#succession planning consulting

Explore tagged Tumblr posts

Text

Comprehensive Tax and Estate Planning Solutions by Swat Advisors - Expert Tax Planning in California

Introduction

Navigating the complexities of financial planning can be challenging, especially when it comes to tax-related matters. At Swat Advisors, we offer comprehensive tax planning solutions designed to help individuals and businesses optimize their financial strategies. As a leading tax planning advisor in California, we specialize in advanced tax planning, estate planning, succession planning, and life insurance planning. Our team of experienced financial advisors is dedicated to guiding you through the intricacies of these critical areas to secure a prosperous financial future.

Advanced Tax Planning: A Strategic Approach

Effective tax planning is not a one-size-fits-all solution. It requires careful consideration of individual financial goals, tax implications, and long-term planning. Swat Advisors provides advanced tax planning strategies that take into account the evolving tax landscape, leveraging opportunities to minimize liabilities while maximizing financial growth.

Our advanced tax planning services are tailored to meet the unique needs of each client. Whether you're a high-net-worth individual, a small business owner, or a corporation, our advisors will craft strategies that align with your financial objectives and reduce your overall tax burden. By staying up-to-date with the latest tax laws and regulations, we ensure that our clients benefit from the most effective planning techniques available.

Estate Planning Tax Advisor: Preserving Your Wealth

Estate planning is a critical component of ensuring that your assets are distributed according to your wishes after your passing. However, it’s not just about transferring wealth; it’s about doing so in the most tax-efficient way possible. As your estate planning tax advisor, Swat Advisors will guide you through the process of creating a plan that minimizes tax liabilities and maximizes the transfer of wealth to your beneficiaries.

We work closely with our clients to develop customized estate plans that incorporate strategies to reduce estate taxes, inheritance taxes, and other financial burdens. Our estate planning services include drafting wills, establishing trusts, and planning for charitable donations. We also advise on how to structure your assets to achieve tax efficiency and preserve wealth across generations.

Succession Planning Consulting: Securing Your Business Legacy

For business owners, succession planning is vital to ensuring the continuity and success of the enterprise. Succession planning involves preparing for the future leadership of your business and securing its long-term stability. At Swat Advisors, we offer specialized succession planning consulting services that focus on both the personal and financial aspects of the transition.

Our team works with business owners to design a succession plan that aligns with their vision for the company, while also addressing the tax implications of the transition. We consider various factors, such as business valuation, tax strategies, and the structure of ownership transfers, to create a plan that supports both the business and the family involved. By proactively planning for succession, we help business owners avoid unnecessary tax burdens and ensure a smooth transition of ownership.

Life Insurance Planning: Protecting Your Financial Future

Life insurance is a crucial tool for protecting your financial future and providing for your loved ones in the event of an unexpected tragedy. However, selecting the right life insurance plan requires careful consideration of your financial goals and needs. At Swat Advisors, we offer life insurance planning services to help you choose the best policy to protect your family, business, and estate.

Our life insurance planning experts analyze your specific situation to recommend policies that align with your financial objectives, including those related to estate planning, tax efficiency, and retirement planning. Whether you're looking to secure income for your family, create a tax-free inheritance, or fund your business succession plan, we have the expertise to guide you in choosing the right life insurance solutions.

Tax Planning Advisor: Your Trusted Financial Guide

As a tax planning advisor in California, Swat Advisors offers personalized services that help individuals and businesses minimize tax liabilities while maximizing financial opportunities. We take a holistic approach to tax planning, considering all aspects of your financial situation, including income, assets, investments, and future goals.

Our team of experts works with clients to identify tax-saving strategies that align with their overall financial plan. We assist with tax-efficient investment strategies, retirement planning, and tax deferral options, ensuring that you take full advantage of the available tax benefits. By providing proactive and ongoing advice, we help you stay ahead of changes in tax laws and adapt your strategies accordingly.

Holistic Financial Planning: A Complete Approach

At Swat Advisors, we believe in a holistic approach to financial planning. Our services extend beyond tax and estate planning to include investment management, retirement planning, and risk management. We recognize that each client’s financial situation is unique, and our goal is to develop a comprehensive plan that addresses all aspects of your financial life.

