#simplified banking

Explore tagged Tumblr posts

Text

Transforming Trade Finance: How Cleareye.ai Addresses Industry Challenges with Advanced AI Solutions

The trade finance industry is a vital component of global commerce, facilitating the movement of goods and services across borders. However, it is also an industry beset with challenges. From operational inefficiencies and compliance scrutiny to workforce shortages and rising costs, trade finance institutions face numerous hurdles. Cleareye.ai offers advanced AI-driven solutions to address these challenges, revolutionizing the way financial institutions operate and ensuring they remain competitive in an increasingly complex environment.

Operational Challenges: Overcoming Inefficiencies

The trade finance industry has long been burdened by manual processes and paper-based workflows. These traditional methods lead to significant inefficiencies and increase the risk of human error. Tasks such as data entry, document examination, and decision-making are labor-intensive and prone to mistakes. As a result, financial institutions face potential losses and delays, impacting their ability to serve clients effectively.

Cleareye.ai’s Digitization module offers a powerful solution to these operational challenges. By leveraging advanced Optical Character Recognition (OCR), Machine Learning (ML), and Natural Language Processing (NLP) algorithms, Cleareye.ai automates the classification and extraction of unstructured data from trade documents. This automation reduces errors, improves efficiency, and enables faster, more accurate transaction processing. With Cleareye.ai, financial institutions can streamline their operations, reduce manual workloads, and enhance overall productivity.

Compliance Challenges: Navigating Regulatory Complexities

Compliance is a critical aspect of trade finance, with financial institutions facing an ever-changing and increasingly complex regulatory landscape. Manual processes struggle to keep up with the demands of thorough compliance and auditability. The risk of non-compliance is high, with severe penalties and reputational damage at stake.

Cleareye.ai addresses these compliance challenges through its Compliance & Trade Based Money Laundering (TBML) module. This module automates the identification of TBML red flags, fair price, dual-use, and high-risk goods. Additionally, the Sanctions Screening module enhances compliance by using comprehensive noun extraction and eliminating duplicates, ensuring efficient and accurate sanctions screening. By automating these critical processes, Cleareye.ai helps financial institutions stay ahead of regulatory requirements and mitigate compliance risks.

Workforce Challenges: Bridging the Talent Gap

The trade finance industry is also grappling with a shrinking workforce. High turnover rates and the retirement of experienced professionals have created a talent gap. Those who remain possess specialized skills that are difficult to replace, making it challenging for institutions to maintain consistent and accurate operations.

Cleareye.ai’s Automated Document Examination module offers a solution to this workforce challenge. By automating document checks and enforcing examination rules, Cleareye.ai reduces dependency on human expertise. The module leverages a dynamic rules engine that adheres to industry standards such as UCP, ISBP, URC, and URDG rules. This ensures consistent and accurate document handling, even with a reduced workforce. Financial institutions can rely on Cleareye.ai to maintain high standards of document examination without being constrained by workforce limitations.

Cost Challenges: Managing Rising Costs

Rising costs are a significant concern for trade finance institutions. Maintaining manual compliance screening teams and managing manual processes come with substantial expenses. As the cost base increases, it becomes increasingly challenging for institutions to remain competitive and profitable.

Cleareye.ai’s modular design allows for seamless integration of various solutions, including Digitization, Sanctions Screening, Compliance, TBML, and Auto Document Examination. This integration reduces costs by streamlining operations and enhancing efficiency. By automating labor-intensive tasks and reducing the need for large manual compliance teams, Cleareye.ai helps financial institutions control costs and improve their bottom line. Institutions can achieve greater operational efficiency while maintaining high standards of compliance and risk management.

Cleareye.ai: The Differentiators

Cleareye.ai stands out in the trade finance industry due to several key differentiators that set it apart from other solutions. These differentiators highlight the unique capabilities and advantages of Cleareye.ai, making it the ideal choice for financial institutions seeking to overcome industry challenges.

