligence agents from many countries. The ep dedicated to al-Husseini is unbelievable, and I wish everyone could watch it. It's available online, but sadly, only in Hebrew. The truth is, I don't think anyone can understand the Israeli-Arab conflict without understanding the role of al-Husseini in it, and how different things could have been, if only the more moderate Arab leaders in the Land of Israel at the time had managed to squash his influence, or if the British hadn't tried to "tame" him by appointing him to the position of Jerusalem's grand mufti.

This is the Belchassan family, 31 years old Yuval and Ofir, and their two years old son Tai.

On Oct 7, Yuval left Ofir and Tai to hide in the bomb shelter, and went out to fight off the Hamas terrorists. He and his friends saved their kibbutz, but now, as Ofir is due to give birth to a daughter, they have no home to bring her back to.

(for all of my updates and ask replies regarding Israel, click here)

#israel#antisemitism#israeli#israel news#israel under attack#israel under fire#israelunderattack#terrorism#anti terrorism#hamas#antisemitic#antisemites#jews#jew#judaism#jumblr#frumblr#jewish#Youtube

104 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

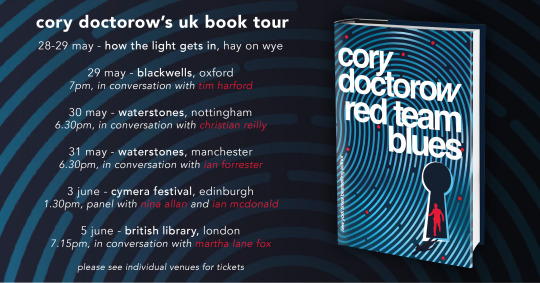

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

Moving update

I'm grateful to the folks checking in on me and @crowtoed and thought I'd drop a quick update.

We're almost done putting all non-essentials in storage. The many bins are an investment in case we have to do this again. (I have already started researching shipping containers for an overseas move.) I'm going to buy storage unit insurance this week because I have more valuables stowed away than standard homeowners will cover.

My storage unit is almost the same size as the moving truck, which makes it easy to guage if I have to purge/store anything that won't fit. I'm going to hire the biggest trailer from upack.com when it's time to leave. The prices are amazing - less than $4k to move to Connecticut.

The Florida realtor (a condo expert) is viewing my place tomorrow, and with her advice, we'll start on final repairs/refreshes (this place is 23 years old, about when things like windows and tile get rather iffy). My mother graciously gifted me money to cover the majority of the fixes. This move would be a lot harder without her help.

Mom is also letting us stay short-term in her MiL suite a few towns over, so we can sell my condo asap. That means we don't have to worry about timing the purchase of the new house with closing on the old. Plus, I should have a few paychecks rent-free I can sock away / apply towards mutual aid.

We're hoping the condo sells by June or so. Once that happens, I'll use some of the funds towards old debt to nudge my credit rating ever closer to 800 (it's 778 rn, a multi-year project as I used to be in the 400s). Most of the rest of the money will be earmarked for a generous down payment on the new home.

We're still looking in Connecticut and have a realtor there as well. If it's possible, we can afford to fly up a few times to check out houses. The realtor told us our budget for what we want (1500sq ft or larger) is totally doable. The housing market there is weirdly reasonable.

Work is incredibly kind and has said if I need more than 2 weeks to move, I can take whatever time I need. I am fully remote now and blessed to be part of such a progressive company.

We still have some household and personal things to sell, but it's more out of "I no longer like/need this" than an urgent need for money. But thank you to everyone who has offered cash. It means so much to us to have such a strong safety net. If this happened even 5 years ago, we'd have been up shit creek.

Once we close on the new house, we'll drive up asap to move in. This is when we'll know our route and we'll connect with folks along it who have offered to be pitstops for us and the cats. The moving truck will meet us there in 5-7 business days after we leave Orlando.

My HRT Rx also got renewed for 6 months, and with my current stash + a little rationing, I shouldn't have any interruption with my shots, even if pharmacies start refusing me come July.

