#short term loans australia

Text

0 notes

Text

Half of Americans say student loans aren't worth it

#student loans#personal loans#short term loans uk#same day payday loans#loans#student#student debt#debt recovery#debt collection#debtfree#debt#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#university#universities#college#school#education#class war#eat the rich#eat the fucking rich#exploitation

0 notes

Text

A Quick and Secure Way to Access Funding Guide by Mango Credit

In the world of finance, obtaining a loan is a common practice for individuals and businesses alike. Traditional loans often involve a lengthy approval process, stringent criteria, and extensive documentation. However, there are alternative financing options available, and one such option gaining popularity is the caveat loan. Mango-Credit, a reputable financial institution, offers caveat loans, and this article aims to provide a comprehensive guide to understanding this unique financial product.

What are Caveat Loans?

A caveat loan, also known as an unregistered second mortgage or an equitable mortgage, is a secured loan that uses an existing property as collateral. Unlike traditional mortgages, caveat loans do not require registration on the title of the property. Instead, a caveat is lodged on the title, which acts as a legal notice of the lender's interest in the property.

Key Features of Mango-Credit's Caveat Loans

Speedy Approval Process:

Mango-Credit understands the importance of time when it comes to financial matters. The caveat loan application process is designed for quick approval, allowing borrowers to access funds promptly.

Flexible Repayment Terms:

Unlike traditional loans with fixed monthly payments, caveat loans offer flexibility in repayment. Mango-Credit works with borrowers to establish terms that align with their financial situation, ensuring a more manageable repayment process.

Asset-Based Collateral:

The primary collateral for a caveat loan is the borrower's real estate or property. Mango-Credit assesses the value of the asset to determine the loan amount, making it accessible for individuals who may not qualify for conventional loans.

Short-Term Solution:

Caveat loans are typically short-term, ranging from a few months to a couple of years. This makes them an ideal solution for those in need of quick capital for specific projects, investments, or to bridge a temporary financial gap.

Transparent Terms and Conditions:

Mango-Credit is committed to transparency. Borrowers are provided with clear terms and conditions, ensuring they fully understand the repayment structure, interest rates, and any associated fees.

Benefits of Choosing Mango-Credit's Caveat Loans

Accessibility:

Mango-Credit's caveat loans offer accessibility to individuals and businesses that may face challenges securing financing from traditional sources. The asset-based approach widens the pool of eligible borrowers.

Customized Solutions:

The flexibility in repayment terms allows Mango-Credit to tailor loan solutions to the unique needs of each borrower. This personalized approach enhances the borrower's ability to successfully meet financial obligations.

Quick Response to Financial Needs:

With an expedited approval process, Mango-Credit provides a swift response to urgent financial needs. This speed is crucial for individuals and businesses requiring immediate capital to seize opportunities or address pressing financial issues.

Conclusion

Caveat loans from Mango Credit provide a valuable alternative financing option for individuals and businesses seeking quick and secure access to funds. With their competitive rates, flexible terms, and streamlined application process, Mango Credit's caveat loans can help borrowers achieve their financial goals efficiently.

#bridging loan australia#bridging loans#short term bridging loan#bridging loan#bridging finance#best bridging loans australia#Caveat loans#Caveat loan#Mango Credit#tumblr

0 notes

Text

Guide to Understanding Small Business Loans

Australia's thriving entrepreneurial landscape demands accessible financing solutions to fuel business growth and innovation. Small business loans play a pivotal role in empowering local ventures, offering capital infusion to fund expansions, equipment purchases, and business optimisation. The most common reason for SMEs in Australia to look for small business loans is to buy equipment. Cash flow management, business expansions, inventory purchases, and invoice payments are other critical reasons why they need the funds. Loans for small businesses can help entrepreneurs manage exigencies and seize opportunities in the market. Let’s discuss everything you need to know about small business loans in Australia!

Purpose of additional finance SMEs, % Aug 2021 & 2022

WHAT ARE SMALL BUSINESS LOANS?

youtube

A small business loan is a financing option that allows business owners to get a lump sum amount from lenders to manage various business expenses. They are required to repay the loan at a fixed interest rate over a specified period. There are many types of small business loan products that suit a variety of enterprises. From start-up business loans to bad credit small business loans, there are numerous options to explore. Let’s break down the typical terms of small business finance products available in the market:

● Loan Amount: Small businesses can get loans in the range of $5000 to $1 million, depending on a multitude of factors. The average loan amount for small businesses in Australia is on the rise, growing by 15% between 2021 and 2022. Fuelled by post-pandemic recovery, many lenders are now lending more money to small businesses than ever before.

● Loan Term: In most cases, lenders provide small business loans for three months to three years.

● Interest Rate: Small business loan rates Lenders determine the interest rate based on factors like the firm’s financial strength, credit history, availability of collateral, industry prospects and more. A small business loan calculator can help you estimate your potential repayments based on the indicative interest rates typically charged by lenders.

● Repayment Frequency: Small businesses can make weekly, fortnightly, or monthly repayments according to their loan agreement with the lender. This flexibility makes it convenient for small-scale businesses to pay back these loans.

What Can You Do with a Small Business Loan?

A firm can use its small business loan to take care of various business expenses. Lenders usually do not place restrictions on how you can utilise the loan amount, provided it goes towards a legitimate business expenditure. Here are some of the ways of using a small business loan to maximise your firm's potential for success.

(Source: https://www.nbcbanking.com/business-banking/business-lending-guide/how-business-loans-work/)

● Working Capital Needs: Small loans for businesses can help these firms navigate their day-to-day expenses. Seasonal ventures with cash flow fluctuations often rely on small business loans to manage expenditures.

● Equipment Purchase: Many businesses rely on key pieces of equipment to provide their services and drive value for customers. They may need to purchase new equipment or machinery to scale their operations or replace an old asset. In such situations, they can borrow money from lenders to fund this essential business expense.

● Real Estate Investments: If you run a small business, you may want to purchase or lease new premises for your firm. You may want to expand and renovate your current premises or open new branches to grow your business. A small business loan can come in handy for all these purposes and help you take your venture to new heights.

● Buying Inventory: Lack of inventory can lead to the loss of sales and competitive advantage in the market. Hence, it is essential to maintain adequate inventory stocks to meet your demand forecasts. Many firms take out small business loans during festive seasons or other high-demand periods to buy more inventory to cater to the demand.

● Start-up Costs: Often, an entrepreneur may have an excellent business idea, but they may lack the funds to execute their plans. In such situations, small business loans can come to their rescue. They can borrow money to initiate their operations and lay the foundations for growth.

Small Business Loans: Options to Explore

If you want to explore loans for your small business, there are numerous options to explore. Let’s discuss the various types of small business loans available to firms:

● Unsecured Small Business Loans: Small businesses may lack the assets or time required to take out secured loans. In such situations, they can browse unsecured business loans to meet their needs. Lenders provide unsecured loans without any security or collateral. Since the risk for the lender is high, they tend to charge a slightly higher rate of interest to compensate for the same. Unsecured loans are a hassle-free source of funding because it takes very little time to process and approve these loans. A firm needs to submit only their bank statements for loans up to $250K. They can get a quick business loan within 24 hours for a term of 3-36 months if they opt for unsecured credit.

● Secured Small Business Loans: A secured business loan is a lump sum amount lent against some security or collateral. The borrower must offer a real estate property to the lender to secure this type of loan. Secured small business loans are excellent for start-ups that have no business activity or financial strength to show. They can pledge a residential or commercial property as collateral to cover the lender’s risk and get favourable terms on the loan. They can get small business start-up loans up to 80% of the value of their pledged asset. These loans are available for 3-18 months, allowing sufficient time for new firms to set up their operations.

