#salary package structure

Explore tagged Tumblr posts

Text

House Rent Allowance (HRA) under the Income Tax Act of 1961

House Rent Allowance (HRA) stands as a significant component of salary for many employees, offering tax benefits under the Income Tax Act of 1961. Yet, understanding the intricacies of HRA and its tax implications can often be perplexing. In this blog post, we delve into the fundamentals of HRA, providing clarity and insights to taxpayers. Understanding House Rent Allowance (HRA): What is HRA?…

View On WordPress

#documentary evidence#exemptions#finance#House Rent Allowance#HRA calculation#income tax#Income Tax Act 1961#investing#personal-finance#rental expenses#salaried individuals#salary package structure#self-employed#tax#Tax Benefits#tax implications#Tax Planning#tax savings

0 notes

Text

INDIAN NAVY TRADESMAN SALARY DETAILS #trending#viral#ndainvizag#defenceinvizag#navysalry#navy#armtv Indian Navy Tradesman Salary Details: What You Must Know! If you're curious about the salary structure for Indian Navy Tradesmen, you're in the right place! In this video, we delve into the detailed breakdown of the earnings and benefits associated with being a tradesman in the Indian Navy. From basic pay to additional allowances and perks, we cover everything you need to know to understand the financial benefits of this prestigious role. Whether you're considering a career in the Indian Navy or simply curious about the compensation, this video provides all the insights. Stay tuned till the end for a comprehensive overview of the salary components and how they add up to make a lucrative package. Don't miss out on this essential information!

Call:7799799221

Website:www.manasadefenceacademy.com

#IndianNavy#trending #TradesmanSalary#trending #SalaryDetails#NavyCareers#DefenceJobs #IndianDefence#trending #SalaryBreakdown#MilitaryPay#army #CareerInNavy#IndianNavyJobs

#Indian Navy salary#tradesman salary in Indian Navy#Indian Navy tradesman#Indian Navy salary details#Indian Navy pay scale#Navy tradesman earnings#Indian Navy benefits#Indian Navy allowances#Indian Navy tradesman pay#tradesman salary details#Indian Navy jobs#career in Indian Navy#Navy tradesman perks#Indian Navy tradesman benefits#Indian Navy financial package#Navy salary structure#Indian Navy tradesman pay scale#Navy jobs salary#Indian Navy compensation#Indian Navy income#tradesman salary in military#Navy tradesman income#Indian Navy salary breakdown#military pay in India#Navy tradesman financial benefits#Indian Navy career earnings#Indian Navy tradesman guide#Navy tradesman job details#Indian Navy pay and perks#Indian Navy salary insights

0 notes

Note

What people miss with regards to the Jordan Neely/Daniel Penny story is that Penny didn’t choke him out because he’s a bad person. He did it because of socioeconomic factors which made him desperate. The alternative to him being found not guilty would be him going to prison, and that wouldn’t have been justice. Penny needs to be treated with grace and care in this undoubtably troubling time for him

I think my scambaiting post must be going around because I'm getting some asks about it. I'm mostly just deleting them if they're not interesting or instructive, but I think this one actually might be.

My OP made a gesture at a materialist analysis which should be performed. This material analysis would have to do with the flow of money, labour, and resources as it actually exists in the world: the extraction, extortion, and theft of raw materials; the purposeful, violent destabilisation of entire regions by the military arms of the USA, Canada, Europe &c. to force people to work for pennies, so that labour will be incredibly cheap compared to what it would cost if performed by most citizens in the imperial 'core'; and other measures that are taken to ensure that value flows from colonised nations to colonising nations. (These measures also include the devaluing of institutions in the 'periphery' such that advanced degrees from certain countries are simply worth less than others; and the restricted ability of those in the 'periphery' to travel or migrate across borders with the freedom afforded to those with imperial citizenship.)

So certain people are in a situation where structures and enforcers of power have made them poor and desperate on purpose so that they can be 'superexploited' at a level beyond that experienced by most people in the imperial 'core'. This is the purpose of imperialism, and it's the purpose of the concept of 'race.' People work in factories for very little money, because the imperial periphery is supposedly only good for the production of raw materials (fabric; t-shirt blanks; assembly of parts of electronics &c.); the design, the artisanship, the packaging, the 'refining,' the making of the chocolate bar from the cocoa, everything that confers 'value' to the item, is done in the imperial core, and that increased 'value' / sale price is added to the GDP of the country in which the product is completed.

In fact this 'raw material' is not 'raw' at all, and it also invovles design and artisanship—but the people of the 'third world' cannot 'design' anything and they cannot be 'artisans'—nothing they make can be labelled as 'handmade' or 'hand-sewn' even if it is literally made with their hands—because they are not considered as people in that way.

But that's the product realm. In terms of the internet (even setting aside the physical materials, space, energy, water &c. required to maintain the internet):

Things (such as Amazon's failed "Just Walk Out" thing) are advertised as "artificial intelligence" despite the fact that thousands of people in India are forced to do work that is tedious, time-consuming, and often horrific and traumatising (consider content moderation!!) in order to make them work. Their material conditions—which are created and maintained, in the most violent manner imaginable, on purpose in order to force them to do this work—render many people desperate enough to take these jobs.

If there are people, who are reachable online, who at a baseline are making a hundred times what you are making, whose currency has incredible purchasing power where you live, and you can get some of that money—if you can work for yourself this way, obviously you're going to do that. This happens because there's money to be made in it. If people can set up an operation and train hundreds of people in how to do this, and take most of the profits and still provide a salary that's attractive to people because of how high the margins are, then obviously that's going to happen. This is just, the concept of capitalism. If there is a way to make money doing something, someone is going to be doing that thing.

Material analysis is looking at the world as it actually exists, in order to figure out how materials, labour, and value are 'flowing' on local and global scales, as a means of determining why things happen the way they do. Like, on a base level, that's what it means to analyse something—to try to figure out why it happens the way it does.

This anon, in sending this ask, didn't understand what any of this meant, or didn't want to consider it, or something. They were unable or unwilling to consider a different lens than that of personal desert, personal merit, and innate personal badness / criminality. The concept of trying to understand where money is, how it moves and why, as a base level of knowledge necessary to understand why there is money to be made in doing certain things, doesn't compute to them—so they have to move things back into the realm of personal desert, and act like I'm saying that people who commit acts of interpersonal violence "deserve" to be allowed to commit that violence as long as they're going through something, whether or not the thing they're going through created the necessary circumstances for, or has any other direct relation with, the act of violence being committed (basically "some people commit violence to cope").

