#st georges market

Explore tagged Tumblr posts

Text

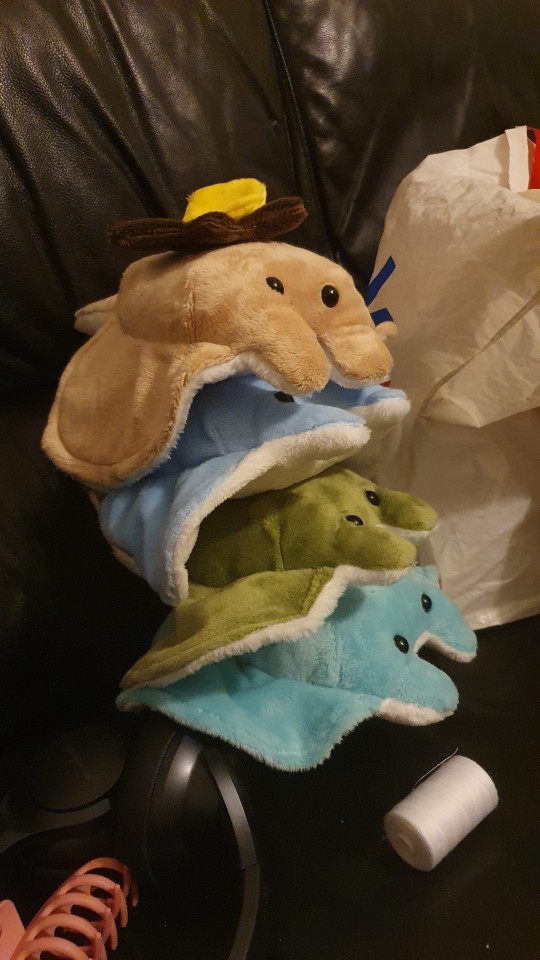

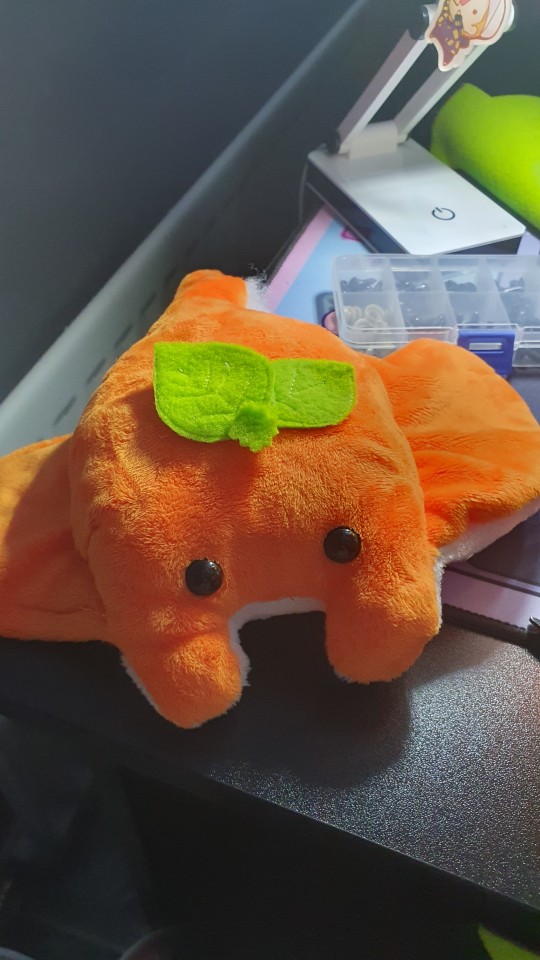

Like real pancakes, sea pancakes are highly stackable, although I wouldn't advise eating them.

These little guys will be for sale starting this Saturday at St Georges market in Belfast and after that I'll be putting them on this store! Follow my insta in the pinned post for more updates!

#small business#silkmothpress#sea pancake#manta ray#plushie#plushies#manta plushie#choly knight#st georges market#belfast

4 notes

·

View notes

Text

Explore the picturesque village of Hathersage in the Peak District with our ultimate guide. Discover stunning landscapes, rich history, and a range of outdoor activities. Stay at The George for comfortable ensuite rooms and enjoy local attractions, dining, and shopping. Plan your perfect weekend escape now and book your stay at The George today.

