#tax Settlement

Explore tagged Tumblr posts

Text

Disputing Your Property Tax Appraisal? Online Settlement vs. Formal Protest: Which is Right for You?

Texas property owners, When dealing with the County Appraisal District, have you opted for an online tax settlement or a formal protest? Share your: 1) Experiences with Online Systems 2) Strategies for Formal Protests 3) Questions about the Process Check out our resource on the topic and join the conversation! Share Your Insights: Online Settlements vs. Formal Protests with County Appraisal Districts. Visit:- https://www.poconnor.com/blog/settling-with-the-county-appraisal-district-online-system-or-formal-protest/ for more information about Property Tax Appraisal with O'Connor

0 notes

Text

#Tax Investigation#Tax Compliance#Tax Preparation#Tax Resolution#Tax Consultation#Tax Relief#Tax Settlement

0 notes

Text

The Ultimate Guide to Tax Resolution Services: Everything You Need to Know

Tax resolution services are specialized firms or professionals that assist individuals and businesses in resolving their tax problems with government tax authorities, such as the Internal Revenue Service (IRS) in the United States. These problems often involve unpaid taxes, tax disputes, audits, and other tax-related issues. Here's your ultimate guide to tax resolution services, including everything you need to know:

1. Understanding Tax Problems:

a) Unpaid Taxes: Individuals or businesses may owe taxes that they can't pay in full.

b) Tax Liens: The government may place a lien on your property for unpaid taxes.

c) Tax Levies: A levy allows the government to seize property or assets to satisfy a tax debt.

d) Audits: IRS audits can be stressful and may lead to disputes over tax liabilities.

e) Penalties and Interest: Unpaid taxes accrue penalties and interest, increasing the amount owed.

2. What Are Tax Resolution Services?

a) Tax resolution professionals, often Enrolled Agents, Certified Public Accountants (CPAs), or tax attorneys, help individuals and businesses address these tax problems.

b) They negotiate with tax authorities to reach a resolution that is manageable for the taxpayer.

3. Types of Tax Resolution Services:

a) Offer in Compromise (OIC): This program allows taxpayers to settle their tax debt for less than the full amount owed.

b) Installment Agreements: Taxpayers can set up payment plans to pay their tax debt over time.

c) Penalty Abatement: Professionals can request the removal of certain penalties.

d) Audit Representation: Professionals represent clients during IRS audits.

e) Tax Liens and Levies: Assistance in removing or releasing tax liens or levies.

4. Choosing a Tax Resolution Service:

a) Look for experienced professionals with relevant credentials.

b) Check for accreditation with organizations like the National Association of Enrolled Agents (NAEA) or the American Society of Tax Problem Solvers (ASTPS).

c) Read reviews and ask for references.

d) Ensure they provide a clear fee structure and contract.

5. Working with a Tax Resolution Service:

a) The process often begins with a consultation to assess the tax situation.

b) The professional will review financial information and establish a strategy.

c) They negotiate with tax authorities on your behalf.

d) You may be required to provide documentation and comply with the agreed-upon resolution terms.

6. Costs and Fees:

a) Tax resolution services charge fees for their assistance.

b) Be cautious of services that promise unrealistic results at very low costs.

7. Important Considerations:

a) Tax resolution services can't guarantee specific outcomes, as decisions ultimately depend on tax authorities.

b) Ensure the professional or firm is responsive and communicative.

c) Keep up with your obligations during the resolution process, like making payments on time.

8. IRS Fresh Start Program:

a) The IRS offers the Fresh Start program, which provides more flexible terms for settling tax debt.

b) Eligibility is based on your financial situation.

9. Tax Resolution and Legal Representation:

a) For complex cases or legal issues, consider hiring a tax attorney.

b) Attorneys can provide legal advice and represent you in court if necessary.

10. Ongoing Tax Compliance:

a) After resolving tax problems, it's crucial to remain in compliance with tax laws to prevent future issues.

Conclusion

In summary, tax resolution services can be a valuable resource for individuals and businesses facing tax problems. However, it's essential to choose a reputable and qualified professional or firm and be aware of the costs and the limitations of what they can achieve. Tax resolution can help you regain control of your financial situation and resolve tax issues with government tax authorities.

