#residency by Investment program

Explore tagged Tumblr posts

Text

Second Passport & New Legal Identity Consulting in Canada

Get a new legal identity, a second passport, and necessary documents with the help of the best Canada's Amicus International Consulting. We offer 100% guarantees for all our clients who choose to work with us. Contact us for a free consultation today!

#second passport program#second passport program canada#best second passport programs for anonymity#passport and Legal Services#passport and Legal Services Canada#dual citizenship consulting#legal services for dual citizenship#Canada Residence by Investment Program#Apply for dual citizenship Canada#Second Passport Consultants

0 notes

Text

How to Open a European Bank Account in Canada?

How to Open a European Bank Account in Canada 🌍💶

Opening a European bank account while living in Canada might seem challenging, but it’s easier than you think! At Fast Passport in Toronto, we help simplify the process of managing your finances across borders. Here’s a quick guide on what to know:

Research Banks That Offer International Accounts Some European banks allow Canadian residents to open accounts without traveling. Look into international branches or digital banks like N26, Wise, or Revolut that offer services across Europe.

Prepare Essential Documentation Typically, you’ll need to provide identification (passport or ID card), proof of address, and possibly proof of income. Every bank has unique requirements, so check specifics in advance.

Consult International Banking Services Many Canadian banks have partnerships with European banks. Contact your local branch for guidance on cross-border banking or account referrals.

Consider Residency Requirements Some European banks may have residency requirements. Research which countries and banks offer accounts to non-residents or opt for an online banking solution that allows international clients.

Get Professional Assistance Setting up a bank account internationally can be time-consuming and confusing. At Fast Passport, we offer expert guidance on European banking requirements, documentation, and process steps to make it smooth and stress-free!

Let us help you connect globally with ease! Contact us at Fast Passport, Toronto, ON, Canada.

0 notes

Text

struggling with how to word this, but putting it out there anyway:

i can fully understand the posts on here from a lot of americans being tired of "vote blue no matter who" posts when the #1 thing that people are constantly (and sometimes only?) addressing is how the republican party is going treat trans/queer people if elected.

it's part of an unfortunate pattern of prioritizing the effects on a demographic that includes white + upper class people, when people of color and those in the global south are actively and currently being killed or relegated to circumstances in which their survival is very unlikely

it is genuinely exhausting to witness this, and i was also on the fence about even participating in voting because i a) felt like it didn't matter and b) every time i voiced being frustrated with the current state of the country, white queer people would immediately step in with "but what about trans people!" -> (i am mixed race trans man)

and i say this with unending patience toward people who do this, because i know that it's not something they actively think about. but everyone already knows how the republican party is going to treat queer people. you are probably talking to another queer person when you bring up project 2025. the issue is that, for those of us who aren't white, or for those of us who are but who are conscious of ongoing struggles for people of color worldwide, the safety of people around the world feels more urgent than our own. that is the calculation that's being made.

you're not going to win votes for the democratic party by dismissing or minimizing these realities and by continually centering (white) queer people.

very few people on here and twitter are actually talking about issues beyond queer rights that concern people of color, or how the two administrations differ on these issues instead of constantly circling back to single-issue politics. this isn't an exhaustive list. but these are the issues that have actually altered my perspective and motivated me to the point of committing to casting a vote

the biden administration has been engaged in a years-long fight to allow new applicants to DACA (Deferred Action for Childhood Arrivals, the program that allows undocumented individuals who arrived as children to remain in the country) after the Trump administration attempted to terminate it. the program is in limbo currently because of the actions of Trump-backed judges, with those who applied before the ruling being allowed to stay, but no new applications are being processed. Trump has repeatedly toyed with the idea of just deporting the 1.8 million people, but he continues to change his mind depending on whatever the fuck goes on in his head. he cannot be relied on to be sympathetic toward people of hispanic descent or to guarantee that DREAMers will be allowed stay in the country. biden + a democratic controlled congress will allow legal challenges to the DACA moratorium to gain ground.

the biden administration is open to returning and protecting portions of culturally important indigenous land in a way that the trump administration absolutely does not give a fuck. as of may 2024, they have established seven national monuments with plans to expand the San Gabriel Monument where the Gabrielino, Kizh / Tongva, the Chumash, Kitanemuk, Serrano, and Tataviam reside. the Berryessa Snow Mountain is also on the list, as a sacred region to the Patwin.

i'm recognizing that the US's plans for clean energy have often come into conflict with tribal sovereignty, and the biden administration could absolutely do better in navigating this. but the unfortunate dichotomy is that there would be zero commitment or investment in clean energy under a trump-led government, which poses an astounding existential threat and destabilizing force to the global south beyond any human-to-human conflict. climate change has caused and will continue to cause resource shortages, greater natural disasters, and near-lethal living conditions for those in the tropics - and the actions of the highest energy consumers (US) are to blame. biden has funneled billions of dollars into climate change mitigation and clean energy generation - trump does not believe that any of it matters.

i may circle back to this and add more as it comes up, but i'm hoping that those who are skeptical / discouraged / tired of the white queer-centric discourse on tumblr and twitter can at least process some of this. please feel free to add more articles + points but i'm asking for the sake of this post to please focus on issues that affect people of color.