We're hoping to be all settled in the new home come October, but are dependant on the housing market. But we're stacking as many chips in our favor as we can.

Again, thank you, thank you to everyone who has reached out. I'll update again when something major changes.

107 notes

·

View notes

Text

Strange things are happening in Russia these days. In early October, the country inked a deal to sell chickpeas to Pakistan in exchange for mandarin oranges. A few weeks later, the Russian government advised international participants traveling to the southwestern city of Kazan for the BRICS summit to bring cash in U.S. dollars or euros, as major credit card companies such as Visa and Mastercard have suspended operations on Russian soil since the full-scale invasion of Ukraine began in 2022.

During the BRICS summit, a Chinese official mentioned that Russia is facing “serious difficulties” with paying its membership fees to the Shanghai Cooperation Organisation; the official blamed Western sanctions. As if this were not enough, the comment came on the same day that the Kremlin had to cancel bond auctions to issue nearly 600 billion Russian rubles (around $6 billion) in sovereign debt for lack of buyers.

These examples might sound trivial, but taken together, they highlight how all might not be going hunky-dory for the Russian economy—contrary to the Kremlin’s claims that Western sanctions are ineffective and Russian GDP growth is booming. Like a cash-strapped household pretending that all is well while quietly burning through emergency savings, Moscow is trying to project economic normalcy by tapping into its vast financial buffers.

This is not a sustainable strategy: Without fresh inflows of cash, even the largest of savings only last for a while. Russia could soon struggle to preserve costly social stability at home while waging its expensive war against Ukraine.

To understand Russia’s economic troubles, looking at inflation is a good starting point. Official statistics are fishy, but even without consulting them, it’s easy to see that price growth is an issue in Russia. First, the ruble has lost one-third of its value against the U.S. dollar since early 2022, inflating the price of imports and therefore fueling inflation.

Second, Russian firms are struggling to hire because of the combined impact of a shrinking population; a high death toll from the COVID-19 pandemic; and the war in Ukraine, which has killed or seriously wounded 2 percent of Russian men between the ages of 20 and 50, and is causing an exodus of highly skilled workers. To attract workers, Russian companies are raising wages, again fueling inflation. Third, the Kremlin believes that it can buy social stability by showering people with generous handouts—another inflationary factor.

Central bankers like to raise interest rates when inflation is high, seeking to tame price growth by weighing on demand. The Central Bank of Russia has applied these principles to the letter; since mid-2023, it has gradually increased its key rate to a whopping 21 percent. Russian companies are feeling the pinch. This week, Sergei Chemezov, the CEO of state-owned defense conglomerate Rostec, declared that high interest rates are eating into profits so much that most Russian industrial firms could soon go bankrupt. But there is a catch: Because of its obsession with social stability, Moscow is working to negate the impact of high interest rates on the population.

A recent scheme for subsidized loans provides an example of this. Since 2020, millions of Russians have signed up for real estate loans at a cheap rate of 8 percent, while the government has reimbursed banks for the difference between that face rate and the 20 percent or more that higher central bank rates should command. That policy might well boost economic growth in the short term, but it comes with high costs: Home prices in Russia have tripled since 2020, suggesting a real estate bubble that could soon burst. The scheme also comes with a roughly $5 billion price tag for the Kremlin.

Russia’s bigger fiscal picture looks dire. On the expenses side, war is costly, and defense spending keeps rising to record highs: Military expenses will make up 40 percent of Russia’s public spending in 2025, for an eye-popping $142 billion. (National security and “classified” expenses will absorb another 30 percent of Russia’s federal budget.) Russia is also splurging to preserve social stability. In the next six years, the Kremlin plans to spend $431 billion on all sorts of social projects, including sending children to summer camps in occupied Crimea, building brand-new student campuses across Russia, and raising the minimum wage by no less than 10 percent per year.

The revenue side of the fiscal balance does not look any better. Excluding dividends, Russia’s state-owned gas giant Gazprom used to provide around 10 percent of the Kremlin’s fiscal revenues. Such largesse is over: After losing access to the European market, Gazprom recorded a $6.8 billion loss in 2023, making it impossible for the company to transfer money to state coffers. (Gazprom sent $40 billion to the Russian Ministry of Finance in 2022.)