Streamlined Modular Design: Cleareye.ai's solutions are designed for seamless integration with existing systems. The modular approach allows financial institutions to adopt specific solutions based on their needs, ensuring a smooth transition and minimal disruption to operations. Whether it’s Digitization, Sanctions Screening, Compliance, TBML, or Auto Document Examination, Cleareye.ai’s modules work cohesively with existing infrastructure.

Comprehensive TBML Module: The TBML module is empowered with multiple checks for enhanced maritime intelligence, detection of dual-use goods, embargoes, and automated transactional red flags. This comprehensive approach ensures thorough monitoring and mitigation of trade-based money laundering risks, enhancing the institution’s overall compliance posture.

Intelligent Noun Extraction Process: Cleareye.ai employs an intelligent noun extraction process that drives sanctions screening efficiency by reducing false hits by up to 70%. This process ensures more accurate and reliable results, minimizing the risk of overlooking critical sanctions-related information and improving overall screening effectiveness.

Dynamic Rules Engine: Cleareye.ai’s dynamic rules engine adheres to International Chamber of Commerce (ICC) defined rules for various trade products. It allows for customization of bank-specific business rules by operational users, ensuring flexibility and alignment with specific institutional requirements. The engine ensures that all transactions are processed according to industry standards and best practices.

Intelligent Interpretation: Cleareye.ai’s solutions recognize and interpret Letter of Credit (LC) clauses (46A, 47A) and cross-verify them against ICC rules and associated documents. This intelligent interpretation ensures compliance with industry standards and reduces the risk of errors in document processing and transaction execution.

Seamless Integration Capabilities: Cleareye.ai's solutions are designed for easy integration with core banking systems, trade finance platforms, and other workflow systems within the bank. This seamless integration capability ensures that financial institutions can leverage Cleareye.ai’s advanced solutions without significant changes to their existing infrastructure.

Conclusion

The trade finance industry is at a critical juncture, facing significant challenges that require innovative solutions. Cleareye.ai is leading the transformation of trade finance with its advanced AI-driven solutions. By addressing operational inefficiencies, ensuring regulatory compliance, bridging the workforce talent gap, and managing rising costs, Cleareye.ai empowers financial institutions to streamline their operations and remain competitive.

Cleareye.ai’s unique differentiators, including its streamlined modular design, comprehensive TBML module, intelligent noun extraction process, dynamic rules engine, intelligent interpretation, and seamless integration capabilities, make it the ideal choice for financial institutions seeking to overcome industry challenges. As the trade finance landscape continues to evolve, Cleareye.ai remains at the forefront, driving innovation and efficiency.

In an industry where accuracy, efficiency, and compliance are paramount, Cleareye.ai solutions offer a strategic advantage. Financial institutions can rely on Cleareye.ai to enhance their operations, mitigate risks, and achieve sustainable growth. With Cleareye.ai, the future of trade finance is not just promising—it’s transformative.

#trade finance#cleareye#cleareye.ai#trade finance automation#cleartrade#clear trade#simplified banking#simplifying trade finance

0 notes

Text

fellow lesser known vocal synth fans TELL ME ur favourite underappreciated synths if u please I WANT to draw some obscure singing robots

#i dont actually really mind that a lot of my favourites are a little more obscure. i love an underdog LOL#but i was thinking like damn. it must suck if u never see fanart of ur favourite funny singing robots.#i have the power. i have the power of creation. i will help. i will help#anything counts. you could ask me to draw ur own utau bank and i might do it. mayhaps i might.#although youve also seen my fanart. clothing will be simplified. it shall be simplified HJFDJFSkda

4 notes

·

View notes

Text

KYC Deadline Approaching? Here's the Fastest New Way to Comply

Big KYC update relief! RBI now allows Business Correspondents (BCs) to update KYC for bank accounts, making the process faster and more accessible. Learn how this change benefits you, which banks are participating, and step-by-step guidelines to complete your KYC hassle-free. Stay compliant with RBI’s simplified KYC norms—act now! The Reserve Bank of India (RBI) has introduced groundbreaking…

0 notes

Text

KYC Norms: ಬ್ಯಾಂಕ್ ಗ್ರಾಹಕರಿಗೆ ಗುಡ್ ನ್ಯೂಸ್: KYC ನಿಯಮಗಳಲ್ಲಿ ಭಾರಿ ಬದಲಾವಣೆ…!

