#mobile payment

Explore tagged Tumblr posts

Text

Mobile Card Readers: How Portable Payment Processing is Revolutionizing Commerce

Emergence of Mobile Card Readers Mobile card first emerged about a decade ago as simple magnetic stripe readers that connected to a mobile device via the audio jack. These early solutions allowed basic in-person credit card processing but lacked robust security and functionality. In recent years, advancements in technology have enabled the development of sophisticated mobile card readers that connect via Bluetooth and support chip cards, contactless payments, and value-added features. These next-gen devices are fueling massive growth and transforming how businesses accept payments on the go. Evolution of Connectivity and Compatibility Early mobile card used the audio jack connection, which provided a simple plug-and-play experience but came with security risks. As Bluetooth became mainstream, readers migrated to this wireless standard, allowing for a more seamless pairing with iOS and Android devices without compromising data. Now the latest mobile readers even support wireless payment formats like NFC/contactless that don't require direct tapping. In terms of compatibility, the first readers only worked with certain mobile models, but now universal readers are available that are compatible with virtually any smartphone or tablet. This wide compatibility combined with simple Bluetooth pairing has significantly lowered the barrier to entry for mobile payments acceptance. Expanded Acceptance of Payment Types Initially mobile card were limited to magnetic stripe cards only, which posed problems for newer chip-based cards. However, as EMV compliance grew in importance, card reader manufacturers added chip card slots and contactless payments to their products. Now a single mobile card reader can accept all major payment types, from magnetic stripe and EMV chips to NFC/contactless technologies. Mobile Card Reader unified acceptance allows merchants to receive all forms of customer tenders regardless of the cards' underlying technologies. The emergence of mobile wallets like Apple Pay and Google Pay has further expanded the opportunities for mobile merchants to accept new types of touchless payments. Advanced Functionalities and Integration Options Early card readers were basic platforms for swiping or inserting cards. However, modern readers integrate robust point-of-sale features into intuitive mobile apps. These apps turn a smartphone or tablet into a fully-functional mobile POS by enabling inventory management, integrated invoices/receipts, customer profiles, loyalty programs, analytics, and more. Leading providers also deliver payment APIs to seamlessly connect readers to leading shopping carts and platforms. Merchants gain access to robust back-end tools while retaining control over their brand experience. Additionally, many readers now feature integrated card-not-present payment options, allowing remote or mail/phone order merchants to accept payments seamlessly. Rise of New Mobile Commerce Models The combination of powerful yet affordable mobile card readers and extensive payment acceptance has spurred innovative new mobile business models. Food trucks, pop-up shops, delivery services, traveling consultants and more can now easily start and run commerce operations from a smartphone or tablet. Door-to-door and direct-to-consumer merchants no longer need to rely on costly POS terminals or delay accepting payments. Events and trade shows have also benefited as exhibitors gain the ability to quickly and securely accept payments at their booth. This proliferation of mobile commerce opportunities allows entrepreneurs to pursue flexible, entrepreneurial ventures that were not previously financially viable without robust payment acceptance solutions. Get more insights on Mobile Card Reader

Also read related article on Synthetic Aperture Radar Market

Unlock More Insights—Explore the Report in the Language You Prefer

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

Vaagisha brings over three years of expertise as a content editor in the market research domain. Originally a creative writer, she discovered her passion for editing, combining her flair for writing with a meticulous eye for detail. Her ability to craft and refine compelling content makes her an invaluable asset in delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

#Mobile Card Reader#Portable Card Reader#Mobile Payment#Credit Card Reader#Mobile POS#Contactless Payment#Mobile Payment Device

