#stock market fund flows

Explore tagged Tumblr posts

Text

Malaysia’s Stock Market Revives Amid Foreign Investment Surge - Al Jazeera

Malaysia’s stock market is experiencing a significant revival, with billions of dollars pouring in, driven by robust post-pandemic economic growth and surging foreign investments from U.S. tech giants. The Bursa Malaysia’s benchmark index has climbed 17% over the past year, with 289,000 new trading accounts opened in the first seven months of 2024, nearly double that of 2023. Stephen Yong, a…

0 notes

Text

Debunking business loan myths

There can be a lot of confusion around business loans - what's available, who business loans are for, when you can apply for them, when you can't, and so forth.

Perhaps the most confusing thing for any business owner is who to trust - how do you find a reputable lender if you're not going to a high street bank – keeping in mind that high street banks don't generally offer businesses the kind of funding they need, like working capital loans?

Usually, the result is word of mouth - a recommendation from someone you know, or perhaps you liaise with a broker who introduces you to a lender like Rivers. In this article we look to help you make the best decision for you and your business by debunking a few of the common myths we have heard on the grapevine.

If you would like to speak to us about whether a Rivers business loan is right for you, contact us or check your eligibility, including possible repayment amounts using the online business loan calculator at the bottom of our homepage.

Read full blog - https://www.riversfunding.com/news/debunking-business-loan-myths

#Business finance#Business growth funding#Business loan calculator uk#Business finance loans#Business loan finance#Business loans#Cash flow solutions for smes#Medium term Business loans#Short term Business loans#Small Business loans#Unsecured Business loans#Vat funding for Businesses#Working capital loans#Trusted lender transparent fees#Cash flow loans#Affordable business loan renewal options#Small business loan renewal process#Easy business loan renewal in UK#Loans for Christmas marketing campaigns#Loans for Christmas stock#Loans for seasonal stock#Affordable loans with transparent fees#Affordable startup loans UK#Affordable loans for small businesses

0 notes

Note

I saw how you said that describing the PRC as capitalist betrays a lack of understanding of capitalism and I actually really liked how well you explained that being against capitalism isn't proper Marxism/communism so I was wondering if you could open that post on understanding capitalism a bit more! Only if you're okay with it, of course!

Eventually I should do a real proper Effortpost on this with all the graphs and figures to really drive home the point that I'm making, but very briefly since it's getting late here:

In Marx's time, capitalism was an emergent societal mode of production that was closely entertwined with the enclosure movement and the industrial revolution. On the level of labor, it saw the decline of peasant and artisan labor and the rise of proletarianization, and with it the tendencies of mechanization and rationalization of production (e.g. de-skilling of manufacturing and measurement of efficiency by the labor-hour)

On a consistent historical level, from Marx's time to ours, capitalism has been characterized by the role of liquidity holders (e.g. banks, joint stock companies, investment funds &c) in investigating growth industries and investing in them for the purpose of greater profit. Notably: the demand from financial actors for returns on their balance-sheets is constant, regardless of the state of the development in any given productive market. Meanwhile the nature of industrial development is that it happens in fits and starts, in great surging advances followed by relatively stagnant plateaus. The results of this mismatch are twofold:

First, as Lenin chronicled, it leads for a demand to engage in imperialist expansion to open new markets and seek new profits that way. The other, arguably larger and more important frontier however is that of speculation. Because the inflation of the value of an asset creates purchasing power in and of itself in the short term, which is maintained on balance sheets so long as the arrears on credit derived on it keeps getting paid on a notional path to amortizaiton.

The tendency in capitalism since Marx's time has been the ever-growing importance of these two dynamics and the gradual receding of the importance of low-elasticity economic activity like manufacturing goods.

The tendency of imperialist expansion within capitalism has created a networked global bourgeoisie throughout the financial capitals of the world who extract rentier profits from the various rural peripheries of the global south, and the speculative nature of investment capital in the late 20th and early 21st century defines the quality of the "capitalist develpment" we see in bourgeois states in the contemporary global south: namely, extremely uneven development between rural and urban, trapping of the labor force in a holding-pattern of low-pay low-skill work such as textile production or low-end manufacturing (e.g. Bangladesh and Malaysia) while their capitals enjoy wealth near that of the imperial core, with relatively very high-paying jobs in the knowledge industries (this should ring a bell with India lol). Any country that is actually ruled by its bourgeoisie will follow this pattern, because financialized paper profits are larger (in nominal terms) than the highly investment-intensive industrial development that has gone on in the PRC under the stewardship of the Party. However the result is that the PRC has relatively low inequality among middle-income countries and the technological benefits of the industrialization led by cities is beginning to flow to rural China, which is what allowed them to lift 800 million people out of extreme poverty, something that has yet to happen in actually capitalist bourgeis states like India.

279 notes

·

View notes

Note

This is a weird question I’m sure. How much does Arden and Kadek charge for scenes? I guess I’m trying to understand their income. I’m assuming Kadek makes a lot more money than Arden since he owns several clubs and is more tenured.

Hi anon,

I'm not sure! Except that I'm sure it's been very variable over time.

It's definitely not at all the primary source of Kadek's income. His biggest income source would be subscription access to all the classes he teaches, and also flow-through funding from entry fees and course fees at the clubs he hosts.

When Kadek gets paid in kink, it's not as a professional dominant, it's as a rigger to host workshops at ateliers, where the atelier is likely to pay or partially fund his flights and accommodation, etc. Or workshop fees are expected to cover that. What he does is extremely different to what Arden does. He's not really opening himself up for like, clients who pay him to dominate them at all. He's not charging by the hour for that because he doesn't do that.

But Kadek's always about a smart hustle, and to him that was creating online courses at a moderate/minimal subscription fee, in all aspects of kink, and establishing one of the best databases online for it (similar to Shibari Study now).

He makes a fair amount of money from the stock market and financial investments too. He probably makes the least from the bookshop (which is more like a novelty project for him).

Arden on the other hand charges a sliding scale based off a person's income/circumstances for professional domination of around $200-500 per hour, as he's often tipped very well by clients, he could sometimes easily pull $20,000 in a week without working anywhere near to full-time hours (which gives him time to teach classes, work - as a novelty project - at Cosy, do judo etc.). A lot of that is down to his level of expertise though. Starting pro doms are not charging this much, but the ones who have a reputation and are experience are definitely making bank.

Kadek has much more money than Arden, but he's older, and he's also been raised to invest broadly and widely, and also work less for more. His parents are financially savvy and he enjoys being good at what he does. If he quit every job he had tomorrow, he could survive on stock investment alone and occasionally selling stocks / re-investing alone.

Kadek lives literally like 1-2 streets away from Crielle and the An Fnwy estate, he's loaded.