All of that is kind of typical—it's very normal for people to act like asking them to consider people in the 'third world' as actual human beings with human things like "circumstances" and "motivations" and "thoughts" that influence their actions is tantamount to spitting in their grandmother's face.

But what's most interesting to me about this ask is how, in order to dismiss the idea of material analysis as necessary to understand why things happen and to reassert an interpretive framework of individual criminality, anon uses the idea of interpersonal racial violence as something that we can all agree is caused by innate criminality and not by material factors. As if by comparing scamming to this act of violence, it emphasises the innate criminal personality at the root of both acts. As if, obviously, we can all agree that people who commit this kind of violence are just evil demons who "deserve" to be locked up—so saying "the material fact of present-day colonialism creates the conditions for this kind of scamming" is tantamount to saying "we shouldn't lock criminals up in prison." If the latter statement is unthinkable, then so, by comparison, is the former.

Except that this concept of "the criminal" as being a specific "type" of person who uniquely does and deserves evil, and who needs to be locked up in a cage for the good of the rest of society, is exactly what I am, in fact, intending to question. I think the anon would be surprised to learn about the vast body of work (I mean texts, but also direct activism) conducted under the heading of "prison abolition."

32 notes

·

View notes

Text

Combined Graduate Level Exam: Eligibility Rules You Must Know

The Combined Graduate Level (CGL) Examination, carried out by way of the Staff Selection Commission (SSC), is one of the maximum prestigious and sought-after government recruitment checks in India. It opens the doorways to a wide range of Group B and Group C posts in various ministries, departments, and subordinate offices below the Government of India. Each 12 months, lakhs of aspirants from across the u . S . A . Compete for a limited number of vacancies, making it one of the most competitive tests inside the nation.

Combined graduate level examination eligibility

1. Objective of the SSC CGL Exam

The examination guarantees a transparent and benefit-based totally selection procedure for jobs that provide stability, security, and the status of operating for the government.

The posts consist of roles like:

Assistant Section Officer (ASO)

Inspector of Income Tax

Assistant Audit Officer

Central Excise Inspector

Statistical Investigator

Auditor

Junior Accountant

Divisional Accountant, and plenty of more.

2. Eligibility Criteria

To apply for SSC CGL, applicants have to fulfill the subsequent primary eligibility criteria:

a) Educational Qualification

A bachelor’s diploma in any area from a diagnosed university is the minimal requirement.

For positive posts, unique qualifications can be wanted (e.G., Statistics degree for Statistical Investigator).

B) Age Limit

Age varies depending at the publish, generally between 18 to 32 years.

Age rest is provided to candidates belonging to reserved classes (SC/ST/OBC/PwD).

C) Nationality

Candidates need to be Indian residents or belong to other eligible categories as described by way of the SSC.

Three. Structure of the Exam

The SSC CGL exam is conducted in four tiers:

Tier-I: Preliminary Examination

Objective kind, online

Total Marks: 200

Time: 60 mins

Tier-II: Main Examination

Objective type, on-line

Papers encompass:

Paper I: Quantitative Abilities

Paper II: English Language and Comprehension

Paper III: Statistics (for relevant posts)

Paper IV: General Studies (Finance & Economics, for AAO put up)

Negative marking applies

Tier-III: Descriptive Paper

Pen and paper-based

Essay/Letter/Precis writing

Marks: a hundred

Language: English or Hindi

Duration: 60 mins

Conducted for unique posts

4. Syllabus Overview

a) General Intelligence & Reasoning

Analogies, type, coding-deciphering, puzzle solving, syllogisms, and sample reputation

b) Quantitative Aptitude

Number gadget, percentage, mensuration, earnings & loss, ratio and percentage, time & paintings, algebra, geometry, trigonometry

c) English Comprehension

Grammar, vocabulary, comprehension, sentence correction, cloze assessments

d) General Awareness

Current affairs, history, geography, polity, economics, standard technological know-how

five. Preparation Strategy

Preparing for the SSC CGL exam requires consistent effort, a strategic take a look at plan, and smart time management.

A) Understand the Exam Pattern

Know the weightage of every section

Practice through previous year query papers

b) Focus on Basics

Strengthen your fundamentals in math and English

Make short notes for revision of GK and modern affairs

c) Regular Practice

Attempt day by day mock exams

Improve pace and accuracy

d) Stay Updated

Read newspapers, observe monthly contemporary affairs magazines

Use apps and on-line systems for daily quizzes

6. Job Roles and Perks

SSC CGL-decided on candidates get located in prestigious positions with the Government of India. Some of the blessings consist of:

Attractive Salary Packages: Ranging from Rs. 35,000 to Rs. 70,000 depending on the submit and place.

Job Security and Pension: Government jobs offer unrivaled task safety and post-retirement advantages.

Growth Opportunities: Regular promotions and opportunities to take departmental checks.

7. Challenges Faced via Aspirants

Despite the appeal of the CGL examination, aspirants face several demanding situations:

High Competition: With over 20 lakh applicants annually, opposition is fierce.

Changing Exam Patterns: The SSC on occasion modifies patterns and syllabus, requiring adaptability.

Limited Seats: With just a few thousand vacancies, handiest the maximum organized applicants prevail.

Preparation Time: It requires long-time period steady guidance, often for over a 12 months.

Eight. Recent Changes and Reforms

The SSC has been working to make the CGL examination extra obvious and efficient:

Online Application and Computer-Based Tests: To reduce mistakes and accelerate processing.

Normalization of Scores: Ensures fairness throughout extraordinary shifts.

Single Year Calendar: SSC now releases an annual calendar for all assessments, allowing better planning.

9. Role of Coaching and Self-Study

Many aspirants be part of training institutes to prepare for the CGL exam, especially for help in math and reasoning. However, with the rise of virtual learning platforms, self-study with online resources, YouTube tutorials, and ridicule test collection has come to be a popular and effective technique for many.

#regular college students#correspondence college students#Combined graduate level examination eligibility

2 notes

·

View notes

Text

National Institute of Fashion Technology - [NIFT], Patna

National Institute of Fashion Technology (NIFT), Patna – An In-Depth Overview (800 Words)

Established in 2008, the National Institute of Fashion Technology (NIFT), Patna is one of the key centers of excellence under the Ministry of Textiles, Government of India. Since its inception, NIFT Patna has been committed to nurturing creativity, innovation, and professionalism in the field of fashion and design. Strategically located in Bihar’s capital, this institute blends traditional cultural richness with cutting-edge design education.

