#savings certificates

Explore tagged Tumblr posts

Text

Post Office Grievance: Kisan Vikas Patra Issues

Grievance Status for registration number : DPOST/E/2025/0000008Grievance Concerns ToName Of ComplainantYogi M. P. SinghDate of Receipt01/01/2025Received By Ministry/DepartmentPostsGrievance DescriptionPosts >> Allegation of Corruption/ Malpractices/Harassment >> Allegation of corruption Post Office : 210428An application on behalf of Deependra singh S/O Ranjeet Singh, Village and post…

1 note

·

View note

Text

Shang Qinghua, internally: Since I'm now married to Mobei-Jun, that means I'm basically his wife, right? I can sleep in late and do some writing? Can I finally... relax?

Mobei-Jun, handing Shang Qinghua a shit ton of paper work: You are in charge now, I'm going to spend the day napping

Shang Qinghua: ...

Shang Qinghua: MOBEI-JUN'S THE WIFE?!?!?!?!

#shang qinghua: i did not sign up for this shit#mobei jun holding up their wedding certificate: you literally did#what sqh doesn't know is that he has been doing mbj's job for years#i love this overworked hamster#shang qinghua#airplane shooting towards the sky#mobei jun#moshang#mxtx#mxtx svsss#svsss#scum villian self saving system

2K notes

·

View notes

Note

He's taking his eleven children to dunkin donuts after school

"Hi can I get a lahge iced regulah, three big things uh assorted munchkins, an'... eleven small strahberry coolattas. With whipped cream."

#asks#fun fact after saving the image in the ask i remembered i had to email my supervisor my first aid certification#can you guess which image i accidentally included as an attachment#i caught it right before sending though 👍

148 notes

·

View notes

Text

The Birth Certificates

Israel killed his wife, and his newborn children as he was picking up their birth certificates.

The mother was also a physician.

Richard Medhurst

#photography#palestine#gaza#islamophobia#israel#Birth certificate#war crimes#war criminals#crimes against children#crimes against women#crimes against humanity#genocide#gaza genocide#palestinian genocide#israel is committing genocide#stop the genocide#genocide joe#ethnic cleansing#israeli occupation#unrwa#free gaza#gaza strip#gazaunderattack#fuck israel#palestine genocide#free palestine#save palestine#i stand with palestine#palestine news#palestinian lives matter

82 notes

·

View notes

Note

Hi! I just got The Batman Files and I was really just looking for the pages pertaining to my favorite character ever, Jason Todd, and I just got to his Death Certificate, and I realized that on it, it says he died of asphyxiation due to smoke. Which basically says that he was alive while the Joker tortured and beat him, that he was alive when the bomb in the warehouse went off, that he was alive even after the warehouse came down on top of him. That he didn't die due to his injuries, to the explosion, to the rubble; he was 15 years old and he survived all of that, but he died of the smoke inhalation.

Meaning that if Bruce has been just a little bit faster, he may have been able to have another moment or too to hold his dying son, but ultimately not save him; not with all the injuries Jason would have undoubtedly sustained from aforementioned torture, explosion, and collapsed building.

Yeah that’s the tragedy of it all. That he didn’t actually die from the explosion, which Joker apparently made “soft” enough not to kill immediately, no, Jason died because he couldn’t breathe. Not even due to a collapsed lung, no. Smoke.

I’ll never not be salty about Bruce taking too long to get there 😔

#the Batman files#honestly I blue screene for a second the first time I read the certificate#that is NOT what I imagined getting the Batman files#likewise was just looking for content on Jay#and instead I got this#but you know if we already think that’s horrible#imagine Bruce getting the autopsy results and realizing that he couldn’t blame joker for Jason’s death#not entirely#because in the end BRUCE was too late to save Jason#and joker even ‘left’ him that tiny window to save Robin#but he didn’t#there’s a reason he showed the most symptoms of ptsd after Jason’s#death#a death in the family#ghost talks

52 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

ah shit, here we go again. welcome zi rui!!

#ts4#s#*soju save#next baby will be delivered at home I cant EYE CANT#its saur long#i only go to the hospital so that they can have a birth certificate kfdjkfg#*abigail gen

238 notes

·

View notes

Text

the suffererrrrrrrrr

#I be rushing these drawings but IM SICK IM FUCKING SICK IM GOING TO FUCKING KMS UGHHHHGGGGG 💔💔💔💔💔💔💔#So I stuck w the idea. Fugo’s pc box is now the host of virus Nara’s organs ❤️#And he’s forced to listen to his heartbeat. Loud. Every second of the day.#And I’m making him khs bc there is NO WAY you wouldn’t go insane from that#Lowkey I was thinking ab the tell tale heart bc while the story is unrelated the heartbeat thingie inspired me ig#Ibispaint tools are saving my life I love the squiggly line setting thing#I have learnt the basics of ibispainting….. when do I get my certificate to become an ibispainter#I fucking hate this man’s hair I will probably rework it#It looks good in my other art style but not this one idk 💔#Is the text legible#Fugo my baby it’s not the floorboards#Something took over me and made me use something that isn’t a shade of red or pure white/black.#Idk feels weird to use gray#It probably sounds rlly weird of me to say that but 😭#jjba#jojo no kimyou na bouken#jojo's bizarre adventure#pannacotta fugo#Jjba au#au#alternate universe#numerical guillotine au#Digital art#ibispaintx#Listening to suki suki daisuki (ghhh animation memes…..) and I get even more inspired by the covers aesthetic#I HEAR YOUR HEART BEAT TO THE BEAT OF THE DRUMS ‼️‼️‼️ but it’s making you cry and sob and fret