● Small Business Line of Credit: A business overdraft is a flexible source of finance for small business owners. In this case, the lender approves a credit limit, and the firm can withdraw money according to their unique business requirements. They have to pay interest on the amount they withdraw and not the entire credit limit. Business lines of credit in Australia help firms navigate their working capital needs by providing an interest-free buffer.

● Bad Credit Loans: Lenders evaluate the credit score of applicants in detail before approving their loans. However, this does not mean that it is impossible to get a small business loan because of the applicant’s poor personal or business credit history. Bad credit small business loans are available to Australian firms with some stringent terms and conditions. These loans often carry higher rates of interest and have more rigorous lending criteria. Typically, bad credit business loans are available for a short-term period between three to twelve months.

● Short-term Loans: Short-term business loans are perfect for bridging capital needs. Firms can get short-term credit to meet urgent working capital requirements and tackle cash flow fluctuations. These loans require minimal documentation and are usually quick to be processed.

● Small Business Equipment Finance: 27% of SMEs borrow money to buy new equipment to streamline their operations. Hence, lenders frequently offer favourable terms to secure loans for this purpose. Firms can secure equipment loans against the value of the newly acquired asset and pay lower interest rates compared to unsecured loans. These loans can usually be taken for up to seven years, ensuring flexibility and convenience for the borrowers.

Eligibility Criteria to Get Small Business Loans in Australia

Borrowers have to meet the required criteria to be eligible for small business loans. They are as follows:

● Registration: The borrowing firm must have a valid and active Australian Business Number (ABN) to apply for business financing.

● Trading History: Many lenders prefer to advance small loans for business purposes to firms that have been in operation for six months or more. However, start-up businesses can also secure loans by pledging collateral to the lenders.

● Monthly Turnover: Small businesses need a monthly turnover of $5K or more to be eligible for most business loan products.

Advantages and Disadvantages of Taking a Small Business Loan

Small business loans can be a game-changer for business owners who want to grow their ventures or navigate challenging times. However, it is crucial to weigh the pros and cons of these loans before deciding to borrow. Here are the advantages you can expect with small business loans:

● Access to Capital: Small business loans provide a vital infusion of capital, enabling entrepreneurs to fund startup costs, expand operations, invest in equipment, or seize growth opportunities.

● Smooth Cash Flow: Small business loans can help address cash flow gaps, ensuring the continuity of operations and providing stability during lean periods or unexpected expenses.

● Flexibility in Use: Business loans offer flexibility in how the funds are utilised. Entrepreneurs have the freedom to allocate them as needed to drive their business forward.

● Building Credit: Responsible borrowing and timely repayments can help establish and improve your business credit profile. Increasing your credit score can potentially open doors to more favourable terms in the future.

● Quick and Hassle-Free Approvals: In most cases, lenders process small business loans very quickly. You can get unsecured loans in just 24-72 hours, while secured loans take about 3-7 days for unconditional approval and settlement. The experience of applying for small business loans is quite hassle-free, as businesses have to submit just a few documents to facilitate the process. Most small business loans are low-doc, requiring the applicants to submit their last six months’ bank statements and identification proofs to secure approval.

● Variety of Options: Small businesses can explore various loan products to find the options that suit them the best. They can compare small business loan rates and the terms offered by lenders to fit their unique business model. There are numerous small business loans available in the market, allowing business owners to compare the loans and opt for flexible sources of funding.

Now that you know the advantages of taking a small business loan, let’s discuss the potential disadvantages to help you make an informed decision:

● Small Amounts: Lenders often consider small businesses riskier than established firms because of their limitations in scale. As a result, they tend to approve lower amounts for small business loans to minimise their risks.

● Higher Rates of Interest: Small-scale businesses may have to pay a higher interest rate than larger firms with a demonstrated history of success. Lenders tend to charge higher interest rates to cover their risks in case the borrowers go bankrupt and fail to repay their loans. The higher interest rate can lead to high repayments, affecting the firm’s cash flow situation.

● No Guarantee of Business Growth: While small business loans are valuable tools for growing local ventures, they do not guarantee long-term business expansions. Success and growth depend on execution and not just the infusion of funds. A small business loan may not solve long-term business challenges. Hence, it is crucial to carefully weigh your requirements and business plans before taking out a loan.

You should carefully understand these advantages and disadvantages before applying for a loan. A detailed analysis will help you make an informed decision and avoid pitfalls in the future.

How to Apply for a Small Business Loan?

First-time borrowers may be daunted by the idea of applying for a small business loan. SMEs in Australia often struggle to figure out how to get a bank loan for small businesses, with many of them experiencing difficulties in finding a willing lender or an affordable loan. In such cases, firms can work with experienced finance brokers to connect with alternative lenders who offer flexible loan terms for small-scale ventures.

(Source: https://www.smefinanceforum.org/post/survey-finds-funding-gap-is-stifling-small-business-growth-in-australia)

If you are a small business owner looking for an affordable loan, following a structured approach can help you navigate the application process. Here are the steps you can take to simplify your loan application journey:

#1 Determine Your Funding Needs

Before applying for a small business loan, evaluate your funding requirements. Clearly define how much capital you need, what it will be used for, and the repayment terms you can comfortably manage. You can use a small business loan calculator to ascertain the potential repayments and assess if the amount fits your business budget.

#2 Research Loan Options and Eligibility Criteria

Thoroughly research different loan options and lenders to find the most suitable fit for your business. Understand the eligibility criteria for getting a small business loan to suit your requirements. At this stage, you can contact a financial broker to discuss your needs and explore the loan products that may be right for you. Compare the business loans and decide where you want to apply.

#3 Prepare Your Documents

Applicants must submit the required documents to facilitate the loan approval process. If you want a loan up to $250K, a low-doc application will suffice. You need the following documents for low-doc loan approval:

● A valid identification document.

● Bank statements from the past six months.

The lenders may require some more documents based on the nature of the loan you want. For example, if there is no ATO payments cited in the bank statement, the lender may ask for ATO statement. Your finance broker can guide you to prepare the necessary documents for a hassle-free application process.

If you want to apply for an unsecured loan over $250K, you have to submit the following documents in addition to the bank statements and identification proofs:

● Financial statements.

● ATO statements.

You can prepare your documents in advance before filling up your loan application.

#4 Submit the Application

Once you have gathered the required documents, submit your loan application. Ensure that all information provided is accurate and complete. Double-check the application for any mistakes or omissions that could potentially delay the approval process. You can submit your application online with all the required details. Your financial broker can go through your application and forward it to the most suitable lender to fast-track the process.

#5 Review and Accept the Loan Offer

After submitting your application, the lender will evaluate your eligibility and provide their loan offer. Carefully review the terms, including interest rates, repayment duration, and associated fees. Once you are satisfied, you can accept it by following the lender's instructions. If you have any queries, you can consult your financial broker for clarification. Once all requirements are met, the lender will finalise the loan and transfer the funds to your designated account. In some cases, you can receive the approval and the loan amount within just twenty-four hours.

How do Lenders Evaluate Applications for Small Business Loans?

Lenders evaluate the following factors to determine the status of a loan application:

● Industry and Market Factors: Lenders consider the industry in which the business operates, examining its growth potential, market conditions, and competitive landscape. They evaluate the risk associated with your industry's stability and your firm's position within the industry.

