#real estate financing options

Explore tagged Tumblr posts

Text

Master the Art of Home Staging: Tips to Wow Buyers and Sell Fast

Home staging has become an essential part of the selling process in real estate. By showcasing your home in its best light, you can attract more buyers and sell your property faster. In this article, we will provide you with valuable tips and insights on mastering the art of home staging to wow buyers and sell fast. Section 1: Understanding the Importance of Home Staging Home staging is the…

#benefits of owning rental property#Best real estate investment opportunities#current real estate market trends#finding the right real estate agent#guide to property management.#home staging tips for sellers#how to sell your property fast#navigating the home buying process#real estate financing options#real estate investment strategies#real estate market analysis#tips for buying a home#top cities for real estate investment#trends in commercial real estate#understanding property valuation

2 notes

·

View notes

Text

Property Funding And Financing

With the customized financing options offered by NCCG Consulting Group, you may seize opportunities in Cincinnati's real estate market. Find our customized solutions for your tasks right now!

#Easy Financing#100% Financing#Real Estate Financing Options#Private Real Estate Financing#Property Funding And Financing

0 notes

Text

US stock trading sharing

As long as you have any investment questions, you can ask me and I can help you solve any investment problems. My confidence comes from the recognition of my abilities

#donald trump#finance#investing#nyc#stock market#ask#answered#ask game#stock trading#shares#stock tips#stockstowatch#stockstobuy#stockholm#investment#investors#real estate investing#investing stocks#savings#options#opportunities

4 notes

·

View notes

Text

House for Rent in Kigali: Your Guide to Finding the Perfect Property

House for Rent in Kigali: Your Guide to Finding the Perfect Property Kigali, the vibrant capital of Rwanda, is a city full of opportunities. Whether you are relocating to Rwanda for work, business, or simply seeking a fresh start, renting a house in Kigali offers a wonderful living experience. The growing real estate market in Kigali has attracted both locals and expatriates, making it an ideal…

#affordable apartments in Rwanda#affordable estates in Rwanda#affordable family homes in Kigali#affordable homes in Kigali#affordable homes Kigali#affordable homes Kigali for expats#affordable housing in Kigali#affordable housing Kigali#affordable housing options Kigali#affordable land in Kigali#affordable land plots in Kigali#affordable living options in Kigali#affordable luxury homes in Kigali#affordable properties in Kigali city#affordable properties in Rwanda#affordable real estate in Kigali#affordable rentals in Kigali#affordable renting Kigali#and properties in Kigali.#apartments in Kigali#apartments near Kigali city center#architectural design Kigali#architecture tours Kigali#bank financing Kigali#best agents Kigali#best hospitals in Kigali#best locations Kigali#best neighborhoods in Kigali for families#best neighborhoods Kigali#best places to buy property in Kigali

0 notes

Text

Investment Property Loans - Financing Options for Real Estate Investors

Explore competitive investment property loans at Prop I Mortgage. We offer flexible financing options tailored to real estate investors, whether you're purchasing residential or commercial properties. Benefit from low rates, quick approval, and expert guidance to help you grow your real estate portfolio. Apply now to secure the right investment loan for your needs.

#Property loan options for investors#Investment property financing#First time home buyer loan in texas#Texas investment mortgage solutions#Real estate investment loans

0 notes

Text

Overcoming Financial Beliefs That Hold You Back: Easy Steps to Build Confidence with Money

When it comes to managing money, mindset is everything. 💭 Thoughts like “I’m just not good with money” or “Money is always hard to come by” can sneak into your mind and hold you back from achieving financial freedom. These beliefs may seem small, but they can affect your decisions, actions, and ability to grow your wealth. Here’s the good news: 💡 You have the power to change them. In this post,…

#budgeting#Buying a Home#Due Diligence#finacial freedom#finance#Financial Planning#Financing Options#First-Time Home Buyers#Homeownership#House Flipping#investing#Investment Strategy#leverage#Location Analysis#money#Mortgage Loans#passive income#personal-finance#Property Investment#Real Estate Agent#Real Estate Investing#Real Estate Market#Rental Properties#wealth

0 notes

Text

When investing money, the timing is just as important as the investment itself. On the special occasion of Dhanteras, the best time to make investments is during the “Shubh Muhurat,” which is a special time when the positions of the planets are favourable for financial success and always bring good luck.