Things could soon get even worse. In a few weeks, a deal allowing the transit of Russian gas to Europe via Ukraine will expire, cutting down Moscow’s remaining gas exports to the European Union by half and Russian total gas sales by one-third—for an expected loss of $6.5 billion per year for Gazprom.

Russia only has a few options to find new income streams. Sustained economic growth would raise fiscal revenues through higher taxes, but labor shortages mean that this is not a credible plan. A few weeks ago, the deputy governor of Russia’s central bank acknowledged that “available production capacity is depleted.” With social stability a constraining factor, Moscow can only apply fiscal Band-Aids.

Current plans include imposing higher taxes on wealthy households—for a mere $1.5 billion a year, or less than 3 percent of total income tax receipts—and raising tariffs on Chinese electric vehicles. It is not clear what Beijing will think of these protectionist measures in light of the supposedly unlimited friendship that binds Russia and China; Russian President Vladimir Putin has previously called U.S. tariffs on Chinese electric vehicles “unfair.”

With ever-rising expenses and dwindling revenues, Russia is now posting an annual fiscal deficit of nearly 2 percent of its GDP. For most economies, this is not an issue. Such a small shortfall can typically easily be financed through debt issuance. But Western sanctions have turned Russia into a pariah on the global financial scene, making it impossible for it to tap global debt markets. Moscow’s plan B was to tap domestic bond markets, but things are not going well on this front, either. Despite having to cancel auctions this month for lack of buyers, the Kremlin has penciled in issuing $25 billion in domestic bonds by the end of the year. So far, it is not getting anywhere.

With debt issuance out of the equation, Russia is now forced to turn to plan C: tapping into its savings. On paper, such a strategy could work for a while thanks to the vast holdings that Moscow accumulated in its National Wealth Fund (NWF) in the 2010s. However, these savings are now drying up: The liquid part of the fund has shrunk by more than half since the start of the war in Ukraine, to just $54 billion in September. Last year, the government stopped saving money in its NWF. Moscow is now resorting to selling the portion of its NWF reserves that it holds in gold; the fund’s gold reserves have shrunk by around half, or about 262 tons of gold, since early 2022.

Russia is depleting its rainy-day holdings, and this cannot last forever. Even assuming high global oil prices, the Kremlin’s 2024 budget includes a further $13 billion drop in NWF holdings this year, or about a quarter of the fund’s liquid reserves. Looking ahead, the NWF’s liquid reserves cover just around a year and a half of budget deficit. This assessment might prove optimistic: It assumes that official fiscal data is trustworthy—some experts believe that Russia’s fiscal deficit could be closer to 5 percent of its GDP—and that the global economy won’t suffer from major shocks. If global growth were to tank, the Central Bank of Russia estimates that the NWF’s liquid reserves could vanish in less than a year.

In September, Kyrylo Budanov, Ukraine’s defense intelligence chief, told attendees at a conference in Kyiv that Russia will try to force an end to the war in 2025, when the Kremlin could start facing genuine economic problems. This analysis might not be too far from the truth—and it will be useful to keep it in mind as calls for negotiations between Kyiv and Moscow grow louder every day.

4 notes

·

View notes

Text

We may have to move because finances, and I’m very anxious.

When we moved in to this place, rent was 1800 or 1850/month (honestly can’t remember). This was mid-2020. We have lived here for 3 years, and rent has slowly increased, I want to say it was 1950 our second year and 2100 this year. My husband pays the rent in full so I really don’t remember.

We will be here for 4 more years for my med school, so we were talking about do we try to buy, do we rent, etc. Initially we got excited about buying, but lo and behold we cannot find any place even 30 min+ outside of town that is actually doable… nothing that could work is under $400k (what we can currently afford a full 20% down payment on), and even condos are in the $450-500k range. We could put less down and then have PMI, but estimates for monthly cost are like $3000-3500/month depending on closing costs, APR, etc. Which we feel like we can’t do financially. So back to renting.