0 notes

Text

A Beginner’s Guide to Tax Settlement

Taxes, whether managing personal finances or overseeing a business, often prove intricate and daunting. If you currently confront tax-related issues or require the professional accounting services of a seasoned accountant for a tax settlement, rest assured that you are not alone. In this comprehensive guide, we shall demystify the concept of tax settlement and elucidate the role of professional accountants in facilitating this critical financial process.

#professional accounting services#accountant#cpa accounting#cpa accountant#professional accounting#professional accountant#professional tax settlement#tax settlement#American tax settlement

0 notes

Text

on real thin ice with this year end art review but i made it whew

#art i made#how do i even tag this. huh??#first year im doing this bc i think this is the first year i actually drew something every month (including the animatic)#wow the way i draw han sooyoung is really inconsistent LMAO#a lot of my art this year was posted in august/september/october so i had so much to chose from for those few months and like#nothing for the rest lmao#frankly its a miracle i posted anything in november at all cuz its my exam month but anw#side note but when i was looking for year end art review templates like#i translated the caption for the one from one of the korean lcb artists i follow and#fsr the year end art review part got translated as 'year-end tax settlement' LMAO

5 notes

·

View notes

Text

Revert Palestine to its original territory, to multiculturalism and to democracy. Stop funding crimes with US taxpayer money.

"..the Israeli air attacks and ground actions in Jenin “amount to egregious violations of international law and standards on the use of force and may constitute a war crime”."

#palestine#israeli apartheid#palestinians#israeli occupation#illegal settlements#justice#free palestine#jenin#free gaza#west bank#rightwing extremism#settler violence#war crimes#icc#icj#united nations#international law#un violations#un sanctions#us taxes#taxpayers#usa

42 notes

·

View notes

Text

The most unexpected part of being an adult is definitely just getting random checks in the mail for weird things. Like bills I expected, but the regularity in which I seem to get checks is super weird. I mean it’s not often but still.

Anyway me and my 66 dollar check from my mortgage settlement (for when they accidentally took everyone’s payments twice) will be getting something fun

#it’s really not often or a lot but still way more than expected#I got a refund from my title company a couple months ago#still confused about that one#and a three dollar settlement before that#and then their was my tax refund from 2016#but that was because I forgot to cash it as a baby adult#and then found it on that unclaimed money site#being an adult is weird

7 notes

·

View notes

Text

people saying jews and muslims have been in conflict forever is funny because in the ottoman empire jews were treated better than in europe

15 notes

·

View notes

Text

I will (try very hard to pretend to) forgive Bethesda's many sins if the next Fallout game has a faction which is just the local representatives of the IRS.

Not some larpers who found an IRS office and revived it.

Not some weird cult based on the mythologised importance of tax collection (though that could be fun too).

The actual Internal Revenue Service, who survived the bombs and never stopped collecting taxes because that's something the IRL IRS is actually planning for.

#a settlement is being audited#I'll mark it on your map#fallout#bethesda#Caesar conquers the Mojave only to find out there's another Caesar he has to render unto#there's no T in S.P.E.C.I.A.L so there will be no Tax Evasion skills

8 notes

·

View notes

Text

Benefits for Business: - IRS Tax Audit and Our Process to Get Expert Help

Benefits for Business: - IRS Tax Audit and Our Process to Get Expert Help

An IRS tax audit can be a daunting experience, often causing anxiety and worry, especially if faced alone. It's important to remember that an auditor's primary purpose is to ensure the accuracy of your tax return, not to automatically assume errors or dishonesty. At The Bee Dance, we believe you deserve fair treatment, and we are committed to ensuring the IRS adheres to the boundaries set by income tax law.

The Benefits for Your Business

While the issuance of a Tax Compliance Report is optional by law, the tax auditing process offers substantial benefits for businesses.

Early Identification of Tax Risks: A IRS Tax Audit is an opportunity to detect and manage tax risk areas proactively. This helps minimize potential future consequences and ensures your financial stability.

Security in a Changing Tax Landscape: In a rapidly evolving tax environment, a tax audit provides an extra layer of security for both your company's management and the professionals responsible for tax returns. It ensures compliance with the latest tax regulations.

Expert Guidance: Our Tax Resolution Expert comprises highly experienced tax professionals who keep you informed about the latest developments that may impact your business. We are available to address any tax issues or concerns that could affect your Tax Compliance Report.