0 notes

Text

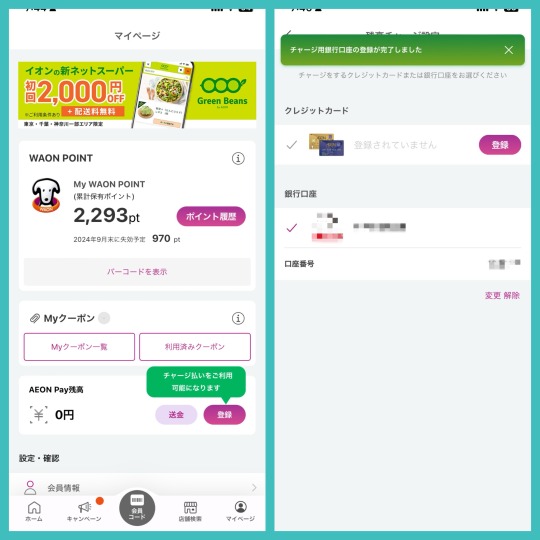

クレカ無理で銀行チャージのAEON Payセルフレジ初買物。大人の発達障害アスペルガー/自閉スペクトラム症の就労継続支援A型事業所帰宅後。WAON POINT獲得でバーコード2回と予習のiAEONアプリ,割引クーポン適用で急遽スキャン増え高齢者年寄り自閉症スペクトラムASD予定外パニックで失敗し店員誘導さるる

#pixlr#autism spectrum disorder#high functioning autism#aeon pay#イオンペイ#iaeonアプリ#銀行口座#mobile payment#electronic payments#smartphone payment#統合記念セール#ザ・ビッグ#ザビッグ#AEON

0 notes

Text

How does POS payment work?

(Human directed ai content.)

POS (Point of Sale) payment is a method of transaction where a customer pays for goods or services at the point of sale, typically using a debit or credit card. Here's how it generally works:

Initiation: The customer selects the goods or services they want to purchase and proceeds to the checkout counter or POS terminal.

Transaction Entry: The cashier or the customer inserts, swipes, or taps their debit or credit card into the POS terminal. The terminal reads the information stored on the card's magnetic stripe or chip.

Authorization: The POS terminal sends the transaction details, including the card information and the transaction amount, to the card network (e.g., Visa, Mastercard, etc.) through the acquiring bank (the merchant's bank).

Authentication: The card network validates the transaction and verifies if the card has sufficient funds or credit limit to cover the purchase. It may also perform additional security checks such as requiring a PIN or signature.

Approval/Decline: Based on the authentication process, the card network sends back an approval or decline response to the POS terminal. If approved, the transaction proceeds; if declined, the customer is informed, and alternative payment methods may be used.

Confirmation: Once the transaction is approved, the POS terminal prints a receipt for the customer to sign or confirm the transaction. In some cases, customers may also receive a digital receipt via email or text message.

Settlement: At the end of the business day, the merchant's POS terminal batch processes all approved transactions. The acquiring bank then transfers the funds from the customer's card issuer (the bank that issued the debit or credit card) to the merchant's account.

Funds Availability: Depending on the merchant agreement with the acquiring bank, the funds from the transactions are typically deposited into the merchant's bank account within a couple of business days.

Overall, POS payments offer a convenient and efficient way for customers to make purchases without the need for cash, while also providing merchants with a secure method of accepting payments and managing their finances.

Disclaimer:

Information in the articles is not business or investment advice, and these articles are created primarily for entertainment purpose. THE USE OR RELIANCE OF ANY INFORMATION CONTAINED ON THESE ARTICLES IS SOLELY AT YOUR OWN RISK.

#How does POS payment work#card payment#payment processing#how does a pos work#payment#payments#payment gateway#how merchant account payments works#cashless payment#payment machines#pos payment process#card payment process#contactless payment#payment method#mobile payment#pos payments#card payment app#pos card payment#card payments#payment terminal#pos payment system#pos payment method#accept payments#online payments#how do pos systems work#real time payments

1 note

·

View note

Text

0 notes

Text

today i bring u. the creachers. tomorrow? who knows...

#lets pretend i did not disappear off the face of the planet for months i was having an Episode#finally feel human again. actually#considering opening flash comms in this style#guys how weird would it be to take payment in top-ups for mobile games. cause it Sounds weird but at least i wont have to worry about#platforms not giving me my money and also the ethics of paying tаxes.#um anyway the tags#on air island#ezhanju#yandere polycule#ezrahansejulia#julia on air island#ezra on air island#hanse on air island#lee hanse#charismaticdragonarts

10 notes

·

View notes

Text

add me on animal crossing pocket camp: complete if you're playing it! you add people by going to the "cards" section and then scanning or uploading someones QR code.