#Dhanteras Investment#Shubh Muhurat#Astrological Consultation#Financial Success#Hindu Panchang#Birth Chart#Wealth House#Kundali Analysis#Planetary Positions#Investment Options#Gold Purchase#Real Estate#Stocks Advice#Business Investments#Planetary Influence#Safe Investments#House Wealth#Financial Guidance#Jupiter Venus#Planetary Period#Money Horoscope#Astrological Insights#Personalized Advice#Dhanteras Finance#Growth Wealth

0 notes

Text

Ultimate Guide to Shopping Center Financing: Secure Construction Loans and Maximize Profit

Introduction to Shopping Center Financing Securing financing for shopping center construction is a complex process that requires a strategic approach, detailed planning, and a comprehensive understanding of both the real estate market and the financial instruments available. Shopping centers, being large-scale commercial projects, require significant investment, which is typically sourced…

#CMBS loans#commercial real estate#construction loans#equity partnerships#feasibility studies#joint ventures#market volatility#mezzanine financing#permanent financing#real estate development#real estate investment#refinancing options#regulatory compliance#shopping center financing#tenant leasing

0 notes

Text

#AIF Category 3#AIF Investments#Commodity Investment India#Fractional Real Estate Investments#Fractional Real Estate tax#Sukanya Samriddhi scheme returns#Investment Options In India#Your Free Finance Newsletter#Retirement planning India#Personal finance learning#Financial education India

0 notes

Text

Understanding the FHA Bankruptcy Waiting Period

Navigating the world of home loans can be particularly challenging if you've recently filed for bankruptcy. If you're thinking about an FHA loan, it's crucial to understand the FHA bankruptcy waiting period and how it impacts your eligibility. This comprehensive guide covers everything you need to know, answering key questions to help you along the way.

What Is an FHA Loan and How Does It Work?

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). These loans are designed to assist individuals who may not qualify for conventional mortgages, including first-time homebuyers, borrowers with lower credit scores, and those with adverse credit events such as bankruptcies. FHA loans typically feature lower down payments and more lenient credit requirements compared to conventional loans, making them an appealing option for many borrowers.

Benefits of an FHA Loan

Lower Down Payment Requirements: FHA loans allow down payments as low as 3.5%, making homeownership more accessible.

Flexible Credit Score Requirements: FHA loans are particularly accommodating for borrowers with lower credit scores or past bankruptcies.

Low Interest Rates: FHA interest rates are generally lower than those of conventional loans, such as those offered by Fannie Mae.

Cash-Out Refinances: FHA loans allow for cash-out refinances up to 80% loan-to-value, providing flexibility for homeowners needing access to cash.

A Note on Mortgage Insurance: While FHA loans require both upfront and monthly mortgage insurance, it's worth noting that conventional loans also require mortgage insurance when the down payment or equity is less than 20%. Mortgage insurance protects lenders in case a borrower defaults on their loan.

How Does Bankruptcy Affect Your FHA Loan Eligibility?

Bankruptcy can have a considerable impact on your credit history and financing options, but it doesn’t mean you’re permanently ineligible for an FHA loan. Understanding the waiting periods and specific requirements tied to different types of bankruptcy is crucial for determining your eligibility for an FHA loan, whether you're looking to refinance or purchase a home.

Chapter 7 Bankruptcy

For Chapter 7 bankruptcy, you generally need to wait at least two years from the discharge date before qualifying for an FHA loan. This waiting period is designed to give you time to rebuild your credit and show improved financial stability. During this time, you'll need to:

Rebuild Your Credit: Re-establish a good credit history and provide a satisfactory explanation for the bankruptcy.

Demonstrate Financial Stability: Show that you have managed your finances responsibly since the bankruptcy discharge.

