#us retail banking

Explore tagged Tumblr posts

Text

How can I access my US retail bank account?

Hi there! It sounds like you're looking for information on how to access your US retail bank account. As an expert in this field, I'm happy to help you out.

First, you'll need to gather your U.S. Bank card or account number and PIN along with your Social Security number. If you don't have a PIN or need a new one, you can contact 24-Hour Banking at 800-USBANKS (844-266-5789) to request one.

Once you have your information, you can enroll in online banking at usbank.com. From there, select "My Accounts" at the top of the page, then choose the account you'd like to view. You'll be prompted to enter your login credentials, which will include your U.S. Bank card or account number and PIN. If you're enrolling in online banking to view your business accounts, you'll need an ATM or debit card PIN.

If you're having trouble accessing your account online, you can also call U.S. Bank's customer service line at 800-872-2657 for assistance. They'll be able to help you troubleshoot any issues you're experiencing and get you back into your account quickly.

I hope this information helps! Let me know if you have any other questions.

On a personal note, accessing my own bank account used to be a hassle until I started using U.S. Bank's online banking system. I love how easy it is to log in and manage my finances from anywhere, at any time. The website is user-friendly and I appreciate the added security features like multi-factor authentication. Plus, the customer service team is always available to help if I need it. Overall, I highly recommend U.S. Bank for all your banking needs.

Visit "cashpayservice" to know more idea about on

#us bank retail support#us bank retail banking#a u.s. bank#u.s retail sales#what is a retail bank account#us retail banking#u/s/w retail#hsbc retail credit usa inc#ecommerce#accounting#marketing#business

2 notes

·

View notes

Text

Finals week or my final week??? Stay tuned to find out😽

#finals#finals week#ready to kms#hell is a teenage girl#final weeks for americans to score free money from $190 million settlement with major us bank – exact steps to apply#final weeks until tj maxx shuts down location but retailer emailed detailed instructions on where to shop

11 notes

·

View notes

Text

I got paid? so much money this week? what is going on???

I'm hardly complaining though, I finally have some extra money to donate again <3

#personal#sofi.txt#i just got minimum wage for training before which is the kind of pay I'm used to and this time it was nearly double that???#it's almost the pay i used to get for two weeks but for ONE week holy shit#there was a bank holiday but that was this week so it shouldn't count yet 🤔#anyway is this what it feels like to have a normal non-retail job??#(it's still not that much it's like €870 it's not like I'm suddenly rich lmao. my weekly expenses are €450 which is what i got before)

2 notes

·

View notes

Text

the cha cha cha hologram flame boots restocked at koi footwear!!

#i bought them!!#i probably should have waited until they restocked at US retailers buy i didn’t wanna wait#i really hope they fit cause i’m usually a US 7 or 7.5 but i ordered a UK 5 so fingers crossed🤞🤞#my bank declined the perchase the first time and i had to have my mom help me😭😭#käärijä#my posts

8 notes

·

View notes

Text

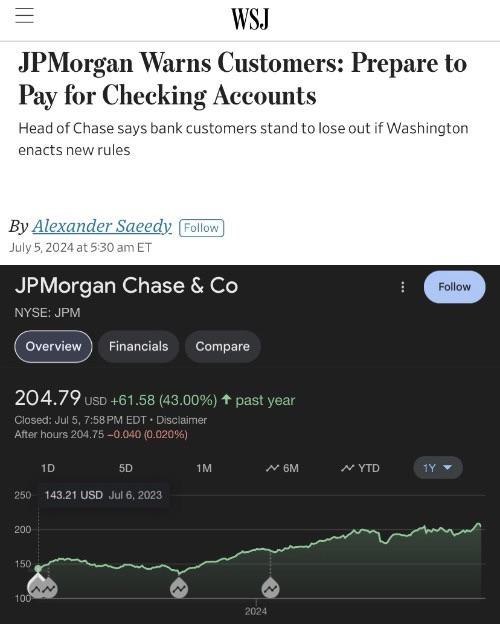

THINK OF THE SHAREHOLDERS.

