#money loans

Explore tagged Tumblr posts

Text

Best Title Loans in Florida

Introduction

Title loans are a popular choice for Floridians who need quick access to cash. With the right lender, you can secure the best title loans in Florida and enjoy flexible repayment terms. In this article, we’ll highlight the benefits of title loans and review some of the top providers in the state.

Features of the Best Title Loans

Low Interest Rates: Competitive rates to minimize your repayment burden.

No Hidden Fees: Transparent terms ensure no surprises.

Quick Processing: Same-day approvals for urgent needs.

Leading Title Loan Providers in Florida

Car Title Loans USA This provider is known for its low-interest rates and straightforward application process.

Loan Cheetah Loan Cheetah specializes in offering flexible terms for title loans.

Speedy Funds Now Speedy Funds Now provides some of the best title loans in Florida, with a focus on customer convenience and satisfaction.

Why Choose Speedy Funds Now?

Speedy Funds Now ensures a seamless experience for borrowers. They offer competitive rates, flexible terms, and fast disbursement, making them a standout option for title loans in Florida. Whether you’re new to title loans or seeking a reliable lender, Speedy Funds Now has you covered.

Conclusion

Finding the best title loans in Florida requires careful consideration of rates, terms, and lender reputation. Speedy Funds Now stands out as a trusted partner for those seeking quick and reliable financial assistance. Explore their services today to experience top-tier lending solutions.

0 notes

Text

Understanding the Legalities of Bail Money Loans in Rowland Heights

Navigating the legal intricacies of bail money loans in Rowland Heights is a crucial aspect for anyone faced with the task of arranging bail. This article aims to provide a clear understanding of the legal framework surrounding bail loans, helping individuals make informed decisions while ensuring compliance with local laws and regulations.

The Legal Framework of Bail in California

In California, the bail system is regulated by both state laws and local regulations. In Rowland Heights, these regulations determine bail amounts, the process for posting bail, and the operation of bail bond services. Understanding these laws is essential to ensure that one's approach to securing a bail loan is legally sound and in line with state and local guidelines.

Rights and Protections for Loan Seekers

When seeking a bail money loan, it’s important to be aware of your legal rights and protections. California law provides safeguards against predatory lending practices, including caps on interest rates and fees that bail bond companies can charge. Knowing these rights can help protect individuals from unfair loan terms and financial exploitation.

Key Legal Terms in Bail Bond Agreements

Bail bond agreements often include legal terms that can be complex and difficult to understand. Key terms such as 'collateral', 'indemnitor', and 'forfeiture' should be clearly understood before signing any agreement. It's advisable to consult with a legal expert or attorney to review and explain the terms of any bail bond contract.

Avoiding Predatory Lending Practices

In Rowland Heights, as in other areas, the potential for predatory lending practices exists. Being vigilant about the terms of the loan, the reputation of the lender, and the overall cost of the bail bond is crucial. This includes being aware of any hidden fees, high interest rates, or unfair collateral requirements.

Local Legal Support and Resources

For those in Rowland Heights, accessing local legal support can provide additional clarity and assistance. Local legal aid organizations, attorneys specializing in bail bond law, and community legal clinics can offer valuable advice and support. Utilizing these resources can help ensure that one navigates the bail loan process with a full understanding of their legal rights and obligations.

Conclusion

Understanding the legalities of bail money loans in Rowland Heights is a fundamental step in responsibly managing the bail process. By being informed about the legal framework, knowing your rights and protections, and seeking professional legal advice, individuals can navigate this complex terrain more effectively. This knowledge not only aids in making informed decisions but also helps in protecting oneself from potential legal and financial pitfalls.

0 notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about school#submitted june 5#polls about money#student debt#college#student loans#debt#economics

3K notes

·

View notes

Text

Private Student Loan $100 Bonus NO FEES

🧑🎓Hi! I thought you might want to check out SoFi’s Private Student Loan with flexible repayment options and no fees. Learn more and use my link to apply for a SoFi Private Student Loan and you can get a $100 welcome bonus 💰:

#referral codes#referral links#driskol referrals#money loans#student loans#private loan#fyp#for your page#for you page#driskolestate#follow#like

0 notes

Text

One thing that is often overlooked with federal student loan forgiveness is that for every outstanding loan, the federal government is giving taxpayer money to a massive private fintech contractor to service that loan. It actively costs the government money to have loans outstanding. It is more expensive for the government to have someone who is on a low or no-pay income driven plan sit on that debt for 20 years than it would be to just forgive it outright today.

So like. Your tax dollars could go to relieving the debt burden of some struggling millennial OR they can line the pockets of Aidvantage's CEO, but that money is being spent either way.