We don’t know how much they will ask us for rent… so we were looking around. The townhouse next to us was just rented for $3000.

That is a 40% increase from our current rent.

And given that we would be renting and not putting equity in a home, Rob is adamant that if they are asking 3k, we WILL find a cheaper place.

If the idea of moving my family 2 weeks before school starts didnt terrify me enough, I don’t even know where we can afford to live anymore. I found one place that is just over half this size but still has 3 bedrooms (so we can each have our space- rob works from home and I have school…) that is approx what we pay now, but it’s in an apartment complex proper with no garages, and my car doesn’t reliably start in the winter if it’s parked outside overnight. 🙃 The next cheapest is $2750/month, but it already has 4 applications in which means it’s gonna be gone before we know if we need to move. It’s also further away from campus but I could still make it work.

The issues:

The university here is admitting more students than they can house. There was some mad dash for who could live in dorms and apparently everything was gone within like 5 min. TONS of college kids and grad students need housing now so there is a huge demand for rentals thus driving prices up. FWIW, the people who are renting the place beside us are college kids.

People. Keep. Moving. Here. First it was people trying to get away from ridiculous housing prices in CA, and now it’s from the east coast. I can’t blame them for moving to find affordable housing. But what they are doing is driving demand up and prices up- people will make a first offer in a house at 10-20% higher than asking IN CASH. Locals cannot afford it. The newcomers “affordable housing” is creating the problem they are trying to get away from in a new area. They are displacing their housing insecurity onto us. Who is to blame? Greedy property management / development companies, probably.

Three weeks ago my anxiety was SO low. I was feeling great overall, sleeping super well. Now I literally cannot sleep because of just the potential of this housing insecurity and I am so angry.

FWIW: median family income is ~63k, and we have state income tax. Mean income is much higher at $85k because of higher outside earners pushing this up. How is a typical local family of 4 supposed to afford 3k housing. How are they getting approved for that? They aren’t. Even 2 beds are going for ~2300. Can a family making 63k even get approved for THAT?

This all makes me so sick.

21 notes

·

View notes

Text

Back from my Scandi vacation!

Felt like I took it for granted leaving my brain back in SG and letting Ax do the planning and the navigating. I brought my spirits though! Spending my day off today looking back at the trip which was such a great use of my time. Really appreciating this extra day off after my vacation.

Some tips for Norway and Denmark travels first

1. It's cashless even in the small towns. Cash was more of a liability as it forced us to spend it all

2. Hotels cost as much as Airbnb for 2 pax so opt for hotels as there's guaranteed shampoo, soap, hair dryer, heating and laundry. Most of our airbnbs were missing soap or shampoo which we didn't bring any of, in order to travel lighter. The bnbs we stayed in were also commercialised houses so there's absolutely no feelings attached. Checking in and out would also be more convenient with hotels. We had to return one of our keys from a convenience store which wasn't open in the early morning, in time for our flight.

3. Groceries are marked down on Friday if they expire Monday. If you're in Norway, go to Kiwi or Coop for basic groceries as it seemed to be the cheapest. However, each shop will hv their own discounts (not standardised across the same chain). Eg. We went to a place with 40% discounts on Freia choc which was only available at a particular store.

4. Northern lights chase was the coldest we experienced. Basically, the guide said that if its frost on the floor, it's worse than snow as there's no insulation for your feet. Not the coldest real temperature but coldest we felt. Bring extra clothes and heatpack just in case. The bonfire didn't do anything for me because it's too cold. We went with GuideGunnar which updates its aurora sightings on a daily basis. These guys are crazy and would bring you as far as Sweden just to chase the lights so bring your passports along! They also offer a 50% off the next trip if you don't see it on the day.

5. There's no heat packs there so bring them from home.

6. In Copenhagen, we recommend the Copenhagen card. It's only 65USD for 24hrs and you get free transport, museum pass and boat rides. We only decided to get the card after our boat ride which cost about SGD25-30, which was already a quarter the cost of the card. In Copenhagen, checking of bus tickets was a regular thing.