● Financial Position: Lenders assess the firm's financial strength to determine whether they can service the debt. Typically, a high monthly turnover is a positive indicator for lenders, leading them to approve higher amounts.

● Security: Lenders may require collateral to secure the loan. They assess the value and marketability of the offered collateral, such as real estate, inventory, or equipment, to mitigate the risk in case of default. If you take an unsecured small business loan, the lenders often prioritise applications where the firm or its directors are asset-backed.

● Credit Score: Lenders carefully assess your creditworthiness by reviewing your personal and business credit history. They consider factors such as your credit score, payment history, outstanding debts, and any past bankruptcies or defaults. The credit score is especially important for a new business, as it can minimise the lender’s risk and make them more likely to issue an approval.

● Trading History: Businesses operating for more than one year often get precedence when lenders evaluate loan applications. However, newer firms can also get start-up business loans from several alternative lenders.

Lenders analyse these factors to determine the loan amount, interest rate, and other terms they are willing to approve. Evaluating these aspects can give you more clarity about your loan prospects.

Tips to Simplify Your Small Business Loan Application Process

Applying for a business loan can be a complex process, but with the right approach, you can simplify it and increase your chances of success. By taking steps to streamline your loan application, you can save time, reduce stress, and present an excellent application to lenders. Here are some tips to simplify your application:

● Strengthen Your Credit Profile: You should prioritise improving your credit profile by paying bills on time, reducing outstanding debts, and correcting any errors on your credit report. A strong credit profile enhances your credibility and increases your chances of loan approval.

● Consult a Finance Broker: Once you identify your funding requirements, you can start exploring suitable options. Many SMEs in Australia struggle to find bank loans to fund their business operations. If you face this issue or do not know how to get a bank loan for your small business, it is better to partner with a finance broker. These brokers can connect you to a network of alternative lenders who provide tailored financing solutions for your firm. Moreover, their expertise can help you navigate the complexities and ensure your application is thorough and compelling. They can guide you about various aspects of the process and provide you with relevant information. From average loan amounts for small businesses to typical interest rates, they have in-depth knowledge about all facets of small business loans to help you.

● Explore Government Schemes: You can check government small business loans to find options that may fit your needs. The Australian government sometimes initiates loan assistance programmes to fuel the growth of SMEs. A knowledgeable finance broker can provide you with information about government small business loan schemes, enabling you to make the best decision for your firm.

● Prepare a Detailed Business Plan: Although lenders do not mandate the submission of a business plan, it is better to be prepared to demonstrate your growth trajectory. Craft a detailed and professional business plan that outlines your business objectives, strategies, financial projections, and market analysis. A well-prepared plan demonstrates your preparedness and increases the lender’s confidence.

If you want guidance and support to apply for various small business loans, you should contact Broc Finance today! Its team of financial brokers can help you apply for working capital loans and other credit options to help you achieve your business goals.

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-small-business-loans/

#working capital loans#business overdraft#Business lines of credit in Australia#bad credit business loans#Short-term business loans#unsecured business loans#small business loan

0 notes

Text

What Are The Common Factors Probing To Debt Trap In The Case Of Short Term Loans ?

There is an increasing number of people availing Short Term Loans in Australia every year. They are small cap loans meant to be repaid in the short term. One availing these loans should be very strategic in handling the loan repayments to avoid falling in the debt traps. If you are the one who is scared of getting clutched into the debt trap after taking the Short Term Loans for your emergency, here are a few tips to avoid it.

Stop Living Beyond Means

Life style changes are probing people to live beyond means and they are getting deeper into the debts trying to manage their life expenses. Taking Short Term Loans is not a bad idea to fill the financial gap but, you have to be careful in managing the repayments of the loan. When you have debts on board, you have to stop living beyond means. When you limit yourself to necessities, you will have funds left to manage your loan installments effectively.

Have Emergency Fund For Unexpected Expenses

Short Term Loans are meant to be availed only twice a year. Irrespective of loan spread for short term loan, you should maintain the emergency fund spaced out in the budget. Having these funds in the budget will not let you go for the second loan while the first one is open. Having two loans in parallel will give you bigger installments in the month will improve your chances of falling into the debt trap. You should always have emergency fund irrespective of debts in your account.

Lack Of Financial Literacy

Short Term Loans are designed to be approved on the same day. They have different terms and conditions compared to banking loans. Before the amount is deposited into the loan account, the borrower has to accept the terms and conditions of the loan. Just reading them out will not give you all the necessary information about the loan. Lack of financial literacy may misguide you about the information or you may lack a proper understanding about the loan terms. When you don’t understand what it costs to get a short term loan online, you may end up falling into the debt trap for lack of proper knowledge about short term credit.

Predatory Lending

You may also get stuck into the debt trap if you get in touch with predatory lending. These kind of lenders enter the market with the motive of deceiving the people rather than offering the lending services during the times of need. These kind of lenders don’t get themselves registered with the credit union thus don’t have any control over the charges offered. They tend to run the business with many hidden charges and you will be jammed with the high cost loan installments that the lender will charge you at the later date

Unaffordable Loan Installments

Short term loan installments are offered at varying tenures while the shortest of it is three months and longest of it is year. You remain flexible to choose any loan tenure in between the cap limits as per your affordability. The installment for short term loan varies depending on the loan tenure as well as the amount you have availed for the purpose. You should be quite calculative in figuring out the right loan tenure. You can even take the help of loan calculators to figure the probable loan installment as per the three different factors, the interest rate, loan tenure and loan amount. If you fail to gauge your affordability against your loan installment, you end up in picking the wrong loan tenure which in turn makes your short term loan installment unaffordable. When you fail to manage the loan repayments as scheduled, you end up falling into unrecovered and endless debt traps.

Unforeseen Events

If you have availed Short Term Loans for a longest period of a year, you are bound to repay the loan installments till the picked up the tenure. Longer installments always expect some unforeseen circumstances in between and you should always have an emergency reserve to afford loan repayments in case of unforeseen circumstances. Accumulated installments along the penalties and interest charges will push you into debt tarp.

0 notes

Text

I'm Publishing Serial Webnovels

Hi guys! I'm @elvensemi, and some of you might know me from writing Dragon Age fanfic Keeping Secrets, or from writing weird gargoyle porn with @unpretty, or from that time I accidentally told a popular blog I write dragon porn on my main blog @solitarelee, or maybe from that one fanfic where the knight with a crossdressing kink fails at slaying a dragon so hard he gets seduced!

I've graduated college, and you know what that means! Student loans Free time! And so I'm finally pursuing my long term dream and publishing serial webnovels. The short version is: ebooks, I'm publishing ebooks via Patreon to see if it works because I don't want to deal with Amazon and marketplaces. Chuck Tingle does it, kind of!

I am writing such things as!

The Problem with Faeries

An urban fantasy series for fans of Holly Black, featuring faeries and a librarian who has been cursed by a witch to turn into a tiny dog at night.

Everything at Once

A coming of age fantasy novel set in a post-post-apocalyptic world full of many monsters and very few humans, with a nonbinary (genderfluid) protagonist and a rotating cast of gods and monsters.

The Demon Isles

An adult romance series set in the same world as Everything at Once, this one's for the monsterf*ckers. Step into the shoes of an escaped slave who's been stranded in Fantasy Australia But All The Dangerous Things Can Be Seduced.

A Place Among the Stars

An adult sci-fi political space opera that is also technically just solidly omegaverse sm*t plus space dragons. That's right, one of my friends dared me to write omegaverse and I overdid it and now they're aliens! All for you my friend.