By integrating tax planning with investment strategies, insurance planning, and retirement solutions, we create a cohesive financial plan that aligns with your goals and ensures long-term success. Whether you're planning for retirement, saving for your children's education, or protecting your assets, Swat Advisors provides the guidance and expertise you need to achieve financial peace of mind.

Partner with Swat Advisors for Your Tax and Financial Planning Needs

With a deep understanding of tax laws, financial strategies, and estate planning, Swat Advisors is your trusted partner for all your financial planning needs. Whether you're looking for advanced tax planning solutions, guidance on life insurance planning, or succession planning consulting, we are committed to helping you achieve your financial goals with confidence.

Our team of professionals takes the time to understand your unique circumstances and create personalized strategies that maximize your financial potential. With our comprehensive suite of services, we ensure that every aspect of your financial life is optimized for tax efficiency and long-term success.

#tax planning solutions#estate planning tax advisor#succession planning consulting#advanced tax planning

0 notes

Text

Succession Planning Services

Succession planning ensures that businesses continue to run smoothly and without interruption, after important people move on to new opportunities, retire, or pass away. For succession planning services contact us or visit www.excellenceenablers.com

#Succession Planning services#succession Planning services in India#Succession planning#Succession planning consulting

0 notes

Text

No one person in a family-owned business should have too much power over the others. By availing our services we help ensure that your family-owned business doesn't become somebody's personal business. As a family & business blossoms, the web of complexities can strain relationships and hinder Business's growth too. And, to mitigate these challenges, you need to proactively address the growing complexity by implementing KEY strategies, specially applied in case of Family Businesses. Join the highly acclaimed 30-minute Family-Business Talk(FBT) by Rakesh Sharma, India's #1 Succession Guru for Family Businesses

0 notes

Text

If i don’t get an update soon on my god damn top surgery insurance negotiation im going to lose my fucking mind

#it’s been just. a fucking absurd amount of time#mostly not their fault in that my dad fucked everything up last year by dropping me from his insurance without prior notification#and i had to go through authorization + LOA negotiations all over again with my new plan once i FINALLY got said plan#and now im at that LOA part again which is almost entirely out of my hands (negotiation of coverage between the clinic and my insurance#cause the clinic is out of network and blah blah blah)#so I don’t really know what’s going on and I just have to wait indefinitely until they contact me. it’s been 3 weeks since I last messaged#them begging for an update. it’s been much longer than that since the LOA thing started#funny that this is Still preferable to if I went with the in-network location I was originally referred to. which I called in January 2024#just to be told the soonest CONSULTATION appointment would be in late January of 2026#again just for the consultation. god knows when the actual surgery would be#so. all things considered I think i chose the best option I could here but ghrgsggsgghh im still losing my mind#I hate having no timeline and no idea what’s going on and I just have to wait and pray#I can’t even start planning or anything re: money + booking a hotel + etc#beyond like. just generally saving money. which I certainly have been trying to (with moderate success)#actually pretty decent success if things keep going the way they currently are + I get my financial aid money throughout the year#does not help though that I have literally no decent point of reference for what my insurance might have me pay out of pocket#like taking a shot in the dark (+ some reddit posts that Might apply)….maybe 4-7K out of pocket?#but I don’t know man. I really do not know#im just hoping going through all this is worthwhile and I don’t waste all this time just to be given an estimate that’s not even that#different from the totally out of pocket cost#at least I have like three different ways of getting massive hotel discounts that’s a godsend#sigh#kibumblabs

3 notes

·

View notes

Text

Hit the bullseye with the right ERP software! 🎯

Magtec Business Solutions helps you choose the perfect ERP solution to take your business to new heights.

Contact us today for a demo!

#erp#magtec#magtecsolutions#business#solutions#uae#software#technology#growth#success#innovation#digitaltransformation#cloud#enterprise#resources#planning#implementation#consulting#support#customization#integration#automation#efficiency#productivity#cost#savings

2 notes

·

View notes

Text

Partnering with a leading wealth management firm ensures expert financial guidance, strategic investment planning, and long-term wealth growth for financial security.