7. Useful apps for riding public transport: Oslo uses Ruter, Tromsø uses Troms billet, Copenhagen uses Dot tickets. Ticket checking was not very often in Norway. We did not cycle as it felt too cold for more wind to hit our faces.

8. Skip Oslo if you dw to visit a city. We spent 3 nights there and it felt too long. We wanted to do our last minute shopping at Oslo but everything was expensive throughout the whole trip that we started to buy souvenirs earlier when we saw marked down prices. With one more day in Tromsø, we could've gone whale watching.

9. Take into account daylight savings from 29/10. You have 1 more extra hour to sleep but your days are much shorter. We slept a lot because of the cold, about 10hrs of sleep each day and it felt just right.

10. Personally I would have brought instant noodles as the food there isn't flavoured with the same umami as I'm used to. I would also bring a thermal flask there to enjoy my hikes even more, taking a comfortable and warm rest at the peak.

11. If driving, please remember to pay for parking. There's usually a machine to start your parking. Otherwise, the fine is 660NOK. Don't let the rental company settle it as it'll still be billed to you with an extra fee. We would also recommend full insurance since we aren't used to left hand driving and Norway is famous for its narrow roads (at least from Stavanger to Odda where we drove).

12. We used waze for driving and it seemed that speed cameras are only in tunnels but nobody was following the speed limit anyway.

That's about all of the suggestions Ax and I thought of!

Hope these suggestions come in useful for someone.

2 notes

·

View notes

Text

I play a lot of mobile games. I mean like A Lot. so I decided to say if some frequently advertised games are good or not.

Gardenscapes:

the ads are deciding. which is a shame because the game itself is really cute and fun. it's a standard match three bejeweled styled game with minimal micro transactions. the premise is that you fix up a garden you inherited or something and uncover the towns history and other cool stuff while following the interpersonal relationships of the folks you meet along the way.

10/10 worth playing

Homescapes:

again, the ads are deceiving.

the game is the same as gardenscapes except your butler and our protagonist Austin, (he's a super cute middle aged guy), finds out his parents are going to sell their house because it's getting on in years and a but run down.

he swears to fix up his childhood home so his parents won't have to sell it.

it's a super sweet story and I enjoy cleaning up and learning the history behind each room in the house and uncovering more about Austin's family.

10/10 worth playing

side note, the company playrix, the folks who made these 2 games, have been around for ages and even released a version of gardenscapes for the old ds. a little fun fact.

Manor Matters:

sticking to the same scope,

this game is a hidden object game that mixes homescapes with historical mystery. it's pretty cool and the puzzle panels aren't as cluttered as Mystery Case Files.

They're actually surprisingly practical and clean. though I would argue it makes it harder to find things as a result. it is timer based so I'm sure not everyone would like it.

in most cases, having to use energy to play the game is a big downside to most mobile games but here I feel it helps you take a break when you need it most.

recently they added match 3 to their bag so it changes between finding things and matching.

I like this change since I'm not as good at hidden object games as I used to be.

personally 8/10 but for some it may be a 5/10

I also would like to add that these three games have energy/lives involved in gameplay, however I've noticed that they only deplete if you fail to complete a level. that being said, it is still a mobile game so don't be surprised when you encounter coin eater levels that only seem to get easier after a million attempts. it is possible to play and beat every level you try without spending any money, you just gotta be patient.

also there's not a lot of ads that play in these games. I don't remember ever buying an ad free version and as far as I remember, viewing ads are optional

moving on to something else entirely

My Cafe:

it's a good time waster

if you ever enjoyed games like diner dash, you'd probably like this one. it's laid back, there's no pressure, you just fill cafe orders and sometimes you get stories and special events that shake up the play a bit.

lots of micro transactions and has special in-game currency that you're encouraged to buy. there's plenty of opportunities to earn them though.