#asks and answers#kadek setiawan#efnisien ap wledig#arden mercury#arden is much more self-made in some ways#kadek is more 'my parents gave me a start'#falling falling stars#kadek wouldn't let someone hire him for an hour to dominate them#even if they put#$10k on the table#he's just not that kind of guy#administrator gwyn wants this in the queue

20 notes

·

View notes

Text

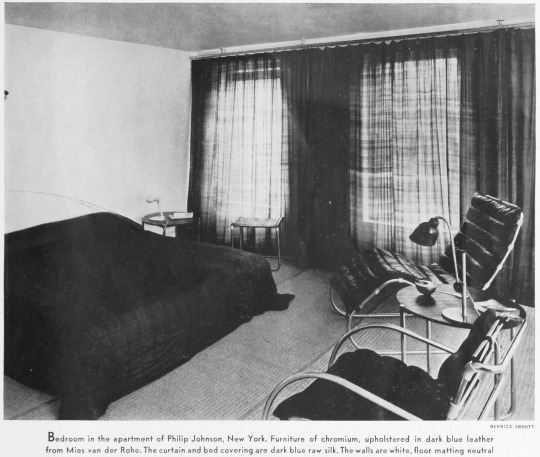

Berenice Abbott in Philip Johnson’s apartment

Berenice Abbott, 1930 (Walker Evans) / Philip Johnson, 1933 (Carl Van Vechten)

These portraits are the most obvious choices from this time period and conveniently suggest the biographical contrast between the two: Abbott had been a struggling American artist in Paris, an assistant to Man Ray, but she later established a portrait business, built a reputation and gained a steady flow of sitters. In January 1929, at age 30, she left for New York.

Abbott departed on the ship from France with the archive of Eugène Atget: 17 crates according to the Julia van Haaften's biography. She naively thought selling Atget prints and licensing would provide a healthy income.

The new architecture of the city enthralled her and Abbott quickly began to conceive and photograph a topographic survey of the city. By fall 1929 the stock market had crashed, the Great Depression had begun and the portrait business was no longer promising. Abbott wanted to charge $150 a portrait, at a time when you could get one done for a dollar. This environment forced her to change business models, looking for patrons for the New York project.

Abbott first encountered Philip Johnson in New York in 1931, at the “Rejected Architects” exhibit, a salon des refusés for modern architects and an early introduction of the International Style to New York.

Johnson was a 25-year-old who came from inherited wealth. Rachel Maddow’s "Prequel: An American Fight Against Fascism" suggests his portfolio produced, in today’s dollars, from $240,000 to $1.2M in dividends a year. His financial backing of the architecture department at MOMA resulted in him becoming director of that department. He had discovered Mies van der Rohe on one of his traipses across the continent and was eager to bring the new style to New York. While Johnson was financially very comfortable, he had unsatisfied ambitions, larger than being a curator of architecture and beyond architecture itself.

In 1932 Abbott was part of MOMA’s Murals by American Painters and Photographers exhibit, which Johnson certainly would have been aware of, if not directly involved in, as the point of the show was large modern murals for architecture projects such as Rockefeller Center in the form of seven by twelve foot murals. Greg Allen has the backstory on that exhibit (since his 2010 post the full catalog with her photos has been published on the MOMA site).

For her New York survey, Abbott was looking for $18,750 ($390,000 in today’s dollars), enough to fund a year long project, travel, a car with two full time assistants to deliver 350-500 prints and negatives. Johnson did not financially support Abbott’s New York project, nor did the museum sponsor it, but he offered a strong letter of recommendation, on MOMA letterhead: "You have a deep love for New York, you are an excellent photographic technician and you have the artistic power of selecting the essential."

The goal was to find 75 patrons among the wealthy MOMA donors to contribute $250 each. Despite Johnson’s endorsement, this fundraising effort was a flop. It would take her until 1940 to finish it, but "Changing New York" became one of the great photographic projects of the 20th century.

Van Haaften describes an architecture and photography exhibition Johnson and Abbott planned to do together, called "America Deserta," about the visual repercussions of the Depression. It sounds like an early version of what we now call "ruin porn." She writes that Johnson could have financed the project out of his own pocket, but neither he, nor the museum, pulled the trigger. (Decades later, architecture critic Reyner Banham wrote an excellent book about the actual desert titled "Scenes in America Deserta")

