#trump wants to increase tariffs on all goods.

Explore tagged Tumblr posts

Text

#trump wants to increase tariffs on all goods.#this includes goods that can't be produced in the US#like coffee beans#and will end up making them (amongst other things) more expensive#us politics#funny#memes#dank memes#comedy#humor#meirl#relatable#mental health#jesterscourt#voter education is important

546 notes

·

View notes

Text

Something else that stands out: Trump was repeatedly asked questions about what he would do to improve various issues: healthcare, the environment, the war in Gaza. And all he does is say “well this problem never would have happened if I had been the president.” And that’s not the question asked! Like, tough luck, but you weren’t president. Here is what the situation is now. What are you going to do about it? And he doesn’t have an answer. Not on healthcare, not on environment, not on Gaza. He appears to think that all these problems will magically disappear if he becomes president. Well, they won’t. The problems will still exist, and he has no plan to deal with any of it; if he had a plan, he would have told us. (He’s so good at telling us his plans for illegal immigrants, after all.) He does have a plan for the economy, but it’s a complete disaster that would raise the cost of living and increase the deficit—tax breaks always increase the deficit unless you offset them with a tax hike somewhere else, and the cost of tariffs is always passed on to consumers (which is why Harris was calling it a sales tax, because more people would understand how that affects cost of living). Oh, and he also accused immigrants of eating cats, accused the FBI of fraud, repeatedly trashed our country, and generally sounded like a listing for an alphabet-soup brand’s product on Amazon, only instead of “chair seat papasan loveseat perfect for living room bedroom parlor,” it’s “immigrants crime China Mexico Venezuela fracking guns executing babies.”

Harris, by contrast, has plans. I personally think they are pretty good plans. There are some minor details I would change, but it’s a hell of a lot better than “no plans, I’m too awesome for plans” and/or a reskinned Project 2025. She also hasn’t accused immigrants of eating cats or accused anyone of “wanting abortions in the ninth month” (an utterly ridiculous claim; if someone doesn’t want a baby at that point, you induce labor and the newborn becomes a ward of the state).

It’s a race between utterly incompetent dictatorial insanity and a competent woman whose policy positions may be somewhat off from your preference (or not).

Please don’t vote for the guy who thinks immigrants eat cats and dogs.

223 notes

·

View notes

Text

Tbh I think the wildest thing about Trump is that he literally doesn’t understand soft power

And possibly cannot even perceive it

He’s going around bitching about trade deficits and defence spending…

But a trade deficit means that the country with the deficit is buying more of your stuff than you are buying of theirs

It’s a good thing for your market, especially if you want independence and to get money from people buying your stuff - it’s not people not paying for things, it’s people buying your products and you not buying theirs in return

You’re “trading” products for money. You still get the money. And you can do things like influence the market and sell shitty dvd players that break after a year so that people need to buy Even More dvd players from you, because they aren’t making their own and are used to buying yours

(Note: in this example, “you” are the party with a trade SURPLUS. That means someone else has a deficit in their trade with you

Being the person with the deficit is also not a bad thing, so long as you’re actively trading; it means rather than creating your own industries that may not do as well as another country’s for immutable reasons like being able to mine for specific minerals, you can buy a good product and skip all the construction costs and focus on the things you can do better

The general rule of trade is that if you keep trading, everyone wins)

But Trump is essentially saying that he wants to stop other countries from buying American goods; he wants our imports (us buying your stuff) to match our exports (you buying our stuff)

So

You get less money, because either you’re buying more of our stuff (our exports rise to match imports), or you can’t sell us anything (we lower imports to match exports)

And he wants to do this with tariffs, which mean it becomes more expensive for American retailers to import international goods - because they pay tariffs to the American government, and the exporter does not pay those

(So you can’t afford imports)

So the only way to do what he wants… is to stop buying American goods

This will do good things for the American economy I pinky swear 🙄

The defence spending thing is actually even worse, which is fucking wild to me

The main reason that America is a military world power is that you waste all that money on an army you’re not really using to anything but go around showing off and declaring how big your army is

Other countries spend less on defence because we’re spending on things like infrastructure and improving the well-fare of our citizens

So we don’t have a big strong army that can fight your army, because we don’t need one, but we do need things like food for children and healthcare

But Trump is demanding that everyone else make themselves a big strong army

Because the US being able to essentially run a protection racket and ever so casually say “oh gee Russia looks so big and strong. Let us put a military base in your country so we can keep you safe… oh, and I guess maybe some beneficial trade deals while we’re there 😉😉 keeping you safe 😉😉” is… America being exploited?

And listen, Trump doesn’t do subtle. He’d probably just blatantly say “do what we want or we will invade”, and start a war

But because he can’t do that, he seems convinced that there is no value in America spending more on defence, and insists that the very same people he is antagonizing and threatening the sovereignty of should be expanding their own military power

Frankly, they’d probably start spending a little more on defence anyway

Nothing he’s doing will increase American influence on the world stage, because he’s actively forcing the rest of the world to start acting like America has already left

“Stop buying our exports. Build your own army.”

And as a Canadian? I do think it’s about time we were a little less economically dependent on the US - because it gives them too much power

They’re our closest and most convenient trade partner, but not the only game in town

82 notes

·

View notes

Text

In speeches, interviews and campaign videos, Trump has promised to:

Use the military to participate in the largest deportation of undocumented immigrants in American history;

Order the National Guard into cities with high crime rates, whether local officials want it or not;

Prosecute Californians who protect minors coming to the state for gender-affirming care;

Impose a 10% tariff on almost all foreign goods, increasing prices for consumers;

Appoint a special prosecutor to “go after” his political opponents, beginning with Biden;

Purge the federal civil service of anyone who questions his views.

lets be clear here, Donald Trump wants to use the military to hunt immigrants and if you think it'll stop at "illegal" immigrants I have a bridge to sell you. He wants to place major American cities, Democratic cities under military occupation, oh also while he fires any Democrats from the civil service and "goes after" his political enemies. And as a cherry on top he'll make being trans illegal.

right now the world is trying to distract you from this, trying to act like this is a normal election with two more or less equal choices that both have problems and draw backs, thats not true. One side is selling an authoritarian dictatorship that wants to carry out a genocide of trans people, the other side is not.

#Politics#US politics#Donald Trump#Trump#Joe Biden#Republicans#vote#trans rights#trans#immigration#refugees

410 notes

·

View notes

Text

What Can Canada Do About It?

Alright ya hosers, buckle up. I am not usually one to make huge text posts but this is going to be long and goddam irate. There will, however, be things in this that will be actionable, so if you're a fellow Canuck, give ‘er a read, and feel free to share, reblog, print it off and staple it to a moose—whatever gets the word out. And to just to make sure our ol' neighbours can't look in on us too easily, I'm gonna lace this thing with enough Canadianisms to make your toque spin.

To any of our neighbours who are up for the challenge of deciphering this maple-syrup-coded manifesto: keep in mind that we don't have anything against regular Americans. The guy who's threatening our country and screwing us over is the same guy who's threatening and screwing yours. Fuckin' buddy's downstairs thinking we wouldn't say boo to a goose, and we're just tryin' to remind him who exactly those gooses are named after, eh? I hope at least some of you will get that.

OK, beauts. Let's get into it.

I've got mes yeux dans la graisse de bines seeing Canadians act like we don't have a good hand in this absolute gong-show of a trade war. Of course we do. We’ve got a lot of leverage, and we can get 'er done. And it starts with the ol’ classic: buying Canadian. But we know that one already and that’s just the warm-up. There are also other things our government can leverage that would be deeply felt - to the point of makin' sure their economy falls arse over kettle along with us.

We are the US's largest trading partner. Last year we exported roughly $450b fuckin' piasse (CAD) to the US in electricity alone. That’s an awful lot of hydro, folks. So, let’s say we just... cut that off. Flip the breaker. Not forever, but just long enough for them to know we're serious. And when we bring it back? Buddies, we do it at an absolute piss-show of a mark-up.