Novelizations of works that previously existed only as RPs, such as Sanctuary and The Kingdom of Aeris.

AND SO MUCH MORE.

For $5 you get access to SFW material, and for $10 you get access to that and the things that are not SFW. You can view a full summary of the serials I'm working on at tinyurl.com/SemiSerials , or click the read more.

The Demon Isles (NSFW, Second Person)

Oceanside is a world full of elves and gods, monsters and magic. You, however, a human with no magic, no martial training, and a fear of... most things. Stranded on an unfamiliar island full of monsters, you must learn to harness humanity’s true power in order to survive. The issue with that is, as far as anyone can tell, humanity’s true powers are friendship and fuckability.

The Demon Isles is a erotic, second-person monsterfucking romp through the dangerous Demon Isles. The second person character is referred to by gender neutral terminology and they/them pronouns, physical appearance left ambiguous. Sex scenes have two versions with different sets of genitalia for the main character. Tags and content warnings are available for each chapter.

The Problem with Faeries (SFW, Third Person)

The problem with faeries is that we love them. We know all the sharp and cruel ways they twist us apart and we love them with a helpless, hopeless foolishness that never fades until it destroys us.

Bree is a human living in Valesport, a small town on the east coast of the United States that functions as a secret haven for the supernatural. As a cursed human, it’s one of the safer places for her... at least, safe from other humans. Everything else Valesport has to offer remains a threat. She’s already had her run-ins with werewolves, vampires, and whatever the hell Jean Cernunnos is... so, in retrospect, she was probably due to get into trouble with the Fae.

A fan favorite finally finding a venue of publication, The Problem with Faeries is a SFW urban fantasy with a side of romance perfect for fans of Holly Black. It is third person and follows the point of view of the protagonist, Bridget “Bree” Corey, as she finds herself tangled up trying to navigate faerie drama and her own personal feelings, neither of which she is particularly equipped to handle.

Everything at Once (SFW, First Person)

Babs wants everything the world has to offer... everything except what it’s actually prepared to hand over. As the eldest child of the ruling noble family--or what passes for it--of the only human village remaining old and large enough to still have a ruling noble family, even if just in name, Babs’s whole life has been laid out in front of them since the moment they were born. And they want none of it. However, after a bold escape from the village they knew all their life, they find themselves adrift in an unfriendly world of monsters and magic that seems much larger and much less friendly than they had hoped.

Everything at Once is a SFW fantasy novel set all over the world of Oceanside as our determined protagonist, Babs, attempts to explore all there is to explore and experience all there is to experience (it is possible they have not thought this through). Babs is a non-binary, gender fluid illusionist referred to varyingly by he, she, and they pronouns based on presentation. The story is a first person mixed POV exploring a wide range of characters and topics, but always staying focused on the many transformations of the main character as they learn what it is they want... and what it is to want.

Future Projects: Projects that are in development but do not have a set release date yet.

A Place Among the Stars [Working Title] (NSFW)

A Place Among the Stars is a NSFW erotic political space opera featuring Omegaverse style aliens and also space dragons, amongst other alien races. It features two protagonists: an exiled and excommunicated Saint who once led a cult that threatened the peace and stability of his homeworld, and a mid level government official presiding over the walled ghetto where the Ab’ed keep all foreign visitors and immigrants to their planet. They quickly find themselves entangled: politically, as the Saint once again threatens the stability of the world around him--in more ways than one--and sexually, as the tension between the two reaches a fever pitch.

Sanctuary (NSFW, Third Person)

Most people would consider Ren unlucky. After all, she’s been homeless since she was a child, has no living family she knows of, and she was recently kidnapped by sex traffickers and ripped away from the city she had been living in for years. But as far as Ren is concerned, she’s the epitome of good luck: not only has she survived all the things life has thrown at her, but she’s escaped said sex traffickers and even found shelter in an abandoned, boarded up cathedral. The fact that the cathedral, undisturbed for a century or more, is home to a guardian whose only experience with the world is violently murdering intruders, well... once again, whether that’s good or bad luck is based purely on interpretation.

Sanctuary is a NSFW urban fantasy erotic romance featuring a cis female protagonist and a male (as these things go) gargoyle love interest, as well as a mix of other romantic interests (primarily M/F with some F/F or NB/F thrown in). Tags and content warnings are available for each chapter. This fan-favorite returns in serialized, ebook form for easy reading. Follow Ren’s journey anew from mixed perspectives as she explores the streets of Valesport and finds something she’s never had before; a place to call home.

78 notes

·

View notes

Text

Daniel Ricciardo finishes 13th on his return to Formula One at the Hungarian Grand Prix...while Oscar Piastri crosses the line fifth as young Australian narrowly misses on first podium of his career

Daniel Ricciardo finishes 13th on his return to Formula One at the Hungarian Grand Prix...while Oscar Piastri crosses the line fifth as young Australian narrowly misses on first podium of his career

By Dan Cancian For Daily Mail Australia

Updated: 10:48 EDT, 23 July 2023

Daniel Ricciardo finished 13th at the Hungarian Grand Prix on his return to Formula One, while Oscar Piastri narrowly missed out on his first podium by finishing

In his first start since being axed by McLaren at the end of last season, Ricciardo started 13th, four spots ahead of teammate Yuki Tsunoda.

The Australian fell to 18th at the first corner after Zhou Guanyu hit Tsunoda, causing a collision that forced the Alpine duo of Pierre Gasly and Esteban Ocon to retire.

Ricciardo recovered well and despite running last for the opening spell of the race, he managed to climb back into midfield.

It is a positive start for the eight-time Grand Prix winner, who joined AlphaTauri for the remainder of the season on loan from Red Bull earlier this month after the team parted ways with rookie driver Nyck De Vries.

Ricciardo's return has been welcomed by many in the paddock, with reigning world champion and former teammate Verstappen admitting he never wanted the Australian to leave Red Bull in 2018.

Daniel Ricciardo finished 13th on his return to Formula One with AlphaTauri on Sunday

The Australian returned to the sport earlier this month after signing a short-term contract with AlphaTauri to replace Nyck De Vries

'I never actually wanted him to leave,' he said.

'It's great to have Daniel back on the grid and within the family.

'We know that we get on very well, and if Daniel does well where he is now, then of course you have the opportunity to go back up [to Red Bull], right?

'It's all open, to be honest.

'I spoke already quite a bit with Daniel last week. I could see he was very excited, also after driving our car [in a tyre test at Silverstone].'

Piastri, meanwhile, looked well poised to claim a maiden podium finish but had to settle for fifth place instead.

The 21-year-old, who replaced Ricciardo at McLaren this season, started fourth and ran in second in the early stages of the race behind race winner Max Verstappen, who secured his seventh consecutive win.

Oscar Piastri finished fifth, narrowly missing out on a first career podium

But the Australian was overtaken by teammate Lando Norris after his first step, with the Briton making the most of McLaren's decision to pit him before Piastri.

Norris eventually held on for second place, securing back-to-back podiums for the first time in his career after finishing second at Silverstone a fortnight ago.

Sergio Perez finished third with Lewis Hamilton a disappointing fourth after starting from pole position.

Verstappen's win means Red Bull have now won the last 12 races in a row, a new Formula One record.

