#monthly Dividends

Explore tagged Tumblr posts

Text

YieldMax Rotation Strategy - Update

We discussed YieldMax ETF’s back on 4/1/24. We noted that there are trade offs. One trade off is limiting capital appreciation for consistent monthly dividends. Another trade off to consistent monthly dividends is exposure to full participation of drawdowns. My YieldMax Rotation Strategy is to use a bullish/bearish crossover of the 10/20 MA’s as the buy/sell signal limits the downside drawdowns…

View On WordPress

0 notes

Text

#Dividends#dividend#dividend yield#dividend retirement#dividend stocks#dividend investment#best paying dividend#monthly Dividends#weekly Dividends

0 notes

Text

Today's Trade: $O

I had a buy order in place to add to my holdings in Realty Income $O, were it to dip below $52.42. My order for 100 shares was filled today. Pays 6% dividend monthly Dividend Aristocrat, 25+ years of dividend increases

0 notes

Text

Prospect Capital Corporation

Prospect Capital recent news Prospect Capital Corporation (NASDAQ:PSEC) A stock with a very good monthly dividend. Prospect Capital Corporation is a leading publicly-traded Business Development Company (���BDC”). We make debt and equity investments in U.S. middle market businesses across a range of industries, and seek to deliver steady, attractive returns to our shareholders. N.B. I wrote this article in 2017, but in these days I updated it. Find out more at Yahoo Finance or at the Prospect Capital Corporation official website. Thanks. Profile Prospect Capital Corporation is a business development company. It specializes in middle market, mature, mezzanine finance, later stage, emerging growth, leveraged buyouts, refinancing, acquisitions, recapitalizations, turnaround, growth capital, development, capital expenditures and subordinated debt tranches of collateralized loan obligations, cash flow term loans, market place lending and bridge transactions. It also makes real estate investments particularly in multi-family residential real estate asset class. The fund makes secured debt, senior debt, senior and secured term loans, unitranche debt, first-lien and second lien, private debt, private equity, mezzanine debt, and equity investments in private and microcap public businesses. It focuses on both primary origination and secondary loans/portfolios and invests in situations like debt financings for private equity sponsors, acquisitions, dividend recapitalizations, growth financings, bridge loans, cash flow term loans, real estate financings/investments. It also focuses on investing in small-sized and medium-sized private companies rather than large public companies. The fund typically invests across all industry sectors, with a particular expertise in the energy and industrial sectors. It invests in aerospace and defense, chemicals, conglomerate services, consumer services, ecological, electronics, financial services, machinery, manufacturing, media, pharmaceuticals, retail, software, specialty minerals, textiles and leather, transportation, oil and gas production, coal production, materials, industrials, consumer discretionary, information technology, utilities, pipeline, storage, power generation and distribution, renewable and clean energy, oilfield services, healthcare, food and beverage, education, business services, and other select sectors. It prefers to invest in the United States and Canada. The fund seeks to invest between $10 million to $500 million per transaction in companies with EBITDA between $5 million and $150 million, sales value between $25 million and $500 million, and enterprise value between $5 million and $1000 million. It fund also co-invests for larger deals. The fund seeks control acquisitions by providing multiple levels of the capital structure. The fund focuses on sole, agented, club, or syndicated deals. http://www.prospectstreet.com/ PSEC Chart by TradingView Why Invest in Prospect? Prospect Capital Corporation is among the oldest and largest BDCs. Throughout our 20 years as a public company, we have provided consistent returns to our shareholders through our disciplined approach to investing in the U.S. middle market. Attractive Dividend Yield PSEC is a yield-oriented investor and has paid a continuous, regular dividend to its investors since inception. We have declared dividends to common shareholders totaling $4.3 billion, since our 2004 IPO1. We have also declared 86 consecutive $0.06 per share dividends to common shareholders. Focus on Senior and Secured Lending PSEC is focused on providing senior and secured term loans to U.S. middle market businesses. Of our total investments, 81% are in the form of loans secured by a first lien or other secured debt2. For the quarter ended on June 30, 2024, 89% of our total investment income was interest income on loans. Proven Origination Strategies Our team has developed a broad and deep network of U.S. middle market relationships over many years of investing, including extensive relationships with private equity firms, other capital providers, business owners and managers, and intermediaries. Dividend Reinvestment Plan We encourage any shareholder interested in participating in our dividend reinvestment plan (also known as a “DRIP” or “DRP”) to contact his or her broker to make sure such DRIP participation election has been made for the benefit of such shareholder. In making such DRIP election, be sure to specify to your broker the desire to participate in the "Prospect Capital Corporation DRIP plan through DTC" that issues shares based on 95% of the market price (a 5% discount to the market price), and not the broker's own "synthetic DRIP” plan with 0% discount. Broad Investment Portfolio Since its 2004 IPO, PSEC has made over 400 investments totaling 20.9 billion of capital with 117 current portfolio companies spanning 35 separate industries. Large and Experienced Team We cover the U.S. middle market with a team of over 120 professionals with experience investing across a range of industries and through multiple economic and investing cycles, with offices in New York, Florida, and Connecticut. Our investment professionals are supported by a dedicated team of attorneys, accountants, and other specialists. Conservative, Strong Capitalization With $7.9 billion of assets, PSEC is among the largest of the BDCs. We benefit from a strong balance sheet with long-term matched-book funding, reasonable leverage, and a high level of unencumbered assets. As affirmation of our financial profile, we have investment grade ratings from S&P, Moody’s, Kroll, DBRS, and Egan-Jones. Management and affiliates of Prospect own 26% of outstanding PSEC shares as of June 30, 2024, so we are very much aligned with our shareholders. Direct Stock Purchase Plan Prospect Capital Corporation offers the opportunity to directly purchase its stock through a Direct Stock Purchase Plan administered by Equiniti Trust Company, LLC.

