#stock value inc.

Explore tagged Tumblr posts

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager. But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.” As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece: Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales. In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday. Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be. Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot. As CNN put it in its report on growing fears of an AI bubble, Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN. The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future. This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

184 notes

·

View notes

Text

🦄The Sims 4🦄

🍉Grocery Store Bundle🍍

💕EARLY RELEASE💕

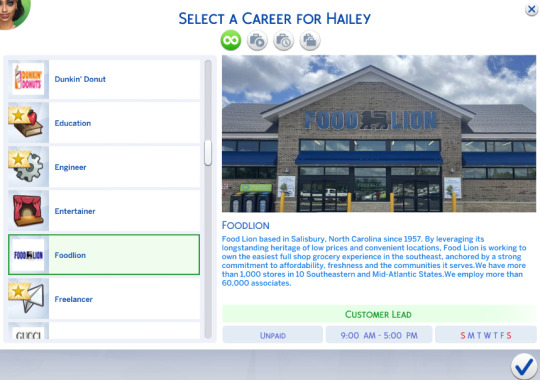

Foodlion

Food Lion based in Salisbury, North Carolina since 1957. By leveraging its longstanding heritage of low prices and convenient locations, Food Lion is working to own the easiest full shop grocery experience in the southeast, anchored by a strong commitment to affordability, freshness and the communities it serves.We have more than 1,000 stores in 10 Southeastern and Mid-Atlantic States.We employ more than 60,000 associates.

Customer Lead

Customer Service Leader

Food Lion To Go Associate

Center Store Lead

Sales Associate Cashier

Frozen Food Dairy Associate

Cake Decorator

Deli Bakery Sales Associate

Allow Teens

Allow Young Adults

Allow Adults

Allow Elders

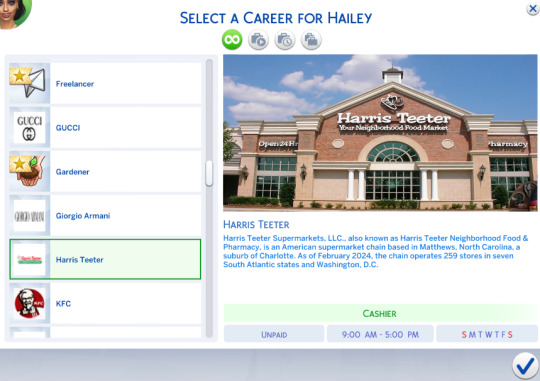

Harris Teeter

Harris Teeter Supermarkets, LLC., also known as Harris Teeter Neighborhood Food & Pharmacy, is an American supermarket chain based in Matthews, North Carolina, a suburb of Charlotte. As of February 2024, the chain operates 259 stores in seven South Atlantic states and Washington, D.C.

Cashier

Assistant Dairy/Frozen Manager

Deli Bakery Clerk

Meat Clerk

Grocery Manager

Produce Clerk

Personal Shopper

Allow Teens

Allow Young Adults

Allow Adults

Allow Elders

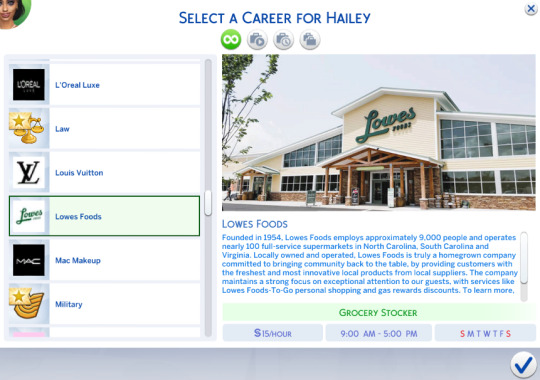

Lowes Foods

Founded in 1954, Lowes Foods employs approximately 9,000 people and operates nearly 100 full-service supermarkets in North Carolina, South Carolina and Virginia. Locally owned and operated, Lowes Foods is truly a homegrown company committed to bringing community back to the table, by providing customers with the freshest and most innovative local products from local suppliers. The company maintains a strong focus on exceptional attention to our guests, with services like Lowes Foods-To-Go personal shopping and gas rewards discounts. To learn more, visit lowesfoods.com or follow Lowes Foods on Facebook or Twitter. Lowes Foods, LLC is a wholly owned subsidiary of Alex Lee, Inc.

Grocery Stocker

Personal Shopper

Deli Clerk

Bakery Clerk

Dairy/Frozen Stocker

Cake Decorator

Allow Teens

Allow Young Adults

Allow Adults

Allow Elders

Sam's Club

Sam’s Club is home to more than 100,000 associates in more than 660 locations all working together to provide great service and value to our members. By providing innovative products, a shopping experience infused with digital solutions such as Scan & Go and Club Pickup and support to the communities we serve, we truly differentiate our company in the marketplace. The constant pursuit to surprising and delight our members drives our business every day.

Backroom Associate

Cafe Associate

Team Lead

Personal Shopper

Merchandise and Stocking Associate

Freezer, Cooler and Deli Stocker Associate

Allow Teens

Allow Young Adults

Allow Adults

Allow Elders

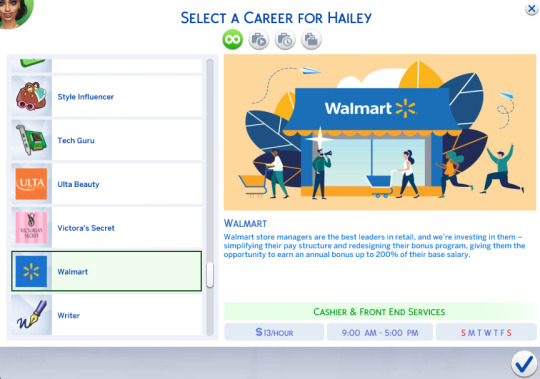

Walmart

Walmart store managers are the best leaders in retail, and we’re investing in them – simplifying their pay structure and redesigning their bonus program, giving them the opportunity to earn an annual bonus up to 200% of their base salary.

Cashier & Front End Services

Food & Grocery

General Merchandise

Online Orderfilling & Delivery

Stocking & Unloading

Auto Care Center

Fuel Station

Health & Wellness

Allow Teens

Allow Young Adults

Allow Adults

Allow Elders

DOWNLOAD NOW

#gaming#the sims 4#the sims university#the sims 4 cc#pink#celebrities#nicki minaj#victoria secret#the sims 4 mod#sims 4 career#foodie#retail#fyp#fypシ#fypage#tumblr fyp#text post#nicki is coming#nickelodeon#female rappers#miley cyrus#kanye west#new album#latto#latto777#latte#cardi b#megan thee stallion

83 notes

·

View notes

Text

Sweet Secret (Levi Ackerman x Reader)

Pairing: Levi Ackerman x F! Reader CEO Levi Ackerman coming in hot. I've been wanting to write a CEO Levi/Sugar daddy Levi story for a hot minute. Enjoy! Summary: You needed a job. Ackerman Inc was hiring for an in house assistant for none other than the CEO: Levi Ackerman. He's known to be essentially the worst to work with, you decide to take the job and take on the challenge that is Levi Ackerman. Will your relationship remain professional, or will their be monetary value added to the stakes? Or possibly even... love? ao3 Chapter Six: Buy It

Your back is turned towards the door as you refill the k-cups in the break room. While your hands are busy stocking coffee, your mind is somewhere else entirely.

It’s been a couple of days since you and Levi came to an agreement about your ‘arrangement’ and nothing has really changed. Levi is still piling work on your desk to keep you busy, making sure you have little to no time to do anything else.

At home it’s the same. Few words are exchanged, but you notice that Levi is a little softer. He hasn’t touched you nor tried to, so maybe he’s rethought about the arrangement.

