#over 1.5 banker of the day

Explore tagged Tumblr posts

Text

[ad_1] Miami-Dade County's apartment gross sales ticked greater over the past full week of January, whereas the common sale worth and worth per sq. foot stored sliding. Brokers closed 97 apartment gross sales totaling $74.1 million from Jan. twenty first to Jan. twenty seventh. The earlier week, brokers closed 81 apartment gross sales totaling $70.6 million. Final week's models bought for a mean of $764,239, decrease than the $871,473 common sale worth from the earlier week. The typical worth per sq. foot fell only a greenback, to $542 from $543, based on knowledge from apartment.com. Condos closed after a mean of 69 days in the marketplace. For the highest 10 gross sales, costs ranged from $1.5 million to $7.5 million. Two gross sales broke the $5 million worth barrier. Aria on the Bay unit PH 15, at 488 Northeast fifteenth Road in Miami, took the highest spot with a $7.5 million closing. Farrah Zarghami with Parsiani Actual Property had the itemizing. Heather McCabe with Beachfront Realty represented the client. The sale closed after 300 days in the marketplace at $1,564 per sq. foot. Monad Terrace in Miami Seaside, unit 2F at 1300 Monad Terrace, closed for the second highest quantity, $6.5 million, or $2,445 per sq. foot, after 94 days in the marketplace. Jill Hertzberg with Coldwell Banker Realty had the itemizing. Bryan Harr with One Sotheby's Worldwide Realty represented the client. Leaflet map created by Adam Farence | Information by © OpenStreetMapbelow ODbl. Here is a breakdown of the highest 10 gross sales from Jan. twenty first to Jan. twenty seventh: Most Costly Aria on the Bay, 488 Northeast fifteenth Road, unit PH 15, in Miami | Worth $7,500,000 | $1,564 psf | Itemizing agent: Farrah Zarghami with Parsiani Actual Property | Purchaser's agent: Heather McCabe with Beachfront Realty | Days on market: 300 Least Costly Capobella, 5025 Collins Avenue, unit 1401, in Miami Seaside | Worth $1,475,000 | $793 psf | Itemizing agent: Michele Redlich with Coldwell Banker Realty | Purchaser's agent: Mickael Lancri with Mickael Lancri | Days on market: 301 Highest Worth Per Sq. Foot Monad Terrace, 1300 Monad Terrace, unit 2F, in Miami Seaside | Worth $6,500,000 | $2,445 psf | Itemizing agent: Jill Hertzberg with Coldwell Banker Realty | Purchaser's agent: Bryan Harr with One Sotheby's Worldwide Realty | Days on market: 94 Lowest Worth Per Sq. Foot Capobella, 5025 Collins Avenue, unit 1401, in Miami Seaside | Worth $1,475,000 | $793 psf | Itemizing agent: Michele Redlich with Coldwell Banker Realty | Purchaser's agent: Mickael Lancri with Mickael Lancri | Days on market: 301 Most Days on Market Capobella, 5025 Collins Avenue, unit 1401, in Miami Seaside | Worth $1,475,000 | $793 psf | Itemizing agent: Michele Redlich with Coldwell Banker Realty | Purchaser's agent: Mickael Lancri with Mickael Lancri | Days on market: 301 Fewest Days on Market Casa Del Mar, 881 Ocean Drive, unit 11G, in Key Biscayne | Worth $1,680,000 | $896 psf | Itemizing agent: Carmen Tonarely with Berkshire Hathaway HomeServices EWM Realty | Purchaser's agent: Dolores Urdapilleta with Urdapilleta Actual Property | Days on market: 6 (apartment.com) [ad_2] Supply hyperlink

0 notes

Text

Jeff Bezos - Inspirational Story

Jeff Bezos is the founder of Amazon, one of the most successful companies in the world, and one of the wealthiest people on the planet. His story is one of determination, risk-taking, and innovation.

Bezos was born in Albuquerque, New Mexico in 1964. His mother was a teenager when she gave birth to him, and his parents divorced when he was young. Bezos showed an early interest in science and technology, and went on to study computer science and electrical engineering at Princeton University.

After graduation, Bezos worked in a variety of roles in the technology industry, including stints at Fitel, Bankers Trust, and D. E. Shaw & Co. It was at D. E. Shaw where Bezos first came up with the idea for Amazon. He recognized the potential of the internet as a platform for commerce and began researching the idea of an online bookstore.

In 1994, Bezos left D. E. Shaw and moved to Seattle to start Amazon. He set up the company in his garage and began selling books online. In the early days, Bezos did everything himself, from packing boxes to writing code. He was determined to create a customer-centric company that would offer a wider selection of books than traditional brick-and-mortar stores and would provide a more convenient shopping experience for customers.

Over time, Amazon grew rapidly, expanding into new product categories and geographies. Bezos became known for his willingness to take risks and his relentless focus on innovation. He introduced new products and services, such as Amazon Prime, which offered free two-day shipping on many products, and the Amazon Echo, a voice-controlled smart speaker that became a best-seller.

Today, Amazon is one of the most valuable companies in the world, with a market capitalization of over $1.5 trillion as of 2021. Bezos has stepped down as CEO of the company but remains involved as the executive chairman.

Also, Read - Jeff Bezos Quotes on Money

Bezos' story is an inspiration to entrepreneurs and innovators around the world. His determination, risk-taking, and focus on customer satisfaction have made Amazon one of the most successful companies in history, and his impact on the technology industry and the broader economy is sure to be felt for many years to come.

0 notes

Text

Low Cost Homes For Sale In Albuquerque, Nm

If your group is excited about becoming a Stacker distribution associate, email us at. Stacker believes in making the world’s knowledge extra accessible through storytelling. To that end, most Stacker tales are freely obtainable to republish beneath a Creative Commons License, and we encourage you to share our stories with your audience. There are a quantity of tips and restrictions, which you can evaluate under. 41.6% year-over-year within the first quarter of 2021, rising significantly more than the smaller enhance for extra moderately priced homes.

The Stoney Ridge Lighthouse, positioned in a landlocked space in central Minnesota, is out there for hire on Vrbo for $300 per night. The 2,000-square-foot lighthouse has seven levels, including a crow's nest that is over 50 toes high. Unique homes hit the market all across the United States over the previous year — together with Brad Pitt's citadel homes for sale in albuquerque new mexico in California and a treehouse for rent in South Carolina. Wow, meticulously maintained Pulte single story 4 bed room home with separated proprietor's suite and open ground plan! This home has all the bells and whistles carried out so that you can... Gorgeous 4 bedroom, 3 bath home ready for the next proprietor.

It is incredibly affordable compared to any market in California. It isn’t so scorching that property values are skyrocketing. Demand isn’t so soft that property values are declining. This is a sign of a healthy real estate market that will stay secure except the job market collapses. The most costly homes in the space hit 1.5 million dollars, but that’s for a spacious luxury property.

There’s no etiquette when it comes to buying or promoting until you’re persuaded by RE agents that there's such. If you have good answers to questions like these, I’d say be affected new home builders in albuquerque person and make low-ball offers on homes your thinking about. But, there’s additionally plenty of other components to suppose about.