#servicing contracts are so so huge#Servicing that many loans costs the government a lot of money and it will KEEP costing the government a lot of money ongoing#where forgiving debt is writing off money that is already spent.#STOP BANKROLLING STUDENT LOAN SERVICERS TO SPITE THE POOR

2K notes

·

View notes

Text

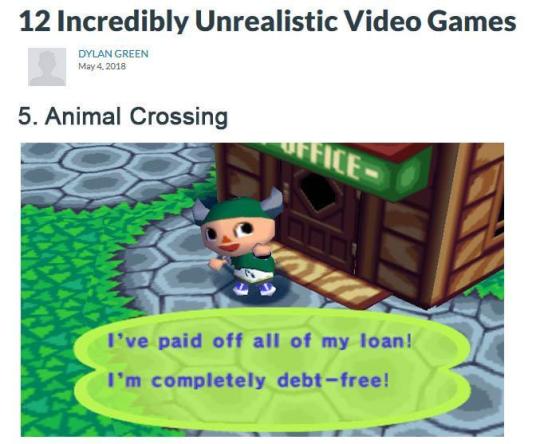

#animal crossing#nintendo#gamecube#gaming#video games#funny#lol#humor#meme#relatable#debt#economy#money#student loans#acww#ds#accf#wii#acnl#new leaf#3ds#acpc#pocket camp#new horizons#acnh#switch#nintendo switch#tom nook#villagers#ac

709 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

494 notes

·

View notes

Text

Because one deal with the devil wasn't enough, apparently.

#declan o’hara#aidan turner#rivals 2024#what'd they need that ginormous fucking house for?#how much did that cost?#and then he takes a loan from Tony?#this man is horrible with money#but he's great in bed#what's a girl to do

129 notes

·

View notes

Text

Spent hours decorating my Build a City Challenge Neighborhood and i enjoy every second of it✨

#finally my hood is coming life#i literally did this without money cheat & loans#eventually all building will have the same vibe as the 1st pic. i ran out of money to decorate#sims 2#ts2#simblr#hood: frostedvalley

177 notes

·

View notes

Text

one of the things about having an unstable parent is that it can so easily ruin your future. you want to get out, but getting out takes having agency. it takes the resume and the grades and the stellar community service history.

but you have to choose your battles. you know if you sign up for an after-school activity, it'll be okay for a while, so long as the activity is parent-approved and god-fearing. over time, like all things, it will become an argument (i can't keep carting your ass to these things) or a weapon (talk to me like that again, see if you get to go to practice). sometimes, if you love the thing, it's worth it. but you also know better than to love something: that's how they get you. if you ever actually want something, it will always be the center of their attention. they will never stop threatening you with it. telling you of course i'm a good parent, i came to all of those stupid events.

you learn to balance yourself perfectly. you can either have a social life or you can have hobbies. both of these things will be under constant scrutiny. you spend too much time with her, you should be at home with family is equally paired with you're acting like this because you're addicted to what's on that goddamn screen. you cannot ever actually win, so everything falls within a barter system that you calculate before entering: do you want to learn how to drive? if so, you'll need to give up asking for a new laptop, even though yours died. maybe you can work on a computer at the library. of course, that would mean you'd be allowed to go to the library, which would mean something else has to bleed. nothing ever actually comes free.

and that bitter, horrible irony: you could be literally following their orders and it still isn't pretty. they tell you to get a job; they hate that your job keeps you late and gives you access to actual money. they tell you to do better in school; they say no child of mine needs a tutor. they want you to stop being so morose, don't you know there are people who are really suffering - but they revile the idea you might actually need therapy.

you didn't survive that fall the way other people would. you've seen other people scramble and get their way out, however they could. maybe you were made too-soft: the answer didn't come to you easily. it wasn't quick. it was brutal and nasty. some people even asked you why didn't you just work hard and escape during school? and you felt your head spinning. why didn't you? (they control your financial aid. they control your loan status. they love having that kind of thing). maybe in another life you got diagnosed sooner and got the meds you needed to actually focus and got attention from the right teachers who helped you clear hurdles to get up out of here - but for now? here?

the effort of trying. the effort of not-dying. that kind of effort was absolutely agonizing.

#writeblr#btw i got out#even though i felt this way#i was undiagnosed and was in a particularly fucked up situation#(it's complicated lol)#i had no money and no way out#no car no license . i still had a curfew at 22 years old#and still. i got out.#you can get out too.#i wasn't allowed to literally do anything after school we were pretty much only allowed 1 hobby#and STILL i got out.#it wasn't bc i was particularly smart or capable or clever. it's that 1. i got lucky & 2.#i knew there had to be The Rest of The World#and I wanted to at least VAGUELY get to the Rest of the World before i gave up trying#sometimes it's the spite that gets u thru it. that sense - fuck u#FUCK YOU ACTUALLY.#im gonna make my own life u stupid bitch. since u seem so convinced i could never REALLY do it.#whenever ppl are like <3 just cut out ur parents <3 im like <3 have u never been poor lol <3#<3 i needed them to sign my loans <3#<3 bestie not every person who is struggling is going to be able to make the grades and hero status to get a free ride.#and guess what baby!! we still deserve to get out and have a good life.

2K notes

·

View notes

Text

Personal Loan Providers in Louisiana

Introduction

If you’re in Louisiana and searching for reliable personal loan providers, you’re in the right place. With numerous lenders offering customized solutions, it’s essential to know which ones suit your financial needs. This article dives into the top personal loan providers in Louisiana and how they can help.