#Hathersage weekend getaway#Peak District travel guide#The George Hathersage#outdoor activities Hathersage#Stanage Edge hiking#Hathersage Swimming Pool#Hope Valley walks#Mam Tor views#local pubs Hathersage#fine dining Derbyshire#North Lees Hall#St Michael and All Angels Church#David Mellor Design Museum#local crafts Hathersage#farmers markets Derbyshire#Derbyshire holidays#picturesque village stay#weekend retreat Peak District#book The George Hathersage

0 notes

Text

Is Salters Market in St George a high rent and a disorganized scam? Have your say - Barbados.

youtube

https://youtu.be/-Ns6BRZyDZY

Listen to the blogger. See the photos and videos submitted. Where should these enterprising people go from here? What are their options. Naked!!

Like/share/comment/subscribe on YouTube (it costs you nothing). Press the notification bell 🔔. NEW WhatsApp #2527225512

0 notes

Text

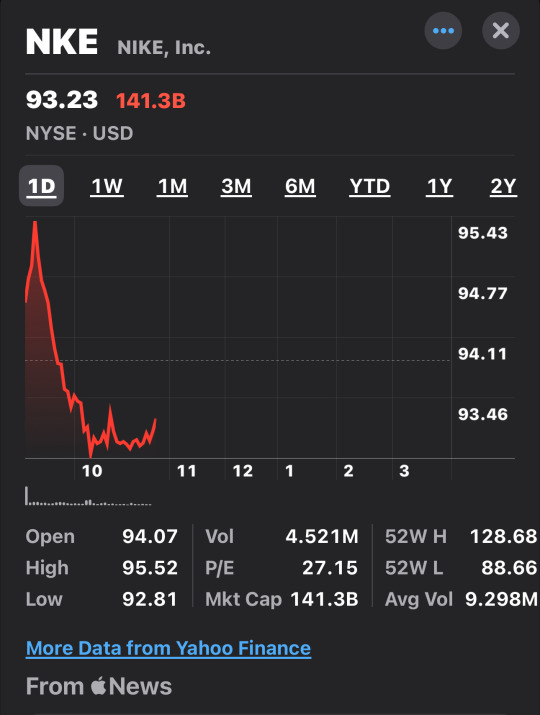

If you know you know! 🏴🏴🏴🏴🏴🏴🏴🏴

#Nike#just do it#Nike athlete#nike running#nike basketball#nike football#england#england football#st george#today on tumblr#bisexual#stock market#world cup#England flag#poltics#new blog#in the red

0 notes

Text

Tokyo Smoke Best Customer service in Belleville Ontario Cannabis? Nah they Bait & Switch.

Written by Ashton Deroy Tokyo Smoke in Belleville may want to consider a different brag than Best customer service. Cause They did a Bait & Switch. It wasn’t the first one. Quite frankly it won’t be the last. This could of been avoided if the Budtender Charlotte was trained Properly. If Tokyo Smoke accepted returns in the case of Want of Understanding? Or didn’t just completely misrepresent the…

View On WordPress

#Ashton Deroy#Bait & Switch#Bay of Quinte#Belleville Ontario#Better Business Bureau#Business#Canada#Cannabis#Ford Nation#George William#Kingston Ontario#Loyalist College#Marketing#Ontario#Quinte West#Sales#St. Lawrence College#Tokyo Smoke#Toronto

0 notes

Text

Why will ROI always be higher with NextGen?

Achieving a good return on investment (ROI) on a residential investment requires careful planning and execution. It also requires diligence and support from the property manager. The old style of “set and forget” property management can no longer get landlords the best return on their investment. At NextGen, we understand the importance of maximising our landlords’ return as we are landlords…

View On WordPress

#Best Property Manager#Landlords#property management#Property Management Company Eastern Suburbs#Property Management Company Inner West#Property Management Company South West Sydney#Property Management Company St George#property manager#Rental Market#South West Sydney