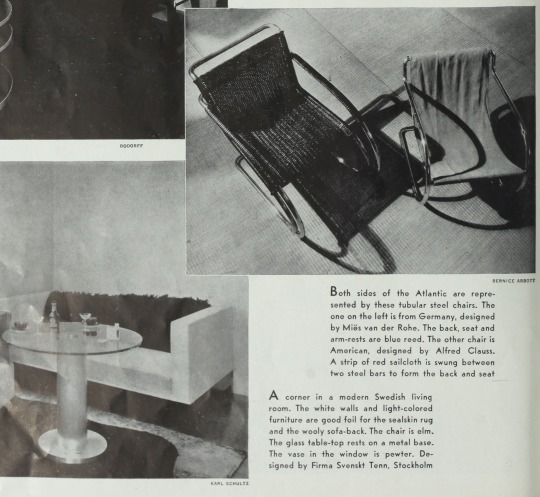

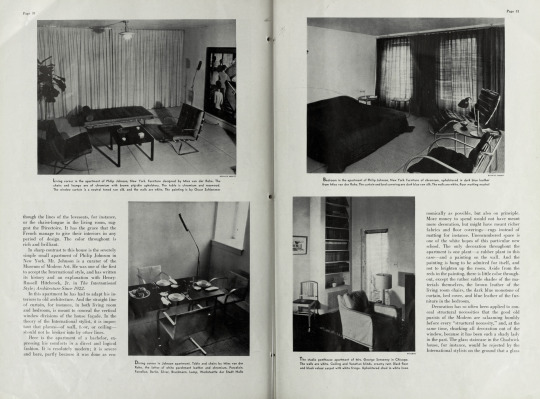

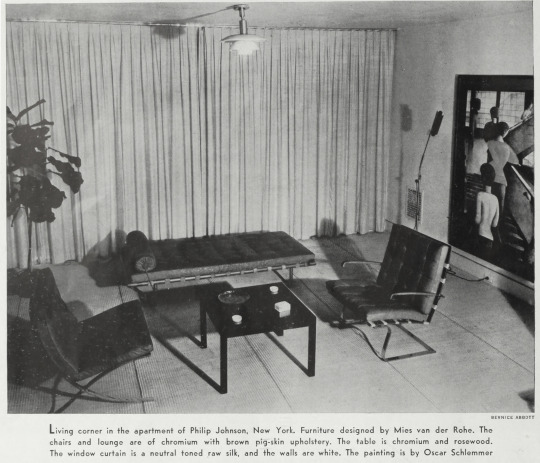

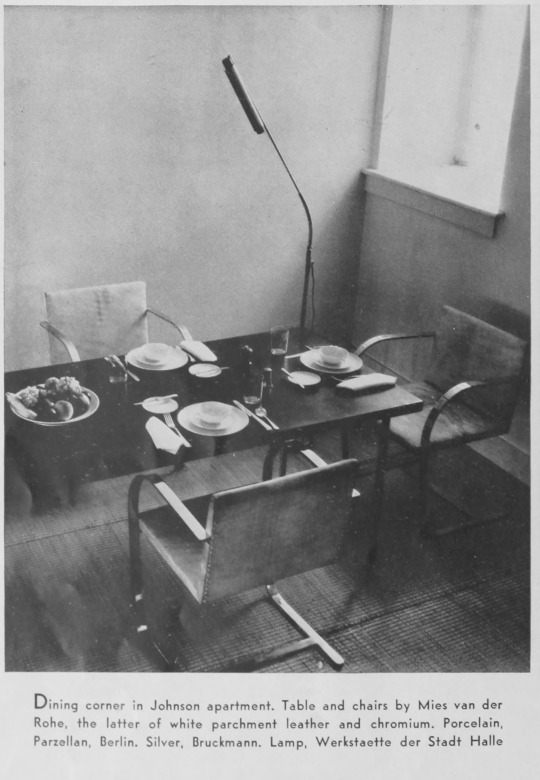

Johnson was doing interior design in New York for friends and acquaintances, hoping the examples of his work could help establish him (and the International Style he had signed on with). An early project was for MOMA’s Alfred Barr. Mark Lamster writes in "Man in the Glass House" that Barr couldn’t afford the real Mies furniture that Johnson had already acquired for himself, so Johnson designed knock-off tubular chairs.

cover of Arts and Decoration, September 1933, from the Burlingame, California library via archive.org

Johnson’s own apartment was his first top-to-bottom interior design project. He was eager, bordering on desperate to get paying clients, to establish himself. He didn't need the money, but wanted clients as a stamp of approval from the New York elite, like the Rockefellers. He enlisted Abbott to take photos to premiere it in Arts and Decoration magazine.

The International Style had already taken root in Los Angeles, but New York was not ready for what he was offering. Perhaps Abbott’s photos of his apartment are part of why the new thing seemed unconvincing. Starting with the watercolor cover or paging through this magazine aimed at the wealthy, the features contrast traditional style versus examples of the new style.

If you've never been in a modern interior before and these photos are your first glimpse, it's not appealing. Johnson was no Neutra and he had not found his Julius Shulman. The magazine's reproduction quality of the photography is not good. Abbott's photographs feel cramped. The lighting is a combination of murky corners and distracting shadows. The styling, a fiddle leaf fig, the place settings at the dining table, feels forced.

In terms of art history, the most interesting of Abbott's photographs features a painting directly from the Bauhaus. It's Oskar Schlemmer's Bauhaus Stairway (1932). Lamster outlines the very messy deal that brought the painting to New York. In March 1933 Barr asks Johnson to buy it, unseen, thinking it will end up at MOMA. As the Nazis breathe down Schlemmer's neck for being a "degenerate artist," Johnson sends a telegram offering a price, but then claims a typo added a zero and pays 10x less. This dispute isn't resolved until after the year 2000. Johnson keeps the painting in his collection for another ten years.

the captions drop the "e" Abbott had added to her name (Bernice vs Berenice).

What explains the vast difference between the great photos Abbott is making on the streets of New York and these mediocre interiors? She creates "Exchange Place" the same year. Spending time with Abbott’s archive on NYPL and Getty looking for interior photos to compare to these photos of Johnson's apartment to, left me with another question: Why are photographs of interiors uncommon until the 1940s? In her Paris portraits the interior of her studio plays a significant role as background.

Van Haaften writes that Abbott is using two cameras in these early years in New York:

5x7 inch view camera (with reducing back to 12x9cm, which is a large “medium format” negative )

Graflex that she acquired to do portraits of Guggenheim children (probably a 4x5 inch press style camera).

Abbott is on a ladder to make the photographs of Johnson's place and perhaps the combination of lens focal length and the size of the apartment presented a challenge in creating enough space. It’s possible, despite the two cameras, that she simply didn’t have a wide enough lens to do interior work at a time when lenses were expensive and money was tight. Or that she didn’t prefer to use spotlights or flash. Perhaps her focus was so intense on the exterior of the city that she rarely set up the camera indoors.

For Johnson, it’s possible to imagine if New York had been more open to the new style, if the magazine caused a stir, if he was encouraged to become an architect at this moment, his descent into fascism would have never happened. After the photos are published in the September 1933 issue, 1934 is a rollercoaster year for Johnson: he has a breakout hit of an exhibit in Machine Art (March-April). But by December, he quits MOMA to focus on his fascist party. He’s 28 years old. His pursuit of the fantasy of a domestic version of Nazism brings him to Germany, to cheer on the invasion of Poland. Lamster writes that he only to returns to architecture in 1941, when it’s clear that he has barely escaped being charged with treason. He goes from being a millionaire who shipped his own car to Europe for his Nazi tour to cleaning Army toilets.

Van Haaften’s biography of Berenice Abbott is not specific about when Abbott broke off her friendship with Johnson. We can assume it happens sometime between the apartment photoshoot and Johnson leaving MOMA. Abbott was a communist or socialist for most of her life and American Nazis like Johnson were very clear on what they would do to communists if they gained power. Van Haaften writes: "the two friends later parted ways over Johnson’s political views and his enthusiasm for the Third Reich." The book's footnote indicates the source for this is her 1993 phone interview with … Philip Johnson.

22 notes

·

View notes

Text

Close Call (smut) ❤️🔥

The dinner table was a mess of laughter and clinking plates, the kind of chaos only family gatherings could bring. Your mom and mine were deep in conversation, their Spanish flowing fast and furious, while my sister was trying to convince your dad to try her infamous spicy salsa. I glanced across the table at you, and you gave me that look—the one that said, Can we please get out of here?

“Wanna go upstairs?” I mouthed, trying not to smirk. You nodded, pushing your chair back with a loud scrape that everyone ignored. We slipped away while the adults were too distracted to notice, and the moment we hit the stairs, we both let out a breath.

“God, I thought I was gonna die of boredom,” you said, flopping onto your bed. I followed, sitting on the edge, the familiar comfort of your room wrapping around us. Posters of your favorite bands covered the walls, and your desk was cluttered with notebooks and half-empty water bottles.

“Same,” I said, leaning back on my hands. “Your dad was really trying to explain the stock market to me. Like, bro, I’m 24. I don’t even know what I’m doing tomorrow, let alone with my retirement fund.”

You laughed, kicking off your shoes and scooting over to make room for me. I lay down next to you, our shoulders brushing, and for a moment, we just stared at the ceiling. It was quiet, the kind of quiet that felt heavy, like there was something unsaid hanging between us.

Then you turned your head to look at me, and I could feel it. That thing. The thing we’d been dancing around for years, ever since we were kids. Your eyes were dark, your lips slightly parted, and I swear I stopped breathing.

“Alex,” you whispered, and my name on your lips sent a shiver down my spine.

“Yeah?” I asked, my voice sounding way too rough.

You didn’t answer with words. Instead, you leaned in, your hand sliding up my arm, and then your lips were on mine. It wasn’t our first kiss—that had happened years ago, when we were teenagers and experimenting, but this was different. This wasn’t curiosity. This was want.

I kissed you back, my hands finding your waist as you climbed into my lap, your legs straddling me. Your mouth was warm, your tongue teasing mine, and I could feel my heart pounding in my chest. I’d wanted this for so long, but I’d been too scared to admit it, even to myself.