Our Comprehensive Tax Audit Services

At The Bee Dance, we offer a wide range of Tax Audit Services, including but not limited to the following:

Employee Retention Tax Credit Assessment

Historic Rehabilitation Credits

Reconstruction Projects

Façade Preservation Easements

NYC Green Roof Abatement

NY Agricultural Buildings Tax Credits

NY Farmers & Commercial Horse Operator's Sales Tax Exemptions

Yonkers Empire Zone

The Process We Follow

With The Bee Dance you can trust the tax audit process with confidence. We take every measure to ensure that you are well-prepared, well-represented, and well-defended.

Tax Audit Preparation:

We begin by precisely reviewing your tax returns and financial records by diving deeper into your financial history to identify potential areas of concern, ensuring that you are fully prepared for the audit process. Our experts will work closely with you to gather and organize the necessary documentation, addressing any possible discrepancies.

Tax Audit Representation:

Facing the IRS during an audit can be intimidating and complex. That's where The Bee Dance steps in. Our team serves as your dedicated representative, shouldering the responsibility of communicating with the IRS on your behalf. We ensure that all interactions with the IRS are handled professionally and in accordance with the law.

Tax Audit Negotiation:

In some cases, the IRS may conclude that additional taxes are owed. In this situation, The Bee Dance steps up to the plate to help you negotiate a fair and favorable settlement with the IRS. We use our expertise to explore potential resolutions, whether that involves arranging manageable payment plans, pursuing offers in compromise, or exploring other suitable options.

Tax Audit Defense:

In the most challenging scenarios, the IRS may allege tax fraud. In such cases, The Bee Dance acts as your staunch defender. We work tirelessly to refute the IRS's allegations, presenting a robust defense to protect your rights and reputation. Our team leverages extensive experience and in-depth knowledge of tax law to ensure that you receive a fair and equitable outcome.

At The Bee Dance, we understand the complexities of tax audits and the importance of navigating them with precision. We're here to guide you through the intricate world of tax audits, making sure you emerge with your financial health and peace of mind intact.