19K notes

·

View notes

Text

Contact us today for more information and started your journey towards a new home.

#Croatia residence permit#Europe residency program#Investment opportunities#Live in Croatia#Citizenship by investment

0 notes

Text

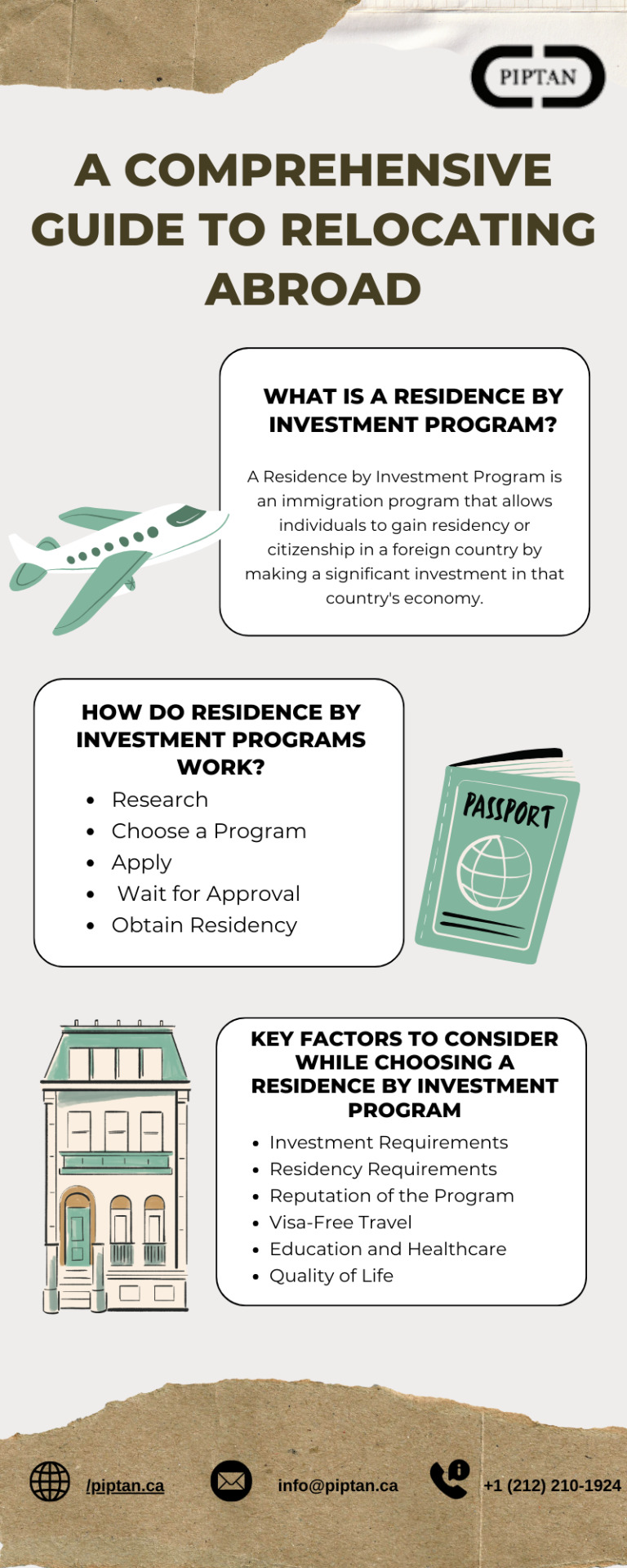

A Comprehensive Guide to Relocating Abroad.

In recent years, an increasing number of people have been exploring options for obtaining residency in foreign countries through investment. This has led to the rise of Residence by investment programs, also known as investor visas or golden visas. These programs allow individuals to gain residency in a foreign country by making a significant investment in the country's economy. The investment requirements and benefits vary by country, but the general idea is that the country grants residency or citizenship in exchange for the investment. In this article, we will delve deeper into what a residence by investment program is, how it works, and the benefits it can offer. In this blog post, we will delve deeper into what Residence by Investment programs are, how they work, and the key factors to consider while choosing a Residence by Investment Program.