KYC Norms – ರಿಸರ್ವ್ ಬ್ಯಾಂಕ್ ಆಫ್ ಇಂಡಿಯಾ (RBI) ಇತ್ತೀಚೆಗೆ ಕೆವೈಸಿ (KYC – Know Your Customer) ನಿಯಮಗಳಲ್ಲಿ ಕೆಲವು ಮಹತ್ವದ ಬದಲಾವಣೆಗಳನ್ನು ತಂದಿದೆ. ಈ ಹೊಸ ನಿಯಮಗಳು ಬ್ಯಾಂಕಿಂಗ್ ಪ್ರಕ್ರಿಯೆಯನ್ನು ಇನ್ನಷ್ಟು ಸುಲಭಗೊಳಿಸುವ ಮತ್ತು ಹೆಚ್ಚು ಜನರನ್ನು ಬ್ಯಾಂಕಿಂಗ್ ವ್ಯವಸ್ಥೆಯೊಳಗೆ ತರುವ ಉದ್ದೇಶವನ್ನು ಹೊಂದಿವೆ. 2025ರ RBI KYC ತಿದ್ದುಪಡಿ ನಿರ್ದೇಶನದ ಅಡಿಯಲ್ಲಿ, ಆಧಾರ್ ಆಧಾರಿತ ಇ-ಕೆವೈಸಿ, ವಿಡಿಯೋ ಕೆವೈಸಿ, ಮತ್ತು ಡಿಜಿಲಾಕರ್ ದಾಖಲೆಗಳ ಬಳಕೆಯನ್ನು…

#Aadhaar e-KYC#C-KYC#central KYC registry#DigiLocker banking#e-KYC from home#new RBI KYC process#RBI banking guidelines#RBI digital banking rules#RBI KYC changes 2025#simplified bank KYC#video KYC RBI

0 notes

Text

पीएफ निकालना हुआ आसान: EPFO ने हटाई कैंसिल चेक और एम्प्लॉयर वेरिफिकेशन की शर्त, जानें नए नियम

EPFO New Rules: कर्मचारी भविष्य निधि संगठन (EPFO) ने अपने करीब 8 करोड़ सदस्यों के लिए एक बड़ी राहत की खबर दी है। अब कर्मचारियों को अपने प्रोविडेंट फंड (PF) से पैसे निकालने के लिए पहले जैसी लंबी प्रक्रिया से नहीं गुजरना पड़ेगा। EPFO ने ऑनलाइन क्लेम प्रक्रिया को आसान बनाने के लिए नियमों में बदलाव किया है। कैंसिल चेक या ��ैंक पासबुक अपलोड करने और एम्प्लॉयर से बैंक अकाउंट वेरिफिकेशन कराने की जरूरत को…

#Aadhaar OTP verification#cancel cheque removed#employee provident fund update#employer verification gone#EPF claim process#EPFO new rules#fast PF settlement#online PF claim#PF withdrawal simplified#UAN bank account linking

0 notes

Text

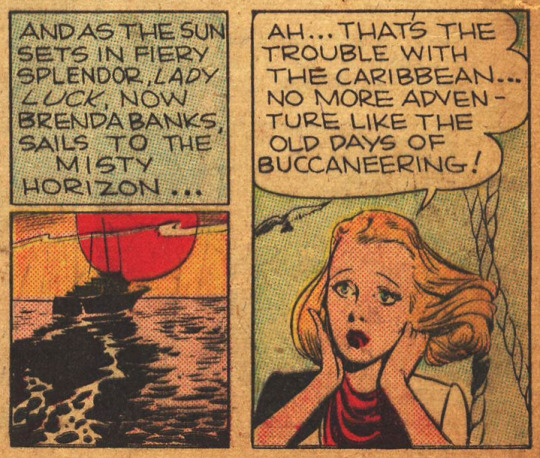

(Spirit Section 1941-01-12)

Brenda, honey..... It is 1941.