#wealth management#investment planning#financial growth#asset management#financial security#portfolio strategy#expert advisors#wealth creation#risk management#retirement planning#tax optimization#financial consulting#estate planning#money management#investment strategy#financial success#wealth protection#capital growth#savings plan#financial freedom

0 notes

Text

Rolling with the Changes To Stay Ahead Financially

Trucking has always been a tough business, but lately, it feels like it’s getting even harder. Fuel prices keep jumping around, insurance costs are climbing, and new regulations are always right around the corner. On top of all that, profit margins are tightening, making it even more important for truckers and fleet owners to keep a close eye on their finances. But here’s the good news—there are…

View On WordPress

#accounts receivable financing#business#cash flow management#financial planning for truckers#fleet efficiency#fleet management#Freight#freight industry#Freight Revenue Consultants#fuel prices#independent truckers#logistics#owner operator finance#small carriers#Transportation#transportation finance#trucker financial strategies#trucker profitability#trucker success#Trucking#trucking acquisitions#Trucking business#trucking business growth#trucking cost control#trucking costs#trucking expenses#trucking finance#trucking industry#trucking industry trends#trucking loans

1 note

·

View note

Text

Transform your restaurant with expert consulting services! From menu planning to operations, we ensure success and profitability. Elevate your dining experience today!

Phone: +91-9391522652/9985913344 Email: [email protected] WhatsApp: https://wa.me/+919391522652

Enquiry Now at https://restrosol.com/

Find us on Google: https://goo.gl/maps/vuq6DqKwq31QEFvD6

#Restaurant Consultant#Hospitality Experts#Restaurant Growth#Food Business#Menu Planning#Restaurant Success#Dining Experience#Hospitality Industry#Business Consulting

0 notes

Text

Succession planning is one of the most important aspects of personal finance, yet it is often overlooked until it is too late. For individuals and families in Ireland, ensuring that your wealth is passed on to future generations in a tax-efficient manner requires careful planning, especially in the face of Ireland’s complex inheritance and gift tax regime. Read more...https://www.mkconsultancy.ie/tax-succession-planning-in-ireland/