#Golden Visa Program#Financial Advisory Firm#Residency by Investment#Residency by Investment Programs

1 note

·

View note

Text

Expert in Business Immigration Services & Move to Canada - Yalla Canada

Yalla Canada specializes in providing expert Business Immigration Services tailored for professionals over 40, ensuring a smooth transition for your entire family. With our guidance, you can begin to experience the richness of Canadian life in under a year. We focus on making the process clear and manageable, so you can look forward to establishing your business and laying down roots in a supportive and vibrant economy.

#Canada Start Up Visa program#Intra Company Transfer#canada residency by investment#business migration to canada#invest in canada for citizenship#permanent residency in canada by investment#immigration through investment canada#canada permanent residency through investment#permanent residency in canada through investment#permanent residency by investment in canada#canada business immigration programs

0 notes

Text

Why the Portugal Golden Visa Investment Programme is Still Relevant?

Explore unparalleled opportunities with the Portugal Golden Visa program! Unlock European access, diverse investment options, and stability in a culturally rich environment. Your pathway to residency by investment begins here.

#Portugal Immigration Visa#Portugal Golden Visa Program#Portugal National Visa#Residency by Investment#Portugal Golden Visa#National Visa#Golden Visa#Golden Visa Portugal

0 notes

Text

#“”“USA Residency by Investment#Green Card Investment Program#Get Your U.S. Green Card#Investment for U.S. Residency#U.S. Immigration Advisors“”“

0 notes

Text

Understanding EB-5 Investor Visas: Your Pathway to US Residency

Fabrice Fernandes PA, Florida Miami Investments Group, we understand the significance of global investments and the opportunities they provide, especially for individuals seeking to invest in the United States and secure residency through the EB-5 Investor Visa program. The EB-5 program has emerged as a prominent pathway for foreign investors aspiring to obtain U.S. permanent residency.

#Employment based fifth Visa#Investor visa Miami#Miami resident visa#Miami E-2 EB-5 Investor Visa#EB-5 Investor Visas#E2 Visa Program#property for investment in Miami#rental properties for sale

0 notes

Text

Unlock Your Path to the American Dream with the Visa EB-5 Program!

#Visa EB-5#USA Green Card#USA Investment#EB-5 Program#Immigration#Permanent Residency#Green Card Pathway#Investment Options#Job Creation#USA Economy#Immigration Requirements#Visa Application#Investor Program#USA Citizenship#Regional Centers#Direct Investments#USA Immigration#Visa Eligibility#Lawful Source of Funds#Immigration Benefits#USA Education#Financial Returns#Investment Opportunities#USA Economic Growth#USA Immigration Professionals#USA Business Opportunities

0 notes

Text

In the past, people in the Animal Crossing community would make fun of Tom Nook as a sleazy landlord. Since then, he's really rehabilitated his image as this 'heart of gold' businessman (he's the one who puts bells and furniture in trees for you to find! he adopted orphans! he donates to charity!), but New Horizons genuinely paints the most devious version of him.

He's successfully privatized settler colonialism: you pay HIM to move to a "deserted island" (which apparently the oceans in the AC world are just full of) and start a colony that he is directly invested in. At best he's running a weird vacation package scam (you arrive on the island with no money and in debt for "using his services"). At worst, he's using you to set up company towns. For god's sake, he literally has his own fake currency that he forces you to use to pay off your debt. But don't worry, he's repackaged it in a way that definitely doesn't sound like an MLM scam: the Nook Mileage Program!

You're no longer just his tenant or his temporary part-timer, you're his business lackey. The entire tutorial section of the game has you spending actual weeks running around completing tasks and doing hard labor to set up his colony. You're even tasked with preparing his properties and finding buyers for them. No, you aren't a tenant anymore. You work for the landlord. You are directly responsible for finding tenants for him. And he doesn't even fucking pay you. Not for setting up town hall and museum, or his nephew's shop –– which is the ONLY store on the entire island that sells necessities –– or bringing KK Slider to town, or helping populate his town. Not a single cent. No, actually, you have to pay HIM to BUY infrastructure like bridges and stairs and park benches. And all the while, he's telling you're the "resident representative"; you get to call the shots! That the reward is the community's progress. That what you're doing is in everyone's best interest (but most importantly, his).

Since NH's release, people have done a lot of legwork to say that Tom Nook isn't a capitalist while the game shows him at his very worst. He owns the only general store in town. You're forced to use a phone that he modified and branded as his own. Buy Nook-branded furniture and merchandise at the self-serve kiosk in the town hall, a governmental building! There's no conflict of interest here!

But hey, if you're tired of being the landlord/business mogul's goon, you can also find work as a deluxe resort home designer for a company that also pays you in their special company currency that can only be used to buy their products instead of a real salary! Because that's what the Animal Crossing franchise needs! More vacation homes!!!