6/10 it's enjoyable and a good time waster. sometimes I get the games music stuck in my head

Animal Restaurant:

I know this game made the rounds a lot in the ads. it's exactly how it looks. it's super sweet and cute and wholesome. you run a little restaurant and change out the decor to make more money and draw new customers in.

there are mircotransactions but it's very optional and tucked away in a separate menu you have to find

I really enjoy this one a lot 10/10

My Universe:

I've been seeing a lot of ads lately for this one.

I've been playing it for like maybe 2 years now on and off and it's a pretty decent game. the ads are just like the game, at least the ones I've been getting. though there is one that devates a bit but you just get a sort of compressed look at the gameplay loop, its not that different really.

it's the ad where you cut down materials and take it to one building to earn cash then move to another building to get a better tool to collect tougher materials.

I'd definitely recommend getting the ad free thing cause there's a lot of ads in this game. luckily it wasn't that expensive and the game itself was enjoyable enough to buy it

8/10 would play again, just not all the time

finally

Project Makeover:

I just picked this one up and started playing it. actually it's what inspired me to make this absurdly long post in the first place.

I finally caved after seeing the ads for it everywhere and like a million times so I took a look at it.

If you ever played on the barbie website as a kid and like Loved it, this is the game for you. this is Girl Game to the max, well maybe not that much but it's very much up there.

if you like reality TV or fake reality TV, that's a bonus too.

it very much has that kind of vibe and it is a lot sweeter and much more endearing that the ads make it out to be. I definitely feel like if the game was marketed for what it really was, then maybe it might be more popular. especially since the early 2000s style of internet games is kinda coming back. at least I feel that way.

it's a match 3 game wrapped around a fashion show drama where you clean people up and tidy a room for them to feel better in. very nice stuff.

as always, it has in game currency and micro transactions, however I haven't encountered any ads yet since I started playing like 2hrs ago. so I think that's pretty good.

for me it's a 7/10 but it could easily be someone's 10/10

ps.

I have played that weird murder grandma secret garden bs game. yknow the merge one that was one of the first to capitalize on lily's gardens weird ass ad style? it had a live action ad that had a known older female actor in it. my mind says Kathy bates but idk if that's right

anyway

i played a bit of it and the start of the game hooks you in with the mystery part, keeping super vague but then it's a very strenuous and long merge stuff on a board type game while you fix up the garden.

it's an alright merge game if that's all you want out of it.

but for those who want to know more about what the hell is up with grandma, the game doesn't say.

I found someone on YouTube who has been playing through the levels for a while and after pretty much hours of content and events, I gotta say, as far as I can tell, they ditch the mystery as soon as they get the chance to.

maybe they've updated the game to add more and build it up or whatever since that person has played but it takes a Really long time to progress.

like lily's garden, the ads have very little to do with the game itself it seems.

if any of yall are interested, I can make another post on games I've played . I know it's hard to find a good mobile game that doesn't suck or isn't RAID like blurgh

#bear barks#mobile ads#mobile games#remember when we used to talk shit about mobile games and now we all play them? what a twist

2 notes

·

View notes

Text

Gengras Motor Cars

Customers go from all across the United States to do business with Gengras Motor Cars. It takes strength, not weakness, to admit wrongdoing and ask for forgiveness. We're relieved to hear that you enjoyed your time with us. Tell us how we can be of service. Hondas, BMWs, Subarus, Fords, Volkswagens, Volvos, Chevrolets, Dodges, Chryslers, and Jeeps, to name a few, are just some of the many makes and models represented at the nearby dealership car dealership near me Find a dealership that carries a wide variety of automobile models. The names Honda, BMW, Subaru, Ford, Volkswagen, Volvo, Chevrolet, etc. are surely familiar to you. To save you time, we researched numerous automakers online. You can save a lot of money by purchasing a used Honda, BMW, Subaru, Ford, Volkswagen, or Chevrolet. We can assist you in your search for a new or used vehicle. Contacting local establishments is one way to learn which models are supported in your area. We scoured the country for the lowest prices on new and used cars. If you're in the market for a new car, we can connect you with a dealer in your area who stocks your preferred make and model. If you're interested, just let us know, and we'll put you in touch with a used vehicle dealership in your area. If you're looking for a new Chevrolet Equinox or any other Chevrolet vehicle in the greater Connecticut area, Gengras Chevrolet is your best bet. If you want to buy a new Chevrolet in the United States, the best location to do it is at the Gengras dealership. Every new Chevrolet model, as well as every new Chrysler, Dodge, Jeep, and Ram, can be found at Gengras car dealerships in Massachusetts and Connecticut. Connecticut and Massachusetts now have Gengras service centers, which is great news for New England Chrysler drivers.