Your hands were in my hair, tugging gently, and I groaned against your lips. “Fuck,” I muttered, breaking the kiss to trail my mouth down your neck. You tilted your head back, giving me more access, and I nipped at your skin, earning a soft gasp.

“Alex,” you breathed, your voice shaky. “Don’t stop.”

I didn’t plan to. My hands slid under your shirt, exploring the soft skin of your back, and you squirmed in my lap, grinding against me in a way that made me see stars. I could feel how turned on you were, and it only made me want you more.

I pulled your shirt over your head, tossing it aside, and then my mouth was on your chest, kissing and sucking until you were a writhing mess above me. “You’re so fucking beautiful,” I said, my voice low as I looked up at you. Your cheeks were flushed, your lips swollen, and I’d never seen anything hotter.

“Alex, please,” you begged, and I didn’t need to be told twice. I flipped us over, pinning you to the bed, and kissed my way down your body, stopping at the waistband of your jeans. I looked up at you, my hands on your hips, and you nodded, biting your lip.

I undid your jeans, tugging them down along with your underwear, and then I was staring at you, completely bare and trembling beneath me. “Fuck,” I whispered, my mouth watering at the sight. I’d never done this before, but I’d be lying if I said I hadn’t thought about it.

I leaned in, pressing a kiss to your inner thigh, and you whimpered. “Alex, please,” you said again, your voice breaking, and that was all it took. I kissed you there, my tongue dipping between your folds, and you let out a moan that went straight to my dick.

I licked you slowly, savoring the taste of you, and you arched off the bed, your hands gripping the sheets. “Oh my God,” you moaned, and I thought I might lose it right then and there. I slid my tongue up, circling your clit, and you gasped, your thighs tightening around my head.

“Alex, that feels so fucking good,” you said, your voice shaky as I continued to lick and suck, my hands gripping your hips to keep you still. You were so wet, so responsive, and I couldn’t get enough. I slid a finger inside you, curling it just so, and you cried out, your body trembling.

“That’s it, baby,” I murmured against you, my voice low and rough. “Let go for me.”

You did. I felt you clench around me, your whole body shaking as you came, your moans muffled by your hand. I slowed down, gently lapping at you as you caught your breath, and when I looked up at you, your eyes were dark and hooded.

“Holy shit,” you whispered, and I couldn’t help but grin.

Before I could say anything, though, we heard footsteps on the stairs. We froze, our eyes locking in panic. “Are you guys up here?” your mom called, her voice getting closer.

“Shit,” I whispered, scrambling off the bed. You grabbed your clothes, shoving them on as quickly as you could, and I pulled my shirt back over my head. By the time your mom opened the door, we were sitting on the bed, looking completely innocent—or as innocent as we could, given the circumstances.

“There you are,” she said, giving us a suspicious look. “Dinner’s almost done. Come downstairs.”

“Okay, Mom,” you said, your voice steady even though I could see the panic in your eyes. She left, closing the door behind her, and we both let out a breath.

“That was close,” I said, running a hand through my hair.

“Too close,” you agreed, biting your lip. “We should probably go back downstairs.”

“Yeah,” I said, but I didn’t move. I couldn’t. Not when you were looking at me like that, your lips still swollen from my kisses.

“Alex,” you said, your voice soft, and I knew we were in trouble. Because this wasn’t over. Not even close.

“Let’s go,” I said, standing up and holding out my hand. You took it, your fingers lacing with mine, and I knew there was no going back now. Not after what just happened.

We walked downstairs, our hands brushing the whole way, and I couldn’t stop thinking about how close we’d come to getting caught. But more than that, I couldn’t stop thinking about how much I wanted to do it again.

“Alex,” you whispered as we reached the bottom of the stairs, and I turned to look at you.

“Yeah?” I asked, my voice low.

You didn’t say anything. You just looked at me, your eyes dark and full of something I couldn’t name. And I knew…

14 notes

·

View notes

Text

Don't ask what I'm doing I'm not doing anything (VBS Data Stream guys look at it)

Kohane An Akito Toya and Luka

(actually nice and finished looking lyrics under cut)

Eventually, all walls meet demolition

So Wall Street had to keep the tradition

Their financial systems resigned to ignition

And out of the ashes, we have arisen

An empire is forged in the fire of ambition

In business, there isn't the time for attrition

Invest to suppress then ingest competition

Then each acquisition is new ammunition

When governments crumble and fall to the floor

That was paved with the graves of a corporate war

A fundament funded in blood just to shore

A foundation for founding our covenant

Born of a need for control of societal entropy

Enterprise at the price of your indemnity

Chart out the course and of course you were meant to be

Bent to the will of a corporate entity

Arasaka Security. You're in safe hands

We're the light in your screens, we're the lead in your veins

Then you wake from your dreams, so we can sell them again

In the light we distract with the shiny and new

So you're blind to the fact that the product is you

So let your brain dance and replay the dream

But don't drown in the data stream

'Cause we see where you are and we see where you go

'Cause we know what you own and we own what you know

From the top of all our towers, the corridors of power clearly need rewiring

Arasaka saw the spark and then embarked upon the path to turn that spark to lightning

There's no autonomous megalopolis so populous or prosperous you could reside in

And every citizen that's living in this city is a digit on the charts we're climbing

Political systems are too inefficient

They split like the atom and burned in the fission

Now every department and every decision

Defer to the herds of our corporate divisions

If you don't remember the ballot you cast

It's printed on every receipt you were passed

Each time you selected our products and services

We were elected in each of your purchases

What's left to do when you've got the monopoly?

Turn the consumer into the commodity

It isn't hard where you've hardware neurology

Honestly, do read the company policy

Take information and trade it for wealth

You pay it in each augmentation we sell

It's easy to cut out the middleman

When he's cut out most of himself

Arasaka Finance. Investing in your future

(chorus)

All that you say on the net we composite

To maps that go straight from your head to your pocket

Complain if you want, you're still making deposits

Of data — each day you log on is a profit

Society currently lists electronic

So isn't conducting resistance ironic?

We've plenty of skeletons locked in our closets

But yours are assembled from old-stock hydraulics

So lucky we know just the pieces you need

All plucked from your social media feeds

The places you go and the posts that you read

All snatched for a new algorithm to feed

Now, holding our gold isn't par for the brand

Our silver is sat in the palm of your hand

Quit whining and sign on the line in the sand

The supply does not get to make the demands

(chorus)

Arasaka Manufacturing. Building a better tomorrow

Name, age, qualifications

Race, faith, career aspirations

Political leaning, daily commute

Marital status, favourite fruit

Family, browser, medical history

Hobbies, interests, brand affinity

Fashion, style, your occupation

Gender identity, orientation

Lifestyle choices, dietary needs

The marketing contact you choose to receive

Posts, likes, employers, friends

Social bias, exploitable trends

Tastes, culture, phone of choice

Facial structure, the tone of your voice

If it's inside your head, we know

You can't escape the ebb and flow

(chorus)

When guiding the hand of the market

If it's holding a cheque or a gun

The fingers go deep in your pockets

And you can live under the thumb

You seem so surprised, what did you expect?