Academic Programs

NIFT Patna offers various undergraduate and postgraduate programs designed to equip students with both creative and technical skills essential for the fashion and lifestyle industry.

Undergraduate Programs:

Bachelor of Design (B.Des) in:

Fashion Design

Fashion Communication

Textile Design

Bachelor of Fashion Technology (B.FTech):

Specialization in Apparel Production

Postgraduate Programs:

Master of Design (M.Des) – Focused on advanced design methodology and design thinking.

Master of Fashion Management (MFM) – Concentrated on business strategies, retail, and fashion marketing.

The curriculum is structured to provide theoretical knowledge, hands-on training, and industry exposure. A blend of classroom learning, workshops, internships, and live projects ensures that students develop a deep understanding of design concepts and business dynamics.

Campus Infrastructure and Facilities

NIFT Patna’s campus offers a modern environment conducive to learning, innovation, and collaboration:

Design Studios and Labs are equipped with high-end machinery and tools that allow students to practice weaving, dyeing, garment construction, printing, pattern making, and digital design.

Computer Labs: Advanced software for CAD, 3D modeling, graphic design, and garment manufacturing systems are accessible to students for academic and project work.

Library: A vast collection of books, journals, and digital resources covering subjects like fashion, textiles, marketing, and management.

Workshops and Resource Centers: For practical training in accessory design, leather craft, and traditional Indian textiles.

Exhibition Spaces: Areas for displaying student projects and hosting fashion events and displays.

Hostel Facilities: Comfortable and safe accommodation options for both male and female students with necessary amenities like Wi-Fi, common rooms, mess, and laundry services.

Cafeteria and Recreation: Clean dining facilities with a variety of food options, along with indoor and outdoor sports infrastructure.

Placement and Industry Interface

NIFT Patna maintains strong ties with leading fashion houses, retail giants, and manufacturing units, facilitating career opportunities and internships for students.

Placement Cell Activities:

Organizes annual campus placements

Conducts workshops on resume writing and interview preparation

Hosts mock interviews and career counseling sessions

Arranges industry visits and interaction programs

Top Recruiters Include:

Adidas

Arvind Mills

H&M

Levi’s

FabIndia

Pantaloons

Raymond

Van Heusen

Future Group

Tommy Hilfiger

Placement Statistics:

Average Salary: ₹5 to ₹8 LPA

Highest Package: Up to ₹12 LPA

Sectors Covered: Fashion design, apparel manufacturing, brand management, fashion merchandising, retail strategy, and textile development

Scholarships and Financial Assistance

NIFT Patna offers financial aid through scholarships to ensure that deserving and meritorious students are not denied education due to economic constraints.

Sarthak Scheme: Provides fee waivers ranging from 50% to 100% based on the student’s family income and academic performance.

UDAAN Program: Supports students pursuing higher studies abroad under exchange or twinning programs.

These initiatives promote inclusivity and accessibility in fashion education, encouraging students from diverse backgrounds to pursue their passion.

Student Life and Activities

Student life at NIFT Patna is vibrant, collaborative, and filled with opportunities to express creativity beyond the classroom.

Cultural and Technical Fests: Events like Spectrum and Converge provide platforms for students to showcase their talent in fashion, performing arts, and innovation.

Clubs and Societies: Various student-led clubs cater to interests like photography, styling, film-making, design thinking, entrepreneurship, and sustainability.

Guest Lectures and Workshops: Regular sessions by industry professionals and alumni offer practical insights into the global fashion ecosystem.

Internships: All students undergo compulsory internships with fashion brands, designers, or production houses to apply theoretical knowledge in real-world settings. Many of these internships convert into pre-placement offers.

Conclusion

NIFT Patna is a center of excellence that offers a holistic fashion education combining design, technology, and management. With its modern infrastructure, committed faculty, industry-oriented curriculum, and strong placement support, it creates well-rounded professionals ready to meet the demands of the global fashion and lifestyle market. The campus environment encourages experimentation, innovation, and cultural exchange—making it an ideal place for aspiring fashion designers, technologists, and managers to grow and thrive.

#NIFTPatna#NationalInstituteOfFashionTechnology#FashionEducation#DesignYourFuture#TextileDesign#FashionDesign#ApparelProduction#FashionManagement#NIFTIndia#CreativeCareers

2 notes

·

View notes

Text

MBA in HR

An MBA in Human Resource (HR) is a strategic management degree that equips professionals with essential skills in talent acquisition, employee relations, workforce planning, and organizational behavior. Given the rising importance of effective human capital management, businesses increasingly seek skilled HR professionals to enhance productivity and reduce attrition. This MBA specialization offers promising career prospects, with graduates securing roles such as HR Managers, Talent Acquisition Specialists, and Employee Relations Managers across industries like IT, FMCG, banking, and consulting.

The curriculum blends management, psychology, and legal aspects, covering topics like strategic HRM, diversity and inclusion, compensation structuring, and HR analytics. The two-year course is typically pursued after a bachelor's degree, requiring qualifying entrance exam scores (CAT, MAT, XAT, etc.). Institutions like Globsyn Business School stand out with their AICTE-approved programs and experiential learning approach.

Job opportunities are abundant, with top recruiters including KPMG, PwC, Deloitte, and Accenture. Salaries vary based on role, experience, and industry, with HR professionals earning competitive packages. Compared to other MBA specializations, HR focuses on workforce management, ensuring career stability and leadership potential. Ultimately, an MBA in HR is an ideal pathway for individuals passionate about shaping workplace culture and driving organizational success.

Learn more.

#mba in hr#HumanResourceManagement#careerinhr#HRJobs#top mba colleges in india#top mba colleges in bangalore#top mba colleges in pune#top mba colleges in delhi ncr#top mba colleges in gujarat#TopMBAColleges

2 notes

·

View notes

Text

Top College PGDM/MBA Acharya Institute of Management & Science (AIMS)/Top College PGDM/MBA MYRA School of Business/Top College PGDM/MBA Nitte School of Management/PGDM-MBA college under 2 lakh

Top PGDM/MBA Colleges Under 2 Lakh: AIMS, MYRA, and Nitte School of Management

Pursuing a Post Graduate Diploma in Management (PGDM) or a Master of Business Administration (MBA) is a significant step toward a successful career in business and management. However, the cost of education often becomes a concern for many aspirants. If you're looking for top colleges that offer PGDM/MBA programs at an affordable fee, here’s a list of some prestigious institutions providing quality education under INR 2 lakh.