You feel a pair of hands slide onto your waist softly as you close the drawer. The familiar scent of eucalyptus and musk fills your nostrils.

“Excuse me.” Levi says lowly into your ear as he slides past you. You spin around and notice that there’s no one else around in the office, just you and him.

“Levi.” You warn him.

“It’s 7:45. No one else is here yet. Besides, you were in my way.”

“You had this entire room but where I was standing was in your way?”

“Precisely.” Levi starts to steep his tea. “I need you to learn how to make my tea.”

“Why? You seem to make it fine for yourself.”

The corner of his mouth form a slight smirk as he peers at you through his half lidded eyes. He takes a few steps toward you before speaking.

“Because I want to watch you make it.” His breath blankets your skin as you watch his lips move. You turn yourself back around, refusing to give him the reaction he wants.

You keep your attention on your hands, trying not to think about Levi behind you. Then, you hear a ‘beep’ signaling that someone is entering the office.

You let out a breath that you’ve been holding in since Levi touched you.

“Good morning!” Erwin smiled, holding up his cup of coffee. “Thank goodness you’re restocking those now, I already need a second cup.” The tall man breezed to his office.

You smile at Erwin as you finish up your task, noticing that Levi’s left the room without a sound.

The rest of the office trickled in, the sound of fingertips on keyboards surrounding you.

You hear a ‘ping’ from your laptop. It’s a message from Levi.

Levi Ackerman: Come in my office please. Shut the door behind you.

You do as you’re told and make your way to Levi’s office. He’s at his desk seemingly focused on whatever he has on his screen.

“You wanted to see me?” You softly shut the door behind you, hoping no one watched the way you walked in his office. You had just a slight pep in your step.

“Yeah.” He looked up from his laptop screen. “How do you feel about Cabo?”

“As in… Cabo, Mexico?”

“Unless there’s another Cabo I’m not aware of.”

“I don’t have any feelings on it.” You raise your eyebrow. “I’ve never been out of the country.”

Levi’s eyes opened a bit, like he just absorbed more information about you that he’s going to tuck away and use for later.

“One of our clients owns a hotel down there. He’s asked if I wanted to go. Would you come with me?”

You stare at Levi for a moment, waiting for the ‘just kidding, why the hell would I bring you’ punchline.

That didn’t happen.

“You would be compensated, obviously. Along with your expenses being paid.”

“I’m not sure Levi. I-“

“What are you not sure about?” He cuts you off. “I haven’t been on a vacation in 5 years. The last one was with Erwin and Hange and that’s hardly considered a vacation. What are you worried about?”

“What if people suspect-“

“You think that I didn’t think of that already?” His eyes rolled so far you thought they would get stuck behind his head. “I’m telling everyone it’s for a conference. Erwin knows what’s actually happening, though.”

“Levi! What? He knows about the arrangement?”

He looked at you like you were stupid. “Of course he does.”

“And why does he know?”

“Because I told him.” Levi crosses his arms over his chest, leaning back in his chair. “Now what?”

You bite down on your bottom lip, hoping Levi doesn’t notice. His legs are slightly spread, his thighs pressing against the leather of his chair.

“When are we going?” You finally speak. You can’t help but be excited to be traveling - it’s always been a dream of yours.

But then you think of Alexis. Will she be okay if you’re thousands of miles away?

“Next week. So reschedule all the meetings that fall on that week and make sure you stick to the story.” Levi looks at you. “We’re going for a conference.”

“Conference, right.” You nod. “Is that all you needed?”

Levi only nods and waves you to leave. As you turn around, you can’t help but hope that he’s staring at your ass as you walk back to your desk.

“Did you get yelled at or something?! You were in there awhile.” One of the associates, Connie said as he leaned on your desk. His best friend Jean wasn’t too far behind him.

“Oh no, he was just telling me about a work conference next week.” You start typing on your laptop.

“Good, I don’t want him to run you off.” Connie laughed, slapping the back of his hand on Jean’s chest. “It’s nice having a beautiful woman in the office.”

“Connie, leave her be.” Jean looked around, hoping no one hears.

“What? I’m sure she doesn’t mind compliments!”

“Springer. Kirstein.” You hear Levi’s voice in a lower octave than usual. “Do you have anything better to do than bother my assistant? She has plenty of work to do.”

Jean almost sprinted back to his desk, while Connie decided to participate in the conversation. “I do sir, but everyone needs a break sometimes.” Connie pressed his hand to your desk. “I hope you didn’t take what I said the wrong way.” He whispers.

“I didn’t.” You smile at him, stealing a glance at Levi who is now, very obviously, glaring at Connie.

“Get back to work.” Levi’s voice got louder. “That’s an order.”

Throughout the day, you browse some online shops for clothes suitable for Cabo. You click on a bikini - high thigh, stringly, and jet black. It leaves very little to the imagine but hey, it’s Cabo.

You feel your phone vibrate in your pocket as you continue to browse.

ZELLE: $1,000 FROM LEVI ACKERMAN

Your eyes got wide as you stare at the notification. $1,000? For what? It must be a mistake.

Levi: Buy that black bathing suit and whatever else you want.

Oh shit. He can see your screen. Your cheeks turn red as you close the browser. Next time, use your phone instead of your work laptop to shop.

____________________________

It’s finally the end of the work day. You and Levi are usually always the last to leave, mostly because you don’t want people to see you leaving together.

“I’m sorry about earlier.” You push your tote bag over your shoulder. “I shouldn’t have been shopping on the company laptop.”

“I enjoyed it.” Levi half smiled. “I’m fully expecting you to wear that black number, though.”

Your cheeks burn as you clear your throat. “Did you want me to order takeout tonight?”

“No, I was thinking we could cook.” Levi grabbed his keys from valet. “Is that okay with you?”

You nod as he opens the car door for you, per usual.

___________________________

Levi is already in the kitchen after you unpack your work bag. He’s setting up the kitchen with the ingredients for tonights dinner.

“What’s on the menu tonight, chef?” You giggle as you lean forward on the kitchen island.

“Lasagna.”

“You have a thing for pasta huh?” You look around at the ingredients. “Looks like you got everything ready.”

“Are you gonna watch me cook or are you gonna help?” Levi turned to you, revealing his apron. It’s simple, a navy blue color, but you still can’t help but smile at the sight of him wearing an apron.

He looks so… cute. He looks like an exhausted dad who wants to make his kids favorite meal. The dark circles under his eyes haven’t gone away - maybe he doesn’t sleep that often.

“Help me with the cheese, won’t you?” Levi handed you the bowl of ricotta cheese.

As you help spread the cheese on the lasagna noodles and begin stacking them, you feel Levi’s eyes on you. And he’s not being subtle about it.

“Do I have something on my face?” You turn to him.

“Actually you do.” Levi took his index finger and pushed it onto your cheek. He turned his finger around to show you the bit of ricotta cheese that got stuck to your face. As you look at it, he brings his finger to his mouth, sucking the food off gently.

You watched as his lips wrapped around his long finger, a ‘pop’ sound leaving his lips as he takes his finger out of his mouth.

Fuck.

“Thank you.” You turn back to what you were doing. You didn’t want to give in just yet. He didn’t do enough. “Wash your hands, nasty.” You joked.

If anyone ever tells you that no man is sexy wearing an apron and baking lasagna, they’re dead wrong.

#levi ackerman#levi ackerman x reader#levi ackerman fanfiction#levi x reader#levi ackerman fanfic#levi ackerman smut#attack on titan#aot#levi ackerman attack on titan#levi ackerman x you#levi x you#ceo levi ackerman#sugardaddy levi

53 notes

·

View notes

Text

Biden’s ironically named Inflation Reduction Act (IRA) was supposed to create millions of green jobs and launch the “sustainable power” industry.