Share or comment on this article:

Daniel Ricciardo finishes 13th on his return to Formula One at the Hungarian Grand Prix...while Oscar Piastri crosses the line fifth as young Australian narrowly misses on first podium of his career

via Formula One | Mail Online https://www.dailymail.co.uk?ns_mchannel=rss&ns_campaign=1490&ito=1490

#F1#Daniel Ricciardo finishes 13th on his return to Formula One at the Hungarian Grand Prix...while Oscar Piastri crosses the line fifth as you#Formula 1

2 notes

·

View notes

Text

Private Lenders and Private Loans in Australia: A Flexible Financial Solution

In the ever-evolving world of finance, securing the right kind of loan can sometimes be a challenge. Whether you're a business owner, a property investor, or simply someone looking to cover personal expenses, traditional banks might not always be the best fit. For Australians looking for alternative funding options, private lenders and private loans are becoming increasingly popular. These non-bank lending solutions provide flexibility, speed, and a more personalized approach to financing.

What Are Private Lenders?

Private lenders in Australia are non-bank financial entities or individuals who offer loans to borrowers. Unlike traditional banks or credit unions, private lenders don't operate under the same regulatory framework, which allows them to be more flexible in their lending criteria. This means that even borrowers with poor credit scores or complex financial situations can find opportunities through private loans.

Private lenders range from small, independent investors to larger, established companies specializing in various types of lending. They may offer loans for real estate investments, business expansion, personal loans, or even short-term financing for immediate cash flow needs.

How Do Private Loans Work?

Private loans from private lenders in Australia work similarly to traditional loans, but they tend to have more flexible terms and conditions. Borrowers can typically secure loans quickly, with fewer bureaucratic hurdles. These loans often come with terms tailored to the specific needs of the borrower, rather than a one-size-fits-all approach.

The process usually involves a more direct negotiation between the lender and borrower, which can lead to customized interest rates, repayment terms, and loan amounts. This flexibility can be particularly useful for borrowers who may not meet the strict lending criteria set by banks, such as those with low credit scores, insufficient documentation, or unconventional income sources.

Benefits of Private Lenders and Private Loans

Private loans offer several key benefits, making them an attractive option for many Australians:

Faster Approval Process: Private lenders often provide quicker approval times compared to traditional banks. Without the rigid protocols of larger institutions, private lenders can evaluate and approve loans in a matter of days, making them ideal for borrowers in urgent need of funds.

Flexible Lending Criteria: Banks often have strict lending requirements, particularly regarding credit scores, income verification, and existing debts. Private lenders, however, are typically more flexible and willing to take on borrowers with unique or complex financial situations.

Tailored Loan Terms: One of the most significant advantages of working with a private lender is the ability to negotiate customized loan terms. Whether you need a longer repayment period or a short-term loan to cover a specific project, private lenders are more likely to adjust their terms to suit your needs.

Diverse Loan Types: Private lenders offer a variety of loans, including personal loans, real estate loans, business loans, and more. This diversity allows borrowers to find the type of loan that best fits their financial goals.

Potential Risks of Private Loans

While private loans offer flexibility and faster access to funds, they are not without their risks. Some private lenders may charge higher interest rates compared to traditional banks, reflecting the higher risk they take on when lending to less qualified borrowers. It's essential to compare loan options and ensure that you fully understand the terms before committing.

Additionally, since private lenders are not subject to the same level of regulation as banks, borrowers should exercise caution when selecting a lender. Ensuring the lender is reputable and has clear, transparent lending terms is critical to avoiding potential pitfalls.

Is a Private Loan Right for You?

Private loans in Australia offer a viable alternative to traditional bank loans, particularly for individuals and businesses that need flexibility or face challenges meeting standard lending criteria. Whether you're looking for fast access to funds, a tailored loan solution, or a more lenient approval process, Non-Bank Private Lender Australia can provide an attractive financing option.

However, it's essential to do thorough research, compare lenders, and read the fine print. Understanding both the benefits and potential risks will help you make an informed decision about whether a private loan is the right financial solution for your needs.

0 notes

Text

0 notes

Text

0 notes

Text

Australian Finance Group

Australian Finance Group Ltd provides mortgage brokerage, personal loans, commercial finance, and insurance services. The Company is an aggregator and offers products through its broker network. Australian Finance Group serves customers in Australia.

Get a clear picture of Finance Group Australia Ltd's performance with key financial ratios and data on financial growth. Compare against peers.

Mortgage Brokerage

Mortgage brokers provide a service to their clients, allowing them to secure financing from lenders. They collect documents such as credit reports, proof of income and asset details to help a client find the most suitable loan. They also act as a liaison between the lender and borrower throughout the application process.

In Australia, mortgage brokers are paid a commission for arranging loans. This may be paid by the mortgage lender or by the client. A mortgage broker should disclose all fees before they arrange a loan. This allows a borrower to compare the cost of loans and choose the most appropriate one for them.

Get detailed financial information on Australian Finance Group Ltd including historical security price data, important key dates, ASX announcements, financial reports and presentations. View and analyze company performance with

benchmarking insights comparing the Company to its peers. IBISWorld’s Enterprise Profiles give you a comprehensive understanding of the company’s business operations, strategic positioning and growth opportunities.

Personal Loans

The company offers personal loans to individuals. It also provides mortgage brokerage, insurance, and commercial finance services. It serves customers throughout Australia. The company's services include unsecured and secured loans, bridging loans, and home loan refinance. Its unsecured loans offer fixed and variable interest rates. Its bridging loans help foreign nationals in need of short-term funds.

Its personal loans are available for a variety of purposes, including paying for study costs, buying furniture, renovating your house, or going on holiday. Its unsecured personal loan is suitable for people who have poor credit histories. Its low credit score personal loans are available for those who are residing in Australia on an approved visa and earning steady income.

Get a full financial picture of Australian Finance Group Ltd with detailed revenue and asset information. Compare relative performance to peers and industry benchmarks. Understand the key drivers of Australian Finance Group Ltd's growth and profitability. Obtain key contact details and analyse the competitive environment for your business.

Commercial Finance

Whether it's for purchasing equipment, expanding your business, or buying land and buildings, commercial loans are available to help you reach your goals. But the terms, rates, and fees can make a huge difference in your bottom line.

The company's business lines include mortgage aggregation, consumer asset finance and commercial finance. It operates its aggregation segment in the form of a securitisation program that packages mortgages into trusts and sells them on. The trusts are backed by non-recourse debt, meaning that AFG will not be liable for defaults within the trust.

Get detailed financial information on 3M+ companies with PitchBook Pro. Compare financial ratios and growth across segments, industries and geographic locations for a clearer picture of performance.

Insurance

There are several large insurance companies in Australia that offer a wide variety of products and services. Some provide general insurance while others specialize in specific types of coverage. Some of these companies include Steadfast, which operates the largest network of insurance brokers in Australia and New Zealand with more than 417 brokerages. Other insurers include nib, which offers health and travel policies, and GIO, which provides car, home, business, and caravan insurance.

Some of these insurance companies also offer specialty commercial products. These products can cover financial risk exposures such as agribusiness and manufacturing. They can also cover the costs of business interruption and cyber crime.

Some of these companies have a market capitalization of more than $10 billion, making them one of the world’s top insurance companies. Their market cap can help customers and investors decide whether they’re a safe investment. In addition, their market share can indicate whether the company is financially stable enough to meet its future obligations.

0 notes

Text

Bridging Loan: Your Path to Seamless Property Transitions

Need a financial bridge for your property transition? Explore the world of Bridging Loans! Bridging loan offer a flexible solution for homeowners, enabling you to secure a new property while awaiting the sale of your existing one. Discover how Bridging Loans can make your property dreams a reality.