0 notes

Text

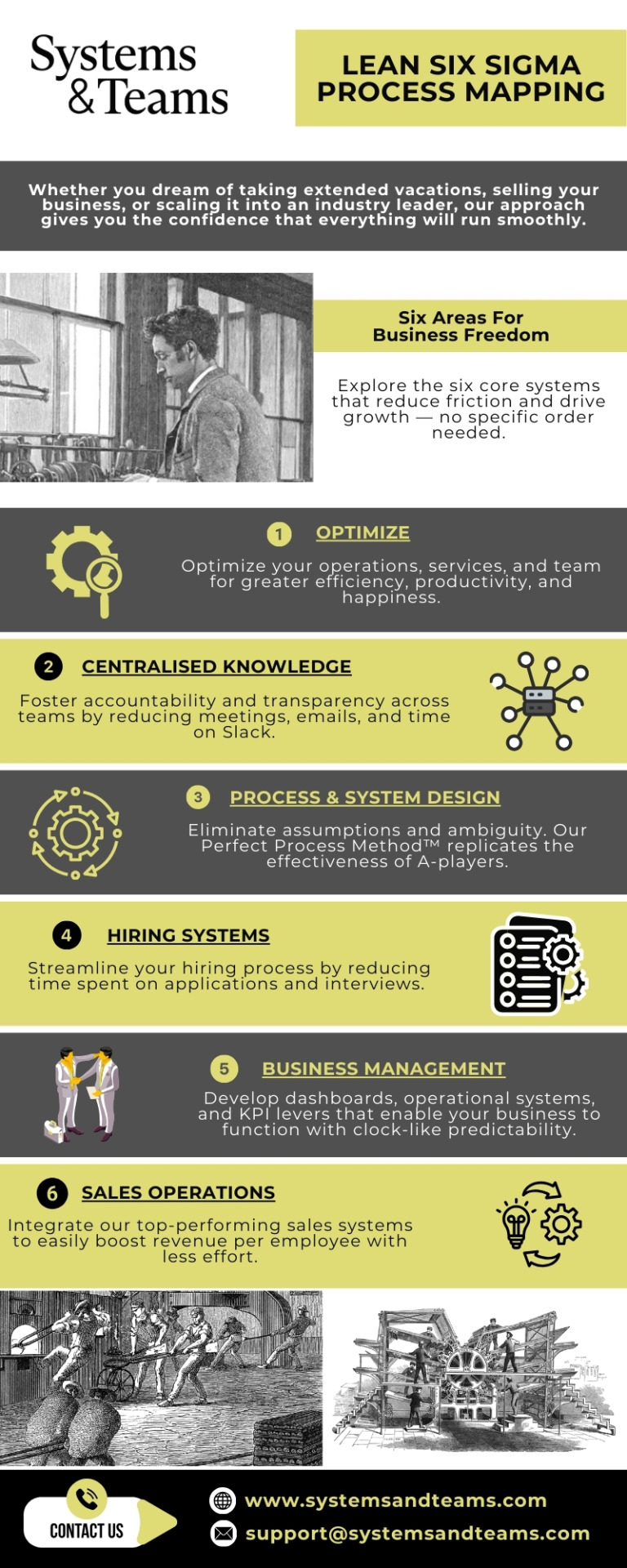

Six Sigma Process Mapping - Systems And Teams

#Six Sigma Methodology#Six Sigma Process Mapping#Small Business Systems#Business Processes#Lean Thinking#Lean Methodology#Business Process Management System#Business Process Operations#Succession Planning#Business Process Management#Business Process Mapping Consultants

1 note

·

View note

Text

Comprehensive Tax Planning Services for a Secure Future: Your Trusted Tax Planning Advisor

Introduction

In today's complex financial landscape, effective tax planning is more crucial than ever. Whether you're an individual looking to optimize your personal finances or a business seeking to minimize tax burdens, partnering with a reliable tax planning advisor can be a game-changer. At Swat Advisors, based in California, we offer tailored tax planning solutions that not only focus on current tax needs but also secure long-term financial goals. From estate planning tax advisor to succession planning consulting, we ensure that your finances are strategically planned, making your financial future more predictable and less stressful.

Tax Planning Solutions for Long-Term Success

Tax planning is an essential part of every individual and business's financial strategy. It's more than just filing taxes annually—it's about making informed decisions that can reduce tax liabilities and help you preserve wealth over time. At Swat Advisors, our tax planning solutions are personalized to meet the unique needs of each client. We evaluate your financial situation thoroughly, identify opportunities for tax savings, and provide actionable strategies to optimize your tax position, ensuring you can keep more of what you earn.

Effective tax planning is a forward-thinking process that takes into account various factors such as income, investments, business activities, and estate planning goals. Whether you're facing a large capital gain, planning a business sale, or considering retirement options, we provide comprehensive guidance to help you navigate the complexities of tax law. By working with a tax planning advisor at Swat Advisors, you'll gain insights into how to structure your finances for optimal tax benefits.

Estate Planning Tax Advisor: Securing Your Legacy

One of the most important aspects of financial planning is ensuring that your wealth is passed on according to your wishes. Estate planning tax advisory services play a vital role in helping individuals plan for the distribution of their assets after death, minimizing the tax burden on their heirs, and ensuring that family wealth is preserved.

Our estate planning experts at Swat Advisors help you navigate the intricacies of estate taxes, trusts, and inheritance laws to develop a strategy that maximizes the value passed on to your loved ones. Whether you're looking to reduce estate taxes, establish trusts, or develop a succession plan, we provide comprehensive solutions that give you peace of mind knowing your estate will be managed efficiently. By working with an experienced estate planning tax advisor, you'll ensure that your legacy is preserved and that your beneficiaries are not burdened with unnecessary taxes.

Succession Planning Consulting: Building a Strong Future for Your Business

For business owners, succession planning consulting is an essential part of safeguarding the future of the company. Succession planning is the process of identifying and preparing future leaders who can take over when the current owners or key management depart. A well-executed succession plan ensures the continuity of the business, minimizes disruptions, and helps preserve its value.

At Swat Advisors, our succession planning consulting services are tailored to help business owners develop strategies for transferring ownership and management. We work closely with you to assess your goals, whether you're planning to retire, sell the business, or pass it on to family members. Through careful analysis, we help you develop tax-efficient strategies that optimize the transition, minimize taxes, and ensure the smooth handover of the business to the next generation.

Effective succession planning also takes into consideration the tax implications of selling or transferring a business. Our team ensures that the transition is not only seamless but also financially advantageous, helping you avoid unnecessary tax liabilities and maximize the value of your business.

Advanced Tax Planning: Navigating Complex Financial Strategies

For high-net-worth individuals and businesses, advanced tax planning is essential to managing complex financial situations. This type of planning involves strategies that go beyond standard tax-saving techniques and are designed to address unique needs and challenges.

At Swat Advisors, our advanced tax planning services focus on the more sophisticated aspects of wealth management, such as asset protection, international tax strategies, and tax-efficient investment planning. We work with clients to develop customized solutions that help manage high-value portfolios, reduce tax exposure, and optimize overall financial growth. Whether you're dealing with complex tax laws related to multiple income sources or looking to optimize your tax strategy for retirement, our advanced planning services ensure that your wealth is protected and enhanced.

Through comprehensive assessments, we identify opportunities to minimize your taxable income, defer taxes, and strategically allocate assets. We also help you navigate complex tax rules related to real estate, investments, and inheritance. With our guidance, you can make informed decisions that protect your assets while ensuring maximum growth potential.

Life Insurance Planning: A Pillar of Financial Security

Life insurance planning is a cornerstone of a comprehensive financial plan, especially for those looking to secure their loved ones' financial future. Whether you're planning for retirement, covering estate taxes, or providing for your family's financial needs after you're gone, life insurance can be a powerful tool.

At Swat Advisors, we offer personalized life insurance planning services designed to meet your specific needs. Our team helps you determine the appropriate type of life insurance coverage, whether it’s term, whole, or universal life insurance, based on your financial goals. Life insurance is not just about providing a death benefit; it can also be used as a tax-advantaged investment tool to build wealth over time.

By integrating life insurance into your overall financial strategy, you can protect your assets, provide for your beneficiaries, and potentially reduce your estate's tax burden. Our experts help you assess the best options to ensure that your family and loved ones are financially secure, no matter what happens.

Why Choose Swat Advisors for Your Tax Planning Needs?

Swat Advisors stands out as a trusted partner for individuals and businesses seeking expert tax planning guidance. With a deep understanding of California's tax laws and a commitment to delivering personalized financial solutions, we provide services that help clients optimize their tax strategies and secure a stable financial future.

Our team of professionals brings decades of experience in tax planning, estate planning, business succession, and wealth management. Whether you're looking to reduce your tax liabilities, safeguard your estate, or ensure the continued success of your business, Swat Advisors is here to help. With our personalized approach and comprehensive tax planning services, we ensure that your financial goals are within reach.

#tax planning solutions#estate planning tax advisor#succession planning consulting#advanced tax planning

0 notes

Text

Secure your company’s future with effective Succession Planning.

#succession planner in India#succession planning advisor India#succession planning consulting#succession planning consultant#succession business planning#successful succession planning#strategic succession planning

0 notes

Text

The Secret Weapon for Business Success: A Business Plan

You probably want to act immediately upon a fantastic business idea. You’ll want to get started as soon as possible by searching for suppliers, creating products, and locating clients full of energy and inspiration. I promise you won’t want to sit down and draft a business plan amid all of this excitement. But you might be surprised to learn that skipping this crucial first step before starting…

#business advice#business consulting#business development#business funding#business growth#business plan#business success#entrepreneurship#financial planning#goal setting#investor pitch deck#marketing strategy#small business#startup#strategic planning

0 notes

Text

Understanding the Basics: Sale, Lease, and Mortgage Explained(lease\Sale deed registration in delhi)

When it comes to property transactions, terms like "sale," "lease," and "mortgage" are commonly used, but they can be confusing. Understanding the differences between these concepts is crucial for anyone involved in buying, renting, or financing property. Let's break down these basic concepts in simple terms.

Sale deed registration delhi | Succession Planning Services Delhi| Best Delhi Lawyers for Wills / Trusts

Sale: The Complete Transfer of Ownership

A sale is a transaction where the ownership of a property is fully transferred from one person (the seller) to another (the buyer). Once the sale is complete, the buyer becomes the new owner of the property, with all rights and responsibilities attached to it. The seller, in return, receives the agreed-upon payment, and their connection with the property ends. In simple terms, a sale is like buying something from a store—once you pay for it, it's yours, and you can do whatever you like with it.

Top Recovery Agents in Delhi | Top Lawyers For Property Case in Delhi | check land registration online

Lease: Temporary Use of Property

A lease, on the other hand, does not involve transferring ownership. Instead, it allows one person (the tenant) to use the property owned by another person (the landlord) for a specific period. Tenants pay rent to landlords during this time. The lease agreement outlines the terms, such as the duration of the lease, rent amount, and any rules for using the property. At the end of the lease term, the tenant must return the property to the landlord unless the lease is renewed. Think of a lease as renting a car—you can use it, but it doesn’t belong to you.

lease deed registration in delhi | stamp duty in delhi |transfer of property lawyer

Mortgage: Securing a Loan with Property

A mortgage is a bit different. It’s a legal agreement where a property is used as security for a loan. When someone wants to buy a property but doesn’t have enough money, they can borrow from a bank or lender. The property itself serves as collateral, meaning that if the borrower fails to repay the loan, the lender has the right to take the property. In a mortgage, the ownership remains with the borrower, but the lender has a claim on the property until the loan is fully paid off. It’s similar to borrowing money with a valuable item as a guarantee.

real estate consultant in delhi ncr | realestate consultant| property registration in delhi

Conclusion

Understanding the differences between a sale, lease, and mortgage is essential whether you’re buying, renting, or borrowing against a property. A sale transfers full ownership, a lease provides temporary use, and a mortgage secures a loan with the property as collateral. Each has its unique implications, so it’s important to choose the right option based on your needs.

Best Delhi Lawyers for Civil Case title search report delhi due diligence services in delhi

#lease\Sale deed registration in delhi#Sale deed registration delhi | Succession Planning Services Delhi| Best Delhi Lawyers for Wills / Trusts#real estate consultant in delhi ncr | realestate consultant| property registration in delhi#Best Delhi Lawyers for Civil Case title search report delhi due diligence services in delhi

1 note

·

View note

Text

Benefits of Partnering with a Leading Wealth Management Firm

In an increasing number of complicated financial panoramas, individuals and households with considerable assets face specific challenges when navigating funding selections, tax implications, and long-term monetary planning. This complexity has pushed many to recognize the value of partnering with a specialized wealth management firm in preference to attempting to control massive belongings independently.

Understanding Comprehensive Wealth Management

Genuine wealth management encompasses a holistic technique for financial well-being, integrating investment strategies, tax planning, property issues, retirement coaching, and chance control right into a cohesive monetary framework.

For excessive-net-worth people, the difference between simple financial planning and complete wealth management will become increasingly more sized as asset stages grow. The stakes grow higher, the tax implications more complex, and the opportunities more nuanced.

Key Benefits of Partnering with an Established Wealth Management Company

Personalized Investment Strategies

A main wealth management company develops customized investment approaches primarily based on unique dreams, time horizons, hazard tolerance, and private values. This tailored method stands in stark assessment to the only-length-fits-all techniques frequently employed by less specialized economic advisors.

Top portfolio management services contain state-of-the-art asset allocation models, admission to institutional-magnificence funding automobiles, and opportunities not often to be had by individual traders. These benefits can probably cause more suitable returns whilst keeping suitable risk parameters.

