#dmt software

Explore tagged Tumblr posts

Text

India's No.1 One Stop Solution Provider For Money Transfer, Aadhar Pay,AEPS, mPos & Mini ATM, Account opening,Neo banking, Service Provider of , Enterprise, B2B, White Label Software, visit: www.rrfinpay.com

#fintech service#it company#software company#app development company#b2b lead generation#white label agency#white label solution#rrfinpay#rrfinco#dmt software#recharge software#loan service#travel Service#e-government services#dth recharge#mobile recharge#bill payment#adhar pay#payment getaway#Qr/UPI Services#gst Services#Uti pan

2 notes

·

View notes

Text

Paytrav-B2B Fintech Software API Provider in India

Looking for API integration? Paytrav is a Direct API provider company across the India. We provide API for the products like AEPS, MATM, DMT, Multi-recharge and Fastag. If you want to plug API solutions then don’t think it’s time to integrate. We are available with dedicated software and digital solutions as well.

You can integrate AEPS API (Application Programmable Interface)/ software in your website or whitelevel. We are service provider of AEPS software. Create unlimited agents, distributor, master distributor under you. Highest commission assured.

With its cutting-edge goods and services, Paytrav is the top AePS API provider company in India.

Banking API Providers In India| Fintech API provider| best API service provider company in India|Aeps api service provider| Travel Portal API Provider India| Aeps Aadhaar Enabled Payment System Service

#flight api provider#dmt api provider#hotel booking software#dmt api#travel api provider#aeps api provider

0 notes

Text

Get EzulixB2b Software - Recharge, Aeps, BBPS

Are you planning to start your own b2b fintech admin portal and looking for best opportunity then this is for you?

Ezulix Software's, Year End Sale is live now.

You can start b2b fintech business with your own brand name and logo and can make it a handsome source of Income.

For more details, Click on below Image.

#aeps software#aeps software provider#aeps software developer#mobile recharge software#multi recharge software#money transfer software#bharat bill payment system#pancard software#b2b fintech admin portal#ezulix software

2 notes

·

View notes

Text

Currently on the earth, without common knowledge of the NAA agenda that uses many forms of Artificial intelligence and Satanic Ritual Abuse to Mind Control and implant the public, there is much controversy on the discussions on positive and negative results of AI, as it is a growing threat to the planet, as well as a threat to human freedom and sovereignty.

youtube

Ayahuasca, also commonly called yagé, is an entheogenic brew made out of Banisteriopsis caapi vine, often in combination with various other plants. It can be mixed with the leaves of Chacruna or Chagropanga, dimethyltryptamine (DMT)-containing plant species. [1]

Ayahuasca, other ceremonial shamanic plants and psychedelic drugs are high risk behaviors that invite Attachments, Addiction Webbing and Possession for human beings on the planet during the Ascension Cycle at this time.

Ayahuasca plant spirit has been hijacked by many of the dark avatars and the consortium of NAA entities that are on this planet during the Ascension Cycle looking to harvest Soul bodies and the possibility to take over the physical body. It is designed to interfere with true spiritual communication links and shut off the neurological communication functions between the persons consciousness and their higher spirit. It will install its own software programs to run the body, and brain in the autonomic functions of the Central Nervous System. It is usually an astral enlightenment program to trick the person into believing their artificially induced spiritual and altered consciousness state is real. The Ayahuasca plant is connected to a massive spirit, that has grown in size from many people being falsely lead on this path and taking it at high quantities during this time. The design of this plant ceremony in most common cases, is that the spirit of the plant is manipulated by negative forces that want the original consciousness of the person taking the drug to leave the body and/or change Timelines. The goal for the Imposter Spirit that want to take over the human body either in the current time, or in the future timelines, use the Ayahuasca plant to act as its conduit and dark portal opening to allow access into the inner spiritual sanctum of that person.

From the Guardian Krystal Star host perspective, Ayahuasca should be avoided and steps taken to understand its true energetic signature and know who is behind its aggressive promotion in the spiritual communities.