2 notes

·

View notes

Text

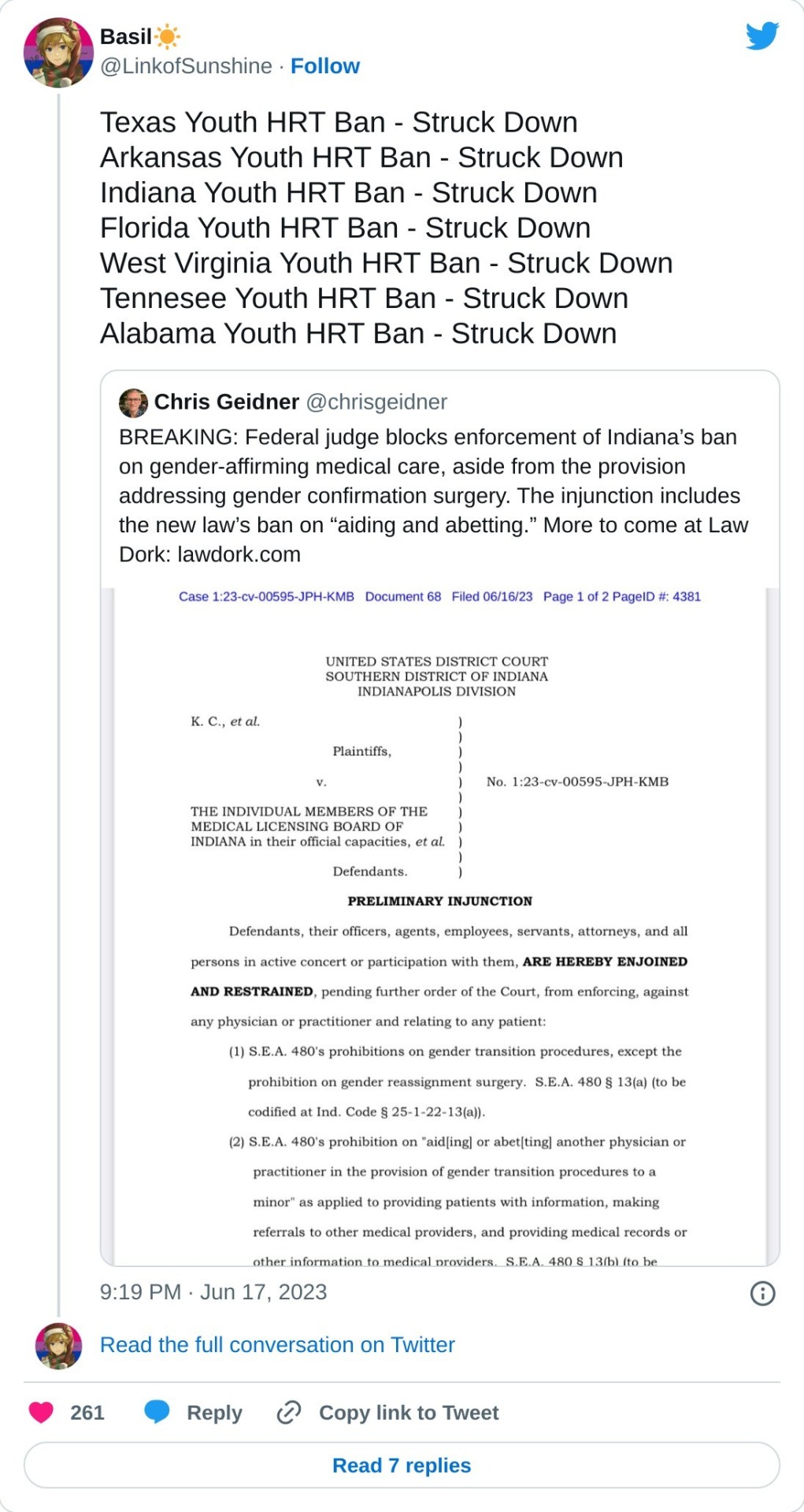

I wish conservatives would look at this shit and be able to understand that every ban like this that gets struck down represents thousands of wasted tax dollars. Their party wastes thousands in labor constructing and putting forth unconstitutional policies. They bitch and moan about wasteful government spending every time Democrats do literally anything but are unconcerned when their party throws money in the ditch for policies on topics that are, frankly, none of the government’s business.

I should note a different Missouri near total adult ban was also taken out

So if you're reading about these bans, and you're scared where you live or that you can't travel/move to different parts of America, remember these bans are legal nonsense and failing in court over and over and over again

41K notes

·

View notes

Text

Tax Settlement Services for Tax Assistance

Taxes are complicated no matter what the size of the business is. Individuals have a hard time resolving tax debts. This is not because of incapability, but due to lack of information.

What are Tax Settlement firms?

Tax settlement firms help clients reduce a lot of money on their tax liabilities. They have a group of professionals who have previously worked as an intricate part of different revenue and tax services internationally. This helps the client to get the best prospect on their tax liabilities. They also help settle the debts and vouch for the client.

Why are Tax Settlement Services important?

Clients might be too pressurized by the tax liability they face. The anxiety increases when they make it to the tax office. Facing people and directly sharing problems is a bit discomforting. Tax settlement firms send representatives on your behalf.

These representatives:

1. Know the laws better than the client

Representatives understand the way laws work better than the clients. They would not be startled by the laws and rules told by Tax collectors or representatives. After understanding your case, they can explain it with technical terms unlike you.

2. Already well-versed with the functioning of the office

Being sent to different counters every time you walk into the tax office? Let someone with a better hold on office functionality assist you with your cause. It saves time, effort and money! They know the right people to talk to, in the rightest way possible. You can also learn some of these laws in renowned journals like Virginia Tax Review.

3. Take charge of getting you a reduction

The client’s representatives are mostly ex-tax office employees. Combining the previous two things to get you into the best possible scenario. They take charge of getting your taxes reduced through exemptions and laws which you might not be aware of.

Roles of Tax settlement services

Tax settlement services ensure proper tax deduction from liability. This helps the client achieve their goals without much involvement or investment of time. A reasonable tax settlement firm like Unity Tax Relief helps clients convert their 'Dollar liabilities’ into ‘penny liabilities’.

Many times, there are no tax deductions. But, your representative can get you a time extension for repayment. It helps growing businesses.

Who can benefit most from Tax settlement services?

Tax settlement services know the conditions under which a person could have tax exemptions. It can benefit any taxpayer but tax debtors can benefit the most out of it.

There are three situations under which there could be tax exemptions or reductions:

Leading to economic hardship

The government does not like putting citizens in tough places. If the taxpayer is in a critical condition and paying the taxes would put them in economic hardship, they provide concessions.