#best bridging loans australia#bridging loan#bridging loan australia#bridging loans#bridging finance#short term bridging loan

0 notes

Text

GUIDE TO UNDERSTANDING UNSECURED BUSINESS LOANS

Small and medium enterprises (SMEs) in Australia play a crucial role in the national economy. They collectively provide over 65% of the private sector employment and contribute more than $700 billion to the country's GDP. However, despite their economic significance, many SMEs struggle to get loan approvals from traditional lenders like banks. In such situations, they can rely on alternative financing sources for business loans in Australia. SMEs can explore numerous loan products and choose the options that suit their requirements. Some of the most popular loan products fall in the category of unsecured loans. An unsecured business loan allows a firm to secure collateral-free funding, helping it manage urgent expenses and fuel critical expansion plans. Let’s discuss this funding option in detail and understand how to get the best unsecured business loans!

Unsecured Business Loans: An Overview

An unsecured business loan is a financing option that allows a firm to borrow money without providing any collateral. The collateral represents an asset offered as a security to the lender. A firm must submit collateral for secured business loans, allowing the lender to liquidate this asset if the borrower fails to repay the money. Since an unsecured loan does not involve this security, the lender issues it based on the firm’s performance, financial health, and creditworthiness.

Unsecured small business loans are perfect for firms that require quick funding or lack the assets to apply for secured loans. Lenders often charge slightly higher interest rates on unsecured loans to compensate for their risks. However, borrowers often prefer unsecured financing over secured loans when they have an urgent need for cash. Fast unsecured business loans can get approved within one to three days, providing businesses with a much-needed infusion of cash. Firms can get unsecured loans for various business purposes. They may utilise the amount for buying inventory, paying wages, financing renovations, or managing their working capital needs. While the proportion of unsecured loans may be low compared to other forms of SME financing, these options are highly advantageous for new businesses that require quick funding.

youtube

Unsecured business loan interest rates and other terms vary based on several factors. Lenders consider the borrower's requirements, the associated risks, and their internal policies while determining the loan terms. However, typically, the terms for unsecured business finance fall within the following range:

● Amount: Firms can borrow between $5,000 and $500,000 without providing any collateral.

● Interest Rate: Unsecured business loan rates start from 5.5% per annum.

● Loan Term: Firms can take an unsecured business loan for three months to three years.

● Frequency of Repayments: Borrowers can repay the loan on a daily, weekly, or fortnightly basis.

● Approval Time: The pre-approval process takes between two to four hours. Additionally, the unconditional approval and settlement procedures require one to three days.

Types of Unsecured Business Loans

SMEs have several options to get quick business loans without providing any security. The following are the three unsecured business loan types to consider depending on a firm's unique requirements:

● Small Business Loans

Unsecured small business loans allow SMEs to get a lump sum amount without tying up their assets. The application and approval processes are seamless and quick, allowing the borrower to secure funding within twenty-four hours.

● Business Line of Credit

A business line of credit in Australia is a flexible financing option. The lender approves a credit limit and the borrower withdraws the amount they need. The firm can borrow any sum under the limit and pay interest on the amount they utilise. An unsecured business overdraft facility can help seasonal businesses navigate cash flow fluctuations with minimum risk and hassle.

● Invoice Finance

The invoice finance facility allows a firm to take a loan against their unpaid invoices. The lender provides an advance based on the value of pending invoices. The firm can borrow large sums without submitting assets like equipment or property.

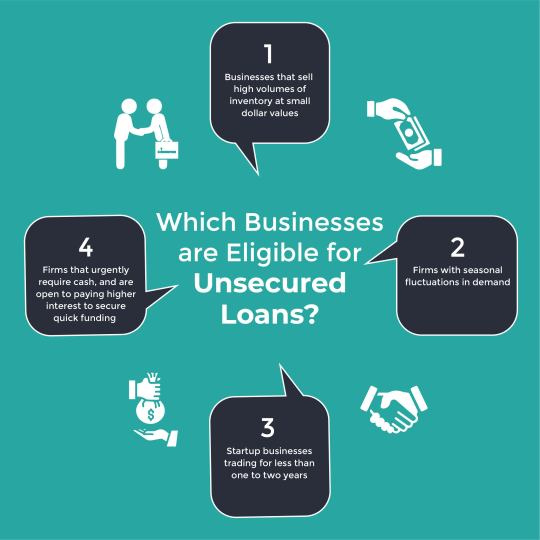

Which Businesses are Eligible for Unsecured Loans?

Firms must meet the eligibility criteria for getting unsecured loans.

The following are the minimum requirements to qualify for collateral-free small business loans:

● ABN: The firm must have an active Australian Business Number (ABN) to apply for collateral-free funding. In Australia, sole traders are not mandated to register for an ABN. However, if you apply for unsecured business loans for sole traders, having a registered ABN is required.

● Business History: The borrower must demonstrate that the firm has been operational for six months or longer to get a collateral-free working capital loan.

● Turnover: The firm must have a monthly turnover of at least $5000. This requirement ensures the business is financially stable enough to service repayments considering typical unsecured business loan rates.

A business owner must assess if they meet the eligibility criteria before applying for an unsecured loan. In addition, they should also consider if this form of funding is suitable for their business. Typically, the following types of businesses benefit the most from unsecured loans:

● Businesses that sell high volumes of inventory at small dollar values.

● Firms with seasonal fluctuations in demand.

● Startup businesses trading for less than one to two years.

● Firms that urgently require cash, and are open to paying higher interest to secure quick funding.

Pros and Cons of Taking an Unsecured Business Loan

A firm can leverage several benefits when they get an unsecured business loan. However, they must also consider certain downsides before deciding to go for collateral-free funding. The following are the top advantages of taking an unsecured loan:

● No Need for Collateral: Unsecured business loans allow business owners to get access to funds without putting up their assets as security. They can keep their property and other valuable assets safe no matter what happens in the business. Startup enterprises with little to no assets also benefit from unsecured business loans.

● Quick and Seamless Approval Process: Unsecured loans require minimal documentation as no collateral is involved. In most cases, firms can get low-doc approvals when they apply for unsecured business loans upto $500,000. The approval process takes less than a day for most applicants, and a borrower can get the money in their account within one to three days.

● Cash Flow Optimisation: Unsecured loans can help businesses manage their cash flow fluctuations more efficiently. The quick infusion of cash allows the borrower to optimise their cash flow and fulfil their working capital requirements. This aspect is especially beneficial for seasonal businesses that experience a lot of variations in their cash flow.

● Flexibility in Use of Funds: Unsecured loans offer flexibility in how you can utilise the money. Unlike certain forms of business lending like asset or trade finance, unsecured loans do not have hard and fast rules about the use of funds. Business owners can use it for inventory, expansion, hiring, or any other business purpose.

● Building a Good Credit History: Many alternative lenders provide collateral-free funding to businesses that do not have high credit scores. Your firm can get an unsecured business loan with a bad credit history and focus on timely repayments to improve the records. When you repay the loan diligently over time, it can help you build a strong credit history to get better loan terms in the future.

Businesses should consider both sides of the coin when they compare business loans and decide on the type of loan to choose. The following are some potential issues that borrowers must keep in mind while taking unsecured loans:

● Higher Interest Rates: An unsecured loan represents a high risk for the lender. If the borrower defaults on the repayments, the lender cannot fall back on any collateral to recoup their loss. That is why they charge a higher interest rate that reflects this risk. However, the interest rates vary depending on the unsecured business loan types and the creditworthiness of the borrowing firm.

● Shorter Loan Terms: Lenders typically want their money back faster when they lend a sum without any collateral security. That is why many unsecured financing options come in the form of short-term business loans. Generally, SMEs can get collateral-free funding for upto three years.