0 notes

Text

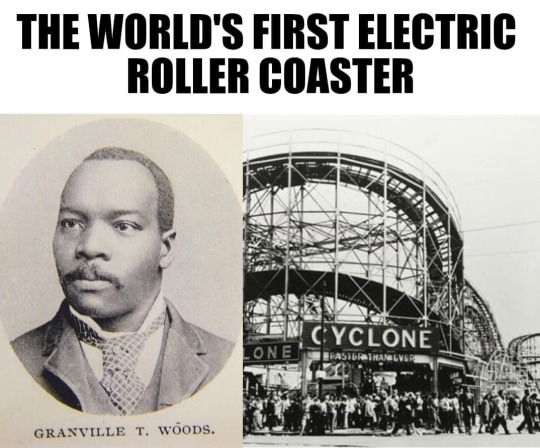

THE WORLD'S FIRST ELECTRIC ROLLER COASTER

Granville T. Woods (April 23, 1856 – January 30, 1910) introduced the “Figure Eight,” the world's first electric roller coaster, in 1892 at Coney Island Amusement Park in New York. Woods patented the invention in 1893, and in 1901, he sold it to General Electric.

Woods was an American inventor who held more than 50 patents in the United States. He was the first African American mechanical and electrical engineer after the Civil War. Self-taught, he concentrated most of his work on trains and streetcars.

In 1884, Woods received his first patent, for a steam boiler furnace, and in 1885, Woods patented an apparatus that was a combination of a telephone and a telegraph. The device, which he called "telegraphony", would allow a telegraph station to send voice and telegraph messages through Morse code over a single wire. He sold the rights to this device to the American Bell Telephone Company.

In 1887, he patented the Synchronous Multiplex Railway Telegraph, which allowed communications between train stations from moving trains by creating a magnetic field around a coiled wire under the train. Woods caught smallpox prior to patenting the technology, and Lucius Phelps patented it in 1884. In 1887, Woods used notes, sketches, and a working model of the invention to secure the patent. The invention was so successful that Woods began the Woods Electric Company in Cincinnati, Ohio, to market and sell his patents. However, the company quickly became devoted to invention creation until it was dissolved in 1893.

Woods often had difficulties in enjoying his success as other inventors made claims to his devices. Thomas Edison later filed a claim to the ownership of this patent, stating that he had first created a similar telegraph and that he was entitled to the patent for the device. Woods was twice successful in defending himself, proving that there were no other devices upon which he could have depended or relied upon to make his device. After Thomas Edison's second defeat, he decided to offer Granville Woods a position with the Edison Company, but Woods declined.

In 1888, Woods manufactured a system of overhead electric conducting lines for railroads modeled after the system pioneered by Charles van Depoele, a famed inventor who had by then installed his electric railway system in thirteen United States cities.

Following the Great Blizzard of 1888, New York City Mayor Hugh J. Grant declared that all wires, many of which powered the above-ground rail system, had to be removed and buried, emphasizing the need for an underground system. Woods's patent built upon previous third rail systems, which were used for light rails, and increased the power for use on underground trains. His system relied on wire brushes to make connections with metallic terminal heads without exposing wires by installing electrical contactor rails. Once the train car had passed over, the wires were no longer live, reducing the risk of injury. It was successfully tested in February 1892 in Coney Island on the Figure Eight Roller Coaster.

In 1896, Woods created a system for controlling electrical lights in theaters, known as the "safety dimmer", which was economical, safe, and efficient, saving 40% of electricity use.

Woods is also sometimes credited with the invention of the air brake for trains in 1904; however, George Westinghouse patented the air brake almost 40 years prior, making Woods's contribution an improvement to the invention.

Woods died of a cerebral hemorrhage at Harlem Hospital in New York City on January 30, 1910, having sold a number of his devices to such companies as Westinghouse, General Electric, and American Engineering. Until 1975, his resting place was an unmarked grave, but historian M.A. Harris helped raise funds, persuading several of the corporations that used Woods's inventions to donate money to purchase a headstone. It was erected at St. Michael's Cemetery in Elmhurst, Queens.

LEGACY

▪Baltimore City Community College established the Granville T. Woods scholarship in memory of the inventor.

▪In 2004, the New York City Transit Authority organized an exhibition on Woods that utilized bus and train depots and an issue of four million MetroCards commemorating the inventor's achievements in pioneering the third rail.