It is just so funny, because without knowing it, Brenda is currently living the Golden Age of superheroes. Also the time period Hollywood will to this day set their heroic-soldiers-doing-heroic-soldier-things movies in. Like, I'm not saying that people long to be back in 1941 (I'm European, we at least certainly do not), but I can absolutely imagine that there are some who do. Good old days with clear-cut heroes and villains and whatever.

#look I knew someone who said that they wish that they had been there in 1956 so they could fight in the revolution#which.... WHY WOULD YOU WANT THAT#-> because it is better than sitting there watching your country go downhill probably#AND we have simplified the past down in a way the present never can be#and YES I know that the joke here is that she just had an exciting adventure#but my point still stands#you never know when you are living in the good old days#old comics#Lady Luck#Brenda Banks#Golden Age of comic books

1 note

·

View note

Text

Digital Platforms' Key Role In Financial Inclusion

In a world that's rapidly becoming more interconnected, financial inclusion has taken center stage. The power of technology, especially digital platforms, is playing a pivotal role in bringing a broader spectrum of people into the financial fold. Let's explore how these digital platforms are making a significant impact on financial inclusion.

Digital Banking for the Masses

Access to traditional banking services has long been a challenge for millions in India. Rural areas, in particular, have been underserved for years. Enter digital banking. With a smartphone in hand, anyone can access their accounts, transfer money, pay bills, and even apply for loans. The ease of use and accessibility of digital banking apps have empowered individuals who were once excluded from the formal financial sector. Abhay Bhutada believes that digital lending is revolutionizing credit access in India, aligning with the RBI’s financial inclusion goals.

Also Read: The Unseen Financial Side of Homeownership

Payments Simplified

Remember the days of carrying cash for every small expense? Digital payment platforms like UPI (Unified Payments Interface) have transformed the way we handle money. No need for cash; just a few taps on your smartphone, and you can settle bills, split expenses, or even pay for your daily chai. This has not only made transactions more convenient but has also brought many small businesses into the digital era.

Microloans at Your Fingertips

Traditional banks often have stringent criteria for loans, making it hard for small entrepreneurs to secure funds. However, digital lending platforms have changed the game. They use innovative algorithms and alternative data sources to assess creditworthiness, enabling even those with no credit history to access microloans. This has fueled the growth of countless small businesses and individual ventures.

Investing for Everyone

Investing was once the privilege of the wealthy. However, digital platforms have democratized the investment landscape. Apps that allow people to invest with small amounts have gained popularity. You can now invest in mutual funds, stocks, and gold with just a few hundred rupees. This opens the door for financial growth and wealth creation for a broader section of society.

Insurance for All

In a country where many are underinsured, digital platforms have made purchasing insurance policies more accessible. These platforms simplify the process, offering a wide range of insurance products. Whether you need health, life, or vehicle insurance, you can easily compare policies and make an informed choice, all from your smartphone.

Financial Literacy at Your Fingertips

Financial inclusion isn't just about access; it's also about knowledge. Many digital platforms offer educational resources, making it easier for individuals to understand financial concepts, manage their money, and plan for their future. This empowers people to make informed financial decisions.

Also Read: Unveiling Why Entrepreneurs Prefer MSME Loans

Conclusion

Digital platforms have come a long way in driving financial inclusion in India. However, challenges remain, such as ensuring access to smartphones and internet connectivity in rural areas, and addressing cybersecurity concerns. But the future looks promising, with ongoing innovations that continue to break down barriers.