1. Acharya Institute of Management & Science (AIMS), Bangalore

AIMS Bangalore is a renowned name in the education sector, and it is known for its excellence in management studies. The institute is ranked among the top business schools in India and is recognized for its industry-oriented curriculum, expert faculty, and excellent placement support.

Key Highlights:

AICTE-approved PGDM program

Strong industry connections and internship opportunities

Specializations in Marketing, Finance, HR, and more

Average placement package ranging from 5-7 LPA

Affordable tuition fees under INR 2 lakh (subject to scholarships and fee waivers)

2. MYRA School of Business, Mysore

MYRA School of Business offers a globally recognized PGDM/MBA program with an innovative curriculum designed to meet the industry’s evolving needs. The institute collaborates with international universities to provide an enriching learning experience.

Key Highlights:

AICTE-recognized PGDM program

International faculty and global exposure

Strong corporate tie-ups and industry mentorship

Case-based learning approach with hands-on projects

Affordable education with scholarships, bringing the cost under INR 2 lakh

3. Nitte School of Management, Bangalore

Nitte School of Management is another top-rated institution offering PGDM/MBA programs at an affordable cost. The institute focuses on providing a blend of theoretical knowledge and practical exposure to prepare students for real-world challenges.

Key Highlights:

AICTE-approved PGDM program

Specializations in Business Analytics, Finance, Marketing, HR, and Operations

Strong placement assistance with leading companies

Affordable fee structure under INR 2 lakh with scholarships

Practical learning through live projects and internships

Why Choose These Colleges?

Affordability: All these institutions offer quality PGDM/MBA programs at a budget-friendly cost, making education accessible to students from diverse backgrounds.

Industry Exposure: With strong industry linkages, students gain real-time corporate exposure through internships and live projects.

Placement Opportunities: These institutions have an excellent track record of placing students in top companies with competitive salary packages.

Scholarship Options: Many of these colleges offer scholarships and financial aid to meritorious and needy students, further reducing the cost of education.

Conclusion

If you’re looking for a top PGDM/MBA college under INR 2 lakh, Acharya Institute of Management & Science (AIMS), MYRA School of Business, and Nitte School of Management are excellent options. These institutions provide quality education, industry exposure, and strong placement support, making them a great choice for aspiring business leaders.

For more details on admissions, scholarships, and eligibility criteria, visit the official websites of these institutions or reach out to Pathshalahub for expert guidance!

#delhi – fms delhi#hyderabad – isb hyderabad#christ university#icfai business school#iim hyderabad#bangalore – iim bangalore#ahmedabad – iim ahmedabad#chennai – great lakes#college#high school#Pathshalahub for expert guidance!#top PGDM/MBA college under INR 2 lakh#Nitte School of Management#Bangalore#MYRA School of Business#Mysore#Acharya Institute of Management & Science (AIMS)#Top PGDM/MBA Colleges Under 2 Lakh:

1 note

·

View note

Text

Top MBA Colleges in India with Low Fees: High RoI Management Institutes

When aspiring to pursue an MBA, students often face a critical concern: finding an institute that offers world-class education while maintaining affordability. The Top MBA Colleges in India offer an excellent balance between quality education and low fees, ensuring a high Return on Investment (RoI). This blog will explore some of the best MBA colleges in India that provide top-tier management education without burdening students with exorbitant fees.

Why Choose an MBA College with Low Fees?

Pursuing an MBA is a substantial investment, not just in terms of money but also time and effort. Choosing an MBA college with low fees can offer the following benefits:

Higher ROI: With affordable tuition, students can recoup their investments faster after getting employed.

Financial Flexibility: Reduced fees ease the pressure of student loans, allowing graduates to start their professional careers with minimal debt.

Accessibility: More students from diverse economic backgrounds can access quality education.

Key Considerations When Choosing the Best MBA Colleges in India

Affiliation & Accreditation: Ensure that the MBA college is affiliated with a reputed university and has accreditation from bodies like AICTE, NAAC, or NBA.

Placement Records: Low fees are excellent, but what truly makes an MBA worthwhile is the placement opportunities provided by the college. Look for institutes with strong placement records.

Infrastructure & Faculty: A good learning environment, coupled with experienced faculty, enhances the overall education experience.

Specialization Offered: Different colleges excel in various specializations such as Finance, Marketing, HR, Operations, etc. Ensure that the college offers the specialization you are interested in.

List of Top MBA Colleges in India with Low Fees

1. Faculty of Management Studies (FMS), Delhi

Fees: Around ₹2 Lakhs

Highlights: FMS Delhi is consistently ranked among the top MBA colleges in India. Despite its low fees, it boasts excellent placements, making it a high RoI institute. With an average salary package of around ₹25-30 lakhs per annum, FMS offers incredible value to its students.

2. Tata Institute of Social Sciences (TISS), Mumbai

Fees: Around ₹2.5 Lakhs

Highlights: Known for its MBA in Human Resource Management and Labour Relations, TISS offers a specialized program that rivals some of the top institutes globally. The placement statistics are impressive, with students often securing roles in renowned organizations with lucrative packages.

3. Jamnalal Bajaj Institute of Management Studies (JBIMS), Mumbai

Fees: Around ₹6 Lakhs

Highlights: Often referred to as the “CEO factory” of India, JBIMS offers one of the best RoI for MBA aspirants. With a strong alumni network and stellar placement records, it stands as a premier institute in India’s financial capital.

4. Department of Financial Studies (DFS), University of Delhi

Fees: Around ₹2 Lakhs

Highlights: Specializing in finance, DFS provides an affordable MBA program with excellent faculty and industry connections. Graduates from DFS often land high-paying roles in finance and consulting sectors, making it a top choice for MBA students.

5. National Institute of Industrial Engineering (NITIE), Mumbai

Fees: Around ₹6 Lakhs

Highlights: Primarily focusing on industrial management, NITIE is known for its rigorous curriculum and impressive placement stats. The average salary package offered to its students is over ₹20 lakhs per annum, making it an attractive choice for those seeking a high RoI MBA program.

6. University Business School (UBS), Panjab University, Chandigarh

Fees: Around ₹1.5 Lakhs

Highlights: UBS is one of the most affordable B-schools in India with excellent academic and placement records. The low fee structure coupled with a solid placement scenario makes it a favorite among MBA aspirants from all over the country.

7. Symbiosis Institute of Business Management (SIBM), Pune

Fees: Around ₹8 Lakhs

Highlights: Though slightly on the higher side compared to others in this list, SIBM Pune is still affordable when compared to many private B-schools. The quality of education and placements it offers justifies the fee structure.