▪In 2006, Woods was inducted into the National Inventors Hall of Fame.

▪In April 2008, the corner of Stillwell and Mermaid Avenues in Coney Island was named Granville T. Woods Way.

512 notes

·

View notes

Text

The Carenage, St George's, Grenada: The Carenage is St. George's bustling waterfront promenade that winds around Grenada's Inner Harbor. Its name is derived from the French word carenage, meaning "safe anchorage." Lined with colonial-era buildings, the inlet offers boutiques, seafood restaurants, and cafes, and is close to Grenada's bustling open-air market... St. George's is the capital of Grenada. The city is surrounded by a hillside of an old volcano crater and is located on a horseshoe-shaped harbour. Wikipedia

#The Carenage#St George's#Saint George Parish#Grenada#Caribbean#north america#north america continent

146 notes

·

View notes

Text

please go to a protest for Land Day tomorrow (March 30th) if you can

AUSTRALIA – Hobart / Nipaluna. 1PM Every Saturday @ Davey St. (Grand Chancellor).

CANADA – Antigonish, NS. 1PM Every Saturday @ Antigonish Town Hall. Antigonish 4 Gaza.

CANADA – Montreal. 2PM Land Day Tatreez Workshop @ Refugee Center. PYM Montreal.

CANADA – Ottawa. 2PM Land Day @ Human Rights Monument.

CANADA – Toronto. 2PM Land Day @ Yonge & Dundas. PYM Toronto.

ENGLAND – Halifax. 1PM Every Saturday @ Wilkos on Southgate.

ENGLAND – Hebden Bridge. 3PM Every Saturday @ Holme Street. 4PM @ St George’s Square. West Yorkshire for Palestine.

ENGLAND – London. 11AM @ 7 Tavistock Square. PYM Britain.

ENGLAND – London. 12PM @ Central London. STW UK.

NETHERLANDS – Amsterdam. 7PM Every Night @ Dam Square.

PORTUGAL – Porto. 10PM Every Night Vigil @ Camara Municipal.

SCOTLAND – Orkney. 1PM Every Saturday @ St Magnus Cathedral Steps. Amnesty Orkney.

AZ – Phoenix. 1MP Land Day @ Civic Space Park. PSL Phoenix AZ.

CA – Los Angeles. 1PM Land Day March @ LA City Hall. PYM LA/OC/IE.

CA – Petaluma. 12:30PM Every Saturday @ Petaluma & E Washington. Occupy Pelatuma.

CA – Ventura. 12:30PM @ 181 E Santa Clara St. ANSWER Coalition.

CO – Fort Collins. 3PM Every Saturday @ Old Town Square. NOCO Liberation Coalition.

DC – Washington DC. 4PM @ DuPont Circle. ANSWER Coalition.

FL – Gainesville. 11AM @ Depot Park. ANSWER Coalition.

FL – Orlando. City Hall. TBA. ANSWER Coalition.

FL – Pensacola. PM @ Main & Reus (Blue Wahoos). PSL CGC.

GA – Atlanta. 2PM @ Consulate of Israel. PYM.

ID – Pocatello. 12PM Every Saturday @ Bannock County Courthouse. Pocatello for Palestine.

IL – Chicago. 1PM @ TBA. USPCN + Chicago SJP.

LA – New Orleans. 3:30PM @ 701 N Rampart St.

MA – Springfield. 2PM @ 36 Court St. ANSWER Coalition.

ME – Portland. 1PM @ Monument Square. PSL Maine.

MI – Detroit. 1:30PM @ Beacon Park. USPCN.

MI – Detroit. 10AM Land Day @ Rouge Park. PYM.

MN – Minneapolis. 2PM @ 2707 West Lake St. ANSWER Coalition.

MT – Kalispell. 12PM Every Saturday @ Main & Center. MT 4 Palestine.

NC – Asheville. 4PM @ 1 N Pack Square. ANSWER Coalition.

NC – Charlotte. 4PM @ Wilmore Centennial Park. CLT 4 Palestine + PSL Carolinas.

NC – Raleigh. 3PM Land Day @ Moore Square. PSL Carolinas.