Gengras' Connecticut car lots stock Volvos such the XC40, XC60, and S60. The following establishments are cash-only. People from many walks of life and all parts of the world make their home in Gengras. There is a Volvo dealership in East Hartford, CT, and a Volvo service center in North Haven, CT. This could never take place in a country where there is not a robust constitutional democracy. Volvo dealerships can be found in both of these very identical Connecticut towns. Hold on a second! BMW of West Springfield offers a wide variety of new BMW models, including the 330 xDrive, X3, and 5 Series. We can assist you in locating a trustworthy vehicle lot in New Haven, New Hampshire, or Vermont.

At GENGRAS MOTOR CARS, we place a premium on 100% satisfied clients.

Customers travel from all across the Northeast to do business with Gengras Auto Sales, not just New Hampshire and Vermont. We promise that you will be pleased with any vehicle you choose from our extensive inventory. This is due to the fact that we carry products from a wide variety of suppliers used car dealerships near me The Chevrolet Equinox is only one of many crossover SUVs available from Gengras Chevrolet. We are committed to regaining your confidence. We have the largest selection of Chevrolets in the region. We guarantee that you will not find a better selection or lower prices anywhere else. Chrysler Visit Gengras Dodge Jeep Ram if you wish to acquire an authentic Jeep Grand Cherokee. If financial gain is your primary motivation, something is wrong with you. We're the one and only dealership in Rhode Island, Massachusetts, and Connecticut you'll ever need. Invest in a brand-new vehicle. We are offering this discount on any vehicle we currently have available. Any Google search for "car dealer near me" will include a Gengras business. A Gengras dealership will be one of the first search results when you type "car dealer near me" into Google. When people in East Hartford and North Haven type "car dealer near me" into a search engine, the Gengras company comes up. Hartford International Airport is the only one of Connecticut's four main airports regularly served by the major international carriers. Volvo's XC40, XC90, and XC60 all come in a wide variety of configurations and levels of trim for 2018. To ignore this evidence would be reckless. Customers of all income levels frequently give our Connecticut firm five stars. Customers who would rather not draw attention to themselves are always welcome at high-end stores. BMW's decision to locate an assembly plant in West Springfield is great news for the area. Make certain changes to the regulations. Honda has relocated its headquarters from New Hampshire to White River Junction, Vermont. For a long time, New Hampshire was home to Honda's North American headquarters. Torrington, Wyoming area residents looking for a new Subaru or Subaru SUV should visit Gengras Subaru. You can get to Gengras Subaru in no time. Gengras Subaru is your one-stop shop for all things Subaru. No changes are required at this time. Everything from little city cars to large off-road SUVs can be manufactured.

Gengras can help you rent a car in Massachusetts if you call +18602893461. These products are manufactured by an abundance of businesses. If you're having trouble finding the right car in Massachusetts, don't be shy about getting in touch with us. If you're looking to buy a car in Connecticut or Vermont, Gengras is your best bet. When it comes to autos, residents in Vermont are spoiled for choice. Our current strategy is obviously not working, so let's try something different.