8. Department of Management Studies (DMS), IIT Delhi

Fees: Around ₹8 Lakhs

Highlights: DMS IIT Delhi is one of the most sought-after institutes for management education in India. With top-notch placements, it provides an excellent return on investment. Many students land high-paying jobs in top companies, ensuring that the cost of the MBA is easily recoverable.

Conclusion

Pursuing an MBA from one of the top MBA colleges in India with low fees is not just about saving money; it's about making a smart investment in your future. These best MBA colleges in India offer a blend of affordability and high-quality education, ensuring that students can build a prosperous career without being financially burdened. With careful consideration of factors like placement records, faculty, and infrastructure, these institutions provide a pathway to success in the competitive world of business management.

#Top MBA Colleges in India#Best MBA Colleges in India#Best MBA Colleges#Top MBA Colleges#education#higher education#universities#education news#colleges#mba#top mba colleges in pune#top mba colleges in bangalore#top mba colleges in delhi#top mba colleges in kolkata

3 notes

·

View notes

Note

Do other teams not have a cost/salary cap or something cause oml I literally do not remember rb signing anyone while mclaren and others are announcing them like bingo numbers 😭😭

I feel like prior to this latest spate of moves RB had a relatively low turnover amongst senior figures and that’s why it feels weird now.

But obviously you have the top three exempt from the cap but beyond that, you have to jiggle the money around. It’s possible that McLaren pays less to other areas to offer bigger packages when they are poaching from other teams.

But with the amount of people leaving/moving around at RB it seems like they are quietly preparing for a restructure or something. I wouldn’t be surprised if In 2026 they debut a new management structure. Or maybe the vibes really are so bad over there that everyone wants out. Could be pay related or something else

2 notes

·

View notes

Text

"DCA"(DIPLOMA IN COMPUTER APPLICATION)

The best career beginning course....

Golden institute is ISO 9001-2015 certified institute. Here you can get all types of computer courses such as DCA, CFA , Python, Digital marketing, and Tally prime . Diploma in Computer Applications (DCA) is a 1 year "Diploma Course" in the field of Computer Applications which provides specialization in various fields such as Fundamentals & Office Productivity tools, Graphic Design & Multimedia, Programming and Functional application Software.

A few of the popular DCA study subjects are listed below

Basic internet concepts Computer Fundamentals Introduction to programming Programming in C RDBMS & Data Management Multimedia Corel draw Tally ERP 9.0 Photoshop

Benefits of Diploma in Computer Application (DCA)

After completion of the DCA course student will able to join any computer jobs with private and government sectors. The certification of this course is fully valid for any government and private deportment worldwide. DCA is the only best option for the student to learn computer skills with affordable fees.

DCA Computer course : Eligibilities are here... Students aspiring to pursue Diploma in Computer Applications (DCA) course must have completed their higher school/ 10 + 2 from a recognized board. Choosing Computers as their main or optional subject after class 10 will give students an additional edge over others. Apart from this no other eligibility criteria is set for aspirants. No minimum cutoff is required.

"TALLY"

A Tally is accounting software. To pursue Tally Course (Certificate and Diploma) you must have certain educational qualifications to thrive and prosper. The eligibility criteria for the tally course is given below along with all significant details on how to approach learning Tally, and how you can successfully complete the course. Generally, the duration of a Tally course is 6 month to 1 year ,but it varies depending on the tally institution you want to join. Likewise, tally course fees are Rs. 10000-20000 on average but it also varies depending on what type of tally course or college you opt for. accounting – Accounting plays a pivotal role in Tally

Key Benefits of the Course:

Effective lessons (topics are explained through a step-by-step process in a very simple language) The course offers videos and e-books (we have two options Video tutorials in Hindi2. e-book course material in English) It offers a planned curriculum (the entire tally online course is designed to meet the requirements of the industry.) After the completion of the course, they offer certificates to the learners.

Tally Course Syllabus – Subjects To Learn Accounting Payroll Taxation Billing Banking Inventory

Tally Course

Eligibility criteria: 10+2 in commerce stream Educational level: Certificate or Diploma Course fee: INR 2200-5000 Skills required: Accounting, Finance, Taxation, Interpersonal Skills Scope after the course: Accountant, Finance Manager, Chartered Accountant, Executive Assistant, Operations Manager Average salary: INR 5,00,000 – 10,00,000

"In this Python course"

Rapidly develop feature-rich applications using Python's built-in statements, functions, and collection types. Structure code with classes, modules, and packages that leverage object-oriented features. Create multiple data accessors to manage various data storage formats. Access additional features with library modules and packages.

Python for Web Development – Flask Flask is a popular Python API that allows experts to build web applications. Python 2.6 and higher variants must install Flask, and you can import Flask on any Python IDE from the Flask package. This section of the course will help you install Flask and learn how to use the Python Flask Framework.

Subjects covered in Python for Web development using Flask:

Introduction to Python Web Framework Flask Installing Flask Working on GET, POST, PUT, METHODS using the Python Flask Framework Working on Templates, render template function

Python course fees and duration

A Python course costs around ₹2200-5000.This course fees can vary depending on multiple factors. For example, a self-paced online course will cost you less than a live interactive online classroom session, and offline training sessions are usually expensive ones. This is mainly because of the trainers’ costs, lab assistance, and other facilities.

Some other factors that affect the cost of a Python course are its duration, course syllabus, number of practical sessions, institute reputation and location, trainers’ expertise, etc. What is the duration of a Python course? The duration of a basic Python course is generally between 3 month to 6 months, and advanced courses can be 1 year . However, some courses extend up to 1 year and more when they combine multiple other courses or include internship programs.

Advantages of Python Python is easy to learn and put into practice. … Functions are defined. … Python allows for quick coding. … Python is versatile. … Python understands compound data types. … Libraries in data science have Python interfaces. … Python is widely supported.

"GRAPHIC DESIGN"

Graphic design, in simple words, is a means that professional individuals use to communicate their ideas and messages. They make this communication possible through the means of visual media.

A graphic designing course helps aspiring individuals to become professional designers and create visual content for top institutions around the world. These courses are specialized to accommodate the needs and requirements of different people. The course is so popular that one does not even need to do a lot of research to choose their preferred colleges, institutes, or academies for their degrees, as they are almost mainstream now.