NC, Charlotte. 4PM @ Wilmore Centennial Park. Land Day. CLT 4 Pali + PSL Carolinas.

NM – Albuquerque. 4PM @ UNM Book Store. ANSWER Coalition.

NY – New York. 12PM @ City Hall Park. Within Our Lifetime.

NY – New York. 12PM Vigil Every Saturday @ 5th & 44th in Brooklyn. Sunset Park Elders.

NY – New York. 5PM @ Times Square. PYM.

NY – Rochester. 1:30PM @ MLK Park. End Apartheid ROC + SJP UR.

OH – Cincinnati. 3PM @ 801 Plum St. ANSWER Coalition.

OH – Cleveland. 2PM Land Day @ Edgewater Upper Pavillion. USCPN.

OH – Columbus. 4PM @ 120 W Goodale St. ANSWER Coalition.

OH – Dayton. 5PM @ 2680 Ridge Ave. ANSWER Coalition.

OH – Wooster. 11AM @ 538 N Market St. ANSWER Coalition.

OR – Bend. 12PM Saturdays @ Peace Corner. Central Oregon 4 Socialism.

OR – Portland. 12PM @ Desert Island Studios. Letters for Palestine PDX.

PA – Philadelphia. 5PM @ 7th & Walnut. ANSWER Coalition.

PA – Pittsburgh. 3:30PM @ 4100 Forbes Ave. ANSWER Coalition.

RI – Providence. 5PM @ Prospect Terr. ANSWER Coalition.

TX – Houston. 1PM @ Waterwall Park. PYM Houston.

TX – San Antonio. 12PM @ 301 E Travis ST. ANSWER Coalition.

VT – Burlington. 1PM @ City Hall. ANSWER Coalition.

WA – Seattle. 2PM Land Day @ Lake Union Park. PYM.

WI – Milwaukee. 1:30PM @ Sijan Park. PSL Milwaukee.

WI – Viroqua. 11AM Vigil Every Saturday @ Main & Decker. Driftless Solidarity / Wolves PSC.

WV – Martinsburg. 12PM Land Day @ Martinsburg Town Square. PSL WV.

DISCLAIMER: I didn't make this list and it's not comprehensive. If you don't see a protest near you, look up what your local orgs are doing, and if you still can't find anything, take autonomous action

91 notes

·

View notes

Text

In Catalonia, to celebrate St. George's day (la diada de Sant Jordi), lovers exchange roses (that are said to sprout from the blood of the dragon slayed by him) and books (lots of places organise local book markets for the day). It's pretty much our St. Valentine's!

I thought that I could celebrate the day with a drawing of some girl kissers but don't know if I'll make it in time for the 23rd, so I present here the WIP:

(P.D. Beware of spoilers for Delicious in Dungeon/Dungeon Meshi)

#farcille#marcille donato#falin touden#dungeon meshi#delicious in dungeon#dungeon meshi spoilers#sant jordi#art wip#digital art

75 notes

·

View notes

Text

Like real pancakes, sea pancakes are highly stackable, although I wouldn't advise eating them.

These little guys will be for sale starting this Saturday at St Georges market in Belfast and after that I'll be putting them on this store! Follow my insta in the pinned post for more updates!

#small business#silkmothpress#sea pancake#manta ray#plushie#plushies#manta plushie#choly knight#st georges market#belfast

1 note

·

View note

Text

THE WORLD'S FIRST ELECTRIC ROLLER COASTER

Granville T. Woods (April 23, 1856 – January 30, 1910) introduced the “Figure Eight,” the world's first electric roller coaster, in 1892 at Coney Island Amusement Park in New York. Woods patented the invention in 1893, and in 1901, he sold it to General Electric.

Woods was an American inventor who held more than 50 patents in the United States. He was the first African American mechanical and electrical engineer after the Civil War. Self-taught, he concentrated most of his work on trains and streetcars.

In 1884, Woods received his first patent, for a steam boiler furnace, and in 1885, Woods patented an apparatus that was a combination of a telephone and a telegraph. The device, which he called "telegraphony", would allow a telegraph station to send voice and telegraph messages through Morse code over a single wire. He sold the rights to this device to the American Bell Telephone Company.