Chapter 13 Bankruptcy

If you’re in a Chapter 13 repayment plan, you may qualify for an FHA loan under specific conditions:

While in Repayment Plan: You can apply for an FHA loan if you’ve made timely payments for at least one year and have received court approval.

After Discharge: There’s typically a 12-month waiting period post-discharge before you can apply for an FHA loan.

Consistent, timely payments during the repayment period are crucial to demonstrate financial responsibility.

FHA Chapter 7 Bankruptcy Waiting Period

The waiting period for an FHA loan following Chapter 7 bankruptcy is generally two years from the discharge date. This allows you time to rebuild your credit and demonstrate improved financial stability. Here's how to use this period effectively:

Rebuilding Credit: Key Steps to Improve Your Score

Obtain Secured Credit Cards: Secured credit cards require a cash deposit as collateral, which typically becomes your credit limit. Use these cards for small purchases and pay off the balance in full each month. This will help rebuild your credit score over time.

Pay Bills on Time: Consistently paying all bills, including utilities and rent, is crucial. Timely payments are the largest factor in your credit score, so set up automatic payments or reminders to avoid missing due dates.

Monitor Your Credit Report: Regularly check your credit report for errors or inaccuracies. You’re entitled to a free credit report from each major bureau (Experian, TransUnion, and Equifax) once a year. Dispute any incorrect information to ensure your report accurately reflects your financial behavior.

Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This ratio is the percentage of your credit card balances relative to your credit limits. High credit utilization can negatively impact your score, while a lack of utilization can also be detrimental.

Avoid Opening Too Many Credit Accounts: While having at least three credit accounts is beneficial, opening too many accounts in a short period can lower your credit score due to hard inquiries. Focus on managing your existing accounts before considering new credit.

Saving for a Down Payment: Why It Matters

Even though FHA loans require a lower down payment, saving more can enhance your loan application and provide several benefits:

Strengthen Your Loan Application: A larger down payment reduces the lender’s risk and demonstrates financial discipline, which can be especially important after bankruptcy.

Lower Monthly Payments: A bigger down payment reduces the amount you need to borrow, lowering your monthly mortgage payments and making homeownership more affordable.

Better Loan Terms: While less of a factor with FHA loans, a substantial down payment might help you negotiate better terms, such as a lower interest rate.

Emergency Fund: Extra savings not only aid with the down payment but also provide a safety net for unexpected expenses, helping you avoid future financial difficulties.

What Is the FHA Chapter 13 Bankruptcy Waiting Period?

If you've filed for Chapter 13 bankruptcy, the waiting period to qualify for an FHA loan differs from that of Chapter 7. Here’s a breakdown of what you need to know to prepare for your FHA loan application after a Chapter 13 bankruptcy:

While in the Chapter 13 Repayment Plan

Eligibility: You may qualify for an FHA loan while still in the Chapter 13 repayment plan if you meet specific criteria.

Timely Payments: You must have made at least 12 months of timely payments to the bankruptcy trustee and/or creditors.

Court Approval: You need to obtain written approval from the bankruptcy court. This approval indicates that the court believes you can handle new debt without jeopardizing your repayment plan.

After Chapter 13 Discharge

12-Month Waiting Period: Once your Chapter 13 bankruptcy is discharged, there is typically a 12-month waiting period before you can apply for an FHA loan.

Maintaining Stability: During this period, continue to manage your finances responsibly. Ensure timely payments on all remaining debts and avoid any new derogatory marks on your credit report.

Document Financial Improvement: Be prepared to provide documentation of your financial history and improvements since your bankruptcy discharge. This includes your credit report, proof of income, and a letter explaining your bankruptcy and the steps you've taken to improve your financial situation.

Understanding these timelines and requirements will help you navigate the FHA loan process more effectively and increase your chances of securing financing for your future home.

During the Repayment Plan: Can I Qualify for an FHA Loan?