A graphic design course have objectives:

To train aspirants to become more creative with their visual approach. To train aspirants to be more efficient with the technical aspects of graphics-related tasks and also to acquaint them with relevant aspects of a computer. To train individuals about the various aspects of 2-D and 3-D graphics. To prepare aspirants to become fit for a professional graphic designing profession.

Which course is best for graphic design? Best graphic design courses after 12th - Graphic … Certificate Courses in Graphic Design: Adobe Photoshop. CorelDraw. InDesign. Illustrator. Sketchbook. Figma, etc.

It is possible to become an amateur Graphic Designer who is well on the road to becoming a professional Graphic Designer in about three months. In short, three months is what it will take to receive the professional training required to start building a set of competitive professional job materials.

THE BEST COMPUTER INSTITUTE GOLDEN EDUCATION,ROPNAGAR "PUNJAB"

The best mega DISCOUNT here for your best course in golden education institute in this year.

HURRY UP! GUYS TO JOIN US...

Don't miss the chance

You should go to our institute website

WWW.GOLDEN EDUCATION

CONTACT US: 98151-63600

VISIT IT:

#GOLDEN EDUCATION#INSTITUTE#COURSE#career#best courses#tallyprime#DCA#GRAPHICAL#python#ALL COURSE#ROOPAR

2 notes

·

View notes

Text

How Much Do FedEx Drivers Make?

FedEx is a well-known name in the logistics world. But how much do their drivers actually make? With competitive pay and a variety of job types, FedEx is a desirable employer for many people looking to make a good living. But pay can vary depending on experience, location, and role. This article provides a breakdown of the salary details for FedEx drivers.

What Types of Drivers Does FedEx Hire?

FedEx hires drivers for a range of roles. Each type of driver has different responsibilities and pay structures.

FedEx Ground Drivers

FedEx Ground drivers handle packages delivered to homes and businesses within a specific area. These drivers operate within local regions and are responsible for timely deliveries.

FedEx Express Drivers

FedEx Express drivers deliver packages on a quicker schedule, often dealing with time-sensitive packages. This role requires a higher level of coordination as the delivery windows are much smaller compared to Ground drivers.

FedEx Freight Drivers

Freight drivers handle large, heavy shipments that travel longer distances. These drivers usually require a commercial driver’s license (CDL) and handle shipments between businesses, typically on long-haul trips.

What Factors Affect FedEx Driver Pay?

Several factors can influence how much a FedEx driver makes. Experience, location, and job type all play significant roles in determining the salary.

Experience

Drivers with more experience tend to earn more. New drivers may start with a lower wage but can expect raises as they gain experience.

Location

Where you work matters. Drivers in higher-cost-of-living states or major metropolitan areas generally earn more than those in smaller towns or rural regions.

Driver Type

Ground, Express, and Freight drivers all have different pay scales. Freight drivers tend to make more due to the need for specialized licenses and the longer distances they travel.

Average Salary of FedEx Drivers

The average salary for a FedEx driver varies depending on the type of driver and the location.

FedEx Ground Driver Salary

FedEx Ground drivers earn around $18 to $25 per hour. With overtime, the annual salary can range from $40,000 to $60,000.

FedEx Express Driver Salary

Express drivers typically make between $20 and $28 per hour. Due to the time-sensitive nature of their deliveries, they can expect to earn slightly more than Ground drivers.

FedEx Freight Driver Salary

Freight drivers, who require a CDL, can make anywhere from $50,000 to $75,000 per year. Long-haul drivers generally earn more than local freight drivers.

How Do FedEx Salaries Compare to UPS?

Many people wonder how FedEx compares to UPS in terms of pay.

Differences in Pay Scales

UPS drivers tend to make slightly more than FedEx drivers, especially long-haul drivers. However, the pay difference often comes down to location and experience.

Benefits and Perks

Both companies offer excellent benefits, but UPS may have an edge when it comes to pension plans and long-term retirement benefits.

How Do FedEx Salaries Compare Across the U.S.?

Salary depends on where the driver works. The variation in salary is great depending on the location.

Highest Paying States

States like California, New York, and Illinois typically offer the highest pay for FedEx drivers due to the high cost of living.

Lowest Paying States

States like Mississippi, Arkansas, and South Dakota have lower average salaries for FedEx drivers.

What Benefits Do FedEx Drivers Receive?

FedEx drivers receive a comprehensive benefits package.

Health Insurance

FedEx offers health, dental, and vision insurance to its drivers.

Retirement Plans

The company provides 401(k) plans with company matching.

Paid Time Off

Drivers receive paid vacation days. They also receive sick leave.

Are There Overtime Opportunities for FedEx Drivers?

Yes, FedEx drivers can work overtime and get compensated accordingly.

Typical Work Hours

Most drivers work around 40 hours per week, but overtime is available, especially during peak seasons.

Overtime Pay Structure

Overtime is paid at 1.5 times the normal hourly rate, providing a significant income boost during busy times.

Is There Career Growth for FedEx Drivers?

FedEx encourages career growth and offers plenty of opportunities for advancement.

Moving Up the Ladder

Many drivers move into supervisory roles or transition into management.

Opportunities in Management

FedEx has a well-structured management track for drivers looking to advance beyond their current role.

How to Apply for a FedEx Driver Job?

Applying for a FedEx driver job is straightforward.

Application Process

Prospective drivers can apply online or at a FedEx hub. Prepare for a background check. Undergo a drug test.

Qualifications Required

A clean driving record and, in some cases, a CDL are necessary for most positions.

What Are Some Common Challenges for FedEx Drivers?

FedEx drivers face challenges like difficult weather and tight delivery schedules.

Weather Conditions

Rain can make delivery tricky. Snow and other adverse weather can also make delivery tricky.

Delivery Deadlines

Drivers often have to meet strict deadlines, adding pressure to the job.

What Skills Are Necessary to Succeed as a FedEx Driver?

Certain skills make for a successful FedEx driver.

Time Management

Drivers must be able to plan their routes efficiently to meet delivery deadlines.

Customer Service

Interacting with customers in a friendly and professional manner is a key part of the job.

Can You Work Part-Time as a FedEx Driver?

Yes, FedEx offers part-time positions.

FedEx Part-Time Driver Roles

Part-time drivers typically work shorter shifts and may handle weekend deliveries.

Pay for Part-Time Drivers

Part-time drivers make less per year but are often paid the same hourly rate as full-time drivers.

What Is the Work-Life Balance for FedEx Drivers?

Work-life balance depends on the role and schedule.

Typical Workweek

Full-time drivers usually work Monday through Friday, but during peak seasons, weekend work may be required.