Canada supplies over half of U.S. crude oil imports—4.3 million barrels per day. That's a couple-three too many to just replace overnight. That means if we turn off the taps, they can kiss those gas prices goodbye, ‘cause they’d be skyrocketing to $5–$7 per gallon, roundabaouts. And higher energy costs would increase inflation, worsening the cost-of-living crisis faster than a deer on the 1A.

Canada also supplies about 10% of total U.S. natural gas consumption. Minnesota, Michigan, Illinois, and the Northeast rely heavily on Canadian gas, especially in the winter to keep the wind from cutting 'em in half. A sudden loss would lead to shortages and insane heating costs, particularly when it's colder than a witches' tit in a brass bra out and a bunny hug alone won't save ya... which is now, conveniently! Factories would also see costs rise by a significant percentage (though not as much as regular folks would because America).

That said, Industries that rely on fuel from the Great White North are still going to start seeing prices that cost more than a Leafs ticket in the playoffs, with oil refineries, agriculture, and manufacturing industries bein' especially kicked in the mitts.

Trump's all full of piss and vinegar, swearin' up and down that the U.S. can produce all its own energy. Okay, bud. Giv'r. In the meantime, we could be slick as a smelts and sell some of that oil to Mexico instead (we already do a bit but there's room to almost double how much), which would have the added bonus of helping them dodge some of these tariffs that are about as useful as tits on a bull while we’re at it. Sure, it’s a little spicy CUSMA-wise, but you know what else is a bit spicy for CUSMA? Trump’s goddamn tariffs. So in for a loonie, in for a toonie, my friends. Let him challenge it - that would trigger NATO oversight and I'm pretty sure that dog won't hunt.

The great thing about this is, should Fürher von Cheeto realize he fucked up but not want to admit it, his only other play would be to increase imports from OPEC. Last I checked, OPEC was made up of countries who's hackles he's already gotten up by supporting Israel (Iran, Iraq, Kuwait, Saudi Arabia, the UAE), as well as countries who he referred to as "shit hole countries" and/or accused of just being criminals and rapists (Venezuela, Libya, Algeria, Nigeria, Gabon, Equatorial Guinea, and Congo). I'm sure the screeching in would go super well.

Cutting off our energy would knock down the U.S. GDP by almost 1%, and could raise inflation by up to 2% very quickly. This is just the energy sector and we're already havin' a time, folks!

Now, let's talk about critical minerals!

We are sitting on a goddam goldmine. Or, well, a lithium, nickel, cobalt, graphite, copper, rare earth elements (REEs) and uranium mine—but you get the idea. If we cut off mineral exports to the U.S., this whole hootenanny would turn into a real tire fire real quick. Canada is the lead dog in the sled when it comes to supplying most of these materials to the U.S., and they're essential for defense, technology, and green energy (though we know the leafs will make the playoffs before he ever gives a hoot about that last one).

Let's see what that would look like: right off the hop, the EV, and Battery Industries would be totally hooped. Canada supplies 88% of U.S. nickel imports, which is a necessary material in EV batteries. We're also a top supplier of cobalt and lithium, and we're almost 100% of the US' graphite supply, all of which are essential for Tesla, Ford, GM, and others to make their cars. And the icing on your timbit? All of Elon Musk's companies right now rely almost exclusively on us hosers for cobalt. Without this, EV production could plummet, resulting in thousands of jobs lost, increased prices, and tardy adoption timelines. It would also cause Musk's stock and net worth to drop faster than a puck onto fresh ice, just sayin'.

(Note: he'd still be stupid rich because the world is a terrible place, but he'd be slightly less stupid rich)

Sort of on that note, say goodbye to American-made smartphones, laptops, and semiconductors. Most of the materials the tech industry needs for that come from us. That supply chain will be colder than a banker's heart when chip production in the U.S. freezes over.

Oh, and this one's my favourite... DEFENSE. Guess who the big cheese is when it comes to supplying uranium, the thing the US needs to keep making nukes, submarines, and reactors? Canada! Not that we should be especially proud of this one. We are also a major supplier of Rare Earth Elements (REEs), that they use for fighter jets, guided missiles, and satellites. This would not only mean delays in the manufacturing of all this military equipment, but would leave the US with no option but to turn to China for the REEs. Both those things are - you guessed it - actual threats to national security. Guess the DoD is about to get redder than a Mountie in a blizzard... maybe in more ways than one.

Being so fucking for real, though: trade war or no trade war, we need to stop providing critical military materials to a nation that is actively threatening not only our sovereignty, but that of our allies. Seriously, what are we doing?

To add more curds to this poutine, this cutoff could lead to the offing of nuclear power plants relying on Canadian uranium. Add that to the fact that we also supply critical minerals for wind turbines, solar panels, and energy storage, and not only is almost the entire green energy sector getting dragged to the back forty, but the energy crisis we talked about earlier would get rougher than a badger's backside, particularly in nuclear-dependent states.

It would take years for the U.S. to find someone else to help 'em fill their boots, which means critical minerals are probably Canada’s biggest geopolitical asset in this. And it's not like we'd be sitting around waiting for America to come crawling back. The EU---Sweden and Germany specifically---are looking to find more reliable ethically sourced minerals. Would they ever be able to bring in the kind of Muskoka money that the US does for us now? No. But it might make the hit more tolerable on our end, while also opening the door for more future cellies with the EU.

And these are just the things we could cut off completely. But why keep all our eggs in the basket of a country led by a man who couldn't empty his boots if the instructions were on the heel? Trade diversification in general is an effective tool to leverage our power here and stabilize our economy on a long-term basis. And when it comes to opportunities for that, the world is our prairie oyster:

We could ramp up our Agricultural trade with the EU. We already have CETA in place and our goods meet and exceed their quality regulation.

We could parter with EU countries on sustainable energy projects (we already have a lot of groundwork done for that, so we could put it into place faster than most Canadian learn to say "je suis un ananas").

Japan’s craving high-quality beef and pork, and our farmers could absolutely dominate that market.

We could virtually flood the global dairy market (or at least the US' share of it). We literally produce more dairy than we consume right now because of a stupid clause in CUSMA (which, again, seems to be going out the window) where we're not allowed to export our excess dairy in order to protect the US dairy industry that would be completely priced out of the game if they had to compete with Canadian prices. So much for free market, eh? Canada’s dairy industry is also just more regulated and stable, meaning it could present itself as a more reliable dairy exporter to regions where the U.S. dominates, like Latin America and Asia.

We could get corn products (and other produce, but especially corn) exclusively from Mexico, a country that actually determines US corn prices because they're a government subsidized industry, and the government deliberately subsidizes to just under Mexican corn prices in order to stay competitive.

We could invest in establishing Agricultural Infrastructure Development projects with Brazil and Argentina, which would streamline their distribution and solve a lot of their supply chain logistics needs, strengthening all our economies and reducing American dependencies on all sides

I don't really love this one, but we could expand our aerospace and defense sector. The U.S. is currently the world’s largest exporter of aircraft and defense technology, but Canada has a really strong aerospace sector too, with Bombardier, CAE, Pratt & Whitney Canada, etc. There are lots of countries (including some neutral/allied countries) wanting to reduce reliance on U.S. military exports due to political reasons, which could open opening opportunities for Canada.

We could - and should, even for just internal reasons - expand our pharmaceutical industry. The U.S. dominates global pharmaceutical exports, but Canada produces many high-quality generic drugs at lower costs, and our public healthcare system, flawed as it may be, ensures strict quality control, making our pharmaceuticals appealing to countries with emerging healthcare systems. Also, a lot of countries would just like to reduce reliance on U.S. pharma giants like Pfizer, Merck, and J&J simply due to costs. If we expand generic drug exports to Latin America, Africa, and Asia, compete with U.S. companies on vaccine and biotech exports, and sell cheaper insulin & prescription drugs to Mexico and Europe, we'd seriously undercut a massive sector in the US. We'd also have more accessible drugs for us, and we could partner with a variety of allied countries on manufacturing and R&D investments that would result in great deals for them and a faster implementation and expansion timeline for us.