Lack of gainful employment

If the debtor does not have employment paying well enough to pay off the taxes, they are exempted to a certain degree. If a long-term illness or disability causes this problem, there are many more exemptions.

When assets become liabilities

If a debtor has no assets whatsoever or assets which are non-functional, asset seizures would not help the government. In such cases, there are huge concessions.

Conclusion

Always make sure to hire certified professionals for tax-related problems. Tax settlement services like Unity Tax Relief help clients after studying their cases properly. They find out everything that they can do and inform the client.

#tax relief services#tax debt relief#irs tax relief#irs fresh start programs#tax resolution#tax preparation#tax settlement

0 notes

Text

Coca-Cola is now on the official BDS boycott list!

From the website:

November 2024

1) Why?

Because Coca-Cola is implicated in Israeli war crimes.

According to research by WhoProfits, the Central Beverage Company, known as Coca-Cola Israel, which is the exclusive franchisee of the Coca-Cola Company in Israel, “operates a regional distribution center and cooling houses in the [Israeli] Atarot Settlement Industrial Zone.” Furthermore, its subsidiary, Tabor Winery, “produces wines from grapes sourced from vineyards located on occupied land in settlements in the West Bank and Syrian Golan.”

The International Court of Justice affirmed in July 2024 that Israel’s entire occupation of Gaza and the West Bank, including East Jerusalem, is illegal, as are all Israeli settlements built on occupied land. As Israeli settlements – on occupied Palestinian and Syrian land – are considered war crimes under international law, Coke is complicit in a war crime.

Corporations that are implicated in the commission of international crimes connected to Israel’s unlawful occupation, racial segregation and apartheid regime - within or beyond the Palestinian territories occupied in 1967 - are all complicit and must be held accountable. Direct complicity includes military, logistical, intelligence, financial and infrastructure support. The corporations, as well as their boards of directors and executives, may face criminal liability for this complicity.

Local alternatives are popping up worldwide to substitute Coca-Cola, an unnecessary and replaceable beverage

Local alternatives to Coca-Cola have been gaining market share across the world, including in Palestine, China, Bangladesh, Sweden, Egypt, India, South Africa, Turkey, Lebanon and elsewhere.

2) Why NOW?

The BDS movement has always considered Coca-Cola boycottable but has not prioritized it as a target based on its careful and strategic target-selection criteria, so why endorse the Coke boycott now?

Human rights and health activists, among many others, have been campaigning against Coca-Cola and similarly complicit corporations for decades, including grassroots drives targeting the company for its complicity in Israel’s gross violations of Palestinian human rights.

During Israel’s ongoing, livestreamed genocide, Israeli soldiers have often been pictured with Coke cans, donated to them by various genocide-enabling groups. This has provoked even more anger against the company, particularly given that Israel is starving 2.3 million Palestinians in the occupied and besieged Gaza Strip, severely limiting their access to clean water and, as a result, inducing the mass spread of contagious diseases.

Given this context, Palestinian activists in Gaza and many BDS activists in the Arab world, in many Muslim-majority countries, and in some European countries as well, have called on the BDS movement to add Coke to its priority targets.

The BDS movement had previously targeted General Mills for its manufacturing of Pillsbury products in the illegal Atarot Settlement Industrial Zone - the same Zone where the Coke facility operates. Thanks to effective BDS campaigning, we won the demand for General Mills to end its business in Atarot. We know a campaign against Coke is winnable too.

Based on all the above, and given Coke’s large contribution (through business-as-usual and taxes) to Israel’s war chest during the genocide, the Palestinian BDS National Committee (BNC), the largest Palestinian coalition leading the global BDS movement, has endorsed the grassroots, organic #BoycottCoke campaigns to pressure the company to end its complicity in Israel’s illegal occupation, apartheid and genocide.

UPDATED VERSION!!!!

18K notes

·

View notes

Text

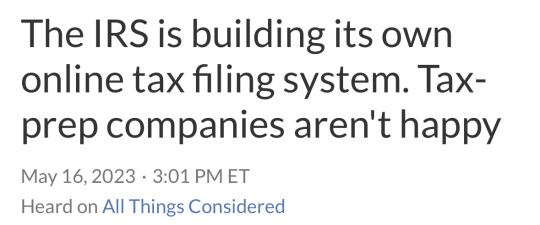

Turbotax stole money from poor people for years.