We're thinking outside of that box that you checked

The terms were presented in full to inspect

You scrolled to the end just to get to "Accept"

Arasaka would like to know your location

Arasaka would like to know your location

Arasaka would like to know your location

Arasaka would like to know your location

#this song is way longer than I thought it was#can you tell i got a little lazier as i went on#it's difficult to switch a color back and forth for each letter#also you might notice that some of the lyrics i wrote are not the same as i highlighted#that's because#i changed my mind#about who should sing what#this is just for fun#it probably wouldn't ever happen#but it would be cool right#project sekai#pjsk#vbs#vivid bad squad#vbs luka#kohane azusawa#vbs kohane#pjsk kohane#project sekai kohane#an shiraishi#an vbs#vbs akito#vbs toya#shiraishi an#akito shinonome#pjsk akito#akito project sekai#the data stream#the stupendium#cyberpunk 2077

11 notes

·

View notes

Text

As I see it, we are waiting for some public announcements to come forth including the following

1. Public announcement of the USN on the gold and asset standard

2. Public announcement of the new USN notes money supply

3. Public announcement of USN bills paid

a. Iraq has a trust problem with the US

b. they need to see items 1-2 and three above publicly announced So they can go forward

4. Public announcement of the new Iraq international Dinar rate

5. Public announcement of the new Iraq international data rate published in The Gazette

6. Public announcement of Nesara

7. Public announcement of Gesera

8. Public announcement of Biden gone

9. Public announcement of trump's return

10. Private announcement of RV notifications including 800 numbers and starlink

a. Private announcement of tier 3 liquidity and spendable

b. Private announcement for liquidity of all tiers

11. Public announcement of the following

a. Social Security increase and change of system

b. Reclamation monies

c. Debt forgiveness jubilee

d. Other funds as applicable

We should begin to see these flowing out in the soon coming immediate future

There are other events that are important such as the stock market crash, EBS, and the new financial system. I have chosen not to include them in the list above, but those things are coming and we should pay attention to real events that are about to and very soon begin to unfold.

Hold the line and stay steady. Lock your faith into the Word of God. What is about to happen is biblical and we should understand that.

See you on the other side. The other side is the Promised Land.

Are you truly ready?

I'm Locked and Loaded !!!!!!! 🤔

- Benjamin Fulford

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think about it#think for yourselves#think for yourself#do your homework#do some research#do your own research#ask yourself questions#question everything#benjamin fulford#news

29 notes

·

View notes

Text

So uhm, financial update, the ocean is rough, but that's normal, but there's a kraken moving at the bottom of the ocean and that's new.

I'm going to do a quick little explanation of what's happening here.

Normally when stocks go down, bond yields go down. Bond values are reverse to their value.

Let's say I have $100 bond that is at a 5% interest rate. Tomorrow the interest rate goes to 6%. The effective value of my $100 bond is now lower because current interest rates are higher, so it's worth less in effective payout than a bond you could buy today. So, interest rates go up, bond values go down. Interest rates go down, bond values go up.

When equities markets crash, people flee stocks to the safer bonds. More people buying means more money available to bonds. In other words, I want to borrow $100 - when stock markets are up, there are fewer people wanting to take that lower return, so I have to accept a higher interest rate. However, when markets are down, people are more willing to accept a lower yield in exchange for a safer investment, so interest rates go down. More people offering to buy, I can find the lowest rate.

Remember that day trump announced a 90 day tariff pause? It's because the bond rates went UP despite equities going down. That means that even as people were fleeing equities MORE people were still selling bonds. This was likely international sellers.

This is such a big deal that even trump couldn't ignore it. But while all this was happening, the USD lost 10% value compared to the euro. All of these things tend to be more balanced, x drops so y goes up, y goes up so z drops. Right now it feels like it's all dropping, only a little here and there, but I'm unsure if this is a pebble or the start of an avalanche.

What this means: it's a crack in the US's status in the global financial systems. It means that people were selling US bonds despite uncertainty.

What this means to you: if this isn't simply a blip, borrowing rates could skyrocket over the next couple of years. Think all loan rates jumping to above 10%, the USD buying significantly less than it does today as companies do more massive layoffs - but importantly, it could last years, way longer than anything any of us have experienced.

Right now it's just a little blip, I know many people here hate the financial systems, but hating a system doesn't mean that you won't be impacted by it. I know people will see all of this and think "good!" But if this continues, lot of people will be very negatively impacted by this, both in the US and abroad. Many countries hold us bonds and USD as a safety fallback - they will also feel all of this.

I really hope I'm being alarmest for no reason.

I'm not well off by any means, I am mostly a poor masters student still, but I have some savings, I'm moving it international via EU bond funds. I help my mother with her 401k and moved her to US bonds before the trump presidency, but I think I'm also moving her international.

I am very much not the "everything is going to explode" type - I tend to view things as ebb and flow. This feels different. This feels bigger. Gold has gone from $2750 in February to $3340 today. This is normally a recession indicator, but it doesn't feel like a normal recession is coming. I hope the kraken is simply a whale, I tend to dismiss kraken sightings as simply whales, but I'm not entirely convinced it's not a kraken here.

4 notes

·

View notes

Text

Just after 1 p.m. this past Wednesday, President Trump posted a statement on Truth Social saying that he was pausing, for ninety days, the historically steep, economically nonsensical Liberation Day tariffs on virtually the entire world, which he had announced the week before. Retreat was inevitable. The tariffs had been so hastily designed that they imposed duties of ten per cent on Antarctic islands inhabited by only seals and penguins, and placed a duty of nearly fifty per cent on Cambodia, a producer of cheap textiles that is too poor to plausibly buy much of what we produce. The markets predictably plunged, wiping out more than six trillion dollars in value; Jamie Dimon, the chief executive of JPMorgan Chase, said that the “likely outcome” would be a recession; and a sell-off of government bonds raised the ominous possibility that the U.S. Treasury market would no longer be the world’s reserve of choice. The labor economist Arindrajit Dube wrote, “Never in human history has a whimsical decision by a single person destroyed so much wealth.”

The markets, the President allowed, had become “a little bit yippy.” But Trump never really retreats; he repositions. In his Wednesday post (“Thank you for your attention to this matter!” he closed), he revealed that he would be leaving in place ten-per-cent duties on most countries and immediately escalating a trade war with China, imposing tariffs of nearly a hundred and fifty per cent. The stock market rebounded rapidly on Wednesday, when most of the more inane tariffs were rescinded, and then fell again on Thursday, when the reality of the conflict with China set in. Had the President actually pulled back at all?

Jason Furman, who’d chaired President Obama’s Council of Economic Advisers, wrote on social media, “I don’t think people realize that in important respects tariffs are now higher & more inflationary than what was announced” on Liberation Day—even the “reduced” tariffs are now far higher than those levied by any other large nation. So the President’s new approach may not be the end of a self-induced destabilizing and hugely risky period in global economics but the beginning of one.