We could revisit the CANZUK agreement - ideally not from a colonialist tradionalist lens this time (fucking conservatives) - and establish a proper free trade and free movement agreement between Canada, Australia, New Zealand, and the UK, focused on growing the tourism, services, business, banking, and tech sectors rather than import/export of agricultre and raw materials, which would let us circumvent some of the logisitcal issues initially brought up with establishing long-distance supply chains, while strengthening each country's economy and trading power and encouraging shared cross border investment and economic shares in R&D and manufacturing.

And finally, my favourite but the absolute most longshot option, we could join the EU. It's a very very very long shot (no one should hold their breath), but it's not like those discussions haven't happened. If not fully join, we could angle at becoming an associate member, or expand CETA or establish some other such agreement to allow free movement, industrial development incentives, and further free trade opportunities.

And if we absolutely must trade with the U.S., we can be tighter than bark on a tree and process our goods through third-party countries. By setting up subsidiaries in Latin America, Asia, or the EU, we could reclassify our exports under different tariff rates. Sure, our allies would get a cut, but it might still be less than the tariffs in some cases. Example? Shipping goods through Saint-Pierre and Miquelon (yep, that tiny island just up the line from Newfoundland) technically counts as shipping through France. Would it be feasible for everything? No. But it’d be just feasible enough to piss off the right people and let 'em know that the deerflies are out. Buddy might retaliate with tariffs on the EU, but the US economy would go straight in the fishin' hole if he tariffed himself out of trade deals with ALL of us.

Finally, on that subject, we are not exactly in a canoe without a paddle. We've got friends in NATO and we've got friends in the Commonwealth, one of who's core pillars is to "help grow economies and boost trade." We can find ways to come together so we're all laughin' by the end of it. We can also put pressure on our NATO allies to impose tariffs and sanctions on the US if this carries on down the road a ways, or to turn over some of the US' share of their spending to our industries whenever possible. And we should be after doin' that with Mexico already.

Is this all feasible and would this all work? No, of course not! I'm not an economist or an international trade specialist or any kind of top lobster when it comes to this stuff... In fact, I'm willing to bet there's nuance behind a lot of what I say that would make things worse! I'm just someone who did too much reading while losing sleep and taking notes on all of this. I would encourage you to do your own research as well and not just trust an anonymous stranger from the internet! But once you do and you have a sense of what you think would be a good idea, fuckin' give'r!!! Quit chirpin’ and start workin’, buds.

We are still lucky enough to live in a democracy where our elected officials do - for the most part - respond to their constituents, and are obligated to at minimum receive a compiled briefings on all correspondence that comes in for them. Right now, this is the most I've ever seen Canadians come together, as the vast majority of our representatives recognize this for the threat that it is, and are unwilling to get smoked like a cheap pack of darts. Flawed as our system might be, it is still functioning and it is still our right to participate in it and make our voices heard. So, write your MPs and your MPPs and ask them to expedite the cutoff of electricity and critical minerals to the US.... or whatever demand you land on after looking in to things yourself! While you're at it, write to every provincial premier, and to every cabinet minister, and to all the major party leaders. Hell, write to your mayor, to Industry Groups, to Cross-Border Coalitions... quelqu'un qu'y a du poids dans l’arène!

These are rights we can and SHOULD be exploiting, and more than that it is our duty as citizens who care about our democracy to exert political pressure on our leaders to move in the direction we want them to. But you gotta be in the canoe to paddle the river! Go exercise that right and make some demands. Nicely, but firmly. And repeatedly when it comes to the elected officials. This day and age, you can even schedule and automate the writing, tailoring, and sending of these messages (though be responsible with that). Basically, don't sit down and shut up until we get what we want.

Be a nuisance, but be polite about it. Be fuckin' Canadian... eh?

#canada#canada politics#canadian politics#cdnpoli#canadian news#justin trudeau#god i love canada#us politics#trade war#trump tariffs#donald trump#us tariffs#trade tariffs#canada tariffs#american politics#oh canada#made in canada#schitts creek#letterkenny#trailer park boys

50 notes

·

View notes

Text

“The UN Charter was drafted in 1945 by people who had learned the lessons that the aggression, isolationism and tariff barriers of the 20’s and 30’s had led the world into a conflagration. Article One makes it clear: threats of annexation are illegal. So are unilateral tariffs in breach of a trade agreement.” - Canadian Ambassador to the UN Bob Rae

Here is some good analysis of why Trump is like this:

"I’m going to get a little wonky and write about Donald Trump and negotiations. For those who don’t know, I’m an adjunct professor at Indiana University - Robert H. McKinney School of Law and I teach negotiations. Okay, here goes.

Trump, as most of us know, is the credited author of “The Art of the Deal,” a book that was actually ghost written by a man named Tony Schwartz, who was given access to Trump and wrote based upon his observations. If you’ve read The Art of the Deal, or if you’ve followed Trump lately, you’ll know, even if you didn’t know the label, that he sees all dealmaking as what we call “distributive bargaining.”

Distributive bargaining always has a winner and a loser. It happens when there is a fixed quantity of something and two sides are fighting over how it gets distributed. Think of it as a pie and you’re fighting over who gets how many pieces. In Trump’s world, the bargaining was for a building, or for construction work, or subcontractors. He perceives a successful bargain as one in which there is a winner and a loser, so if he pays less than the seller wants, he wins. The more he saves the more he wins.

The other type of bargaining is called integrative bargaining. In integrative bargaining the two sides don’t have a complete conflict of interest, and it is possible to reach mutually beneficial agreements. Think of it, not a single pie to be divided by two hungry people, but as a baker and a caterer negotiating over how many pies will be baked at what prices, and the nature of their ongoing relationship after this one gig is over.

The problem with Trump is that he sees only distributive bargaining in an international world that requires integrative bargaining. He can raise tariffs, but so can other countries. He can’t demand they not respond. There is no defined end to the negotiation and there is no simple winner and loser. There are always more pies to be baked. Further, negotiations aren’t binary. China’s choices aren’t (a) buy soybeans from US farmers, or (b) don’t buy soybeans. They can also (c) buy soybeans from Russia, or Argentina, or Brazil, or Canada, etc. That completely strips the distributive bargainer of his power to win or lose, to control the negotiation.

One of the risks of distributive bargaining is bad will. In a one-time distributive bargain, e.g. negotiating with the cabinet maker in your casino about whether you’re going to pay his whole bill or demand a discount, you don’t have to worry about your ongoing credibility or the next deal. If you do that to the cabinet maker, you can bet he won’t agree to do the cabinets in your next casino, and you’re going to have to find another cabinet maker.

There isn’t another Canada.

So when you approach international negotiation, in a world as complex as ours, with integrated economies and multiple buyers and sellers, you simply must approach them through integrative bargaining. If you attempt distributive bargaining, success is impossible. And we see that already.

Trump has raised tariffs on China. China responded, in addition to raising tariffs on US goods, by dropping all its soybean orders from the US and buying them from Russia. The effect is not only to cause tremendous harm to US farmers, but also to increase Russian revenue, making Russia less susceptible to sanctions and boycotts, increasing its economic and political power in the world, and reducing ours. Trump saw steel and aluminum and thought it would be an easy win, BECAUSE HE SAW ONLY STEEL AND ALUMINUM - HE SEES EVERY NEGOTIATION AS DISTRIBUTIVE. China saw it as integrative, and integrated Russia and its soybean purchase orders into a far more complex negotiation ecosystem.

Trump has the same weakness politically. For every winner there must be a loser. And that’s just not how politics works, not over the long run.

For people who study negotiations, this is incredibly basic stuff, negotiations 101, definitions you learn before you even start talking about styles and tactics. And here’s another huge problem for us.

Trump is utterly convinced that his experience in a closely held real estate company has prepared him to run a nation, and therefore he rejects the advice of people who spent entire careers studying the nuances of international negotiations and diplomacy. But the leaders on the other side of the table have not eschewed expertise, they have embraced it. And that means they look at Trump and, given his very limited tool chest and his blindly distributive understanding of negotiation, they know exactly what he is going to do and exactly how to respond to it.