I even have Lenders that I work carefully with and can allow you to acquire the BEST Mortgage Program obtainable to you. Here are a number of the items you will need to supply... "What is the process for purchasing a home?" "How much do you cost to purchase a home?" These are typical questions I receive from First time Home Buyers.

Our new homes for sale offer Life Tested Home Designs® with features just like the Pulte Planning Center®, a multi-functional area for kids to do homework or help hold their household organized. Our luxurious bogs present conveniences like double sinks, spacious counters, and optionally available privateness doorways to make mornings easier for large households. With stunning kitchens and the Oversized Pantry, you'll have plenty of room to keep homes for sale albuquerque all of your favorite necessities on hand. Desirable options like our spacious kitchen island designs will name the household to gather around for snack time. We also offer versatile spaces, together with lofts which would possibly be excellent on your personalised home theater or office. With 310 days of sunshine and the Sandia Mountains to explore, Albuquerque is good for work and play.

Please contact us if you can not correctly expertise this web site. I am in a sizzling Southeastern housing market and I am happy to report that over the previous month or so there has finally been a drastic discount in the amount of unsolicited “I want to make a proposal in your property” calls. Over the past month I’d say it’s gone down from 4-5 calls per property per day to a minimum of one call per property each different day. Meanwhile, median gross sales value per sq. foot has remained fairly stable, down only about 4-5% from the July peak.

You can get even more specific with keyword search. Try trying out our interactive maps, photos, and school information. And whenever you're prepared to speak to a real property agent, Coldwell Banker has scores and critiques written by actual estate shoppers nationwide that can assist you discover a great agent.

So almost 10 years of nothing appreciation wise. If I had to place cash on a situation, this would be my largest odds bet. Even with costs falling, inflation and worth hikes on other gadgets might make it a better choice to hold on to the actual property. If wages and revenue keep new homes albuquerque up with uppward costs of goods and companies, the value of holding on is falling. I estimate that the price of a typical home mortgage payment + prop taxes + maintenance is about 40% more expensive than renting an equal property in my space. It’s exhausting to inform how long such a wide disparity can last.

We are right here to help you, so please contact us; let’s have a no-hassle no-pressure dialog about your Albuquerque real estate goals. In 2019, New Mexico registered a job growth price of two.4%—a full proportion point higher than the national average. This makes it the sixth most competitive state within the country, tied with Alabama, Arizona, and Texas. The achievement was made attainable by a business-friendly setting, sensible homes for sale in albuquerque nm infrastructure investments, and a strong focus on STEM and healthcare careers. Leisure, hospitality, development, and skilled providers have been among the many prime job gainers for the 12 months. There is also news that Netflix will make investments $1 billion to broaden its Albuquerque studios, generating 1,000 more jobs within the course of.

0 notes

Text

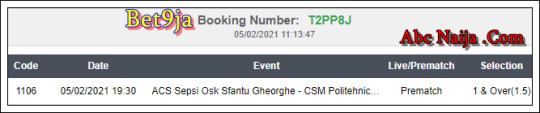

Safe 2+ Odds Daily - Time To Win Tips 24 7

Safe 2+ Odds Daily – Time To Win Tips 24 7

Safe 2+ Odds Daily – Time To Win Tips 24 7 Safe 2+ odds daily soccer prediction has been set aside for you today to play and have to play our omega soccer prediction, sure football tips for today. Community betting tips have always been that strategy we have been using to provide the best betting tips for you here and it has also helped us a lot to record best winnings ever and you can attest to…

View On WordPress

#2 odds banker#Best soccer prediction site free#Community betting tips#football 3+ odds#free 2 odds daily#Free Soccer and Football Predictions#free sure 2 odds prediction#high odds soccer predictions#omega soccer prediction#over 1.5 banker of the day#over 5.5 goals predictions#over 6.5 goals stats#safe 2 odds daily#sure 1.5 odds rollover#sure 2 odds prediction#Sure football tips#Time To Win Tips 24 7#tips 1x2 free 100#vip bet 88

0 notes

Text

FILMS I WATCHED IN 2021

(for the first time)

January

Best Wishes, Warmest Regards: A Schitt’s Creek Farewell [2020] (5/5)

Over the Moon [2020] (1.5/5)

Soul [2020] (3.8/5)

Wonder Woman [2017] (4.2/5)

February

Mulan [2020] (3.3/5)

Lady Bird [2017] (3.8/5)

Greyhound [2020] (2.9/5)

The Banker [2020] (3.5/5)

Lady and the Tramp [2019] (4/5)

The Photograph [2020] (3/5)

The Nanny Diaries [2007] (5/5)

Back to the Future [1985] (5/5)

Back to the Future Part II [1989] (4/5)

Knives Out [2019] (4.5/5)

March

Spare Parts [2015] (4/5)

Spider-Man: Far from Home [2019] (4.9/5)

Sherlock Holmes [2008] (4.7/5)

The Great Gatsby [2013] (4.7/5)

April

Midway [2019] (3.3/5)

The Perfect Score [2004] (3.6/5)

The Devil Wears Prada [2006] (3.6/5)

Ferris Bueller’s Day Off [1986] (2.7/5)

May

My Octopus Teacher [2020] (5/5)

Pirates of the Caribbean: The Curse of the Black Pearl [2003] (5/5)

Pirates of the Caribbean: Dead Man’s Chest [2006] (3.2/5)

Cruella [2021] (5/5)

Cheaper by the Dozen [2003] (2.5/5)

June

Cheaper by the Dozen 2 [2005] (3/5)

Liberal Arts [2012] (3.5/5)

Luca [2021] (5/5)

July

Black Widow [2021] (10/5)

Shark Beach with Chris Hemsworth [2021] (5/5)

Up [2009] (4.6/5)

Almost Famous [2000] (4/5)

August

Easy A [2010] (5/5)

The Breakfast Club [1985] (5/5)

Forrest Gump [1994] (5/5)

Closer [2004] (2/5)

Wanderlust [2012] (3/5)

Romy and Michele’s High School Reunion [1997] (3.2/5)

The One Where They Got Back Together [2021] 5/5)

September

Cinderella [2021] (3/5)

Shang-Chi and the Legend of the Ten Rings [2021] (4.5/5)

America After 9/11 [2021] (4.5/5)

The Crash Reel [2013] (2.8/5)

October

Muppets Haunted Mansion [2021] (3/5)

Enola Holmes [2020] (3.7/5)

Blue Miracle [2021] (2.6/5)

Dune [2021] (100000/5)

Hot Summer Nights [2017] (3/5)

A Rainy Day in New York [2019] (2.7/5)

Mr. Church [2016] (4.1/5)

November

Eternals [2021] (3.4/5)

Beautiful Boy [2018] (4.6/5)

Passing [2021] (2.3/5)

Mayor Pete [2021] (5/5)

Dead Poets Society [1989] (3.8/5)

Take Your Pills [2018] (2.2/5)

House of Gucci [2021] (3.2/5)

Call Me by Your Name [2017] (4.1/5)

December

National Lampoon’s Christmas Vacation [1989] (3/5)

Sonic the Hedgehog [2020] (2/5)

Spider-Man: No Way Home [2021] (10000/5)

Don’t Look Up [2021] (4.8/5)

#film#actor#romance films#drama film#pg 13#comedy film#letterboxd#don’t look up#a rainy day in new york#eternals#dune#no way home#luca#lady bird#timothée chalamet#chris evans#leonardo dicaprio#2021 films#back to the future#the breakfast club#house of gucci#the devil wears prada#knives out#mulan

17 notes

·

View notes

Text

MAGA Terrorists Making Threats At All Levels Of Government

These 63 Billionaires Who Bankrolled Trump All The Way To Insurrection Have 'No Right To Feel Shocked'

Gas pipeline magnate Kelcy Lee Warren, worth $2.9 billion, gave eight donations totaling $2,248,906.