Trump’s efforts to make a bold adjustment in the relationships that govern the economic world have some financial analysts asking why. Viktor Shvets, a global-market strategist at Macquarie Capital, said, on Bloomberg’s “Odd Lots” podcast, “I keep asking myself, ‘What is this Administration trying to do?’ ” Was the objective to reindustrialize the United States, or to raise revenue to help pay for tax cuts to the rich, or to change the global flow of funds? “My answer consistently is, they want to remake America,” Shvets said. “But you can’t remake America unless you remake the world at the same time. So it’s a revolutionary movement.”

As Shvets went on to hint, the second Trump Administration is taking shape as a through-the-looking-glass Team of Rivals. It comprises big personalities (Trump, Elon Musk, J. D. Vance) with incongruous views of what America’s role in the world should be—a rift highlighted this past week, when Musk publicly denounced the Trump trade adviser and tariff architect Peter Navarro as “dumber than a sack of bricks.” But, even if the advisers have different objectives, they seem to share a sincere repugnance for the universalism of the liberal world order and a desire to reimagine it radically—to weaken its universities, to abridge the global movement of people and goods, to retreat into a fortress of self-interest.

If the Trump Administration could pivot so easily from a punitive tariff system aimed at practically everyone to one that summoned a sudden trade war with China (which quickly imposed retaliatory tariffs), perhaps that’s because the details of the policy change mattered less to the White House than its scale—that it represents a dramatic break from the old system. On Tuesday, as the markets were plunging, Trump told the National Republican Congressional Committee, “They’ve ripped us off left and right, but now it’s our turn to do the ripping.”

That remark presumes a brute power—an ability to apply transformative torque—that the U.S. may not have for much longer. The week of the Liberation Day tariffs operated as a test of how the markets would react and how the real economy would reset, and it provided some results. We now know that investors don’t trust Trump to reinvent the trade system, and neither do many people in his own party: in a hearing this past week, Senator Thom Tillis, of North Carolina, asked the U.S. Trade Representative, Jamieson Greer, “Whose throat do I get to choke if this proves to be wrong?”

The White House’s theory seems to be that high tariffs will eventually incentivize manufacturers to relocate, say, auto plants and aluminum smelters to the U.S. But businesses need stability to make the kinds of major capital investments that building new factories in this country requires, not a climate defined by ninety-day pauses and abrupt reversals. Even amid tariffs, the Times found little appetite for re-shoring among companies: “Staying in China and making China work is everyone’s strategy right now,” a U.S. entrepreneur said. Meanwhile, China and the European Union are exploring their own trade relations. The danger behind Trump’s posturing is that, by so emphatically insisting on America’s indispensability, he may be undermining it. (On Friday, Axios reported, “The world’s hot new trade is ‘sell America.’ ”) Currently, some ten per cent of global trade flows through the U.S., but, if nations continue to look for other trading partners, how much of that will be lost?

Beijing, for its part, is preparing for a trade war. According to the Financial Times, Chinese state and commercial institutions have organized a “national team” to fight the tariffs, coördinating investments in Chinese companies to offset trade losses. And, though Trump has spent a decade inveighing against the effects of China’s economic gains on American communities, the current chaos indicates he does not really have a road map for how to unwind them, beyond complete faith in his own ability to pull off a deal. He means to gamify tariffs so that he can leverage each threat for a better negotiating position. But too much now rests on presumptive talks to come: one estimate suggested that the new tariffs would cost the average American household forty-seven hundred dollars a year. Unlike partisan politics, trade wars aren’t zero-sum. Sometimes everybody loses.

2 notes

·

View notes

Text

Regional fund inflows could benefit the local market

The FBM KLCI dropped to 1,590 due to profit-taking, likely driven by foreign fund outflows. Fund flows However, expectations remain that regional fund inflows could benefit the local market. The index is expected to trade within the 1,590-1,600 range today. Gold prices have surged past USD2,900/oz, with USD3,000/oz as the next target. Technical View – SUNWAY (5211): • Resistance: RM4.85…

0 notes

Text

How can small business loans help fashion retailers?

From short-term business loans so you can employ seasonal staff in the lead up to Black Friday and the Christmas sales, to medium-term business loans that mean you can secure next season's stock today, small business loans can provide significant support to fashion retailers in multiple ways. In this article we look at how our carefully considered cash flow solutions for SMEs can power retail businesses as part of a sensible commercial strategy and judicious approach to capital management.

Read Full Blog - https://www.riversfunding.com/news/how-can-small-business-loans-help-fashion-retailers?searchQuery=&pageNo=1&limit=25

#Cash flow solution loans#Clear fee structure business loans in UK#Transparent fees for small business loans#Affordable loan renewal with transparent fees#Business growth funding loans#Trusted lender transparent fees#Business growth funding#Cash flow loans#Affordable business loan renewal options#Small business loan renewal process#Easy business loan renewal in UK#Loans for Christmas marketing campaigns#Loans for seasonal staff#Loans for Christmas stock#Loans for seasonal stock#Affordable loans with transparent fees#Affordable startup loans UK#Affordable loans for small businesses#Best affordable business loans UK#Affordable financing for small businesses#No hidden fees loans in UK#Transparent pricing business loans#UK small business loans no hidden fees#Business loan providers no hidden charges#Transparent fees business funding#Clear pricing for business loans UK

0 notes

Text

Is Bitcoin a Good Investment For Beginners?

What is Bitcoin, and Why is it Popular?

Bitcoin is a digital currency that operates on a decentralized network. Unlike traditional money, it’s not controlled by banks or governments. Instead, Bitcoin transactions are verified by thousands of computers worldwide. This makes it resistant to censorship and inflation.

People are drawn to Bitcoin for different reasons. Some see it as digital gold — a scarce asset that could increase in value over time. Others use it for fast, borderless payments. In countries with unstable currencies, Bitcoin offers a way to store wealth without relying on banks. Businesses and institutions are also adopting Bitcoin, seeing it as a hedge against economic uncertainty.

Bitcoin is popular, but it’s still evolving. It has the potential to reshape finance, but it also faces challenges like regulatory uncertainty, environmental concerns, and security risks.

Bitcoin Halving 2024: Less Supply, More Hype?

In April 2024, Bitcoin underwent its fourth halving. This event reduced block rewards from 6.25 to 3.125 BTC. Historically, halvings decreased Bitcoin’s supply rate. This scarcity often led to price surges. For instance, post-2012 halving, Bitcoin soared from $12 to $1,000. Similarly, after the 2016 halving, prices escalated. By March 2025, Bitcoin’s price dynamics remain influenced by the 2024 halving. Investors anticipate potential bullish trends. However, market conditions and external factors also play pivotal roles. Thus, while halving impacts supply, other elements shape Bitcoin’s price trajectory.

The Benefits and Risks of Investing in Bitcoin

Bitcoin is one of the most exciting and controversial investments of the 21st century. It has made some investors millions, but it has also wiped out fortunes overnight. Let’s break down the pros and cons.