Subsidies flowed to support electric vehicles, wind farms, and solar energy. We have been covering the slowdown in the EV market, and residents of the East Coast are questioning all the promises made by the wind energy companies after the Vineyard Wind blade failure.

Now, it’s time to turn our attention to solar power. SunPower, the company that provides solar panels to many Californian homes in the sunny Coachella Valley area, filed for bankruptcy this week.

It is the latest development in a saga that has seen the company facing numerous serious and seemingly escalating challenges over the past several months, including allegations about executives’ misconduct related to the company’s financial statements and a recent decision that SunPower would no longer offer new solar leases. Days after the latter announcement, Coachella Valley-based Renova Energy, which markets and installs SunPower systems, said it was ending its partnership with SunPower and temporarily pausing operations after not receiving required payments from SunPower. SunPower’s executive chairman wrote in a letter posted on the company’s website on Monday that the company had reached an agreement to sell certain divisions of its business and suggested it was looking for one or more buyers to take on the rest, including the company’s responsibilities to maintain solar systems it has previously sold or leased.

It is important to note that SunPower was the industry’s “darling” to understand the magnitude of this development.

Founded in 1985 by a Stanford professor, SunPower was, for the past two decades, a darling of the solar industry. The company helped build America’s biggest solar plant, called Solar Star and located near Rosamond, California, and has installed solar panels on more than 100,000 homes. The company’s stock price has fluctuated dramatically, peaking during the solar stock frenzy of late 2007. As recently as January 2021, SunPower’s valuation momentarily reached $10 billion, buoyed by the expansion of its residential solar panels program. But since then, the company’s value has cratered — and this year, its situation became particularly dire.

It is also important to note that earlier this month, the bankruptcy of a solar-powered company in South Florida created an array of problems on the South Coast of California. Subcontractors are scrambling to find ways to guarantee payment for work on homes with equipment from the firm.

Meanwhile, homeowners are regretting their misplaced trust in eco-activists and city officials.

The business — Electriq Power Inc. — was putting solar panels and batteries on Santa Barbara rooftops at no expense to homeowners and with the blessings of the cities of Santa Barbara, Goleta, and Carpinteria. But then Electriq filed Chapter 7 on May 3, freezing all its operations. This prompted one of its subcontractors, Axiom 360 of Grover Beach, to place mechanics liens on homes for which it had yet to be paid. This preserves Axiom’s options for full payment of its installation work and is not unusual among contractors. But for homeowners who didn’t expect any financial outlay, it came as a shock, especially as the recording notice lists foreclosure in 90 days among the penalties. “You’re helping the environment. You’re not paying high rates to Southern California Edison,” said homeowner Randy Freed, explaining why he signed on to Electriq’s PoweredUp Goleta program. He was pleased with the savings in the solar array and storage batteries, but then he received the mechanics lien in June. The possibility of foreclosure was unanticipated, Freed said, and he’d relied on the cities’ endorsements. “It’s a great program; we’ve checked them out,” he recalled the cities saying on a postcard he received.

Hot Air's Beege Welborne takes an in-depth look at the cascade of warnings that indicate SunPower and the residential solar market are in serious trouble. She also hits on a point that is true for all green energy schemes: Today’s technology cannot keep up with the promises being made about tomorrow.

The technology side still hasn’t ironed itself out and may never with as saturated as the market is. With interest rates as high as they are and home prices through the roof, no one wants to pay a fortune for something that’s not rock solid. …That “sustainable” growth is only possible once all the artificial supports are knocked away and the technology proves viable and worth the cost once and for all.

Of course, the solar industry isn’t helped by the fact that the cost savings for customers aren’t quite as lavish as originally promised.

12 notes

·

View notes

Text

Trump Media & Technology Group, the Truth Social parent company majority-owned by former president Donald Trump, filed a document with the Securities and Exchange Commission this morning that helpfully details all of the ways Trump himself poses a threat to the company and its shareholders. While the company generated just over $4 million in revenue in 2023, Trump Media’s valuation has fluctuated wildly since going public in March, at one point reaching more than $7 billion. As of this morning, the company was valued at $3.7 billion. Trump Media has become a meme stock, where the stock price is governed more by vibes than traditional financial performance.

The SEC document filed by Trump Media this morning, which announced the public stock offering of 21.5 million shares, also detailed the company’s “risk factors.” These statements are standard for publicly traded companies, and usually include anything from macroeconomic headwinds to worst-case scenarios like earthquakes or terrorist attacks. The filing does include several risk factors that aren’t directly related to Trump, including competition from other social media companies, deficiencies in bookkeeping and accounting, and data privacy laws. And the company has faced multiple lawsuits from early employees of the company, who argue they deserve more shares.

But an entire section is dedicated to Trump-associated risks, making Truth Social’s risk factors unique because they cast Trump’s role as chief promoter and majority shareholder as a threat to the company’s success.

“TMTG may be subject to greater risks than typical social media platforms because of the focus of its offerings and the involvement of President Donald J. Trump,” the company said in the SEC filing. “These risks include active discouragement of users, harassment of advertisers or content providers, increased risk of hacking of TMTG’s platform, lesser need for Truth Social if First Amendment speech is not suppressed, criticism of Truth Social for its moderation practices, and increased stockholder suits.”

Here’s how Trump Media says Trump himself could threaten the company:

Trump’s Legal Issues

Trump Media noted that if Trump “were to discontinue his relationship with TMTG due to death, disability, criminal conviction, incarceration, or any other reason, or limit his involvement with TMTG due to his ongoing candidacy for political office, TMTG would be significantly disadvantaged.”

Trump’s History of Bankruptcy

“Entities associated with President Donald J. Trump have filed for bankruptcy protection in the past,” the company said in the filing, which noted that the Trump Taj Mahal, Trump Plaza, the Trump Castle, the Plaza Hotel, and Trump Entertainment Resorts Inc. had all previously filed for bankruptcy.

“While all of the foregoing were in different businesses than TMTG, there can be no guarantee that TMTG’s performance will exceed the performance of those entities,” the filing said.

Other Companies Refusing to Work With Truth Social

“To date, several potential third-party partners have expressed an unwillingness or reluctance to work on TMTG’s products or provide services for reasons including TMTG’s connection with President Donald J. Trump,” the filing stated.

Trump’s Use of Other Platforms

The company warned that if Trump stopped using Truth Social, its business would be adversely affected.

Trump has an agreement to post all content he deems as “nonpolitical” to Truth Social first, and must wait six hours before posting it on any website. But Trump, as a political candidate, may be able to argue that anything he posts is political content, meaning the company doesn’t have much power if he wants to start tweeting again.

“Consequently, TMTG may lack any meaningful remedy if President Donald J. Trump minimizes his use of Truth Social,” the filing states.

Politically Motivated Hackers

Trump’s involvement makes the company a prime target for hackers, according to the filing.

“TMTG believes that it is a particularly attractive target for such breaches and attacks, including from nation states and highly sophisticated, state-sponsored, or otherwise well-funded actors,” the company said in the filing. “And TMTG may experience heightened risk from time to time as a result of geopolitical events.”

Trump’s Self-Interest

Trump, who owns 57.6 percent of Trump Media, could steer the company to his benefit in a way that might not align with other Trump Media investors.

“President Donald J. Trump will, as a controlling stockholder, be entitled to vote his shares in his own interests, which may not always be in the interests of TMTG’s stockholders generally,” the filing says.

21 notes

·

View notes

Text

I did it again

Welcome from FICSIT Inc. to our brand new engineer

We're thrilled you picked us, we're here to bring you a brilliant new career

Yes, it's true that the terms of your servitude are a little bit unclear

But don't fear the years you'll be spending here, you're a lifelong pioneer!