Psec financial summary Prospect Capital Corporation Upsizes Preferred Stock Offering to $2.25 Billion 10/21/2024 NEW YORK, Oct. 21, 2024 (GLOBE NEWSWIRE) -- Prospect Capital Corporation (NASDAQ: PSEC) (“Prospect”, “our”, or “we”) announced today an upsize to Prospect’s preferred stock offering (the “Preferred Stock” or the “Offering”) with Preferred Capital Securities (”PCS”). The Offering has seen strong demand from the private wealth, institutional, and Registered Investment Advisor channels, with $1.8 billion in aggregate liquidation preference issuances since the initial closing in the quarter ending December 31, 2020. “Prospect’s non-traded preferred stock offers investors recurring cash income with a stable stated value, ongoing liquidity, management alignment, leverage caps, and over $3.7 billion of junior common equity credit support," said Grier Eliasek, President of Prospect. “Prospect is the number one market share issuer of non-traded preferred stock in 2023 and 2024 year-to-date, with each of institutional, registered investment advisor, wirehouse, independent private wealth, and international investor channels having invested in Prospect’s preferred stock. With interest rates declining, we believe our A4/M4 preferred stock series, with a current 7.28% annualized floating rate dividend structure and 6.50% dividend rate floor, offers an attractive option for income-oriented investors.” PCS is a securities broker dealer and the dealer manager for the ongoing offering of the Series A4 and M4 Preferred Stock. PCS has raised $5.0 billion of capital since its formation in 2011. This press release is for informational purposes and is not an offer to purchase or sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. The ongoing offering of the Series A4 and M4 Preferred Stock is being made only by means of the prospectus supplement and the accompanying prospectus, copies of which may be obtained by writing to PCS at 3290 Northside Parkway NW, Suite 800, Atlanta, GA 30327. Investors are advised to carefully consider the investment objective, risks, charges and expenses of Prospect and the Preferred Stock before investment. The prospectus supplement and accompanying prospectus contain this and other important information about Prospect and the Preferred Stock and should be read carefully before investing.

Psec common stocks dividends Disclaimer: The views, opinions, and information expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any company stakeholders, financial professionals, or analysts. Examples of analysis performed within this article are only examples. They should not be utilized to make stock portfolio or financial decisions as they are based only on limited and open source information. Assumptions made within the analysis are not reflective of the position of any analysts or financial professionals. Top Master Trading Links and Resources Trading and finance news Market, financial, business news Money, wealth, investments news Economics and Liberty Financial Safety Rules Trading or investing Traders Insight Campus Trader’s Academy Campus InteractiveBrokers.com Trading tips and advice 1 Top stocks gainer today Stocks and Bonds to watch Technical analysis history Stocks analysis dictionary Best trading practices Technical approach to trading Trading lovers Rolex best watch investment 50 great quotes about trading Prediction and trading Paul King trading rules On Investing story Golden rules of trading 20 golden rules of trading Penny stocks trading Jesse Livermore trading lessons Jesse Livermore trading rules The true words of Jesse Livermore The wisdom of Jesse Livermore 50 Famous Quotes by Jesse Livermore Visual Capitalist Data Trading versus gambling Great trading advice Golden trading rules Salva Read the full article

#company#Corporation#debt#dividend#earnings#equity#financial#good#investment#monthly#Nasdaq#private#ProspectCapital#PSEC#services#share

0 notes

Text

Top Dividend Stocks: Monthly Payouts with a Flawless Track Record

Written by Delvin Investors seeking reliable income often turn to dividend stocks, and those that pay out on a monthly basis can provide consistent cash flow. For some, the ideal dividend stock is one that has never missed a payment, offering reassurance and stability. Here are five dividend stocks renowned for their monthly payouts and impeccable track records: 1. Realty Income (O): Known as…

View On WordPress

#dailyprompt#Dividend Stocks#Financial#Financial Literacy#money#Monthly Dividend Stocks#Passive Income#Personal Finance

0 notes

Text

Neither the devil you know nor the devil you don’t

TONIGHT (June 21) I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On SATURDAY (June 22) I'll be in OAKLAND, CA for a panel (13hPT) and a keynote (18hPT) at the LOCUS AWARDS.

Spotify's relationship to artists can be kind of confusing. On the one hand, they pay a laughably low per-stream rate, as in homeopathic residues of a penny. On the other hand, the Big Three labels get a fortune from Spotify. And on the other other hand, it makes sense that rate for a stream heard by one person should be less than the rate for a song broadcast to thousands or millions of listeners.

But the whole thing makes sense once you understand the corporate history of Spotify. There's a whole chapter about this in Rebecca Giblin's and my 2022 book, Chokepoint Capitalism; we even made the audio for it a "Spotify exclusive" (it's the only part of the audiobook you can hear on Spotify, natch):

https://pluralistic.net/2022/09/12/streaming-doesnt-pay/#stunt-publishing

Unlike online music predecessors like Napster, Spotify sought licenses from the labels for the music it made available. This gave those labels a lot of power over Spotify, but not all the labels, just three of them. Universal, Warner and Sony, the Big Three, control more than 70% of all music recordings, and more than 60% of all music compositions. These three companies are remarkably inbred. Their execs routine hop from one to the other, and they regularly cross-license samples and other rights to each other.