Yes, it's possible to qualify for an FHA loan while you're still in a Chapter 13 repayment plan, but there are specific conditions you need to meet. Here’s what you need to know:

Timely Payments

Requirement: You must have made at least 12 months of timely payments to the bankruptcy trustee and/or creditors as specified in your Chapter 13 repayment plan.

Purpose: This shows lenders that you have successfully managed your financial obligations and regained financial stability.

Court Approval

Obtain Approval: You’ll need written approval from the bankruptcy court to proceed with an FHA loan application.

Reason: This approval confirms that the court has reviewed your financial situation and agrees that you can handle new debt without disrupting your repayment plan.

Conditions: The court’s permission is often based on your ability to continue making Chapter 13 payments while managing a new mortgage.

Documenting Your Financial Responsibility

Payment Documentation: Prepare to provide detailed records of your payment history during the Chapter 13 plan. This includes receipts or statements showing consistent, on-time payments.

Explanation Letter: Write a letter explaining the circumstances of your bankruptcy and how your financial situation has improved. This letter helps lenders understand your financial journey and the steps you’ve taken to improve your creditworthiness.

Assistance

Seek Expert Help: Work with a lender who has experience handling bankruptcies. An experienced lender can guide you through the process, answer your questions, and help ensure that you meet all the necessary requirements for your FHA loan application.

By following these steps and meeting the requirements, you can navigate the FHA loan process more effectively while still in a Chapter 13 repayment plan.

After Discharge: What Are the Next Steps?

Once you've successfully completed your Chapter 13 repayment plan and received your discharge, you're looking at a 12-month waiting period before you can apply for an FHA loan. Here’s what you need to focus on during this time:

12-Month Waiting Period

Start Date: The waiting period begins from the date of your Chapter 13 discharge.

Purpose: This period is designed to help you further stabilize your financial situation and continue rebuilding your credit profile.

Maintaining Financial Stability

Timely Payments: Continue to make timely payments on all your remaining debts and obligations. Maintaining a clean payment history is crucial.

Avoid Negative Marks: Steer clear of late payments or any new derogatory marks on your credit report, as these can impact your FHA loan application.

Saving for a Down Payment

Importance: While FHA loans require a down payment as low as 3.5% (for those with credit scores of 580 or higher), saving more can strengthen your application.

Benefits: A larger down payment not only improves your attractiveness as a borrower but can also lower your monthly mortgage payments and potentially secure better loan terms.

Documentation and Proof of Financial Improvement

Prepare Documentation: Gather comprehensive documentation of your financial history and improvements since your bankruptcy discharge. This should include:

Credit report

Proof of income

Employment history

Any other relevant financial documents

Explanation Letter: Write a letter explaining your bankruptcy and how your financial situation has improved since then. This can help lenders understand your financial journey better.

Consultation with a Mortgage Professional

Seek Expertise: Engage with a mortgage professional who has experience handling cases involving bankruptcy. They can provide valuable guidance and help you navigate the FHA loan application process effectively.

By focusing on these steps, you'll be better prepared to apply for an FHA loan once the waiting period has elapsed, and you’ll be on your way to achieving your homeownership goals.

How Can I Improve My Chances of Getting an FHA Loan After Bankruptcy?

Improving your chances of securing an FHA loan after bankruptcy involves several key steps. Here’s how you can enhance your application:

Build a Positive Credit History

Make On-Time Payments: Ensure all your current debts and bills are paid on time. Payment history is a significant factor in your credit score.

Keep Credit Utilization Low: Maintain a low ratio of credit card balances to credit limits, ideally below 30%.

Avoid New High-Interest Debt: Be cautious about taking on new debt, especially high-interest loans, which can negatively impact your credit profile.

Save for a Down Payment

Increase Your Down Payment: Although FHA loans have a lower down payment requirement, saving more can strengthen your application. A larger down payment not only demonstrates financial responsibility but can also help reduce your monthly mortgage payments.

Provide a Detailed Explanation

Explain Your Bankruptcy: Prepare a clear, honest explanation of the circumstances that led to your bankruptcy and how your financial situation has improved since then. This explanation can help lenders understand your financial journey and assess your current stability.