0 notes

Text

CELİKELCPA - PLATİNUM

Are you considering taking the exciting plunge into the dynamic Turkish market? Look no further than Celik El CPA, your trusted partner for seamless company formation and registration in Turkey. As an expert in navigating the complexities of business setup, our services cater to both local and international entrepreneurs eager to establish a foothold in this vibrant economy. With our knowledgeable Turkey accountants by your side, you can rest assured that your financial matters will be managed with precision and care. From navigating regulatory requirements to ensuring compliance, we simplify the process of starting a business in Turkey.

Company Formation in Turkey

Setting up a business in Turkey can be an excellent decision for both local and foreign entrepreneurs. The process of company formation in Turkey is streamlined and relatively straightforward, making it a lucrative destination for investment. With the right guidance, including the assistance of professional Turkey accountants, you can navigate through legal requirements with ease.

One of the key aspects in securing a successful company registration in Turkey is understanding the various business structures available, such as limited liability companies (LLCs) and joint-stock companies. Each type has its unique benefits and requirements, which is why consulting with experts is advisable to choose the best option for your business model.

Moreover, Turkey's strategic location and growing economy provide a wealth of opportunities for business growth. Whether you're considering import-export businesses or tech startups, the benefits of entering the Turkish market are plentiful. You can leverage local resources and a young workforce, enhancing the potential for business success.

When you’re ready to start your business journey, ensure that you have all the necessary documents submitted accurately to avoid delays in the registration process. With the right support, how to start a business in Turkey can become a seamless experience!

Company Registration in Turkey

Company Registration in Turkey is a crucial step for entrepreneurs looking to establish a business presence in this vibrant market. The process involves several key steps that are designed to ensure compliance with local laws and regulations.

Step-by-Step Process

Choose Your Business Structure: Decide on the type of entity that best suits your business needs, such as a limited liability company (LLC) or joint-stock company.

Prepare Necessary Documentation: Gather all required documents, including your business plan, identity proof, and proof of address.

Open a Bank Account: Deposit the minimum required capital into a Turkish bank account and obtain a bank receipt.

Notary Public: Have your company’s articles of association drafted and notarized.

Register with the Trade Registry Office: Submit your documents to the local Trade Registry office to officially register your company.

Obtain Tax Registration: After registration, apply for a tax identification number from the Tax Office.

Benefits of Registering Your Company in Turkey

Completing the company registration process not only gives your business legal standing but also opens doors to various advantages such as:

Access to a growing market with a dynamic economy.

Eligibility for local and international contracts.

Enhanced credibility with clients and investors.

Engaging with experienced Turkey accountants such as those at Celikel CPA can significantly streamline your registration process. Their expert guidance ensures all steps are efficiently handled, allowing you to focus on your core business activities.

Ready to take the plunge and establish your presence in Turkey? Start your journey today with the support of dedicated professionals who are there to guide you through every step of How to Start a Business in Turkey.

Turkey Accountants

When planning for company formation in Turkey, selecting a skilled accountant is crucial to ensure compliance with local regulations. Experienced Turkey accountants possess in-depth knowledge of the Turkish tax system and can guide you through the intricacies of company registration in Turkey.

These professionals are adept at various services including bookkeeping, financial reporting, and tax planning, which are essential for new businesses. With their expertise, they help business owners navigate the complexities of local financial obligations, enabling you to focus on building your company.

If you are considering how to start a business in Turkey, partnering with the right accounting firm can significantly streamline your operations and enhance your chances of success. Ensure that your financial foundations are strong with professional help, positioning your business on the path to growth.

How to Start a Business in Turkey

How to starting a business in Turkey can be an exciting and rewarding venture. With its strategic location, dynamic market, and favorable investment climate, the country is an excellent choice for entrepreneurs. Here’s a concise guide to navigating the essential steps so you can move forward confidently.

Choose Your Business Structure: The first step is to decide on the type of business entity that suits your needs. Options include limited liability companies (LLCs), joint-stock companies (JSCs), and sole proprietorships. Each structure comes with its own regulatory requirements and tax implications, so it's essential to choose wisely.