Bitcoin Investment Pros

High potential for long-term growth. Over the past decade, Bitcoin has outperformed traditional investments like stocks, gold, and real estate. Some analysts predict it could reach $150,000+ by the end of 2025 if adoption continues.

Fixed supply. Only 21 million BTC will ever exist. Unlike dollars or euros, which governments print endlessly, Bitcoin’s scarcity makes it resistant to inflation and a hedge against economic instability.

Borderless transactions. Send Bitcoin anywhere, anytime without banks, restrictions, or excessive fees. In countries with weak financial systems, Bitcoin provides financial freedom like never before.

Growing institutional adoption. Hedge funds, Fortune 500 companies, and even countries are adding Bitcoin to their balance sheets. The launch of Bitcoin ETFs has made it even easier for big money to flow in.

Open and decentralized. No single government, bank, or corporation controls Bitcoin. No one can freeze your funds or block your transactions. This makes it one of the most independent financial assets ever created.

Bitcoin Investment Cons

Extreme price volatility. Bitcoin is not for the weak-hearted. Its price can skyrocket 200% in a year or crash 50% in weeks. If you panic-sell during dips, you will lose money.

Security risks. If your wallet is hacked, or you lose your private key, your Bitcoin is gone forever. Unlike banks, there is no customer support to recover lost funds.

No consumer protection. Send Bitcoin to the wrong address? Stolen funds? Too bad. Unlike traditional banks, there is no way to reverse a mistaken transaction.

Uncertain regulations. Some governments embrace Bitcoin, while others ban or heavily tax it. New laws could impact how Bitcoin is traded, owned, or even mined.

High energy consumption. Bitcoin mining consumes more electricity than some countries. This has raised environmental concerns, though new advancements like renewable energy mining are helping reduce the impact.

Bitcoin vs. Traditional Investments: What’s Better for Beginners?

Investing is all about balancing risk and reward. Some assets are stable but offer slow growth. Others are risky but can deliver massive returns. Let’s break it down.

Which One is Better?

Bitcoin is high risk. High reward. It has outperformed every traditional asset over the past decade, but it also experiences wild price swings.

Stocks offer steady growth with dividends. They are less risky than Bitcoin but still require knowledge of the market.

Gold is a safe-haven asset. It doesn’t crash like Bitcoin, but it also grows much slower. Investors use it to protect their wealth rather than grow it quickly.

Bonds are the safest but offer the lowest returns. They provide stability and guaranteed income but won’t make you rich.

What’s Best for Beginners?

A balanced approach. Don’t go all-in on Bitcoin. Diversify your investments across multiple asset classes to manage risk.

A simple beginner-friendly strategy.

50% stocks for steady long-term growth.

20% Bitcoin for high-risk, high-reward potential.

20% bonds for stability.

10% gold as an inflation hedge.

This way, you maximize potential gains while protecting yourself from major losses. Investing isn’t about betting on one asset. It’s about building a smart portfolio.

Read the continuation at the link.

3 notes

·

View notes

Text

Why Bitcoin is Still Early

Bitcoin has been around for over a decade, yet we’re still in the early stages of its adoption. This statement might seem strange at first—after all, Bitcoin has been on the news, major companies are integrating it, and governments are beginning to take it seriously. But when we zoom out and compare Bitcoin’s trajectory to other revolutionary technologies, it becomes clear that we are nowhere near full adoption. In fact, the biggest opportunities still lie ahead.

The Adoption Curve: Where Are We?

Every major technology follows an adoption curve, beginning with innovators and early adopters before reaching mainstream acceptance. The internet, for example, started in the 1960s, but it wasn’t until the late 1990s and early 2000s that most households began getting online. Even then, it took years for businesses to fully embrace e-commerce, streaming, and the digital economy we take for granted today. Bitcoin is following a similar pattern.

Despite its growing presence, Bitcoin is still in the early adopter phase. Less than 5% of the world actively owns or uses Bitcoin. Compare that to the internet’s trajectory: in the 1990s, only a fraction of the world was online, and many dismissed it as a niche technology. Today, it’s impossible to function without it. Bitcoin is on that same path, moving from speculation and skepticism to necessity.

Big Players Are Just Warming Up

One of the strongest indicators that Bitcoin is early is the growing interest from institutions. For years, Bitcoin was dismissed by banks, governments, and large corporations as a passing trend. Now, the same institutions that once mocked it are finding ways to integrate it. Major banks are offering Bitcoin custody services, corporations are holding Bitcoin on their balance sheets, and Bitcoin ETFs are opening the floodgates for trillions of dollars in capital to flow in.

Yet, even with these developments, institutional Bitcoin adoption is just beginning. The vast majority of global wealth is still locked in traditional financial assets, with Bitcoin accounting for a tiny percentage of total global investment. The shift toward Bitcoin as a mainstream financial asset is still in its infancy. As more companies, pension funds, and even governments start holding Bitcoin, its impact will grow exponentially.

Infrastructure is Still Developing

Another sign that Bitcoin is in its early stages is the ongoing development of its infrastructure. The Lightning Network, designed to make Bitcoin transactions faster and cheaper, is still being built out. While adoption is growing, it hasn’t yet reached the point where Bitcoin can seamlessly replace traditional payment networks.

Think back to the early internet days. Slow dial-up connections, clunky websites, and limited applications made it seem like an interesting experiment rather than a world-changing technology. But as infrastructure improved—faster connections, better interfaces, and more use cases—the internet became indispensable. Bitcoin is undergoing the same transformation. As wallets, exchanges, payment platforms, and regulatory clarity improve, Bitcoin’s usability will skyrocket.

Volatility is a Feature of Early Adoption

Many critics point to Bitcoin’s volatility as a weakness, but in reality, it’s a symptom of its early stage. Emerging assets often experience large price swings as markets figure out their true value. Amazon stock in the early 2000s was incredibly volatile, yet those who understood its long-term potential and held onto it were rewarded beyond measure.

Bitcoin is going through the same growing pains. As adoption increases and more liquidity enters the market, volatility will naturally decline. But for now, those who understand Bitcoin’s long-term value have an opportunity that won’t be around forever.

Bitcoin’s Supply is Still Being Distributed

Unlike traditional currencies, Bitcoin has a fixed supply of 21 million coins. However, most people don’t realize that the majority of Bitcoin has already been mined, but it hasn’t been fully distributed. Many early holders continue to accumulate, and large portions of Bitcoin remain inaccessible due to lost wallets or long-term storage.

The remaining supply is getting harder to acquire. Every four years, the Bitcoin halving reduces the amount of new Bitcoin entering circulation, making it increasingly scarce. As demand continues to rise, the available supply will become more difficult—and expensive—to obtain. In other words, Bitcoin’s early accumulation phase is still happening, but it won’t last forever.

Mass Adoption is the Next Phase

The biggest misconception about Bitcoin is that if you didn’t get in early, you’re too late. The truth is, we’re still in the earliest chapters of Bitcoin’s story. When Bitcoin reaches mainstream adoption—when holding it is as common as having a bank account or using a credit card—that’s when the real shift happens.