[image description: the front and back of my 'camper card' from animal crossing pocket camp: complete, which is pink and on the front shows my character standing with fauna (a deer animal crossing character), and on the back shows a QR code. end description.]

#its the mobile animal crossing app but theyve made a new app that is an up front payment but no micro transactions#so its easier to get the items and theres nothing paid past purchasing the app#it just came out but i think it'll be fun#animal crossing pocket camp#acpc

11 notes

·

View notes

Text

me rubbing my hands together as more blogs return,,,,, hehehehehe,,,,

#this gif is probably large i can't tell im on mobile.#i wanted to use tom the cat but this wifi on the plane sucks.#out of payment.

7 notes

·

View notes

Note

HI ok I gotta ask - your post has made me insanely curious - you mention having cash at hand while waiting for your new card (resourceful) but none of the sources of cash was a bank or ATM.

Where I'm from cash is still used a lot (as we minimum wage workers get paid in cash) and as a result there are multiple ATM's within walking distance at all times and banks no more than 15-20 minutes drive away. Is this... different where you're from? (For context I'm from Africa)

We get paychecks directly to the bank account here, and I usually just pay with my card everywhere I need to, because it's more convenient than having a lot of coins and bills around. While there are ATM machines here (there are several within a walking distance from where I live), you use them with your card, so without having one, I can't get money out of the money withdrawing machine. I don't know how you do it, but without a card I can only get money out of the bank account by (online) bank transfers, and that's pretty hard at grocery store register.

Our bank offices stopped handing out cash several years ago, of which I am still very salty about.

I got some cash from my mom, and I had a handful of coins left over from the last time I had used an ATM a while back, but that's kinda rare for me, since most places accept card.

#I used to have cash savings last year but that was specifically for a tattoo in a studio that preferred cash payments#so I saved up by withdrawing a little bit of money every month to stash in my book shelf#but other than that it's generally easier to not handle cash#but like mobilepay links to the card so I need one to use it#and so does this delivery service app I've used before#linking to a card instead of directly to your bank account is safer#even if it makes it inconvenient if you lose your card#(it is only afterwards that I notice there's an option to close one's card TEMPORARILY in my mobile bank app...)#(but by that time I had already called my bank and terminated the old card and ordered the new one)#(hind sight is great)

11 notes

·

View notes

Text

ok so i occasionally play little stupid idle games if the point multiplier on mistplay is good and this one has little Bulbasaur looking guys that eat the candy obstacles, but i don't have any room for this tiny guy to do anything so he's just taking a nap

and he's so comfy and small i just wanted to show him off

comfy. moisturized. in his lane. at peace. snoozing.

#z plays games badly#and if you find yourself spending a lot of time on mobile games due to like anxiety or avoidance#u might look into it I've kind of made a lot of 'fun money' off it#not a rent payment or anything but like. borger or fun beverage

2 notes

·

View notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account app#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app

2 notes

·

View notes

Text

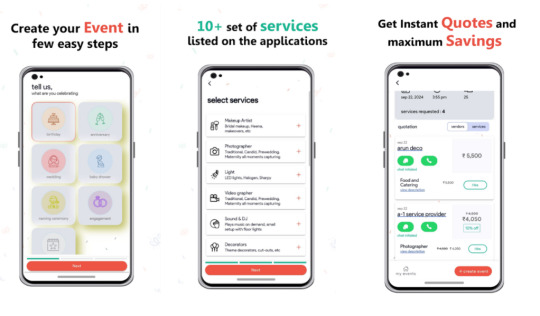

🎉 Say Hello to Seamless Event Planning with Ootbo App! 🎉

Planning an event can feel like juggling too many tasks at once. From finding the perfect venue to managing vendor communications and staying within budget, it’s easy to get overwhelmed. But what if you had an app that handled everything in one place? Enter the Ootbo App��the ultimate event planning tool designed to make organizing events stress-free, seamless, and fun! 🎈

Whether you’re planning a wedding, corporate event, birthday party, or any special occasion, the Ootbo App is your go-to solution for managing every aspect of the event planning process. 🗓️✨

🌟 Why Choose Ootbo App?