The Big Three told Spotify that the price of licensing their catalogs would be high. First of all, Spotify had to give significant ownership stakes to all three labels. This put the labels in an unresolvable conflict of interest: as owners of Spotify, it was in their interests for licensing payments for music to be as low as possible. But as labels representing creative workers – musicians – it was in their interests for these payments to be as high as possible.

As it turns out, it wasn't hard to resolve that conflict after all. You see, the money the Big Three got in the form of dividends, stock sales, etc was theirs to spend as they saw fit. They could share some, all, or none of it with musicians. Big the Big Three's contracts with musicians gave those workers a guaranteed share of Spotify's licensing payments.

Accordingly, the Big Three demanded those rock-bottom per-stream rates that Spotify is notorious for. Yeah, it's true that a streaming per-listener payment should be lower than a radio per-play payment (which reaches thousands or millions of listeners), but even accounting for that, the math doesn't add up. Multiply the per-listener stream rate by the number of listeners for, say, a typical satellite radio cast, and Spotify is clearly getting a massive discount relative to other services that didn't make the Big Three into co-owners when they were kicking off.

But there's still something awry: the Big Three take in gigantic fortunes from Spotify in licensing payments. How can the per-stream rate be so low but the licensing payments be so large? And why are artists seeing so little?

Again, it's not hard to understand once you see the structure of Spotify's deal with the Big Three. The Big Three are each guaranteed a monthly minimum payment, irrespective of the number of Spotify streams from their catalog that month. So Sony might be guaranteed, say, $30m a month from Spotify, but the ultra-low per-stream rate Sony insisted on means that all the Sony streams in a typical month add up to $10m. That means that Sony still gets $30m from Spotify, but only $10m is "attributable" to a specific recording artist who can make a claim on it. The rest of the money is Sony's to play with: they can spread it around all their artists, some of their artists, or none of their artists. They can spend it on "artist development" (which might mean sending top execs on luxury junkets to big music festivals). It's theirs. The lower the per-stream rate is, the more of that minimum monthly payment is unattributable, meaning that Sony can line its pockets with it.

But these monthly minimums are just part of the goodies that the Big Three negotiated for themselves when they were designing Spotify. They also get free promo, advertising, and inclusion on Spotify's top playlists. Best (worst!) of all, the Big Three have "most favored nation" status, which means that every other label – the indies that rep the 30% of music not controlled by the Big Three – have to eat shit and take the ultra-low per-stream rate. Only those indies don't get billions in stock, they don't get monthly minimum guarantees, and they have to pay for promo, advertising, and inclusion on hot playlists.

When you understand the business mechanics of Spotify, all the contradictions resolve themselves. It is simultaneously true that Spotify pays a very low per-stream rate, that it pays the Big Three labels gigantic sums every month, and that artists are grotesquely underpaid by this system.

There are many lessons to take from this little scam, but for me, the top takeaway here is that artists are the class enemies of both Big Tech and Big Content. The Napster Wars demanded that artists ally themselves with either the tech sector or the entertainment center, nominating one or the other to be their champion.

But for a creative worker, it doesn't matter who makes a meal out of you, tech or content – all that matters is that you're being devoured.

This brings me to the debate over training AI and copyright. A lot of creative workers are justifiably angry and afraid that the AI companies want to destroy creative jobs. The CTO of Openai literally just said that onstage: "Some creative jobs maybe will go away, but maybe they shouldn’t have been there in the first place":

https://bgr.com/tech/openai-cto-thinks-ai-will-kill-some-jobs-that-shouldnt-have-existed-in-the-first-place/

Many of these workers are accordingly cheering on the entertainment industry's lawsuits over AI training. In these lawsuits, companies like the New York Times and Getty Images claim that the steps associated with training an AI model infringe copyright. This isn't a great copyright theory based on current copyright precedents, and if the suits succeed, they'll narrow fair use in ways that will impact all kinds of socially beneficial activities, like scraping the web to make the Internet Archive's Wayback Machine:

https://pluralistic.net/2024/05/13/spooky-action-at-a-close-up/#invisible-hand

But you can't make an omelet without breaking eggs, right? For some creative workers, legal uncertainty for computational linguists, search engines, and archiving projects are a small price to pay if it means keeping AI from destroying their livelihoods.

Here's the problem: establishing that AI training requires a copyright license will not stop AI from being used to erode the wages and working conditions of creative workers. The companies suing over AI training are also notorious exploiters of creative workers, union-busters and wage-stealers. They don't want to get rid of generative AI, they just want to get paid for the content used to create it. Their use-case for gen AI is the same as Openai's CTO's use-case: get rid of creative jobs and pay less for creative labor.

This isn't hypothetical. Remember last summer's actor strike? The sticking point was that the studios wanted to pay actors a single fee to scan their bodies and faces, and then use those scans instead of hiring those actors, forever, without ever paying them again. Does it matter to an actor whether the AI that replaces you at Warner, Sony, Universal, Disney or Paramount (yes, three of the Big Five studios are also the Big Three labels!) was made by Openai without paying the studios for the training material, or whether Openai paid a license fee that the studios kept?

This is true across the board. The Big Five publishers categorically refuse to include contractual language -romising not to train an LLM with the books they acquire from writers. The game studios require all their voice actors to start every recording session with an on-tape assignment of the training rights to the session:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

And now, with total predictability, Universal – the largest music company in the world – has announced that it will start training voice-clones with the music in its catalog:

https://www.rollingstone.com/music/music-news/umg-startsai-voice-clone-partnership-with-soundlabs-1235041808/

This comes hot on the heels of a massive blow-up between Universal and Tiktok, in which Universal professed its outrage that Tiktok was going to train voice-clones with the music Universal licensed to it. In other words: Universal's copyright claims over AI training cash out to this: "If anyone is going to profit from immiserating musicians, it's going to be us, not Tiktok."