Right now, Bitcoin is still a choice. In the future, it may be a necessity. Hyperinflation, debt crises, and failing financial systems are already pushing people toward Bitcoin as an alternative. The same way the internet became a requirement for modern life, Bitcoin is positioning itself as a fundamental financial layer of the future.

Final Thoughts

It’s easy to look at Bitcoin’s current price, its media coverage, or the number of people talking about it and assume it’s already reached its peak. But in reality, Bitcoin is still in its early days. Adoption is just beginning, infrastructure is still being built, and the financial system has only started to acknowledge Bitcoin’s potential.

The internet revolutionized information. Bitcoin is revolutionizing money. And just like the internet, most people won’t realize how essential it is until it’s fully integrated into everyday life. Those who recognize this now are still early.

Tick tock, next block.

#Bitcoin#BTC#Crypto#BitcoinAdoption#FinancialFreedom#Decentralization#HardMoney#SoundMoney#DigitalGold#Blockchain#CryptoEducation#MoneyRevolution#HODL#BitcoinFixesThis#FutureOfFinance#FreedomMoney#Satoshi#BitcoinStandard#OrangePill#BitcoinIsStillEarly#financial empowerment#finance#globaleconomy#financial experts#digitalcurrency#cryptocurrency#financial education#unplugged financial

6 notes

·

View notes

Text

25 Passive Income Ideas to Build Wealth in 2025

Passive income is a game-changer for anyone looking to build wealth while freeing up their time. In 2025, technology and evolving market trends have opened up exciting opportunities to earn money with minimal ongoing effort. Here are 25 passive income ideas to help you grow your wealth:

1. Dividend Stocks

Invest in reliable dividend-paying companies to earn consistent income. Reinvest dividends to compound your returns over time.

2. Real Estate Crowdfunding

Join platforms like Fundrise or CrowdStreet to invest in real estate projects without the hassle of property management.

3. High-Yield Savings Accounts

Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn guaranteed interest.

4. Rental Properties

Purchase rental properties and outsource property management to enjoy a steady cash flow.

5. Short-Term Rentals

Leverage platforms like Airbnb or Vrbo to rent out spare rooms or properties for extra income.

6. Peer-to-Peer Lending

Lend money through platforms like LendingClub and Prosper to earn interest on your investment.

7. Create an Online Course

Turn your expertise into an online course and sell it on platforms like Udemy or Teachable for recurring revenue.

8. Write an eBook

Publish an eBook on Amazon Kindle or similar platforms to earn royalties.

9. Affiliate Marketing

Promote products or services through a blog, YouTube channel, or social media and earn commissions for every sale.

10. Digital Products

Design and sell digital products such as templates, printables, or stock photos on Etsy or your website.

11. Print-on-Demand

Use platforms like Redbubble or Printful to sell custom-designed merchandise without inventory.

12. Mobile App Development

Create a useful app and monetize it through ads or subscription models.

13. Royalties from Creative Work

Earn royalties from music, photography, or artwork licensed for commercial use.

14. Dropshipping

Set up an eCommerce store and partner with suppliers to fulfill orders directly to customers.

15. Blogging

Start a niche blog, grow your audience, and monetize through ads, sponsorships, or affiliate links.

16. YouTube Channel

Create a YouTube channel around a specific niche and earn through ads, sponsorships, and memberships.

17. Automated Businesses

Use tools to automate online businesses, such as email marketing or subscription box services.

18. REITs (Real Estate Investment Trusts)

Invest in REITs to earn dividends from real estate holdings without owning property.

19. Invest in Index Funds

Index funds provide a simple way to earn passive income by mirroring the performance of stock market indexes.

20. License Software

Develop and license software or plugins that businesses and individuals can use.

21. Crypto Staking

Participate in crypto staking to earn rewards for holding and validating transactions on a blockchain network.

22. Automated Stock Trading

Leverage robo-advisors or algorithmic trading platforms to generate passive income from the stock market.

23. Create a Membership Site

Offer exclusive content or resources on a membership site for a recurring subscription fee.

24. Domain Flipping

Buy and sell domain names for a profit by identifying valuable online real estate.

25. Invest in AI Tools

Invest in AI-driven platforms or create AI-based products that solve real-world problems.

Getting Started

The key to success with passive income is to start with one or two ideas that align with your skills, interests, and resources. With dedication and consistency, you can build a diversified portfolio of passive income streams to secure your financial future.

2 notes

·

View notes

Note

Hello pptm! Would you talk a bit more about the current state of tv series? You mentioned briefly about an oversaturated market and how The Golden Age is now gone, but what were some of they key problems that lead to it in your opinion?

Would you consider Succession as part of the series that knew the importance of character development? Could we consider it like the final good show in this dire landscape of tv and streaming?

Lastly, what do you think will come next? There's a shift in the movie business in Hollywood if we look at the past year, but I don't know if we should be overly optimistic. Will we take a step back from prestige tv for a while until a new wave will bring something new?

Hello Madam M! Thanks for sending such a thoughtful Ask.

I think that over-saturation was part of the problem. What I mean by that is everyone and anyone trying to cash in on the money to be made through so-called prestige TV, and how the late stages of prestige dovetailed with the rise of streaming platforms.

Not every network went after prestige, but they've all gone after streaming, which has led to these conglomerates of streaming. Platform-wise, this is a huge turn off for "discerning" audiences. People watch HBO because they know what they're going to get. Now, if you sign into Max, you're confronted with the dregs of TV and can't make heads or tails of any of it.

This has been the case for Netflix for years now. They've dumped huge money into developing series but half the time when they cancel a show, that's the first a lot of people have even heard of it.

The other side of this is that platforms have dumped money into these series no one can find (lol), but say you do find it -- it looks and feels prestige but it ends there because the writing isn't solid. My understanding is that the writers' room tradition, which has a big practical training side to it, has been decimated by new ways of working these streaming platforms have brought. Usually, you start as an assistant in the room to learn the ropes. As the series goes on, assistants move up to writing scripts.

If these rooms aren't being put together anymore (which I read is the case more often than before), new writers aren't going through the learning stages.

The other factor is how quickly funding is pulled on these shows. If rooms are put together, there's no time for the craft to be taught or for the head writer to master it.

Do I think Succession got the writing right? Absolutely. When Ii wrote that BTS/Succession crossover for you (remember our bet... actually I can't remember what we were betting on 💀), trying to nail the dialogue and characters was incredibly difficult. It's like when you're spec script writing, you have to show you can follow the format but also write the characters so they are in-character but also not caricatures of their most obvious traits. The last part is what happened with the writing on Friends, for example. Most of the characters became the lowest common denominator of their most notable traits. Obviously, sitcom is a different format, but the point still stands because this is what happened to Greg in the last season of Succession. His character became a stock gimmick and stopped progressing.

I think things come in ebbs and flows, so the industry will self-correct. People keep joking that by amalgamating, platforms are reinventing cable TV. Lol. What needs to happen is for there to be less projects and more time, effort and oversight (The Idol FFS... where the fuck were HBO on that?) on the projects that are greenlit.

Well, there's my two cents. My flight was delayed so this turned into an entire essay.

9 notes

·

View notes