Integrated Tax Efficiency

Perhaps one of the maximum disregarded components of constructing and retaining wealth is tax performance. A sophisticated wealth management firm employs tax experts who work alongside investment advisors to make sure that funding choices recall tax implications at each stage.

From strategic tax-loss harvesting to area optimization (setting investments inside the most tax-fantastic accounts), those proactive strategies can extensively affect lengthy-time period wealth accumulation. Without integrated tax planning, even robust investment returns may be unnecessarily diminished by tax consequences.

Coordinated Estate and Legacy Planning

Building wealth often extends beyond private financial security to considerations about own family legacy and philanthropic effect. Experienced wealth management company experts assist customers in articulating and enforcing meaningful legacy plans.

Through coordinated property-making planning techniques, a wealth management firm ensures that belongings switch successfully to heirs or charitable causes in step with customer needs, probably minimizing estate taxes and administrative complications.

Access to Specialized Expertise

Leading wealth management companies preserve networks of professionals across numerous disciplines—from business succession planning to specialized lending solutions. This breadth of information turns into an increasing number of valuable as wealth grows and monetary conditions end up more multifaceted.

Rather than needing to perceive and coordinate a couple of advisors independently, customers gain from a centralized group of experts who collaborate seamlessly. Top portfolio management services frequently encompass getting admission to specialists with specialized credentials and a long time of revel in coping with complicated financial situations.

Disciplined Process During Market Volatility

Perhaps the maximum essential advantage emerges for the duration of periods of market volatility or economic uncertainty. A wealth management firm affords not only the best technical knowledge but also the emotional field during tough marketplace situations.

When markets decline, even state-of-the-art investors may be tempted to make choices based on emotion instead of a lengthy-term approach. Professional wealth managers assist clients keep perspective and adhere to installed funding disciplines, potentially fending off luxurious reactionary selections.

Selecting the Right Wealth Management Partner

Choosing a wealth management firm represents an enormous choice with long-term implications. The relationship between consumers and marketing consultants regularly spans decades and a couple of generations. When evaluating wealth management companies, consider these essential factors:

Fiduciary dedication and transparent fee systems

Depth of information and specialized credentials

Collaborative approach and communication style

Investment philosophy alignment

Long-term track record and stability

The most productive client-guide relationships develop when values align and verbal exchange patterns supplement each other. Beyond technical competence, the interpersonal measurement of wealth management frequently determines the ultimate success of the relationship.

The Value Proposition of Professional Wealth Management

For individuals with widespread assets, the question isn't whether or not expert wealth management provides value—instead, it's whether handling belongings independently creates useless boundaries and dangers. A wealth management firm brings sources, expertise, angles, and fields that few people can mirror independently, regardless of personal financial acumen.

The compounding impact of knowledgeable selections across investment management concerns and danger mitigation creates considerable costs over the years. When considered through this complete lens, expert wealth management represents no longer just a rate but alternative funding for financial well-being and long-term peace of mind.

#wealth management#investment planning#financial growth#asset management#financial security#portfolio strategy#expert advisors#wealth creation#risk management#retirement planning#tax optimization#financial consulting#estate planning#money management#investment strategy#financial success#wealth protection#capital growth#savings plan#financial freedom

0 notes

Text

Why Do So Many Owner-Operators and Trucking Companies Fail?

Starting a trucking business as an owner-operator is an exciting venture, offering a sense of freedom and control over one’s destiny. However, the road to success in this industry is fraught with challenges. Despite the promise of independence, many owner-operators and small trucking companies find themselves struggling to keep their wheels turning. So, why do so many of these businesses fail?…

View On WordPress

#business#cash flow management#customer creditworthiness#DOT compliance fines#Freight#freight industry#Freight Revenue Consultants#fuel cost management#logistics#owner-operator challenges#owner-operator tips#prevent trucking failure#small carriers#small trucking business#successful trucking business#Transportation#truck maintenance#truck repair costs#Trucking#Trucking business#trucking business plan#trucking business success#trucking business tips#Trucking cash flow#trucking company failure#trucking compliance#trucking cost control#trucking finance#Trucking Financial Management#trucking industry

0 notes