Retired CEO of Marvel Entertainment, Isaac Perlmutter, is worth $5.8 billion and donated $1,871,200.

Telecommunications mogul Kenny Troutt, worth $1.5 billion, donated $1,849,000.

Biotech investor Robert Duggan, worth $2.6 billion, donated $1,638,200 to the Trump Victory Fund. In the final days of the campaign, Duggan gave $4.6 million to various Trump campaign groups, according to Forbes.

Casino magnate Steve Wynn, worth $3 billion, contributed over $1,523,500.

Casino owner, Phillip Gene Ruffin, worth $2.3 billion, donated $1,375,000.

Owner of ABC Supply, the giant home supplier, Diane Hendricks $8 billion (Forbes), donated $1,175,000.

Casino megadonor Sheldon Adelson, and his wife Miriam Adelson, worth over $35.9 billion (Forbes), contributed $1.16 million, along with massive donations to other Republican PACs and candidates.

Texas Banker Daniel Andrew Beal, worth $7.5 billion, gave $1,161,200.

Software entrepreneur David Duffield, worth $13.3 billion, donated $1,151,600.

More at the link.

3 notes

·

View notes

Text

something needs to change soon bc i have so much i wanna do and make, and the dead weight of my own body and the prolonged suffering i dip in and out of is just untenable

had a well and truly terrible mental health day on tues... monday night was acute suffering and rumination and DAMAGED GOODS feeling, I drunk drafted an email to [redacted] shedding light on [redacted] (amazingly articulate, graceful even? though a tad dramatic), I drank gin, I went to bed. set off by watching vids of a young person i follow having a manic sobbing laughing undressed spiral online which really just grabbed my heart by the throat. Tuesday I couldnt get up until 3pm, and Angel sneezed so I panicked, either lung cancer or dust from her bedding (which i’d been changing daily!!) so I deep cleaned her cage extremely, held her on me almost the whole time, spent hours with her really while I did it and drank coffee and swept the house and handwashed her cloths and sewed things for her cage and then suddenly, cried and cried for awhile while she crawled on my shoulders. then made rly good dinner bc cooking is now something i like????

facetimed my sister super grumpy from my bad day and she was sour too, bad day on her end, rude boss, lotsa pressure, but she practiced delivering her presentation of the neuroscience data she gleaned and described in her (first! ever!) published manuscript/experiment. somehow cheered each other up. went to bed sober and not too late.

I am struggling to write and struggling to paint, collage with words is completely off the table lately bc my brain just convulses and turns into a wet towel and cannot focus. I think I need to aggressively enforce a week of NO MAKING ANYTHING, its okay to just cook and watch movies and play with the rats. No drawing or painting and most of all no shame over that. my self worth is all wrapped up in it, im supposed to be wildly productive in all my downtime so that I est a body of work, all weekend and all week nights go to this second life which will emerge - and I just gotta stop and chill tf out with making that my identity and my everything. this is about cooking! im worried about money all the time (bad bad bad, youre supposed to exercise gratitude and act and believe as if you already have the things you want, you know this!) but I have an overflowing pantry and a full fridge and freezer (its a minifridge and freezer lmao) and lately, unable to finish projects or deal with words, I’ve gotten into cooking! and baking! it keeps the kitchen warm, too, and is profoundly comforting.

french onion soup, nondairy tomato soup, brussel sprouts roasted with potatoes dressed in balsamic + garlic with eggs fried in there, butternut squash

so something is level and good within me, i suspect a lot of things are getting there.

today:

1. get to fedex/office depot and make 50 copies of zine

1.5. mail 2 maya while there

2. pick up carriers for the babes

3. assemble zines at home to send tmrw

4. get rid of a ton of the paper scraps and ephemera I’ve been hauling around the country for ten yrs. collage and material belongings are stressful rn so best be rid of em. clear desk and files. make sewing stuff accessible.

5. prep batch of mail - for C in Fresno, R’s forgotten birthday card, MK’s thank you, grandparents, C + M, early bday to T??? and J in NC and E.

It’s funny though bc the new rat just hung with me for over an hr while I wait on hold with unemployment and I have little pulled-apart raspberries and carrot slices on an old open journal and my coffeetable is littered with envelopes and a banker’s lamp and nail polish pain meds allergy meds earache oil chapstick toothpaste lighter mouthguard and also an open bottle of charles shaw right next to a mcdonald’s cup i’ve been using for days to drink water out of bc the straw really helps, and super floral-smelling black tea i just made myself and I looked at this mess and thought to myself “is this happiness? i think maybe i’m really happy.”