Obtain Court Approval (For Chapter 13 Applicants)

Seek Court Permission: If you are still under a Chapter 13 repayment plan, make sure to obtain written approval from the bankruptcy court. This approval indicates that the court believes you can manage a new mortgage without disrupting your repayment plan.

By following these steps, you’ll be better positioned to navigate the FHA loan process and enhance your chances of approval, paving the way toward your homeownership goals.

What Are the Exceptions to the FHA Bankruptcy Waiting Period?

While FHA guidelines typically adhere to standard waiting periods after bankruptcy, there are exceptions for cases involving extenuating circumstances. If you can prove that your bankruptcy resulted from factors beyond your control, you might be eligible for a waiver. Here are some scenarios that might qualify for an exception:

Significant Income Loss

Criteria: Demonstrate a temporary loss of at least 20% of your income for a minimum of six months.

Evidence: Provide documentation such as unemployment records, income statements, or other proof of reduced earnings.

Medical Emergencies

Criteria: Severe illness or injury that led to substantial financial hardship.

Evidence: Medical records, hospital bills, or other documentation showing the impact of the medical emergency on your finances.

Death of the Primary Earner

Criteria: The death of the main income earner in your household.

Evidence: Death certificate, financial statements showing the impact on household income.

To qualify for an exception, you’ll need to present thorough documentation of these extenuating circumstances and show that you have maintained responsible financial behavior since your bankruptcy discharge.

Frequently Asked Questions

What is the FHA bankruptcy dismissal waiting period?

If your Chapter 13 bankruptcy case is dismissed rather than discharged, you must wait two years before qualifying for an FHA loan. This waiting period provides time to re-establish your credit and demonstrate financial stability.

How Long Does It Take to Get an FHA Loan?

Once you meet the qualifications, securing an FHA loan typically takes 30 to 45 days. Here’s a quick breakdown:

Application and Documentation: 1-2 weeks to submit and review documents.

Loan Processing: 2-3 weeks for verification and appraisal.

Underwriting: 1-2 weeks for final approval.

Closing: About 1 week to sign documents and finalize the loan.

Factors that can affect timing include the lender’s processing speed, the complexity of your financial situation, and any property issues. Staying prompt with your paperwork can help expedite the process.

How to Rebuild Your Credit After Bankruptcy

Get Secured Credit Cards: Apply for one or more secured credit cards and make timely payments to start rebuilding your credit.

Manage Credit Utilization: Keep your credit utilization below 30% and avoid high-interest debt.

Pay Bills on Time: Consistently pay existing debts like rent and utilities to build a positive payment history.

Establish Credit Accounts: Aim to have at least three credit accounts, which can be a mix of credit cards and installment loans.

FHA Loan Requirements for 2024

Credit Score:

580 or higher for a 3.5% down payment.

500–579 for a 10% down payment.

Debt-to-Income Ratio:

Typically under 43%, though exceptions can apply.

Income & Employment:

Proof of steady income and employment is required

Property Use:

The home must be your primary residence.

Yes, the same guidelines apply to both refinances and purchases when it comes to bankruptcies. You can refinance your existing mortgage during and after bankruptcy, following the same rules as for new home purchases.

The Bottom Line

Navigating the FHA bankruptcy waiting period can be complex, but you don’t have to do it alone. At JVM Lending, we specialize in helping borrowers with unique financial situations, including those who have filed for bankruptcy. Our team of experts is dedicated to providing personalized service and guiding you through every step of the loan process. Whether you’re rebuilding your credit, saving for a down payment, or looking to refinance, JVM Lending is here to help.