You're entering planetfall to a planet full of resources

Your contract calls that your life revolves around rounding up and exporting

And if you happen upon our previous ones, well, it's your job to report it

Take inventory of the spent debris, but best to leave any corpses

No time for grief, so take relief in this briefing

These core values, FICSIT needs you believing

You'd better learn them if you want to be leaving

But if you miss it, then we'll keep on repeating

Construct!

Rebrand that land before you as a grandiose factory floor

Automate!

Command it to handle it, so you're free to construct more

Explore!

You'll fall to a world of wonders that none have seen before

Exploit!

Convert that fertile earth to a furnace for churning ore

Flora and fauna, forced to the boundaries

Par for the course when your sport's tearing down trees

Pounding them down into powder to power these

Towers you've founded to round our accounts

Seize bountiful mountains of countless amounts

Each ground into compounds bound for the foundries

Sound of it drowns out the howls of the foul beasts

Ousted and out for revenge, so look out

Deep down underground, a fortune awaits

We've just got to burn down what's in the way

How fortunate that you have opted to stay

With your life on the bottom line for our pay

So slave away and save the day

In place of wage, you'll pave the way

Stay in the black with shades of grey

Keep sending stacks, you'll get back someday

We enterprise and synergise

You improvise and synthesise

To bring supplies and tint the skies

With inky spires as chimneys rise

The market cannot be denied

We couldn't stop it if we tried

That natural snapshot that you prize

Is simply profit in disguise

Drop a thousand rods in the pod

Ship them off, don't stop and move on to the Modular Frames

The Rotors and Cables

The table says we are waiting on lots of Crates

And if we haven't got enough on your plate

Well, we haven't got enough of the plates!

And the state of the Caterium isn't great

So fill the elevator by end of the day

Mother Nature is minted, it's evident

If we're her kids, then what is the precedent?

Where there's a will, there's a way to inheritance

Whether we killed her or not is irrelevant

No defense for delay, it's expensive

So pay up, foreclosure's a moment away

Financially, we're fine actually

So contractually say it again!

(i couldn't be bothered to color this next section in)

Construct!

An industrial wonderland with a hundred belts to ride on

Automate!

Set beams to plunder and then find somewhere else to siphon

Explore!

There's a whole ton of funds to be funnelled under that horizon

Exploit!

So tear it asunder with thunderous, sulfurous pyres and pylons

This is a FICSIT reminder!

It's a lizard-doggo-eat-lizard-doggo world out there

But that doesn't mean it won't also try and eat you

So be careful

Those uniforms aren't cheap

You've been hurled without leave to build worlds without leaves

Scorch the earth, burn the trees, crush the birds, squash the bees

Yes, the customer may moan, kicking creatures from their home

But they'll scream and rant and rave if they don't get their mobile phone

You may think that it's a lot, slaying nature so our stocks gain

You may rethink extinction when your neck is on the Blockchain

All things bright and beautiful, all creatures great and small

Will be scanned and logged and processed for the shareholder's bankroll

It's a little bit of sweat, a little bit of toil

And a big blind eye to the wildlife spoiled

If they go the way of the dinosaur

What you crying for? We're just making oil!

So the seas may boil and the skies might burn

But we'll reap the spoils of the prize you've earned

No quarrel, it's morally grey, just quarry away

Morals make for downturn

Mother nature ought to be

Hung, drawn and quarterly

Diced up and torn to pieces, export and reset

Our big spreadsheet says more for me

Unlike a life, a price is dependable

Cutting expenses to keep you expendable

Spreading our message, we made you a prophet

So make us a profit, we'll grant you ascension

All manner of valuables need our attention

The fact that there's animals ain't worth a mention

If there's a creator, I guess in a sense then

That we are a case of divine intervention

Beyond the heavens, there is revenue to glean

So turn that greens to black and we can turn it back to green

Tax law is more lax for planets unseen

And in space, no one can hear the machines

Right, I want ten thousand steel beams at my desk by four

No, not literally, where would I put them?

#wonderlands x showtime#wxs#wxs tsukasa#wxs emu#wxs rui#wxs nene#wxs miku#slightly#a matter of factories#the stupendium#project sekai#pjsk#gonna be honest#this one is a bit more intense than their usual music#but it would sound good in their voices#also sorry if this feels a bit rui heavy at the end#or if it feels unbalanced in any way really#in my defense#i need to sleep

6 notes

·

View notes

Text

It's obvious that RFK Jr. picked his running mate, Nicole Shanahan, because he needed somebody who was filthy rich to fund his campaign. Shanahan is the ex-wife of Google co-founder Sergey Brin who probably has enough money to buy one of the smaller Hawaiian Islands.

Why Shanahan doesn't mind being an ATM for the worm-brained RFK Jr. is that she shares his idiotic conspiracy theory which falsely links autism to vaccines.

It’s easy to see why the controversial heir to the most prestigious liberal name-brand in American politics chose Shanahan, a relative unknown, to be his nominee for vice president. As an ambitious and athletic millennial who surfs and grows her own food with her boyfriend, a cryptocurrency software developer she met at Burning Man, the 38-year-old attorney brings a woman’s presence, and youthful energy, to a race dominated by octogenarian men, not to mention the 70-year-old Kennedy. And as the former wife of Google co-founder Sergey Brin, the seventh richest man in the world, Shanahan brings another factor crucial to the campaign: unfathomably deep pockets. Her backing enables Kennedy to skirt questions about why the notoriously anti-immigration GOP megadonor Timothy Mellon is financing the super PAC supporting Kennedy’s campaign, American Values. Mellon has poured millions into Trump’s Make America Great Again Inc., while donating $53 million in stock to the state of Texas to build the former president’s border wall.

As an aside, shouldn't the RFK Jr.-curious be concerned about the loot he's getting from MAGA megadonor Timothy Mellon? 🤔

Back to Shanahan...

So how did Shanahan end up on a “spoiler” ticket praised by right-wing ideologues like Alex Jones, Steve Bannon, Michael Flynn and Roger Stone, the notorious GOP mischief-maker who called an alliance between Kennedy and Trump his “dream ticket”?

The turning point in her life came in 2020, she says in an Instagram video, when (daughter) Echo was diagnosed with autism. The Daily Beast claims that Shanahan “chafed at Brin’s left-brain thinking” about the best practices for raising a child on the spectrum, and the Google co-founder filed divorce papers shortly thereafter, citing “irreconcilable differences.” She initially contested their prenuptial agreement and sought $1 billion of Brin’s fortune but eventually settled out of court.

"Left-brain thinking" is often a euphemism for being logical and analytical. In other words: rational. Rationality is not a strong point for conspiracy freaks.

But while she claims that world-class experts keep her apprised of cutting-edge autism research, her ideas about her daughter’s condition seem stuck in the 1990s; during that era, actress Jenny McCarthy was hailed as an autism expert, and Andrew Wakefield triggered a global panic about vaccines with the publication of a paper in The Lancet linking autism to vaccines. That paper was later retracted after multiple investigations found it based on fraudulent data and riddled with conflicts of interest.

So Nicole Shanahan is fixated on a debunked and retracted article from three decades ago.

For somebody who is allegedly concerned about her autistic daughter, why is she the running mate for a candidate who calls people with autism "zombies"?

And you wouldn’t know it from listening to Kennedy, who routinely caricatures people on the spectrum as “vaccine-injured” zombies. “They get the shot ... and three months later, their brain is gone,” Kennedy told an audience in 2015. Insisting that previous generations of autistic people simply never existed—when in truth, they were often hidden away in institutions because of a thoroughly discredited theory that autism is caused by bad parenting—the candidate told radio and TV host Michael Smerconish last year: “I have never in my life seen a man my age with full-blown autism, not once. Where are these men? One out of every 22 men who are walking around the mall with helmets on, who are non-toilet-trained, nonverbal, stimming, toe-walking, hand-flapping. I’ve never seen it.”