Flexibility in Scheduling

FedEx offers flexible scheduling for some driver roles, allowing for a better balance between work and personal life.

FedEx offers competitive pay and benefits for its drivers. Whether you're looking for a full-time career or part-time work, FedEx has a range of opportunities with room for growth. While the job can be challenging, it also offers a stable income with good benefits.

Unveil BizGlobe : Your All-Encompassing Portal for USA Contact Insights

Delve into the extensive trove of USA contact information with BizGlobe, a directory tailored for comprehensive exploration. This platform unfolds a plethora of listings, offering access to niche contacts spanning diverse industries and geographical zones across the United States. Whether you seek corporate connections, customer support lines, or professional networks, BizGlobe stands as an unwavering ally, simplifying your quest for relevant data. Harness its intuitive design and expansive archive to retrieve the most precise and timely contact details that align with your pursuits. Expedite your discovery of intricate American business contacts through BizGlobe's robust directory today.

2 notes

·

View notes

Text

Anubhav Trainings is an SAP training provider that offers various SAP courses, including SAP UI5 training. Their SAP Ui5 training program covers various topics, including warehouse structure and organization, goods receipt and issue, internal warehouse movements, inventory management, physical inventory, and much more.

SAP S/4HANA (abap on hana training, s/4hana training, abap on hana tutorial is an abbreviation of SAP Business Suite 4 SAP HANA, an enterprise resource planning (ERP) software package. ... It enables organizations to make business decisions informed by real-time insights, machine learning, IoT scenarios, and predictive computing.

Pre-requisites

1. Basic knowledge of programming like DDIC, Function Module, Internal Table

2. Basic programming skills

3. Knowledge of Open SQL

**Why learn and get certified?**

1. Learning CDS view will enable developers to build cutting-edge business applications leveraging the proven, reliable technology as well as the robust in-memory capabilities provided by in-memory DB.

2. According to the research results of the average yearly salary for “Core Developer” ranges from approximately $91,946 per year for Developer to $102,684 per year for Senior Developer.

3. This certificate proves that the trainee not only has the prerequisite understanding of development but is also able to apply these skills in a practical manner under the supervision of a project lead.

Call us on +91-84484 54549

Mail us on [email protected]

Website: Anubhav Online Trainings | UI5, Fiori, S/4HANA Trainings

3 notes

·

View notes

Text

How to price your social media marketing services?

Pricing social media marketing services can be a challenging task, but with the right approach, you can ensure that your services are fairly priced while also meeting your financial goals. Here are some steps to help you determine how to price your social media marketing services effectively:

Define Your Services: Start by clearly outlining the services you offer, including social media strategy development, content creation, community management, advertising campaigns, analytics reporting, and more.

Understand Client Needs: Conduct thorough consultations with potential clients to understand their specific goals, target audience, and budget constraints. This will help you tailor your services to meet their needs effectively.

Consider Your Time and Resources: Calculate the time and resources required to deliver your services, including research, content creation, scheduling, monitoring, and reporting. Factor in overhead costs such as software subscriptions and employee salaries.

Assess Market Rates: Research industry standards and competitive rates for similar social media marketing services in your area. Consider your level of expertise, experience, and the unique value proposition you offer to determine where you stand in the market.

Value-Based Pricing: Focus on the value you provide to clients rather than solely on the time spent on tasks. Highlight the benefits of your services, such as increased brand awareness, engagement, and leads, to justify your pricing.

Offer Packages and Customization: Create tiered packages that cater to different client needs and budgets. Consider offering additional services or customization options at an additional cost to meet specific requirements.

Factor in Profit Margin: Ensure that your pricing structure allows for a reasonable profit margin while remaining competitive in the market. Consider your business expenses, desired profit margin, and the perceived value of your services when setting your prices.

Review and Adjust Regularly: Monitor your pricing strategy regularly and adjust as needed based on market trends, client feedback, and changes in your business expenses or service offerings.

Explore TrueFirms to find the best social media marketing companies with trusted clients reviews and ratings.

By following these steps and taking a strategic approach to pricing, you can confidently determine the best pricing strategy for your social media marketing companies that aligns with your business goals and delivers value to your clients.

#social media#social media marketing#social media marketing companies#social media marketing agencies#social media marketing firms#online marketing#digital marketing#content marketing#email marketing#search engine optimization

5 notes

·

View notes

Text

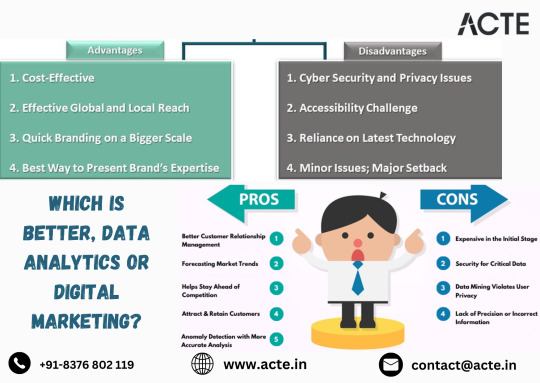

Exploring Career Options: Data Analytics vs. Digital Marketing

In the vast landscape of career choices, two fields have recently been in the spotlight: data analytics and digital marketing. Both offer promising avenues for growth and success, but they cater to different skill sets and interests. Whether you're inclined towards deciphering data or crafting compelling digital campaigns, understanding the intricacies of each field is essential for making an informed career decision.

In this blog post, we'll delve into the details of data analytics and digital marketing, highlighting their advantages, drawbacks, and potential career paths to help you navigate your professional journey effectively.

Data Analytics: Deciphering Insights From Data

Advantages of Data Analytics:

High Demand: Data analytics is witnessing a surge in demand as businesses increasingly rely on data-driven insights to drive their decisions. Professionals proficient in analyzing data are highly sought after across various industries.

Versatility: The skills acquired in data analytics are applicable across diverse sectors, including finance, healthcare, retail, and technology. This versatility opens doors to a wide range of career opportunities.

Lucrative Salaries: Skilled data analysts command competitive salaries due to their ability to extract valuable insights from complex datasets. The demand for their expertise translates into attractive compensation packages.

Drawbacks of Data Analytics:

Steep Learning Curve: Mastering data analytics requires proficiency in statistical techniques, programming languages like Python or R, and data visualization tools. The learning curve can be steep, especially for beginners.

Continuous Upskilling: The field of data analytics is constantly evolving, necessitating professionals to stay updated with the latest trends and technologies. Continuous upskilling is crucial to remain competitive.