Read more

#FHA bankruptcy waiting period#home loan options#FHA loans#bankruptcy impact#real estate financing#mortgage guidelines#loan approval

0 notes

Text

Fast Track Your Property Sale: Proven Methods for a Speedy Transaction

Introduction Are you looking to sell your property quickly and efficiently? In today’s fast-paced real estate market, time is of the essence when it comes to selling your property. From staging your home to pricing it right, there are proven methods that can help you fast-track your property sale. In this comprehensive guide, we will explore some strategies and tips to ensure a speedy…

#benefits of owning rental property#Best real estate investment opportunities#current real estate market trends#finding the right real estate agent#guide to property management.#home staging tips for sellers#how to sell your property fast#navigating the home buying process#real estate financing options#real estate investment strategies#real estate market analysis#tips for buying a home#top cities for real estate investment#trends in commercial real estate#understanding property valuation

2 notes

·

View notes

Text

Industrial Property Market Analysis

Stay ahead of the curve in the competitive commercial real estate market in Atlanta with insights from Stratus Property Group. Our industry expertise and local knowledge ensure you make informed decisions!

#https://stratuspg.com/portfolio/#atlanta commercial real estate market#atlanta commercial real estate#commercial real estate market#commercial real estate#commercial real estate in atlanta#commercial properties#atlanta commercial properties#commercial real estate market in atlanta#atlanta business opportunities#atlanta economic growth#atlanta commercial real estate trends#atlanta office space#atlanta warehouse properties#atlanta business support#commercial real estate trends#real estate investment strategies#property management tips#office space leasing#retail space development#multifamily property investment#commercial real estate financing options#industrial property market analysis#commercial real estate technology#Property Service#Stratus Property Group#stratuspg#stratuspg.com

0 notes

Text

youtube

Do you want to get financing in Mexico? Getting financing in Mexico, whether for personal or business purposes, involves navigating a diverse financial landscape. Mexico offers a range of options for securing funding, from traditional banks to alternative sources of financing. In this episode, we're talking about how to get financing in Mexico.

Getting financing in Mexico can be similar to securing financing in other countries, but there are specific steps and considerations you should keep in mind. Whether you're looking for personal loans, business financing, or investment, here's a general guide on how to get financing in Mexico:

Identify Your Financing Needs: Determine the specific purpose of your financing, whether it's for personal expenses, starting or expanding a business, buying a home, or any other financial need.

#financinginmexico#howtogetfinancing#buyingpropertyinmexico#realestate#movetomexico#realestateinvesting#financingpropertiesinmexico#financing#financingrealestatemexico#bankfinancinginmexico#financingoptionsinmexico#lorettacernowski#connectingourcontinent#bankloan

#how to get financing in mexico#buy home in mexico#move to mexico#real estate#real estate investing#how to get financing#buying property in mexico#how to make money#how to get a loan in mexico#financing in mexico#financing properties in mexico#how to get a mexican mortgage#financing#financing real estate mexico#bank financing in mexico#financing options in mexico#how to get financing in puerto penasco#loretta cernowski#how to buy a house in mexico#bank loan#Youtube

0 notes

Text

Top 10 Residential Properties in Kigali for 2025

Kigali, the capital city of Rwanda, has seen rapid growth in recent years, and with this growth comes an expanding real estate market. Whether you’re a member of the Rwandan diaspora or a foreign investor looking to buy property in Rwanda, Kigali offers a range of opportunities for residential properties. In this post, we will explore the top 10 residential properties in Kigali for 2025, catering…

#affordable apartments in Rwanda#affordable estates in Rwanda#affordable family homes in Kigali#affordable homes in Kigali#affordable homes Kigali#affordable homes Kigali for expats#affordable housing in Kigali#affordable housing Kigali#affordable housing options Kigali#affordable land in Kigali#affordable land plots in Kigali#affordable living options in Kigali#affordable luxury homes in Kigali#affordable properties in Kigali city#affordable properties in Rwanda#affordable real estate in Kigali#affordable rentals in Kigali#affordable renting Kigali#and properties in Kigali.#apartments in Kigali#apartments near Kigali city center#architectural design Kigali#architecture tours Kigali#bank financing Kigali#best agents Kigali#best hospitals in Kigali#best locations Kigali#best neighborhoods in Kigali for families#best neighborhoods Kigali#best places to buy property in Kigali

0 notes

Text

"In some cities, as many as one in four office spaces are vacant. Some start-ups are giving them a second life – as indoor farms growing crops as varied as kale, cucumber and herbs.