2 notes

·

View notes

Link

Golf Homeownership Is Heating Up, Even Where You’d Least Expect it After several years of falling out of favor, golf homes are once again in high demand. According to Sotheby’s International Realty 2021 Luxury Outlook report, the pandemic has renewed interest in owning a golf home: sothebysrealty.com saw a 26 percent increase in golf property searches globally from January 2020 to February 2021, compared with the same period in 2019. Sales have also increased, says Philip A. White Jr., president of Sotheby’s International Realty and an avid golfer. “2020 was the year that golf homes became hot commodities,” he says. Golf homes became less popular before the pandemic because interest in the game had slowed and the market was oversaturated with golf properties, according to Doug Treadwell, the owner of Golf Life Properties, which sells golf homes in the United States to international buyers. The pattern reversed, he said, over the last year. Mr. Treadwell said that Golf Life Properties sold around $85 million in properties last year; in 2019, that number was $40 million. “Following five plus years of flat or declining sales, we did a 180,” he said. “Golf properties offer privacy and security, which is what home buyers want right now.” But rather than seek out established golf markets such as Naples, Fla., and Portugal’s Algarve region, buyers today are looking to emerging areas around the world with better values and fewer crowds. Here are five up-and-coming spots: Bend, Ore. About three hours southeast of Portland by car in central Oregon, the city of Bend has more than 30 golf courses within a 60-minute drive, including the prestigious Jack Nicklaus signature course at Pronghorn Resort. Several data points indicate that the area has become a highly desirable place to own a golf home in the wake of the pandemic: on sothebysrealty.com, searches for golf homes in Bend increased 71 percent from January 2020 to February 2021, while sales were up 53 percent. Cascade Lifestyle Group, part of Coldwell Banker Bain, saw $39 million of sales in Bend in 2020, compared with around $30 million the year before. “Our group has been inundated with buyers from Seattle, California, and even the U.K. ever since Covid,” said Catherine Scanland, a broker at Cascade Lifestyle Group. Many of the golf courses in the region are within luxury, amenity-rich communities, she said, where the average price of a home is around $1.5 million. Tetherow Resort and Golf Course and Crosswater Club are examples. Surrounded by the Cascade Range and dotted with lakes, Bend and the countryside around it are appealing to home buyers because of the sunny days and good weather for golfing most of the year. Outdoor enthusiasts also can enjoy other pursuits, such as skiing in winter and paddle-boarding, fly fishing and hiking when the weather is warmer. Loire Valley, France France isn’t known for golf, but the Loire Valley is fast changing that, said Mr. White, of Sotheby’s International Realty. A two-and-a-half-hour drive from Paris, the region was where French royalty summered in their castles and is a UNESCO World Heritage Site for its beauty and cultural landscape. There are 15 courses in Loire, said Grégory Thouzé, an agent with Bretagne Sud Sotheby’s International Realty, in France, and many are near golf estates or within communities. Golf International Barriere La Baule, with three courses spanning 540 acres, a driving range and a putting green, is the largest. Another option is Les Bordes Golf Club, which has two courses and is expected to open a third in July designed by the American golf course architect Gil Hanse; all are surrounded by forests. The club introduced real estate in 2020 with 48 homes ranging in size from two to seven bedrooms and with prices starting at around $1 million; 48 more residences will debut this fall. A spokeswoman for the property, Kerry McClinton-King, said that most buyers were from Britain, the Netherlands and the United States. The Loire is an attractive area to own a golf home, said Mr. White, because of its proximity to Paris and the availability of diversions beyond golf. “You have a lot of history and great wine country,” he said. Slovakia Located in Central Europe, Slovakia is among the hottest emerging destinations for golf in the world, according to Michael Valdes, the president of eXp Realty. “With its strong infrastructure and beautiful, mountainous landscape, the country is designed for great golf and with that, comes the burgeoning popularity of golf homes,” he said. Slovakia has 28 courses, said Ivan Micko, the publisher and editor in chief of the Slovakia golf lifestyle magazine Golf Revue, and several have a real estate component. Penati Golf Resort, for example, which is surrounded by pine forests and lakes, is in a village with contemporary golf homes. Then, about a 30-minute drive from the capital city of Bratislava, there’s Green Resort Hrubá Borša with more than 250 new homes. One of the courses that gets the most international attention is the 27-hole Black Stork, situated at the foothills of the Tatra Mountains in Vel’ká Lomnica, a village with more than 50 parcels of land where golf homes are being built. Mr. Micko said that most golf property buyers in Slovakia were either locals or from Germany, Austria and the Czech Republic. Cape Winelands, South Africa Popular with tourists for its wineries and thriving culinary scene, South Africa’s Cape Winelands region, around 45 minutes east of Cape Town, is lately also becoming known as a prime golf destination as well. Maria De Villiers, the owner of Chas Everitt Winelands, a brokerage that sells real estate in the area, said that there are five high-end golf estates here including Devonvale Golf Estate, outside Stellenbosch, and Boschenmeer Golf Estate, in Paarl. On top of world-class golf, all offer an array of amenities such as swimming pools, restaurants, gyms, a lineup of fitness classes and meeting rooms. “You have amenities equivalent to a luxury resort, but these estates are very spread out, so you get a rural feel,” Ms. De Villiers said. De Zalze Winelands Golf Estate, in Stellenbosch, for one, has a course designed by the renowned Zimbabwean golf architect Peter Matkovich and offers mountain biking, running trails and three restaurants. The development is set on a working farm with olive groves, nearly 300 acres of vineyards and a wetlands area with wildlife including birds and fish. The Winelands see a growing number of international golf home buyers, according to Ms. De Villiers. “They come from Europe and spend their winter, which is our summer, working remotely,” she said. Real estate in South Africa is inexpensive for these homeowners, compared with prices in Europe. For $500,000, Ms. De Villiers said that prospective buyers can find a 3,000-square-foot, four-bedroom property — possibly with a pool — in a luxury estate. Nashville The Nashville area is seeing a steadily growing market for golf properties, according to Mr. White, and has two well-established luxury golf communities: the Governors Club, with an Arnold Palmer signature course, and the Grove, an 1,100-acre development with a Greg Norman signature course. Both communities have a lengthy list of amenities, including fitness centers, spas, pools and restaurants, and are increasingly drawing in buyers from out-of-state who want to own a golf property in Tennessee because it has no state income tax. Many of the latest buyers are from California. “Nashville specifically is appealing because you have such a great restaurant and music scene,” Mr. White said. “And in addition to golf, there is great horseback riding.” With its vast countryside to accommodate scenic, spread out courses and temperate climate most of the year, Nashville is also an ideal locale for golf. The value for the money adds to the appeal. Mr. White said that buyers could find a luxury home for a significantly lower price than they would for a comparable property in a more popular golf spot such as Palm Beach, Fla. The latest addition to the area’s golf lineup is Discovery Land Company’s Troubadour Golf & Field Club, an 860-acre estate about a half-hour from downtown Nashville with a Tom Fazio-designed course and sites for 369 homes. Amenities include fishing and kayaking, horseback riding, a game room and craft studio for children and a recording studio. Source link Orbem News #Expect #golf #Heating #homeownership #Youd