4 notes

·

View notes

Text

Dynamics 365 Data Migration: A Step-by-Step Guide

Migrating data to Dynamics 365 can seem like a daunting task, but with the right approach and tools, it can be a smooth and efficient process. Whether you’re moving from legacy systems, CRM platforms, or other business solutions, ensuring data integrity and consistency during the migration is crucial for the success of your Dynamics 365 implementation. Partnering with a reliable service provider like Vbeyond can ensure that the Dynamic 365 migration process is carried out seamlessly and effectively. In this blog, we’ll walk you through a step-by-step guide to help you plan, execute, and validate your data migration with Vbeyond as your trusted Dynamics 365 migration partner.

Step 1: Define the Scope of the Migration

Before diving into the migration process, it’s essential to define the scope. Understanding what data you need to migrate is the first step towards a successful migration. Take the time to assess and document:

What data needs to be migrated? Identify the specific tables, entities, and records that are critical to your business. This could include customer records, transaction data, contacts, sales orders, and more.

What format is the data in? Understand the source data structure, whether it’s from spreadsheets, other CRM systems, or legacy databases.

What’s the timeline and resource allocation? Determine how much time you have for the migration and what resources (team members, software, etc.) are available.

This stage also involves setting clear goals for your migration. Ask yourself:

Do you need a full historical data transfer, or just a subset?

Will you need to migrate attachments or custom fields?

Are there any compliance or security considerations regarding your data?

Step 2: Cleanse and Prepare Your Data

Data quality is paramount to ensure that your Dynamics 365 environment works smoothly. Inaccurate or inconsistent data can lead to operational inefficiencies and a poor user experience. Therefore, it’s important to clean your data before migrating it to the new system.

Data Cleanup: Remove any duplicate records, outdated information, or incomplete records. You may need to standardize data formats, such as phone numbers, addresses, and date fields.

Data Enrichment: Fill in any missing or incomplete information where possible. You can use tools or external databases to enhance data quality.

Data Mapping: Map your source data to the corresponding fields in Dynamics 365. Ensure that custom fields, relationships between entities, and lookup fields are accurately mapped so that no vital information is lost during the migration.

Step 3: Choose the Right Migration Tool

Once your data is ready, you need to choose the right tools for migration. Microsoft Dynamics 365 offers several ways to import data, depending on the complexity and scale of your migration:

Data Import Wizard: Ideal for smaller, simple migrations, the built-in Data Import Wizard allows you to map data fields from Excel or CSV files directly to Dynamics 365 entities. It’s simple but limited in functionality.

Data Migration Tool (DMT): For larger migrations, the Data Migration Tool is a more robust option. It allows you to migrate a wide variety of data from multiple sources, including legacy CRM systems, to Dynamics 365. This tool provides flexible configurations, mapping options, and can handle complex relationships.

Third-Party Migration Tools: Solutions like KingswaySoft, Scribe, or KingswaySoft provide advanced features, including support for integrations, batch processing, and data transformation.

Step 4: Test Your Data Migration Process

Testing is crucial to ensure that everything is working as expected before executing the full migration. Perform the following steps:

Pilot Test: Start with a small batch of data to verify that it migrates correctly. This is especially important for validating the mapping of fields and ensuring that your data structure matches Dynamics 365.

Data Validation: Ensure that data is accurately transferred and appears in the right fields, with correct relationships, formatting, and data integrity.

Check for Errors: Review logs and reports for errors or failed imports. This can help identify issues early on and make troubleshooting easier.

Step 5: Execute the Full Data Migration

Once your testing phase is successful, it’s time to migrate your entire dataset. Before migrating, ensure that:

Backup Existing Data: Always create backups of your existing data, whether it’s from your legacy system or your testing phase.

Establish a Migration Window: Schedule the migration during off-peak hours to minimize disruption to your business processes.

Communicate with Stakeholders: Inform all team members about the migration, its timing, and any system downtime that may occur during the migration process.

With Vbeyond’s proven expertise, the execution of your full migration will be handled with the utmost care. Their team ensures minimal downtime and maximum efficiency, ensuring that your business operations continue smoothly during the migration.