Since its 1967 construction, Canada's "Calgary Tower", a 190m (623ft) concrete-and-steel observation tower in Calgary, Alberta, has been home to an observation deck, panoramic restaurants and souvenir shops. Last year, it welcomed a different kind of business: a fully functioning indoor farm.

Sprawling across 6,000sq m (65,000 sq ft), the farm, which produces dozens of crops including strawberries, kale and cucumber, is a striking example of the search for city-grown food. But it's hardly alone. From Japan to Singapore to Dubai, vertical indoor farms – where crops can be grown in climate-controlled environments with hydroponics, aquaponics or aeroponics techniques – have been popping up around the world.

While indoor farming had been on the rise for years, a watershed moment came during the Covid-19 pandemic, when disruptions to the food supply chain underscored the need for local solutions. In 2021, $6bn (£4.8bn) in vertical farming deals were registered globally – the peak year for vertical farming investment. As the global economy entered its post-pandemic phase, some high-profile startups like Fifth Season went out of business, and others including Planted Detroit and AeroFarms running into a period of financial difficulty. Some commentators questioned whether a "vertical farming bubble" had popped.

But a new, post-pandemic trend may give the sector a boost. In countries including Canada and Australia, landlords are struggling to fill vacant office spaces as companies embrace remote and hybrid work. In the US, the office vacancy rate is more than 20%.

"Vertical farms may prove to be a cost-effective way to fill in vacant office buildings," says Warren Seay, Jr, a real estate finance partner in the Washington DC offices of US law firm ArentFox Schiff, who authored an article on urban farm reconversions.

There are other reasons for the interest in urban farms, too. Though supply chains have largely recovered post-Covid-19, other global shocks, including climate change, geopolitical turmoil and farmers' strikes, mean that they continue to be vulnerable – driving more cities to look for local food production options...

Thanks to artificial light and controlled temperatures, offices are proving surprisingly good environments for indoor agriculture, spurring some companies to convert part of their facilities into small farms. Since 2022, Australia's start-up Greenspace has worked with clients like Deloitte and Commonwealth Bank to turn "dead zones", like the space between lifts and meeting rooms, into 2m (6ft) tall hydroponic cabinets growing leafy greens.

On top of being adaptable to indoor farm operations, vacant office buildings offer the advantage of proximity to final consumers.

In a former paper storage warehouse in Arlington, about a mile outside of Washington DC, Jacqueline Potter and the team at Area 2 Farms are growing over 180 organic varieties of lettuce, greens, root vegetables, herbs and micro-greens. By serving consumers 10 miles away or less, the company has driven down transport costs and associated greenhouse emissions.

This also frees the team up to grow other types of food that can be hard to find elsewhere – such as edible flower species like buzz buttons and nasturtium. "Most crops are now selected to be grown because of their ability to withstand a 1,500-mile journey," Potter says, referring to the average distance covered by crops in the US before reaching customers. "In our farm, we can select crops for other properties like their nutritional value or taste."

Overall, vertical farms have the potential to outperform regular farms on several environmental sustainability metrics like water usage, says Evan Fraser, professor of geography at the University of Guelph in Ontario, Canada and the director of the Arell Food Institute, a research centre on sustainable food production. Most indoor farms report using a tiny fraction of the water that outdoor farms use. Indoor farms also report greater output per square mile than regular farms.

Energy use, however, is the "Achilles heel" of this sector, says Fraser: vertical farms need a lot of electricity to run lighting and ventilation systems, smart sensors and automated harvesting technologies. But if energy is sourced from renewable sources, they can outperform regular farms on this metric too, he says.

Because of variations in operational setup, it is hard to make a general assessment of the environmental, social and economic sustainability of indoor farms, says Jiangxiao Qiu, a landscape ecologist at the University of Florida and author of a study on urban agriculture's role in sustainability. Still, he agrees with Fraser: in general, urban indoor farms have higher crop yield per square foot, greater water and nutrient-use efficiency, better resistance to pests and shorter distance to market. Downsides include high energy use due to lighting, ventilation and air conditioning.