From a professional negotiation point of view, Trump isn’t even bringing checkers to a chess match. He’s bringing a quarter that he insists of flipping for heads or tails, while everybody else is studying the chess board to decide whether it's better to open with Najdorf or Grünfeld.”. — David Honig

#trump tariffs#“the dumbest trade war in history” - Wall Street Journal#that last 🦫 gif upsets me but it is apropos#canada

22 notes

·

View notes

Text

“I’m going to get a little wonky and write about Donald Trump and negotiations. For those who don’t know, I’m an adjunct professor at Indiana University - Robert H. McKinney School of Law and I teach negotiations. Okay, here goes.

Trump, as most of us know, is the credited author of “The Art of the Deal,” a book that was actually ghost written by a man named Tony Schwartz, who was given access to Trump and wrote based upon his observations. If you’ve read The Art of the Deal, or if you’ve followed Trump lately, you’ll know, even if you didn’t know the label, that he sees all dealmaking as what we call “distributive bargaining.”

Distributive bargaining always has a winner and a loser. It happens when there is a fixed quantity of something and two sides are fighting over how it gets distributed. Think of it as a pie and you’re fighting over who gets how many pieces. In Trump’s world, the bargaining was for a building, or for construction work, or subcontractors. He perceives a successful bargain as one in which there is a winner and a loser, so if he pays less than the seller wants, he wins. The more he saves the more he wins.

The other type of bargaining is called integrative bargaining. In integrative bargaining the two sides don’t have a complete conflict of interest, and it is possible to reach mutually beneficial agreements. Think of it, not a single pie to be divided by two hungry people, but as a baker and a caterer negotiating over how many pies will be baked at what prices, and the nature of their ongoing relationship after this one gig is over.

The problem with Trump is that he sees only distributive bargaining in an international world that requires integrative bargaining. He can raise tariffs, but so can other countries. He can’t demand they not respond. There is no defined end to the negotiation and there is no simple winner and loser. There are always more pies to be baked. Further, negotiations aren’t binary. China’s choices aren’t (a) buy soybeans from US farmers, or (b) don’t buy soybeans. They can also (c) buy soybeans from Russia, or Argentina, or Brazil, or Canada, etc. That completely strips the distributive bargainer of his power to win or lose, to control the negotiation.

One of the risks of distributive bargaining is bad will. In a one-time distributive bargain, e.g. negotiating with the cabinet maker in your casino about whether you’re going to pay his whole bill or demand a discount, you don’t have to worry about your ongoing credibility or the next deal. If you do that to the cabinet maker, you can bet he won’t agree to do the cabinets in your next casino, and you’re going to have to find another cabinet maker.

There isn’t another Canada.

So when you approach international negotiation, in a world as complex as ours, with integrated economies and multiple buyers and sellers, you simply must approach them through integrative bargaining. If you attempt distributive bargaining, success is impossible. And we see that already.

Trump has raised tariffs on China. China responded, in addition to raising tariffs on US goods, by dropping all its soybean orders from the US and buying them from Russia. The effect is not only to cause tremendous harm to US farmers, but also to increase Russian revenue, making Russia less susceptible to sanctions and boycotts, increasing its economic and political power in the world, and reducing ours. Trump saw steel and aluminum and thought it would be an easy win, BECAUSE HE SAW ONLY STEEL AND ALUMINUM - HE SEES EVERY NEGOTIATION AS DISTRIBUTIVE. China saw it as integrative, and integrated Russia and its soybean purchase orders into a far more complex negotiation ecosystem.

Trump has the same weakness politically. For every winner there must be a loser. And that’s just not how politics works, not over the long run.

For people who study negotiations, this is incredibly basic stuff, negotiations 101, definitions you learn before you even start talking about styles and tactics. And here’s another huge problem for us.

Trump is utterly convinced that his experience in a closely held real estate company has prepared him to run a nation, and therefore he rejects the advice of people who spent entire careers studying the nuances of international negotiations and diplomacy. But the leaders on the other side of the table have not eschewed expertise, they have embraced it. And that means they look at Trump and, given his very limited tool chest and his blindly distributive understanding of negotiation, they know exactly what he is going to do and exactly how to respond to it.

From a professional negotiation point of view, Trump isn’t even bringing checkers to a chess match. He’s bringing a quarter that he insists of flipping for heads or tails, while everybody else is studying the chess board to decide whether its better to open with Najdorf or Grünfeld.”

— David Honig

21 notes

·

View notes

Text

"Trump, as most of us know, is the credited author of “The Art of the Deal,” a book that was actually ghost written by a man named Tony Schwartz, who was given access to Trump and wrote based upon his observations. If you’ve read The Art of the Deal, or if you’ve followed Trump lately, you’ll know, even if you didn’t know the label, that he sees all dealmaking as what we call “distributive bargaining.”

Distributive bargaining always has a winner and a loser. It happens when there is a fixed quantity of something and two sides are fighting over how it gets distributed. Think of it as a pie and you’re fighting over who gets how many pieces. In Trump’s world, the bargaining was for a building, or for construction work, or subcontractors. He perceives a successful bargain as one in which there is a winner and a loser, so if he pays less than the seller wants, he wins. The more he saves the more he wins.

The other type of bargaining is called integrative bargaining. In integrative bargaining the two sides don’t have a complete conflict of interest, and it is possible to reach mutually beneficial agreements. Think of it, not a single pie to be divided by two hungry people, but as a baker and a caterer negotiating over how many pies will be baked at what prices, and the nature of their ongoing relationship after this one gig is over.

The problem with Trump is that he sees only distributive bargaining in an international world that requires integrative bargaining. He can raise tariffs, but so can other countries. He can’t demand they not respond. There is no defined end to the negotiation and there is no simple winner and loser. There are always more pies to be baked. Further, negotiations aren’t binary. China’s choices aren’t (a) buy soybeans from US farmers, or (b) don’t buy soybeans. They can also (c) buy soybeans from Russia, or Argentina, or Brazil, or Canada, etc. That completely strips the distributive bargainer of his power to win or lose, to control the negotiation.

One of the risks of distributive bargaining is bad will. In a one-time distributive bargain, e.g. negotiating with the cabinet maker in your casino about whether you’re going to pay his whole bill or demand a discount, you don’t have to worry about your ongoing credibility or the next deal. If you do that to the cabinet maker, you can bet he won’t agree to do the cabinets in your next casino, and you’re going to have to find another cabinet maker.

There isn’t another Canada.

So when you approach international negotiation, in a world as complex as ours, with integrated economies and multiple buyers and sellers, you simply must approach them through integrative bargaining. If you attempt distributive bargaining, success is impossible. And we see that already.

Trump has raised tariffs on China. China responded, in addition to raising tariffs on US goods, by dropping all its soybean orders from the US and buying them from Russia. The effect is not only to cause tremendous harm to US farmers, but also to increase Russian revenue, making Russia less susceptible to sanctions and boycotts, increasing its economic and political power in the world, and reducing ours. Trump saw steel and aluminum and thought it would be an easy win, BECAUSE HE SAW ONLY STEEL AND ALUMINUM - HE SEES EVERY NEGOTIATION AS DISTRIBUTIVE. China saw it as integrative, and integrated Russia and its soybean purchase orders into a far more complex negotiation ecosystem.

Trump has the same weakness politically. For every winner there must be a loser. And that’s just not how politics works, not over the long run.

For people who study negotiations, this is incredibly basic stuff, negotiations 101, definitions you learn before you even start talking about styles and tactics. And here’s another huge problem for us.

Trump is utterly convinced that his experience in a closely held real estate company has prepared him to run a nation, and therefore he rejects the advice of people who spent entire careers studying the nuances of international negotiations and diplomacy. But the leaders on the other side of the table have not eschewed expertise, they have embraced it. And that means they look at Trump and, given his very limited tool chest and his blindly distributive understanding of negotiation, they know exactly what he is going to do and exactly how to respond to it.