I understand why Universal would like this idea. I just don't understand why any musician would root for Universal to defeat Tiktok, or Getty Images to trounce Stable Diffusion. Do you really think that Getty Images likes paying photographers and wants to give them a single penny more than they absolutely have to?

As we learned from George Orwell's avant-garde animated agricultural documentary Animal Farm, the problem isn't who holds the whip, the problem is the whip itself:

The creatures outside looked from pig to man, and from man to pig, and from pig to man again; but already it was impossible to say which was which.

Entertainment execs and tech execs alike are obsessed with AI because they view the future of "content" as fundamentally passive. Here's Ryan Broderick putting it better than I ever could:

At a certain audience size, you just assume those people are locked in and will consume anything you throw at them. Then it just becomes a game of lowering your production costs and increasing your prices to increase your margins. This is why executives love AI and why the average American can’t afford to eat at McDonald’s anymore.

https://www.garbageday.email/p/ceo-passive-content-obsession

Here's a rule of thumb for tech policy prescriptions. Any time you find yourself, as a worker, rooting for the same policy as your boss, you should check and make sure you're on the right side of history. The fact that creative bosses are so obsessed with making copyright cover more kinds of works, restrict more activities, lasting longer and generating higher damages should make creative workers look askance at these proposals.

After 40 years of expanded copyright, we have a creative industry that's larger and more profitable than ever, and yet the share of income going to creative workers has been in steady decline over that entire period. Every year, the share of creative income that creative workers can lay claim to declines, both proportionally and in real terms.

As with the mystery of Spotify's payments, this isn't a mystery at all. You just need to understand that when creators are stuck bargaining with a tiny, powerful cartel of movie, TV, music, publishing, streaming, games or app companies, it doesn't matter how much copyright they have to bargain with. Giving a creative worker more copyright is like giving a bullied schoolkid more lunch-money. There's no amount of money that will satisfy the bullies and leave enough left over for the kid to buy lunch. They just take everything.

Telling creative workers that they can solve their declining wages with more copyright is a denial that creative workers are workers at all. It treats us as entrepreneurial small businesses, LLCs with MFAs negotiating B2B with other companies. That's how we lose.

On the other hand, if we address the problems of AI and labor as workers, and insist on labor rights – like the Writers Guild did when it struck last summer – then we ally ourselves with every other worker whose wages and working conditions are being attacked with AI:

https://pluralistic.net/2023/10/01/how-the-writers-guild-sunk-ais-ship/

Our path to better working conditions lies through organizing and striking, not through helping our bosses sue other giant mulitnational corporations for the right to bleed us out.

The US Copyright Office has repeatedly stated that AI-generated works don't qualify for copyrights, meaning everything AI generated can be freely copied and distributed and the companies that make them can't stop them. This is fantastic news, because the only thing our bosses hate more than paying us is not being able to stop other people from copying the things we make for them. We should be shouting this from the rooftops, not demanding more copyright for AI.

Here's a thing: FTC chair Lina Khan recently told an audience that she was thinking of using her Section 5 powers (to regulate "unfair and deceptive" conduct) to go after AI training:

https://www.youtube.com/watch?v=3mh8Z5pcJpg

Khan has already used these Section 5 powers to secure labor rights, for example, by banning noncompetes:

https://pluralistic.net/2024/04/25/capri-v-tapestry/#aiming-at-dollars-not-men

Creative workers should be banding together with other labor advocates to propose ways for the FTC to prevent all AI-based labor exploitation, like the "reverse-centaur" arrangement in which a human serves as an AI's body, working at breakneck pace until they are psychologically and physically ruined:

https://pluralistic.net/2022/04/17/revenge-of-the-chickenized-reverse-centaurs/

As workers standing with other workers, we can demand the things that help us, even (especially) when that means less for our bosses. On the other hand, if we confine ourselves to backing our bosses' plays, we only stand to gain whatever crumbs they choose to drop at their feet for us.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/21/off-the-menu/#universally-loathed

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#openai#ai#llms#gai#generative ai#models#music#umg#universal music group#spotify#tiktok#creative labor markets#chokepoint capitalism.#copyfight

306 notes

·

View notes

Text

Why you should roll over your old 401k

The opportunity cost. Compound interest—the Eighth Wonder of the World according to Our Lady of Berkshire Hathaway, Warren Buffett—requires two ingredients to work its magic: money and time. If you leave an old retirement plan to languish, you’re giving it time… but you aren’t giving it any more money. Your deposits stop when your paychecks do. You’ll still earn compound interest, but that interest won’t benefit from the fattening influence of regular fresh and meaty deposits.

The fees can add up. Even though you’re no longer depositing cash on the monthly, you still could be paying servicing fees. And those are therefore coming straight out of whatever dividend interest you earn.

If you don’t do it, they’ll do it for you. Some companies don’t allow former employees to keep a retirement plan open past a certain point. So if you don’t roll that bad boy over, they’ll do it for you. And they won’t be nice about it: they could just mail you a check minus the taxes and 10% early withdrawal fee whether you like it or not.

Your old retirement plan might suck. Every retirement plan servicer is different. Why would you want to keep money in your old 401k at Bank A when their fees are way higher than those Bank B is charging for your new 401k, or the pennies Bank C is charging for your glorious Roth IRA???

Keep reading.

If you found this helpful, consider joining our Patreon.