#this is a really long winded way to say i really really really really hate new horizon's storyline and player role#i really hate that not only your house but the entire TOWN. the whole COMMUNITY you're a part of is owed to tom nook's business#i really hate the “vacation getaway package” angle because it shows just how commercialized the entire premise of nh is#and how lost the game is in its original core concept#animal crossing is about the experience of moving to a new town and becoming a part of that community#just to compare: all past ac games have a similar opening#you're on a bus or train or taxi to someplace new. a stranger strikes up a conversation and you get to know them before arriving#new horizons opens with you at customer service desk filling out an client application before a flight.#in prev games working for nook in the tutorial is meant to be demeaning. you want it to be over with so you can actually start living life#but in new horizons working for tom nook IS your life. and it's so rewarding! don't you feel rewarded?#you aren't a person. you aren't a new neighbor. you're tom nook's client. and then his unpaid employee. and the game insists it's fun to be#that's how void the game is#because it's bad enough that a rpg life sim got turned into a sandbox game where you have to build the town yourself#but the only reason why you're building it is because the landlord who you're in debt to TOLD you to build it.#everything is a rewards program! everything is a tour service! be sure to do your daily tasks to earn nook bucks to spend on nook merch!#that really sucks imo.#i mean. the entire game is based around the vacationing industry. of course it all feels fake and temporary. it's only a vacation.#long post#rant#not art#god the fact that your starter villagers can't even decide where to live you have to decide for them#i've never played a game that does the opposite of handholding#where instead it's the PLAYER who has to handhold the npcs through everything. and newsflash!! it's really exhausting and boring

3K notes

·

View notes

Text

"Across the country, thousands of public schools face closures due to low enrollment.

But Detroit, Michigan-based nonprofit Life Remodeled is welcoming vacant schools into a new era.

The organization, which has invested $51 million in revitalizing Detroit neighborhoods, primarily works to purchase vacant properties and work with dozens of area organizations to provide life-changing resources to community members.

Its first remodel — the Durfee Innovation Society — opened in 2023. A former elementary and middle school, the building is now what the organization calls “an opportunity hub,” providing resources like after-school programs, career preparedness, and support in accessing healthcare, financial literacy, and more.

“The Durfee Innovation Society is an Opportunity Hub,” Brandy Haggins, the director of the project, told CBS News. “We call it that because we’ve taken an old school building that probably would have set back vacant, and we housed it with the best and brightest nonprofits in Detroit.”

She continued: “An Opportunity Hub is a place where individuals can come and get opportunities that they deserve, that they probably otherwise would not have access to.”

The building is home to over 35 organizations, including Nursing Detroit, Big Brothers Big Sisters, and Starfish Family Services.

Since it opened, the Durfee Innovation Society has provided 3,400 Detroit students with after-school programming, 5,600 with job opportunities, and 13,400 children and families with resources and support.

Ultimately, the organization says, 22,000 Detroiters take part in Durfee’s programs every year.

These numbers represent exciting milestones, but they are also in competition with what Life Remodeled is up against.

According to the organization, 88% of third graders in Detroit read below grade level. 30% of Detroiters can’t access the healthcare they need. And Detroit residents’ median household income is 50% less than suburban residents.

School closures impact low-income communities hardest, with low enrollment rates causing school districts to consolidate resources — and infrastructure.

In 2017, Durfee Elementary School merged with a local high school, and Life Remodeled swooped in to save the space.

“It’s not just community history; It’s personal history for a lot of people,” Haggins told CBS News in 2024. “What better way to work with the community than to reopen their school building into something that still belongs to them?”

The services available at the hub are free to anyone in the community. Nonprofits housed there pay for their space “at cost,” meaning they only pay what it takes to keep the building up and running.

It’s a model that seems to be working.

“The best part about being involved is seeing the actual change be made,” Charles Spears, the youth alliance president for Durfee Innovation Society, told CBS News. “You know, a lot of people talk about it. But when you get to see first hand, you actually see what is happening. It’s just like, wow, there is literally opportunity for all.”

Now, Life Remodeled is onto their next project: another “opportunity hub” on the east side of Detroit. The new property, formerly Winans Performing Arts Academy, is a 90,000-square-foot space that plans to open in December of 2025.

It’s called Anchor Detroit, and it’s located in the Denby community — an area in which residents “face significant poverty and lack access to opportunities related to educational attainment, job opportunities, and health and wellness resources,” according to a press release from Life Remodeled.

More than 50,000 square feet of the space will be leased by nonprofit partners, who will bring more after-school youth programs, workforce development initiatives, and health resources to the area...

Anchor Detroit is currently being renovated to prepare for its reopening and will reportedly include a “significant presence” for arts and culture programs.

Once it opens, Life Remodeled estimates the new space will support 18,000 community members per year.

“This should be a nationwide model for other schools that have closed across the country,” Haggins told CBS News. “I think taking a school building, or any historical building that means something to a community, and repurposing it into something that’s for the community — that’s huge and necessary.”"