From a professional negotiation point of view, Trump isn’t even bringing checkers to a chess match. He’s bringing a quarter that he insists of flipping for heads or tails, while everybody else is studying the chess board to decide whether its better to open with Najdorf or Grünfeld."

— David Honig

#last thing i'm posting on this because i'm not coping and i gotta unplug a bit#donald trump#trump#politics#us tariffs#tariffs#current events#current events cw#politics cw#trump cw#china#russia

23 notes

·

View notes

Text

President-elect Trump has suggested that he will impose a wide-range of tariffs when he takes office, including a blanket tariff of 10–20% on all imported goods, an additional tariff between 60 and 100% on Chinese goods, a 100% tariff on countries within the BRICS alliance if they attempt to undermine the U.S. dollar’s status as a global reserve currency, and a 25% tariff on all products imported from Mexico and Canada. Notably, he wants to impose at least some of these tariffs on day one. Can he impose tariffs that quickly? Potentially, yes.

The executive branch has an unusually broad menu of options when it comes to tariffs—the president is able to dictate tariff rates, which countries and goods they apply to, and when and how to impose them without Congressional approval and sometimes without public input or judicial review. We can’t think of another economic policy issue where the executive has so much power and escapes the checks and balances that apply elsewhere to executive branch actions. This is a choice made by the U.S. Congress.

To be clear, we—like most economists—have a dim view of unilateral tariffs. Tariffs increase the cost of consumption for domestic consumers, and they inefficiently shift economic activity towards sectors where production is more expensive. Moreover, tariffs often provoke retaliation from our trading partners and escalate into trade wars. Putting the economic issues aside, the proposed tariffs by the president-elect raise procedural and institutional questions about whether and how the executive branch should have the authority to unilaterally impose tariffs, and how quickly it can act.

The power to impose taxes, including tariffs, unequivocally resides with Congress according to the U.S. Constitution. This authority is essential for funding government operations, such as national defense, public services, and infrastructure. The development of tax legislation—jointly managed by the House Ways and Means and Senate Finance Committees—is a process that ideally includes careful study and public debate and can take months or even years. This means that the legislative process cannot realistically impose new taxes on day one of a new administration.

Tariffs are unusual in that they are a tax that is not implemented by congressional legislation, and thus circumvent a potentially lengthy and deliberative journey through the House and Senate. Instead, tariffs are imposed by executive branch regulation—but unlike most federal regulations, tariffs avoid almost all the legislated guardrails, administrative procedures, and judicial reviews that apply to other executive regulations. This means implementing new tariffs can proceed much more quickly than other significant regulatory actions implemented by the executive branch. How fast depends on which authority Trump chooses to invoke.

The executive branch has the authority to impose tariffs through two different processes. First, a series of Trade Acts—enacted between the 1930s and 1970s—empower the executive branch to proclaim tariff rates to protect American workers and consumers from unfair trade practices. This is the authority that empowered President Trump to impose limited tariffs on products like solar panels and washing machines during his first administration. To invoke this authority, an investigation is initiated by either the Department of Commerce or the Office of the U.S. Trade Representative to determine whether tariffs are necessary to remedy unfair trade practices. These investigations take some minimal time—including a 30-60 day notice-and-comment period that allows the public an opportunity to raise concerns—meaning that these authorities cannot realistically be used to impose new tariffs on trading partners on day one.

Instead, if President Trump wishes to impose tariffs more quickly, he will likely need to invoke the authority under the International Emergency Economic Powers Act (IEEPA) of 1977. Under the IEEA, Congress grants authority to the executive branch to address “unusual and extraordinary” peacetime threats to national security, foreign policy, or the economy. In May, 2019, President Trump threatened to use the IEEPA to implement escalating tariffs on Mexican imports in May 2019. He withdrew this threat after Mexico committed to specific measures aimed at curbing immigration.

Unlike tariffs enacted under the various trade acts, those imposed under the IEEPA bypass departmental reports, reviews, and public notice-and-comment periods. This streamlines implementation but bypasses essentially all regulatory checks and balances. The IEEPA’s speed makes it a likely tool for imposing new tariffs on day one. However, this path also raises legal questions, as seen in 2019, when skepticism emerged over its appropriateness for tariffs on Mexican imports. These criticisms are likely to resurface if the IEEPA is again invoked to justify now-broader tariffs on Mexican and Canadian imports.

To restore the balance of power, Congress could consider reforms to restore oversight and accountability in trade policy. In a new research brief, we trace the evolution of executive authority in determining tariff rates, highlighting how this authority bypasses the rigorous process that is already in place to provide a check on executive authority to impose other regulations, and we outline what options are on the table to restore oversight. While several bipartisan legislative efforts to address this imbalance have surfaced, they have gained little traction. Without meaningful reform, unchecked tariff authority has the potential to destabilize economic and diplomatic relationships. As the threat of sweeping, unilateral tariffs looms, the need for a more balanced and accountable system has never been more urgent.

7 notes

·

View notes

Text

He will get rid of 10 regulations for each new regulation

Tariffs, whose amounts are not yet established, will be imposed on foreign goods

Federal tax breaks will be given for companies that make products within the US: he will lower it from 21% to 15% if products are produced in the USA.

He will reduce interest rates and inflation

The US is becoming a merit-based country

He (of course) talked about the border

There are only 2 genders. Transgender surgeries will be rare. Transgender athletes will not compete with women.

The United States is a sovereign country

We are returning to freedom of speech, no misinformation/disinformation labels to suffocate Americans’ free speech

Asks nations to increase their defense spending to 5% from 2% (this was a US request to NATO nations under Biden last fall)

It is time to end the Ukraine war, it is a carnage. He said millions are dying. He wants to talk to Putin soon about this. Hopefully this is an exaggeration.

There will be no support for electric cars. People can buy whatever car they want.

Prolonged delays for project approvals will end

With AI, we will need twice the energy in the US as we use now. (!). He suggests electricity generating plants be built next to AI plants, avoiding need to use the grid.

President Trump spoke about the use of “clean coal.” Does this mean we will use better scrubbers? RF Kennedy sued coal-burning plants for releasing large amounts of mercury into the air, generally harming low income communities where they were located.

President Trump said “debanking” is wrong and told the big banks to stop doing it.

President Trump said we don’t need Canada for wood, for making our cars, etc. He pointed out that essentially everything Canada has, the US has. This presages some tough negotiations on tariffs.

The President said President Xi called him. We have a 1.1 trillion dollar deficit with China that needs to be corrected. Hopefully China can help stop the Ukraine war. We’d like to see denuclearization of our two countries (Russia and the US) and China could come along. President Putin really liked the idea of reducing our nuclear capability. Xi did too.

The Ukraine war should never ever have been started. A lot of stupidity all around. “Far more people have died than is being reported.”

6 notes

·

View notes

Text

The one big constraint on Trump

ROBERT REICH

NOV 25

Friends,

Will anything stop Trump?

He will have control over both chambers of Congress, a tractable Supreme Court, a political base of fiercely loyal MAGAs, a media ecosystem that amplifies his lies (now including Musk’s horrific X as well as Rupert Murdoch’s reliably mendacious Fox News), and a thin majority of voters in the 2024 election.

He doesn’t worry about another election because he won’t be eligible to run again (or he’ll ignore the Constitution and stay on).

Of course, there are the midterm elections of 2026. But even if Democrats take back both chambers, Trump and his incipient administration are aiming to wreak so much havoc on America in the meantime that Democrats can’t remedy it.

The Republican-controlled Senate starting January 3 won’t restrain Trump. Yes, Trump overreached with his pick of Matt Gaetz for attorney general. Apparently even Senate Republicans can’t abide sex trafficking girls for drug-infested orgies, but this is a very low bar.

So, as a practical matter, is anything stopping Trump?

Yes, and here’s a hint of what it is: On Friday, Trump picked Scott Bessent to serve as treasury secretary.