#401(k)#401k#retirement#retirement fund#retirement account#capitalize#401k rollover#roll over your 401(k)#saving money#saving for retirement#personal finance#career advice

65 notes

·

View notes

Text

At the end of 2022, Dmitry Medvedev—Russia’s former prime minister and the current deputy chairman of its Security Council—offered his predictions for the coming year. He warned that Europeans would suffer badly from Russia’s decision to curb natural gas exports to the European Union, suggesting that gas prices would jump to $5,000 per thousand cubic meters in 2023—around 50 times their prewar average. He probably assumed that that sky-high prices would translate into a windfall for Russian state-owned energy company Gazprom, which was still supplying several European countries via pipeline, ramping up exports of liquefied natural gas, and eyeing new deals with China. Perhaps Medvedev also hoped that Europeans would beg the Kremlin to send the gas flowing again.

It turns out that Medvedev might want to polish his crystal ball: Last year, European gas prices averaged a mere one-tenth of his number. And just this month, Gazprom posted a massive $6.8 billion loss for 2023, the first since 1999.

Gazprom’s losses demonstrate the extent to which the Kremlin’s decision to turn off the gas tap to Europe in 2022 has backfired. In 2023, European Union imports of Russian gas were at their lowest level since the early 1970s, with Russian supplies making up only 8 percent of EU gas imports, down from 40 percent in 2021. This has translated into vertiginous losses for Gazprom, with the firm’s revenues from foreign sales plunging by two-thirds in 2023.

Gazprom’s woes are very likely setting off alarm bells in Moscow: With no good options for the company to revive flagging gas sales, its losses could weigh on Russia’s ability to finance the war in Ukraine. This is especially ironic given the fact that EU sanctions do not target Russian gas exports; the damage to the Kremlin and its war effort is entirely self-inflicted.

The most immediate impact of Gazprom’s losses will be on Russian government revenues, a crucial metric to gauge Moscow’s ability to sustain its war against Ukraine. Poring over Gazprom’s latest financials paints a striking picture. Excluding dividends, Gazprom transferred at least $40 billion into Russian state coffers in 2022, either to the general government budget or the National Welfare Fund (NWF), Moscow’s sovereign wealth fund.

This is no small feat. Until last year, Gazprom alone provided about 10 percent of Russian federal budget revenues through customs and excise duties as well as profit taxes. (Oil receipts usually account for an additional 30 percent of budget revenues.) This flood of money now looks like distant history. In 2023, the company’s contribution to state coffers through customs and excise duties was slashed by four-fifths, and like many money-losing firms, it is due a tax refund from the Russian treasury.

For Moscow, this is bad news on several fronts. Because of rising military expenses, the country’s fiscal balance swung into deficit when Moscow invaded Ukraine. To help plug the gap, the Kremlin ordered Gazprom to pay a $500 million monthly levy to the state until 2025. Now that the company is posting losses, it is unclear how it will be able to afford this transfer. In addition, Gazprom’s contribution to the NWF will probably have to shrink. For the Kremlin, this could not come at a worst time: The NWF’s liquid holdings have already dropped by nearly $60 billion, around half of its prewar total, as Moscow drains its rainy-day fund to finance the war. Finally, Gazprom’s woes could prompt the firm to shrink its planned investments in gas fields and pipelines—a decision that would, in turn, hit Russian GDP growth.

As if this was not enough, a closer look at Gazprom’s newly released financials suggests that the worst may be yet to come, with three telltale signs that 2024 could be even more difficult than 2023.

First, Gazprom’s accounts receivable—a measure of money due to be paid by customers—are in free fall, suggesting that the firm’s revenue inflow is drying up. Second, accounts payable shot up by around 50 percent in 2023, hinting that Gazprom is struggling to pay its own bills to various suppliers. Finally, short-term borrowing nearly doubled last year as Russian state-owned banks were enlisted to support the former gas giant.

Whereas these figures come from Gazprom’s English-language financials, the company’s latest Russian-language update yields two additional surprises—both of which show that the firm’s situation has worsened even further since the beginning of the year.

First, short-term borrowing during the first three months of 2024 roughly doubled compared to the previous quarter. If Russian state-owned banks continue to cover Gazprom’s losses, the Russian financial sector could soon find itself in trouble. This begs a tricky question: With the NWF’s reserves dwindling and Moscow’s access to international capital markets shut down, who would pay a bailout bill? Second, Gazprom’s losses were almost five times greater in the first quarter of 2024 than in the same period of 2023, hinting that the firm may post an even bigger loss this year than it did in 2023.

Looking ahead, 2025 will be an especially tough year for Gazprom. The transit deal that protects gas shipments through Ukraine via pipeline to Austria, Hungary, and Slovakia will probably expire at the end of this year, further curbing what’s left of Gazprom’s exports to Europe. A quick glance at a map makes it clear that China is now the only remaining option for Russian pipeline gas.

Yet Beijing is not that interested: Last year, it bought just 23 billion cubic meters of Russian gas, a mere fraction of the 180 billion cubic meters that Moscow used to ship to Europe. Negotiations to build the Power of Siberia 2 pipeline, which would boost gas shipments to China, have stalled. And in truth, China is not a like-for-like replacement for Gazprom’s lost European consumers. Beijing pays 20 percent less for Russian gas than the remaining EU customers, and the gap is predicted to widen to 28 percent through 2027.