In 1887, he patented the Synchronous Multiplex Railway Telegraph, which allowed communications between train stations from moving trains by creating a magnetic field around a coiled wire under the train. Woods caught smallpox prior to patenting the technology, and Lucius Phelps patented it in 1884. In 1887, Woods used notes, sketches, and a working model of the invention to secure the patent. The invention was so successful that Woods began the Woods Electric Company in Cincinnati, Ohio, to market and sell his patents. However, the company quickly became devoted to invention creation until it was dissolved in 1893.

Woods often had difficulties in enjoying his success as other inventors made claims to his devices. Thomas Edison later filed a claim to the ownership of this patent, stating that he had first created a similar telegraph and that he was entitled to the patent for the device. Woods was twice successful in defending himself, proving that there were no other devices upon which he could have depended or relied upon to make his device. After Thomas Edison's second defeat, he decided to offer Granville Woods a position with the Edison Company, but Woods declined.

In 1888, Woods manufactured a system of overhead electric conducting lines for railroads modeled after the system pioneered by Charles van Depoele, a famed inventor who had by then installed his electric railway system in thirteen United States cities.

Following the Great Blizzard of 1888, New York City Mayor Hugh J. Grant declared that all wires, many of which powered the above-ground rail system, had to be removed and buried, emphasizing the need for an underground system. Woods's patent built upon previous third rail systems, which were used for light rails, and increased the power for use on underground trains. His system relied on wire brushes to make connections with metallic terminal heads without exposing wires by installing electrical contactor rails. Once the train car had passed over, the wires were no longer live, reducing the risk of injury. It was successfully tested in February 1892 in Coney Island on the Figure Eight Roller Coaster.

In 1896, Woods created a system for controlling electrical lights in theaters, known as the "safety dimmer", which was economical, safe, and efficient, saving 40% of electricity use.

Woods is also sometimes credited with the invention of the air brake for trains in 1904; however, George Westinghouse patented the air brake almost 40 years prior, making Woods's contribution an improvement to the invention.

Woods died of a cerebral hemorrhage at Harlem Hospital in New York City on January 30, 1910, having sold a number of his devices to such companies as Westinghouse, General Electric, and American Engineering. Until 1975, his resting place was an unmarked grave, but historian M.A. Harris helped raise funds, persuading several of the corporations that used Woods's inventions to donate money to purchase a headstone. It was erected at St. Michael's Cemetery in Elmhurst, Queens.

LEGACY

▪Baltimore City Community College established the Granville T. Woods scholarship in memory of the inventor.

▪In 2004, the New York City Transit Authority organized an exhibition on Woods that utilized bus and train depots and an issue of four million MetroCards commemorating the inventor's achievements in pioneering the third rail.

▪In 2006, Woods was inducted into the National Inventors Hall of Fame.

▪In April 2008, the corner of Stillwell and Mermaid Avenues in Coney Island was named Granville T. Woods Way.

#granville t woods#black inventor#invented#world's first#electric roller coaster#1893#read about him#read about his invention#reading is fundamental#knowledge is power#black history

124 notes

·

View notes

Text

“I mean, it’s going to be fun,” Ron encouraged. “Big family reunion. Ottery St. Catchpole does a Christmas market and they have the best marshmallow hot chocolates. Fred and George are in charge of decorations. Even Percy’s sticking his head out of his pile of work to come.” “Fred and George being in charge of decorations is not a ringing endorsement,” Ginny pointed out. “It’ll be great, they’ll get all the gnomes and the chickens involved, and Mum will bring out the big ham.” Ron stretched an arm to rest on the booth behind Hermione and grinned down at his wife. “Perfect Christmas. And it’ll be nice for you, Ginny.” “Why would it be nice for me?” “You show up with a boyfriend, Mum and all the aunts won’t be nagging you about it all through Christmas lunch and dinner.”

Ginny is not totally looking forward to a Christmas spent at home with all her relatives asking her why she's the only unmarried Weasley child. Ron suggests she bring Harry as her fake boyfriend. There are a million ways this could go wrong.