#THINK OF THE SHAREHOLDERS.#shareholders#eat the rich#eat the fucking rich#jpmorgan#class war#chase bank#exploitation#exploitative#gst registration#gstfiling#gst accounting software for retail#gstreturns#gst#property taxes#us taxes#death and taxes#filing taxes#taxes#tax#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

3 notes

·

View notes

Note

what medication do you think you need and why

honestly I have no clue but I do know I need SOMETHING. I for sure I know I have depression. as for any other diagnosis I'm unsure but my friends have told me (who are diagnosed with these) I probably have quiet bpd/autism🧍🏻♀️

#letters 2 me#of course this is assuming im getting therapy as well but i can't afford that with everything going on rn#my mom got diagnosed with lymphoma recently and my hours are down bc it's slow season for food service and theres just no way#if i personally had money to help myself i would use it for my mom or just for rent before it went towards myself#i feel so bad because my friends want to do all these fun things but I just cant rn#i wish i lived in solitude sometimes in a cabin in the mountains so i didnt have to worry about money or anything. thats the dream#or maybe i should just sell a non important organ on the black market and make bank idk#LOL sorry im gonna stop ranting now#im looking into overnight retail rn i need out of food service and something more stable

2 notes

·

View notes

Text

turns out the secret to rediscovering my love of christmas was "actually having time off work"

#the last few years i would still do at least a day or two of christmas overtime cos it's double time#and i worked retail for 6 years so im used to having to work around christmas. so doing like. one bank holiday#when i used to do all of them was like 'pfft. that's nothing'. but this year i didn't pick up any OT#and im sat here like... four whole days off?? christmas AND boxing day?? what a concept

5 notes

·

View notes

Text

my hot guy ice cream scoop summer tryst romance novel persona vs my anthropologie woman in the city commuter romanticizing the little things iced coffee button up perfume persona FIGHT

#looks like im doing two jobs this summer which is great bc ive nothing to do and limited funds in my bank account. esp since i girl mode at#my retail job bc i got hired when i barely ever passed…now of course i show up w my voice three octaves deeper and i go to college w one of#my coworkers who knows me outside of work as a man. n at this point its like why bother djsjs i dont mind bc i use they#there so its fine. n e way i digress

2 notes

·

View notes

Text

Key Economic Events and Data Releases for June 27, 2024

Stay updated with today's major economic events including Fed Bank Stress Test Results, Continuing Jobless Claims, GDP Data, and more. Find detailed insights and forecasts.

#Economic Events#June 27 2024#Fed Bank Stress Test#Jobless Claims#GDP Data#Durable Goods Orders#Core PCE Prices#Pending Home Sales#Retail Inventories#Goods Trade Balance#Economic Forecasts#US Economy#Financial News

0 notes

Text

Top Banking Industry Opportunities in 2024

The banking industry is poised for significant growth and transformation in the coming years. With the rise of digital technologies and shifting customer expectations, banks are faced with both challenges and opportunities to innovate and expand their offerings. Here are some key areas where the banking industry can capitalize on emerging trends and trends

Commercial Lending

Commercial lending presents a prime opportunity for banks to bolster their revenue. With the escalating demand for business loans, banks can streamline their processes by leveraging technology, including digital portals, AI-powered credit risk analysis, and API integrations with accounting software. Leading banks are already pursuing commercial loan growth through organic and strategic acquisitions, such as Truist Financial's expansion from $62 billion to $164 billion in commercial and industrial loans.

Wealth Management

The wealth management landscape offers a colossal opportunity, with over $68 trillion in generational wealth transfers underway. Banks can harness this potential by establishing omnichannel high-touch/high-tech service models, combining personalized advice with cutting-edge digital capabilities. Top-quartile wealth management offerings consistently deliver higher returns and income growth, and banks are increasingly acquiring registered investment advisors (RIAs) to enhance their trust capabilities and build automated investment platforms.

International Expansion

Developing regions such as Southeast Asia and Latin America represent promising growth frontiers for banks. By adapting products and distribution to local customer needs and regulatory nuances, banks can secure a first-mover advantage. Partnerships or acquisitions of regional players can facilitate market entry and aid in navigating regulatory landscapes. According to Bain's research, developing market opportunities have the potential to contribute up to 25% of global revenue for leading banks by 2030.

Open Banking and Emerging Technologies

Banks can seize opportunities to use emerging technologies to reduce risk, streamline operations, and build trust with customers. Open banking initiatives that give customers more control of their finances are gaining steam globally. Regulators and central banks are lowering barriers for data sharing, and the US market may soon follow suit. This could open the door for third-party firms to seek consent for access to customer data through APIs, providing more tailored services such as budgeting, financial management, and lending.

Talent and Agility

Finally, banks will need to manage their talent effectively to succeed in the future. The war for tech talent remains a pressure point, and banks may have to pay dearly to hire specialized talent or train their own employees to become more tech savvy. Bankers should be empowered with the knowledge and resources they need to advise clients amid market uncertainties. Agility will be a fundamental attribute for banks to adapt to the changing landscape.

Conclusion

The banking industry is poised for significant growth and transformation in the coming years. By capitalizing on emerging trends and technologies, banks can expand their offerings and stay competitive. Key areas of opportunity include commercial lending, wealth management, international expansion, open banking, and talent management. As the industry continues to evolve, banks must be bold, decisive, and creative to remain relevant and successful.

#banking industry#banking growth#banking trends#banking opportunities#banking industry outlook#banking market forcast#Retail banking market size#banking market share#banking market size#global banking industry trends#us banking industry analysis#banking & finance industry#digital banking industry opportunities

0 notes

Text

Boycott Israeli Dates this Ramadan, from Call 2 Action Now, 28/Feb/2024: (caption under images)

This Ramadan, don’t break your fast with an Israeli date. Stand in solidarity with the Palestinian people.

Israel’s genocidal assault on Palestinians in the Gaza Strip has now killed tens of thousands. Palestinians, facing down Israel’s catastrophic violence, call on us to boycott Israeli products in solidarity with their struggle for freedom.

Follow this quick guide to boycotting Israeli dates:

• Always check the label when buying dates. Don’t buy dates that are produced or packaged in Israel or its West Bank settlements. If no country of origin can be found on the box, check the retailer’s website.

• One of Israel’s largest exporters is called Hadiklaim. It sells dates in supermarkets under these names: King Solomon, Jordan River and Jordan River Bio-Top, as well as under the labels of supermarket chains. Check the box carefully, if the dates were “exported by Hadiklaim” – don’t buy them.

• Avoid these companies: Mehadrin, MTex, Edom, Carmel Agrexco, and Arava

#checkthelabel is not enough. Israel has been caught labelling their dates as ‘produce of Palestine’. Tesco, Sainsbury’s, Waitrose, M&S, Morrison, Aldi, Lidl and Asda package Israeli dates under their own labels!

Buy dates from Zaytoun, Alard, Yaffa, and Holy Land Date all support Palestinian Farmers. If you cannot get hold of these brands then buy dates from Tunisia, Saudi Arabia, Iran, Pakistan, UAE and Algeria.

#ramadan#muslim#ramadhan#palestine#free palestine#gaza#free gaza#from the river to the sea palestine will be free#i stand with palestine#rafah#save rafah#palestinian lives matter#boycott israeli products#boycott israel#defund israel

13K notes

·

View notes

Text

The Current and Future Landscape of the US Micro Lending Market

Buy Now

What is the Size of US Micro Lending Industry?

US Micro Lending Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. Micro-lending is a driving force behind efforts to promote financial inclusion. Many individuals and small businesses lack access to traditional banking services or face barriers in obtaining credit. Micro-lenders offer accessible financing options, helping bridge this gap and empowering underserved populations to participate in economic activities. The rise of startups and small businesses has led to an increased demand for flexible and immediate financing. Micro-lending addresses their funding needs for initial capital, expansion, working capital, and operational adjustments, propelling their growth and innovation.

Moreover, regulatory changes that encourage responsible lending practices and consumer protection contribute to the growth of micro-lending. Focused efforts to balance innovation with consumer safeguards foster a favorable environment for micro-lending expansion. Micro-lending supports economic recovery by providing access to capital for individuals and businesses during challenging times. This aids in preserving jobs, stimulating entrepreneurship, and bolstering local economies.

Click Here :- Download a sample Report

US Micro Lending Market By type of product

The US Micro Lending market is segmented by Microloans, Savings and Deposit Services, Micro insurance and Remittances. In 2022, in type of product segment, microloans are dominance in US Micro Lending market. Microloans, characterized by their relatively small loan amounts, have gained prominence due to their suitability for a wide range of borrowers. Small businesses, startups, and individuals often require quick and accessible financing for immediate needs such as working capital, equipment purchases, or unexpected expenses. Microloans provide a tailored solution for these scenarios, offering manageable borrowing options without overwhelming debt commitments.

US Micro Lending Market by end user

In US Micro Lending market, they are segmented by small enterprises, Solo entrepreneurs & self-employed, Farmers & Agriculture workers, Healthcare Recipients and Small enterprises. In 2022, in end user segment, small enterprises are dominance in US Micro Lending market. Small enterprises often face challenges accessing traditional financing options from banks and larger financial institutions. Micro lending platforms have stepped in to bridge this gap, offering streamlined application processes, faster approvals, and smaller loan amounts tailored to the needs of these businesses.

The US Micro Lending market is segmented by Region into North, South, East, West. In 2022, the dominance region is north region in US Micro Lending market. The North region's diverse industries, technological infrastructure, and access to skilled professionals contribute to its prominence in the micro-lending market. The established ecosystem of financial expertise, combined with the region's economic diversity, positions the North as a hub for both traditional and innovative micro-lending solutions, influencing its dominance in 2022.

Visit this Link:- Request for custom report

Competition Scenario in US Micro Lending Market

The US micro-lending market is marked by intense competition as various players aim to cater to the diverse financial needs of individuals and small businesses. Established financial institutions like JPMorgan Chase and Wells Fargo have ventured into micro-lending, leveraging their brand recognition and infrastructure to offer small-dollar loans.

Furthermore, peer-to-peer (P2P) lending platforms like Funding Circle enable individuals to invest directly in loans for small businesses, creating a unique form of competition and democratizing lending. Emerging neo-banks such as Chime and Varo Money offer overdraft protection and small-dollar credit lines, tapping into their growing customer base to provide micro-lending options with a focus on consumer-friendly terms. Credit unions and community development financial institutions (CDFIs) also compete by offering micro-lending programs that align with their mission to serve underserved communities.

What is the Expected Future Outlook for the Overall US Micro Lending Market?

The US Micro Lending market was valued at USD ~Million in 2022 and is anticipated to reach USD ~ Million by the end of 2028, witnessing a CAGR of ~% during the forecast period 2022- 2028. The integration of technology, particularly digital platforms and artificial intelligence, will likely drive the micro-lending market. Online lending platforms will continue to grow, making the application process more convenient and accelerating loan approvals. Micro-lending is expected to play a crucial role in promoting financial inclusion, especially among underserved communities and individuals lacking access to traditional credit sources. Online platforms and mobile apps can bridge this gap by offering accessible and affordable loan options.

The use of alternative data sources for assessing creditworthiness will expand. This includes analyzing factors beyond traditional credit scores, such as social media activity, payment history, and education levels, to assess risk and determine loan eligibility. Regulatory changes will impact the micro-lending market. Striking the right balance between fostering innovation and ensuring consumer protection will be a challenge. Regulations governing interest rates, fees, and transparency will continue to influence lending practices. Moreover, Micro-lending could expand its focus beyond individuals to include small and medium-sized enterprises (SMEs). Online platforms can offer swift and accessible funding options to help these businesses grow and innovate.

Micro-lenders might emphasize education and financial literacy initiatives to empower borrowers with better financial management skills. This could lead to more responsible borrowing and reduced default rates. As digital lending becomes more prevalent, ensuring data security and privacy will be paramount. Lenders will need to invest in robust cybersecurity measures to protect sensitive borrower information.

#US Micro Lending Market#Microfinance Industry in#On Deck Capital Inc market revenue#Biz2Credit market Growth#Bluevine Capital market share#Lending Club Bank US Micro Lending Market#Lendio Inc US Micro Finance Sector#Micro Lending Market opportunities#Micro Lending Market forecast#USA Micro-credit Market#Potential Investors in micro lending market#Retailers in Micro Lending Market

0 notes

Note

Could you please write sweet,subtle,cute things batboys+Bruce does when they are crushing on reader?

Dick

He wants to spend a lot of time with you. Literally.

He’s very much the kind of guy who wanted to see you smile and laugh with every interaction that you had with him, just so he could shamelessly memories both your laughter and smile to his memory long after the outing you both had was over.

He would make goofy remarks or recall a story from recent memory that he thought would make your day a bit brighter. Gotham was often a depressing city that could easily damper anyone’s mood with its lack of dramatic change to better the lives of the people who lived within the seemingly cursed town.

So seeing you happy and smiling was more than enough to keep Dick’s hopes up for a better future, hopefully for the both of you should you reciprocate his feelings. He’d gladly die knowing that the last thing he remembers was your laughter and smiling face, looking like an absolute angel in his eyes, but this was him just being a dramatic romantic who just wished to be the very reason you lived a relatively happy life.

Dick would use Hayley quite often when he wanted you to prolong your stay at his place, claiming she’s going to miss you greatly, when it was actually him who’d miss you the moment you walked out the door. After all who could say no to a cute doggy that looked up at you with thoughtless but happy to be there eyes. So it wasn’t uncommon that you and Dick would take Hayley out on walks together through a safe area where he would let Hayley off the leash, only to watch with a warmth blossoming within his chest as you and Hayley enjoyed each others company.

Dick would come to see you, himself and Hayley as a little family of your own making and would love nothing more than to have this become a common thing. Something he wished would become a thing of reality rather than a fantasy he’d visit within his sleep, but he can take what he can get for you being in his life was more then enough, even if there wasn’t a label to what you were to each other.

Another thing he would do was buy you things that he’d thought you’d like. Anything that he saw within a shop window that reminded Dick of you was already bought within minutes as he would then go on a hunt for more things to buy you for the sake of spoiling you for being his anchor and his person through thick and thin. It could be blankets, plushies or sweets that he knew you’d find comfort in it didn’t really matter as he’d treat you like the royalty you were in his mind, all the while getting you a silly card with a cleverly thought out pun that he would write an equally silly message within it, hoping it would become a keepsake to look back on with a sappy but warm feeling within your chest.

Bruce

Very giving but he would act like a real distinguished gentleman towards you.

Alfred raised him right that’s for fucking sure.

He’s the type to never let you pay for anything, always having his card in hand to hand off to the waiter, nor to place on the card reader in a retail store, before you has the chance to reach inside your purse/wallet. It didn’t help that he looked smug after paying for the things that you let your eyes linger a second too long upon.

The man didn’t fear for the loss of money in his bank for as soon as the money was spent, the money lost was quickly replenished within the blink of an eye. No exaggeration.

Bruce would only want to be a provider for you and the type of partner that you could feel safest with as he takes care of you and your needs first and foremost, all the while making sure to make your life a hell of a lot more easier as he helps you by helping you into your shoes, zipping up your coat when it’s cold and put gloves on your hands while stroking the backs of your hands gently; offering you his arm with a smile afterwards as he escorted you both out of the manor to attend a charity event that Wayne Enterprises was hosting.

He personally asks for you to company him to these such grand events as his plus one, even offering to buy you formal attire should you lack any in your wardrobe, or go ahead into buying you one regardless and giving it to you as a present just so he could see your raw reaction himself when you opened the box to see the high quality attire he had picked out for you. Ironically it matched his own attire but in the most subtle of ways that not many would spot unless they were actively looking.

The press have a field day with this as you were frequently seen on Wayne’s arm, so much so that they called you his secret spouse in the tabloids, not that you see them as serious though as the press will make anything up to get people to read their half baked stories.

Offers to drive you home all the time no matter what, it didn’t matter if your home was within walking distance Bruce didn’t feel it was necessary for you to walk alone home when he had a perfect car in excuse use to take you home instead. Just give him a text and he’ll come over within minutes, but even if you didn’t text him he’ll turn up anyway as though he knew where you’d be, and when asked about it he only shrugs and says that he was merely in the same place at the same time, you joked and said that he might’ve been tracking you and Bruce only cleared his throat as he drove you home.

Damian

He’s not so quick to anger when it comes to you, almost like your presence was all that was needed to reassure his mind and bring peace to it without needing to try.

No outbursts came your way at all that many thought you were the one person Damian would never yell at, and they were right but Damian would deny all of this, but even deep down he knew it was something he couldn’t deny forever not if he was going to confess his deepest feelings sooner or later.

He felt as though he could experience a normal life with you as he found himself confining in you with things that he didn’t tell anyone else. You were his safe space whether or not you were aware of it, and sooner or later Damian found himself smiling and laughing and enjoying life as he taught you how to draw.

He was patient with you, more then he ever was with anyone else as he taught you brush strokes, to knowing what type of pencil to use for effective shading along with shading techniques and which ones would make your sketches some more life to them. If it seemed as though you were struggling with his verbal instructions, he’ll use a fresh page in his sketch book and show you firsthand how to do it in a step by step manner, waiting for you to follow along his steps and smiling softly to himself when your finish sketch looked similar to his.

He’s happy that he’s made you happy, it’s not something he’s ever done but if it was just for you then he’ll do it again for the rest of his life.

He’ll even let you name an animal he found abandoned somewhere, letting you hold it in your hands and loving the image before him as you smiled down at the animal he found, handling it with uttermost care as though you were afraid of hurting them. Once you’ve given it a name, Damian will treasure it by always holding them against his chest wherever he could when the occasion arises, as they were the closest thing to you in this point and time. And he smiles every time he looks at them and feels a lightness within his chest.

He’ll use the little guy to have your constant company…not that he’ll ever admit to using such a tactic to anyone.

Jason

He’s a lot more lighthearted with you and playful, almost as if the boy he used to be was coming through.

He’s softer towards you also as he would always be the first to offer you help with whatever you needed without a second thought. He wanted to be helpful towards you, and so he would go out of his way and prove himself as such by doing small but meaningful things that he’d knew you’d appreciate greatly, whether that be getting your coat or reminding you of whether you were forgetting to take your mandatory medication. Literally anything you needed help with Jason will do it without being hesitation.

This then becomes him doing stuff on your behalf that he knew you didn’t like by memory because he remembered everything about you, from your likes to your dislikes, anything related to you he remembers it as though he had known for a long time.

He just wanted to show to you that he wasn’t what others perceived him to be, he didn’t want you to think of him as an angry, broken, hollow husk of a man who knew nothing but revenge and self destructive tendencies that left him feeling lonelier then ever.

Jason would offer up his apartment as your safe reprieve, you were allowed to enter his place whenever you please. He didn’t mind either way as your presence was a much welcomed one, for Jason had never had he felt comfortable in going home just to find you waiting for him with a smile, whether or not your good at cooking didn’t matter as he could easily cook you both up something, or you’d both go to the nearest fast food restaurant for some much needed greasy comfort food.

The domestic act of having you in his apartment constantly that sooner or later he’s seen that you’ve made the apartment even more like home to him, for it has traces of you scattered here and there and Jason couldn’t help but smile at seeing your touches made to his home that he could only wish that he could ask you to move into his apartment permanently. He knew he couldn’t ask that of you yet, especially not when he has still to confess to you.

He’s protective over you and was more then willing to scare off anyone that was doing your head in by overstepping your boundaries. So once they had left you alone Jason would look to you and ask whether you were okay in a soft tone. His eyes filled with concerned he holds you by the shoulders, looking you over incase you were hiding anything from him before moving forward, making sure that there was no one else to cause you problems for the rest of the day.

#dc imagine#dc x reader#dc x you#dc comics x reader#dc fanfic#dc fic#dc x y/n#jason todd x reader#jason todd imagine#jason todd fluff#jason todd imagines#jason todd x y/n#dick grayson x you#dick grayson imagine#dick grayson imagines#dick grayson x reader#dick grayson fluff#bruce wayne x you#bruce wayne fluff#bruce wayne x reader#bruce wayne imagine#bruce wayne fanfiction#damian wayne x you#damian wayne imagine#damian wayne x reader#damian wayne imagines#damian wayne fluff

857 notes

·

View notes

Text

Nirvana - Drain You 1991

"Drain You" is a song by American rockband Nirvana, written by vocalist and guitarist, Kurt Cobain. The song was released as a promotional single in late 1991 for their second album, Nevermind (1991), and also appeared as a b-side on UK retail editions of the first single from that album, "Smells Like Teen Spirit".

A live version, recorded on December 28, 1991, at Del Mar Fairgrounds in Del Mar, California, was released as the second promotional single from the live compilation, From the Muddy Banks of the Wishkah, in 1996. This version peaked at number 44 on the Radio & Records US Alternative Top 50 chart. Another live version of the song, recorded by MTV at the band's Live and Loud performance on December 13, 1993, at Pier 48 in Seattle, was released as a music video on MTV2 in November 1996, to support the release of the From the Muddy Banks of the Wishkah album, even though it was a different version that actually appeared on the album. No known footage exists of the Del Mar Fairgrounds performance.

Cobain cited "Drain You" as one of his favorite compositions, telling David Fricke in a 1993 Rolling Stone interview that he thought it was as good, if not better, than "Smells Like Teen Spirit". "I love the lyrics, and I never get tired of playing it," he said. "Maybe if it was as big as 'Teen Spirit', I wouldn’t like it as much." The song appears in the video games Rock Band 2 and Rock Band Unplugged.

"Drain You" received a total of 74,1% yes votes! Previous Nirvana polls: #118 "The Man Who Sold the World".

youtube

550 notes

·

View notes

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

424 notes

·

View notes

Text

Every jerk CEO right now

#bank of america & wells fargo among bank ceos pushing back on new regulations after warning of impact on customers#fuck ceos#ceo steve rogers#ceos#banana republic ceo calls its new change ‘pinnacle’ of luxury and shoppers will immediately see the difference#h&m ceo confirms retailer is being forced to hire more security across the us as shoplifting spikes#ceo of beloved coffee franchise with 127 stores in 29 states speaks out to announce major expansion change outside us#ceo#poverty#pizza#wage slavery#slavery#chattel slavery#anti slavery#antiwork#slaves#slave#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war

6 notes

·

View notes