Gone are the days of switching between multiple apps, emails, and spreadsheets. Ootbo App simplifies the entire event planning process, from start to finish. Here’s how:

1. Create Events Effortlessly 🎨

Ootbo offers an intuitive interface that allows you to create detailed events in minutes. Simply input event details, set the date and time, and let Ootbo do the rest. 💡 Pro Tip: Customize your event profile to include specific requirements and preferences for vendors!

2. Receive Multiple Vendor Quotes 💼

Why chase down vendors when they can come to you? With Ootbo, you can: 🔍 Post your event requirements. 📩 Receive multiple quotes from verified vendors. 📊 Compare options side-by-side to choose the best fit.

This saves you time and ensures you get competitive pricing without the hassle of endless phone calls. 📞

3. In-App Vendor Chats 💬

Communication is key when planning an event, and Ootbo has you covered! 📱 Chat with potential vendors directly through the app. 📋 Discuss availability, services, and pricing in real time. 📎 Share documents, photos, and event details seamlessly.

Forget the confusion of scattered email threads—Ootbo keeps all your conversations in one place, organized and easy to access.

4. In-App Calls for Quick Decisions 📞

Sometimes, a quick call can make all the difference. Ootbo allows you to: 🔊 Make in-app calls to vendors without sharing personal contact details. 📌 Record important discussions and reference them later. 📈 Keep all event-related calls connected to your event profile.

No more searching through your call history for vendor numbers—everything stays in the app!

5. Hire Vendors with Confidence 🤝

Once you’ve reviewed quotes and discussed details, hiring your chosen vendor is as easy as a tap! 📄 Securely finalize agreements within the app. 💳 Pay vendors through a secure payment gateway. 🔒 Enjoy peace of mind knowing your transactions are protected.

With Ootbo, you’re not just hiring vendors—you’re partnering with professionals who are ready to make your event a success! 🎉

🏆 The Benefits of Using Ootbo App

All-in-One Solution: Manage your event from creation to completion in a single app.

Time-Saving: No more endless emails, phone calls, or spreadsheets.

Competitive Pricing: Receive and compare quotes to get the best value for your budget.

Seamless Communication: Chat and call vendors directly within the app.

Secure Transactions: Make payments and finalize contracts with confidence.

🎯 Who Can Use Ootbo?

Ootbo is designed for everyone! Whether you’re:

👰 Planning a wedding. 🏢 Organizing a corporate event. 🎂 Hosting a birthday party. 🎭 Coordinating a community event.

Ootbo App is your trusted event planning companion.

📲 Download the Ootbo App Today!

Ready to take the stress out of event planning? Download the Ootbo App today and experience the future of event management!

🔗 Visit Ootbo App to learn more. 📱 Available on iOS and Android.

Make your next event unforgettable with Ootbo! 🎉

With the Ootbo App, event planning has never been easier or more efficient. Start planning your dream event today! 🎈

#vent planning app#Best event management tool#Event vendor management#In-app vendor communication#Compare event vendor quotes#Event budget management app#Online event planning solution#Seamless event planning app#Event planning made easy#Chat with event vendors#Event organizer tool#Hire vendors online#Manage events from mobile#Event planning software for Android & iOS#ow to plan events with a mobile app#Best app to hire event vendors#Manage event budgets and vendors in one app#Event planning solution for weddings and parties#Secure in-app payments for event vendors

2 notes

·

View notes

Text

wow the $30 date tickets really did kill obey me for good huh

#i know i know 'obey me will live on'#conceptually i have so much love for the world of om#and it has a very special place in my heart for many reasons#but you have to admit that the games have been falling apart lately#at exponentially more worrying rates#i might be able to articulate this better tomorrow#but man i think the vision of what obey me could have been was always undercut by its inherent form as a mobile gacha game#i think the trappings of the medium held back what is a genuinely cool creative premise#my first thought is a fe:3h style jrpg#like dance battle combat + dating sim + choose your own adventure story with lots of replayability#but it really could be so much more#as the boundless creativity of the fandom has shown#i would love a world where solmare puts it all on the line and turns this into a proper video game#or at the very least one that is a one time payment and just has a complete story#considering the gigantic cash cow that mobile gacha games are compared to traditional video games i get why that probably wont happen#but yeah. i am hoping against hope that someone at solmare can rub some brain cells together and do right by the potential of obey me