2 notes

·

View notes

Text

[ad_1] Miami-Dade County's apartment gross sales ticked greater over the past full week of January, whereas the common sale worth and worth per sq. foot stored sliding. Brokers closed 97 apartment gross sales totaling $74.1 million from Jan. twenty first to Jan. twenty seventh. The earlier week, brokers closed 81 apartment gross sales totaling $70.6 million. Final week's models bought for a mean of $764,239, decrease than the $871,473 common sale worth from the earlier week. The typical worth per sq. foot fell only a greenback, to $542 from $543, based on knowledge from apartment.com. Condos closed after a mean of 69 days in the marketplace. For the highest 10 gross sales, costs ranged from $1.5 million to $7.5 million. Two gross sales broke the $5 million worth barrier. Aria on the Bay unit PH 15, at 488 Northeast fifteenth Road in Miami, took the highest spot with a $7.5 million closing. Farrah Zarghami with Parsiani Actual Property had the itemizing. Heather McCabe with Beachfront Realty represented the client. The sale closed after 300 days in the marketplace at $1,564 per sq. foot. Monad Terrace in Miami Seaside, unit 2F at 1300 Monad Terrace, closed for the second highest quantity, $6.5 million, or $2,445 per sq. foot, after 94 days in the marketplace. Jill Hertzberg with Coldwell Banker Realty had the itemizing. Bryan Harr with One Sotheby's Worldwide Realty represented the client. Leaflet map created by Adam Farence | Information by © OpenStreetMapbelow ODbl. Here is a breakdown of the highest 10 gross sales from Jan. twenty first to Jan. twenty seventh: Most Costly Aria on the Bay, 488 Northeast fifteenth Road, unit PH 15, in Miami | Worth $7,500,000 | $1,564 psf | Itemizing agent: Farrah Zarghami with Parsiani Actual Property | Purchaser's agent: Heather McCabe with Beachfront Realty | Days on market: 300 Least Costly Capobella, 5025 Collins Avenue, unit 1401, in Miami Seaside | Worth $1,475,000 | $793 psf | Itemizing agent: Michele Redlich with Coldwell Banker Realty | Purchaser's agent: Mickael Lancri with Mickael Lancri | Days on market: 301 Highest Worth Per Sq. Foot Monad Terrace, 1300 Monad Terrace, unit 2F, in Miami Seaside | Worth $6,500,000 | $2,445 psf | Itemizing agent: Jill Hertzberg with Coldwell Banker Realty | Purchaser's agent: Bryan Harr with One Sotheby's Worldwide Realty | Days on market: 94 Lowest Worth Per Sq. Foot Capobella, 5025 Collins Avenue, unit 1401, in Miami Seaside | Worth $1,475,000 | $793 psf | Itemizing agent: Michele Redlich with Coldwell Banker Realty | Purchaser's agent: Mickael Lancri with Mickael Lancri | Days on market: 301 Most Days on Market Capobella, 5025 Collins Avenue, unit 1401, in Miami Seaside | Worth $1,475,000 | $793 psf | Itemizing agent: Michele Redlich with Coldwell Banker Realty | Purchaser's agent: Mickael Lancri with Mickael Lancri | Days on market: 301 Fewest Days on Market Casa Del Mar, 881 Ocean Drive, unit 11G, in Key Biscayne | Worth $1,680,000 | $896 psf | Itemizing agent: Carmen Tonarely with Berkshire Hathaway HomeServices EWM Realty | Purchaser's agent: Dolores Urdapilleta with Urdapilleta Actual Property | Days on market: 6 (apartment.com) [ad_2] Supply hyperlink

0 notes

Text

Theories on Amelia Earhart (Article)

Explore theories about Amelia Earhart’s final days—some more plausible than others.

Theory #1: Earhart ran out of fuel, crashed and perished in the Pacific Ocean.

This is one of the most generally accepted versions of the famous aviator’s disappearance. Many experts believe Amelia Earhart and navigator Fred Noonan got slightly off course en route to a refueling stop at Howland Island in the Pacific Ocean. Earhart radioed U.S. Coast Guard ships stationed in the area, reporting that neither she nor Noonan could spot the tiny island where they were supposed to land. According to the so-called “crash-and-sink” theory, the plane eventually ran out of gas and plunged into the ocean, killing both Earhart and Noonan. It then sank, leaving no sign of their whereabouts.

Theory #2: Earhart’s flight was an elaborate scheme to spy on the Japanese, who captured her after she crashed.

Did President Franklin D. Roosevelt enlist Earhart to spy on Japan? If so, the aviator did it in a very roundabout fashion. Earhart’s east-to-west route took her from California to South America, across Africa to India and across the northern tip of Australia en route to a refueling stop at Howland Island in the Pacific Ocean. According to the official account, at least, Earhart never got anywhere close to Japan. Besides, her flight was hardly a secret mission: Newspapers around the world tracked her progress on their front pages. The Earhart-as-spy theory emerged from a 1943 film about Earhart called “Flight for Freedom” and starring Rosalind Russell, but no evidence supports its veracity.

Theory #3: Earhart crash-landed, was captured by the Japanese military and died while being held prisoner on the island of Saipan.

In 2017, investigators announced the discovery of a photo, buried in the National Archives for nearly 80 years, that may depict Earhart and navigator Fred Noonan days after their disappearance. According to the team, led by former Executive Assistant Director of the FBI Shawn Henry, Earhart crash-landed in the Marshall Islands, was captured by the Japanese military and died while being held prisoner on the island of Saipan. Retired federal agent Les Kinney scoured the archives for records related to the Earhart case, uncovering a photo from the Office of Naval Intelligence (ONI) that shows a ship towing a barge with an airplane on the back; on a nearby dock are several people. Kinney believes the plane on the barge is the Electra, and that two of the people on the dock are Earhart and Noonan. The Marshall Islands/Saipan theory of Earhart’s fate isn’t a new one; it first surfaced back in the 1960s, and relies on accounts of Marshall Islanders who supposedly saw the Electra aircraft land and witnessed Earhart and Noonan in Japanese custody. In 2015, Kinney and another amateur Earhart sleuth, Dick Spink, found two metal fragments on Mili atoll in the Marshalls, which they believed came from Earhart’s plane.

Theory #4: Earhart survived a Pacific Ocean plane crash, was secretly repatriated to New Jersey and lived out her life under an assumed name.

A 1970 book put forth a creative solution to the Earhart mystery. The author claimed the famous pilot survived a Pacific Ocean plane crash and was taken prisoner by the Japanese. At the end of World War II, U.S. forces purportedly found her in Japan and secretly repatriated her to New Jersey. There, Earhart took the name Irene Bolam and became a banker. When the real Bolam got wind of the book’s claims, she vigorously denied being Earhart and sued the author and publisher for $1.5 million. (The lawsuit was later withdrawn, though Bolam may have settled out of court.) Numerous experts who investigated Bolam’s life and compared her photos to Earhart’s agree that Bolam, who died in 1982, was not the missing aviator.

Theory #5: Earhart was captured by the Japanese and became “Tokyo Rose.”

Related to other World War II-era myths that place Earhart in various Pacific Theater locales, including Saipan and Guadalcanal, this story originated immediately after the end of the war. A rumor circulated that Earhart had spread Japanese propaganda over the radio as one of many women collectively referred to as “Tokyo Rose.” Her husband, George Putnam, actively investigated this lead at the time, listening to hours of recorded broadcasts, but he did not recognize his wife’s voice.

Theory #6: Earhart was captured by the Japanese and traveled to Emirau Island.

Emirau Island, off Papua New Guinea, seems an unlikely place to find Earhart because it’s far from the spot where her last radio transmissions occurred. Still, a U.S. Navy crew member in World War II told of being sent to the island and spotting a photo of Earhart tacked up in the hut of a local man. The photo showed Earhart standing with a Japanese military officer, a missionary and a young boy. The sailor alerted naval intelligence officers, who allegedly took the photo from the hut against the owner’s wishes. The photo has never been found. Since Emirau Island had been a haven for Europeans stranded after a shipwreck in 1940, it’s likely the photo contained a lookalike and not the real Amelia.