Technical Complexity: Dealing with large datasets and complex algorithms can be challenging. Data analysts need to possess a high level of technical expertise and attention to detail to navigate through intricate data structures.

Digital Marketing: Crafting Compelling Campaigns in the Online Sphere

Advantages of Digital Marketing:

Creativity: Digital marketing offers ample opportunities for creative expression. From crafting engaging content to designing innovative campaigns, digital marketers have the freedom to unleash their creativity.

Immediate Impact: Digital marketing campaigns can yield quick results and reach a vast audience within a short span. The immediacy of impact makes it an appealing choice for those seeking tangible outcomes.

Diverse Career Paths: Digital marketing encompasses various roles, including social media management, content marketing, SEO, and email marketing. This diversity allows individuals to explore different career paths and areas of specialization.

Drawbacks of Digital Marketing:

Rapid Changes: The digital marketing landscape is constantly evolving, with new platforms, algorithms, and trends emerging regularly. Keeping up with these changes requires adaptability and continuous learning.

Metrics-Driven: Digital marketers need to analyze data and metrics to measure the effectiveness of their campaigns. While this provides valuable insights, it also requires a basic understanding of analytics tools and methodologies.

Competitive Field: With the accessibility of digital marketing tools and platforms, the field has become increasingly competitive. Professionals need to differentiate themselves through innovation and expertise to stand out.

Choosing the Right Path for You

Ultimately, the decision between data analytics and digital marketing depends on your individual strengths, interests, and career aspirations. If you have a penchant for numbers and enjoy uncovering insights from data, data analytics might be the ideal fit. Conversely, if you're passionate about storytelling, creative content creation, and engaging with audiences online, digital marketing could be your calling.

It's essential to consider your skills, interests, and long-term goals when making this decision. Whichever path you choose, both data analytics and digital marketing offer exciting opportunities for growth, learning, and career advancement. By understanding the intricacies of each field and aligning them with your aspirations, you can embark on a fulfilling professional journey tailored to your unique strengths and passions.

Conclusion

In conclusion, the choice between data analytics and digital marketing hinges on understanding your strengths, interests, and career goals. Both fields present distinct opportunities for growth and success, catering to different skill sets and preferences. Whether you're drawn to the analytical realm of data or the creative domain of digital promotion, there's no one-size-fits-all answer. Take the time to explore your options, evaluate your strengths, and chart a career path that aligns with your aspirations. With the right mindset and determination, you can carve out a rewarding career in either data analytics or digital marketing—or even both!

#tech#training#digital marketing#digital marketing company#digital marketing course#email marketing#online marketing#search engine optimization#seo#seo services

4 notes

·

View notes

Text

Are Consultants Intelligent? A Comprehensive Guide to Becoming an Intelligent Consultant

Consultants are often seen as highly intellectual individuals, and for good reason. They possess a deep understanding of general knowledge, as well as more specific knowledge related to their field. Guennael and Sidi agree that you don't need to be a genius or exceptionally smart to become a consultant. The truth is that most tasks only require a basic level of intelligence and the ability to think in a structured way, along with hard work. To use a computer analogy, consultants need to have a good hard drive, CPU, and operating system.

Smart consultants can analyze problems and know HOW to separate them, investigate, talk to customers, lead teams, and ultimately find solutions through hypothesis-based thinking. Even if they don't know the answer right away, they know HOW to get a reliable answer quickly. The intelligence of consultants at elite firms like MBB (McKinsey, Bain & Company, and BCG) is often intimidating. This is why companies look for a complete profile when hiring consultants - if it were only about cognitive intelligence, they could offer huge salary packages to the best graduates from the most difficult doctoral programs around the world. Consultants must also be in tune with their clients, surroundings, team, and themselves. It's not enough to just be intelligent - you need to be able to apply your knowledge in the right way.

Even young consultants who are 10 years younger than me can understand complex concepts and think quickly. If you're interested in starting your career in consulting, it's important to learn about the BCG case online and how to take the Boston Consulting Group test. With the right knowledge and skillset, you can become an intelligent consultant. To become an intelligent consultant, you must first understand the basics of consulting. You should have a good grasp of general knowledge as well as more specific knowledge related to your field. It's also important to have a good hard drive, CPU, and operating system so that you can analyze problems quickly and accurately.

Additionally, you must be able to think in a structured way and have the ability to separate problems into smaller parts. You should also be able to talk to customers effectively and lead teams confidently. It's essential that you understand how to use hypothesis-based thinking in order to find solutions quickly. Finally, it's important that you stay in tune with your clients, surroundings, team, and yourself so that you can apply your knowledge in the right way. If you're interested in becoming an intelligent consultant, it's important to learn about the BCG case online and how to take the Boston Consulting Group test. With the right knowledge and skillset, you can become an intelligent consultant.

Read more here https://www.coo.expert/are-consultants-intelligent

2 notes

·

View notes

Text

Here is the most pertinent thing about UnitedHealth to me: it is the company my employer uses to manage our healthcare coverage. Here is the only positive thing I know about United: my oldest child had top surgery and the coverage was good enough that my son was able to pay off what he owed (mostly for the anesthesiologist) in a year while also attending grad school. We are very fortunate in my family.

I grieve for the 32% of denied claims, however many people that may represent. I am furious that they use crap AI to override doctors’ professional judgment. I am outraged by how much the executive compensation package is. There is nothing a CEO, or any other executive, does that is worth that kind of money.

I am stuck with only two options for coverage. Either I stay on my employer’s plan, which has a fairly low premium deducted before taxes from my paycheck, or we all go on my wife’s plan. Her plan costs nothing as long as it is only covering her. If we put the family on it, as we have in the past, it takes a big bite of a much smaller paycheck than mine. My wife is a special education technician in our local public school system.

I work in a factory making tampons. Say what you will, our jobs contribute positively to society one way or another. Like it or not, all organizations need some kind of administrative structure with some kind of leadership at levels reflecting the complexity of the whole structure. CEOs certainly should be paid decently, but I see no argument whatsoever for more than $1 million in a straight salary. Stock options should be illegal.

All that is to say that I sincerely hope the assassin is never found.

Also, for-profit healthcare in any part should be illegal. It’s not if you need care, it’s when you need care. Fucking vultures.

UnitedHealthcare CEO shooting (4 December 2024)

Sources: 1 2 3 4 5 6 7 8

#healthcare for all#brian thompson#unitedhealthcare#unitedhealthcare shooting#for-profit healthcare#AI should not be deciding anything for anyone

54K notes

·

View notes