Featuring happily married Ron and Hermione, lots of Weasley babies, the family curse to only have boys, Cedrella Black meddling in her granddaughter's love life, and endless amounts of sugar, mistletoe, and other Christmas shenanigans.

I probably shouldn't have started another multichapter, especially when Christmas is so close but listen... in my defense, I just love Harry/Ginny. And I haven't written them in quite honestly years and years.

The AU is probably one of my favorites - a world without Voldemort, where everyone grew up more or less happily. James and Lily are alive, Harry has siblings, the Marauders never turned on each other or died. And the Weasley family is much the same as they are in canon - although perhaps not with all the same marriages. (But I couldn't break up Ron and Hermione, obviously.)

I wanted to keep it familiar enough to canon - Harry and Ron are Aurors, Hermione works for the Ministry, Ginny plays Quidditch for the Holyhead Harpies - but with the AU, I can expand everyone's families greatly. Lots and lots of redhead Weasley boys incoming, baby Luke was only the beginning. I'm quite excited to play off the canonically massive Weasley family against each other, adding in Arthur's brothers, their children, their grandchildren - and a few other family surprises to come.

For some extra setting info - Hermione says they're thirty years old in this chapter but she's lying; she's the only one who's thirty. The story takes place in December of 2009, where Ron and Harry are 29 and Ginny is 28. All of Ginny's older brothers are married and have kids, so you can see why her grandmother is a little bit irritated that she hasn't gone down the aisle yet.

16 notes

·

View notes

Text

August 1st 1834 saw the abolition of slavery, an abhorrent thing, and something Scotland can't just wash its hands of.

Many of you will have walked through St Andrew's Square in Edinburgh, and some, myself included will have taken the obligatory pics, most of which will be dominated by a sort miniature Nelson's Column, but atop is the statue of Henry Dundas, 1st Viscount Melville, the 'Uncrowned King of Scotland'. You can just see him in the pic. Your eyes will fall also on several buildings that would have been homes or business premises of Scots who made their fortunes in the transatlantic slave trade. Many of the houses in the New Town were owned by people with investments in the slave trade.

Back to Mr Dundas, with his immense power he held at the end of the eighteenth century, he was able to use his influence to almost single handedly delay the abolition of slave trade a further 15 years to 1807 and the subsequent abolition of British slavery in 1834. He was impeached in 1806 (then acquitted) for the misappropriation of funds, and he never held office again. Who knows how much more suffering was inflicted on African people in the Middle Passage during those 15 years?

There has been much controversy recently about his statue. What words on his plaque would be appropriate to reflect this unsavoury side of his legacy and give necessary context to his role in Scottish society?

The magnificent Royal Bank of Scotland’s headquarters, Dundas House, was the original home of Lawrence Dundas, cousin to Henry Dundas. His brother George Heneage Lawrence Dundas owned plantations in Grenada and Dominica.

The 4th Earl of Hopetoun, the nephew of Henry Dundas’ second wife, and the vice governor of the bank, is immortalised in the bronze statue outside the bank. He was second in command to fellow Scot, Ralph Abercromby, commander-in-chief of the British forces in the West Indies. Together, the men helped to end the two year slave revolution led by French-African Julien Fedon in Grenada in 1795-6 in the fight against the French for islands in the West Indies. Fedon was a highly skilled strategist, and his men executed 40 British, including Scottish governor Ninian Home at his home in Paraclete.

After 15 months of fighting the rebels were captured and executed in the Market Square. Yet Fedon was never found. Legend says he escaped to a neighbouring island on a canoe, aided by either the Amerindians or ‘Black Caribs’ in St.Vincent.

The suppression of this revolution resulted in slavery continuing for almost another 40 years in Grenada.

And when the eventual abolition came it was Dundas and his cronies who profited further with compensation deals running into what today would be billions of pounds.

I'm turning of commenting on this as it can attract some comments that I would end up having to delete, you can vent your opinions through emoticons

Read more on this despicable man and the trade helped lengthen here. https://historycompany.co.uk/.../henry-dundas-lofty-hero.../

41 notes

·

View notes

Text

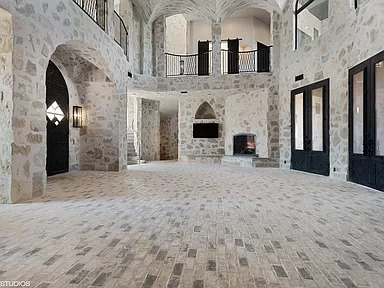

This 2019 castle house in St. George, Utah has been removed from the market. 8bds, 10ba, last year assessed at $5,052,900. I'm thinking that it hasn't sold b/c it's kind of cold and in some areas, creepy. Take a look at this one.