RFK Jr. is intent on being the 2024 version of Ralph Nader. In 2020 Nader, as the Green Party candidate for president, hoodwinked enough gullible progressives into voting for him so that he helped George W. Bush take Florida – the deciding state in the 2000 election. Bush then gifted the US with two recessions (including the Great one), two wars (one totally unnecessary and one which could have been avoided if he had paid more attention to terrorism), two rightwing appointees to the Supreme Court (one bad, one horrendous), and two rounds of tax breaks for the filthy rich.

One way to undermine RFK J.'s support among some people on the left is to strongly debunk his autism vaccine conspiracy theory.

Annenberg Public Policy Center (APPC) at the University of Pennsylvania published a new survey showing that 12% of Americans feel that a link between the MMR vaccine is either definitely true or probably true.

False Belief in MMR Vaccine-Autism Link Endures as Measles Threat Persists

While anti-vaxxers tend to be Trumpsters, there's a sizeable number of misinformed people on the left who share this view regarding MMR. So debunking the MMR-autism bullshit should be a routine part of your anti-Trump activism.

#rfk jr.#nicole shanahan#rfk jr.'s atm#rfk jr.'s running mate#autism#anti-vaxxers#mmr conspiracy theory#mmr#measles#public health#third parties#turd parties#spoilers#ralph nader#election 2000#george w. bush#election 2024#vote blue no matter who

10 notes

·

View notes

Text

Scuderia Ferrari Corporate Talks

Their current board of directors

A note that Delphine Arnault, John Galantic and Fransesca Belletini have ties to LVMH (Louis Vuitton Moët-Hennessy) which explains why Giorgio Armani is Ferrari's sponsor (Armani is also under LVMH same as Chanel, Dior and Yves Saint Laurent)

Their shareholders

Exor NV : John Elkann (Giovanni Agnelli's nephew. Heir to the Agnelli family, Italian version of Kennedys)

Trust Piero Ferrari: Piero Ferrari himself

Blackrock Inc, Thomas Rowe Price Associates: No info just basic shareholders ig

^ 55% of shares are public but....

Their voting rights

As you can see Exor NV or John Elkann holds the most outstanding voting shares which is 70.15% with Piero Ferrari's being 29.83% and the public shareholders being 0.2%

What is an voting shares? Voting shares are a kind of shares that allow shareholders to express their opinions on company matters. This includes the election of board members and other corporate issues. Common shares that firm issues are typically referred to as voting shares. Each share has a value of one vote (took it from google cuz im bad at explaining these stuffs man 😭)

A voting right is the rights granted to shareholders to vote on certain corporate actions. These rights are proportional to the number of shares owned by the shareholder.

Voting shares give the stockholder the right to vote on matters of corporate policymaking. In most instances, a company's common stock represents voting shares. Different classes of shares, such as preferred stock, sometimes do not allow for voting rights.

Outstanding Voting Shares means, with respect to a particular matter, the aggregate of all shares of the company's capital stock outstanding from time to time which pursuant to the Charter Document are entitled to vote on such matter.

What is Outstanding Shares? Outstanding shares are all the shares issued and sold by a company that are not held by the company itself. Outstanding shares include a company's common stock held by individual investors, institutional investors and restricted shares held by company officers and insiders.

So as @grbambi63 's anon has said about Elkann not having any obstacle on his way to sign Lewis. It is true since Exor N.V or basically his side has 70% voting shares that determines the outcome so he basically could do anything with that much voting shares.

7 notes

·

View notes

Text

The Pioneering Path: MicroStrategy's Bold Bitcoin Adoption Plan

Bitcoin adoption is rapidly gaining momentum, with various institutions and companies integrating the digital currency into their financial strategies. Among these pioneers, MicroStrategy stands out with its bold and strategic approach to Bitcoin investment. This post explores MicroStrategy's Bitcoin plan, its financial implications, the broader impact on Bitcoin adoption, and how other companies are following suit.

The Rise of Bitcoin Adoption

Bitcoin, once a niche interest for tech enthusiasts, has now become a mainstream financial asset. Companies and institutions are increasingly viewing Bitcoin as a hedge against inflation and a store of value. The decentralized nature of Bitcoin and its potential for high returns have fueled its adoption across various sectors.

MicroStrategy's Bitcoin Strategy

MicroStrategy, led by CEO Michael Saylor, has been at the forefront of corporate Bitcoin adoption. In August 2020, MicroStrategy made headlines by announcing its first Bitcoin purchase, acquiring 21,454 BTC for $250 million. As of June 20, 2024, MicroStrategy holds a staggering 226,331 bitcoins. This aggressive accumulation demonstrates the company's deep conviction in Bitcoin's long-term value.

Michael Saylor has been a vocal advocate for Bitcoin, emphasizing its role as a superior store of value compared to traditional fiat currencies. MicroStrategy's Bitcoin strategy is driven by the belief that Bitcoin is a better long-term investment than holding cash.

Financial and Strategic Impact

MicroStrategy's Bitcoin holdings have significantly impacted its financial statements. The company's Bitcoin assets have appreciated, enhancing its balance sheet and boosting investor confidence. This strategic move has also positioned MicroStrategy as a thought leader in the crypto space, attracting attention from both traditional and crypto investors.

Effect on Stock Price MicroStrategy's stock has experienced significant fluctuations over the past few years. Here is a summary of its performance:

2024: The average stock price so far is $1,169.45, with a year-to-date increase of 134.91%. The stock opened the year at $685.15 and reached a high of $1,919.16, closing at $1,483.76.

2023: The average stock price was $350.03, with a substantial annual increase of 346.15%. The stock opened the year at $145.02 and closed at $631.62, with a high of $670.71.

2022: The average stock price was $293.60, but the year saw a significant decline of 74.00%. The stock opened at $558.26 and closed at $141.57, with a high of $558.26.

2021: The average stock price was $656.31, with an annual increase of 40.13%. The stock opened at $425.22 and closed at $544.49, with a high of $1,272.94.

Overall, MicroStrategy's stock has seen a dramatic rise, particularly in 2023 and 2024, driven largely by its aggressive Bitcoin acquisition strategy and the corresponding increase in Bitcoin's value. Despite the fluctuations, the overall trend reflects the market’s growing confidence in MicroStrategy’s innovative approach to asset management.

The Ripple Effect: Other Companies Following Suit

MicroStrategy's bold move has set a precedent for other companies and institutions. Several high-profile companies have since followed MicroStrategy’s lead, adding Bitcoin to their balance sheets:

Square (now Block, Inc.): Square has made multiple Bitcoin purchases, with its CEO Jack Dorsey being a strong advocate for Bitcoin. The company views Bitcoin as an instrument of economic empowerment.

Galaxy Digital Holdings: This financial services and investment management firm focuses on the digital assets and blockchain technology sector, holding a substantial amount of Bitcoin.

These companies, among others, are recognizing the strategic advantages of holding Bitcoin. Their actions signal a growing acceptance of Bitcoin as a legitimate asset class, potentially leading to wider adoption in the corporate world.

The Broader Implications

MicroStrategy's bold move and the subsequent actions of other companies have set the stage for broader Bitcoin adoption. By demonstrating the potential benefits of Bitcoin investment, these companies have encouraged others to consider adding Bitcoin to their balance sheets. This ripple effect could lead to increased Bitcoin adoption and greater integration of digital currencies into the global financial system.