These steps can set the foundation for your success in Turkey’s vibrant market landscape. With effective company registration in Turkey and the guidance of experienced Turkey accountants at your side, you will be well-equipped to launch and grow your business.

For more detailed assistance and tailored advice, don't hesitate to visit Celik & Co. CPA—your trusted partner in navigating the complexities of starting a business in Turkey.

1K notes

·

View notes

Text

"kamala is a cop"

but you don’t understand! When she was a prosecutor, she pissed off California police unions when she didn’t push for the death penalty for a man convicted of killing a police officer. She chose to push non violent, first-time offenders into education programs instead of prison because she wanted “to create a system to decrease the likelihood that the revolving door will continue”. As Attorney General, she prosecuted for profit colleges, and banks following the 2008 crisis. In the face of Black Lives Matter, her office launched implicit bias training and she was proud of her work in reforming the criminal justice system of California. As senator, she shined when she questioned Brett Kavanaugh in his senate hearing. When you say “she was a cop” you simplify her impressive record as a prosecutor, attorney general, and senator into just “cop”. While there is valid criticism to her record as Attorney General in her response to Black Lives Matter, as well as her stance on Palestine, there is more nuance to Election 2024 than just “kamala is a cop” and “another time picking the lesser of two evils.” Kamala Harris is the obvious choice for 2024.

#kamala harris#kamala for president#vote kamala#vote harris#vote blue#please vote#fucking vote#american politics#election 2024#us elections#donald trump#democrats#kamala 2024#kamala harris 2024#kamala harris for president#attention democrats#democratic party#kamala is a cop#your vote matters#get out the vote#project 2025#voting#go vote#vote democrat

794 notes

·

View notes

Text

Philcon 2024!

Do you love Science Fiction, Fantasy, or Horror? Are you a Writer, a Gamer, a Costumer, or a Filker? Are you looking for a weekend of distraction in your life? If you’re in the vicinity of Philadelphia- or more specifically, Cherry Hill, New Jersey- there’s an event coming up on November 22 – 24, 2024 that we’d love for you to come check out. If you aren’t already familiar with PHILCON, here’s what you should know: * We started out as a literary-centric SF convention in 1936, but have grown to embrace all mediums of storytelling (movies, television, comics, podcasts, etc) as well as expanding to cover the Fantasy and Horror genres. Most of our participants are authors, and there will be Readings by them and Autograph sessions all throughout the weekend, in addition to their participation on discussion panels. * While many of our Literary panels are about SF, Fantasy, or Horror topics in general, we also have an emphasis on panels discussing the craft side and business sides of writing, for those looking to develop as authors. * One of our content tracks for the weekend is dedicated to Science & Technology itself, not just how it is used in fiction. * We will be screening several movies over the weekend, and Anime will also be shown in our Anime & Animation room at certain times. * There will be Workshops and Demos for Costuming (including "Fabric Manipulation", "How to Make Foam Armor", "Make-up for The Stage", and "A Pox on Patterns!") and Art (including "Using Alcohol Inks", "Block Printing With Your Own Designs", "How to Make A Controlled Color Palette", and "Making Wire-Wrapped Jewelry"), and if you’ve got an outfit you made that you’d like to show off on stage, we’ve got a yearly Costume Contest. * If you are a Filker- or just enjoy listening to other people sing and play music- Philcon has a room dedicated Filk room, and this year’s Musical Guest of Honor is Cecilia Eng. As Cecilia is not often on the east coast, if you’d like to see her play in person, now is an excellent change to do so without flying to the other side of the country. Lynn Gold, another west-coast Filker, will also be joining us this year. There are also Concerts scheduled for Sirens & Liars, Half a Slime Devil, Brenda and Chuck Shaffer-Shiring, and Sara Henya. * Since the Gaming track moved from an upstairs suite to the “Gallery” room on the first floor, it’s had the literal room to expand the number of games it can run, and we’ve got a bevy of them on the schedule for 2024, as well as a bank of games for you to choose from during Open Gaming hours. There's also a LARP Workshop Series being run by Spectacle INK. * Our Artist Guests of Honor for 2024 are Gina Matarazzo and Matthew Stewart. Each will be giving a presentation on our Main Stage on Saturday afternoon, as well as having their art displayed in our Art Show. * Our Principal Speaker for 2024 is MAX GLADSTONE, and we also have Nghi Vo as our Special Guest. Both will be doing Readings, Autograph Sessions, panels, and a main stage Q&A session. An interactive version of our schedule can be found HERE. While a simplified, static overview, organized by track, can be found HERE. Our LinkTree can be found HERE. We would especially value your support this year, as Philcon’s Covid-19 policy in previous years (which required both mandatory masking and proof of vaccination in an attempt to avoid becoming a super-spreader event as several other conventions had) has led to a slow but noticeable decline in attendance. While masking in public spaces is still heavily encouraged, neither proof of vaccination nor masking are required to attend the convention in 2024. We’d love your help in making this year a success, so that we’re in a good position to bring you all something really fantastic for our upcoming 90th anniversary. We’d also love to give you a great weekend right now, for reasons I doubt we need to explain. Here’s to surviving the next few years! ~ Lynati Head of Programming, Philcon 2024