Step 6: Post-Migration Validation and Testing

After the full migration, perform a thorough validation:

Revalidate Data Integrity: Check that all records are complete, accurate, and migrated correctly. Test relationships between entities (e.g., contacts and opportunities, accounts and leads) to ensure that they are intact.

Functionality Testing: Ensure that all Dynamics 365 functionality, such as workflows, custom entities, reports, and integrations, is working as expected with the migrated data.

User Acceptance Testing (UAT): Involve end-users in testing to ensure that the data in Dynamics 365 meets their needs and is easy to work with.

Step 7: Monitor and Maintain the Data Post-Migration

Once the migration is complete, it’s essential to keep monitoring the system to ensure everything continues to run smoothly.

Ongoing Monitoring: Regularly check for errors or data inconsistencies, particularly if your system is integrated with other applications.

Training and Support: Provide training for users to help them navigate the new system with the migrated data. Offer support for any issues that arise during the transition.

Conclusion

Data migration is a complex but essential part of implementing Dynamics 365. By following these seven steps, you can ensure that your data migration is smooth, efficient, and successful. The key to a successful migration lies in thorough planning, data cleansing, using the right tools, and rigorous testing.

Partner with Vbeyond Digital today for expert Dynamics 365 data migration services, and experience a seamless transition to a smarter, more efficient business solution.

0 notes

Text

Sec2pay India is the leading AEPS Admin Panel Software and B2B Fintech Solutions Provider We offer a wide range of software including white label Admin, AEPS Admin Panel Software, B2B Fintech Software, Banking Software, DMT Software, Pan Card software, Micro ATM, and IRCTC Software

0 notes

Text

Trusted DMT API Provider in Jaipur

Ecuzen Software Private Limited is a premier DMT API Provider in Jaipur, delivering efficient and secure digital money transfer solutions. With seamless integration, high security standards, and dedicated support, Ecuzen Software ensures reliable transactions and customer satisfaction. Choose Ecuzen to enhance your business with trusted DMT API services at competitive rates.

0 notes

Text

Creating a Successful Life with the Diploma in Medical Transcription (DMT) Course Introduction

The Diploma in Medical Transcription (DMT) is a specialized course designed for those interested in pursuing a career in the healthcare sector without direct patient interaction. Medical transcriptionists play a critical role in converting voice-recorded medical reports into text formats, ensuring accuracy in medical documentation. The diploma in medical transcription is an ideal option for individuals who possess excellent listening and typing skills and have a keen eye for detail.

What is Diploma in Medical Transcription?

The Diploma in Medical Transcription is a comprehensive program that prepares students to understand and transcribe medical dictations accurately. This course teaches the terminology, procedures, and ethics required to handle medical documentation with precision. The 2-year diploma in medical transcription covers various medical fields, including radiology, pathology, and surgery.

Eligibility for Diploma in Medical Transcription

To enroll in a Diploma in Medical Transcription (DMT) program, students must have completed their higher secondary education (10+2) from a recognized board. Basic proficiency in English and a good understanding of biology are additional advantages. The diploma in medical transcription eligibility criteria may vary slightly depending on the institution, but these are the general requirements.

Application Process for Diploma in Medical Transcription

Students interested in applying for the Diploma in Medical Transcription must fill out the diploma in medical transcription application form, available on the respective college or institute’s official website. The form usually requires the applicant’s academic details, personal information, and sometimes a statement of purpose explaining why they want to pursue a career in medical transcription.

Course Details of Diploma in Medical Transcription

The Diploma in Medical Transcription program provides a thorough understanding of medical terms, transcription techniques, and healthcare systems. It typically lasts for 1-2 years depending on the institution, including both theoretical and practical training. The diploma in medical transcription course details include modules on medical terminology, anatomy, and transcription software training.

Syllabus for Diploma in Medical Transcription

The diploma in medical transcription syllabus covers key subjects such as:

Introduction to Medical Transcription

Medical Terminology

Anatomy and Physiology

Healthcare Documentation

Medical Ethics and Laws

Transcription Software Training

Practical Transcription Exercises

This well-rounded syllabus equips students with the skills needed to excel in the field of medical transcription.