Written By: Elizabeth Hanes

Sources:

https://www.history.com/news/what-happened-to-amelia-9-tantalizing-theories-about-the-earhart-disappearance

2 notes

·

View notes

Text

Home win & over 1.5 Goals - Best Prediction Ever

Home win & over 1.5 Goals – Best Prediction Ever

Home win & over 1.5 Goals – Best Prediction Ever Home win & over 1.5 goals prediction for today’s soccer match was prepared for you by our team of experts from England that specializes of soccer prediction. Single bets tips for us today is the best accurate single bet of the day and we are winning all the way – best football prediction site 2021.Continue reading

View On WordPress

#1 5odds daily#1.5 odd daily#1000 odds predictions#2 odds rollover#3 odd daily#7+ goals predictions#accurate over 1 5 tips today#accurate single bet of the day#banker of the day#best 2 odds prediction app#best football prediction site 2020#best over 1 5 prediction app#Best Prediction Ever Home win & over 1.5 goals home win and over 1.5 prediction#Bet and win single#btts and over 2.5 goals#btts and over 3 5 goals#buy sure odds in kenya#daily odds#daily sure 2+ odds apk#england championship over 1 5 prediction#footyguru365 com over 3.5 predictions#free 1 5 odds daily#home win tip#kick off profits review#kickoff 1x2#netprediction#odd 2 sure wins free#one sure game daily#over 1 5 and 2 5 predictions#over 1 5 goals accumulators

0 notes

Text

How Millennials are changing banking?

The fastest growing customer base is changing the way banks do business

Soon, Millennials will dominate the business world, as they will represent 44% of the workforce by 2022. This mobile and tech-savvy segment requires drastic transformation when it comes to banking with digital solutions assisting them in managing their money.

A bank in their pocket – anytime & anywhere

The digital world is now a reality with 72% of the interactions between the clients and the bank happening online according to a FIS consumer banking report.

In fact, the ABA (American Bankers Association) found that Millennials are 3 times more likely to open a bank account with their phone (e.g. mobile app) than in person. In addition, 67% want digital budgeting tools from their bank.

Even if they prefer using a mobile application to satisfy their needs, 38% of Millennials are abandoning the institutional bank app when it’s too slow according to a study by Jumio and Javelin Strategy & Research.

They are used to exchanging emails and receiving an instant reply. The old age of receiving a reply by mail waiting for a few days for your financial planner is over!

The Millennials habits on mobile application are 24/7:

Plan payments between friends and family members

Manage wire transfer between different accounts

Check transaction’s history

Budget tools to plan more efficiently their future

The use of video, geo-location, social engagement and other supporting technologies to facilitate a proactive, personalized interaction with bank experts are the key features to develop according to a study from CGI.

New face for physical proximity – multipurpose & convivial

The physical presence needs to be rethought for proximity to kill the ancient codes. Capital One understood this major shift and proposed a different banking experience targeting Millennials with their desire for flexibility and non-formal.

In its flagship branch in Union Square (Manhattan), the first floor of their three-story operations includes a Peet’s Coffee Shop adjacent to a seating area to facilitate impromptu meetings, temporary wait or recharging phone or laptop.

The coffee shop displays a warmer tone with natural textures and wood announcing quieter workspace contrasting with the community tables in front of the 3 ATM.

For creating this modern feel with LED screen, bright colors, linear fixtures and vivid patterns, the design agency CallisonRTKL won the “Gold Awards” at the 2017 Shop! Awards.

New product needs vs. older generation – rough start, earning less & risky culture

The Millennials don’t have the same financial ease as their baby boomer or Gen X/Y parents, already settled in their existence. In the US, 75% of college graduates have student loan debt according to ABA with an average $29k balance debt.

Millennials are working to build their finances with two top priorities:

Put money into savings each month (86%)

Paying down debt (43%)

Consequently, Millennials tend to delay major life events with only 26% married before the age of 32 years old while 70% wanted to get married and 93% to buy their home. However, they are set to inherit $30 trillion over the new 30 to 40 years.

There is a taste for risk to increase their level of wealth. CGI found out that 55% of Millennials wish to be oriented towards financial products. Banks have cleverly exploited the popularity of online trading and facilitated the online access to it.

In 2018, J.P. Morgan’s has unveiled a new investing mobile app with an eye-catching and disruptive price: free. With this new offer called “You Invest”, any bank client who downloads it or uses its website can get at least 100 free trades in the first year. Wall street, which was reserved to the elite in until now, is becoming affordable.

New era for retail bank, change or die – neobanks, rewarding & AI

The neobanks are becoming popular – when Millennials becomes unhappy or dissatisfied with their traditional retail bank, they’re not afraid to look for specialized fintech (financial technology) alternatives. According to a Gallup poll, Millennials are 2.5 times more likely than Baby Boomers and 1.5 more likely than Gen Xers to switch banks.

Rewarding matters – 80% of Millennials would be willing to switch banks for better rewards as mentioned in a Kasava Survey. For example, these include a higher interest rate on deposit accounts, cash back on purchases and foreign ATM fee refunds. In addition, 94% of Millennials are prioritizing a no-fee banking offer.

Artificial Intelligence (AI) is a key differentiator – chatbots were the beginning of AI for companies to ease the customer service. But when completely automatized, it often lacked self-learning capabilities―quickly becoming frustrating. As Bill Gates said: “We always overestimate the change that will occur in the next 2 years and underestimate the change that will occur in the next 10”.

AI has the potential for many practical applications for traditional banks and Fintech industry including:

Reduce the payment fraud

Improve service leveraging predictive analytics and real-time personalization

Assist consumers with financial decisions by suggesting opportunities based on the user profile, habits, risk and financial situation

Mercator Advisory Group recently published a recent study of 80 start-ups utilizing AI for the fintech and banking industry. The study includes NextUser, a San Francisco and New York based AI SaaS platform that has developed new personalization applications to help banks stay relevant to the millennial retail consumer. Research from Business Insider has identified most of the use cases for AI in finance as demonstrated in the diagram below. They feature NextUser’s key AI partner, IB Watson.

2 notes

·

View notes

Text

VOODOO ECONOMICS: '$15K A Second...', How The Federal Reserve & Allied Central Bankers Wrote The Obituary For Competitive Capitalism - By Nomi Prins

VOODOO ECONOMICS: ‘$15K A Second…’, How The Federal Reserve & Allied Central Bankers Wrote The Obituary For Competitive Capitalism – By Nomi Prins

Source – scheerpost.com “…From the housing crisis to the pandemic, all disasters are an opportunity for plunder of the vulnerable. As Prins writes: “The world’s 10 richest men more than doubled their fortunes from $700 billion to $1.5 trillion at a rate of $15,000 per second, or $1.3 billion a day during the first two years of a pandemic that has seen the incomes of 99% of humanity fall and over…

View On WordPress

0 notes

Text

The Lizzie and Kwasi Shitshow

Christ, if you thought Boris was a liability, then welcome to a whole new world of crazy.

Kwasi Kwarteng sat in a pub on a Saturday with Liz Truss (no, this is not the opening line of a joke - or maybe it is). The recently-elevated downed a few dwinkies (hic or sic) and reminisced about the old days and then concocted a fairly crazy tax-cutting plan.

