#10. Sell Property for Cash

Explore tagged Tumblr posts

Text

How to Sell Your Property Quickly and Easily Online for Cash

If you’re looking to sell your property quickly, selling online is one of the fastest and most convenient options. Many people today are opting to sell their property for cash to avoid the lengthy process of traditional home selling. With just a few clicks, you can connect with trusted buyers who can make a fast offer, often within 24-48 hours.

When you choose to sell your property fast, online platforms can simplify the process by offering a direct sale to cash home buyers. This allows you to skip the traditional route of listings, showings, and negotiations. Whether you're facing financial difficulties, relocating, or just want to move quickly, online platforms provide a hassle-free way to sell property quickly.

By deciding to sell my property online, you can experience a smooth, fast transaction and get the cash you need without the stress of a lengthy sale.

#1. Sell Property Quickly#2. Sell House for Cash#3. Fast Property Sale#4. Sell My House Online#5. Cash Home Buyers#6. Quick House Sale#7. Sell Home Fast#8. Online Property Sale#9. Cash for Property#10. Sell Property for Cash#11. Fast Home Sale Online#12. Property Buying Companies#13. Sell My Property Fast#14. Quick Cash Offer for House#15. Sell Home Without Hassle#16. Sell House Without Agents#17. Easy Property Sale#18. Get Cash for Your Home#19. Fast Cash Property Buyers#20. Online House Sale Process

0 notes

Text

Silver Slipper Gambling Hall '50-'88

Silver Slipper at Last Frontier Village, April 1955.

'50: Hotel Last Frontier opens GOLDEN SLIPPER on 9/6/50 as a part of Last Frontier Village on property previously occupied by the livery stables. Original building had casino and bar on ground floor, convention space on second floor. Renamed SILVER SLIPPER in Dec.

'54: Road sign installed circa Feb or earlier.

'55: Slipper sign installed on the rooftop circa Feb or earlier. Design and fabrication by Jack Larsen and YESCO.

'56: Silver Slipper and adjacent 22 acres leased by Frontier owners to Slipper Corp (R. Schulze & partners). The casino will be independent of Frontier through '68. (RJ 2/22/56 p29)

'62: Casino painted red, slipper sign all white.

'64: Casino closed after gaming violations (RJ 5/31/64)

'65: Jun. 16, Owners M. Richardson & co lease Silver Slipper to Shelam Inc. (Sam Diamond, Shelby Williams, Dr. Louis Friedman, Ben Moss, Jack Shapiro, Tom Bellsnyder Jr.) purchase, reopen; slipper sign moved from casino rooftop to the attraction board circa Oct.

'66: Casino expansion, remodel. H. Rissman, architect.

'68: Shelam Inc. lease is sold to Howard Hughes, bringing Silver Slipper & Frontier under the same operations. Hughes buys Silver Slipper outright from Friedman & co. later circa '72. Details of the practice are revealed later in a suit by Bob Maheu against Hughes.

The story of Howard Hughes and the Silver Slipper sign.

'68-'70: Hundreds of thousands from Hughes personal account at Silver Slipper are used, in cash, for payments to county, state, and federal political candidates of both parties.

'87: Silver Slipper & Frontier sold to M. Elardi (Unbelievable Inc) (RJ 12/16/87, 10/20/91).

'88: Closed in Nov. Slipper sign moved to YESCO boneyard. Casino demolished, becomes parking space for Frontier.

'98: Elardi sells Frontier while retaining the 16 acres where Silver Slipper stoodas Tishmar LLC.

Photos scanned from Kodachrome stereo slides, Vintage Las Vegas collection.

389 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

870 notes

·

View notes

Text

The majority of rich people on this earth are broke. They don't have any money. I'll explain why:

Rich people don't make enough money to afford their lifestyles. What they do is that they they take out loans. These loans are countered against the property, businesses, and shares they hold.

So a rich person who brings in about 250,000 a month, will take out a loan for about $10 million to afford their lifestyle. That's for buying property, cars, going on vacation, hosting parties, jewelry etc.

They don't have enough liquid cash to afford any of these things on their own. That's why they take out these loans. Plus they have lines of credit.

This of course is not free money. They have to pay back monthly premiums. If they ever default, the banks will start snatching up their assets. This is where we start the nonsense:

Lower taxes? Rich person bringing home $250,000 a month that means they pay close to $150,000 dollars in taxes. They want to pay less taxes so they can:

get bigger loans

have more cushion rooms to pay their premiums

As you can imagine, getting a 10 million dollar loan, and spending it on luxury life style, will cause that money to quickly run out, and now they're paying premiums and are broke. They have to take out more loans, get more credit, it's a violent spiral.

(This is why I always say that people who complain about taxes are bad with money.)

How it fucks you: Less taxes means services get cut, and become worse.

Rent? A lot of rich people invest in property because it gives monthly income that they can use to pay their bills. The push against work from home? Majority of companies rent out their corporate spaces. With WFH, many companies downsized or got rid of their spaces. We saw a lot of rich people who expected monthly income suddenly lose that income. This scares them because they were counting on that income to pay their bills.

They're also against zoning reform, and building more houses because that could potentially lower rent, which would mean their monthly income would reduce.

Remember, the loans and credit that these broke fucks have to pay back, don't decrease.

Layoffs? Rich people who have shares in companies get dividends. When a company makes 1.2 billion in profit, those dividends go to the shareholders. If next year, the same company makes 800 million in profits, the shareholders get smaller dividends. Rich people are expecting on the money they receive from these companies to stay the same or get bigger.

Every wonder why companies rush out products that are obviously not ready? Those shareholders are pushing for the product to get out as soon as possible so they can quickly get the profits so they can pay their bills.

Investment bubbles? Rich people throwing their money in the new shiny thing in hopes it explodes and they make profit in order to pay off all their loans and credits, and then get even bigger loans and larger credit lines.

Literally every shitty thing in society can be traced back to rich people's poor money management. Very few rich people have liquid cash. This is why billionaires are so powerful.

When interest rates go up and causes premiums to balloon, rich people have to sell their assets to stay afloat, Billionaires can eat the costs, buy up businesses, properties and capital at lower rates, and then sell them when the economy recovers and the value bounces back.

You ever wondered why celebrities and athletes make so much money and then seem to lose it all? It's because of what I described as above. They get loans to afford their lifestyle, and then when their earnings dry up, they can't afford to pay their monthly premiums and the bank takes everything away.

We are told stories of "irresponsible spending" ex: buying golden yachts. When in actuality, they were simple doing as the romans do. Majority of celebrities don't have consistent income that lasts for decades unlike rich people have jobs and companies that pays them regularly for decades.

In conclusion: we need to destroy the lifestyle of the rich.

Loans should be regulated to things like buying property (homes people live in, and primary cars), entrepreneurship, life events, (weddings, ceremonies, plastic surgery, medical issues, emergencies, necessary renovations etc), education, research, etc. and other loans (luxury items, extra homes, personal loans etc.) should be penalized and taxed.

By forcing rich people to live on their liquid cash, would literally shift our society to a more egalitarian one, and make a healthy economy that focuses on progress and growth.

95 notes

·

View notes

Text

Recs | January 25

January readings ❤️

Please, rb the fics you appreciated, that's how they live ❤️🙏

Check the warnings before reading, some of the fics are very dark

Joel Miller

How to break a girl in 10 easy steps | part 2 | part 3 | part 4 @corazondebeskar-reads

joel miller is a lonely old man, but he likes it that way. he has everything he needs: a nice piece of property in the woods, a cozy cabin, and plenty of cash. there is one thing missing, though. one thing he needs that he can't give himself

Borrowed time @aurorawritestoescape

Joel and you are enjoying an ideal vacation together. Warm ocean, white sand, soft kisses, and hot sex make it feel like paradise. But as your time here is running out, the thoughts that you‘ve been trying to keep at bay start eating at your soul

The warden @arcanefox207

Your hike into the woods doesn’t go as planned when a depraved Game Warden catches you breaking the rules

Lost in the dark part 4 @iamasaddie

the one time you decide to cheat on your boyfriend is, of course, the time his dad catches you red-handed. once a normal relationship turns into anything but, and you are forced to face the new reality

Raider!Joel Original (re read ✨) @toxicanonymity

He's a bad guy, and you're his good girl. Joel saves you from bad men, but claims you for himself. His persona starts to crack, but he gets even more possessive. You're his world, and he'll do anything to keep you

Forest floor (raider!Joel) @toxicanonymity

When sweet pea escapes, what if Joel finds her before fedra does?

BDSm chapt 8 | chapt 9 @mountainsandmayhem

After recently graduating you take what is supposed to be a job to save money before you go back to university to get your law degree

Basement breeder @toxicanonymity

One night early @almostfoxglove

You vow to find out where Joel hides his Christmas gifts while he's away on patrol

Cuddles & hot chocolate @megangovier

You're laid on the bed in a foetal position, hot water bottle resting on your cramping stomach. Joel was downstairs making chili hot chocolate for the both of you

Austin, Texas, on a cloudy january sunday, 2003 @magpiepills

you and Joel go to a movie, he is in love with you

Never took you for a pervert, Miller @pearlispunk

You borrow a jacket from joel, and it returns to him with a stain. he goes crazy over your scent, and he wants more

Let's go @thundermartini

You decide to channel your inner party girl on this Friday night. But things won’t go as planned. You’ll get even more from this night than a dance in a club and free drinks from strangers

No strings to hold me down @baronessvonglitter

Enjoying the freedom of being friends with benefits with Joel Miller, a new emotion flares when you see him out with someone much younger

Sell-out @aquariusmiller

After a smuggler Joel and Tess were working with didn’t pay for his end of the deal, Joel captures his girlfriend, you. Tired of your boyfriend’s scheming ways, you decide to use the situation to your advantage

My Paramour, My Evermore @schnarfer

Joel Miller is the loss of your life

All the good girls go to hell @aurorawritestoescape

You can't stop thinking about your stepdad so you do something risky to have a little more of him. But Joel is not the "little more" kind of guy

The neighbors @iamasaddie

Of rage and ruin chapt 9 @corazondebeskar-reads

Joel Miller made it twelve years into the apocalypse without getting bit. He turns into a much different kind of monster than he expected, though

Pants (raider!Joel) @toxicanonymity

Thoughts on hbf!Joel @baronessvonglitter

Reincarnated @joelmillerisapunk

A late-night text from an unknown number stirs up memories you thought you’d buried. It’s been years since Joel walked out of your life, but now he’s back. Old wounds resurface, boundaries blur, and the question lingers: is this a second chance or just another heartbreak waiting to happen?

Not the real deal @itwasntimethatdidit40

Joel convinces you that there’s nothing wrong with a bit of grinding

Joel and Tommy Miller

Collared | Tommy's turn @tateypots

You are kidnapped by Joel and Tommy 3 years after the outbreak.

Javi P

Strangers @joelmillerisapunk

you meet a sexy stripper at your bestie's bachelorette party and he tries his absolute hardest to get your number

A new year's distraction @lotusbxtch

Javi doesn't realize that you've got a surprise waiting for him at home

Don't go @wannab-urs

You and Javier fight in the rain

Left behind @wannab-urs

Cleaning your apartment after Javi leaves the DEA and you

The morning commute part 1 @iknowisoundcrazy

In the midst of escobar’s desperate war for control in colombia, your morning commute is disrupted when you find yourself tangled up in his latest bomb threat

How could you love somebody like me? @itwasntimethatdidit40

Javi is under protection and has asked you to join him in the hotel room where he is confined. When you discover his secrets and lies, however, that room will become too small. Too small for both of you

Always tomorrow @604to647

Javier chooses an impossible new year's resolution

Frankie Morales

Extra cream and sugar @itwasntimethatdidit40

Frankie is your barista, every morning you walk into his café asking for a tall coffee with extra cream and sugar. He dreams of giving you another kind of cream…

Eyes on the mirror part 1 | part 2 @itwasntimethatdidit40

You're at a turning point in your relationship with Frankie, he tells you that his mother insists on meeting you

Dave York

Law of attraction chapt 4 | chapt 5 | chapt 6 | chapt 7 | chapt 8 @baronessvonglitter

Attraction isn't an easy thing to ignore. Especially when you and Dave find yourselves entangled in each other's professional and then private lives

The stranger | Unveiled | Cuts deep | Ice cold @punkshort

Fresh on the heels of a breakup, you move into a new apartment in a shady part of town. When a mysterious man breaks in, insisting he knew the prior tenant and needs to recover something left behind, you get caught up in a whirlwind of danger and attraction

Pero Tovar

What's a TomDaya? @604to647

Pero regrets getting into a group chat with your friends

Confession @sawymredfox

A late visit to the farmer's market causes a confession

Tim Rockford

While we were texting @sawymredfox

Help and surprises come from unexpected places

Training days @604to647

Detective Rockford leaves for a weeklong tactical training course and you miss him something fierce

Multi p boys

The detective and the agent part 2 @604to647 (Tim x f!reader x Marcus p)

Your detective boyfriend agrees to share you with his friend in the FBI

Non standard issue @bonezone44 (Ezra x Frankie)

Ezra and Frankie stay behind while the other Triple Frontier boys go out

Unnamed/crack fics/other

Sunrise @sawymredfox (unnamed ppcu)

A little bit of body positivity on a Saturday morning, thanks to your husband

Joel's twin @aurorawritestoescape

Fuck boy @sizzlingcloudmentality (unnamed ppcu)

You meet this guy at a bar, drink too much and he shows you his questionable definition of making out aka storage room sex. spoiler: it's never just the tip

Fine ideas @thebrothel (raider!Carter x you x Sweet pea x Joel, by Carter)

Bad girl shit @thebrothel (Slasher Joel x f!reader, by Night Walks)

Special blend @thebrothel (Carter!raider x vamp Joel)

No strings @thebrothel (Night Walks Joel x f!reader, by Vamp)

The heat @thebrothel (sd!Joel)

Wet booth @thebrothel (bf's dad!Joel x f!reader by thighs out)

Non ppcu

Candles @toxicanonymity (Bo Sinclair)

Lovesick @sunshineispunk (Steve Murphy)

Getting dressed @thebrothel (Ghostface)

My writing

Close-up (Joel Miller x fem reader)

Joel receives a script that takes him back to the memories of your love story. He realizes that out of protective instinct after the break up, he has not been honest neither with his own feelings nor with you

Fics recs

66 notes

·

View notes

Text

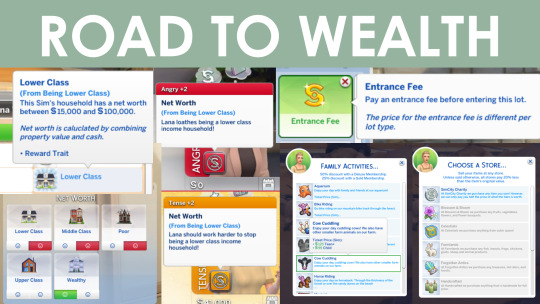

Road to Wealth

If you've any questions or find any problems or spelling mistakes. Please let me know in my Discord

Please Read Terms of Use

More Info about Road to Wealth

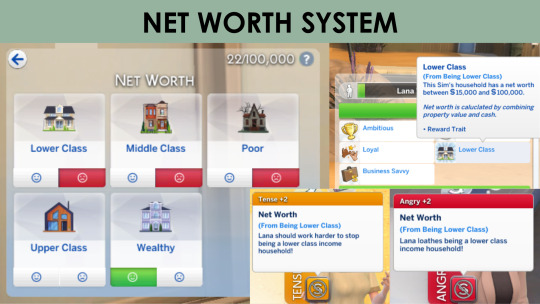

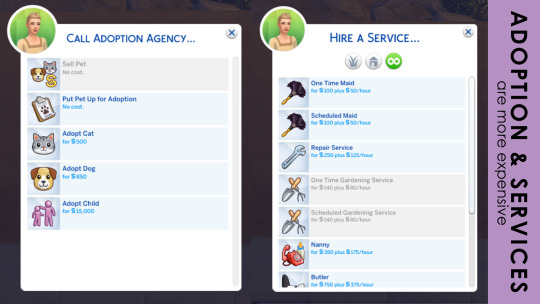

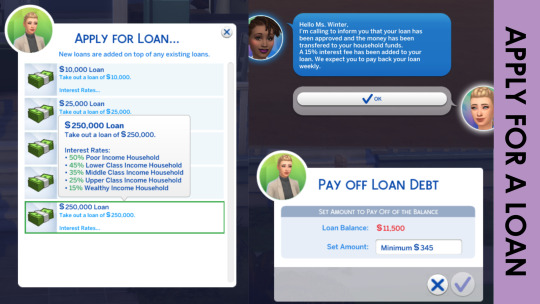

The road to Wealth mod adds a Net Worth system to your game. Depending on your Sims net worth (property value + cash) they will automatically receive a trait and the trait will also be automatically updated when your Sim goes into another class. The five traits are: poor, lower class, middle class, upper class, and wealthy.

The new traits have also been added to preferences, so your Sim can like or dislike a certain net worth class. If they are in a net worth class they don't like they will receive negative buffs and if they are in a net worth class they do like they will receive positive buffs. Also, it is harder to make friends with Sims who are in a net worth class your Sim dislikes and easier with Sims who are in a net worth class your Sim does like.

Not only does this mod add a net worth system it also adds more ways for your Sims to spend or earn money:

They can now go on activities, by themselves or with friends and family.

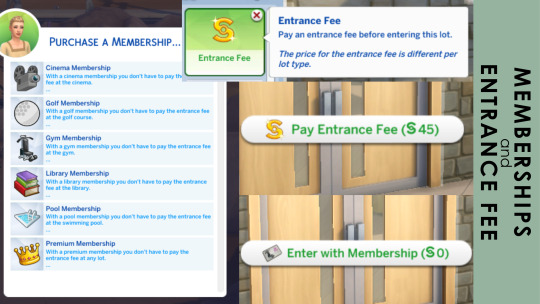

They'll have to pay an entrance fee on certain lots that have the new lot challenge activated: Entrance Fee.

They can purchase memberships, so they don't have to pay the entrance fee anymore. These memberships will last 7 or 14 days.

They might receive scam calls where they either loose or win a lot of money.

They can take out a loan. Paying back the loan works the same as the Discovery University loan system, but the system has been made Base Game Compatible and has become less buggy.

Poor and lower class Sims can now search for money on certain furniture items.

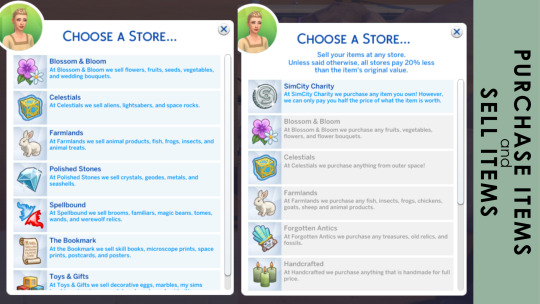

Instead of selling all your inventory items directly in the inventory your Sims can now sell their items at the new stores. The interaction can be found in the shopping tab on their phone or computer. Not only can your Sims sell their items at these store they can also purchase item from these stores.

And there is also a new aspiration available: Road to Wealth.

Then this mod also comes with a few optional files. All these optional files are optional and the reason they are optional is because they are either overrides or they require DLC.

Lot Prices: changes the price of each lot in game. You can choose to have them all as §0 or the original price x 5 or x 10.

Starting Funds: changes the amount of money a new household starts with. Your Sim will have to pay back this money. It's a loan!

Adoption & Animals: changes the prices of all adoptions and animals (except for goats, sheep, cows, llamas, and chickens). Also, animal food has become more expensive.

Diaper & Bottle: adds pricing to each diaper change and each bottle feed. Cloth diapers and breastfeeding is free.

Reward Store: adds 50% of the original price to any rewards store item. For example if it costs 2000 it will now cost 3000.

Science Baby: makes having a science baby a lot more expensive!

Services: all services have now become more expensive. This includes massages, manicures, and pedicures.

University: All university classes have become more expensive.

Translations:

Russian by Pumpkin

Chinese by ImmoralSSS

Spanish by RoshySims

PATREON | DOWNLOAD

278 notes

·

View notes

Text

How rich is Tony Stark?

Throughout his superhero career, Tony's net worth in the MCU has always been between $10 and $20 billion. How much is that? Let's talk about Tony Stark's real financial resources and purchasing power.

The numbers themselves don't tell us anything, so we'll compare. Some real billionaires are much richer than him (Elon Musk - $210 billion, Jeff Bezos - $195 billion, Bill Gates - $129 billion). Huge difference, don't you think?

Let's list Tony's expenses: he founded and funded Damage Control. He covered the cost of the destruction caused not only by the Avengers, but by everyone they fought. He funded scientific projects and charitable foundations. He covered all the Avengers' expenses (compound, equipment, tech, vehicles, quinjets, food, medical and legal services, staff, team members' salaries, etc.). He made Iron Man suits and equipment for himself, Peter, Rhodey, and later Pepper. It takes a LOT of money to cover all of this. And it's all pure expense. He didn't make any profit from it.

Reminder: He's not nearly as rich as Musk, Bezos or Gates. How much can these guys do, buy and finance? Less than you think. Now divide by 10 to get an idea of how much Tony could.

I'll help you: we'll count in Helicarriers. Let's say Tony had $20 billion (that's max). The price of one real aircraft carrier is 13 billion dollars. Helicarriers, even the basic ones (from The Avengers and AoU), are much more advanced (they fly, have retro-reflective panels that cover them entirely, and have a fancy interior with expensive equipment on board). It will cost much more. Let's give it a price tag of $20 billion. That is - Tony could only buy 1 Helicarrier and get $0 in his bank accounts.

Or another example: how much did the Battle of New York cost? Secretary Ross showed us - $88 billion in property damage. Tony would need another $70 billion to cover the cost of this one battle.

BUT let me tell you, his $10-20 billion isn't even real money. It's net worth. He would never have seen that $10-20 billion in cash or been able to use it. Because these are assets: shares and property he had. He would have to sell them, then pay taxes, and only then would he see the actual amount of money he could use. Which is about half of the net worth - $5-10 billion. Thus, his purchasing power would amount to a small insignificant fraction of the Battle of New York, or 0 Helicarriers, or even 0 real-life aircraft carriers. That's it. This is why the Avengers never had their own Helicarrier - Tony COULD NOT AFFORD ONE.

He didn't have unlimited resources. He couldn't buy everything. Stop imagining him as Scrooge McDuck. He had to work several jobs to provide for the team and protect the Earth. Alone. Where were Thor and Black Panther's resources?

Conclusion: no, Tony wasn't that rich. He worked his butt off to be a wallet of Earth's protection, in addition to being its shield. Remember that.

112 notes

·

View notes

Note

WIBTA for reporting my landlady for tax evasion?

I’ll keep this fairly short. 🦄🫧 to maybe search this later.

I (32nb) have been renting one side of a duplex from an individual (as opposed to a company) (60s F) who I’ll call slumlady. Slumlady has done everything possible to make my life hell since move in, though we’ve done no damage to her property, paid rent on time every month, and submitted a single maintenance request in the 2 years i’ve lived there. She had a beef with my ex, who originally moved in with us, and has held it over our heads ever since (yes, ex was kind of a dick but has been out of state for nearly 2 years). From next to no notice drop ins, unreasonable maintenance demands, weekly undercover drive bys, and just general condescension, she’s been insufferable.

Since living in her property (which is not great and in a bad area) has sucked, i’ve been house hunting for the last year. I’ve finally found a house to buy and am closing in a couple weeks, so the move out date is soon. During the process though, I found that she’s claimed the property I live in as one that she(owner) lives in, which is taxed at a lower rate.

I am not sure how I would report her, but I want her to experience consequences for being so rude for no reason, and this seems like a justified way to do it. She owes those missing taxes and our state’s budget is in deficit right now.

some additional background, she has told us she has not had a job in 50 years, owns 10-15 units being rented out to mostly immigrants and other vulnerable groups (i think so they don’t feel comfortable taking her to court), and has threatened to sell our home and kick us out multiple times. she bullied our neighbor out and bragged about never returning security deposits. She also charged double deposit and two months rent, in cash, before move in all while laughing about how that was illegal and she didn’t care.

so AITA?

What are these acronyms?

149 notes

·

View notes

Text

Even, or perhaps especially, when everything is turbofucked, I think it's important to try to imagine realistic proposals for how things COULD be NOT shit. To that end I have a few policy proposals:

Housing: All housing becomes rent-to-own by default, with sale to the council incentivised.

Why: Funding social housing, tackling unaffordable rents, lowering house prices, improving tenant's rights, discouraging commercial landlords and the financialisation of housing.

How?

The rent is set at home value + X (for private landlords, up to 10% of that to cover admin, repairs etc, or for social landlords the average cost per household of finding and matching tenants to homes) divided by the length of the lease.

That is then rent-locked for the duration of the lease.

At the end of the lease, you own the home.

If you don't want to own the home, you can at any time take back the capital you invested as cash (so if you're halfway through the lease, you subtract the amount that you paid to cover costs (X) and get half the original home value in liquid capital.) You can also pay it off early or readjust the terms of the lease, by mutual agreement.

All funds collected in this way by social landlords are ringfenced for spending on increasing the housing stock (buying or building property).

Additionally, increases in high-end marginal income tax will cover other costs of social housing (short term emergency accommodation, upgrading housing stock, covering grants and loans, increased admin costs, casework, outreach, etc)

To discourage commercial landlording, council tax on additional properties increases exponentially (so you pay regular council tax on your home, double tax on a second property, 4x tax on a third property etc), with additional amounts due from the landlord, not the tenant. In lieu of payment, you can sell on your additional properties to the council in exchange for a 6-month pause on your main property council tax.

If your property is found to be left unused for over 3 years, you have a grace period of up to 6 months to begin repairs/find an occupant; if you do not, the council can force a sale of your house for an amount equivalent to the estimated sale value of the property/land following work, minus the cost of repair/demolition. That bottoms out at zero (ie at worst you lose the property you weren't losing and get no recompense) so people who can't afford to fix up a property aren't being financially punished - however, there may be fines for serious repeat offenders.

All this will result in the price of housing dropping significantly, which is good and what we want but does negatively impact existing mortgage holders who may be dealing with negative equity and no way to recoup the price of their house if they need to move. So if people need to default on a mortgage, their personal debt is written off, the bank claims the property, and the bank is then required to consider an offer from the council (probably for the current sale value of the house) before taking their chances on the open market. As the transition is the key thing, there's a 6-18 month amnesty after introducing these policies where defaulting on your mortgage does not affect your credit rating. Beyond that point, the idea of rent-to-buy is to effectively have a non-interest-based mortgage system which cuts out the banks, so hopefully the issue of negative equity goes away as the new system establishes itself.

13 notes

·

View notes

Text

How Trump's billionaires are hijacking affordable housing

Thom Hartmann

October 24, 2024 8:52AM ET

Republican presidential nominee and former U.S. President Donald Trump attends the 79th annual Alfred E. Smith Memorial Foundation Dinner in New York City, U.S., October 17, 2024. REUTERS/Brendan McDermid

America’s morbidly rich billionaires are at it again, this time screwing the average family’s ability to have decent, affordable housing in their never-ending quest for more, more, more. Canada, New Zealand, Singapore, and Denmark have had enough and done something about it: we should, too.

There are a few things that are essential to “life, liberty, and the pursuit of happiness” that should never be purely left to the marketplace; these are the most important sectors where government intervention, regulation, and even subsidy are not just appropriate but essential. Housing is at the top of that list.

A few days ago I noted how, since the Reagan Revolution, the cost of housing has exploded in America, relative to working class income.

When my dad bought his home in the 1950s, for example, the median price of a single-family house was around 2.2 times the median American family income. Today the St. Louis Fed says the median house sells for $417,700 while the median American income is $40,480—a ratio of more than 10 to 1 between housing costs and annual income.

ALSO READ: He’s mentally ill:' NY laughs ahead of Trump's Madison Square Garden rally

In other words, housing is about five times more expensive (relative to income) than it was in the 1950s.

And now we’ve surged past a new tipping point, causing the homelessness that’s plagued America’s cities since George W. Bush’s deregulation-driven housing- and stock-market crash in 2008, exacerbated by Trump’s bungling America’s pandemic response.

And the principal cause of both that crash and today’s crisis of homelessness and housing affordability has one, single, primary cause: billionaires treating housing as an investment commodity.

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

— Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities. — Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily. (Emphasis theirs.)

It seems that everywhere you look in America you see the tragedy of the homelessness these billionaires are causing. Rarely, though, do you hear about the role of Wall Street and its billionaires in causing it.

The math, however, is irrefutable.

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper. That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

This trend is massive.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes young families can afford to buy, billionaires then begin raising rents to extract as much cash as they can from local working class communities.

In the Nashville suburb of Spring Hill, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street billionaire investor] landlords was about $1,773 a month…”

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street.”

It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

This all really took off around a decade ago following the Bush Crash, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

America should, too.

ALSO READ: Not even ‘Fox and Friends’ can hide Trump’s dementia

16 notes

·

View notes

Text

𝐁𝐞𝐜𝐨𝐦𝐢𝐧𝐠 𝐖𝐞𝐚𝐥𝐭𝐡𝐲

⋆ ˚。⋆୨ 𝑯𝒐𝒘 𝒕𝒐 𝑩𝒆𝒄𝒐𝒎𝒆 𝑹��𝒄𝒉 ୧⋆ ˚。⋆

𝑨𝒔𝒌 𝑨𝒍𝒍𝒂𝒉 𝑺𝒖𝒃𝒉𝒂𝒏𝒂𝒉𝒖 𝒘𝒂 𝒕𝒂❜𝒂𝒍𝒂

♡ Always and forever pray to your lord, Allah subhanahu wa ta'ala for wealth and success in a healthy and halal way ♡

Make constant dua, repentence, Tahajjud, and perform goodness as well. With goodness, eliminating bad habits and doing good for your lord, repenting, and seeking to our Rabb; Allah subhanahu wa ta'ala grants our duas, grants us more than what we asked.

Ask Allah subhanahu wa ta'ala by the 99 names:

-`♡´- Al - Ghani (The Rich, The Independent One, The Wealthy)

-`♡´- Al - Wajid (The Wealthy)

-`♡´- Al - Razzaq (The Provider)

-`♡´- Al - Mughni (The Enricher)

Never lose hope and know that with every blessing we have and whatever way we earned that wealth being an amazing job offer you received or marrying a good wealthy man--that is all due and thanks to Allah subhanahu wa ta'ala.

Be sure to always thank Allah subhanahu wa ta'ala, and strive to become a good muslim and never be deceived or change no matter how much wealth you have

𝑺𝒕𝒂𝒚𝒊𝒏𝒈 𝑶𝒖𝒕 𝑶𝒇 𝑫𝒆𝒃𝒕

♡・゚:。.:・゚ The more debt you have, the less wealth you will have. Debt is dangerous in terms of becoming rich, as well as limiting your freedom.

Unfortunately, VISA or any form of credit card is a tool that makes us less rich--of course it depends how you use it or repay it--therefore, I suggest you to not always use your credit card and only use it if it is an emergency or that is the only payment method; however, please make sure to repay those debts as soon as possible. Give yourself a 10 day due date to repay the amount owed. ♡・゚:。.:・゚

𝑺𝒂𝒗𝒊𝒏𝒈

❥ Saving does not only mean save your money, but it also means saving liquid money--cash--or any item/product that has the value to convert it to cash--with a higher price.

This makes you richer even though it may not seem like it. For instance, your house or your apartment you bought, if you end us selling it you get half the money.

If you have cash, instead of trying to get rid of it and only relying on your debt card or apple pay; save the cash money, those quarters and dimes you think is useless but it is not.

Save your liquid money, those investment objects because that is the true secret of becoming rich.

𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕

As mentioned above, save and make investments through your money like liquid money and physical items that obtains higher value each year or month.

As much as we love shopping, try your best to purchase more of the things that brings more value and more wealth in the long-run. This includes the following:

-`♡´- Full Karat Gold

-`♡´- A Property

-`♡´- Any clothing with higher value each year

-`♡´- Good Quality Device

-`♡´- Books (Especially College/University Textbooks)

-`♡´- House

-`♡´- Car

-`♡´- Diamond or Gem

・❥・There are a lot more items, but basically whatever item that has a increased value/price over the month or year.

𝑫𝒐𝒏❜𝒕 𝑻𝒂𝒌𝒆 𝑴𝒐𝒏𝒆𝒚 𝑭𝒐𝒓 𝑮𝒓𝒂𝒏𝒕𝒆𝒅

Do not think little of a few dimes or dollars. Money is still money and is still worth something.

Whenever you earn lets say a quarter or 50 cents, be grateful and happy as if you earned $100. With this mindset, and treating every amount as it is huge, this will ultimately manifest money itself.

Be grateful no matter the amount--as you are more grateful, Allah subhanahu wa ta'ala grants more.

𝑮𝒊𝒗𝒆 𝑪𝒉𝒂𝒓𝒊𝒕𝒚

✧˚ · Giving charity is so important and mentioned a lot in hadiths ✧˚ ·

"Those who spend their wealth (in Allah's way) by night and by say, secretly and publicly, they will have their reward with their Lord. And no fear will there be concerning them, nor will they grieve." (Al - Baqarah 2.274)

When you give charity to those in need, it certainly does not decrease wealth.

And giving charity does not always mean giving it with money. Sometimes others cannot give money; however, there are also many ways such as:

Making dua for that person

Making someone feel better

Smiling

Speaking good to and about someone

Helping others

Respect

Not being indulged to backbiting

Charity means so much more because there are so much to give to someone!

Never hoard your money of your other abilities to help, but instead help others as it also helps you in ranks, wealth, respect, rewards, and the hellfire.

˗ˏˋ 𝐷𝑢𝑎 𝑡𝑜 𝐵𝑒𝑐𝑜𝑚𝑒 𝑅𝑖𝑐ℎ ´ˎ˗ Allahumma akthir malee, wa waladee, wa barik lee feema a'taytanee O Allah! increase my wealth and offspring, and bless me in what You have given me.

#aesthetic#affirmations#becoming her#becoming that girl#deenislam#deenoverdunya#girl blogger#glow up#health and wellness#healthylifestyle#healing journey#rich girl#rich aesthetic#luxury#manifesation#manifesting#muslimah#islampost#islamdaily#islamicquotes#islamic#islam#holy quran#quran#this is a girlblog#girlblogging#it girl#that girl#self care#luxury lifestyle

35 notes

·

View notes

Text

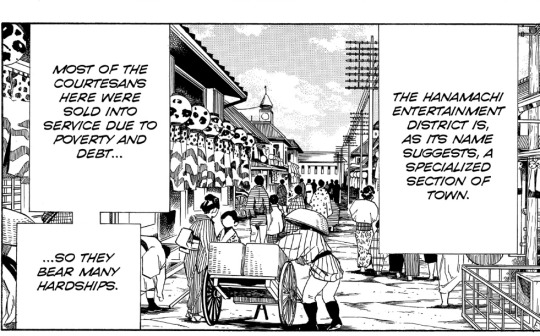

Ah the Red light- I mean “entertainment” district 💄

It is true that there are three figures that we associate with Japan: Naruto, Luffy and Goku - I mean the ancient samurai, the modern salary man, and the eternal Geisha. Especially during the Edo Period, there was a rise in the so-called red-light districts, stage of the mesmerizing ukiyo-e, that the common mortal would happily purchase, in special, the shunga, that could picture the most obscene acts. But things aren’t always like the art portrait am I right? Sex trade in early modern Japan was so important that its history can also be read as the history of the society. But even though the prostitution relationship with the government changed, one thing they always had in common: it was the exchange of sexual services for a payment [most of the times in cash]. Before all, let's say something: male prostitution did exist. But it was just not considered the same business than the woman’s prostitution. Male sex trade became more associated with the theatre world and the teahouses. It was never recognised or regulated and had never the same punishments that woman did. This could be linked to the function of the man and woman in the households. Since a man could only be a brother, but the woman could start turmoil and try to substitute the wife in the family and give the male heirs. (Ah yes, always the baby problem. So be gay do crime I guess) During the 17th century prostitution was flued by the demographic movements of man opening cities, by the 18th the power shifted to the small provinces. And to where the man goes, the sex trade goes. In the 19th century the sex trade spread to all the territory. In the beginning of the Edo period, the rule of the "wife" and the "prostitute" could be confused. After all the women could be said to only have those two paths, and it wasn't for her to choose, but her male guardian. Since the woman was viewed as an object of the man's property, he could sell her as he wished. Yes, even wives and daughters from "good" families were sold as a way to pay a debt. “There was no question that the Tokugawa authorities’ vision of status order had been confining for woman: it subordinated them to male household heads and emphasized the values of obedience and submission. Indeed, some must have welcomed the opportunity to step outside their narrowly defines roles as wives and daughters. (…) But for the vast majority of woman who worked in the sex trade, the crises of the gendered order, and the disintegration of the limited protection it offered, was hardly a form of liberation.” - Stanley,2012;

In 1612 a man called Jin'emon tried to ask the Shogunate to recognise his business. He said that unregulated sex trade could cause a lot of problems like young girls being kidnapped, samurais plotting rebellions in the courtesans' beds, man splurging their wages on woman (and babies a lot of unwanted babies coming back for their illegitimate families let’s not forget that). The shogunate (finally) agreed and gave him a plot of land in the outskirts of town with (a lot of) conditions: they would regulate the sex trade, they would record the comings and goings, report anything suspicious, and the woman - yujo - could not leave the "pleasure quarters" and thus the Red Light district was born, at the time called Yoshiwara or "Reed Plain". The Shogunate soon started to forbid the selling and buying of humans, believe it or not this also included woman. But, as always, with exceptions. Woman could enter the “pleasure quarters” if the hitonushi [the woman’s legal guardian] allowed and if she consented. The same would apply if a family was in extreme poverty, the man could only sell is wife as a last resort. Also, eternal servitude was now illegal, the limit was now 10 years, but obviously the Yoshiwara’s pleasure houses lords would manipulate the contracts to go around this rule. The Shogunate tried to regulate the clandestine prostitutes that the common people called baita [whores]. But these women, that normally worked in the side of the streets, were paid very little and were the wives and daughter of marginal men. There was also the problem of the “bathhouses”, where pretty woman would scrub the backs and rinse their hair of men. Yoshiwara brothels complained that these bathhouses were hurting their business since it was at the time that bordels were forbidden from working during the night, so this bathhouses would do drinking parties with shamisen music and everything. And the yuna [bathing girls] were cheaper than the yujo. Bit after the big fire of Meireki at 1657 these bathhouses choose to relocate to Yoshiwara. But there was a problem is this tentative of politicised the sex trade: the woman that only sold sex as a secondary option. She shogunate realised this problem and declared that all the waitresses, dancers and entertainers that agreed with patrons to sell sex would be considered clandestine prostitutes. But there was a risen of a type of artistic woman, that was skilled in entertainment, that started to imitate the male way entertainment - the Geisha. “Originally, both men and women professionally living on light accomplishments inseparably went under the name of “geisha”, although men were called “otoko geisha” or male geisha, and women “onna geisha” or female geisha. Subsequently the term “onna” was dropped, so that the onna geisha came to be called simply geisha, and the otoko geisha or male geisha changed simultaneously their name into “hokan” or jester.” – Longstreet; Mansfield; Longstreet, 2020; The word geisha can be split into "art" and "person", meaning that the geisha were the perfect mix between the performance and prostitution. They were supposed to have many artistic talents like singing, reciting poetry, performing the tea ceremony, playing the shamisen, arranging flowers, telling the best jokes, whispering obscene things, in short entertaining men. Selling sex was a last thing. They were sexually available, but they had a price, and with a higher price came its social value.

These Geisha usually had their hair up in the traditional maga style [which was mostly made of wigs], wore colourful makeup, kimonos, and obi. Normally they had various apprentices called maiko or hangyoku. (Yes I'm sorry to break your heart but the little girls at House Tokito (Tanjiro infiltration), that help the Koinatsu Oiran were either sold or daughters of courtesans at that house, being trained to be the next Oiran) Obviously, they also had lovers, but outside their job. In the workplace they would smile and bow to entertain their patrons. Sometimes they could choose a wealthier patron that would sponsor their lifestyle. Sometimes they had another lover that was their true love, but that was not the best option since time was money. Unlike the courtesans the geisha could choose their patrons, but sooner or later their professions would start to be confused. Many of the trends of the Edo period continued after the Meiji restoration. Until the Taisho Era [1912-1926] the number of prostitutes registered in brothels doubled. The number of Geisha alone as circa 79.348. It was estimated that 1 out of 31 Japanese young women were employed in the sex trade (that excluding the comfort woman cause non-Japanese did not count, cause ah the imperialism) The funny part was, the money that these women made was income that would be invested in important modernizing infrastructures like elementary schools. With the westernization government started to being pressure to liberate this woman, but soon these women realized that they did not have were to go. So, in technical terms nothing really changed. But the Japanese started to be see this woman as impure, in part because of the sexual deceases that were starting to be aware of. Now we understand why one of the Demon Slayer arcs takes us to the pleasure district, because during a lot of time it was the center of a lot of what we now call the japanese culture.

Linfamy. 2023 - Two Oh-So-Happy Destinies Forced Upon Daughters in Edo Japan. [Consulted on the 27th June 2023] Available on: <https://www.youtube.com/watch?v=Wcewuw0sMOo>; LONGSTREET, Stephen. LONGSTREET, Ethel. MANSFIELD, Stephen. 2020 - Geishas and the Floating World: Inside Tokyo’s Yoshiwara Pleasure District. Clarendon: Tuttle Publishing. [Ebook]; STANLEY, Amy. 2012 - Selling Women: Prostitution, Markets, and the Household in Early Modern Japan. California: University of California Press. [Ebook];

#demon slayer#demon slayer from history to fantasy#demonsslayerfromhistorytofantasy#kimetsu no yaiba#demon slayer history#anime history#history#japanese history#research#history reseach#red light district#oiran#kamado tanjiro#zenitsu agatsuma#kny daki#kny gyutaro

74 notes

·

View notes

Text

Side Hustles That Actually Pay in 2025

In 2025, side hustles continue to be a great way to earn extra income, with more opportunities than ever due to technological advancements and evolving work trends. Whether you're looking for a flexible gig, a way to turn a passion into profit, or a stepping stone to financial independence, choosing the right side hustle can make a huge difference.

1. Online Freelancing

Freelancing remains one of the most profitable side hustles, with services like graphic design, writing, website development, and virtual assistance in high demand. Platforms like Fiverr and Upwork have made it easier for skilled professionals to find clients worldwide. Many side hustlers now make over $1,000 per month, with top earners turning their gigs into full-time careers. Learning how to manage side hustle income has also become essential, as governments worldwide are adjusting tax regulations to accommodate the growing gig economy, including raising the income threshold before requiring tax returns in places like the UK (read more here).

2. AI Spokesperson Videos

With AI tools advancing rapidly, creating AI-generated spokesperson videos has emerged as a top-earning side hustle. Businesses use these videos for marketing and training purposes, reducing the need for live actors. This trend is expected to grow even further as AI technology becomes more accessible.

3. Print-on-Demand and Custom Merchandise

E-commerce entrepreneurs are increasingly turning to print-on-demand services to sell unique T-shirts, posters, and other customized products. Platforms like Etsy make it easy to set up a store with minimal upfront investment. Those who successfully market their designs can generate steady passive income.

4. Delivery Services

Food and grocery delivery remains a reliable side hustle, especially in urban areas. Many gig workers combine multiple delivery apps to maximize earnings. In fact, reports show that a growing number of people are using delivery jobs as a stepping stone to financial independence, helping them reach personal savings goals in just a few months (see how some people are doing it).

5. Home Services

Cleaning, landscaping, and handyman services continue to be in high demand. Unlike digital side hustles, these jobs cater to local clients, allowing service providers to build long-term relationships and stable income.

6. Copywriting

As businesses increase their online presence, the need for skilled copywriters is growing. Writing engaging content for brands, websites, and advertisements is a valuable skill that pays well. Many successful copywriters have used side hustling as a gateway to full-time self-employment.

7. Business AI Implementation

AI is revolutionizing industries, and businesses need experts to integrate AI tools into their operations. Those with knowledge of AI applications can offer consulting services, helping companies streamline their workflows and improve efficiency.

8. Real Estate Investments

Owning rental properties or flipping houses can be a highly lucrative side hustle, though it requires significant upfront capital. For those who invest wisely, real estate can generate long-term passive income. Many self-made millionaires have built their wealth by strategically growing their real estate portfolios (here are some of their strategies).

9. Content Creation

Platforms like YouTube, TikTok, and Instagram offer multiple ways to earn money, from ad revenue to sponsorships. While growing a following takes time, successful creators can generate thousands of dollars per month through brand collaborations and product sales.

10. Online Tutoring

With online education on the rise, tutoring is a rewarding side hustle that allows experts in various subjects to teach students worldwide. High-demand subjects like math, science, and language learning offer competitive pay rates.

Conclusion

Side hustles in 2025 provide a wealth of opportunities, whether you're looking for extra cash, financial independence, or a career change. From AI-driven gigs to traditional services, choosing the right side hustle depends on your skills, interests, and long-term goals. By staying informed and strategic, anyone can turn a side hustle into a profitable venture. Check out this video: https://www.youtube.com/shorts/N2Bj6UcKr6c

3 notes

·

View notes

Text

Fast Cash for Property | Sell Your Home Quickly & Easily

Need fast cash for property? We buy houses in any condition, offering a quick and hassle-free selling process. No repairs, no agent fees, and no long waiting—just a fair, all-cash offer within 24 hours. Whether you're facing foreclosure, relocating, or dealing with an unwanted or inherited home, we provide a smooth and reliable solution. Close in as little as 10 days and get the cash you need without the stress of traditional listings. Trust our experienced team to make selling your home fast and easy. Contact us today for a no-obligation cash offer!

#sell house quickly#sell my house cash fast#cash buyers for homes#sell my house fast#instant cash offer for house#sell home quickly#fast cash home buyers#reputable Cash Home Buyers#fast cash for property#passive property investments

2 notes

·

View notes

Text

It was the most spectacular trial ever held in Vietnam, befitting one of the greatest bank frauds the world has ever seen.

Behind the stately yellow portico of the colonial-era courthouse in Ho Chi Minh City, a 67-year-old Vietnamese property developer was sentenced to death on Thursday for looting one of the country's largest banks over a period of 11 years.

It's a rare verdict - she is one of very few women in Vietnam to be sentenced to death for a white collar crime.

The decision is a reflection of the dizzying scale of the fraud. Truong My Lan was convicted of taking out $44bn (£35bn) in loans from the Saigon Commercial Bank. The verdict requires her to return $27bn, a sum prosecutors said may never be recovered. Some believe the death penalty is the court's way of trying to encourage her to return some of the missing billions.

The habitually secretive communist authorities were uncharacteristically forthright about this case, going into minute detail for the media. They said 2,700 people were summoned to testify, while 10 state prosecutors and around 200 lawyers were involved.

The evidence was in 104 boxes weighing a total of six tonnes. Eighty-five others were tried with Truong My Lan, who denied the charges and can appeal.

All of the defendants were found guilty. Four received life in jail. The rest were given prison terms ranging from 20 years to three years suspended. Truong My Lan's husband and niece received jail terms of nine and 17 years respectively.

"There has never been a show trial like this, I think, in the communist era," says David Brown, a retired US state department official with long experience in Vietnam. "There has certainly been nothing on this scale."

The trial was the most dramatic chapter so far in the "Blazing Furnaces" anti-corruption campaign led by the Communist Party Secretary-General, Nguyen Phu Trong.

A conservative ideologue steeped in Marxist theory, Nguyen Phu Trong believes that popular anger over untamed corruption poses an existential threat to the Communist Party's monopoly on power. He began the campaign in earnest in 2016 after out-manoeuvring the then pro-business prime minister to retain the top job in the party.

The campaign has seen two presidents and two deputy prime ministers forced to resign, and hundreds of officials disciplined or jailed. Now one of the country's richest women has joined their ranks.

Truong My Lan comes from a Sino-Vietnamese family in Ho Chi Minh City, formerly Saigon. It has long been the commercial engine of the Vietnamese economy, dating well back to its days as the anti-communist capital of South Vietnam, with a large, ethnic Chinese community.

She started as a market stall vendor, selling cosmetics with her mother, but began buying land and property after the Communist Party ushered in a period of economic reform, known as Doi Moi, in 1986. By the 1990s, she owned a large portfolio of hotels and restaurants.

Although Vietnam is best known outside the country for its fast-growing manufacturing sector, as an alternative supply chain to China, most wealthy Vietnamese made their money developing and speculating in property.

All land is officially state-owned. Getting access to it often relies on personal relationships with state officials. Corruption escalated as the economy grew, and became endemic.

By 2011, Truong My Lan was a well-known business figure in Ho Chi Minh City, and she was allowed to arrange the merger of three smaller, cash-strapped banks into a larger entity: Saigon Commercial Bank.

Vietnamese law prohibits any individual from holding more than 5% of the shares in any bank. But prosecutors say that through hundreds of shell companies and people acting as her proxies, Truong My Lan actually owned more than 90% of Saigon Commercial.

They accused her of using that power to appoint her own people as managers, and then ordering them to approve hundreds of loans to the network of shell companies she controlled.

The amounts taken out are staggering. Her loans made up 93% of all the bank's lending.

Vietnam secret document warns of 'hostile forces'

US denies Cold War with China in historic Vietnam visit

The country where Kissinger left a legacy of death and chaos

According to prosecutors, over a period of three years from February 2019, she ordered her driver to withdraw 108 trillion Vietnamese dong, more than $4bn (£2.3bn) in cash from the bank, and store it in her basement.