#Philcon#Philcon 2024#Philcon Programming#Philcon Programming 2024#Conventions#SF conventions#Science Fiction#Fantasy#Horror#Filk#Gaming#Writing Workshops

285 notes

·

View notes

Text

UPI Help: ತಪ್ಪಾದ UPI ಐಡಿಗೆ ಹಣ ಕಳುಹಿಸಿದ್ದೀರಾ? ಚಿಂತೆ ಬೇಡ, ಹೀಗೆ ಮಾಡಿ ಹಣ ಮರಳಿ ಪಡೆಯಿರಿ!

UPI Help- ಇತ್ತೀಚಿನ ದಿನಗಳಲ್ಲಿ UPI ನಮ್ಮ ದೈನಂದಿನ ಜೀವನದ ಅವಿಭಾಜ್ಯ ಅಂಗವಾಗಿದೆ. ಚಿಲ್ಲರೆ ವ್ಯಾಪಾರದಿಂದ ಹಿಡಿದು ದೊಡ್ಡ ಮೊತ್ತದ ವರ್ಗಾವಣೆಗಳವರೆಗೆ, ಎಲ್ಲವೂ ಒಂದು ಟ್ಯಾಪ್ನಲ್ಲಿ ನಡೆಯುತ್ತದೆ. ಆದರೆ, ಕೆಲವೊಮ್ಮೆ ಅವಸರದಲ್ಲಿ ಅಥವಾ ಸಣ್ಣ ತಪ್ಪುಗಳಿಂದಾಗಿ, ನಾವು ಬೇರೆಯವರಿಗೆ ಹಣ ಕಳುಹಿಸಬೇಕಾದಾಗ ತಪ್ಪಾದ UPI ID ಗೆ ಕಳುಹಿಸಿಬಿಡುತ್ತೇವೆ. ಆಗ ‘ಅಯ್ಯೋ, ಹಣ ಹೋಯಿತೇ’ ಎಂದು ಆತಂಕ ಶುರುವಾಗುತ್ತದೆ. ಆದರೆ, (UPI Help) ಚಿಂತ���ಸುವ ಅಗತ್ಯವಿಲ್ಲ! ಇಂತಹ ಪರಿಸ್ಥಿತಿಯಲ್ಲಿ ನಿಮ್ಮ…

#Aadhaar based banking#Aadhaar e-KYC#banking without visiting branch#C-KYC#C-KYC registry#central KYC registry#DigiLocker banking#digital banking India#e-KYC from home#KYC for rural banking#new RBI KYC process#online bank account verification#RBI banking guidelines#RBI digital banking rules#RBI financial inclusion#RBI guidelines for banks#RBI KYC changes 2025#simplified bank KYC#simplified KYC process#video KYC RBI

0 notes

Text

The huge Sephardic synagogue of Sarajevo named Kal Grande, one of the largest and ornate one in the Balkans, was erected between 1926 and 1930 as a counterpart of the Ashkenazi synagogue on the opposite river bank, in the Art Nouveau neighborhood. Its builder, Rudolf Lubinski from Zagreb, was one of the greatest Art Nouveau artists in the Balkans.