Through the quiet dusty light and above the horse chatter of the tea-timer locals the plan looked good. In fact, with no counterbalance (who really needs the OBR?) it felt goddam epic. "I can't believe how easy this PM lark is" mutters Lizzie to her day-drinking partner, Kwasi.

The plan was nothing new. The virgin duo are too moist behind the ears to come up with something innovative - NO, let's resurrect the past and bring back Reaganomics! "Another Gin, Lizzie?" slurs Kwasi from the bar, "but it will have to be my last as I've got a bankers champagne event in the City later", he goes on to clarify.

Also called Voodoo Economics, "supply side economics" theory states: lower tax rates increase .gov tax take due to economic growth. Except, there is no proof that this works.

Most economies that tried this in the 70s thru 90s now have far greater sovereign debt. And it is often perceived as beneficial to the wealthy, which many see as politically rather than economically motivated.

Either way, the planned changes were dramatic, abrupt, and introduced by an inexperienced PM/chancellor team - and an unelected one at that.

It has subsequently driven the popularity of the government to a 2-decade low. It's difficult to see how the current government will win the next election in late '24, never mind retain the 150+ seat advantage enjoyed today.

So, with the deepest tax cuts in the UK for 50 years, with zero funding, the £100bn+ package (including energy price support) will be paid entirely from debt.

This drove the banks and finance markets into a panic. Even the ultra-conservative IMF reacted badly. So, for posterity, this is what happened.

1. The UK Government bond marketplace goes into free-fall. The BoE steps in with a £75bn Bond Buyback (QE) to save Pension Funds facing margin calls. Plans for a Bond sale, to raise much-needed funds for .gov, are put on hold.

2. Real-world interest-rates spiked, 40% of mortgage products are pulled from the marketplace. New mortgage products appear, but many priced over 5% (vs <1% in the 2020 low period). The shock to the housing market will likely be felt for the rest of this decade.

3. The pound (GBP) crashed close to USD parity. Its worst performance in over 75 years. Imports shoot up In price. Exports now more price competitive, but a dearth of post-Brexit trade deals hampers real progress.

4. £60bn worth of .gov support to cap energy rates. Not means-tested, provides greater support to larger houses. No end in sight, no windfall tax on energy companies, scrapped the green levy, restart coal-fired power station. Two decades of green agenda and trying to deal with climate change is abandoned.

5. Top rate of tax (45%) abolished, basic rate tax cut 5% down to 19%. Recent 1.5% National Insurance reversed, as is the planned corporate tax rise from 19 to 25% also scrapped. These changes disproportionately help those who are better off and massively helps the rich.

6. Questions remain around the planned CPI rise for benefits or maybe even cuts, yet the pension triple lock is likely to drive a ~10% rise in pension payments come April '23.

7. The Office for Budget Responsibility, the ultimate arbiter of what .gov can and cannot afford to do is sidestepped entirely so the public have limited confidence in any of the affordability calculations.

8. World leaders say the plan is Mickey Mouse and call for the "Lizzie and Kwasi Shitshow" to be canned.*

Ok, once Truss started her U-turn a week later, markets started to recover but the damage is likely done and the policy virgins Truss and Kwasi should be sacrificed with extreme prejudice. Now.

Increases in living costs, mortgage/rents, and imports is likely to have a largely negative effect on the UK population as a whole.

As a lifelong Conservative believer/voter, I am having a serious crisis of confidence in "Blue". No, I'll never vote Labour and don't like enough members of the Lib-Dem party leadership so does that make me officially a disenfranchised voter?

Seriously? I'm a middle-aged, intelligent and well informed chap who is modestly wealthy, earns a decent crust yet struggles to find a political party that echoes my beliefs and values. Maggie would be turning in her grave.

*This point might be made up, but it's more than possible that's what they were privately thinking.

0 notes

Photo

What’s Ahead for Real Estate in 2019?

As we begin another year, everyone wants to know: “Where is the housing market headed in 2019?”

It’s not only buyers, sellers, and homeowners who are impacted. The real estate market plays an integral role in the overall U.S. economy. Fortunately, key indicators point toward a stable housing market in 2019 with signs of modest growth. However, shifting conditions could impact you if you plan to buy, sell, or refinance this year.

HOME VALUES WILL INCREASE

The value of real estate will continue to rise. Freddie Mac predicts housing prices will increase by 4.3 percent in 2019.1 While the rapid price appreciation we witnessed earlier in the decade has slowed, the combination of a strong economy, low unemployment, and a lack of inventory in many market segments continues to push prices higher.

"Ninety percent of markets are experiencing price gains while very few are experiencing consistent price declines," according to National Association of Realtors (NAR) Chief Economist Lawrence Yun.2

Yun predicts that the national median existing-home price will increase to around $266,800 in 2019 and $274,000 in 2020. "Home price appreciation will slow down—the days of easy price gains are coming to an end—but prices will continue to rise."

What does it mean for you? If you’re in the market to buy a home, act fast. Prices will continue to go up, so you’ll pay more the longer you wait. If you’re a current homeowner, real estate has proven once again to be a solid investment over the long term. In fact, the equity level of American homeowners reached an all-time high in 2018, topping $6 trillion.3

SALES LEVELS WILL STABILIZE

In 2018, we saw a decline in sales, primarily driven by rising mortgage rates and a lack of affordable inventory. However, Yun isn’t alarmed. "2017 was the best year for home sales in ten years, and 2018 is only down 1.5 percent year to date. Statistically, it is a mild twinge in the data and a very mild adjustment compared to the long-term growth we've been experiencing over the past few years."2

Yun and other economists expect home sales to remain relatively flat over the next couple of years. Freddie Mac forecasts homes sales will increase 1 percent to 6.08 million in 2019 and 2 percent to 6.20 million in 2020.1

“The medium and long-term prospects for housing are good because demographics are going to continue to support demand,” explains Tendayi Kapfidze, chief economist for LendingTree. “With a slower price appreciation, incomes have an opportunity to catch up. With slower sales, inventory has an opportunity to normalize. A slowdown in 2019 creates a healthier housing market going forward.”4

What does it mean for you? If you’ve been scared off by reports of a market slowdown, it’s important to keep things in perspective. A cooldown can prevent a hot market from becoming overheated. A gradual and sustainable pace of growth is preferable for long-term economic stability.

MORTGAGE RATES WILL RISE

The Mortgage Bankers Association predicts the Federal Reserve will raise interest rates three times this year, resulting in a rise in mortgage rates.5 While no one can predict future mortgage rates with certainty, Realtor.com Chief Economist Danielle Hale estimates that the rate for a 30-year mortgage will reach 5.5 percent by the end of 2019, up from around 4.62 percent at the end of 2018.6

While mortgage rates above 5 percent may seem high to today’s buyers, it’s not out of line with historical standards. According to Hale, “The average mortgage rate in the 1990s was 8.1 percent, and rates didn’t fall below 5 percent until 2009. So for buyers who can make the math work, buying a home is likely still an investment worth making.”7

What does it mean for you? If you’re in the market to buy a house or refinance an existing mortgage, you may want to act quickly before mortgage rates rise. To qualify for the lowest rate available, take steps to improve your credit score, pay down existing debt, and save up for a larger down payment.