Top Colleges for Diploma in Medical Transcription in India and West Bengal

For students looking to pursue a diploma in medical transcription in West Bengal, several top institutions offer this program. Some of the renowned diploma in medical transcription colleges in West Bengal are:

Institute of Health Science, Kolkata

West Bengal University of Health Sciences

Additionally, students can explore a variety of diploma in medical transcription colleges in India, such as:

Apollo MedSkills, Hyderabad

Medvarsity, Hyderabad

AIIMS, Delhi

These colleges provide excellent training and placement opportunities for students pursuing a career in medical transcription.

Conclusion

The Diploma in Medical Transcription (DMT) offers a rewarding career path in the healthcare industry, providing crucial support to medical professionals. With a 2-year diploma in medical transcription, students can gain in-depth knowledge of medical documentation and transcription techniques. Whether you are looking for a diploma in medical transcription in West Bengal or exploring options across India, this course equips you with the skills necessary to thrive in the ever-growing healthcare sector.

#education#top colleges#college student#topcolleges#best courses#best college#learning#career#students#higher education

0 notes

Text

Ezulix B2B Fintech Admin Portal - Start Fintech Business

Do you want to invest in fintech industry then this is for you? Here we will discuss, how you can start your own brand b2b fintech business with India's top fintech software development company.

In this I have explained about Ezulix b2b fintech admin portal, this is a web and app based portal that allows a business owner to offer all recharge, Aeps, Bbps, Pan card, DMT and Travel Booking Services to customers and earn commission.

Check out how you can start with small investment and can setup a successful b2b admin business in 2024-25.

#aeps software#mobile recharge software#money transfer software#bbps bill payment software#pancard software#travel booking software#fintech software development#fintech app development

0 notes

Text

Upgrading Dynamics AX 2009 to Dynamics 365 for Finance & Operations

Microsoft Dynamics AX 2009 Data migration tool (DMT) to migrate your Data from AX 2009 to Microsoft Dynamics 365 for Finance and Operations. Sunbridge Software Services Pvt. Ltd can assist with Upgrading Dynamics AX 2009 to Dynamics 365 for Finance & Operations. The DMT helps you locate and fill gaps between the table schemas of both AX 2009 and Finance and Operations, as well as helping you transfer your information.For further information contact us on +1 208 817 0051 and email us [email protected], our website http://sunbridgeglobal.com.

0 notes

Text

Cashless B2B DMT services

Here are some key aspects and benefits of cashless B2B DMT services:

1. Electronic Fund Transfers: Businesses can transfer money electronically using various channels such as bank transfers, wire transfers, or electronic funds transfer (EFT) systems. These methods eliminate the need for physical cash and provide a secure and efficient way to transfer funds between business entities.

2. Digital Wallets: Digital wallets offer a convenient way for businesses to transfer money without the need for physical currency. These wallets can be linked to bank accounts or other funding sources, allowing for quick and seamless transactions.

3. Online Payment Platforms: PayRup offers B2B DMT services can leverage online payment platforms that provide secure and streamlined payment processes. These platforms may offer features such as invoicing, payment tracking, and integration with accounting systems to simplify financial management for businesses.

4.Reduced Risk of Fraud: Cashless transactions typically have built-in security measures, reducing the risk of fraud associated with physical cash handling. Encryption, authentication protocols, and other security features contribute to a safer financial environment for businesses.

5. Automation and Efficiency: Digital B2B DMT services can be integrated into business processes, enabling automation and improving overall efficiency. This includes features such as scheduled payments, automatic invoicing, and real-time transaction tracking.

6. Record-keeping and Accountability: Cashless transactions leave a digital trail, making it easier for businesses to maintain accurate records of their financial transactions. This enhanced record-keeping facilitates accountability, transparency, and compliance with financial regulations.

7. Cost Savings: Going cashless can lead to cost savings for businesses by reducing the need for physical cash handling, transportation, and associated security measures. Digital transactions often have lower transaction fees compared to traditional cash-based methods.

8. Accessibility and Convenience: Cashless B2B DMT services offer businesses the flexibility to initiate transactions anytime and anywhere with an internet connection. This accessibility and convenience are especially beneficial for businesses engaged in global trade or operating in diverse geographic locations.