Conclusion

MicroStrategy's pioneering Bitcoin strategy highlights the growing trend of Bitcoin adoption among corporations. By embracing Bitcoin, MicroStrategy and other forward-thinking companies have not only enhanced their financial standing but also influenced the broader adoption of digital currencies. As more companies explore Bitcoin investments, the landscape of global finance is poised for significant transformation.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#BitcoinAdoption#MicroStrategy#FinancialRevolution#Blockchain#DigitalCurrency#Investing#FinancialFreedom#CryptoNews#BitcoinStrategy#TechInnovation#FutureOfFinance#BitcoinInvestment#CorporateFinance#EconomicEmpowerment#BitcoinCommunity#financial education#financial empowerment#unplugged financial#financial experts#finance#globaleconomy

3 notes

·

View notes

Text

Office Receptionist

Location

Brampton, ON

BenefitsPulled from the full job description

Designated paid holidays

RRSP match

Tuition reimbursement

Full job description

_

Dawn Foods is a global leader in bakery manufacturing and ingredients distribution. As the partner of choice for inspiring bakery success, we help customers grow their business through meaningful partnerships, research-driven insights and innovations, and products and expertise they can depend on. As a family-owned company, our commitments to our people, products, customers, and corporate values, are all part of our recipe for success.

_

Why work for Dawn Foods?

PEOPLE. PRODUCTS. CUSTOMERS.

Why should you apply? We invest in you!

Industry-leading health insurance after 30 days

Competitive Pay

Generous company retirement benefit contributions

10 Paid Company Holidays

3 weeks of vacation each year

Professional training

Family-owned business over 100 years in service

An opportunity for career advancement, working as part of an empowering workforce

What will you do as an Office Receptionistat Dawn Foods?

Answer all incoming telephone calls, direct appropriately and/or take messages

Meet and greet all visitors and provide assistance as required

Oversee and control all office courier services in accordance with standard operating procedures

Manage incoming and outgoing mail and upkeep of postage equipment

Manage invoices in AP system related to Brampton location

Maintain adequate stock of all office and building supplies and control the supply room.

Assist Customer Service team members when needed.

What Does It Take to be an Office Receptionist at Dawn Foods?

Below are the minimum qualifications to be a fit for this job.

Minimum 1 year of experience in an administrative role

Detail oriented and have the ability to work independently and complete objectives.

High School Diploma or GED.

Ability to multi-task

Maintain confidentiality

Proficient in Microsoft Office, including Excel, Word, PowerPoint, Outlook and Teams.

SAP experience preferred but not required.

Physical Demands & Work Environment

The physical demands described here are representative of those that must be met by a Team Member to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

Ability to work in a professional office environment. Will be expected to work onsite.

Specific vision abilities required by this job include close vision, distance vision, color vision, peripheral vision, depth perception, and the ability to focus

Note: The level of physical effort may vary from site to site and in some cases be greater or lesser than documented here.

If this sounds like the opportunity that you have been looking for, please click "Apply.”

About Our Benefits

Dawn is proud to employ the top talent in the baking industry, and we reward our people with competitive compensation packages and award-winning benefit offerings. We also help protect our Team Members’ future financial health with a generous RRSP matching program that provide additional retirement funds and many tools and resources on financial wellness. The contributions start from your first pay. Dawn also encourages professional growth through tuition assistance and educational programs, and we are always searching for ways to improve our industry-leading services and benefits.

Compensation: $41,430 - $62,150 Annual Salary

_

An Equal Opportunity Employer. All qualified applicants will receive consideration for employment without regard to race, color, religion, age, sex, national origin, disability, pregnancy, sexual orientation, gender identity/gender expression, citizenship status, military or veteran status, genetic information or any other status or condition that is protected by applicable law.

2 notes

·

View notes

Text

Offering Solace: The Importance of Home Inspection in Nassau County

Providing Comfort: The Significance of House Inspection in Nassau

Acquiring a home is a big monetary commitment, so you need to be fully informed about the property's condition to make sure your investment is sound. In Nassau, where houses differ in terms of age and design, a thorough house inspection is an essential part of the purchasing process. Your reliable home inspection partner, Safe Harbor Inspections, is essential in giving potential homeowners the knowledge they need to make wise decisions. This blog post discusses the value of home inspections in Nassau and how Safe Harbor Inspections establishes the bar for comprehensive and trustworthy examinations.

The Benefits of Nassau Home Inspections

1. Identifying Potential Issues:

Nassau's diverse housing stock includes properties of varying ages and construction types.

A home inspection brings to light potential issues such as electrical problems, plumbing issues, and structural concerns, allowing buyers to make informed decisions.

2. Assessing Safety Standards:

Ensuring that the home adheres to safety standards is paramount.

Home inspectors in Nassau evaluate elements like electrical systems, carbon monoxide detectors, and fire safety to guarantee a secure living environment.

3. Uncovering Hidden Defects:

Some defects may not be apparent during a casual walkthrough.

Home inspections reveal hidden defects like water damage, mold, and structural issues that might not be immediately visible to the untrained eye.

4. Negotiation Leverage:

Armed with information from a home inspection, buyers can negotiate repairs or adjustments to the sale price.

This can be a valuable tool in ensuring a fair transaction for both parties.

Safe Harbor Inspections: Raising the Bar

1. Experienced and Certified Inspectors:

Safe Harbor Inspections boasts a team of experienced and certified home inspectors.

Their knowledge extends to Nassau's unique housing characteristics, ensuring a comprehensive assessment.

2. Thorough Evaluation of Structural Elements:

From the foundation to the roof, every structural element is meticulously inspected.

This includes assessing the integrity of walls, floors, ceilings, and the overall stability of the property.

3. Detailed Reports:

Safe Harbor Inspections provides clients with detailed reports.

These reports include photographs and descriptions of any identified issues, empowering clients with a clear understanding of the property's condition.

4. Focus on Safety and Code Compliance:

Evaluating safety features and code compliance is a priority.

Safe Harbor Inspections ensures that homes meet or exceed safety standards for the well-being of the occupants.

5. Client Education:

Safe Harbor Inspections believes in empowering clients with knowledge.

Clients are encouraged to attend the inspection, ask questions, and gain insights into the maintenance and care of their prospective homes.

Invest Safely with Safe Harbor Inspections Inc.

A home inspection is an essential step in guaranteeing a safe and prudent investment in Nassau, where the real estate market is diverse. Safe Harbor Inspections is a dependable collaborator that is dedicated to offering thorough assessments and equipping customers with the information they require to make wise choices.

Uncover more about the services delivered by Safe Harbor Inspections Inc., then move on with the purchase of a house with assurance knowing that your investment is in capable hands.

2 notes

·

View notes

Text

10 Cent or Nutties?

China's gaming industry, the world's largest, is facing new rules that limit spending and rewards in online games. These rules ban daily login rewards, incentives for first-time and consecutive spending, and probability-based lucky draw features for minors. Besides banning reward features, games are also required to set limits on how much players can top up their digital wallets for in-game spending. Games are also banned from offering probability-based lucky draw features to minors, and from enabling the speculation and auction of virtual gaming items.

Rules Change Implemented

•Playtime limits for minors: Since 2021, minors are only allowed to play online games for 1.5 hours on Fridays, Saturdays, and Sundays, and are prohibited from playing during weekdays.

•Content restrictions: Guidelines restrict games from having graphic violence, promoting gambling, or featuring "effeminate males."

•Stricter approval process for new games: The approval process for new games has become more stringent, with a focus on content review and ensuring alignment with government guidelines.

•Self-regulation pact: Major gaming companies have signed a pact to avoid content deemed "politically harmful" or "historically nihilistic."

The regulations have caused panic among investors, resulting in an $80 billion market value loss for China's top gaming companies.