-via GoodGoodGood, February 5, 2025

#detroit#michigan#united states#north america#community#community support#nonprofit#resources#poverty#schools#infrastructure#good news#hope

953 notes

·

View notes

Text

Why Choose Us For An EB5 Investment Programme ?

We have Best and Amazing Sports Village located in Attleboro, Massachusetts with 140 acres of Real Property. Through EB5 investment visa immigrants can gain lawful status in the US For more info visit our website https://eb5us.in

1 note

·

View note

Text

A Seattle-area guaranteed basic income pilot gave low-income residents $500 a month to help reduce poverty. Employment in the group nearly doubled, and numerous unhoused residents secured housing. The Workforce Development Council of Seattle-King County launched a 10-month guaranteed basic income pilot program with 102 participants in fall 2022. New findings by research firm Applied Inference reveal that the $5,000 total payments improved participants' quality of life, housing, and employment outcomes.

Oh gosh look: another successful UBI pilot program.

Not only was employment doubled in the test group, their savings increased, and health & life insurance coverage tripled. Many participants got health insurance for the first time.

It's time to roll this out nationwide and with more money. The return on investment is undeniable and would be huge if it applied to everyone.

2K notes

·

View notes

Text

Unlock Your Future: Residency Programs in Croatia for 2024

Are you considering making Croatia your new home? As we enter 2024, Croatia’s residency programs offer exciting opportunities for individuals looking to live, work, or retire in this beautiful European country. At Liv Croatia , we specialize in guiding you through the residency process, ensuring a smooth transition to your new life in Croatia.

Why Choose Croatia for Residency?

Croatia has become a popular destination for expatriates and remote workers alike. Here are some compelling reasons to consider applying for residency in Croatia:

Stunning Natural Beauty: From the breathtaking Adriatic coastline to the serene national parks, Croatia offers a diverse range of landscapes that are perfect for outdoor enthusiasts.

Rich Culture and History: With its ancient towns, UNESCO World Heritage Sites, and vibrant festivals, Croatia is steeped in history and culture, making it an inspiring place to live.

Affordable Cost of Living: Compared to many Western European countries, Croatia offers a more affordable lifestyle, making it an attractive option for expatriates.

Friendly Communities: Croatians are known for their hospitality. You’ll find welcoming communities that make it easy to settle in and build a network.

Types of Residency Programs in Croatia

At Liv Croatia, we provide comprehensive information on various residency options available in 2024:

Temporary Residency: Ideal for individuals looking to stay for a limited time, whether for work, study, or family reunification.

Permanent Residency: A great option for those who wish to establish a long-term residence in Croatia, allowing for a more stable living situation.

Digital Nomad Visa: Perfect for remote workers, this program allows you to live in Croatia while working for a company based outside the country.

How Liv Croatia Can Help You

Navigating the residency application process can be complex, but with Liv Croatia, you’re not alone. Here’s how we support you:

Expert Guidance: Our team of professionals is knowledgeable about the latest residency requirements and can help you prepare your application.

Personalized Support: We offer tailored solutions to meet your specific needs, whether you’re applying for temporary or permanent residency.

Resources and Information: Stay updated with the latest news, tips, and requirements related to residency in Croatia through our comprehensive resources.

Conclusion

Making the decision to relocate to Croatia is exciting, and with the right support, the residency process can be seamless. At Liv Croatia , we are committed to helping you unlock your future in this beautiful country.

Explore your options, embrace a new lifestyle, and start your journey in Croatia today!

#Investment opportunities in Europe#Croatia residence program#citizenship by investment#croatia#Citizenship and prime land#Start a new life#Business opportunities in Europe#Residency Expert

0 notes

Text

Best Countries for Offshore Company Formation in 2023

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered.

These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In the second part of this blog, we will explore the best countries for offshore company formation in 2023.

Anguilla

When it comes to establishing an Best Offshore Company formation service, Anguilla has emerged as a highly desirable destination. This beautiful Caribbean island offers a range of benefits and advantages that make it an attractive option for individuals and businesses seeking to register an offshore company

Registering an offshore company in Anguilla can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. Let’s delve into the numerous advantages of choosing Anguilla as the jurisdiction for your offshore company.

Best Country To Set Up An Offshore Company Register :

How to Register an Offshore Company in Anguilla?

Step 1: Choose a company nameThe first step in registering an offshore company in Anguilla is to choose a unique company name that is not already registered in the jurisdiction. The name should not be similar to any existing Anguillan company and should comply with the relevant regulations. It's advisable to conduct a name search to ensure availability.