9 .Integration with Financial Systems: Many cashless B2B DMT services can integrate seamlessly with existing financial systems and enterprise resource planning (ERP) software. This integration streamlines financial management and enhances overall business operations.

As technology continues to advance, businesses are increasingly adopting cashless B2B DMT services to enhance the speed, security, and efficiency of their financial transactions.

Read more Our latest blog : UNLOCKING SUCCESS — HOW PAYRUP E-SHOP MERCHANT CAN TRANSFORM YOUR ONLINE EARNING

Popular bill payment facilities available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid , dth, electricity, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchase, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services and municipal taxes’ payments Payrup has it all covered for our users under one roof.

0 notes

Text

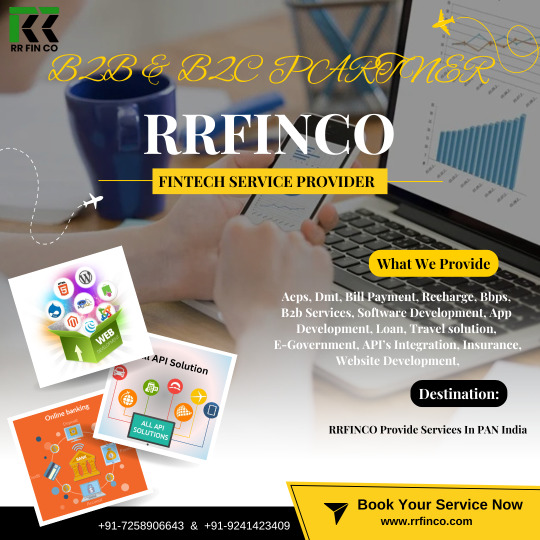

B2B & B2C Partner

All Type Fintech services like: AEPS, DMT, recharge, Bill Payment, Loan, Insurance, b2B Service, Whitelabel, reseller panel, Bbps, UPI/QR, Software & Application Development services result in tailored and easy-to-evolve solutions for automated financial service delivery.

#rrfinco #rrfinpay #b2bservice #whitelabelservice #resellerservices #b2bsoftware #whitelabelsoftware #b2bSoftwareCompany #whitelabelSoftwareCompany

#aeps #appserviceprovider #aepsservice #top10aepsservice #fintech #fintechservice #softwarecompany #rechargesoftware #dmt #bbps #billpayment #pancard #giftcard #fasttag #insurance #dthrecharge #mobilerecharge #whitelabelSoftware #b2bsoftware #resellersoftware #b2bservice #whitelabelservice #mobileapplication #gameapplication #loan #DematAccountOpening #PayLICpremium #softwarecompany #websitecompany #softwaredevelopmentCompany #fintechsoftware #b2bsoftware #whitelabelsoftware #mlmsoftware #mlmsoftwaredevelopment #b2bsoftwaredevelopment #fintechsoftwaredevelopment #AePS #dmt #aepsservice #apes #upi #loan #loanservices #Payment #paymentgateway #eGoverment #travels #insurance #insurancecoverage #DTHrecharge #mobilerecharge #billpayments #Adharpay #paymentgateway #paymentsolutions #CMS #HotelBookings #ticketbookings #API

#account opening#aeps software#gst services#api solution#api integration#recharge software#loan service#dmt software#b2b service#b2c services#whitelabel software development#white label services#white label agency#white label solution#whitelabel service#bill payment software#best aeps service provider#bill payment#b2b lead generation#e commerce software#software company#mlm software

0 notes

Text

Paytrav-AEPS API provider company in India

Paytrav is a cutting-edge platform in India that offers a unified payment experience through APIs. It boasts of having the best payment gateway in the country, enabling seamless collection, transfer, and refund of payments both online and offline. With a plethora of payment modes available, such as debit cards, credit cards, wallets, UPI, Bharat QR, and more, Paytrav ensures the highest success rates for your transactions.