Shares in Tencent Holdings (0700.HK), the world's biggest gaming company, tumbled as much as 16% at one point, while those of its closest rival, NetEase (9999.HK), plunged as much as 25% after the National Press and Publication Administrations published the new draft rules.

When asked about the draft rules' impact, Tencent Games' vice president Vigo Zhang said Tencent will not need to fundamentally change "its reasonable business model or operations" for games, adding that the company has been strictly implementing regulatory requirements.

Zhang added that minors had been spending a historically low level of money and time on games since 2021 in the industry when minor protection became a focus for Beijing.

"The removal of these incentives is likely to reduce daily active users and in-app revenue, and could eventually force publishers to fundamentally overhaul their game design and monetization strategies," said Ivan Su, an analyst at Morningstar.

As a result of Beijing's crackdown on gaming in 2021, 2022 was the Chinese gaming industry's most difficult year on record as total revenue shrank for the first time.

Task at Hand:

You are the CMO of NetEase Inc your stocks have dropped down to 25% after the announcement. With regards to these changes, suggest new marketing strategies to promote your games to the Teenagers (having multiple restrictions) or Elderly (having little to no market) (ANY ONE MARKET!!!)

Deliverables:

Decide your target market and state your reason for the same.

Prepare marketing strategies for your chosen target market.

Provide new pricing strategies for generating income by keeping the new laws in mind.

Prepare a PPT in 7x7 format mentioning all the deliverables.

Submission deadline: 11:20AM

4 notes

·

View notes

Text

A Fruitful Investment: Analyzing Apple's Stock Price

When it comes to investing in the stock market, few companies have captured the attention of both seasoned investors and newcomers quite like Apple Inc. (NASDAQ: AAPL).

The tech giant, known for its iconic products like the iPhone, iPad, and Mac, has not only revolutionized the way we live but also how we invest.

Let's take a closer look at Apple's stock price and what makes it such an appealing investment option.

Steady Growth: Apple's stock price has demonstrated impressive resilience and growth over the years. Since its IPO in 1980, the company has weathered economic storms and market fluctuations to become one of the most valuable publicly traded companies globally.

This track record of steady growth has made Apple a favorite among long-term investors.

2. Product Innovation: One of the key factors behind Apple's stock price success is its commitment to innovation. The company's ability to consistently release groundbreaking products keeps consumers coming back for more.

Whether it's the latest iPhone model or a revolutionary new service like Apple Music or the Apple Watch, innovation drives consumer demand, which in turn positively impacts stock performance.

3. Services Revenue: Apple's shift towards a services-based business model has also contributed significantly to its stock price. The App Store, Apple Music, iCloud, and other services generate a steady stream of high-margin revenue.

This diversified income stream is seen as a stabilizing force in the stock's performance.

4. Global Presence: Apple's global reach extends far beyond its Cupertino headquarters. The company's products and services are available in nearly every corner of the world.

This global presence not only ensures a wide customer base but also helps mitigate risks associated with regional economic downturns.

5. Shareholder Returns: Apple has a long history of returning value to its shareholders through dividends and stock buybacks.

These actions not only reward long-term investors but also create demand for the stock, which can drive its price higher.

Conclusion:

While past performance is not indicative of future results, Apple's stock price history paints a picture of a company that has consistently delivered value to its shareholders.

Its combination of product innovation, service revenue, global presence, and commitment to shareholders makes it a compelling choice for investors seeking long-term growth and stability.

However, as with any investment, it's essential to conduct thorough research, consider your financial goals, and consult with a financial advisor before making any investment decisions.

Apple's stock may be sweet, but it's essential to ensure it aligns with your overall investment strategy and risk tolerance.

Hope you enjoyed this small piece of information.

3 notes

·

View notes

Text

“Big banks including JPMorgan Chase & Co. and PNC Financial Services Group Inc. are vying to buy First Republic Bank in a deal that would follow a government seizure of the troubled lender, according to people familiar with the matter.

A seizure and sale of First Republic by the Federal Deposit Insurance Corp. could come as soon as this weekend, the people said.

The San Francisco-based bank has teetered for weeks following the March 10 failure of fellow Bay Area lender Silicon Valley Bank. The SVB meltdown spurred panicky First Republic customers to pull around $100 billion in deposits in a matter of days.

The stock has lost some 97% of its value since.

(…)

A seizure and sale of First Republic would cap the astonishing collapse of a lender that was, until recently, the envy of finance. With some $233 billion in assets at the end of the first quarter, it would be the second-largest bank to fail in U.S. history.”

“The Federal Deposit Insurance Corp. has asked banks including JPMorgan Chase & Co., PNC Financial Services Group Inc., US Bancorp and Bank of America Corp. to submit final bids for First Republic Bank by Sunday after gauging initial interest earlier in the week, according to people with knowledge of the matter.

The regulator reached out to banks late Thursday seeking indications of interest, including a proposed price and an estimated cost to the agency’s deposit insurance fund. Based on those submissions Friday, the regulator invited some firms to the next step in the bidding process, the people said, asking not to be named discussing the confidential talks.

(…)

JPMorgan is among a small number of giant banks that have already amassed more than 10% of nationwide deposits, making the firm ineligible under US regulations to acquire another deposit-taking institution. Authorities would have to make an exception to allow the country’s largest bank to get even bigger.”

5 notes

·

View notes

Text

How to buy marijuana penny stocks

Clinical and sporting pot use has been legitimised in a developing number of U.S. states and on a public level in Canada, filling a thriving lawful pot industry lately. Weed stocks are presently a superb concentration for financial backers looking for possibly hazardous deals and stock development. In any case, there are sure contemplations related to marijuana stocks that financial backers ought to remember.

Regardless, pot stocks face higher-than-ordinary gamble and instability because of a not insignificant rundown of elements. Many public weed organisations are youthful, problematic endeavours that face a confounded, quick changing business sector that incorporates various regulations across numerous neighbourhood, state, and provincial purviews. Marijuana use is as yet unlawful at the U.S. government level. In any case, 37 states have legitimised marijuana for clinical use in somewhere around one structure as of February 2022 and 19 states have authorised weed for grown-up use as of May 2022.

The difficulties are especially perfect for financial backers with regards to marijuana penny stocks. Financial backers ought to be particularly careful and perform more than their typical expected level of effort while putting resources into these organisations, which incorporate anticipated names like Cansortium Inc. also, Goodness Development Possessions Inc.

Marijuana stocks, addressed by the ETFMG Elective Collect ETF (MJ), a trade exchange store, have emphatically failed to meet expectations of the more extensive market. MJ has given a complete return of - 64.1% throughout the course of recent months, well behind the Russell 1000's all out return of - 12.1%.

MJ focuses on a wide combination of pot industry stocks, including penny stocks.

Here are the main three marijuana penny stocks with the best worth, the quickest development, and the best presentation. The market execution numbers above and all measurements in the tables underneath are as of Oct. 4, 2022.

Best Worth Marijuana Penny Stocks

These are the marijuana penny stocks with the most reduced year following cost to-deals (P/S) proportion. For organisations in beginning phases of improvement or enterprises experiencing significant shocks, this can be subbed as a harsh proportion of a business' worth. A business with higher deals could ultimately create more benefit when it accomplishes, or gets back to, productivity. The P/S proportion shows the amount you're paying for the stock for every dollar of deals created.

Americans purchased billions worth of weed in 2021 and legitimate pot deals could reach $30 billion out of 2022. The Canadian marijuana retail market is extending as well. However pot stocks took a gigantic beating, and a few famous names lost over 80% of their worth last year.

Industry goliath Shelter Development Corp (NASDAQ:CGC) lost 66% of its value esteem in 2021 in spite of rising 150% during a marijuana industry stocks rally of late 2020 to mid 2021 and multiplying during the initial a month and a half of a year ago.