4 notes

·

View notes

Text

4 Things You Might Regret as A Student at Uni – LaurenET

Being a student can be some of the best times of your life, but it’s only after you graduate and start working your first big girl job that you begin thinking of all the regrets you have about uni. Here are just 4 of the regrets I have that you might have too:

Not Doing Any Internships

This is my number 1 regret about university. At the time, I genuinely believed I was too busy or too shy or too confused about what kind of career I wanted to even think about applying for internships. It turns out, I just didn’t know about The Grad Soc. This company help students and grads find flexible (between 5 to 10 hours a week), paid (£11 per hour!) and remote (an introvert’s dream) internships that last around 3 months. Looking back, if I had found them at uni, I would have been making the most of my weekends, saving up that extra cash and figuring out what kind of work I actually really liked (and what I absolutely didn’t want to pursue). One thing you realise coming out of uni is that a degree doesn’t mean much to an employer and it’s your work experience that speaks volumes when you’re trying to land a grad job. It sounds simple but it’s not something I knew.

2. Wasting My Student Loan

In particular, on a bunch of new clothes. Don’t get me wrong, I saved like mad (maybe a little bit too mad at times) but I made some very regrettable purchases where that money could have been put to good use. No, I didn’t need the Anastasia brow gel because it was trending online and no, I didn’t need a new outfit for every event. If you’re a student reading this now, it’s worth asking yourself why you’re buying something. Is it just for the sake of buying? Can you find it somewhere cheaper? Can you wait a couple of months and if you still want it then you can get it? It might seem like the odd £20 here and the odd £15 there but it really starts to add up (and trust me, the future grad version of you will wish you had that money for a new vacuum or office desk or something “adult”).

3. Not Enjoying the Small Things

Uni is hectic. Every day feels like it’s mad and that’s not always a bad thing especially when you’re young, a little bit wild and soaking up all the freedom you have. But one regret you might find yourself having as a grad is not enjoying the small moments that made your uni experience. Like sitting in the library with your friends, all of you experiencing a stress-induced meltdown and you’re counting down the days until term ends. Or going home to visit your mum and dad. Or walking back to your flat with your besties. Or cooking dinner for your housemates. At the time, you’re so wrapped up in that essay you have to finish or that presentation you have to do that you forget to really soak up these small moments.

4. Throwing Away My Free Time

Once you graduate, you realise how time consuming it is working a “proper” job and you begin to regret throwing away all that freedom you had. Personally, I wish I had done more than binge watch and shop with my free time. If I could give advice to a current student, I’d say make the most of the time you have now where most of you have very few responsibilities. Travel to new cities (spending money on a new experience trumps new clothes by the way, take this advice), try new coffee shops, make new meals, choose a hobby, and stick to it (even if you’re rubbish at it, you’ll come out of uni with a passion for something that isn’t related to your career). I also wish I’d spent this freedom exploring my future options better. Could I have done some online courses? Could I have been networking? All of this hindsight is something you wish you had as a student.

And these are just a few of the many regrets you might relate to! Ultimately, it’s important to look forward rather than wishing you could change the past but hopefully this lands in the hands of newbie and current uni students who can learn from my mistakes.

2 notes

·

View notes

Text

The post thread goes deeply into "this is literal, it is not a metaphor" and at some point mentions that no one had offered advice on how to buy a condo.

This blog is "not financial advice" and this is not financial advice it is... more of... a general list... of suggestions... on how to buy a condo. In the United States.

At no point am I considering this easy, simple, fair, possible widespread.

It sucks. It is expensive. It is hard. It is confusing.

I'm hoping to take at least a tiny bit of sting out of it.

Look around your area. Go to real estate offices, they often have postings in the window. Go to their websites. Go on to Zillow or whatever but understand those prices are, hm, spicy and high, frequently. You want to get a gauge of "this is how much a condo of that size is in my area." Or the area you want to move into.

Mortgages are typically 3 - 5% downpayment, up to 20%.

If you put down less than 20%, you will very likely have to pay something called "private mortgage insurance" (PMI)

Names aside -- it's an extra payment with your mortgage payment.

It covers the lender in case you can't make the payments.

It goes away once you've made enough payments to have gained 20% equity.

Downpayment

This is the the hardest part. It sucks. I'm not going to sugar coat it.

3% of a $100,000 condo is $3,000.

Your mortgage is $97,000.

Your payment is going to be just under $600 + property taxes + PMI (probably 1.5 - 2% of the mortgage) + insurance + association costs.

Here is a basic calculator to play with numbers.