They face other challenges, too. As Seay notes, zoning laws often do not allow for agricultural activity within urban areas (although some cities like Arlington, Virginia, and Cincinnati, Ohio, have recently updated zoning to allow indoor farms). And, for now, indoor farms have limited crop range. It is hard to produce staple crops like wheat, corn or rice indoors, says Fraser. Aside from leafy greens, most indoor facilities cannot yet produce other types of crops at scale.

But as long as the post-pandemic trends of remote work and corporate downsizing will last, indoor farms may keep popping up in cities around the world, Seay says.

"One thing cities dislike more than anything is unused spaces that don't drive economic growth," he says. "If indoor farm conversions in cities like Arlington prove successful, others may follow suit.""

-via BBC, January 27, 2025

1K notes

·

View notes

Text

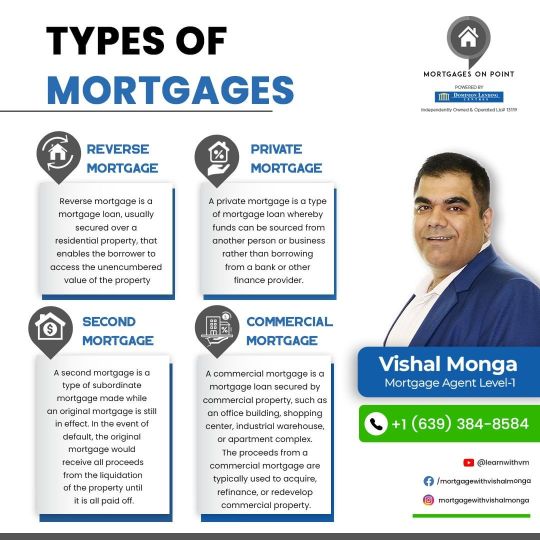

Exploring Mortgage Variety: A Guide to Home Loans

In the complex world of real estate and home financing, understanding the different types of mortgages is essential for making informed decisions. Whether you're a first-time homebuyer, considering an investment property, or exploring options for your retirement, there's a mortgage type tailored to your specific needs. In this guide, we'll delve into various mortgage options, including Fixed-Rate, Adjustable-Rate, Interest-Only, FHA, VA, Reverse, Private, and Commercial mortgages, to help you navigate the mortgage landscape.

1. Fixed-Rate Mortgages:

Fixed-rate mortgages are the gold standard in home financing. With a fixed-rate mortgage, your interest rate remains constant throughout the loan term, providing predictability in monthly payments.

Pros: i). Stable, predictable monthly payments. ii). Protection against rising interest rates. iii). Long-term financial planning.

Cons: i). Initial rates may be higher than adjustable-rate mortgages. ii). Less flexibility if market rates decrease.

2. Adjustable-Rate Mortgages (ARMs):

Adjustable-rate mortgages offer an initial lower interest rate, which can adjust periodically after an initial fixed-rate period. ARMs can be a good choice if you plan to move or refinance within a few years.

Pros: i). Lower initial interest rates. ii). Lower initial monthly payments. iii). Suitable for short-term ownership.

Cons: i). Rates can increase, leading to higher payments. ii). Uncertainty regarding future payments.

3. Reverse Mortgages:

Reverse mortgages are tailored for homeowners aged 62 and older, allowing them to convert home equity into cash without monthly mortgage payments. The loan is repaid when the homeowner sells the property or passes away.

4. Private Mortgages:

Private mortgages, also known as hard money loans, are provided by private individuals or non-traditional lenders. They can be an option for those who may not qualify for conventional loans due to credit or property issues. For more information → learnwithvm.com/

#Home Financing#Mortgage Types#Real Estate Loans#Property Investment#Mortgage Options#Loan Variety#Home Loan Guide#Mortgage Insights#Borrowing Strategies#Housing Finance

1 note

·

View note