● Cap on the Loan Amount: Low-doc unsecured loans are usually capped at $500,000. Since unsecured business loans carry more risk, lenders are often hesitant to approve sums higher than this cap. However, it is not impossible to get a higher loan amount. Eligible businesses with a good credit history may be able to borrow more than $500,000 in some cases with full-doc approvals with formalities on the ATO portal.

How to Choose the Right Option for Your Business?

If you are a business owner in Australia seeking collateral-free loans, you should carefully compare your options before applying for credit. Making multiple credit inquiries can potentially ruin your credit score. Hence, it is crucial to be selective about the options you explore. The following tips can help you simplify the process and help you get a business loan product that suits your needs:

● Look for Loans Tailored to Your Requirements: As a first step, you should ascertain the business purpose for which you need a loan. Do you require money to renovate your business premises? Or do you need a cash flow buffer to navigate seasonal dips and peaks? In the first case, a lump sum loan might be a suitable choice to fund your renovation project. In the second scenario, an unsecured credit line may provide a better solution. Your loan purpose will help you narrow down to the best unsecured business loans for your unique requirements.

● Evaluate Your Business Performance: Lenders determine unsecured business loan interest rates and other loan terms based on factors like business performance and creditworthiness. If you have been operating for over a year with a high monthly turnover rate, you may find it easier to get large unsecured loans. On the other hand, if your business is relatively new with limited cash flow, the lenders may be more conservative with lending you money. You should account for these factors while choosing the most suitable options to ensure an easier approval process.

● Check Available Government Schemes: Business owners in Australia can check for available government schemes before applying for loans. For example, the Australian government implemented the SME Guarantee Scheme till June 2022 to extend the availability of credit for SMEs in the country. Although this scheme has expired, you can keep an eye out for unsecured business loans with government guarantees. Government-backed loans tend to be cheaper, making it easier for SMEs to get funding for growth. An experienced financial broker can help you discover relevant schemes and select the best loan products to finance your business.

● Consult a Finance Broker: SMEs rarely get unsecured loans from banks due to their strict lending criteria. In such cases, they can apply for collateral-free loans with alternative lenders. However, many business owners do not know which lenders to approach and how to access the right loan products. When such a situation occurs, it is best to consult an expert broker. A finance broker can evaluate your business performance and assess your financial requirements to suggest suitable options. They can connect you to trustworthy lenders and streamline the process of choosing and applying for loans.

Documents and Procedures to Apply for Unsecured Loans

After exploring and comparing various loan products, you can apply for a suitable option. The procedure to apply for an unsecured business loan typically consists of the following steps:

● Finalise Your Loan Requirements: An eligible business owner can get an indicative quote from the finance broker to determine the potential repayments for an unsecured loan. This quote will help you ascertain how much you should borrow, considering your ability to afford the interest payments.

● Prepare Your Business Documents: Typically, SMEs must submit their identification details and banking documents for the past six months while applying for low-doc unsecured loans. However, if the loan amount exceeds $500,000, you may have to complete formalities on the ATO portal and submit additional documents. Full-doc loan approvals require detailed financial statements, ATO statements, and business activity statements (BAS).

● Submit Your Loan Application: You can fill out the online loan application form and furnish the required documents in consultation with your broker. You can expect to hear back from the lender within twenty-four to seventy-two hours. In most cases, applicants get their loan approvals within one day.

● Sign the Loan Agreement: Once the lender shares the approval, the borrower must carefully check the loan terms. You should assess the agreement to determine the interest rate, repayment period, and additional requirements like a personal guarantee. In case of queries or concerns, you can discuss them with your finance broker to get more clarity. If you are satisfied with the loan agreement, you can sign the document. Once the agreement is finalised, the lender will provide you with the borrowed sum.

Do’s and Don’ts for Streamlining Your Loan Application

When applying for unsecured business loans for sole traders or other types of SMEs, you should follow certain best practices. Being careful while finalising your loan application can increase your chances of getting approved. But before we delve deeper into the do’s and don’ts, let’s break down the common issues that can cause lenders to reject your loan application:

● Poor Credit History: An unsecured loan is quite risky for the lender. As a result, they may be hesitant to lend money to a firm with a poor track record of managing credit. If your credit score is low, you should consult a finance broker to connect you to lenders who provide unsecured business loans despite bad credit history.

● High-risk Industry: Some industries are more volatile than others. Companies operating in these industries may find it tougher to raise large unsecured loans. Lenders assess the firm's performance alongside key industry trends to determine whether to accept or reject the loan application.

● Cash Flow Issues: Businesses with inconsistent revenues or long invoice cycles may struggle to service the debt and default on repayments. In such cases, lenders may reject loan applications from firms with high-risk cash flow problems.

● Inadequate Trading History: Typically, businesses trading for six months or more are eligible for unsecured loans. However, some lenders may consider a trading period under one or two years to be too risky for lending a collateral-free sum. Thus, inadequate trading history can be one of the likely reasons for getting rejected when you apply for a loan.

● Existing Debt: If your business already has a lot of debt on the balance sheet, lenders may be more conservative when they evaluate your application. High existing debt is one of the top reasons for rejecting applications for unsecured loans. When you have a significant debt burden, a new lender may be worried about your ability to service all the loans.

The above issues can give rise to roadblocks when you apply for an unsecured loan. However, the following do's and don'ts can help you avoid common mistakes and get approved for a loan.

What to Do While Applying for an Unsecured Business Loan?

● Be Transparent: A detailed and transparent application is more likely to get approved. When you furnish all the relevant documents, it becomes easier for the lender to gauge your requirements and assess your intentions.

● Clarify the Loan Purpose: A firm can use the amount from an unsecured for any type of business expense. Typically, lenders do not impose any rules about how the funds can be used as long as they are utilised for legitimate business purposes. However, a firm can increase the competitiveness of its loan application by clarifying the purpose of the funds. They can explain how they plan to use the money to run, grow, or expand the business. This plan can help convince the lender that the borrower has a legitimate reason for borrowing the amount.

● Improve Your Credit Score: Lenders assess the risk level associated with a loan application by reviewing the applicant's credit history. A high credit score indicates that the applicant is likely to repay the loan without defaulting on instalments. Hence, businesses with good credit records find it easier to get collateral-free loans. If your credit score is poor, you can still get unsecured business loans. However, it is advisable to focus on increasing your creditworthiness to ensure easier approvals in the future.

What Not to Do While Applying for Unsecured Business Loans?

● Avoid Excessive Borrowing: Debt is a valuable source of funding for most businesses. However, firms must strike the right balance when taking new business loans. Excessive borrowing or applying for a sum higher than required can put off potential lenders.

● Do not Submit Multiple Applications within a Short Span: If you apply for business loans with multiple lenders in quick succession, it can lower your credit score. It is crucial to carefully compare lenders and submit well-thought-out applications. Indiscriminately applying for different loan products signals to lenders that you do not exercise discretion while seeking credit. As a result, they may flag your application in the high-risk category.

● Do not Allow Repeated Credit Checks: Business lenders request permission from firms before running hard credit checks. They cannot run these checks without the borrower’s formal consent. Too many hard inquiries within a short span can harm your credit score. Hence, you should be cautious before allowing multiple credit checks. Instead of permitting credit checks, you can get an indicative quote from expert finance brokers. They can help you get pre-approved without any upfront credit checks so you can get the necessary information without compromising your credit score.