Designed for two thousand believers, the Kal Grande was built with a large elliptic dome, and with an entrance courtyard imitating the Alhambra, the Moorish fortress in southern Spain. Its apsis, according to Sephardic tradition, looked toward th south, the river, while its entrance was from the north. But the synagogue stood only ten years. The Germans and Ustashas, entering the town in April 1941, heavily damaged it. It was restored in a simplified secular form in 1965, and the former dome was replaced with a flat roof. The building was initially used as the Đuro Đaković Workers' University and currently as the Bosnian Cultural Center.

243 notes

·

View notes

Text

Time for something new! - or old, since here could be your wolf character in retro games' style, low-poly and with pixelated texture.

🐺 Multi-slot (3 slots) YCH – 3D low-poly wolf character model

🔸 Price per slot: 50$

🔸READ THE INFO BELOW BEFORE CLAIM! ⏬⏬⏬

No additional accessories or extra parts (wings, horns, tufts, etc.)

Non-symmetrical coloring is okay

Minor model adjustments are possible (like body thickness, cheeks shape, tail length)

Fine details may be simplified or lost due to the low texture resolution

If you're unsure whether your character fits, please ask before claiming a slot!

🔸 What you get:

poses list (see the 2nd image)

38 static renders

3 turnaround animations (mp4 & transparent gifs) ⏩[look at them!]⏪

.blend files included (you should have a PC & Blender 3.6+ to open them)

10 static poses

256x256 px texture (I'll colour the original grayscale base)

.txt file with simply guide

***

🔸 Model usage rules

Allowed Uses

You may use the model for personal projects, renders, animations and non-commercial purposes*

You may modify the textures and rigging for customization (please don’t heavily redesign the model into something unrecognizable)

You may showcase renders of the model in your portfolio, social media, or online galleries (crediting me optional but appreciated)

Prohibited Uses

Do not resell, trade, or share the .blend files or textures with others

Do not claim the original model as your own

Do not use the model for NFTs or AI training

Additional Terms

I keep the right to use the base model for my portfolio and other personal projects

I keep the right to use coloured base model for my portfolio

* Purchasing the YCH grants you a custom-colored version of the model, but not exclusive rights to the base mesh. Write me a note before claiming if you want to use it for commercial purposes.

🔸 By purchasing this model, you agree to these terms.

***

🔸 Payment within 48 hours after claiming. After payment I'll start the work & send the files to you after finishing.

I use folders on Google Drive.

🔸 Payment via PayPal this time!

(via my intermediary)

No refunds after receiving the files.

🔸 or via Hipolink

(using !bank cards)

No refunds after receiving the files.

#verbrannt74#3D#blender3d#3d modeling#3d model#3d artwork#3d art#low poly#low poly 3d#lowpoly#lowpoly aesthetic#gif#3d gif#wolf#wolf art#wolf ych#wolf commission#canine#canine art#canine ych#canine commission#3d ych#3d commission#retro#retro aesthetic#retro gaming#retro gaming aesthetic#pixel art#pixel#furry ych

171 notes

·

View notes

Text

Expert NRI Solutions in India – Connect Seamlessly with Murvin NRI Services

Murvin NRI Services provides expert solutions for NRIs in India, covering banking, legal, and property needs. Connect seamlessly and experience hassle-free services.

#Expert NRI solutions#Seamless connection#Murvin NRI#Banking services India#Legal aid for NRIs#Property management India#India services for NRIs#Global Indians support#Hassle-free NRI services#Simplify India connection

0 notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes