#atlanta economic growth

Explore tagged Tumblr posts

Text

Industrial Property Market Analysis

Stay ahead of the curve in the competitive commercial real estate market in Atlanta with insights from Stratus Property Group. Our industry expertise and local knowledge ensure you make informed decisions!

#https://stratuspg.com/portfolio/#atlanta commercial real estate market#atlanta commercial real estate#commercial real estate market#commercial real estate#commercial real estate in atlanta#commercial properties#atlanta commercial properties#commercial real estate market in atlanta#atlanta business opportunities#atlanta economic growth#atlanta commercial real estate trends#atlanta office space#atlanta warehouse properties#atlanta business support#commercial real estate trends#real estate investment strategies#property management tips#office space leasing#retail space development#multifamily property investment#commercial real estate financing options#industrial property market analysis#commercial real estate technology#Property Service#Stratus Property Group#stratuspg#stratuspg.com

0 notes

Text

Congressional Democratics need to be bolder, louder, and more disruptive!

March 4, 2025

Robert B. Hubbell

In a rational world that operates according to time-tested principles of economics and politics, the Trump-Musk rampage should generate negative consequences in the financial and electoral markets. In a rational world, politicians would heed negative feedback and modify their behavior accordingly.

Since there is no evidence to suggest that Trump or Musk are capable of modifying their behavior in response to any feedback, the more likely outcome is that voters will modify their behavior to punish the Republican Party for letting the hounds of hell loose on a booming American economy and a functional federal government.

Strong evidence suggests that the financial markets are preparing for a significant contraction in the economy, a.k.a., a “recession.” In GOP-speak, “recession” means “the end times are upon us.” Republicans spend their time out of power constantly claiming that booming Democratic economies are evidence that a recession is just around the corner. On the other hand, Republicans spend their time in power creating nearly instantaneous recessions—which is what Trump's cuts and tariffs appear to be doing. See Fortune Magazine, US economy has suddenly been thrown into reverse.

Per Fortune,

The Atlanta Fed’s GDP tracker now indicates that the economy is headed for a 1.5% contraction in the first quarter, after showing 2.3% growth just days earlier. That also marks a sharp reversal from the fourth quarter, when GDP expanded by 2.3%. Several economic indicators have been raising alarms as consumers and businesses brace for Trump tariffs and federal job cuts.

As Josh Marshall of Talking Points Memo explains in his editor’s blog entitled, Ominous Economic Data, the 1.5% contraction reference in the Fortune article is old news. The Fed has re-revised its projection downward to negative 2.8% growth for the quarter. Per Marshall,

The Atlanta Fed has again lowered its projection for first quarter 2025 GDP. It had been predicting growth of 2.3%. At the end of last week that was revised to 1.5% contraction and this morning they were again down-revised 2.8% contraction, or in other words 2.8% negative growth. To be clear these aren’t final or official stats. We’re only two-thirds of the way through the quarter. They are a prediction based on current indicators

The double-whammy downward revisions come on the eve of 25% sanctions on Canada and Mexico that will go into effect on March 4, 2025. See NYTimes, No last-minute deal for Canada and Mexico to avoid tariffs, Trump says.

Marshall notes that the downward pressure created by threatened tariffs is being exacerbated by “extreme economic uncertainty” depressing consumer confidence and purchasing behavior. Random, arbitrary job cuts that ripple through the economy tend to depress consumer confidence in their future prospects.

The attempt to slash government spending is so alarming to consumers that Commerce Secretary Howard Lutnick says that the Trump administration will change the way it estimates GDP—by removing government spending! Candidly, I have no view on whether government spending should be included in the calculation of GDP. But I do know that changing how GDP is calculated to remove government spending as you are slashing government spending is like changing the scoring system in the middle of a baseball game. It stinks.

[I note that people who do know what they are talking about believe that government spending should be included in GDP. See Neil Irwin in Axios, Why government spending counts in GDP, as Trump admin mulls exclusion.]

As I write this edition of the newsletter on Monday evening in London, the S&P and Dow indices have fallen 500 and 600 points, respectively, for the day—the biggest loss this year. There is no hint that Trump will suddenly reverse course on dozens of economic policies to spur growth. Instead, it appears that Trump is hell-bent on turning the US economy into a kleptocracy like Russia.

For example, the US Treasury will end regulations that seek to prevent (or punish) US taxpayers who use shell companies to conceal taxable income. See ABC News, Treasury ends enforcement of database meant to stop shell company formation. Per ABC,

The U.S. Treasury Department announced it will not enforce a Biden-era small business rule intended to curb money laundering and shell company formation.

Trump is shutting down anti-money laundering regulations at the same time DOJ has announced that it will not enforce legislation that prohibits US businesses from engaging in foreign bribery.

Those worrisome actions must be viewed in the context of Trump's announcement that the United States will establish a cryptocurrency reserve—a move that will effectively grant government financial backing to cryptocurrencies that are (a) subject to wild volatility and (b) used to finance international criminal enterprises. The largest beneficiaries of a US crypto reserve will be current holders of cryptocurrencies (including Trump), many of whom are international criminals, tax cheats, assassins for hire, drug cartels, and smugglers.

Oh, perfect! Just the crowd that the US should legitimize by establishing a crypto reserve. See Reuters, Trump names cryptocurrencies in strategic reserve, sending prices up. The worst part is that the US will use taxpayer money to enrich criminals across the globe. I am not a crypto currency expert, but this move has disaster written all over it.

Finally, Republicans are realizing that their budget blueprint is a recipe for disaster in 2026. See Axios, Republicans fear their big budget win is actually a 2026 time bomb. The analysis in the Axios article is unsurprising to anyone with a television who has watched a recent Republican town hall. In 100% of those GOP town halls, the constituents are as mad as they have been in decades. And their ire is directed at GOP representatives who are allowing Trump and Musk to destroy the economy to extend a tax cut to billionaires and millionaires.

My point is not to suggest that Democrats can ease up because they have a lock on victory in 2026 and 2028. They do not. Rather, my point is to suggest that the laws of electoral and economic gravity still exist and are beginning to tug on the low-earth orbit of Musk’s ketamine high and Trump's teetering bouffant.

Millions of Americans are and will continue to suffer because of the reckless actions by Trump and Musk. Democrats must be smart and relentless in communicating the root causes of the suffering inflicted by Trump and Musk to voters who abandoned the Democratic ticket in 2024. If we can’t do that with the tragic motherlode of political riches that are being created every day, we do not deserve to win. We are up to the task, but we must be louder, bolder, and more creative in our approach.

“Shut down Tesla” protests are spreading across America

Musk has turned himself into the evil billionaire everyone loves to hate. That is a bad look when you sell cars based on the notion that they are modern, cool, and virtuous. No more. Protesters across America are making the point that Elon Musk is singularly responsible for eviscerating government programs and decimating the ranks of federal workers who help deliver services to the American people and ensure their health, safety, and security.

Jessica Craven of Chop Wood Carry Water describes her experience protesting a Tesla dealership in Westchester, CA. See Chop Wood, Carry Water 3/3 - by Jessica Craven.

Jessica includes a description of the effectiveness of the organic protests:

These protests are working, by the way. The AP reports that “as of Friday, [Tesla stock] has dropped 37% since Inauguration Day, a loss of $550 billion in investor wealth.” GOOD! If you haven’t yet attended a Tesla Takedown event please plan to. You can find one here. We can really, really hurt Musk by tanking this stock. Let’s do it!

In addition to the Tesla protests, brave souls in Vermont protested JD Vance’s ski vacation, during which he apparently intended to celebrate his destruction of the NATO alliance by abandoning Ukraine on live TV. Congrats to the Vermonters who did a great job disrupting Vance’s vacation—a move that undoubtedly punctured Vance’s smug, self-satisfied grin after disrespected a global hero.

Former NATO deputy commander says allies can no longer trust America

For anyone who believes I was hyperbolic in describing the effects of the Friday disgrace in the Oval Office, the former Navy deputy commander of NATO, General Richard Shirreff, said

I think we have to assume, after the events of the last 10 days, that we cannot in any way count on America as an ally.

That is exactly the result that Putin wanted—the dissolution of the NATO alliance by eroding the trust between the parties developed over 80 years of post-war cooperation.

And Trump is doubling down on his attack on Ukraine and cooperation with Russia. Trump is holding talks with senior advisors to discuss canceling military aid promised to Ukraine by the Biden administration but not yet delivered. And Trump has leaked to the press that he will not sign a minerals extraction agreement with Zelensky until the Ukrainian leader apologies to Trump on live TV. (Per Steve Doocy on Fox.)

Ominous silence from the Supreme Court

Chief Justice John Roberts granted an “administrative stay” last week, which allowed Trump to continue withholding USAID payments. The purpose of the stay was to allow the full court to consider Trump's request to stay the decisions of the lower courts that effectively compelled him to comply with the law. To state the obvious, it should not take long for the full Court to decide that the president must comply with congressional statutes that appropriate funds (as permitted by Article I of the Constitution).

The longer the delay in hearing from the Supreme Court, the more likely (I believe) it is that the Court will find a way to say that the president can withhold funds appropriated by Congress. That would be a disgrace equivalent to the decision granting Trump immunity from criminal prosecution.

Concluding Thoughts

[..]

Trump will address Congress on Tuesday. Although the speech is not an official State of the Union Address, it is customary for new presidents to address a joint session of Congress during the first months of a new administration.

Democrats need to be bold, loud, and creatively disruptive—up to and including a mass walk-out. The old rules do not apply and the sooner that Democrats internalize that fact the sooner we can get on with the serious business of using every lever to shut down Trump's unlawful rampage of destruction and betrayal. Let’s hope that our elected leaders rise to the challenge!

[Robert B. Hubbell Newsletter]

#Robert B. Hubbell Newsletter#Robert b. Hubbell#coup#SCOTUS#corrupt SCOTUS#MUsk#NATO#tesla#GDP#the economy

10 notes

·

View notes

Text

Ben Meiselas at MeidasTouch:

Donald Trump wants you to shut up. Shut up about inflation. Shut up about egg prices. Shut up while he crashes the economy, slashes federal jobs, and golfs his days away at Mar-a-Lago, all on the taxpayer’s dime. While Americans struggle to afford groceries, Trump spent his weekend vacationing—again—and posting on his failing social media platform. This time, he shared an article from right-wing conspiracy theorist Charlie Kirk, titled: “Shut Up About Egg Prices.” That’s the message from Trump and his cronies to the American people. Stop complaining. Ignore the recession he’s steering us toward. Pretend his disastrous trade wars aren’t sending prices through the roof. But we’re not shutting up. The economy is tanking under Trump’s so-called leadership. The Atlanta Federal Reserve is predicting GDP will contract between around -2.8% in the first quarter—a clear sign of recession. Inflation isn’t just a temporary inconvenience; it’s leading to stagflation, where we have low economic growth but rising prices. That’s a nightmare scenario, one that Trump’s erratic policies and billionaire tax giveaways are making worse by the day. Even Wall Street executives are sounding the alarm, warning that Trump's reckless tariffs could trigger a Great Depression-level economic collapse. But while economic experts worry about the future of the country, Trump and his team are busy gaslighting the public. Trump’s Secretary of Agriculture, Brooke Rollins, went on Fox News to offer a “solution” to skyrocketing egg prices: just buy chickens! Seriously. She said Americans should simply raise chickens in their backyards to “solve” the problem. Because in Trump’s America, you’re on your own. While his administration mocks working Americans, Trump’s media allies continue running cover. Larry Kudlow, one of Trump’s top economic propagandists, dismissed the economic crisis as just a “short-term disturbance.” Meanwhile, Trump is busy partying with billionaires at Mar-a-Lago, making shady deals involving crypto scams and meme coins—schemes designed to line his pockets while everyday Americans suffer.

Whiny manbaby Donald Trump posted a Charlie Kirk Daily Caller column on Truth Social titled “shut up about egg prices.” This is more proof that both Kirk and Trump are clueless on the economy and other issues.

6 notes

·

View notes

Text

This is a good article about Atlanta's I-MIX zoning designation, created in 2020 to allow for mixed-use development in formerly industrial spaces while leaving space for some industrial uses. Some of the biggest recent developments in the city have happened through this zoning.

Apparently the success of it is prompting other cities to explore similar zoning designations.

And while it's good to see new life on these properties, there's still some serious work to be done to improve the projects. Apart from the obvious need to fund affordability in theme, there's also the transportation component that needs to be addressed.

The article focuses on The Works on Chatthoochee Avenue. It's a street that lacks frequent transit, has no protected bike lanes, and has spotty sidewalks. We can do better than drive-to urbanism. Instead of just applauding individual developments in a vacuum, let's work at a more holistic level and ensure that these projects are part of equitable, sustainable urban neighborhoods.

8 notes

·

View notes

Text

The government produces many of America’s most important economic indicators. And that data influences the media’s coverage of the economy, which likely colors voters’ views of the president.

These facts have long led partisans to fear presidential manipulation of economic data. Specifically, during Democratic presidencies, conservatives have often sought to dismiss positive economic trends by alleging data manipulation. Last August, Donald Trump accused the Biden administration of “manipulating jobs statistics” to make unemployment look artificially low before Election Day.

Such allegations have always been baseless. Presidents might have an incentive to tamper with economic data reported by the executive branch. But they have always been constrained from doing so by respect for the independence of data-gathering agencies like the Bureau of Labor Statistics and Bureau of Economic Analysis, fear of scandal, and a desire to provide the private sector with clear and accurate information about economic conditions.

But Trump appears uniquely unencumbered by such constraints. His administration is openly contemptuous of agency independence, arguing that the president should boast unitary authority over all of the executive branch’s activities. It also evinces no concern for giving off the appearance of corruption (before taking office, the president established a memecoin that enables any interest group to directly burnish his net wealth). Trump’s constantly shifting tariff threats indicate an indifference to providing business owners with clarity about the economy’s future trajectory, while his entire history as a public figure suggests an indifference to the truth.

All this gives us some cause for fearing that Trump might tamper with government economic data, should it become politically inconvenient. And over the weekend, Commerce Secretary Howard Lutnick suggested that he intends to do just that, by altering how the government calculates gross domestic product (GDP) — the total value of goods and services produced in the economy.

“You know that governments historically have messed with GDP,” Lutnick said during a Fox News interview Sunday. “They count government spending as part of GDP. So I’m going to separate those two and make it transparent.”

Lutnick’s remarks came days after Elon Musk argued that “A more accurate measure of GDP would exclude government spending” since “Otherwise, you can scale GDP artificially high by spending money on things that don’t make people’s lives better.”

In other words, Musk believes that the US government has been producing useless goods and services just to inflate GDP numbers.

This argument is substantively unsound. And it also appears politically motivated: Musk’s comments came in response to a new projection from the Atlanta Federal Reserve, which showed GDP on pace to decline during the first quarter of this year. Musk’s implication was that this projected decline is entirely attributable to his elimination of wasteful government activities that had been distorting growth statistics.

Stripping government spending from official GDP data would not be the most corrosive form of data manipulation. Such tampering would at least be transparent; the administration would not be producing fabricated economic statistics, but merely seeking to redefine an existing measure. But the administration’s desire to alter the content of GDP — seemingly, due to political concerns — makes the threat of more covert and destructive data manipulation more plausible.

5 notes

·

View notes

Text

The Democratic party needs drastic changes in messaging to win the next election. The party is seen as old, affulent, and out of touch with middle America.

Harris did, in part, what she attempted to: make gains in white, college educated suburbs while minimizing losses everywhere else. She did the first part relatively well.

The Democrats believed that by moving to the right on specific issues, they could win moderate suburban (generally wealthier) voters. Harris portrayed herself as tough on crime, strong on border control, and put forth means tested welfare policies. She did her best to portray herself as an extension of the status quo, and Trump as a radical.

Democrats made gains they desired: in the suburbs of Atlanta and Dallas, and shifts to the right were minimized in wealthy suburbs outside cities like Milwalkee and Austin, even as those states made hard turns to the right. In 2024, more than any other election year in recent history, voters for the Democratic candidate were comparitively wealthier and older.

It is clear that voters wanted a change to the status quo. If the Democrats want to get back the voters they lost: Hispanic and Black voters in high cost of living cities, working class voters in the rust belt, young voters, they need to acknowledge that the issues they are facing are real.

Globalization and neoliberal economic policy have led to a loss in manufacturing jobs. Poor planning has made large cities too expensive to live in. Inequality and midde class flights have led to poverty concentration in urban centers and increased crime. Job growth is strong, but most of this growth has been in lower paid service sector work: underemployement is a real issue for young voters, and they are generally worse off than previous generations. And politicians, wealthier than ever, seem more bothered by fundraising and corporate interests.

And Republicans have been able to make these issues stick to Biden-Harris.

Workers feel screwed over and overworked, and Trump is telling people that they are. He says immigrants and "coastal elites" are bringing crime and taking jobs, while Americans are being left behind. Trump, to the working class voters who left the Democrats behind, was seen authentically pointing out issues "everyones thinking about:" job loss, crime, immigration, war, and inflation. Trump's platform is short and to the point, while Harris's takes 600 words to answer one policy question.

Elections are based on vibes, and the "Vibe" of the Democratic party is that it's dominated by liberal intellectuals and party machine candidates. Policy such as student loan forgiveness, tax cuts for first-time homebuyers, etc, mean nothing to voters who never went to college and can't imagine buying a home in this economy.

If the Democrats want to move to the right on issues like crime and immigration--if they think this will better reach voters--they cannot simply just take a page out of the Republican's playbook and start talking about border security and being tough on crime. Using Republican framing will fail and will just legitimize Republican talking points.

If they want to move right on issues of immigration and crime, Democrats need to frame the issues in "Democrat" ways. Talk about the potential depressing effect immigrants have on wages. Talk about how big agribusiness loves illegal immigration because they can exploit that labor more, and this is why nothing is done. Talk about inequality and its relation to crime. Talk about how large chains have eaten away at small businesses in middle America, killing downtowns and a small town middle-class.

Democrats also must talk about issues that are generally relatable to voters and motivate their base. Issues like expensive health insurance, strong union rights, high housing costs, stagnant real wages, and money in politics.

A Republican would tell you that it was DEI, abortion, and lgbt issues that caused voters to leave the Democratic party, but I would disagree. Harris, more than Hillary, minimized her gender and focused on policy. Voters broadly agree with the democratic party on issues of abortion and lgbt, but those issues are simply not as important as the core economic issues that bring people to the polls.

I voted for Harris, but I could see her loss coming before the election started. I work with people on the ground, and they feel unheard.

3 notes

·

View notes

Text

I love this scene. But it's not enough.

Getting affordability right and implementing rail are both key components for equity on the Atlanta Beltline.

If the Beltline ends up as a playground for wealthy & able bodied people, that means we've spent tons of public resources to benefit the privileged -- to generate gentrification.

This has to become a transportation and neighborhood-building project that benefits every economic group, and every ability. We have to do better with funding affordable homes here amid the new growth, and we have to build the rail that has always been at the heart of the Beltline concept.

28 notes

·

View notes

Text

This quote comes from Dan Immergluck's great book "Red Hot City: Housing, Race, and Exclusion in Twenty-First-Century Atlanta." Recommended reading.

Atlanta saw a 28% increase in its tech talent pool from 2013-18. During that boom, we missed a huge opportunity for equitable outcomes.

Instead of transforming that economic growth into critical public services such as subsidies for housing for lower-income Atlanta, the inflow of higher-wage workers just ended up driving local rents higher, hurting low-income folks the most.

I'm glad to see the city make good efforts toward affordable housing in recent years. We're moving in the right direction.

But going forward, we need to think of growth and investment as a tool for truly equitable outcomes, with measurable success. We're not at that point yet.

City leaders are constantly getting an earful of demands from the local elite about remaining "business friendly" and not disturbing the status quo of investment returns for powerful interests. They need to hear from the rest of us.

9 notes

·

View notes

Text

How to Buy a Business in Atlanta: A Step-by-Step Guide

Buying a business in Atlanta can be a lucrative investment, offering immediate revenue, an established customer base, and a proven business model. However, the process requires careful planning and due diligence. This step-by-step guide will help you navigate the complexities of buying a business in Atlanta successfully.

Step 1: Define Your Business Goals

Before purchasing a business, determine your goals and objectives. Ask yourself:

What industry are you interested in?

What is your budget?

Are you looking for a hands-on or absentee-owner business?

What size of business are you comfortable managing?

Having clear answers to these questions will help you narrow down your options and find a business that aligns with your aspirations.

Step 2: Research the Atlanta Market

Atlanta offers diverse business opportunities across various industries, including technology, real estate, healthcare, and food services. Conduct market research to understand:

The demand for specific businesses in Atlanta

Economic trends affecting different industries

Competitor landscape

Understanding these factors will help you identify profitable business opportunities and avoid industries with declining potential.

Step 3: Work with a Business Broker

A business broker can be an invaluable resource when buying a business. They provide:

Access to business listings

Confidential negotiations

Expert advice on valuation

Assistance with paperwork and legal requirements

Hiring a broker saves time and helps ensure you make a well-informed purchase.

Step 4: Find the Right Business

Once you have a clear understanding of the market, start searching for businesses that match your criteria. Consider factors such as:

Location and customer demographics

Revenue and profitability trends

Business reputation and brand recognition

Employee and management structure

Evaluate multiple businesses before making a decision to find the best fit for your goals.

Step 5: Conduct Due Diligence

Due diligence is one of the most critical steps in buying a business. This process involves thoroughly reviewing:

Financial records (profit and loss statements, tax returns, and balance sheets)

Legal documents (contracts, leases, licenses, and permits)

Existing debts or liabilities

Customer and supplier agreements

Work with an accountant and an attorney to ensure all financial and legal aspects are properly assessed.

Step 6: Secure Financing

Many business buyers require financing to complete a purchase. Explore different funding options, including:

Bank loans and Small Business Administration (SBA) loans

Seller financing

Investor partnerships

Personal savings or lines of credit

Choosing the right financing method will depend on your financial situation and the business’s cost.

Step 7: Negotiate the Purchase Agreement

Once you decide on a business, enter into negotiations with the seller. Key aspects to negotiate include:

Purchase price

Payment terms

Transition period (will the seller stay on for training?)

Included assets (inventory, equipment, intellectual property, etc.)

A business broker or attorney can help ensure that you negotiate favorable terms and avoid costly mistakes.

Step 8: Finalize the Legal Documentation

After reaching an agreement, finalize all legal paperwork, including:

Sales agreement

Lease transfer agreements

Employee contracts

Licensing and permits

Ensuring all documents are legally sound will prevent issues down the road.

Step 9: Close the Deal

At the closing stage, funds are transferred, ownership changes hands, and all final documents are signed. Be sure to:

Review all closing documents carefully

Ensure all assets included in the sale are accounted for

Verify that financing and payments are properly structured

Step 10: Transition and Grow the Business

Once you take over, focus on:

Learning the business operations

Building relationships with employees and customers

Implementing growth strategies

Managing finances effectively

A well-planned transition ensures long-term success and a smooth handover of operations.

Conclusion

Buying a business in Atlanta is a strategic investment that can provide financial stability and growth. By following these steps, conducting thorough due diligence, and seeking professional guidance, you can successfully acquire a business that aligns with your goals and secures your future success.

youtube

#Business Broker Atlanta#Business Brokers Atlanta#Business Broker Atlanta ga#Business Brokers Atlanta ga#Business Brokers Atlanta georgia#Small business brokers near me#Youtube

0 notes

Text

U.S. Labor Market Holds Steady Amid Trade and Budget Uncertainty

Source: foxbusiness.com

Job Growth and Unemployment Rate Trends

The U.S. labor market remained resilient in February, with job growth expected to show an uptick despite ongoing economic uncertainty. According to economists, nonfarm payrolls likely increased by 160,000 jobs in February, following a rise of 143,000 in January. Forecasts for job additions ranged widely from 30,000 to 300,000, reflecting uncertainty over the impact of winter storms and ongoing economic disruptions.

The national unemployment rate was projected to hold steady at 4.0%, maintaining recent stability. However, underlying concerns related to trade policies and deep federal spending cuts could pose risks to future job growth. Many businesses remain cautious in their hiring plans due to the unpredictability of regulatory and supply chain conditions. Jane Oates, a senior policy advisor at WorkingNation, noted that uncertainty in economic policies creates a challenging business environment, with potential negative impacts on job creation.

Impact of Trade Policies and Government Funding Freezes

The recent imposition of tariffs has intensified concerns among economists and business leaders. This week, the administration implemented a 25% tariff on imports from Mexico and Canada, along with a doubling of duties on Chinese goods to 20%. However, a temporary exemption for Canadian and Mexican goods under an existing trade agreement helped to ease immediate concerns about the impact on the U.S. Labor Market.

The labor market may also be affected by government employment trends. Hiring freezes and budget uncertainties have led to workforce reductions, particularly within federal agencies and grant-funded organizations. While layoffs of probationary federal employees at the Department of Government Efficiency (DOGE) are not expected to reflect in February’s employment figures, experts predict that hiring constraints could result in job losses ranging from 5,000 to 10,000 in government positions.

Government funding disruptions have already led to instability in sectors dependent on federal grants. Contractors and workers in government-supported entities have faced employment disruptions, adding to broader concerns about job market stability. Additionally, with job gains largely concentrated in lower-wage sectors such as leisure and hospitality, some economists warn of emerging challenges for white-collar workers.

Wage Growth and Broader Economic Indicators

Despite ongoing economic turbulence, wage growth continues to show steady progress. Average hourly earnings were projected to rise by 0.3% in February, following a 0.5% surge in January. Annual wage growth was expected to match January’s 4.1% increase, indicating that consumer incomes remain on an upward trajectory.

However, broader economic indicators suggest potential headwinds. A decline in consumer spending and homebuilding, coupled with a widening trade deficit in January, prompted economists to revise their GDP growth estimates downward. Projections for first-quarter GDP growth fell below 1.5%, down from the previous 2.0% estimate. The Atlanta Federal Reserve projected an economic contraction at a rate of 2.4%, signaling potential concerns for future growth.

With these economic shifts, the Federal Reserve has opted to maintain its current interest rate policy. The benchmark overnight interest rate remained unchanged within the 4.25%-4.50% range, as policymakers assess the evolving impact of tariffs and economic policy decisions. Some analysts believe that the current economic climate mirrors historic periods of trade policy turbulence, adding to the complexity of forecasting future U.S. Labor Market trends.

0 notes

Text

Donald Trump wants you to shut up. Shut up about inflation. Shut up about egg prices. Shut up while he crashes the economy, slashes federal jobs, and golfs his days away at Mar-a-Lago, all on the taxpayer’s dime.

While Americans struggle to afford groceries, Trump spent his weekend vacationing—again—and posting on his failing social media platform. This time, he shared an article from right-wing conspiracy theorist Charlie Kirk, titled: “Shut Up About Egg Prices.” That’s the message from Trump and his cronies to the American people. Stop complaining. Ignore the recession he’s steering us toward. Pretend his disastrous trade wars aren’t sending prices through the roof.

But we’re not shutting up.

The economy is tanking under Trump’s so-called leadership. The Atlanta Federal Reserve is predicting GDP will contract between around -2.8% in the first quarter—a clear sign of recession. Inflation isn’t just a temporary inconvenience; it’s leading to stagflation, where we have low economic growth but rising prices. That’s a nightmare scenario, one that Trump’s erratic policies and billionaire tax giveaways are making worse by the day.

Even Wall Street executives are sounding the alarm, warning that Trump's reckless tariffs could trigger a Great Depression-level economic collapse. But while economic experts worry about the future of the country, Trump and his team are busy gaslighting the public.

Trump’s Secretary of Agriculture, Brooke Rollins, went on Fox News to offer a “solution” to skyrocketing egg prices: just buy chickens! Seriously. She said Americans should simply raise chickens in their backyards to “solve” the problem. Because in Trump’s America, you’re on your own.

While his administration mocks working Americans, Trump’s media allies continue running cover. Larry Kudlow, one of Trump’s top economic propagandists, dismissed the economic crisis as just a “short-term disturbance.” Meanwhile, Trump is busy partying with billionaires at Mar-a-Lago, making shady deals involving crypto scams and meme coins—schemes designed to line his pockets while everyday Americans suffer.

Trump also posted about a continuing resolution (CR) to fund the government, begging Republicans to vote yes. Yes, begging. “Please,” Trump wrote. The same man who pretends to be a strongman is now pleading with Congress to pass a CR because his party is incapable of passing an actual budget.

Republicans control the House. Republicans control the Senate. Republicans control the White House. If they actually wanted to govern, they could. But they don’t. Instead, they want to blame Democrats, who have zero control over the legislative process right now. It’s pathetic.

So what else did Trump do this weekend, besides telling struggling Americans to shut up? He appointed Laura Ingraham and Maria Bartiromo to the Kennedy Center board. Because clearly, what the nation needs in the middle of an economic crisis is two Fox “News” hacks overseeing the performing arts.

Talented artists want nothing to do with Trump’s authoritarian regime. So go ahead, Laura—book Kid Rock and Ted Nugent for your first event. The Kennedy Center is just another piece of America Trump wants to degrade and corrupt.

And of course, no Trump weekend would be complete without a fresh round of scams. He sent fundraising emails begging supporters to buy gold-plated “Trump Oval Office” membership cards, complete with an American flag defiled with his name. He also launched a sweepstakes to have dinner with him at Mar-a-Lago—because nothing screams “populist” like charging your own supporters for a fake chance to eat rubbery steak with a billionaire who despises them.

Trump thinks if he says “shut up” enough times, we’ll stop noticing our wages aren’t keeping up with inflation, that he’s gutting federal jobs, and that his trade wars are making everything worse. But Americans are pissed off—and rightfully so.

Trump promised prices would drop on Day One. Instead, he’s made everything worse, and now he and his lackeys are mocking the very people suffering under his economic mismanagement.

So no, Donald, we won’t shut up. Not about egg prices. Not about inflation. Not about your corruption. We’ll keep growing this network and calling you out every step of the way. If you are able to, please consider joining as a paid subscriber now to keep us going.

0 notes

Text

Atlanta Commercial Real Estate

Unlock Opportunities For Your Business in the Atlanta Commercial Real Estate Market

Welcome to the heart of opportunity—Atlanta, Georgia, where our thriving commercial real estate market stands as a beacon for businesses seeking growth and prosperity. Nestled in the bustling southeastern United States, Atlanta offers more than just a strategic location; it's a dynamic hub flowing with possibilities. Learn more as we explore what makes Atlanta the premier destination for your commercial real estate ventures and discover the advantages awaiting your business.

Strategic Location and Connectivity

Our city seamlessly connects us to the world through the renowned Hartsville-Jackson International Airport, ensuring unparalleled accessibility for businesses aiming to expand regionally or nationally. Atlanta’s strategic positioning makes it a coveted choice for those seeking to amplify their reach.

Diverse Industry Sectors

In Atlanta, diversity isn't just a buzzword; it's the cornerstone of our thriving commercial real estate market. From tech titans to healthcare heroes, Atlanta accommodates a plethora of industries, ensuring that every business finds its perfect match in our vibrant landscape.

Growing Economy

Atlanta isn't just growing; it's thriving. Fueled by a potent mix of corporate giants and burgeoning startups, our city nurtures innovation and fosters growth like no other. With each passing day, Atlanta solidifies its status as an economic powerhouse, attracting investment and driving demand for commercial real estate.

Variety of Commercial Real Estate Options

Whether you're dreaming of a sleek downtown office space or a sprawling suburban warehouse, Atlanta has it all. Our diverse portfolio of commercial properties caters to every need and aspiration, ensuring that your business finds its ideal home amidst our dynamic landscape. Additionally, Atlanta boasts mixed-use developments that combine retail, office, and residential spaces, providing a dynamic environment for work, leisure, and living.

Affordability

Atlanta's commercial real estate market offers affordability without compromising quality. Compared to other major cities, our rates are competitive, allowing businesses to stretch their resources further and invest in their growth with confidence.

Supportive Business Environment

At the heart of Atlanta lies a community dedicated to your success. From government incentives to bustling networking events, our city pulls out all the stops to support businesses of every size and sector. In Atlanta, your success isn't just a goal; it's a shared mission.

Conclusion

Atlanta isn't just a city; it's a promise of growth, opportunity, and success. With its strategic location, diverse industries, booming economy, expansive property options, affordability, and unwavering support for businesses, Atlanta stands as the ultimate destination for commercial real estate ventures. So why wait? Contact us today and allow Stratus help your business dreams come to life amidst a landscape brimming with possibilities!

#https://stratuspg.com/portfolio/#Atlanta Commercial Real Estate Market#Atlanta Commercial Real Estate#Commercial Real Estate Market#Commercial Real Estate#Commercial Real Estate In Atlanta#Commercial Properties#Atlanta Commercial Properties#Commercial Real Estate Market in Atlanta#Atlanta Business Opportunities#Atlanta Economic Growth#Atlanta Commercial Real Estate Trends#Atlanta Office Space#Atlanta Warehouse Properties#Atlanta Business Support#Commercial Real Estate Trends#Real Estate Investment Strategies#Property Management Tips#Office Space Leasing#Retail Space Development#Multifamily Property Investment#Commercial Real Estate Financing Options#Industrial Property Market Analysis#Commercial Real Estate Technology

0 notes

Text

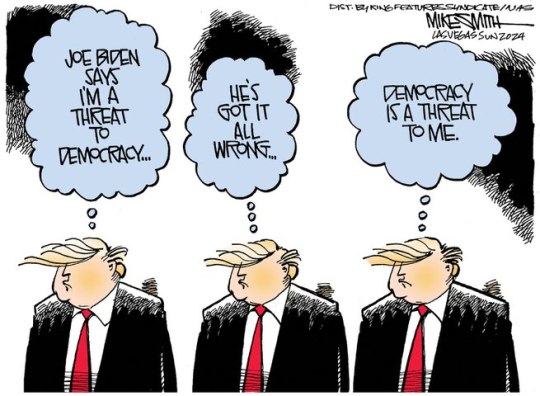

Mike Smith :: Las Vegas Sun

* * * *

LETTERS FROM AN AMERICAN

April 29, 2024

HEATHER COX RICHARDSON

APR 30, 2024

In December 2020, when the pandemic illustrated the extraordinary disadvantage created by the inability of those in low-income households to communicate online with schools and medical professionals, then-president Trump signed into law an emergency program to provide funding to make internet access affordable. In 2021, Congress turned that idea into the Affordable Connectivity Program (ACP) and made it part of the bipartisan Infrastructure Investment and Jobs Act (also known as the Bipartisan Infrastructure Law).

The program has enabled 23 million American households to afford high-speed internet. Those benefiting from it are primarily military families, older Americans, and Black, Latino, and Indigenous households. In February, the Brookings Institution cited economics studies that said each dollar invested in the ACP increases the nation’s gross domestic product by $3.89 and that the program has led to increased employment and higher wages. It also cuts the costs of healthcare by replacing some in-person emergency room visits with telehealth.

Slightly more of the money in the program goes to districts represented by Republicans than to those represented by Democrats, which might explain why 79% of voters want to continue the program: 96% of Democrats, 78% of Independents, and 62% of Republicans.

But the ACP is running out of money. Back in October 2023, President Joe Biden asked Congress to fund it until the end of 2024, and a bipartisan bill that would extend the program has been introduced in both chambers of Congress. Each remains in an appropriation committee. As of today, the House bill has 228 co-sponsors, the Senate bill has 5.

Senate majority leader Chuck Schumer (D-NY) has said he supports the measure, but House speaker Mike Johnson (R-LA) has not commented. Judd Legum pointed out in Popular Information today that the 2025 budget of the far-right Republican Study Committee (RSC) calls for allowing the ACP to expire, saying the RSC “stands against corporate welfare and government handouts that disincentivize prosperity.” More than four fifths of House Republicans belong to the RSC.

The differences between the parties’ apparent positions on the ACP illustrates the difference in their political ideology. Republicans object to government investment in society and believe market forces should be left to operate without interference in order to promote prosperity. Democrats believe that economic prosperity comes from the hard work of ordinary people and that government investment in society clears the way for those people to succeed.

Wealth growth for young Americans was stagnant for decades before the pandemic, but it has suddenly experienced a historic rise. In Axios, Emily Peck reported that household wealth for Americans under 40 has risen an astonishing 49% from where it was before the pandemic. Wealth doubled for those born between 1981 and 1996. This increase in household wealth comes in part from rising home prices and more financial assets, as well as less debt, which fell by $5,000 per household. Households of those under 35 have shown a 140% increase in median wealth in the same time period.

Brendan Duke and Christian E. Weller, the authors of the Center for American Progress study from which Peck’s information came, say this wealth growth is not tied to a few super-high earners, but rather reflects broad based improvement. “A simple reason for the strong wealth growth is that younger Americans are experiencing an especially low unemployment rate and especially strong wage growth,” Duke and Weller note, “making it easier for them to accumulate wealth.”

In honor of National Small Business Week, Vice President Kamala Harris today launched an “economic opportunity tour” in Atlanta, where she highlighted the federal government’s $158 million investment in “The Stitch,” a project to reconnect midtown to downtown Atlanta. This project is an initial attempt to reconnect the communities that were severed by the construction of highways, often cutting minority or poor neighborhoods off from jobs and driving away businesses while saddling the neighborhoods with pollution.

While some advocates wanted to use the $3.3 billion available from the Bipartisan Infrastructure Law and the Inflation Reduction Act to take down highways altogether, the administration has shied away from such a dramatic revision and has instead focused on creating new public green spaces, bike paths, access to public transportation, safety features, and so on, to link and improve neighborhoods. More than 40 states so far have received funding under this program.

The administration says that projects like The Stitch will promote economic growth in neighborhoods that have borne the burden of past infrastructure projects. Today it touted the extraordinary growth of small businesses since Biden and Harris took office, noting that their economic agenda “has driven the first, second and third strongest years of new business application rates on record—and is on pace for the fourth—with Americans filing a record 17.2 million new business applications.”

Small businesses owned by historically underserved populations “are growing at near-historic rates, with Black business ownership growing at the fastest pace in 30 years and Latino business ownership growing at the fastest pace in more than a decade,” the White House said. The administration has invested in small businesses, working to level the playing field between them and their larger counterparts by making capital and information available, while working to reform the tax code so that corporations pay as much in taxes as small businesses do.

“Small businesses are the engines of the economy,” the White House said today. “As President Biden says, every time someone starts a new small business, it’s an act of hope and confidence in our economy.”

In place of economic growth, Republicans have focused on whipping up supporters by insisting that Democrats are corrupt and are cheating to take over the government. Matt Gertz of Media Matters noted in February that “Fox News host Sean Hannity and his House Republican allies spent 2023 trying to manufacture an impeachable offense against President Joe Biden out of their fact-free obsession with the president’s son, Hunter.” At least 325 segments about Hunter Biden appeared on Hannity’s show in 2023; 220 had at least one false or misleading claim. The most frequent purveyor of that disinformation was Representative James Comer (R-KY), chair of the House Oversight Committee, who went onto the show 43 times to talk about the president’s son.

The House impeachment inquiry was really designed to salt right-wing media channels with lies about the president and, in the end, turned up nothing other than witnesses who said President Biden was not involved in his son’s businesses. Then the Republicans’ key witness, Alexander Smirnov, was indicted for lying about the Bidens, and then he turned out to be in contact with Russian spies.

Comer has been quietly backing away from impeaching the president until today, when he popped back into the spotlight after news broke that Hunter Biden’s lawyer has threatened to sue the Fox News Channel (FNC) for “conspiracy and subsequent actions to defame Mr. Biden and paint him in a false light, the unlicensed commercial exploitation of his image, name, and likeness, and the unlawful publication of hacked intimate images of him.” His lawyer’s letter calls out FNC’s promotion of Smirnov’s false allegations.

Last year, FNC paid almost $800 million to settle defamation claims made by Dominion Voting Systems after FNC hosts pushed the lie that Dominion machines had changed the outcome of the 2020 presidential election.

Legal pressure on companies lying for profit has proved successful. Two weeks ago, the far-right media channel One America News Network (OAN) settled a defamation lawsuit with the voting technology company Smartmatic. Today, OAN retracted a false story about former Trump fixer Michael Cohen, apparently made to discredit the testimony of Stormy Daniels about her sexual encounters with Trump. OAN suggested that it was Cohen rather than Trump who had a relationship with Daniels, and that Cohen had extorted Trump over the story.

“OAN apologizes to Mr. Cohen for any harm the publication may have caused him,” the network wrote in a statement. “To be clear, no evidence suggests that Mr. Cohen and Ms. Daniels were having an affair and no evidence suggests that Mr. Cohen ‘cooked up’ the scheme to extort the Trump Organization before the 2016 election.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Mike Smith#Heather Cox Richardson#Letters From An American#defamation claims#Affordable Connectivity Program#income inequality#small businesses#economic growth#RSC Republican Study Committee#trickle down economics

13 notes

·

View notes

Text

Sanjana Karanth at HuffPost:

President Donald Trump refused to say whether he expects his planned tariffs and resulting economic uncertainty to lead the United States into a recession this year, in an answer that contradicted his own commerce secretary’s position that Americans should not brace for such an outcome. In a taped interview aired on Fox News’ “Sunday Morning Futures,” the president told Maria Bartiromo that his plans for bigger “reciprocal” tariffs will go into effect on April 2. The White House had initially imposed 25% tariffs on imports from Mexico and Canada before quickly pausing them, leaving Wall Street unstable over concerns of a possible trade war. When asked by Bartiromo about the Atlanta Federal Reserve’s warning of an economic decline in the first quarter of the year — in which there are fewer goods and services produced — Trump appeared to acknowledge that his tariffs could impact the country’s economic growth. But despite claiming the tariffs will ultimately be “great” for the U.S., the president refused to say whether he expects the country to enter a recession this year, as major banks now warn. “I hate to predict things like that. There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing,” he said. “And there are always periods of — it takes a little time, it takes a little time. But I think it should be great for us. I mean, I think it should be great. It’s gonna be great ultimately for the farmers.” Trump’s answer contradicts Commerce Secretary Howard Lutnick’s remarks aired the same day, in which he said Americans should “absolutely not” brace for a recession.

Speaking to Maria Bartiromo on Fox “News”’s Sunday Morning Futures, Donald Trump admitted that a recession is possible (likely due to his policies on tariffs).

From the 03.09.2025 edition of FNC's Sunday Morning Futures:

youtube

See Also:

The Guardian: ‘I hate to predict things’: Trump doesn’t rule out US recession amid trade tariffs

2 notes

·

View notes

Text

Trump Downplays Business Concerns About Uncertainty From His Tariffs and Prospect of Higher Prices

President Donald Trump is dismissing business concerns over the uncertainty caused by his planned tariffs on a range of American trading partners and the prospect of higher prices, and isn't ruling out the possibility of a recession this year.

After imposing and then quickly pausing 25% tariffs on imports from Mexico and Canada that sent markets tumbling over concerns of a trade war, Trump said his plans for broader “reciprocal” tariffs will go into effect April 2, raising them to match what other countries assess.

“April 2nd, it becomes all reciprocal,” he said in a taped interview with Fox News Channel's “Sunday Morning Futures.” “What they charge us, we charge them.”

Asked about the Atlanta Fed's warning of an economic contraction in the first quarter of the year, Trump seemingly acknowledged that his plans could affect U.S. growth. Still, he claimed, it would ultimately be "great for us.”

When questioned whether he was expecting a recession in 2025, Trump responded: “I hate to predict things like that. There is a period of transition because what we’re doing is very big. We're bringing wealth back to America. That's a big thing.” He then added, “It takes a little time. It takes a little time."

On Wall Street, it was a tough week with wild swings dominated by worries about the economy and uncertainty about what Trump's tariffs.

Trump brushed aside concerns from businesses seeking stability as they make investment decisions. He said that “for years the globalists, the big globalists have been ripping off the United States" and that now, "all we’re doing is getting some of it back, and we’re going to treat our country fairly."

“You know, the tariffs could go up as time goes by, and they may go up and, you know, I don’t know if it’s predictability,” the Republican president said.

Trump last week lifted the Mexico and Canada tariffs on American car manufacturers, and then virtually all imports to the U.S., but kept them on goods from China.

More tariffs are coming this week, with Commerce Secretary Howard Lutnick telling NBC's “Meet the Press” that 25% tariffs on steel and aluminum imports will take effect Wednesday. Lutnick said Trump's threatened tariffs on Canadian dairy and lumber though would wait until April.

“Will there be distortions? Of course,” Lutnick said. “Foreign goods may get a little more expensive. But American goods are going to get cheaper, and you’re going to be helping Americans by buying American.”

0 notes

Text

Atlanta’s Secrets: Humidity-Resistant Hair Products for Year-Round Care

Imagine stepping out on a humid summer day, your hair perfectly styled, only to have it frizz up within minutes. For many with black hair, this is a common struggle. But what if there was a way to keep your hair looking flawless, no matter the weather? As a Black-Owned Business Advocate, I’m here to share insights on humidity-resistant hair and the importance of year-round care, especially for businesses in the black hair and wig industry. Whether you’re a salon owner, stylist, or retailer, understanding these concepts can help you better serve your clients and grow your business.

Understanding Humidity-Resistant Hair

Humidity-resistant hair is all about maintaining style and health in high-moisture environments. For black hair, which often has a tighter curl pattern and can be more prone to dryness, humidity can be particularly challenging. The key lies in the hair’s ability to resist absorbing excess moisture from the air, which can lead to frizz and loss of definition.

What Makes Hair Humidity-Resistant?

Hair Porosity: This refers to how well hair can absorb and retain moisture. Low porosity hair naturally resists moisture, which can be beneficial in humid conditions but requires specific care to ensure it doesn’t become weighed down.

Cuticle Sealing: Products that seal the hair cuticle can prevent moisture from entering the hair shaft, reducing frizz. Look for ingredients like silicones, certain oils, or polymers that create a protective barrier.

Anti-Humectants: These ingredients repel moisture, helping to keep hairstyles intact even in damp conditions.

For businesses, stocking products that feature these properties is essential. Additionally, educating clients on techniques like the LOC (Liquid, Oil, Cream) method can help them lock in moisture while protecting against external humidity.

The Importance of Year-Round Care for Black Hair

Black hair requires consistent care, but the approach should adapt to seasonal changes. Each season brings unique challenges, from winter dryness to summer sun exposure, making year-round care a necessity for maintaining healthy, resilient hair.

Seasonal Hair Care Needs

Winter: Cold air strips moisture, leading to dryness and breakage. Deep conditioning treatments and protective styles are essential during this time.

Spring: As humidity rises, focus on products that control frizz and maintain curl definition.

Summer: Heat and sun exposure can damage hair. UV protectants and regular trims help prevent split ends and breakage.

Fall: After summer’s wear and tear, hydration and repair treatments are key to restoring hair health.

A year-round care routine ensures that hair remains strong and vibrant, no matter the season. For businesses, this means offering a diverse range of products that cater to these evolving needs and educating clients on how to adjust their routines accordingly.

How Black-Owned Businesses Can Lead in Humidity-Resistant and Year-Round Hair Care

Black-owned businesses have a unique advantage when it comes to addressing the specific needs of black hair. Their deep understanding of cultural and hair care challenges positions them as leaders in creating effective solutions for humidity resistance and seasonal care.

Why Black-Owned Businesses Excel

Cultural Insight: These businesses often have firsthand experience with the challenges of black hair, leading to more authentic and effective products.

Community Trust: Consumers trust black-owned brands for solutions that are tailored to their specific hair needs.

Innovation: From natural ingredients to advanced formulations, black-owned businesses are at the forefront of hair care innovation, particularly for textured hair.

Supporting black-owned businesses not only fosters economic growth within the community but also ensures that the products available are designed with black hair in mind. For B2B partners, this means access to authentic, high-quality solutions that resonate with clients.

Tips for B2B Partners

For businesses in the black hair and wig industry, leveraging humidity-resistant and year-round care products can set you apart. Here are actionable tips to help you maximize these opportunities:

Educate Staff: Train your team on the benefits of humidity-resistant and seasonal care products so they can confidently recommend them to clients.

Seasonal Promotions: Create marketing campaigns around seasonal hair care needs, highlighting products that address specific challenges like winter dryness or summer sun protection.

Partner with Black-Owned Brands: Stock products from black-owned businesses to offer authentic solutions and support the community.

Offer Workshops: Host events or online tutorials for stylists and clients on how to use these products effectively, especially for maintaining styles in humid conditions.

By implementing these strategies, you can enhance your product offerings and provide valuable education to your clients, positioning your business as a trusted resource in the industry.

In the ever-changing world of hair care, addressing the challenges of humidity and seasonal changes is crucial, especially for black hair. By understanding the science behind humidity-resistant hair and the necessity of year-round care, businesses can better serve their clients and stay ahead of industry trends. Partnering with black-owned businesses ensures that the products and solutions you offer are not only effective but also rooted in a deep understanding of the community’s needs. Together, we can keep black hair looking and feeling its best, no matter the weather.

Ready to elevate your hair care offerings? Explore our directory of black-owned hair care brands and discover products that truly make a difference. Share this post to spread the word about the importance of humidity-resistant and year-round hair care!

0 notes