AFFORDABILITY ISSUES WILL PERSIST

Although the desire to own a home remains strong, the combination of higher home prices and rising mortgage rates will make it increasingly difficult for many first-time buyers to afford one.

“Buyers who are able to stay in the market will find less competition as more buyers are priced out but feel an increased sense of urgency to close before it gets even more expensive,” according to Hale. “Although the number of homes for sale is increasing, which is an improvement for buyers, the majority of new inventory is focused in the mid-to-higher-end price tier, not entry-level.”6

What does it mean for you? Unfortunately, market factors make it difficult for many first-time buyers to afford a home. However, as move-up buyers take advantage of new high-end inventory, we could see an increase in starter homes hitting the market.

MILLENNIALS WILL MAKE UP LARGEST SEGMENT OF BUYERS

“The housing market in 2019 will be characterized by continued rising mortgage rates and surging millennial demand,” according to Odeta Kushi, senior economist for First American. "Rising rates, by making housing less affordable, will likely deter certain potential homebuyers from the market. On the other hand, the largest cohort of millennials will be turning 29 next year, entering peak household formation and home-buying age, and contributing to the increase in first-time buyer demand.”4

Danielle Hale, chief economist for Realtor.com, predicts the trend will continue. “Millennials are also likely to make up the largest share of home buyers for the next decade as their housing needs adjust over time.”6

What does it mean for you? If you’re in the market for a starter home, prepare to compete for the best listings. And if you plan to sell a home in 2019, be sure to work with an agent who knows how to reach millennial buyers by utilizing the latest online marketing techniques.

WE’RE HERE TO GUIDE YOU

While national real estate numbers and predictions can provide a “big picture” outlook for the year, real estate is local. And as local market experts, we can guide you through the ins and outs of our market and the local issues that are likely to drive home values in your particular neighborhood.

If you’re considering buying or selling a home in 2019, contact us now to schedule a free consultation. We’ll work with you to develop an action plan to meet your real estate goals this year.

START PREPARING TODAY

If you plan to BUY this year:

Get pre-approved for a mortgage. If you plan to finance part of your home purchase, getting pre-approved for a mortgage will give you a jump-start on the paperwork and provide an advantage over other buyers in a competitive market. The added bonus: you will find out how much you can afford to borrow and budget accordingly.

Create your wish list. How many bedrooms and bathrooms do you need? How far are you willing to commute to work? What’s most important to you in a home? We can set up a customized search that meets your criteria to help you find the perfect home for you.

Come to our office. The buying process can be tricky. We’d love to guide you through it. We can help you find a home that fits your needs and budget, all at no cost to you. Give us a call to schedule an appointment today!

If you plan to SELL this year:

Call us for a FREE Comparative Market Analysis. A CMA not only gives you the current market value of your home, it will also show how your home compares to others in the area. This will help us determine which repairs and upgrades may be required to get top dollar for your property, and it will help us price your home correctly once you’re ready to list.

Prep your home for the market. Most buyers want a home they can move into right away, without having to make extensive repairs and upgrades. We can help you determine which ones are worth the time and expense to deliver maximum results.

Start decluttering. Help your buyers see themselves in your home by packing up personal items and things you don’t use regularly and storing them in an attic or storage locker. This will make your home appear larger, make it easier to stage ... and get you one step closer to moving when the time comes!

Call (916) 660-3002

Sources:

1. Freddie Mac Economic & Housing Research Forecast – http://www.freddiemac.com/research/pdf/201811-Forecast-04.pdf

2. National Association of Realtors 2019 Forecast – https://www.nar.realtor/newsroom/2019-forecast-existing-home-sales-to-stabilize-and-price-growth-to-continue

3. Bankrate 2018 Year in Review – https://www.bankrate.com/mortgages/year-in-review-for-housing-market/’

4. Forbes 2019 Real Estate Forecast – https://www.forbes.com/sites/alyyale/2018/12/06/2019-real-estate-forecast-what-home-buyers-sellers-and-investors-can-expect/#a98b80a70d9a

5. Mortgage Bankers Association Forecast – https://www.mba.org/2018-press-releases/october/mba-forecast-purchase-originations-to-increase-to-12-trillion-in-2019

6. Realtors.com 2019 National Housing Forecast – https://www.realtor.com/research/2019-national-housing-forecast/

7. FOX Business – https://www.foxbusiness.com/personal-finance/where-mortgage-rates-are-headed-in-2019

1 note

·

View note

Text

draw prediction

Best Football Prediction Site

SAFE DRAWS is the best football prediction site worldwide. We provide the best football predictions to lovers of football who want to make gains. If you are looking for a site that predicts football matches correctly and has the success of the punter in mind, you are at the right place because Safedraws is one of the best football prediction sites that predicts football matches correctly. As the best football prediction site in United State and also ranked as one of the best football prediction sites in the world, we offer accurate football tips that are guaranteed to help you win more football games. Whether you are looking for a sure banker prediction or more, we have all the information you need to win more bets.

We offer forecasts for different markets and a number of them are 1.50 Odds, 2.00 Odds, 3.00 Odds, Accumulators, Over 1.5 Goals, Over 2.5, Under 2.5, UNDER 3.5, Both Teams to Score(BTTS), Double Chance, Draws, Half-time, full-time, handicap, Under 1.5 goals, and many others.

We also provide analysis for over 40 Leagues worldwide! This makes us the biggest tips service globally. Our goal is to ensure that every punter who makes use of Safedraws, rakes intangible profits week in - and week out using the free football tips and predictions we provide. We have a management system in which we guide our users step by step in their betting journey. This goal differs us from all other forecasting platforms around the world.

If you are a punter who only takes on specific markets, we have already simplified the process for you by presenting the several markets and offering them in the simplest way ever. We have a team of dedicated experts that use algorithms and well-thought-out research in order to produce quality games to be staked on. You can find our analysis on the English Premier League, Spanish La Liga, German Bundesliga, Italian Serie A, French Ligue 1, Brazilian league and a number of others. Join us to increase your winning rate by using our sure forecasts and tips.

Is Safe Draws The Best Football Prediction Site?

Are you confused about which soccer prediction site you should register? Then Safe Draws is your preferred destination for accurate football betting tips and predictions. We are one of the top soccer prediction sites and have been recognised as the best football prediction site in the world by different bodies. Looking for the best football match news, today's football match prediction banker or football prediction for tomorrow's matches, then Safedraws is the place to be.

Football Betting Tips For Today

Every day, with tips from Europe, Italy, and the UK we offer you the best betting tips every day. Our betting tips are picked based on machine learning algorithms and analysis of sports statistics, information, injuries, psychological factors and much more. Based on this, we are able to offer accurate football predictions every time.

We provide a user experience that is unrivalled anywhere else. Whether you are browsing on your mobile phone, tablet or laptop computer, you will have the same football entertainment experience which is consistent across all platforms. We also provide a great football blog where you can learn about soccer betting, statistics, news and much more.

0 notes