11 notes

·

View notes

Text

#chanukahproject#This is the menorah my Rabbi gave me after I finished my conversion (well. After I signed the Certificate)#(get your shit together DAVID)#He very publicly gave me a set of beeswax candles and was VERY surprised to hear that I didn't have a menorah to fit them#I had a mini-norah and a candelabra that happened to have nine branches but mom and I were saving up for a really nice one#So he 'stole' one from the Sisterhood gift shop#Wrote his name on a post it that said he'd bring a check when they were open on Sunday#All of my menorahs are my favorite but this one is SPECIAL

76 notes

·

View notes

Text

I don’t know what young person with their own laptop/computer/whatever device for the first time needs to hear this but:

Get yourself a goddamn password notebook. Label the pages alphabetically. Add your important log-in information, passwords, etc. Put the notebook in your underwear drawer and sleep easy knowing that if your device is stolen, trashed, or bricked, you will not spend three hours manually recreating new passwords or accounts.

This has been a PSA.

#ra speaks#personal#computers#technology#growing up ma and dad had a password book that had everything from AAA membership info to webkinz accounts.#I got my own laptop and moved out and BAM. I didn’t know my passwords for anything and the computer didn’t have them saved so I had to call#my mom and get her to look em up in the notebook. made my own the next day and been cruising smooth ever since.#‘bwahhh but what if someone steals it?’ I mean that would suck but if someone is being so thorough as to steal a password notebook from#from you underwear drawer they probably took your SS card and birth certificate and more important things#than your webkinz account information.

20 notes

·

View notes

Note

So I can put money in a cd and just forget about it? That sounds lovely to me lol I love not having to remember things

Sweetie, you can forget it for years--DECADES, even! The set-and-forget model of savings and investing is super helpful if you have an anxiety attack every time you think about money. Here's more:

From HYSAs to CDs, Here's How to Level Up Your Financial Savings

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

If you found this helpful, consider joining our Patreon.

47 notes

·

View notes

Text

how people learn ii: learners, contexts, and cultures (2018)

pspsps autism website. were all so valid actually

#ive started the classes for my learning and motivation certificate#starting with human development and the psychology of learning#4 week and 8 week summer classes at the same time!! save me!!!

9 notes

·

View notes

Text

Ferdibert Hot Frosty

Ferdinand, after his brush with snowman-turned-human death and Christmas miracle recovery: I think... I'm real now. Hubert, cupping his face and looking at him warmly: This is going to be a legal nightmare.

#hot frosty#fe3h#ferdibert#fe3h crossover#fe3h incorrect quotes#hot frosty spoilers#spoilers#basic premise is Ferdinand snowman becomes a person from a magic scarf from Hubert#then by the power of love and Christmas - he becomes a real for real person#and I guarantee you that Hubert is 100% occupied with getting him paperwork from then out#this man had no fingerprints until Christmas magic saved him xD#he has no birth certificate...... no documented history........ he was born from a magic snow bank#Hubert's love language is acts of service and this is gonna be one wild act#anyway this was a wildly predictable film but the kind of bad that's sorta good

6 notes

·

View notes

Note

I know we've only spoken a few times, but might I ask what discipline you're hoping to go to grad school for?

my BA is in art history, and ideally i’d like to work in museum curation! so whether grad school is art history or some variant of Museum Studies, something related to that (i know it’s a tough field to get into 😭 but so is everything these days so…)

getting a c1 certificate in german (and eventually italian…) is partly because it’s a good language to know for art history, but mostly it’s a combination of 1) really just enjoying the language and 2) i’ve spent. so many years studying it. at my first college it was a second major, and when i transferred, because i was online, i couldn’t even minor in it, so i would like something to show for it! i’ve been at a b2.2 since 2018 and was about to take c1 classes last fall before Stuff Happened, and even if i never use it professionally in any capacity i would just like to be able to have some sort of official recognition of proficiency lol

#q&a#galileosballs#(you didn’t ask about the language thing but i thought i’d elaborate based on the post you were responding to lol)#also i am considering staying in the us for a few years working and saving money and then looking into grad school in europe possibly#we will see. lol#but in that case germany or austria would be placea i’d consider highly so a c1 german certification would help a lot with that as well

7 notes

·

View notes

Text

CHAT I JUST APPLIED TO COLLEGE LET'S GOOO

5 notes

·

View notes

Text

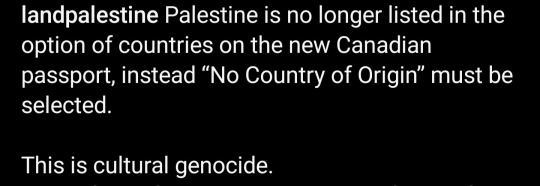

I would expect something like this from the US or Germany. Kinda surprised that Canada would pull this. Are people going to start burning old maps, books and almanacs? Israel has already done a great deal to destroy official Palestinian records. This is Canada's complicity in literally erasing an entire land and its people.

#no country of origin#this is some bleak dystopian shit#really Canada?#apartheid#save palestine#ethnic cleansing#israel is an apartheid state#seek truth#free palestine 🇵🇸#genocide#illegal occupation#israel is committing genocide#israeli war crimes#from the river to the sea palestine will be free#birth certificates#passports#college degrees#property deeds#im the least religious person you will ever meet but Israel is bringing a biblical level apocalypse down onto their own heads#israel is like a bratty child plugging their ears refusing to hear reality#you will never erase Palestine or its people#stolen lives#stolen land#stolen culture#palestinian culture#right to self determination#seek the truth and share it#spread awareness#we will never forget#this simply will not stand forever

10 notes

·

View notes