Without pipelines, raising exports of liquefied natural gas (LNG) is the only remaining option for Moscow. However, Western policies make this easier said than done. Western export controls curb Russia’s access to the complex machinery needed to develop LNG terminals, such as equipment to chill the gas to negative160 degrees Celsius so that it can be shipped on specialized vessels. And Washington has recently imposed sanctions on a Singapore-based firm and two ships working on a Russian LNG project, signaling that it will similarly designate any entity willing to work in the sector. Finally, U.S. sanctions make it much harder for Russian firms to finance the development of new liquefaction facilities and the gas field designed to supply them. In December, Japanese firm Mitsui announced that it was pulling staff and reviewing options for its participation to Russia’s flagship Arctic LNG 2 project. As a result, the Russian operator announced last month that it was suspending operations of the project, which was originally slated to launch LNG shipments early this year.

Gazprom’s cheesy corporate slogan—“Dreams come true!”—does not ring so true anymore as Moscow’s former cash cow becomes a loss-making drain. Data from the International Energy Agency confirms the extent of the Kremlin’s miscalculation when it turned off the gas tap to Europe: The agency predicts that Russia’s share of global gas exports will fall to 15 percent by 2030—down from 30 percent before Moscow’s full-blown invasion of Ukraine.

This was probably predictable. It is hard to imagine how a gas exporter configured to serve European customers and reliant on Western technology could thrive after refusing to serve its main client—signaling to every other potential customer, including China, that it is an unreliable supplier. Corporate empires tend to rise and fall, and it looks like Gazprom will be no exception to the rule.

25 notes

·

View notes

Text

Brazil’s Central Bank makes record dollar intervention in December

Last month, monetary authority sold $21.57bn in the spot market to counter a record $26.41bn outflow

The Central Bank of Brazil carried out its largest monthly intervention in the spot dollar market in December 2024, marking the most significant activity since the country adopted the floating exchange rate in 1999. The monetary authority sold $21.57 billion in the spot market last month, a record intervention driven by a historic dollar outflow of $26.41 billion, according to monthly currency flow data dating back to 1982.

“December is always a challenging month. However, the outflow in 2024 was significantly stronger, heavily concentrated in the financial account,” explained Sérgio Goldenstein, chief strategist at Warren Investimentos and former head of the Central Bank’s Open Market Department (DEMAB). “It made sense for the Central Bank to intervene in the spot market rather than through swaps because the pressure was concentrated precisely in the spot market, given the volume of physical dollar outflows.”

Until November, Brazil’s currency flow remained in positive territory, buoyed by strong commercial account results that more than compensated for financial outflows. However, this trend reversed sharply in December, a month typically marked by substantial dollar outflows for profit and dividend remittances. In October, Valor had already highlighted that financial account outflows were heading for a record high in 2024.

Over the year as a whole, Brazil posted a total net outflow of $18.01 billion. The commercial account contributed positively with an inflow of $69.2 billion, but this was outweighed by the financial account’s outflow of $87.21 billion.

Continue reading.

#brazil#brazilian politics#politics#economy#central bank#image description in alt#mod nise da silveira

4 notes

·

View notes

Text

The 9/22/24 YieldMax Rotation Strategy Update

YieldMax™ ETFs seek to generate monthly income by pursuing options-based strategies on one or more underlying securities. YieldMax™ ETFs aim to harvest compelling yields from assets that are not typically associated with monthly income. One primary risk is the potential opportunity cost, as the strategy may limit the ETF’s participation in significant market upswings. Another risk is that if the…

View On WordPress

0 notes

Text

#Dividends#dividend#dividend yield#dividend retirement#dividend stocks#dividend investment#best paying dividend#monthly Dividends#weekly Dividends#dividend investing#investing course

1 note

·

View note

Text

Budgeting Tips

Hey young stars and hearts! As you all may know, i am on my big girl finance journey and if you didn’t know you do! Welcome or welcome back my loves! My name is Mimi if you are just coming across my posts.

My goal is to be a representation for the finance, manifestation, and money mindset for black girls and other POC. I spend a lot of money, that’s okay because i am changing my mindset about money. Instead of surviving in scarcity mindset, choosing to live in abundance mindset. Living in a state of abundance does require a little work.

As much as i changing my mindset into believing i am deserving of more money and that it flows to me effortlessly, I want to actually keep it and not over spend my money that flows to me easily by overindulging.

So, with that being said, here are some budgeting tips i will be implementing into my finances to improve my financial health:

- Assessing Your Financial Situation

Before you can create a budget, you need to understand your current financial situation. Take a peek into those bank credit card statements! This all includes:

- Bank statements

- Credit card statements

- Pay stubs

- Bills and receipts

2. - Calculate Your Monthly Income

Determine your total monthly income, this is very crucial. I cannot stress this enough! This includes your salary, any freelance or side income, rental income, dividends, and any other sources of income. Make sure to calculate your net income (after taxes) rather than your gross income. Write down an estimate in a monthly budget planner, if you don’t have one you can purchase one here, or write it on paper to stay organized.

3. - List Your Monthly Expenses

Make a list of all your monthly expenses. You actually might not have any, but what if you’re down to your last five dollars and Apple just takes that shit? That would be frustrating, right? because you didn’t know it was coming up or that you even had a subscription for anything at all, list that also! These can be categorized into fixed and variable expenses:

- **Fixed Expenses:** Rent or mortgage, utilities, insurance, car payments, and subscriptions.

- **Variable Expenses:** Groceries, dining out, entertainment, clothing, and miscellaneous expenses.

4. - Track Your Spending

For at least one month, track every penny you spend. This will give you a clear picture of where your money is going and help identify areas where you can cut back. Use a spreadsheet, or budgeting app, purchase a budget planner, or write it down in a notebook.

5. - Set Financial Goals

Define your financial goals. These could be short-term (e.g., paying off a credit card), medium-term (e.g., saving for a vacation), or long-term (e.g., retirement savings). Having clear goals will motivate you to stick to your budget.

6. - Create Your Budget

With your income, expenses, and financial goals in mind, create your budget. Allocate a specific amount of money to each category of expenses. Make sure to prioritize essentials (like housing, utilities, and groceries) before allocating money to discretionary spending (like entertainment and dining out).

Example Budget Categories:

Housing: $1,200

Utilities: $200

Groceries: $400

7. - Stay Committed and Be Flexible

Sticking to a budget requires commitment and discipline. Be patient with yourself and remember that it's okay to make mistakes. If unexpected expenses arise, adjust your budget accordingly. The key is to remain flexible and adaptable while staying focused on your financial goals.

These are tips I have created according to my digital budget planner, which can be purchased below. Again, building your finances takes time and discipline but it is very rewarding once you actually start to create a flow and a plan. I am implementing this asap to get ahead of my finances. Have fun with this of course!

Budget Planner

xoxo mimi💋

#aesthetic#inspiration#beauty and wellness#black women#black beauty#beautiful women#beauty#affirm and persist#affirmdaily#affirmyourlife#afffirmations#manifesation#manifesting#luxurious#black luxury#self love#luxury#self care#money#abundance#growth#growth mindset#becoming that girl#becoming her#it girl#wellness girl#girlblogging

7 notes

·

View notes

Text

If you're unfamiliar with trading/investing, there's an asset class called an Exchange Traded Fund (everyone calls them 'ETFs') that's basically like a bundle of individual stocks that you can buy collectively as a single asset, usually for much cheaper than individually buying one of each stock in an ETF's portfolio. They usually have a theme or strategy to which stocks are included in the ETFs holdings, and usually trade under a nonsensical or uninspired ticker symbol. But here are some of the more amusing ticker symbols I've come across in my research:

TAN - Invesco Solar ETF (Bunch of solar energy companies)

PBJ - Invesco Food & Beverage ETF (Bunch of food companies)

TGIF - SoFi Weekly Income ETF (Pays a dividend weekly, instead of monthly or quarterly like pretty much everything else)

SHE - SPDR MSCI Gender Diversity Index ETF (Tracks companies that internally focus on gender equality)

YINN - Direxion Daily FTSE China Bull 3X Shares (Tracks the 50 biggest Chinese companies and leverages a three times swing over their daily movements)

YANG - Direxion Daily FTSE China Bear 3X Shares (Same thing as YINN, but moves in the opposite direction)

CURE - Direxion Daily Healthcare Bull 3X Shares (Same thing as YINN but with American healthcare stocks)

NETZ - TCW Transform Systems ETF (Activist ETF that tries to seat members on corporate boards with a focus on Net-Zero emission goals)

HACK - ETFMG Prime Cyber Security ETF (Bunch of cyber-defense companies)

11 notes

·

View notes

Text

Finland's infamous online message board Ylilauta has removed advertising on its website over the summer as the site transitioned to a user paying model last year.

"Yes, all our financing is now independent of others," the site's administrators wrote in a reply to Yle.

Ylilauta reported last year that it had 2.5 million monthly users. It has not publicly disclosed the number of paying users.

The decision to remove ads was voluntary, according to the site's management. However, there have been a number of problems with the site's advertising model in the past given some of the controversial content posted on Ylilauta.

Police found casino advertisements illegal

Yle MOT reported last year how Ylilauta paid millions of euros in dividends to its owners in tax havens. The proceeds were obtained, among other ways, by selling advertising space to online casinos.

The advertising of foreign online casinos is prohibited in Finland. The police could have imposed a fine on the gambling promoter.

Finnish police first intervened in Ylilauda's gambling advertising in 2021. Lauta Media, the Maltese company that owns Ylilauta, has denied violating the Lotteries Act.

However, in June it said it would remove the gambling ads to please the police.

"As a gesture of goodwill, Lauta Media will take steps to remove banner ads from foreign gambling companies," CEO John Farrugia wrote in a response to the police department.

Google removed its own ads from Ylilauta

In July, Tivi reported that Google had removed its own Adsense ads from Ylilauta because the forum violated its rules on hate speech and harassment.

Tivi cited the discussion threads exposed by Svenska Yle in June as an example. Ylilauta users had posted pictures of women without their consent.

According to the site's administrators, there are no longer any ads on the site, which also improves the user experience.

Ownership transferred to Estonia

Ylilauta is owned by Lauta Media, registered in Malta. The largest owner is Aleksi Kinnunen, the founder of the forum also known by the username Sopsy.

Kinnunen has owned around 32 percent of Lauta Media through Goldhill Holdings, a company registered in Gibraltar. In May, however, he transferred the shares to Pulju OÜ, registered in Estonia.

The rest of Lauta Media is owned by Halonen Holding, registered in Gibraltar, and Sissonen Capital, Stelbur Capital and Huhtikuu, registered in Finland.

3 notes

·

View notes

Text

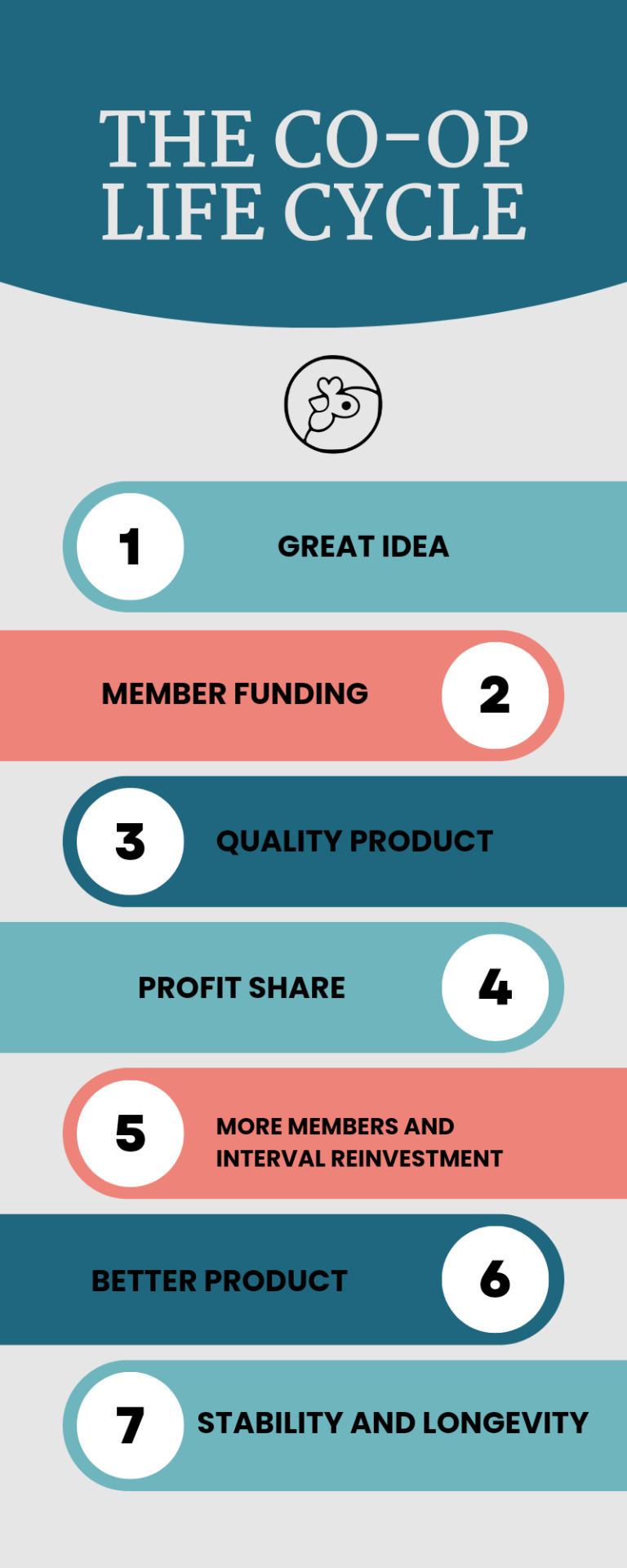

If you have talked to me or seen any social media posts from me in the last year then you have heard of Artisans Cooperative. We started last year with the #EtsyStrike coming together because we knew there was a better way. In May of 2023 we started our Capital compaign; in 2 months we have gained 133 members, 300 email subscribers, and $33k. Our goal initially was 100 members, 800 email subscribers, and $25k but seeing how excited people were to join us we made some stretch goals AND WE ARE ALMOST THERE! We have 7 days left of our capital campaign, 7 days to get another 500 email subscribers, and another $17k.

Here's why you should join: first and foremost as a member you will receive dividends once the co-op is making money, second members help make decisions within the co-op (1 member = 1 vote), third as a member you will have lower commission fees (founding members: 6.5%, members, members: 8%, non-members: 9.5%) for the first two years. There are NO listing fees, NO monthly fee: just the membership buy-in and the commission rate.

In order to make this goal I need your help! If you can't join, donate, if you can't donate then share this post.

23 notes

·

View notes

Text

The side savings account made two cents yesterday as interest dividend even though the balance was not to the minimum yet. Turns out, the minimum balance for earning any interest is zero. The balance I am chasing is the minimum needed for APR parity with my first credit union.

The savings account at my first credit union also received two cents yesterday as interest dividend. The balance is literally ten times the amount in the side account. They made the same interest dividend.

I am quietly fuming.

So. Here's the plan. The first savings account is the Oh Shit fund. I will build that to at least one month's pay in balance so that I can immediately shift funds to my checking account if necessary.

After the first savings account reaches "One Month's Pay", future amounts will go to the side savings account. Transferring funds from the side savings account could take minutes to a full business day depending on the amount I'm moving, so that's why I want the Oh Shit fund to be closer at hand. I will build up the side savings account to "Three Month's Pay" and leave TMP as readily available as I can.

But, once I hit TMP, then it's time to build up a surplus in Side Account so that I can start making Certificates of Deposit with Side Credit Union. That starts at $500 with a minimum term of six months, but with an APR that would require me to have literally five digits in plain savings to duplicate otherwise. Get a couple of low CDs started on 6-month terms, continue to build the cash, then eventually graduate to larger CDs, but still with 6-month terms until I feel comfortable enough to do minimum $1k CD with 1-year term.

Sweep monthly budget surpluses into Side Cash Account. Eventually build Main Account to Three Month's Pay and Side Account Cash to Six Month's Pay. This is an endurance test, not a sprint. Give myself permission to spend money to enjoy myself from time to time. Remind myself that there is a balance to be made between saving money for saving's sake and spending money because life is meant to be lived.

I'm sure there is a reason why "miserly" and "misery" sound so much alike.

Not to mention, there are no Muppets in my zip code so any penurial haunting is not going to be enjoyable by any means or hopes.

(Much gratitude to @notfinancialadvice for inspiring me to take a closer look at the financial institutions within reach.)

This is what hope looks like.

6 notes

·

View notes