Bessent is the man Elon Musk derided only a week ago as the “business-as-usual choice” for treasury secretary, in contrast to Howard Lutnick, who Musk said would “actually enact change.”

Musk’s view of “change” is to blow a place up, which was what Musk did when he bought Twitter.

Over the last two weeks, Musk has convinced Trump to appoint bomb-throwers Robert F. Kennedy Jr. to Health and Human Services and Pete Hegseth to Defense, and to put Musk and Vivek Ramaswamy in charge of cutting $2 trillion from the federal budget.

But Bessent is the opposite of a bomb-thrower. He’s a billionaire hedge fund manager, founder of the investment firm Key Square Capital Management, and a protege of the MAGA arch-villain George Soros (he’s also gay, which the MAGA base may not like, either).

Why did Trump appoint the “business as usual” Bessent to be treasury secretary? Because the treasury secretary is the most important economic job in the U.S. government.

Trump has never understood much about economics, but he knows two things: High interest rates can throttle an economy (and bring down a president’s party), and high stock prices are good (at least for Trump and his investor class).

Trump doesn’t want to do anything that will cause bond traders to raise long-term interest rates out of fear of future inflation, and he wants stock traders to be so optimistic about corporate profits they raise share prices.

So he has appointed a treasury secretary who will reassure the bond and stock markets.

Stock and bond markets constitute the only real constraint on Trump — the only things whose power he’s afraid of.

But wait. What about Trump’s plan to raise tariffs? He’s floated a blanket tariff of 10 to 20 percent on nearly all imports, 25 percent on imports from Mexico, and 60 percent or more on Chinese goods.

Tariffs of this size would increase consumer prices and fuel inflation — driving interest rates upward. (The cost of tariffs are borne by American businesses and households, rather than foreign companies.)

Tariffs could also invite retaliation from foreign governments and thereby dry up export markets for American-based corporations — in which case the stock market would tank. (The last time America raised tariffs on all imports — Herbert Hoover’s and Congressmen Smoot and Hawley’s Tariff Act of 1930 — the Great Depression worsened.)

In short, tariffs will rattle stock and bond markets, doing the exact opposite of what Trump wants.

So Trump has appointed a treasury secretary who will soothe Wall Street’s nerves — not just because Bessent is a Wall Street billionaire who speaks the Street’s language but also because the Street doesn’t really believeBessent wants higher tariffs.

Bessent has described Trump’s plan for blanket tariffs as a “maximalist” negotiating strategy — suggesting Trump’s whole tariff proposal is a strategic bluff. The Street apparently thinks tariffs won’t rise much when other countries respond to the bluff with what Trump sees as concessions.

Instead, the Street expects Bessent to be spending his energies seeking lower taxes, especially for big corporations and wealthy Americans, and helping Musk and Ramaswamy cut spending and roll back regulations.

It’s a sad commentary on the state of American democracy when the main constraint on the madman soon to occupy the Oval Office is Wall Street.

I suppose we should be grateful there’s any constraint at all.

4 notes

·

View notes

Text

“I’m going to get a little wonky and write about Donald Trump and negotiations.

“I’m going to get a little wonky and write about Donald Trump and negotiations. For those who don't know, I'm an adjunct professor at Indiana University - Robert H. McKinney School of Law and I teach negotiations. Okay, here goes.

Trump, as most of us know, is the credited author of "The Art of the Deal," a book that was actually ghost written by a man named Tony Schwartz, who was given access to Trump and wrote based upon his observations. If you've read The Art of the Deal, or if you've followed Trump lately, you'll know, even if you didn't know the label, that he sees all dealmaking as what we call "distributive bargaining."

Distributive bargaining always has a winner and a loser. It happens when there is a fixed quantity of something and two sides are fighting over how it gets distributed. Think of it as a pie and you're fighting over who gets how many pieces. In Trump's world, the bargaining was for a building, or for construction work, or subcontractors. He perceives a successful bargain as one in which there is a winner and a loser, so if he pays less than the seller wants, he wins. The more he saves the more he wins.

The other type of bargaining is called integrative bargaining. In integrative bargaining the two sides don't have a complete conflict of interest, and it is possible to reach mutually beneficial agreements. Think of it, not a single pie to be divided by two hungry people, but as a baker and a caterer negotiating over how many pies will be baked at what prices, and the nature of their ongoing relationship after this one gig is over.

The problem with Trump is that he sees only distributive bargaining in an international world that requires integrative bargaining. He can raise tariffs, but so can other countries. He can't demand they not respond. There is no defined end to the negotiation and there is no simple winner and loser. There are always more pies to be baked. Further, negotiations aren't binary. China's choices aren't (a) buy soybeans from US farmers, or (b) don't buy soybeans. They can also (c) buy soybeans from Russia, or Argentina, or Brazil, or Canada, etc. That completely strips the distributive bargainer of his power to win or lose, to control the negotiation.

One of the risks of distributive bargaining is bad will. In a one-time distributive bargain, e.g. negotiating with the cabinet maker in your casino about whether you're going to pay his whole bill or demand a discount, you don't have to worry about your ongoing credibility or the next deal. If you do that to the cabinet maker, you can bet he won't agree to do the cabinets in your next casino, and you're going to have to find another cabinet maker.

There isn't another Canada.

So when you approach international negotiation, in a world as complex as ours, with integrated economies and multiple buyers and sellers, you simply must approach them through integrative bargaining. If you attempt distributive bargaining, success is impossible. And we see that already.

Trump has raised tariffs on China. China responded, in addition to raising tariffs on US goods, by dropping all its soybean orders from the US and buying them from Russia. The effect is not only to cause tremendous harm to US farmers, but also to increase Russian revenue, making Russia less susceptible to sanctions and boycotts, increasing its economic and political power in the world, and reducing ours. Trump saw steel and aluminum and thought it would be an easy win, BECAUSE HE SAW ONLY STEEL AND ALUMINUM - HE SEES EVERY NEGOTIATION AS DISTRIBUTIVE. China saw it as integrative, and integrated Russia and its soybean purchase orders into a far more complex negotiation ecosystem.

Trump has the same weakness politically. For every winner there must be a loser. And that's just not how politics works, not over the long run.

For people who study negotiations, this is incredibly basic stuff, negotiations 101, definitions you learn before you even start talking about styles and tactics. And here's another huge problem for us.

Trump is utterly convinced that his experience in a closely held real estate company has prepared him to run a nation, and therefore he rejects the advice of people who spent entire careers studying the nuances of international negotiations and diplomacy. But the leaders on the other side of the table have not eschewed expertise, they have embraced it. And that means they look at Trump and, given his very limited tool chest and his blindly distributive understanding of negotiation, they know exactly what he is going to do and exactly how to respond to it.

From a professional negotiation point of view, Trump isn't even bringing checkers to a chess match. He's bringing a quarter that he insists of flipping for heads or tails, while everybody else is studying the chess board to decide whether its better to open with Najdorf or Grünfeld.”

— David Honig

2 notes

·

View notes

Text

lololol y'all hey guess what!

Voters are being set up as economic cannon-fodder for a second red sweep in the US midterms!

"Hot take," you say? "It's only a few countries," you say? "What do you mean $5/gal. gas," you say? "Wasn't Trump going to fix the economy," you say?

Well - read on. It's not quite that simple.

This is a long one so bear with me. I promise I'll get to the Congress stuff. (Click links under images/in unbolded underlines for sources.)