Conclusion

Unsecured loans can be instrumental to business growth and expansion in many Australian SMEs. These loans offer incredible flexibility to borrowers, providing them with the leeway to fuel their businesses without tying up assets. You can explore various collateral-free funding avenues and unsecured business loans with government benefits. Contact the lending experts at Broc Finance to learn more about the available options and find unsecured loans that match your needs. Our experts can help you with everything from startup business loans to bad credit business loans to help you steer your venture to success!

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-unsecured-business-loans/

#business loans in Australia#secured business loans#unsecured business loan#unsecured business loan types#quick business loans#business overdraft#business line of credit in Australia#short-term business loans#small business loans

0 notes

Text

Financialization & Zombie Neoliberalism

Paul Keating tells us that Australia is on its way to becoming the unofficial 51st state of America. The former PM is not being complimentary in his assessment of our current defence policies when saying this. No, Keating is issuing a warning about our docile behaviour in this space. The truth is that Australia does follow the United States in many ways when it comes to economic and political trends. Especially, those on the conservative side of politics are constantly looking to take our country down well-trodden American roads. Financialization and zombie neoliberalism is where the US finds itself with private equity investment firms gobbling up all areas of life and business in America.

Housing A Major Investment Commodity

We have a housing affordability crisis in Australia, as they do in America and in most Western nations around the globe. Shelter has become a major investment commodity globally, which has left large chunks of the population out in the cold. In Australia, our banks have grown incredibly wealthy on the back of the home loan business over the years.

“Household net wealth sat at a record $16.2 trillion in the March 2024 quarter, boosted by a record level of property assets of $11.0 trillion as at 31 March 2024. As a proportion of net household wealth, residential property accounted for around 67.9%, up from 61.7% in December 2020.”

(https://www.adviservoice.com.au/2024/06/household-wealth-rises-to-record-over-16-trillion-spurred-on-by-property/#:~:text=Householdnetwealthsatat,from61.7inDecember2020.)

High levels of immigration into the country has exacerbated a housing shortage in combination with a proliferation of short term holiday rental properties draining the available stock further. Long term rents have sky rocketed in response to these market forces. Our timid governments still in thrall to zombie neoliberalism refuse to consider caps on things like rent increases despite the inflationary effect of these 20% and 30% increases.

Private Equity Investment In Residential Property In America

In America, Wall St hedge fund investors and private equity firms have been buying up residential property in cities around the nation. In a number of cities they have become the major landlords in town. They now own around 10% of properties nationally. This could be seen as a good thing economically if not for their behaviour. You would think cashed up corporations would be good landlords. No, in the extreme world of American financialization these landlords have not only pushed up rents more aggressively than ever, by around 30%, but they also skimp on fixing the property and maintenance for their tenants. Only in America! It is all about return on investment and screwing every dollar possible at the lowest cost. Rising rents are a major factor in sticky high inflation in economies everywhere. President Joe Biden, prior to stepping out of the race, promised to cap rent increases by corporate landlords to 5% annually. Even, the avaristic Americans are looking to cap rental increases but sleepy Australian governments leave the market to sort itself out. Zombie neoliberalism still stalks the halls of power in Oz. Most Aussie MPs are landlords by the way, including PM Anthony Albanese. More Australians get rich via property investment above and over everything else.

“The latest data from the Australian Taxation Office (ATO) reveals that 2,245,539 Australians or around 20% of Australia’s 11.4 million taxpayers owned an investment property in 2020-21 – this is the latest data available at the time of writing and was released in June 2023.”

(https://propertyupdate.com.au/how-many-australians-own-an-investment-property/)

Financialization Poses Further Wealth Inequality Opportunities

Financialization is really a cannibalising of existing societal infrastructure. It feeds on the necessary stuff we have put in place to make our lifestyles possible. Shelter, a roof over our heads, is now commodified as the major investment opportunity for a section of our population. If Australia goes the way of America, with private equity financialization running rampant through everything we will see an increase in the already growing divide between the wealthy and the working poor. We don’t tax wealth in this country but income, mainly from workers. This means with the aid of tax minimisation arrangements, like family trusts and shifting profits to tax shelters, the wealthy avoid paying their fair share of tax in Australia. We learned this from our former British colonial masters. Conservative British billionaires contribute even less to annual tax revenues in the UK than their American counterparts. Capital gains tax contributes less than 2% to annual tax revenues in the UK, this is despite the enormous wealth within the financial sector operating in Britain. Many of the tax havens are British island territories and are a part of the web of tax minimisation established by the financial realm in the UK at the height of the Thatcher years. Stripping the state of assets and access to the wealth of private citizens are all aspects of the neoliberal playbook. Meanwhile, for everyone else at the bottom of the food chain neoliberals want the ‘user pays’ economic model to cover everything in life. You will notice already the plethora of fees, charges, subscriptions and rents being levied on everything you do in life in the 21C. In Australia, this means our hospitals and health system ultimately becoming privatised. This is already happening with private equity buying up hospitals in Australia. They promise greater efficiencies if the hegemony of capital markets reign, but ‘for profit’ ownership of health facilities invariably see cost cutting measures which do not put patient care first and foremost. Education under the LNP will see further neglect of the state school system and the prioritisation of looking after private schools. This occurred for the decade they were last in power and saw more parents leaving public education for the private sector with their kids. The best schools in the world are consistently those in the Scandinavian nations and they are public schools, where they fund them well to ensure top quality educational outcomes for their children. The split between public and private in Australia is a perennial canker displaying the century long tussle between models and ideological philosophies in our nation.

Choose An Independent Australian Future

We do not want to become the unacknowledged 51st state of America because the US is a deeply divided and extreme nation. The China scare tactics of conservatives and US economic and defence policies must not box us in to the tacit support of everything America proposes in this space. Yes, we do not agree with the totalitarian regime underpinning China, but we should also be clear about the extremely unfair state of economic life in the US. The minimum federal wage in America is $7.24, whereas in Australia it is $24.10. The neoliberal economic policies which have proliferated in America since Ronald Reagan have produced a massively inequitable state of wealth among Americans. A land of billionaires boasting obscene levels of wealth and tens of millions of Americans living in abject poverty. Two speed economies have become the norm in neoliberal economies around the globe. The ‘trickledown effect’ never materialised and the economic theories of Hayek and Friedman made some very wealthy at the expense of the rest of us.

It is time to redress this situation and rebalance the wealth distribution around the globe. Financialization and zombie neoliberalism must be rooted out from our governments and business sectors.

Biden Invested In American Manufacturing

President Joe Biden has overseen the injection of trillions of dollars into American homegrown manufacturing. This contrasts the previous decades of financialization in the US and the growth of private equity. America had been putting all its eggs into the money market to the detriment of its millions of skilled workers, as manufacturing jobs flooded offshore. The rise of Trump as the king of grievance politics was borne on the back of this. Of course, Trump is a liar and conman and has never done anything for American workers but make them empty promises. President Biden has led the greatest investment in America by an administration ever.

“$563.6 Billion in public infrastructure, semiconductor and clean energy investments in the United States under the Biden Administration, including: $303.4Bannounced for transportation investments in roads, bridges, public transit, ports and airports, as well as electric school and transit buses, EV charging, and more.”

(https://www.whitehouse.gov/invest/#:~:text=563.6Billioninpublicinfrastructure,EVchargingandmore.)

This is just some of the massive investment in American manufacturing for a clean energy and high tech future for American workers. Trump did next to nothing during his chaotic time in office, accept lower the tax rate for the wealthy and corporations.

Investing In Australian Manufacturing?