Paytrav's AEPS API is the ideal solution for those new to the industry or looking to expand their business. Our advanced AEPS API is seamlessly integrated with multiple APIs, delivering a swift response with a 99.7% success ratio using cutting-edge technology. Integration is a breeze and can be done effortlessly by any skilled programmer. Our AEPS API boasts an array of updated features and services that can boost your business. By integrating with Paytrav's AEPS API, you can offer top-notch AEPS services with the highest commission and take your business to the next level.

Paytrav is leading AEPS API provider company in India over the last few years. Along with this, we offer multiple API solution for all the services.

We are a Money transfer API provider that also offers a comprehensive dashboard for complete control over payments.

#flight api#aeps api provider#DMT API provider#bus api provider#bus booking portal#hotel booking software

0 notes

Text

Are you planning to start your own b2b fintech admin portal and looking for the best opportunity then this is for you?

On this Ganesh Chaturthi, Ezulix Software is launching India's first-ever AI smart fintech admin portal. It includes mobile recharge software, AEPS software, bbps software, pancard software, money transfer software, and travel booking software.

As an admin, you can create unlimited members all over India and can earn the highest commission on all services. For more details visit our website or request a free live demo. (+91)7230086664

#aeps software#mobile recharge software#money transfer software#bharat bill payment system#nsdl uti pancard software#travel booking software

2 notes

·

View notes

Text

In recent years, India has emerged as one of the world’s fastest-growing markets for fintech companies. Fintech, short for financial technology, refers to the innovative use of technology to provide financial services and solutions. The fintech revolution in India has disrupted traditional banking and financial services, offering consumers and businesses new and more convenient ways to manage their finances.

The Fintech Boom in India

India’s fintech journey can be traced back to the early 2000s when online banking and digital payment systems began to gain traction. However, the government’s push for financial inclusion and the proliferation of smartphones truly accelerated the fintech revolution. The introduction of the Aadhaar biometric identification system and the Unified Payments Interface (UPI) played pivotal roles in making financial services accessible to millions of Indians. There are many Fintech companies like Bankit, Paynearby, Rapipay in the market providing financial assistance such as MATM, AePS as well and DMT services.

Key Drivers of Fintech Growth in India

Government Initiatives: The Indian government has actively promoted fintech through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), Digital India, and Make in India. These initiatives have aimed to increase financial inclusion, digitize the economy, and encourage domestic fintech innovation.

Digital Transformation: The widespread adoption of smartphones and affordable mobile data plans has enabled fintech companies to reach even the remotest parts of the country, making digital financial services accessible to all.

Regulatory Support: The Reserve Bank of India (RBI) and other regulatory bodies have crafted fintech-friendly policies, fostering an environment conducive to innovation and growth.

Rising Consumer Demand: Indian consumers are increasingly looking for convenient and secure digital solutions for their financial needs, from payments and lending to insurance and wealth management.

Impact on the Indian Economy

The rise of fintech companies in India has had a profound impact on the economy:

Financial Inclusion: Fintech has brought millions of unbanked and underbanked Indians into the formal financial system, fostering economic growth and reducing poverty.

Ease of Doing Business: Fintech has simplified financial transactions for businesses, leading to increased efficiency and productivity.

Job Creation: The fintech sector has created a significant number of jobs in areas such as software development, data analytics, and customer support.

Increased Competition: Fintech has forced traditional financial institutions to innovate and improve their services to stay competitive, ultimately benefiting consumers.

Challenges and Future Outlook

Despite the remarkable growth, the Indian fintech sector faces data security, regulatory compliance, and competition challenges. However, the future looks promising with ongoing innovation and support from the government and regulators. We can expect to see more collaboration between traditional banks and fintech startups, further enhancing the financial services landscape.

Conclusion

The fintech revolution in India has not only transformed the way Indians manage their finances but has also positioned the country as a global fintech hub. With continued innovation, collaboration, and regulatory support, India’s fintech sector is poised for sustained growth, contributing to the country’s economic development and financial inclusion. As fintech companies continue to disrupt and redefine the financial services industry, they are playing a pivotal role in shaping India’s digital future.

0 notes

Text

Moneyart is the platform for AEPS, BBPS, DMT(Direct Money Transfer), and Recharge API software service providers in India.

1 note

·

View note