4 notes

·

View notes

Text

#from the desk of anachron#pixel art#it's not a perfect program but for a one time payment mobile app it's pretty good

14 notes

·

View notes

Text

India's No.1 One Stop Solution Provider For Money Transfer, Aadhar Pay,AEPS, mPos & Mini ATM, Account opening,Neo banking, Service Provider of , Enterprise, B2B, White Label Software, visit: www.rrfinpay.com

#fintech service#it company#software company#app development company#b2b lead generation#white label agency#white label solution#rrfinpay#rrfinco#dmt software#recharge software#loan service#travel Service#e-government services#dth recharge#mobile recharge#bill payment#adhar pay#payment getaway#Qr/UPI Services#gst Services#Uti pan

2 notes

·

View notes

Photo

currently being driven to madness by @rukafais posts about how kimmuriel picked up rai’gy’s item enchanting / alchemy skills after he was gone and since I only read Servant of the Shard and not the other 2 I don’t know if they talk about what happens to all his leftover stuff out of the room they shared like. screams

#legend of drizzt#ME art this time#sory forever to my 8 followers who did not read this series . all u need to know is hes sad and im crawling up the wall#thank u ruka for the good posts online please accept my humble offering as payment for reading them for free#colours normal on my monitor but dark as he'll on mobile. Peace and love

50 notes

·

View notes

Text

Choosing Between PayPal, Stripe, and Local Gateways for Business

Selecting the right payment gateway is a key decision when starting an e-commerce business or moving into digital payments. Each gateway comes with its features and benefits, which can be helpful for different types of businesses. In this article, we'll compare three options: PayPal, Stripe, and local payment gateways, to help you decide which one is best for your business, such as mobile app development.

1. PayPal: Well-Known and Widely Used

Easy to Set Up: PayPal is known for its ease of use. Setting up an account and starting to accept payments can be done quickly, making it ideal for small businesses, startups, or anyone new to e-commerce.

Customer Trust: PayPal is trusted and recognized by many consumers. People feel comfortable using a payment system they know, which can help increase sales.

Higher Fees: One downside is that PayPal charges transaction fees, which can be higher than some other options. If your business processes a large number of transactions, these fees can add up.

Mobile Integration: PayPal works well across websites, apps, and other platforms, making it a versatile option for different types of businesses.

2. Stripe: Developer-Friendly with Advanced Features

Customizable for Developers: Stripe offers a lot of customization options, making it great for companies with their developers. You can have more control over the payment process.

Supports Multiple Currencies: Stripe is ideal for businesses operating globally. It supports payments in various currencies, making international transactions easier.

Mobile App Integration: If your business involves mobile app development, Stripe's simple APIs can be easily integrated into your app for a smooth payment experience.

Complex for Beginners: While Stripe offers flexibility, it might be harder to use for those without coding skills.

3. Local Payment Gateways: Best for Regional Needs

Lower Transaction Fees: Local payment gateways often have lower fees compared to international options like PayPal and Stripe, making them attractive for businesses focusing on a specific region.

Local Payment Methods: Some customers prefer using local payment methods. Local gateways allow businesses to accept these, which can improve sales within a particular market.

Customer Support: One advantage of using a local gateway is that customer support is often more accessible and personalized, which is helpful for small businesses.

Limited Global Reach: The main drawback of local gateways is that they’re better suited for businesses with little or no international presence.

Final Words

The best payment gateway for your business depends on several factors. If ease of use and customer trust are important, PayPal might be the right choice. Businesses involved in mobile app development or those that need more customization may find Stripe to be a better fit. For businesses focusing on local markets and wanting to save on fees, local gateways are a good option.

Choosing the right payment system is an important step, and understanding the features of each option will help you make the best decision for your business.

2 notes

·

View notes