Step 2: Engage a Registered AgentTo register an offshore company in Anguilla, it is mandatory to engage a registered agent licensed by the Anguillan Financial Services Commission (FSC). A registered agent will assist you in navigating the registration process, ensuring compliance with local regulations, and acting as a liaison between your company and the authorities. Step 3: Determine the Company StructureAnguilla offers various company structures for offshore businesses, including companies limited by shares (Ltd.), companies limited by guarantee (Guarantee Ltd.), and limited duration companies (LLC). Choose the most suitable structure based on your specific needs, considering factors like liability protection, ownership, and operational flexibility.

Step 4: Prepare the Required DocumentationTo register an offshore company in Anguilla, you will need to gather and prepare the necessary documentation. This typically includes:

Articles of Incorporation:This document outlines the company's regulations and internal workings. Memorandum of Association:It provides details about the company's purpose, structure, and activities. Consent of Directors and Officers:The consent of all directors and officers should be obtained and documented. Declaration of Compliance:This document certifies that the company meets all legal requirements. Step 5: Submit the Application to the Registrar of CompaniesOnce you have prepared the required documentation, you will need to submit the application to the Registrar of Companies in Anguilla. Your registered agent will assist you in submitting the application along with the necessary fees. Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the requisite fees to the Anguillan authorities. The fees will vary based on the type of company and the services provided by your registered agent. Step 7: Obtain a Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Registrar of Companies. This document serves as legal proof of the existence of your offshore company in Anguilla. Step 8: Fulfill Ongoing Compliance RequirementsAfter the registration process is complete, you must fulfill the ongoing compliance requirements for your Anguillan offshore company. This may include annual filings, maintaining proper accounting records, and adhering to any other obligations outlined by the Anguillan authorities.

In Conclusion, registering an Offshore company registration can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. By following the step-by-step guide outlined above, you can successfully navigate the process of registering an offshore company in Anguilla. Remember to consult with a registered agent or legal professional to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a thriving offshore company in Anguilla and reap the benefits it offers.

Benefits of Registering an Offshore Company in Anguilla

Privacy and ConfidentialityAnguilla is renowned for its strong commitment to privacy and confidentiality. The jurisdiction has strict laws in place to protect the privacy of individuals and businesses. When you register an Offshore Company in Anguilla, you can enjoy enhanced privacy protection, ensuring that your personal and financial information remains secure and confidential. Tax AdvantagesOne of the primary reasons individuals and businesses opt to register an offshore company is to enjoy tax advantages. Anguilla offers a favorable tax environment for offshore entities. There are no income taxes, capital gains taxes, inheritance taxes, or wealth taxes imposed on offshore companies registered in Anguilla. This allows you to retain a larger portion of your profits and optimize your tax planning strategies. Easy Company FormationAnguilla boasts a streamlined and efficient company formation process. Setting up an offshore company in Anguilla is relatively straightforward and requires minimal bureaucracy. The jurisdiction offers user-friendly procedures and a supportive regulatory framework, making it hassle-free for individuals and businesses to establish their offshore entities. Asset Protection:Asset protection is a crucial consideration for many individuals and businesses. Registering an offshore company in Anguilla provides a layer of protection for your assets. The jurisdiction's legislation is designed to safeguard your assets from potential legal threats, creditors, and lawsuits. By establishing an offshore company in Anguilla, you can mitigate risks and shield your assets effectively. Flexibility and Operational Ease:Anguilla offers significant flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, there is no mandatory requirement for annual general meetings or the disclosure of beneficial owners, further enhancing the operational ease and convenience of running an offshore entity in Anguilla. Proximity to North America and Europe:Anguilla's strategic location in the Caribbean region provides easy access to both North American and European markets. This proximity makes it an ideal choice for businesses looking to expand globally and establish a presence in these lucrative markets. The well-developed infrastructure and connectivity of the island further facilitate trade and communication with international partners. Professional Support and Services:Anguilla has a well-established network of professional service providers, including lawyers, accountants, and company formation agents, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and maximizing the benefits of your offshore company.

Panama

Panama is renowned for being a favorable jurisdiction for offshore company formation due to its strategic location, robust economy, and attractive tax regulations. Setting up an offshore company in Panama can offer numerous benefits, such as tax optimization, asset protection, and enhanced privacy.

Panama has gained a reputation as one of the most attractive jurisdictions in the world. Known for its business-friendly environment, and strategic location, Panama offers numerous benefits for individuals and businesses seeking to establish an offshore company. In this guide, we will walk you through the process of registering an offshore company in Panama.

How to Register an Offshore Company in Panama?