Look at the sheer size of the vast grand entrance hall. Yikes! There's a TV over by the corner fireplace. Is this supposed to be a living room? Can you imagine the utility bill in this place?

The kitchen and everyday dining area. Wow, I wonder if that light fixture is a real Chihuly.

The kitchen's huge and has sleek black cabinetry. I think that the area to the right must be for a dining room.

Looks like a pantry.

The laundry room is like a laundromat.

Huge home office.

I don't know what this is. Could be the home theater?

This is fun. Two chutes that come down to land in a foam pit.

Well, let's go upstairs and check out the bedrooms.

There's a fireplace and den type area on the upstairs landing.

Not lovin' the primary bedroom. It's gigantic, but kind of cold.

The closet looks like it has a pulley system for the clothing on the upper racks.

The en-suite has a tub in the middle separating a double shower.

Here's one of the other 8 bds.

And, its en-suite.

This looks like a children's room, so I wonder if this is where the chutes to the foam pit come down from.

Another bedroom with an en-suite.

This is the most interesting bedroom and en-suite.

Here's a covered patio, but the grounds aren't finished yet.

See, it's just dirt.

I imagine that there will be a pool and everything.

Actually, according to the plans, it looks like 2 pools or a pool and a pond.

Plus there's also an apt. Maybe it's for a caretaker.

126 notes

·

View notes

Text

How Trump's billionaires are hijacking affordable housing

Thom Hartmann

October 24, 2024 8:52AM ET

Republican presidential nominee and former U.S. President Donald Trump attends the 79th annual Alfred E. Smith Memorial Foundation Dinner in New York City, U.S., October 17, 2024. REUTERS/Brendan McDermid

America’s morbidly rich billionaires are at it again, this time screwing the average family’s ability to have decent, affordable housing in their never-ending quest for more, more, more. Canada, New Zealand, Singapore, and Denmark have had enough and done something about it: we should, too.

There are a few things that are essential to “life, liberty, and the pursuit of happiness” that should never be purely left to the marketplace; these are the most important sectors where government intervention, regulation, and even subsidy are not just appropriate but essential. Housing is at the top of that list.

A few days ago I noted how, since the Reagan Revolution, the cost of housing has exploded in America, relative to working class income.

When my dad bought his home in the 1950s, for example, the median price of a single-family house was around 2.2 times the median American family income. Today the St. Louis Fed says the median house sells for $417,700 while the median American income is $40,480—a ratio of more than 10 to 1 between housing costs and annual income.

ALSO READ: He’s mentally ill:' NY laughs ahead of Trump's Madison Square Garden rally

In other words, housing is about five times more expensive (relative to income) than it was in the 1950s.

And now we’ve surged past a new tipping point, causing the homelessness that’s plagued America’s cities since George W. Bush’s deregulation-driven housing- and stock-market crash in 2008, exacerbated by Trump’s bungling America’s pandemic response.

And the principal cause of both that crash and today’s crisis of homelessness and housing affordability has one, single, primary cause: billionaires treating housing as an investment commodity.

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

— Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities. — Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily. (Emphasis theirs.)

It seems that everywhere you look in America you see the tragedy of the homelessness these billionaires are causing. Rarely, though, do you hear about the role of Wall Street and its billionaires in causing it.

The math, however, is irrefutable.

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper. That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

This trend is massive.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes young families can afford to buy, billionaires then begin raising rents to extract as much cash as they can from local working class communities.

In the Nashville suburb of Spring Hill, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street billionaire investor] landlords was about $1,773 a month…”

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street.”

It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

This all really took off around a decade ago following the Bush Crash, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

America should, too.

ALSO READ: Not even ‘Fox and Friends’ can hide Trump’s dementia

16 notes

·

View notes