Why Personal Loans Are Popular in Louisiana

Personal loans have become a preferred choice for borrowers due to their versatility and ease of access. Louisiana’s leading providers cater to individuals with varying financial needs, from debt consolidation to emergency expenses.

Top Personal Loan Providers in Louisiana

Here are some of the best personal loan providers you should consider:

Speedy Funds Now

Offers: Loans for every situation with flexible repayment options.

Advantage: User-friendly online application and fast processing.

OneMain Financial

Offers: Personal loans for those with good to average credit.

Advantage: Physical branches for in-person support.

OppLoans

Offers: Loans for borrowers with bad credit.

Advantage: Quick approvals and no credit check required.

Upgrade

Offers: Competitive rates and free credit monitoring.

Advantage: Excellent for consolidating high-interest debt.

Prosper

Offers: Peer-to-peer lending with low rates for creditworthy borrowers.

Advantage: Transparent fee structure and flexible terms.

Types of Loans Available in Louisiana

Small Personal Loans

Ideal for immediate needs, such as car repairs or medical bills.

Unsecured Loans

No collateral required, making them accessible to more borrowers.

Debt Consolidation Loans

Combine multiple debts into a single, lower-interest payment.

How to Apply for a Personal Loan in Louisiana

The application process is straightforward. Follow these steps:

Check Your Credit Score: Higher scores typically get better rates.

Compare Lenders: Use online tools to evaluate terms and conditions.

Gather Documentation: This includes ID, proof of income, and bank statements.

Apply Online or In-Person: Choose the method that works best for you.

Receive Funds: Most lenders disburse funds within 24-48 hours.

Benefits of Choosing Local Lenders

Personalized Service: Local lenders understand Louisiana’s economic landscape.

Fast Approvals: Shorter wait times compared to national institutions.

Community Impact: Supporting local businesses strengthens the state’s economy.

FAQs about Personal Loan Providers in Louisiana

Are there options for bad credit? Yes, lenders like OppLoans cater to individuals with low credit scores.

Can I pre-qualify without affecting my credit? Many providers offer pre-qualification using a soft credit check.

What loan amounts are available? Loan amounts typically range from $1,000 to $50,000, depending on the provider.

Conclusion

Choosing the right personal loan provider in Louisiana can be life-changing. Whether you need a small loan in Louisiana or a larger amount, these providers have you covered. Evaluate your options, consider your financial goals, and select a loan that aligns with your needs.

0 notes

Text

The Debt

Bob robs Peter to finally pay Paul,

for the five hundred dollars Paul loaned him last fall.

Bob felt ashamed but he needed the dough,

and knew that good Peter would not even know.

Paul gets the cash and is off in a sprint,

to pay back old Morris for the money he lent.

Old Morris is happy with money in hand,

and finds young Maurice to pay him as planned.

Young Maurice is happy with five hundred bones

and goes to his uncle to pay off his loans.

Maurice’s uncle is proud of the boy,

and heads off to locate his good friend Miss Joy.

Miss Joy is a helper who’s helped many others,

helped Maurice’s uncle and all of his brothers,

when all of them found themselves in a tight pinch

and Miss Joy was ready to help in a cinch.

Miss Joy takes a ferry to go and see Mary,

with all of the thanks that a person can carry.

She’ll pay Mary back for all that she borrowed

when Miss Joy was lonely and drowning in sorrow.

Mary herself had some people to pay,

and one of these people was her old Aunt Kay.

Aunt Kay gave her money to pay for her rent

because Mary found that her money was spent.

Since Aunt Kay was also a one in the red,

she went down the docks and she found Captain Ted.

The captain had given her five hundred dollars

so Aunt Kay could answer her IRS callers.

The captain went down all the streets of his town,

looking to see if old Bob was around.

The captain had owed Bob a small sum of money

that Bob floated Ted on the Sound.

Bob took up the money and squared up with Peter,

who never once knew it had left his two-seater.

Bob re-placed the cash and was off in a dash—

his fleet feet had never been fleeter.

So what is the value of money?

What’s the appropriate call?

For these ten quartets have balanced ten debts,

and no one paid anything at all.

#money#debts#loans#personal loans#stories#storytelling#story poem#poems on tumblr#poetry#original poem#my writing#creative writers#rhyme scheme#quartets

120 notes

·

View notes

Text

Answer for how long (after graduation/after stopping) it was until you no longer had any student debt, regardless of how you achieved that– including if any of it was cancelled or forgiven, or you had outside help paying it off (e.g. your parents or partner helped).

–

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#submitted june 5#polls about school#student debt#student loans#economics#college#university#debt#money#finances

265 notes

·

View notes

Text

SoFi Medical Loan $1000 Bonus

If you’re interested in lowering your student loan payments, SoFi just announced special low rates just for doctors and dentists. Use my invite link to earn a $1,000 bonus!

#referral codes#referral links#driskol referrals#medical expenses#fyp#money loans#for your page#for you page#like#follow#finance#banking#driskolestate#SoFi

0 notes

Text

It's so awesome how canada's answer to the housing crisis is giving more money to people who already have houses so they can renovate shitty overpriced basement rentals

54 notes

·

View notes