Step 1: Choose a company nameThe first step in registering an offshore company in Panama is selecting a unique company name that is not already registered. The chosen name should not be similar to any existing Panamanian company and must comply with the regulations set by the Public Registry of Panama. Step 2: Engage a Registered AgentTo register an offshore company in Panama, it is mandatory to engage the services of a registered agent. A registered agent will facilitate the registration process, assist with the necessary documentation, and act as a liaison between your company and the Panamanian authorities. Step 3: Determine the Company StructurePanama offers several company structures for offshore businesses, including Private Interest Foundations (PIFs) and International Business Corporations (IBCs). Consider the advantages and characteristics of each structure to determine the most suitable option based on your business objectives and needs. Step 4: Prepare the Required DocumentationTo register an offshore company in Panama, you will need to gather and prepare the necessary documentation. The typical documentation includes: Articles of Incorporation: This document outlines the company's purpose, share capital, and internal regulations. Certificate of Good Standing: If incorporating a company that already exists, you may need to provide a certificate of good standing from the jurisdiction where the company is currently registered Passport Copies and Proof of Address: Provide passport copies and proof of address for all directors, officers, and shareholders. Notarized Power of Attorney: This document authorizes your registered agent to act on your behalf during the registration process. Step 5: Submit the Application to the Public Registry of PanamaOnce you have prepared the necessary documentation, your registered agent will submit the application to the Public Registry of Panama. The application includes the company's Articles of Incorporation, along with the required fees and supporting documents. Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the Public Registry of Panama. The fees vary depending on the type of company and the services provided by your registered agent. Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Public Registry of Panama. This certificate serves as legal proof of your offshore company's existence in Panama. Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in Panama, it is crucial to comply with ongoing obligations and requirements. This includes maintaining proper accounting records, filing annual tax returns, and adhering to any other obligations outlined by the Panamanian authorities.

In Conclusion, registering an offshore company in Panama can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and enhanced privacy. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in Panama.

It is essential to consult with legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in Panama and capitalize on the benefits it offers.

Benefits of Registering an Offshore Company in Panama

Favorable Tax EnvironmentOne of the key advantages of registering an offshore company in Panama is the favorable tax environment it offers. Panama operates on a territorial tax system, which means that offshore companies are only taxed on income derived from Panamanian sources. Income generated outside of Panama is exempt from local taxation, providing significant tax planning opportunities and potential tax savings for businesses. Asset ProtectionPanama offers robust asset protection laws that make it an ideal jurisdiction for individuals seeking to safeguard their assets. By registering an offshore company in Panama, you can separate your personal assets from those of your company, reducing the risk of personal liability. The country's legal framework provides strong asset protection, making it more challenging for creditors or litigants to seize assets held within your offshore company. Privacy and ConfidentialityPanama has strict laws and regulations in place to protect the privacy and confidentiality of individuals and businesses. The country's corporate laws ensure that the identities of beneficial owners, directors, and shareholders remain confidential and are not part of the public record. This level of privacy protection is highly sought after and provides individuals and businesses with peace of mind. Simplified Company Formation ProcessSetting up an offshore company in Panama is relatively simple and straightforward. The process involves minimal bureaucracy and paperwork compared to other jurisdictions. The government has streamlined the company formation procedures, allowing for quick and efficient registration. This enables entrepreneurs and businesses to establish their offshore entities with ease and start operating swiftly. Political and Economic StabilityPanama has long been regarded as a politically and economically stable country. It boasts a robust economy, a well-developed banking system, and a favorable business climate. The country's stable political environment ensures a secure and predictable investment climate, attracting businesses and entrepreneurs from around the world. Strategic Geographical LocationSituated at the crossroads of the Americas, Panama enjoys a strategic geographical location. It serves as a vital international trade and logistics hub, connecting North and South America. This strategic position provides businesses with easy access to markets in both continents, making Panama an ideal base for expanding into the Americas. International Banking and Financial ServicesPanama is home to a thriving banking and financial sector. The country has a well-established reputation as an international financial center, offering a wide range of banking services, including asset management, private banking, and offshore banking. Access to reputable and internationally recognized financial institutions can enhance the credibility and operational capabilities of your offshore company.

British Virgin Islands

The British Virgin Islands (BVI) has long been recognized as one of the premier offshore jurisdictions for company registration. Known for its favorable tax laws, robust legal framework, and business-friendly environment. The BVI offers numerous benefits for individuals and businesses seeking to establish an offshore company.

In this guide, we will delve into the advantages of choosing the British Virgin Islands as the jurisdiction for your offshore company.

How to Register an Offshore Company in the British Virgin Islands?