Source

We deserve to live in a society where companies like Intuit cease to exist

#if you make below a certain amount you are supposed to be able to file tour taxes for free#those motherfuckers stole $200 from me and I got a $30 settlement#i hope their offices burn down

34K notes

·

View notes

Text

In the competitive world of tax resolution services, connecting with the right audience is critical. Many individuals and businesses struggle with tax debt, seeking reliable solutions to help them regain financial stability. Leveraging tax debt leads is one of the most effective strategies to connect with these prospects in real-time and close deals faster. For professionals in the debt relief industry, this approach offers unparalleled opportunities to generate high-quality tax resolution leads and drive business growth.

What Are Tax Debt Leads?

A tax debt lead is an individual or business struggling with unpaid taxes and actively seeking assistance from a tax relief professional. These leads are pre-qualified to ensure they meet specific criteria, such as owing a significant amount in back taxes and facing IRS collection actions.

The Process:

Leads are generated through targeted marketing campaigns.

Each lead is pre-screened to ensure they meet tax debt resolution eligibility criteria.

The lead is transferred directly to your sales team for immediate consultation.

Why Tax Debt Leads Are Essential for Tax Resolution Providers

1. High-Intent Leads

The most significant advantage of tax debt leads is that they connect you with highly motivated individuals who are actively seeking tax relief. These leads are ready to discuss their financial struggles, making them far more likely to convert than cold or shared leads.

Benefit:

Increased efficiency for your sales team.

Higher conversion rates.

2. Exclusive Tax Resolution Leads

Exclusive tax debt leads mean that you are the only company engaging with the prospect. This eliminates competition and gives your team a better chance to establish trust and close the deal.

Key Advantage:

Higher ROI due to exclusivity.

More personalized customer interactions.

3. Real-Time Engagement

Timing is everything in lead conversion. Tax debt leads allow you to connect with prospects at the peak of their interest, making it easier to address their concerns and guide them toward a resolution.

Impact:

Shorter sales cycles.

Stronger rapport with potential clients.

4. Tailored Solutions for Taxpayers

Individuals and businesses with tax debt often have unique financial situations. Engaging with them in real time enables your team to offer customized solutions that align with their needs, enhancing the overall customer experience.

Result:

Increased customer satisfaction.

Higher chances of referrals and repeat business.

Strategies for Maximizing Tax Debt Leads

To get the most out of tax debt leads, it’s essential to have a clear strategy. Here are some tips:

1. Partner with a Trusted Lead Provider

Choose a reliable lead generation company that specializes in tax resolution leads to ensure you receive pre-screened, high-quality prospects. Providers like The Live Lead offer tailored solutions that match your business’s specific criteria.

2. Train Your Sales Team

Equip your team with the knowledge and skills needed to address taxpayers’ unique concerns, such as IRS penalties, payment plans, and tax settlements. A well-trained team can turn inquiries into successful resolutions.

3. Leverage Technology

Use CRM systems to track and manage tax debt leads efficiently. Automated tools can help streamline follow-ups, ensuring no opportunity slips through the cracks.

4. Focus on Personalization

When dealing with tax resolution leads, a personalized approach goes a long way. Understand their financial struggles, provide tailored solutions, and build trust by emphasizing your expertise in tax relief.

Why Choose The Live Lead for Tax Debt Leads?

At The Live Lead, we specialize in delivering exclusive, high-quality tax debt leads to help tax resolution professionals achieve their sales goals. Here’s why we’re the preferred partner for many in the industry:

Exclusive Tax Resolution Leads: Our leads are pre-screened and delivered to you in real time, ensuring the highest quality and intent.

Customized Solutions: We tailor our services to meet your business’s unique needs and goals.

Expert Support: Our team works closely with you to optimize lead conversion and maximize ROI.

Conclusion

For tax resolution professionals, tax debt leads represent a powerful tool to grow your business and connect with high-quality prospects. By engaging with taxpayers in real time, you can build trust, close deals faster, and secure a competitive edge in the market.

Ready to transform your lead generation strategy? Partner with The Live Lead to access exclusive tax resolution leads and take your business to new heights. Contact us today to learn more about our tailored solutions for tax relief professionals.

0 notes