Missing government authorization, U.S. pot administrators keep on major areas of strength for announcing development year-over-year. In any case, their valuations experienced a plunge as financial backer confidence about government legitimization wound down during the year. It's normal that weed change in America could altogether further develop the administrators' business climate, help their profit edges and further develop incomes.

InvestorPlace - Financial exchange News, Stock Exhortation and Exchanging Tips

Authorization in the U.S. could likewise open up new learning experiences for very much financed Canadian marijuana players. Further, Canadian pot stocks could likewise flood if edge choking correctional unit-based extract charge regulation gets reconsidered in 2023.

Hence, any clearness on the way to government legitimization, or fresh insight about charge changes in Canada could list marijuana stock costs. Expansions in financial backer hopefulness connected to U.S. legitimization endeavours generally lifted Canadian marijuana stocks as well. A rising tide lifts all boats, and pot industry penny stocks could flood more than their bigger partners.

Hence, I've evaluated weed organisations with stock costs underneath $5 an offer, and a base market capitalization of $200 million to some way or another whose illiquidity takes a chance on the littlest issues. Both U.S. pot stocks and Canadian pot names are addressed, independent of their essential posting.

Marijuana stocks are dope, the business' developing like a weed — take your pick of plays on words, however putting resources into marijuana is a long way from a joke. With sporting marijuana legal in 19 states and clinical marijuana lawful in undeniably more, this once-obscure corner of trade has turned into an undeniable industry, yet one still in its beginning phases.

From the outset, marijuana stocks might appear to be to some degree restricted to retail activities. Yet, when you dig somewhat more profound, you'll find a few subsectors inside the business, where everything from biotech and think-tanks to experts in dispersion and utilisation work.

Everything that is expressed, it's memorable critical this is an incipient industry whose primary item is as yet a Timetable 1 medication at the government level. That by itself makes any marijuana venture unsafe, however there are a few different motivations behind for what reason you'll believe should do intensive examination prior to plunging heedlessly into weed stocks.

Why marijuana stocks are interesting and unsafe

A stock's a stock, isn't that so? Definitionally, sure: You're purchasing portions of proprietorship in a public corporation. Yet, marijuana stocks convey a few extra difficulties and dangers, including:

Moderately new industry. Marijuana authorization past therapeutic purposes started in 2012. Thus, numerous marijuana stocks are tiny, falling into the classification of penny stocks, which is a hazardous field for financial backers, particularly fledglings. Youthful organisations are at higher risk of leaving business, their stocks can encounter wide cost swings, they might exchange less every now and again (making it harder to sell when the opportunity arrives) and there's less openly accessible exploration for would-be financial backers. At last, with marijuana not yet lawful on a government level, there could be implementation dangers later on.

Theoretical bet. For every one of the above reasons, marijuana stocks ought to be viewed as speculative ventures as of now. Try not to contribute beyond what you can stand to lose.

Likely tricks. Many individuals are anxious to bring in cash in pot stocks, including trick craftsmen. The Protections and Trade Commission has made explicit awareness of marijuana stocks, advance notice financial backers of potential venture misrepresentation (unlicensed dealers, commitments of ensured returns, spontaneous offers) and market control (counting exchanging interruptions and phoney public statements intended to impact costs).

Unfamiliar stocks. Numerous weed stocks exchanging in the U.S. are Canadian, and they're likewise among the biggest. While wandering abroad in your portfolio, there are a few extra dangers — there might be more restricted admittance to monetary information, for example, examination or organisation reports, than what's expected in the U.S. Furthermore, possibly no legitimate plan of action in the event that a venture is fake.

Not yet embraced by the monetary administrations industry. Since marijuana is unlawful governmentally, many banks are hesitant to contact this industry. Therefore, some speculation experts, like counsels or portfolio supervisors, will not have the option to prescribe marijuana stocks to put resources into. (To buy them all alone, see our bit by bit guide for how to purchase stocks.)

6 notes

·

View notes

Text

♕ headcanon . Quinn's corporate structure, management and key business segments

I wanted to further expand a bit on how Quinn is structured in Path to Nowhere given the details offered by canon sources and which help put certain things into perspective. Eirene's beloved child, Quinn is a business conglomerate headquartered in DisCity and also the biggest private enterprise of the city (with tax revenue generated being over a billion, according to her interrogation). In other words: there is no other company with a similar turnover and/or importance for DisCity (and Eastside) such as Quinn.

In terms of corporate structure:

Quinn was founded by Eirene upon moving to Eastside, however it eventually went through an IPO and is currently listed at the local stock exchange. Shares for Quinn are therefore freely traded in the regulated market, making it a public company (see how Eirene remarks on the effects that her imprisonment may have on the stock price, as well as how her successful management of the sleepwalker incident boosted Quinn's corporate value and even how Eastside councilors were willing to use Quinn to break the monopoly on hypercube transportation).

This doesn't mean that Eirene surrendered her power - in fact, only Class A shares are available to be traded; Eirene is the sole holder of Class B shares which are exclusive for her (as the single founder) and have super voting rights - therefore, although Eirene has approximately 5% of the total shares, her Class B privileges grant Eirene approximately 25% of voting power.

The entity listed at DisCity's stock exchange is Quinn Holdings Inc.; Quinn Holdings is the sole shareholder of several different subsidiaries, which are operational and engaged in the actual businesses that carry the Quinn seal. Overall, the holding and its subsidiaries form the 'Quinn Group', which is the biggest private conglomerate of DisCity alluded to above ('private' in the sense that the government has no involvement rather than being privately held).

In terms of management:

Eirene is referred by canon sources as president (epilogue of the Dreamy Bubble event), CEO (her standard outfit image description) and director of Quinn (performance in serving team details). For the purposes of my portrayal and given how controlling (and frankly, workaholic) Eirene seems to be, I don't think Quinn would have different people serving as president & CEO - she has therefore retained both positions and reigns absolute over the company's management, while also having a seat at the board of directors.

Quinn has an one-tier board structure at the holding level and directors are appointed directly by shareholders - Eirene self-appoints herself routinely given the rights associated to her super-voting shares and Quinn's articles of association. Eirene also has a seat at the board of directors of all operational subsidiaries, however she doesn't get involved as much - people report to her on operational matters and she works in a more supervisory role.

In terms of key business segments:

The first industry that Quinn targeted was the hypercube one - however, considering how important it is and that only government companies are allowed to deal with mining and processing, Quinn invested in closely related activities that also made sense given the trade channels with Outlands - therefore, Quinn's first line of business is freight and transportation, including external (import and export from DisCity to Outlands and other settlements) and local (delivery and passenger transportation services within DisCity).

The second business line that Quinn joined and which grew to be incredibly relevant as part of the group portfolio was entertainment: as further confirmed by the archives in-game, Eastside is a 'never-ending party', and all forms of entertainment play a significant role. Quinn owns the Midsummer Night's Club, one of Eastside's most respectable locations, as well as several restaurants, nightclubs, bars and a record & production company for musicians (which is mentioned in Joan's profile).

The third segment that Quinn started to participate was the production of personal care items and fashion lines; Eirene herself is the greatest ambassador to her own brands (as indicated under the details for her files under 'performance in serving team') and they are all manufactured with high quality ingredients and materials, often sourced from exclusive distributors/suppliers and engaging a number of influencers and others famous actors and entertainers to showcase them.

This list is non-exhaustive; Eirene is, as shown in-game, always looking for new business opportunities, and is involved with minor activities such as financing and hospitality; however, the main three lines above correspond to approximately 90% of the group's revenue and have the strongest association to Quinn as a brand.

#♕ headcanons . everything is as I’ve planned#me: takes one company law course#also me: now I will use everything for Quinn headcanons :)

2 notes

·

View notes