That much cash, even if all of it was in Vietnam's largest denomination banknotes, would weigh two tonnes.

She was also accused of bribing generously to ensure her loans were never scrutinised. A former chief inspector at the central bank was given a life sentence for accepting a $5m bribe.

The mass of officially sanctioned publicity about the case channelled public anger over corruption against Truong My Lan, whose fatigued, unmade-up appearance in court was in stark contrast to the glamorous publicity photos people had seen of her in the past.

But questions are also being asked about why she was able to keep on with the alleged fraud for so long.

"I am puzzled," says Le Hong Hiep who runs the Vietnam Studies Programme at the ISEAS - Yusof Ishak Institute in Singapore.

"Because it wasn't a secret. It was well known in the market that Truong My Lan and her Van Thinh Phat group were using SCB as their own piggy bank to fund the mass acquisition of real estate in the most prime locations.

"It was obvious that she had to get the money from somewhere. But then it is such a common practice. SCB is not the only bank that is used like this. So perhaps the government lost sight because there are so many similar cases in the market."

David Brown believes she was protected by powerful figures who have dominated business and politics in Ho Chi Minh City for decades. And he sees a bigger factor in play in the way this trial is being run: a bid to reassert the authority of the Communist Party over the free-wheeling business culture of the south.

"What Nguyen Phu Trong and his allies in the party are trying to do is to regain control of Saigon, or at least stop it from slipping away.

"Up until 2016 the party in Hanoi pretty much let this Sino-Vietnamese mafia run the place. They would make all the right noises that local communist leaders are supposed to make, but at the same time they were milking the city for a substantial cut of the money that was being made down there."

At 79 years old, party chief Nguyen Phu Trong is in shaky health, and will almost certainly have to retire at the next Communist Party Congress in 2026, when new leaders will be chosen.

He has been one of the longest-serving and most consequential secretary-generals, restoring the authority of the party's conservative wing to a level not seen since the reforms of the 1980s. He clearly does not want to risk permitting enough openness to undermine the party's hold on political power.

But he is trapped in a contradiction. Under his leadership the party has set an ambitious goal of reaching rich country status by 2045, with a technology and knowledge-based economy. This is what is driving the ever-closer partnership with the United States.

Yet faster growth in Vietnam almost inevitably means more corruption. Fight corruption too much, and you risk extinguishing a lot of economic activity. Already there are complaints that bureaucracy has slowed down, as officials shy away from decisions which might implicate them in a corruption case.

"That's the paradox," says Le Hong Hiep. "Their growth model has been reliant on corrupt practices for so long. Corruption has been the grease that that kept the machinery working. If they stop the grease, things may not work any more."

14 notes

·

View notes

Text

Apache Hotel / Horseshoe Club / Binion’s Gambling Hall

Apache Hotel, Fremont & 2nd, right around the time of opening in March 1932. No signs on the building. Photo by Larry Ullom.

Apache hotel and various clubs:

‘05: Property bought by W.R. Thomas, begins building a hotel in ‘10, abandons the project, leaving exposed open basement through the 20s.

‘31: P.O. Silvagni buys the property, begins building. A.L. Worswick, architect.

‘32: Apache Hotel opens 3/19/32. Hotel leased to R.R. Russell for 15 years. Silvagni opens a series of clubs in the basement in ‘32-34 - Apache Indian Village, Kiva Club, and ‘Pache Club. Apache Casino, a separate business, opens on the ground floor in Oct. by Pop Houskey, T. Thebo.

‘41: New Western Casino on the ground floor in Jul.; closed Spring ‘42.

‘42: Forester Jewelers on the ground floor (10/1/42-7/28/44).

‘45: S.S. Rex Club on the ground floor, opened 3/3/45. Partners include T. Cornero, Silvagni, W. Alderman. Sign by Nevada Outdoor Advertising. City orders partners including owner/landlord Silvagni out in Jun; G. McAfee licensed to take over the club in Jul. The "S.S." was dropped from the club name on paper post-Cornero, but the signs never changed.

‘46: Rex Club sold to M. Bernstein in Feb; M. Sedway as manager; casino becomes Eldorado Club in Aug, Sedway continues as manager.

‘47: Apache Hotel rooftop sign installed (c. late ‘47). Arthur Rozen, Ed Moss take over management at Eldorado Club.

‘50: Eldorado closed in Dec. The club reopened as Clover Club circa Jan.-Feb ‘51 with Eldorado sign in place.

‘51: May, Benny Binion buys and closes Clover Club. Eldorado sign removed from marquee that month as renovations to the club begin.

Horseshoe club:

‘51: Horseshoe Club opens on the ground floor 8/14/51.

‘52: “Benny Binion” name added to the Horseshoe sign c. May, after Binion is licensed.

‘53: Binion loses license in Dec after federal conviction; casino under control of new partners J. Brown, W. Dorsett, “Doby Doc” Caudill; Binion name removed from the sign in late ‘53 or early ‘54.

‘54: Dec. 10, Grand opening Horseshoe Club's new restaurant and bingo room in a new building on South 2nd St, and the Horseshoe's Million Dollar Display. Apache Hotel Annex occupies the second floor of the new building. An alley separates the main building and the annex.

‘58: Horseshoe Club leases Apache Hotel. Rooftop sign removed, replaced with a sign that says "Hotel," and the Apache name retired until 2019. Brown’s stake sold to Ed Levinson & Fremont Hotel partners, Levinson becomes president of Horseshoe.

‘59: Million dollar display removed, currency belonging to Joe W. Brown estate.

‘60: Jack Binion, age 22, approved as 2 ½ owner of Horseshoe

‘61: Neon facade installed on the building and expansion onto former Boulder Club property.

‘62: Parking garage addition, McAllister & Wagner, architect.

‘64: Binion family becomes sole shareholders of the Horseshoe. Main building and annex joined, removing the alley at unknown date in mid-late 60s.

‘69: Million Dollar Display re-introduced.

‘70: World Series of Poker begins.

‘88: Horseshoe buys The Mint in Jun; expands into the club in Jul; “Mint” lettering immediately removed from the signs; signs entirely replaced throughout Fall ‘88-early ‘89. Benny Binion statue sculpted by Deborah Copenhaver, at Casino Center & Ogden, unveiled in Nov.

‘90: Culinary Local 226 and Bartenders Local 165 union workers at Binion's Horseshoe go on strike, Jan. 27 to Nov. 7.

‘98: Becky Binion Behnen sole owner of Horseshoe.

‘99: Million Dollar Display sold, removed.

‘04: Horseshoe closed after cash seizure, 1/9/2004. Sold to Harrah’s. Harrah’s retains Horseshoe brand and World Series of Poker, sells remaining assets to MTR Gaming.

Binion’s Gambling Hall:

‘05: Hotel-casino rebranded Binion’s Gambling Hall & Hotel in Mar.

‘08: Casino and hotel lease sold to TLC Gaming.

‘09: Hotels closed (former Mint tower and Apache).

‘19: Older hotel reopens as Apache Hotel.

Photos from the collection at Nevada State Museum, Las Vegas. Sources include: D. Swanson. Blood aces: the wild ride of Benny Binion, the gangster who created Vegas poker. Viking, 2014.

Below: circa 1932, view on 2nd Street, main hotel entrance.

3 notes

·

View notes