The Oil Trade and The Tariffs:

We've all heard about the Trump Tariffs. So far he's imposed:

25% tariff on Mexican imports, full stop (Mexico is also imposing retaliatory tariffs)

10% tariff on Chinese imports (China, by the way, will be suing us over this)

25% percent tariff on Canadian imports, with a carveout that energy imports will be subject to a 10% tariff

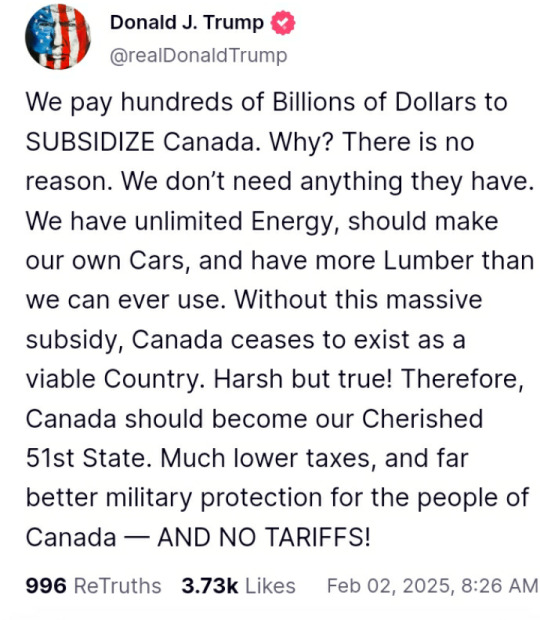

Trump is already under fire for these, and already trying to pass off the consequences as a necessary evil on social media, in...in capslock:

"Worth the price?" Okay. Then let's unpack that price.

I'm going to primarily take Canada as an example here, and I am not at all intending to discount the tariffs levied on goods from China and Mexico by doing so. Rather - I'll primarily talk about about Canada because I want to talk about oil.

The US does almost $3B USD in business with Canada PER DAY. CA exported $550B USD in goods to the US last year. Roughly 3/4 of ALL Canadian exports come to the US.

Trudeau has just announced the following tariffs on exports to the US (which most of us anticipated):

CA will impose 25% tariffs on C$155 billion of US goods

Trudeau says C$30 billion will take effect on Tuesday

Duties on the remaining C$125 billion will be due in 21 days

These have been imposed in (wholly justified) response to the tariffs imposed to-date by the US's illustrious new administration.

The interesting part for purposes of this post is the hilarious caveat that there will "only" be a 10% tariff on CA energy imports. That 10% adds up REAL quick, because "energy imports" includes imported crude oil/refined petroleum products -

And 60% of crude oil/52% of ALL petroleum products imported by the US come from Canada.

(We absolutely import petroleum products from/export to Mexico, too; US crude oil imports from Mexico were already slumping in 2022 and sure as hell will keep slumping now.)

Let's hear from an Actual Canadian who grew up smack in the middle of this industry! Hey @twosides--samecoin, d'you think the Irvings will pause for one second before bumping costs to pass that 10% tariff along to both Canadian and U.S. consumers (and while they're at it, bumping costs to well above "breakeven" to rake in profits, given the tariffs as a convenient excuse)? Because I don't.

"What happened to OPEC? Doesn't the US get most of their oil from them?" The US definitely still imports from OPEC+ countries, but Canada has provided the US with most of its imported petroleum products, both refined and unrefined, for over two decades:

Here's what that looks like by the numbers -

AND CONSIDER: the US imports this massive amount of crude oil even after hitting an all-time high for for its domestic oil production! In fact, in 2023, we were the world's largest producer:

"High domestic energy demand." That demand, by the way, is increasing alarmingly fast with AI development (and will continue to do so given the new administration's AI-friendly policies), the infrastructure for which currently consumes an obscene amount of energy. AI proponents have promised that it will eventually help reduce global emissions, but cannot yet deliver on those promises. (An aside, this is an increase in domestic energy usage that the US grid system ABSOLUTELY cannot support.)

The "double whammy" increase in petroleum costs this will cause cannot be understated.

The US is historically dependent upon foreign oil and to date this has significantly factored into the direction of US foreign policy. It's not just with respect to Canada where that policy has just been tossed out the window. The new administration has systematically escalated or started pissing contests with a majority of the foreign powers upon whom the US depends upon for imported petroleum products.

For instance - even with the ceasefire in Gaza we are seeing absolutely wild policy takes that continue alienating the pro-Palestinian members of OPEC+ (and discounting the personhood of Palestinians - a separate issue which is way too big to get into in this post):

"But fucking why," you ask?

Interestingly, pissing off foreign exporters and making foreign petroleum imports prohibitively expensive can serve as VERY GOOD leverage to remove protections, regulatory controls for, and environmental protections surrounding domestic petroleum production. To a degree, upping domestic production will have to grind through bureaucratic processes that Trump vehemently despises -

- however, as the above-linked article acknowledges:

It will be "time-consuming" because the new administration cannot simply sign executive orders to get rid of every safeguard imposed. These safeguards are not even primarily Biden-created - in fact, Biden got rid of many - and were imposed for various reasons: to prevent fast depletion of US oil deposits (a huge asset to keep in our back pocket in the event of, say, foreign wars that interrupt imports; global energy shortages; etc.), to control supply/keep export prices from tanking, to prevent the unmitigated destruction of protected lands which offer the easiest access to those deposits, et cetera.

So the one nearly insurmountable barrier Trump faces to what he views as "fixing the economy," in part by ending foreign oil dependence, is time. And time is not just a barrier because of legal "red tape." Time is a barrier because - and I cannot stress this enough - infrastructure to support increased domestic petroleum production will take time to build.

It will be years before domestic petroleum demand could conceivably be met by domestic petroleum production - nevermind by domestic refined petroleum production - even if all barriers to production vanished tomorrow.

Now I can talk about the larger picture, including the midterms. In the words of Bill Nye, it's time to Consider the Following.

The Midterms and The Setup:

TL;DR:

The new administration has put the cart before the horse with these tariffs, and knows it.

"But why not deal with removing barriers first, and boost domestic oil production before imposing tariffs? This approach means he's going to also screw over his supporters and create an economic crisis and-"

Because the goal is an economic crisis. This is not lack of forethought. This is 100% intentional.

Indulge me. Here's a possible playbook.

The current administration continues to alienate foreign petroleum producers by implementing tariffs and through political instigation. The cost of crude and refined petroleum products - and by extension gas and goods transported over land (including and especially food) - will go sky high in the US and stay that way. Remember how COVID "supply chain issues" were used as an excuse to drive rampant price increases, and how costs mysteriously stayed high after lockdown? Remember how we learned that a huge amount of this cost increase was artificial? Now add something like the 1973 oil embargo to that problem. I don't like that math.

As imported petroleum products remain prohibitively expensive, the new administration will find traction for its domestic crude production push among prior opponents. It will quickly become "un-American" to oppose, regulate, or cause anything to slow or curtail expansion of domestic crude production, including on protected lands. This will work. Centrists and many liberals will absolutely be convinced that drilling in protected lands looks very, very reasonable as gas and food prices go insanely high. They will feel the strain of the current party line vs. the pocketbook.

The GOP's constituents (and everyone else) will suffer from these actions. GOP leaders will scapegoat Dems/independents/other opposition to redirect blame for the sustained high cost of gas, food and other necessities. The GOP could then easily claim that all GOP opposition has created an economic crisis by trying to regulate/slow/limit domestic petroleum production.

The economic crisis blame game is a huge "vote grabber" during midterm elections in the US. GOP leaders will already be set up to blame opposition for economic strain, and will be well-positioned to use this as leverage to pick up new seats in the House and Senate, and keep their existing ones. (It will almost certainly have been primarily caused by the new hyper-nationalist and isolationist trade policies.)

The desirable outcome for the GOP: Keep both the House and Senate from flipping away from GOP control in 2026. Meanwhile, unfortunately, voters will be forced to line the pockets of US oil magnates and other conglomerates to a crippling degree.

It's a very simple setup - and it is a setup, because as I said earlier: energy and petroleum production infrastructure takes time to build. The new administration knows that it does not have that time before USAmericans feel the pinch: they also do not care. Absent a gratuitous federal subsidy to reduce gas prices, and no matter what the Dems/GOP opposition do or do not do between now and the midterms, the tariffs will - until removed - cause petroleum prices (and by extension everything else) to skyrocket and remain high.

And this is just one way in which we could see the GOP try to spin what's happening with the US economy - but no matter which way you slice this, any new economic crisis we're about to face can only be laid at the feet of the GOP's new trade policies.

The ultimate answer is, of course, to rescind the tariffs. But the new administration will need to break a major campaign promise to do that. However, they’re setting up to break a bigger campaign promise when the economy goes into a tailspin because they choose not to do it. Thanks for coming to my TED talk. BONUS:

"Hurrhurr I drive a Tesla-"

Nope. In this model scenario, you're screwed like the rest of us.

Why? Because our power bills are about to go sky high(er) too.

Guess what? We also IMPORT AND EXPORT energy from our closest neighbors - billions USD worth of trade, and that trade helps balance the power grid when our energy demands peak. Don't take my word for it - take the US Energy Information Administration's word for it.

That trade will be subject to the 10% Trump tariff for energy we import, and possibly to Trudeau's tariffs for energy we export! In addition, Trump is also hampering development of wind and other renewably-sourced power while this is all going on! Guess what that does? Drive up consumer electricity costs - or serve as an excuse for power companies to do so.

(And frankly even if this weren't the case, electric vehicles aren't a sustainable solution here. If everyone started using them we'd be screwed because our power grid isn't up to it. Take it from someone who spent a summer doing EXTREMELY detailed policy research on energy regulations and power transmission: Our grid is already way over capacity and held together by duct tape and chewing gum, and that is before we factor in rising AI energy consumption.) The Trump administration knows that energy costs will be a problem - it's why the Canadian energy import tariff will be "only" 10%. He wants a crisis - but not one that will impact his buddies in AI, you see. He also wants things to be bad - but not bad enough that he's unable to redirect blame.

And we're all going to suffer for it.

3 notes

·

View notes

Text

Rep. Alexandria Ocasio-Cortez, D-N.Y., weighed in on President Donald Trump's ongoing tariff feud with Colombian President Gustavo Petro – but not every social media user bought her comments.

The spat between Trump and Petro began when the Colombian leader refused to accept two deportation flights over the weekend, prompting Trump to unleash retaliatory measures. Both world leaders threatening to raise tariffs on imported products by 25% to 50%, and Trump ordered a travel ban and visa revocations for all Colombian government officials.

"I was just informed that two repatriation flights from the United States, with a large number of Illegal Criminals, were not allowed to land in Colombia," Trump wrote on Truth Social. "This order was given by Colombia’s Socialist President Gustavo Petro, who is already very unpopular amongst his people."

"Petro’s denial of these flights has jeopardized the National Security and Public Safety of the United States, so I have directed my Administration to immediately take the following urgent and decisive retaliatory measures."

In an X post on Sunday, Ocasio-Cortez insisted that American consumers are the only party that pay tariffs.

READ ON THE FOX NEWS APP

"To ‘punish’ Colombia, Trump is about to make every American pay even more for coffee," the New York congresswoman said in a post. "Remember: WE pay the tariffs, not Colombia."

"Trump is all about making inflation WORSE for working class Americans, not better," she added. "He’s lining the pockets of himself and the billionaire class."

Petro appeared to be a fan of AOC's post, reposting it on his own X account.

While tariffs do have the potential to inflate prices, the importer, which is the company or entity bringing the goods into the U.S., will pay the actual tariff to U.S. Customs and Border Protection (CBP).

But inflated prices are not guaranteed – sometimes, tariffs can reduce the world price of an object as suppliers rush to retain access to the large U.S. market. It is possible that coffee suppliers in different countries, such as Vietnam and Brazil – which produce more coffee than Colombia – would lower or maintain their prices.

Ocasio-Cortez's tweet racked up over 47,000 likes from supporters as of 8 p.m., but received scorn from Trump supporters and tariff advocates.

"World record. 35 minutes and the tweet already aged like hot milk," the social media account Catturd wrote, referencing Petro's immediate offer to transport Colombian migrants on his presidential plane.

"Who wants to tell her that there are other countries that export coffee, not just Columbia," California State Assembly Bill Essayli wrote.

Conservative commentator John Cardillo echoed Essayli's sentiment, suggesting that the South American country "should take their illegal aliens back."

"Plenty of other nations grow coffee beans," Cardillo wrote on X. "We can buy the coffee from them."

Activist Adam Lowisz responded to Ocasio-Cortez by insisting that the Democratic politician "doesn't understand how tariffs work."

"Coffee from Colombia will increase in price, so we will purchase coffee from suppliers in other countries who do take back their illegals," the conservative X user wrote. "Businesses will hesitate to invest in Colombia any further if they continue to be bad actors."

Fox News Digital reached out to Ocasio-Cortez's office for additional comment.

#nunyas news#she's not entirely wrong#but donny is flexing right now#and it's working so it's best#to sit back and wait for something to fail#before opening your flap up

5 notes

·

View notes

Text

The Coming Storm

We're days away from the face of the entire world changing, besides what happened in Syria. The symbol of the new world order reigning supreme. I say this not in hyperbole. Right now, we're witnessing a phony ceasefire in Gaza meant to give Trump points, and Israel a bag of goodies for when the first phase runs dry. That is if the deal is even upheld to begin with. There is no stopping the genocide.

People tend to underestimate the impact of the first Trump presidency. Trump had changed the face of US and world politics then, and he most certainly will now. His first presidency was marked by a shift towards nationalism, polarization, militarization. Joe Biden simply continued this legacy through his own interpretation of it, the Blue MAGA version. Instead of direct drone strikes, it was support for armed groups or gestured support. Instead of tariffs and trade war with China it was mass subsidies domestically. Trump immigration policy had also pretty much continued under Biden (Biden deported more people than Trump did in 4 years).

So I don't say it to be hyperbole. We can expect to see Mark Zuckerberg, Jeff Bezos, Elon Musk at the inauguration. An inauguration, ironically, being met with an extreme polar vortex. Scientists hypothesize that climate change can cause a weakening polar vortex leading to more sporadic behavior, but this is only theorized, not enough data supports it. Nonetheless, this is just the reality we face. Even when faced with reality, we're drowned out by the symbolic order and its hypernormalization.

Joe Biden in his final farewell address channeled Eisenhower with his "tech industrial complex" warning. Which considering both presidents have spoken at both ends, it's not shocking. What are we really in for? Unfortunately, I'm not an analyst so I couldn't tell you, except maybe guess.

I do believe we're in for a troubling reactionary movement. Trump was a rallying cry for the right, he will continue to be so. We have a movement of fearmongering over Iran and China. It also seems that any peace promise Trump had "day one" between Russia and Ukraine was completely nullified by Putin. Any possibility of it moving could be months away if at all.

It's all falling apart in real time for Trump voters, but how could you be so blind? We already had 4 years before to tell us everything. According to polls, most people voted for Trump because of economy. As if he was any good on economy. Blowing up deficit spending on military, dregulations, tax cuts that increased income inequality, spending on the rich during COVID. Lets suppose he was, what's the basis for capitalist economies? Booms and busts. Busts just mean an opportunity to redistribute wealth to the top, booms are just a scam until bust. Of course, we have a populace that doesn't understand the basis of their beliefs. They don't understand the radical conclusions to a capitalist economy. But the tech oligarchs do. Crypto was the second highest source of donations for the 2024 election.

They got it all laid out for us. Capitalism won't end with the means of production in the hands of the workers. It'll turn into a neo-feudalist haven. A cyberpunk dystopia. Post-capitalism in this case just means a consolidated oligarchy, corporatocracy, whatever word you like best. Trump is a final tantrum for the US empire to attempt to extend its reach across Canada, Greenland, Panama. And then when it settles? What will be left? Would national empires still exist?

I suspect that the genocide to follow will be to cull the herd. But the genocide didn't need Trump to begin with, it's just how capitalism works. The states are ahead of Trump. From California to Tennessee. I'm not saying a specific genocide. A universal genocide. I don't believe that Elon Musk truly worries about a depopulation. What he worries about is a population of the "weakest genes". He wants a specific type of repopulation to exist. Something that weeds out the weak. We can extend this thinking to Mark Zuckerberg's words saying how companies need more "masculine energy". Reinforcing the social Darwinism of social media. Where is this going? What's this for?