Step 1: Engage a Registered AgentTo register an offshore company in the BVI, it is mandatory to engage the services of a registered agent. A registered agent will guide you through the registration process, assist with the required documentation, and act as a liaison between your company and the BVI Financial Services Commission. Step 2: Choose a Company NameThe next step is to select a unique company name that is not already in use. The chosen name should comply with the regulations set by the BVI Registrar of Corporate Affairs and should not be misleading or similar to existing companies in the jurisdiction. Step 3: Determine the Company StructureThe BVI offers various company structures for offshore businesses, with the most common being the BVI Business Company (BVIBC). Consider the company structure that best suits your business objectives, taking into account factors such as liability protection, ownership flexibility, and ease of administration. Step 4: Prepare the Required DocumentationTo register an offshore company in the BVI, you will need to gather and prepare the necessary documentation, including: Memorandum and Articles of Association: These documents outline the company's purpose, activities, and internal regulations. Consent Forms: Obtain consent forms from all directors, officers, and shareholders, confirming their agreement to act in their respective roles. Registered Office Address: Provide a registered office address in the BVI where the company's official correspondence will be sent. Identity Documents: Submit certified copies of passports or other identity documents for all directors, officers, and shareholders. Step 5: Submit the Application to the BVI Financial Services CommissionOnce the required documentation is prepared, your registered agent will submit the application to the BVI Financial Services Commission. The application should include the necessary forms, fees, and supporting documents. Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the BVI Financial Services Commission. The fees vary depending on the type of company and the services provided by your registered agent. Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the BVI Financial Services Commission. This certificate serves as legal proof of your offshore company's existence in the British Virgin Islands. Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in the BVI, it is important to fulfill the ongoing compliance requirements. This includes maintaining proper accounting records, filing annual returns, and adhering to any other obligations outlined by the BVI authorities.

In Conclusion, registering an offshore company in the British Virgin Islands can offer significant advantages for entrepreneurs, including tax benefits, asset protection, and confidentiality. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in the BVI.

It is essential to seek advice from legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in the British Virgin Islands and enjoy the benefits it offers.

Benefits of Registering an Offshore Company in the British Virgin Islands

Tax AdvantagesOne of the key benefits of registering an offshore company in the BVI is the favorable tax environment. The jurisdiction does not impose taxes on offshore companies' profits, capital gains, dividends, or inheritance. This means that your offshore company can benefit from significant tax savings and optimization of your global tax planning strategies. Privacy and ConfidentialityThe British Virgin Islands places a strong emphasis on privacy and confidentiality. The jurisdiction has strict laws and regulations in place to protect the identities of company directors, shareholders, and beneficial owners. Registering an offshore company in the BVI allows you to maintain confidentiality, as these details are not available to the public. Asset ProtectionThe BVI offers robust asset protection laws, making it an attractive destination for individuals seeking to safeguard their assets. By establishing an offshore company in the BVI, you can separate your personal assets from those held within the company. This separation reduces the risk of personal liability and provides a layer of protection against potential lawsuits or creditors. Simple and Efficient Company FormationSetting up an offshore company in the BVI is a relatively straightforward process. The jurisdiction has a well-established company formation framework, with streamlined procedures and minimal bureaucracy. This allows for quick and efficient registration, enabling you to establish your offshore entity promptly and start conducting business. Flexibility and Operational EaseThe BVI provides considerable flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, the BVI allows for the appointment of corporate directors and offers simplified reporting requirements, making it convenient to run your offshore company. International Recognition and CredibilityThe British Virgin Islands has gained international recognition as a reputable offshore jurisdiction. The jurisdiction's legal system is based on English common law, providing familiarity and credibility to international investors and business partners. This recognition enhances your offshore company's reputation and instills confidence in your stakeholders. Professional Service ProvidersThe BVI has a well-developed network of professional service providers, including lawyers, accountants, and corporate service providers, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and optimizing the benefits of your offshore company.

Conclusion

In conclusion, Piptan offshore company registration can offer significant benefits to businesses seeking to optimize their tax liabilities, protect their assets, and increase their privacy. However, this process also carries several risks and challenges that businesses must carefully consider before pursuing offshore registration. Regulatory compliance, reputation risks, legal and financial risks, tax risks, and operational risks are among the most significant challenges associated with Best Offshore Company formation service. Businesses must ensure that they comply with all relevant laws and regulations, carefully manage their reputation, mitigate legal and financial risks, carefully evaluate tax implications, and effectively manage their offshore operations to successfully navigate these challenges. Despite these challenges, many businesses have successfully established offshore companies and taken advantage of the benefits associated with this process. However, businesses must carefully evaluate the potential benefits and challenges of offshore company registration and seek professional advice to ensure that they make informed decisions. Overall, Offshore Company Registration online can be a complex and challenging process, but with careful planning and execution, businesses can successfully navigate these challenges and reap the benefits of offshore company registration.

#Citizenship by Investment#Residency by Investment#Citizenship by Investment Program#Residency by Investment Programs#Offshore Company Registration#international business service#Citizenship programs#Residency Programs#Second Passport#Golden Visa#Economic Citizenship#Setting up a company in Singapore#offshore company formation#LLC Formation#Dual Citizenship#Offshore Banking#Pitan#Immigration by Investment#Golden Visa Program#Financial Advisory Firm#Offshore Company Incorporation Dubai#business setup consultants

0 notes